The Fed likes the word “credit.” Sounds less onerous than “debt.”

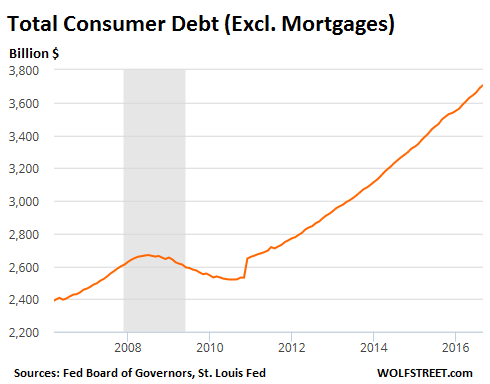

Consumer debt rose by $19.3 billion in September to $3.71 trillion, another record in a five-year series of records, the Federal Reserve’s Board of Governors reported on Monday. Consumer debt is up 6% from a year ago, at a time when wages are barely creeping up and when consumer spending rose only 2.4% over the same period.

This follows the elegant principle of borrowing ever more to produce smaller and smaller gains in spending and economic growth. Which is a highly sustainable economic model with enormous future potential, according to the Fed.

Consumer debt – the Fed uses “consumer credit,” which is the same thing but sounds a lot less onerous – includes student loans, auto loans, and revolving credit, such as credit cards and lines of credit. But it does not include mortgages. And that borrowing binge looks like this:

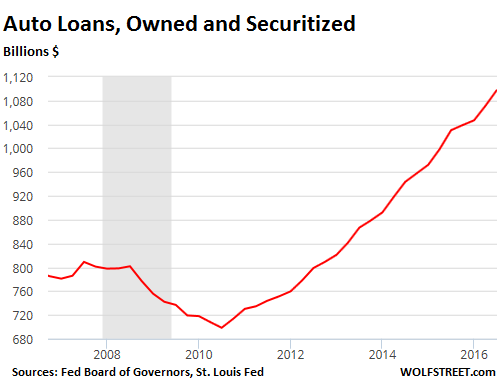

Diving into the components, so to speak: outstanding balances of new and used vehicle loans and leases jumped by $22.6 billion from Q2 to $1.098 trillion, another record in an uninterrupted four-year series of records.

Auto loans have soared 38% from Q3 2012, the time when they regained the glory levels of the Greenspan bubble before the Financial Crisis:

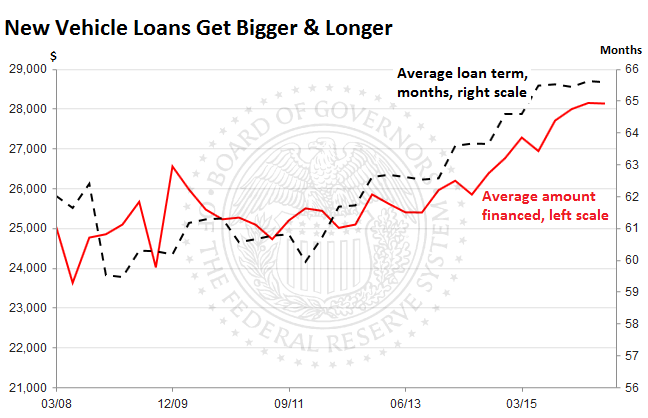

Auto loan balances have soared because people bought more cars. New car sales hit an all-time record last year, though they’ve started to flatten out or decline in recent months. The balances have also been rising because loan terms are getting stretched, and because the balances on individual loans have been getting bigger as cars got more expensive and loan-to-value ratios rose:

Then to the next-generation debt slaves, many of whom might not even know yet what that term means since they haven’t started to make payments on it.

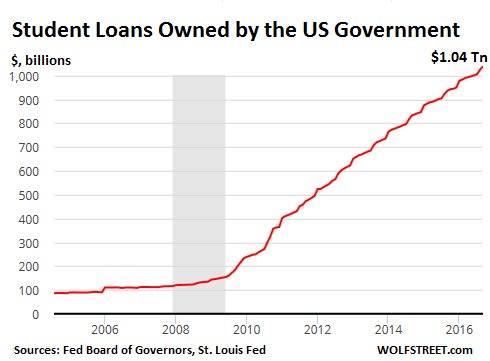

Total student loans, owned by the US government and by private-sector lenders, were $1.396 trillion at the end of September. The portion owned by private-sector lenders fell during the third quarter by $4.8 billion to $357.6 billion, as they’re pulling back from this business.

But student loans owned by the government jumped by $14.2 billion in September alone, and by $37.5 billion in Q3, to a new record of $1.039 trillion. So here’s what’s coming at these hapless debtors:

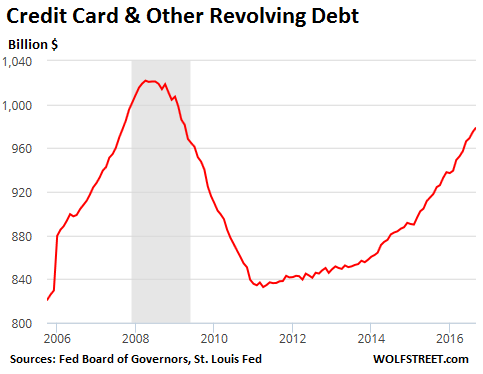

Credit cards are the most expensive way for consumers to go into hock. Interest rates deep into the double digits are not uncommon. There are fees out the wazoo for people who drop the ball. In return, banks borrow from savers at interest rates that are suspiciously close to zero.

Credit card debt is the biggest money maker for banks. If folks don’t pay off their balances, it’s a rip-off. It hits the financially weaker people and those with already some credit problems the worst. And the more urgently they need to borrow (to put food on the table, for example), the more money they’re going to pay in interest and fees. Banks know when they have a consumer by the balls.

But you can’t blame the banks. Banks are not forcing consumers to use these credit cards. During the Financial Crisis, consumers got burned, and they decided to get out of credit-card debt one way or the other, with a lot of this debt defaulting. And that’s when banks got burned.

For a year or two afterwards, consumers were prudent, to the greatest desperation of the Fed. But by 2014, they were forgetting the lessons they’d learned. By 2015, they were back binging on stuff they couldn’t afford. And now credit-card and other revolving debt is once again shooting into the stratosphere, on its way to $1 trillion, though it still has a little ways to go before it hits the prior levels that blew up with such fanfare:

This is the portrait of the American debt slave who is trying to keep the economy hobbling along singlehandedly by buying stuff they cannot afford and may not need, with money they don’t have but need to pay back later when they can afford it even less. But that won’t ever be a problem – until it is.

One of the big expenses for consumers is health care. And there’s a reason for it. Read… How PE Firms Are Flipping Drugs in Price-Gouging Scheme that Cannibalizes the Entire US Economy

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Taking on far more debt than one can ever hope to repay is the new normal. Governments do it, corporations do it, and all the little people are naturally following suit. It is all about trying to maintain the lifestyle to which we have become accustomed during a time when the excess energy and abundant resources are no longer available to support that lifestyle. It is all about just hanging on to what you have for just a little while longer, desperately hoping for a change in fortune, while the ground is crumbling beneath your feet. It all about taking a firm stand in regards to the future and saying “fuck it”, I’m living with the maximum gusto possible today, because there sure as hell isn’t going to be a tomorrow — not one I want to contemplate anyway.

The secret to being a successful consumer is dying at the proper time.

“He who dies with the most toys wins.”

One can only hope that more banksters follow this mantra as the zero interest free money economy rolls over.

Except for the trillions in student loan

You died before you reached your full potential and lost the lottery?

Well the whole system is designed to push you in this new normal debt direction.

Say you have some savings. (Many don’t have any)

Soon, cash will not be permitted. And there will be negative interests on savings. You will be forced to use up those savings and buy ‘things’ or your saving will slowly (but surely) erode.

And after that, you are done. When you will want to buy something bigger again, your savings will be gone, then even you, dear saver, even you will be in debt. Just like others who never cared to save something to begin with. Gold, silver, barter…? This can be outlawed as well.

Since creating of central banks, whole system is designed to pull everyone into the debt. Nations and individuals. So some psychopaths can become even richer. :-(

well said!

Agreed ! I know it was just a film … but towards the end of the movie starring Clive Owen .. ” The International ‘ from 2009 the banker that turns makes the statement .. and I paraphrase ; ” Power isn’t money or wars . Power is creating and controlling the worlds debt ”

A film yes … but a plausible one .. with a conclusion methinks any intelligent person can agree with

great movie and i couldn’t help but take notice of the same thing you mention. It’s about the debt.

I love that movie. My favorite line was “Reality unlike fiction doesn’t have to make sense.”

Pulling production forward means never saying sorry!

The system works because of your tomorrow earnings and not your yesterdays savings?

Your earnings are stolen from the same system that guards your savings!

Cash will always be a part of the financial system for the foreseeable future, but many of us rarely if ever use cash as there is little to no need to use it for anything which is why the use of cash has diminished significantly and why there is only about $1.3 trillion in total physical cash as part of the US money supply.

Very nifty explanation in one paragraph.

Thanks NW….

Thanks for the info! Your site keeps me on top of things!

And it’s free too!

IMO, this site is worth more than any site that I know of which charges for its “news”.

Donate a little – help Wolf keep it going!:

http://wolfstreet.com/how-to-donate-to-wolf-street/

THANK YOU, RD!

And thank you for donating the other day!

You are MORE than welcome, Wolf – Useful information, well organized, authoritative and in depth, isn’t easy to find in the vastness of the web. Congratulations!

The scariest graph is the one that shows student deb (owned by USG) going from 100B to 1T in a matter of 8 years. It is incredible.

Justme,

Student debt was the graph that jumped off the page for me also. Any quantity that increases by an order of magnitude in a short period of time bears watching. Student debt is a runaway train.

relax….it was mostly bartenders school tuition.

Lots of job offerings there. Good future too….have a drink and save the economy.

at one of my local watering holes a bartender let it leak out that she made over $60K bar tending.

she’s happy, relaxed and has loads of fun at work everyday.

and, unlike what i deal with, people don’t come by and say “remember that drink you made me 6 months ago? well i have a problem with it now and need you to remake it, for free”

luckily for me i make customers do everything via email. they try ALL THE TIME to give me instructions via talking on the phone (NEVER leaving a message if i don’t take the call…it’s always call me back when you get this non message) and i think they do that so it’s you said we said situation so i always follow up with a summary email to CMA which has saved me $1,000’s

i can see why I’d rather be a bar tender.

What is NOT shown in all those scary student debt graphs is the inverse source of the rise in gov’t ownership…..i.e. private ownership of student debt (bank and other private student lenders) has dropped greatly over the same period.

Essentially, the gov’t pushed out private enterprise to provide another riskless source of funding for the money center banks (who securitize all the crap to hide…for a time….the various problems that current lending standards create).

In the absence of the gov’t subsidizing all risk, the rate of inflation in college tuition would be a lot less….and the growth in student loans (both private and gov’t owned) would be less. Unfortunately…this would burst the social fantasy that all young people NEED to get a college degree. So…the can is kicked down the road.

Normally….affordability is a quick feedback loop as students can’t pay off the initial loan payments….but with the gov’t ability to extend and defer repayment of loans (because the gov’t doesn’t need to show a profit motive…it needs to buy votes!) ….which is exactly what the loan statistics show is occurring….the can gets kicked MUCH further down the road than if private enterprise was holding the loans.

That is a very good point. But maybe it was not USG pushing out banks, but rather banks pulling out and lobbying USG to buy their soon-to-bad student loans. That would not surprise me at all.

What about total student debt?

Total student debt has soared over the years, but the composition has changed, with this shift from lenders to the government.

Great Point…..

I think the same concept applies to healthcare…..as soon as you have a third party (s) overlay…..all checks and balances evaporate.

A lot of money sloshing around with the US govt ( Taxpayer) the ultimate destination.

Yes, quite right it seems.

The only question is: when will this Ponzi scheme collapse?

Tomorrow.

And funniest thing is you could be right.

What would trigger any “collapse?” Japanese government debt is now around 250% of Japanese GDP and continues to rise. US government debt is only about 107% of US GDP which would suggest that US government debt could go up to around $45 trillion for just government debt alone with no significant consequences on a go-forward basis. Total debt in the US is current around $64 trillion for actually incurred debt broken down roughly as follows:

The breakdown of the $64 or so trillion of DEBT outstanding is approximately as follows by big picture category:

30% Federal Government Debt

20% Total Consumer Debt

23% Total Corporate Debt

27% Other debt including Municipalities

The biggest issue on a go-forward basis is INTEREST RATES which are rising and will continue to rise. When interest rates go back to normal levels of around 5.25% for 3 month US Treasuries, then there will be ENORMOUS additional costs for the US government and since all interest rates in the US economy that matter are based on the yields of US Treasuries then all interest rates will rise. Moreover, there will be many more defaults will will result in RISK OF LOSS actually being priced into interest rates, unlike at present.

You forgot a word : “buy stuff they don’t NEED”.

Most of the new stuff people have been buying is totally irrelevant and won’t help the world improve.

Debt is “good” only when it is generated by a productive investment. For example, if a government borrows money to build a power plant or to repair the roads, it should result it general economic improvement.

Same goes for individual consumers : if they borrow money for a new car, because the old one is about to fall apart, it will help them go to work (or perform their work).

But on the other hand, if they borrow money to buy the new UHD 3D megagiant screen television, and to replace their less-than-a-year old iPhone, it certainly won’t boost their productivity… it’s useless debt.

Smartphones and tablets have been conquering the world since less than a decade, on the promise that they would enhance our lives, make us more productive, and so on….. Now look at the numbers, global economy hasn’t been growing faster than before the age of smartphones… on the contrary.

I tend to think smart phones are part of the problem with the economy. You can use this one device to replace dozens of devices: phones, calculators, maps, etc… And it gives you access to the Internet along with social experiences. If someone is spending 4 hours of their day on their phone, that’s 4 hours that they aren’t earning and/or spending.

Well said.

I will take your post to the logical and inevitable . . . and finally, the necessary conclusion :

WE NEED A CLEANSING CRASH ! A crash that reduces the debt-serfs to absolute penury, teaching them a necessary lesson : DO NOT USE EXPENSIVE DEBT TO BUY THINGS YOU DO NOT WANT, CANNOT AFFORD and CERTAINLY DON’T NEED.

The fed clowns have been preventing that lesson from even germinating in any way, by reducing the [apparent] cost of credit to almost nothing. And by not regulating the credit-issuers AT ALL – – so that 125% LTV loans are possible for new cars. As one example.

The lesson will be learned, and the debt-serfs will ultimately do what I finally did in May of 2016 :

I ELIMINATED ALL DEBT but my 4% mortgage which I see as rent, not debt. I mean, I gotta live someplace, right ? And I ain’t rich enough to pay cash for a house, yet. It has taken me more than two years to become debt-free.

Point being I have no Credit Cards ( but one with a zero balance – – for rental cars, emergency repairs, a flight or a hotel should I ever do any of those things, ever ) – – and no other loans, not even an auto loan.

I am free of the elite cabal of NY Banksters and their chains of debt; and I am also immune to Madison Avenue’s insistence that I must have what I cannot afford and do not need.

Good Luck all, this will not end well.

SnowieGeorgie

Credit cards are great you just have to use the system . I get free miles to travel the world . I got a last minute ticket from Hanoi to San Diego that would of cost $3200 , it cost me 32000 mies so in that case I was getting 10 cents for every dollar spent .I pay off and get new cards whenever they offer a sign up bonus .When travelling you also get the best currency rate by using a cc.

Thanks! I added “may not need.” (I usually say that but it just didn’t happen last night).

:-]

OK, I’ll be the dissenting voice. Who are you to decide what a consumer needs? If that big screen tv and cable bill is the only entertainment a family has, it is worth it to them. Then there’s the family in that bad neighborhood trying to keep their kids at home, away from the harm they may come to on the street. The only people who should be dictating what they need are the people spending the money. Your opinion doesn’t count. Next you will be picking what they eat, drink, or wear. And yes, I do need flip flops with rhinestones.

Thanks Pet, I love and read and respect all of your posts !

Here’s a dissent to your dissent ( with a caveat at the end ) :

HALF OF ALL AMERICANS HAVE NO SAVINGS, and the mean for the other half is something like $15,000.00 ( the mean is generally a useless number in many respects )

Come on, an American with ZERO SAVINGS can get a 30-something inch LED TV for well under $200.00. THAT FAMILY WITH NO SAVINGS NEEDS NOT MUCH ELSE IN THAT DOMAIN !

Call me a nanny ( daddy ) but someone needs to wake the serfs up from their soporific consumption.

Or – – they could have their $1000.00 television, and have no money for the furnace repair coming next week when the cold snaps. Or the $1000.00 repair for the transmission in their 9 year old auto, oh so necessary for the serf to get to work.

Again, the penury forced upon them by the coming crash will teach that lesson, and teach them good. Or they could take my friendly but firm advice !

THE CAVEAT : Yet I believe in 100% freedom for adults ! So I voted up legalized marijuana and more gambling in my state at 7:00 a.m. this morning. Adults are free to make ( economically ) bad choices. And I am equally free to give friendly, but firm advice.

You don’t need what you can’t afford when you are in debt with no savings. Or not . Either way. Freedom is all.

SnowieGeorgie

Georgie,

Freedom includes the right to make bad decisions. The right to save or not to save should be made by people exercising free will. I think all those people investing their savings in gold are stupid, but I would never stop them. I think anybody injecting more money into the corrupt financial system is going to get what they deserve, more financial repression. The savings are being used to feed the beast, it won’t be there in any case.

Take a look at what India announced today. They are eliminating certain denominations of notes to force people back into the system, so that there is more for them to steal. I would rather have that big screen tv while I can.

Don’t assume all debt everyone holds is frivolous or their fault. The only debt I have is student loan debt, and that amount is so huge it’s ridiculous. I went to college because everyone said that was the only way to get ahead in life, and I was Valedictorian, so I was expected to succeed. Guess what? When I got out the jobs weren’t there. I’m working as a waitress. The kicker is at a different restaurant where I worked a few years ago, I was talking about my Tulane education and found out that my coworker, another waitress, had a degree from Vanderbilt. We’re screwed.

Another waitress I know is so underwater on her house she and I have fun filled arguments about whether my college education or her house (shared with her also-employed husband and 2 kids) were a worse decision. We were only doing what everyone said we were supposed to do, we thought we were being responsible. So don’t wish utter collapse on all of us just because you think you made better decisions. You don’t know anything about a person until you walk a mile in their shoes.

For the record, not only do I not buy the big screen TV, I cancelled my cable because my life is better without the droning indoctrination of TV. (Funny story, they got my payment down to $20 a month and I still cancelled it! Haha)

J, these are terrible stories. But so common. Thank you for sharing. All high school students should read this as a piece of additional info when they make their college decisions.

Excellent point and one I don’t hear enough in my old age. “Who are we to decide for others?!”

The whole point of freedom is that we DONT decide for others.

I may think 50 deodorants or cereals for sale seems stupid, but they sell products because people buy them.

I find the amount of “correct” action and behavior being preached lately very alarming. It’s the speech of authoritarian control. Careful what you wish for!

Jealous old people.

We get a better deal on consumption because of their excessive buying habits and a better borrowing rate from their foolish extension of credit to keep the party rockin’?

Do as I say and don’t look like you enjoy it?

I find it very naive to think that we are free to choose and should not interfere with opinions. If we scratch even a surface history we will find out that we have never been free to choose because we were always bombarded with propaganda and conditioning since our birth. Hegelian dialectic and Skinner’s behavioral psychology is at the core of destroying our free will in modern days pretty successfully as everyone can see. And it starts from preschool. If we shut up diggers, truthers and eye-openers who point to us and our brainwashed nature, whats left?

“And yes, I do need flip flops with rhinestones.”

YES INDEED!–and THIS is why i listen to you!

x

Pos to of the year!!! What is freedom if not to enjoy it. Well said and yes I agree with responsibility but we are not here on this little blue marble very long. Sometimes we just spend. We are human and we do this. The world is not about to end with a rhinestone flip-flop purchase!! You go-girl!

And if you’re rich and greedy, yet still want to appear “religious”- You might not want to “Forgive us our DEBTS, as we forgive our DEBTORS”. Heck no, that’s going way too far.

(“Let’s just call it trespasses instead… yeah, that’s it …. way more murky and way less trouble

PS ” now about that stupid camel and the needle ……….”

Right on; the ideal would be for informed people to freely choose to not take on disproportionate amounts debt, but better they make their own mistakes than have everyone’s behavior dictated.

I am frequently concerned that my comments may not convey the proper sense of alarm.

I got it ! – It was a good one !

*chuckle…*

“I am frequently concerned that my comments may not convey the proper sense of alarm.”

—OH! on the contrary; your deliveries and irreverence/irreverent humor reek of a “Titanic short hand.”

Must be my literary ability to say much while writing little. Either that or I’m lazy.

If I didn’t know any better I’d say that pile of consumer debt has been the main driver behind US economic growth post 2010.

But one thing I’ll say after looking at that chart and at similar ones for corporate and China. The law of diminishing returns is hitting our economy on the head with a brick: to generate growth that struggles to keep up with real-world inflation and population growth we have to create ever increasing quantities of debt.

Even China, where growth figures are simply conjured out of thin air for the consumption of gullible Westerners, has to resort to debt creation on a scale that would make their steel and glass pane industries proud: I remember earlier this year they were creating half a trillion dollars new debt every month. That’s half the US student debt held by the US government created in just one month.

And things are about to get a whole lot crazier. Financial markets expect Hillary Clinton to have some miracle cure for the economy (and especially corporate profits), like proven by the asinine dead cat bounce financial markets performed yesterday.

But it soon it will dawn she has no more magical financial powers than Janet Yellen, Haruchiko Kuroda and Mario Draghi. Simply put, what financial markets expect out of central bankers and politicians has grown to irrealistic proportions.

The US Federal Reserve has so far avoided directly purchasing corporate securities, like the BOJ and the ECB have been doing, contenting itself with managing yields. But as Wall Street and her spoiled sisters will start throwing a temper tantrum after another due to the lack of “results”, Yellen will be forced to yield.

Note that this doesn’t exclude further actions on interests or treasuries: just look at Japan and Europe.

“If I didn’t know any better I’d say that pile of consumer debt has been the main driver behind US economic growth post 2010.”

Perhaps you have been misled into believing that it is ‘growth’.

Economic ‘growth’ is measured by the increase in GDP. But GDP only accounts for consumer, business, and government spending, plus the difference between imports and exports.

Debt is not accounted for in GDP statistics, which makes it perfectly possible to borrow a trillion dollars, throw it on a bonfire, and tote it up as a trillion in growth. Which is absurd, but that’s how it’s done, and it’s done all the time.

It makes no more sense than someone who borrows a million dollars and calls himself a millionaire, when ultimately he is worse off than before because he has no way to pay it back. It is only a matter of waiting for reality to assert itself. In due course the millionaire is exposed as being a million dollars in debt and therefore bankrupt.

Yes, the U.S. has experienced growth, but it is growth in debt, and not growth in the economy. To properly measure ‘growth’ the increase in debt would have to be subtracted out of the GDP numbers. But that would not perpetuate the deception, and that deception most helpful to banksters who aim to confiscate and consolidate the world’s wealth by way of irresponsible borrowing.

It gets worse. Environmental assets are also not accounted for, and for similar reasons. If that were done it would be obvious that humanity has been plunging blindly into utter destitution.

I think Hillary’s plans would help the economy. Take excesses from the rich and give necessities to the poor and middle class. This increases overall demand. Whether you think it’s fair or not is a whole different question.

Your naivete is both charming and disarming at the same time.

For decades I’ve heard politicians threatening “the rich” with anything, including not so subtle hints of bodily harm. After election day is over, “the rich” invariably morphs into “the middle class”, for the simple reason it’s far easier game: rich people tend to be very liquid and hence very mobile, while the middle class has most of its wealth pinned down in local real estate and capital goods.

I’d also like to add Mrs Clinton’s escapades into foreign policy have resulted in Libya being turned not merely in a failed State, but in a conduit for all sorts of people to pour into my Continent. Just yestaerday we got the news we are getting an extra helping of these “refugees”.

You Americans are kept well insulated from the effects of your politicians’ failed Imperial adventures: you’d probably have far less enthusiasm for a man promising to antagonize the Chinese and a woman promising to antagonize the Russians if you saw some of the consequences.

OK, now define “necessities”.

A smart phone with a data plan? Free housing, food, medical care? Money for drugs and/or alcohol? Things to boost their fragile ego?

Now, define “rich”.

If YOU make more money than I do, then YOU are rich and need to give more money to a fair and generous government agency and let them decide how best to best distribute the loot (after taking a “modest” salary for themselves, oh and pay for their retirement plan).

The socialist approach always runs out of steam once the people putting more effort into the system realize that ultimately they will not get ahead. Why put forth extra effort only to have it “taxed” and redistributed to someone not willing to exert as much effort as you do? The theory behind the novel Atlas Shrugged is not some far-fetched idea from a think tank, it is based on observation of human nature.

A little reactionary are we? All I’m saying is wealthy people put a larger portion of their net wealth into passive investment. Middle class and poor spend it, which leads to active investment by businesses to serve that demand. That means transfer of wealth is good for the economy at least in the short term. Hillary’s plan would do that, and that’s why stocks jumped yesterday.

I hope that was sarcasm.

Folks, especially white folks, in this country have an expectation that they should be middle-class. Nobody wants to appear to be lower-class to their friends and family.

But they’re not. The only way to maintain the pretense is through debt (and a lot of desperation).

I think a lot of these folks have been reliable conservative voters for decades, and have found out that it was all a lie. Cutting taxes on the rich doesn’t lead to more investment. Free trade doesn’t lift all boats.

Hence Trump.

Hence Trump and his lies about what is possible. Providing soothing words to his average voter = 55 yr old White male with HS degree or less. So the literal economic ignorant will vote for dead on arrival promises from an idiot ‘brand’ developer who has filed for bankruptcy 4 + times.

Trump is the latest snake oil salesman promising to fix all that is wrong in the world with little hope to even help his own mortgaged to the hilt empire. Trump was not created he only offered to fix more of the things that cant be fixed, as the others running against him were not stupid enough to offer the literal stupid voters who think, and blindly so, he is the messiah. They forget the truth shoved down their throats about personal responsibility and cry out for Government to save them, all the while before casting a vote for the very party that is using them to gain and hold power and cut their Gov funded saftey net!

The world changed and the less than fortunate are not prepared at all for the world that is now real and very real. They cannot fathom that the normal, get a degree, get a job and a house and wife or hubby world is literally gone.

Get a gig not a job. Watch your job be automated or sent overseas. That is the only norm and that is the utter technological cold water on reality. Trump no matter if he wins or loses, will only prolong the inevitable crushing reality for the average Trump voter. They will just plug along, more poor and under educated as before Trump. He is not capable of uplifting them any more so than Ghandi lifted the lower caste.

They can only lift themselves and given the average Trump voter’s age its way beyond too late for most.

At least Trump is listening to those poor suckers who don’t have a chance anymore. You point out that Trump has exploited the system successfully, 4 bankruptcies and every tax deduction he could use, is that really his fault or a fault at all? He is exploiting the system the establishment created and he knows that system stinks. Do you think Hillary will change the system she has created and has supported for decades? The answer is no. She will change the TPP to make it more profitable to offshore jobs and she will leave the working class on the street, like she did before. Enjoy your delusions as well.

I recommend that all of you get and watch:

“Requiem for the American Dream”

Watch it and you will understand everything and where WE are going and how WE got here.

While you are at it, read ‘Thieves Emporium’.

as a college educated art chick who had an ivy league educated mother and PhD candidate pops who realized it was ALL a sham, i’m beginning to resent the division made between high school education vs. college because it’s supposed to delineate some kind of higher intelligence, but more and more i see higher education as shorthand as a stamp of The Bullshit Borg.

i’ve had more intelligent conversations with plumbers and car mechanics, the most philosophical moments with homeless people, and have learned more about making an actual living at what i do from LIBRARIES. with paper books. still they are the secret bastion of knowledge that the internet cannot begin to touch with these popularity algorithms regurgitating remedial information.

i guess i’m trying to say that the more i went around to colleges to speak, read, perform, i was horrified at how…. THEORETICAL and vague their idealistic worlds had become.

that’s why it makes no sense to me that there are homeless students in berkeley… WHAT is making them believe enough to keep showing up and signing up for more loans?

it’s the college educated who sound like ghetto kids dreaming of being basketball stars to me, now.

Yes! The media loves to point out this divide when talking about the plotical polls. It’s almost like shaming someone for having only a highschool education.

‘They’re uneducated and thus are voting this way’.

My experience is very much like yours. My parents were highly educated and I have a masters degree from the UC system. I work for myself and deal with people in the Trades every day. Their ability to reason and calculate is not weak.

KL,

A college education has nothing to do with learning or financial position. It is a class distinction in America. The college degree is like a ticket to the super bowl, it gets you a seat at the game. Where you sit depends on where you bought your ticket.

The value of the degree comes from having successfully navigated the system of education.

It proves you know how to deal successfully with bullshit and can submit when necessary. It proves you know the rules of the game.

PETUNIA:

re college: “It proves you know how to deal successfully with bullshit and can submit when necessary. It proves you know the rules of the game.”

that’s BRILLIANT. when i went to school, i’d just come out of a group home/foster care situation and tried desperately to use my artistic talent to foist myself into some form of higher education so i wouldn’t totally go down the toilet i was going, and this older liberal arts college girl told me the first year is the test to see if you’re college material. she said to stay in because it’d get easier afterwards. they try to weed people out on purpose.

it got my competitive side to click in, but i didn’t realize how nefarious it truly was–like what you just said. the group think is creepy. artists copied or humped their teachers to get good grades.

and when i grew up and dealt with college admins, teachers, and students, i realized they could be skeptical and dissect and learn to think…but LEARN TO THINK like how YOU said!

James says the same thing as you. he’s the first to go to college in his family and realized when he got into engineering, they were all pussies willing to work harder for less money to keep their jobs and they’d bitch in private but clam up at meetings leaving James to protest alone (and eventually get fired). he said, “This isn’t what i went to school for.”

he was LOGICAL. you went to school to make more money. that’s HILARIOUS to me! because i (and a lot of others went) just went because i was told that’s what you do. even if you’re an art chick for whom all of school was a deadly fucking nightmare. in art school, even the artists are as uptight as accountants and as obsequious as any ambitious person. i guess anyone who wants to belong to any group is toast.

but college folks? amazing how they’re actually taught NOT to think, even and especially when it’s in their best interest.

they’re shrouded in clouds of bullshit and theory.

and people who live in reality and all its true MATH… they’ve somehow become code words for the “under educated” morons who vote for Trump. that in itself is so embarrassingly condescending. and embarrassingly WRONG.

man, that was too funny and RIGHT about rhinestone flip flops. i don’t need much anymore and i like it that way. more swagger that way. but just matching my $2.50 opaque bright pink lipstick to the side stripes in my workout pants can make my entire DAY.

From -915000000 dollars to +915000000 in 18 months.

Better than cattle futures!

I have this vision of all the financially conservative scattered throughout the country in their modest but paid-for castles surrounded by moats filled with the unfortunate, the ill-advised, the ignorant and the stupid clamoring for rescue……and we cant help them for fear they would pull us under also.

And fortunately, a lot of us have the means to protect ourselves. I started to put my assets in precious metals-gold, silver, and copper-jacketed lead.

vacuum tubes….$3.00 turned into $100.00 in 10 years.

Like all things, you best know what to buy and what to hold and what to dump.

And like the ‘markets’ it is long in the tooth.

Nilrem

pull you under? Merlin… they’re going to EAT you and your family.

“we cant help them for fear …”

Fear?

We cant help many of them because they not only don’t know, they don’t even suspect, how to help themselves.

To quote you again: “… ill-advised, the ignorant and the stupid …”

These amounts are no bigger than the Bernanke toolbox. Surely the boffins can come up with an extender for this round just like they did in 2008. I propose they print enough to send everybody $100K and call it problem solved, a biblical reset. Then cover the urban areas with Soviet style housing so the former debtors have an abode at a reasonable price (since they won’t be able to afford the standard million dollar house).

Stock market would skyrocket, making us feel rich enough to eat out 4-5 times per week, resulting in employment opportunities for all, including any “citizen of the world.”

That ship sailed in 2008. They should have let the people keep their homes. The resulting cash flow would have created a booming economy.

yes, but that would have hurt Deutsche Bank and Wells Fargo, and we can’t have that.

No it would not have hurt them. They were paid off, made whole, and they still let them take the houses.

Your “Requiem for the American Dream” post ( missing the reply button ) :

I pre-ordered the Chomsky book on Amazon, and it is due out in March I think. I think I learned about the book from an earlier post of yours.

I think I’ll buy the DVD ( which I definitely do not need . LOL )

https://www.amazon.com/Requiem-American-Dream-Noam-Chomsky/dp/B01BT1VXAY/ref=sr_1_2?ie=UTF8&qid=1478623481&sr=8-2&keywords=requiem+for+the+american+dream

This is the book :

https://www.amazon.com/Requiem-American-Dream-Principles-Concentrated/dp/1609807367/ref=sr_1_3?ie=UTF8&qid=1478623481&sr=8-3&keywords=requiem+for+the+american+dream

There are no reviews on Amazon for the book yet, but I am anticipating getting my copy eagerly !

Thanks for the recommend !

SnowieGeorgie

and PETUNIA-

I’ve got a copy of “Chaos Monkeys” waiting for me at the library now.

I suppose I should have added ‘sarc’ after the ‘loving’ comment on Ditch Bank and Weasel Fargo. Indeed the criminals made whole at our economy’s expense and the welfare on of citizens. Who have yet to wake up or just have shitty memories…thus the data that Wolf presents.

And Snowie George, you will find your eyes opened wider than you might wish with my recommendations on the DVD and Books….good luck, but it will be like pealing back the roof and see all the pimples in bright light on the necked ass of America’s ‘leaders’ and how they LONG planned every digression you now suffer. It fits with all on this page and every comment.

Tell your children to learn Chinese and become real estate brokers, or bartenders. As the kids say, everything is right in the mix.

Funny that no one but tens of millions of Americans thought of that. As Stigler said of IMF economists, “Second-rate students from first-rate schools.” If they were first-raters, we’d all be bankrupt.

Gorilla on a motorcycle ,5,6,7,8……

When the money being loaned out was created from thin air…who is harmed in a default? The counterfeiter who created it? It’s all a charade.

The system is absolutely dependent on a huge foundation of debt and the accessibilty to more of It. Why else is there BK laws to discharge debt or credit protection for student loan debtors? Our overlords know that access to become indebted MUST be preserved for the system to be perpetuated. Getting low on access to become more indebted? Look for more of it. After all, it’s all conceptual.

You can’t do a Donald in Italy and its the glaring weakness the bankers expoilt.

In Europe you don’t ” burn all your crops to eat the worms”

Does anybody here remember Vera Lynn how she said, we would meet again? Some sunny day!

i’m from the generation where i heard Vera Lynn’s “we’ll meet again” through Roger Waters’ agonized warble from Pink Floyd’s “Wall.” still plenty ominous, although I was listening to The Wall in the bathtub the other day because it suddenly seemed like a sweetly nostalgic, safe kind of despair compared to our current bat shit reality.

suggest you download the words to SHEEP and PIGS. So far ahead of their time as if they time travelled …..”good by blue skies” maybe in the near future as short as that tune is, it too may be foretelling.

Student debt on the rise? Well, at least the commoner can get a shot at an education of their choice. Sure, it feeds the antiquated and bloated higher education system. But there’s always gotta be some strongman getting a taste of the largesse in order to keep the money flowing.

If one attends a community college then transfers at two years to a public university, they can get a debt that’s not onerous for a decent 4 year degree.

I can think of a lot of other gov sponsored debt programs that don’t get down to the average joe.

yeah, so the commoners have a shot at degrees in any of the social studies to breed more SJWs with plenty of aggression and faith in the system. On the other hand, what can’t you become these days online without help of college? You can even enroll in NASA one on one training and mentoring with rocket scientists via skype at age of 9 and above. Can you imagine if you keep doing it till you are 18 without interruption of 7 hours a day school and standardized testing? But then again, who the heck needs 18 year old geniuses who create perpetual motors? Nope, we need SJWs to keep the system going! So get your kids to school, make them do their homeworks, deprive them of their own choices that they will never find out they have because they don’t have time for that, and then make them to get a debt and go to college so they can keep the system alive and be proud of their degrees!

“On the other hand, what can’t you become these days online without help of college? You can even enroll in NASA”

My son went to a notorious “party college” for one term, 30 years ago, for one term. So much loud noise in the dorm and vandalism of laundry and vending equipment he came home and took up old house renovation and rental to students in an adjoining college town. He is now in his early fifties and is well fixed the rest of his life.

Internet not even needed, then or now – just an enterprising plan and resolute execution.

Thanx for sharing! It is very inspirational! I have two boys myself and I can only hope they will have enough of critical thinking to always question ruling paradigm whatever it is. I can only hope that they will choose sustaining themselves and their families instead of moving to the cities alone for living independent lives, getting degrees for “better chances” or “better lives” and become completely dependent on government re clothing, electricity, sewage, food, shelter, and subsidies, when things go just a bit sour. When I look at the election map, it is very clear to me that the degrees only make you more dependent on help, not less.

“So how does the average person pay for the big ticket items such as a house ,a car or college.”

We have to recognize that the United States is not rich country any more. The average American has no business owning a house, a car or going to college. The average American needs to accept his lot in life.

We love wolf. Nobody will kill this host.

Apparently he doesn’t mind being right nearly all the time. That’s probably because his subjects are such worthy objects of criticism, evidently selected to maximize interest while minimizing the possibility of controversy. Global financial flounderings certainly seem to offer a lot of material.

You have to admit it’s a pretty clever basis for a blog.

my dear Walter Map, please don’t undermine and kill your own sense of romance and Cubs magic by insinuating to yourself that this blog was “clever.”

you CAN dare to believe in cubs magic and the magic of serendipity and being in touch enough to smell the ways winds are blowing and being a part of the zeitgeist.

i was gonna let this go, but we’re all romantics stumbling to find the light again so we can forge ahead into whatever’s next as our world disintegrates as it is, so that we can find NEW MAGIC.

so i couldn’t let it go because you ARE too much of a sweetheart after all. i saw you! yeah. even in the anonymity of here. there are only few basic human screams and i’ve tried ’em all.

and please forgive my presumptuousness. this is how i am in real life and why people wanna punch me, avoid me, or cry with me.

(smile)

but it’s my JOB…

besos, Mr Walter Map. you’re a total LOVE. dare to believe…just for today.

x

“dare to believe…just for today.”

Like I said, I’m am sometimes concerned that my comments are insufficiently alarmist. Belief is irrelevant. I know how badly it turns out.

–i’m talking about how you try to undermine your own compliment instead of letting it just …SIT there and be taken in. i think this blog wasn’t clever as much as Wolf’s own scream. that’s how art and projects of all kinds usually start out. our desperation for why something isn’t there, doesn’t exist. that’s why i think he found a corner. something special. and i have NO idea how everyone here ISN”T a douche bag when everywhere else on the internet, it can turn you off to humanity in a second. i don’t even understand how tinder and grinder have participants anymore. the internet inspires misanthropy on a whole other epic scale. but you know that.

(wink)

if Wolf puts through my other comments to you, i have to apologize as i feel i’ve overstepped on a COMMENTS board. but i’ve fallen in love with this place.

and i’ve even laughed about YOUR chicken jokes in the tub and laughed how CHICKEN just ignores you or says things with words i have to look up.

it reminds me of my estranged little sister and me.

yeah, i practiced this on HER first!

anyhow, i’ve lost a lot of the funniest people in the world to me, to suicide, and i had to find a way of escaping into my humor without it always keeping my safely distant from everything that hurts.

and so i see other funny people and when you all show your romance, it’s like seeing GOD. and i want you rejoice in whatever THIS blog thing is. it’s a fucking BLOG and yet i love it, too.

who knew so many cool people even still EXISTED???

so forgive me. you’re hilarious. i love how you DEFIED Wolf with your chicken jokes–but of course you would! this whole site attracts the badasses.

as an artist, it’s like finding Greenwich Village of the mind or something.

so forgive me for overstepping. i love it when you’re funny romantic over the top, pissed off, tenacious as fuck… i meant NO DISRESPECT.

i NEED for such people as yourselves to show me your slips of gushy romance and beliefs in magic. i NEED them. i crave them. because here in SF, i’ve believed in magic all this time, but that this place could die so easily and quickly…

i’m often in need of reminding of the reality of magic.

blah blah blah.

thanks for forgiving me. i’m often an asshole. i struggle with it.

(smile)

x

Walter is not the only one who “DEFIED Wolf” here…

:-]

Helping one’s children through college without debt generally is a smart thing to do, when compared to the debt loads. In the neo-liberal world the payment decision also encourages more clarity about a viable post-college life plan.

There may also be a component of early estate (no matter how small) distribution in the college expense payments. That estate trade-off would appear to be mitigated slightly by the current lower alternative asset reinvestment rates, trading foregone income for potential offspring income. At least, that is how some have described the thought process to me.

“We love wolf. Nobody will kill this host.”

oh man, that’s beautiful. apocalyptic love notes.

Stick around kitten, we love you too. :)

aw, thanks.

(huuuge smile)

x

My barber is a very successful guy. Has a nice house, two cars and a boat. Send two kids to college. His family love him. So, does the “FIRE” department. Most of his income, from cutting hair, produced daily in very long hours, day after day, is consumed by the :

F, financial/banking industry.

I, the insurance industry.

RE, the real estate industry.

He is the “FIRE” department slave. Paying monthly mortgage for 30 years, monthly payment on two cars and a boat and of an

insurance on all the above. Rent in a good shopping center. Student loan. RE taxes. All, parasite sucking his blood for many

years in the future. But, my barber live in a blissful ignorance, really a great guy. A happy guy.

I love the fact that when I was done reading this article, the bottom of the page had a caddilac ad for a car starting at 74K, which is a piece of junk. No thanks.

Beats getting a payday-loan ad. With something like this in the small print disclosure that you can’t read: “1,698% APR”

:-]

Credit card borrowing is UNSECURED DEBT which is not in any way collateralized and has a vastly higher risk of default and therefore a much higher amount of interest charged on it.

There are 3 components to interest rates.

Interest rates are comprised of:

1) real rate (typically around 3% historically)

2) inflation adjustment (now correctly at zero)

3) risk of default (now rising astronomically)

The risk of DEFAULT is higher than ever and will continue to rise.

mortgage borrowing binge:

a) the common man wishing to purchase a home.

So what if they owe .. as long as they make the repayments.

Property will only increase in value.

If they default .. the property is regurgitated .. & making money for the lender once again.

b) the property investors .. who never sell .. but list & pretend to sell .. so as to increase the value of the property .. to increase borrowing capacity .. this is the hot air in the property bubble .. this one is bad.

student loans:

a) either they are real & if these loans are not repaid it is that there are no jobs .. this is the fault of the government & the banks & the bad luck is that the nation is being run by an inept political & financial/banking sector.

b) the loans & students are fake .. corruption within the political & education system .. outright fraud.

credit cards:

Q: can one get a credit card in the USA without credible financial capacity to service the credit card ?

as long as you can make the repayments .. where is the problem ?

who is the consumer ?

this is the 6 million dollar question

if it is the common man there is no problem

but when the common man is blamed

when in fact it is the hotshot milking the system

I love it when they say debt per household is up to alarming rates in Australia .. they are talking about me .. I don’t owe diddlysquat to no man .. it aint me.

I musn’t get it .. hey !

A few years ago:

I have a credit card – in credit most of the time.

I own a property outright – kaching man.

I have a bank account.

I have no job at the moment – welfare / lose change.

I want a second bank account & credit card – I go to a new bank.

They refused to give me a credit card ….. ( ? )

Are they insane – go figure.

I am the best credit risk they will ever have.