The red flag: “slump” in imports despite the Strong Dollar

The dollar has strengthened against other currencies since mid-2014 as the Fed was tapering QE Infinity out of existence, and as it began flip-flopping about rate increases. Dollar strength should have done two things in terms of international trade:

- Weaken exports as US goods would become less competitive for buyers using other currencies;

- Strengthen imports as imported goods would be cheaper compared to US-made goods.

The first has happened. But the second has not happened: Imports have been in a down-trend since mid-2015. This is something that should not happen when the dollar is strong, and it has flummoxed the folks at the New York Fed’s Liberty Street Economics:

The growth in US imports of goods has been stubbornly low since the second quarter of 2015, with an average annual growth rate of 0.7%. Growth has been even weaker for non-oil imports, which have increased at an average annual rate of only 0.1%.

So oil imports cannot be blamed.

This is in sharp contrast to the pattern in the five quarters preceding the second quarter of 2015, when real [inflation adjusted] non-oil imports were growing at an annualized rate of 8% per quarter.

The timing of the weakness in import growth is particularly puzzling in light of the strong US dollar, which appreciated 12% in 2015, lowering the price of imported goods relative to domestically produced goods.

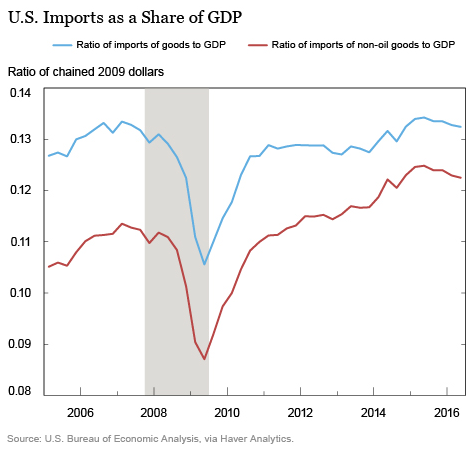

The “recent slump” in imports of non-oil goods becomes clear in this chart that shows imports as a ratio of GDP, adjusted for inflation. The ratio of non-oil imports = red line; the ratio of total goods imports (including oil) = blue line:

The analysis looked at imports by its major components and found that imports of capital goods – equipment that businesses buy and invest in to expand or improve their operations – were “quite soft” from Q2 2015 through Q1 2015. Here’s why:

Early in 2015, this weakness in capital goods was due in part to declines in drilling-related equipment imports, while in the first quarter of 2016, it was due to other subcategories, such as telecommunications and aircraft.

Where are the American consumers?

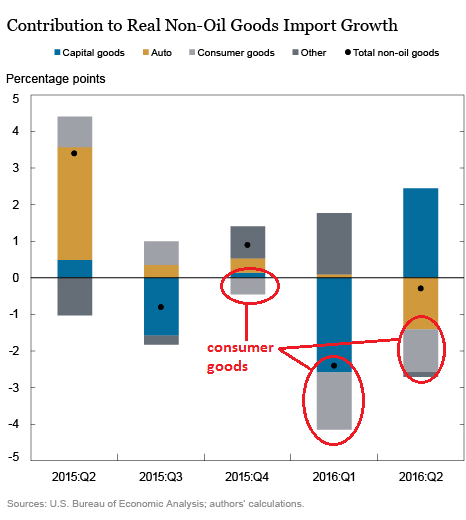

Another striking feature is the negative contribution from consumer goods in the period from the fourth quarter of 2015 through the second quarter of 2016: despite the strong dollar, US consumers and retailers were not switching to imported goods.

That’s not supposed to happen, according to economic modeling. The chart below shows the contribution to import growth of capital goods (blue), auto (yellow), consumer goods (light gray), and other (dark grey). The black dots inside the columns denote total imports of non-oil goods – a drag on imports in three of the last four quarters.

I circled the consumer “contribution” to imports over the last three quarters: that “contribution” has been a big drag. Note that the contributions from “auto” also turned into a drag in Q2, which is when growth in the US auto sector began to wane:

And business investment in equipment is weak.

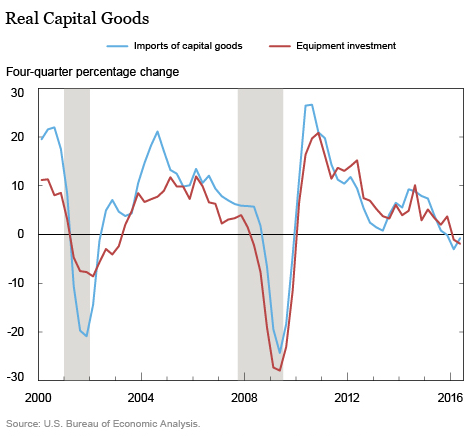

Imports of capital goods are “very highly correlated” with investment by businesses in equipment. Alas:

Equipment investment has been unusually weak, with its four-quarter percentage change falling into negative territory, which is unusual outside a recession period.

These data suggest that the slowdown in import growth likely stems from whatever is behind the weakness in equipment, rather than from trade-specific factors such as trade policies or higher trade costs.

This chart shows the deterioration of imports of capital goods and equipment, adjusted for inflation. Note how the declines in the prior two cycles were followed by recessions:

“Standard economic models” predict that a stronger dollar should push up imports by making them cheaper for US consumers and businesses, thus increasing demand for them, the analysis points out. But that’s not happening. Demand isn’t there – demand from consumers and from businesses.

There has been much speculation in the media and by economists and free-trade gurus how the now obvious deterioration of global trade, which we have documented in numerous articles, is a function of recent anti-free-trade movements and policy changes, as supposedly nervous nations are starting to build up hurdles to trade. But for the US trade picture at least, this just isn’t the case, the New York Fed analysis says.

Instead, “the recent slump in import growth is primarily a reflection of weakness in other parts of the US economy.”

Businesses have been loath to invest in business equipment and expansion. They have used the record proceeds from their borrowing binge to buy back their own shares and buy out each other, rather than invest.

And consumers are dedicating a big part of their spending to health care and housing costs, which have been soaring, and college expenses fall into this category as well. These costs mostly don’t impact imports. But by the time consumers get through paying for them, many of them don’t have that much money left to buy enough other goods to move the needle.

While waning imports help lower the trade deficit and thus help nudge up GDP, they signify weak demand from US consumers and weak investment by US businesses, conditions that are usually associated with recessions.

This is how global trade is playing out in the real economy: Orders plunge 87% for Korean shipbuilders from an already terrible 2015. Read… Done in by Overcapacity, Stagnant World Trade, and China, Korean Shipbuilders Collapse on Top of Taxpayers

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Net income for labor is already spoken for . Demand has been pulled forward about as far

as it can go.

Gosh…Lets See here..? What part of the ‘Basic American Consumer’ is Broke with credit cards maxed-out….Do these ‘Economic-Einsteins’ and ‘Consumption/Production Guru’s’ not Understand…? lololol thanks for reading

“Do these ‘Economic-Einsteins’ and ‘Consumption/Production Guru’s’ not Understand…?”

They understand perfectly well that their jobs depend on the continued ignorance and capitulation of a majority of people.

Economics as practiced is now the propaganda division of the Financial Industrial Complex. Like everything else it had to be corrupted to serve the interests of TPTB.

Ah…the Shadow of Edward Bernays…Slithers across the ‘Economic Carcass’ of American Business….lololol Though in a sense of clarity and candor..I truly believe some of them can not see the “Forest for the Trees”…..thanks for reading,aloha

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in a democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government, which is the true ruling power of our country. We are dominated by a relatively small number of persons who understand the mental processes and social patterns of the masses. It is they who pull the wires and control the public mind.” -Edward Bernays

Perhaps this is changing, and the masses are waking up?

I am not in any way a trained economist. I have been reading various sites and blogs and worked through Sowell’s Basic Economics (as well as PJ O’Rorke’s “on the Wealth of Nations” analysis). I can’t help but wonder what is keeping this whole system going. I see Deutsche Bank in Germany with Siena in Italy, the Abenomics in Japan, China’s tottering remnant of communism, the entire EU economics, and the crazy gyrations of our own stock exchanges. Add in an insane if amount of debt and interest rates without any cushions and this should have collapsed a while ago. How the heck is this game still going on?

Excellent questions!!

Dont have the answer to his question.

Have the answer to you article question.

NPL’S and zombies.

Zombie company’s, being supported by NPL’S, are preventing healthy companies from growing or even making a profit. Everywhere.

Then world is not drowning in debt.

It is being drowned, by the results of that debt, the zombies.

On a happier note, the live version of “Citizen Kaine” is almost over.

Look’s like Kaine loses, again, this time, to a Woman.

God help America, if I am wrong.

“How the heck is this game still going on?”

Massive debt and an almighty deity with one horrific sense of humor. But mostly debt.

The world economy is actually bankrupt. The banksters are just holding off on the notifications.

Walter, Probably insolvent and not yet actually BK. BK means actually admitting you are insolvent. Arrogance keeps them from admitting that and the FED buying what ever assets they have that are worth buying. I say this can go on as long as there is still some semblance of worth in their assets. Pretty difficult though when the revenues keep falling.

I will give your question a shot. The economies are surviving the same way an adulterous marriage survives, one spouse pretends they don’t know.

They are lying about the inflation in the economy. Do you really think any house is worth 100M, 10M, or in an average neighborhood 1M. It isn’t.

Do you think any of the tech companies are worth 1B, 10B, 100B, they are not. Traditionally most companies are worth around 10X their income stream. Most tech companies are barely profitable.

The federal reserve is sitting on all the bad debt they purchased from the banks. The debts were purchased at full face value. If the debt was really worth what the fed paid, the banks would have been able to sell it on the open market, but they couldn’t, so it isn’t worth the booked prices. But since the fed is not subject to audit, we have to take their word that the system is solvent, which helps to keep up the pretense.

Speaking of audits, how many firms have gone under in spite of having glowing earnings year after year, too many. Financial statements are now masterpieces of deception and obfuscation, they hide much more than they show.

You can extend these examples to other countries, where some may be more extreme than others, and there are many more reality milestones, but I think this is a good start.

Yes, I definitely include companies that are worth billions with few assets and little to no real profit. I am out of the market except for a few legacy shares I won at companies and keep for old time’s sake. I also agree with Walter-the banksters haven’t let us know because they have been hiding things and are eventually going to run out of hiding places. A saying I have seen is “a thing which cannot go on forever will not go on forever. I fear what may happen after the election as I fear the markets have been propped up up to the election and God knows what is coming after.

You’re absolutely right on that account. Those tech companies are junk (just look at Fitbit or Twitter) and that crap shack in Cupertino is not worth $2 million.

The entire Bay Area tech economy is a build upon money printing.by the Central bank. You got too much money chasing too few good companies.

The whole thing is a house if cards. I am sure Fitbit is going to be a great long term business for California like McDonnel Douglas was.

How is this game still going on? I’d say the simple answer is that the decision-makers are extrapolating past their data sets. All the current economic models ignore the impact of declining real median incomes – choosing instead to look at average incomes (If a man worth $10 billion dollars walks into a bar where nine people with an average income of $50,000 are sitting, the average income of the folks in the bar is $1 billion dollars ($10 billion divided by 10) – but the median income is still $50,000.)

Given that the average consumer took a big hit in the Great Recession, and are not inclined to take on more debt if they can avoid it, it’s not surprising that import volumes are down. It’s an obvious result of the dropping number of people who can afford to buy consumer goods.

My big box employer is not seeing any value in its supply chain?

A couple of shipping collapses / restructures and rates should come back down to more manageable levels?

Shipping quotes are all over the board like they are being run by HFT outfits?

Looting through war for NWO is my guess.Syria has nat gas, that supplies EU,gold,oil.Russia protecting it for a price I am sure.Obama’s red line propaganda failed.

“Unusual outside a recession period.”

But perfectly normal during a recession, which is over ten years old now. U.S. GDP growth last peaked above zero briefly in 2004. That peak was so weak a valid argument could be made that the present recession is really over fifteen years old, dating back to the pop of the dot-com bubble:

http://www.shadowstats.com/alternate_data/gross-domestic-product-charts

That this condition is likely to be more or less permanent is left as an exercise for the student.

“The economy is doing great, anyone saying otherwise is peddling fiction”

Says your legislators.

“Says your legislators.”

Governments are convenient to you as scapegoats, particularly since you have found them easily corrupted and therefore easy to blame, but they as much the victims of corporatists as everybody else.

I can continue to expose your schtick for what it is for as long as you want to catapult the corporate propaganda.

Debt is the fuel that keeps it all going. Can people and gov get more in debt? Yes!

If you have doubts, look to Japan as your guide. Can interest rates go lower? Yes. They almost have to in order to keep the charade going.

They can go into debt until they can no longer make the payments. It may not take much more than 25 or 50 bps. Or a little loss in their net worth with a real market correction.

It’s not charades to have 5 trillion parked at the fed while social security is more under funded than the post office!

10% Y-o-Y decline in store sales….. this is the latest from a popular mall store called ‘The Buckle.’ Granted, demographic trends aren’t in their favor currently or the next few years. But double-digit drop is a severe drop outside of a recession.

“The Buckle” sorta has a crippling choice of name for a business.

From”Q2 2015 through Q1 2015″ is a neat trick if you can pull it off. (9th paragraph)

You really must stop reading in the mirror!

May i offer the services of a copy editor?

Aloha friend…you KNEW what he meant…lolol As if you have Never made a mistake in your Life..? lolol

“The analysis looked at imports by its major components and found that imports of capital goods – equipment that businesses buy and invest in to expand or improve their operations – were “quite soft” from Q2 2015 through Q1 2015”

A typo? I think it should read Q2 2015 through Q1 ‘2016’.

Glad you did not repeat the “secular stagnation” brainf*rt designed to blame the victim for the crime.

“US consumers were not switching to imported goods”

i just sit back and shake my head and laugh at the confusion these “smart” people are having.

we’ve destroyed the middle class in the USA via offshoring, HB1 visa’s and importation of illegals and nobody can seem to understand the lack of demand.

give them my email address, I’ll explain it to them like they are a 2nd graders…..it’s not freaking rocket science folks, it’s just math.

i barely have enough to spend on survival…..how am i supposed to buy anything else?

“we’ve destroyed the middle class in the USA via offshoring, HB1 visa’s and importation of illegals and nobody can seem to understand the lack of demand.”

Don’t forget the rise of automatons which are replacing human labor:

http://wolfstreet.com/2016/10/25/why-jobs-arent-coming-back/

The automatons aren’t buying the autonomous output.

Walter

We’re having the “Wiley E Coyote” moment before Mr Coyote falls into the canyon.

if you export all the good paying jobs either to China / Vietnam / India / Korea and we’ve only had a bartenders and waitresses recovery, then you eventually run out of consumers to buy your stuff. The concept of exporting the cheaper manufacturing of low priced cars to Mexico is good for Ford and its shareholders but doesn’t give the guy still in Detroit a chance to make a living wage.

Now you’ve got newer technologies like the iPhone ecosystem where the phones are made @ Foxconn in China and the $10-14/hr jobs of being phone guru support tech and that’s it. Now Apple isn’t even paying any taxes in Ireland anyways so the whole gig is moot as these governments are bankrupt.

Agreed. Here, at least, corporate predators really aren’t fooling anybody, even when hiding behind official imprimaturs.

But the politicos although great at giving us poison water and selling our manufacturing jobs, they’re also great at selling firearms. 3rd quarter of 2011, Smith and Wesson did $92m in sales and now they’re doing more than $200m

How’s that CIA/DEA Mexican gun running operation coming along?

“But the politicos although great at giving us poison water and selling our manufacturing jobs, they’re also great at selling firearms.”

You’re still pretending the blame lies with the puppets rather than with the puppeteers who pull their strings.

LOL,

I just read thru the comments. Just send the economists a link to this thread and presto, all is explained as i attempted to do as well!!

Some economist somewhere: “It’s strange, but it’s only now that I understand that you need money to buy things. ”

LOL.

It will be interesting to see what Holliday sales will look like ….

The stagnant wages for the last thirty years is the obvious answer. The bigger question is “has this decline in purchasing power over a generation caused a permanent change in the behavior of consumers?”

What I see is the generation of millennials rejecting the entire concept of being a “consumer”. Forced to re-evaluate the American Dream because they can not afford it. So they are creating an entirely new value system on what it takes to be happy and it doesn’t involve buying a lot of cheap plastic crap to impress your friends.

Demand is going into a permanent decline due to changing behavior, lack of disposable income, an overage business cycle, and a shrinking generational cohort.

Printing free money and giving it to a handful of bankers who hoard it amongst themselves will not fix any of these externalities.

I think you’re going to see a generational downshift in demand for buying houses by millenials, due to several factors —

High student debt.

Low incomes and unstable jobs.

They have a cultural bias against “stuff” to begin with, and unstable jobs means staying mobile out of necessity and not accumulating a lot of stuff to drag from place to place.

Not having a lot of stuff means you don’t need a house, or need less of a house, to store it.

Houses have become ridiculously expensive relative to incomes in most places the mobile want to move to.

The decades-long cycle of spreading affluence through rising house prices fueled by both rising incomes and rising debt levels for the mass population appears to be coming to an end.

I work for a company that exports 90% of its product to the USA. We have not decreased our US price at all, even though the C$/US$ has moved massively in our favour (in fact we upped our C$ prices at home). We have chosen to keep the exchange gain to compensate for the reduced volumes due to a slow economy – and in our industry reducing prices would not significantly move sales volume higher. Net result, even with slower sales we are still doing quite well.

Housing costs and healthcare/insurance are reducing disposable income. Those that have any disposable income are either paying down their debt or are spending their money not on inferior imported goods but rather on entertainment in the form of subscriptions, dining, travel and entertainment. Retail doesn’t want to admit that consumer tastes have changed. Macy’s is reducing their footprint and shedding jobs as are other struggling retailers. Amazon is taking away brick and mortar retail business. I live in a town that has had the most sales per zip code for many years and I can see empty store fronts in prime locations sitting vacant for a long time.

If you want to measure the state of retail in America, you take a walk up and down Madison Ave in New York City. This is where the wealthy shop. You can probable deduct 1% of national retail sales for every empty storefront. When the rich don’t spend, you know it’s bad.

To a lesser extent you can do the same on Worth Ave. in Palm Beach, FL. If there are any empty parking spaces on the street, watch out.

This adds to the strain on local property taxes when the owners appeal their assessments based on the vacancy. The burden shifts from commercial property owners to residential homeowners. Here in NJ it only gets worse as municipal, county and school taxes go up faster than household incomes. Why spend on stuff when you know next quarter’s tax bill is going up?

I just read that property taxes in Dallas, TX may have to go up 130% because all the cops are cashing out their pension money. Every level of govt sees a homeowner like an ATM machine. Get out while you can, it is easier than you think.

S.Brock

Avid reader. If everyone is in debt, then who owns all the debt.

Owners of the this debt are the entities with “assets.”

Debt has two sides: it’s an obligation for the borrower and an asset for the lender. It can be repackaged and sold in various ways. They’re putting subprime auto loans into asset-backed securities, just like they do with mortgages. “Securitization” of consumer loans, including credit card debt, is big business. The loans are owned by the lenders. Or they’re repackaged (“securitized”) and sold to pension funds, investors in Japan, hedge funds, mutual funds…. you name it.

Student loans owned by the government are the exception. Default rates are huge. And so the government is going to eat the losses on these assets.

The Federal Reserve Bank of NEW YORK

you PAY on and for it.

– Quite simple. The US consumer got a windfall profit from falling oilprices and decided to save that profit/pay down debt instead of spending it.