These US Markets Have Cracked, and the Cracks are Spreading

“There’s enormous risk in public markets because that’s the one that central banks have distorted to the greatest extent,” El-Erian, chief economic adviser at Allianz SE, told Bloomberg TV, in reference to stock and bond markets. He confessed to the heresy of holding 30% of his portfolio in cash.

“It’s very hard to say I’m going to buy a basket of public equities and go to sleep for the next five to 10 years and feel good about the returns. Similarly with bonds,” he said.

These “public markets” are not the only markets that central banks have totally distorted and larded with “enormous risks.” Practically everything that is an asset has been inflated, including residential and commercial real estate in much of the country, and assets that are the objects of admiration of the wealthy: collector cars and art.

But these markets have started to crack at the edges, and some of the cracks are spreading.

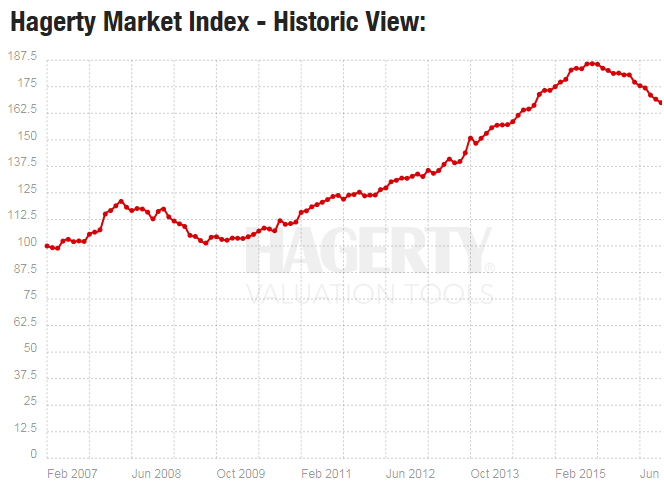

Collector car prices fell again in October. They’ve been on a relentless skid since their peak in September 2015, according to data by Hagerty, which specializes in insuring classic cars. Auction activity experienced “another significant drop this month,” Hagerty reported. Over the past 12 months, the number of cars sold at North American collector car auctions has dropped 8%. Among the other observations:

- Requests for value increases for broad market vehicles fell for the 13th consecutive month.

- Requests for value increases for high-end vehicles also decreased, but only by about half as much as did broad market vehicles.

The Hagerty Market Index – which is based on change in dollars and volume of the market, “similar to the DJIA or NASDAQ Composite” – fell 1.7% in October to 167.51. The index, which tracks 66,000 transactions of classic cars, is now down nearly 10% from its peak in September 2015. A gradual but relentless decline:

Note that the decline is similar in magnitude to the one during the Financial Crisis, before the Fed QE and ZIRP bailout kicked in. Now, there’s no bailout in sight. QE is gone. And the Fed is flip-flopping about raising rates.

The index had soared 86% from the trough of the Financial Crisis to its peak last September. Like other assets, it started its ascent when QE and ZIRP became the law of the land. The people who invest in collector cars – which may sell for millions of dollars, with the record at around $38 million – already own a lot of other assets.

So these folks became instant beneficiaries of the “distributive consequences” of monetary policies, as central bankers call it when QE and ZIRP purposefully and resolutely redistribute wealth from labor to those who hold assets, from prudent savers to Wall-Street speculators, from those who hold the least to those who already hold the most.

Fed economists publicly discuss the “distributional consequences” of monetary policies as if they were a some unavoidable side effect, rather than the primary goal, in line with what Bernanke himself had called the “wealth effect.”

Classic cars had soared 490% over the past 10 years, including the dip during the Financial Crisis, followed by the Fed’s bailout of investors. But these “distributional consequences,” however hard central banks are pushing them, are starting to run out of juice, it appears.

There had already been a wake-up call in February, as stock and bond markets were coming unglued: The Hagerty index experienced its steepest drop since the Financial Crisis.

“Right now, there’s a focus on global markets, and you’re seeing that filter through to the classic-car market,” Brian Rabold, VP of valuation services at Hagerty, told the Wall Street Journal at the time.

Andrew Shirley, editor of the Wealth Report at property broker Knight Frank, told the Journal that wealthy investors are having second thoughts about collectibles. “People who want to collect are still spending bucketloads,” he said. “But if you dig below some standout sales, at quite a lot of auctions you find lots that don’t get sold or make their reserve,” referring to the minimum bid.

The art market too went into convulsions. In March, at the big auctions in New York, sales plunged, sending shivers through the market. The turmoil has since spread.

Speculators, especially “young speculators,” are getting hit hard in the current downturn of the art market, Todd Levin, director of Levin Art Group in New York, told me in a phone conversation the other day.

During the Financial Crisis in late 2008, early 2009, the art market, after soaring since 2000, “seized up a little bit”; it was a “manageable depression,” he said, with “some panicky shifts.” But it was brief.

As soon as QE and ZIRP kicked in, the beneficiaries of these policies plowed money into art. Volumes picked up. Prices recovered at lightning speed. Since then, the art market has been “skewed” by global QE and ZIRP, along with the sharp gains in stocks, bonds, and real estate, to form “a perfect storm” for creating a “bubble,” he said. By the first quarter 2015, the art market hit its “most frenzied levels.”

Now the market is “reverting to normal, to a healthy market,” he said.

For “young speculators” who jumped into the market and bought the works of young artists, “looking to flip the work” after making outsized gains in the shortest amount of time, as only a bubble allows you to do – “now they’re finding out that they’re the end user.”

“Buying your peer group is wonderful,” Levin said, in reference to young collectors buying young artists. It offers a lower entry point and a lot of upside potential, though it comes with bigger risks.

In recent years, prices of these works have seen “vertiginous ascents.” But speculators who were buying with the intention of flipping can’t get out, now that prices for many young artists have plunged amid a “glut of work,” as sales volume has dried up. That was never part of the plan.

Speculators have approached the works of young artists with an IPO mentality, Levin said: Get in, make a lot of money, and flip it. Some of the works they bought late in the cycle in 2014 or early 2015 may lose 90% of their value. And some may never recover.

So “reverting to normal” can be a harsh and painful trip for speculators who got the timing wrong. “Depending on what your sense of normal is,” Levin said, for some of them, the trip “feels more like a crash.”

Has this sort of asset price inflation run its course because in the end, the real economy has languished? “We’ve been patiently waiting for the consumer.” Read… US Freight Volume Drops to Lowest Level since 2009, “Industrial Recession” Hits Full Stride, Overcapacity Crushes Rates

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“now they’re finding out that they’re the end user.”

Love that line – direct that to be used often from now on.

i’m donating my 1998 vw to goodwill, 201k miles and creaking, and invested 3k in a 2003 volvo with 125k miles. hope to hit 200k.

that’s my kind of classic.

though a 57 detroit iron belair convertible would be nice.

as to the auctions, old farm equipment’s been dropping for a few years.

‘Practically everything that is an asset has been inflated’

Yep, about the only sectors left, that haven’t had massive bubbles blown, are precious metals, gold miners and oil to some extent. Hence why I’ve loaded up. That said, I don’t see any crash-to-end-all-crashes for a very long time if ever. If you truly believe the coming crises (plural) are about debt & currencies then you only need to look to Venezuela & Argentina markets as your guide. Click on Historical & Max

http://www.tradingeconomics.com/venezuela/stock-market

http://www.tradingeconomics.com/argentina/stock-market

So do these markets, in countries trapped in a depression, look like they’re crashing? When the local currency devalues ‘everything’ becomes more expensive inc. equities. But choose wisely…as those NOT providing basic necessities like electricity, communications and gas & oil transportation will be the biggest losers. So buy the BIG dips and dollar cost average in.

Venezuela stock market is a damn good example to build your investment strategy.

I agree with you that a central bank can keep a stock market afloat for a very long time (Zimbabwe in the 1990’s comes to mind too).

But I wonder whether a fundamental difference between those countries and the West is the size of bond markets in the US and Europe. These will probably start selling off, when yearly inflation figures get over 5%.

One already sees inflation creeping up (over 2% yearly) in the UK.

Heard an interview with Gary shilling a few weeks ago. He’s been a bond bull fir decades. He said his fund is almost 50% cash, the most it’s ever been.

Isn’t he still lo0king for %1 on the 10 year

Pretty much true of the thoroughbred auction market where the high end blood stock has deflated somewhat, but is still holding value while the bottom has fallen out of the lower end of the sales market.

Tobias,

Thanks for the info. Interesting.

To help me out a little, what the’s typical price range at the “high end blood stock?”

“To help me out a little, what the’s typical price range at the “high end blood stock?”

Very location related a cloned proven cutting horse, or a premium natural one in some parts of the US, 7 figures.

In another country, what it weighs, based on current dog meat retail prices.

I have worked on bankruptcy cases where some of the key assets were horses. A proven winner with good lineage can easily fetch > $1 million, and can charge $5K or so in stud fees. Multiple this by 100x per year and it adds up to real money. On the other hand, “professional” horses are like pro athletes – most of the money goes to those at the very top, while the rest of the lineup scratches a living at the league minimum. Yearlings of proven stock can fetch $5K, but they had better win, or end up as dog chow. If a proven winner’s descendants don’t win, then their stud value can drop quite rapidly as well. On another note, my understanding is that the quarter horse market is now dominated by Mexican cartel money. Thoroughbreds not so much.

Thanks, David. Makes sense.

The average at the Keeneland beginning session this past Sept. 2016 was $319K. The first few sessions sell the premium yearlings or future racing stock and each session thereafter is considered to be descending in terms of quality. The last session, which is the 13th, sells the more risky, but not necessarily hopeless pedigree empty entrants, and the average for that session was $7K, with the median being $3K.

Sales of future racing stock (which comprise this Sept. sale are yearlings that will race next year)—have been falling in price since 2008 year after year and are now approx. at half of what prices were in 2008. Consequently the amount of broodmares going to stallions has halved as well. In fact it is more like 60%. So the dynamic is that only the better broodmares are being covered by the better stallions and yet the market for these fewer and presumably better horses is in a contraction that is quite startling. The externalities of this are effecting the racing industry as a whole since less racing stock means that less race tracks can put on a full program of racing due to a scarcity of race horses. Additionally, there has been a consolidation of horses to top trainers whereby the same time trainers and owners are being driven out of the industry in the manner that Walmart invades a community and eliminates competition. It is a micro economic environment that has some very interesting phenomenon occurring and is worth watching as a barometer of how the wealthy have pulled back on their expensive hobbies that contain elements of risk disproportionate to art collecting and car buying.

Thanks. Fascinating!

I’m glad I asked. So much to learn.

I like this paragraph.

“central bankers purposefully and resolutely redistribute wealth from labor to those who hold assets, from prudent savers to Wall-Street speculators, from those who hold the least to those who already hold the most”.

how come people can’t see that this has taken place? or are they starting to see it?

I welcome any comments.

Maybe most people see it, they just don’t know what to do about it. I know I don’t…

The SEC exempted federal lawmakers from its anti-corruption rule, unbelievable

Hillary Clinton And Wall Street: Financial Industry May Control Retirement Savings In A Clinton Administration

http://www.ibtimes.com/political-capital/hillary-clinton-wall-street-financial-industry-may-control-retirement-savings

There’s a lot going on at WikiLeaks (@wikileaks) | Twitter tonight.

Spock,

Like it? I love it! But you left off the euphemism, a thing of beauty,

“distributional consequences”

When I get my electronic bumper sticker that definition will be on the rotation.

People do see what’s happened, but they don’t know what to do about it. Ergo, they seek a degree of comfort in denial and end up frozen in place. That’s not a viable investment strategy; its a form of financial self destruction . When the pain becomes intolerable, they will sell and that will be the bottom…… possibly years from now.

how come people can’t see that this has taken place? or are they starting to see it?

They’ll see it IF the Fed raises rates. Doubtful in Novemener but if trump pulls this off, most likely we will see an increase in December. This is the key to “seeing it take place”, what the Fed has done. It cannot raise the daily funds rate without crashing the markets. We all saw what happened in January 2016.

That Feb 2015 peak and the entire ramp-up to it was “bought” with newly printed money (zeroes and ones). It was a massive energy burn, a one-shot resource extractive extravaganza, the final hurrah of our consumption and waste-based economy. Now we’re on a slow ride down with most likely a steep drop-off dead ahead — think Dante’s Inferno. You have to admit, it was one hell of a party — if you were invited.

It’s not a party … but a nightmare .. and we’re all in it

At least they’re keeping us entertained with a presidential clown show and the Kardashian clan — all part of the nightmare I suppose.

Entertainment? Okay, well I’m really looking forward to the season finale!

Trump can’t believe Hillary made it through the debates without drugs. Telling ya, if there was another, don’t believe I could make it through another debate without drugs…

Well, most of us definitely were NOT on the guest list.

But a lot of us were at the fence looking in or in the line pleading with the doorman.

That’s why the rage now is so very palpable.

Please explain why it’s one shot. The system is still captive to Central Bankers, etc. Remember that the Fed hasn’t officially ventured into stocks and corporate bonds yet. Please explain why prices would not rise when the Fed has an emergency mandate to buy the above.

By “one shot”, I am alluding to the massive debt binge and associated full press propaganda campaign that promised to make America “energy independent”. They drove the price of oil up high enough to frack and squeeze those shale plays for all they were worth, in the process generating another boom of debt-fueled “good times”, the biggest ever, a grand finale. That was the one shot. Now as the shale fraud falls flat on its ass, the world is left to ponder the fact that it is almost entirely dependent for its energy on legacy fields that are very old, largely depleted and currently being squeezed for their last few precious drops by very costly technology. The end has been in sight for a long time, it’s just that now we’re drawing very close to it.

“The system is still captive to Central Bankers, etc. ”

Indeed. And the consequences were predictable:

It should be obvious that it is a mistake to leave financial and economic policy to the pirates. Forget nationalizing the banks for the time being. Start by nationalizing the currency.

Having owned several classic boat anchors in the past I can say with absolute certainty the market is in an extreme bubble. Just look at what is now considered ‘classic’. Anything between1975 and the early 90s is cringe worthy in terms of style, reliability, rust issues and safety yet look what people are asking for this automotive dreck. There is a very large annual classic car meet near me in Bothwell, ON which I get to every other year or so. They have a fifty-fifty draw which I use as a yardstick to measure classic car pricing insanity on a somewhat local level. Last year the total was $44,000. This year it was $60,000. That’s a 36% increase in case you were interested. Blow off top anyone? Next August will be the tell.

“As soon as QE and ZIRP kicked in, the beneficiaries of these policies plowed money into art. ”

This is the smart money, by definition they’re not victims of bubbles, right?

But it’s nice to know their winnings weren’t wasted on schools, bridges and infrastructure, which are all bubbles as well.

The hard part is getting out. When prices begin to sag, liquidity dries up. Suddenly there are no buyers at survivable prices. For buyers to emerge, prices would have to drop a lot.

That happens in real estate too. The RE market is only liquid on the way up. To get out and keep your gains, you have to sell early.

going to cash when there’s lot of cash around. the conundrum.

Wolf: Well, yes and no. As we discussed, those who had invested (or speculated) recently in younger, fashionable Art that is more of the IPO variety definitely have the concern of few or no buyers at survivable prices. But that is not the case across the board (the Art Market is not a singularity – it is a vast plurality). When the sky was falling in the final quarter of 2008, I had a client who had to raise a mid-seven figure sum in a week’s time under intense pressure. We sold a basket of four blue chip contemporary Artworks he had purchased with an average hold time of four years. The ROI was about 300% – in mid-October of 2008! So getting out can be very hard, or it can be very easy. It all depends on who your Art Advisor is!

And luckily another this upwards it would fall was invested in, you know productive assets. Because who on earth would want to do that? Some of that money would end up paying wages to working people maybe even building up the average wage … certainly wouldn’t want that. Better to burn it all up in a great big bonfires of Vanity and importancy display. I’m pretty sure Veblen had a word for all this but I can’t think of it at the moment.

Maybe you are thinking of ‘honorific waste’. I believe he coined that term.

The high end auto collector market of online auctions, has not received the memo. Yet. I follow auctions. Check this item with a current bid of a cool one million dollars and almost four days to go!

http://www.bringatrailer.com/listing/1955-lancia-aurelia/

Sold 2014 for 1.1m… market is softening. See Barret Jackson results from LV last week

A lot of the hedge fund types were buying guitars back in the early 2000s, especially those previously owned by guitar gods. I wonder how those prices are holding up?

Some things never change. Much of what has been going on in the world in seems to function as stock-market manipulation.

The bad news is nothing lasts forever

The good news is nothing lasts forever

Hold on to your hats folks…

So- when rates start going up…. 1/4 point or so ~ lets say each year for the next 2 – 4 years, does the bubbles reduce in size, slowly or does everyone freak out and it all crash….? Assuming Hillary, no wars, flat, 2016 economy, freight remains at 2016ish, oil $50. calm seas….. No sharp ups and no sharp downs….. Does the bubbles have to pop, Why yes, because there is a bubble everywhere and they will all drop? because with everything going down everyone freaks out at once…..yah, I know answered my own question….

I saw outlookingin’s post and the red Dakota caught my eye:

http://bringatrailer.com/listing/1989-dodge-shelby-dakota/

I got a PJ ’88 V6 long bed auto with the paint-fall-off option most white and grey vehicles had back then, Great machine, makes me wanna paint it and get it auction ready !

I have an interesting hobby, collecting and restoring old tv sets. Some have a $500. – $2K. value, there are collector websites, and price points for many models have been soft for about 2 years, some like me are turned off at some highs reached.

I think some of the price run-up on tv’s beany-baby stuff maybe even fans is low end speculators with only $500. to invest, and just wanna drive up the price of crap for beer money….. With some of the crap on cable – every hill-billy is a collector now…..

Take a look at craigs list a lot of old cars rusted to hell are on with hefty asking prices.

The markets are waiting for the shadow banking system to give up the ghost!

Watch 2017 when statements go out! Money coming out and less going in? It will take a panic in one of the insurance companies usually prudential? And shadow banking will realize they are part of a failed system!

Much the same as a government shutdown. Money is being shifted around to cover there tracks and delay announcements until after 1 January?

The Fed is going to crush the shadow banking system in to little bite size pieces?

Financial deflation is starting to show up in dollar strength?

“The Fed is going to crush the shadow banking system in to little bite size pieces?”

Don’t be silly. The Fed is the entertainment division of the shadow banking system.

Inquiring minds want to know: Where do rich people “park” their cash?

Monaco.

Most rich “Peopel” not actively trading, dont have that much “Cash” they have assets, and lines of credit.

Almost everybody, gives them credit, as in the medium term, they dont need it.

In our country, the truly rich, are the slowest payers of all, its how many of them got rich. By waiting for the people they owed, to go bankrupt, and settling with the liquidator, for 25 cents in the $.

Most of the truly rich in our country arent very nice people either, Neither were their ancestors that lived here.

I dont give anybody credit. Then I dont have a collection problem

In Art located in anonymous European freeports…

If a person knowledgeable on this topic were to write a good article on it, I would love to publish it!

:-]

The Classic Car bubble is one I have thought about quite a few times. The younger generations, below the Boomers, are less and less interested in cars with the Millennials having almost no interest. Cars have also become so complicated to work on that not even us old car buffs want to work on modern vehicles with all their sensors and compacted engine compartments. So my contention is that as the Boomers get older and older there will be less and less interest in the Classic Cars. We may be already seeing that in the pricing but even if this is because of the income stagnation/squeeze that most people are experiencing I see the value of the Classic Cars really falling at some point in the future.

Other things affecting this is what Wolf talked about with Chris Martenson about living in the cities. It is very expensive to live in them and the younger generations have migrated inward. This means, like in Europe, that consumerism starts dying because there just isn’t any place to store STUFF.. It costs to much to store stuff where space is a premium.. Even art needs a place to be. I have a smallish home and the walls are spaces are covered with art we have brought back from all over.. Now I buy no more art because I just have NO place to put it..

Don’t think of it as art. Other people don’t, if nobody wants to buy it. Think of it as overpriced wall paper. And don’t believe everything you see on Antiques Roadshow.

I feel lucky and sad at the same time. I have lived thru the great cheap oil era. My friends and I would drive a hundred or more miles at night just for entertainment. The suburbs grew because of freeways and cheap energy.. At the same time the loggers were cutting endless forests for cheap and often subsidized timber to make into endless rows of ticky tacky houses.. We gorged ourselves on cheap cheese burgers, french fries and Cokes.. It was a wonderful era..

Now energy is expensive, the great forests of the Northwest have been converted to tree farms which burn so easily and people can’t just go create work any more. Now it takes a license, a permit and a bond to do anything.

The past was good for most. And Now, some how, we are going to bring back the past (Making America Great again) when we elect a new President! Wow! What dreamers and magicians! Group Think believes it is possible even though all the evidence says no.

For all the Group Thinkers (Although there are few at this site), Don’t Watch Cosmos on Netflix! Especially #7 about the guy who discovered how old the earth is. The arguments might just make you think about the arguments against Climate Change.

Hmm, climate change and group thinkers, my points as follows… Firstly, water vapour is an abundant ‘greenhouse’ gas. Secondly, the role of the sun in global temperature fluctuation is often forgotten and almost certainly requires further study. Thirdly, the climate has always changed, not least prior to the industrial revolution. Fourthly, in the recent past, the expected increase in global temperatures has not been realised.

6CO2 + 6H2O —— > C6H12O6 + 6O2

Finally, as per the above equation, carbon dioxide cannot really be considered a pollutant in the traditional sense since it is required for photosynthesis by plant life. Nuclear, wind and solar energy all have negatives. But moreover, in terms of clean breathing, biomass and wood burning worldwide are significantly implicated in respiratory disease. And the post script on Wolf Street would be which is more of a threat to us as a species: the modern financial system or climate change?!?

“Thirdly, the climate has always changed, not least prior to the industrial revolution. ”

Yes it has.

only a fool, or denier, would try to assert, human activity, has not increased the speed and level pf change to a dangerous level (for human’s)

” And the post script on Wolf Street would be which is more of a threat to us as a species: the modern financial system or climate change?”

How about the Modern financial system is the enabler of human accelerated climate change. To the extent that the two are in fact now one combined problem.

Humans could not do, or have done, the damage they have, that has accelerated climate change, without credit fueled bank blown bubbles and some banks (European in particular with their huge leverage ratios) have been fueling bubbles that only they really gained from, for a very long time.

The banks ability to create money from air was nearly taken from them in the early 30’s. The leftist stopped that happening, on the basis that it would make, the then current dire financial situation, worse.

Since then, the leftist, have repeatedly brought election’s, all over the world. With their ability to buy election, by making long term untenable financial promise, then simply allowing the banks to create the money to keep them, short term.

Now we have a global, Private, National/State/Government, and Commercial, debt, and non performing Debt/Credit/Loan Mountain, like noting else before in history.

There is a direct correlation, between the size of that Debt/Credit/Loan Mountain, and the human acceleration of global warming.

Unfortunately it will be a lot easier and faster to wipe out the Global Debt Problem’s than it will repair the damage associated with Human accelerated global warming.

As now at the least. A mini ice age is required in the southern hemisphere, to start the true recovery process.

‘Unfortunately it will be a lot easier and faster to wipe out the Global Debt Problems (no apostrophe) than it will repair the damage associated with Human accelerated global warming.’

Incorrect I Fear.

If you and I both live through the former I think we will both have forgotten about the latter.

‘Only a fool or denier…’

Are you a journalist?!?

Or a politician?!?

Or perhaps big into carbon credits?!?

Whenever you find yourself on the side of the majority it is time to pause and reflect

Twain Of Course…

Neither of us know for sure the truth about what was formerly known as global warming until they realised it wasn’t warming that much…

Ps remember it’s the economy stupid?!?

Well for economy read sun

;-)

“Are you a journalist?!?

Or a politician?!?

Or perhaps big into carbon credits?!?”

None of the above.

I have seen and am seeing what you can not, due to location.

The Amundsen field, broke up due to the anchor foot melting off. No big change as it was all sea ice any way.

The foot melted off in my lifetime.

Now the land based ice-fields behind it are moving into the sea at an alarming pace. As the anchored Amundsen field is not there to stop them.

that will case levels to rise by METER’S. Even if the ice in Greenland stays out of the sea.

“Ps remember it’s the economy stupid?!?

Well for economy read sun.”

NO only a fool would belive that.

It was the hole in the OZONE layer caused by CFC use, that hole was on top of the Amundsen field.

Humans stopped using CFC’S the hole is almost sealed, to little, to late.

The hole also caused huge skin cancer problems in our country as the Ozone layer keeps out lots of UV, you now the melty burny stuff UV.

Humans now need a mini ice age at least to put that foot back on the Amunsden field.

Antartica is the driver of most of the world’s weather.

Humans may just be F&*^%$ only time will tell their good ecological behavior now is even more important the before.

good ecological behavior and Globalised vampire Corporates are incompatible.

so

“If you and I both live through the former I think we will both have forgotten about the latter.

we, I any way, wont live through the former If there is a sudden implosion there will be big wars and some muslim fool will throw a nuclear weapon at Israel, then we are all finished

“If the world tries to take down Israel, Israel will take the world down with it” Golda Meir

The woman who said “no, not yet” when Dyan asked if he should start preparations for the us of the weapons system. After the start of the muslim attack, in what came to be known as the “Yom Kippur War”.

Israel is not the only country with an “If we go, you go to” state policy. Once that weapon system starts to be used, it will snowball then humanity is over, as we know it.

Alternatively the debt mountain could be wound down.

This would take probably more decades that it took to create it. Its been growing for over 260 years I dont think I will live that long.

Britain is still paying interest on debt that predates the Napoleonic wars. Recently they brought back some Perpetuals from WW I, as the interest rate was now in the States favor, to refinance them.

NOTE REFINANCE WW I Debt..

There were scientists and denialist who refused to believe that lead from gasoline was also a threat to human life. The petroleum industry and the chemical industries in general have never seen any thing they do as detrimental even though some of what they do is extremely detrimental. They have a lot of influence and are able to propagandize amply. The decline and illness of the bee populations is just one of the consequences. We have only data from other countries as to the negative effects of GMO seeds. Not to mention the effects of highly processed sugars and fats in our diets. They supply us with crap and then tell us it is our fault we are unhealthy. And then they sell us lots of drugs to ameliorate what they created.. Come on!

Yes, the sun has an effect but the chemical industry and nuclear power have polluted our oceans. Have you seen any of the data on the radiation plume from Fukushima? GE is a partner in that so you probably haven’t.

Denying will do no good. Waste of time.. Change that has been denied or held back is not something that doesn’t exist. Change that isn’t planned is called chaos.

You haven’t read my post. Carbon dioxide is not a pollutant. Pollution is a killer for sure. Big pharma has brought good and bad but in the modern world the balance has tipped to the negative I fear. I am medically trained by the way. Most of us eat and drink terribly. We should all strive to eat and drink clean and near aware of how we are destroying our planet. In my opinion global warming/ climate change or whatever they choose to call it tomorrow is not a great threat to humanity. Yes the majority disagree.

Carbon Dioxide isn’t listed as a pollutant but as the atmospheric content of CD increased the earth has been heating up.

“According to an ongoing temperature analysis conducted by scientists at NASA’s Goddard Institute for Space Studies (GISS), the average global temperature on Earth has increased by about 0.8° Celsius (1.4° Fahrenheit) since 1880.”

“Greenhouse Effect – The phenomenon whereby the earth’s atmosphere traps solar radiation, caused by the presence in the atmosphere of gases such as carbon dioxide, water vapor, and methane that allow incoming sunlight to pass through but absorb heat radiated back from the earth’s surface.”

NOAA recent study says the global increase in temperature has continued unabated since at least the 1950’s. BUT then GE, XOM, CVX, DuPont all say nothing is going on. It is much easier to go with the propaganda than to look for yourself and understand.

How will this affect the world as we know it? Science suggests that as the earth warms it will be wetter and there will be more severe weather events which include violent storms as well as droughts in regions that previously had adequate water. Sea levels will continue to rise. This should be progressive and rather slow but over a few decades some areas of the earth that have been very habitable will no longer be. The coast lines and much of the historic farm land are two areas of concern.

Ignoring these trends does not make them go away. Migration and survival may be a lot bigger issues than endless growth.

The world could probably ameliorate the consequences but it is not likely due to human’s propensity toward denial and dislike of change. Plus the money interests are lazy and just want things to stay like they are so they can continue to consolidate power and control. The money interests control the media and what most people are fed as facts is BS. Even though most free thinkers know what the media sells is a divide and conquer form of keep up with the neighbors bs they end up being marginalized and isolated. All for the profit of the few at the expense of the many.

It really doesn’t do much good to think out side the box when your circle believes in the mystic of the Wizard. And by the time the worst of the consequences are very apparent, many of us old Boomers will be gone or on our way out. So don’t worry, Be Happy! And just Believe in the Wizard. Dorothy did until she finally found out.

I owned a number of 1950s European sports cars when I was young, most of my friends had GTOs or early Mustangs or Camaros. Those cars were fun but you had to work on them every weekend if you didn’t want to break down somewhere unexpectedly. People will gamble on the price of almost anything when the mania gets going. I don’t regret selling my Triumphs and Austin Healey’s and Porsche convertible (356) because, while a lot of fun, those cars were unreliable, unsafe, uncomfortable and just really time consuming to own. I drove some old Ferraris, they mostly drove like trucks and were broke down most of the time. I used to see Lamborghinis and Maseratis on used car lots, tempting but nothing but a headache to own.

How reliable is the garbage index as a leading indicator? This is garbage shipped by rail, so maybe a switch to trucks?

http://moslereconomics.com/wp-content/uploads/2016/10/102008.png

Shows 2009 levels of activity for waste carried by rail.

So I may bet my early 70’s Cutlass Convertible at a good price yet!

A year or so ago only the alt media were talking about potential recessions/depressions, Deutsche Bank, the Italian Banks, housing/market bubbles, economic collapse and dollar collapse. Now it’s a pretty regular topic in the mainstream media and espoused by ‘experts’ and corporate and financial insiders. Obviously, the fundamental flaws in the economy and the relative weighting to imminent financial woes are dumbed down. But the fact it’s commonly discussed means it’s coming. Sooner rather than later. This debt based system we have created cannot go on forever. And we know how it’s likely to play out: the big reset; economic then dollar collapse; and the SDR solution. Won’t be pretty though. And again Jefferson saw it coming in the longterm; pretty sure it’s weeks-months rather than centuries now…

“I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

Something has to happen to cause a bubble. It is not the availability of cheap money that does it, that is merely the symptom. The cause I reckon is that most people are brainwashed into believing that cash is not a positive investment. It has to be spent on something so much so that in the end anything can be called an asset.

Illiquid assets are popular because demand makes them go up in value and appeal to momentum investors. Illiquid assets as a store of value depend upon demand being kindled to ensure there is always a buyet at a higher price.

One day more people will realise that when you regard cash as a positive investment, cash is just as much an asset as what it can buy.

Cash is an asset, if you buy it at the correct price, so is gold.

However if the gold selling price (Note I say Selling price) rises, you get a return on your asset.

Gold can also reduce in selling price (Devalue) a loss on your asset.

Cash never rises in selling price, its buying power is eaten away every day, by inflation. If there is no inflation, why does it cost more to buy the same groceries, and fill your car/truck with fuel, than it did not so long ago.

The O bummer inflation numbers, are a bigger lie, than the CCP Economic growth numbers.

Just like a car/truck, cash, is in fact, a depreciating asset.

Cash is a headache. I have to much of it around, but in this global financial environment, a bank is not the place to put it, and to many asset classes are way to heavily over inflated, and unstable, to invest in.

Most of the traders who claim to be in cash, are actually in short term treasury’s..

‘Cash is a headache. I have to(o) much of it around, but in this global financial environment, a bank is not the place to put it, and to many asset classes are way to heavily over inflated, and unstable, to invest in.’

Agreed

Finally

;-)

“In the absence of the gold standard, there is no way to protect savings from confiscation through monetary inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold.”

Alan Greenspan

QE+ZIRP+NIRP+BOJ+ECB+FED+BIS+IMF=COLLAPSE