Investors are not amused.

The European banking crisis simply doesn’t let up. Currently, the big two German banks are grabbing the headlines away from the Italian banks, due to their size and the damage they could do to the global financial system. Other banks are in bigger trouble still, and some have already collapsed, with bailouts and bail-ins getting lined up.

Deutsche Bank had to endure a horrendous Monday after it was leaked on Friday that Merkel had refused to entertain bailing out the bank before the general elections a year from now. Merkel’s popularity has gotten broadsided recently, and bailing out bank bondholders with taxpayer money is just not popular at the moment.

Then Commerzbank, in which the government already owns a stake of 16% as a result of the bailout during the Financial Crisis, graced the headlines with leaks that it would lay off 9,000 employees, nearly one-fifth of its workforce. This will cost about €1 billion, according to the sources. To pay for it, the bank will scrap its dividend for 2016 to reduce the bleeding and preserve capital, in what is turning out to be the hellish environment of negative interest rates.

We’ve been writing about the European banking crisis for a long time, it seems, as it drags on, and meanders from one country to another, and sometimes we write about it in an amused fashion because we’ve got to keep our sense of humor in all this gloom.

But investors who believed in all the hype and in Draghi’s promises and in Merkel’s strength and in the willingness of all of them to do whatever it takes to protect bank bondholders and stockholders, and who believed in the miracle of Spain’s recovery, and in Italy’s new government and what not – well, they’re not amused.

For them, it has been bloody. The global financial crisis got swept under the rug. Then the euro debt crisis took down some banks at the periphery, and taxpayers stepped in to bail out the bondholders, mostly, and a lot more things got swept under the rug. But the problems weren’t solved. And as the decomposing assets under the rug kept exuding their pungent odor, investors held their nose and played along for a while.

But now it’s just getting worse. And investors are wondering what exactly is under these rugs – or maybe they’d rather not know for it’s too ugly to behold. And every time someone does look, for example at the Italian banks, they find even bigger problems that have started to metastasize.

This banking crisis has the potential to transmogrify into a financial crisis. All it takes is for one of the big ones to suddenly topple. The flow of credit would freeze up instantly. In an economic system that depends on credit, and whose lifeblood is credit, such an event is a financial crisis.

The problem isn’t restricted to a couple of Italian or German banks. It’s deep and wide.

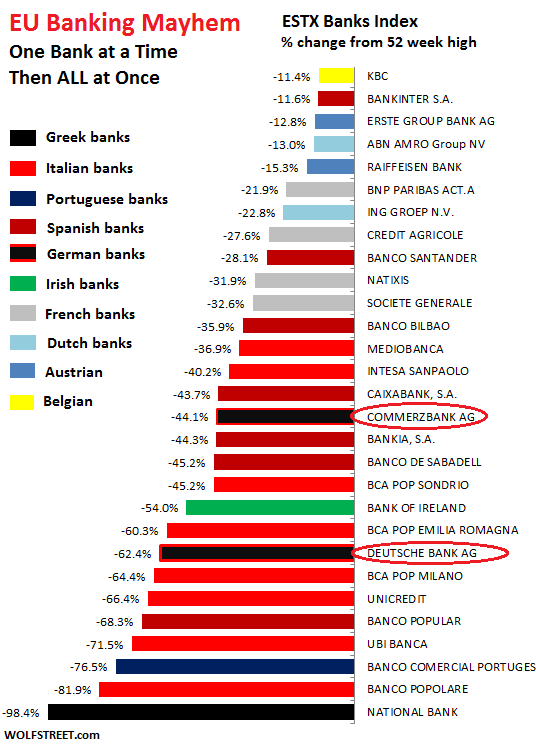

Here are the 29 banks in the ESTX Banks Index of Eurozone banks (so Swiss and UK banks, for example are not included). It shows the percentage drop from their 52-week high. But for some of these banks, particularly for Italian and Portuguese banks, that 52-week high was just about last year’s 52-week low, so relentless has their decline been over the years. Some of them had already been reduced to penny stocks years ago, and for them, in euro terms, the biggest losses occurred back then. So these mayhem banks, color coded by country:

The shares of four of these banks trade well under €1. Three trade just above €1. Another five trade between €1.97 and €2.44. These 29 banks form a big part of the European financial system. It includes some of the world’s largest banks, such as Deutsche Bank, Societe Generale, and BNP Paribas. It includes a slew of other “systemically important financial institutions,” such as Unicredit, ING, and Santander.

They’re troubled at the same time. The can has been kicked down the road for years. Now negative interest rates appear to have inadvertently crushed the can.

So when will Merkel buckle? Read… Deutsche Bank in Free Fall. Shares, CoCo Bonds Plunge. Merkel Gives Cold Shoulder on Bailout. Bank Denies Everything

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Top Tip- everybody Short Deutsche Bank. it`s going to kill Merkel. the ECB is toast. Deutsche is going to break the EU Bank of Brussels. All EU financial rules will be bent and broken for the Germans. Brexit Rules OK.

They’ll find a way to punish shorts. In China, they’ll throw them into the hoosegow; in the US, we sue them; in Europe, they flagellate them with … well, what do they have… NIRP? Or the central bank can just buy the bonds and stocks and crush the shorts.

Hi Wolf,

On the 22 August it was reported that Merkel said, “Germany warns its citizens to stockpile emergency food and water in case of terror attack”

Since attacks are normally local events it would seem that this warning is a bit over kill. But if you change the words “Terror Attack” to “Banking Collpase” the warning would make more sense.

Do you think that Merkel may have seen the writing on the wall with the BREXIT and is planning to use Deutsche Bank as an excuse to return to the Deutsche Mark? I think Merkel has had enough of these endless meeting with Greece, Spain, France, Italy and Portugal all in the vein effort to try and hold the Euro together.

There rumors a few years back that DM’s are printed and ready to go.

They actually ARE following a coherent plan for rebuilding the European banking system…

They’re waitin’ for the wealth to come back.

I think it’s like people telling us here in San Francisco to stockpile enough food and water to get through at least five days. Five days is a rule of thumb, it seems. A major attack can damage infrastructure, such as the supply of electricity. No electricity, no shopping. So from that point of view, it makes sense to always have a few days of supply at the house.

I would not relate this to a banking collapse. That kind of banking collapse where everything comes to a total halt won’t be allowed to happen. That’s not what I’m worried about.

That said, there’s a lot of political hand-wringing in Germany now over the ECB, and I wouldn’t be surprised if there are backup plans in place, “just in case,” such as a stockpile of DM.

Merkel and foresight, you mean see has been planning to destroy Europe from day one? More likely she simply executes the daily orders from Washington, and that small tail that wags the dog.

On another note, today’s rumor that ‘Turkey should buy DB’ would fit the plan. First take EU citizens hostage to millions of mostly muslim migrants with crazy ideas about entitlement (and many millions more to come and potentially 20 million or so Turks that Erdogan would prefer to get rid of), then let a muslim banking cartel take over one of the biggest EU banks (with others to follow). Thanks to Merkel, Erdogan already has a big foot in the EU door with the ‘refugee’ policy, a takeover of DB would make the farce complete.

One just has to wonder if this is according to plan for the masters in Washington (who knows, maybe any way that Europe self-destructs is fine as long as they can take the spoils).

There have been numerous financial commentators stating that Germany will be the first to leave the Euro.

Their predictions maybe just about to come true.

Why would Merkel give DB 14 billion so DB can give it to US DOJ?

DB has to be able to plead poverty in talks with DOJ- maybe even hinting that DOJ is causing the next Lehman.

Deutschland the place can’t credibly claim poverty- nor could a a DB backed by it.

Deutsche Bank can always be drip fed until after election and after DOJ settles amount.

Deutsche Bank, because it has USA branches, was able to walk right up to the FED window and borrow enough money to (perhaps) save 100,000 homes owners from loosing their homes. NO, what did Deutsche Bank do? Why they lent it to Blackstone to buy those same homes.

Hateful criminal bank, that will get bailed out again at US taxpayers expense….just watch. 2008 all over again only bigger. And the DOJ will forgive the crimes on orders from our great nurturing law and order leader.

10 hours, that is about it, and then all hell will break loose.

No US member bank may borrow at the Federal Reserve Discount Window under the Federal Discount Rate to lend that money to anyone. Any such borrowing must be strictly for very short term (typically overnight) liquidity purposes to clear transaction imbalances in the Federal Reserve System and must be fully collateralized and is a very high interest rate (the Federal Discount Rate) relative to the rate at which banks can borrow from each other for the very same purposes under the Federal Funds Rate. The Federal Discount rate is always set at 0.50% higher than the Federal Funds Rate and is presently DOUBLE the amount of the Federal Funds Rate.

They’ll go in Mr Juncker’s little black book

Wolf, and I know this might be a difficult subject, but I would LOVE to see/hear how the IMF/SDRs fold into a potential upcoming banking crisis – particularly if the crisis ends up being pan-national (is that the appropriate word?) as it seems the next one will be at least a EU/ Japan/US/China crisis at minimum due to the interconnectedness of the system at this point. To be clear – this next crisis doesn’t feel “Chinese only” or “Japanese only” or “EU only” or … well, you get the idea.

WS commenters, I would love to hear constructive disagreement or commentary (go-go-gadget comments). ZH used to have guys like “CheekyBastard” who would post stuff that seemed deeply cognizant, but really kept me scrapping to keep up – looking for something like that per our recent comments thread. I am not a finance genius or professional, but I do enjoy reading and thinking. :-D

We have had a few folks post about SDRs and related in the past, but it was fairly atypical commentary and missed by most readers. It was actually a poster here on WS a while back that turned me on to the idea that SDRs are the CB bail out mechanism – which I think is on deck at this point (assuming I parsed their comments properly).

I know SRSs are fairly mechanical – how they will prop things up – and heck, and we all know rules change (kind of expected) – but when things go south this time, SDRs are going to be smack in the middle and I suspect will be the glue that holds things together through the NEXT blow up … (don’t ask what the next NEXT blow up looks like) …

And, for what it is worth, the SDRs “expansion” events are curious in their timing and frequency, I think they have been pacing the “magnitude of the problem” for decades, sort of like a back stop that never happened (yet), another interesting angle …

I know you got a full plate – but just in case you need a side project … because I don’t for now – but winter is coming …. ;-)

Regards,

Cooter

Cooter, Here is one perspective on SDRs from The Daily Coin site. They see SDRs as an interim world currency; a tool to dismantle the dollar gradually as the new economic system is being developed the SDR collapsing the dollar . Other analysts (such as Jim Rickards) see SDRs collapsing the system rather suddenly after a few weeks or months.

I’ll be damned if I know. Better luck to you.

Replacing The U.S. Dollar with an SDR Note “Remains the Overriding Vision”

freedomoutpost.com/replacing-the-u-s-dollar-with-an-sdr-note-remains-the-overriding-vision/

Rory Hall — September 23, 2016

The Epoch Times recently published their follow up to the G20 Meeting held in early September in China. It is interesting to note how their reporting dramatically differs from the typical Western media reporting. Had a person followed only Western media outlets for reporting on the G20 meeting, one would have come away with the sense the only thing accomplished was Obama and Russian President Putin facing off in a stare down that looked like two boxers about to go toe-to-toe.

In an article The Daily Coin published, we clearly stated that the meetings that would take place on the “sidelines” would be where the real meetings would determine the next step(s) in the currently unfolding monetary shift. The Federal Reserve Note (U.S. dollar) is now on the chopping block of history. While the axe has not been lowered, it is certainly being sharpened. China has made it clear there is going to be a change, and “the United States had to go along with the Chinese because they hold a large portion of the U.S. government debt.” I have heard it said before – the debtor is the slave to the creditor and the master determines the fate of slave.

“Behind the scenes, the system preparations have been made to the international monetary system which will allow us to introduce the SDR as one of the world’s reserve currencies, as a world reserve currency which could become and replace the dollar.”

He [Willem Middlekoop] thinks the United States had to go along with the Chinese because they hold a large portion of the U.S. government debt. This does not mean, however, that the dollar will become meaningless in the near future, as it is still the most important currency within the SDR basket.

“Adding the Chinese yuan to the SDR is a great way for the United States to stay in control. The U.S. dollar is still more than 42 percent of the SDR, even after Oct 1. So this is a solution which is acceptable for both the Chinese and the Americans. Even Putin can agree with this. By upgrading the SDR the United States will become less important, but it will still be the leading currency. Both Russia and China understand the need for the dollar for the foreseeable future.” Source

Small changes along the way make for one big change at the end of the line. The people that believe the U.S. dollar is going to crash and burn overnight are missing the point of these communiques’ from the IMF, BIS, and World Bank. What is happening right now is that the people that are making policy changes are putting into place the mechanisms required to convert a global monetary system from one system to the next. China and Russia have been doing exactly this for the past several years. The AIIB was set up for the specific purpose of shifting accounts out of the BIS, IMF, World Bank, or all three, into a new global banking system. The alternative to the current SWIFT system that has been built by both China and Russia, independently, represents other tools necessary to make this shift. There are a great many more tools necessary to making this type of global change. China and Russia have both been, independently, developing other banking systems and monetary tools necessary for such a change. There is still much work to be done.

Small changes are hidden in plain sight. In its Articles of Agreement, the IMF states each member is obligated to “making the special drawing right the principal reserve asset in the international monetary system.”

Within the context of these small changes, however, the Chinese won a symbolic victory to have one of the U.S. controlled global institutions, the World Bank, issue a bond denominated in SDR in China.

“It’s more symbolic but highly significant. It shows that the U.S.-centered institutions, the IMF and the World Bank, really accepted the Chinese demand,” said Middelkoop. Source

The new M-SDR, in conjunction with the two other SDR’s–O-SDR and R-SDR–are in place and ready to fill the ledger sheets around the world. This is not going to happen overnight, next week, or next year – as of today, this is not the plan. The plan is to continually drain the current system and propagate the new system at the same time. This has the potential to create problems as these two systems move in opposite directions. Gold could be a “counterweight” to smooth out the transition and create a more level currency, as one system grows and the other recedes. I did not say gold would be part of the system, nor did I say gold is going to play a role, at all, in this transition.

According to the former head of the IMF’s SDR division Dr. Warren Coats, China does plan on completely replacing the U.S. dollar in the long term and that private bond issues like the one from the World Bank are necessary to build capital markets and pricing mechanisms for the SDR.

“That goal to replace the dollar and euro and other currencies as international reserves with the SDR remains the overriding vision that China has in mind,” he said. “Any serious undertaking to promote the SDR as an attractive, viable international reserve asset requires an extensive private use of SDRs, like the World Bank bond and there needs to be lots more of that.”

He suggests for the SDR to take over from the dollar, major commodities like oil also need to be priced in SDR, and the banking system needs to create deposits and loans in SDR as well. Source

Furthermore, gold is not currently allowed to play any role in the SDR Basket of Currencies.

Gold could “provide a counterweight to the impact of the depreciation/appreciation of the dollar (and other currencies) since the gold price tends to be inversely related to the dollar,” she writes in a 2011 paper.

However, although the IMF holds 2,814 metric tons of gold reserves, it won’t be part of the SDR anytime soon according to Dr. Coats: “This would not be allowed under the current articles. They prohibit gold from being part of the SDR.” Source

So, for those that believe gold is going to be part of the new system, which it very well could be, please re-read the couple of statements to understand this is far from over. Gold could be part of the new system; however, as of today, it is not.

Article reposted with permission from The Daily Coin

Don’t forget to Like Freedom Outpost on Facebook, Google Plus, & Twitter. You can also get Freedom Outpost delivered to your Amazon Kindle device here.

SDRs have been around a very, very long time (e.g. pre-post Bretton Woods). Is Pre-Post legal vernacular here on WS?

Anyway, I have seen an old school PM prospectus (primarily pitching silver) with my grandfather’s notes (in latin IIRC) from the late 70s – and prominently in the prospectus is … SDRs! 79/80/81 was a big SDR expansion year – right before O’l cigar jacked rates to the freaking moon (which the Russian’s did not too long ago).

Anyway, SDRs aren’t new. My curiosity is how they play into the next collapse – particularly the mechanics. If you can add more, I am all ears. I didn’t catch an answer to what I thought I was asking, so wanted to clarify. I feel it was a repost – had SDRs in the subject – but lacked any commentary or clarification on the points I raised.

Sorry to be insufferably pedantic. ;-)

As I understand it, SDRs are a way for a CB to create liquidity in another currency (via the basket) at a carry cost of interest calculated in the SDR basket. Superlative narratives (which are like propaganda) don’t help me understand how that plays out – and sadly that is most news which is the typical fare these days.

And I thought this (i.e. the banking system, etc) was all tits up damn near 10 years ago – so mechanics of how that looks is really what is going to “rope my goat” as it were. So, maybe my point/question is, I don’t even know what I am asking.

Appreciation in advance.

Regards,

Cooter

not sure if this answers your question, but iirc, according to Rickards, SDR’s will be used to bail out the CB’s, (much like CB’s / taxpayers were used to bailout Wall St in 08).

The IMF has the last remaining clean balance sheet and can imbibe all the debts and distribute SDR’s at will with no accountability, elections or oversight.

So, if a collapse occurs Rickards assumes national currencies will be just that (national) and SDR will become the de facto global reserve, but only to be used by CB’s between each other. Whether this is a solution that works or just another can-kick is up for debate, but it seems sure that it instigates a global monetary reset.

The burden of the USD reserve seems to be disastrous in a heavily indebted global economy. It can be used as a weapon or its inadvertent strength / weakness can crush developing countries.

Further SDR’s are a ready made excuse for governments – ‘this inflation isn’t our doing, we don’t control the money supply anymore’

I don’t know much about SDR’s but ‘pre-post’ does seem odd- ‘before- after’?

If SDR’s precede BWoods what were they drawn on?

BWoods is 1944 I think, so the US$ was not yet the world currency.

If you drew what did you get?

BTW: I’m sometimes sarcastic with rhetorical questions but not this one

“I have heard it said before – the debtor is the slave to the creditor and the master determines the fate of slave.”

That applies with normal enforceable credit arrangements.

International Treasury notes, are not normal credit arrangements.

There is no mechanism, other than war, to liquidate a country. if that country, will not allow its national assets to be sold.

See Athens for the first of these events, long ago, Athens invented international default, and the enforcement war, that goes with the creditor, trying to enforce payment.

The IMF does not concern itself with bailing out banks directly: it lends money directly to governments.

However this doesn’t mean that it cannot dictate conditions that include banking “reforms” such as the capital levy on Bank of Cyprus deposits in 2013 the Cypriot government executed.

Intriguingly enough the top four IMF debtors are all EU members: Greece, Ireland, Portugal and Romania.

Again intriguingly enough all four countries faced a serious budgetary crisis in 2008-9 brought about by the double pincer of having to bail out a rapidly crumbling banking system and a complete collapse of government revenue.

The case of Romania is particularly striking: it was fast-tracked for EU membership in 2004, when it became a NATO member and due to three years of astonishingly quick economic growth.

However neither the EU nor the IMF (whose mandate includes warning member States of potential economic crisis) saw the Romanian miracle was built on very shaky ground.

First, it had become a manufacturing hub for European firms, chiefly German and Italian, which took advantage of a low wage/low tax/weak currency environment, even if this meant having to deal with high corruption and primitive infrastructures .

Second, it experienced a cheap-credit fueled consumption and housing bubble which even a layman could see would end in tears.

When Romania became a EU member in 2007 the first signs of the crisis were already visible, but the IMF remained silent, just like it was remaining silent over Ireland’s stupendous housing bubble and Greece’s consumption fueled phony growth.

In early 2009 the Romanian government asked for an IMF loan to avoid defaulting on its debt: not only there was a serious budget shortfall brought about by the end of the housing and consumption bubble, but State.owned bank CEC needed emergency cash transfusions to stay alive.

The Romanian government quickly learned Faust had struck a better deal with Mephistopheles than they had with the IMF: in return for a $20 billion loan, the IMF demanded and obtained not merely a cut in the salary of teachers, firemen and other government employees, but also a sharp spike in taxes.

High taxes meant two things: the definitive end of Romania’s consumption bubble and the still ongoing exodus of foreign investors, who are relocating in Slovakia, Serbia, Vietnam or even going back home.

I call the IMF “No sovereign bond left behind”: albeit its mandate include helping members to negotiate debt restructuring and orderly defaults, under Christine Lagarde the IMF has evolved into a machine whose whole strength seems devoted to avoiding the “dishonor” of a default,no matter the costs.

Given central banks such as the Bank of Japan are buying up ever sovereign bond that isn’t nailed down and sequestering them in their virtual vaults, this is odd behavior.

So Romania has gone on a spree, is now broke, and to qualify for a loan it must cut public sector salaries and raise taxes.

Sounds like what the Scottish lady on the TV show ‘Til debt do us part’ does with spendthrift families.

Little tidbit from Greece where all the nasty austerity has 25% of the workforce idled- there has been roughly one public sector job loss for every seven private sector.

Cooter,

The best explanation for the use of SDRs, I have read, comes from Jim Rickard’s book “The Death of Money”. It is an arduous read, even for finance junkies, but very in depth. I highly recommend it.

At the IMF, the US has 18% voting power, and it takes 85% to change anything. The story in a nutshell.

I think in the long run the SDR is also toast as it is made of only a paper basket. Every Government can print and one Government printing begets the next to print for competitive devaluation. A basket of diversified paper money in the end will fail too. Until they link money to something that is independent from Government meddling, independent from printed money and has intrinsic scarcity, like Gold there will be no disciple brought back to money.

People don’t know squat about the money system and will fall for the SDR representing now a basket of “paper” money for the next 40 years until one day that falls apart and they decide they have to go back to a market based gold/currency system. Brenton woods shows a fixed exchange system does not work, the Euro will be the second proof. You need a system where gold is also a pillar and the market can run to gold when paper loses its discipline. Let the market decide what the gold/currency ratio is. Governments can buy or sell gold depending on their opinion of what their currency in gold is worth. Trade in the end has to be settled in gold so that you don’t have what the US has now…ability to consume and not have to give any scarce good in return; they just give printed dollars for stuff. It is a great deal for Americans.

Paper for stuff. Like land for beads…

Scarcity is what constituted value in an agricultural economy. Now utility is the new store of value. If you are following Venezuela, or any community which has experienced a real breakdown, like Baton Rouge, Louisiana, it is extremely obvious.

Good graphic. Could it be matched with the total assets of each bank? Or just a summation line at the bottom of the total assets and then compared to GDP (not really a relevant measure but does give some sense of scale). It is not clear to me that even with bail in procedures that some of these banks could be rescued if their “assets” are really just claims on other defunct businesses. There may not be enough to bail in. When do the bank runs start?

Churchill it is said remarked “Americans always do the right thing after trying everything else.”

There may be more wisdom in that crack than first appears.

Perhaps he meant “Americans always do the right thing after trying everything else, unlike other people.”

It is not beyond ones imagination that Merkel will stubbornly let the temple fall around her. In this scenario America will cut a deal regarding the fine. Not because Merkel is a great brinkmanship negotiator, rather because she is unaware of the ramifications.

Signed

Not an algo, not an American nor German.

I’m sorry, not even Merkel could possibly be that stupid.

Everyone saw what Lehman Brothers did to the Global Financial System.

The decision about Deutsche Bank is an entirely geo-politico-strategic decision.

Just how would the game play out, how would the German Government look after Germans, and how would a failure of Deutsche Bank impact foreign relations.

And what are they trying to achieve?

You can’t possibly know what the German Government will do with Deutsche Bank until you know the answers to those questions and I’d submit anyone who says they know the answers to all those questions is lying.

Agree. Bailout won’t happen until DB settles with US DOJ and after German election.

Why give DB money so it can give it to DOJ?

What about a fine exchange (Deutche / Apple) between US / EU. Could be the cheaper way to solve the situation.

How does Don Quijones feel about you muscling onto his beat? I assume this won’t stir up bad blood between you two and i gotta search for Dr. Q on another website.

I’m certainly don’t have the money to short but i will call my bookie to get odds on the chances that one of the candidates might be asked about this.

Because i gotta feeling that this could burst before the election and i can parley a $100 bet into thousands.

They might have to give a response.

Like John McCain’s powwow that never happened to fix the financial crisis

Don’t worry. The EU is big enough for both of us.

I’ve been writing about euro and EU banking problems since I started doing this – 2011. DQ is covering it now mostly, but I still like to offer my 2 cents worth every now and then. Sometimes we coordinate in order to not end up writing about the same thing (which we have done before).

Contagion Spreading?

Wolf, I know as you stated in the article, you didn’t include the UK or Swiss banks. Just for everyone’s info;

Barclays (BCS) is down at $8.64 its lowest since 2009

Credit Suisse (CS) is down at $12.89 barely above its low early this year

Looks like this is hardly contained. Too many cross-connections.

The Germans say no bail out, the ECB says no bail-in. It all looks like the old-system banks including central banks are going down. Of course they fight, they fight each other.

A new system will emerge sooner or later, with currencies adjusted to the needs of a globalized digital era. Maybe a war will be needed for that. The billion dollar question is what will happen to the old fiat money.

>The billion dollar question is what will happen to the old fiat money. <

Paper makes a good bonfire.

Between the lines Merkel might have been saying Deutsche Bank is too big to save.

Has the counterparty run started, like when JPMorgan cut off Lehman triggering it’s gradua-to-overnight collapse?

“Between the lines Merkel might have been saying Deutsche Bank is too big to save.”

The entire debt-laden, derivative-laden financial system is too big to save.

It is in fact deeply unsustainable and a reset is absolutely inevitable, and if you look closely you’ll notice the chips have been set to fall in such a way that a couple of thousand people will control everything of any value.

Given technological advances TPTB have no real need to control more than a few million people at most to continue to enrich them. The rest are merely wasting the resources of their planet and are disposable but are welcome to live like Haitians until they die off, which they will certainly do in due course.

It’s pretty easy to see things this way when you take present trends and present conditions to their logical conclusions. I’m just here to watch my predictions come true. Also for the hors d’oeuvres.

KBC is Belgian, not Dutch, BTW.

Ha, I know that. I used to bank there, at the branch downstairs at my office on Ave. Louise. near Vilain XIIII in Brussels. But I screwed up a label on my color coding. If you look at the chart, you see “Dutch banks” (blue) and then a little further below again “Dutch” (yellow), which should read “Belgian.”

Thanks for pointing this out. I’ll fix the chart and upload the fixed chart when I have a moment.

Oh, no need to fix it. KBC is not that important, at least not compared to the other banks further down the list. And it is holding up pretty well.

As long as things do not go wrong in Eastern Europe…

While the bail-in risk for savers in all EU banks keeps growing every day (because all these banks are tied together, and it is easy money for politicians because people with significant savings are a very small subset of voters), you are lucky to get a paltry 0.05% interest on your savings here in Netherlands; for company savings and large investors some EU countries already have negative rates. Because of the bail-in risk alone, rates on savings accounts should be north of 5-10% nowadays, plus inflation … but the magic of sorcerer apprentice Mario is stronger than the market, until it isn’t …

Anyway, will be interesting to see what happens in the EU political circus now that a bail-out of DB in some form is clearly on the table in Germany. Will Italy also take over Monte Paschi, and possibly many other banks? Will the ECB print the money for all this activity, so it ‘doesn’t cost anything’ for governments?

So many important elections to win in the next year for EU politicians, while they royally f*ed up over the last years … we are in for an epic bag of tricks.

strikes me these banks are being made into public utilities without the ability to make a return, thus they must consolidate. but how do you consolidate weakness?

with difficulty. as to the bottom line, the risk free rate, it is the underpinning of layered assets. with rates negative, one can approximately calculate what the relative solidity of what is above, which is dependent on said negative rates. thus we have a continuous refinancing into the future, until one day asset prices/flows etc can support a “tightening,” which is what we already have, because of the need to support shaky credits with a. tightish credit generating a real “utility” return, except to certain layers, which are the underpinning above the foundation, and b. negative rates.

and, yes, the chinese think they will ultimately finally conquer the world and show everybody the superiority of confucius sun tzu and the han dynasty. oh wait, i forgot the communist party.

all this circuity leads me to wonder what is “money good.”

Banking systems that look this bad must create some kind of reaction by the public. Hoarding? Capital flows into other asset classes? Any data on this?

which public, the ones with money? that’s a small minority nowadays so it may be difficult to notice the capital flows. for most of the public it’s irrelevant as long as the credit card still works and they can get an even bigger mortgage or car loan next year; thanks to central banks these people have no need to worry until the whole system breaks down.

I remember reading when in 2008 one of the Belgian banks (Fortis) almost went under, commercial customers and probably some private customers with lots of money had pulled out over half of their money at the bank within one week – not from an ATM of course. I think I’m relatively well informed about such things, but when I heard this the authorities already had taken control of the bank. The smart (well-connected) money prefers to operate in silence.

Not sure why investors would be fretting. The amount of money they’ve lost on Europe bank stocks have been fully made up and more by their holding of US stocks. When DB stock dropped yesterday, US stocks rallied, and if DB goes down in flames, I expect Dow 30K (not sarcasm).

Investors hold a basket of stocks. Speculators hold single stocks or just a couple of stocks. The later is just getting their just deserts.

‘diversified’ investors are probably the ones who are going to eat the biggest losses once central banks lose control of the market. The whole stock and bondmarket is one epic bubble that has NOTHING to do with ‘investing’, just speculation that central banksters will levitate the market to infinity.

And if we get Dow 30K (who knows …) you might still be better off in gold or some other inflation hedge because the current economic climate definitely doesn’t justifiy an ever rising stockmarket.

This is a stickup, hand over your money.

The two German banks may be bailed out with the depositors’ Money.

https://ellenbrown.com/2014/12/12/bail-in-and-the-financial-stability-board-the-global-bankers-coup/

All the proof you need that there will be a bailout:

“The report is wrong. The government is not preparing rescue plans. There are no grounds for such speculation,” the ministry said in a statement.

Also, “We’re fine, we don’t need a bailout” – Paraphrased statement from bank CEO

‘“We’re fine, we don’t need a bailout” – Paraphrased statement from bank CEO’

Of course not. They already have the money, from their depositors and such. They just don’t want to pay it back.

No-interest loans, assorted subsidies, auto-profit sweetheart deals, and immunity from criminal prosecution aren’t bailouts.

She’s so fine, there’s no telling where the money went.

The rentier class will continue to pillage the planet until there is nothing left to steal, and they will blame their victims every step of the way.

Officials can be bought off or replaced with saboteurs and those who resist can be coerced, marginalized, and persecuted. The general population can be brainwashed into believing tax cuts for the rich will generate jobs, and can be told who to blame and who to hate.

And you know what? It works.

Still not sure why this ‘crisis’ will not be another non event in which the EU or Germany or even the USA bails out these banks. Certainly the US market behavior hints this will be the case.

Yes I read Wolf’s previous article on DB’s problems, but I think that the stock’s tanking is just a way for insiders to buy cheap shares.

Tell me when a bank the size of DB has been allowed to fail? If you answer never, I suggest you start buying.

You’re correct. It won’t be allowed to fail. I’ve been saying this from day one.

It will be bailed out. The only question: who pays? Stockholders, certain junior bondholders, or taxpayers? Probably a combination of the three. Senior bondholders and depositors will not be bailed in.

So it’s not a “non-event” if you’re a bondholder or stockholder. Or a taxpayer.

The interesting question is what happens when they use taxpayer money for the bailout, as many more banks throughout Europe will be in line for the sweet candy and there simply isn’t enough to bail out all of them. I don’t doubt another smokescreen like the EFSF etc. will be used to make it as difficult as possible to see who is really paying for it, so maybe they will convince the voters that nobody is paying ;-(

As to depositors, I don’t think the ones with over 100.000 in deposits (which includes many small businesses) are safe. Grabbing their money will be cheered by the sheeple, especially with the right government propaganda added in the mix. And Cyprus already set a precedent for this.

And I guess stockholders in banks are also mostly taxpayers nowadays thanks to the direct and indirect buying from ECB and other government and central bank entities.

It’s always a “non event”? Really? Negative interest rates and negative bond yields are not a “non event”. Ok, hoard up your stocks. I’d like to see you pay creditors with stocks. They have no intrinsic value. When cash is needed they are the first to be sold. So, go ahead and buy. :-) But the S&P 500 monthly chart looks like it’s about to roll into the abyss.

“Investors hold a basket of stocks. Speculators hold single stocks or just a couple of stocks. The later is just getting their just deserts.”

Currently i hold 3 stocks. Which is 2 too many. The only different between speculators and investors is snobbery. Thinking that a basket of stocks is simehow better overlooks that it is the same market regardless. When the market tumbles some stock prices may hold but the spread widens.

Remember: an investment is a speculation that went wrong.

—

On banks, no one forces investors to buy into banks. That many investors are losing money is their own fault. Also i doubt many investors have owned the stock since the bank’s IPO. Mostly they wouod have bought the stock second- hand (or more). Expectming something second-hand to go up in value is high risk.

“The only different between speculators and investors is snobbery. ”

Should read

The only different between speculators and investors is that investors are greedy snob’s.

++

Some speculators on the other hand, are simply trying to make a living, any way they can..

Interestingly, Deutsche Bank has been one of the Trump’s main providers of finance, lending over $2.5 billion. Other big German companies like Bayer are also said to support Trump, including by contributions. No wonder they have been targeted.