“Intrigued by gold and its price action.”

By Christine Hughes, Chief Investment Strategist, OtterWood Capital:

I expected February to be better than January for the simple reason that January was so bad, and markets don’t go down in a straight line. Markets in North America were barely able to eek out a gain during February, and now I think we’re at the tail end of that relief period for markets.

Much of the recent rally has been spurred by short covering, which forces buyers into the market when they don’t really want to buy. Here’s what Morgan Stanley said today about short-covering by massive, computer-driven funds:

Quants have now covered for 9 straight sessions (days) which is the longest uninterrupted cover streak in over 2 years (period starting January 2014).

I’ve noted many times how the bond market has not confirmed the recent stock market rally. In addition, the amount of money participating in the rally has been pathetic as seen in our recent blog post here.

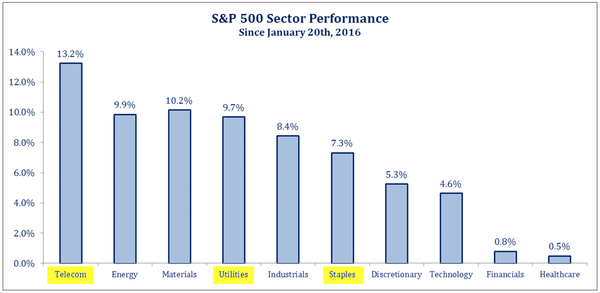

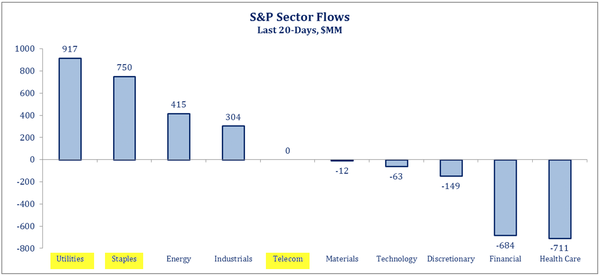

Furthermore, the sectors within the stock market that have rallied this year demonstrate a very defensive tone. Staples, telecom and utilities are the go-to sectors during bear markets and uncertain times. They are boring, reliable businesses that aren’t very tied to the economic cycle and they are rockin’ it. The charts below also show how the very popular and still heavily owned healthcare sector is not participating in the rally.

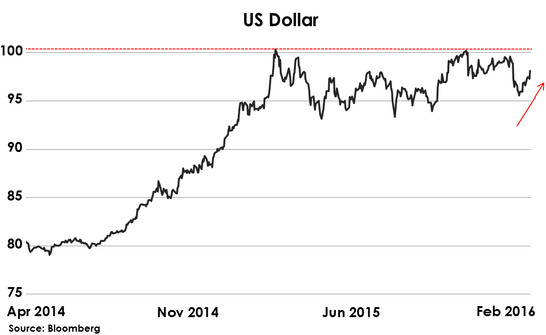

One thing I’m keeping my eye on is the recent strength in the US dollar. In sympathy to stronger than expected inflation data, the US dollar had a strong showing today. Should the rally continue and break higher through 100 on the chart below, it will spell trouble for risk assets globally. A strong dollar is what caused all the havoc in the markets in the first place.

Lastly, I will leave you with this great comment about gold from Jeff deGraaf, at Renaissance Macro Research, one of the most intelligent market analysts out there:

We’re intrigued by gold and its price action. The metal had a big move over the last few weeks, and is now consolidating those gains. We believe this consolidation is buyable, and our trend model is now bullish for the barbaric relic. We’ll see which is more barbaric, negative rates or a store of value that has never in the history of the world, ever defaulted. The institutional inertia of the last 30 years is slowly eroding.

By Christine Hughes, OtterWood Capital

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

“We’ll see which is more barbaric, negative rates or a store of value that has never in the history of the world, ever defaulted.”

Great post, Wolf. I chose the truth as my friend when I was twelve. He’s been a good friend for sixty-three years. Not once has he asked that I worship, serve or give him money. I have in the last 25 years discovered that gold makes a good friend as well.

From a value perspective, the US stock markets do seem overpriced. The Shiller 10 year P/E ratio, the slow down in shipping and trucking, the lack of revenue growth in large corporations and, as Wolf has pointed out, the financial engineering of borrowing capital to buy back shares does not paint a rosy picture.

But where does one park their money? It sure as hell doesn’t pay to buy negative interest rate bonds or deposit cash in a bank that charges you to hold it!

When I was on the road doing what Wolf is doing online, the same two questions were asked at every stop.

1. “When will the greed bring this house of cards down?” No one knows the answer to that question.

2. “Where can I park my money in the main time?” I always answered that question by saying what I was doing. I make sure I have a paid for vehicle that is in great shape. That my home and all furnishing are paid for. That I have at my finger tips a few gold and silver coins and $5,000 cash. Being debt free eliminates stress. Eliminating stress not only adds years to your life, it makes it a life worth living. I wasn’t being sarcastic in my post yesterday. I was being truthful. I do not begrudge these people who are living above their means that wonderful lifestyle, but neither do I feel sorry for them when the party ends. Mr. and Mrs. Piss Poor Prior Planning and Mr. and Mrs. Childish Dependence have always, and will always, end up in some kind of handout line. Naturally, through no fault of their own.

Excellent comment Mr. Miller, and very true. Right now my best friend is going through a period of unemployment. I mentioned to him for years that perhaps when he was making the big bucks he might want to forgo a few vacations and pay down his mortgage? My suggestions were greeted with scoffing, to be honest about it. My oldest brother, same thing. In his case he is pushing 70 years old. My brother has worn out his welcome in his search for handouts from his siblings. I asked him, “Do you want the money I saved from working three jobs when my kids were little, or do you want the money from working out in the storms and cold rain”? Needless to say, all of his siblings now have his emails marked as spam. I can still remember the photos he sent of his family vacations; “Here we are skiiing in Grenoble. See________ as he is diving off Egypt”. (Granted, they live in France so the distances are about as exotic as me driving to the Okanagan, but it is galling, nevertheless. While his wife still rides horses every week or so, he still asks for money to help pay…….) And my buddy phoned me up after being stiffed by a future employer and he was beyond depressed. It is brutal out there, brutal. I really feel bad for my friend, for while a lot of his condition is self-made, he really didn’t know any better and now he is learning the hard way in his late fifties.

I did the same thing as you, paid off the mortgage on three different houses, as soon as I could. On the 2nd house my (ex) wife embarked upon a mid-life divorce quest in search of the green grass other side of the fence thing, and I had to refi in order to square up, including, “You might as well take the furniture and the car too, I can always get more and bike for awhile.” I figured it was cheaper than paying for a divorce lawyer, (and boy was it). Paid off the last house, re-married and retired where I want to live, and live the way I want to. (Both of us do). The ex states she will be working until 70, and I tell her she will really enjoy retirement.

I thought about sending my brother a link to Aesops, “The Ant and the Grasshopper”, but why bother? It really is that simple. My youngest son, who I have been helping a bit to get his business off the ground remarked last week, “I guess what you say is true, I either don’t make enough money or I spend too much”. I did notice yesterday, that when I went to check on his place, (he is away on a job), all the lights were turned off and the heat was off in the back rooms.

It really is this simple, “Don’t just live within your means, live below them”. When the music slows down what you find is that you bought freedom along the way without even knowing it.

regards

Thank you, Paulo. When my friend Mr. Truth and I find a few kind words mixed in with the boat load of condemnation, we deeply appreciate them. Someone bashed the entire generation of baby boomers simply because they were offended by the truth. I wanted to share Louis L’Amour with them but decided it would be an action doomed to be futile. I believe you will enjoy it.

“Up to a point a man’s life is shaped by environment, heredity, and the movements and changes in the world around him. Then there comes a time when it lies within his grasp to shape the clay of his life into the sort of thing he wishes to be. Only the weak blame parents, their race, their times, lack of good fortune, or the quirks of fate. Everyone has it within his power to say, ‘This I am today; that I will be tomorrow.’ The wish, however, must be implemented by deeds.”

Yet the farce continues…

Stocks across the Middle East advanced after China’s central bank governor highlighted scope for further policy stimulus in the world’s biggest commodities user. “The world seems to be a better place this week,” said Saleem Khokhar, the head of fund management and equities at the asset management group of National Bank of Abu Dhabi PJSC, the United Arab Emirates’ biggest bank.

http://www.bloomberg.com/news/articles/2016-02-28/dubai-stocks-lead-advance-across-gulf-arab-markets

UAE is going to be a big beneficiary of the opening of Iran economy, plus they’re getting the world expo in 2020. So, aside from real estate slow down and oil price collapse, it’s got a few other things going for it.

“…never in the history of the world, ever defaulted.”

Unless you count the default caused by explicit outlawing of gold ownership and subsequent loss of use as a store of value for decades.

I think some people might have hidden their gold rather than sell it to the government. The various and numerous prohibitions have always run their course and it is easily smuggled. An ingot cast as a button would weigh an ounce.

Private gold ownership was banned in the States. But abroad, it ALWAYS carried on to be a store of value. I am also very aware of the EU/US/Japanese/…. central bankers and politicians who want to rob you. I am outside of the banking system ( give or take a few 1000 US$ ), the stock markets, bond markets, and my wealth is hidden in a hole in the ground. I know where the hole is.

I think she’s right about short covering being the rally. Defensive action is very evident right now. Bonds and gold, park your money and hope it s not a melt down this time.

The SP 500 formed a W which is bullish parking place for investable cash reserves. Ride the bull all the way up to the 500 MA then reassess the outlook going forward.

However, if the W collapses on Monday, it would be bullish for Strips.

The W collapsed. Staying in cash.

I believe stockpiling personal gold is really…pointless? Because there is no middle ground between a deep depression economy where there is still social order where cash is still king and a Mad Max scenario where gold is worthless against survival stuff like food and ammo. If it’s the latter I won’t want to live anyway, gold or not.

Finally someone who shares my opinion on gold! You put that very nicely, imo opinion gold could turn out to be a very risky investment. Just 15 years ago it traded in the sub 300s.

My recession proof investment are a few parcels of timbered land. They’re managed by local timber companies which pay the property taxes so there’s no cost involved in holding, in fact a small profit. And on each plot I’ve marked some acres of woods to keep standing as a refuge for local wildlife and biodiversity. Isn’t that a better investment than a lemon sized piece of shiny metal?

And land is truly limited. Imagine what would happen if gold could be extracted from sea water, or asteroids. Land will keep its value for many generations.

This argument is also pretty rubbish. When California goes back into being a dessert, I wonder how much value there can be in the “land”. I also wonder how much Chernobyl and Fukushima lands are worth nowadays. In a Mad Max scenario, your land can also be confiscated by a band of marauders.

I am not a gold bug, although I hold 10% of my portfolio in gold, but there’s no such thing as something that holds its value forever.

Sure there is: H2O

Well, Jonas, that all sounds like a plan. However, what happens when and if you can’t pay the taxes, the banks are closed for an unknown period, and you have nothing under the mattress?

18,000 acres surrounding Raleigh from Garner to Cary to Winston Salem, in timber and tobacco lost in the depression because my grandfather was a stubborn man who refused to see the writing on the walls. Yes, he too was an environmentalist, and when a lumber company wanted to buy 200 area in cash, he told them no…even though he had a tax lean on the property. But his real downfall was trusting his banker who ended up with many of those lost acres sold at the courthouse stairs.

cash is and as long as we are all alive….KING.

If it is not in your hand, you do not have control over your destiny.

Why are there only 2 scenarios? Why can’t there be one where gold is used to transition to a new, better financial order?

The only Mad Max scenario is if the US (and white people) can’t accept the new world order where they are no longer at the top i.e. through the use of nuclear war.

We are facing a:

THE PERFECT STORM (see p. 58 onwards)

The economy is a surplus energy equation, not a monetary one, and growth in output (and in the global population) since the Industrial Revolution has resulted from the harnessing of ever-greater quantities of energy. But the critical relationship between energy production and the energy cost of extraction is now deteriorating so rapidly that the economy as we have known it for more than two centuries is beginning to unravel.

http://ftalphaville.ft.com/files/2013/01/Perfect-Storm-LR.pdf

The problem is one of food. Without petrochemical fertilizers there will be next to none – because the soil has been ruined by these inputs.

7.4 billion people – and no food.

They’ll race past a kg of gold if they say a can of beans.

between 25% and 33% of all food produced is thrown away. Either as unacceptable in appearance or out of date, of uneaten. There is no shortage of food, there is a shortage of getting to people who need it.

But yes, 7.4 billion people is enough…so tell the religious leaders that more is not better.

Too bad the global population has been thoroughly infected with politically correct bullshit in the name of “human rights” that not allowing people unqualified to reproduce is the moral equivalent of the Holocaust even though it’s just a very simple extension of personal responsibility of “if you can’t raise kids properly then don’t fucking do it.”

All of you like to rag about the 1% elites, but let’s admit the average individual can has some stupid regressive beliefs especially the religious types.

An interesting comment. However I think a study of history (full of disasters) and even parts of the present world will show that there is not a digital 0 or 1 transition from an intact social order to complete anarchy.

Rather- as the larger society disintegrates smaller ones emerge. The walled city states of the Dark Ages and Middle Ages survived the fall of the Roman Empire.

They are examples of large post- crash communities but small ones can be found in villages, barrios, even jails.

In the Yukon gold rush there were miners’ courts to deal with stealing food etc. There are photos of a one guy being flogged (not to extreme) and another banished -given enough supplies to make it back to Dawson and DON’T be seen here again.

As for your last sentence I sympathize but apparently when faced with the actual choice most people decide they prefer to live in a chaotic environment. It has after all been humans’ lot through much of history and all of pre-history.

Re: your point about ammo- .22 calibre ammo is very cheap and can be bought in 1000 round cartons (the small box is 50 rounds) . It keeps virtually forever.

However, lately retailers have had a hard time keeping the bulk sizes in stock.

Yes ammos lasts a long time. I found 2 boxes of 9mm CCI Blazer with cheap Alumium casing I bought in 1992. Went to range during X-mas and shot them and not a single misfeed.

Palmetto State Armory in SC and Cabela’s often have good ammo deals with Cabela offer low or free shipping and no sales tax in Cali. Stocked up on 9mm, 5.56mm and buckshots as I recall how difficult it was to find 9mm rounds few years ago when the Fed went on ammo buying binge.

For those who may be interested in buying gold – there are good deals on eBay which had $100 eBay bucks promo (2/25 & 26) cashback on Canadian Maples bringing the price to $1,207 plus 1-2% credit card cashback.

There are other none eBay bucks promo like this intriguing deal near spot:

Valcambi jfor $1,239 per oz (not as good as sovereign government coins lime US Eagle/Can Maple but still excellent deal).

http://www.ebay.com/itm/121826620158

Krugerand for $1,250:

http://www.ebay.com/itm/141847131500

Interesting article about the soon to be demise of the unicorns even in the SillyCON valley per Tech Crunch. So much for faith in VC spigots and hundreds of aspiring startups are about to face the music and boom & bust of tech biz. And more than likely bring back the RE and rent back to earth in SF bay area.

http://techcrunch.com/2016/02/25/who-lives-and-dies-in-a-down-economy/

“We’re intrigued by gold and its price action.”

If you worship at the church of technical analysis then eh, maybe.

But gold and silver have value because they are closer to the means of production. The labor and energy taken to make it are baked into the metal.

This of course is relative to the time at which it is produced. As oil has crashed, this has yet to be ‘baked into the price’. You might note China is one of the factors that figured into its meteoric rise. I would guess another 20-50% fall would be reasonable.

Maybe worries about neg rates and such wiill overcome such a fall, maybe.

I buy rental properties. At least they have cash-flow AND intrinsic value….unlike shiny yellow metal.

Where?

I do the same in Dallas, am selling into the bubble, and either leveraging up the rest or paying them off. Paid off properties are firewalled behind companies, trusts, etc.

My accountant calls rental houses “gold with cash flow”. I pray for inflation and figure that the paid-off houses will protect my nest egg in the event of deflation.

Interesting thoughts Pete, the price of energy to produce the metals has fallen considerably.

I always cringe when the salespeople come out of the woodwork following years or months of higher prices, never seems to pan out over and over they show up as distribution is taking place. I’ve noticed time and again it’s only when crickets are chirping and the streets are bloodied, buying into weakness might work.

T-bills are the shortest borrowing of the U.S. government. A good place to park.

Intrigued by gold? Or by its “price action”?

Remember that these lemming-like mainstream investor types only buy stuff already rising and sell anything falling. There’s not a speculative bone in their bodies…

http://davidstockmanscontracorner.com/wp-content/uploads/2016/03/MW-EG702_mkmFeb_20160229063102_NS.png