A lot of air underneath Friday’s close.

Wall Street soothsayers were salivating Friday morning. The employment report for December tickled them. For days, they’d pronounced that the bloodletting was a buying opportunity, that stocks had dipped enough, that it was time to jump back in with both feet.

So Friday morning, that’s what folks, hedge funds, and HFT algos did: they shook off the unpleasantries of the year so far, and shortly after trading started, the S&P 500 was up 0.9%.

But then everything came unglued. The three major indices fell about 1% for the day. It ended a week to remember: the Dow plunged over 6%, the S&P 500 nearly 6%, and the Nasdaq 7.3%. As MarketWatch titled it so eloquently: “US stocks see worst opening week ever.”

There were some standouts.

Twitter, which lost $1.3 billion over the past three years and which doesn’t know what to do next, saw its shares fall to $19.98, below $20 for the first time ever.

That’s 23% below its IPO price of $26. But that’s not where trading started in November 2013, when QE3 Infinity was still in full swing and when all things were possible, no matter how impossible. Behind closed doors, Wall Street ran up the price. The first trade was at $45.10. Twitter instantly became a Wall Street hero. By December 30, 2013, shares pierced the $70 mark. On Friday, Twitter was 56% below its first-trade price and 71% below its peak.

Among the other standouts was the Container Store. on Friday, it crashed 41% in one fell swoop to $4.21. Same pattern as Twitter and many of other Wall Street heroes: IPO price of $18 in October 2013. First trade at $36. The stock soared to $47.07 in two months. Now it’s 88% below its first trade and 91% below its peak [read… This is What Happens after PE Firms Get Through with a Retailer].

This chart by Doug Short of Advisor Perspectives shows the indignities the S&P 500 suffered over the past five days in hourly increments. Only Tuesday was flat-ish. The rest was bloodletting:

This leaves the S&P 500 9.8% below its record close on May 21, 2015, flirting with a “correction.” The Dow and the Nasdaq, down 10.7% and 11.0% respectively, are already in a correction. On a 12-month basis, all of them are in the red.

So how painful is this selloff?

We’re just not used to this anymore. Seven years of scorched-earth monetary policies – whose explicit purpose it was to inflate asset prices to achieve the “wealth effect” – created what once was a relentless bull market.

The assumption was – and still is in many corners – that this would somehow go on forever. A whole new generation of investors has not yet figured out that they can and will lose a lot of money some day, and the old generations of investors seem to have forgotten it.

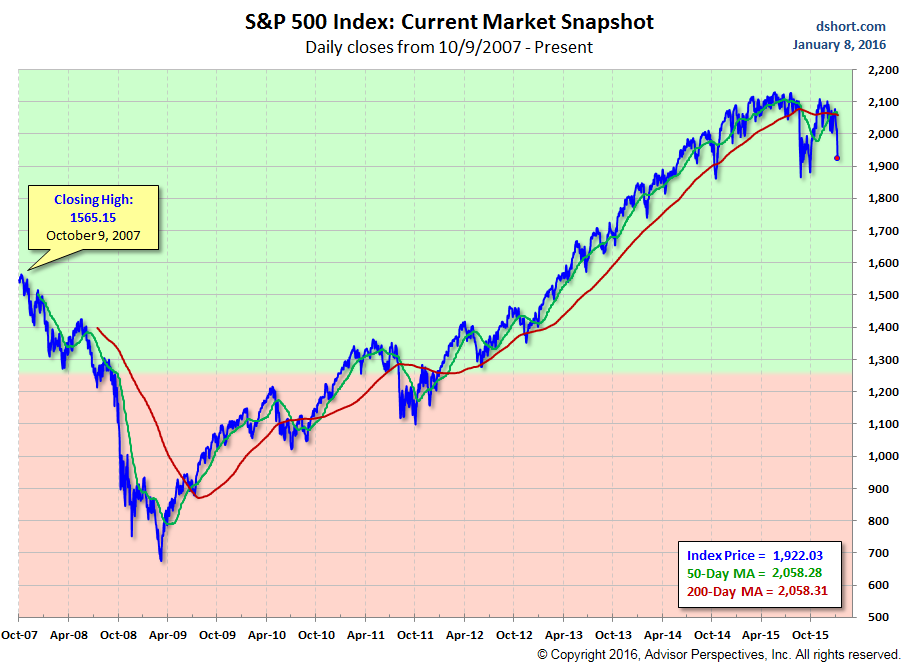

Nearly seven years is a long time. So here is a reminder that this selloff is just a small dip in the big picture. This log-scale chart by Doug Short of Advisor Perspectives shows the daily closes since the bubble-high prior to the Financial Crisis. Note how much air is underneath Friday’s close:

The week was even uglier in other markets.

China had one of its market tantrums. The devaluations of the yuan, and the government’s efforts to prop it up rattled the world. On two trading days, the Shanghai Stock Exchange plunged 7% each before trading was halted. For the week, the index lost 10%. It’s down 38% from its 52-week high last spring. Most of the government-mandated rally since the summer crash has gone up in smoke. But despite its gyrations, the index is only down 3% from its already inflated level a year ago.

Japan’s Nikkei lost 7.0% for the week, the Hong Kong’s Hang Seng 6.7%. The Nikkei is the only major Asian index that is up for the 12-month period, a measly 2.9% despite an enormous money-printing and asset-buying binge by the Bank of Japan. The other major Asian indices are in the red for the 12 months, with the Hang Seng down 14.5% and Singapore down 17.6%

In Europe, where stocks should be soaring based on the ECB’s QE and negative deposit rates, stocks are plunging.

The German DAX dropped 8.3% for the week straight into “bear market” purgatory – down 20.5% from its peak in April last year.

The French CAC 40 lost 6.5% for the week and 18% since April. The British FTSE lost 5.3% for the week and 17% since April.

But the Spanish IBEX 35 is special. After a 6.7% plunge for the week, it’s down 25% since April – deep into a bear market. This is the very same Spain whose economy has been ballyhooed as the model for post-crisis Europe, a model of cheap labor, with wages pressured by an unemployment rate of 21%. It seems investors have opened their eyes.

And that’s how market downturns start: investors open their eyes – sometimes suddenly – and they don’t like what they’re seeing. So they poke around and peel away some of the covers, and they’re discovering risks that have been there all along, and they behold the ugliness and smell the putrefaction, and they get skittish, and some lose their appetite.

Junk bonds too are quaking in their boots. The Distress Ratio is soaring, and globally, the corporate default rate is the highest since 2009. Things are coming to a head. Read… Global Corporate Debt is Coming Unglued

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Mr. Richter..you say “..when investors open their eyes..”. Of course, you really mean, when gamblers open their eyes.

I’m old-fashioned. I call them “investors.”

:-]

I’ve always discriminated strongly between value investors and momentum players. Understanding which of the two had sway over the markets at any particular time seemed important to me during my trading days. I would suggest that the LBO crowd, and their over-financialization of the stock market has definitely had it’s effect in making the market untenable to value players. Any company that had a respectable earnings outlook was looked upon as a cash cow and jumped on by them. This to a point where the only way to make money was through momentum investing which is why I reason that most companies now have quite extreme PE values. Misallocation of resources at it’s extreme.

The House of Morgan has a pretty good history of when the practice began. Basically, when industry became self financing, such as General Electric, and banking lost a source of loans. If I remember correctly, the practice began in England with Morgan Grenfel (sp?), which makes sense given the British industrial revolution had an earlier start.

‘Twitter, which lost $1.3 billion over the past three years and which doesn’t know what to do next’

Who would have guessed gossiping on the Internet does not produce enormous profits. I play poker, but I still would not have gambled on this.

The 292K job print, following the October and November prints, are indicative that we nearer to the end of this phony economic recovery rather than to the beginning of it.

That is because hiring always peaks at the end of an expansion. When companies figure out that their business isn’t good enough to justify all the new hires, the layoffs begin.

My guess is that this next round of financial distress is going to be a doozy – possibly worse than 2008-9.

Ten, nine, eight, seven, six…

C’mon, even a six-year old these days understands how ridiculous official unemployment statistics are when it doesn’t say anything about the quality of jobs created, or not counting people who gave up looking for work after a certain period of time (IIRC that is six months?) even though they desperately need one as unemployed.

destruct sequence in 5..4..3..2..1………………………………….

Stocks don’t represent the future of the real economy any more but just the present of gambler’s speculations. God or devil with them.

The future of the real global economy depends on the governments policy regarding QEs. The one and only low needed is to forbid QE from entering into gambling in any overt or covert manner. Simple as this.

Patience is a virtue. For 5 years now I have watched as my shorts were crucified. And in one week, I recovered 1/3 of the losses. I’m not bragging because while I was being crucified, my three friends made over two million each. They are now stock free and waiting for more of that blue in Doug Short’s chart to disappear before returning. Like Wolf, I’ll never short again. If you do not have a key to the backroom, tread easy. The big boys play hardball.

With shorts you not only need to be correct but you have to time it precisely too. That’s just too hard. Many people went broke betting against a 1000 idiots going the wrong way. An easier way is to pick a contrarian stock like a profitable gold miner who’s AISC is very low. People leaping out of blue chips need to park their money somewhere and some of it flows to these guys.. One I watch (ASX:SBM) jumped 16% in a single day. I wasn’t in on it having pulled out ahead of the expected crash but I did ride it up from 55c to $1.26 before that anyway.

The timeline for the collapsing global economy.

Japanese banks had been on a maniacal lending spree into real estate and the bubble popped in 1989. Rather than own up to losses and admit their bankers were fools, they covered up the problems with loose monetary policy.

Japan then had the rest of the world to trade with that was still doing well but it never really recovered.

US banks went on a maniacal lending spree into real estate and the bubble popped in 2008. Rather than own up to losses and admit their bankers were fools, they covered up the problems with loose monetary policy.

US banks used complex financial instruments to spread this problem throughout the West.

Rather than own up to losses and admit their bankers were fools, the UK and Euro-zone covered up the problems with loose monetary policy.

Japan, the UK, the US and the Euro-zone had the BRICS nations to trade with that were still doing well but they never really recovered.

The BRICS nations are now heading for recession.

Doesn’t look good does it.

Jeb was expecting to win and reset the system with another war. That’s what the initial100M in contributions was for, unfortunately for him, the peasants have other ideas.

That is so true. That military industrial complex to is gunning for another trillion dollar war. The empire must go on. Dollar hegemony must go on. The men pulling the strings have both parties in their pockets.

Every now and then the peasants get something right.

Jeb Bush would have likely been an unmitigated disaster as president, perhaps even worse than the horrific specter of Hillary Clinton as president.

That said, at this point the system is probably too far gone for anyone of any political party to fix. The scale of the damage done to the US economy over the last 30 years or so has no historical precedent, and the current default setting of politicians of all persuasions is to do harm, not good.

The only thing most of the politicians are willing to do is to play the extend and pretend game, hoping the whole sorry mess doesn’t blow up before their term of office expires.

Given the current turmoil in the stock markets, I suspect that, to paraphrase George W. Bush, ‘this sucker is going down.’ If it does, Obama’s legacy will be that he presided over a doubling of the national debt from $10 trillion to $20 trillion while the foundations of the US economy rotted to the core.

I totally agree with you. We need to vote them all out while we still can, and keep doing it until no one can remember the last time a politician served two terms. And please people, don’t give the old ones any money, they have stolen enough.

And the BRICS will throw em and look east!

Many years ago when Alan Greenspan first proposed using monetary policy to control economies, the critics said this was far too broad a brush.

After the dot.com crash Alan Greenspan loosened monetary policy to get the economy going again. The broad brush effect stoked a housing boom.

When he tightened interest rates, to cool down the economy, the broad brush effect burst the housing bubble. The teaser rate mortgages unfortunately introduced enough of a delay so that cause and effect were too far apart to see the consequences of interest rate rises as they were occurring.

The end result 2008.

With this total failure of monetary policy to control an economy and a clear demonstration of the broad brush effect behind us, everyone decided to use the same idea after 2008.

Interest rates are at rock bottom around the globe, with trillions of QE pumped into the global economy.

The broad brush effect has blown bubbles everywhere.

We know what comes next.

The wealth effect.

Assets bubbles and imaginary wealth ….

One house worth £100,000

Housing boom ……

Same house worth £200,000

Housing bust ……

Same house worth £100,000

£100,000 of imaginary wealth created and destroyed, underlying asset unchanged.

unless you sold just before 200K per and buy it all back in at 100k per, then you have 100% gain. Then you lever and borrow 100k as at that level. Eventually the market will go up, and your income will in the interim amply cover the 100 k loan.

last week was really good to short the short the S & P index

The global debt driven economy is today resting on a $240 trillion debt bubble that needs to be inflated to create economic growth. The American, European and Chinese QE’s has kept this bubble alive for 7 years and by doing so they have made the situation worse. When the bubble no longer is inflated and the global economy starts to contract, then business, oil, commodities, stocks starts to collapse and default on this $240 trillion debt bubble ?

Anybody seen any good CAPE (cyclically adjusted P/E) comparisons of the major stock indices? My guess is China is stupidly expensive while the U.S. is merely “rich”. Might give us some sense of how far “down” is, or at least fair value.

This market is ready for mini-bear market after 6 yrs of bull market. CNBC commentators are still assuring investors to on pull back and why not as that worked so well so far. Capitulation is few months off IMHO though.

Looking for dead cat bounce soon for shorting opportunities and load up on double short ETFs QID (nas), SDS (s&p) and TWM (russell).

Yes Vespa, a nice roaring fire, polishing my shiny and a nice glass of Alphonse Mellot Sancerre Rouge with my roast beef…nice image for a fall, no?

Cheers

There is no market; not since 2008/9, at least.

I think stocks can only fall so far before we will be back to asset purchases from the Fed. I’m sure they’ll call it something else this time as their creativity for falsifying financial markets knows no bounds. Actually, I still see a ‘buy-the-dip’ SOP at play; just watch the ‘market’ move in the last 30 minutes of trading every day.

The comment about traders not knowing a market to go down is very astute. with a seven year ‘cycle’ each generation of youngsters gets wiped out as they move on to become used car salesman(women), only to be replaced by a new generation of green peas, and the process repeats.

Like on cue, the Fed sent out it’s spokespeople to say there is nothing to look at, everything is fine.

“Two regional Federal Reserve bank presidents, Loretta Mester of Cleveland and John Williams of San Francisco, dismissed concerns over stumbling stocks on the first trading day of the year and said the U.S. economy’s expansion was on solid ground.”

http://www.bloomberg.com/news/articles/2016-01-04/fed-s-mester-shrugs-off-stocks-drop-and-says-u-s-economy-sound

Twitter and the Container Store both have the same problem. They have a product/concept that is very easy to replicate. And if it can be copied it will be copied.

Last month the number of hours worked dropped. This month wages dropped. I’d say these are bad jobs reports rather than good ones.

So, if not the stock market, where does one put their lowly CDN cash-ola for 2016 and beyond?

Use to love me those GIC’s except for, well, you know, all the things that are WRONG with loving them (ie low, below inflation returns, high taxation, boring, safe, etc).

Preservation of capital is always a good thing. Every investor will find some time in their lives when cash is king. Of the three paper investment vehicles, commodities have topped and are definitely in decline, the bottom not yet defined; bonds are at a top thanks to QE and stocks are way over historical PE valuations with only momentum players still in play. Understand that this is only my view, others have theirs. Play ’em as you see ’em and good luck.

Julie,

Being now 60, I put my extra cdn dinero into cash a few years ago. While I missed out on returns, being a member of what the investment industry refers to as ‘bottom feeders’, day traders, marks, chumps and/or suckers, I stuck with what I know.

1) The Market is a casino. Valuations are insane. It does not reflect the economy or reality.

2) Outsiders enter at their own risk.

3) If I don’t have inside information, why on earth would I believe I could ‘outsmart’ insider traders or ‘experts’?

4) I know many of our local ‘investment advisors’ and appreciate they are in overreach and don’t know much more than I do. I wouldn’t let them learn/work with my money.

Anyway, it has worked for me. Keeping up with inflation is better than losing it all. I made my past money by fixing up and selling houses, which in Canada means no capital gains as I lived in them as primary residence. Being a carpenter and living to build made it fun and worthwhile. Right now I am waiting for a particular piece of property to come up. If it doesn’t, the money stays put and I will sleep nights.

Best of luck 2016.

compelling argument for the most ridiculously undervalued assets on the planet–physical gold and silver.

Could Macy’s be emblematic? Best for a ‘long’ ’16 Wolf…PJS

My Millennial observations and answers to my inquiries go as follows: Container Store….”Yeah my Mom used to shop there.” Twitter….”No I don’t follow anyone or I set up an account but never used it.” Snapchat…”Used it a ton at first but only occasionally now.” Facebook….”Not as much as I used to.” AOL or Yahoo…..”Hahahaha! My Grandmother uses that.” HuffPo or Yahoo News….”No, Buzzfeed and Reddit.” Sears….”Huh?”

JP Pennys…..”My Mom bought my school clothes there when I was a kid.” Macy’s…..”TJ Maxx.” JCrew….”When My Mom used to buy for me.” Abercrombie…..”Are you serious?” Olive Garden….”We go there every year for my Grandmother’s Birthday.” Apple Watch (only came across one purchaser)…..”I didn’t really think that purchase through.”

You can buy my full report at…. Just kidding, but I do softly quiz just about every Millennial I come in contact with and my daughter’s friend’s run the upper and lower parameters of the Millennials so many long conversations have been had.

It seems, to borrow from Marx, it’s a historical inevitability reality always come back with a vengeance.

Speaking of stocks, I’d like to give the example of the most important stock (by market capitalization) in the world: Apple (AAPL).

Until May 2015, AAPL had one fantastic ride and it sure looked like the FANG (Facebook, Amazon, Netflix, Google), the four megacap saviors of Wall Street, would become the FAANG.

But then something happened. To say it all, despite Tim Cook’s valiant PR efforts, it seems something broke in Cupertino.

Sales in Asia are tanking, prompting Apple to cut prices on some important markets (such as India).

While economic contraction surely has something to do with it, the laundry list of issues the iPhone 6 has are making even Apple enthusiasts wary. Even worse, shortly before his death Steve Jobs had warned the company avoiding competing with itself, meaning keeping tablets and phones well separated and avoid the phablet market like the plague.

A lot rode on the iWatch. But while sales figures have apparently been everything the company expected, iWatch promotional sales have already started here… perhaps the company engaged in a bit of channel stuffing to reach those figures?

To top an awful second half of 2015, financial newspapers and websites all across Asia report Apple has cut orders for various components between 10 and 40%. Some may have to do with the company shifting vendors to fix the problematic iPhone 6, but the drop seems to be all across the board.

Result: AAPL is now under the $100 barrier. It has cost its largest shareholders (which include all the world’s largest private hedge funds, the Banque Nationale Suisse and the Norwegian sovereign pension fund) untold billions.

It’s very likely Tim Cook will once again attempt working his magic but will it work this time? Investors do not just wish for Apple to continue increasing its sales and profits: they’ve come to expect nothing short of eternal expansion (preferably in double digit) from Cupertino.

But how long can that expansion last? And how long will Apple be able to satisfy those phenomenal growth expectations?

Smartphones and tablets are increasingly becoming “commoditized”, meaning profit margins are bound to fall off a cliff.

Western, Korean and Japanese manufacturers are increasingly feeling the heat from Mainland Chinese competitors, which have grown savvy to the game: the latest smartphones from the likes of Xiaomi and Huawei are highly sophisticated, well designed and often use exactly the same high-quality components as their more famous competitors, like Qualcomm processors, Toshiba batteries and Sony screens.

I am sure Apple will continue to do well, but I see its stock value falling down a long way over the next few years. The products they sell are not unique.

The old Apple died with Jobs. Don’t expect any great innovation from them. The only thing the new Apple has going for it is that it is not Microsoft. The road to survival for Apple is to highlight the choice between the two. I always used MS because it was cheaper and good enough, but even I have my limits, and Apple is starting to look like a better alternative. We are not Microsoft is the road to salvation for Apple.

Apple road the crest of a wave, being the first entry into mobile digital music and Apps.

They thought of platforms that could utilise them:

iPod, iPhone, iPad

Is there anything new to carry on the success story?

The iWatch … maybe not.

They do what they do very well, but something really new …. unlikely.

Guessing the next big thing is something a tech. firm does once and once only, you ride the wave and crash on the other side.

Apple car, Apple tv, home automation, more wearable tech (ie. health applications)….plenty of innovation in the pipeline.

Apple car, Apple TV …… I think someone has got there first.

Let’s put the Apple spin on an existing product …….

The iWatch ….. oh dear

The iPod was Apple’s innovation.

It was developed up to the iPod Touch.

The iPhone is a hybrid of a mobile phone and an iPod touch.

The iPad is a large iPod touch.

The one innovation has been spun out already.

What else can we combine with iPod touch?

The watch (iWatch)….. the display was too small for it to work well.

Apple has run out of Steve Jobs’s ideas. Now not having any original ideas of its own, Apple is waiting for someone else to come up with something new whereupon Apple will latch on and launch its own version.

As for Apple stock, no one mentions stock shortage. The more buyers for a limited amount of stock the higher the sp. Apple is not an investment stock, it’s demand and supply momentum. Why buy when there is nothing new anymore.

Disclosure: I have 2 ipads, 1 iphone, 3 imacs. Snow Leopard was the best.

The market for sensible price 5.5 -6″ screen phablets will expand. As a growing % of the population needs the larger screen.

There is a slice of this market than would be well served by a version model with a lot less of the useless software crud that phablest are loaded with today.

Apple should move there before a samsung note lite arrives (Light being light on crud not, cpu, memory, display, and battery, power.)

The one I am looking at currently has 20 vendor and provider applications in it, that have never been opened, in its 3 year (App) life.

HEADS UP

An email sent out by FXCM is warning it’s FOREX clients, of a change coming in margin requirements:

As of close of trading January 15, 2016 the margin requirement will double on the USD/CNH pair trade.

Sounds like a positioning move expecting another round of Yuan devaluation coming soon.

Thanks!!!

On the basis that we are both FXCM clients, why are you giving away, what we pay for.

This party is slowing down. Someone get another bottle of Everclear

for the punch bowl!

The last thirty minutes on Friday were the most telling for me. The bulls managed a last minute ramp all week, but Friday it seemed like they were just throwing in the towel. I also thought we would have one more rally, but now I’m wondering if there are any “greater fool” buyers left.

Western Stock Markets… buying and selling pieces of paper representing *corporations that buy and sell pieces of paper for profit.

Is this a sustainable model of financial stability?

* Even corps that still actually make a product shuffle paper to make profit, create tax credits, and boost share price so the CEOs can buy $100M penthouses.

Blackrock admitted this year that their profit was due to “Accounting magic.” Also check out the number of CEOs who have taken tens to hundreds of millions of dollars of personal loans against their stock ownership.

And I have ten that says the assets brought with those loans, along with the other assets the CEO has are all well protected from any claim that would occur out of a bankruptcy.

Should the stock tank and the loans get called.

They know.

So if I win the Powerball tonight, where do I put my winnings?

SGt – I will help lighten your load, only need a million as I am a Cooter lookalike in terms of debt and owning nothing but my little piece of sod in the country. :)

Donate it to WOLF STREET – but keep some money to pay your taxes because the donation won’t be tax deductible.

If you don’t want to donate, I can also sell you an ad for $1 billion. It will run for the next 10,000 years on this site

Not in a bank, or gold.

The U.S., China, Europe,…in fact, most of the planet, seems to be under what I would term as a kind of ‘Financial Arrhythmia’ Maybe this is Gaia’s way of Knocking us humans down a notch or two……

I would invest in CNBC if it were a stand alone stock. Its ratings go up when markets go down. It is more entertaining to watch Jim Cramer backtrack on Chipotle Mexican Grill while Bobs Doll and Pisani look like they just dined there!

How much longer can markets sustain themselves on entertainment stocks.

The world today is not into wealth creation anymore. The world economy is driven by spending. Consumer spending with borrowed money. And, what is the money spent on: much of it on entertainment. Yes, the world suffers from overcapacity in most everything and the lack of jobs. And, where is one of the biggest voids: idle time – overcapacity in idle time.

Apple/Samsung and others make cell phones. The cell phone is possibly used up to 50% of the time as a utilitarian device (getting info or communicating). But, people are so bored and have so much idle time, that they vacuously stare into a little screen and possibly no longer know why they do that. Just reaction to stimulus?

Facebook/Twitter/Netflix – idle time pursuit – entertainment

Google – the backbone of the Internet, which also functions up to 50% as an entertainment vehicle.

Amazon/Ebay – good places to shop – but then shopping has an entertainment function too.

Fast Food chains – the entertainment function here is probably greater than 50%.

In the old days, people used to work, pay their bills, save some money and consume the rest on forms of entertainment. But, no matter whether it is yesterday, today or tomorrow, the limiting factor is surplus money.

Yes, you can contend with boredom by entertaining yourself for free – counting pigeons in the park. But that gets old after a while – so you decide to invest in some entertainment: Save up a little money and buy a shotgun at a gun show and start shooting birds in the woods. That takes real money.

Entertainment is not a necessity. And, when you run low on dough to pay your bills, you cut down on restaurant visits. People are running lower and lower on discretionary income – they can not afford a ticket to a NFL game. And, forget a pay-per-view boxing match on TV.

I rent out my ski house and spend $400/year for a listing ad on HomeAway. Why? Because the people searching that site have money to spend. Resulting in very good rentals from responsible people. I have been doing this since HomeAway started up its business. But every year, while the volume of inquiries remains high, the number of leases closed is slowly declining. I am not complaining – I make out fine. But, I have to vigorously process a couple of hundred inquiries to close one lease. The limiting factor is money: I charge a lot and am picky about the rental parties. I am willing to rent for fewer days resulting in less income. The positive result is no rental disasters (property damage) and fewer dings and dangs inside the house. But, I keep asking myself: where do the people get money for a ski trip – skiing is damn expensive entertainment.

I question the premise that society can support itself on entertainment. Idle time is increasing. People want to be entertained – but can they afford it.

Despite massive negative hype over the weekend we didn’t have a waterfall decline on Monday. Call me a contrarian, but with many traders now short the bull could (briefly) return with a vengeance and cause some major pain to bears.

“It ain’t over ’til it’s over”

It never fails, does it? Shorting is for folks with a huge pain tolerance.