When will the data stop raining on the parade?

Second quarter GDP growth in the US was hot, at 3.9% annualized rate. That wouldn’t have been hot in any prior US recovery, but it is hot here and now because this misbegotten, Fed-engineered recovery has run at a measly annual growth rate of about 2%.

That’s considered “stall speed” in normal times, below which the economy doesn’t have enough lift to keep flying.

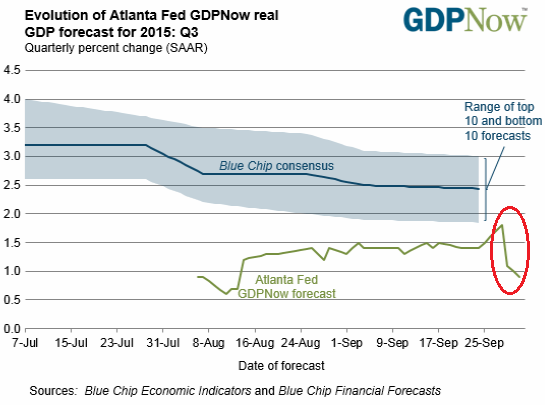

So the previously lukewarm is hot today. The most recent adjustments even pulled the GDP estimate for the first quarter into the positive, if barely. All hopes are now riding on the third quarter. But recent data has been lousy, and Wall Street economists have been busy lowering their forecasts into the range of 2% to 3%.

Today, it’s the Atlanta Fed that’s raining on the parade with its updated GDPNow forecast for the third quarter. Oh my!

The data point that caused the update of the “nowcast” was the advance report on US international trade in goods that the Census Bureau released September 29. It was ugly. At $67.2 billion, it was the second worst monthly goods deficit in years, behind March’s deficit of $70.5 billion, which had been part of the infamously crummy first quarter.

So the “contribution” to GDP growth of the goods trade deficit fell from the already negative -0.2% to -0.9%. And this “contribution” slashed the Atlanta Fed’s GDPNow forecast by half, from an already below-stall-speed growth of 1.8% last week to 0.9% today (green line):

GDP Now, which the Atlanta Fed started in 2011, is a computer model. Data go in, forecasts come out. The purpose is to forecast not actual GDP, but the government’s first estimate of GDP, however off that first estimate may be. Forecasting GDP accurately is impossible. But the model has the advantage that its forecast is not determined by human interpretation of incoming data, or even wishful thinking. It’s the model that decides – not economists paid by Wall Street to hype stocks and bonds and sell their financial instruments while extracting fees coming and going.

Since the model doesn’t attempt to smoothen out the data, it can be volatile. But as it approaches the GDP release date, it can be very accurate. For instance, it totally nailed the first quarter. So this will be interesting. More data for Q3 is coming down the pike over the next few weeks, and some of it might be strong, but this sudden and drastic change in direction of the forecast can give someone the willies.

“It feels like someone just flipped the switch to ‘off’ without any concrete reasoning,” one of the executives commented. Read… US Manufacturing Recession Draws Eerie References to 2009

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How can the 4th Q GDP be so mediocre? Must be all that warm Summer/Fall weather keeping people from buying more useless stuff?

Ok, my weekly sarcasm quota has been met. : – )

News reports that September US auto sales were up. A colleague of mine who just purchased a new BMW last weekend said there were only three other customers the entire 4 hours he was there. Who to believe.

Ask the dealer how bussiness is doing. Or several dealers

At least he’s not a VW dealer. This VW thing is odd. If all its swans roost it could be advisable to go bankrupt – but would the US courts let it?

I expect that the German government will bring pressure at a very high level. I’m not one of these omnipresent conspiracy guys but it wouldn’t surprise if the pressure is secret and the deal involves geo- politics. If VW can satisfy the US the rest will follow.

Remember the old expression ‘what’s good for GM is good for America’ ?

Well VW is a larger part of the German economy and Germany can’t let it go down.

Every time I hear about a model predicting something I am very leery. When I worked on Wall St. the models were changed all the time, daily, weekly, monthly. We use to refer to certain models as the model du jour. You have no guarantee that the data is not being interpreted by a changing model over time. In accounting the concept of restating statements is used when the accounting methods are changed. Restating a database created by a changed model should also be done, but I can assure you, I never saw it done. The worst case is that the historical data points were all created by different models and have no relation to each other. The best case is that they always use the same model. My bet is the model changes all the time.

My suspicions as well. Like when the Fed makes its seasonal adjustments, or restates their GDP or Employment statistics. Restating the past is likely just as much a game as remodeling or restating predictions. Now that GDP includes R&D expense, valued at whatever corporations think they can get for “assets” in the future, it is hard to know what to believe anymore.

Wolf,

I don’t know if you know this but i would like to know how Obamacare is going to impact 2016. i read that there are increases of 50 pct. This is a kind of price rises :- But price increases are included in GDP so GDP will go up. Two ways. First the import/export will improve secondly the money can not be saved but must be spend if there is no increase in wages. (i think due to global competition that is nearly impossible.) The cost of health care must go up because you have more old people who consume more health care. Don’t know about increases of the own risk. If they also go up its even better for GDP.

There are a lot of stories out there on this, and I can’t figure out what if anything is true. Personally, our insurance rates went up 1.8% – the lowest annual increase in my life. About 6 years ago, we had two back-to-back increases that amounted to over 100%!

So we switched to a different insurance company.

Obamacare impacts the economy in many ways since healthcare is so huge in the US. But trying to figure out which way and how much is way above my pay grade, as they say in government.

How come nobody ever says well this whole economy has gotten out of hand and longshore men and doctors and corporate attys, and the schools that educate, ect … are going to have to recognize it was all a scam and the money owed and the salaries received are just unsustainable based on the 90-10 wealth divide. There just isn’t enough money in the hands of the 90 to keep this game going and compound interest makes it too dangerous to let the 90 have more than they need. If that ever happened in 2 generations most people wouldn’t have to work because compound interest would allow a savings rate beyond what is required to make people need to work. This gets real ugly, the rubber band in now in full contraction mode and building momentum quickly. All budgets continue negative revisions, cap ex is not existent because no-one from the hotel builder to the starbuckx manager to the global conglomerate mining company to Apple have any idea what real demand is going to bring in the years ahead because it’s all been financed for the lady 40 hrs and principal can never be paid back and the interest in still more than makes sense based on future margins.

Hi Me,

Are you asking the universe ‘why’ nobody has woken up to the impossibility of our system?

May I attempt to put it another way? Assuming that TPTB know full well the futility of this system:

A) What do they plan to do with all of the jobless, resourceless millions of lower to middle class peons, who will continue to emerge from this ‘war on civilisation (or, of attrition)’ into abject poverty or starvation, like the Syrian refugees who have been flooding Europe, as this continues to unravel?

B) who is going to defend them against these millions of hungry, desperate and apathetic people?

I invite any and all criticism of the questions, if they aren’t adequate or suitable. But, surely something along these lines has been considered by the think tanks etc. what are the answers?

Debravity

Thank you for your comment. My comment is more of a general stmt/rhetorical question. I just don’t get why people post all these facts when it is so simple. We must all demand a correction by not consuming and telling 100 other people the same thing and insisting they each tell 100 and so on. I say we because I assume everyone on this site is smart enough not to use credit. The people must shut the system by refusing to partake in it. Yes we all need food and water. That’s not what I’m talking about. I am referring to anything non essential. It amazes me we still have business travel for example. So many people unnecessarily paying for a plane ticket when we have Facetime and webcams. We do we insist on having everyone work from 9-5. There is absolutely no need for most people to go into an office everyday or at all if we’re really being honest. We all have home computers and cell phones with unlimited minutes but yet we continue to waste time and consume gas and put unnecessary miles on our car. We pay 5 dollars for something that 20 yrs ago was 1 dollar or less. It’s not because of inflation it’s because we refuse to deny ourselves things in short term and save and pay cash later. If we refused to dine out for example the cost of going to dinner would be half because people still need to work and would do it for whatever the market would pay. That of course assumes we actually enforce our immigration laws and stop shipping jobs abroad to create fake short term unsustainable growth.

One reason for face time as distinct from e-time is when you want to discuss what you don’t want recorded FOREVER. Like price fixing, rat f*cking competitors etc.

One advantage that all financial players including (sort of) straight ones swear by is that of London, i.e., the City, where within a square mile you have the world’s most concentrated financial power.

When they’ve had their panics, a real physical meeting can be convened within hours of all major players.

There is no, nor will there ever be, an equivalent virtual meeting.

Just as there will never be an equivalent of real sex and virtual sex.

Petunia, your comment reminded me of something I haven’t thought of in years. Do you remember Bio-rhythms? I was 18 and working for a taxi company in Omaha, and our new owner from Denver swallowed this scam hook, line and sinker. It was one of these computer GIGO models that had three parameters (I don’t recall what they were) that were graphed for a monthly period and posted in the drivers room for each driver. If two lines intersected on a given day it was a ‘double critical’ day and more than ordinary caution should be used. But if all three converged OMG you were toast. I was in the Transportation Workers Union at the time (what can I say I was 18) and shop steward. One of my limo drivers came to me and said she was told she couldn’t work her scheduled shift because she had a triple critical day and she was in a bind financially and needed the work. I checked the current contract and discovered the company had the right to not let her work but since she was scheduled they were required to pay her for the day. When I checked with the owner he relented and she worked her shift. The Bio-rhythms disappeared shortly thereafter.?

I think the Fed knew, or strongly suspected, that this was coming, which is why they didn’t raise rates in September. That stuff they said in the summer about “we’re thinking about it, it depends on what the final data is, blah blah blah” was mostly spin; they knew perfectly well that the data was going to be discouraging and that they would probably want to hold off tightening until at least December (more likely Q1 2016). When practically the whole freakin’ world is slowing down, then of course it will affect you too.

With the EMs and FX being they way they are right now, only to get much worse with time, and the entire world entering what will most be likely be a very, very deep recession which will take even longer to “recover” from than the 2008 crash because:

All of the central bank tools other than more QE and negative interest rates (accomplishing nothing positive as always) have been used and spent.

There will be no China to malinvest 15 trillion dollars worth of infrastructure using borrowed money enabled by world CB easy money to consume us out the of recessionary/deflationary pit. As a mater of fact, China is coming in very a very hard landing.

I don’t see Fed rates going up for a very, very long time. Raising rates would only exacerbate the EM/FX issues. If anything, they’d take rates negative.

THIS is finally the end game of the idiotic three decade long worldwide debt bubble. All of this talk of “when will they raise rates” is amusing.

How can their be any growth in the US economy when the Fortune 500 companies revenues are down on average 3.4% and profits down in the region of 5%?

This GDP number is a LIE.

Just as the job numbers is a LIE

Maybe small businesses and mom-and-pop operations are like totally boooooming to make up for the lack of growth in Corporate America?

Wolf: Small business owner here.

Nope.

Nigelk, I hope you got my sarcasm… :-]

Recipes’ for “models” vary widely. Likely the Atlanta FED will discover the bad ingredient of their “model.” Perhaps, they will offer a revision, and technical correction, perhaps we will discover their model IS correct, and since the US has been addicted to both Debt and credit we m,ay well find we are vastly over levered, and terminally damaged. Naw… no way in hell anybody would EVER admit that one.