Amid tight supply and strong demand.

By Wolf Richter for WOLF STREET.

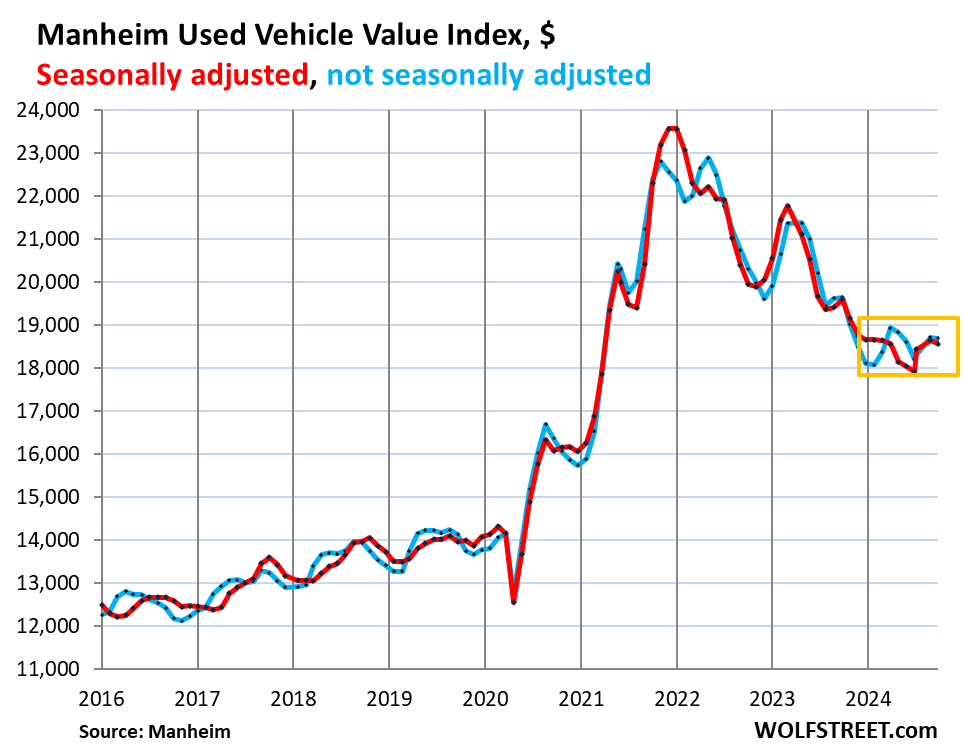

Prices of used vehicle sold at auctions across the US barely dipped in September after having jumped for two months in a row.

Not seasonally adjusted, wholesale prices inched down by $26 on average per vehicle, or by 0.1%, in September from August, to $18,693, after having jumped by $513 in the prior two months combined, according to the Manheim Used Vehicle Value Index, which is adjusted for changes in mix and mileage (blue in the chart below).

Wholesale prices usually decline in September, but they declined less this September than they normally do in September. In 2019, for example, before all the pricing craziness started, wholesale prices fell 0.7% in September from August, compared to the 0.1% decline this September.

“The new normal is likely that we continue to see wholesale depreciation, but it may be more muted than the market is accustomed to for the rest of the year,” Manheim said. It runs about 8 million vehicles a year through its auction lanes.

Year-over-year, prices were down 4.9%. This compares to the double-digit drops in the first five months of 2024 as part of the historic plunge in prices.

Wholesale prices have now given up nearly 50% of the pandemic spike, and it appears that this may be about as good as it gets for car buyers.

Seasonally adjusted, wholesale prices fell by $89 on average per vehicle, or by 0.5% in September from August, to $18,565, after the $720 jump in the prior two months combined. In September 2019, seasonally adjusted prices fell by 1.0%, double the rate of this September’s decline.

This less than normal dip in September and the two months in a row of substantial price increases indicate that used-vehicle wholesale prices have been stabilizing, pointing at a potential end of the historic plunge, and that retail prices, which lag wholesale prices by a few months, may fade in their substantial contribution to pushing down CPI inflation.

Dealers buy at these auctions to replenish their used-vehicle inventories. Supply comes from rental fleets that sell some of the vehicles they pull out of service, from finance companies that sell their off-lease vehicles and repos, from corporate and government fleets, other dealers, etc.

The Three-Year-Old Index decreased by 1.6% over the last four weeks, which was less than the typical pre-pandemic decline for this period of 1.8% for the same four weeks in five years from 2014 to 2019, according to Manheim, a unit of Cox Automotive.

Supply in the three-year-old segment is constrained by the lower influx of off-lease vehicles whose 3-year leases are now maturing. Leasing activity plunged in 2021 to 2023, amid new-vehicle shortages and uncertainties about lease-end residual values due to the insane spike of used vehicle prices at the time. This sharp drop in leasing activity during those years now translates into a sharp drop in lease maturities, and a sharp drop of supply to the three-year-old segment going through auctions. This will drag into 2025 and 2026.

The average daily sales conversion rate in September, at 60.3%, was higher than normal for September, according to Manheim — same scenario that had also played out in prior months, amid strong demand from dealers who want to replenish their used-vehicle inventories, and tight supplies of used vehicles. Over the previous three years, the conversion rate in September averaged 53%, according to Manheim.

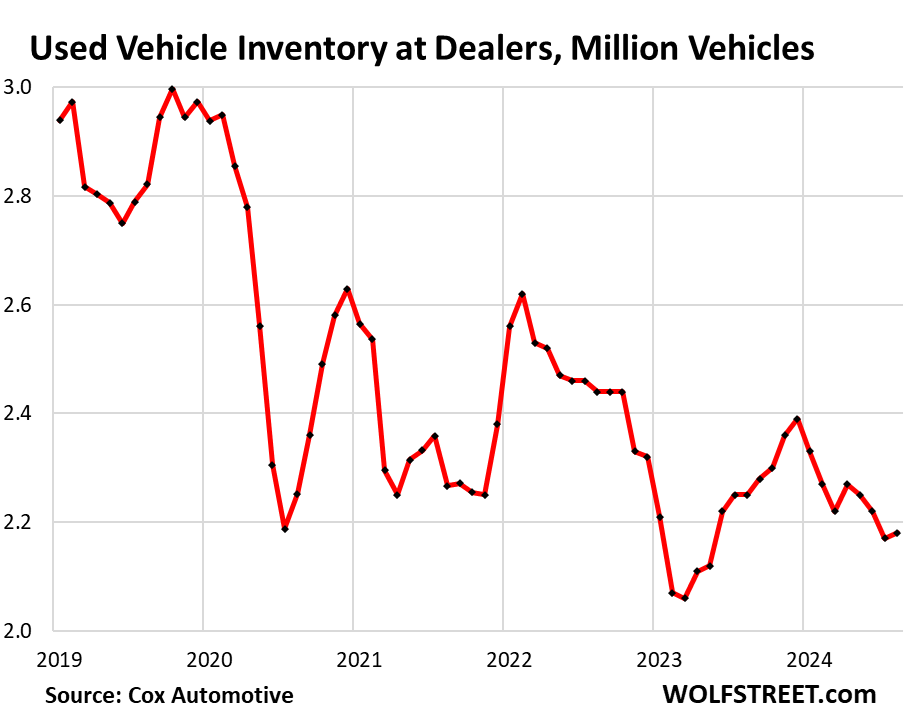

Used-vehicle retail inventories remain tight.

Retail inventory of used vehicles at the start of September, at about 2.18 million units, was down from the prepandemic range of 2.8 million to 3.0 million vehicles, according to separate reporting by Cox Automotive.

A very basic issue for used-vehicle supply in 2024 through 2026 is that new-vehicle production plunged in 2021 and 2022 due to the semiconductor shortages.

Over the seven quarters that the chip shortages hit vehicle production and sales – from Q2 2021 through Q1 2023 – automakers sold 6 million fewer new vehicles than over the seven-quarter period before the pandemic. These 6 million vehicles that haven’t been built cannot provide supply to the used vehicle market. And that issue of the missing 6 million vehicles won’t just vanish overnight.

But used vehicle retail sales, in terms of the number of units sold, rose 9% year-over-year in September, according to preliminary figures from Cox Automotive. Dealers are buying at auction to restock their retail inventory, amid tight supply. And this appears to be putting a floor under the historic price plunge of used vehicles.

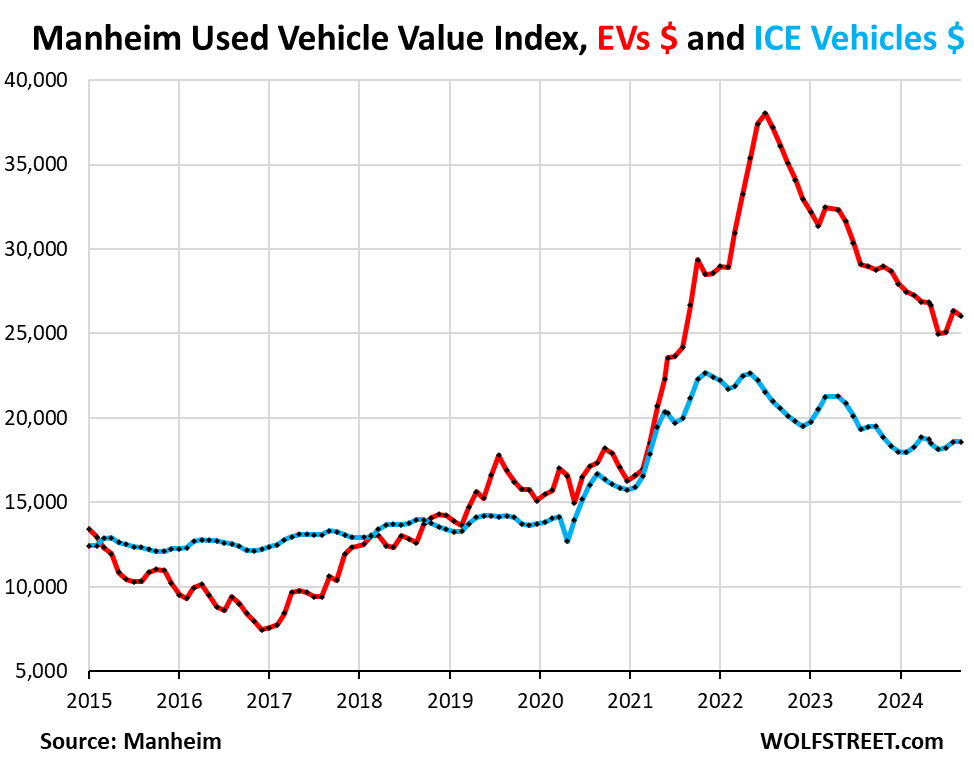

Prices of used EVs and ICE vehicles.

EV wholesale prices, after spiking by 5.1% in August from July, fell by 1.1% in September (red in the chart below, not seasonally adjusted).

ICE-vehicle prices, after rising 2.0% in August from July, dipped 0.1% in September (blue, not seasonally adjusted).

Used EV prices had spiked by an insane 145% from January 2020 through July 2022 when Tesla-flipping was a thing. Tesla has largely killed Tesla-flipping by ramping up production and cutting prices starting in 2022.

Used ICE vehicle prices had spiked by less than half that rate, by a still crazy 64% from January 2020 through July 2022.

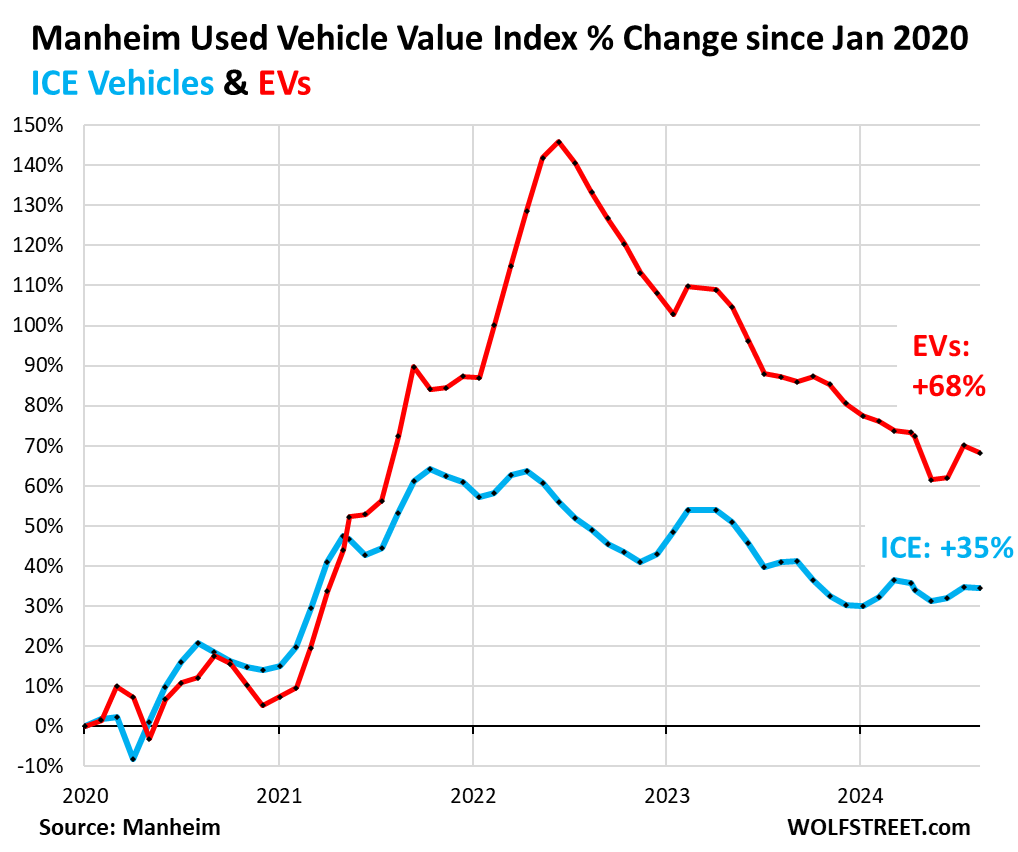

EVs have given up about 53% of their 145% spike; ICE vehicles have given up 46% of their 64% spike. And so EV prices remain far higher in relationship to ICE vehicle prices than before the pandemic, and are still far more out of whack than ICE vehicle prices:

Since January 2020, EV wholesale prices are still up 68%. ICE-vehicle prices are up 35%:

Wholesale prices in some of the most popular segments:

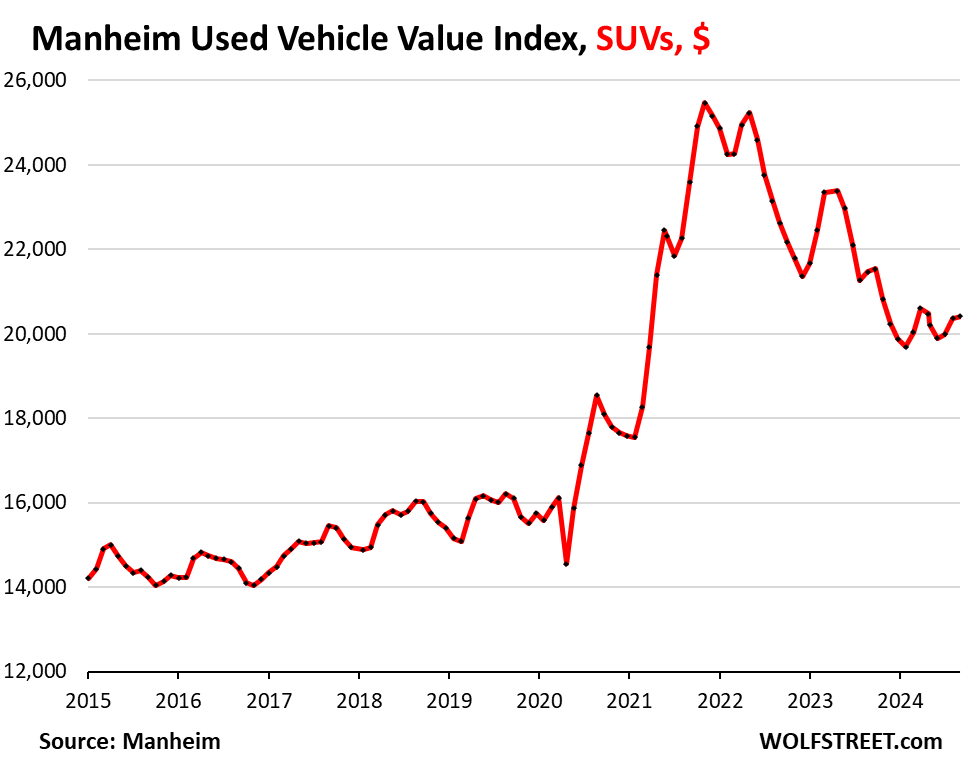

Prices of SUVs rose. Auction prices of all types of SUVs in aggregate, from compact to full-size, inched up 0.2% in September from August, the third month in a row of increases, to $20,411, down by 5.2% year-over-year and have given up 49% of their pandemic spike:

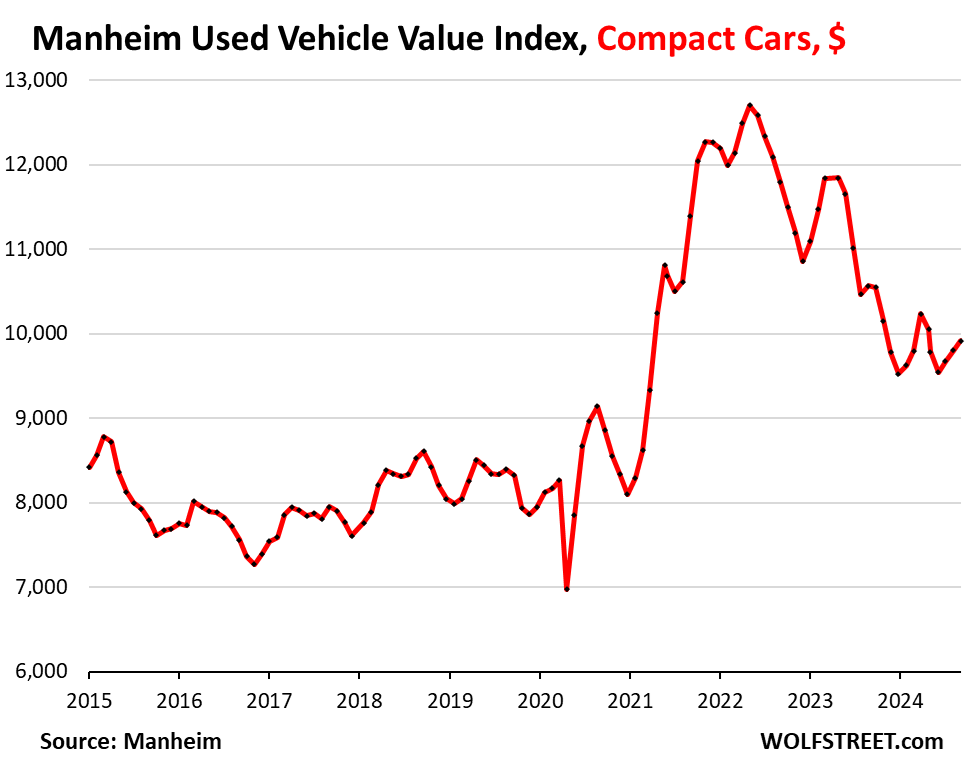

Compact car prices rose: Auction prices of compact cars rose 1.1% in September from August, the third month in a row of increases, to $9,915, and are down by 6.0% year-over-year, and have given up 61% of their pandemic spike:

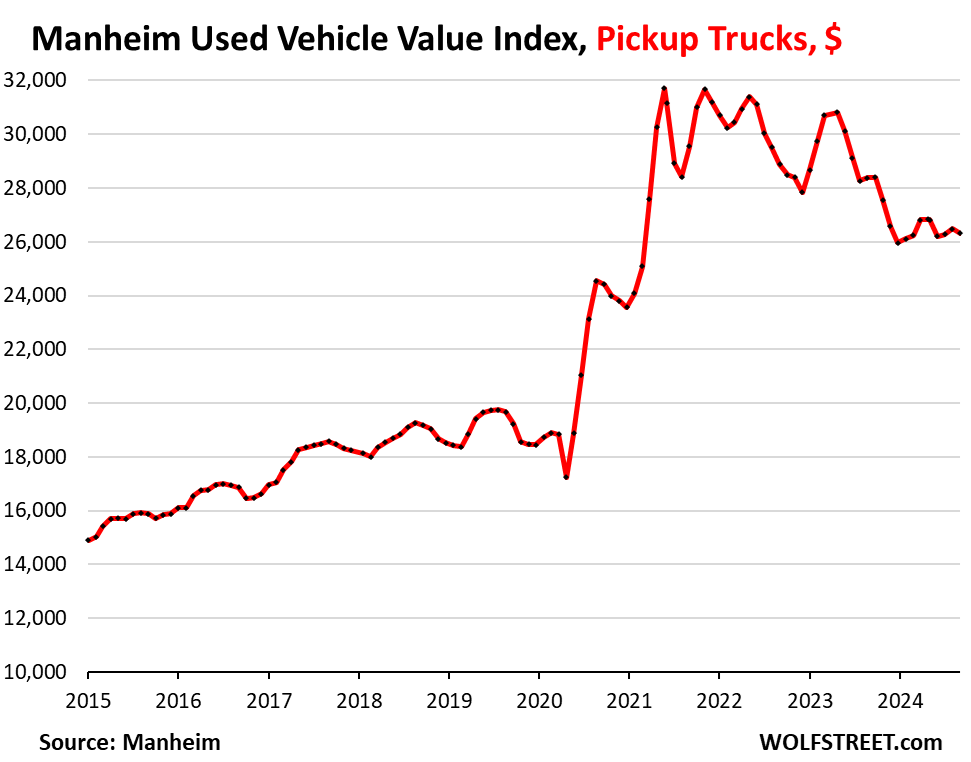

Pickup truck prices declined 0.6% in September from August to $26,235, and are down 7.3% year-over-year, and have given up 40% of their pandemic spike:

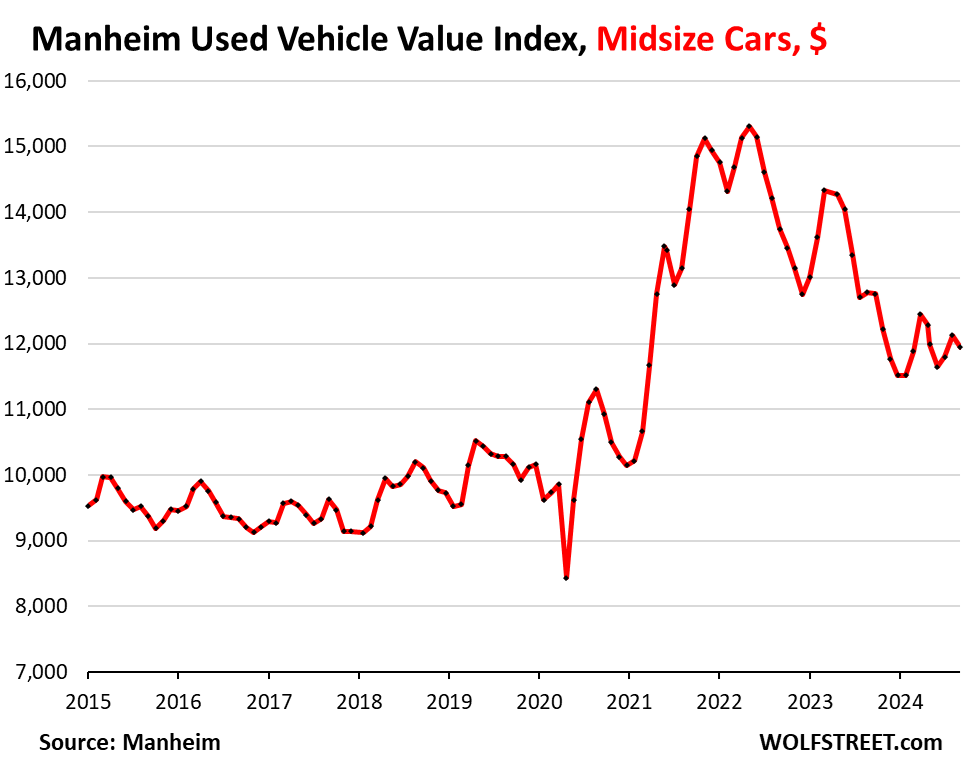

Midsize car prices fell 1.5% in September from August to $11,946, down by 6.3% year-over-year and have given up 59% of their pandemic spike:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Having ~ 6-9 million extra people in the US looking for cars sure does help demand….

I thought thr same thing. And also now more people are required to go back to the office, and there were a lot fewer new cars produced during the pandemic. Those price charts seem to be back on trend.

Cars are good for 150-300k+ miles, I’m starting to see early 2000s stuff back on Craigslist, grandmas old Camry with 130k is suddenly worth a few thousand bucks to someone. Better than sitting unused I guess.

Back in 2018, I had a loaner from a small repair shop: a 1996 Camry with 380k miles on it and modded with a turbo. The shop owner said the car only had one owner before they bought it, and they had been servicing it since it was basically new.

That car ran REALLY well for being 22 years old with that many miles, and I really enjoyed it.

It wouldn’t surprise me to see older, well-kept Japanese vehicles like Civics and Camrys having above-market resale values in the coming years.

There is nothing even slightly ‘enjoyable’ about an old Toyota Camry. I had a loaner 2015 Toyota Yaris with about 22,000 miles some years back when one of my BMWs was in for service and it clanked and clunked and was a falling-apart piece of junk. I have no idea how Toyota can sell any of its cars except to people who know nothing about real cars of excellence.

The 1993-96 Camry was a very well-made car, they benchmarked the W124 Mercedes E-class from the late 80s.

When the yen soared in the mid-90s Toyota got serious about de-contenting their cars to make them less expensive to produce, so its successors were lesser vehicles. My parents owned four different generations of Camry and that was the best by far.

So since Toyo is rated # 1 for reliability and BMW is way behind this looks like a case of ‘every one is dumb except me’ Benz is even further back, rated very unreliable for its electronics.

Tidbit re: BMW ‘Smart’ Car: Brake master cylinder: 2000 C$. The part, install extra

SCBD,

To each his own. The only thing I didn’t enjoy about that car was the lack of AC and CD player. If it had those two things it would have been more than enough car for me.

My 2000 tundra with 150k miles runs like a beast 24 years in. I bought it in 2015 with 93k miles. Put in a new timing belt (preventative) and other than that, just a thermostat in 9 years.

Awww that pessimistic attitude just doesn’t mesh well with this booming economy.

It’s like when you take grandpa outside to feed the ducks and all he can talk about are his aches and pains!

Awww grandpa life is ☀️. Look!👀

ah shucks, my 2001 F250 diesel can take most off start line

just broken in at 282,000 miles

People sure like exhibiting their hobby horses.

A guy waded across the Rio, went in and bought a three year old Tesla. Paid over list. drove prices up.

I wouldn’t dismiss the impact of several million people buying low end used cars. They aren’t buying Teslas but they sure are buying 20 year old work trucks and minivans here in Denver to do landscaping and house cleaning. That has to drive prices up from the low end.

funny I had landscaper ask if I wanted to sell my 2001 f250

no it’s my work truck and I couldn’t replace it for $25k

With “higher for longer” reasserting itself (Fed be damned), I expect used cars/truck to gain a certain premium. Looking at your chart on pickup trucks, I’d bet that the rate of change returns to the pre-COVID trend ($800-$1,000 per year increase in prices).

Prices of used cars were approaching former new car levels for a while, so they had room to drop. But we’re squeezing the margins now. And dealers are going to be reminiscing fondly about former pricing while they figure out what to price currently. That’s a psychological barrier to lower-still pricing.

Anything we have between $25k-45k sells pretty fast. Lease returns are hard to come by so that keeps those prices up. More expressive units, well they are getting some big price reductions.

Declines in durable goods prices have been material in reducing inflation numbers. That’s probably over now.

The death of the durable good decline.

“I hope you enjoy your higher prices” she says as she rings up my candy bar, “where else can you pick up a candy bar for 20 dollars” I say.

The check engine light comes on you new used car, the engine shutters and dies. She looks at you and says, “well this is great”.

Those flipper cars are the worst.

The next few years will be interesting as the shortage of new vehicles has turned into a glut as highlighted by Stellantis’ latest report. Are high interest rates pushing people away from buying new cars hence causing greater demand for the already tight supply of used cars? And, will the prices of new cars drop enough to offset the used car effect on CPI?

The check engine light has nothing to do with the engine. It’s about pollution controls and can be set off by as little as a loose gas cap. But that light with the pic of an engine gets more attention. I drove my Civic 100 K kilometers with it on.

We’re you born in a manger….even the three wise men can’t help you on this one.

its about pollution stuff

why I keep my 2001

want to get rid of F350 – 2016 diesel – all that pollution stuff = 10mpg

You will see a crash in the car market next year. It’s inevitable, just like the housing crash 15 years ago. Similar issues: overpriced cars, questionable financing, and consumers left with the reality that they owe much more than their aging car is worth. Greedy car salesmen sold their future by selling cars over sticker price in long-term loans, all but guaranteeing prolonged negative equity. Now, all those consumers have been taken out of the market for the foreseeable future. We all know what less demand equals.

But wait a minute… there already was a huge sales crash in 2020-2022, in the new vehicle market. And for the past two years, used-vehicle prices crashed from the ridiculous spike. So we had these two crashes already.

But there’s pent-up demand because 6 million fewer new vehicles were bought because of the shortages in 2021 and 2022. This also creates a supply problem in the used-vehicle market.

So 61% of used-vehicle buyers pay cash, and they have 100% equity, no matter what prices do. And those of the 39% who borrowed to buy a used vehicle and are hugely upside down, well, they’re going to be driving their vehicle for a few years, no problem. You don’t have to sell your car when you move or get a new job, unlike a house. You can just keep it and drive it.

See the crash in new vehicle sales that we’re still trying to dig out of? (for the cash in used vehicle prices, see above) It’s hard to have so many crashes back-to-back:

That’s interesing that they sold 14-15 million vehicles during the pandemic. I was going to dealers and they had nothing for sale. I was chatting with the honda sales manager while they made me a key. He said he laid off all but one salesman.

Honda lost my business. Kia had inventory before anyone else and I bought there.

Still 40% higher than 2019 , even after a historic ‘plunge’.

We already kissed those 2019 prices good-bye. They’re not coming back.

I agree. Same with the real estate market IMO. Even with price drops in many markets, still 40-50 percent higher than pre pandemic. More like 100% in my ski town market. It’s still incredible to think about.

Any data on what percentage of used vehicles sold at auction are repos? All indications are those continue to rise.

Minuscule. They’re rising from near-zero during the free-money pandemic and are still relatively low. You can see this on the delinquency rates.

About 61% of used vehicle buyers pay cash, according to Experian. For the 39% who borrow to buy a vehicle, the share of subprime borrowers was about 14% of loan originations. This means that about 5.5% of all used vehicle buyers (those that pay cash and those that finance) get subprime loans. It’s just a small specialized high-risk high-profit corner of the overall used vehicle market.

New vehicle buyers are less than 1% subprime-rated.

So the number of subprime-rate vehicle buyers is small. And the delinquencies occur in that small subprime space.

60+ day delinquency rate of prime borrowers: below 0.3%

60+ day delinquency rate of subprime borrowers: 5.7%.

A borrower has to default first before there is a repossession by the lender.

https://wolfstreet.com/2024/08/08/auto-loans-the-burden-of-auto-loans-subprime-lending-and-delinquencies-in-q2/

What caused that huge spike in the 1990s? Worse than the great recession. What am I missing?

Subprime lending was a new and huge thing back then. They’d started securitizing these subprime auto loans, and there was a ravenous market for these subprime ABS because the yields were so high, and profits were huge, and everyone was in heaven. Even franchised dealers jumped on it. It was called “special financing” back then, and there was a lot of pressure on me (running a big Ford store) to get into it as well. But it gave me the willies, and I refused. I quit that job in 1995 and started traveling around the world, and when I came back in February 1999, it had all collapsed amid huge losses for everyone involved. One of the unsung* going-against-hype victories of my life, LOL

*no one ever thanked me for staying out of it, but they sure harassed me for not getting into it.

Wolf,

In a dog-eat-dog environment, nobody is more hated than the guy who turned out to be right when everyone else was wrong.

We had more voluntary returns in these last several months than anytime in the last 5 years. We usually don’t have many because we are in an affluent area. The people returning are either financially stressed and bit off more than they can chew, or just realized they are so buried so it’s the only way to get out. Again this is just my experience.

A cute little Rossa Corsa 1972 Ferrari 365 GTB/4 Daytona Berlinetta just sold this morning on BAT (BringATrailer) for $701,000 and the prices of other Ferraris appear to be continually increasing.

Very practical piece of transportation for the average American, I’d say.

If one wants to ‘transport’ themselves in a Ferrari then I would suggest something more pedestrian such as a 308 or 328 which can be had for only around $80,000 for a decent one.

Veblen goods. If that ferrari was listed at $70k no one would want it.

Ferrari 1972 356 Daytonas are among the most desirable Ferraris in existence and this car wasn’t ‘listed’ for anything but rather up for open bidding on BAT where it closed at $701,000 this morning with reserve met. There are many models of Ferraris to choose from to satisfy all tastes. My personal favorites are the 456 and 456M and there is a lovely blue one up on BAT now.

A 1963 Ferrari 250 GTO sold for $70m.

Somebody way overpaid. A 1963 Ferrari 330 America Sold for $428,000 on 6/29/24 on BaT and it is a superior car to the 1963 Ferrari 250 GTO which has a much smaller engine. The 330 America was introduced in late 1963 and served as an interim model between the outgoing 250 GT/E and its redesigned successor, the 330 GT 2+2 that has a 4.0-liter Colombo V12 breathing through triple Weber carburetors. Only 50 were produced. The 330 America shared the chassis and Pininfarina styling of the third series of the 250 GT/E while gaining a displacement and power increase that would be carried over to the 330 GT. The 330 America was introduced in late 1963 and served as an interim model between the outgoing 250 GT/E and its redesigned successor, the 330 GT 2+2.

Hurricane Milton should be a nice boost to the prices of used cars as many will have to be replaced due to drowning issues and the supply will go down substantially while demand rises along with the record storm surges expected Wednesday for central Florida.

In 2008, I bought a 2004 Toyota Tundra. With 235k miles on it, I still was not having any mechanical issues but the paint had multiple scratches and dents. So I finally traded it in for a 2021 F-150. Interested if I will be able to keep it until 2041 without any issues.

I knew Stellantist had issues but didn’t know stock down 50%. YTD. CEO Tavares has ordered extreme cash conservation. any outside $ extra scrutiny.

If we are looking at Cryco crash redux. do we have ECB on the hook instead, or maybe with US govt?