Inflation-adjusted consumer spending & GDP will reflect that strength.

By Wolf Richter for WOLF STREET.

There are two crucial things that go into retail sales: Seasonal adjustments and inflation/deflation in goods, which is what retailers sell.

Turns out, our Drunken Sailors, as we’ve come to call them facetiously and lovingly, are out there buying new and used vehicles (unit sales jumped in May) and all kinds of other stuff, and they’re splurging online, but they’re paying less because prices of many goods are coming off their pandemic spike. Today’s retail sales will boost inflation-adjusted consumer-spending and GDP. So we’ll walk through it.

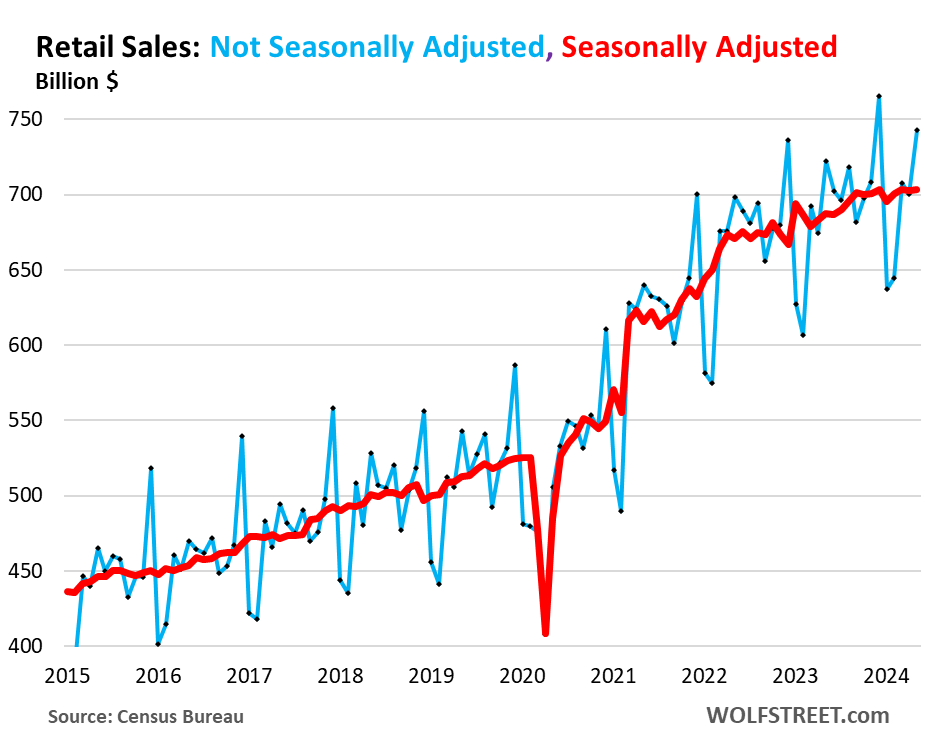

1. Seasonal adjustments: Not seasonally adjusted, retail sales jumped by 6.1% in May from April and were up 2.9% from May last year, to $742 billion, behind only the December holiday sales surge (blue line). A month-to-month jump like this is normal in May. So massive seasonal adjustments whittled that 6.1% month-to-month growth down to just 0.1%; and they also whittled down the 2.9% year-over-year growth to 2.3% (red line):

2. Deflation in goods. Retailers sell goods, not services. Inflation in the US has been raging in services, where two-thirds of consumer spending goes. But prices have been dropping sharply across many categories of goods, which is what retailers sell.

And retail sales – unlike consumer spending – are not adjusted for price changes.

Even though consumers bought more goods in unit-numbers (including new and used vehicles, where we have the unit sales data), the price declines saw to it that the dollars spent on those goods rose more modestly. In categories where consumers bought the same number of items, the lower prices saw to it that they spent fewer dollars. That’s great for consumers, and not so great for retailers.

Durable goods prices fall off the pandemic spike: Retailers sell durable goods – cars, furniture, appliances, electronics, tools, etc. – and prices of durable goods have been dropping for nearly two years, led by a historic plunge in used vehicle prices.

The CPI for durable goods fell 0.5% in May from April, and by 3.8% year-over-year, the biggest year-over-year plunge in over 20 years. Since the price-spike top in mid-2022, the CPI for durable goods has dropped 5%. The declines have accelerated recently. And that’s a big part of what retailers sell.

Durable goods prices are dropping because during the pandemic, they’d spiked in a ridiculous manner, with used vehicle CPI spiking by 55% in two years, for example, and now they’re working off that spike. New vehicle prices, after the pandemic surge, have finally started to drop too. Prices of electronics, appliances, furniture, etc., they’re all coming off their pandemic-era spike. We discussed all this in our report, “Beneath the Skin of CPI Inflation.”

Lower prices for cars mean new and used vehicle dealers get less money for their cars. But they sold a lot more cars:

- New vehicle unit sales: +8.5% in May from April (+111,700 vehicles!); and +4.8% year-over-year, according to Bureau of Economic Analysis data.

- Used vehicle unit sales to retail customers: +15.9% in May from April, and +15.8% year-over-year, according to data from Cox Automotive.

These are large sales gains, but because prices were lower, the dollar-sales that we’ll get to below didn’t fully reflect the surge in unit sales – but the inflation-adjusted consumer spending and GDP data will reflect that, boosting “real” consumer spending and “real” GDP

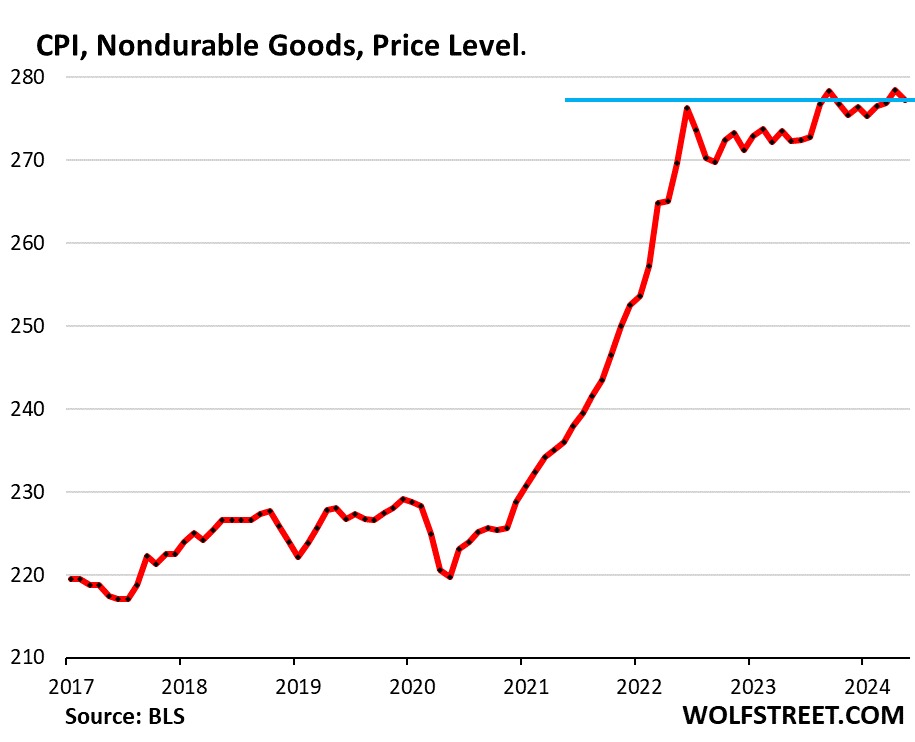

Nondurable goods prices dropped in May from April by 0.4%, driven by a drop in gasoline prices, a drop in apparel prices, and flat prices at grocery stores. Year-over-year, the CPI for nondurable goods was up only 1.8%. In May, the index was up just a hair from the top of the huge pandemic spike in June 2022 (our CPI report).

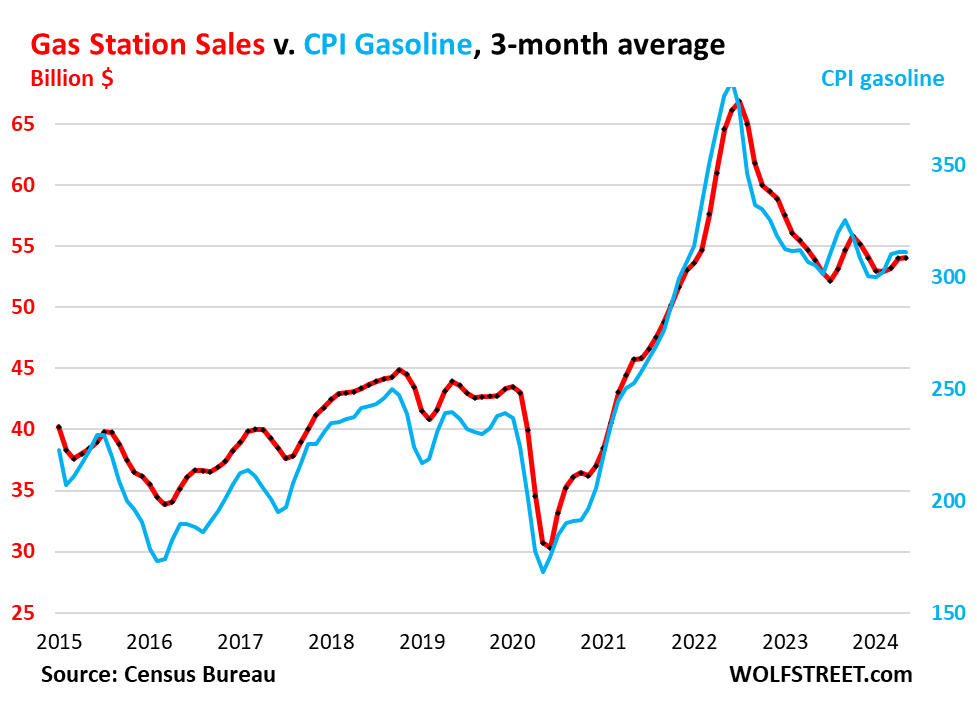

So, as we’ll see in a moment, gasoline dollar-sales follow the CPI for gasoline in lockstep: dropping prices mean lower gasoline sales in dollars. Dropping prices at apparel retailers was great for consumers, but not for retailers, etc.

Retail sales by major segment of retailers.

For most charts below, we use the three-month moving average (3mma) which irons out some of the month-to-month squiggles.

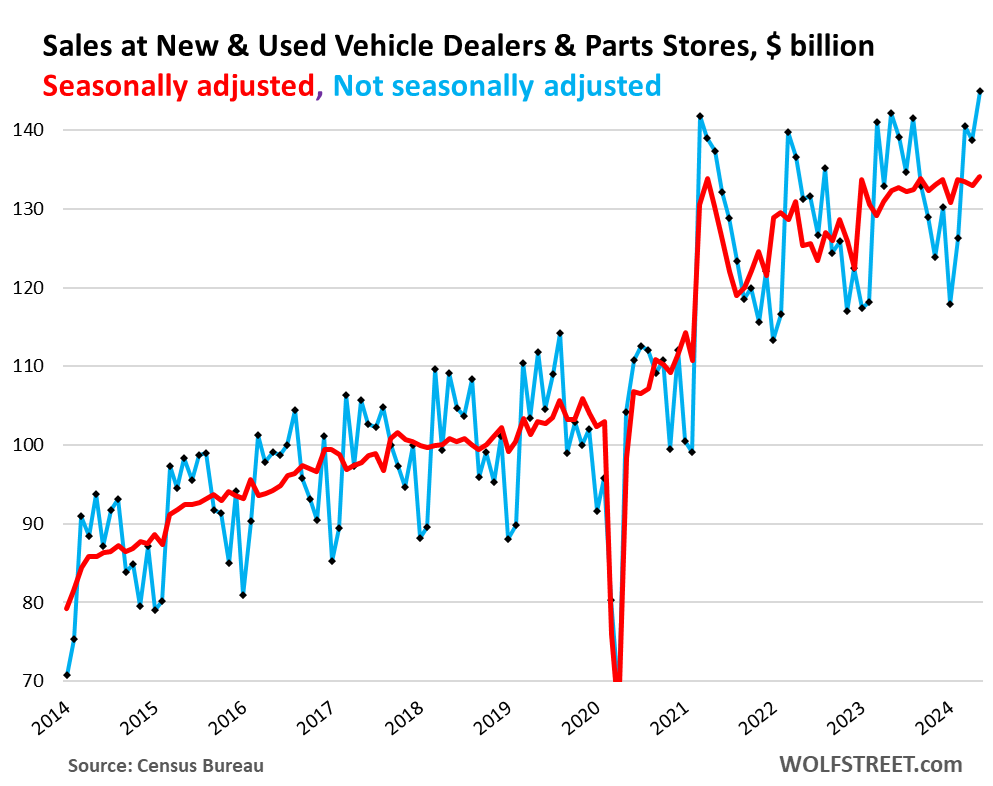

New and Used Vehicle and Parts Dealers (19% of retail trade). These retail sales at auto dealers are in part an expression of the historic price drops in used vehicles, and the still more modest but accelerating price drops in new vehicles that are now unwinding part of their pandemic spike.

In May, as mentioned above, new vehicle unit sales jumped by 8.5% from April, and used vehicle unit sales spiked by 15.9%. And yet:

- Sales, not seasonally adjusted: $145 billion

- From prior month: +4.5%

- Sales, seasonally adjusted: $134 billion

- From prior month: +0.8%

- Year-over-year, 3mma: +2.0%, despite historic price drops!

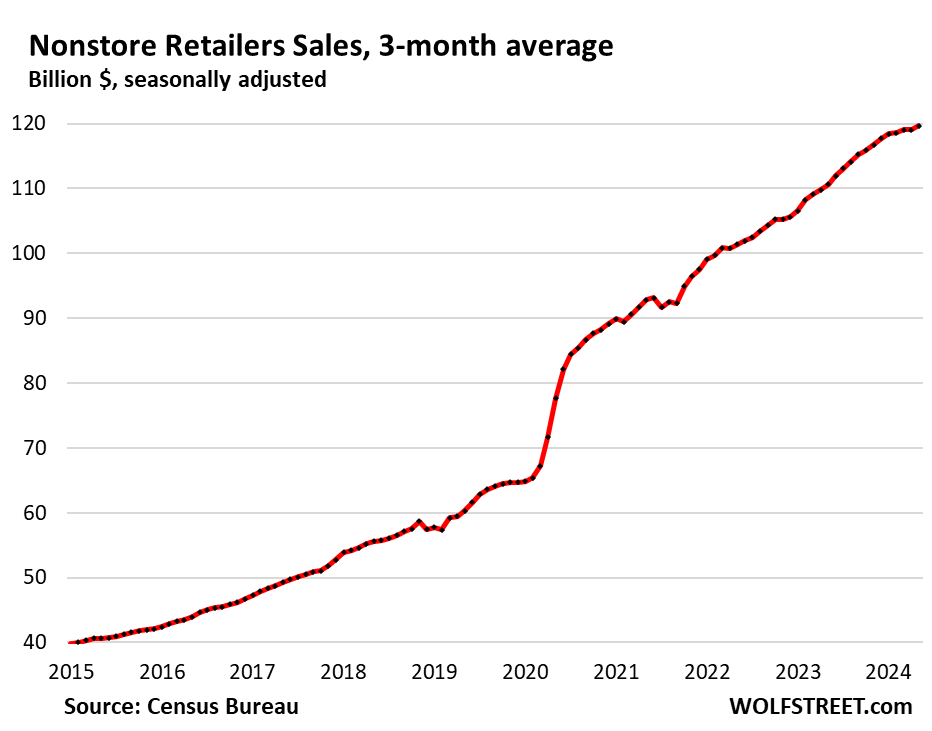

Ecommerce and other “nonstore retailers” (17% of total retail trade), includes ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets:

- Sales: $120 billion

- From prior month: +0.8%

- From prior month, 3mma: +0.5%

- Year-over-year, 3mma: +8.2%

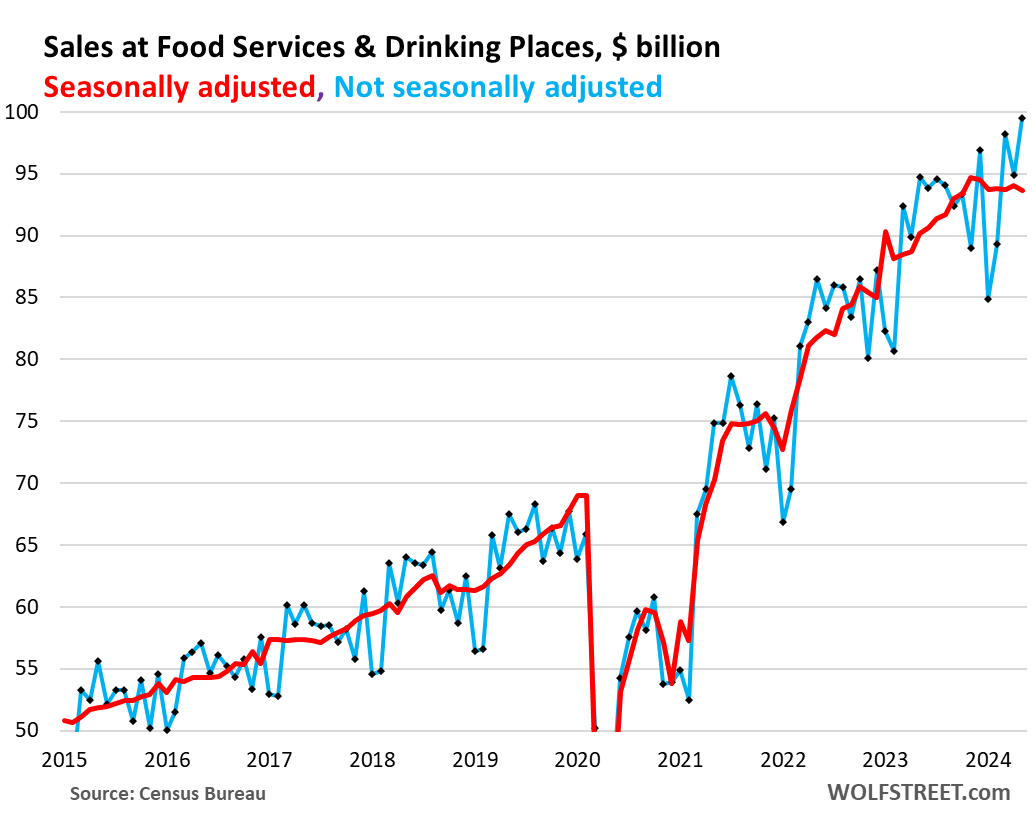

Bars & restaurants (13% of total retail). Here we can see that the huge surge in eating out that started in 2022, and the big surge in prices, peaked in early 2024. Or can we?

- Sales, seasonally adjusted: $94 billion (red)

- From prior month: -0.4%

- Sales, not seasonally adjusted: $100 billion, a record (blue)

- From prior month: +4.9%

- Year-over-year, 3mma: +5.2%

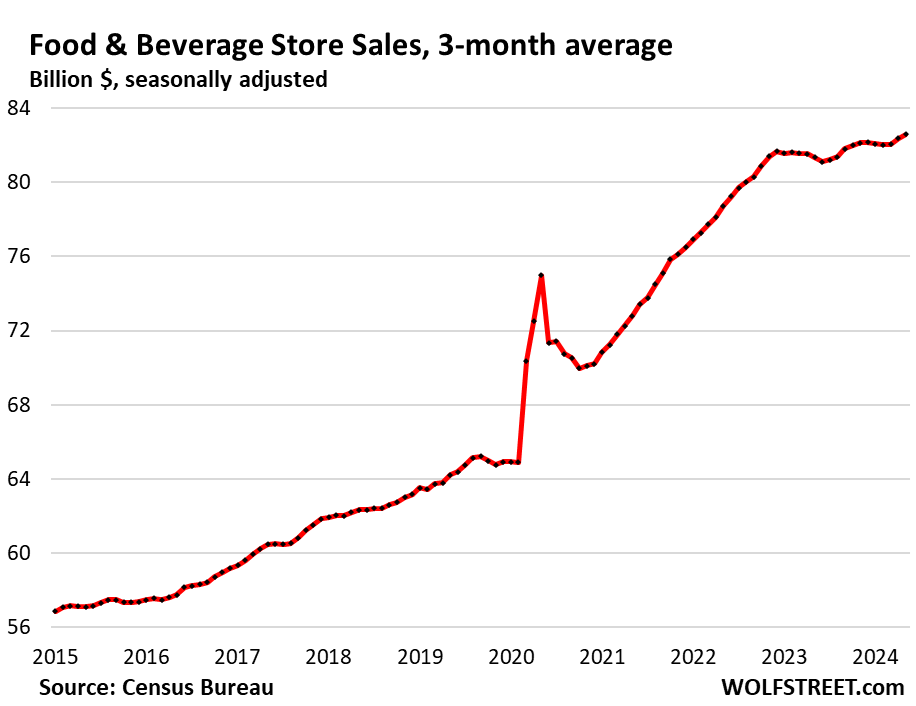

Food and Beverage Stores (12% of total retail):

- Sales: $83 billion

- From prior month: -0.2%

- From prior month, 3mma: +0.3%

- Year-over-year, 3mma: +1.5%

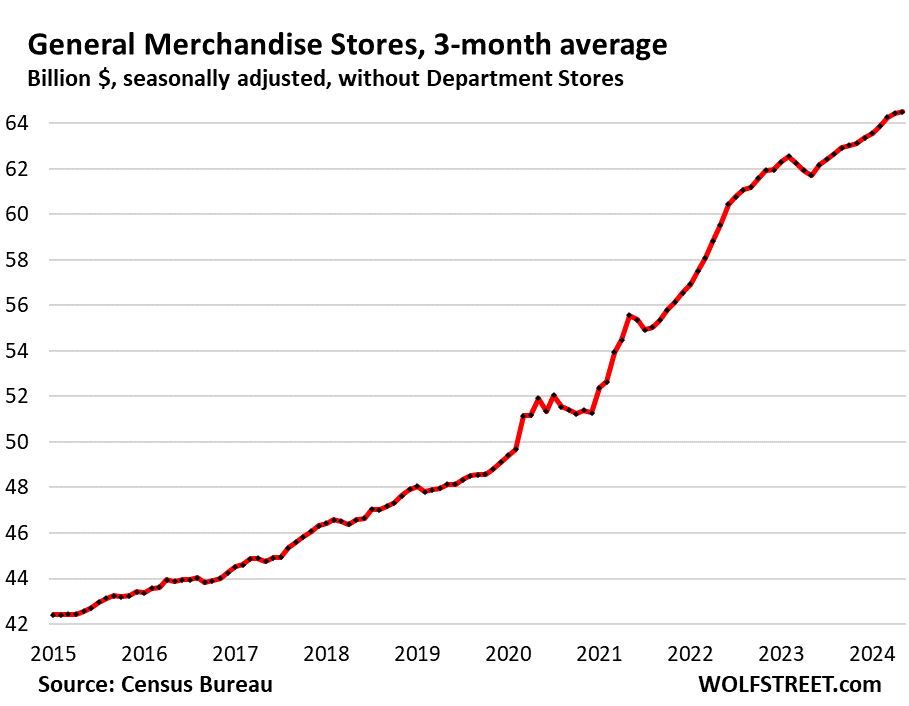

General merchandise stores, without department stores (9% of total retail).

- Sales: $64 billion

- From prior month: +0.1%

- From prior month, 3mma: +0.1%

- Year-over-year, 3mma: +4.6%

Gas stations (8% of total retail sales). Sales at gas stations move in near-lockstep with the price of gasoline:

- Sales: $54 billion

- From prior month: -2.2%

- From prior month, 3mma: +0.1%

- Year-over-year, 3mma: +0.4%

Sales in billions of dollars at gas stations, including other merchandise that gas stations sell (red, left axis); and the CPI for gasoline (blue, right axis):

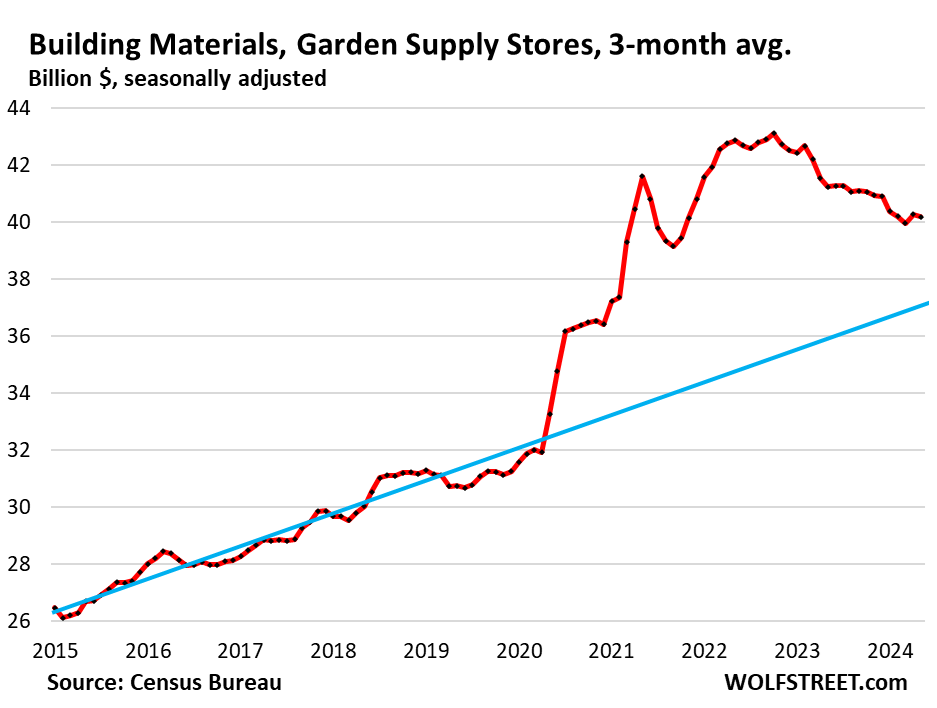

Building materials, garden supply and equipment stores (6% of total retail). Pandemic spike peaked in October 2022, and then deflated. Note the prepandemic trendline (blue):

- Sales: $40 billion

- From prior month: -0.8%

- From prior month, 3mma: -0.2%

- Year-over-year, 3mma: -2.6%

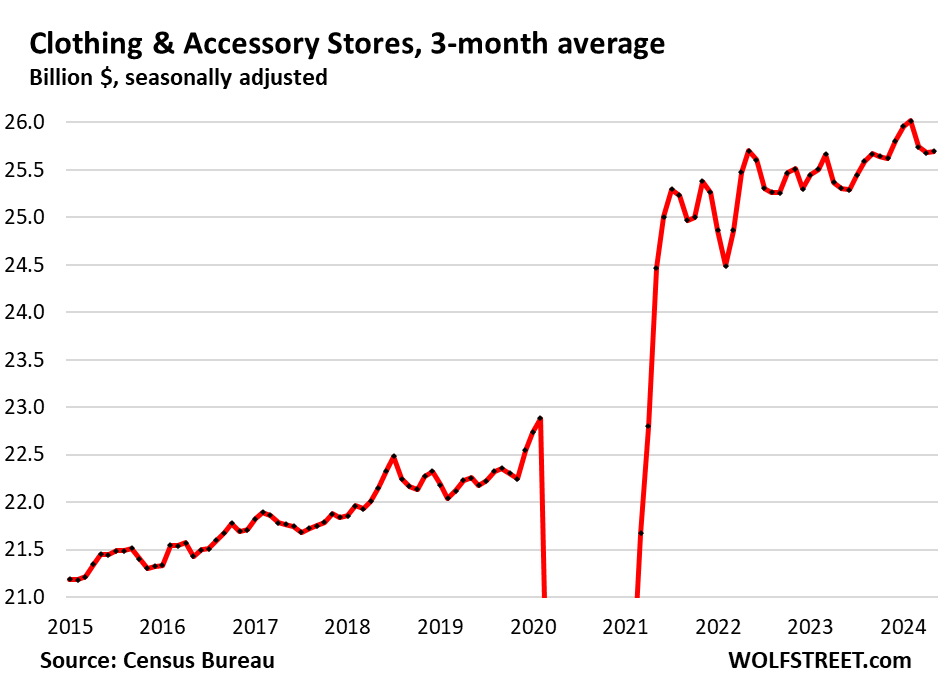

Clothing and accessory stores (3.7% of retail):

- Sales: $26 billion

- From prior month: +0.9%

- From prior month, 3mma: +0.1%

- Year-over-year, 3mma: +1.5%

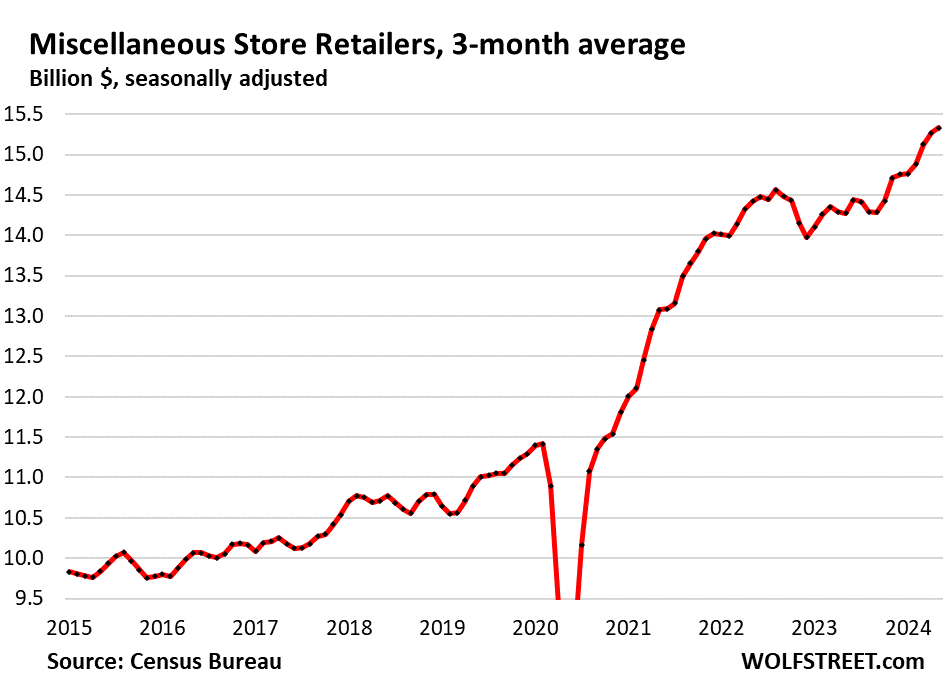

Miscellaneous store retailers (2.2% of total retail): Specialty stores, including cannabis stores.

- Sales: $15 billion

- Month over month: +0.4%

- Month over month 3mma: +0.4%

- Year-over-year, 3mma: +7.4%

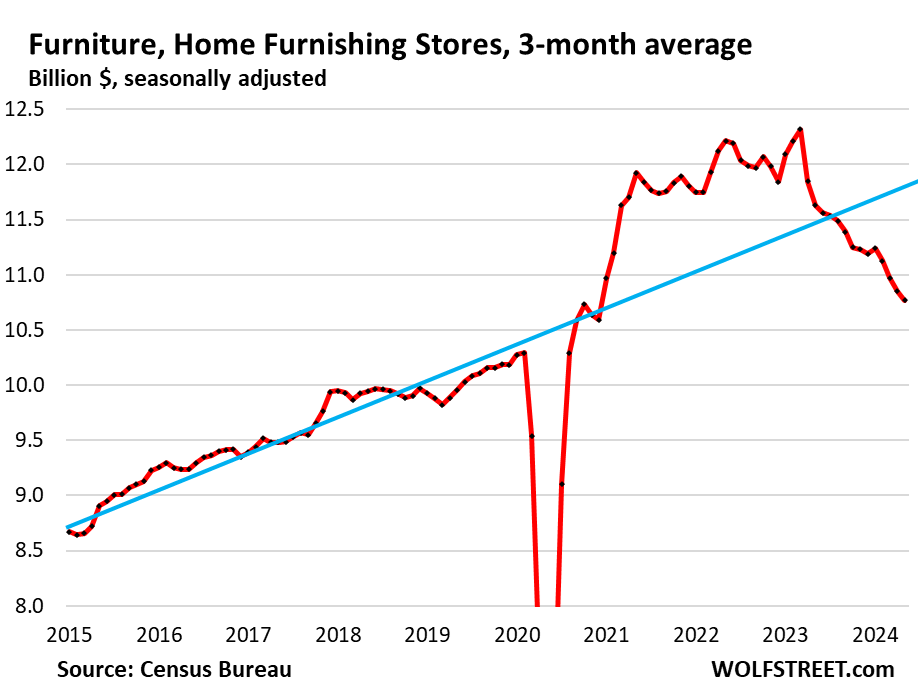

Furniture and home furnishing stores (1.6% of total retail). Much of furniture and furnishing sales have moved to ecommerce. This is what’s left over at brick-and-mortar retailers that specialize in furniture and furnishings. They’ll go the way of department stores – see further below – that have been taken out one by one over the past ten years, which started to document in 2016 under our column, Brick and Mortar Meltdown.

- Sales: $10.8 billion

- From prior month: -1.1%

- From prior month, 3mma: -0.9%

- Year-over-year, 3mma: -7.4%.

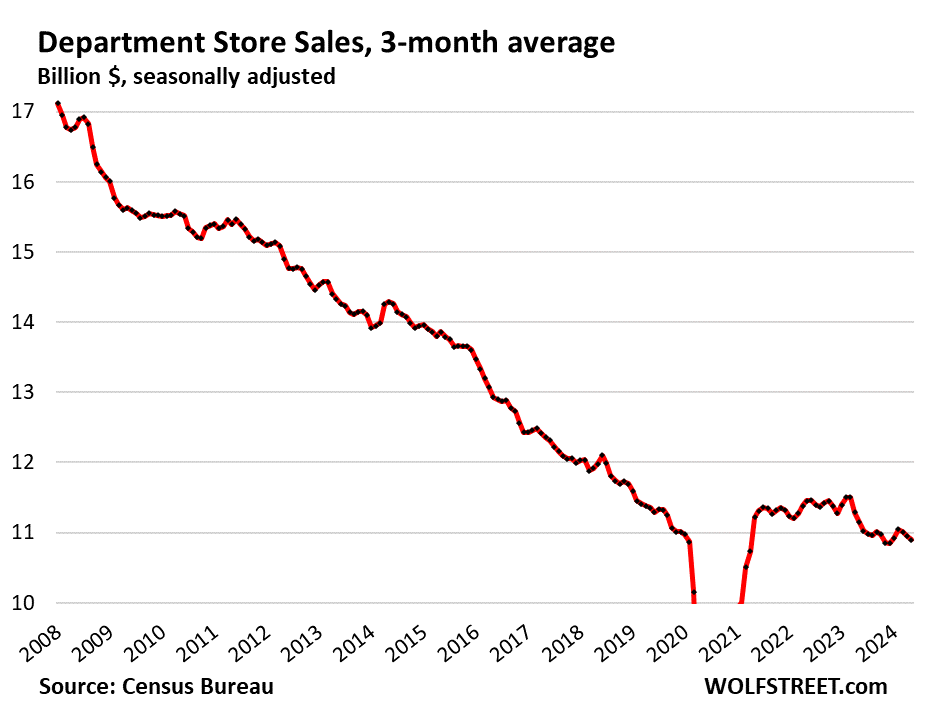

Department stores (now down to just 1.5% of total retail sales, from around 10% in the 1990s). Ecommerce sales by department store chains are not included here, but are included in ecommerce retail sales above.

- Sales: $10.9 billion

- From prior month: 0%

- From prior month, 3mma: -0.5%

- Year-over-year, 3mma: -2.2%

- From peak in 2001: -43%.

Sporting goods, hobby, book and music stores (1.2% of total retail).

- Sales: $8.3 billion

- Month over month: +2.8%

- Month over month, 3mma: -0.3%

- Year-over-year, 3mma: -3.7%.

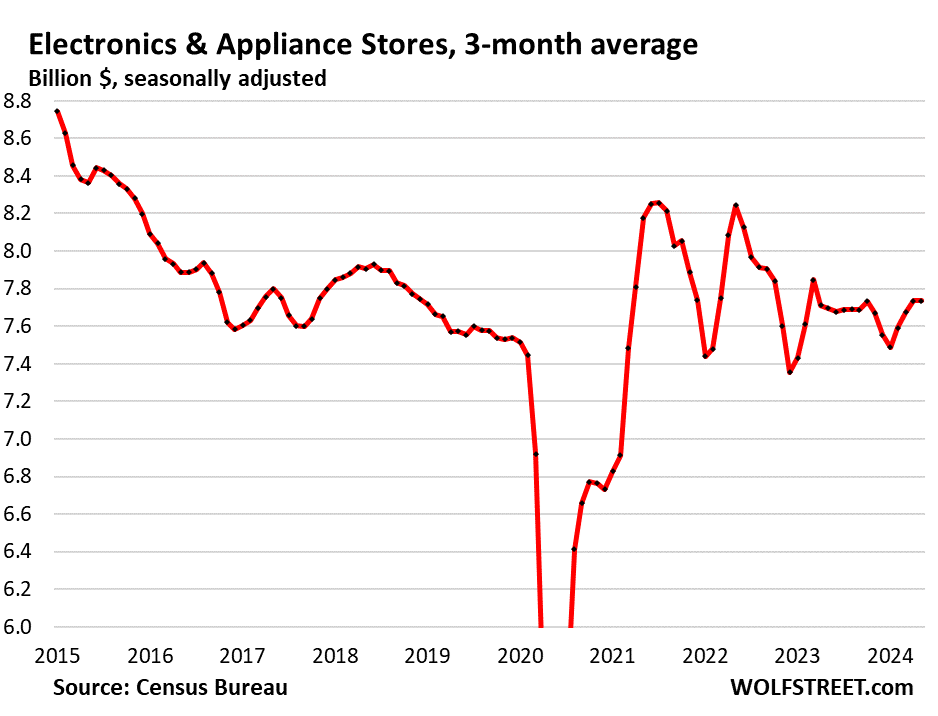

Electronics & appliance stores (1.1% of total retail):

- Sales: $7.8 billion

- Month over month: +0.4%

- Month over month, 3mma: 0%

- Year-over-year, 3mma: +0.5%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

MW: CBO raises U.S. budget-deficit forecast to close to $2 trillion

MW: S&P 500, Nasdaq book fresh records as Nvidia overtakes Microsoft as most valuable company

Are Wall Street economists purposely setting high expectations, so when incoming data inevitably misses, the Federal Reserve is pressured into easing?

The Wall Street “expectation” was for +0.3% M/M, seasonally-adjusted. Since May’s headline CPI came in at 0, and retail sales are not inflation-adjusted, the +0.3% would have had to be real growth. Instead, the actual number was +0.1% (and +0.3% excluding gasoline, which dropped a lot in May), which are still healthy numbers.

Instead, Wall Street saw the “miss” as an opportunity to pile into Treasuries, pile into stocks, and increase bets on Federal Reserve rate cuts.

Walmart stock also hit a new record today. If Wall St were truly concerned about consumer spending, this wouldn’t be happening.

To adjust retail sales for overall inflation is ignorant BS. Overall inflation is 65% services, which is where inflation is raging. Retail sales are sales of GOODS, not services, they have nothing to do with rent and owner’s equivalent of rent, or auto insurance or whatever. Those services are surging in price. But many goods prices have been falling, and steeply.

When consumers buy goods, they’re adjusted to inflation by the price changes in those goods. Anyone on Wall Street or in the media adjusting retail sales to overall CPI inflation is a card-carrying idiot.

So just about everything we buy is 15-30% higher than pre pandemic, even after recent deceleration of inflation. We’re not making much meaningful progress, from the consumer’s standpoint, which is why I still feel we need and will get a recession rather than a soft landing.

Blame greedflation. Companies are selling lower dollar volumes of goods at higher and higher profit margins, which will only be forced back down by recession.

I know I’m early, but I also know I’m right. It’s already starting to show up in real estate and auto markets, consumers’ two biggest expenses.

There is zero sign of recession in these retail numbers, on the contrary, if you read the article. On an inflation adjusted basis — adjusted for DEFLATION in goods that retailers sell — these are strong numbers. You can tell, after getting this data, the Atlanta Fed GDPNow stayed at 3.1%

Lol, I did read the entire article and perused all charts. I still don’t agree with the soft-landing scenario.

So here is the question… if there is no recession and high services inflation, even with low “stuff” inflation, will there be any interest rate relief this year or next? Past experience says no.

The fed says high rates will eventually kick in – and do what? Slow the economy down. What is a recession? A slowdown in economic activity. I think the fed is right. It’s just taking longer than expected because of all the cash out there and all the interest in that cash.

This is why I said I’m early. But the signs are showing up elsewhere. Try to sell a piece of real estate someplace other than Miami. Price reduction after price reduction after price reduction and still few buyers other than uber rich. Wealth effect will kick in eventually and like Swampy below, folks will stop buying anything other than necessities.

No interest cuts this year, much less two cuts.

Can’t the housing market correct without pulling down the rest of the economy?

The best part of this site is that it’s data-dependent. Nothing you said here holds any weight, it’s entirely speculative opinion. Try to buy a piece of real estate in the northeast where price appreciation is still ranging in the 7-8%/year bucket. “Only the uber rich” yet first time buyers still make up 30% of real estate transactions (with a mortgage) and investor transactions account for +/- 17% depending on the monthly data.

The reality is people are making more money. Look up the SS wage index, it might surprise you to study history. If you did actually look at the charts, things are normalizing, as you previously stated, at 15-30% of pre nonsense, just at higher levels. There’s always a recession, that’s what credit cycles cause. There just isn’t a basis to say pending doom is coming today.

There are no real estate price cuts in my locale. Reaching new median sales prices every month.

Everything is up 20% over pre-pandemic. I expect a certain quality in everything I buy and I’m only buying things I need. If it’s up 20% then I pay it. I think a lot of the rise in retail sales are nothing more than inflation in prices. I’m now going to a higher end grocery store because the 80 year old family owned grocery chain (Giant Food) which was born in the DMV has outsourced their business to a Dutch Company. The quality of the food sold and the service has gone straight downhill. They are hiring mostly temp employees at minimum wages with no benefits.

Good idea. I’d like to start with Chobani yogurt and their irritating flip style yogurt containers. That’s the yogurt that has two compartments and I guess the idea is to either collapse one compartment over the other or try and dig out the granolas with a spoon. Either way I wind up with granola all over the floor. So I’m doing my part to fight inflation by boycotting Chobani’s annoying yogurt.

Love these drunken sailors, guess a AA intervention is not needed anytime soon…good times

E-commerce is the future. The King is dead, long live the King.

A good return on my treasury bills is nice, if the king must die then, so be it.

I’m stuck with these high prices, they are horrible and hated and I think they will creep higher. In services is where I find the horrible highness.

I went and bought about 200 lbs of stuff at a target today. Send that to me via UPS and someone is going to go broke.

Where’s the Jeremy Grantham albums playing these days, chicken little the sky is falling….dooms day drum beat for anyone that will follow. Millennials and Gen Z buying up new homes in this over inflated economy, 1 million new vehicles sold last month. Send the boys out, it will be a long hot summer, I see no cracks in the armor. This gravy train is on automatic pilot sanctioned by the FED.

It is hard to imagine paying these housing costs and carrying a mortgage for more than ten years. It’s indentured servitude more or less. Definitely freedom restricting. Having lots of good options is priceless. What’s a generation or two to do? By forty everyone should be able to coast or cut back to part-time, unless they decide to raise children. What a world!

A 12 year mortgage is the Goldilocks spot. Go 15 year, then when rates drop, lock in a lower rate. Bam, like 100k less interest than a 15 year and better cash flow for the buyer.

Forgot to add drop from the 15 year to a 10 year.

Yes, there is safety in numbers. If enough people buy overpriced homes, and enough banks provide mortgages for those overpriced homes, systematic risk is created and the Fed will bend over backwards to reduce that risk, which is what we are seeing now. They have take steps to stop 5-10% inflation, but they seem willing to accept years and years of 3-5% inflation in order to avoid a recession and what else that might trigger (e.g., asset price reductions).

We haven’t seen a real recession in 15 years. There’s a reason for that. The Fed has changed its mindset. Intervention is now the norm, not the exception. Market discipline has clearly eroded as a result.

GSEs like Fannie Mae and Freddie Mac are providing 88% of the mortgages, not banks. Make no mistake, the originators would not make loans without the ability to unload those loans effectively immediately.

I thought real retail sales and real personal spending on goods were both having hiccups? I probably really should look closer

Yes, you should look closer. Start by reading this article very carefully.

The Atlanta GDPNow, after it picked up retail sales today, stayed at 3.1%, which is hot.

There has been a monumental shift in debt expenditure from the private sector to the government. I don’t know if the “bond vigilantes” are coming, but how long can the US sustain these levels of Treasury issuance and have buyers waiting? The demand side for the 20-year auction this week legitimately blew my mind.

The bond vigilantes are all dead and buried. No one cares anymore.

The bond vigilantes picked a fight with a central bank that can create money/credit out of thin air. They didn’t stand a chance.

Dept store sales are higher low, above 2020 low. The 30Y downtrend, since the 90’s, is broken.

The most impressive collapse is in gas stations. Gas prices fell, but taxes are higher, relatively to the bill.

Pickup owners trucks spend about $70/$100 at the pump with junk. Small cars and SUV about $40/$50. When Price collapsed drivers can fill up more liters and visit less often.

Gas stations cannibalized each others. 7-eleven expansion was a disaster.

Gas is a small part of a convenience store’s profit. The stuff inside the store is where the real money is made.

The 7-11 stores around here always seem to have plenty of people going in and buying things. I’ve gone there instead of a restaurant as they have quick food that tastes pretty decent (probably terrible for me, but that’s a topic for another day). I don’t see any issues with 7-11s expansion here.

I’m a big fan of grocery store attached gas stations. Everyone needs groceries.

Costco and Sam’s are a good idea as well, however I cannot make myself go wait in long lines at Costco. When you enter it feels like a prison and when you exit it does as well. Want to feed at the trough after shopping too? Oh don’t forget gas on the way out or in to the prison. lol

And the need for a physical card to buy gas? Cmon Costco.

Wolf I read that the Bloomberg financial conditions index is as loose as it was during the meme stock era. Despite 5% Fed funds rate. Is it true that money is still loosey goosey for anyone who wants it?

Bank lending to CRE has tightened up a LOT. It’s hard to get anything financed or maturing loans refinanced. But the public markets (bonds, leveraged loans, etc.) are loosey-goosey.

What would it take to tighten financial conditions in public markets?

Maybe just lots of time at these rates and QT. Markets are still counting on two rate cuts this year. The Fed should just come out and say that 5.5% is the new normal.

@Wolf,

That announcement would solve a lot of fundamental economic problems. Too bad they won’t do it.

I wonder how the markets would have fared in 2024 if the Federal Reserve hadn’t started talking about rate cuts & shown a clear easing bias since the latter part of 2023 – even if they haven’t actually delivered the easing.

I think 2024 would still be a positive year for stocks, credit spreads would still be tightening, etc. But it wouldn’t be this crazy. Then again, markets haven’t significantly corrected at all this year despite the lack of actual cuts.

Howdy Folks and YOU are welcome. Promise to continue as always.

Sober Sailor: Retired and loving it….. Some of US have been though these times before……

The FED has created a speculative orgy.

No it hasn’t at all. Speculators have.

Great comment.

Speculators go where the speculative orgy is to be held, at Jerome’s cathouse and gambling hall.

Who are you kidding? The FED created the speculators.

The Fed’s job is to control inflation, and it hasn’t been doing that job. Speculation would subside if the Fed were doing its job.

There has been 20% inflation in four years.

How would speculators fare without the inflation? Not very well, I think.

The fed should be talking about the circumstances that would necessitate a rate increase, such as a flattening of 3% inflation, continuation of high deficit spending, etc.

The last thing they should be entertaining is rate cuts, given inflation is too high and unemployment too low.

We need the Fed to focus on the primary indicators – CURRENT inflation and unemployment – and not get hung up on a multitude of lesser data points.

If I were getting punched in the face, I wouldn’t try to analyze the offender’s motives, determine whether he’s left or right handed, observe the type of shoes he’s wearing, or explain the error of his ways. I’d be punching back, saving questions for later.

Speculators are essentially grown childrem. They will push limits to the max, wherever there is an opening. The Fed knows this, hence it is the Fed’s fault. Just like a parent that spoils their children and ultimately creates a worse society, overall.

Well seeing how they used to look at Greenspan’s hair or his briefcase strut to discern intentions. Now there is a long speech.

It’s always been speculative.

Met a “bottom-feeder” once that remarks he always sells “marked down 40%” and quote: “marked down 40% from what?” These near monopoly selling situations have prices pumped to the moon, with a little backsliding that makes it look like a reduction, when in reality it still is pandemic price gouging.

Nice to see the actual numbers charted in a way that makes sense and filters out some of the noise and agendas that folks push.

I’m firmly in the camp that the government’s interference in the markets have created severe reverberations that will lead to problems down the road, but based on the data presented here, that is still a ways off.

These numbers look downright respectable.

Doing my part with a rover and the gas it requires.

Going to feel sorry for the bottom 50% whenever the shoe drops on this parade.

Hey people!!!!!

Good mood and good luck to everyone!!!!!

5 exclamation points.

I think I would have to have all day queso nachos and cervesas to attain 3 exclamation points, let alone 5.

So to sum up the June 7th article and this one, wages are up, and goods prices are down? What’s not to like? Well, services prices. Of course, services and rent and such are a problem, but at least this part of the problem is solved! Keep popping the housing bubble, and rent will be solved too, leaving only services.

Keep the interest rates up in the historically normal range, and all will be well!

People throw lots of numbers around without context. “Inflation is up 15-30% since pandemic”. Sounds like a lot, but I’m counting 4.5 years since it started. Considering all the money dropped from helicopters (Trump and Biden admins), seems like it could have been worse.

The job is 2% inflation. If a person or organization can’t or won’t get the job done, they should step aside and let someone else do the job.

Why are we sitting here, now, with lower than normal unemployment and higher than normal inflation? The Fed is significantly off target on both mandates.

It’s time to start erring on the side of those who have suffered the most from inflation.

Home prices are up well over 50% per square foot where I live, and I’m betting well over 30% for most of the country. Emphasis on “well over”.