It’s spring selling season, when prices always rise month-to-month, and they did, but it wasn’t enough.

By Wolf Richter for WOLF STREET.

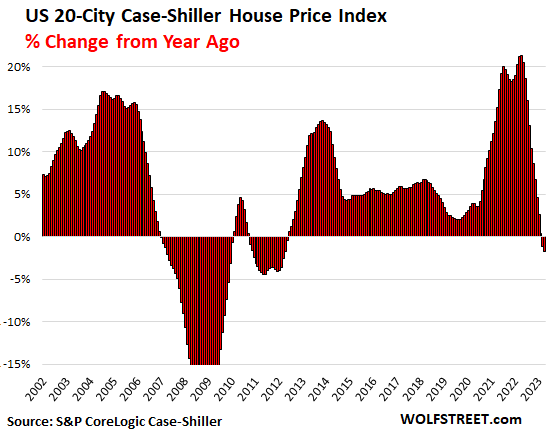

It’s still spring selling season, when sales volume and prices nearly always rise on a month-to-month basis, and they did this spring too, but not enough, and compared to a year ago, the 20 cities in the S&P CoreLogic Case-Shiller Home Price Index, released today, fell by 1.7%, the biggest year-over-year decline since 2012, following the 1.1% decline in the prior month, after the gigantic Fed-money-printer gains during the pandemic. The 20-City Index is now down 3.5% from the peak last June:

Today’s data for “April” is a three-month moving average of home prices whose sales were entered into public records in February, March, and April. That’s the spring selling season, when prices always rise from the prior month, and did so even during Housing Bust 1.

On a month-to-month basis, the 20-City Index rose 1.7% in April from March, but that was a lot less growth than in April 2022 (+2.3%) and in April 2021 (+2.2%), which is why year-over-year, prices fell further:

The list of year-over-year price decliners keeps getting longer. Prices are now down in 10 of the 20 metropolitan areas that the S&P CoreLogic Case-Shiller Home Price Index covers. Here are the metros with year-over-year price declines:

- Seattle: -12.4%

- San Francisco Bay Area: -11.1%

- Las Vegas: -6.6%

- Phoenix: -6.1%

- San Diego: -5.6%

- Portland: -5.2%

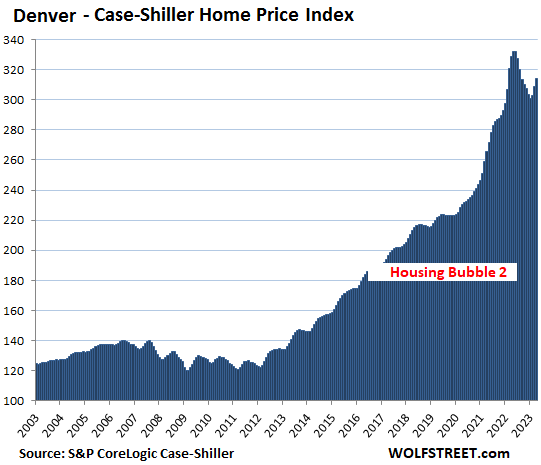

- Denver: -4.5%

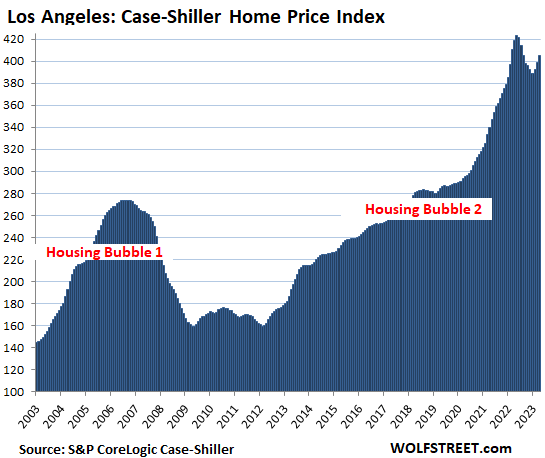

- Los Angeles: -3.2%

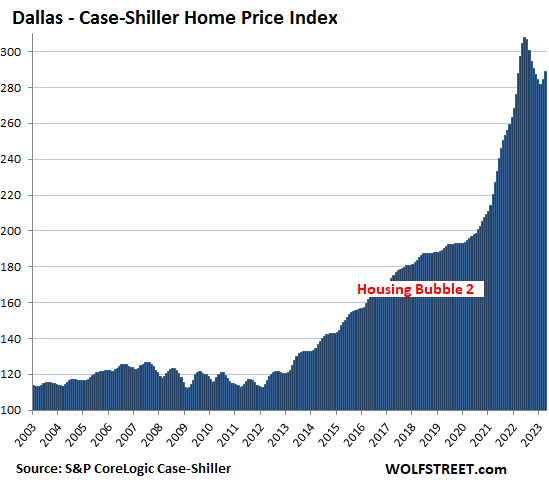

- Dallas: -2.9%

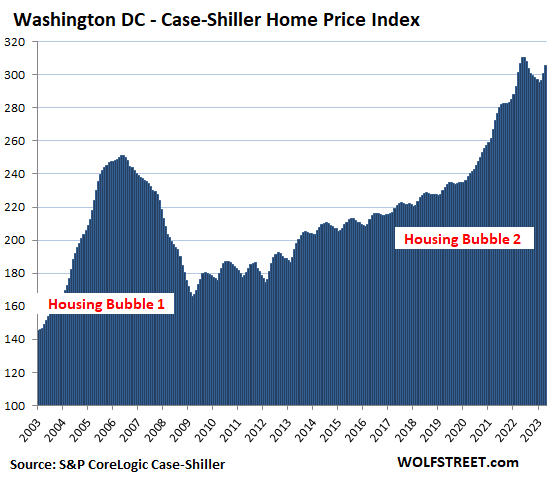

- Washington DC: -0.5%

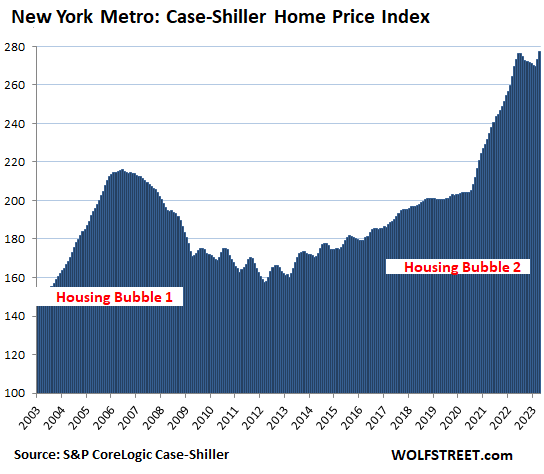

Prices in 19 of the 20 markets have dropped from their respective peaks (ranging from May to July 2022). The exception is the New York City metro, which squeaked past its prior high of July 2022. From their respective peaks, prices have dropped the most in these metros:

- Seattle: -12.9%

- San Francisco Bay Area: -12.0%

- Las Vegas: -9.9%

- Phoenix: -9.4%

- Dallas: -8.5%

- San Diego: -6.1%

- Portland: -6.0%

- Denver: -5.6%

- Los Angeles: -4.2%

- Tampa: -3.0%

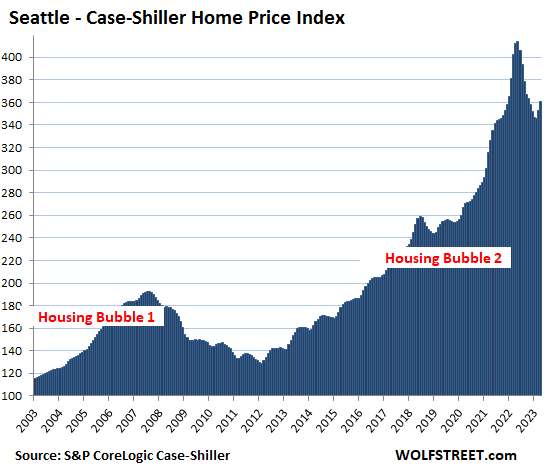

Seattle metro:

- Month to month: +2.3%.

- From the peak in May: -12.9%.

- Year over year: -12.4%.

Seattle’s year-over-year decline of 12.4% was the fifth month in a row of year-over-year declines.

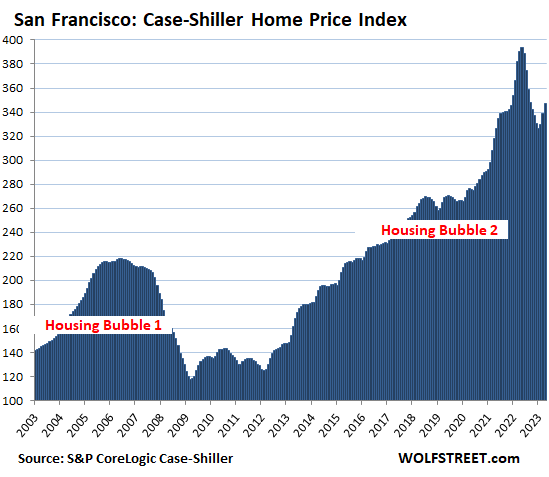

The San Francisco Bay Area:

- Month to month: +2.2%.

- From the peak in May: -12.0%.

- Year over year: -11.1%.

This was the sixth month in a row of year-over-year declines.

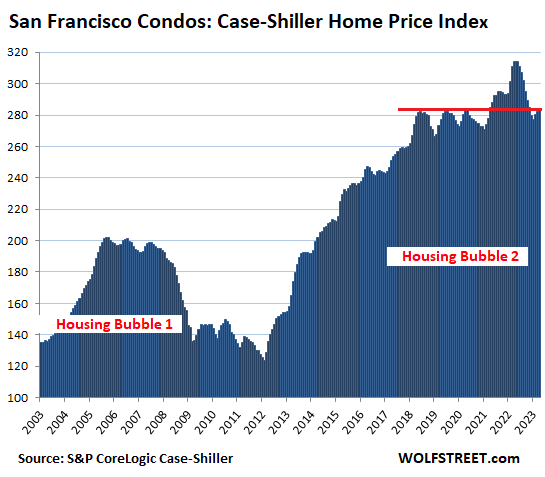

And this is the situation for condos in the San Francisco Bay Area: After a big run-up, they’ve now fallen back to where they’d first been in May 2018:

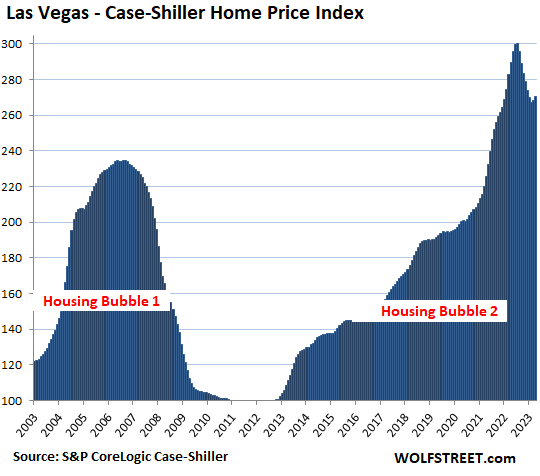

Las Vegas metro:

- Month to month: +0.7%.

- From the peak in July: -9.9%.

- Year over year: -6.6%

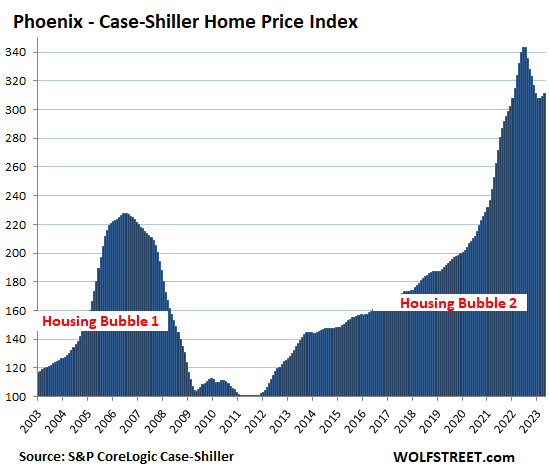

Phoenix metro:

- Month to month: +0.7%.

- From the peak in June: -9.4%.

- Year over year: -6.1%

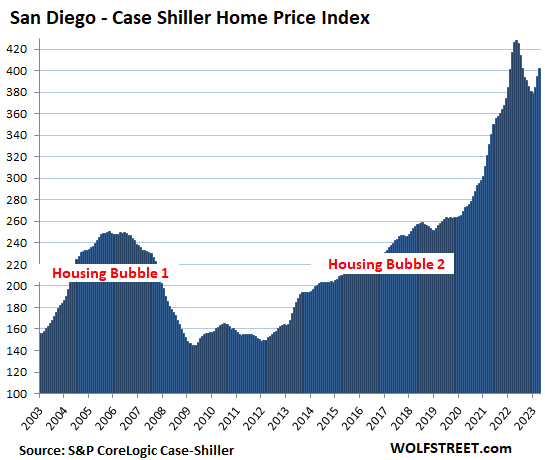

San Diego metro:

- Month to month: +2.0%.

- From the peak in May: -6.1%.

- Year over year: -5.6%.

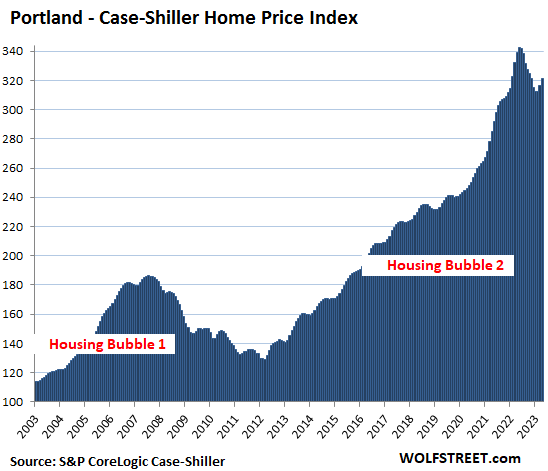

Portland metro:

- Month to month: +1.5%.

- From the peak in May: -6.0%.

- Year over year: -5.2%.

Denver metro:

- Month to month: +1.6%.

- From the peak in May: -5.6%.

- Year over year: -4.5%.

Los Angeles metro:

- Month to month: +1.7%.

- From the peak in May: -4.2%.

- Year over year: -3.2%.

Dallas metro:

- Month to month: +1.4%.

- From the peak in June: -8.5%.

- Year over year: -2.9%

Washington D.C. metro:

- Month to month: +1.6%.

- From the peak in June: -1.6%.

- Year over year: -0.5%

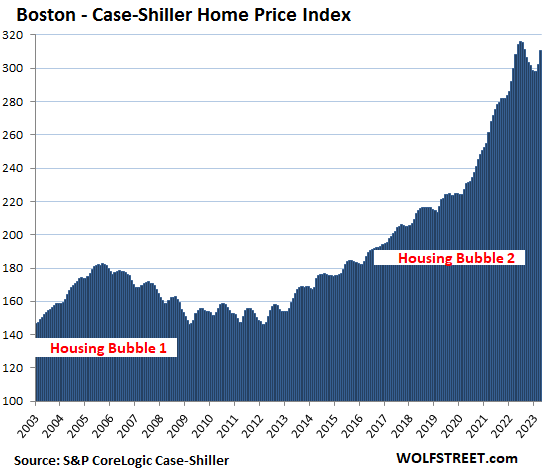

Boston metro:

- Month to month: +2.9%.

- From the peak in June: -1.6%.

- Year over year: +0.9%

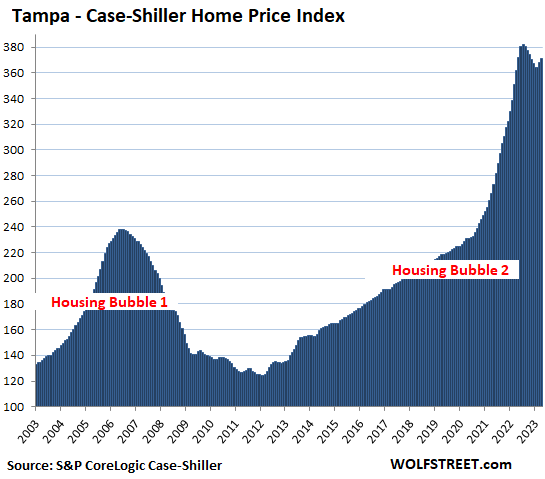

Tampa metro:

- Month to month: +0.8%.

- From peak in July: -3.0%

- Year over year: +2.4%

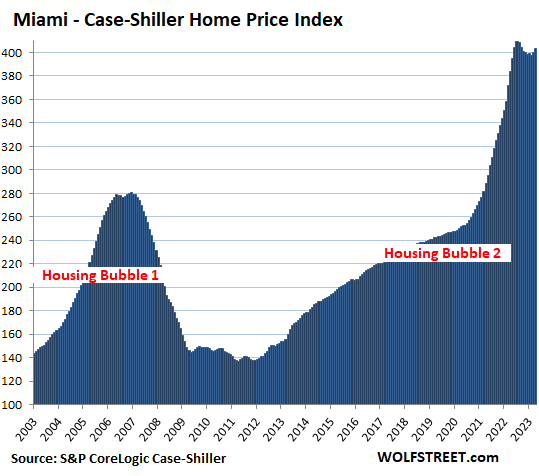

Miami metro:

- Month to month: +0.9%

- From peak in July: -1.3%

- Year over year: +5.2%

New York metro:

- Month to month: 1.5%.

- Squeaked past the July high: +0.4%

- Year over year: +3.0%

Methodology. The Case-Shiller Index uses the “sales pairs” method, comparing sales in the current month to when the same houses sold previously. The price changes are weighted based on how long ago the prior sale occurred, and adjustments are made for home improvements and other factors (methodology). This “sales pairs” method makes the Case-Shiller index a more reliable indicator than median price indices, but it lags months behind.

The Case-Shiller indices were set at 100 for the year 2000. The Los Angeles index value of 405 in April is up by 305% since 2000. This makes Los Angeles the #1 most Splendid Housing Bubble in terms of price increases since 2000. Miami and San Diego are just a hair behind, both up by over 300% as well.

The remaining six markets in the Case Shiller index have experienced far less house price inflation since 2000, and don’t qualify for this list of the Most Splendid Housing Bubbles.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks WR for cranking out articles over articles so fast.

The price drop from peak at least in my hood san Diego is quite small ( 5 plus percent ) keeping in mind the price increased by more than 50% in last 3 years or so.

Slowly and then suddenly

here in Tucson we’re not declining in nicely done homes

the junk is sitting and getting repriced

little inventory is main reason

we’ll see what happens this fall

worst case is I add rental to portfolio

Tucson lol. I’m in Phoenix, originally from Tucson, so I keep an eye on Tucson. Plenty of price drops, even on so-called nice homes. Same in Phoenix. Inventory is low everywhere but so is demand. Tucson still has very few good jobs, and the roads still suck. Only FOMO types are out buying now or really desperate, low information types. It started slowly in 2008 and kept getting worse. As long as the Fed doesn’t pivot, I expect it to keep getting worse.

Arizona AirBnbs are up 40% in 1 year.

Up 90% since 2019.

Now they’re facing “competition” and declining occupancy (go figure).

“Revenues… have dropped by nearly 50 percent in cities like Phoenix, Arizona, and Austin, Texas.” (Airbnb Revenue Collapse Sparks Housing Market Crash Fears, Newsweek, 6/28/2023)

Wait for all the wannabe landlords to dump them!!!

“Revenues… have dropped by nearly 50 percent in cities like Phoenix, Arizona, and Austin, Texas.”

Yes, that’s a measure called “revenues per available listing,” or RevPAL. If listings double because everyone wants to make some cash to help pay for their vacant home that they sit on and refuse to put on the market, well, then, the listings double, and if overall revenues stay the same, with listings doubling, the RevPAL plunges by half, meaning everyone’s slice shrinks by half because there are twice as many slices, and the overall pie has remained the same. So eventually, there should be a shakeout. There are a gazillion vacation rentals around me.

That is not what NAR says.

@WaterDog

I have read the analysis in Nick Gerli’s piece “Why Airbnb owners are about to sell”, and it seems plausible to me.

Only time will tell. A decent amount of schadenfreude would be great.

and multi-unit rental market is still real crazy priced

Rent concessions galore in Phoenix market where there are jobs. Once again, Tucson lolololol. Moving on from my hysterical laughing fit after reading Joe’s NAR-inspired rhetoric, rent concessions started happening big time in May. April looked like rent increases wouldn’t stop, but then May came. Huge concessions, one to two months in some cases. Granted, prices usually come down in summer when it’s 115, but May was still nice weather. Hmmmmmm!

Fed Up – Do you see the U shape on every housing bubble 2 chart? Prices are bouncing. We may well see higher highs on lower volumes, similar to autos.

And perhaps a few false starts. I notice a double peak on all of these markets. Anyone got thoughts on that? Pure psychology? Policy? Cycle?

And I just got emailed a big report by a realtor claiming that Seattle area prices are increasing year on year by a small percentage and that “Its a sellers market”. I believe wolf and case shiller more.

Funny, my realtor sent me an email claiming that prices are back on the move and it’s been something like 5 months of month over month increases and he expects it to continue. He forgot to mention that there are always month over month increases during the spring but we are still below last year and if history is any indicator prices should start heading down this month or next.

I’m praying for the Moerhrl vs NAR (and another one) class action lawsuits to go through and upend the realtor business model. We would be better off without realtors. Only people who think we wouldn’t be are realtors and the dumb people realtors convinced they need a realtor.

We rec’d a mailer from a corporate investor stating they want to buy my home for cash and “now is the best time to sell”, because the market is declining and won’t have the same opportunity in the coming years.

The western ‘burbs of Chicago are an interesting, at least to those of us living here, place.

We get a very nice looking mailing on a single two-sided piece of heavy paper each month from a local realtor. We feel so very, very important as it is sent to us specially, as our name is ‘occupant’!🤪

Anyway … it shows ONLY numbers and graphic trends. NO commentary at all.

In almost every metric the numbers are down.

The only item going up recently are the number of apartments for rent. Which, with all the multi-unit buildings being built currently.

Is this Realtor©️™️ “honest”? Who knows? I think she’s just keeping her name ‘out there’ in case someone DOES want (need?) to sell.

Realtors’ income is from making their commission off a deal. The % income doesn’t change much whether the home sells for $550k or for $500k. If a broker makes 6%, they make $33k v. $30K. But if they cannot put the deal together because the price is too high, they make $0k, and they’re out $30k income.

Wait for Ai to be able to formulate well written home offers for people to escape buyers realtor commissions.

jon you are living in a very special place, a place where everyone and i mean everyone wants to live, a place where dreams come true, where herds of shimmering unicorns bound across rolling fields of wildflowers, where there is no sickness, no poverty, no crime, a place where flatulence has no smell. jon, real estate values do not and in fact are forbidden to fall in such a place, as mandated by the magical mystical forces of the universe and the local Realtors’ Association.

Lol, let me add more.

In King County, WA, (Seattle area) you have these neighborhoods with houses worth over $2.5 million where everyone is more than 60 years old with kids having settled far away.

You go to one of these open houses, you often have a listing agent claiming everyone wants to live here, there is huge demand. The funny part is that most young buyers cannot afford these houses and they quickly realize that this is a geriatric community, where they will find hard to fit in.

If you look later you see that the house is delighted, but doesn’t show up as pending or sold. The home owner having multi-million dollar houses seem be Pivot believers and are more inclined to wait. They probably have money to be able to buy retirement home without having to sell the older house.

No, they delist not because of pivot belief/hope, but because they know the sharks are circling if they relist right away. But that fools almost no one anymore with access to Zillow/Redfin.

Hahahaha

You forgot the perpetual rainbows, that lead you to a posh local supermarket where there is no inflation and everything is always in stock.

Jon

Looking forward to Fall when prices suddenly show year over year gains again in San Diego but month over month declines. Then watch the narrative here change real fast

I have no skin in the game.

Sold my rentals last year in San Diego and donated most of my money to feed poor children .

I won’t be buying homes even if it crashes .

My worry is more in general for the younger generation

Lot of people are priced out of market and this is not good even got people holding multiple homes..

I came to this world with nothing and I intend to go away like that 😀.

By pure luck I did ok in my life.

No complaints.

Jon,

Wolf literally called you out with data in the last article.

Too funny.

Trollin! Except you probably believe yourself…

༼ ºل͟º ༽

I guess that would be denial instead?

I’m most impressed by that ASCII (?) artwork that somehow survived internet transit and Wolf’s blog filters…

I guess everyone missed the 15 or so graph showing prices have bottomed and are reaccelerating.

Tom Miffed,

I guess you missed the thing about SELLING SEASON, when prices ALWAYS rise — and did so during Housing Bust 1. This time, prices rose LESS in April and over the past few months than during the same months in 2022 and 2021. Is this so hard to understand? It was all over the article, including in the subtitle, no?

Looking at these charts, there appear to be spikes in most of these metros that don’t show up in the corresponding parts of the charts for HB1. Have we not reached the peak? Are prices going to keep heading up further? Or are these the housing equivalent of a dead cat bounce?

Read the text. At least, paragraph 3. Plus a few others. So I’ll repeat here what it says in the article:

The overall increase in April from March 2023 was +1.7%. That was a lot less than in April 2022 (+2.3%) and in April 2021 (+2.2%), which is why year-over-year, prices fell further. It’s spring selling season, and so price increases are normal, even during Housing Bust 1. But most of them this year were smaller than those a year or two ago. That’s the answer.

A similar pattern played out in many metros, not all. As you can tell, each metro dances to its own drummer.

This is an incredibly screwed-up market, as you can tell from the charts. Since early 2020, all movements have been exaggerated, up and down. Look at some of these crazy two-sided spikes.

Too much money in circulation still fighting the fed? Indicative of still mildly simulative interest rates? Buckle up, we’re still in for a wild ride?

Howdy DD. YES YES and YES

I like when it is Housing Day on Wolf Street.

Its the only thing that gives me hope

33% year to date sales volume decline in CA should also give hope…demand/volume decline usually presages price drops/collapses.

If it weren’t for sub 2018 “for sale” inventory levels, the price cratering panic would have already kicked off…newbie RE speculators think everything is peachy so long as prices don’t fall (even if volumes collapse…uh huh…) then go into leveraged panic mode once the inevitable price declines actually start.

Then you get cascading panic sales.

Howdy, Thank goodness the Bubble is deflating. Probably years to go with all the deficit spending. Maybe they should quit creating these bubbles picking the winners and losers for US. That is just me I guess….

So what exactly is the difference between a NY with fairly small dip and even a new high now and the others like LA, SF, Seattle etc.? Is it just the smaller price increase relative to the peak in bubble 1? It also looks like the correction post bubble 1 is smaller than some of the other cities as well.

Timing. The places that inflated the earliest they are leading the charge in opposite direction. Soon it will be all over.

Still holding out hope for NY to crash to whatever degree it will, eventually. While we have plenty of big money ghouls in metro NYC, there is still evidence of ’08 in the mid-upper Hudson Valley in the form of abandoned properties, some with half-completed renovations, and none of the ghouls seem interested in buying those properties up. AirBnb ‘passive income’ ‘landlords’ saturated up here in the lakes & sticks, fingers crossed AirBnb goes tatas up. Plus so many lower & middle class residents are leaving, I can’t figure out who’s buying into this state except for money hiders and investors charging insane rents, how long can they keep that up? They can’t all be trapped here by custody law like I am, but T-9 years and counting.

Failing that, Indian Point could go boom and the property values will too. Not that I’d want that or anything.

God I hate it here.

“I (we all) hate it here”

Lili,

“It’s twwue, it’s twwue!!”

NYC did not have the exponential increases experienced across the country, in fact during the pandemic I couldn’t rent out my apartment for 3 months and then had to lower the rent dramatically — so I’m not so sure NYC will crash — if it had experienced the 40% increased like California — then definitely yes — and I’m hoping California does crash —

at least for my hood, the “high” was very spiky with maybe 2 or 3 houses painting the chart. Charts can be misleading.

Now they’ve settled down to like -15% of spike which is still a lot higher than I ever expected at least in a reasonable time frame.

3rd house in a row closed today over asking.

The majority want prices to come down. The market never gives what the majority wants.

Spring is over. Expect even bigger declines going forward. And down 15% is a very good start. Not enough, of course, but a good start.

There are some who advocate not using a real estate salesman. That’s fine. Everyone wants to “save the commission.” Don’t we all? But reality tells us that a commission is never “saved.” It’s earned. Seller wants to sell at market price to save the commission. FSBO. Buyer buys from FSBO to save the commission. Who wins? Buyer or Seller. There are labor expenses involved in every transaction. Either the Seller earns the commission. Or the Buyer earns the commission. Or the real estate salesman earns the commission. Why are only 5% of FSBO transaction successful? If you hate real estate salesmen so much, go get a real estate license. By the way, Realtors do not set prices. The market always sets the price. Either a ready, willing and able Buyer buys at a certain price or they don’t. Price is adjusted accordingly. FYI I don’t like paying car sales commissions either but the exact scenario is in place. Sales people are what make the economy function. If there were no sales people and no transactions took place tomorrow, the world would come to a screeching halt. Just my opinion, of course.

The only reason FSBO never sells in my state is because those sellers consistently price at 20% above market value or higher.

& the only reason houses are not selling right now is that the market price is too damn high. Of course you know that.

If you’re whining about people not wanting to pay commissions why don’t you take less of a percent? 2.5% on a $300K home is well paid. I know what paperwork you do. & talk down the sellers price when you represent them so that you can actually get a commission. That’s probably the best you can do for everyone concerned, including yourself.

In many markets, prices are down +/- 10% from the peak. But since mortgage rates doubled the monthly nut is significantly higher today. Many think prices will continue to fall and many have predicted a recession. Yet, nobody knows for sure that a recession and price crash will happen. Just because HB1 deflated a certain way doesn’t mean this will happen for HB2. Homeowners today are in a good spot (high credit scores and high equity). Owners in HB1 bought on “stated income” and ninja loans. Waiting for a massive crash might end up in a huge disappointment. Good luck to everyone.

The investors are not in a good spot. That is what matters. Homeowners who live in their houses are zero sum and you know that. Right now the investors are just playing hot potato musical chairs and trading back and forth with each other.

“ The investors are not in a good spot. That is what matters”

What in the data makes you believe that?

When I think about investors, I think mainly about inventory bought as rental investment property. Rents haven’t collapsed and investors bought a fixed debt.

Are you talking about investors that bought at the 2022 peak and something went sideways because the tenant stopped paying and needs to be evicted?

Looking at region case schiller charts above, housing correction seem to be over. The next level is going to 500.

Oh wow.

Howdy, RI , A Bubble inside the Bubble? That would be something.

Is that like Inception’s “a dream within a dream”? Maybe there is a parallel there.

Hope dies last!

Sit back and enjoy this magnificent benchmark real estate crash not only in the US but also in Canada, Australia, New Zealand and Europe,

I think it already is happening in China

Hope dies last!

Sit back and enjoy this magnificent benchmark real estate crash not only in the US but also in Canada, Australia, New Zealand and Europe

Todays housing market is like a jalopy cruising down the hill in to Death Valley. The radiator fluid is almost gone and the oil has turned to sludge, but the passengers are smiling because they are hitting the speed limit and the cool breezes are still blowing and gravity is their friend, The piper will have to be paid when they hit the valley floor.

Looks to me more like the muscle car climbing the rockies, stopped for some more fuel and is about to finish the trip to the top now.

Unless the big bad recession avalanche comes along. If/when that hapoens, the whole country is going to be under a lot of rocks. High home prices wil be the least of everyone’s worries.

When and if the recession comes, housing prices won’t stay high, and people with cash waiting for that to happen will be very happy

Let’s see: prices up 65% in the last 3 years…now down 3%. Way to go Powell! Thank you for bringing this market into balance!🤡. Oy vey

Yes, it will be interesting to buy when they are down 65%.

If the price of a $500K house rises by 65%, it’s $825k. If the price then falls 65%, it falls to $288K, or 42% below original price of $500k. Percentages up and down are kind of funny that way.

Thanks Wolf it’s quite fun to calculate, then according to your calculations I have to wait only about 40% down, now at 3% we are still a long way off but my patience knows no bounds.

Yep, math is funny like that. If you double prices, say go from $100,000 to $200,000, that is a 100% gain. However it only takes a 50% decline from $200,000 to get back to $100,000. People

sometimes misunderstand percent change.

Joe says he reads the value of his house doubled and brags it is up 100%. He reads sometime later that the value of his house has declined 50% from its doubled amount. Joe thinks, oh well, I am still up 50%. Nope, poor Joe is back where he started.

Quoting nominal price changes like this is somewhat deceptive because in a normal housing market house prices rise slightly faster than general inflation which has been very high the last couple of years.

Looking at real national house prices these rose during the pandemic by about 25% before peaking and are now down about 8.5% from that peak.

In San Fran real house prices peaked 26% higher than pre pandemic but have given up 80% of those gains and are now up only 6%.

In Seattle the figures are 38% down to just 19% today so half the total pandemic gains given up already.

Pauper,

1. Do you quote changes of the “nominal” price of gasoline or changes of the CPI-adjusted price of gasoline? Tell me the truth!! Do you quote changes of “nominal” stock prices or inflation-adjusted stock prices? What’s the inflation-adjusted change in the price of IBM shares? Is your employer paying you in “nominal” dollars or in inflation-adjusted 2012 dollars?

2. The Case-Shiller is an inflation index, it measures house price inflation, since it shows how many more dollars it takes to buy the same house since it’s based on the “sales pairs” method. It’s conceptually wrong to adjust one inflation measure by another inflation measure, such as adjusting the PPI by the CPI, or adjusting the CPI for rent of primary residence by the CPI for gasoline.

1) Nominal for gasoline. For my stock portfolio and salary I calculate both nominal and real because I need to know if my wealth and income is keeping pace with the cost of living.

2) OK but my overall point remains. In a normal non bubbly housing market over the long term house prices increase with general inflation. So when assessing how big a bubble is and how much it has deflated from the peak it’s useful to measure deviation from the normal trend. For example if nominal house prices are flat from now until 2030 while general inflation averages 3% a year that’s a total 20% downside deviation from normal appreciation i.e. a 20% deflation in bubble pricing.

I will try to say it in a different way that is less objectionable.

Bubbles result in extreme overvaluation i.e. Pricing that is way above trend.

Bubble bursting or crash is a large reduction in overvaluation over a short period of time.

FAU tracks overvaluation of 100 largest U.S. Metros and published graphs based on monthly estimates

Their methodology does not use CaseShiller index.

Their figures show San Fran overvaluation peaked at 24% last year and is now down to 7%.

I’m surprised how stubborn prices have been in the Boston area.

In my ‘hood (NH, just over the MA border along a commuter corridor), the only recently-closed listings <$300k are condos and modular homes, both of which include substantial HOA fees (so not really that affordable).

Prices still have a long way to fall to be affordable at current rates.

I’m surprised that anyone working class still wants to live in the Boston area. I gave up long ago trying to compete with the professional classes in Boston, which in my opinion are highly overpaid and overvalued for what they do. But my opinion doesn’t matter – that’s what society and Massachusetts wants, an economy that produces very little in the way of tangible goods but also rewards the administrators in this system handsomely.

So we voted with our feet long ago and went somewhere that we could do what we want to do (I’m in the trades) and afford to live and eat without competing with power couples. Best decision of our lives.

FYI my formerly agrarian region was absolutely ruined by urban-induced sprawl – the worst kind of development, 1-2 acre single family homes on former family farms. I like farm-fresh food. Massachusetts ruined that too. Now we can actually afford to eat well on modest income, because that is no longer an option in Mass. either.

I did the same myself – however since I still work in Boston, I settled down just over the NH border.

Cost of living in NH is substantially lower than metro Boston. I was paying more in rent for an apartment than my combined monthly PITI is now.

Me too. I’m perplexed. Mortgage payments are 30-50% above rents, and that’s even with rents rocketing. Horrible as investments. The economics for builders was already squeezed with them buying plots and putting the largest possible sq ft they’re allowed and now they’re carrying costs have soared. And what used to require a chunky deposit and 300k family incomes couple of years ago (not rare here) now needs the same chunky deposit but 500k family income. Who’s buying these things?!

Well, markets with some new builds give options for low existing home inventory. No new builds in desirable areas mean limited inventory in general and in smaller markets can mean almost no good inventory. I saw a video with an economist reporting that existing home listing had time on-market less than 50% of the months on market for new builds, although the new builds likely have a reduced buyer pool until they are nearing completion.

Mr. Wolf you have debunked the low inventory blamed on owners with low interest rates not wanting to trade up and get a 7% mortgage. In an overall view, no issue with your counters, but lots of long distance buyers moves and in some markets, the lack of inventory I believe is at least partially attributable to less sellers looking to trade up in the same localized market. The bulk of buyers are migrating in and not dependent on locals as a meaningful component in the demand base, so the net impact is reduced inventory for sale. I know you strongly disagree.

After 10 weeks, we are back on the road heading to a non-state-tax state to rent. We are cash buyers and flexible in pricing, just picky. . Sellers are more likely to accept contingent offers to get higher price, in supply constrained markets even a few waiting equity pig buyers can great multiple quickly when properties are listed for sale. We went through small towns in multiple states and the more desirable districts had short exposure periods.

Sitting on cash out short-term T-bills is not run. Our destination city has home prices double one of the towns we were looking in and 50%+ greater than the other. Rents are like 25% to 40% higher but in nominal terms, the state tax savings is worth it to rent, but not really to own. The GIM on for listed homes is probably 20x to 25x. I

It’s a brutal market that we’re in for buyers not willing to hit 5he ask and overlook older roofs, older HVAC, etc. If prices and values don’t real in, I will have egg on my face.

Until they get the mega landlords out of the SFH markets this will continue.

Some political steps are being implemented in Florida to curb investor purchases, but they won’t address the elephant in the room, because the mega landlords are the donor base in these overpriced areas.

Look at the number of retirees leaving the country and being joined by much younger mobile workers. The country is unaffordable for the average person and the leadership is completely captured. Many are taking their marbles and getting out. That’s the best deal.

Meant create multiple offers above.

“Here are the metros with the biggest price declines:”

Washington, DC came in at -.5%

BFD

I would say the prices here are stable or actually increasing at a slow pace. Every piece of crap is selling within 18 days or less. And given the fact that interest rates on mortgages have doubled in the last two years this would indicate that the shortage in available affordable housing outweighs all the other factors. It’s all about supply & demand.

The “biggest” was an editing issue. It should not have been there. “Prices are now down in 10 of the 20 metropolitan areas…” is what it says at the beginning, and then I listed all 10, and “biggest” should not have been in the sentence.

I have been trying to get a home since last year. I live in San Diego and it’s been impossible. Mind you my price range is not small. I have a budget of 1.8m and have a 700k downpayment but houses in the 1.6-2m range have stayed up despite million dollar mortgages now carting an extra 3k a month in interest payments thanks to higher rates. Yet volume is non existent so prices stay high. When will this deadlock end?

It will be the day after I buy.

If you only knew how crazy this sounds out here in the real world. When you can’t get a house with 700K cash, it’s time to get out. Really!

You absolutely can get a house for 700k cash.

Just not in overpriced west coast markets.

Anton is just humble bragging.

Anton,

I don’t understand the problem. Your budget is $1.8M, and you have almost 40% to put down. Lots of assumptions coming, so bear with me.

1. I just did a search online for San Diego, single family homes from $1M to $2M and got 180+ active listings/coming soon. Seem to be plenty of choices. I don’t see an inventory issue at first glance.

2. I assume you WANT to live in SD, otherwise you would take your cash and move elsewhere. I don’t see a “I’m stuck here” problem.

What exactly is the problem? What is actually preventing you from buying a home? Do you not feel the homes are “worth” that money? Just curious.

Invest your $700k.

Bank $35,000 a year in interest and rent a place.

You can get a decent little place in La Jolla if you toss in as much as your mortgage would have been on $2 mil (I checked Zillow).

If you’re high tax bracket use VTEB/VTES or similar for tax free income. U can use CA munis to avoid CA taxes too.

No reason to drop that much coin and catch a falling knife.

You should ‘mansion-up’ and ink a deal, they aren’t making anymore Tijuana-adjacent.

Amazing the cost-of-living difference of Cali vs other places.

In my area, you could buy outright 2000+ sqft on a 1/4 acre for $700k and not even need to take out a mortgage.

Anton, your comment is completely tone deaf.

Anton,

We were in your situation in S. CA back in the early 90’s. Other than the magnitude of numbers, it hasn’t changed much. You didn’t mention your income.

We had an income of about 40K (a great starting engineer salary in 1990) with a growing family. The size of house we wanted was around 500K (12X income) without stacking multiple kids into bedrooms.

We could have bought a smaller older house for 300K (7.5X income) and stacked the kids.

Some of our friends stretched and purchased a 300K house with a co-signer and lived in paradise in a smaller house. They are doing well now with their smaller houses since the kids have all moved out and the houses are now paid for and worth 1M.

We decided to move away and I found a job for 37K in and area where we could buy the house we wanted for 200K (5.5X income). We saved the rest and we can retire early. The upside is we can still have the kids come home and visit with the grandkids since the house is larger. The downside is that we haven’t been able to walk or bike to the beach in 30 years. We hike in the mountains instead.

S. CA has always had a “paradise premium”. Starting engineers in S. CA now make about 120K. Compared to our situation in the 1990’s, 12X of 120K is 1.4M for a larger house. 7.5X is 900K for a smaller house. The totals are mind-boggling higher now but the ratios compared to salary are only a little higher compared to the early 1990’s. The prices now could drop 5-10% and have equivalent ratios.

BobE,

It worked!!!

Thanks.

Thanks for the tip!

Now I’ve seen it all.

🤣🧡🥂

I think a lot of people buying at today’s prices will be in a world of hurt if/when interest rates don’t drop. I’ve anecdotally spoken to people who really are stretching their budgets, but feel that all will be fine when they refinance into a 4.25% mortgage next year.

They better also hope they don’t get laid off.

I keep pointing out that it’s going to be years before interest rates go down. We’re into the second year of rising rates, the Fed has said they are going up more, and to START to lower the inflation rate they need to be higher than said inflation rate. At this rate the Fed will be raising rates for another 2 years before anything really levels out. Two more years of inflation is going to massively impact Joe Consumer.

I’ve been through this. It wasn’t pretty. I seriously worry about the 20-30 yr olds who’ve never had to deal with a major recession/depression.

What a lot of folks have yet to realize is this is not just a USA issue; it’s worldwide.

No the Fed will NOT be raising interest rates much above current levels. They are only jawboning to that effect.

Conversely, they will NOT be lowering interest rates much from here for quite a long time per my earlier comments about being boxed in with world opinion moving against dollar hegemony.

Whatever comes up (and bad stuff will most certainly surface), they will deal with….with their alphabet soup names of bail out facilities.

A crash in housing prices is unlikely and were it to occur, would be devastating to the economy; likely putting us in depression. So there too, the Fed will keep a close eye on price levels.

Mortgage interest rates are keyed off the yield on 10-year US Treasuries plus around 3% and those yields are definitely going much higher than they are now regardless of the Federal Funds rate set by the Federal Reserve.

“I’ve been through this.“

Are you referring to the 70’s? You had high inflation and housing/rent inflation took off. Bodybuilders like Arnold became millionaires by buying houses. That was prior to his acting career.

Yes rates will stay up, until the labor market breaks. People keep thinking recession means housing crash. I am not so sure. If labor breaks, what stoops the FED from loosening? Besides, the 10y treasury yields trend down during recessionary times….. which pulls mortgage rates down…..

Unsustainable finance is the hallmark of a bubble.

In the first housing bubble we had teaser rates, interest only and negative amortizing.

Regulations imposed in the aftermath have limited these today but maybe what you described is the modern equivalent.

People committing to long term loan repayments they cannot afford unless mortgage rates plummet or their incomes skyrocket.

“ People committing to long term loan repayments they cannot afford unless mortgage rates plummet or their incomes skyrocket.”

I recently went through the buying process myself and can tell you that if you wouldn’t be able to afford the house at current condition they are not going to lend you money. You can actually try for yourself to get pre-qualified. They will tell you exactly what purchase price you can afford after turning every stone in your financial situation.

Hindsight I should have bought that $100,000 2Bd 1bath up on the mudslide bluff in magnolia, wa back in 1996. Moving from Mississippi watching folks pay $7.00 for ice coffee as I drove down the hill to Pier 86 to work. I always thought it was cool I could catch fresh salmon off the dock. Indeed the bubble is slowly bursting in overpriced and overcrowded best places to live. Housing FOMO to sleeping on the floor at US major airports, seems to me that basic services and expectations on downward trend. $YOLO and the 5.5% interest collectors will now exacerbate inflation. I only hope the juice is worth the squeeze for folks buying into American Dream. I’m seeing to many of my favorite watering holes and family ran restaurants closing their doors.

Magnolia? Yes, yes you should have. I regret passing on a place there just off Gov’t Way going into Discovery Park back around 2000.

In America…you can run up a lot of debt and say ooops. Then file bankruptcy and get a free pass to start over. lol

It allow many people to live beyond their means. I have seen this happen with family and friends.

What is sad they really do not learn their lesson. They just do it again.

Considering how outrageously inflated housing prices were at the peak, many of these price declines are rather paltry and geographically biased towards the West Coast. Price declines of 5-10% don’t count for much when mortgage rates move from 3% to 7% in less than 2 years. For many of us living along the East Coast, price declines have been imperceptibly small, especially outside of the major cities.

An additional 10-20% decline in housing prices would move the needle back towards affordability. A drop in prices of this magnitude would most certainly require a major recession demarcated by substantial job loss. In my mind, there are two obvious potential catalysts for this recession:

1) The return of student loan payments exposing a much weaker consumer than we are led to believe.

2) Jim Cramer declaring the beginning of a new bull market (1/Cramer = $ is the only economics equation you need to know).

Agree that housing needs to done to come down and broaden out it’s declined. It will as long as rates stay high and they should stay “high” permanently IMO.

Housing is a slow mover tho because it takes people needing to sell to bring prices down.

I don’t agree with your other two points. People thinking the student loan payment pause ending will matter are wrong. First off we don’t actually know for sure they will re start until they actually do she that’ll happen soonest in October. Second there is all sorts of loop holes so people don’t have to actually pay them. It’s a joke and the debt will likely get completely forgiven at some point which will actually be good for housing prices dropping because it’ll be inflationary and force rates up!

A Cramer forced market crash will only put pressure on the Fed to cut rates and therefore support housing. Seems like we’re closer to new highs in the market indexes then a crash in the short term at least but I think that’ll actually be again be bad for housing prices because again higher stock prices are inflationary and that’ll keep rates higher for longer

There may be some adjustments to price, but the real reset in the Great Financial Crisis occurred when the banks failed. The same price drop happened in the depression. As long as people can borrow money this housing disaster will be on going.

Perhaps our friends in the Financial speculation world of short selling banks will be able to assist as a byproduct of their wealth creation. Jamie Dimon commented that short selling in banks should be prohibited, so short selling must be an effective and profitable endeavor.

Good point. Many times it is about liquidity. If banks are lending, then assets will go up. Their are plenty of people out their who would borrow at 10% to buy a house even when they cannot afford it. They may believe they can but they cannot. Then eventually it catches up with them.

If banks do not lend ….then prices will drop.

Anyone remember who the GSEs started saying….okay….we know you filed bankruptcy in 2009 and it is only 3 years later, but if you take a course on budgeting, we will give you a loan again at 3.5% with a 3% down payment and guarantee the loan so a bank will not decline the loan. Maybe if your income is low enough, we will pay the downpayment for you. Don’t worry about the 7 year scarlet letter of bankruptcy. All that happened in the 2012 to 2015 time frame to get housing moving up again.

oops. Sent to soon while checking spelling.

Also, one thing that is a bit different now than the GFC and the depression, most mortgages (96% of all mortgages since 2010) are guaranteed by the government GSEs.

They are a very risk free investment. Any housing bust will not hurt the investors of GSE backed mortgages. If we have any type of housing downturn/recession, the government will take the loss on the mortgages and then probably just resell the houses to Blackstone at pennies on the dollar. LOL

Honestly, this will help prevent any type of housing crash like during HB1. Since the government owns the mortgage, they can do a forbearance of payments during the recession. Just like they did during COVID. Another option (which was a proposed program during COVID), is to not kick out the homeowners if they are facing foreclosure and sell the loans to a Wall Street company at pennies on the dollar and have the people become renters.

IMHO…. If anyone is looking for a HB1 type of crash, the odds are low. Since the GSE’s now own/guarantee more than 70% of all mortgages, they have a lot of tools to prevent a fire sale crash like HB1. From bankrate.com: As of 2023, Fannie Mae and Freddie Mac support around 70 percent of the mortgage market, according to the National Association of Realtors. That means the majority of conventional loans, those offered by private lenders, end up being backed or purchased by one of the two entities.

Good Post RU82

Do you (or anyone else) know if the US mortgages contracted in last 3-4 years included any of the “fixed to floating” variety that was used in UK?

If yes, might the rate-rise reset stress housing market, and simultaneously nick consumer spending.

Not saying, just asking….

A 20% drop in price doesn’t make up for a 5% increase in the rate of interest. Interest rates have doubled the monthly mortgage for the average wannabe homeowner.

Good point… which is why they are and will remain “wannabe” homeowners. The majority of existing homeowners have locked in low mortgage rates and arent going anywhere unless they have to. Thus, low inventory.

The wannabes will just have to keep renting, which is why the bulk of new housing starts are multifamily rentals.

This goes right in line with the 2030 agenda…you will own nothing and be happy, and you’ll move to a 15min area from your work and rent forever.

In the Suncadia vacation area an hour outside Seattle, I counted around 70 homes for sale but only 11 sales over the past three months (the hot selling season). To me, that says prices have much more downside than upside, assuming people want to sell those homes, many of which are Airbnb properties. There clearly is no shortage of inventory in that market. The eager sellers will score.

They say the second homes get hit hardest in a recession. It seems to be setting up that way.

Bobber,

I have similar observations. After concluding a two month search for a primary residence in Oregon and SW Washington, and inspecting over 50 homes and tracking them, I am seeing similar ratios. About half of the homes have cut their pricing at an average of 3% after about three weeks of list without an offer. The exceptional properties are selling, but not with the multiple offer mania of times’ past. There is definitely a volume slowdown yet prices are still high and sticky.

I dont doubt the validity of the data offered.

However, that which is occurring before my eyes suggests different.

I stepped away from a bidding war just last month on a house that had been on the market one day. The house listed 22% above two years ago price.

And I am hearing similar stories.

7% mortgages only seem high due to the absurdity of the false rates pushed by poor Fed policy for years. Replacement and building costs are keeping housing high…IMO.

Why have replacement and building costs increased so much since 2019?

What fundamental permanent change has happened in last 3 years?

The money supply was increased, and the Fed has no intention (regardless of what it says) of removing all of that extra liquidity. It has removed some and will remove some more, but it won’t be nearly all of it.

Yes I understand that.

The thing is that house prices have raced far ahead of general inflation.

If this is due to building and replacement costs why have those costs raced so far ahead of general inflation?

That is my question.

My theory is that assets reset almost immediately to an increased money supply, while consumer goods and services do so gradually.

Dollar devaluation comes to mind poor one.

Take a good look at the BLS inflation calculator for the official rate of inflation for any time period, then compare it with your own personal anecdotal experience, then make up your own mind.

Our overall hood — 144 blocks between nearest ”busy” streets now has a property for sale for over a million.

That’s about $400/SF and the highest priced one ever AFAIK.

We bought a fixer for less than $90/SF in 2015, and similar props went for even less right down the street at that time.

CRAZY RE markets far damn shore, and the result, at least historically, has always been a crash.

Of course it’s different this time,,, eh

LLL, Did you miss the worldwide Covid-19 pandemic

C/S is running out of positively biased pairs.

That 1st chart, if we track what happened during the GFC, the 2007-2009 drop already happened (past 15 months), the bump up (2010 Spring Sales) just now happened and like in 2011-2012, we might see a 4% to 5% drop in next 2 years (mid-2023-2025). That sounds about right – then stability or the rise starts again. With inflation at 5%, you lose 10% to the market in 2 years. The sloggy bottom may thus already be here.

LOL. In the 2007-2009 drop, prices dropped by 40-50% in many places. How can you say that has already happened?

We could have avoided a good bit of the investors pumping up Real Estate prices dynamic if we had a designed to be progressive consumption tax instead of the poorly designed income tax.

I would elaborate, but the probability of Wolf calling me a billionaire shill is already at 50 percent.

I expect much bigger drop to attain decent affordability for people else most would be screwed but who knows

This proves we need higher rates for longer

B

Something to consider: The case shiller graphs here show that home prices in most of these metros are around or a little under 3 times what they were in 2003 – 20 years ago. That roughly jibes with the Fed’s median house price data. From 1970-1980, the median price nearly tripled, and from ’80-’90, it nearly doubled again. The 20 year period from ’70-’90 saw the median house price multiply by 5.5 times despite the highest interest rates in American history! That is what money printing does. In comparison, the last twenty years have actually been sort of slow on price growth… Prices “only” barely tripled in 2 decades.

It astonishes me that so many of the folks here claiming that house prices have to crash are the same folks that lived through decades of much faster price increases. Wolf has shown that the consumer is actually in great shape on debt, so no GFC 2.0 is in the works. This is simply what money printing looks like. Anybody waiting for another 50% drop in house prices is delusional. And if we did see that kind of drop, A) most commenters here will be in a world of hurt due to a dead economy, and B) the money printers would be running full blast well before we would reach 50% asset deflation.

Not Sure

Thanks for adding historical data (1970’s and beyond) which supports my hypothesis when combined with Wolf’s chart. With high end Multi-Fam entering the market at an accelerated rate as well, seems SFHs will be more of a luxury for those already ensconced in the market (i.e. who already own a home) – unaffordable for most others. “Bubble” will remain in the lexicon, but “Crash” ain’t happenin’ unless 30% down from 40% peaks (a “net” -8% or so) counts as a crash.

I’m with you on your multi-fam point Beardawg. We had a big peak in the homeownership rate around 69% before the GFC, but our current 66% homeownership rate is still historically quite high. That’s higher than pretty much any period in modern American history except from 1998-2011. There’s no guarantee of homeownership… Who is to say that the ownership rate couldn’t or shouldn’t drop down around 55% like it was in the 1950’s? Below 45% like it was in the 40s? Renting has been the norm for most of human history. We’ve historically been a nation of renters. It only makes sense we would return to that eventually.

Trade deficits, budget deficits, and money printing for decades has and will continue to drain U.S. domestic middle class buying power. A lot of future Americans will be renting apartments to maintain an ever decreasing standard of living while others pack more family (parents, adult offspring, siblings, aunts/uncles/cousins) into SFHs to share the cost like much of the rest of the world does.

A small note, New York metro single family home prices are up. But looks like condos (representative of housing in the city itself) is starting to go down.

My landlord (SFH rental investor in metro NYC) sent out a surveyor the other day. They tend not to do that unless they’re looking to sell, or improve the property.

Given the latter is definitely ruled out, and they more than tripled their $ in the last 3 years, I’m anticipating it’ll be up for sale soon and bracing to move the fam yet again. Which, sucks horribly, but the perhaps the writing is on the wall market-wise, locally anyway.

I’m located in Cleveland and prices are actually at new all time highs, superseding 2021/2022. The market is insane, houses that were 50k ten years ago going for 250k.

It’s interesting to see as we have so many low wage earners, not sure who can afford all of this housing. I know investors and flippers are piling in non stop. I’m in the industry and know dozens of people making 1m+ annually.

I don’t know what the future holds, but Cleveland is looking pretty strong.

$250k is still cheap. LOL

I humbly suggest that the current situation has no comparable, not in the GFC (2007-2009) or even the early 1980’s. I suspect that many of Wolf’s readers have no real experience with an extremely high inflation environment like the early 1980’s, and then compare the current situation to what they know, the GFC. The early 1980’s inflation did not have the easy money( money printing) element we see today. I would tend to believe that fact alone will exacerbate the problems experienced in the 80’s. It was a “shit show” then (I was selling real estate at the time), but only for a segment of the overall population, with many sailing through it relatively unscathed and able to load up on long bonds at the right time. The easy money aspect of the current situation may broaden the base of people impacted by the high inflation, and make the impact more broadly based and take longer to dissapate with higher rates for longer. Keeping your powder dry makes sense to me right now. It might help the discourse on this site if people took more time to look closely at the early 80’s inflation. It isn’t ancient history, and recency bias may blind people to doing just that.

“…if people took more time to look closely at the early 80’s inflation. ”

Any resources or recommended reading?

Sorry, I don’t have the resources as requested. Talking to people you know who are older and who you respect might help.

We did a nice rambler in Silver Spring Maryland, just outside of DC, close to Metro and the downtown Silver Spring. Newly renovated using top grade materials. Not the crap you see with these teardown new builds. The neighborhood was suburban with tree lined streets and large amounts of green space. Based on the final sale price, I calculated the price per sq foot. It came out to $1,200/sq foot. That’s some real serious inflation. Those Case Shilling figures of -.5% YOY price changes of existing homes in a large Metro area like DC is very misleading, and probably includes sales far out from the highly desirable locations. It would be advantageous to have a Case Shiller Index down to the zip code level.

Is RE really in a bubble?

A government debt monetization plan is being executed. Anyone with common sense and respect for results can see this. This plan permanently increased price levels by 20% in about three years. The plan continues with 4-5% inflation and continuing deficits, as far as the eye can see, as the Fed chooses to pause the inflation fight and formally pursue goals of continued inflation.

I think some speculative areas could suffer significant price reductions, but I don’t the Fed has the stomach to handle a nationwide price reduction of more than 15%.

why do you think that FED does not have appetite to make houses affordable to common people again ?

The results over decades show the Fed maintains a misguided belief in trickle down theory and wealth effect, but it doesn’t admit to that.

Until rates are over 7% (=10%+ mortgages), housing prices won’t fall dramatically, short of a major black swan event. We have the equivalent of a “supply chain” shortage of homes. The fed may have figured this out after only 18 months.

If the fed raises rates to those 7% levels, which I believe they will, the entire economy will get crushed first and we’ll have a big nasty recession snd housing will fall with everythi g else.

The fed’s premise was ridiculous from the start. They told us they could stop the back of the train (housing) without stopping the front of the train (the economy).

2008 was an anomaly where housing caused the recession. Normally home prices fall within a recession, although in the ’74 & ’80 recessions they rose.

“If the fed raises rates to those 7% levels, the entire economy will get crushed first and we’ll have a big nasty recession…”

I used to think that – but here we are at 5+% and things are mostly fine.

Maybe that’s the goldilox scenario: higher rates which the economy digests, along with a multi-year downtrend in asset prices.

To Bobber:

“The results over decades show the Fed maintains a misguided belief in trickle down theory and wealth effect, but it doesn’t admit to that.”

Trickle down effects does not work and only helps with wealth inequality.

I am not saying it, the data shows this.

But FED needs to acknowledge this.

But we all know that FED works for the wealthy. Unless poor/middle class wakes up with pitch fork in their hands, things won’t change.

But at the same time, it is good for haves to have consideration for have-nots for their own safety, security , sanity and freedom. Just look at the 3rd world countries with obscene wealth gap..

I think it’s a bubble based on buyer FOMO behavior, but I do see some RE people keep yelling about an 18 year housing cycle and it will keep going up until 2025 (sounded like some RE hype bs). I don’t know where this money is coming from to buy these homes at these prices as the Fed is doing QT and M2 is going down. But yes I think they overall lifted the floor on prices about 20-30% across the board with this COVID money printing and only hoping to spread it out over the next 5 years or so based on longterm M2 growth trend (2025 is when M2 should be at longterm trend). Asset prices immediately pop with money printing while CPI/PCE and wage inflation takes longer to get there. Home prices for buyers have gone up substantially when you look at monthly payment based on rates even though the list/sale price came down a little.

Wife thinks Seattle is still going up after the spring. So that’s not good. Doesn’t make sense that no one can afford a house in any city. Has to correct.

Ask your wife to summarize her thoughts in bullet points. That will probably change her mind, or at least make her realize she’s speculating based on RE jargon.

Says all the “cheap” houses get gobbled up. Only over 1 million is dropping.

So after thinking this through, I’ve come to arrive at the following conclusion.

The core problem continues to be too much money in the system. The Fed has barely even really started to decrease the massive balance sheet and the ECB has not done it at all and the BOJ is actually still increasing. This money all goes into propping up asset bubbles.

They can raise short term interest rates as much as they want, but the real change will occur when long term rates rise and when more money is bled out of the economy.

After the debt ceiling was passed, the Treasury issued lots of short term debt, which sold really well since the interest rates are so high, but they have only issued a little long term debt and it didnt go so well. Dealers took a larger share than usual. Once the Treasury starts to issue buckets of long term debt, long term rates will soar and that will kill the stock market rally and as homes on the market start to finally increase, we will finally see home prices fall.

Inflation is going to remain fairly durable, so we will need to see an economic contraction before it gets broken. There can be no break in core inflation until the housing market gets hit because with home prices so high, rental prices will continue to go up.

Estimated timeline, if you were to guess…?

gametv,

Is there a ceiling on what the Treasury can issue on short term Tbills?

Or can the Fed just keep issuing short term, or are they constrained that they have to move to longer term bonds?

you are wrong, the ecb is way ahead of the fed.

the ecb withdrew 1 trillion and 200 billion euros

fed about 700 billion dollars

The season turned to Summer on June 21, 2023. It is now summer.

2nd paragraph in the aritlce:

“Today’s data for “April” is a three-month moving average of home prices whose sales were entered into public records in February, March, and April.”

MW: Congressional Budget Office paints grim long-term U.S. deficit picture in the years ahead…

One of two things have to be true in the long run:

1) Owning a house will only be an option for the wealthy.

2) Median home prices must approach what the median family can afford.

Today, a family making $60k a year can afford a $255k house (20% down).

The FOMO buyers can support the unreasonable prices for a decade as long as supply remains anemic.

Terra, no, false choice.

There is no reason the median income family should be expected to afford the median-priced home. The two medians are unrelated. Think about it more, how the math of medians works, and how the two populations (households, homes) can be distributed entirely differently. After all, many households are, and want to be, renters. Or very low income, approaching zero.

Are you kidding? No family earning 60K can save 50K to afford a 255K house. They are barely saving up a 3% down payment and probably borrowing the closing costs on top of the mortgage. When they get their new tax bill or insurance bill, it’s over.

3rd scenario for your consideration:

Home prices come down, but remain unaffordable as the next decade+ is marked by high interest rates and inflation.

Property ends up being handed down in families, rather then being sold between them. Grown-up children stay at home longer before moving out, if doing so at all.

Living alone becomes a luxury for the wealthy – most end up living with family, taking on roommates etc.

Squatters taking up in abandoned properties becomes commonplace.

You blame inflation for housing prices but the truth is the housing bubble fueled the inflation!

The difference between 7.00% and 4.00% on an 800k loan is $1,500 a month. Those thinking that a rate drop will save the day are in for a rude awakening if buying now, or have purchased in the past two years. That $1,500 in savings will quickly be eaten up by taxes, increased HOA’s, energy costs and general inflation, especially food. But hey, ya didn’t miss out!

There’s a few things I wonder about with this, if it is the beginning of a bubble deflation:

– The US policy has been for so long to incentivize home ownership as the only savings vehicle for boomers, will they really let values substantially decline before that huge block of voters is dead in 20 years?

– In many inflation indexes, home costs are a huge chunk, no? So if they let home prices drop dramatically, they have to say we have deflation, which they won’t do?

– Finally and more specifically: Most of this evidence seems to support the idea of an east/west US market. Falling values in the west and slow rises in the east. Contrasted to ‘bubble 1’ where the fall was more universal?