The entire mindset has changed.

By Wolf Richter for WOLF STREET.

Services are about two-thirds of the economy. During the Pandemic, discretionary services such as travel and entertainment have been hard hit, and consumer spending on services in February was still down 5.2% from a year ago. But the services sector is enormous, ranging from healthcare to tech, and demand has been strong in many segments, and is coming back in others. Amid backlogs and shortages, input prices are soaring and companies are able to pass on those higher prices. The Fed might refuse to acknowledge it, but everyone else is seeing it.

“The biggest concern is inflation, with price gauges hitting new survey highs in March as demand often exceeded supply for a wide variety of goods and services,” reported IHS Markit in its Services PMI today.

“On the price front, input costs soared in March. The rate of inflation accelerated to the fastest since data collection for the services survey began in October 2009,” the report said.

“Subsequently, firms sought to pass on higher costs to clients through a sharper rise in selling prices,” the report said.

“A number of companies also stated that stronger client demand allowed a greater proportion of the hike in costs to be passed through. The resulting rate of charge inflation was the quickest on record,” the report said.

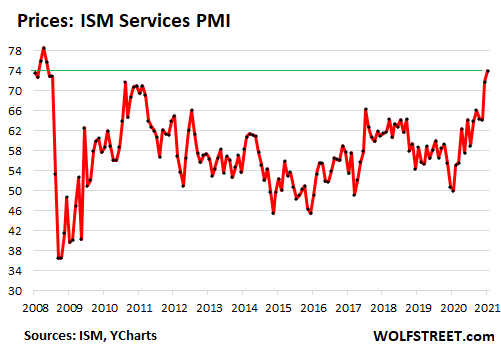

These types of price pressures in the services sector were also reported today by the Institute of Supply Management’s broad ISM Services Report on Business, whose index for prices paid for materials and services increased in March at the steepest rate since 2008.

All 18 services industries in the index reported higher prices. The index has now shown price increases for the 10th month in a row, after the price declines in April and May last year.

Values above 50 indicate that companies are paying rising prices in the current month compared to the prior month, values below 50 indicate that they’re paying lower prices than in the prior month. The higher the value above the gray line, the sharper the acceleration in prices. The value of 74 in March indicates the sharpest acceleration in prices paid since July 2008 (data via YCharts):

All 18 industries in the index reported higher prices in March. They were, in that order: Construction; Wholesale Trade; Utilities; Mining; Real Estate, Rental & Leasing; Management of Companies & Support Services; Public Administration; Retail Trade; Transportation & Warehousing; Finance & Insurance; Other Services; Accommodation & Food Services; Agriculture, Forestry, Fishing & Hunting; Health Care & Social Assistance; Arts, Entertainment & Recreation; Professional, Scientific & Technical Services; Educational Services; and Information.

One of the executives on the panel, whose company is in the construction business, reported:

“Residential new home construction demand continues to outpace supply. Building material delays, discontinuations and shortages are beginning to develop. Shipping delays at the L.A. and Long Beach ports have contributed to longer lead times. Cold weather in Texas has hurt several component manufacturers for building materials. We have encountered the ‘perfect storm’ for building material shortages and price increases.”

An executive whose company is in the information sector, reported:

“Resin/oil price increases are beginning to filter down to products that we procure. In addition to price increases, we are also seeing longer lead times as supply chains pivot to find cheaper supply options.”

What this shows is that price increases are now spreading across the services sector, that companies are broadly paying higher prices and that they’re broadly able to pass on higher prices as their customers have become more accepting of price increases. The entire mindset has changed.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I can pretty much name my price on work and get it. There are not enough qualified tradesmen out there. I plan on doubling my income this year.

Are you an electrician or carpenter?

I’m a carpenter. I have experience in all phases of construction, plus I’m a welder, so there’s really nothing I cannot do. I generally like to do smaller jobs and specialty work that other people don’t want to do, or can’t. That being said, I’m not “specialized,” so I can handle a large breadth of work.

2022 gonna be scarce work out there when no one can afford anything anymore

Depth,

Same here, same credentials, similar focus. I like doing renovations by the hour. However, retired. I get asked all the time to take on work. Instead, now working on my own stuff. My electrician son in same position as well as his business partner. They are as busy as they want to be.

My brother in law is new to construction and works with a long time carpenter. They have work lined up for months, and have declined to take on big projects. They are busy enough doing renos. BIL used to be a meat cutter for a big chain. He quit that years ago and still gets calls to return to work. They cannot find butchers.

For me, the best thing about trades, besides seeing the completed project and the satisfaction, is the respect and appreciation for a job well done. It can’t be beat. Today I had load of materials delivered. The site is tight and tricky to get into. The driver was amazing. It’s a good industry to be a part of.

There are a lot of people that don’t want to work especially with these unemployment benefits. One house that I rent, the Mexican guys are roofers. I know building is going hot, but they’re at home. One of the guys has a Wrangler that needs work. I told him he’s young, that he needs to go to work, make money, and fix the car.

I see this with people I work with. They complain about money, but no way they will work OT once in a while to catch up with expenses. I don’t know how they expect to get ahead with this mentality. A lot of Americans just live for today. I’m supposed to feel sorry for them? You gotta be kidding.

I have several properties. I rent below market, but just increased everyone’s rent $150-200. They are still happy and I’m happy to have them for YEARS. God bless the renter and happy landlord!

Yes, Paulo,

People appreciate good work. It keeps us in business.

I’m semi-retired and only take on smaller jobs now. Most of my work is for Dr’s and nurses who refer me to colleagues, I never have to look for anything to do.

There are not enough qualified tradesmen out there

yup. we’ve been looking to take on a new guy for years. i thought that tens of millions of newly unemployed might shake a few loose. but nope, people are still scared of real, committed work. non-unionized trades are a great place to be right now and mastering a skill set is just soo valuable – financially and personally. oh well, more for us.

My son is a self-employed electrician. His wholesale supply house has updated price sheets TWICE in the past 4 months. All the prices, of course, went up, some by double-digit percentages.

This, ladies and gents, is called inflation.

Check out lumber prices.

Spot lumber prices have gone from $259, a year ago, to over

$1,020, yesterday. Drywall prices are up 20% in the last two months. Can’t even track the inflation of container shipped building supplies anymore. Building costs have got to be up over 30% y/o/y. When I can actually hire a sub, I pay him whatever he/she asks. It’s double what I paid two years ago, and subs now show up when they please. My jobs are treated like filler work, and subs are purposely way overbooked.

I’m sitting on some of the best waterfront lots I’ve ever owned, but I just can’t see paying these skyrocketing building costs. All dressed up and nowhere to go.

Started selling off the lot inventory. The pandemic taught me that, other than for food, I’ve got all the crap I’ll ever need. Luxury goods just make one a target. There ain’t no reason to try to impress anyone, anyway. Best to keep a low profile in public, and stay off of Twitter and Facebook, because folks are getting more desperate all the time, and they hate at least half of their fellow Americans.

I hope to buy a lot this coming winter from someone who no longer can afford to build

I’ll discount price on take it or leave it basis

Read today that the recent price rise for materials will be adding on an additional 25-30 K for new construction. A few years ago framing lumber was the least of the worries. Retail is $60 per sheet for 1/2″ fir sheathing.

My opinion is that RE commissions need to be lowered, big time. Even with the sliding scale, I think my son paid 20K towards commission with a recent house purchase. I don’t see how a few showings is worth anything near that amount of money. The bill is hidden in the sale price.

He did get a nice card, though.

Unless salaries are also going up, doesn’t that make it Stagflation?

Try hiring a plumber or electrician. They are getting all the money.

Do it yourself, it’s not that hard if you go slowly and carefully. Just dirty and usually uncomfortable. And very satisfying to do a nice neat job. And you don’t need a lot of expensive tools like a mechanic or welder. Just use quality materials and not bargain junk so you don’t have to redo it later.

YouTube and do it yourself books show you everything you need. They should also show code requirements.

Heh, I just bought a vacation home from a retired electrician.

I think the one, single(!), room, where an illegal electrical installation has not yet been performed, is the bathroom!

The house sold at 15% below the valuation because of this.

Now, I do not really understand the mentality at work here:

It seems like that because one understands the dangers / inconveniences, one takes shortcuts, choses to live with them for years and years, rather than getting ones lazy old ass down to the olden shoppe and procure the proper materials!

… or rip them off from some job, or have ones business “lose” them, if one is too damn stingy.

An stingy it is indeed: “Here”, VAT-registered tradespeople get up to 80% discounts on materials (plumbing being the worst ripoff there is, buying at retail).

It can be worth the time & bureaucracy for setting up a new VAT-registered business before doing some significant home renovation work, then closing it down when done. Just for the discounts!

The suppliers hate this, but, there is little they can do, except adjusting the volume discounts, which then hacks off all their “proper” clients.

Painted three rooms.

Renovated and rearranged the laundry room

Next I will be building my own shed.

This stuff isn’t hard, just time consuming if you are a layperson. Just takes more time and planning step by step.

BTW.. I am amazed at all the tradespeople hanging around a financial news site.

This for ”faj”:

With two brothers also carpenters with one also a formerly licensed now retired PB an EL, the saying in our family is ”the only time one of our homes is actually ”finished” is when we are ready to move out.”

The rest of the time, sometimes decades, it’s a ”work in progress” because, unfortunately, when ya have the time ya don’t have the money, and when ya have the money, ya don’t have the time” is the frequent whine of a trades worker…

One other reason may be, as you suggest for your new digs is that ya know what ya can live with and without burning down the place.

“BTW.. I am amazed at all the tradespeople hanging around a financial news site.”

Think “small business owner,” because that’s what I am. Yes, I am a tradesman, but I own my own business. Businessmen like to pay attention to the economy and financial system. We are impacted.

MiTurn:

Yes. But look waht Fed has to say about inflation:

FED TARGETS – In Chairman Jerome Powell’s 3/17/21 postmeeting press conference, he said the Fed will not raise

interest rates until our nation records a 3.5% unemployment

rate and annual inflation of at least 2%. The country’s jobless

rate as of March 2021 was 6.0% and inflation, using the

“personal consumption expenditures” (PCE) index preferred

by the Fed, was up +1.6% for the 1-year through 2/28/21

(source: Federal Reserve).

Cyber,

Their metrics are intentionally disconnected from reality. This is faux-science at its best. Intentionally disinformational.

Makes a person jaded.

General price inflation will surge, and then rage, when demand for currencies in question (i.e. confidence in currencies) drops sharply and then collapses…while currency debasement accelerates. Shortages and the level of economic activity aren’t the issue. The panic out of fiat currency hasn’t started. There will be no doubt regarding what is happening once this now inevitable outcome is underway.

Jerome Fowl (turkey) and Janet Felon (convictions awaiting) are on it. They are smiling ear to ear and singing happy tunes that all is well.

Everyone would do well to go back and see what Fed members were saying prior to every financial collapse. The reality is they never have a clue what is about to happen; in fact they are generally at their warm and fuzziest just prior to financial disaster. The Fed’s decades long “avoid hangovers stay drunk” strategy is about to fail spectacularly, and they are of course oblivious. With short rates at zero and no path other than ever increasing monetary debasement ahead decades of monetary distortion will be wrung from the system this time. And it will be via price inflation.

The game is for all central banks the world over to print like mad, so they’re all dirty. That way, all currencies are garbage and there is no flight to other currencies because everybody is doing the same thing. When a responsible central banker goes rogue and tries to raise rates, he’s promptly fired (see Turkey).

We are in an unprecedented time period where central bankers essentially went nuts. And they’re laughing about it. Don’t think for a moment they don’t know in private EXACTLY what they’re doing. These people are NOT stupid. They’re just liars. If their lips are moving, they’re lying to the public.

The entire game they’re playing is “protect asset prices and the wealth of the rich, society be damned.” Now they’re publicly bragging about inflation and how they are going to let it “run hot.” Inflation hurts people badly. Why on earth do we even have a cabal in charge of our currency who acts like this? They are essentially saying “we are going to financially destroy you” to the public.

Unfortunately, I don’t see an end until the guillotines are rolling. Obviously the millions upon millions of homeless people they’re creating isn’t enough. Only when those with a little more to lose start losing it all will we get some serious blowback. And that will not be healthy for said bankers.

And the worst of it starts when dollars can no longer purchase oil…

LOL, funny, but I prefer Jerome “Weimar Boy” Powell. That was your best work.

I like to mix it up with these clowns. One of my own favorites is Jerome “Lil Zim” Powell. It fits in well with today’s culture.

The panic out of fiat into what transaction medium?

Anything. That’s what happens in a crack-up boom. People buy anything they can.

That’s why people are paying $90 for flatulence in the form of NFTs.

There are many private currencies emerging at the moment.

I like Kinesis currencies KAU (allocated gold) and KAG (allocated silver), which is basically vaulted gold and silver that own outright (no IOU or scams like that and of course fully redeemable at low cost) with your ownership registered on a distributed ledger. This makes gold and silver spendable currencies once again.

But it is so much more than just another token and an exchange. It’s an entire monetary system where revenue income from transaction fees within the system is shared between stakeholders. So you can actually earn yields on holding gold or bringing bullion into the system to be “minted” into spendable currency (KAU).

The more I think about it, the more I like it. See, a monetary system should serve everybody. But in our current debt based monetary system this is not the case anymore. Savers really have no stake in the system anymore, with 0% interest and a currency that is being debased and default risk is added on top! So they are looking for an escape hatch, and Kinesis offers one.

In the Kinesis Monetary System, yields don’t arise from interest payments on debt. They come from transaction fees inside the system. When you buy an ice-cream with your gold-backed currency, you pay a small transaction fee. These fees are pooled and distributed among all stakeholders and paid out monthly in gold and silver.

So this links yields to economic activity. If everybody is just hoarding (i.e. no transactions take place), no yields can be paid. But when the economy flourishes (i.e. people are spending and receiving money), all stakeholders benefit from yields.

And this is not just pie in the sky big aspiration. It is already happening. Kinesis offers white label solutions for everybody who wants to connect to the Kinesis back end. In Indonesia, the four biggest banks offer Kinesis to their customers. This is being rolled out right now. A travel agency that facilitates their customers to save for their Mecca pilgrimage has adopted Kinesis KAU as the currency for their savings. That’s millions of people (but generally poor ones, so it take them years to save up for it).

Half the population there (and in many other developing countries) is unbanked, but many more have access to a smartphone with a Kinesis app. And they can now use gold and silver as a means of payment.

Kinesis offers an (optional) virtual Visa debitcard (can be used for online payments) and they already offering a plastic one in the US. Roll out in the EU will be in the coming months. The actual payment with these cards is still fiat (i.e. you convert your KAU to US$ and load the card with it) but you can pay other people on the Kinesis Monetary System directly in gold or silver. So the path to a mainstream adoption of honest, gold-backed currency is really there.

Their yield engine is not yet online, but they will be paid retroactively so holders and minters are already accumulating. Minters yields will come online first. Once they start paying yields, I expect that they will draw in quite a few people who are not traditional gold investors but just normal savers and bond holders who are disenfranchised with the current debt based system after a decade of ZIRP and debasement and no end in sight out of this misery.

YuShan, it sounds too clever by half. It’s going to end in tears. Crypto is still unregulated and as such, there are no protection mechanisms. They sound like they have covered the concerns of their target audience, but without legal recourse, it is still a risk. If you think the actual regulated market is the Wild West, unregulated markets are hell on earth. What if I have a fraudulent chit that declares that I have $10,000,000 in gold in a vault? Whose job is it to investigate the validity of the chit? Are they liable for any losses that may arise from accepting such fraudulent documents? Are you able to view those documents or are they “commercial in confidence”? What country is this company incorporated in? Please tell me there’s an extradition treaty. Even if you told me the country had the same level of accountancy best practice as America, I’d still be somewhat worried! I think this is the Nigerian Prince scam upgraded for a new breed of savvy sucker.

No offence Yu, I don’t mean to call you a sucker, cos you’re a smart guy and you post some cool, thought provoking stuff. Yet, as VintageVNVet would tell us, theory and practice are two very different things.

What I see is most fishy about cryptos is the lack of self regulation. No push for an industry wide code of practice, which is a base level need for anyone dealing with other people’s money. They are in no hurry to do so either. They seem to have turned the liability of their unregulated scheme into the hero of the tale. “We are NOT regulated, which means we don’t have to listen to those guvmint jerks!” they say. Just the sort of perfect excuse for a lack of oversight that criminals just love. Very clever stuff.

Crypto delenda est. Hmm, I’m starting to sound like Cato, aren’t I?

Fat Chewer, you are 100% right to be sceptical about initiatives like this. And I feel I’m sticking my head out here, knowing what a sceptical bunch we are here at WolfStreet. Nobody claims this is risk free at this point. However, you should also not dismiss them out of hand without investigating them.

They are audited by an independent auditor and the audit report is public. So is the ledger on which ownership is registered. These are guys with 10+ years experience in allocated bullion market (they are not crypto kiddies and this is not a crypto currency). There is a whole section on their website about trust which may or may not satisfy your concerns.

I understand most people don’t want to (and shouldn’t!) jump in with both legs at this point. But I think you should keep an eye on how these kind of initiatives develop.

The fact is that the current system doesn’t deliver anymore for many people, especially the ones who want to live prudent lives and be able to save, so something will replace it. This can be it, or it will be something else. Just keep an eye out and you might want to support initiatives that you think are on the right track.

Reserved rental SUV in February, for 10 days in May for $409. If I were to reserve now for the same dates, the same vehicle is $641. Quite the increase!

.

But will demand continue to outpace supply?

Are paychecks getting larger?

If the answer to either is no, this is the tidal wave that precedes the calm.

Paychecks??? This economy runs on government stimulus. That’s what is triggering all this.

And yes, paychecks are getting larger, at the top end for all the normal reasons, and at the bottom because of minimum wage hikes in many states and cities.

But Wolf… what about the middle…

Oh wait… there isn’t much of a middle any more. Joe, hurry up with reinstatement of SALT deductions, cause your job is riding on it. Well, Kamala’s job is certainly.

SALT deductions, ha. I had an argument with someone on another thread who was raging about the unfairness of limiting property tax deductions on Federal taxes. He claimed I was for higher taxes. I told him to fight for lower state and local taxes which are the problem in the first place.

In CA, lower taxes? Hahahaha, what are you smoking, just because it’s legal, doesn’t mean it’s a good idea.

??

Wolf,

Hmm…I’d like to see the historical government personal income stats that show that any of these price increases are sustainable sans G money printing/”stimulus”.

Are we going to have a pandemic pretext every two yrs to artificially pump up incomes?

Will ZIRP triggered asset price volatility disappear (even though corporate results are more and more detached from share prices)?

How does quadrupling of home lumber prices get sustained by non-pandemic incomes that have stagnated since the 90’s?

Things that can’t go on, stop.

This is the issue, these price increases can’t be sustained. Even with slightly increased salaries. we’ll see in 6-9 months when those sweet stimulus payments are gone and forbearances/deferrals vanish.

This is sector consolidation run amok. So few players in every sector that the remaining consolidators can simply name their price.

A friend works for an elevator servicing company. He says that private equity is gobbling up all the smallish companies, mostly for the service contracts which just gets passed on to the tenants anyways. Plus, by eliminating competitors, the servicer has more control over the labor market.

antitrust, antitrust, antitrust.

Nobody has the guts for antitrust anymore. They’re all on the take.

The politicians are working 100% for the bankers, ensuring the complete destruction of the country.

Antitrust hell. It’s government/corporate fascism. CBS and Coca Cola helping the democrat government with propaganda and funding and the democrats helping corporations to eliminate competition.

I don’t know…MLB and Airlines have just betrayed the political party that was more likely to defend their sure-looks-close-to-monopolies.

And the public is in an angry mood, period.

Tossing political traitors (and stupid ones at that) in a volcano is a popular sport for both parties.

My guess is that bills are already being filed to crawl up baseball’s and airlines’ *sses with an antitrust/C19 grants/China canoodle microscope.

Republicans are pissed…and Dems ain’t going to be grateful.

Break ’em up might soon be a partisan call.

WEALTHIEST – The top 10% of US households (as

measured by net worth) own 70% of all assets nationwide as

of 12/31/20, i.e., $85.6 trillion out of $122.9 trillion. The

bottom 50% of US households own just 2% of all assets as of

12/31/20, i.e., $2.5 trillion out of $122.9 trillion (source:

Federal Reserve)

You know cyber, I’ve posted similar indisputable facts and almost nobody seems to want to comment, much less include such things in their “worldview”. There are a few here, but very few.

I can guess why, but the silence after such comments is DEAFENING.

That’s why I prefer a “class warfare” model to a stupid Dem/Rep or “pre-selected issues” one….and in class warfare only one side can do any fighting….by making a profit on everything and everyone possible. Corporations are leading the charge.

Net wealth inequality is “destroying the Republic”, just as Abe Lincoln predicted….the Gettysburg Address plea was ignored…as were the hippies and Carter and others. Democracy can’t work with such extremes, even Plato spoke of that, he’d seen enough of our “civilizations’ over 2000 years ago.

If prices increase and wages don’t, sooner or later you hit a hard wall. Predatory capitalism is going to destroy capitalism, the benefits of which are supposed to be rooted in competition. I’m 97% sure they’re still teaching in undergrad econ that economies of scale don’t exist, and this is all to “prove” that competition is the great attractor in economics. Meanwhile in the engineering world they talk about economies of scale all the time like it’s real and something to vie after. Hmm, I wonder who’s full of shit. Neoclassical economic theory was the biggest con-job of the century in academia, and what do you bet the Fed heads believe it.

Agree totally with all of your comment R, but there is one little detail, at least as far as around the tpa bay area:

When we had to return here to take care of elderly parents in 15, independent trades folks were getting $15-25/hour; same folks doing the same work are now at $40-50 per hour and hard to find, as has been mentioned on this thread.

Other locations where younger friends are still working, including NE, NW, CA, folks are about double per hour compared with even three years ago.

Don’t even think about SF bay area and other places close by where the strong unions support over all wages for SKILLED labor.

In February the govt. reported 20 million people on unemployment. There are shortages of skilled workers as usual. Rumors of a truck driver shortage persist.

Yeah,

It is hard to square these stories of labor shortages with huge numbers of unemployed.

Not really. The unemployment is largely confined to low-skill people. We’re talking about skilled trades here.

Do you want the average cashier wiring your house or building a bridge that you have to drive over?

Exactly.

Maybe not, but the average waiter can carry lumber, drive a nail, paint a wall, dig a hole, etc.

And they can read books/watch Youtube/work on site to get 70% of the way to what is sometimes over generously called skilled labor (guiding loads? pulling wire?). Not every “skilled” job takes anywhere near the same level of training.

That’s what apprenticeship is for. Some are dumb as rocks though. Most aren’t, but whether they’re really good or not, the majority are at least marginally effective. Motivation is a big part of it because most trades really aren’t that hard, just greuling at times and since a lot of people are soft, it tends to attract rocks and money flies looking to build a paycheck. Self-actualization move on. The pride is in pointing out the buildings as you drive by and saying I built that. Nah, say the others, no dust, heat exhaustion, and a** freeze for me.

The problem is this: when you’re a bartender in a good bar and make good money on tips, and then it all stops, it’s not easy to just switch to driving over-the-road trucks or putting up drywall. The labor market is not that liquid.

Wolf, are you saying that a bartender’s job is not that “liquid”? He he he.

AOC switched from being a bartender to being the de facto Speaker of the House. Sounds pretty liquid to me

Hundreds of thousands of travel/lodging workers have been hoisting luggage for years. How different from hoisting building supplies?

Haha, well, technically there are 435 of those job openings, plus another 100 if you count the senate. We could do worse than a whole bunch of lying bartenders.

Swamp Creature,

Plenty of people work waiting jobs or other such service jobs whilst they’re students, before going on to other things more in line with their life aims, but in these cases they are only temporary jobs to generate income whilst studying (as I imagine was the case for AOC), not full time career options – these latter are the people that cannot easily switch when their job suddenly doesn’t exist any more.

I see signs on the major interstate highways here. Truck Drivers wanted. All you have to do is get a commercial drivers license. Landscapers are booked solid. At Home Depot I had to load 10 bags of heavy bags of topsoil and 10 bags of mulch because there was nobody to do this job.

I am so sick and tired of hearing all this wining and complaining by these unemployed service workers. The problem is many are getting paid more by not working than if they take another job, thanks to this excessive Fed unemployment insurance program. Get rid of this welfare program for abled body workers and you’ll see things change overnight. End of Story!

@swampy

How dare you suggest people work for a living. You need to be taken away for that… for encouraging structural r*****… the government should be paying people to sit on their fat asses and do nothing.

To the internment camps in Canada with you. ?

My son was doodling with “Paint” on the PC today, I told him we could sell it as an NFT, and he instantly doubled his prices!

The discussion about supply in the housing market continues, there is really a lot of it. What happens when the kinks in the supply chain straighten out? Then it’s really all about the supply of money and there are no problems there. The Fed is going to have to figure out a way to throw cold water on the market without rousing the Wall St crybabies.

Prison would do the trick, regarding the crybabies… it’s what should have been done 2008.

It actually was a real problem when bidding construction work in fall of 2017, and likely continues similarly on top of any covid caused supply challenges AB.

Was told very clearly by a friend who was buyer of trainloads at a time for major national (non consumer ) lumber provider to industry that orders were at least six months out.

And framing contractors capable of 5-600 unit multifamily projects were booked out as long as three years at that time.

Was told of an industry union that went to a large non union project and hired every worker of their trade with guarantee to provide permanent green card to each person. (They all went to the union.)

I did see this in the early 70s when I just started my apprenticeship. I had about 18 months experience, was hired on as a third year apprentice and was paid $1 more per hour than the contract rate. The business agent came by and checked pay stubs to make sure everything was on the up and up. He said, “Well there’s no rule against a company paying more than what was negotiated”. The boss, (company owner and project developer) would sometimes buy us new tools. One day he bought me and a few others new framing hammers. When I thanked him he remarked, “Don’t worry about it, I’ll get the work out of you in attitude. You’ll pay for that hammer many times”.

That was he beginning of that inflationary decade. We all remember the cure for it in ’81. Workers and homeowners got it up the kazoo.

This is very much like the 70s. Friend came home from Nam and became a carpenters apprentice. He milked that as long as he could, because journeymen did not get as much work. The building surge wound down slowly, and after a few years he was working non-union jobs and then he finally took a job with the school district. The trades are seasonal and cyclical. Like you say, when it ends all you have is the callouses, and most guys don’t save enough money. In the 70s commercial was hot, concrete tiltups. We seem to have enough industrial parks, and there is residential housing supply overhang. This cycle could be much shorter. Trucking may be an easier trade to enter, however self driving tech is about to finish that. Tech makes work more egalatarian, a woman can handle a nail gun all day, or drive a semi with P/S and A/C. The trades are no longer the boys club.

I was in Yugoslavia during their 300% inflation in the early 80s, during my stay we had to take a pen and cross out all the zeros on the paper notes as the Govmint could not issue enough new currency,

Prices increased daily, people purchased as much food and drink as they could whenever they had any cash, some peoples homes looked like a store with cases of food and beer stacked in every room and hallway.

Everyone with a car kept the tank full of fuel at all times.

However what I remember is how normal life still seemed to be, people adapted and carried on, eventually of course the whole country fell apart, but that took another 10-12 years.

If this somehow happens to the US, Jerome Powell and his merry band of criminals need to be held accountable. PRISON.

We heard you the first ten times, Mr. 20% of comments already.

I’ve got a great idea for you: Don’t read my comments ever again. Then you don’t have to whine on a public forum like a total Karen.

.

Could be a bot.

They are pretty good these days.

.

I like Depths comments. At least he works for a living so has a valid opinion. (This is 18.6% of comments).

I like his comments, too. I don’t think he’s a bot, either.

10 years down the line, I think Jerome Powell will have transitioned into the loving arms of the Holy Father.

Gods work in this work must be truly our own, as someone once told me.

DC

Don’t any any attention to him. Keep up the good work.

Bratko, dobro dosli America! ?

My parents are from there. Yugoslavs are a different breed. Over here, you would have mass suicides from any stress like that. Sad thing is Yugoslav’s don’t know how to get along in their own country, but I’ve seen them, for the most part, get along in America quite fine.

Sorry, discussion for another place, but had to say zdravo.

Had an interesting talk with a fellow from Yugoslavia while awaiting jury selection. He said the first rule was to pay by credit card or check to anyone that would take them. Even minutes of float would save you money.

Some service spending increase is moved directly into the GDP column, yes? So just do that for all service increases in spending. Problem solved, eh Jerome/Janet? If that doesn’t work, just reclassify services as “investment” like we did for housing.

We are still trying to decide if the price surge is transitory or hedonstic.

Signed,

The FED

The 500 square foot plywood shack in my town with no clear access to public roads just reduced their asking price from $200k to $195k. That like a -2.5% deflation in just a few weeks!

There’s probably never been a better time to unload such a piece of crap. All the rotten garbage sells at the peak.

When bitcoin collapse, Soros might choke on a T- Bond Steak.

Now that China has a digital Yuan that day may be here. We can only hope.

That means most people in the US are doing very well because they can afford the price increases.

Dow 1 million

S&P 100K

My pension just got a bump — +$17 a month. Yay!

Pent up demand coming out of a pandemic lock-up, liberally seasoned with stimunculus. Surf the wave or get knocked over.

Here is another way to look at it. What if due to global supply chain disruptions we are seeing a massive wave of onshoring. If sourcing things domestically has higher cost it could show up as inflation in many areas in both goods and services.

I think all the on-shoring chatter is mostly just talk. It’s easier said than done. Management will ultimately choose the cheapest option, as is basically their mandate.

“Buy American” doesn’t fetch much of a price premium, unfortunately.

“Buy American” died for me with the Ford Taurus that had little or no heat, and occasionally a white mist would come out of the vents instead.

I picked up a load of rock with my Toyota truck recently. The smartaleck forklift driver asked if my truck could handle the load since it was just a Toyota. As I drove away with the load, I reminded him my 24 year old truck lasted the equivalent of three Ford trucks.

the end of days will be be when the USD weakens while at the same time interest rates increase.

Could be a month, could be several years but its not if but when. Guard yourselves accordingly.

I remember in 2007, I would channel every penny of every paycheck that I was getting right into my brokerage account and buying stocks with it right away. I paid huge wiring fees just to get the money into my account just to get a day earlier. I’d invite friends to lavish dinners where I’d spend $1000 for the dinner. By the end of 2008, I had lost 90% of all the paper money that I thought I had; and reality kicked me in the face.

The only problem is that with the FED and gov willingness to spend trillions to stop any market crash, they may be able to postpone the inevitable by months, or even years as they have done in the last 10 years.

I didn’t know that people with “paychecks” bought $1,000 dinners. I thought that was for the capital gains crowd.

No, it’s for regular Joes like Gavin. I bet prices at French Laundry has been pretty stable.

For one thing, it depends on how big your paycheck is. Someone might call $2000 a paycheck; that wouldn’t be me.

Secondly, I wasn’t drunk (I’m talking drunk metaphorically; you seem like someone that can’t read between the lines; so, I’m making it crystal clear) over my “paycheck.” I was drunk over the paper gains on my stocks.

We were out last week celebrating a special occasion. The upscale steakhouse was packed on a weeknight and the wine bottles were selling. It was nice to be part of the 1% for an evening.

Also, I was talking about the group dinner costing $1000; maybe you should read before you reply. $1000/plate is only possible for your majesty ???.

I think the “mindset” of consumers of Services has only temporarily changed with the free money out of Washington in the Trillions of Dollars, and such low financing rates from soup to nuts that one would be stupid not to leverage up and enjoy the good life. Add in the longer-than-expected disruptions to Supply Chains a la the Wuhan Flu, and we have the perfect storm for a Storm of Inflation Stateside.

Since a solid 70% of U.S. GDP is service based, the Fed is going to have a very hard time going forward of sweeping the bad numbers via the prized PCE Deflator and BLS CPI under the carpet (or radar via side-mouthed pronouncements). But the sheeple just don’t operate based on questionable numbers out of Washington; they have learned to be very skeptical of the Swamp. They react to what they see on the ground. For the average Joe and Josephine in 2021, they are seeing the direct result of the factors stated above in their loss of Purchasing Power via their bank accounts and checkbooks. The Dollar Index does not have to sink to 80 to signal a sudden loss of American Purchasing Power.

The more essentials cost per month, the less Americans have to spend on discretionary items like rolling the dice on Wall Street. While margin debt is setting new highs along with grossly over-priced equities, the first repeat of the 2020 Price Reset is going to cause margin calls that result in throwing the baby out with the bathwater. Excessive leverage at this late stage of the “bull” cycle just makes the inevitable adjustment in prices for hot air machines like Tesla and Bitcoin that much more abrupt and devastating. Many neophytes will have to leave the Casino.

Have never seen a stock market like the current one. And I probably never will again because when this Hot Air Balloon bursts, its going to ruin the ride for many budding retirees for the next 20 years, no exaggeration. The global economy is a very shaky edifice build upon a foundation of sand called unpayable/unserviceable debt, so the disconnect between equity price advances and economic stagnation at best (more realistically ….. decline) has never been greater. TIMBER SAYS THE LUMBERJACK.

It’s transitory……..you know……this decade will have inflation and the next decade will not. So if the CPI goes up 100%……its nothing to worry about.

The capital of the country will be destroyed……so what…..its transitory.

Savers will stop saving…..so what…..its transitory.

Powell’s only objective is to keep the incompetent children of the rich in charge. Why are we surprised……did you actually believe you had a chance to become one of them. How quant.

Note to Powell…..world labor is unlimited therefore inflation may be transitory….but…..the damage you will be doing to the dollar, allowing those drunks to spend like a river, will be permanent and long lasting and anything but transitory.

The stock market is rallying in dollar terms because dollars are worth less.

Assets are king cash is trash, inflation is here. Get used to it.

Just got my monthly statement on my Treasury Money Market fund. I complained when I was getting only 8 basis points. The past few months It has dropped to 1 basis point. And that is with the fund reimbursing management fees. Without that benefit the fund would be yielding negative interest. I used to be able to get a cup of coffee & donut with the yield from my fund. Now I can’t even pay the parking meter in front of the donut shop.

But you’re better off than the folks that held long-term Treasury bond funds and that dropped something like 15% to 20% for the quarter.

American Express bank savings account pays a whopping 0.4%, if you want to get rich quick :-]

There are other savings accounts out there that pay above 0%.

I really don’t feel sorry for those people that made such a bone headed investment, such as long term bonds, when it was obvious that we were heading for some inflation that was going to devastate this asset class. They were greedy, looking for the last spec of interest return and risked their entire principle. They are going to lose a lot more in the coming months as this spending and inflation get completely out of control. It will be worse than the Jimmy Carter days. If you look back, in a previous post I said “Who are the idiots buying these long term Treasury securities” . I still wonder who they are.

My Wells Fargo MM savings account paid 8 basis points. I told them to take their 8 basis points and shove it and closed the account. Bought a 1 year CD at my credit union yielding 37 basis points. Better than nothing and virtually risk free. Losing a few % but preserving my principal.

That’s why I want to see the bond market collapse. I want to see a liquidity trap caused by people refusing to hold bonds and just holding cash instead.

That’s the only thing that might wake the sociopaths in D.C. up.

Swamp Creature,

You might want to check out I-bonds at Treasurydirect.gov. They’re variable rate bonds that pay an interest that is equal to CPI, plus a base rate (now =0). As CPI goes up, the interest paid on those bonds goes up. There are many limits (including $10,000 per year per person/entity max investment) and restrictions. So read the details carefully. They’re not a place to keep your dry powder. But they’re a credit-risk-free savings product that hedges against inflation (CPI).

Wolf,

Thanks for the tip. I checked it out and they offer a competitive rate on a 10K I-bond (1.67%). I wonder why more people don’t take this option instead of risking all their principle in long term bond funds.

I have a couple of these 0.4% interest accounts, last time I checked my credit union “high yield” savings was paying 0.5%. Seems not so long go I was earning a whopping 2.5%. In 2006 I had a savings account at CountryWide Bank paying over 5%.

Question: will we ever see bank savings interest rates over 5% again?

As I heard about in the 80’s, people “lived off the interest” of their savings. Seemed like a pretty good idea and a reasonable plan for one’s golden years but perhaps that is now merely a pipe dream.

As I approach the big 6-0, with just Soc Security and my savings, the last thing I want – and I’m guessing a lot of other people feel the same – is to lose a huge chunk from my IRA/mutual funds with the next downturn….if/when it happens. Most of my siblings pay a financial advisor to manage their retirement money. I have yet to do this but…

Anyone have a crystal ball?

Forget financial advisors. They are mostly crooks. There are 1 million of them in the USA today. What are they doing for God & Country. Do your own homework. I put my excess funds in short term munis. Same fund I used to finance my kids college educ fund. DMBAX is doing quite well. All the income is tax free. Good for me because I’m on the borderline of the tax brackets. I don’t want to be put in another tax bracket just because I saved money over the years.

I hope you realize that just by buying at those rates you are helping to keep those rates suppressed. If you didn’t participate, they would eventually have to raise rates to attract buyers.

I don’t see the logic of pursuing a rate so minimal it cost you money to do it. If your money was collecting zero, at least you wouldn’t need to pay for another tax form.

Unless inflation was negative this past month you got a negative real yield anyway. Eating seed corn. The new American way

I know that, but I’m putting money in every month to make up for the loss in purchasing power. I’m breaking even at best.

Small Midwest manufacturer here. Our prices are now 9.25% above jan 1, 2021. This is in an industry that usually sees 1-3% price increases pretty consistently to start the year. We are getting hit with increases on everything. In six months pallets doubled. Some steel tripled. Cardboard boxes up 17%. Cost of shipping up 5%. Copper, aluminum, weld wire… the list goes on. Never seen anything like it.

Reminds me of the construction bidding situation from about 2003 to 2009 in southeast USA:

Bidding commercial/retail Tenant Improvement work in $2-5 MM range per project, we would call new location subs, and were happy to get a call back within a week, and that usually from the office boy, junior estimator, etc…

Until 2008-10, when the call was answered by the boss/owner, or returned within an hour!

Pricing tons of rebar fabbed, tagged, and delivered in 2003-6, quotes in the multi million range were good for 24 hours; by 2008, entire project quotes for all material and labor were good for six months.

IOWs folks, it’s NOW, once again, the part of the cycle where it’s all going up crazy.

Most folks on here remember what happened in 2006 – 2008 depending on the location, eh?

Remember it well. Took savings and retirement to stay afloat.

Always going to be that next crash. The GFC flushed out a younger generation in the trades. Are we busy? Of course. We have been booked out every year since 2011. So are all my friends.

Of course none of us have the work crews we had prior to 08.

I can not speak nationally, but for our region it would not be

possible to find that number of employees.

I fear who will be available to do the work 10 years from now more than the next big crash.

Slip slidin away

The Chinese data on inflation and stuff is now as reliable as America’s, and company. Quite a breathtaking achievement.

Inflation? Just one word — Taxes. Biden is late to the tax raising party and way behind state and local.

My prediction:

1) Raise local property and business taxes

2) Raise federal business and income taxes

3) Institute fee-for-service on top of existing taxes

4) Raise inheritance taxes

5) Slap on a VAT

Price inflation of stuff is telling us we’re going on a New Standard. Anyone brave enough to post it?

Here’s a clue

Nixon signing the Connelly policy, saying “I am a Keynesian now”

Your mission, should you choose to accept it, is to substitute the three surnames, and break the code.

}===}

Ritholtz insists anyone who pretends to see price inflation is a QAnon rube. The Fed is all knowing. Never doubt. Nothing like dogmatists calling others rubes.

I remember the years of inflation during the Reagan years. Groceries were bought on payday because they would go up almost daily. Everyone became poorer, even with wage increases. You just couldn’t keep up.

We never got the credit card bug and we used any extra income to pay off the house. No debt was the key.

I really wonder, after all this free money to buy Bitcoin and Tesla while sitting on your ass at home, are people really going back their a shitty minimum wage jobs when all the free money stops, or are they going to riot on the streets?

I just saw this in a meme:

“In 1964, the minimum wage was 5 silver quarters. In 2021, 5 silver quarters have a melt value of $23.

We don’t need to raise the minimum wage. We need to fix the money”

Spot on.

Yu, you can use this comparison between prices on any commodity or finished product based on silver coins. You will find the leverage and stability of silver in buying power. In many cases prices are much lower in terms of silver.

I apprenticed in Bavaria as electrician, moved to Austin 1980, Mississippi gulf coast 1992, and have always had work, just one year IBEW (613 Atlanta). Quit a fifteen year employment last September, no debt/mortgage/children and cheap rent a block from the beach allows me to pick and choose for who and what I do for side cash. The occasions when I do stuff for someone in return for home cooking and good company invariably lead to more remunerative jobs, word of mouth is the best advertising for a competent tradesman. And there’s return on that money to be had. Those who bought metals to save when they were cheap a few years ago have done pretty decently while maintaining a low profile and negating counterparty risk. I was here for Katrina and other storms, real estate is somewhere to live until the water comes, and this climate beats up houses throughout the rest of the year. Commercial property is another story, I’ve watched much more wealth created there over years than houses. YMMV. But from a privacy perspective nothing beats doing little stuff for other little guys who tell their friends.

Meanwhile all these houses need stuff done, and we can count on a storm now and then to freshen up the work environment. A previous employer who I subcontracted back to my subsequent employer a year ago is continually renewing boardwalks and docks from Biloxi to Bay Saint Louis, is four weeks plus for a service call, and isn’t bidding anything. Lots of houses going up, beach and inland.

It’s true that an individual can get training by watching a video. The IBEW local 613 had us watch the ladder video and a sexual harassment video before taking a call at CDC-Chamblee with Dyna Electric. I learned how not to get written up for not tying off or exceeding the three second rule for ogling female site visitors. Very instructive. The apprentices and journeymen I worked with were professionally very competent and supremely unhurried. I like to get a little more done at a time, so bye bye union.

No amount of training will supplant experience, and experienced workers make less costly mistakes and fewer of them, and any contractor will know that callbacks and rework kill profits, a couple of those put you in a debt hole and back working for somebody else to climb out. It’s a long climb. You put green helpers with experienced hands to develop their skills while assessing whether you can afford their associated screwups until they figure out how to make you money instead of burning it.

Humility is a part of learning a trade, and a competent journeyman will require a learning attitude or train someone more willing. These days. When financial markets were expanding exponentially you couldn’t get a sweaty job filled. Paying attention is seemingly a lot to ask of somebody with “buds” in their ears nowadays. But I cannot be forced to employ anyone or try to teach them what forty-four years has taught me. It’s going to take some doing to find a good tradesman who isn’t too busy working and making big money right now to train anybody, it’s an investment that requires loyalty for a payback and outside a family it’s hard to command loyalty, if then. I and those like me will be gone soon enough, videos won’t cover the gap adequately. Technology solves some problems and creates others. But I don’t see myself doing post-mortem electrical consults. Hope not, anyway. In the meantime,….

Hurricane season starts June first. bring it.

Vincit

rick m

You will pay for the things you need, whatever the price. Until you cannot. Then it will become interesting.

I’m as bearish as anybody here on the dollar’s prospects – but I don’t think this is really *directly* related to dollar debasement resulting from monetization.

Looking at this chart…

https://fortune.com/2021/03/20/lumber-prices-2021-chart-when-will-wood-shortage-end-price-of-lumber-go-down-home-sales-cost-update-march/

It seems pretty clear to me that the price surges are related to the timing of COVID-related surges that took supply offline. There’s been a wave of (irrational) optimism surrounding the (anticipated) end of the pandemic given the vaccination ramp up – and increasingly speculation that the housing price boom has legs – so there is a lot of new construction starting.

If prices were soaring while demand were falling or if supply were continuing to decline – I’d be more worried about this than I presently am.

Yes, the sky is falling, but it’s the swapping-out of cash for hard assets (like housing) that bothers me more on the inflation front right now.

Post 2008 nearly all govts knocked interest rates to virtually zero and have kept them down ever since. Being as old as I am, I expected massive price inflation within 3 or 4 years. It didn’t happen other than houses and ponzi stocks and pictures, etc. not in the index. I think central bankers actually wanted the traditional managed inflation cure for over-indebtedness but, the dog didn’t bark for some reason nobody quite understands yet. Covid was the final straw and I think they are going for bust this time round. They’ll be happy if your predictions are right and general inflation starts to become noticeable at last. I think this non-inflation problem is a very deep issue for govts which Japan has been struggling to solve for 25yrs. Citizens everywhere have paid a very high price in lost savings returns for 12yrs.

To use a Scottish analogy if one whisky a night doesn’t get you drunk try ten the next time.

We live in fascinating times. Round and round the marker goes, where it stops nobody knows!