Work-from-anywhere, unemployment, the land rush for houses, virus-fears about elevators, the oil bust: Big shifts for the fifth month in a row.

By Wolf Richter for WOLF STREET.

The combination of work-from-anywhere, ridiculously expensive rents, and coronavirus-fears associated with being on crowded elevators in apartment towers, is doing a job on the rental market in San Francisco. And not just in San Francisco, but also in New York, Seattle, Boston, San Jose, Los Angeles, Washington DC, Denver, and other expensive big-city rental markets. But it’s hitting San Francisco, the most expensive rental market, the hardest.

In some other markets, rents are skyrocketing. So here we go with our roller-coaster ride through the cities.

San Francisco rents in free-fall but still ridiculously crazy expensive.

The median asking rent for one-bedroom apartments in San Francisco plunged by 6.9% in September from August, after having plunged by 5.0% in August from July, to $2,830. This brings the five-month decline since April to 19%, and the 12-month decline to 20%, according to data from Zumper’s Rent Report. From the peak in June 2019 – which had eked past by a hair the prior high of October 2015 – the median asking rent for 1-BR apartments has plunged 24%!

For 2-BR apartments in San Francisco, the median asking rent plunged by 6.6% in September from August, after having plunged by 3.3% in August from July, to $3,800, bringing the five-month decline since April to 16% and the 12-month decline to 20%. And 24% from the peak in October 2015.

To convert this plunge from percentages into fiat, so to speak, the median asking rent for a 2-BR apartment has plunged by $950 from September a year ago, and by $1,200 from the peak in October 2015. This is no longer a rounding error.

These median asking rents do not include concessions, such as “one month free” or “two months free” or “free parking for a year” and the like. These concessions have the effect of drastically lowering the rent further. “Two-months free” lowers the rent over the 14-month period by 16%. Concessions, instead of rent cuts, allow landlords to show the monthly rents, as they’re spelled out in the lease, without the concessions, to their now very nervous banks.

Despite this huge drop in rents, in terms of cities, San Francisco remains the most ridiculously crazy-expensive rental market in the US. But in terms of zip codes, there are a handful of zip codes in Manhattan and in Los Angeles that are more expensive than the most expensive zip code in San Francisco.

“Free upgrades” is what the people who have decided to stay in San Francisco are now looking for. This is the strategy of shopping around among the soaring vacancies for an apartment with the same rent or even lower rent, but of much higher quality and in a better location. It creates churn. Landlords that lost a tenant to a “free upgrade” now have to price their vacant unit competitively, meaning undercutting other offers. This churn and the high vacancies explain the rapid reaction of the market to the current situation. The City of Boom and Bust always. And now is the bust.

After New York City re-opened, rents plunged.

Similar to San Francisco, New York City is losing part of its work-from-anywhere crowd that would rather work from a nicer bigger cheaper place further away, or even from a house they’d just bought in the suburbs, leading to surging vacancies, aggressive pricing, and lots of concessions.

The median asking rent for 1-BR apartments dropped 3.7% in September from August, to $2,830, after having dropped 4.9% in August from July, and is down 12.5% year-over-year.

For 2-BR apartments, the median asking rent dropped 1.6% in the month, after having plunged 5.0% in the prior month, and is down 11.3% year-over-year. In New York, peak-asking-rent occurred in March 2016, and asking rents have since plunged 23% for 1-BR apartments and 25% for 2-BR apartments.

Landlords are aggressively offering concessions in New York City, and tenants are aggressively shopping for “free upgrades.” Things are moving and churning.

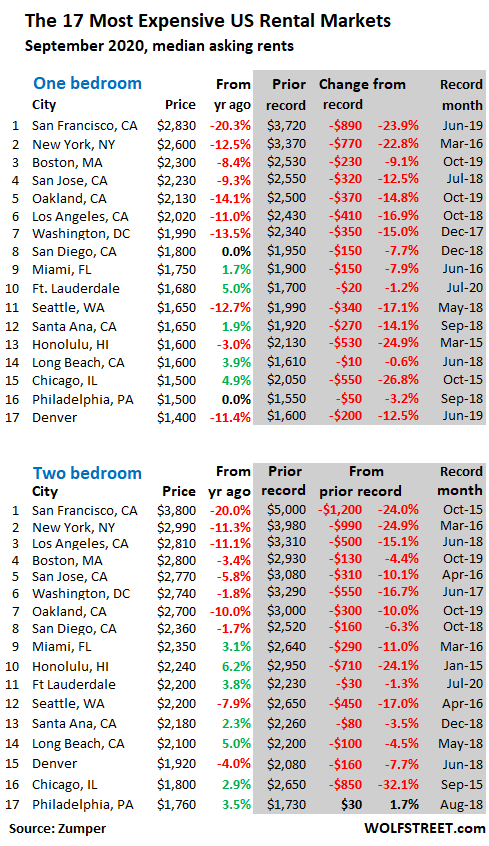

The 17 most expensive rental markets.

The table below shows the 17 most expensive major rental markets by median asking rents, based on Zumper’s data. The more expensive, the bigger the drops. The table shows September rent and the year-over-year percentage. In the shaded area, it shows peak rent and change from peak. Interestingly, Chicago and Honolulu, whose rental markets have gotten crushed over the past few years, appear to have hit bottom:

What’s “median asking rent?”

“Median” means half of the asking rents are higher, and half are lower. “Asking rent” is the advertised rent, a measure of the current market, like a price tag in a store. Asking rent does not measure what tenants are currently paying in rent, such as under rent control. Asking rents do not include concessions.

Zumper collects this data from the Multiple Listings Service (MLS) and other listings in the 100 largest markets, but only for apartment buildings, including new construction. They do not include single-family houses and condos-for-rent.

The 10 cities with the lowest 1-BR rents of the Top 100:

You can work from anywhere and want to save on rent? OK, this list is for you. The cheapest city to rent in among the largest 100 rental markets is Akron, OH. Wichita and Tulsa are second and third cheapest; in all three cities, rents declined. But the list also includes some cities with large rent increases:

| 1-BR rent | Y/Y % | ||

| 1 | Akron, OH | $560 | -5.1% |

| 2 | Wichita, KS | $620 | -3.1% |

| 3 | Tulsa, OK | $650 | -4.4% |

| 4 | Lubbock, TX | $650 | 3.2% |

| 5 | Shreveport, LA | $650 | 6.6% |

| 6 | El Paso, TX | $680 | 6.3% |

| 7 | Tucson, AZ | $730 | 9.0% |

| 8 | Albuquerque, NM | $740 | 5.7% |

| 9 | Lexington, KY | $750 | 1.4% |

| 10 | Tallahassee, FL | $760 | -8.4% |

The 35 Cities with year-over-year declines in 1-BR rents.

Of the 100 cities, 35 had year-over-year declines in median asking rents for 1-BR apartments. San Francisco leads with a 20% plunge, followed by college town Syracuse, NY, with a 14.4% drop. In addition to the outrageously expensive rental markets discussed above, the list also contains six cities in Texas, and cities across the US, but with moderate declines, such as Tulsa and Wichita, that have not participated in the craziness of other rental markets:

| 1-BR rent | Y/Y % | ||

| 1 | San Francisco, CA | $2,830 | -20.3% |

| 2 | Syracuse, NY | $770 | -14.4% |

| 3 | Oakland, CA | $2,130 | -14.1% |

| 4 | Washington, DC | $1,990 | -13.5% |

| 5 | Seattle, WA | $1,650 | -12.7% |

| 6 | New York, NY | $2,600 | -12.5% |

| 7 | Denver, CO | $1,400 | -11.4% |

| 8 | Los Angeles, CA | $2,020 | -11.0% |

| 9 | San Jose, CA | $2,230 | -9.3% |

| 10 | Salt Lake City, UT | $1,000 | -9.1% |

| 11 | Boston, MA | $2,300 | -8.4% |

| 12 | Tallahassee, FL | $760 | -8.4% |

| 13 | Irving, TX | $1,050 | -7.9% |

| 14 | Fort Worth, TX | $1,060 | -7.8% |

| 15 | Pittsburgh, PA | $1,080 | -6.9% |

| 16 | Corpus Christi, TX | $830 | -6.7% |

| 17 | Plano, TX | $1,130 | -5.8% |

| 18 | Madison, WI | $1,130 | -5.8% |

| 19 | Knoxville, TN | $820 | -5.7% |

| 20 | Orlando, FL | $1,220 | -5.4% |

| 21 | Anaheim, CA | $1,630 | -5.2% |

| 22 | Akron, OH | $560 | -5.1% |

| 23 | Louisville, KY | $850 | -4.5% |

| 24 | Tulsa, OK | $650 | -4.4% |

| 25 | Laredo, TX | $800 | -3.6% |

| 26 | Wichita, KS | $620 | -3.1% |

| 27 | Honolulu, HI | $1,600 | -3.0% |

| 28 | Buffalo, NY | $1,060 | -2.8% |

| 29 | Portland, OR | $1,400 | -2.1% |

| 30 | Nashville, TN | $1,270 | -1.6% |

| 31 | Jacksonville, FL | $920 | -1.1% |

| 32 | Arlington, TX | $890 | -1.1% |

| 33 | Aurora, CO | $1,070 | -0.9% |

| 34 | Minneapolis, MN | $1,300 | -0.8% |

| 35 | Providence, RI | $1,540 | -0.6% |

The 34 Cities with 5%-plus year-over-year increases in 1-BR rents.

Rents in September increased on a year-over-year basis in 62 of the 100 rental markets, compared to 35 cities with rent declines. In 34 of those cities, rents increased by over 5%. And in 16 of those cities, rents increased on a year-over-year basis in the double-digits. And in 10 of these cities, rents soared by 15% or more (I threw 14.9%-ers into that basket). The most expensive cities with a double-digit rent increase – Newark ($1,420) and Baltimore ($1,340) – are less than half as expensive as much-reduced-but-still-ridiculously-expensive San Francisco.

| 1-BR rent | Y/Y % | ||

| 1 | Norfolk, VA | $1,020 | 15.9% |

| 2 | Indianapolis, IN | $880 | 15.8% |

| 3 | Cleveland, OH | $1,030 | 15.7% |

| 4 | St Petersburg, FL | $1,270 | 15.5% |

| 5 | Baltimore, MD | $1,340 | 15.5% |

| 6 | Chattanooga, TN | $990 | 15.1% |

| 7 | Detroit, MI | $770 | 14.9% |

| 8 | Des Moines, IA | $850 | 14.9% |

| 9 | Lincoln, NE | $850 | 14.9% |

| 10 | Fresno, CA | $1,080 | 14.9% |

| 11 | Columbus, OH | $890 | 14.1% |

| 12 | Cincinnati, OH | $970 | 12.8% |

| 13 | St Louis, MO | $980 | 12.6% |

| 14 | Newark, NJ | $1,420 | 11.8% |

| 15 | Reno, NV | $1,090 | 11.2% |

| 16 | Bakersfield, CA | $810 | 11.0% |

| 17 | Tucson, AZ | $730 | 9.0% |

| 18 | Spokane, WA | $870 | 8.7% |

| 19 | Rochester, NY | $1,000 | 8.7% |

| 20 | Sacramento, CA | $1,410 | 8.5% |

| 21 | Las Vegas, NV | $1,040 | 8.3% |

| 22 | Chesapeake, VA | $1,180 | 8.3% |

| 23 | Boise, ID | $1,050 | 7.1% |

| 24 | Mesa, AZ | $960 | 6.7% |

| 25 | Shreveport, LA | $650 | 6.6% |

| 26 | New Orleans, LA | $1,450 | 6.6% |

| 27 | El Paso, TX | $680 | 6.3% |

| 28 | Omaha, NE | $850 | 6.3% |

| 29 | Albuquerque, NM | $740 | 5.7% |

| 30 | Durham, NC | $1,110 | 5.7% |

| 31 | Henderson, NV | $1,190 | 5.3% |

| 32 | Tampa, FL | $1,190 | 5.3% |

| 33 | Baton Rouge, LA | $840 | 5.0% |

| 34 | Fort Lauderdale, FL | $1,680 | 5.0% |

For five months, we have seen this move now, and it has been sustained so far, of renters getting out of the most expensive cities, and fewer students are moving back to college towns, and the oil patch is struggling with a double-whammy. Some renters head to cheaper rental markets, others bought a home outside the city center somewhere, and others moved back with mom and dad, leaving behind a vacuum. And landlords who want to fill their vacancies respond quickly to market conditions, by dropping their asking rents.

But the corollary is that this move and likely other factors have sent rents surging in numerous other markets.

The Largest 100 rental markets.

The table below shows the top 100 cities, 1-BR and 2-BR median asking rents in September, and year-over-year changes, in order of 1-BR rents, from most expensive to least expensive. You can search the list via the search function in your browser (if your smartphone clips this 6-column table on the right, hold your device in landscape position):

| 1-BR rent | Y/Y % | 2-BR rent | Y/Y % | ||

| 1 | San Francisco, CA | $2,830 | -20.3% | $3,800 | -20.0% |

| 2 | New York, NY | $2,600 | -12.5% | $2,990 | -11.3% |

| 3 | Boston, MA | $2,300 | -8.4% | $2,800 | -3.4% |

| 4 | San Jose, CA | $2,230 | -9.3% | $2,770 | -5.8% |

| 5 | Oakland, CA | $2,130 | -14.1% | $2,700 | -10.0% |

| 6 | Los Angeles, CA | $2,020 | -11.0% | $2,810 | -11.1% |

| 7 | Washington, DC | $1,990 | -13.5% | $2,740 | -1.8% |

| 8 | San Diego, CA | $1,800 | 0.0% | $2,360 | -1.7% |

| 9 | Miami, FL | $1,750 | 1.7% | $2,350 | 3.1% |

| 10 | Fort Lauderdale, FL | $1,680 | 5.0% | $2,200 | 3.8% |

| 11 | Santa Ana, CA | $1,650 | 1.9% | $2,180 | 2.3% |

| 12 | Seattle, WA | $1,650 | -12.7% | $2,200 | -7.9% |

| 13 | Anaheim, CA | $1,630 | -5.2% | $1,990 | -5.2% |

| 14 | Long Beach, CA | $1,600 | 3.9% | $2,100 | 5.0% |

| 15 | Honolulu, HI | $1,600 | -3.0% | $2,240 | 6.2% |

| 16 | Providence, RI | $1,540 | -0.6% | $1,800 | 9.1% |

| 17 | Chicago, IL | $1,500 | 4.9% | $1,800 | 2.9% |

| 18 | Philadelphia, PA | $1,500 | 0.0% | $1,760 | 3.5% |

| 19 | New Orleans, LA | $1,450 | 6.6% | $1,750 | 7.4% |

| 20 | Atlanta, GA | $1,430 | 1.4% | $1,900 | 5.0% |

| 21 | Newark, NJ | $1,420 | 11.8% | $1,860 | 15.5% |

| 22 | Scottsdale, AZ | $1,410 | 0.7% | $1,980 | 0.5% |

| 23 | Sacramento, CA | $1,410 | 8.5% | $1,650 | 13.8% |

| 24 | Denver, CO | $1,400 | -11.4% | $1,920 | -4.0% |

| 25 | Portland, OR | $1,400 | -2.1% | $1,710 | -3.4% |

| 26 | Baltimore, MD | $1,340 | 15.5% | $1,620 | 14.9% |

| 27 | Minneapolis, MN | $1,300 | -0.8% | $1,910 | 6.1% |

| 28 | Gilbert, AZ | $1,290 | 3.2% | $1,540 | 2.7% |

| 29 | Austin, TX | $1,280 | 2.4% | $1,590 | 1.3% |

| 30 | St Petersburg, FL | $1,270 | 15.5% | $1,710 | 14.0% |

| 31 | Nashville, TN | $1,270 | -1.6% | $1,450 | 0.7% |

| 32 | Chandler, AZ | $1,260 | 4.1% | $1,520 | 7.0% |

| 33 | Dallas, TX | $1,250 | 0.8% | $1,740 | 2.4% |

| 34 | Charlotte, NC | $1,230 | 0.8% | $1,450 | 6.6% |

| 35 | Orlando, FL | $1,220 | -5.4% | $1,400 | -0.7% |

| 36 | Henderson, NV | $1,190 | 5.3% | $1,360 | 0.7% |

| 37 | Tampa, FL | $1,190 | 5.3% | $1,440 | 8.3% |

| 38 | Chesapeake, VA | $1,180 | 8.3% | $1,230 | -1.6% |

| 39 | Richmond, VA | $1,130 | 4.6% | $1,400 | 8.5% |

| 40 | Plano, TX | $1,130 | -5.8% | $1,520 | -5.6% |

| 41 | Madison, WI | $1,130 | -5.8% | $1,360 | -2.9% |

| 42 | Durham, NC | $1,110 | 5.7% | $1,280 | 4.1% |

| 43 | Houston, TX | $1,100 | 2.8% | $1,350 | 1.5% |

| 44 | Reno, NV | $1,090 | 11.2% | $1,400 | 2.9% |

| 45 | Milwaukee, WI | $1,090 | 1.9% | $1,240 | 10.7% |

| 46 | Fresno, CA | $1,080 | 14.9% | $1,320 | 14.8% |

| 47 | Virginia Beach, VA | $1,080 | 0.9% | $1,280 | 4.9% |

| 48 | Pittsburgh, PA | $1,080 | -6.9% | $1,300 | -3.0% |

| 49 | Aurora, CO | $1,070 | -0.9% | $1,430 | -2.1% |

| 50 | Fort Worth, TX | $1,060 | -7.8% | $1,320 | -0.8% |

| 51 | Buffalo, NY | $1,060 | -2.8% | $1,260 | -3.1% |

| 52 | Irving, TX | $1,050 | -7.9% | $1,420 | -0.7% |

| 53 | Boise, ID | $1,050 | 7.1% | $1,240 | 8.8% |

| 54 | Raleigh, NC | $1,040 | 1.0% | $1,230 | 2.5% |

| 55 | Las Vegas, NV | $1,040 | 8.3% | $1,250 | 4.2% |

| 56 | Phoenix, AZ | $1,030 | 2.0% | $1,260 | 0.8% |

| 57 | Cleveland, OH | $1,030 | 15.7% | $1,100 | 14.6% |

| 58 | Norfolk, VA | $1,020 | 15.9% | $1,070 | 8.1% |

| 59 | Salt Lake City, UT | $1,000 | -9.1% | $1,300 | -5.1% |

| 60 | Rochester, NY | $1,000 | 8.7% | $1,210 | 12.0% |

| 61 | Kansas City, MO | $990 | 4.2% | $1,150 | 3.6% |

| 62 | Chattanooga, TN | $990 | 15.1% | $1,120 | 14.3% |

| 63 | St Louis, MO | $980 | 12.6% | $1,270 | 11.4% |

| 64 | Cincinnati, OH | $970 | 12.8% | $1,100 | -11.3% |

| 65 | Colorado Springs, CO | $960 | 0.0% | $1,240 | 3.3% |

| 66 | Mesa, AZ | $960 | 6.7% | $1,200 | 2.6% |

| 67 | Jacksonville, FL | $920 | -1.1% | $1,120 | 8.7% |

| 68 | Anchorage, AK | $900 | 0.0% | $1,200 | 4.3% |

| 69 | San Antonio, TX | $900 | 1.1% | $1,110 | -1.8% |

| 70 | Glendale, AZ | $900 | 1.1% | $1,170 | 10.4% |

| 71 | Arlington, TX | $890 | -1.1% | $1,190 | 6.3% |

| 72 | Columbus, OH | $890 | 14.1% | $1,110 | 2.8% |

| 73 | Indianapolis, IN | $880 | 15.8% | $960 | 7.9% |

| 74 | Spokane, WA | $870 | 8.7% | $1,110 | 11.0% |

| 75 | Des Moines, IA | $850 | 14.9% | $950 | 9.2% |

| 76 | Louisville, KY | $850 | -4.5% | $960 | -1.0% |

| 77 | Memphis, TN | $850 | 4.9% | $900 | 4.7% |

| 78 | Omaha, NE | $850 | 6.3% | $1,090 | 9.0% |

| 79 | Lincoln, NE | $850 | 14.9% | $970 | 2.1% |

| 80 | Baton Rouge, LA | $840 | 5.0% | $940 | 2.2% |

| 81 | Corpus Christi, TX | $830 | -6.7% | $1,050 | -0.9% |

| 82 | Knoxville, TN | $820 | -5.7% | $970 | -2.0% |

| 83 | Bakersfield, CA | $810 | 11.0% | $1,050 | 15.4% |

| 84 | Winston Salem, NC | $800 | 1.3% | $890 | 3.5% |

| 85 | Augusta, GA | $800 | 2.6% | $910 | 7.1% |

| 86 | Laredo, TX | $800 | -3.6% | $890 | -3.3% |

| 87 | Syracuse, NY | $770 | -14.4% | $1,050 | 1.9% |

| 88 | Detroit, MI | $770 | 14.9% | $870 | 14.5% |

| 89 | Greensboro, NC | $760 | 4.1% | $860 | 2.4% |

| 90 | Oklahoma City, OK | $760 | 1.3% | $890 | -3.3% |

| 91 | Tallahassee, FL | $760 | -8.4% | $920 | 2.2% |

| 92 | Lexington, KY | $750 | 1.4% | $900 | -5.3% |

| 93 | Albuquerque, NM | $740 | 5.7% | $920 | 8.2% |

| 94 | Tucson, AZ | $730 | 9.0% | $940 | 6.8% |

| 95 | El Paso, TX | $680 | 6.3% | $820 | 5.1% |

| 96 | Lubbock, TX | $650 | 3.2% | $800 | 6.7% |

| 97 | Shreveport, LA | $650 | 6.6% | $790 | 12.9% |

| 98 | Tulsa, OK | $650 | -4.4% | $820 | 0.0% |

| 99 | Wichita, KS | $620 | -3.1% | $730 | -3.9% |

| 100 | Akron, OH | $560 | -5.1% | $710 | 1.4% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Legal immigration plays a big role in cities like NY, in replenish those that left. Usually about 20,000 new immigrants per month settled in NYC. Due to the shutdown none of them are coming. I suspect this rent decline has a lot more room on the downside to go.

“Legal immigration plays a big role in cities like NY,”

Golly, I wonder if that means that landlords as a class have a vested financial interest in uncontrolled *illegal* immigration as well.

During hard economic times people try to adjust by having fewer children, living with parents longer, having more roommates, etc…all things that cause household formation to crater.

Bad for landlords.

US stats have borne these trends out for a while.

But those personal sacrifices are undone if uncontrolled illegal immigration is used to import millions of new renters.

Good for landlords.

These are obvious dynamics in the debate over mass illegal immigration, but not too frequently pointed out.

It is not rare for loudly proclaimed “liberalism” to mask more dubious vested financial interests.

This is particularly true in a “welfare” state where the rich are frequently paid out of public tax revenues (see middle class) to provide services for the poor.

(For instance, 1 subsidized legal resident sharing an apartment/house with 1 or 2+ illegals…overstuffed rental housing stories are common in CA)

In NYC traditionally, illegals live in the worse parts of the city, in buildings which would be condemned if the residents ever complained to the city inspectors. There are also single family home owners who construct illegal apts in their houses and rent to illegals because they don’t ever complain. This is how you have to live in NYC if you are very low income or illegal.

P.S.

There are also landlords who will rent to anyone who pays in cash and doesn’t insist on a lease.

And illegals frequently live in overcrowded houses in CA…but the point is that intentionally ignoring laws concerning illegal immigration, can (and clearly does) serve the financial interests of landlords because it provides significant apt demand that otherwise would not exist…because US citizens have made significant economic sacrifices (non household formation) in order to adapt to bad economic times.

You really don’t know where the millions of illegals are living (the “condemned property” mythos is just another variation of “illegals do jobs Americans won’t take…”…an assertion without empirical evidence).

But we do know they are living *someplace*…and that fact means that millions of rental units are being taken up where they wouldn’t be due to citizen lifestyle modifications.

Which has translated into higher than otherwise rents. Since at least the 90’s, when a new wave of illegal immigration was quietly tolerated/encouraged by some governments.

I mainly brought the topic up because of the studious avoidance of illegal immigration in the initial post.

Cas/Pet: Supply. And. Demand. Hits rents AND wages.

may we all find a better day.

the idea of putting a price on nyc rentals is problematic. the boroughs have very different renting dynamics. good luck trying to find a two bedroom for $2900 in manhattan. also, the credit check will prevent most undocumented immigrants from getting a legitimate lease.

meanwhile, the rich are waiting this out at their weekend homes and the nouveau riche are getting out of dodge. pretty soon only the hardcore geezers like me will still be here.

Nobody in NYC cares about credit checks. You need a lot of up front cash to rent, first month, last month, security, and key money. Key money is the bribe to the superintendent, or last tenant, or landlord, or agent, or all of them.

years ago yes, but not anymore. at least in high-rises. they want copies of your paycheck and verified bank account balances now. all these millennials are getting co-signed by their parents. there are guarantee services that can get you around this by “insuring you” but they cost an arm and a leg.

I live in Washington DC. Can confirm rents are falling all over the metro area. I will be upgrading at the end of my lease.

Great news! ….but I thought people didn’t need to pay rent. Live for FREE!!!!!

Brady-guess we’re all New Hampshirans now (…Just a JOKE, NH’ers, ref : your fine state’s motto…).

May we all find a better day.

I moved to Northern VA from Norfolk/VaBeach/Chesapeake region. So strange to see it top of rent increases. A lot of friends down there recently bought places to escape rent. Job market isnt that great afaik.

Reminds me of one of those stand-up roller coaster rides where the track makes a little dip at the top of the hill to give you a little scare before the big drop off

Yeah right now, we are in only the first part of the work from home era. It should last until pandemic is over. If pandemic ends and companies find work from home was a success. Then they will really start to lower wages even for those still in expensive cities and instead hire people in lower and more mid range cost of living areas, those who want to keep jobs could be forced to move or dorm up.

Some expensive cities could experience that haircut and have rents decline (and maintain their size), but, NYC and California have too much money put in them and “other stuff” for that to happen smoothly.

Some people in less expensive areas could end up with a much better paying work from home job and move somewhere more expensive. So will those moving from each end, end up in the middle? Possibly small large cities 100,000 to 300,000 people or will new small large cities pop-up or medium cities grow to that size? Or will those small city residents with the new higher paying job stay put and build a bigger house or take “lavish” vacations?

It’s anybody’s guess right now. Of course most work from home jobs could be automated away or be given to gig workers. It’s going to be a wild roller coaster ride after the pandemic ends.

” Of course most work from home jobs could be automated away or be given to gig workers.” that, my friend, is it in a nutshell.

Does this have the potential to cause another massive financial crisis? All these property owners must be hugely levered.

Not to mention holders of all the paper products.

It’s still too expensive. I am looking to hopefully rent an apartment in Vasto Italy, in the Chieti region – if I can ever get there. I found an adorable two bedroom apartment with a view to the Adriatic and a block from the most beautiful beach in Italy. €400 a month on a 3-year lease. Who in their right mind would want to stick around in the US under these circumstances? I hope I don’t get trapped or stuck here.

I feel the same way. I live in the Midwest. Before the pandemic was in sight, I was looking at getting a backpackers visa for Australia. If pandemic didn’t happen, I could have been near the Australian coast by now. Italy was a possibility, but, getting a job there, very difficult. If I could work for America remotely, I might have to look into one of those coastal Italian cities.

I rented an air bnb in Vasto, Italy for a month in 2018 and i decided then I was going to move there. After two years of planning and the difficulty of getting my pugs registered as support dogs so I can have them in the cabin with me, divested myself of things I couldn’t carry, and I was finally ready to go in March and wouldn’t you know- my flight was canceled- I rebooked for Sept and it was canceled too. I’ve been stuck here since and I am not happy about it and prospects for me getting out of dodge look grim. I kick myself everyday for not leaving in December.

That’s cruel, dude! Aren’t there any countries where you can hop to for 2 weeks isolation if necessary, then hop to Italy? Even in the UK you just have to quarantine for 14 days then fly drive or train to Italy. I know loads who’ve come and gone from there.

I needed to go to Warsaw and a friend of mine who is a journalist just got back from Belarus told me to fly from Istanbul to Vienna , get tested and take a train to Warsaw I got lazy and stayed home but according to him it’s doable

Whatsthepoint,

In terms of EU countries, having a US passport means no entry, no matter where you’re coming from.

Seems like Kasadour will just have to sit tight until restrictions are relaxed, unfortunately.

Kasadour, How were you going to stay longer than 90 days? In other words, did you have a plan for some sort of residency visa?

In March I was set up in nicely in a pad in a high rise in Kuala Lumpur. Total living expenses, rent, food, etc., etc., at around $1,500/month. Unfortunately I did not have my extended stay visa lined up yet and had to return to ridiculous California, just in time to listen to everyone run around like their hair was on fire, screaming about Trump.

And now Malaysia has disappeared their once famous visa program for long-term stay.

You’re smart I left in 2015 US is over rated in my opinion and dangerous nowadays from what I hear My good friend in Raleigh just wrote to me that they had two rapes/ assaults in their “safe” North Raleigh neighborhood 400€ a month near a nice beach sounds unbelieveable to me I have family in Arezzo

Good luck to you in your new adventure

Violent crime still near 40-year lows.

Vasto looks like a great location Close enough to Rome and just a ferry ride from the beautiful Dalmatian coast I toured Croatia in 2014 and loved the place All of it , the islands and even Zagreb Even took the train to Verazdin in the north, an old Hapsburg hangout

Nothin’ personal man, but you and the above poster have romanticized the situation in Italy and espec. coastal regions to an extreme.

The place is lock-down central and best avoided. Jobs don’t exist… and gangs from all over the the MENA are running wild.

…good luck.

Someone who wants 1st world medicine perhaps?

My son lived in Stuyvesant Town (largest apartment complex in the u.s. at the time) when it’s owners went bankrupt. It’s value was written down from 5.4 billion to 1.8 billion. That is what needs to happen to the value of all these expensive urban rentals. Massive haircuts to the owners so the capital cost can start over at a much lower basis and rents can be adjusted to reality.

it went bankrupt because the courts found that it had been removed by the new owners from the rent stabilization system illegally. the 5.4 billion valuation was based on the assumption that they could charge market rents.

Hotel taxes, theater taxes, parking fees, parking taxes, and payroll taxes are down–say, if employees are in Kansas, does a San Francisco company still have to pay the 1.5% city payroll tax? Some class action lawyers should get in on that and sue the city.

The big question in San Francisco is where and how does city government slash spending?, as it must.

Homeless services are the logical choice. The less there are in the benefits feedbag, the fewer arrivals will choose to come and more will go back to where they came from.

Next, would be services that attract and host other nation’s surplus uneducated populations. Between that and privately contracting out the ridiculously high labor costs that city government pays, maybe there will be no need for austerity for citizens?

Most homeless people in San Francisco are from there.

This San Francisco native says otherwise.

Maybe you consider people who arrived here four or five years ago or far less as “from here”, but we natives do not. Those who profess to have allegedly been here longer are hoping for benefits, or plain old lie, also they are registered to vote by local non profits.

Two hypothetical examples, a blend of newspaper headlines, reportage and biographies of “homeless.”

Joe comes here from Alabama to

Start a rockband, get away from Alabama, flee his “homophobic” parents, chase a girl, see what Cali is all about, “reinvent himself”.

Mary comes here to flee an abusive husband, her homophobic parents, escape Dubuque, or Manteca, “reinvent herself” get a massage therapy degree, travel, see what the Haight is all about, follow her boyfriend Joe, go to school etc.

No massage therapy degree available in S.F. Hasn’t been that way for at least a decade and a half, it not two decades. And even so . .

One thing I noticed in my 24 years in S.F. is that the natives can sometimes be shockingly parochial and small minded.

According to what study?

It’s quite easy to dig up stats showing that the majority of homeless people in SF had housing before they became homeless.

To Tony22’s not even “anec-data-al” conjecture, it’s harder to know how long people have been here before that, but he’s the kind of person who would consider an adult who’s lived in SF for the entirety of this century so far to not be “from SF”, so ….

You forgot ten dollar tolls to get out of the city Going up every year It’s truly gotten insane They tell me the money goes to subsidize mass transit which is horrible and bankrupt

One pays to drive into S.F., not out. Just sayin’

Why not start by reducing employees salaries? Then they can move on to eliminating jobs by combining job duties and eliminating more redundant jobs. That’s the way we cut costs in industry when times got slow.

Why pay big city rents if all the big city benefits are shut down, and may not come back? No live theater, most restaurants closed, no nightlife… and nobody is going to the office.

You mean like the Met where even an “ inexpensive” seat is like a thousand dollars? But I get your drift with the off Broadway, museums, etc Now I go once a year and stay at nice hotels in midtown for a week to get my taste of the Big Apple

Precisely. Not to mention the increased danger from higher unemployment and (in some cities) lower “defunded” police presence.

As you said, why bother with all of the big city headaches when many of the big city benefits are gone? It adds up to a big “no thanks.”

Interesting people tend to live in interesting places that’s all I know, almost regardless of cost….

True to some extent but there are plenty of interesting( eccentric) people living in non urban areas from my experiences anyway

Black Dahlia killer, Manson Gang, Hillside Stranglers, etc…..all very interesting people attracted to interesting places no matter the costs. Hmmmm.

And let’s not forget,

Public urination

Public defecation

Rents three or four times alternative metros

The highest taxes in the country

All very “interesting”

The US has 53 metro areas with over 1 million in population, and 356 with more than 100k in population…but certain people insist on believing that if you don’t live in one of the top 5 most grossly overpopulated metros…you are essentially living in a ditch in the woods.

There is big…and there is big enough.

The Gross 5 tend to be vestigial artifacts of historical accident and 100+ year old technologies…not exclusive meccas of cultural splendor (see list above).

Cas-coming to an area near you, soon, then?

may we all find a better day.

Worse ( much worse ) the quality of these rentals

is dropping like a rock as people vandalize them,

seething with drunken anger.

That’s one reason I keep my lawyer tenant in my place in Warsaw Ten years and the place is as impeccable as the day he moved in Pays below market but I get to sleep and the rent is in my account every month like clockwork

Warsaw and Krakow will be proved to be the trades of the decade. The smart ones got in when you did.

Here in rural areas too- mostly happening to empty houses though.

Who pays $2K-3K for a single bed? That’s well over the 33% threshold of most people’s income… are people these rich nowadays? And it’s not like they are skyscrapers or beachfronts with breathtaking views.

Exactly. Another thing I noticed listening to the few city folks I actually know, as they mention all the amenities (plays, sporting events, activities) it finally comes out they never go to them. Too expensive. Or, no time…whatever.

$2800 for a single bedroom apt? How is that a good idea? Ever?

A decent hockey ticket is 300 bucks. Add in a $10 beer, maybe 3 or 4, a bite to eat and $30 parking and travel costs to get there we’re nearing $500. Concerts the same.

I had a friend who paid 3k for a 1BR on the upper West side in the 90s He worked for Morgan Stanley , took a limo home from the office and his place was disgustingly dirty That’s eccentric baby His girlfriend was a leftist loon and I couldn’t bear socializing with them anymore They bought an apt in 2018 Hope she’s enjoying what DeBlaso is doing to her investment

There is a current article on Zero Hedge regarding the glut of apartments in NYC. Interestingly the last sentence mentioned apartment CMBS .

Apartment CMBS have been holding up well, unlike hotel and mall CMBS. So far, landlords have not walked away from their debts. This will change if this drags out and prices of apartment buildings begin to plunge.

Tenants here in San Diego tell me that they’ve experienced rising rents and unavailability of decent places. This is the tenants saying this, not me (landlord). I tend to agree with their sentiments as I’ve done research myself and found that if you have a decent place, it’ll rent quickly, and for what you’re asking as long as you’re not asking something stupid. As has been previously mentioned in comments to your other posts, San Diego (mostly the county, not city) is one of the last holdouts of what California used to be like. From my perspective, it’s way different that it was 30 years ago and my mom will say way way different from 60 years ago.

SF is gonna have problems for a while. There’s a much higher percentage of strange strange people up there that’ll take time to cull out for politics to come back to anywhere near normal. It’s strange even by California standards.

LA rents are dropping (down by the double digits), vacancies are rising. San Diego may be behind the curve a little. But I doubt that what’s happening in the LA market isn’t going to happen in San Diego. But we can always hope.

From all the tent cities I’m seeing in videos in places around LA I’m really not surprised People simply can not afford the rents Wonder when true sanity will return to these places If ever Will it take a total collapse? Probably sadly Just how long can they keep this sucker up I wonder

Your comma and question mark keys appear to be working. Is the period key broken? (LOL)

I’m not sure if I’m reading that you think we will or think we won’t go the route of LA. LA and San Diego are two entirely different birds. I have a pretty good feeling that things will remain strong here, at least for housing that’s not mega apartment type stuff. Even the mega apartment stuff (gym, pool, millennial lures) will come back as the young folks jump into good deals they couldn’t afford pre-pandemic. The reality is that if you want to buy something you’re pretty much out of luck for most of the folks. This leaves nicer rentals, then lesser rentals. There simply isn’t enough housing being built for the demand here.

Also, once SDSU gets their head out of their ass and reopens, this place will be on fire again. It’s not very well publicized that the leadership at SDSU is getting a tremendous amount of backlash for her policies and not just from parents. Her faculty and teachers are pushing back on what she’s doing, and it’s having an affect as classes are starting to reopen. As this happens housing will be in short supply all over again, even the monster plexes.

San Diego has a tremendous amount to offer for those willing to stay in CA and will buck the statewide trend for a while

I’m obviously not sure either if San Diego’s rents will or will not move somehow in parallel with LA’s. In terms of houses prices — and I know that’s a different market — they move in near lockstep long-term. You can see this if you compare the Case-Shiller price indexes over the past 20 years. So in terms of house prices, the two markets are joined at the hip.

Also, this data here are for multi-family apartment buildings, not single-family houses or condos for rent. So someone might well move out of a high-rise in order to rent a house.

I am in San Diego city. The home prices are going up quite a lot and economically San Diego has suffered a lot because of covid19.

Lot of forbearance and non rent payment.

Been here for long time and it is getting worse year by year

the suburbs are full of cars meaning multiple families/generations living in a 4 BR home which cost them $4k/month.

Most probably it’s not a good idea to leave your renting home at the moment due to the pricing

I’m in West LA and what we’re seeing is the newest and most high-end buildings taking the biggest hit. Ridiculous 2 bedrooms with fancy kitchens that were $6000 now are $4500 and probably dropping as I type this. Good, decent housing is down some but holding on for now.

It’s going to get a heck of a lot worse. You should see what has happened to NYC. High rise buildings that were once occupied by professional business are 90% vacant. It’s building after building. I wonder what’s going to happen to all those skyscrapers as they sit vacant for an indefinite time period. Most of the restaurants are closed, 18% of NYC’s college students opted out of renting this year and stayed home to study online. Why not? everyone has left or is leaving, and whoever is so unlucky to have to remain, are terrified. Rents are going to the basement hard and fast.

” High rise buildings that were once occupied by professional business are 90% vacant. It’s building after building. I wonder what’s going to happen to all those skyscrapers as they sit vacant for an indefinite time period. ”

i wonder about that, too. it looks like nyc is going to have a huge amount of excess office space and retail going forward.

6k for a two bedroom? Hope they give you golden toilet bowls like in Trumpsters tower for that kind of dough This is unsustainable madness and WILL end very badly no doubt

In good times it’s human nature to want better and larger shelter or more personal space, but the go to during recessions is people choosing to cut expenses by moving to cheaper shelter or by moving in with friends or relatives til things get better. In most of the US there are a lot of spare bedrooms that can be filled to reduce costs. It’s necessary austerity that most be practiced, but government never likes because it’s a negative for sacred gdp.

There are still a lot of single people living in 2, 3 and even 4 bedroom houses around me.

And how about the 17 million empty residences in the country many needing major renovation or demolition If I was younger I would be making money buying and renovating lots of them That’s what I did in 1980 on in and around NYC Hard, dirty work but long term very profitable Too many snowflakes today Many will have to adapt or perish in the new normal

Any sources for stats on 17 million empty residences?

Might be accurate but that is a pretty high number (only maybe 130 million households total in US) to keep empty, yielding $0 in income…when rents have soared over last 6 to 8 years.

Have to be pretty wealthy (and RE invt centric) to lock up that much wealth at zero current yield (unoccupied).

Might be true (occasionally see somewhat smaller figures) but sources of data would be most appreciated.

Also, would like to get your opinion as to whether or not doubling of home prices since 2000 is really being driven by builder costs…or builder opportunism since Fed has halved interest rates.

A lot of those empty residences are held by foreign “investors”, particularly Chinese citizens and their families. Others are still held by banks to keep depreciation off their balance sheets. Still others were abandoned in the midwest as owners lost their jobs. Others are used to launder money for foreign buyers as foreign citizens do not have to account for their monies as US citizens do.

Even before Corona there were large condo buildings with units all sold and about 10% occupancy in NYC, LA, Vancouver, London, and I’ve been told from neighbors- even in SF. Plus all the empty single family homes all over the place.

Can’t post a link here, but there are 2019 stats easily found with an internet search; “”number of empty housing units in us”.

Oh, forgot to say, the numbers range between 1.3 to 1.7 million.

Oops, sorry, I’m tired. The numbers range from 13 to 17 million.

They’re probably undercounted as the numbers come in part from the US census and people pay less taxes if they claim a property is a primary residence.

What I’m seeing in SF is a lot of professional couples are finding that a 1-bedroom is too cramped now that both work from home. So they’re upgrading to 2-bedroom places. Other people are shuffling around, moving to a fancier neighborhood or getting a better deal, or else negotiating a rent reduction.

My landlord owns a few multi-tenant buildings. He’s said the rent changes depend on area. Some areas, he has to drop rent 20% to get vacancies filled. Other areas, not much difference (yet).

1) SPX daily RSI NR will send SPX down to build a cause with Sept 11(L),

to go higher.

2) Unlike the NR case, in the Nov/ Oct 2018, that led to the Dec 24 2018 plunge

If tech analysis works why ain’t you a billionaire?

A Hick-up !

As I wrote in an article last week. My friend got roughly a 50% discount on rent in high end building off Central Park from the rates last year. So figure 30-50% coming even if its not showing up in the numbers yet. I realize all major cities are not alike.

Epidemics have caused this kind of response throughout the history of the US. Maybe it’s always cyclical, or maybe there is a lack of sustainability in the “urban model”.

Malaria, smallpox, TB, etc. all went through the cities in the US in the 18th century. Some estimates are that 10% of most cities were lost.

Urban centers have significant disadvantages- mostly having to do with density of problems of poverty, utilities/pollution/physical safety, dependency, crime. When societies were more agrarian (even into the 20th century), city job markets had to compete with “going back to the farm/plow”.

There are some advantages to the old structures of national economies.

Wonder how rent control factors into the decision of a landlord whether or not to lower rent? Rent control tends to make a decision to lower rents more permanent, so is probably buffering the drop more than if there wasn’t rent control.

I agree.I always felt that rent control has been

a gift to small landlords for over 40 years.It kept

the big boys out of the game.Meant lower vacancy rates

And stable tenants.

NoFreeLunch,

I can’t speak for other cities, but in San Francisco, rent control only applies to apartment buildings built before 1979. Newer buildings, condos for rent, single-family houses for rent are not impacted. In addition, rent control allows for annual rent increases pegged to the CPI. So if someone in SF lives in a rent-controlled unit for 20 years, rent went up over time, but not fast enough to keep up with market rent. So this is a good deal, and the tenant is unlikely to leave.

And the landlord will keep raising rents every year to the max allowed, even if market rents drop, until the tenant moves out. Then the unit goes back on the market at market rent.

So for each unit, there is a math: at what point of market price declines is the long-term tenant better off moving?

I’m sure lots of tenants in rent-controlled apartments are looking at this math. Rent-controlled units are often run down and need to be redone (many of them are dumps). So the reason for a tenant to move might be to find a much nicer better-maintained unit for a similar or slightly higher rent. For tenants who have lived in a unit for 20 years, that moment may not yet have arrived.

pretty much the same system for “rent stabilization” in nyc. one major difference is that when a tenant moves out the apartment is still stabilized but at a slightly higher rate.

There are a TON of condos and co-ops in NYC that sport monthly charges of $4K or more and price tags of $1200-1500/sqft.

The only inflation for the last 15 years seems to be at the super-high-end and the extraordinary monthly charges. Everything else is flat and does not reflect the price chops that are definitely on the way.

As I said in a prior comment, nyc is holding its breath. The GFC didn’t really hit them, a dip then recovery then dead money. Not anymore.

I find it hard to believe Madison is a bigger rental market than Milwaukee. Milwaukee population is around 700K. Also, its two bedroom increased 10%! But this was mostly due to expensive apartments being built downtown on the lake for those that still have access to credit and a job.

DanS86,

“…Madison is a bigger rental market than Milwaukee.”

“Bigger” is not what the table says. The cities are in order or price for a 1-BR apartment. #41 Madison ($1,130) is more expensive than #45 Milwaukee ($1,090)…. regardless of size.

Forbearances are up this week for the first time in months….just an fyi

CA stopped processing unemployment claims for two weeks. And all extended benefits end at the end of this year. It’s going to get worse from here.

“Hot-Bunking” will be the future!

I’ve been told things like, “I couldn’t justify not buying right now” based on a person’s house payments (with low mortgage rates and a healthy down payment) being so comparable to rent.

Well, with rent prices dropping in certain places…

Since auto expenses tend to be the hammer to housing expenses’ anvil in the world of household expenditures, I thought I would pass the following stats along,

https://www.autoremarketing.com/subprime/finance-companies-secure-higher-average-down-payments-q3

The amounts financed and the fact that total costs went up markedly yr over yr, just continues to show how ZIRP leads to financial insanity.

So long as auto makers/auto loan bookies can bamboozle yield starved investors into buying asset backed securities holding car loans underwritten with all the discretion of a crack-addled streetwalker, the mountain of financial instability in the US will grow and grow.

Increasing the down pmt tempers the madness…but total price hikes symbolize the insanity all over again.

One possible mitigating factor…maybe fewer, more expensive cars are being bought (a la housing). That might explain both the total price hike and the ability to meet higher down pmt requirements.

Wolf doesn’t like pests so I keep this particular type of comment limited to once annually:

I told you so. The key takeaway is that rents in “lesser” cities are rising strongly. As for the “big” cities, don’t worry, they’ll only plummet for a little while and then some new source of rent-pumping will be found.

And then, the “big” cities will declare that they have historically been much higher than the lesser cities, and therefore a much larger increase (in real estate related) is justified to get back to “historical norms”.

Sorry for the rant but it’s playing out according to my roadmap.

gary,

“The key takeaway is that rents in “lesser” cities are rising strongly.”

No, that should not be the key takeaway. That’s true only for some cities. Check the rents in some of the lesser cities, such as Tulsa, Wichita, Tallahassee, Irving, etc. Go to the third table — cities with declining rents — and there are lots of “lesser cities” on it.

“Justified to get back to historical norms”

“GDP trendline, employment, stock maaarkettt!”

I believe this is what cloaked Fed Governors chant while ritually sacrificing dollars in the basement.

It’s “Indiana Jones and the Temple of Dolts”

An SF realtor is now offering free cars to move Condos.

I love the smell of desperation in the morning.

Soon it will be buy one condo, get one free.

Wolf,

Be bold and call a bottom.

SF rents from the peak 25%?

NYC rents from the peak 30%?

Go for it.