Financialization of everything, Insurance Rules, Tech & Software Red-Hot, Health Care Eats into Everything. We can just sue each other to boost GDP.

By Wolf Richter for WOLF STREET.

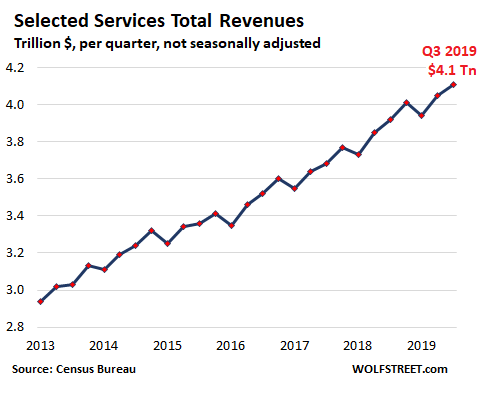

Services-producing industries – not including government services – dominate the US economy, amounting to the equivalent of 70% of overall GDP by value added, and to 80% of the private sector economy. As long as the services-producing industries grow enough, it’s tough for the US economy to fall into a recession. And in the third quarter, according to the Commerce Department’s Quarterly Selected Services Estimates, revenues by the services-producing industries rose 4.9% from a year ago, to a record $4.11 trillion (not seasonally adjusted). For the first three quarters of the year, revenues rose 5.2% to $12.1 trillion:

Four huge industries dominate the services sector and together generated $2.94 trillion in revenues in Q3, accounting for 71.5% of total service revenues (share of each compared to total services revenues):

- Finance and insurance: 31.6%.

- Healthcare: 16.7%

- Professional, scientific, and technical services: 12.6%

- Information services: 10.7%.

During the Financial Crisis, financial and insurance services were getting hit hard as banks were in the process of collapsing, and real estate, which is also hefty, was already collapsing. And it spread from there. That’s what it takes in the US to cause a deep recession – the biggies have to give and contagion has to spread.

But now services-producing industries are growing, and financial and insurance services are hopping, and insurance services alone are blowing them all away – as consumers have no doubt noticed, because someone has to pay for it when the US economy is becoming ever more financialized. So here we go, by sector.

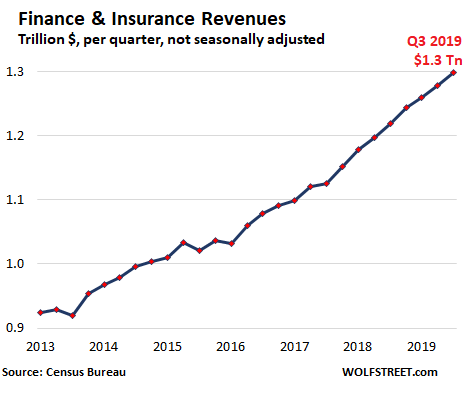

#1 Finance and Insurance.

Finance-and-insurance revenues jumped 6.6% to a record $1.3 trillion in Q3. For the three quarters so far in 2019, revenues jumped 6.7% to $3.84 trillion:

Unlike government services, the Federal Reserve is included in finance and insurance revenues because its 12 regional Federal Reserve Banks are owned by the financial institutions in their districts and thus are part of the private sector. The Fed’s revenues are largely from interest earned on the $4 trillion in bonds it holds. In Q3, revenues fell 11.7% year-over-year, to $25 billion. But in terms of revenues, the Fed is a bit-player in the industry, accounting for just 1.9% of total finance and insurance revenues.

The giant in this group is the “insurance” category of finance and insurance. Insurance dominates the industry both in magnitude and growth, with revenues soaring 8.2% in the quarter to $733 billion. In other words, 18% of all services revenues are from insurance.

The “finance” category includes the banking sector, whose revenues grew by 5.1% year-over-year to $361 billion. This includes commercial banks (they take deposits) and nonbanks or shadow banks (they don’t take deposits). As the table below shows, in terms of revenues, they’re neck to neck. Both grew just over 5% in the quarter, and over 7% year-to-date (if your smartphone clips the five-column table, slide the table to the left):

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Finance & insurance | 1,299 | 6.6% | 3,836 | 6.7% |

| Finance & insurance (except the Fed) | 1,275 | 7.0% | 3,758 | 7.1% |

| The Fed | 25 | -11.7% | 78 | -8.4% |

| Banks & Nonbanks | 361 | 5.1% | 1,074 | 7.1% |

| Deposit-taking banks | 167 | 5.2% | 492 | 7.1% |

| Nonbanks | 167 | 5.1% | 501 | 7.4% |

| Activities related to credit intermediation | 28 | 4.3% | 81 | 4.5% |

| Securities, commodity contracts, and other financial investments | 180 | 6.0% | 527 | 3.0% |

| Securities and commodity contracts, intermediation and brokerage | 82 | 7.7% | 242 | 4.1% |

| Securities and commodity exchanges | 3 | 24.9% | 10 | 11.4% |

| Other financial investment activities | 95 | 4.1% | 276 | 1.8% |

| Insurance carriers and related activities | 733 | 8.2% | 2,157 | 8.2% |

| Insurance carriers | 631 | 8.5% | 1,858 | 8.7% |

| Agencies, brokerages, and other insurance related | 103 | 6.9% | 299 | 4.8% |

#2. Healthcare and Social Assistance

Healthcare and social assistance revenues rose 4.4% year-over-year to $690 billion in Q3 and 4.8% year-to-date to $2.1 trillion. However, these are services only and do not include the goods-portion of healthcare, such as pharmaceutical products, medical devices, supplies, etc.

The largest of the four categories, “ambulatory health care,” generated $271 billion in revenue in Q3, of which $133 billion was generated by doctors’ offices. Note that the growth rates vary, with revenues at medical and diagnostic labs growing only 0.9% year-to-date but revenues at hospitals overall growing 5.5% and at specialty hospitals soaring 7.1%:

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Health care and social assistance | 690 | 4.4% | 2,064 | 4.8% |

| Ambulatory health care (doctors, diagnostics, outpatient, home health care) | 271 | 3.6% | 802 | 3.2% |

| Offices of physicians | 133 | 3.1% | 392 | 2.5% |

| Outpatient care centers | 37 | 7.5% | 111 | 6.1% |

| Medical and diagnostic laboratories | 13 | 1.0% | 39 | 0.9% |

| Home health care services | 22 | 1.3% | 65 | 2.8% |

| Other ambulatory health care services | 10 | 5.8% | 29 | 3.8% |

| Hospitals | 302 | 4.5% | 912 | 5.5% |

| General medical and surgical hospitals | 281 | 4.3% | 849 | 5.4% |

| Psychiatric and substance abuse hospitals | 7 | 4.4% | 21 | 3.7% |

| Specialty (except psychiatric and substance abuse) hospitals | 14 | 7.8% | 42 | 7.1% |

| Nursing and residential care facilities | 67 | 6.0% | 199 | 6.6% |

| Social assistance | 50 | 5.9% | 151 | 6.6% |

| Individual and family services | 26 | 3.7% | 80 | 6.5% |

| Community food and housing, and emergency and other relief services | 9 | 10.8% | 26 | 7.2% |

| Vocational rehabilitation services | 4 | 3.1% | 11 | 5.7% |

| Childcare services | 11 | 8.8% | 34 | 6.5% |

#3. Professional services

Professional services revenues jumped 6.0% in Q3 to $516 billion; and rose 4.7% year-to-date to nearly $1.51 trillion. The largest category, “computer systems design and related services,” generated $117 billion in revenues in Q3, up 5.8% year-over-year. The second largest category is lawyering, which is booming, of course, with revenues growing 6.6% in Q3 to $88 billion. Year-to-date the sector is close to a quarter-trillion bucks. We can all just sue each other to boost GDP.

Advertising services had declining revenues. However, these services (NAICS code 5418) do not include the amounts of running the actual ads, which fall under various other revenue categories, such as in publishing, broadcasting, etc. This category here only includes revenues at ad agencies and the like that create ad campaigns and place them in the media.

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Professional, scientific, and technical services | 516 | 6.0% | 1,513 | 4.7% |

| Legal services | 88 | 6.6% | 246 | 4.8% |

| Accounting, tax preparation, bookkeeping, payroll services | 42 | 5.6% | 144 | 3.4% |

| Architectural, engineering, and related services | 92 | 6.5% | 264 | 3.0% |

| Computer systems design and related services | 117 | 5.8% | 343 | 7.0% |

| Management, scientific, technical consulting services | 75 | 8.5% | 213 | 5.5% |

| Scientific research and development services | 46 | 6.0% | 139 | 8.6% |

| Advertising, public relations, related services | 26 | -1.4% | 76 | -2.0% |

#4. Information Services

Revenues rose 5.8% to $434 billion in Q3, and 6.2% year-to-date to $1.28 trillion. But this growth was very unequally distributed. A number of categories have declining revenues, particularly in the paper publishing segments. Telecommunications, the biggie, was stagnant at $158 billion in Q3.

But revenues at software publishers soared 13.2% in Q3 to $70 billion, revenues at firms that provide data processing and hosting services (think “the cloud”) skyrocketed by 17.9%, and other information services soared by 15.6%:

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Information | 434 | 5.8% | 1,281 | 6.2% |

| Publishing industries (except Internet) | 93 | 8.4% | 277 | 8.6% |

| Newspaper publishers | 6 | -4.9% | 18 | -3.3% |

| Periodical publishers | 6 | -4.7% | 19 | -4.1% |

| Book, directory and mailing list, other publishers | 11 | -3.6% | 29 | -4.4% |

| Software publishers | 70 | 13.2% | 211 | 13.3% |

| Motion picture and sound recording industries | 27 | -1.4% | 83 | 0.2% |

| Broadcasting (except Internet) | 42 | 0.7% | 127 | 1.8% |

| Radio and TV broadcasting | 21 | 1.9% | 63 | 4.4% |

| Cable and other subscription programming | 21 | -0.4% | 64 | -0.6% |

| Telecommunications | 158 | 0.4% | 471 | 1.6% |

| Wired carriers | 78 | -0.2% | 234 | 0.4% |

| Wireless carriers (except satellite) | 67 | 0.2% | 200 | 2.0% |

| Other telecommunications | 13 | 5.0% | 38 | 6.7% |

| Data processing, hosting, related services | 55 | 17.9% | 155 | 15.5% |

| Other information services | 59 | 15.6% | 168 | 15.2% |

#5: Transportation services

Revenues in this sector — from transporting regular folks by aircraft to pumping natural gas through pipelines — barely ticked up 1% in the quarter to $255 billion and 2.3% year-to-date to $746 billion. Overall growth was dragged down the by the decline in trucking.

Revenues at trucking and delivery companies, the sector’s largest category, fell 2.9% in the quarter and 1.4% year-do-date, in line with the downturn in the trucking industry:

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Transportation and warehousing | 255 | 1.0% | 746 | 2.3% |

| Air transportation | 60 | 2.8% | 173 | 3.6% |

| Water transportation | 13 | 1.5% | 36 | 5.5% |

| Truck transportation | 75 | -2.9% | 218 | -1.4% |

| Transit and ground passenger | 9 | 2.0% | 30 | 3.8% |

| Pipelines | 13 | 3.6% | 39 | 4.5% |

| Scenic, sightseeing transportation | 1 | 11.4% | 3 | 11.6% |

| Support activities for transportation | 48 | -0.3% | 145 | 1.6% |

| Couriers and messengers | 25 | 7.6% | 75 | 6.5% |

| Warehousing and storage | 10 | 4.0% | 29 | 7.0% |

#6: Administrative & Support Services.

Revenues ticked up just 0.8% in the quarter to $231 billion, but grew 3.0% year-to-date to $681 billion:

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Administrative and support | 231 | 0.8% | 681 | 3.0% |

| Employment, and travel reservation servies | 105 | -0.3% | 313 | 4.4% |

| Travel arrangement and reservation services | 13 | -2.3% | 38 | -0.1% |

| Other administrative and support services | 113 | 2.2% | 330 | 2.1% |

#7: Rental and leasing services.

These are the services involved in renting and leasing, not the actual rent payments and lease payments. Total revenues grew 6.8% to $195 billion in the quarter. Real-estate renting and leasing activities dominate this sector, growing at 8.0% in the quarter, to $136 billion:

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Rental and leasing, real estate, auto, etc. | 195 | 6.8% | 552 | 6.5% |

| Real estate | 136 | 8.0% | 382 | 7.3% |

| Lessors of real estate | 74 | 4.3% | 215 | 6.0% |

| Offices of real estate agents and brokers | 32 | 11.2% | 85 | 6.1% |

| Activities related to real estate | 30 | 0.0% | 82 | 0.0% |

| Rental and leasing services | 46 | 2.3% | 133 | 4.1% |

| Auto, truck, equipment rental & leasing | 18 | 3.7% | 51 | 5.3% |

| Consumer goods rental | 6 | 3.8% | 18 | 3.6% |

| Commercial, industrial machinery, equipment | 21 | 0.9% | 62 | 3.5% |

| Lessors of nonfinancial intangible assets (except copyrighted works) | 13 | 10.8% | 37 | 6.8% |

#8: Utilities

These revenues by utilities do not include revenues by government-owned utilities but only privately-owned utilities. And they only include revenues from services, such as line charges for distribution, but not revenues from the products such as natural gas, and those revenues ticked down in the quarter and year-to-date:

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Utilities | 158 | -0.5% | 449 | -0.2% |

| Electric power generation, transmission and distribution | 136 | -0.4% | 362 | -0.3% |

| Natural gas distribution | 18 | -1.2% | 76 | -0.1% |

| Water, sewage and other systems | 4 | -1.1% | 11 | -0.5% |

#9: Arts, entertainment, and recreation.

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Arts, entertainment, and recreation | 78 | 4.5% | 218 | 6.5% |

| Performing arts, spectator sports, & related | 35 | 2.0% | 94 | 5.0% |

| Performing arts companies | 5 | 1.8% | 14 | 3.1% |

| Spectator sports | 13 | 4.6% | 33 | 3.1% |

| Promoters of performing arts, sports, and similar events | 9 | 9.3% | 25 | 12.0% |

| Agents, managers for artists, athletes, entertainers, and other public figures | 2 | 0.9% | 7 | 9.4% |

| Independent artists, writers, and performers | 5 | 0.0% | 15 | 0.0% |

| Museums, historical sites, and similar | 4 | -7.6% | 12 | -1.9% |

| Amusement, gambling, and recreation industries | 39 | 8.3% | 112 | 8.8% |

#10: Accommodation Services.

Revenues grew 4.4% in the quarter to $67 billion. For the full year 2018, this sector was the only one that booked a revenue decline.

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Accommodation, traveler and RVs | 67 | 4.4% | 191 | 2.8% |

| Traveler accommodation | 64 | 4.4% | 185 | 2.7% |

| RV (recreational vehicle) parks and recreational camps | 2 | 6.0% | 5 | 6.0% |

#11: Some other services.

Waste Management and Remediation, small, but growing at a good clip:

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Waste management and remediation services | 27 | 4.5% | 79 | 5.7% |

The hodgepodge that doesn’t fit anywhere else lineup, also grew at a decent clip in the quarter, and at strong clip year-to-date:

| Q3 2019, $ billions | Change fr. Q3 2018 | YTD 2019, $ billions | Change fr. YTD 2018 | |

| Other services (except public administration) | 144 | 3.6% | 432 | 7.0% |

| Repair and maintenance | 48 | 6.0% | 141 | 2.9% |

| Death care services | 5 | -0.9% | 14 | -1.3% |

| Dry-cleaning and laundry services | 8 | 2.7% | 23 | 4.3% |

| Religious, grant-making, civic, professional, similar organizations | 66 | 1.1% | 200 | 11.3% |

And a recession?

Revenue growth in services being this strong, and with services dominating the economy, it would require a major downturn in the already weak goods-producing sector to drag the overall economy into a recession.

On the other hand, the downturn could originate in services — such as financial services as was the case during the Financial Crisis, or a tech bust as was the case in 2000 — which, given the magnitude of these services, would quickly drag down the overall of the economy. But that’s is not happening yet.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I learned a little about insurance reading Buffets annual report. I try to self insure as much as I can afford.

With insurance you make the payment and they hold your money and get a return until they have to pay it out. In affect you are paying them to hold your money unlike a bank paying you to hold your money. Of course most of us need to do the numbers and figure out how much risk to retain. To me insurance’s main value is to prevent catastrophic loss. I know some people that are insurance poor simply because they are not rational about it.

Some of these service industries are built on OPM (other people’s money) health care comes to mind.

In the 1950’s Buffet created the modern investment tactic called “Insurnce Holding Company”

Essentially Buffet “Collects Insurance Premiums, and Deny’s Claims”, that made him a billionaire over the years, especially since all the insurance premium money to put into the stock-market, and of course lawyers get paid well to deny the claims.

The Buffet approach to insurance, has gone to every kind of insurance, from auto, to home, to personal liability, to corporate, where ever the GOV demands you have insurance, you can be sure the Buffet “Re-Insurance” companys lobbied.

On OPM the Buffet model is to collect OPM, and then deny the return. In another time&place that was called ‘theft’, now its called financialization.

I am not sure that is true. I think Geico scores near the top on customer satisfaction. It’s up to the purchaser to read the contract to understand the terms.

I remember when State Farm denied Senate Minority Leader Trent Lott’s Hurricane Katrina claim. State Farm claimed it was all water damage and Lott failed to have flood insurance.

I was proud to see that insurance companies hold all policy holders in utter contempt, regardless of their political power.

Geico obtained an overall score of 86.00 in the 2018 customer survey, which placed it 11th out of 20 companies evaluated.

Old School- “understand the terms”??!!?? Surely you jest.

Harold- That anecdote was very satisfying to this insurance customer.

BTW, why am I being hammered by a Pepto-Bismol ad while I peruse this data?

I had an insurance claim on my house earlier this year. About $8K of due to water damage. My insurance paid it, no issue. Very smooth process and they also did most of the work, co-ordinating with contractors.

And I’ve had car insurance claims in the past as well, never had much of an issue.

Not everything has to be negative or a conspiracy theory dudes.

Just Some Random Guy,

We are now suing a guy who rear-ended us because his insurance company refused liability ($3,000 property damage), though they paid to fix HIS car. I assume they will attempt to settle before it goes to trial.

What you don’t get in your simplistic world view, where everything that is a little more complex is a “conspiracy theory,” is that insurance companies routinely deny claims, though they’re more careful denying smaller claims BY their own clients (your case) than claims AGAINST their clients (our case). And then they attempt to settle for less. That’s their business model.

Sure, companies will deny claims and usually with good reason.

Yes, “good reason” being their profit motive. Insurance companies are litigation machines.

In Europe we already (more-or-less) pay the bank to hold our money. But the advantage is that until now you get you money back from the bank, which in my experience has often NOT been the case with insurance services. Agree that one should self insure as much as possible, and just accept that sometimes things go wrong and you have to pay for it.

Most insurance over here (including much of healthcare) seems a boon for fraudsters, if you are honest you are paying for them.

Too many of the industries are parasitic to the rest of the economy, which produces truly essential goods and services: e.g., a large portion of health insurance costs is paid to persons paid to obfuscate the claims process and put barriers to the efficient provision of treatment at minimal costs. Many manage to do so by monopolization: e.g., they modify their intellectual rights to keep them exclusive and thereby keep control the drug or other right. See https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=12&cad=rja&uact=8&ved=2ahUKEwiI_ZyP2LTmAhVTvZ4KHerXDoQQFjALegQIBxAB&url=https%3A%2F%2Fio9.gizmodo.com%2Fthree-sleazy-moves-pharmaceutical-companies-use-to-exte-5865283&usg=AOvVaw3SoLC3cOVeE0NeNVXtIv5t

Other countries have an independent ministry of justice, which seeks to ensure compliance with the laws. In the US, a president gets into power and then the cronies of the president get carte blanche to do what they want to do, because the politician that president appoints as attorney general will not enforce the law. Of course, this political prostitution has recently become more noticeable, but it has been present before.

We need an independent ministry of justice to look out for and prosecute corruption. Otherwise, monopolies, dirty tricks to extend intellectual property rights, and other abuses will continue.

We now have political tribes, who benefit their members, like tribes in some countries protect their members and retaliate against their opponents: e.g., Tutsi persecution. Political considerations have now reached levels in which all laws will be enforced or not depending on the political tribe of the wrongdoer.

Insurance companies must have fantastic representatives to make governments put into laws that they are a necessity.

This is my beef with a great number of things. If something is important enough that everybody ought to have it, why not have the government provide it and skip the “give a private corporate entity a multi-billion dollar captive market” step? This is, of course, the reason why I am against vaccines as currently implemented – the impetus becomes profits and shareholder earnings, NOT the health of the customers, and so one would expect a ballooning number of vaccines to eke out that much more money from every infant.

Of course, the question becomes, “Who pays for the service?” Well, why not have the customers simply purchase it from the government. Of course, that raises the ethical question of whether or not the government should be able to make people purchase (by threat of force) services they provide. Understandably it becomes much more ethical to coerce you into purchasing these things from private entities – much less bureaucratic overhead that way.

The Fed govt is into too many things and does many things poorly. Excellence usually comes when you focus on a limited number of things.

If you compare a government operated system vs a private sector operated system you will find that the private operated system will usually invest in more capital to where the output per worker is much higher. Say post office vs. UPS.

Health care is probably one of the worse systems designed as govt now is about 50% payer and there is much cost shifting and abuse.

Everything is going to get rationed either by price or by political power.

4 out of 5 businesses fail in 5 years. Of those that succeed, 4 out of 5 fail in the next 5 years. The ten year survival rate is 20% of 20%, or 4%. Four percent. Yes, these are the ones that have figured out how to provide goods or services at prices people can afford to buy. However, you can’t use them as the model for private enterprise unless you include all the failures and their cost to society. That is like interviewing only the winners at a casino and ignoring all the losers. You could come up with an assumption that gambling is a sure track to success.

A government run business would have to be pretty inefficient to equal the true success rate of private enterprise.

There being no link to the comment by roddy667 I have to place it here.

“However, you can’t use them as the model for private enterprise unless you include all the failures and their cost to society. That is like interviewing only the winners at a casino and ignoring all the losers.”

What everyone needs to understand is that, if the original investment is made as local prosperity re-invested back into the local economy as free enterprise equity capital; when all those new start up businesses fail, that equity capital remains in circulation; within the surrounding economic model. That the constant competitive re-investment of local equity capital, (rather than as now, debt), constantly increases local prosperity – where a debt based economy, constantly drains away local prosperity. That local competitive failure is good for all local economies based upon the investment of free enterprise equity capital.

“ Health care is probably one of the worse systems designed as govt ”

That must be a joke.

Healthcare in the hands of private sector usually means not curing, nor prevention. It’s about extracting the most profit out of patients and customers, which entails a tendency to favor the most expensive options. A returning “customer” is what they want. Fixing a patient for good and for cheap is against that system’s raison-d’être. There is an inherent conflict of interest.

@intosh:

It is very easy to extract maximum profit if the government helps you do it by forcing everyone to pay up, like in the EU healthcare systems. With a government healthcare system there is in practice no limit to what is spent even for totally useless products and services, patients feel entitled to “everything” whatever the cost and benefit to society. If people have to pay out of pocket or insure for services with a private party, they hopefully think twice about what they want and maybe have a bit more modest expectations.

Inherent conflict is very present in government healthcare just the same. I know a lot about how this works in my country and we have a revolving door between agencies similar to the US CDC/NIH/FDA and Big Pharma industry. Government knows very well what Big Pharma wants, and the government managers get plush industry jobs in return after proving their worth. If Big Pharma had to convince parents to pay at least $500 or so for vaccinating their teenage boys and girls for HPV, I doubt they would have many takers (even less so if people understood the extremely limited benefit and big risk of these vaccines).

@roddy – the private sector outperforms precisely because it tries 25 things and is willing to let 24 of them eventually fail, but will have one succeed spectacularly. The government-run systems only evolve when they have to catch up with new private-sector technologies. Or when politicians tinker to line the pockets of their friends.

BTW, there should be more survivors in the private sector R&D game, but the government isn’t enforcing antitrust properly, and allowing too many monopolies to spring up.

@nhz

“With a government healthcare system there is in practice no limit to what is spent even for totally useless products and services, patients feel entitled to “everything” whatever the cost and benefit to society.”

There is a limit. The obvious factor is taxes and there may be watchdog entities in place. Yes, for sure, it is not perfect and there is tendency for a layer of “fat” to accumulate. “Patients feel entitled to “everything”. That doesn’t mean they’ll gonna get it just because it is a state-run healthcare. Sure, they are abuses here and there but how many enjoy going to the doc or to the hospital just because it’s free or affordable?

“we have a revolving door between agencies similar to the US CDC/NIH/FDA and Big Pharma industry.”

Well, you’re talking about corruption and under-the-table dealings and other similar shady things. That’s illegal. It’s the corruption of these agencies, which makes them turn away from their very vocation, their reason of being. (And what’s corrupting by the way? The *private* entities.) It’s very different from the *inherent* and *natural* conflict of interest in private healthcare — its vocation, its goal is to make money out of patients, not healing them. It’s as if you let private companies provide potable water to the population. They would seek the lowest cost of operation possible, provide just clean enough water not to kill its customers, and set the price for optimal ROI. Their goal would not be to provide the cleanest and safest water to everyone.

@Chris Coles. Nice insights!

@ Intosh reply to nhz

the limit is taxes? what planet are you on?

Have you ever read the WolfStreet blog?

Have you ever heard of $1T annual deficits?

Corruption is the system.

BTW, McDs is a capitalist food distribution system that in the USA offers UNLIMITED access to brand name fountain drinks for $1.00. And they have GREAT chicken breast salads for $5.50. In doing so, they make a profit.

I grew up on Long Island. born 1965. Doctor actually came to my house when I was sick back then. Democrats CREATED the health crisis u now see to win votes.

Read up.

The US medical system (except for the VA) does not provide direct government treatment to patients. Doctors, HMOs, hospitals, and even insurers (e.g., those paid by Medicare) are often paid by government agencies, but care is rendered by private persons. The worst, and most expensive medical care among developed nations is brought to you in the US by private persons, not the government. See https://www.theatlantic.com/health/archive/2014/06/us-healthcare-most-expensive-and-worst-performing/372828/

Nations with single payer systems, e.g., Australia, Canada, UK, Japan, etc., all have longer life expectancy, lower infant moralities, lower maternal mortality, etc., which is why most advanced, developed nations have single payer health care, for much less than what we pay per person.

Not sure I agree with the above because people ‘need’ everything. Food, shelter, clothing, education, health care, transportation. Don’t think government providing all of that will work out well. All you need to ask is how much you are willing to sacrifice for your kids vs. how much you are willing to sacrifice for society in general.

Wow before I believe there was a poster who put us at 1%.

But to be in the 4% club is special as well.

Now if we could “legally” obtain a money press.

I’m sure we could improve on that 4% survival rate.

Maybe a IPO is in order.

You do realize that both you and your kids absolutely have to LIVE within this society, do you not?

Unless you all exist on a “gated” private planet at present…..or maybe are counting on living on one later on?

” …much less bureaucratic overhead that way.”

And more profits for those who paid the piper.

And while we are pushing for government, lets do it right.

Lets outsource the work. I’m sure we can find slave labor in some 3rd world country to do the work. No pensions, and about 1/10th the salary….its a win/win. If its good for the private sector, its gotta be good for the public sector.

Of course we will make sure they are provided with “fair” trade

coffee.

Correct you are, Joe.

Tesla is having money problems, and Buffett & Hathaway have major cash on the sidelines twiddling its thumbs waiting for the contagion.

Powell rebuilt the PPT & has thrown a wall of money at REPO for year end.

Risk is impeachment, China Trade Deal, and Russian Fed natural gas to the EU.

I see a crash on the horizon, Wolf.

MOU

Historically when you print FIAT to infinity and its your own reserve currency, things don’t crash, usually the stock-market goes to infinity.

It’s only when&if that the FED goes 100% austerity that the entire thingy comes to a grinding halt.

It took Volcker last time to bring things to order, and that was the most turbulent time of USA economic history.

Right now its just kick the can to infinity, whose counting? Your trillions is my quad-drillions, tomorrow we’ll be talking sep-trillions, who cares as long as the EBT thingy keeps emitting cash.

If the pendulum swings then yes we’ll see your crash, but Trump is a real-estate swindler, he loves easy money, and the other’s are just as bad, they want heli-copter money for all.

Party on Garth, its not over by a long shot, UNTIL China/India start demanding GOLD instead of USD, which is why the US-MIL has grabbed all the worlds oil, Saudi don’t matter when UncleScam is the only seller and he only takes US Dollars. CIA knows the Saudi Oil is kaput, that’s why since 911, they have stole libya, iraq, syria, … working on Venzuela/Mexicao

Lastly, all the Cops & MIL in the USA are dependent upon their retirement check from uncle-scam, so nobody is going to let the ponzi end. Everything is loaded towards the ponzi, there is nothing working towards its end. Just look at India, China, Brazil they’re all emulating uncle-scam, he’s the worlds role model.

The system is more than ripe for a crash, has been like that for a decade. But they can delay the inevitable by ramping up the printing presses even more and using even crazier policies every year. Probably the crash will arrive due to some “Black Swan” event that nobody had expected (at least not those in charge at the FED etc.).

People who where seeing a crash on the horizon and protecting against it by buying puts (and sometimes by buying gold, after 2009) have lost their money ..

@ ol scam

Agreed, but I think u would agree that any acceleration off the printing press also accelerates us towards the point when someone, somewhere says no to USD and demands ol gold for oil.

And yeah, maybe they will continue to take USD at point of sale, for appearances so as to avoid getting M16’d, but that doesn’t mean they won’t starting flipping that USD for ol gold when Uncle Sam turns his back. Or maybe they will do it right in front of his face.

I don’t understand intricacies of wall street brokers and repo. Stockman seems to blame the Fed for giving them gambling money. When Fed started tightening he said no way the Fed is going to tighten (sell off treasuries) and federal government sell 1 trillion of new debt.

I wonder if year end Fed actions are just that. All the government debt just couldn’t clear at market prices.

Currency is a commodity. What if the printers can’t keep up with demand? What if the choke point is actually the supply?

For category 3, professional services, you state lawyering is #2, however to my eyes the lawyers are 4B below “Architectural, engineering, and related services”. Is that because that category encompasses several things as opposed to the singular lawyering? Of course, to imply that lawyers are better than engineers is rather profane – I might have to sue for everybody’s benefit.

“All the real talent is siphoned off into the Arts and Sciences, that leaves the dregs to put it all together”

-Bucky Fuller

I first read Bully Fucker. Maybe the subconscious… XD

As an attorney that is not living so high off the hog I do believe we provide a valuable service to the community and society at large. In my practice, mostly criminal and probate, I am not seeing an increase in the revenue being generated. I would imagine the increased revenue is from transactional work dealing with mergers/acquisitions and the like. People like to harp on the profession but their lips become silent when they are in need of us. It is also worth noting that a court system with prudent case law is a key cornerstone for investmen and the purchasing of currency in that jurisdiction. Although an argument can be made that the caselaw is deteriorating/contradictory at times, a big reason we have the amount of investment in this country is due to our strong legal system.

The great thing about Western case law is that it will eventually be fully computerized and automated. The only thing needed is actors in costumes (oops – barristers) for courtroom drama. At least for a while. Meanwhile the legal monopoly holds. I’m happy to say I’ve had a number of successful pro se cases to the utter annoyance of ex-lawyer judges.

The other thing that really seems to be everywhere is financial advisers and planners. It’s kind of sad that a lot of people work very hard and put money in 401k’s and do very poorly because they don’t know what they are doing.

I made some huge mistakes when we first were given exposure to mutual funds. In my early days the money was invested in guaranteed insurance contracts and looking back that might have been better for the average person. I always desired to be financially independent and have read, and read and read. If you have experience in business and are comfortable with math it’s not that hard to self manage, but it takes time to keep up with tax laws and now Fed policy.

If I remember correctly the average person gets about a 3% return over the long hall managing their own mutual funds. It’s very easy for people when they have assets to self manage to jump between advisers and kind of be disappointed because they don’t really grasp the basics and become disappointed with the adviser.

@old school:

The nasty thing is that the only way to learn such things is the hard way, paying your apprentice money learning things. Reading and studying things help, but only practice will give the needed experience.

I wonder what will happen with most current advicers never having experienced a real downturn etc

Well its out there, Warren Buffet has said how do it, and so has Ray Dalio. These two kinds are the top rich of the world.

The problem is the signal/noise ratio, you have nothing but noise from TV, and newspapers, and internet(yahoo, msnbc) all designed to thrash portfolios. ( & sell crap like annuity’s, again think buffet, collect premium-deny claims)

So what did Dalio & Buffet tell you all along, a long time ago, and if you had done what they said you would have gotten +8%/annual forever?

TaDA … S&P500 Index Funds, low cost like vanguard, min fee’s 0.01%, nobody can beat this because they toss out the losers, over 50 years +90% of all companys die, but the index fund just tally’s the winners, by following the S&P500 index, your letting the system do all the work.

Any ways both Dalio & Buffet have setup all their family inheritance portfolios to follow this boring tactic.

Nobody can predict the market, if he say’s he can he’s a liar, all you can do is maximize return, and minimize loss. Machines are now better at this than humans.

For highest level of sleep comfy, its probably best to study Dalio’s “All Weather”, which essentially put’s you in INTL Index & GOLD, so that if&when the USA goes into the toilet, your covered.

In the 1960’s JP Getty, at the time richest man on earth wrote a book called “How to Be Rich”, … not like any of this is a new story. The problem is signal/noise, and 99.99% of the stuff out there is noise.

The big question is how those index funds will do in a real downturn, with the massive investment in those funds nowadays and the likely lack of buyers when there is real trouble. We haven’t seen a real stock market crash in nearly 20 years, everything was papered over. I would not be surprised to see a simultaneous downturn on all stockmarkets, as they are now all basically the same FED-ECB-BOJ_BOE Ponzi.

I manage some money for a couple of friends. First question I ask them is how much money are they willing to lose. I then just use a two asset model:

Risk on: sp500 assuming it’s going to lose 50% from time to time

Risk off. Money market and short term treasuries.

If someone is ok with losing 25% I put them 50% in sp500 and 50% money market.

Complicated strategies might tweak you out another per cent but it is important to have a plan that you understand and will not panic.

@ol scam,

“…by following the S&P500 index, your letting the system do all the work.”

Good point. I also think the index works better, generally, because the fed is the main driver. As they say, “A rising tide lifts all boats”.

nhz, you can’t win all the time. It’s impossible. If the strategy that is being described is getting a good return over the long haul, then it already is including those downturns in its returns. You can’t have any strategy that always works when it works, and also works when it doesn’t work. You just have to pick the best strategy and ride it all the way.

If you are saying that the best strategy is to just use the best strategy available depending on market conditions, then you are basically just saying, be able to predict the future. That’s no investment strategy.

I refuse to invest in the S&P500 because it contains all the biggest monopolies and consumer-scam firms that ought to be eliminated, not invested in.

In the 401k I do the stocks / treasuries / cash thing using the mid-cap or small-cap indices instead. The data says the returns are pretty much the same in the long run. But I get to avoid sponsoring monopolies.

Any index will include some doomed/dying companies as well as the good ones. But all indexes drop those out for you over time.

@Old-school and Zantetsu:

I’m a (former) entrepreneur so I understand risk taking. Problem is, risk-off in Europe means losing money every year due to NIRP and/or wealth taxes (on top of very significant inflation). And risk-on means risks that are unacceptable.

I agree that risk-on with a stock index fund means potentially -50% (at least) once every decade or so, which I cannot afford because I would have no time left to make up for such losses. For younger people it may be an option, although I doubt it will keep working due to the way that central banks are rigging the system. After all, the whole system is designed for raping the peasants and having only the 1% profit. If investing in stock index funds becomes a sure thing (even if only long term) they will make changes ;(

@Wisdom Seeker:

Good point, also by avoiding the FANG stocks etc. that make up so much of the main indexes you may be avoiding oversized risk when there is a real crash.

The average investor can’t really duplicate the “All Wx” portfolio. The one that Tony Robbins touts in his book isn’t the real deal because Bridgewater levers the bond segment and the commodities futures allocation would be even harder to duplicate.

Putting all of your hard earned money in any asset class is very common, but also very ignorant. Most Folks have all their wealth tied up in Residential Real Estate & Equity Mutual Funds.

Equities can crash 90% and stay down up to 23 years in the USA and Japan since ’89.

Diversification in asset classes with low correlations like Treasuries (short and long) , Gold, & Diversified Equities might be the answer. You need to rebalance annually in order to sell “winners” and buy “losers” so that you buy low and sell high. This will historically work over time. You can go to portfoliocharts.com to look at different ways to do this. I keep things like Treasuries and Gold in my tax deferred accounts and put the Equities in a “taxable” account, so I can write off loses and my dividends are mostly qualified and not taxable for the first 80k???, or thereabouts.

Currently, I am sitting in 1-3 year treasuries and bills with a 25% allocation to PM and Miners. I have about 2% in IMBBY & BTI and that’s it for my Equities. So, I’m afraid to take my own advice.

I think that we will go into a recession in the next year or two and the dollar will strengthen for one last time as we go into deflation for the short time that it will take the FED to make it’s last big move of monetary inflation followed by a Weimar style collapse and austerity. Btw, on a side note, it wasn’t actually the hyper inflation that killed Weimar, but the Great Depression and their response to it, which was austerity. This policy mistake was followed by the greatest Keynesian Politician of all time: Uncle A. and we know how that ended.

@Realist,

“I wonder what will happen with most current advisers never having experienced a real downturn etc”

In the 2008 crash, the mantra of financial advisors was “There is no place to hide”, i.e., it’s not my fault the financial markets crashed. Everybody got hit.

Hell, most Boomers have never seen a “real downturn”. Pretty much their whole investing life has always been left to right up, up, up. Wonder how they will react if we have a 16-23 year downturn, which has happened, in this country, before.

Imho, keep it simple- most wealth in the world is still generated by property – buy property in wisely chosen locations (location, location, location), you can’t go wrong over the long term. 2 billion more humans on this planet over the next thirty years, they aren’t making more land.

Most of Europe has a housing bubble with extremely extended prices that are often by far the highest ever; just buy FE and close your eyes?

Yes, you could buy in some foreign country or a remote corner of Europe etc. but this has additional risks. Most people who did this after 2001 in Europe (second homes on the Spanish Costa etc.) probably lost money. If RE is still cheap somewhere in the developed world there probably is a good reason for it. I don’t think a rising tide lifts all RE boats, especially not if the tide is already very high to begin with.

Yeah, Old-School, it pisses me off that every non financial specialist Tom, Dick and Harry now seemingly is forced to hop into the shark pools referred to as financial markets just to try to put together some future security for sickness or age, as the store of value in currency erodes and interest rates fail to keep up with costs of living.

The sharks (I regret any poor reflection on actual sharks, which are valuable members of the natural food chain) in the financial world are surely feasting, and when the portfolios eventually get stripped to the bones as mounting pension and social security outflows diminish their real value, the benficiaries of the current state of affairs will have absconded themselves to some villa on the shores of Lake Geneva or something.

financial advisers and planners == toll collectors on the government-funded highway of life

Oh dam!

I foolishly threw my bank financed stone at a banker’s window hoping to grow GDP!

Instead I should have thrown my bank financed stone at an insurance company’s glass window to maximize GDP!

My bad!

Lol, the economy is literally on FIRE!

Who needs anything productive when you can have.. insurance? and bankers, and lawyers?

That sounds like Warren Zevon.

“Send lawyers, guns and money!”

Do NOT forget .. that the ” Services Industry ” produce NOTHING

They exist and are DEPENDENT ON the SERVICING NEEDS of the productive part of Society

It will be interesting to see how BREXIT pans out in the UK, as the are an almost completely services based economy.

Architects produce nothing?

Engineers produce nothing?

Doctors produce nothing?

Software engineers produce nothing?

Pharma researchers produce nothing?

Interesting take on the world.

That’s a very obtuse way to describe it. Everything that everyone ever does for you is a service of some kind. Manning the stamping machine on the assembly line is a service too, someone else is doing it for me so I don’t have to in order to get my part. Why do you think that services that produce physical goods are quantitatively different than services that produce non-goods? They both have value.

While service can have high value and a lot production is totally useless or even damaging (e.g. plastic junk), I think you have to admit that a lot of paper shuffling especially in government is really producing nothing and just making a cut for some privileged parties. I have countless examples from government and semi-government jobs in my country. Everything would be better with those “services” completely eliminated except for the people who now make money with these useless jobs (well, maybe they could enjoy a job that really contributes something?). In a recent poll they found that something like 25% of Dutch government workers have no idea what their “job” contributes to society; and I’m guessing most of the other 75% were not being honest.

Interesting example is New Zealand where they completely reorganized government decades ago and over 90% of government jobs were canceled (of course some useful jobs were transferred to the private sector). After that it was off to the races with the economy and almost everyone profited. Probably in the last 10-15 years things went too far in direction of globalization, wealth disparity etc. but I don’t know if (lack of?) government “services” was the main factor there.

Trump gets impeached. The dollar falls.

The UK is an island apart.

Investing in learning good nutrition might reduce need for expensive medical services. Nitrite processed meat is a Group 1 carcinogen.

Asset protection lawyers thrive in a litigious society. They do not sue the cigarette manufacturers. They sued doctors instead.

Somehow a kitchen remodel may not increase my investment acumen. My home is not an investible asset. Some do not count homes in their net worth. There are expenses generated by home ownership. A home does not pay a dividend.

In the bay area though, home prices are in part driven by the value of the home as an appreciating asset. What’s why it costs twice as much to buy a property as it would to rent it. It’s really crummy because if you do not have confidence in the real estate housing market future, it means you cannot justify buying a home. You are forced to rent if you don’t want to speculate on home prices.

In Netherlands renting is often 2-4x MORE expensive than buying and almost every homeowner sees their home as an excellent investment. Real crummy because if you don’t have faith in continued surge of home prices your only alternative is renting, which is way more expensive (often requiring over 50% of income). Interesting how this is different from the Bay Area… not playing the game is heavily punished here.

Maybe it is like that here because renting in the free market is the exception to the rule; about 50% of homes are privately owned (usually with max mortgage and lots of subsidies), and by far the biggest chunk of the other homes are rentals in the social sector where people pay just a fraction of the market cost, but with nowadays basically zero entry because all the available homes go to “disadvantaged” people (mostly new migrants). The very low rent and other subsidies in the social sector is compensated by having the +/- 5% of citizens who are forced to rent in the free market pay a lot extra ;(

If you read financial history you know that countries every once in a while get into a mania and then it all comes crashing down. If things aren’t rational you just have to not play the game and watch people dumber than you get rich. Some will get lucky and some will get bailed out but you can’t count on that.

I really don’t understand nhz. If owning is cheaper than renting and more desirable than renting, then what is the problem with owning? You’ll save money versus renting and get to own an asset as well.

I just can’t fathom what the problem is unless:

a) you expect rents to drop precipitously in future, making home ownership more expensive than renting in the long run — but why do you think that would be true?

b) you are comparing the cost of renting houses to the cost of owning houses, but the cost of renting an apartment is much lower. Is that what you mean? So your choices are either: reasonable apartment rental, expensive home mortgage, or very expensive home rent.

Are either of these factors in play?

Principle Residence is a tax write off for all of whom file their tax returns.

Yes, a residence is mere debt obligation if it is not owned outright but one has to reside somewhere. Renting is the best way to go right now if the tax rate is inflated.

Servicing debt and paying the cost of living have to be weighted & factored in to the calculus. Sometimes home ownership does pay dividends.

MOU

I like playing around with these things. Where I live appreciation is low so its not so dry cut.

I have rented the last 15 years and invested the equity in financial assets and did much better than if I had kept my house. I like the liquidity I get with financial assets and I like the ability to move easily if I have a life changing event.

Shuffling paper, flipping housing and creating fiat money out of thin air is now a third of the American economy.

What could go wrong?

“Finance and insurance: 31.6%.”

In this FIRE economy as long as we can keep increasing Public,private and corporate debt and have QE the business cycle has been repealed. This could go on for a long time and that’s what Powell is counting on. The sad part is that some of us have children and grand children and the day of reckoning will come.

All that money created had to go somewhere. Wasn’t it Yellen who said there wouldn’t be any recession anymore?

My whole working life time we have added more and more debt pushers as the we have blown the debt super cycle.

One of the wealthier guys I know has built his career on blowing the student loan bubble as a high level manager. His sister is a teacher at a private elementary school and probably makes about 15% of what he does.

As far as I know my patents never paid one realtor fee. They bought a few acres in the country and had someone build them a house for a little over $8000. They paid their home off in 10 years. They are both still much alive and kicking at 89 and 93 and will die there hopefully (skipping the nursing home).

FIRE is technically 31.6% of the ~70% that is services, so more like 22% of the whole economy. That’s still too high though.

This time is different.

I mean it.

This time really IS different.

As far as I know, this is the FIRST time we are seeing preemptive QE (Insurance QR) being deployed.

What will be the result?

QE and rate suppression can cause establishment reports on the economy to not show an official recession, regardless of other problems they cause.

We may now learn if preemptive QE can prevent officially measured recessions when we think one is coming, for the most part.

My gut feeling is that preemptive QE will turn out like the preemptive war in Iraq. A lot of shock and awe then reality slowly sets in over time.

someone should remake the old “Swiss Family Robinson,” movies to reflect the modern economy.So instead of building water wheels, gardens, food mills and survival inventions they would just set up an insurance agency, a law office, a yoga studio and a puppet theatre. Then the Robinson Family would not have to rely on that hard messy stuff to survive.

Yes, Family Robinson will need to have health insurance. It doesn’t matter if their are no hospitals, nurses, doctors on the island because the insurance plan would just classify them as out of net-work anyways and set deductibles and co pays high no body could afford them and life expectancy would fall.

But it sure would make their GDP numbers look fantastic.

A remake today would have the Robinsons quit a self sufficient island and join the Pirates plundering others.

Well this confirms what I had seen in my own finances, insurance costs are eating me alive. It’s so bad I’m considering self insuring on my house. And auto insurance is getting so bad for young people that more and more are unable to drive in my community. Doesn’t bode well for the auto market in the long term, or cities without public transportation.

Medicare costs have gone up 70% in 5 years, while the SS checks have gone up about 8%.

Since I don’t work anymore I spend a lot of time on minimizing cost and taxes. Auto I have mastered I think. Without going into details it’s around $350 per year. Health care is Obama care high deductible at zero cost because I can manage my income. No other insurance cost.

Financial institution cost is where I could probably improve a little. I use Vanguard and total cost even with their small asset fee is about $600 per year. Everything pretty much is there so I consider it a convenience fee for keeping up with all my records.

I rent something small and old. All assets are in retirement trust accounts so you don’t have to worry about being sued. Only Fed’s can come after retirement accounts in N.C. unless they are extremely large.

Is the increase in SS before or after they take out $145 for part B? /s

Before. SS net has been declining for 5 years. The average payment is around $1400 per month(before Medicare), so the $145 is 10%. And that doesn’t include Part D (drugs) and supplemental coverage.

If you make over $84k+ as a widower/single, IRMAA will start kicking in and can increase your Medicare B costs (double)?. Only 5% of SS retirees pay it according to the last statistics I saw.

The question is without all the free money: Fed printing and Government deficits supporting all the debt markets, How much of this activity, sound and fury, would actually exist? Another way to put it is: when the music stops what will people actually hold on to?

Insurers SHOULD be making gobs of money. Health insurance covers you if you get injured. Car insurance covers you or someone else who gets injured in a crash. Home insurance covers someone who gets injured on your property. Injured while you were sitting on the toilet? Well that’s only covered with a personal hygiene rider. How many times over must we pay insurance CEOs to deny our claims for injury?

“Insurers SHOULD be making gobs of money. Health insurance covers you if you get injured.”

Oh really? At least you’re honest that insurers don’t cover you for what they’re BEING PAID FOR:

Pay your bills when you’re sick.

Insurers are parasitical worms. You don’t subsidize and feed parasites – you eliminate them.

Insurers are completely unnecessary middlemen that do nothing of benefit for a national health program.

Supposedly we have a national health plan according our our leaders. If you are the entire pool, what do you need insurance for? Because when you ARE the ENTIRE pool, you in affect self insure. Insurance can offer absolutely nothing of value. They simply become a middle man steeling your money, a middle man you don’t need.

Cut insurance out of the picture and save $$$$.

Also, once you get rid of the insurance parasites, you can move to Universal Single Payer and dramatically cut costs, especially from the rapacious hedge funds getting into for profit medicine.

If you think of the best markets there are a huge variety of choices. Think of autos, groceries, clothes. Once you get to only one choice you are pretty sure it’s going to over time have some problems with poor customer service and political interference.

Yes and if you look at the ACA, only 1 or 2 insurance companies are offered to choose from in most of the nation. Ero monopoly and collusion. This is precisely an area were collective action thru govt is called for.

@timbers:

in Netherlands you can chose from countless different healthcare insurers with many (thousands!!) different plans. However … basically they are all the same, with extremely similar costs as long as you stick to the more basic plans and don’t need all kind of esoteric new-age voodoo covered. Every year all these countless policies go up with about the same percentage, you can jump to another one and save 1% or so and they next year you probably get an extra-high increase.

Reason is that the Dutch “healthcare insurance” is really just a tax and not an insurance policy. Insurers cannot refuse anyone or any treatment from the politically approved coverage (which of course increases every year). The whole industry is fully controlled by our government, while offering insurers (and even more medical service providers) to take their cut while doing nothing useful. Of course, most medical insurance companies have former politicians in their board.

I remember reading that when they were designing Obamacare they took a good look at the Netherlands; weird that they didn’t include this fake choice option.

Insurance remains one of the few things you cannot buy over the internet in lots of states.

Timbers:

Tell that story to the survivors of the northern CA Paradise fire…….

I carefully scrolled through the list until I came to utilities. Conclusion, most of the ‘so-called’ economy could be taken away tomorrow and life goes on in the basic needs venue. Then, there are the utilities. Everyone needs water, electricity, and sewage removal/treatment. Not only is that sector miniscule, the revenues are in decline.

It reminded me of the old joke about who should be in charge of the body? In this case, who/what leads the economy?

Remember when blue chip stocks would include utilities? That sums it up and where we are most likely headed, imho.

Paulo,

Just to clarify: all the items listed here are “private-sector” services. There are a lot of publicly owned utilities in the US, and they’re NOT included here. Most water and sewer systems are publicly owned. There are municipally owned gas and electric utilities. There are state-owned and federally-owned utilities. None of them are part of this list.

Damn! I think the statisticians missed my privately owned utility: My cistern …

Thank you for the info. My sister was describing a newly privatised water utility in western WA the other day. I was under the impression most utilities were private in the US, until they get into trouble and ask for help. (PG&E comes to mind).

The utilities not included here because they’re public include TVA, which is owned by the Federal Government. It had $11 billion in revenues in 2018.

By contrast, investor-owned monster PG&E had $17 billion in revenues, but this includes gas and electric.

Also remember, this is for services only, such as line charges, and not the product (the goods).

Replying here because I couldn’t go below Wolf. PG&E CEO came from TVA before Duke fired him. Duke claimed he mislead them as he was Progress CEO when Duke purchases them. He got $160 million golden parachute if I remember correctly. I think he did a good job at Progress Energy as I was a customer and they didn’t make any huge mistakes while he was there that I recall.

The Utility business is a blocking and tackling business and it involves basic engineering, good management and employee relations. The Utility can be broken by poor management or poor state regulatory policy.

Paulo:

In CA alone there are more than 2,000 “CSD’s”; California Special Districts” that include water, sewage, and also schools. The water and sewage districts themselves are mostly all increasing service charges because of deteriorating infrastructure and rising demand for licensed operators.

I’m willing to bet they missed my privately owned and maintained water and sanitation system. And a lot of others like it too.

Everyone seems very sure this thing will go on forever, financially it can go on for a very long time no doubt. However, look around, the moral decline is in full speed. I’m not talking about religious morality or any of those rabbit holes but basic human morality at large with regards to each other(myself included).

The current system relies on a false veneer of fairness/justice but that’s eroding by the minute. It’s extremely clear that humans will tear down this system long before it actually fails financially/politically. We are in a negative feedback cycle culturally that is growing exponentially.

No reason to despair it’s the way of the world, keep your eyes open buy used, buy good quality, keep healthy, Paulo is a good example. Ignore 99.99% of the media and read the classics, read books, exercise, unplug. The future is bright for the well educated(not paper credentials) healthy whom have a solid base of family/friend support. You will reap what you sow no matter what anyone tells you, whether positive or bad.

Insurance has two problems, one is government regulation, another is deflation. If the cost to rebuild my home drops in half, so do my premiums. My mothers LTC policy went into receivership in 2008 and they capped benefits. A stock market dump would take this industry down. The prescription drug law in Congress is hung up over governments authority to negotiate prices. If you like medicare you should like that, but GOP is opposed. By the end of the year there will be more austerity and fewer GOP congressmen. The key to recession is GDP/inflation ratio, watch dotplots ducklings, the outlier is employment. With labor market this tight, no wage inflation and manu jobs returning cause wage deflation. The only wage sensitive service jobs are landscapers maids and minimum wage burger flippers.

re “healthcare insurance”:

After Obama was elected, and “universal health care” was an alleged goal of his administration, I was one of those who had no idea that this would translate into mandatory health insurance. I had naively assumed that the big legislation would address health care, not healthcare insurance. LOL

Here’s how that is working out for me. After I have reviewed the “Medicare 2020” updates: I am paying more for all aspects of my Medicare insurance (i.e., the sundry parts, for example, Medicare Part D for Drugs); and I learned that, for example, BD disposable insulin syringes, will no longer be covered. I plan to buy WalMart’s brand of disposable syringe at WalMart, along with continuing to buy the NovoNordisk Regular insulin which WalMart provides at affordable price (mid-$ 20s, which is the same as Regular Insulin costed in the early 80s, and earlier). So there is a bright spot, and it is WalMart.

These work-arounds were keeping me out of the donut hole (coverage gap, so-called) for a while, but the insurers are bound and determined that those of us on daily meds will be in the coverage gap. Frown.

In the meanwhile, Lantus insulin, the long-acting basal insulin which is widely used by those of us who must inject insulin, now has a generic counterpart, but as of now the generic counterpart is more expensive, so in this case, “generic” does not mean cheaper.

In a nutshell, I will be paying more in the coming year, and getting less. ….contributing to the U.S.’s growth in GDP, I suppose. LOL

For those of us who suffer from longterm chronic illness, our efforts to find the disciplines that sustain us in the best possible health reward us richly*; while the cost of healthcare insurance, plus actual out-of-pocket costs, continue to rise. Adding INSULT TO INJURY. More dark humor: LOL

*talking about things like diet and exercise

As usual, Wolf, thnx. And the check (contribution for the year) is in the mail ! Smile.

I was remiss in not crediting George W Bush with passage of Medicare Part D (Drug) in 2003. According to Wikipedia, this was a plan generated from proposals by the Bill Clinton admin..

Medicare itself was passed in 1966, under the Lyndon B Johnson admin., but it did in fact represent the snowballing of what was originally an insurance plan for the military, under Eisenhower.

Wow ! Nothing goes to heck in a straight line.

Info above from Wikipedia, and personal recollection (I am an elder).

Thank you!!

If finance-insurance is $5T/year in a ~$20-25T economy… that’s too high. Not much genuine value-added in that industry.

P.S. I’d be interested in knowing how the education sector fits into this picture… recognizing that it’s partly government, partly private.

If you assume 20% of people in school × $10,000 per student = $720 billion. That’s probably a little low.

Wisdom Seeker,

I leave Education out of this report, which I do quarterly, because the Census Bureau’s data includes only a tiny portion, and so it’s just a rounding error. The Census excludes these biggies:

NAICS 6111 (Elementary and secondary schools), 6112 (Junior colleges), and 6113 (Colleges, universities, and professional schools).

What is does include are “Educational services,” $18 billion in Q3, of which:

Business schools and computer and management training: $3.4 billion

Technical and trade schools: $3.9 billion

Other schools and instruction: $7.3 billion

Educational support services: $3.9

So the Census data on education revenues is kind of useless, given how limited it is, and how big education is, and I leave it out. I’m not sure why the Census Bureau excludes the biggies, but that’s how it is.

What if every manufacturer shut down.They represent 30%

of the economy.Would services only fall by 30%.

You should know, did you forget what happened after perestroika. LOL

gorbachev,

“What if every manufacturer shut down.”

What if the sun doesn’t rise tomorrow? Some hypothetical questions are so unlikely that any answers would be just silly.

Full employment recession with hidden inflation (food, etc.) with deflating real estate prices.

There is only so much debt a person/ family can take before hitting a wall.

“only so much debt a person/family can take”:

Not with ZIRP policy, when you are paid to take on more debt all bets are off. Europe is experimenting with this and I have heard some totally crazy examples already, but they are a bit of an exception for now. I’m convinced the whole system will blow up when they push this a little further than the current minor “rewards” for taking on more debt (we are not yet talking about getting a free Porsche if you take out an extra mortgage, but getting close). But such risk doesn’t mean they won’t try.

Read a good article on the other site by economist from Spain explaining why modern economic thinking is flawed.

He had a lot of good points but maybe the best one is when you tell people and governments they can borrow for free they are going to do stupid stuff with the money and society is going to get poorer.

de Soto’s book on the history of banking, “Money, Bank Credit, and Economic Cycles” is well worth reading.

I always wonder how the debt will be leverage out.

Perhaps something like this:

Folks: You can ERASE your debt by going to war.

We are not there in terms of debt and conflict between countries. But no worries assured:

– personal/family (mortgage, cars, etc.) debt is increasing

– already creating tons on tensions between countries

My dear friends, is just a matter of time

Finance and insurance: 31.6%

It’s actually higher than that because some of its costs are buried in other categories. But let’s just say it’s 31.6% of services, or 22% of the entire economy, as Wisdom Seeker notes. That’s a huge overhead just to shuffle money.

Next year it will be higher, because, as the graph shows, the FIRE sector reliably increases 6% per year – three or four times faster than the official GDP of the rest of the economy, at least, assuming you believe the statistics. It has to, because if it doesn’t, its obligations can’t be met, the Lehmans start bursting, and the system crashes. But it can only do so by continuing to bleed the rest of the economy, repressing it, and it can only do that by spiraling interest rates downwards and spiraling debt upwards. But it cannot do so indefinitely. Simple extrapolation tells you when it breaks down.

That’s a lot of parasitism, plenty to strangle to host, and it can only get worse. Still, as a risk to civilization it’s a bit down the list, behind geopolitical and ecological hazards, for example.

The good news is that everybody knows it’s coming, so it won’t be a surprise. The bad news is that it’s going to be ugly, and, after that, it gets weird ugly.

The only way to win is to be in the 0.01%. They’ll be just fine, until it catches up with them too. The only way to avoid losing is . . . not to play.

Don’t worry about me. Really, I’ll be just fine.

Meanwhile, central banks continue to print money like there’s no tomorrow. They would know, wouldn’t they?

Enjoy it while you can.

Unamused, I’m surprised you didn’t put financial parasitism at the top of the list. Parasitism drives politicians to deflect attention by hyping up endless wars, divisive political scams and other propaganda-driven mass panics. That (or else public revulsion to parasitism itself) triggers the national revolutions and geopolitical upheavals on your list.

Meanwhile, parasitism quietly robs the host of the intellectual energy and capital surplus needed to constructively deal with the genuine challenges.

The biggest QOQ gain—almost 25%—was made by Securities and Commodity Exchanges.

As far as commodities are concerned, this comes as no surprise. The mergers and privatizations in the 2000s turned U.S. commodity exchanges from non-profit utilities into global corporations generating most revenue on Wall Street—and thus incentivized to grow speculative trading.

Such incentives, coupled with deregulation, low interest rates and trade tensions fuel an unprecedented surge of financial speculation in ever more commodity markets. This year commodities are likely to overtake equities as the world’s second most-traded derivative category.

The implications are discussed in this article: https://americanaffairsjournal.org/2019/11/commodity-financialization-and-why-it-matters/

The more I read, the more I think you have hit the nail on the head. The world went bankrupt or nearly so in 2008 time frame.

The central bankers are going all or nothing to get the world jump started. The outcome of their policies are much debated, but I think no one really knows how it’s going to turn out. Bernanke believef they didnt print enough after great depression, so they are not going to make that mistake again. If money printing was the answer we all could just add a zero to all of our finances and paychecks and things would be fine. We know it’s a confidence game to some degree so we are not going to get a heads from central bankers. Look at what they do, not what they say. Put them all together and they are still on extreme stimulous mode after 10 years.

When I was stationed in korea, deflation happened. On a specific date, old hundred won notes were worth 10 won. A zero was slashed from all the old money. Could that happen in the US?

Is that really deflation? I thought deflation was a reduction in the monetary supply. That would be more like burning half the won notes, making the remaining half worth more. What you are talking about just sounds like an accounting change that did not fundamentally change anyone’s share of the value pie.

So are these numbers net revenues or gross?

Are they inflation adjusted?

petete,

These revenues are revenues as reported in earnings reports, similar to JPM saying it had X billion $ in revenues last quarter, up Y% from a year ago… multiply this out across the services-producing sector, from barbershops to Google.

However, this data tries to measure revenues by all businesses, not only publicly traded businesses, and companies like mine don’t publish revenues. So the data is also based on surveys of those companies like mine — I’ve gotten those surveys too — that companies are compelled to complete in the time allotted.

Looks like gross and not inflation adjusted from the questionnaire.

They also mention they ask about expenses, but haven´t found that.

Thanks for such nice summary.

In Seattle, you’re not hip if you don’t

physically attack people, steal, squat, trespass,

break windows, inject drugs, and make babies 24/7.

“Thieving Junkie” is the most popular profession.

If the Fed thinks government deficit spending is to be sponsored (QE)….

and they provide term repos for banks funding quants and hedge funds…

the logical step is for the Fed to declare, through actions, corporate deficit spending is to be sponsored also….

crazy?

The BOJ has done just that….