Whiff of short-term capitulation. But fundamentals are not promising.

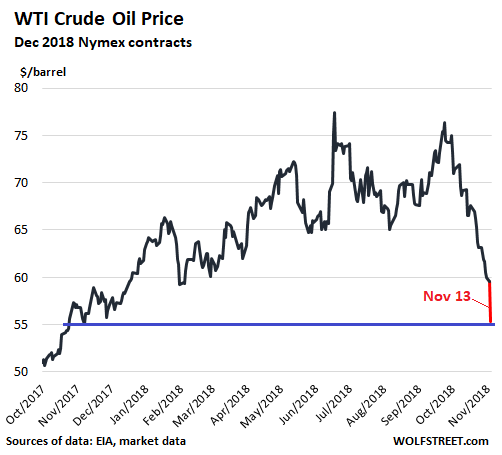

This is like so 2015: The price of the benchmark crude-oil grade West Texas Intermediate (WTI) plunged 7.3% on Tuesday, the biggest percentage drop since March 2016. Since the Financial Crisis, WTI has plunged over 7% on only five days, including today. It has plummeted nearly 28% since October 3. The red line in the chart is Tuesday’s move:

Tuesday was the 12th session in a row of declining prices. Total volume traded was nearly double the 100-day average, in a barrage of speculative fever interlaced with desperation and a whiff of capitulation. Fundamentally, several things are coming together, including:

Surging oil production in the US

US crude oil production reached 11.3 million barrels per day (b/d) in August, according to the EIA, thus exceeding Russia’s disclosed production for the first time. By this measure, the US was the largest oil producer in the world in August. This data point was announced on November 1, and while it didn’t really surprise anyone, the downhill cascade that was already in full swing accelerated from there.

“The forecasts for 2019 for non-OPEC supply growth indicate higher volumes outpacing the expansion in world oil demand, leading to widening excess supply in the market,” OPEC wrote in its monthly report.

“Alarming,” is what OPEC Secretary General Mohammad Barkindo called the surge of non-OPEC supply. He thought that OPEC and its allies should cut production by 1 million b/d.

Iranian exports not as much of an issue

The White House said last week that China, India, Italy, Greece, Japan, South Korea, Taiwan, and Turkey would be able to continue for six months buying Iranian oil and dodge US sanctions and potential penalties for trading with Iran. This, in addition to other ways Iran has to get its oil to market, will allow for much of the Iranian oil exports to continue.

Global demand not so hot

OPEC, which still matters, now sees demand for its own oil at around 31.5 million b/d in 2019, down from its vision of around 32 million b/d just two months ago. OPEC’s outlook shows that global oil inventories will rise in 2019 even if OPEC cut its own output by 1 million b/d.

Because the global economy won’t be so hot

OPEC figures into its scenario slowing global economic growth. It just cut its forecast for global demand growth by a smidgen based on its vision of economic slowdowns in the emerging markets.

But Trump likes cheap oil.

Trying to put a floor under the plunging price of crude oil, Saudi Arabia over the weekend, announced that it would cut its own production by 500,000 b/d.

This drew withering criticism from President Trump, who has taken a stance on cheap oil, despite the economic turmoil and hardship cheap oil causes in the US oil patch, along with a drop-off in industrial production, investment, and the like. Cheap oil is no good for the biggest oil-producing states in the US, such as Texas, North Dakota, and Alaska.

But most of this has been known for a while. Oil production doesn’t just suddenly surge overnight, and demand growth doesn’t normally just slow down on your day off. These things move slowly, spread out over months and years. The fundamentals of the global oil market don’t change in six weeks, and haven’t changed much since October 3. But what did change was market sentiment.

For months, the idea of $100 oil was hung out there, and it was deemed credible and speculators took their sides. Now the bets have swung the other way. Energy junk bonds, which had been immense winners since the oil bust, are now turning the other way. And energy stocks are being beaten up again.

But with sentiment turning sour to this extent, it reeks of capitulation, at least in the short term. And a bounce in oil prices – even if it’s ephemeral – is likely on the agenda.

Longer term, oil production in the US shale patch will continue to surge until investors get tired of funding this cash-burning business. Investors did this briefly, and only to some extent during the last oil bust. A gaggle of smaller oil & gas companies defaulted and filed for bankruptcy. And production ticked down a little. But the money in the yield-starved world of that time – much of it from PE firms and hedge funds – started flowing again in the spring of 2016. And today’s self-defeating surge in production is a consequence.

But now the Fed is tightening, interest rates are rising, and yield investors have other options with less risk, and the next oil bust, if it comes to that, is going to play out in a different environment.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Time for that cross country trip in the Winnebago I’ve put off

Crude will never come down to its true value, and never go up to its true cost.

Fortunately it’s not my problem. I have other problems. Were you aware that general polynomial fifth-order equations have no exact algebraic solution in arbitrary coefficients? I’m going to be stuck using an approximation.

N=NP

That also gets you stuck with approximations.

I suppose the problems with oil can be glossed over by jacking up the subsidies a couple of trillion a year, so they’ll probably do it. You’re welcome to disagree, of course.

The problem with oil? Burning forest fires, dying ocean, drought, floods, mega hurricanes etc. We have about ten years to take serious action or watch our ecosystem collapse. That is the problem. Normal is not an option.

I’m sorry LittleNano, but I am pledged not to respond in kind to gratuitous personal disparagement. You’re certainly welcome to troll elsewhere if you like.

My Quantum Computer says that NP=QNP.

I’m left with a quarter tank and hoping prices get down to 2.25 before I have to fill up again.

With uber I don’t drive all that much these days. And I was just thinking it’s been 2 months since I’ve filled up the tank.

Be sure to tip your driver. He probably hasn’t eaten in two days.

But he’s getting (and burning) gas in his tank from a good customer.

Again! If this is indeed a 2015 style situation it would be caused by a strong dollar leading to a fall in commodities, an oversupply (as stated), and declining demand (as stated). However this time OPEC is decreasing production not increasing (I believe). That leads the question why doesn’t demand for crude oil increase in developing nations as I believe it would?

How long are the nations going to be “developing”? I see pictures and they all seem to have a McDonald’s and a Starbucks……..and some of the cities have a eerie resemblance to cities like Detroit……so…….

->How long are the nations going to be “developing”?

They’re debt peons. Bankers have them by the short hairs. All their economic product gets skimmed off by the McDonalds and the Starbucks and other cheesy American extraction mechanisms, so they’re never going to ‘develop’ and will always be in debt, just like everybody else.

International economic development aid is a sordid scandal on many levels. Among other things, it proves that banksters are people who help you with problems you never would have had without them.

You see, this explains why jokes about bankers never work. Bankers don’t think they’re funny, and nobody else thinks they’re jokes.

You consider Detroit developed?

Detroit lost the war. Hiroshima won. Don’t take my word for it. Look at them yourself.

In the days before insane QE, massive debts and zero interest rates…

Declining oil prices were viewed as a good thing.

Where I am sitting, it isn’t 2015 “again”. 2015 has been the local 2016, 2017, 2018 and looks like it will be the current state for a few more years.

Oil has been cheap to produce and cheap to purchase for close to 4 years, the only people driving the prices up were people trying to limit transportation of the product. That can only do so much.

Talk about cheap oil!

The level of present discounts for Western Canada Select (WCS) oil, Canada is losing $100 million dollars per day.

The past 10 year average discount range for WCS was $17 – $22 bbl.

At present its trading at a red ink discount level of $43 per barrel.

If this continues for long, look to see those oil companies involved with the production of WCS shutting down, being taken over, or seeking financial protection.

IMO, demand is falling in China, the world’s largest consumer. Demand is falling because China is going into recession.

Time to buy airline stocks? What else benefits from low oil? Or is this the harbinger of widespread doom?

Harbinger, no. More like the symptom of a disease. A disease that’s going to require amputations of things you never would have guessed you could survive without.

Economies and militaries run on oil, so price is no object. Militaries are needed to acquire and maintain supplies. Economies are prevented from substituting alternatives by any means necessary. Crude is heavily subsidised to keep its products cheap enough for debt slaves be able to buy them, so they can be swindled.

Be careful with airline stocks. Even with crashes they fluctuate for no discernable reason.

Other than a small speculative stake in DTO, i’m bleh to the oil crisis.

Like most financial assets, it’s impossible to know oil’s intrinsic worth, and how much of its cost is a private consumer tax for the benefit of XOM shareholders, oil sheikhs, and Wall Street speculators.

It is funny that Trump wants a dovish Fed and lower oil prices, when the former may be causing a bubble in the latter. If he really wanted lower oil prices, how about a financial services tax on commodities speculators?

Oil is down because production and consumption associated with international trade is down. Trump’s words to the Fed seem like remarks about bad weather. eg Crappy weather today. Crappy Fed policy this quarter.

I thought most oil frackers in the US weren’t profitable below $75/ barrel. So why isn’t the US oil industry imploding?

Investors are still throwing money at the frackers that they can burn. When that money dries up, watch out.

Is this money generally in the form of variable (or even just adjustable) rate loans? If it’s variable, frackers are being squeezed on both sides now.

Yes, they carry quite a bit of debt in form of variable-rate loans, and this is going to squeeze them. But they also issued a large amount of bonds, and most of them are fixed rate. They’ll have to refinance them at higher rates when they come due, but that will play out over the next few years.

->Investors are still throwing money at the frackers

It may seem crazy for people to be so keen to maximize their negative returns, but it’s actually a splendid way to launder money if the contracts and the counterparties are arranged properly.

Not that anyone would do such a thing. Why, that would be wrong.

Except that investment grade debt is at its worst since 2008!

The breakeven cost for US-based fracking operations has been going lower and lower for the past decade in spite of all the doom and gloom surrounding them.

Most basin average are already under $50/bbl breakeven, and that’s after factoring in a 10% return on drilling and completion costs.

But… leverage rates remain very high and fracking remains very capital intensive.

With interest rates going up investors will have to start demanding higher returns on their money, even from those junk-rated operations that so far have benefited immensely from the insatiable appetite for their bonds, covenant-lite and whatnot.

Most basins (Eagle Ford, Miocene, the Wolfcamps etc) can probably afford the present model even with higher interest rates. A few others (Three Forks, Lower Tertiary etc) would see a veritable oil burst. Others (such as the much talked about Bakken) would see about half the operations keep on doing very well and the other half really struggle.

As always keep an eye out for marginal operators with high breakeven costs, poor access to capital or both and avoid them unless you feel oil prices are going considerably higher.

Where did you get the $75 number? Or should I ask when? If you write down the number and the date and then watch as oil prices drop, the oil production companies will claim they can always produce it for $5 or $10 less than the trading value. Not because they can in reality, but because they need speculators to invest in their debt. Think of PE firms, Fangman stocks or even Tesla shares.

Oil producers can survive at any oil price, as long as they can find wealthy investors. Once the investors leave, the company folds and they fire up a new company.

Oil prices seem very random to me, or maybe manipulated, for someone else’s benefit. Kind of like stocks, real estate, bonds, gold, and Bitcoin.

Most oil production is directed toward transportation, automotive being the single largest segment. Yet, the automotive industry is undergoing a dramatic transformation. Total world wide vehicle sales for 2018 will be approximately 81.5 million units, up 2.5 million units from 2017. But note, world-wide sales of electric vehicles account for nearly 2 million units of sales. Below are the world wide increases for the last five years:

2014 — 320,000

2015 — 550,000

2016 — 777,000

2017 — 1,227,000

2018 — 1,900,000

The reason why IEA estimates for oil consumption are perpetually too optimistic and continually get adjusted down is readily apparent. If world-wide PEV sales were to grow at just 30% a year, well below their average for the last five years, we would expect to see 7 million sold in 2023 or 8% – 9% of vehicles sold. That’s sufficient to push down oil consumption, irrespective of world-wide economic growth.

How do you think electric vehicles get their “fuel” anyways?

Coal. Gas. Nuclear.

Solar and wind are minuscule sources of grid power.

Not really that much of a transformation.

The environmental benefits of electric vehicles was outside the scope of my response. (And the article to which I was responding). The point of my post was that whether the power is generated by nuclear, gas, coal or solar pv, it certainly isn’t going to be crude oil derivatives. (Fuel-oil makes up an insignificant and shrinking portion of world-wide power production)

The energy sector continues to ignore or down-play the impact of electric vehicles as if dismissing them will simply make them go away, much to the detriment of their share-holders.

For example in California, 29% of electricity generation is from renewables, including hydro. 0% is from coal.

Solar is about 1% across America. And California is busy dismantling their dams.

California imports about 25% of their power from other states. Power made almost entirely by fossil fuels.

And yes. Teslas are coal powered cars.

https://www.eia.gov/tools/faqs/faq.php?id=427&t=3

https://www.eia.gov/todayinenergy/detail.php?id=4370

2banana,

You’re being silly, and you know it. Renewables are 17% across the US per the EIA data you linked, and “utility-scale” solar (1.3%) is just part of it. However, this does NOT include rooftop solar, where much of the solar power is generated.

Texas is the largest wind power producer in the US. Oklahoma is hugely into too. Why? Because if you ask the folks in West Texas or in the Oklahoma Panhandle – conservative strongholds – where the wind always blows, they’ll tell you: “They pay me for wind.”

If you favor coal, you’re on the bankrupt side of the energy business. Coal power plants are being retired at record pace – and have been for years. No new ones are being built. Coal mines have gone bankrupt, one after the other. Their only hopes are exports and metallurgical coal. Coal lost out to natural gas starting in the 1990s with the invention of the Combined Cycle Natural Gas turbine, and now coal is losing out to wind too.

Coal power generation has been obviated by these new technologies (CCNG turbines and wind turbines) that make power generation cheaper than what coal can do. These are economic decisions that power generating companies started making years ago. It’s slow moving; you don’t suddenly shut down all coal power plants, but it is moving.

Coal’s share of US power generation was 55% in the 1980s. It dropped to 48% by 2008. In 2017, it was down to 29.9%. And it will continue to dwindle. Just pure economics. Coal is too inefficient and can’t compete on cost with natural gas and now with wind.

Power generation from rooftop solar has surged 170% since 2014. But it’s wind that really matters for coal. And it surged by 27% since 2014 and is now up to 8% of total. Over the same time, power generation from coal has dropped 24%. See the trend?

Time to update your knowledge. Here is a convenient table of the power mix in the US going back to 2008. It also includes a column for roof-top solar.

https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_1_01

Add a comment to 2banana’s link. I wasn’t aware that California imported so much (25%) power. But almost all of this comes from Hydro-electric sources from Oregon and Washington and is cheaper than what Calif could produce. Looks like economics rules the day.

The problem with Wind Power is it is creating pressure on some state budgets. The wind lobbying power is so powerful states like Oklahoma. Oklahoma wanted to stop the subsidies for several years but the lobbyist kept blocking any legislation to end the subsidies. They finally did end the some of the incentives but will these wind turbines be all that profitable with out the incentives.

————————————–

The wind industry’s tax incentives have come under fire as Oklahoma legislators have been scrambling to fill two massive budget holes, a $600 million hole in the current budget and a $878 million hole in the budget for the next fiscal year, which begins July 1.Mar 14, 2018

http://www.thewindfallcoalition.com/data/theOklahomaGiveaway.png

Despite being the number two state for wind power capacity, Oklahoma has soured on its wind industry, which has lost all state-level tax incentives amid a budget crisis brought on by the oil bust. Two bills, one in the House and another in the Senate, have proposed capping the state’s zero emission tax credit.

If passed, the bills could bankrupt existing wind farms, said Mark Yates, the head of the Oklahoma Wind Coalition, which lobbies for the industry.

“It is just absolutely devastating to go back and try to change any of this,” Yates said in February. He added that finances for many wind projects depend on the tax credits.

Yeah, we shut down the nuclear power plant they were trying to build in Tulsa, OK, in the 1970s. Too costly, too many tax incentives, too many subsidies, etc. We protested and filed law suits and shut that sucker down before they ever got to finish pouring the foundation. Nothing is more expensive on tax payers and rate payers than nuclear. All forms of energy are subsidized. It just depends on who is paying.

Wind, solar, and hydro are major players….. Just not in the US

https://www.eia.gov/tools/faqs/faq.php?id=427&t=3

Fossil -63%

Nuclear – 20%

Renewable – 17%

Renewables will continue to grow. Coal is in serious trouble. In many places the old plants don’t make sense with gas being cheaper and more flexible

I presume by renewables you include the hydro plants which have been around for 100 years?

Augusto,

Wind power has been harnessed long before electricity generation had even shown up on the horizon.

8-9% of vehicles sold in 2023? If that pans out, then yes I agree less barrels will be needed to convert to fuel for automobiles. However, wasn’t there an article on this site (from oil.com) that said other uses for oil will be needed in the future for plastics and other uses? Also, and rarely mentioned, is that the US military uses 100 million barrels of oil each year. How much does the Chinese and Russian military use? Go look it up. Japan attacked Pearl Harbor partly over oil because of a US embargo. You all like to bash oil, you may not be considering how important it is today; it is probably the number 1 strategic necessity a world power has. Our lives have benefited, and our survival is dependent on it. What I’m trying to say is 8% in 2023 (if it even comes to pass) is chump change.

2014 was when the crash started, but 4-5 years was bought by sacrificing the oil producers, who sold the world their product at massive discounts for a few years, and now even that scheme isn’t enough to save this Ponzi.

The crash was delayed, not canceled. It will commence in 2019 with no more tricks up the sleeves of the globalists and financiers to stop it.

Saudi and US are talking over each other. Both need higher oil price, US for production cost, Saudi for revenue. Hence Saudi is more reliant on income for oil as a nation. That does not mean oil cuts though, tendency has been for individual opec members to produce more than quota rather than cut production when lower prices. US wants no cuts due to smoothing Iran sanctions. Often playing with supply, cheating opec, is or is taken as economic warfare in the gulf and internationally. Saudi is supplying top limit of quota just now, even talking of no opec.

So you read what you want into this, US vs Saudi vs Iran etc., or psy-ops and propaganda and trial ballons , or just confused policy coordination.

When oil prices drop low you are watching US producers going out of business, Saudi and other’s national accounts failing – they don’t do this because they think it’s nice for the global economy.

Most of the move is hedgefunds dumping for nov 15th, despite the above being true.

And Natty Gas is going the opposite direction, just as fast…

‘China, India, Italy, Greece, Japan, South Korea, Taiwan, and Turkey would be able to continue for six months buying Iranian oil’

In other words all Iranian oil can be sold and will displace non- Iranian oil from markets without waivers. A massive amount of oil can be stored in six months.

Plus Russia has said it will disregard sanctions (for once I’m sympathetic towards Russia). This will please the EU (including UK) who regret the sanctions and withdrawal from the nuke treaty..

So far it looks like Trump’s grandstand play on Iran is a lot like his ‘hard line’ on North Korea: not just achieving nothing, but weakening the US by expending influence for no result.

This is one cause of the oil price decline: the US sanctions have no effect.

Pretty pathetic really. Why would they give China & Turkey a pass on these sanctions??

Insane really.

->Why would they give China & Turkey a pass on these sanctions??

Yeah, really. What’s in it for them? How could they possibly profit from such a situation?

What’s insane is that there are “sanctions” in the first place.

Here is Alberta we are oil country. But we get a huge discount in Canadian Crude to WTI at a $30 to $35 discount now off that $55 a barrel. There is some seasonality in these numbers, this is a normally soft time of year for Canadian prices, but this is truly bad. $20 to $25 a barrel is what we used to get in the mid 1990’s for our oil, and that was tough to make work back then. We been dealing with a down market for four years now, but it ain’t getting any better, and for those companies who have been hanging on it may be capitulation time. Also, this is the time of year when oil production and service companies are planning their budgets including capital spending for next year-with rising interest rates and increased material costs out of the US (Canadian $ sucks). Which means I expect major cuts in spending to be announced early next year as well as layoffs and downsizings in January and February. But I guess consumers will be happy, and home buyers in Alberta as well, if you have a job.

Alberta needs to diversify out of oil. For example, southern Alberta has some of the best solar energy potential in Canada.

Once we have the robots to dig them out of the snow from November to April this will work just fine. For now we can give our workers legal pot and illegal opioids to work in the -20 to -30 weather, since there is no money to be made (but lots lost) in solar panels, and no one in their right mind would build these in Alberta. But not to worry, the government has and is. Last I read from a recent solar project in southern Alberta they were running, on a good day, at 4% efficiency, unfortunately half that was lost in transporting the power. We have been building wind farms all over Alberta for 20 years despite electricity friendly spot gas at record lows. Wind Farms are an enormous waste of capital and killer of birds but do provide some great government jobs, a fantasy narrative about a new economy, and hefty utility bills for all the little people. For those who believe in this stuff I suggest putting some solar panels on their own property and paying for it themselves, as some of my friends have done….all that eco friendly metal, glass, plastic and wire to produce, well nothing…

Natural gas prices going the other way – at least in short term. 45% goes to electrical generation now and that demand was up 17% in Q3. Not saying there is a shortage of supply, rather pipeline capacity is a bit short. (Russian currency holding up better than I would have thought – so far.)

Its all pipeline capacity/constraints. In the NE the States are blocking gas pipeline expansion out of Pennsylvania to prevent global warming…so you liquify natural gas to -160 degrees put it on a tanker from Texas and then warm/reinflate the gas and put it in NE homes and power plants (via the evil pipelines). Of course just extending existing Penn pipelines would do the trick and with a lot less CO2 produced, but hey, the Eco Narrative of “No New CO2 Investment” must be maintained at all costs, economic as well as environmental. We are truly crazy

Boston got one LNG delivery early this year from Russia – the new Yamal Field development.

Russian currency holding up? Russian Federation President Putin hiked the retirement age. Anyone know how to send Care packages to Russian Grandmothers?

Interesting to see the administration’s support of cheap oil despite the obvious ramifications. One has to wonder if that “support” is simply an effort to boost demand within the economy now that the corporate welfare scheme known as the Tax Cuts & Jobs Act has apparently performed its likely true purpose of offsetting the Fed’s normalization efforts.

Amused… are you Unamused’s not so evil twin?!

I have read – don’t remember where – that Trump was hoping to outgrow our debt of all varieties. Unfortunately that idea is stuck in the mindset of perpetual growth, and falls into the same economic line of thinking that got us here. Anything to keep the music playing, I guess.

Is because if the Shale Oil Scam. Cheap Oil at the cost of investors and Shale Oil producers outright losing money or just winning pennies.

The consumer benefits of cheap oil are offset or maybe overshadowed by the impact of low prices on the industry, including the high yield credit market. It’s almost as if the market is pricing in dramatically lower interest rates, a recession, and even worse. Seasonally up until January is still a good travel season, with the holidays.

I don’t know much about the oil business but I’m not unaware that our new foreign policy is being formed around cheap oil. While everybody in America is talking about how uneconomical cheap oil is, the president is bringing the middle east to its knees with it.

There’s evidence coming out of the ME that formally ambitious projects have been stopped, not enough revenue to cover them. Salaries are being slashed and jobs cut. Eventually this shows up on our bottom line too. Cheaper govt spending.

To those of you who don’t know exactly when market sentiment changed, it changed on election day. Have you seen the cast of characters slated to be on the financial committees? I have, I’m torn between buying more popcorn and enjoying the slapstick comedy our economy is on the verge of becoming, or getting ready for an even worse downturn than the last.

Its not new, all of QE had the effect of bringing on more exploration and more supply. The US exports oil, and pretty soon LNG will be used to break Gazproms hold on the EU and give Japan some relief (they pay 5x the rate for NG) You could call it an “energy policy” and it has been continuous, much like our foreign policy regardless of who is in the WH. High yield corporate bonds are hardly bothered, (at this point). The way is clear (for the stock market) and the rate hikes will come off. We’re already in a recession. QE something

Wind farms…consider this;

Weather is formed, partially, by wind…local weather to a significant degree that can be commented upon anecdotally.

A large wind farm will remove Billions of Jules of energy from the wind…

Energy can be neither created nor destroyed…

This implies that the wind downrange from the wind farms will be of less intensity…and to what effect? Will the local weather be noticeably changed? Are there follow-on effects which may impact weather regionally?

Any studies that are empirical? The “Butterfly Effect” was a bit of whimsy…yes?

Not quite so whimsical, but one thing I’ve been curious to see Wolf talk on is Gail Tverberg’s claim that wind power in Texas is actually harmful to power generation as a whole and, sans government subsidies, would lead to a collapse in overall generation. Her argument is that so much power is generated at peak wind times that wholesale electricity prices fall below the price of generating conventional electricity – sometimes even going negative. Below cost prices for electricity will, of course, kill producers that have to pay for fuel. Some might see this as pure economics at work, but without this constant load generation to take up the slack when there is no wind, wind won’t work. Thus the other portion of electrical generation requires subsidies, or the generation market as a whole collapses? I don’t really understand it, but it strikes me as an interesting unintended consequence of intermittent oversupply.

According to her, the world should have collapsed years ago.

The amount of energy extracted from the wind is still miniscule, and it’s put back into the atmosphere in the form of heat once the electricity is used, so I don’t think the overall impact on weather or climate will even be noticeable. Except in the minds of the gullible.

P.S. Planting trees and forests has much of the same wind-reducing effect as building wind turbines, but no one complains about those. And they all reduce soil loss on the Great Plains.

Wisdom,

Who is complaining?

” Except in the minds of the gullible.”…and hence the qualifier…”anecdotal”.

You make a point regarding the planting of trees…my point. Downwind weather might be impacted.

But to what effect? This would make a great Master’s Thesis….

I know this is a major stretch, but considering Trump has publicly called for lower oil prices, is there any chance he has promised to take it easy on Saudi Arabia for the Khashoggi murder and not pin the blame on MBS – in return for not cutting production? Trump seems to care about the economy (and believes low oil is a key to growth) over principles. Plus Trump/Kushner have publicly backed MBS so they have a horse in the game they likely want to keep there. Could this be in play at all?

Cheap oil is great news for us ICE lovers!! Long live ICE, let freedom ring!!