Investors are still blowing off the Fed. But not much longer.

CVS Health Corp. sold $40 billion of bonds on Tuesday to help fund its $69 billion acquisition of Aetna, which is still pending regulatory review that may conclude later this year. CVS will also obtain a $5 billion loan, use $4 billion in cash, and issue a lot of stock to pay for the deal. In total, CVS will take on $45 billion in debt, which is a lot for a company that is rated two notches above junk. S&P’s and Moody’s have put CVS on credit watch with negative outlook as the acquisition “will materially weaken credit metrics,” Moody’s says.

Yet there was strong demand: $120 billion in orders for $40 billion in bonds. The deal was offered in seven tranches. According to investors, the 30-year portion sold with a yield of 1.96 percentage points above the equivalent Treasury yield.

CVS won’t even need the money until later this year when the deal closes, assuming it closes. But it went out there to borrow now, rather than wait, to benefit from the still extraordinarily low interest rates in the corporate bond market and to front-run a flood of new issuance by other companies.

In addition, the US Treasury Department will issue large amounts of debt to cover the ballooning federal deficits.

And in addition, the Fed has raised rates four times since December 2016 and will likely raise rates three or four times this year, and more next year.

So CVS tried to get its bonds sold before all this hits the fan. Because bond buyers – mostly institutional investors, such as bond funds and pension funds – are still in denial. They’re still chasing yield, especially those speculating on the riskiest corporate bonds.

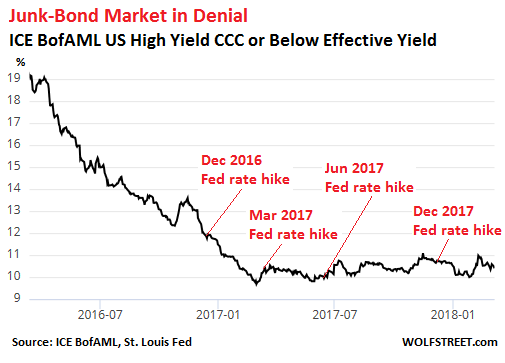

The average yield of junk bonds rated CCC or below – the riskiest category – was at 10.4%, according to the index that tracks them, the ICE BofAML High Yield CCC or Below Effective Yield index. This is down from about 12% in mid-December 2016, when the Fed stopped flip-flopping and embarked in serious on the current rate hike cycle.

In other words, since mid-December 2016, the Fed has hiked rates four times, in total by 1 percentage point, but over the same period, junk bond yields rated CCC or below have declined 1.5 percentage points as the bonds have rallied.

During the oil-and-gas bust, the CCC yield spiked to 21%. During the Financial Crisis, it spiked north of 40%. These are very risky bonds, and when financial conditions tighten – which is what the Fed is trying to accomplish by raising rates and unwinding QE – these companies may not be able to refinance maturing bonds or raise new money to fund their money-losing operations and pay interest. Defaults ensue. Investors normally want to be compensated for those risks, but not today.

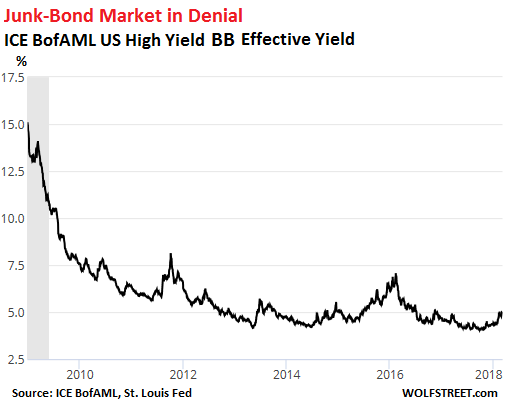

At the high end of junk bonds, just below investment grade, the average yield of BB-rated bonds has begun to tick up in recent months. But at 4.91%, according to the ICE BofAML US High Yield BB Effective Yield index, it remains very low – about where it had been in mid-December 2016. In the longer-term chart, that little uptick over the past two months is barely visible:

When we talk about “yield,” it is from the investor’s point of view, meaning the return on the investment. From the company’s point of view, this is the cost of capital. And this cost of capital even for risky junk-rated companies remains extraordinarily low. These are precisely the financial conditions that the Fed wants to tighten.

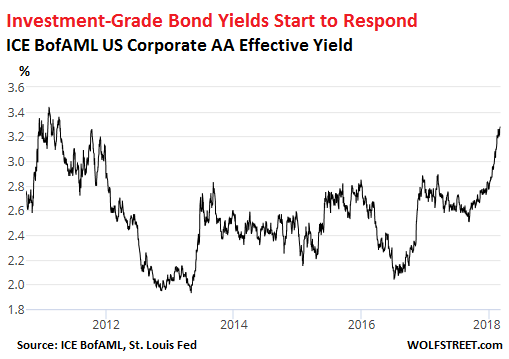

In the investment-grade arena, corporate bonds trade more in parallel with equivalent US Treasuries. According to the ICE BofAML US Corporate AA Effective Yield index, the average yield of AA-rated bonds has risen to 3.27%. While this is still very low by historical standards, it’s the highest since April 2011. So these investment-grade-rated companies have started to see their costs of capital rising — even as junk-rated companies have not:

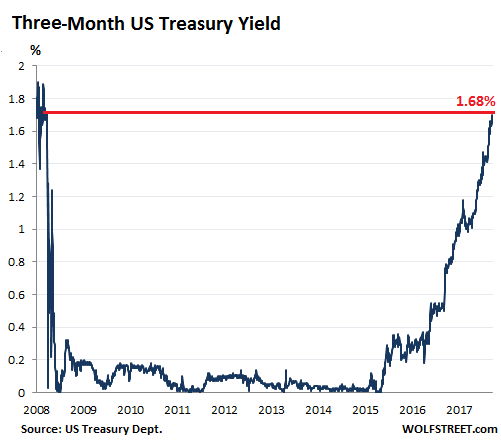

By contrast to corporate bond-market moves, the three-month Treasury yield has done this:

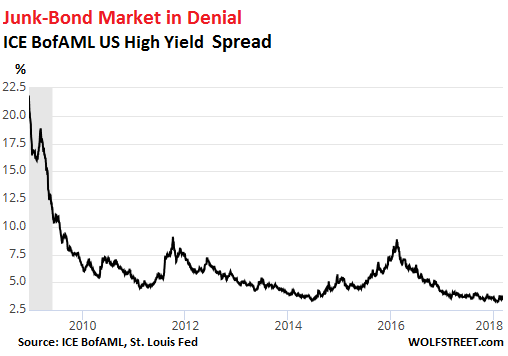

There are measures of risk premiums — what investors demand in order to take greater risks: one of them is the difference in yield (the “spread”) between junk bonds and Treasuries. This spread is now at just 3.53 percentage points, according to the ICE BofAML US High Yield Master II Option-Adjusted Spread index, barely up from historic lows. Investors are not demanding to be compensated for the large extra risks they’re taking, and they’re still blowing off the Fed:

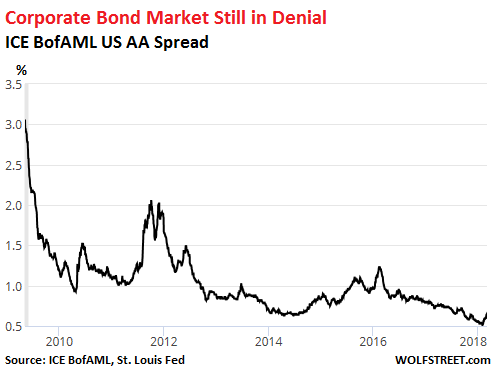

The spread between the yields of AA-rated investment grade bonds and equivalent Treasury securities has risen from a minuscule 0.52 percentage points to a still minuscule 0.64 points, and also remains near historical lows. You can barely see the uptick over the past few weeks:

When the Fed hikes its target range for the federal funds rate, and when it sheds securities on its balance sheet – both of which it has been doing with clockwork predictability – it attempts to tighten “financial conditions” to make credit more expensive and harder to get for credit-dependent companies (and consumers) in a credit-dependent economy. It’s attempting to get investors to be more prudent and circumspect and demand to be compensated more for taking risks. But the corporate bond market continues to thumb its nose at the Fed.

The Fed will succeed in tightening financial conditions. It always does. And when this starts to click, the adjustment will be sharp and possibly harsh for those companies that have relied on cheap and easy money to fund their operations. But for now, investors are still blithely oblivious to the coming reckoning in the corporate bond market.

It started before the sell-off. Read… Retail Investor Bullishness Collapses

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“But the corporate bond market continues to thumb its nose at the Fed.”

“The Fed will succeed in tightening financial conditions. It always does.”

Let us see who wins the bet!

Wolf, would you say conditions in the past have never been riskier than present conditions (all the central bankers all in) as the Fed tightened and may be it is due to this the corporate bond market is thumbing its nose at the Fed. May be just may be the Fed may reverse…

If they reverse course the dollar is toastier sooner Got Gold?

I agree. The bond market is standing there and calling the Fed’s bluff. Straight punking them. They’ve been calling and winning for 9 years now. Fed’s been a remix tape looping over and over. “4 rate hikes next year…….uuuuuhhhhhh”. “Okay 4 times this next year for sure now……uuuuuuhhhhhhh”. Maybe they’re actually on their way this time??? I mean, five big .25% rate hikes coming off of zero % for 8 straight years? That is strong! Or maybe they’ll reverse, or just tap out soon in order to get “further observation”? I bet they do when things get bad enough again. But even if things stay together and they actually DOUBLE Fed Funds from here, that means they actually had the balls to put us aaaaallll the way back to 2.5%. WOW!! It’s only 9 years since the crisis. Why take such big risks??………

But seriously. What in theeee Fxxk? How strong is this economy and banking system again??

Markets are being rational, the Fed is raising rates by paying the extra interest to banks using taxpayer money, which means the market sets these rates lower, the longer the policy continues the less sure we are what rates should be? Concurrently LIBOR is rising faster than Fed rates. So maybe there is something to the Feds decision. If you want fund gov spending in a diminishing pool of global liquidity you have to offer incentives (yield) however if you beggar your currency then attracting global investment is more difficult. (or it gets hard to sell 30yrs to to China through BIS) And if you suppose that markets will reallocate, stocks to bonds, in an orderly fashion, when foreigners own a big piece of the stock market, and the disincentives are greater, you have created a dilemma. Its one thing to lose a few percent in currency exchange when you are making 10% YOY in stocks, the bond market is much longer, and has less margin for error. Hence (the expansion of) global liquidity drops faster and further. The Fed is basically leveraging us into global financial hell in order to keep the falling dollar from falling even farther. I assume the Fed fears deflation, and always acts to prevent it.

“Markets are being rational”

I quite agree, but my explanation is more simplistic.

The Fed’s already said it could back off on rate hikes due to the proposed ham-handed tariffs, signaling that it’s a going to be a wimp and is likely to be a wimp with future negative events as well. The quarter-point baby steps have said they’re going to be run by phobos and deimos anyway. And when the markets do crash, they sure don’t want you to be able to blame their rate hikes. I smell extreme risk-aversion, which is after all only reasonable given the extreme distortions long in place.

Still, investors know the Fed has their back, and for the present the markets in general don’t appear to be all that fragile. They’ve already held up okay against recent shocks and the cracks aren’t widening all that fast. Short-term prospects still seem positive, even though the long term promises rolling catastrophes, but that’s the long term which is always ignored anyway, and until then there’s still time to cash in.

I can say these things because I’m mostly in liquid instruments, with a bit of risk capital in hedged short positions, discretion being the better part of valor. I bet the market serving survivalists is doing pretty well.

Ambrose,

“Markets are being rational, the Fed is raising rates by paying the extra interest to banks using taxpayer money, which means the market sets these rates lower, the longer the policy continues the less sure we are what rates should be? ”

Can you further explain? If the FED is paying 1.50% on interest on reserves to pariticipipating banks, why would a bank, private equity, lower its interest rate on a loan that was earning 5% prior to FED hike to 4.75% to another customer?

So all these “thumbing nose” institutional investors of this junk stuff were born after the 80’s and all the machinations of Michael Milken at Drexel Burnham Lambert? It was a big scandal at the time and lots of greedy people lost lots of greedy money. Did they remove this juicy little tidbit of history from all the financial textbooks? Or maybe these hotshot investors can’t read (as they obviously can’t read the financials of the “dogs with fleas” black holes that they tip their monies into).

I suspect a big part of the reason US junk bonds are still partying like it’s 2017 is because of foreign investors.

The ICE BofAML Euro High Yield Index is a measure of euro-denominated bond yields below investment grade (BB or worse): in short it contain everything from companies just below investment grade to deep financial junk. While it has gone up a seemingly impressive 23% since last November it’s still well below 3%, at 2.88%.

In spite of all the usual dubious tactics to sell retail investors local junk bonds, European savers want yield like savers everywhere. They are not going to be easily swayed by zombie banks, whether their nationality, offering a massive 2% to lend them money for a decade. Let’s leave that to institutional investors.

Yes, there are risks involved due to currency exchange rates but in the long run (the 5 to 10 years average security maturity) they are felt to be more manageable than the inevitable day of reckoning for Europe’s financial undead. Especially with the dollar so crushed as it is today: yes, it can still go down, but not that much.

With the ECB having failed to influence elections in Italy, and failed even more to give a boost to Macron’s spectacularly sagging popularity by igniting that economic boom the media have been screaming about for over a year, things are bound to change. But not right now.

For the time being Corporate America and, to a lesser extent, emerging markets will reap the rewards of a one-sided monetary policy built on the twin cornerstones of rewarding financial irresponsability and beating savers with a big enough stick.

Wolf

A terrific article ,well researched and logical in its conclusions

But I have one question.The Fed is raising short term rates and is reducing its holdings by not replacing its short term holdings as they mature.Both of these actions affect short term rates ,but have no DIRECT effect on longer term rates.

If the Fed really wanted to influence longer term rates,which seem to be an important factor for investors reaching for yield in longer term corporate bonds,why doesn’t the Fed actually sell some of its longer term holdings ,thus reducing the duration of its portfolio

The QE unwind is just in the first baby stages. Just like QE was “tapered” out of existence gradually, the QE unwind is ramped up gradually. So the impact is still muted. But if you look at the 10-year yield, it has started to respond — as have investment-grade corporates and mortgage.

By not replacing maturing securities, the Fed is stepping away from the market and someone else has to be enticed to buy those securities that the Treasury Dept. is issuing and that the Fed would have bought to replace maturing securities. In Q4, this will amount to about $30 billion a month in Treasuries alone (not counting MBS). This will have an impact on long-term rates.

But you’re right: the Fed could really goose long-term rates if it just mentioned that it is thinking about selling securities outright. This would create some real fireworks in the bond market. Bonds would drop and yields would spike, as would mortgage rates, etc. But I doubt the Fed wants those kinds of fireworks :-]

“…the Fed could really goose long-term rates if it just mentioned it is thinking about selling securities outright.”

So could China and Japan, our two largest foreign creditors. In fact, China may eventually come to believe the gold sitting beneath the ground in its own country may be a safer and more secure investment than our Treasuries as the U.S. debt keeps reaching for the stars.

https://www.cnbc.com/2017/09/06/draghi-could-leave-investors-in-dark-qe-exit-delayed.html

the only way to stop the rise in (global) interest rates (LIBOR) is to open the flood gates again. this may only require a backup in the dollareuro to get the unwind going but i doubt it, if the US fed sticks to its rate commandments. of course their yield curve is going to invert, and so will ours, they win they printed more money. you cant put a tariff on that

Wolf I enjoyed your session with Max on the Kaiser Report very much Nice to see two good guys together

What does CVS do if the deal fails? Are they stuck with the bonds? Okay if interest rates keep rising, what if they revert? Now you have bonds for a deal you never made and you are paying a premium to bond holders, and of course the bond rating gets slammed. Is this the short sale of the century?

Oh darn, now everybody’s going to know.

If interest rates keep rising, they will be able to invest the money for a positive carry. Or they may choose to buy back some or all of their outstanding bonds at a significant discount from the original issue price.

The agreement is that, if the deal fails, CVS will repay investors at 101 cents on the dollar EXCEPT for the 30-year tranche, which will stick. So most investors will get their money back if the deal fails.

Another essay by Wolf that is a model of clarity and topical

insightfulness backed up by hard data artfully gleaned….. Thank you, Wolf!

1 comment:

– I can fully understand Wolf’s angst at what he/we are seeing

in the bond markets, but perhaps we underestimate the

degree to which the Fed has conditioned the financial Mkt.s

to expect the Fed to ultimate fold when the financial,

political, and social pressures are amplified in response to

Fed increases and the resultant financial stress. Indeed,

shorting U.S. debt of all types has been a fool’s game for

years and the lessons have been learned. One could write

about this topic at length, but I would like to point out one

salient fact that has served to greatly reinforce the expectation that the Fed will fold once again: If the Fed raised

the fund rate by .5% rather than the water torture .25% just once, the entire debt market would immediately take heed and make the appropriate adjustments. However, the Fed refuses to do so and as a consequence any given Fed hike, even if generally anticipated, has only an incremental .25% impact to which debt buyers and sellers quite realistically feel

the economy can and will adjust to – and those with such an

anticipation normally have 3-6 months to make whatever adjustments necessary. An appropriate analogy would be the

frog in the (eventually) boiling water

Wolf,

I think your underlying premise is what the Fed USED TO DO but is not longer incorrect:

“When the Fed hikes its target range for the federal funds rate…..it attempts to tighten “financial conditions” to make credit more expensive and harder to get for credit-dependent companies (and consumers) in a credit-dependent economy. It’s attempting to get investors to be more prudent and circumspect and demand to be compensated more for taking risks.”

This go around, all I think the Fed is hoping to accomplish is bring interest rates back up a little (10 year around 3%) to assist those that have been shafted for the past 10 years.

I surely don’t believe they want to crush all the debt out there. That will crash the system.

The word on noone’s lips is “Hyper-Inflation.” As Wolf is fond of saying “These things work, until they don’t”, what if the Fed does NOT succeed in tightening financial conditions? The markets go UP and UP and UP until no-one can keep pace and a loaf of bread is $5K. The Fed fears hyper-inflation and is trying to get ahead of it at the risk of another financial collapse, the very thing %0 was intended to forstall. The Fed has created a multi-trillion dollar wall of liquidity hanging over the shining city on the hill that threatens to wash the whole country out to sea. What if it’s petty .25 increments don’t “succeed”? Hyper-monetization = Hyper-Inflation. What if this time ISN’T different.

Perhaps it’s because of a different education, but I have been taught there are three kinds of inflation:

1) Regular inflation, from 0.01% to 9.99% per year

2) Mass inflation, from 10% to 49.99% per year

3) Hyper inflation, 50% or more per year

Inflation takes many shapes: consumer prices, wage, production costs etc.

Just to give an example if home prices in a given area go up 12.5% year on year, I say that area has mass inflation in housing prices.

Another example, if the price of a given commodity goes up 8% year on year, that’s just boring plain old inflation in that commodity sector.

As we have been drilled for decades to consider consumption to be the ultimate driver for all forms of economic activity, various consumer price indexes are taken to be the final measure of inflation. Not unreasonable.

However, due to both brazen manipulation of consumer price indexes (see how food prices are adjusted or omitted) and the shift away from consumption and towards financial asset valuations as the ultimate driver of economic activity (can you eat Tesla stocks? Can you drive around in a GE bond?) these days inflation is only used as a chimaeric indicator of monetary policy success or failure, again an indicator easily manipulated and hence gutted of much of its meaning.

So what if the US goes into Hyperinflation? It’s not as if it’s the first country to do so. You know who first invented paper money? It’s the Chinese, and guess what, they too were first to experience hyperinflation.

Basically there’s been a ton of times in the the past where:

1. This time is not different followed by

2. This time is different.

Interesting commentary over at macrotourist. His thesis is that rates will move up slower than expected.

The one point he makes I’m not sure I believe is that the Fed is concerned about the amount it will be paying on “Interest on Excess Reserves” if rates do go up. So the negative press from bankers getting more free money, he contends, will be a factor which slows the increase in rates.

I would think the opposite, and that a group of bankers would be actually trying to get as high a yield as possible on ‘risk free money’. I don’t think they care about bad press (see Wells Fargo!).

Anyone know about the politics of “Interest on Excess Reserves”?

http://www.themacrotourist.com/posts/2018/03/02/newtourist/

Bad economic data is starting to come out with consistency. The reflation trend may be running out of momentum.

There is some protection from the dual mandate. Lay enough people off and the Fed will show us the volte-face.

2018 will be the year of the green, the year of a stronger dollar. Why is people refusing to believe that the age of cheap credit is over?

Maybe they are forgetting what a huge hole “0% Interest rates” put in the US economy?

There is no such a thing a tax cuts, there is tax redirection, were the money the government doesn’t get due to cutting taxes just comes from another source.

That source being cutting government expending, raising existing taxes and creating new ones. Plus printing less money and getting rid of “imaginary money.” aka money that just exists as numbers.

And raising rates is one way to get money the government lost due to abysmal low interest rates.

Wolf, are you gonna do an article of what the US did to cut “government expending” last year?

NO 2018will most certainly NOT be the year of the green regardless of how many quarter percent rate increases we see

FED stops printing ECB and PBOC still printing massively fed hints to Normalise and SNB starts printing a lot, as well as the other 2.

So

How much of the money still poring into US junk, is hot off the Press in Europe and Asia???

Even more so than in the US, there is no REALY work for that new Euro PBOC Money, in its home markets.

Historically when TSHTF, $, compared to others, GOES UP.

We know its a closer WHEN. Than it has been.

On of the greatest periods of $ strength, was Isolationist America.

Mmmm, maybe after retirement account/mutual fund inflow season is over.