Surging home prices have primed the housing market for this.

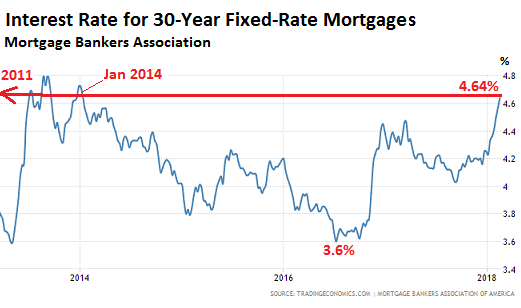

The average interest rate for 30-year fixed-rate mortgages with a 20% down-payment and with conforming loan balances ($453,100 or less) that qualify for backing by Fannie Mae and Freddie Mac rose to 4.64%, the highest since January 2014, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey, released this morning.

This chart (via Trading Economics) shows the recent spike in mortgage rates, as reported by the MBA. There are two spikes actually: The spike off near-historic lows in the summer of 2016 (the absolute low was in late 2012) when the Fed stopped flip-flopping about rate hikes; and the spike when the subsequent rate hikes started belatedly driving up the 10-year Treasury yield late last year. It’s the 10-year yield that impacts mortgage rates. Note that, except for the brief mini-peak in 2013, the average mortgage rate would be the highest since April 2011:

The average interest rate for 30-year fixed-rate mortgages backed by the FHA with 20% down rose to 4.58%, the highest since April 2011, according to the MBA. And the average interest rate for 15-year fixed-rate mortgages with 20% down rose to 4.02%, also the highest since April 2011.

This may be far from over: “What worries investors is that if inflation increases faster than expected, the Fed may be obliged to ‘slam on the brakes’ to keep the economy from overheating by raising interest rates faster than expected,” the MBA mused separately.

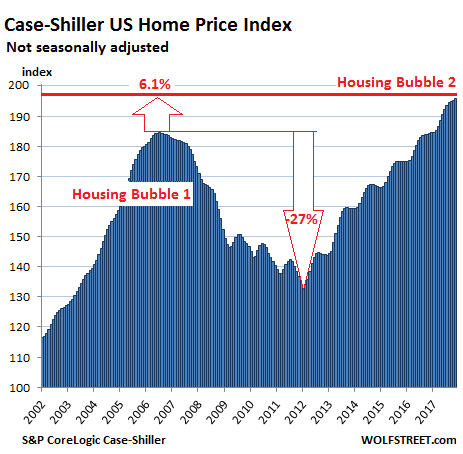

The difference between 2011 and now? Home Prices

Home prices have skyrocketed in many markets since those years of higher mortgage rates, such as 2011 and before. The S&P CoreLogic Case-Shiller National Home Price Index has surged 40% since April 2011:

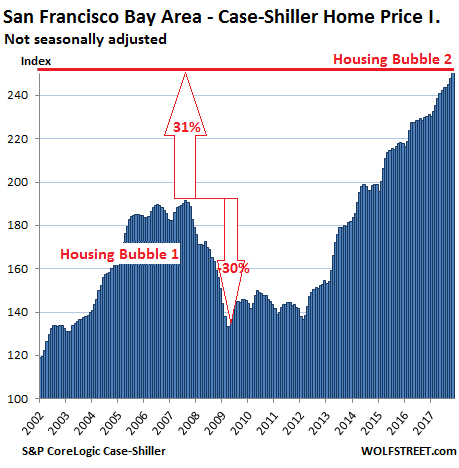

That’s the national index, which papers over the big differences in individual markets, with prices lagging behind in some markets and soaring in others. For example, in the five-county San Francisco Bay Area, according to the CaseShiller Index, home prices have surged 80% since April 2011 [from The US Cities with the Most Magnificent Housing Bubbles]:

So with home prices surging for years and with mortgage rates now spiking, what gives?

Today the National Association of Realtors reported that sales of existing homes fell 4.8% year-over-year in January – the “largest annual decline since August 2014,” it said – even as the median price rose 5.8% year-over-year to $240,000.

I’m not sure if the new tax law, which removes some or all of the tax benefits of homeownership, has had an impact yet since it just went into effect [What Will the Tax Bill Do to the Housing Market?]. But the lean inventories and falling sales combined with rising prices tell a story of potential sellers not wanting to sell, and this could be exacerbated by the new tax law.

And they have a number of financial and tax reasons for not wanting to sell, including:

- They’d lose some or all of the tax benefits that they still enjoy with their existing mortgages that have been grandfathered into the new law.

- Given the higher mortgage rates that they would have to deal with on a new mortgage (which might exceed their existing rate by a good margin after repeated refinancing on the way down), and given the high prices of homes on the market, they might not be able to afford to move to an equivalent home, and thus cannot afford to sell.

Housing markets move very slowly. But the first thing that happens when the dynamics change and things get iffy is that sales are slowing down even while prices still rise.

If the Fed raises rates four times this year, and if the yield curve steepens even a little to edge back toward a normal-ish range, as I expect it to, average interest rates for conforming mortgages may well be around 6% by year-end. And that, I think, would mark the real pain threshold for the housing market.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

QE-unwind is on track and following Sep 2017 plan. Mortgage rates can only go up now, and housing prices will go down shortly if they have not already peaked.

Why will housing prices drop in the near future? If you own a home, why will you give up the tax benefits due to the grandfather clause? I suspect the supply will get tighter with almost nobody willing to forego the benefits unless they have a financial compulsion due to loss of job etc.

So a recession is probably required for the status to change. Or may be building of new homes.

Debt is the factor that will pop this bubble, I am pretty sure debt is always a driving factor. A lot of these families relying on low taxes are most likely to be relying on HELOC’s to pay for expenses instead of saving up to pay. The HELOC is nice when your value goes up, your home value covers your debt, when your home value goes down you are left owing what you borrowed.

This will be what shifts the market, borrowing instead of saving because savers are considered losers in this market until the market collapses. It will collapse, they always do. Just a question of when.

This is what will do it, just like in 06-07. People used their houses as ATMs and got used to being paid $50k a year or so to live in their houses. Then the values started leveling off and then falling, and the usual hiccups like a job change or loss, car repairs, etc. that they cured with another HELOC loan, had to be paid out of pocket and they didn’t have anything in their pocket.

People were losing $750k houses over say, a couple thousand dollars in car repairs. Or the loss of their spouse’s $30k a year job.

Even with a HELOC you still need to qualify with income.

Broker Dan – I think it was based on whether there was equity in the house. Banks love to seize appreciating assets!

Then the houses were not appreciating, and jingle-mail became a thing.

These same kind of HELOCs are being pushed where I am, on the radio. “Based in your house, not on your credit”.

Alex,

If MEWs are the trigger as you suspect that’s actually bullish for housing, given that they just went positive for the first time in roughly a decade last quarter (which would imply they have a long way to go before they’re a factor this time around).

>The HELOC is nice when your value goes up, your home

>value covers your debt, when your home value goes down

>you are left owing what you borrowed.

Home equity allows you to go into debt, but it doesn’t make your monthly payments.

Steve,

In Canada the houses have been positive for 20 years until last month. Depends where you measure positive, the top of asset inflation or at the correction level.

Enjoy the ride.

A local radio station–Alex, you might have heard it–is running an ad by a lender (‘Cash Call?’) which declares ‘Your house is your ATM!’

I thought that HELOC debt was actually pretty low right now- am I wrong?

Broker Dan: While the feds and other central banks were printing money, all assets had to go us since the more money they print, the lower their values. Now, that they are reversing that trend expect the asset prices to go down. There is a very slippery slope from here. It doesn’t matter if people want to stay in their homes or not when they can’t pay their debt as the interest rate goes up. Most people are living pay check to pay check.

Some boomers may decide to sell this Spring because they are counting on the home equity for retirement. If housing prices fall, their retirement outlook would fall with it. This is reason for them to sell now and downsize to a smaller unit or move to a lower cost area. Plus, with rates going up, they can invest the proceeds and actually get a decent safe return. I know several people in that position.

I know one Boomer skedaddling over to Arizona (from Sunnyvale) as soon as his son graduates from high school. I know another Boomer couple who are going to be essentially forced to move soon, as the house is 2-story and unless they massively remodel the place to install an elevator, the wife’s increasing inability to negotiate the stairs will necessitate a move to a single-story place.

Smarter Boomers (I think there are some?) ought to sell now while prices are still crazy, and move to smaller, more conservative places, maybe with some land for gardening.

Bobber spot on: exactly what i am going to do . Also the effects of rising interest rates will weaken other segments of the economy. Investments will become less speculative.

If they waited to sell this spring it may already be too late in my opinion

I am a retired boomer who recently sold his overpriced home of 23 years in Sunnyvale and moved to a cheaper place. Everything worked out fine and as planned financially except for one major detail that I miscalculated due to not being up to date on tax law. Capitol gains tax on my Sunnyvale home are about to deal me a major kick in the teeth. Take this into account if you are a long-term homeowner contemplating a change.

ft, hopefully you have kept track of all capital improvements. They are deductible.

FT, take your 1 time exemption from capital gains on the sale of your residence. I believe its up to $55,000 in capital gains you can exempt. Its been a while so you the cap may have increased.

Lance, thanks for the tip. I did keep track and they will help a little.

Steve, thank you also for your tip. I have put my case in the hands of a tax professional who will figure out my best options.

Ahhh yes the ‘people will just stay put until the market recovers’ argument – one of the usual straws grabbed at by the over-indebted! And a complete load of rubbish, of course.

Of course [smart] people will sell because they realise that their next step up has just become more affordable – and hence the fact they get less for their own place is irrelevant, because the bigger one they’re buying just became even less expensive.

And so it goes.

The dumb ones will just sit there letting opportunities to upgrade pass them by, because they’re not willing to sell their home for ‘less than it’s worth’.

“A man’s view of the future depends very much on the level of debt he carries” – so true.

I tend to agree. Here in Seattle, there is an amazing shortage of homes which are suitable for first-time buyers. If mortgage rates go up, people will feel locked-in to their current situation.

The practical result will be an increase in remodels and extra bedroom projects, which will actually reduce the supply of starter homes.

I don’t see that new construction will help. Any suitable land is so far away that it is un-commutable, and anything like high density can only get funded as “a condo”, which is not what young married couples wanted.

There are no easy answers.

People keep talking about QE unwind, but there won’t be much unwind.

In testimony, during his confirmation hearing, Powell stated the Fed balance sheet will be kept at or above $3 trillion ($3 trillion is the new floor he stated). So even if the “unwind” was fully implemented it would only add up to $1.4 trillion. I understand this is (or once was) a significant sum but it’s planned to be offset by the Trump stimulus – remember, as Cheney said, Reagan proved deficits don’t matter.

The Fed balance sheet is just a shell game. The Fed has begun to monetize government spending and by keeping a “balance sheet” they can pretend the money will be paid back one day – this will never happen.

How do I know the Fed will keep printing money until it has no value? Because the Fed has to print money to raise the funds the government spends. Government deficits are large and structural – we are locked into ever increasing debts that have to be paid with new Fed issued currency. If something has to happen you had better bet it will happen.

The possibility of avoiding hyper inflation died when the current government decided to cut tax revenue and increase spending and grow the government. The die has been cast, Caesar has crossed the Rubicon, there is no turning back – you cannot avoid the fate your leaders have dealt you, acceptance is all that remains. Accept your fate, Caesar is coming for the Republic.

when FED was jaw boning easing when you think market is terrible, you will be punished. When fed jaw boning tigentening while you think they can NOT, you will be punished. There are too many people think the FED can NOT tighten due to spending, wait and see what will happen. I will NOT be on your terms to your anticipation. They own you. The moment you think there is something they can NOT do, they will do it to you.

Tax cuts w/o spending cuts are really tax deferments.

When they increased spending with the new budget, the market realized what is coming.

Hyperinflation is the only possible outcome.

Thirty-five percent of homebuyers in the U.S. aren’t even visiting the property before they put in a bid, amid torrid competition in a tight market, according to the latest survey by Redfin Corp.

The survey, conducted in November and December, polled 1,503 people who had purchased a home in the previous year. It found that the proportion of those bidding sight unseen was almost double the 19 percent reported in June 2016

An interesting twist to the story is the number of new homes on which ground is being broken. They’ll compete with home sales. In a market with rising interest rates that make it expensive to buy and sellers not interested in selling, the rentals are a substitute to homes. The rentals then get more crowded. Most of the new constructions are for luxurious high end where customers with disposable incomes can afford rents but not homes. Most people I know make almost 350k a year but can not afford to buy or rent these luxurious places while being able to support a family in Bay Area and save.

I am waiting for the developers to build affordable homes instead of apartments.

I wonder if the people can overturn the moratorium, fill the bay, and build homes between sfo and Oakland, San Mateo/ Mountain View and Fremont/ Milpitas.

Don’t buy houses – problem solved.

The typical newly formed household may want to live in a dwelling but they simply can’t afford it. You can’t have what you can’t afford. I would like to live in a chalet in Switzerland but it’s just not possible.

Those who currently own houses have the luxury of living in a dwelling the rest of us can and will do without. Upside is: those with houses also get to pay for bloated local government – those without houses get to ignore the useless local government. You want to hire “heroes” to sit around a fire station playing cards, in the off chance someone’s house may catch on fire, than fine you pay for it and pay them to “retire” at age 45 with a fat pension.

Your system is broken – just keep ignoring this fact and hope it will work out for the best.

> Upside is: those with houses also get to pay for bloated local government

Unless you’re literally homeles, as in not living in any sort of shelter structure, then you’re paying property taxes too; it’s built into rent.

I don’t think filling the bay will happen in your or my lifetime. However, more high rises are already sprouting like mushrooms and there is quite a bit of ways the cities can grow vertically. Call them apartments and rent, or condos and sell, it does not matter. There are already tens of thousands of units coming online very soon or have come online in the last year or two. Now, they are high end apartments renting for $3-4K a month. Sell them, and prices will be around $1 million more.

It is already putting a pressure on the rental market around Bay Area.If you go to Zillow or Craigslist, you can see almost all apartment communities have vacancy and most are offering significant incentives such as 1/2 or 1 month free. I even saw 2 months free right before Christmas. They may still be offering the same or better incentives.

More of these units are coming online. In South Bay, El Camino has been turned into a construction zone. From Santa Clara to Palo Alto. Quite a few construction projects are going on at the moment. They will put even more pressure on the market as they come online. As the market turns, you will see that some of these units will be turned into condo projects and they will try to sell. Now, I think that will be a good pressure on the market when the time comes. Say you have a 3/2 1200 sqft 60 year old house in Sunnyvale sitting on a standard 6000 sqft lot. It has seen minimal upgrades and you can sell it for $1.6 Million today. Easily. When a brand new 1400 sqft 3 bedroom condo comes to market at $750 K, what do you think will happen to the $1.6 Million 60 year old house?

I know that Bay Area is different. You can only see $750 K condos in your dreams. Tech is the big winner. There are always jobs in the Bay Area. People are spoiled. They don’t care. They are even stupid. They make easy money so they don’t even know how to spend it. I get all of that.

You know what, the overnight drop in share prices of FAANG stock just a couple of weeks ago was a huge warning sign. I am willing to bet, that alone will affect home buying decision of a lot of people in the Bay Area. Think about it. You are a genius Google engineer who has been around for a while, has $1 M in Google stocks, it only goes up and up and up. And then, one day, you realize your stocks are not worth $1 M any more. They are worth just $900 K. For no apparent reason. Just the market thinks that way. Yeah it recovered, but it left a big question mark in the minds of those genius engineers. Imagine what happens if there is an actual recession and Google and Apple stock goes down 50% and stays there for a while. Based on what we have seen just a couple of weeks ago, this is a very real possibility.

And then how will the geniuses on Apple and Google campuses afford the 60 year old $1.6 Million dumpsters in Sunnyvale?

Great post ASE!

+1

Adam Smith Engineer – There are tons and tons of empty lots in San Jose. Even with all the building, there’s still an immense amount of room. This is why my reaction to Google’s proposed complex downtown is “meh” because where they’re planning to build is a mass of vacant lots, empty buildings, and blighted properties. I know one place down there, a pawn shop, has a dirt floor. Classic Silicon Valley. I’m typing this from a building that started out as a fruit-drying shed and has no running water. Again, classic Silicon Valley. The digital slum with a little shiny filigree added.

Most jobs here are not tech jobs. The biggest employers here, I believe, are Safeway and Kaiser. Runners-up are things like the Valley Transit Agency and the penal system.

Not only that, but most tech jobs, in that tiny sliver of the economy, are not $100k+ “genius engineer” jobs. They’re jobs that pay $12 an hour. Starbucks treats its employees better than 99% of tech companies.

I would advise any young person to go into tech only if they really and truly love it. If they’d work as a janitor and after work do stuff with computers, then and only then do stuff with computers. Because going into tech for the (supposed) money is almost certainly not going to work out well. Meanwhile music teachers and musicians in general I know are doing fine. I studied tech. A guy I know studied sax and clarinet. He has a house in South San Francisco, I live illegally in my office.

Or basket weaving. There’s a fine career. I’d probably have done fine doing that. Set up with a bunch of baskets, weaving away on another, at the swap meet or alongside the Monterey Highway, I’d probably own that house and have paid it off long ago.

TL;DR: Don’t try to get paid to do tech unless you love it so much you’d pay to do tech.

Alex, your nonsense about jobs and pay in San Jose is misplaced here. You’re lying to everyone here, and you know it. I don’t know what your agenda is and why you’re spreading this misinformation. From now, I will block all your comments that relate to this type of misinformation.

Here is a list of major employers in Santa Clara county where San Jose is. Check it out. You won’t find “Safeway” on it. These companies pay their employees a lot of money:

http://www.labormarketinfo.edd.ca.gov/majorer/countymajorer.asp?CountyCode=000085

Adobe Systems Inc San Jose Publishers-Computer Software (Mfrs)

Advanced Micro Devices Inc Sunnyvale Semiconductor Devices (Mfrs)

Apple Inc Cupertino Computer & Equipment Dealers

Applied Materials Inc Santa Clara Semiconductor Manufacturing Equip (Mfrs)

Avaya Inc Santa Clara Telecommunications Services

Christopher Ranch Llc Gilroy Garlic (Mfrs)

Cisco Systems Inc San Jose Computer Peripherals (Mfrs)

E Bay Inc San Jose E-Commerce

Fujitsu Laboratories Sunnyvale Venture Capital Companies

Great America Pavilion Santa Clara Amusement & Theme Parks

Hcl Technologies Ltd Sunnyvale Computer Software

Hp Inc Palo Alto Computers-Electronic-Manufactu

Intel Corp Santa Clara Semiconductor Devices (Mfrs)

Kla-Tencor Corp Milpitas Semiconductor Devices (Mfrs)

Lockheed Martin Space Systems Sunnyvale Satellite Equipment & Systems-Mfrs

Lumileds Lighting Co San Jose Lighting Fixtures-Supplies & Parts-Mfrs

Microsoft Corp Mountain View Computer Software-Manufacturers

Nasa Mountain View Government Offices-Us

Net App Inc Sunnyvale Computer Storage Devices (Mfrs)

Nsg Technology Inc San Jose Computer Peripherals (Mfrs)

Prime Materials San Jose Semiconductors & Related Devices (Mfrs)

Sap Center San Jose Stadiums Arenas & Athletic Fields

Stanford Children’s Health Palo Alto Hospitals

Stanford School of Medicine Stanford Schools-Medical

US Veterans Medical Ctr

Alex, you spread the same type of misinformation on DHB blog before everyone got tired of it and you left.

Let’s talk reality please.

You’re stuck in the gigs!

I worked for Mphasis the 2nd largest outsourcer 2010-14 then Tecsystems La’s biggest gigger.

Tech is very good ol boy, I mean I did a contract at google in ’10 and it was begging for the issues it is now having.

But the Tech industry also pays crazy if you get in ground floor; that is late carrier. And you have to be ruthless… Yet I had 1 year as am infrastructure engineer and apple offered me a contract to manage the apple store server bank for 50k… What I didn’t realize was that was “initial.”

But you have to jump gigs a lot to get the winner. And the smaller the outfit the better.

So you get 12 dollars as a newbie… 25 at mid level… 80 as a dying tech you specialized in to retire.

However, I’m more sympathetic than Wolf. In Los Angeles my last job was telling qualified folks they could get 12 bucks an hour. There is real stratification in tech, its not what but who and the bay area folks are odd…

This so cal boy couldn’t fit… Even in La. Moved to Yankee New Hampshire and life is easy.

I know all kinds of people who work in tech at various levels. They all make good money, a lot more than the lower figures you mention, but somewhere around the upper figure and higher. None of them are gig workers. Plus they get other goodies, such as stock-based compensation. I know the median income data for the different counties, and it’s high. So sure, there are people who work in restaurants or drive for Uber, etc. but those who work for the many tech companies in the area (not as contract bus driver but as actual employee of the tech company), they make good money … though of course, this doesn’t buy a whole lot of housing in the Bay Area :-]

Average glassdoor pay with any of those major engineering companies in that area is at least $150k. A nice step about the average of about $100k every where else base. And those are salaries being washed out by entry level.

If you are in tech and willing to live in any of those bay area locations the big companies always have their recruiters spamming linked in engineers with opportunities.

In addition – easy money policies have driven investors at home and abroad in search of yield. Real growth in ‘value’ stocks are hard to come by/already crowded/priced in. What is a quicker way to see your investment grow than a hot tech stock. Tech companies need a great story, a bevy of tech engineers, and some indicator of growth (increasing clicks, eyeballs, etc.). This counts as growth, even when there is no profit. Case in point: here in Alameda we have 5-6 food delivery apps. Every one of those app development co.’s has a stable of highly paid coders.m, and they spend tons of money on marketing and scaling. Do we need 5-6 delivery apps? No, maybe 2-3. When the easy money goes, half of these apps will likely go belly up. That will release all those engineers, increasing supply, lowering starting salaries, and a potential exodus from the high cost Bay Area. California has always been boom/bust. You know it’s time for a bust when my engineer friends scoff at a downturn stating ‘this time is different’. Of course history doesn’t repeat, but it rhymes.

Bay area is different but it is not immune to housing downturns

Last time.. 2008 to 2011.. housing in bay area went down more than 40 percent or so..

Hello Adam, how livable will these areas be with all that expansion? Let me rephrase…is there a proportional infrastructure being built to support these sizable projects?

You guys all live in the wrong place. There is very affordable housing on the beautiful Gulf coast with warm weather year around, warm enough water temperatures to swim, and few of the mass population problems that are present on the West coast. This stuff is simple – just leave and prices will drop. It is all supply and demand. So quit complaining and do something as simple as LEAVING. DUH!!!

No. Please. Disregard this last post.

Stay where you are!

Don’t move here, it’s horrible – possibly even worse than where you are now. Really!

Everyone usually quotes the 740 fico, 20% down, W2 employee scenario. IF any one of those 3 elements is missing or less than perfect, a 7% to 9% rate is not only possible, but probable. Even Fannie Mae 5% down with 679 fico, the rate ends up being .5% to.75% higher AND once you factor in mortgage insurance, the ACTUAL cost of funds is well over 6%.

IF somebody is self employed, has GREAT income, millions in the bank, but unfortunately, documenting that income is tricky, EVEN WITH 35% down, they could end up with a 7% to 9% interest rate. Dodd Frank has destroyed private mortgage lending; 97% of lending is Fannie/freddie/fha/va/usda and the other 3% has to be underwritten to Federal guidelines. Housing WILL NOT truly recover until Dodd- Frank is repealed. (housing prices going up does not mean the market is functioning properly – it is obviously a monetary phenomenon). ADDED NOTE: Canadian Housing market being supported by Fentanyl sales. (Chinese buy real estate with all the cash from fentanyl )

Canadian residential real estate sales crashed in January.

One of the largest one month drops in history. Fell off a cliff.

http://www.betterdwelling.com/canadian-real-estate-sales-see-largest-drop-since-2008-heres/

Latest numbers in the Canadian retail sales sector for December, show that the amount of retail sales fell off a cliff.

Another “clue” that the supposedly “healthy” economy, has not made it out of its sick bed!

Waiting for the next shoe to drop.

Sorry but Dodd-Frank and the QM mortgage created sound income based underwriting.

They ran Actuarial tables during and after the mortgage meltdown and the number one variable that led to default was not down payment or skin in the game it was income verification.

If this is indeed a bubble it is not solely due to Exotic loan products as approximately 95% of all loans written are income-based.

I know you can get away with 10% down minimum and keep decent rate if as you note you have a steady high income and great credit score.

But you will get forced to pay all costs monthly through an escrow. And the PMI terms can get downright unfriendly.

The lenders exhibit a good amount of distrust but at least they keep the rate low.

FHA will always give you a super low rate. But their new PMI terms are 2 to 3 times the cost of a conforming loan and pretty much permanent regardless of future LTV. Only way out would be to refi which I wouldn’t count on being favorable given rising future rates.

Ranger,

Sorry but so much of this is incorrect (I am a lender).

If you put 10% down you do not need to escrow. Less than 10% or go FHA then yes you do.

You don’t need a great score for conventional 10% down, and actually technically you can get a conventional loan with only 3% down and as low as a 620 fico score. Of course no one takes that loan bc FHA will be much much cheaper (both rate and PMI). Essentially if you are lower than 700 fico with only 3-5% down, FHA is superior.

FHA PMI is permanent unless you put 10% down.

BTW, you can technically get an FHA loan with 3.5% down and a 580 credit score.

Must have been the particular lender forcing the escrow issue for paying taxes monthly for under 20%. At least 2 noted that was their requirement. But if it is not a Fannie Mae rule then it’s would just be up to the lenders discression.

Every FHA I looked at wound up costing more than a conforming loan after upfront fees and their PMI versus PMI for a conforming. Even though yes the loan rate was lower than any conforming. Perhapes that’s not universally true or rather definitely not true if you have a low credit score. My assumption probably only makes sense if you are 740+.

Housing prices came roaring back from the Great Recession. Look at the indexes on home prices, think they went up lockstep with incomes? Prices will come down, how much, who knows. Lets see how the new Fed boss responds if there is a big market sell off (>15%) from where we are now. HELOCS & ARMs will come back to haunt those who overextended, didn’t do the math or just wanted to live like the Joneses. $250B in Treasuries sold this week and sounds like it was a breeze. The rolloff and deficit should but more pressure on rates.

What makes you think central banks will allow housing prices to reverse. I think a drop in prices is not acceptable for the central banks – they will flood the world with currency before that happens.

Plus, with the current government working hard to devalue the currency foreigners need to spend the dollars they are holding to purchase any asset they can get before they are left holding worthless dollars – house prices can never go down, the last bubble proved it. If house prices have a tiny dip just wait a year or two and they will be back higher then ever.

Bernanke turned houses into investments – something to purchase to retain wealth. If you need a house to live in you’re out of luck because there will always be a wealthy investor who can outbid you. Living in houses is so last century. All of you young people looking for a place to live need to start looking at vans you can park overnight at Walmart and remember to be thankful you weren’t born in Ghana or some other country POTUS calls a “shit hole”. How bad do things need to be before you are forced to admit you may, in fact, be inhabiting a “shit hole”.

One day, you will find that the FED is busy protecting themselves and US gov that they will NOT heed house and stock market. I am NOT saying they are cornered or powerless. I am saying house and stock market price is secondary comparing to themselves and government.

“What makes you think central banks will allow housing prices to reverse.”

Because they simply don’t have a fraction of the power to control the markets that you think they do.

If the Chinese authorities– who are FAR more interventionist than the US– couldn’t stop a stock market crash in 2015, what makes you think the US can?

“I think a drop in prices is not acceptable for the central banks – they will flood the world with currency before that happens.”

How? Prey tell, what mechanism will they use to “flood the world with currency” that could stop a active devaluation of housing? And at what point? Would they step-in at a 5% drop? 10%? 20%?

“House prices can never go down, the last bubble proved it. If house prices have a tiny dip just wait a year or two and they will be back higher then ever.”

But that’s the thing: you’re objectively wrong, and in a huge way; you’re totally detached from reality. In some of the hottest markets in the country (e.g. Boston, Seattle), it took close to a decade to get back to previous peak levels. 2/3rds of all houses in America still haven’t recovered to previous peak levels (Trulia, 2017).

>Housing prices came roaring back from the Great Recession.

Easy credit and increased borrowing limits came roaring back.

Spiking mortgage rates, declining sales, record high home prices, and new tax law can’t help the housing market.

But the big question is – what will falling stock prices do? Stocks and RE fall together. If stocks fall fast, this has potential to drop RE very quickly, more so than than the other factors.

When stocks fall, the job picture gets tougher, stock compensation suffers, retirement funds drop, and people feel less secure. People don’t feel like buying a new house in that situation.

Small business confidence at record high

Unemployment at record low

Inventory also ridiculously low

Many argue that the huge run-up in rates will cause potential sellers to rethink their next move up because that same money they had locked in at 30 years in the mid 3s is now in the mid 4s. This may exacerbate the inventory problem.

The inventory problem is not a myth I know firsthand as someone who bought property 7 months ago and who also works in the industry as a lender.

There are many factors both pulling housing up and contributing to a potential pull back I guess the true answer is nobody knows at this point.

Actually in many ways.. lack of affordable inventory is a problem

https://www.cnbc.com/2018/02/21/homeownership-is-increasingly-for-the-wealthy.html

The sharp drop in January home sales was not due to a shortage of homes for sale. It was due to a shortage of affordable homes for sale

Jon – good point.

What’s funny is, anyone who’s apartment-hunted knows a studio rents for more per square foot than a 1 or 2-bedroom. So why aren’t developers making tons of studio apartments? That should bring in the most profit.

Does a hive of studios end up with a “run-down college dorm” vibe that lowers rents? Do tenants move out too often once they pair up and a kid’s on the way? Are there too many parties in those small spaces?

That won’t be a problem if lack of demand for that overpriced inventory causes those prices to come down, which will filter down to lower priced homes and pressure their prices. This happened during the last housing bust, and it solved that overpriced-inventory problem, along with a lot of other housing-affordability problems, but that market fix wasn’t allowed to work itself to completion, and prices were reflated (ZIRP, QE, etc. to “heal” the housing market).

The market knows how to work this out, if we just let it.

“Small business confidence at record high” – confidence is pretty much irrelevant when it hasn’t flowed through in any substantive way via capex etc.

“Unemployment at record low” – pretty much irrelevant given that alternative measures of employment show the picture is still largely grim. The labor force participation rate is about 5% lower than previous periods of “full employment” (4-5% unemployment rate), which effectively means the unemployment rate with a normal labor force participation rate would be closer to 10% than 4%.

I do agree about inventory. I’m sure there’s plenty in Topeka, KS, but not where the jobs and people are going.

Wolf you have listed the places with the highest prices, we can one get the.places with the lowest prices?

Even if working from home is dying, is something I guess a lot of people wanna know.

I’m pretty sure the least expensive places to live are small towns far away from the coasts and cities, or better, in the countryside entirely, such as a cabin in Arkansas but in an area where no one has cabins. Or buy a used motorhome and stay at nice places where you don’t have to pay. There are options. But once you decide to go for a big city, everything is a lot more expensive, even relatively cheap cities.

My rent reports list the 100 most expensive rental markets. The bottom ones are already pretty cheap. But that’s the most expense 100. There are many more that are a lot cheaper still.

Much depends on what you’re looking for, in terms of your daily life. Cost of living isn’t the only thing. You also want to be happy :-]

Besides what Wolf has offered, let me add, do a lot of homework on any place you are considering that you are unfamiliar with. I spent 10 years in relocation mode and found many places that looked good on paper had idiosyncrasies that I couldn’t abide. Things like I love the area and the houses, but a hydrogeologist friend of mine warns me that the area uses wells and two resorts up on the mountain were drilling ultra deep wells to ensure a long term water supply. And did I want to deal with those problems in retirement? I am remodeling the house I have been in since 1994.

I am not saying not to relocate if that is your wish. Just do your homework and visit the area several times, preferably in different seasons if possible.

As a geologist, I was concerned about possible geohazards. Every state has a geological survey or Dept. of Natural Resources. For several areas I was interested in, I called and expressed my concerns and asked about the areas in general. These folks answered my pointed questions and then provided me with pretty detailed overviews of life in these places.

You need a local perspective though, and not just info from the so-called ‘experts’. I supposedly live in a flood plain area, on a river. Our property has never flooded, and won’t because the opposite side of the entire valley is at least 5′ lower elevation, plus the valley spreads out. I have seen geo-tech engineers come in and mandate an electrical service shed for a smallish lodge be rebuilt on 12′ concrete pilings due to this designation. People have only lived there 200 years, what do they know?

Most of the excess regulations involve a bank insisting due to the mortgage/financing involved. If you pay cash you can make common-sense decisions.

As a local I see outsiders purchase properties you wouldn’t let your worst enemy buy. The RE sign goes up and soon it is sold. They listen to the Agent instead of talking to the neighbours.

regards

Your last paragraph is exactly to my point. Talk to anyone who will talk with you. Folks on the ground know the lay of the land, so to speak. And little things can become big things when something as expensive as a house is involved.

Regards to you

Rising rates will cause home prices to go even higher because everyone will be locked in to their low 30 year loans. There is no catalyst that would cause everyone to suddenly sell. It looks like we may have low inventory for decades to come.

I don’t believe long term rates are going to go that much higher. If I’m right, housing prices will be affected, but not hugely. I do agree that supply of housing will stay constrained in areas of demand.

The Fed has some very powerful market controls. They initiated the stock market sell-off to put a cap there. Some money was leaving bonds and going to stocks.

And they are controlling the bond market. 3% on the 10 year or thereabouts. And yes, fiscal stimulus will be forthcoming to pick up the slack as rates have slowed things down a bit.

And finally, I agree they will not significantly reduce their balance sheet; this they cannot get away with. It will be reduced some but more talk than numbers.

We’re only several more years or less before another round of QE will be needed.

If the FED had market controlls QE2 wouldn’t have been necessary. The fed is a bunch of clowns.

Prior to 2008, the Fed and our government did NOT have the type of market controls that I belive they utilize today. And as I’ve said before, their controls cannot control a black swan event (08 was one such event) if major and continued selling results.

That said, it seems quite clear that since 08, the markets have been “managed” and the only entity powerful enough to do this is are the CBs and US Treasury.

Don’t get me wrong, I do not like the situation we are in but just stating what seems to be the reality.

Prior to 2008, the FED wasn’t printing money. Their balance sheet barely budged. They bought assets under Bernanke to bail out Chinese investors in Fannie Mae.

Money is created by making loans not the fed. But the multiplier since 1997 has been in Asia. Today, we are in a situation we haven’t been in since the 30’s when Roosevelt took us off the gold standard.

The common idiocy is that the US has 17 Trillion in debt. The value of gov’t debt isn’t what we owe, it’s what has a prospect of being paid back. None of that is going to get paid back.

It would not surprise me at all if the Fed engineered this recent stock market correction in preparation ahead of this week’s large Treasury bond sales.

Fed minutes today caused the 10yr to bump against it’s 2.95 resistance and mortgage rates spiked. We’re now at 4 yr highs for mortgage rates.

Powell seems not to care, so maybe we are seeing a big change in policy and higher rates are here to stay.

I don’t agree. Retirements, divorces, foreclosures, investors looking to cash out. There are lots of reasons for people to sell. Also, it only takes a few sales at the margin to move the whole housing market. Most people will sit on their home, as you said, but if 2% of them decide to sell at a lower price each year, everybody’s fair market value drops.

This is the beauty of housing market

The technical term is “comps”.

Not decades. We are already late in an expansion. A recession within the next few years is a lock and that by itself will provide a hefty kick to supply.

“There is no catalyst that would cause everyone to suddenly sell.”

Seriously?

Wages have barely budged in a decade. Savings are at or close to pre-recession lows. Credit usage close to all time highs. Income to house price ratio close to if not at all-time highs.

A middling recession would cause an affordability problem for plenty of people, even with 0% interest rates.

Uncle Bob,

While I generally agree with the premise that people will be reluctant to sell (locked in low 30yr rates, loss of tax incentives, etc), there will always be someone selling due to other uncontrollable factors (death, divorce, loss of job). All it takes is a few of those homes to sell lower and affect the comps.

Then psychology takes over for those who may have some equity and were on the fence, thinking about selling. Push a few of those folks over and then what begins as a trickle will turn into a race for the exits as people see 50-100K drops and try to front run those in some of the higher coastal areas.

Flippers (investors) will be one of the first groups to bail as they see any potential profits erode and get weighed down by carrying costs. Then you’ll see those that purchased in the last 1-2 years quickly assess their situation and may bail as well.

Couple that with any real significant and lasting decline in equities and you can kiss that 80% rise since 2011 goodbye (San Fran).

Then look out below…….. always happens, just a matter of when.

This may be true about the comps but also remember that well priced properties today get cash offers with no contingencies or 20+% down buyers waving their contingencies as well.

So that property that waived any appraisal contingency and closes at the accepted contract price just became a new comp at a higher amount which can potentially offset other comps you are referring to that will drag down the market.

“Always happens, just a matter of when”

Forgive me, but apart from the 2008 crash, when has housing gone down appreciably at a national level? That was the whole reason everyone said “can’t happen” – it had never happened in the USA!

Yes markets are bubbly, but let’s not extrapolate a single data point.

Have a look at historical Case-Shiller:

https://fred.stlouisfed.org/series/CSUSHPINSA

Please Look at this..

https://fredblog.stlouisfed.org/2017/10/incomes-determine-house-prices/?utm_source=series_page&utm_medium=related_content&utm_term=related_resources&utm_campaign=fredblog

@Jon – I agree prices can be volatile regionally, but you’re cherry-picking a market most known for that. My comment was that prices haven’t historically gone down *nationally*. I guess that wasn’t really Eric’s point though – he didn’t say *nationally* – so we were sort of talking past one another.

Housing in real terms has fallen nationwide a few times. Since we are looking at 30 year loan terms it is more appropriate to consider real prices, not nominal. I still think your point is a good one. I’ve modeled US housing and, although you can get stat significant predictions from fundamentals, using only three prices “cycles” makes me nervous.

Okay, always may be a bit strong, I’ll give you that. I’ll also own up to my bias lens as a product of growing up in SoCal in the 80’s. I can remember my parents buying a home in 88 only to see the bottom drop out and get crushed in the early 90’s, then waiting another 10 years to break even, only to see it drop once again in 2008.

Many places nationally didn’t participate in the first run up prior to 2008, so their really wasn’t too much of a crash. However, this time, it truly is different, as many parts of the country have all run up way too far, too fast.

I guess my point is we all know that real estate is a cyclical market and unless the Fed just keeps printing away, there’s no way this holds up at these nosebleed levels in Southern California.

It is extremely hard to pin down one measure of housing costs the easily show all peaks and valleys in the housing market. The popular case shiller measure hides a number of more regular smaller hiccups in housing prices over the past few decades.

If you Google analysis of housing ressions over the past 50 years you should find the case shiller measure paints a rosey picture of a mostly ression free past which isnt the whole truth.

It’s still a good measure but it is by no means a complete picture of rising and falling home prices.

The true behavior of all home sales and values accross numerous neighborhoods is simply to complicated to track with one measure.

Several things I think you’re missing in your conclusion is that people that sell still have to find a place to live. This is the primary reason that so many boomers are retiring in place. Only in the case where one sold in a cost area and was willing to move to a low cost area would this make sense. Most have family, ties, etc. so this isn’t an option they want to consider. So yes, there will be sellers but not the level in past generations. And remember, Boomers are getting older and as such contemplating a move is exhausting at best. So I do believe that supply will stay restricted for many years.

Secondly, I do not believe the mortgage risk is anything comparable to 2007/08. We’ve personally sold, bought and refinanced in the last 3 years and from my experience and others, the underwriting is very stringent. This wasn’t the case before….unfortunately.

So while prices may stall in some hot areas and even perhaps trend down a bit, I don’t see the mechanism in place for a massive rush to the exits. That is of course if I’m correct on long term rates which I believe will NOT move signficantly higher from here, and the 10 year staying around 3%.

Don’t get me wrong….I’m not a big fan of our current economic “majic”

But trying to analyze rationally. Hope this enlightens; maybe not.

The word from the street today was that the fed would only raise rates twice this year and rates rose on the news.

I think people misread the feds affect. The 10 year at 3% has already set the stage for a 6% mortgage. All we need isd! an actual MARKET for interest rates.

Heaven forbid!

A 6% mortgage rate would cause the junk bond market, to unravel. That would cause contagion (remember that word) to all bundled debt products. IMO, a 2% rise in the mortgage rate would cause about $7 trillion in bhas $7 trillion in book losses.

“The word from the street today was that the fed would only raise rates twice this year and rates rose on the news.”

That “word from the street” was a bogus effort at market manipulation. It worked for a few minutes to drive up the DOW, then reality sank in and the DOW dropped 440 points in 1.5 hours. And the 10 year yield jumped to 2.95%.

I got a kick out of the very young financial guru’s on Bloomberg today saying the market was “over reacting”. No money manager over 50 would ever say a market was wrong. It’s a market! haha

I think Wolf, you’re one of the lone wolf’s out there talking about mortgages. I’ll bet David tepper is shorting the shit out of them.

“They’d lose some or all of the tax benefits that they still enjoy with their existing mortgages that have been grandfathered into the new law”

Doesn’t this impact a very small segment of the population? I seem to recall reading that at most only 2-5% of homes have mortgages greater than 500k. I don’t have a source just remember seeing it.

With the exception of a few crazy priced markets like in CA, this tax change mostly impacts upper class households. Those households typically are buying for status and not for tax benefits. My 2 cents.

With that said, while I don’t expect tax changes will be an issue in my market, rising rates absolutely will. Many millennial + first time home buyers have never been in adulthood with 6% mortgage rates…that will be a shocker for them. Even 5% will be.

A long way from the 15.53% when I was a young adult.

Another thing though if we are looking at homes under $400k, as being ones that see little to no impact from the new fed taxes. I think this market may also be particularly resilient to rising rates at least in major cities.

I am looking at $300k homes in Dallas right now and will sell a condo in Cali. My overall loan after putting 30% down will be so small they could Jack the interest rate up another few percent and it would only shift my payment by a few hundred a month. Which is still peanuts next to what a place in Cali cost given the high tech pay in Dallas.

Higher interest rates like the taxes will hurt the people who can either barely afford any home and those with extremely expensive properties.

But I think, for better or worse, there will be plenty of high paid middle income people left who can still easily afford a $250k-$400k home in major cities that still have homes of this price. And for them a few extra hundred dollars in interest won’t change anything accept wasting some potential savings.

I would buy at 6% with a smile on a $200k loan. But in Cali it’s a real bitch to eat 6% on a $500k+ loan for a similar home.

For example, the near-doubling of the standard deduction for everyone removes for many filers the need to itemize. And so their mortgage interest cannot be deducted. Instead they will take the bigger standard deduction. This effectively removes the tax benefit of mortgage interest since renters will get the same standard deduction. But there are number of other rule changes in the law that actually hurt people who buy homes after January 1, 2018.

This will give you more detail:

https://wolfstreet.com/2017/12/20/what-will-the-tax-bill-do-to-the-housing-market/

I see what you’re saying. There will be some fallout but each local market will be impacted differently.

I personally don’t believe there should be any mortgage interest tax deduction. Families should buy a house payment that meets their household budget just as renters do with their monthly rent without any consideration for a tax break.

And dangling a tax incentive carrot for HELOC just encourages people to remove equity from their homes for the wrong reasons.

Lastly, taxpayers in low tax states should not be expected to subsidize taxes for high tax states so I agree with a cap on salt.

If a side effect of the tax laws is to improve home affordability by removing tax incentives that do not benefit everyone equally, then I’m all for it. This housing market is way out of whack…regular families are priced out of homes even in markets where median is 230k.

Home prices must come down.

And that may sound odd coming from an RE agent but it’s what I believe despite what NAR tells me I should think.

Not arguing with you Wolf, i find your blog very insightful. I’m just venting. It’s hard out here for the regular folk just trying to find quality shelter. I see it every day.

I agree completely on tax breaks for HELOCs. I would add I would like to see nearly any and every tax break for secondary properties removed. Price of properties being driven up by speculation and land Lords does direct harm to people looking for a primary residence. It sounds like recent taxes changes failed to alter some of these issues with regard to people owning rentals.

What would you consider a high tax state? A lot of people loves raging on Cali for whining about the tax changes. But Im looking at living in Dallas Texas now with their property taxes they are bitching just about as hard as Cali about rising home prices and the possible negative impact of the new deduction limits.

Overall I would agree uneven tax breaks for home ownership like the existing ones even after the new laws still entroduce unnecessary market distortions. And still only benift an oddly chosen sliver of the population.

Every little things add up..

Honestly I have seen this before “this time is different”

I don’t know what the future holds but I know for sure affordability is a big problem when it comes to housing

Although late but the msm is also recognizing this..

I found it interesting that the interest deductions of many Home Equity Lines of Credit will be abolished under the new tax program.

Good historical article on the topic, comparing ‘now’ to the 1980s real estate bust.

http://www.businessinsider.com/gop-tax-bill-could-trigger-new-financial-crisis-by-hurting-real-estate-2017-12

I figured the window was closing and sold my house on the east side of Seattle about 16 months ago . Chinese bought it . I had to sell before the election I felt, and before more capital controls and taxes on the Chinese .So glad I did. Took the dough bought about 80 miles out on the coast and maybe I am dumb. But paid cash

I don’t care if the house loses value I plan on living here for awhile. Houses out here get snapped up in days as more bail and cash out in Seattle and they pay premium

My real estate agent from Seattle sends me quarterly market goop. I am told Seattle rents have dropped the most percentage wise in a decade. Hmmmm

No inventory pushes the market prices up

In my town here real estate agencies have signs up begging for sellers as they have many buyers wanting to pull the trigger

Who’d have thought that matching up all the empty houses with all the newly homeless people would have turned out to be so impossible to accomplish. It’s what you get when you build houses for people who can’t afford them on their long-repressed incomes.

Let this be a lesson to us all. Or at least to those of us who have some willingness to learn something. Even if we can’t do anything about it.

I like the way central bank policy has completely ruined the awareness of interest paid to savers so that nearly everyone only sees the cost of borrowing and not the income that can come from savings.

By inference, it appears that nobody saves much anymore. People must spend what they make and be living up to their means. The concept of interest income does not register in their experience, based on these comments. This implies QE has destroyed a lot of capital, which explains why QE was used as a substitute for it.

I have savings and am anxiously looking forward to earning a little income from it. To some extent this will be another facet of the class warfare the Fed supported with QE, pitting the globalists and their supporters against the 99.9%. Rather than the ultra rich vs everyone else, its the working class vs the working class who still have savings.

To underscore this, sorry for your problems, but don’t drag me down because of them. Move to the Eurozone if you need to be subsidized. Tell them you’re from Syria and they’ll probably give to a stipend and your own private community and make it a no go zone. I am ecstatic that rates are rising. Too bad about the problems the ‘financial markets’ will embrace due to this, but I’m not one of the idiots who thought they invented the perfect free lunch using printed money, interest rate management, and public debt monetization.

Great work.

You’re not alone. There are bout $9 trillion in savings products at US banks and credit unions. They’re all gradually going to make a little more. I heard people talk about it at my swim club yesterday. The additional interest income is now being discussed. It’s large enough people notice it on their statements, and they’re starting to look for higher-paying banks/products.

“my swim club?” Wolf, this caught my eye. I am a fellow swimmer and hope you belong to a good Masters group. I enjoy your site and all the comments. It’s been a long time, but I was a big holder of 2-Year Treasury notes at 6%, which are state tax free. I am not sure of the future if/when 2-Year Treasuries return to 6%. Of course, no one is! I learn a lot here.

Cheers.

You might have to be very, very patient to see a 6% yield for a two-year Treasury. That said, 2-year yields overshoot on the way up, even if only briefly.

I had significant savings for someone my age in 2007 and was getting a nice return like 5% and was happy. Then I let my money sit and make 0% for the next 8 years until I had enough and finally was forced to buy a condo in cash at end of 2015. I now rent it out to a nice couple but the return on it is still subpar 4% (this is without any major repairs needed yet). I’m still pissed the Fed basically forced me to make a speculative decision with my savings.

So you haven’t realised that the whole nub of the neoliberal plan is to basically force everyone into becoming a financial speculator in order to massively ramp up all manner of assets? To force people into 40 years of debt peonage merely for the basic facility of putting a roof over your head?

Looks like the usurers (for that is what they are) suckered you good and proper, moonbeam.

If you want to know what comes next – research Japan 1990.

“If you want to know what comes next – research Japan 1990.”

Maybe if they start it up again.

My wonderment involves the Eurozone and the ECB and how they will allow the QE kick the can plan to evolve. I’m starting to suspect an eventual, far down the road, society that looks like a movie-land benevolent totalitarian society that forces even lower negative rates and more debt monetization onto closed system with a virtual wall around the entire continent. An eventual slave state if it goes on long enough.

No hunger games but a natural evolution of a bad situation that will not relent.

The problem: how to use QE and rate management to subsidize actual costs in perpetuity and escalate as needed to keep the plate spinning without destroying the value of the EU. A closed system is required. The only way to enclose a free society like this is a creeping virtual fence that expands a little at a time with penalties for crossing it.

This, to me, is the future of the EU if ECB QE is allowed to continue for a few more years/decades.

Wolf, I familiar with the concept called velocity of money and it to an extent describes the health of the economy. Is there a “real-estate equivalent” parameter…how many houses are sold relative to the current/monthly/quarterly inventory?

I don’t think housing and “money” are comparable because they function so differently in the economy. I think trading volume in the stock market would be somewhat more comparable, but that doesn’t work anymore either as an indicator since much of the volume is generated by machines.

In housing, a year-over-year (not seasonal) slowdown in sales in a local market is often an indicator of a turning point, when sellers and buyers don’t agree – when sellers want more than buyers are willing to pay — and therefore deals aren’t getting done, or when demand falls off at current prices, which can be the same thing.

It is usually presented as “Months Supply”. You can find it up on FRED.

Housing is just one of the many bubbles initiated by the global QE of the past decade. Housing costs have risen to roughly 50% of net income and can’t remain there – not for long – it’s simply not sustainable. We can speculate all day what will bring costs back down (because income is NOT going up to match it), but something will. And all it will take is a significant correction in one sector to throw off the rest. My bet is on a geopolitical event.

What will ‘bring costs back down’ is simply a good ol’ fashioned bubble bursting.

After all – why would you buy a 500K asset (irrespective of the cost of the loan) when you know you can wait 12 months and get it for 450K..?

Don’t forget – there’s only demand for real estate when prices are rising. When they aren’t, that demand evaporates like spring dew on a sunny morning.

And unlike 2008 there’s no ammo left in the box to prop the whole edifice up. Caveat emptor.

I see houses coming and going off market lately. I agree the tax benefit is probably one reason. Rents are at a premium, rather than sell the owner has that option. There is a false assumption about interest rates and inflation, higher interest rates cause inflation. The inflation meltup scenario has gotten into the already speculative housing market. Prices may be ready for a real takeoff. Currency debasement, mass exit from the bond market, stocks follow suit since it’s hard to gain pricing power when you are your own best customer. What’s your favorite asset?

In the Bay Area, renting your home can make sense if you bought at a much lower price and/or have a lot of equity. Otherwise, for more recent buyers, the cap rates in the region are some of the lowest in the nation.

There are lots of headaches and costs associated with renting which must also be taken into consideration when deciding whether it makes more sense to rent or sell.

With lots of luxury apartments coming online, I don’t think renting is as much of a slam dunk as it might seem in places like the Bay Area.

In San Diego as well renting is cheaper than buying at the current valuations

I also wonder how increasing property taxes will affect the housing market. I know every city is different but here in Colorado Springs my taxes increased about 15% from last year and I am now paying more than I did in 2007. Homeowners will see an increase in their monthly payment real soon!

it’d definitely have an impact.. as I said earlier every little things add up…

When I said at work “We’re due for another recession,” my coworker responded, “We never got out of the last one!”

I hear that a lot. Can someone explain in layman’s terms how we’ve never truly recovered?

Does it have to do with QE?

Thanks!

A “recession” in the US has a well-defined meaning within the “business cycle,” whether or not we agree with it. “Recessions” in the US are called out by the National Bureau of Economic Research (NBER). They look at many variables, including but not limited to GDP and labor data. Here is their list of official recessions and other segments of the business cycles in the US going back to the 1800s:

http://www.nber.org/cycles.html

Here’s my recent experience with trying to buy a house in Boise. We are looking to downsize to a single level.

Property 1: We made a cash offer at more than asking and were outbid by three others. They accepted an offer within 24 hours of listing, 2% above asking.

Property 2: Ditto. We made a cash offer 2% above asking and got outbid.

Property 3: We went to see the property the day of listing, made a cash offer 3% above listing. There was another offer. Ours was accepted. We rescinded the offer because the seller had made an addition to the property without a permit.

We stopped looking and decided to stay put in our current house for another couple of years. Most of those outbidding us are retirees or people from out of state.

Property 4: Our agent called to say there was a property about to be listed and she could get us in to see it before the listing was posted. We went, made an offer and said we can do either a cash or loan offer. The seller was okay with a loan offer if we removed the appraisal contingency and if we bought the property as-is. We opted for the loan.

With a credit score of 825, we got a 4.5% 30-year conventional rate and a 3.1% 5/1 ARM. We opted for the latter since we aim to pay it off under 5 years.

There’s no way we would have got this house once it had been listed ‘cos we weren’t about to join another bidding war.

Now we need to sell our current home and our agent says it won’t be a problem at all.

People must like Boise. In Manitoba, a few hours from where I am, there is a realtor that posted how long houses were listed and how close to listing price after they sold. The constant updates would be 14-30 days on the market and 95-98% of asking price.

Maybe north of the border is going to fall before south of the border this time, since in Canada the housing didn’t drop near the same as in the US back in 2008-09.

Prices are already on a downward trajectory. Everywhere.

just curious, don’t see prices going down yet.. atleast in CA, USA

Joke of a generalized statement

1980 was a bad year for me. Our first house 14.5% 30yr mortgage for run down duplex. Treading water cash flow wise, for years because of it and effect of terrible inflation. Leaves a bad taste in my mouth to revisit it. But for some reason around then everyone was selling their houses, buying in better subdivisions then selling them in 6 months and doing it all over again. I think when rates started getting to 15% real estate started to slow down. I know because that is when I left my real estate job because needed a more reliable income. (The positive effect of this is my ratty old duplex(fixed up somewhat) doubled in price to about $38-40k. We paid 18.5k for it. )

Have always been wondering what drove those conditions and how it might relate to these times.

Other than owning property in a bubble area I don’t see a downside. wish I was able to own more real estate. Excepting the government caused bad mortgage lending problem of course. Unless there is a better,cheaper alternative then home prices should increase in general over time.

And just fo a point of reference for what it is worth;

Cost of Living 1980

How Much things cost in 1980

Yearly Inflation Rate USA13.58%

Year End Close Dow Jones Industrial Average 963

Interest Rates Year End Federal Reserve 21.50%

Average Cost of new house $68,700

Median Price Of and Existing Home $62,200

Average Income per year $19,500.00

Average Monthly Rent $300.00

Cost of a gallon of Gas $1.19

Average cost new car $7,200.00

From http://www.thepeoplehistory.com/1980.html