$9 trillion in deposits go a long way.

Savers have been shanghaied into doing an enormous job, in small increments, day after day, for nine years: Recapitalizing the collapsed US banking system and making it immensely profitable again, leading to high core-capital ratios, record bonuses, big-fat dividends, and massive share-buybacks. And the FDIC, in its Quarterly Banking Profile released today, shows how.

The total number of FDIC-insured commercial banks and savings institutions fell by 271 to 5,787 by the end of the second quarter. Of them, 5,338 were community banks. Most of this shrinkage was due to consolidation. But there were a handful of bank failures: in 2016, five banks failed. So far this year, six banks failed. The remaining banks get a bigger slice of the pie.

Here’s the good news: Almost everything in the report is good news! That is, unless you’re a saver whose income stream has been confiscated in order to make this good news possible.

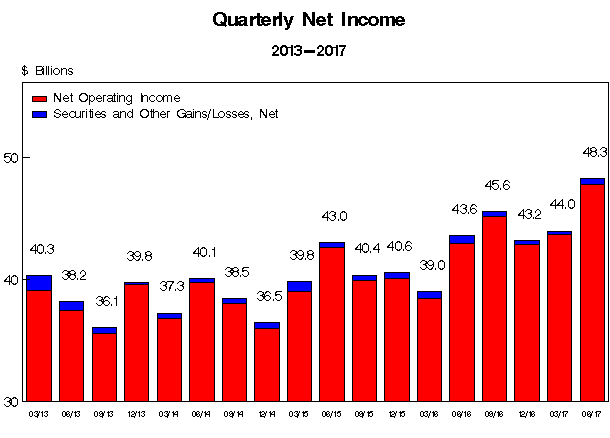

FDIC-insured banks and savings institutions booked a combined net income of $48.3 billion in the second quarter 2017, a post-crisis high. That’s up by $4.7 billion, or 10.7%, from a year ago (chart via FDIC):

This $4.7-billion increase in earnings was caused by a jump in net interest income of $10.3 billion (9.1%).

Net interest income is the difference between a bank’s revenues generated by interest-bearing assets, such as loans, and the costs of its liabilities, mainly deposits but also bonds and the like. Currently banks borrow money from depositors at near zero cost.

And it’s a lot of money. At the end of Q2, all commercial banks held $11.2 trillion in domestic deposits. Of that, $9.1 trillion were savings deposits. This is money that banks owe savers. A lot of nearly free money.

Since the Fed has been raising its target range for the federal funds rate, banks have been able to nudge up the interest they charge on commercial loans, credit cards, auto loans, etc. And their revenues on these loans are starting to increase. At the same time, as most savers can frustratingly confirm, interest paid on deposits has not budged, or only barely so, and remains close to zero (though some banks have started to pay a little more in order to attract deposits.).

During Q2, total assets rose by $161.2 billion to $16.5 trillion. Of them, loans and leases increased 1.7% to $9.1 trillion, with all categories increasing during the quarter. Year-over-year, total loans and leases rose by $337.6 billion, or 3.7%.

Noninterest expenses rose by 3.3% to $108.6 billion, mostly due to a 2.3% year-over-year increase in employment.

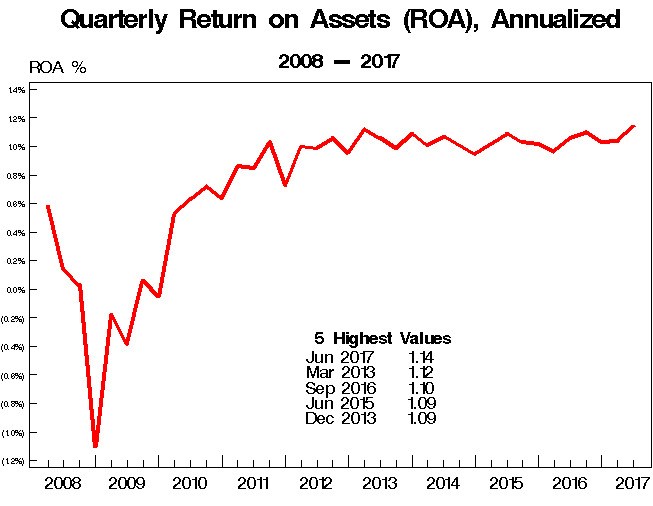

One of the most important performance metrics for banks is Return On Assets. In Q2, for all FDIC-insured banks combined, the Average ROA reached 1.14%, the highest since Q2 2007. Yes, thank you hallelujah dear savers (chart via FDIC):

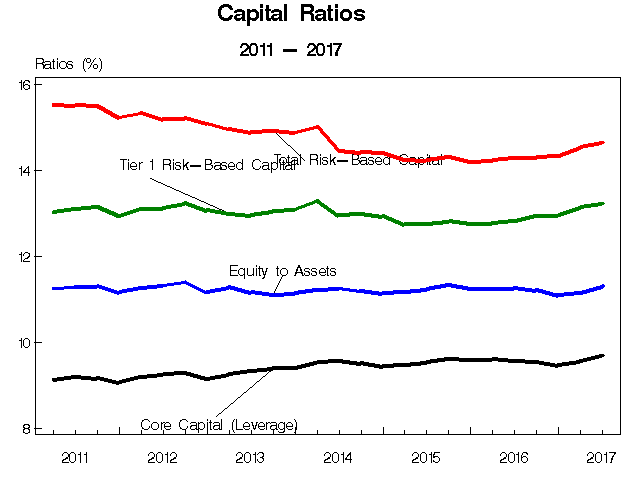

If these profits pouring in over the years are retained and not paid out in dividends or share buybacks, they turn into core capital and accumulate. So the Core Capital Ratio for all banks combined (black line in the chart below) has been ticking up, and edging closer to 10% (via FDIC):

Back in the day, one thing Ben Bernanke said to justify slashing interest rates to zero, and thus lowering the cost of capital for banks to near zero, and thus wiping out the income streams of $9 trillion in savings, was that it would recapitalize the banks.

If on average, savers got their interest rate cut by 2 percentage points across the board, over nine years, they lost $1.6 trillion in income, and banks made that $1.6 trillion in income. If that cut averaged out to 3 percentage points, savers handed $2.5 trillion in income to the banks. This is a lot of money that savers couldn’t spend in the real economy.

This income became part of the banks’ core capital. It’s a zero-sum game. And savers carried the lion’s share in recapitalizing the banks. Bernanke was explicit about that. It wasn’t a secret. It was a basic wealth transfer to recapitalize the banks that then paid out record bonuses to their folks.

During the Financial Crisis and the years that followed, banks weren’t allowed to pay dividends or buy back their own shares. Their job was to increase their capital in part by increasing their profits at the expense of savers. The wealth transfer continues to this day, except now, banks are allowed to pay dividends and buy back their own shares, which they’re doing in record quantity, savers be damned.

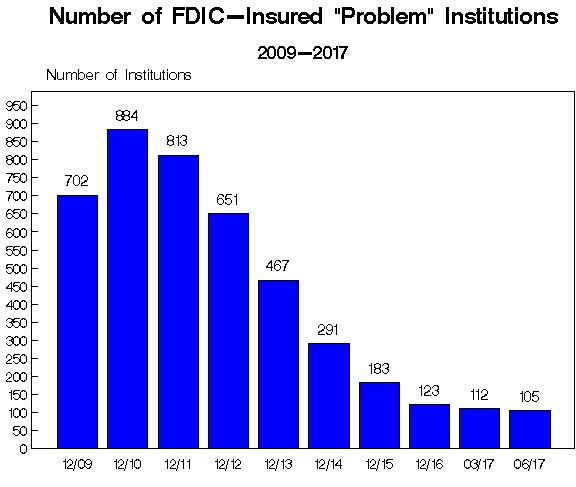

Thanks to the ongoing bank-recapitalization efforts by those hapless savers, and thanks to banks that have collapsed, the number of FDIC-insured “Problem Banks” has plunged over the years. In Q2, it fell by another 7 to 105, the smallest number since Q1, 2008, and down nearly 90% from the post-crisis peak of 888 in Q1 2011. Total assets of problem banks fell by 27% in Q2 to $17.2 billion. This chart shows the number of “problem banks” at the end of each year, except for Q1 and Q2 2017 (chart via FDIC):

“This was another positive quarter for the banking industry,” said FDIC Chairman Martin Gruenberg. But there wasn’t even a hue of appreciation or thank-you for the savers that the Fed’s low-interest-rate policy (though not quite as low as it once was) continues to sacrifice relentlessly at the altar of bank profits and bonuses.

At the same time – oh the irony – penalties imposed during the first half of 2017 on Wall Street firms by their regulators plunged 65% compared to the same period in 2016. The Financial Crisis is forgotten. Even sounds of gentle wrist-slapping fade. Read… Wall Street Firms Win Again, Regulators Capitulate

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Heard this before on your site but it still sounds crazy. Talking Heads get to run around and claim regulations are still strict and there are no bubbles, then at the same time those regulations have clearly stopped getting enforced. 65%…

I am so glad that we can pay free money to our bankster masters. We should build a monument dedicated to our bankster masters so that we can pray to them a few times a day.

No need to pray to them, just bend over on demand. Happily for the banksters, 95% of the ‘Murican sheeple are happy to do just that.

We already have, R2D2. Just like how the Egyptians built the pyramids for their wealthy tyrants… the tallest skyscrapers in pretty much all of our major cities are for the banks. It’s no coincidence.

The difference is that, according to Michael Hudson, there was a debt jubilee upon the completion of each pyramid.

Exactly ! Edifices posing as places of business that are in reality Temples to Hyper verging on Anarcho – Capitalism serving no real purpose other than the intended veneration of the entity within . At the risk of criticism ( as if I care ) the only thing they’re missing is a 14 ft bronze or marble statue of Ayn Rand in their lobbies

TJ I like your point, with one exception. The banks are monuments to kleptocracy not capitalism. True Capitalism still involves upholding the rule of law, true free markets, unlimited competition so that the best company/person/team etc. wins. None of that is true for banks, they get special permission to leach money out of everything and live the high life while most of us toil to either produce something or do something of value…..but you’re right, the Skyscrapers are monuments to those money sucking leaches.

The FDIC should insist on large premium increases at this time, when profits are good. We need to make sure a taxpayer bailout isn’t required when things reverse.

Last time I checked the FDIC insurance fund was inadequate.

Amen, Bobber. Preach.

But then we’d have to listen to Jamie Dimon whine, “How are we supposed to help businesses when you’re sacking us with these enormous premiums?” (They don’t lend to businesses.)

It would be good, but they would have “to invest the funds” in something and most likely it would be spent on consumption. It is not like there is a pot of Gold in these funds, from which to be extracted when times are tough.

It is like the Social Security “Trust” fund. They had surpluses so it was spent…on consumption. The trust fund gets and “IOU” back for it For example, part of the Social Security Trust funds are sitting in the desert in Arizona. The admission price and revenue from spare parts will never generate enough cash flow to pay of the debts originally incurred.

http://www.airplaneboneyards.com/davis-monthan-afb-amarg-airplane-boneyard.htm

Yes Bobber, the FDIC insurance fund would be inadequate if we had another crisis similar to what happened back in 2008-2009. Of course the FDIC does have a line of credit with the Treasury if they ever need it.

What is the charter of FDIC, do they cover gambling losses or depositors?

Depositors are unsecured creditors. They will be bailed in?

FDIC insured depositors will not be part of a bail-in. Uninsured depositors however could be part of a bail-in but only in banks deemed to be systemically important.

AND all the other choices have unacceptably high risks

You’d have to be a turnip to save in paper dollars. They’re trying to force everyone into risk assets. If you don’t wish to chase the bubble and buy egregiously overpriced stocks you have to be a contrarian

I have 1/3 in real estate, 15% in cash, 20% in (very inexpensive!) mining stocks and 1/3 in physical gold and silver.

What are sources for researching mining stocks. Why the concern with US treasury bonds in short term versus heavy into stocks.

But Wolf… I’m getting 1.3% and, um, that’s really good!

Unfortunately, people won’t get concerned about anything until their 401k’s drop 30-50%. Until then, this stuff is noise to most people. Also, a lot of lucky retirees have made stock gains to compensate for the lack of interest income.

The seniors/retirees might have stock gains on the books at the moment to look at and feel good about but they will just watch those gains disappear when the next bear market takes over.

Or the US can hyperinflate, which is the most certain of all outcomes, in which case the stock gains remain and yet you can’t buy anything with those.

Hyperinflation is really the best of all outcomes in terms of getting people paid. All debts will be resolved. Purchasing power has never been guaranteed anyways.

So true, Rates. Alan Greenspan testifying before the Senate Banking Committee on Feb 15, 2005, regarding funding Social Security:

“We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power.”

Thanks Wolf, for more great work.

Commonwealth Bank of Australia posted a full-year after-tax profit of AU$9.93 billion, a 7.6 per cent rise. The rise in profit comes as Australia’s biggest bank (CBA) faces allegations its intelligent deposit machines were used by money launderers and criminal gangs.

Further info: http://www.abc.net.au/news/2017-08-03/commonwealth-bank-latest-scandal-might-be-the-one-that-hurts/8772390

It is alleged that in the 6 months from January 2016 to June 2016 cash deposits through this channel grew to about $5.81 billion.” BILLION!

All this is on the back of fleecing customers $10 million on mortgage insurance, and denying payouts to customers who took out health insurance with the bank.

Interest paid to savers is 2.3% on 12 month term deposit of $50,000 – $1,999,999 with interest paid at end of the term, so not accumulative.

CEO, Ian Narev, is for the chopping block but doesn’t exit until June ’18!

I’m against capital punishment … but I’m beginning to doubt myself.

The real fleecing on the worlds population is how the banksters create money. How many people understand this process, for if they did they would hang every last banker on the planet. Money is created when someone takes a loan out and signs the promissory note. That note is deposited into the bank as if it was a check written from the borrowers own checking account and deposited directly into the banks account. The bank writes a check and issues it back to the borrower to use to buy his new house or car. The transaction is even at this point but what the banks do not disclose is they then sell the promissory note to another bank. So the bank has absolutely NO skin in the game. They create 100% of the money by means of your signature on a promissory note that is deposited directly into their account (bank). The borrower funds 100% of the loan and then reconveys the house back to the bank by means of the signature on the mortgage. Banks extend credit but by law cannot lend money. This is the biggest kept secret and fraud on the planet. I challenge anyone to prove me wrong.

“And savers carried the lion’s share in recapitalizing the banks. Bernanke was explicit about that. It wasn’t a secret.”

Could you point to any source where Bernanke was explicit about robbing the savers, and gifting it to banks?

Neither Bernanke nor I used the word “robbing.” You did. And that’s not what happened. It wasn’t an illegal act, but robbery is illegal.

True, Wolf.

But as the pirate captain famously said to Alexander the Great:

‘I’m called a pirate, but you do the same things and get called a King!’ :)

Great article, thank you.

Exactly on Point.

“When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.”

― Frédéric Bastiat

Awesome. Great quote Gershon.

What a fantastic quote.

Wolf . Within the excessively idiomatic language than English is ( especially American English ) the word Rob – Robbing – Robbery has many meanings and uses including the literal which is a criminal act …. to the figurative / allegorical / literary that in many cases is not though it many times may refer to an act that is on the verge of being criminal .. which in this case may very well apply and which methinks is the use MM is implying

( from the desk of the polyglot linguist wife )

Well, I meant by “robbing the savers” as a figure of speech. I apologise if it caused confusion.

My question was largely rhetorical as I don’t recall Bernanke saying that he is going to lower rates, and thus saving rates to below even the rate of official inflation. The savers had to figure it out themselves, and the pensioners to come.

He rode into the sunset basking in the glory, in certain quarters, as the saviour of the world from a crash (of which he was one of the major architects).

And believe me, I know first hand what it means robbing the savers, non-figuratively.

If it’s not robbery, then what should it be called, a “wealth transfer”?

I do believe some criminal charges were levied here and there, against a few of these criminal enterprises in the form of fines paid by innocent shareholders but for the most part, criminal activity has gone unpunished?

O they are a bunch of blood sucking robbers alright. These are the same kind of people who would sell their grandmother if they thought it would turn a profit.

In New Zealand the interest per annum on your money in the bank is a paltry 3.30%. In the Philippines the banks are falling over themselves to pay all of 0.625% per annum. But its a whole different kettle of fish if you want to borrow from these leeches.

And don’t get me started on credit cards rates which I personally don’t own.

The principal fact is that significant – or even basic – consumption is increasingly difficult for ever greater numbers of people in most of the advanced economies.

Failure to provide any kind of significant return on even substantial lifetime savings is exacerbating this, even as the banks grow more solid. The ramifications of this throughout society and the economy are immense.

For some, this is certainly compensated for -at least in part – by increases in stock values, but for most this is not the case.

Unless the ordinary consumer is feeling prosperous and, well, consuming, the whole industrialised system is increasingly imperilled.

More and more people are falling into the hole where they cannot afford the basic good and services produced by the system.

Great article Wolf.

Even after nine years there’s still 105 banks whatever size classed as problem banks, even after all the support offered by the government.

I would love to see the same analysis of European Banks which would be massively different to the US banks.

As you’ve stated the odds are stacked so in favour of the banks, interest rates rising, costs reducing due to technology the banks don’t require as many buildings-employees now, a lot of the fines have been paid off.

With that in mind the US Government ‘should’ be saying that the core capital should be now at least 10%.

Stevedcfc72,

Even in good economic times you still had banks that had problems which caused some of them to fail. And the vast majority of those 105 problem banks are small in size. Not much of a concern.

Fair point J Miller and agreed the size of the banks is small in comparison.

My point was that even after all the efforts over the last nine years to clean up the system there shouldn’t be still 105 banks deemed as problem banks, they should by now have been taken over-merged with stronger banks-rivals to counter any future financial crisis.

Regards

Steve

I agree Steve. There really should not be 105 banks on the problem list today if the economy was good. However may be the number is higher than it would have be 20 years ago because of the increase in capital requirements. May be 20 years ago some of these same banks would not be on the problem list. Also the number of bank failures in the last couple of years is pretty much the average number. Just a thought.

Wolf, extremely insightful article. Thanks for your work on this.

I guess no real surprises here in terms of big picture. Our current financial and political structure places huge importance on health/profits of the banking industry. There are clear reasons for this which I won’t go into but suffice to say that this priority will remain.

There is banking, which is an important structure in our system, then there is investment banking, which doesn’t deserve a subsidy. Let’s split them up with a chain saw.

We don’t need to hear anything from Jamie Dimon until we ask for his “last words”.

“The few who understand the system will either be so interested in its profits or be so dependent upon its favours that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.” The Rothschild brothers of London writing to associates in New York, 1863.

This article helps to reinforce the attractiveness of your local Credit Union.

… and is why we’re seriously considering switching back to one after years of doing business with our current Edifice / Temple / Bank .

Been with https://www.narfepremierfcu.org/ for years.

In the UK we have credit unions but having had dealings with a few of them I wouldn’t go near one with any of my money much as I like what they stand for.

What’s the problem?

Hi R D Blakeslee,

The problem with the Credit Unions in the UK is that they don’t make any money. I know a few which have closed in the last two years as I used to work in the Charity sector. The big one near where I live lost 70k sterling last year. If it doesn’t improve its financials this year it will go under.

Basically a person puts cash into a credit Union and gets 2-3% interest for example.

Even though they charge 30% interest approx on loans, most of their clients are people who can’t get finance from mainstream banks. (Stops them going to loan sharks, or being charged 5000% interest).

Due to their small size, the bad debts they incur and the regulations which they have to adheer to similar to the Banks the business model doesn’t work.

banks always do well in the first part of the rate hike cycle. the details don’t matter. underneath the rosy profit picture, the banks and the Fed and the Presidency are showing signs of fracture. Dimon broke with potus on his lack of anti-hate rhetoric. He has a lot of employees, all sizes and shapes. Yellen continues to manage as though she were getting policy guidance from the President. she isn’t.

banks have been able to leverage their profits in the stock market. pension fund managers divested themselves of their hedge fund managers which means they have no protection in the event of a stock market correction. The banks may be inclined to set their own rates? remember the Fed was started because government didn’t like JP Morgan setting interest rates. So we’re back to that?

So I will probably long dead by the day that by some miracle, the US government decides to save the taxpayers instead of the banks somewhere in this century.

This is a primary reason i buy very little new items. I am pissed off. i haven’t bought a car/truck since 2008, no new furniture, clothing, to name a few. i purchase items from consignment stores, and a few work clothes. we took our cash and bought a rental unit during the financial crisis. yes we missed out on some money during this stock rally, but we increased the value in property. All values could crash again, but property is always there.

i would like someone to explain to me where central banks get the money to lend to banks at zero interest. i have a feeling that its my money as well. thanks for the information i learn from this site.

Joanrn I am one month new to this site and like you very appreciative of all smart people helping us learn. Also like you, angry and not spending at all if possible.

Hopefully one of the very bright people will answer your question, but I’d like to add to it if you don’t mind…

Think Treasury uses “future taxpayer” as collateral to issue debt called T-bill which can be bought like a CD, investor supplies the principal, “present taxpayer” pays the interest, the Treasury gives the principal to the Fed (Central Bank) for free, which then gives it to the banks for free, which then lend it to “present taxpayer” at 10-15% or more (mortgages currently excepted) interest.

I welcome corrections to above, but if more-or-less correct, here is my addition…If T-bills pay something like 1-3%, why is the interest expense on US debt something like 6%? Or did I misread that somewhere?

MB732 – Thanks, i knew some of that, and you put the rest of it together well. As I suspected its not only my money, but its my money 3 times. Twice as “present taxpayer,” and once as “future taxpayer.” Nice gig if you can get it.

The Fed prints money to buy US Treasury bonds as well as other debt instruments (and books them as assets). The Treasury pays interest to the Fed, who returns the interest less their expenses to you guessed it – the Treasury.

The same Fed that was run by Bernank who along with Timmay (by own admission not a banker) Geithner (Treasury Sec’y after heading NY Fed) were reportedly upside down in their homes (owed more than they were worth).

Speculators should have gone under as well as bad banks… creditors would have been converted to equity with the in-place shareholders getting zippo. Strong hands would have had lower cost basis and less debt.

I read somewhere that that Bank Loan Loss Reserves were being put back onto the Income Statement (maybe an accounting tweak) and that this increase was ballyhooed as the basis for extraordinary bonuses and compensation to bank execs.

My sec’y is 82 yo and says she cringes when she has to draw money outta the bank. Robbery might not be appropriate, rape seems to work though.

The FED decides on a target rate, say 1% today, the base rate in the system. This is the rate which the primary dealers charge each other for short term (collaterized) loans or REPOs. The FED monitors the rate for “cash crunch”, and if the rate rises, it buys securities to supply the market with cash.

QE is an operation where the FED buys securities from banks at face value. These are not repurchased, and stay on the FED balance sheet.

The government, the treasury, is not involved, only to the extent that the government bonds are used as a primary collateral.

thank you QQQball and maximus minimus, for the information. This is so convoluted i need to read it for a few days to have a minimal understanding of the twisted shell game that the fed, the treasury, and the banks have with the taxpayers money. i think i need one of wolf’s superb charts.

Dont like contributing to bank profits

DO SOMETHING about it, put your deflating cash somewhere else.

There is that much liquidity about, that until banks are forced to compete for deposits. deposit rates will not rise.