According to our soothsayers, when the Fed decided to keep interest rates where they’ve been since 2008, at near zero, rather than raise them, it should have triggered a big stock-market rally. But that’s not what happened.

Or rather, it triggered some rallies, but soon the hot air hissed out of them and they deflated. That’s what’s different this time: apparently nothing can keep these stocks propped up at these dizzying levels, not even the Fed.

Friday in the US, stocks rallied at the open, and by 1 PM, the S&P 500 hit 1,953, up 1% intraday and looking strong, when you could suddenly hear the hot air hissing out of it. In two hours it plunged 31 points to 1,922, before bouncing at the last hour to close down 1 point.

That left it down 1.4% for the week and 6.2% for the year. It’s down “only” 9.4% from its all-time high in May, with a lot more room to fall. Despite its nerve-wracking daily gyrations, it has gone absolutely nowhere since June 12, 2014.

The most hated asset class of all

The asset class that the Fed has been trying to render as appealing as a mildewed wet blanket – cash in bank – handily beat the S&P 500 without all the gray hairs and fees.

The Nasdaq wasn’t quite so sanguine on Friday, however. It opened up 51 points, at 4,785, then relentlessly dropped 126 points, for a 2.5% swing, before bouncing off a little at the end and closing at 4,686, down 1% for the day, and 3% for the week. Now it’s back where it had been on November 13, 2014, and in March 2000.

The Dow remained in the green all day despite its gyrations and closed up 0.7%. At 16,314, it’s down 0.4% for the week and back where it had been on Christmas Eve 2013. Yup.

Somber thought: since the Financial Crisis, stocks only rose during periods of QE and Operation Twist. The rest of the time, they languished or fell. But QE was tapered out of existence last year, and now the Fed is talking about the process of “normalizing” rates, whatever dubious thing that will mean in the end. And the fuel that powered stocks to such vertigo-inducing highs, accompanied by a deafening orchestra of Wall Street hype, has been spent.

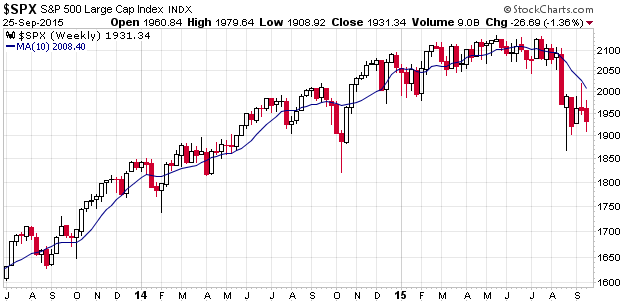

This weekly chart of the S&P 500 by Doug Short at Advisor Perspectives shows the ups and downs on the way up, and since July the downdraft:

This episode is different than the prior downdrafts: it has persisted. It’s hasn’t been just a quick dip, with dip-buyers chasing it enthusiastically to get the dang thing to turn around and head back to new highs. This downdraft, as mild as it still is by historical standards, has persisted for over two months. Part of the initial bounce after the August plunge that put the S&P briefly into a correction is now getting unwound. The last time that happened was in 2011.

Shaping up to be a bad-hair year globally.

In Europe, where Draghi’s QE is still breathing hot and heavy, stocks swooned all week until he finally started talking again to emphasize that QE could even be increased and extended, another whatever it takes, which caused stocks to rally on Friday. But unlike in the US, markets closed before they had a chance to change their minds.

The German DAX dropped 2.3% during the week to 9,689, despite the rally on Friday. It’s down 22% from its peak in April, and thus in a bear market. The beating that the German automakers and component makers took after the Volkswagen fiasco didn’t help at all, but there are bigger sinners out there [German Stocks Crush Dream of Central-Bank Omnipotence].

The UK FTSE managed to remain flat for the week. It’s down 14% from its peak in April.

In Asia, a similarly dreary picture has emerged. The Japanese Nikkei, despite a sharp rally on Friday, is down 1% for the week and down 14.2% from its peak in June, despite the efforts by Bank of Japandemonium to monetize half of the mountain of government debt that Japan has created over the decades. The program was designed also to inflate stocks. It did that wonderfully for a while, but now the construct has begun to crumble.

The Indian SENSEX is down 13% from its peak, and the Hang Seng 26%. Shanghai continues to languish near the 3,000 level that the government has sworn up and down to defend no matter what, even if it has to move heaven and earth. It dropped 1.6% on Friday to 3,092, down 4.4% year-to-date, and down 40% from its peak in June.

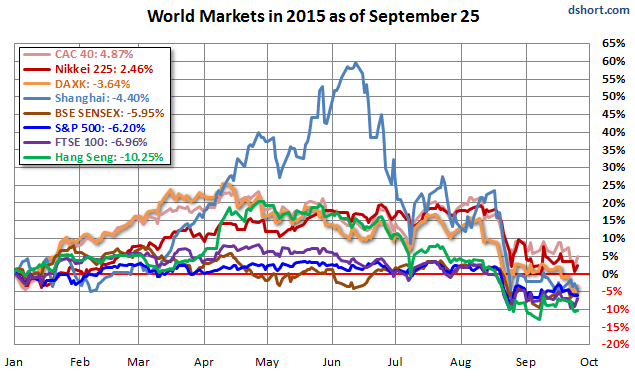

This chart by Doug Short shows the percentage change of the eight indices. The blue bubble is Shanghai. The chart uses the DAXK, which does not include dividend payments (unlike the DAX) and thus is more comparable to the other indices. Only the Nikkei and French CAC40 remain, if barely, in positive territory for the year:

And the Wall Street dogma of lowering your risk by diversifying into global equities? It’s supposed to keep your assets intact when US markets crack. Diversification is a revenue opportunity for Wall Street as investments get shifted around. But all major stock markets are now heading down together, not in lockstep, and not at the same rate, but they’re going down, all of them. And diversification has become an illusion.

Biotech stocks in the US got crushed all week, the worst since the Financial Crisis, part of a bloodletting that had commenced in July. And the finger-pointing has started. Read… It Gets Ugly in Biotech

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, you’re mistaken in one respect. Cash is not the most hated asset class. Precious metals are the asset class most hated by Wall Street and the “Federal” Reserve.

Cash is just taking a break from playing in the casino. Gold or silver represent explicit votes against the casino.

As long as gold maintains the divergence from silver, that developed post Nixon. Gold is a huge element, in the casino.

Chartists and pundits are charlatans. Ignore the noise and buy healthy small caps that are growing. I’m up 30% in the midst of this bear. Do your homework and you’ll be OK. The payoff to a few hours work is outrageous.

Global stock markets are on the blink because the indices are geared to large companies many of whose activities are on the blink – mining for example. It used to be that if the USA sneezes then the world catches a cold, but now it’s China. China’s growth figures reflect the demand from other countries. Interest rates do not drive markets beyond a certain point. Up to that point, the only thing interest rates do is to attract yield hungry investors. Beyond that point it is revenue that is the driver and the large companies are not getting as much as they need to offset their overheads and operating costs.

Yes. After a certain point manipulating interest rates is like pushing on a string. The Fed, in its insufferable arrogance, thinks it’s the most vital factor in the global economy but all they have done is create a mountain of debt spewing cheap credit like a broken fire hydrant.

It must be a prerequisite at the Fed to have failed Econ 101. Since ZIRP provides no incentive to save money in savings accounts, people simply pull that money out of circulation. The Fed has killed the opportunity cost of holding money.

There is not now and has never been an economic recovery since the global financial crisis in 2008-2009. It is all a statistical mirage.

Corporations have masked flat to declining revenues and earnings by borrowing money to fund stock buybacks. But that con job is reaching the end of the line. At some point, all that debt causes a credit rating downgrade.

Ultimately, central bank manipulation will always fail, simply because central banks cannot print revenues or earnings. The fact is that analysts have been busy all this quarter lowering earnings estimates. Like it or not, in the very long term, stock prices are a reflection of the cash flows that are returned to investors.

Curious thing last night on CBC Marketplace. The entire half hour was showing how the big food corps reduce package sizes while keeping prices the same.

Not one word about how this is masking run-away inflation ! Reduce the quantity in a package by 10% and you have a price increase of 11%. But governments tell you there is no inflation.

Of course. Inflation is probably double or triple the official rate. Governments hide it in part by under-weighting some items (e.g., medical and education) and over-weighting other items (e.g., technology products), and hide more of it by pointing to ‘quality improvements’ (i.e., ‘hedonic’ adjustments).

Governments lie. Businesses lie. Individuals lie.

We live in a society where dishonesty has become an accepted practice at all levels. Dishonesty is commonplace in virtually all third world countries, and it has become the norm in the US. It won’t change any time soon because sociopaths and pathological liars are in charge of most governments and large corporations.

Exactly. That really is the gist of it. Earnings. When earnings go down returns on investment would go down with them and then CAPEX vanishes. Fixed asset investments will fall sharply. The business to business slowdown is just the beginning of a downturn.

There has been a shift recently. Unlike the past now the good news is good and bad news is bad for the markets. In other words it seems that the Fed is becoming more or less irrelevant in this phase of the cycle. More QEs, ZIRP and NIRP may only have ephemeral effect. Throwing more credit would only exacerbate overproduction and hence deflationary pressures. At best it would result in the so called ‘liquidity trap’.

The reversion to the mean (or gravity as some would prefer) will always prevail.

Naw …. even more than gold or cash ….. Truth is the most hated asset around.

America’s insane money laundering laws are at the center of how money is flowing around the world. The American war on drugs supposes that anybody with money is a drug dealer unless it can be proved otherwise. This insanity is driving money away from the markets. In many parts of the world, wealth is created in non transparent ways that have nothing to do with the drug trade, and that money cannot now go into the money markets. Instead this money is flowing mainly into the luxury real estate markets around the world. They just sold a $60M condo in Miami and I can assure you this is crazy. The skyline of that city alone is a testament to the insanity, a trillion dollar ghost city.

That’s an odd observation, considering the current ‘flight to safety’ toward US assets, including stocks and good’ ol cash. At least with that over valued RE, local municipalities gain property taxes.

I don’t think any of it is going to stocks in the US markets. It is too hard to introduce large sums without a lot of scrutiny. You can’t even deposit it in many cases. The states have made it easier to let it flow into real estate, which is why the real estate is being bid up artificially. The fact that you can tax it at that point is another sweetener.

It’s all about capital flows at this time as real economic growth seems very fictitious. The US$ is the safe haven as most countries seems to be receding into a global recession. So capital is flowing into the U.S. and thus the DXY is increasing. The govt will increase debt and the Fed will maintain ZIRP until this trend is neutralized.

Good article, putting things in perspective.

I was a little surprised to see the CAC still in positive territory, but I expect all the indices to fall much further this year.

I am starting to see articles about the “coming earnings recession” as more and more companies are warning about decreasing earnings.

What!? Suddenly earnings matter in determining stock prices? Who woudda thought!?

Peterb,

DXY is going down.

The DXY was 80 in mid 2014 and is now bouncing around 95, but shows signs of taking a rest. Safe haven is now in play and the US$ looks to be the play. If that’s going down., then I don’t what to say.

Simple. The largest manufacturer on the planet (China) is slowing, as demand is weak. Where does demand come from? All the countries that buy Chinese manufactured goods. That is the EU America and lots of others including Chinese internal demand.

So, less iron ore, less copper, less oil consumed it just keeps a going….

Where are wages? That’s a clue.

Where are interest rates? There’s another clue. The US had long expected that HUGE .25% increase Ms. Yellen had virtually “promised.” It didn’t materialize, people said, “Oh, shit” and curtailed investing, and spending. The numbers seem to bear that one out. Confidence dented -again! Ask the EU how that “Auesterity thingy” is working out for them? Nothing worse than when people sense the value of money has hit the shitter.

Has the value of money really decreased, or has demand decreased because of wage stagnation in the first world? The consumer has less money, and consumption was driving a large part of this system. It seems like money was never more needed among the broke middle classes of the first world.

“It seems like money was never more needed among the broke middle classes of the first world.”

Thats wright.

The very people, O bummer has robbed blind and deliberately destroyed, to enrich his, unskilled, never will work, welfare sucking voters. That he is importing more of, by the day.

It takes decades to build a consuming middle class, than can afford to, and is willing to, consume. So keeping the Economy moving, at least sideways.

My grandparents could afford to Consume. They never would. As they could remember being sacrificed by the state, when they were young, to fatten those who would not work to help themselves so would never take the risk of depleting their savings, as it “Might” happen again.

O bummer deliberately destroyed the American middle class consumers, in months.

His Agenda has always been to weaken America he is doing a good job.

I have jet to decide whether, iran, china, both of them, or somebody else, brought O bummer the nomination and election, somebody did.

Those somebody’s do not like, a strong America.

They are will to sacrifice most of the West and the global economy to achieve their end’s.

I hate to slow your roll, because I too am disappointed that Obama kept the Bush economic policies and the FED doubled down on the asset bubble model that crashed so spectacularly in 2008. The middle class in the US has been under attack, at least since 1980 and both parties have played the game. Globalization by the corporatocracy and policies pushed by their lackeys, the central bankers, have contributed far more to the plight of the middle class than the availability of welfare programs for the poor.

Many workers have been prematurely and permanently put out to pasture and many of those finding work are now subsidized by programs like Food Stamps due to the low paying jobs that have been created during the so called “recovery”. One thing is clear, the money received by those on government assistance is spent and goes back into the economy. Another $ million or two to the top 1% generates very little economic activity, because they already have anything they wanted, so no need to spend their gains.

The 1% spend lots as they have it and they can afford to. What many of them do if you watch, is spend it outside their home country’s in the rich playgrounds.

Eg how much has Paris Hilton spent on helicopter taxis this summer, in the south of france, and how much else did she spend there??

Didnt help the American economy, did something for the EU but.

The American 1 % in particular, spend lots off shore, as they do not then, have to put up with being continuously hammer, simply for existing.

If you arent nice to tourist, they tour somewhere else, where they dont get milked, and abused, for being who they are. This applies to national and international ones.

Dear D-

In answering your rant, “I have yet to decide who bought O bummer the election.” look no further than the Wall Street Bankers. O bummer’s campaign was on the wane, Hilary ascendant, when suddenly an injection of Wall St. cash appears, and the new ‘mentor’ for him a certain J Dimon.

The rest, as we say is history. You might also wish to speculate WHY not a single wall st. BANKER was prosecuted by this administration? Sure, firms have paid (or rather, their shareholders’ have paid) some fines in settlement. Great gig, commit blatant fraud walk away smiling, AND with the money! Strange, that did not happen with the same type of frauds in the S&L crisis of the 1980’s. WHAT a country!!!

The purchaser was not wall Street.

Blame the Bankers, which really means blame the Jew’s, is not the answer.

Blame the FED, blame the Bankers, Blame the Jews, is worn out, to easy, and nowhere near correct, for the whole 6 1/2 year O bummer debacle.

Hilary had then, and has much now, more support, from Wall St, than O bummer did, or does.

Who ever brought O bummer the nomination, also had the support or at least consent, of the far left Demorats, putting a non white or mixed race man, then a non white or mixed race woman, in the oval office, is part of their agenda, as was and is “anybody but Hillary” part of their agenda.

They dont get into bed with Wall St.