The Fed’s dual mandate is “stable prices and maximum employment, not so much growth” in employment, he said at the press conference.

By Wolf Richter for WOLF STREET.

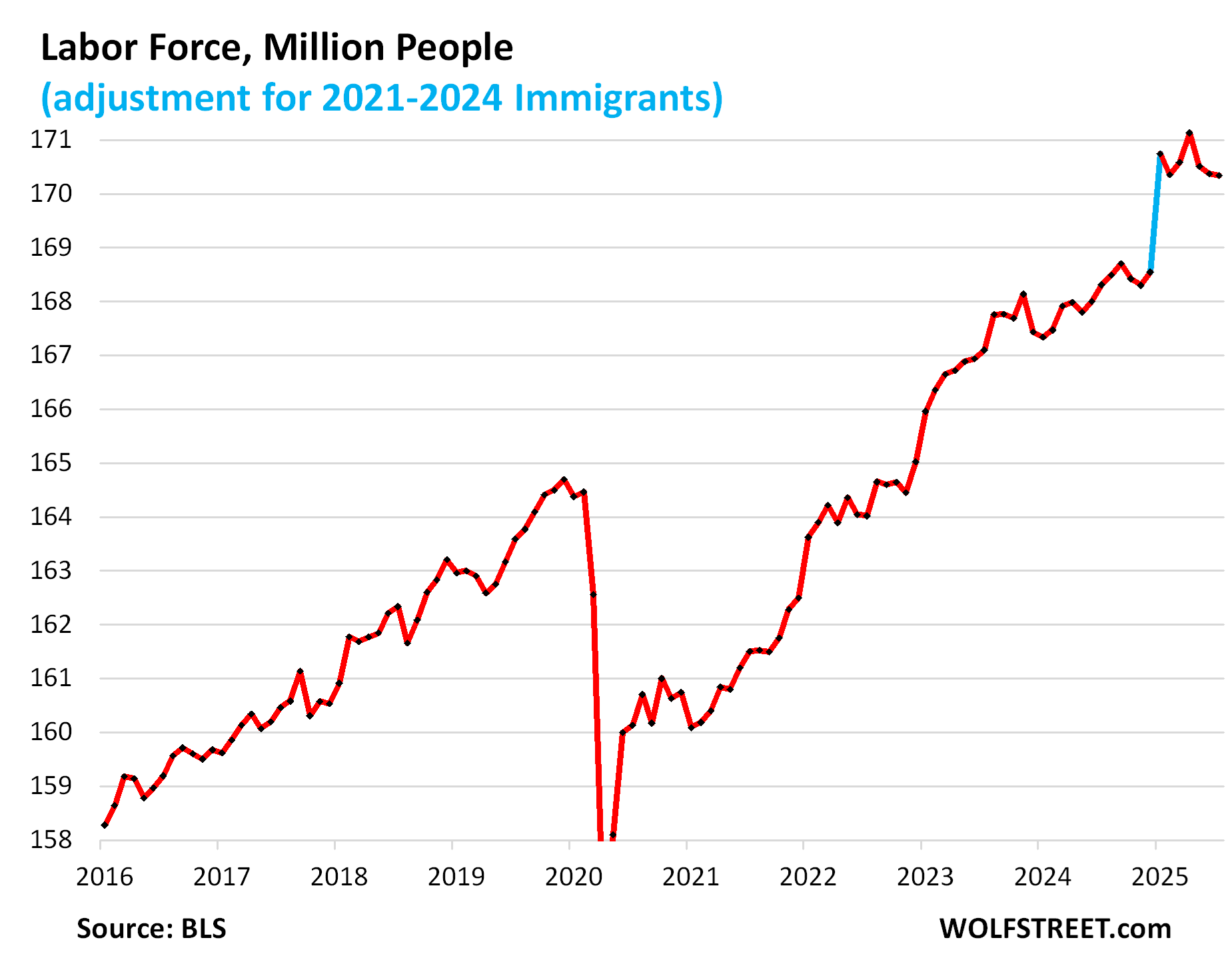

Powell was talking about this during the press conference: The crackdown on illegal immigration has dramatically slowed the influx of immigrants into the labor force, and thereby the supply of labor, and the labor force declined further in July.

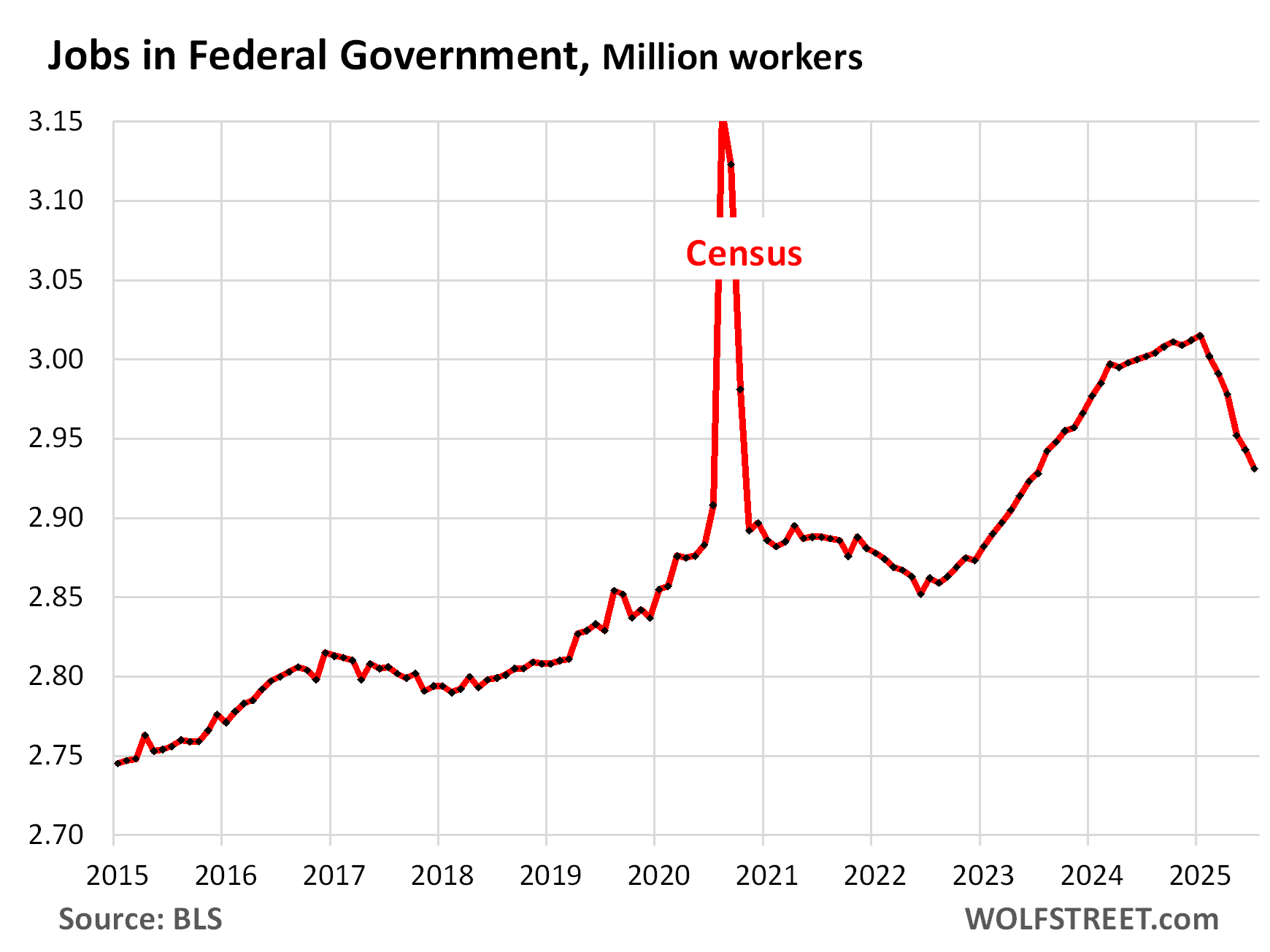

At the same time, the pace of job creation by employers has slowed, in part due to the headcount reduction by the federal government (-84,000 since January, compared to +25,000 over the same period in 2024).

Government payrolls don’t include workers at government contractors. They’re in private-sector categories, such as in “Professional and business services,” and we have seen some declines there too, though it is impossible to determine what portion is due to government cutbacks.

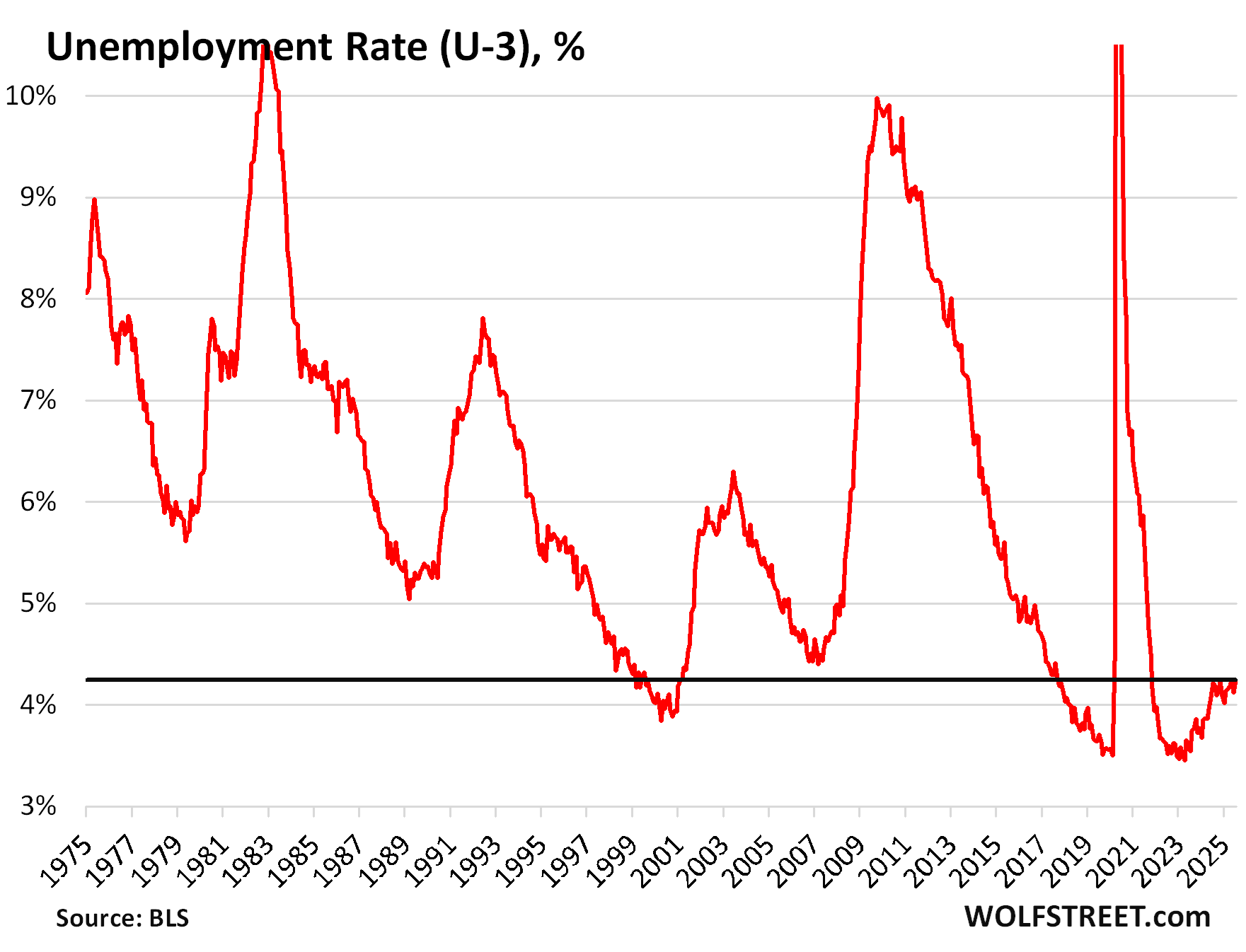

So with growth of the supply of labor down, and with growth of demand for labor down by about the same amount, within these changing dynamics on both the supply side and the demand side, the labor market is roughly in balance with a historically low unemployment rate that has been between 4.0% and 4.2% for the past 13 months.

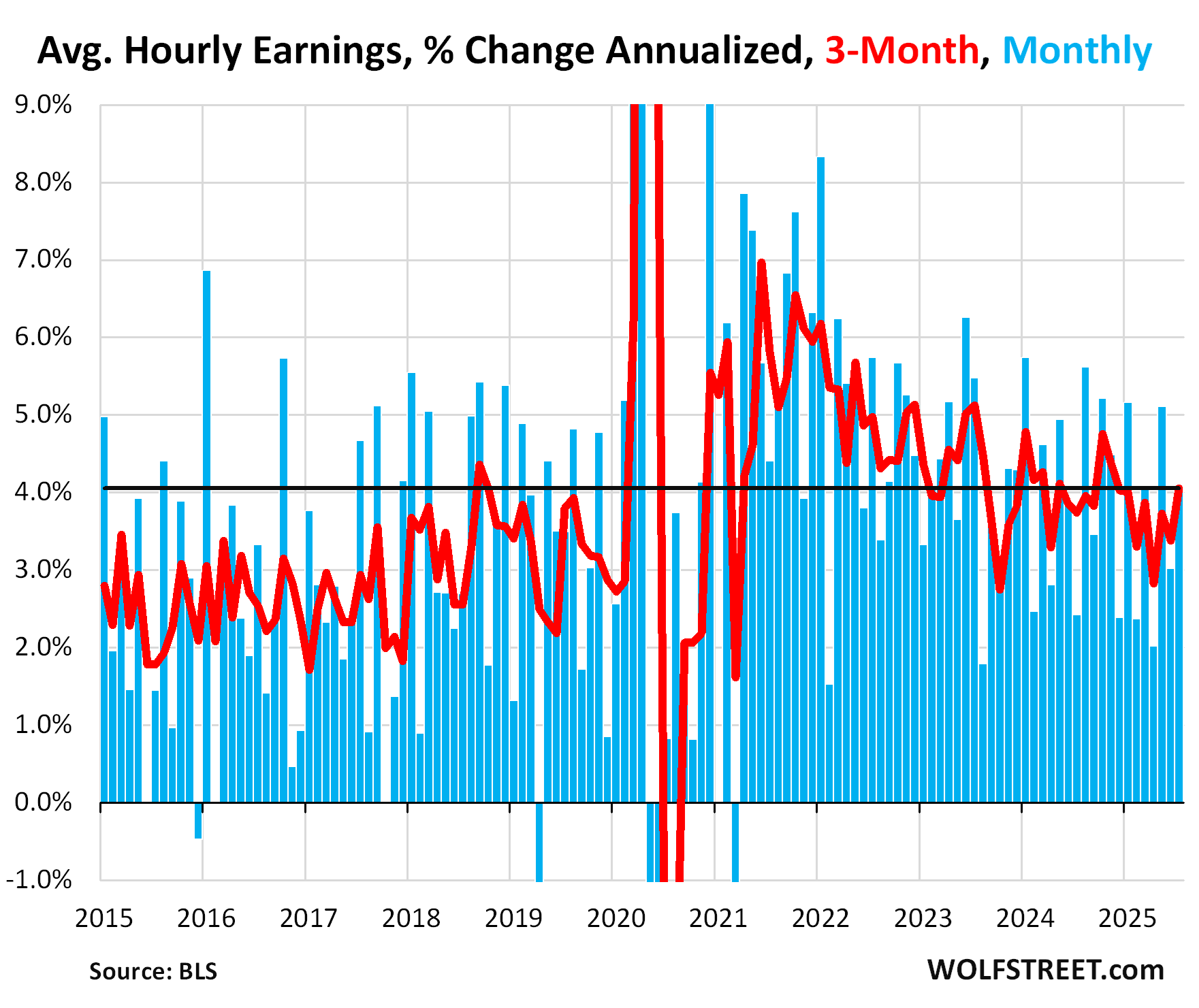

We also see these dynamics in the accelerating wage pressures. We see that in today’s average hourly earnings in a moment, and we saw it in yesterday’s broader Employment Cost Index (includes the cost of benefits), which spiked in Q2.

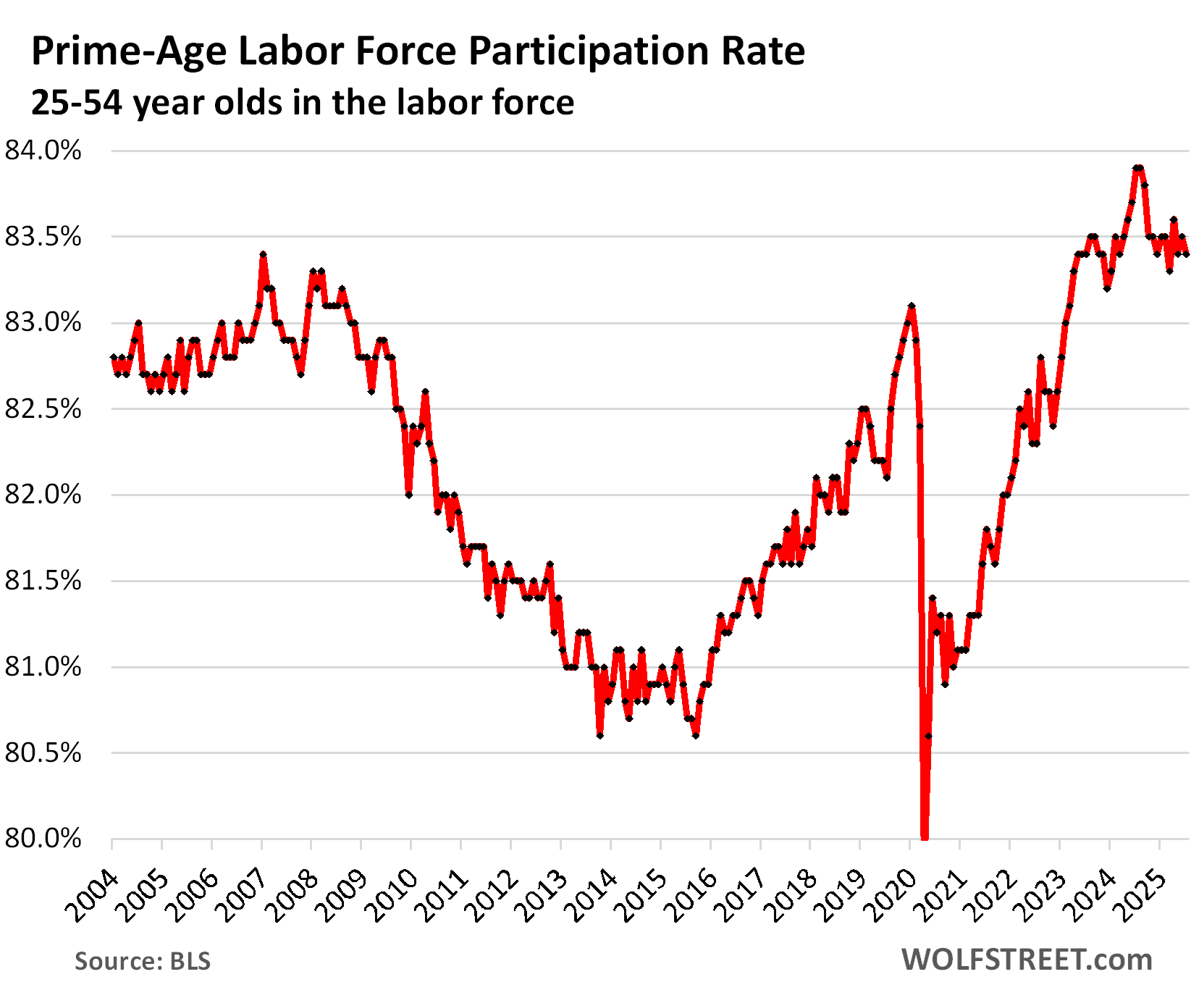

And we see it in the prime-age labor force participation rate (people aged 25-54) which has been higher than in the two decades before the pandemic: 83.4% in July, roughly the same over the past two years.

And this is how Powell discussed it at the press conference on Wednesday:

“You do see a slowing in job creation but also a slowing in the supply of workers. So, you’ve got a labor market that’s in balance, albeit partially because both demand and supply for workers is coming down at the same pace, and that’s why the unemployment rate has remained roughly stable, which is why I said we do see downside risk in the labor market.”

“Our two-mandate variables are stable prices and maximum employment, not so much growth.”

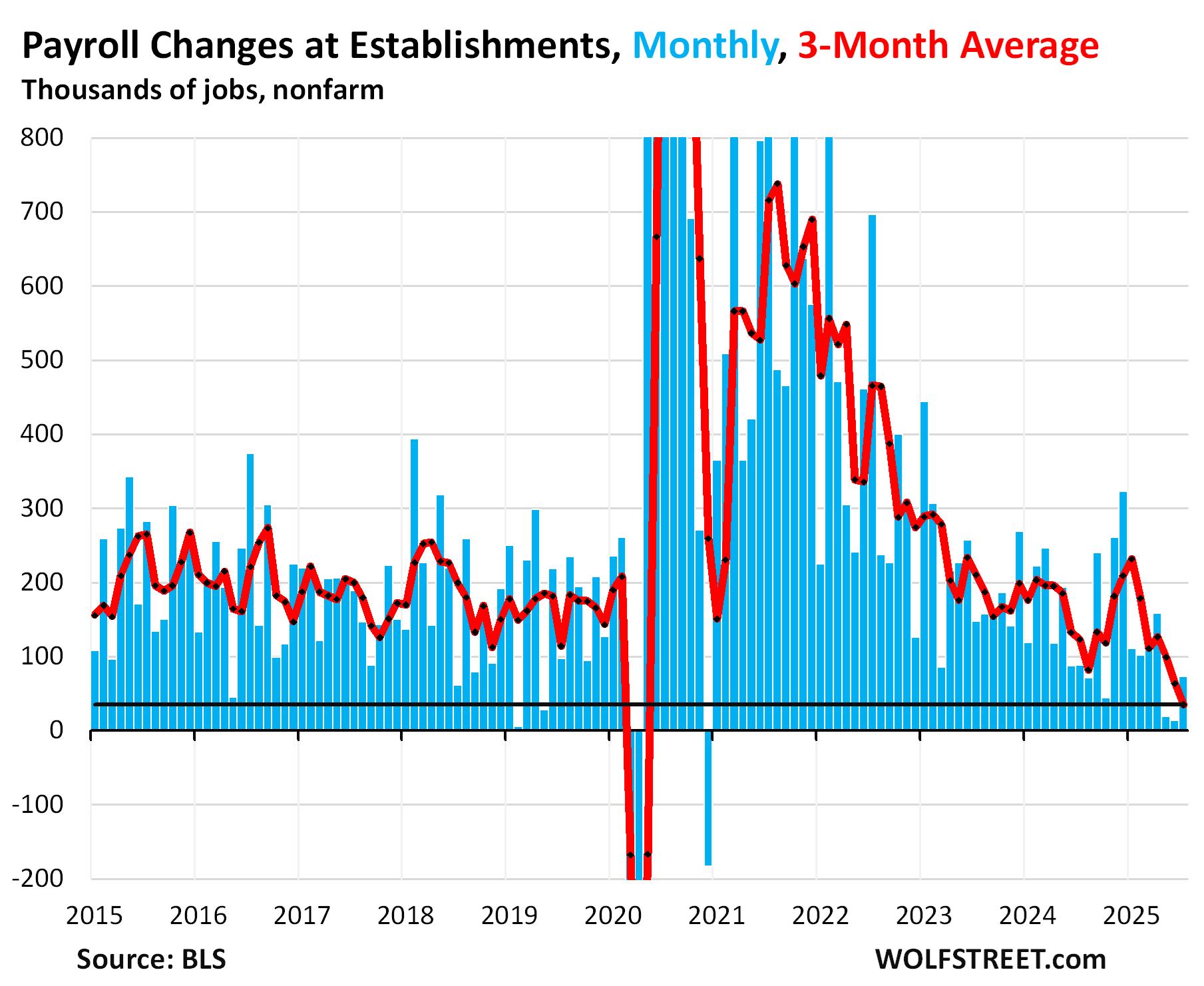

Total nonfarm payrolls rose by 73,000 in July, to 159.6 million, even as the federal government shed another 12,000 jobs, according to the Bureau of Labor Statistics today. The prior two months were revised down sharply.

Over the past three months combined, 106,000 jobs were added to payrolls, even as the federal government shed 47,000 jobs over the three months, and governments at all levels shed 49,000 jobs. The government-job-creation machine has reversed.

The private sector added 83,000 jobs in July and 155,000 jobs over the past three months.

So that’s the slowing growth of demand for labor, balanced out roughly by the slowing growth in the supply of labor – actually supply of labor may be declining as per the labor force data.

The three-month average, which irons out some of the month-to-month squiggles and includes the revisions, rose by only 35,000 (red line in the chart).

Average hourly earnings rose by 0.33% in July from June (+4.04% annualized. The three-month average growth accelerated to +4.05% annualized. The three-month average has zigzaggedly accelerated since April.

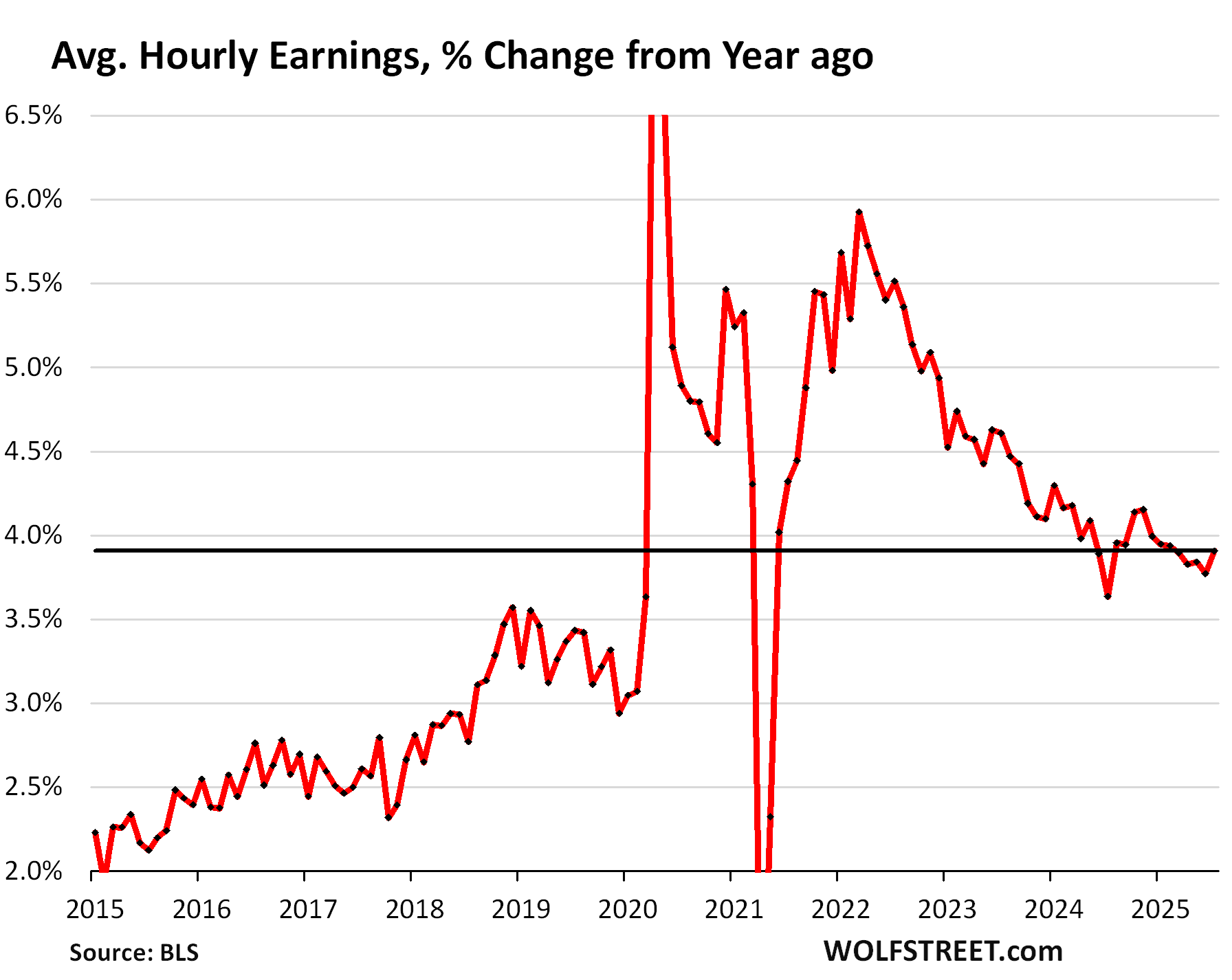

Year-over-year, average hourly earnings accelerated to +3.9% in July, well above the wage growth before the pandemic.

The labor force data was adjusted in January to reflect the flood of immigrants that hadn’t been reflected in the data in 2021 through 2024. That upward-adjustment of 2.20 million is marked in blue in the chart below. Total employment was upwardly adjusted by 2.23 million. I discussed this in detail here.

But over the past three months, the labor force shrank, likely due to the dramatic slowdown of the influx of immigrants and the continued large number of retirements, including from the federal government as part of the federal job-shedding programs.

In July, the labor force dipped by 38,000 to 170.3 million.

This smaller labor force – and therefore smaller supply of labor – is what is keeping the labor market that is growing more slowly in balance, and is keeping the unemployment rate low:

The prime-age labor force participation rate (25-54-year-olds) has remained high and stable. In July, it was 83.4%, same as in July two years ago.

The labor force participation rate shows the percentage of the working-age population that either have a job or are looking for a job. When people retire and stop looking for a job, they exit the labor force but remain in the population until they die. The flood of boomer retirements, which started about 15 years ago and continues to this day, has pushed down the overall labor force participation rate, as these retired boomers are still in the population but no longer in the labor force. The prime-age labor force participation rate eliminates the issue of the retiring boomers.

Unemployment rose by almost the same amount that it had fallen in the prior month, and over the two-month period there was essentially no change, with 7.2 million people unemployed in July, same as in May. The three-month average has been roughly unchanged for the past three months.

The headline unemployment rate (U-3) rose to 4.2% in July, after the dip in June and is back where it had been in May and prior months. For the past 14 months, the unemployment rate has stabilized at the historically low range of 4.0% to 4.2%.

The unemployment rate reflects the number of unemployed people who are actively looking for a job (7.2 million) divided by the labor force (people working or looking for a job, 170.3 million).

Federal government jobs (civilian employment) shrank by 12,000 in July, to 2.93 million jobs, the sixth month in a row of declines. Since January, federal government civilian headcount has dropped by 84,000.

Over the same period in 2024, federal government headcount had risen by 25,000.

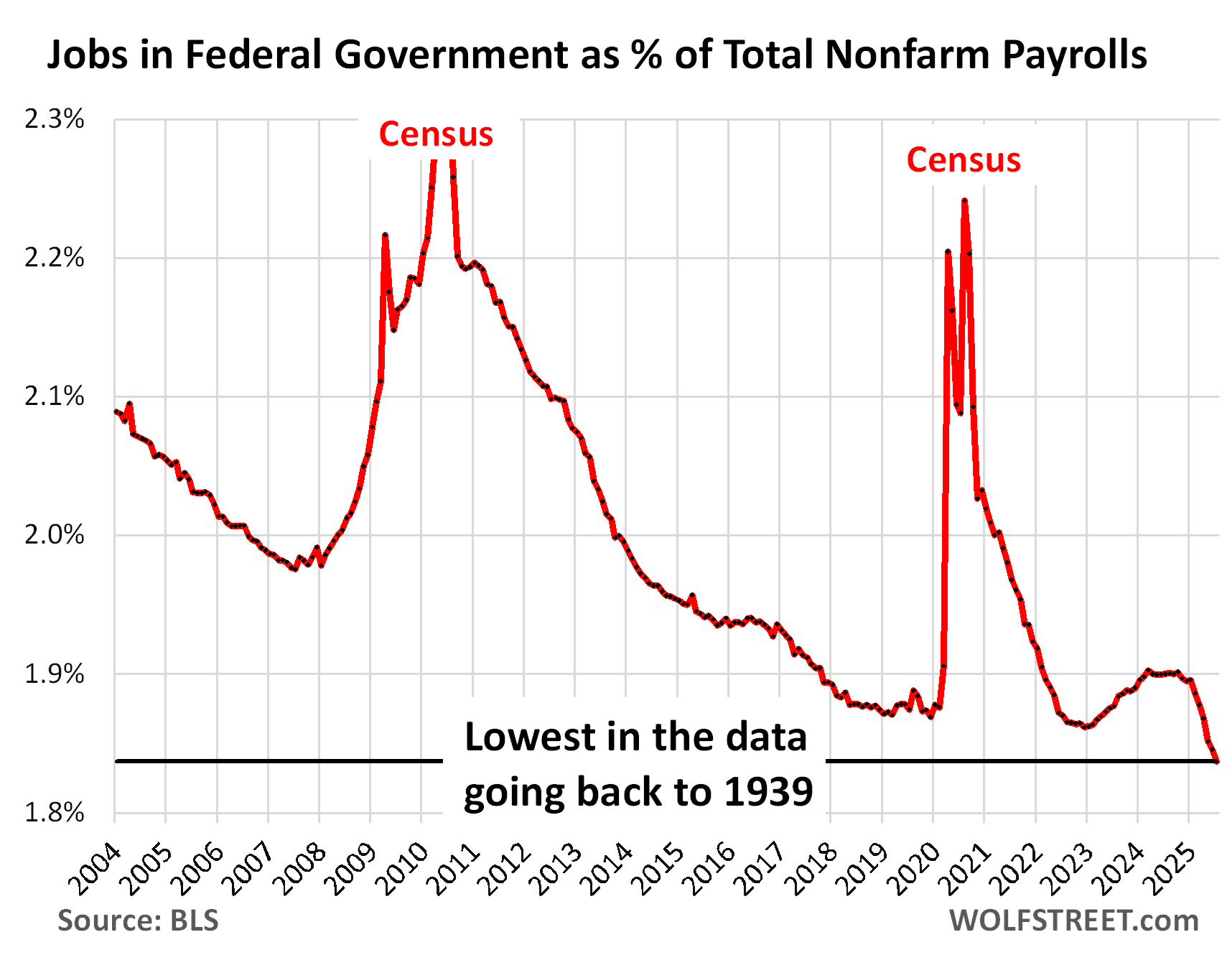

The share of federal government jobs dropped to 1.84% of total nonfarm payrolls, the lowest share in the data going back to 1939. It peaked during the Second World War at over 7%. During the 1980s, it was around 3.0%:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

First. Also, didn’t read the article.

Atta’ boy 🏆

CSpunky –

Well done! Try to add value next time…

The huge downward revisions in the previous two non-farm payroll readings struck me as somewhat awkward for the BLS. Today’s number should have a big P after it, as in Preliminary. When will they revise the revisions? What to make of all this?

Assuming the revisions in non-farm payrolls are correct and today’s number is correct we see a huge increase in non-farm payrolls over the previous two readings. Combined with a 4.2% unemployment rate and the increase in cost of labor, the labor market is doing fine.

Powell and Wolf explained the new dynamics in the labor force, where “both demand and supply for workers is coming down at the same pace.” Automation, robotics, and AI are reducing the demand for labor, and self-immigration, arrests, and the near total end of illegal immigration are driving down the supply. Another piece of good news is the huge number, relatively speaking, of federal workers that have been fired.

So despite MSM, Trump, and Wall Street wailings, all who want bad news so they can get lower interest rates, this report is not so bad. I would call it “good”. The long term bond market yields are down a lot, but maybe they will wake up and see reality later on. I don’t give a f about the stock market.

What exactly is AI doing though?

Is it fixing the roads?

Is it fixing a broken window?

Is it making my coffee?

No

My job is not to do any of those things. My job is to analyze data and publish articles, and AI is doing that all over the place, and lots of people have already lost their jobs to AI because lots of publications are now publishing AI generated content, instead of human-generated content. Reuters, Bloomberg, MarketWatch, etc. started doing this years ago.

Many actors of all kinds, including porn actors first and foremost, fashion models, entire film crews, coders, tech workers, drivers, call center employees in Bangladesh, etc. have already lost their jobs to AI.

But most jobs in the trades are likely safe.

Wolf: Is that generative AI you’re referring to?

Also, do we have numbers to prove that job losses in those categories happened and that the losses were because of AI? Thanks!

Yes.

Yes. Just google it. It has been happening for years, it’s all over the place. you will see. Here are a couple of examples that made the news at the time:

2023: “BuzzFeed will be relying on its creators and AI to propel the site forward, after shutting down BuzzFeed News and laying off 15 percent of its workforce…. “Broadly speaking, I believe that generative AI will begin to replace the majority of static content.”

May 2025: Business Insider announced that it would cut 21% of its staff — the third layoff — and shift work to AI. Quoted from Variety:

“As part of the restructuring, Business Insider is “going all-in on AI,” Peng said. “In the past year, we’ve launched multiple AI-driven products to better serve our audience — from gen-AI onsite search to our AI-powered paywall — with new products set to launch in the coming months,” the CEO wrote. Business Insider is also “exploring how AI can boost operations across shared services, helping us scale and operate more efficiently.”

For better or worse, I don’t see AI taking jobs in the tech industry. It might happen in the next few years, but it’s just not good enough yet.

Consider that writing code is a small portion of overall time that average software engineer spends. Maybe around 10%-20%. Out of that current AI might give a speed up of 10%-20% if you are lucky. So you get 1%-4% productivity improvement. Maybe overall across the industry it will show up in some metrics, but for a given company to layoff engineers because of hypothetical few percent productivity improvement just doesn’t make sense. What does make sense is to hype it up on earning calls to boost the stock price. Or layoff people to make Wall Street happy. But that’s hardly due to any AI revolution.

Apparently AI should be computing BLS Job numbers.

And why isnt it?

Because it is something people want to control and use for their own purposes. We have “data scientists” who are using telephone survey data while acknowledging a lot of businesses do not respond to the surveys – hence the revisions.

We suddenly add “2 MILLION” new workers(!) to adjust our figures for “migrants” working in the USA.

There are more accurate ways to measure employment, but those in power prefer the current corruptible and inaccurate system. An old saying in scientific research, “Garbage in, garbage out.”

sufferinsucatash

Here’s what AI is doing. Booz Allen was just awarded a multi billion dollar contract to equipt every combat soldier with an AI box on his back. The AI will tell him when to fire his weapon, where to fire it and when it’s in need of cleaning and short on ammo. The next step is a complete robot army powered by AI. You won’t need any soldiers anymore.

Yes and no.

The AI has to be fed with near real or real time “authoritative” data. Wickers other factors into play.

There is what AI “does” and there is the set of problems it is moving the ball forward on.

Fixing a window? Nope. Providing a recommended set of steps? Yes.

Working toward solutions in complex engineering disciplines? Yes.

AI isn’t a magic elixer. It leverages knowledge (e.g., probability theory, statistics, higher level math, etc.), evolving technology (e.g., parallel/networked processing, GPUs), capacity (e.g., energy), etc., to broaden the set of tools available to mankind. It has a place. Society must weigh the costs and benefits when making investment decisions – to include ethical considerations.

Stage setting. Back in the day I was part of a team that worked the next gen solution for a very complicated problem space – the single integrated air picture (military). Technology at that time was adequate, but the expansion of data collection sources/volume and data types overtook the current technology. It wasn’t routine, but blue on blue incidents, false tracks, all the rest were no longer acceptable. AI can move the ball forward in this field. Like most human endeavors, the challenge was/is discovering the right path forward.

Yes pointing out the president just fired one of the most senior statisticians in the country because he doesn’t like the numbers is stuff of smooth brains, not the guy quoting mein kampf. This is banana republic stuff.

I believe you quote me in kempf.

And why not fire them? In the last 1.5 years there have been huge revisions. Something is wrong and needs to be fixed.

Are you saying that no one should ever be fired if they suck?

*mein

You are blind. She was was fired because he didn’t like the numbers. He will appoint someone who makes up numbers he likes. Anyone with half a brain could see this coming a year ago. And anyone defending it, doesn’t have half a brain.

Except he never have that as a reason, he said they had been rigged…

Trump takes advantage of people who ignorantly do not understand why there are “revisions” in job numbers.

The revisions do not mean anyone is doing anything wrong. All it means is that they come out with an inital number based off of preliminary numbers, then as better numbers (which take longer to collect) come in, they revise the inital number. This has been going on for years.

Nothing nefarious nor incompetent.

Just ignorance being taken advantage of for political purposes.

Nonsense. The process may have perturbations, but there is still a distribution over time and large variance draws attention – as happened with this particular BLS lead, more than once.

Having worked gov’t data analysis as a collateral duty in the IT field, I can attest that at the large scale of collection gov’t works at, the errors and inaccuracies often multiply. The data “normalizing” and all the rest that goes on behind the scenes can be interesting.

In the event, “revisions are a normal part of the process” doesn’t address the accuracy of the end product. BLS data is not my field so I do not know the specifics in this instance.

What I do know is the executive is fully empowered to fire political appointees – and employees under various policy constraints. All parties have practiced same – forever. Saw it DHS with some friends when Biden admin took over (same happened when Trump took over). At that level, all such decisions are inherently political.

Serious, Eric86; “Everything He Does is Magic” sing along!

Not a Trump fan, but when did firing a beaurocrat become equivalent to the Third Reich? A nationalist boorish chaos agent isn’t the equivalent of a mass murderer. You would have more credibility if the endpoint of every comparison isn’t Adolf H.

The reference to mein kampf is how much he talks about the lying press in it. You would have more credibility if you knew some basic history.

Firing a bureaucrat is one thing. Trying to send the message “if you publish data that goes against my desired narrative, you’ll be fired” is another step towards becoming China.

I always have this FEELING the labor/CPI revisions move from good to worse regardless of administration. Took a look at the labor numbers.

From first to most recent… average absolute revision through Biden and Trump is equal at about 77k. Universally TERRIBLE accuracy.

Looking at the direction of revisions… Biden had a 33% negative bias on initial prints whereas Trump has had a 100% positive bias on initial prints (measured as Mean/MAD).

How that spins? All of Trumps revisions in this term have been down, and that stings, but that also means he’s been getting HIGHER initial prints (positive bias) which at the end of the day is what tends to dominate the headlines. Accuracy is bad, it’s always been bad and that’s not new. However, I’d argue that the current admin has benefited from the inaccuracy.

AaRoW

BS. You are willfully ignoring the 2.2 million UP-adjustment in total employment in the January jobs report (released Feb 7) because it doesn’t suit your bullshit narrative.

READ THIS before you post more BS:

https://wolfstreet.com/2025/02/07/huge-upward-adjustment-of-employment-labor-force-as-wave-of-immigrants-is-finally-included-unemployment-drops-wage-growth-accelerates-the-annual-revisions-are-here/

Seasonally adjusted.

Source:

https://www.bls.gov/web/empsit/cesnaicsrev.htm#2025

That’s “nonfarm payrolls” which is one data set. The second data set in the jobs report is total employment, and that was up-adjusted by 2.2 million for January. The link I gave you covered that. Look at the chart. But you refuse to see it because it doesn’t fit your narrative. So OK, here is that chart again about the 2.2 million up-adjustment in January (blue), and now you cannot unsee it 🤣

If hiring from import substitution happens, when should we expect it to show up in the labor reports?

I assume first we’ll have to see the tariffs stabilize, then the inventories run out, then the US backlogs increase, and some quarters after the backlogs are significant and stable, hiring will happen, and then some time hiring will show up in the reports?

So mid to late 2026? Or can we project a timeline like that?

If they shift production from Mexico to an existing US plant and just increase production at the US plant, that would be fairly quick. They would have to rejigger their supply chains, maybe install additional equipment, and hire people. So maybe your 2026 window is about right for that.

But if they decide to build a new factory… It takes years from making a corporate decision till the factory starts mass-producing. They have to buy a property, deal with the local authorities, arm-twist concessions from them, get the permits, etc., then build the factory, equip the factory with robots, hire and train the employees, and get the whole thing to work smoothly. So that will be years before it shows up in manufacturing employment.

But it does show up in construction employment more quickly, and that has been strong in part because we’ve had a factory construction boom now for three years, and it continues, and construction companies are talking about labor shortages now, that they can’t hire enough workers for their construction sites, amid this crackdown on illegal immigrants:

Wolf, I notice there has been a slowdown in the manufacturing construction spend you reported on last year – do you think this is related to the immigration crackdown, sluggish economy or has the 3x increase in 2021-2024 just run out of steam?

I believe the number of construction workers includes housing as well as other things.

Housing units under construction have been falling for a bit, so that might explain the flat part?

Slowdown? Nonsense.

Spending had spiked in 2023, and in October 2023 hit the magic range of $18 -$20 billion a month, up by 200% from before the pandemic. And 2024 and so far in 2025, spending has run along those spiked levels. This spending has been between $18 billion and $20 billion a month since October 2023, every month! Which is huge, up three-fold from before the pandemic.

In June (today’s data), it was at $19 billion, right in the middle that $18-20 billion spike. There is no slowdown. This is a massive wave of investment.

Big Ooph, the Fed starting to find themselves in a bind. And not just from the political pressure. Job market weakening, but with average earnings remaining stable and new taxes (tariffs) coming into effect, they won’t want to cut yet.

Soon that won’t be their decision though, when ol’ Trumpy gets his way.

Job creation is in the doldrums, inflation is still above the Fed target, and tariffs-mediated price increases may be about to kick in. The beginnings of stagflation?

It really isn’t in the doldrums. Did you read the article?

73,000 seems pretty crappy

Do you mean the second paragraph?

“The pace of job creation by employers has slowed”

Now you’ll target me. Native born workers are up, foreign born down, government down. That basically explains the entire situation. Wage growth is up.

Participation is steady.

I get that you guys want the country to fail

I don’t, nor was I complimentary of everything Biden did. The reason we’ve needed rates consistently high is partially both Trump and Biden’s insistence on ramping up the deficit.

But I also don’t ignore facts. Moody’s which has never had a false positive now sit at 49% probability of a recession. That is where we are.

Ekky – You are a pessimist.

It’s not 49% chance of a recession. It’s 51% chance of continued growth.

Wage inflation still occuring as the economy is slowing. Stagflation is finally on the menu.

Trump lashes out by FIRING Biden-appointed senior official after disappointing jobs numbers report

Donald Trump demanded the firing of a top Joe Biden official overseeing the country’s ‘jobs numbers’ after a lackluster report.

This makes no logical sense if Trump wanted more ammunition to fire Powell.

He could have highlighted fewer than expected jobs being created and blamed Powell for not lowering interest rates.

Instead he fires the BLS director whose data would support lower interest rates.

So his long game for getting a Fed to support lowering interest rates is what, a roaring economy?

Apparently so!

Haha. The genius of Trump. Nothing makes any sense.

Trump is like us. Just reacting to the latest news from his “gut” or “common sense”.

The big difference is that our comments are meaningless. It’s ok if we don’t know what we’re talking about, and don’t want to bother to defer to a more leaned and credible opinion. For POTUS, however, it’s not great.

SoCalBeachDude

Good. It’s about time Trump got rid of all these losers who were held over from the Biden administration. Good riddance to all of them.

Yeah, because shooting the messenger is a great strategy.

Apparently in MAGA world if you don’t like a number, just fire the person who computes it. That’ll fix it! I mean it worked great for COVID. The minute Florida stopped collecting stats, the deaths stopped too, amirite?

Do employers of illegal immigrants (or they themselvers) pay any of the following? Just askin cause I’m not sure.

“Mandatory taxes

Federal Income Tax (FIT): The amount withheld depends on your earnings and the information you provide on Form W-4 to the IRS. The IRS provides income tax brackets that determine the rate at which different portions of your income are taxed.

Federal Insurance Contributions Act (FICA) taxes: These taxes fund Social Security and Medicare.

Social Security Tax: This tax funds retirement, disability, and survivor benefits. In 2025, the Social Security tax rate is 6.2% for employees, applied to wages up to the wage base limit of $176,100.

Medicare Tax: This tax helps fund healthcare for individuals age 65 or older, younger people with disabilities, and those with certain medical conditions. The Medicare tax rate is 1.45% for employees, and there’s no wage base limit for this tax.

Additional Medicare Tax: If your wages exceed a certain threshold (e.g., $200,000 for single filers), an additional 0.9% Medicare tax is withheld from your paycheck. Employers are responsible for withholding this additional tax once your wages reach that amount, according to the IRS.

State Income Tax (SIT): If your state has an income tax, it will also be withheld from your paycheck. Some states have flat tax rates, while others use a bracket system similar to the federal government.

Local Income Tax: Some cities or localities also impose income taxes, which will be withheld from your pay.

Other deductions

Pre-tax deductions: These deductions are taken out of your paycheck before taxes are calculated, which can lower your taxable income. Common examples include:

Contributions to a 401(k) or other retirement plan.

Health, dental, and vision insurance premiums.

Contributions to a Health Savings Account (HSA) or Flexible Spending Account (FSA).

Dependent care Flexible Spending Account (DCFSA) contributions.

Commuter benefits for parking or transit fees.

Post-tax (or After-tax) deductions: These deductions are taken out of your paycheck after taxes have been calculated and withheld. They do not reduce your taxable income. Common examples include:

Roth 401(k) contributions.

Group-term life insurance exceeding a certain coverage amount (e.g., $50,000).

Union dues.

Disability insurance.

Charitable contributions.

529 college savings plan contributions.

Wage garnishments (court-ordered deductions for debts, child support, etc.).

How can they pay most of those taxes if the recipient does not have a valid Social Security number?

If they use a fake SS#, as is apparently the case in many cases (meatpackers got in trouble over this recently), the employer and employee pay those taxes, but the employee can never benefit from SS benefits, unemployment etc. because when they apply with a fake SS#, they go straight to heck and don’t pass Go. So they’re paying into the system without ever benefitting from it.

Doesn’t and/or can’t the government simply check for the validity of any Social Security number being used? How about e-verify?

Sure. But if the government tacitly approves or encourages illegal immigration, and if companies lobby to get the illegal immigrants and be left alone, well then, that’s what you get.

E-Verify was shuffled aside as a requirement. Instead, companies use it because it provides them with safe harbor. But E-Verify has never been modernized apparently and is unable to detect real SS numbers that are used by someone else (identity theft), which is what the meatpacker allowed to happen.

The whole thing is a scandal.

“So they’re paying into the system without ever benefitting from it.”

Was this a plan by the previous administration to help make Social Security solvent?

I may have to revise my opinion of Uncle Joe.

Wolf is correct about workers with false documents not ever receiving their earned benefits, just one more reason to INCREASE the LEGAL immigration INTO USA.

Worked when a company, more than 20 years ago, that had been busted and fined heavily for employing undocumented, so ”vetted” every hire through the E-Verify, (including me) ,,, and, because they knew I was not a rat, many of the people who actually did the very hard work told me how they purchased documents before coming into USA, and it was fairly cheap and they earned about 10 times what they earned at their home countries all over the world, and were very happy even knowing they would not ever get what they earned…

USA, like totally dudes and dudettes, NEEDs to improve the LEGAL system to bring in ALL those who want to work and earn, which was totally the system under which ALL my ancestors came here.

Good luck and God bless all workers!

Thanks for pointing it out contrary to all misconceptions. The poor, powerless immigrants (from the work perspective, not legal) get shafted by their own country (otherwise why they need to come here), our employers (like Trump), and then the system (pay into social security, Medicare but can’t get anything) and finally abuse by the citizen overlords.

I believe the effect (of having less of them) is showing at least in fresh produce. As a vegetarian, I thrive on fruits and vegetables and used to see lots of digital coupons in Kroger etc. This year fruits don’t show up at all and coupons almost twice as last year. Well, avocados still ok.

Go shop somewhere else. Kroger is ripping you off. Check online retailers, check Costco, look around. And couponing had its day and seems to be fading. Look for actual prices.

The US produces absolute gorgeous produce. It’s stone-fruit time. Buy USA-grown stone fruit. If you buy imported stone fruit, you deserve to pay tariffs out of your nose.

Minor quibble with this common narrative about immigrants paying taxes they won’t benefit from:

1) Immigrants benefit plenty from the taxes paid by current and past citizens.

2) Everyone pays in to unemployment, but are actively prevented from collecting even when they do try (especially at the lower economic rungs).

Change Machine: I’ld also factor in all the “external diseconomies” (that seem to get short shrift) directly associated with open borders/uncontrolled immigration: murder, rape, gangs, robbery, drug smuggling/fentanyl deaths, theft, bogus votes, displaced workers, etc., etc.

Moral ambiguities aside, there has definitely been a shifting of risks in terms of who benefited and who suffered.

There is a huge number of illegals working in this country for cash. I have personal experience with this happening in the landscaping industry and the nanny industry – both in the Southwest.

These people want cash every week with no taxes taken out. They know exactly what they are doing – maximizing their income and minimizing and taxes/with-holdings that would reduce their take-home pay. And yes the nannies have multiple children attending schools, etc.

This is a very complicated issue that could have been solved 30+ years ago but our elected representatives preferred to have it as a “wedge issue.”

One can expect payroll taxes to increase and an increase in the caps on income limits…you can’t run deficits ad nauseum, corp rates go up, spending and fraud, graft and grift to tighten up…it’s the plutocrats system, either they save it or destroy it…50,50 either way…

Correct gazing one:

Howsomeever, it would certainly be a ton easier to enact a very simple, straightforward, and completely ”transparent” transaction tax, per earlier Wolf comment.

Other than the fact that such a tax would make many current ”leeches” of the current tax system totally redundant,,, it would spread much more equally the ”tax” burden between the rich/oligarchy and workers at every level, and provide much more ”fairness” for all..

Fact is, I am surprised the rich people in total control, at the moment, have not already suggested this as a way to make our world more balanced, and head off the likely forthcoming more dramatic corrections that have happened to every empire in human history…

Including the last previous one on which the sun never set!!

CNBC: Federal Reserve Governor Kugler, part of the committee that sets interest rates, is resigning

Federal Reserve Governor Adriana Kugler announced Friday she is stepping down from her role at the central bank, creating an important vacancy at a time when President Donald Trump is pushing for lower interest rates.

In a letter addressed to Trump, Kugler, 55, did not state a reason for her decision to leave, only noting that she will be returning to Georgetown University as a professor in the fall.

GOLDMAN Urges Caution as Global Credit Spreads Hit 2007 Lows…

They announced so much profit not too long ago.

Big bonuses!

Dont forget the stock buy backs…

Did they ever repay that $13 Billion from 2009 that was part of the great bailout?

Reminds me of Brexit shortly after it occurred. The brits have been regreting it since.

What’s not to regret?

People here in this country generally don’t regret rising wages.

Can we blame AI, partially sarcastically.

Head of BLS fired. Expect good number next month, boys!

That’ll be funny. Great jobs numbers, rising inflation, reasons for the Fed to hike… Careful what you wish for?

I wish for lower rates and more QT.

I hope we change the way we measure job creation and all the other things they are supposed to track. I think we can be more accurate and have fewer “revisions.”

Bad but not a total disaster and to be expected when payrolls were flooded with immigrant labor over 3 years.

Not really stagflation as unemployment is still very low.

America has always had immigrant labor

It’s how most of us wound up here.

Now Trump is saying he’s going to fire the head of the BLS because he doesn’t like the numbers. Fed Governor Kugler is also resigning.

I think Wolf’s guess on long term rates was like >10% if interest rates become politicized? What’s our guess on that if the economic data does as well? Krugman recently used the analogy of Turkey, where short term rates are currently at 45% to try to control raging inflation.

YOUR FIRED!!! 🤦

Can’t be good for bonds not that they will care in the interim.

We’re headed to 10% plus rates in the next 5-10 years maybe sooner.

So embarrassing for our country

This overt cooking of the books will trigger long bonds shooting past 5%. If the massive buyers are as on point as it seems, we’ll be at 5.5 within weeks.

The 10-year said “meh” and barely moved yesterday…

Lots of variables at play. Time will tell.

No worries. Turkey buys energy from Russia. Popcorn futures are UP! August 8 is Sanctions Day! f Turkey sides with BRICS is it then TRICKS?

I have long questioned the veracity and quality of government data. This doesn’t sit well with Wolf since most of his website depends on such data. I like to think the government gets it “about right.” But these last two gigantic revisions in non-farm payrolls makes me wonder about that fairly low bar. The current data should have a big P following it (as in pee), since we now see such numbers are Preliminary at best.

The BLS should explain in detail why their numbers were off by so much. Firing the head of BLS is okay with me, but the new guy or woman needs to figure out why the numbers were so screwed up, what the heck is going on, and let us know.

This is my point to people. Sure it can be seen as political but Trump also says that huge revisions like this are ridiculous. They were ridiculous a year ago too.

Something is fundamentally broken if huge revisions take place. Only in government is it seen as a scandal to fire someone for this shit.

Trump himself is not claiming that he’s firing this person because the revisions are too large, he’s firing them because the revisions were done for political reasons. The evidence? Because they were large and unfavorable to him. I would love to see someone try to tell me with a straight face that this would have happened if it had been a large positive revision.

1. If you want simplistic answers that are absolute, go to church. Don’t do data.

2. Note the 2.2 MILLION UP REVISION in total employment and labor force in the January data (marked in blue in the chart).

3. Collecting data on a vast, intricate, and decentralized economy, such as the US economy, is a massively complex undertaking.

4. Revisions are scheduled in advance. They KNOW and EVERYONE KNOWS all data will be revised as more data points are being collected and consolidated. Revising data is a lot better than not revising it.

5. But those revisions have been huge, last year the big down-revisions, in February the 2.2 million up-revision, today’s revisions — they may be revised higher next month, which has happened lots of times before…

6. One of the biggest labor data problems: The surge in immigrants in 2021-2024 at first didn’t make it all into the data and caused a lot of problems in the data that then required massive revisions. There are other issues too, and it would be great to get more accurate data. That starts with accounting more rigorously for illegal immigrants in the labor force, and not make this a tabu topic for the government.

7. I’m not opposed to firing the head of an organization that produces subpar results. This happens all the time.

Everyone agrees with your last statement (7)

Are you saying the performance of the Head of BLS was subpar?

I have complained massive and in numerous articles about two huge f**k-ups by the BLS:

1. How they derive their CPI for health insurance. It completely blew up in 2021-2022, and they only patched it. The whole method is bad and needs to be replaced. This should have never happened. And they still haven’t replaced the method. It’s still the same failed method. Google: health insurance chickenshit

2. How they refused to incorporate illegal immigrants in 2021-2024 into the labor force and employment data. They finally did, but three years after the fact. They should have done that immediately when the wave of illegals started pouring in. It messed up the figures in a big way. There are many articles here about this topic. But I have to primarily blame the Census Bureau, because it’s the Census Bureau’s job to track populations. The BLS just takes the figures from the Census Bureau, and it was the Census Bureau that f**ked up, and that then messed up the results that the BLS released. I think there an administrative tabu to really track illegal immigration. It was this issue with the understated population growth (by nearly 10 million in a three-year period) that trigged the hugest revisions. That stuff is just inexcusable. Whoever was responsible for that at Census should have been fired long ago.

Wolf, I certainly agree about the problems with census data. The US is not designed, thankfully, for an accurate census. Sweden, e.g., where the government tracks everybody and everything, does not even bother with a real census. They know what is going on every minute.

For the U.S., among other problems with counting the population, the huge illegal immigration makes census figures only slightly better than guesses. We still have no idea how many illegals there are in our country. I have heard anywhere from 10 million to 30 million. They are difficult to count because they do not want to be counted. Some have been living here for 20, 30 or 40 years, and technically should be deported.

I prefer to live in a country where the census data is not very good. It means the government has less control over the population, and more freedom for individuals. It definitely calls into question economic statistics, allocating membership of the House, the electoral college, and monies coming from the federal government to the states. Despite all this, the U.S. has been doing fine without accurate censuses.

It’s people who watch the data, like Wolf, who keep the stats meaningful, and make the fact checkers publishing of the statistics, more accurate.

MW: Stocks end week sharply lower as tariffs, poor jobs report deliver one-two punch

The 5th seasonal inflection point was july 21st, then down to the middle of october.

If this trend continues, GDP will go down? Productivity improvements, technology advancements and higher labor force contribute to growing GDP. With a declining labor force, GDP will go down so much. Both earnings and spendings by the missing labor force increase. How much will GDP be affected as a result?

So, remember how we questioned the veracity of the ADP numbers last month? …now I’m not saying there may not still be some statistical sampling issues, but sure looking like they may have picked up the change in the direction of the wind. Interesting…hmmm.

ADP number, unlike BLS numbers, are based on actual employment data of their payroll recipients which is a subset of overall employment but vastly larger than any BLS survey sampling.

Nonsense.

ADP is based on payrolls by employers that are customers of ADP. Many bigger companies have their own payroll departments, and there are a bunch of competitors to ADP, and ADP doesn’t get their data. So the ADP data is always weird.

The BLS uses multiple sources of data. Nonfarm jobs data (today) comes from employers. The total employment and labor force data (today) come from household survey. On a quarterly basis, BLS uses the corporate payroll tax filings and unemployment insurance data that companies have to file and pay every quarter, and this data is incorporated once a year, which caused the big adjustment last August and finalized in January (but it doesn’t reflect illegal immigrants). The BLS uses Census Bureau data. In 2024, to get a grip on the illegal immigrants in the labor force, BLS used ICE and immigration court data, which caused the 2.2 million up-revision in the January data. etc.

This is just off the top of my head… there is more. You can read all about it on the BLS website.

The problem is that much of this data is available only on a quarterly basis or annual basis, which is why there are two big adjustments/revisions every year, one around August, the other in February.

Once again Wolf:

THANK YOU, SO much for your clarity, and perhaps more importantly YOUR THOUROUGHNESS…

Exactly why I send you $$ every year, and will continue ’til the cows come home!

Thanks again,,,

I look at the first chart and I see negative payrolls as a very real possibility.

The Brits are arresting their citizens for expressing opinions that are objectionable to their benevolent overlords.

The cultural suicide of the Brits is a far larger issue for them than Brexit

UK has been going downhill ever since we kicked their butts 1775-1783. It is now just a crummy little island in the North Sea. Britain was great once and ruled a big chunk of the world, but the baton has been passed to the United States, just as classical and hellenistic Greece passed her baton to Rome. The recent invasion of Britain by North Africans and Asians was the final nail in the coffin.

The UK grew in power after 1783…

Got your dates wrong t2:

”GREAT Britain” grew from about the time England went to war with Scotland and Wales and invaded and decimated the population of Ireland until they lost control of the Suez Canal, approximately mid 1950s.

That GB is the model of and for USA degradation absolutely IS relevant,,, but only if USA oligarchy does NOT follow now obviously clear lessons from demise of the empire on which the sun never set…

As a former member of USN,,, I hope for all our sailors and Marines and soldiers that USA figures this out sooner in the cycle than GB,,,

I feel like Germany had a little to do with the UK decline…

Wow, it’s pretty rare to have so many politically polarized comments — my antennas are alert, wondering why.

Are the barn doors open now for expressing how we really feel, or is this an experimental thread?

Probably not the right time to post this:

“ Jackson wrote. “With scant justification, the majority permits the immediate and potentially devastating aggrandizement of one branch (the executive) at the expense of another (Congress), and once again leaves the people paying the price for its reckless emergency-docket determinations.”

That — helps explain this:

“ The share of federal government jobs dropped to 1.84% of total nonfarm payrolls, the lowest share in the data going back to 1939”

I hope everyone has a nice relaxing weekend.

LMAO

The stock market lost some weight!

Getting closer to a health BMI! 😂

Trump is attempting to completely change the system of international trade in a very short period of time, and this can not possibly be expected to be without some sort of intermediate slow-down of the global economy. Tariffs will push down corporate margins, which will lead to lay offs in the short term and a rise in unemployment can be expected. The efforts to bring back jobs to the US will take years to have an effect on the labor market. When Biden’s huge government spending measures begin to run out, this will accelerate the the downturn.

The corporations will get their tariff payments back plus 6% interest once the Supreme Court rules on the matter by next June…

Wouldn’t you love that globalization was given free rein to sacrifice America on the altar of high stock prices? That has been the rule, and Trump broke the rule.

My comment is about the law, not about good policy or my opinion of Trump.

Interestingly, if the EU ratifies this week’s agreement, it will be bound by its commitments even if the 15% tariffs are ruled illegal.

If this supreme court does that I will eat a hat shaped cake. If this court does that the POTUS will appoint 6 more judges. 15 is a nice round number.

The Constitution is pretty clear on this point, I believe SCOTUS will rule against Trump, but that Congress may try to make the tariffs into law.

kramartini

I suspect the stock market vigilantes will rule before then.

It is important to distinguish between the introduction of tariffs and the implementation of tariffs.

There might have been an adept way of applying an intended policy. The evident execution, with never ending recalibrations and deadlines, in this sensitive policy area provides a moment to coalesce around the emerging risks. Principally, can CEOs make well judged large CAPEX and OPEX investments (including new jobs) in a capricious policy environment that could change before lunch?

To illustrate the distinction, in the hands of others, interest rates might have been slashed by a couple of percentage points in one order. Many would be comfortable with lower interest rates but perhaps not when implemented in a stunning manner and alongside the daily prospect of snap alterations in either direction.

A FOMC to determine tariff rates to encourage balanced trade or prevent runaway trade deficits might have worked well and with stability during the past 25 years.

Biden’s final budget is done by October (end of the fiscal year). However Trump has pushed through even bigger government spending and bigger deficits in his budget.

Do you really think Trump, the convicted felon who’s declared bankruptcy multiple times, is somehow a paragon of fiscal restraint? If so, he has a crypto currency to sell you….

Would love to know how many former government employees now work for government contractors, with the taxpayer picking up the profit margin for the contractor.

I was going to say this :)

Just because someone is officially off a payroll doesn’t mean we’re saving any money.

In companies it’s not uncommon to fire someone and then be forced to rehire them as a consultant at twice the rate. Same thing frequently happens in government.

At some point in the future, someone will probably comb through the individual firings and correlate to consultants and contractors hired and come up with a number, which will likely conclude that we would have saved money in the long term just these people directly on the payroll.

But for now, DOGE can bask in the headline numbers and not worry about what is actually happening with costs and efficiency.

There were studies I saw years ago that downsizing military bureaucrats cost money because every civilian and military employee involved in program management (ie overseeing weapons development and acquisitions) saved the DoD millions compared to outsourcing that job to the private contractor itself. Somehow we needed a study to tell us that having the fox guard the henhouse was a bad idea…

Corporation for Public Broadcasting, funder of NPR and PBS, says it will shut down after Congress cut money

The Corporation for Public Broadcasting announced Friday that it will begin shutting down, weeks after Congress canceled previously approved funding for the nation’s steward of public media access.

The CPB said in a statement that it will begin an “orderly wind-down” of its operations after nearly 60 years with the support of the federal government.

It said that most staff positions will conclude with the close of the fiscal year on Sept. 30. A small team of employees will remain through January 2026, it added. It did not specify how many people in total were being laid off.

“Despite the extraordinary efforts of millions of Americans who called, wrote, and petitioned Congress to preserve federal funding for CPB, we now face the difficult reality of closing our operations,” the corporation’s president and CEO, Patricia Harrison, said in a statement. “CPB remains committed to fulfilling its fiduciary responsibilities and supporting our partners through this transition with transparency and care.”

The announcement comes less than a month after Congress passed a package of spending cuts requested by President Donald Trump that included stripping $1.1 billion in funding for the CPB.

Currently, the CPB helps support more than 1,500 locally owned public radio and television stations.

I wish Congress paid WOLF STREET lots of money every month.

So do I. Your work is priceless.

Sounds like you need to up your lobbying game!

Have you considered cutting the Trump family into a share of your profits? This is usually how deals are done. Although you might have to rename your blog along with it…

The CPB gets approx. 15% of budget from Federal funding. While they may be claiming to shut down, I find that hard to believe. Some small radio stations may have difficulty if funding through the CPB is drastically cut. No different than any business losing a large client, adapt your business model!

About time!!!

Was NPR ever necessary? This is a free country. Why is there government-produced thought manipulation.

PBS, now that is a different story. I was raised on Sesame Street’s socialist agenda.

Feds paying 154,000 people NOT to work…

The detestable Jim Cramer had an open message for Powell to cut rates. One “bad” jobs reading justifies dropping rates back to 0 in his perverted mind, but the years of good job readings never justified rate increases.

This sick puppy is a one trick pony.

Cancel Cramer and all of CNBS from your living room.

Cramer is a genius.

I love his books

I could never trade how he suggests tho, I actually need to have a retirement fund in the end! Ha

Big companies don’t use ADP? I work for a fortune 500 company that everyone knows and my paystub says ADP.

ADP 1,100,000 clients like Amazon, t mobile, J.P. Morgan. A lot of big ones.

“Client” doesn’t mean what you think it means. For example, Amazon processes its own payroll in the US, but it uses some services from ADP, especially for its overseas staff, including dealing with local compliance issues, etc.

“Amazon processes its own payroll in the US.”

Wolf, big fan of the site, but this is incorrect. Amazon is a huge company with many sub divisions (AWS, Whole foods, etc.). Some of their subdivisions absolutely use ADP. I know. I work for one and I get my paystubs via ADP.

Lower Rates.

Higher QT.

Problems solved.

You’re welcome.

The job numbers are just published too early, before anticipated adjustments.

Great data point, that Federal government employment as a proportion of non-farm payrolls is back at 1939 levels, wow! May that Wily E. Coyote swan dive continue and accelerate.

Honest question- what do you think is the “correct” level of federal payroll? Yes, too many employees means we’re paying too much for our services, but without enough people working, those services get messed up.

In 1939, government did a lot less stuff. Our military was smaller. Departments like NASA, federal highways, the FAA, Medicare, etc didn’t exist. Why should it be the case that the government’s payrolls should go back to that level when the number of things the government now does has ballooned? Without cutting those services, just cutting the employees means those services become poorly run.

Let’s look at efficiency another way: the federal government utilizes 1.8% of the nation’s payroll, to administer ~25% of the GDP. the private sector uses the other 98.2% of jobs to administer 75% of the GDP. Who is really being inefficient here?

And final look: the total federal payroll as a percentage of their total spending is about 5%. IOW if you fire every single federal employee, you’ll have saved about one year’s worth of social security’s COLA adjustment.

The truth is federal employees are a sideshow. They’re a nice scape goat to address our ire, but they constitute such a tiny portion of the federal budget that they’re barely worth talking about when looking for waste.

The true costs in government boil down to insurance (SS, Medicare, Medicaid), defense, and interest payments. Everything else is barely a rounding error.

Lune, well said. Those data points won’t be seasonally adjusted or revised.