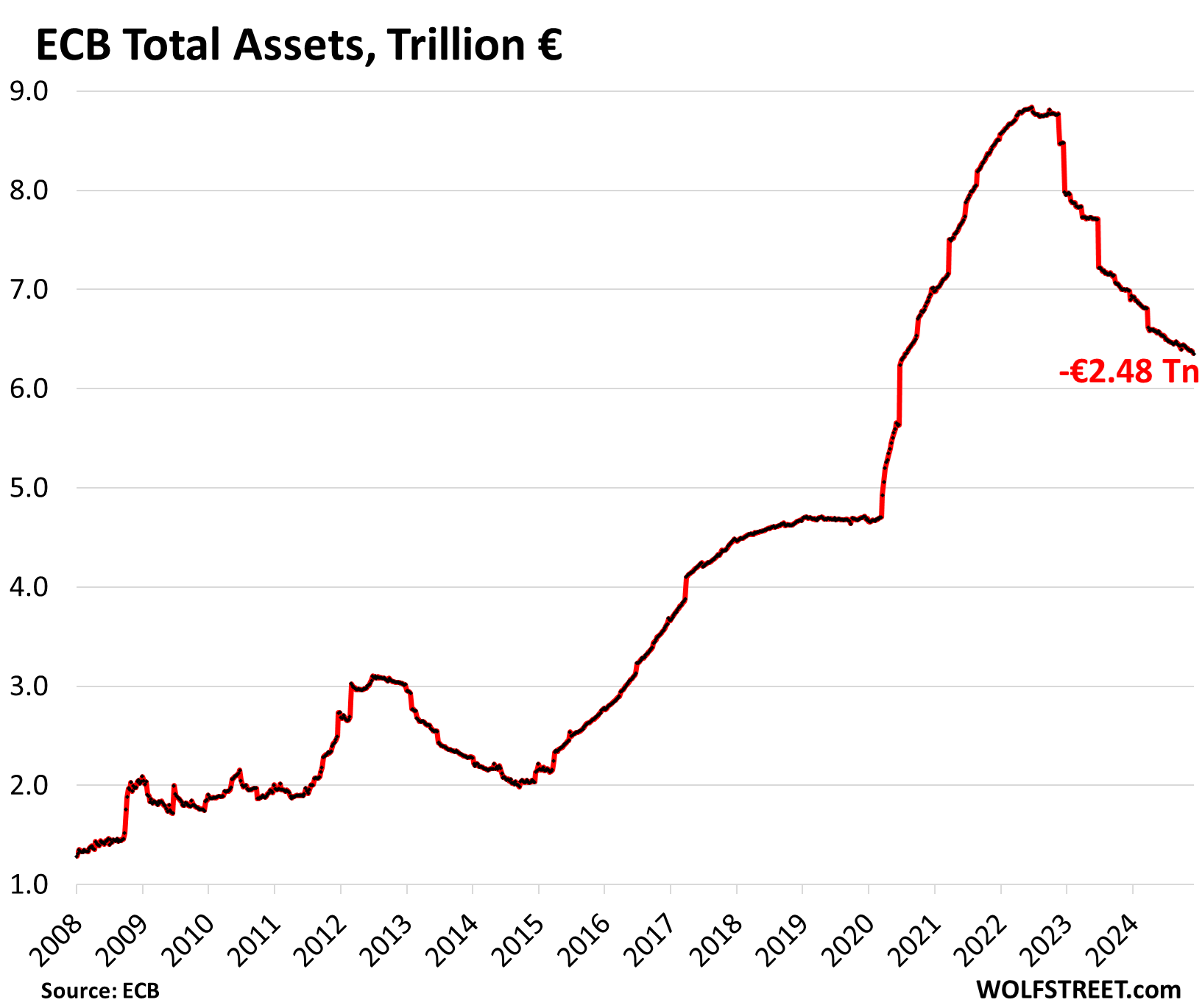

It already reduced its balance sheet by €2.48 trillion and completed its loan QT to near-zero.

By Wolf Richter for WOLF STREET.

The ECB took another step at its policy meeting on Thursday to speed up its bond QT program even as it announced the 25-basis point rate cut: It would step away from the bond market entirely after December 17 by removing the last remaining cap on the bond-roll-off.

After December 17, as bonds in its vast holdings mature and come off the balance sheet, they will no longer be replaced at all. Whatever matures comes off the balance sheet without replacement. And its bond holdings will shrink by the amount of bonds maturing. The effect is a further acceleration of its bond QT. By comparison, the Fed has caps in place and lowered the caps in June to slow QT.

The ECB’s last remaining cap that is now coming off slowed the roll-off of bonds in its “Pandemic Emergency Purchase Programme” (PEPP, started in March 2020). It has already removed the cap on bond roll-offs under its “Asset Purchase Programme” (APP, dating back to the Draghi years).

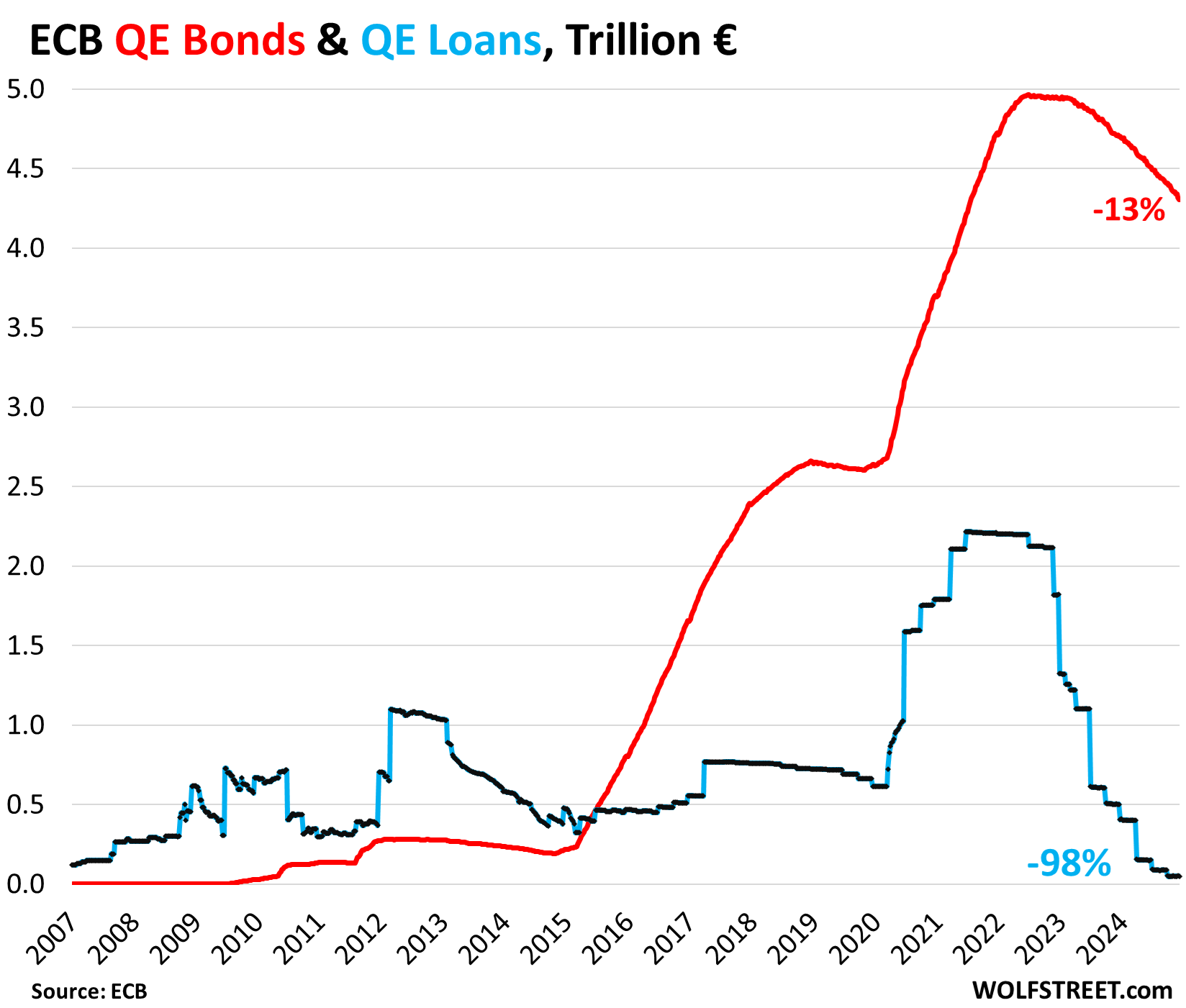

The ECB had two QE programs: Loans to banks that peaked in June 2021 at €2.22 trillion; and the bond buying programs APP and PEPP, which peaked in June 2022 at €4.96 trillion combined. Bonds under these programs include a broad range of government and private-sector securities, but mostly government securities.

The ECB’s QT program has already reduced its balance sheet by €2.48 trillion in total, or by about 28%, since late 2022.

Loan QT – that job is done. Loan QT began in late 2022, when the ECB changed the terms of the loans to make them unattractive, and banks repaid them in large junks. As of its balance sheet this week, the ECB has unwound nearly its entire QE loan program. The balance is down by 98%, to just €49 billion, the lowest in the data going back to 2004 (blue in the chart below).

Bond QT – long way to go and accelerating. Bond QT began in early 2023, when the ECB allowed bonds in its APP holdings to come off the balance sheet when they matured without replacement. Initially, the roll-off amounts were capped, and the amounts of maturing bonds over the cap were replaced with purchases of new bonds.

In July 2023, the cap on the APP roll-off was removed and APP bonds have been rolling off as they mature. In July 2024, the ECB started allowing PEPP bonds to roll off without replacement up to a cap. After December 17, that cap will also be gone, and whatever matures rolls off and adios.

As of its latest monthly reporting on its detailed holdings, the ECB still held:

- €1.62 trillion in PEPP bonds (including €50 billion in private sector securities and covered bonds)

- €2.70 trillion in APP bonds (including €554 billion in private sector securities and covered bonds).

In total, it held €4.32 trillion in securities at the end of November. Another €14 billion rolled off in early December, bringing its total bond holdings down to €4.30 trillion as of its weekly balance sheet this week, down by 13.3% from the peak (red).

QT has reduced total assets on the ECB’s balance sheet by €2.48 trillion, or by 28.1%. Of the amount added during the mega-QE pandemic, 60% is now gone.

The fact that the ECB is speeding up its bond QT, after already completing its loan QT down to near zero, even as it cuts its policy rates amid a slowdown in economic growth, shows that the ECB may be backing away from the QE experiment.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The ECB balance sheet of ~1.4T back in early 2008 – is that their paper currency-offsetting base? Could the US Fed also reduce their BS to only support paper Reserve Notes in circulation? A couple trillion dollars these days at most.

At the Fed, there are four liabilities that dictate the minimum level of assets on the Fed’s balance sheet since a balance sheet is always: assets = liabilities + capital.

1. currency in circulation (paper dollars, currently $2.36 trillion. They’re demand-based through the banking system. Banks have to make sure that paper dollars are in the ATM and branch when you ask for them.

2. The Government’s checking account, the TGA, ca. $800 billion… a result of decisions by the US Treasury Department.

3. Reserves, cash that banks keep at the Fed. That can drop. But the 4,000 banks pay each other through their reserve accounts at the Fed, and trillions of dollars move through them every day, with banks paying and getting paid vast amounts of money each day. This means that there will always be a large balance, but that balance is just a measure of a large flow at one point in time.

4. ON RRPs, but they can drop to near zero and are already pretty close to it.

So if the minimum amount of reserves that flow through the 4,000 reserve accounts at the Fed at one point in time is $2 trillion, the minimum balance sheet = $5.16 trillion ($2.36 + $0.8 + $2.0).

The euro has only €1.5 trillion in paper currency in circulation. I haven’t spent enough time on the ECB’s balance sheet to understand all the ins and outs of each account, and I don’t know if any of the governments have their checking accounts at the national central banks, which would then be consolidated at the ECB. So I cannot tell you how low that ECB’s balance sheet can go theoretically.

So will this drive up the yields of European bonds to attract buyers?

Wolf, I would love to get your take on that. Very different from Fed approach as uve mentioned. Short and longterm consequences?

Many countries have sent debt reduction plans to EU commission.

US trying to break record debt faster every year?

This will be a good A/B experiment. If they don’t run into problems, the Fed may accelerate. If they do have troubles, the Fed will stay the course.

The next Treasury Secretary must immediately reinstate the $60B runoff cap or even better, raise the cap to $100B.

That’s a decision the Fed makes, not the Treasury Dept.

Yep…

Misspoke

Thanks

US3M is 4.33. In Germany the 3M is 2.3. During the next recession, if

it comes, the Fed has twice the room to cut rates than Germany. If there will be no recession, by cutting rates, by reducing the spread between the US and the Germany the Fed will ease the burden of US gov debt payments and work in unison with the ECB.

Nice insight!

It looks like EU added about $4 trillion in asset purchases (bonds and loans) since beginning of covid. Of that they have retired $3 trillion. Not bad.

Why can’t the US do the same. What are we afraid of “breaking” that they aren’t?

Good to hear your sage & understantable words M. Engel…it’s been a while!

That last chart is impressive vs US Fed version. And I think I get the logic behind ‘going slower to go further’.

But given the globalized nature of the financial system, how contagious could an EU liquidity event be? Imagine they go too far, too fast, something breaks and the plumbing gets gummed up. Is our plumbing going to be okay then? Does the pace of ECB QT pose a risk to our balance sheet?

I expect no two liquidity crises are the same (except you Argentina), but I hope somebody is running simulations.

Is there any real difference between the Fed’s drawdown (23% since peak) and the ECB’s (28% since peak)? Even that difference is probably overstated in the past few months since the Fed started slowing its drawdown and the ECB started accelerating its own.

As to your second paragraph, I am quite sure that there is some level of coordination between the largest Central Banks on the planet… particularly since the global meltdown that started in 2007 (to say nothing of during and after the global pandemic).

Wolf,

As we see ECB taking concrete steps like removing caps, its natural to compare them with FED path and their sense of urgency. Your thoughts?

FED is following QT at slower pace. Do you think they slowed too soon in June 2024? Dream will be FED selling Assets in Open Market (at least MBS) to speed up balance sheet reduction. Logan already talked about that possibility but didn’t give any timelines or basis for that decision.

I wouldn’t expect that before March 11th, 2025. That is when the BTFP program will go to zero. It has shed almost $80 billion in the past three months (about equaling the supposed “slowing” of the drawdown of Treasuries) and still has $17 billion to go. The Fed knew when it instituted the slowdown of QT that the BTFP numbers would implode in the fall of this year… so it lanced the boil by slowing down its Treasuries sell-off.

Once that is done they can explore other options. The Fed’s commitment to QT (this time around) is impressive… although I think their actual commitment is to getting their Balance Sheet under control which is not exactly the same thing as being committed to QT.

At least one piece of good news amid all the bad….

Concerning item #3, “Reserves, cash that banks keep at the Fed.” My goodness, how did banks ever manage when required reserves at the Fed were near zero? The overnight Repo market functioned then to get cash from banks that were flush to those in need. What is the difference between then and now? Is it that the banks now get PAID by the Fed for their idle cash? Isn’t this just a gratuitous subsidy that has also made the Fed technically insolvent (-$202 Bil in “Other liabilities and accrued dividends”

Banks also have long been able to borrow for a few hours intraday from the Fed in their reserve accounts to balance their cash-outflow on a specific day with their cash-inflow that might come in a few minutes or hours after they send their payments. There are trillions of dollars flowing through these reserve accounts every day, one big wave in the morning to settle securities purchases, etc., and one in the early afternoon for other transactions.

France is entirely unable to control the deficit. A large EU country is going to hit the wall on debt.

I wonder if the ECB is trying to get dry powder for what is clearly an incoming crisis and they will be expected to intercede.

End of the line on debt folks for the non-dollar countries. Since 2010 the UK has devalued the pound by half.. and also tripled (less than) government debt since 2009. Going forward this cash isn’t going to be spent into the economy.

There is going to be a cash crunch. Even for the US after the Biden sugar rush.

The “Loan QT” ends in December, the last TLTRO mature next week. Regarding the ECB´s bond portfolio, the situation is a bit more complex in my view. Yes, the ECB will run QT at full speed without any caps, but they have a long portfolio duration because they buying mostly between the 10 year and 30 year maturity range.

I think the balance sheet of the ECB will not fall as quickly as expect.

The balance sheet of the ECB will fall by the amount of the bond runoff. And that bond runoff accelerates going forward by removing the last cap. What matures varies a lot every week.

The ECB publishes a handy list of monthly redemptions of its APP bonds. For example, APP bond redemptions:

Jan 2025: €22.0 billion

Feb 2025: €36.7 billion

Mar 2025: €41.7 billion

Apr 2025: €35.5 billion

But I cannot find the equivalent list for the PEPP bond redemptions yet. It will likely start publishing this list next year. Alternatively, I could download the spreadsheets of its holdings which contain maturity dates, and I could figure monthly redemptions based on those maturity dates, but that’s way too much work for me just to figure out what future redemptions will be.

The PEPP portfolio is about 40% smaller than the APP portfolio, but similarly structured, so I assume that the monthly PEPP redemptions will be about 40% less on average than the APP redemptions. Both combined will amount to the bond QT.

For the PEPP portfolio the ECB published no redemption list i also searched for many times. There is only a list which specific amounts of bonds they hold divided by countries, same like the APP.

Sure the balance sheet will fall by the amount they roll off, (i didnt say the opposite) but i think we can agree that the runoff amounts have partially big differencies. The other things is the big PSPP holdings