Core services inflation is the biggie, and it’s going the wrong way. The Fed is already talking down the pace of rate cuts.

By Wolf Richter for WOLF STREET.

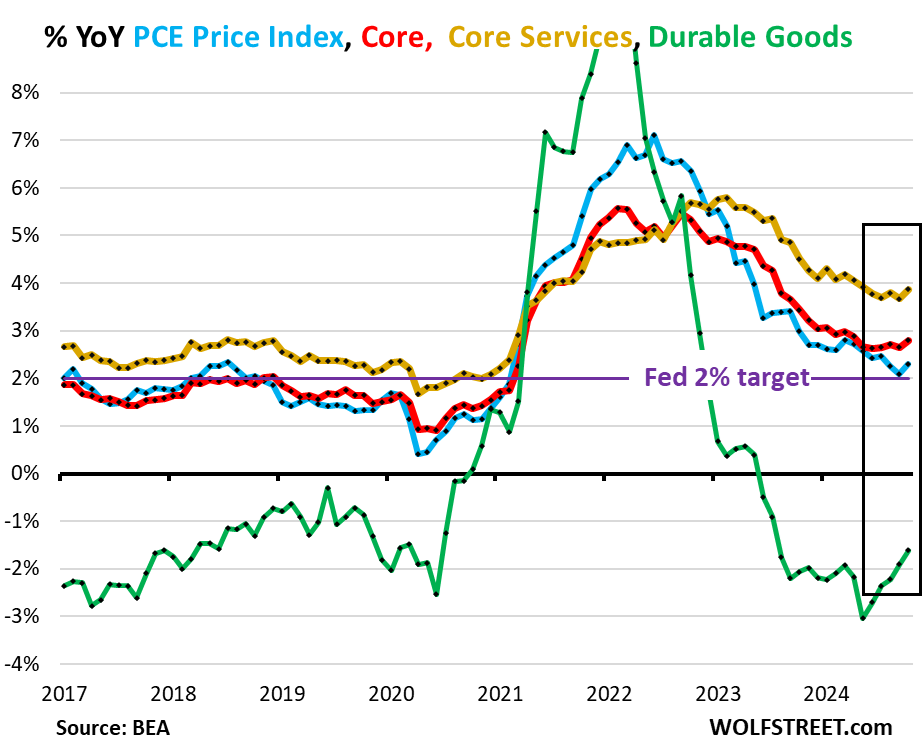

Inflation has been in services and is still in services, it has become sticky in services, and recently it has been re-accelerating in services. Services dominate consumer spending. And durable goods prices rose for the second month in a row, after big drops. But gasoline prices continued to plunge, and food prices ticked up just a little, according to the PCE price index by the Bureau of Economic Analysis today. This is the data the Fed prioritizes as yardstick for its 2% inflation target.

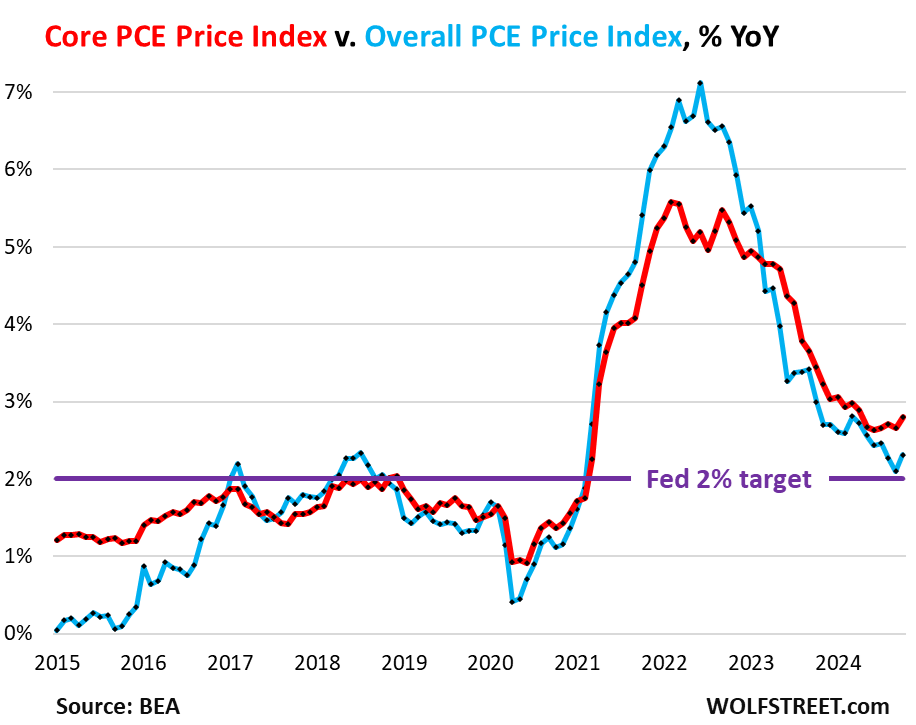

Three of the four major metrics accelerated in October even on a year-over-year basis: the overall PCE price index to +2.3% (blue), the “Core” PCE price index to +2.8%, (red), and the “Core Services” PCE price index to +3.9% (gold), while the durable goods PCE Price index started rising from the ashes and became less negative (green).

The Fed has already been talking down the pace of future rate cuts recently, including in the meeting minutes yesterday and in speeches by Fed governors.

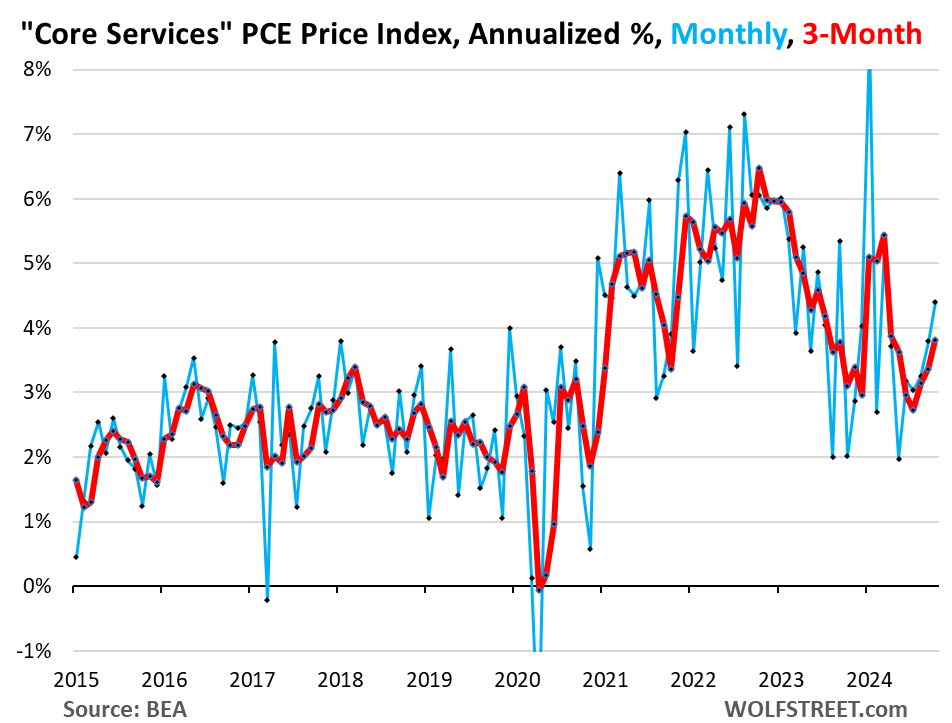

The driver: “Core Services.” The PCE price index for “core Services” accelerated to +4.4% annualized in October from September (+0.36% not annualized), the sharpest increase since March (blue in the chart below). The three-month core services index accelerated to 3.8% annualized (red).

Core services include housing, healthcare, financial services & insurance, transportation services, non-energy utilities, communication services, recreation services, food services & accommodation, and “other” services. But it excludes energy services, such as electricity to the home.

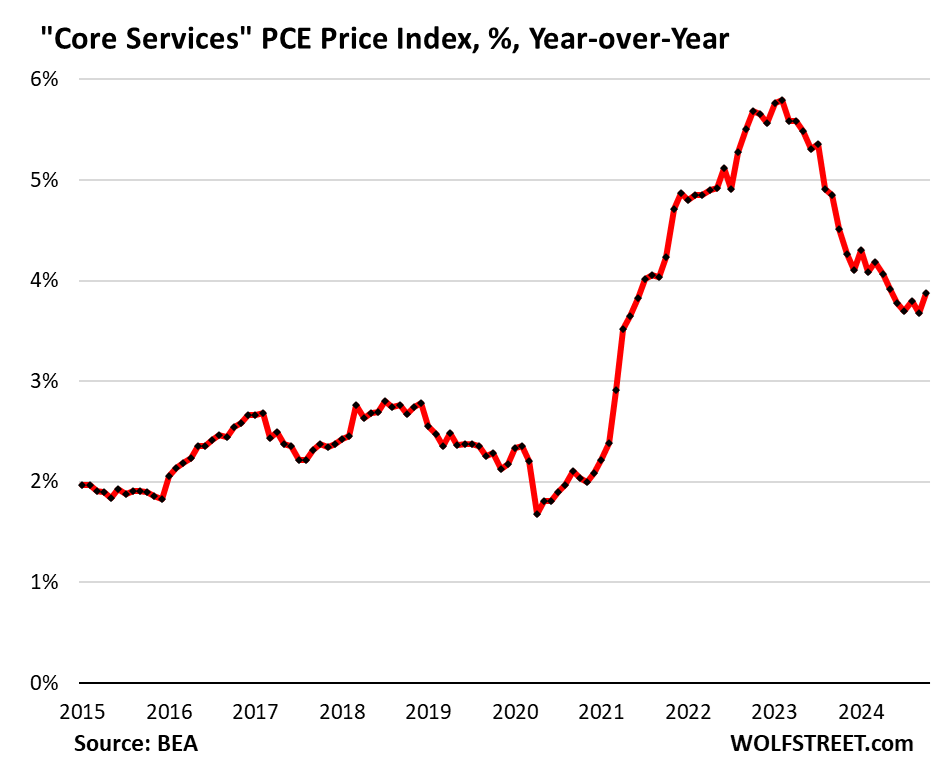

Year-over-year, core services PCE price index accelerated to 3.9%, the fastest increase since May. There has essentially been no progress since May:

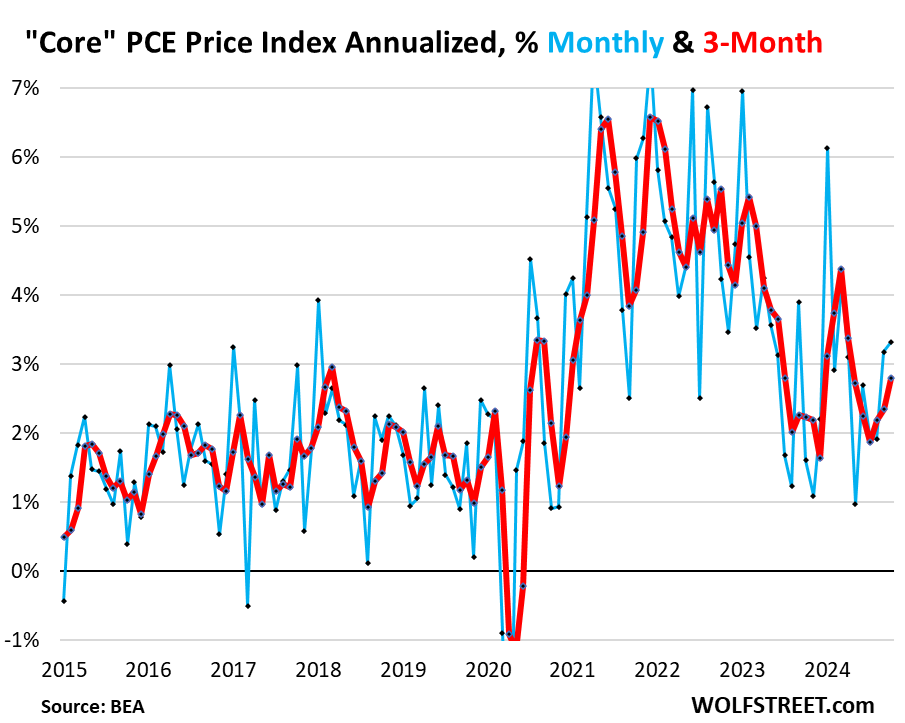

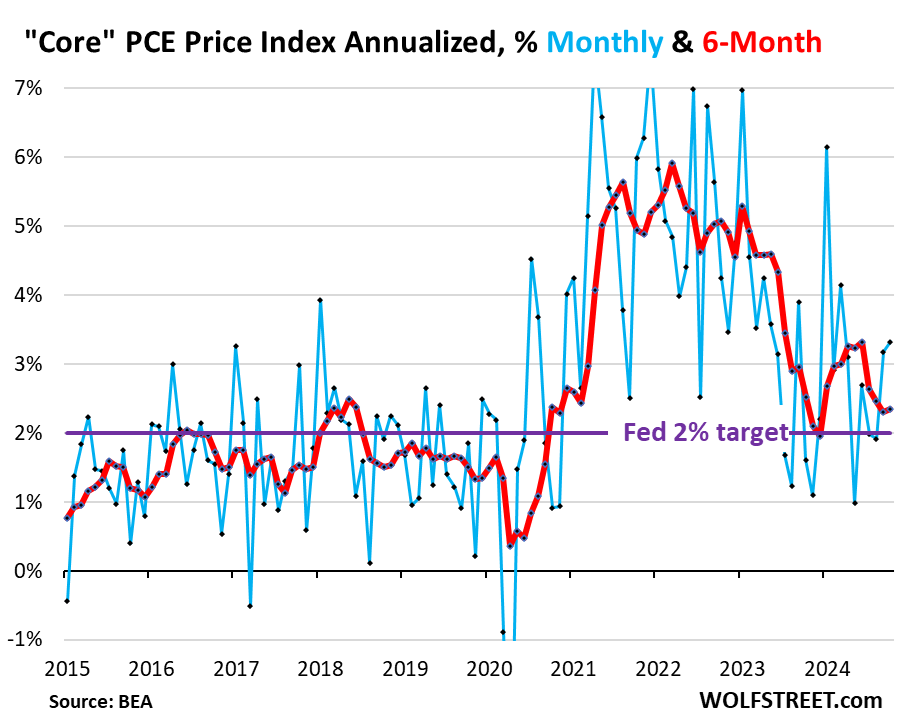

The “core” PCE price index accelerated to +3.3% annualized in October from September (+0.27% not annualized), the biggest month-to-month increase since March.

This month-to-month acceleration was driven by the jump in the core services PCE price index (see above).

The “core” index attempts to show underlying inflation by excluding the components of food and energy as they can jump and drop with commodity prices.

The 3-month core PCE price index accelerated to +2.80% annualized, the third acceleration in a row, and the fastest increase since April (red).

The 6-month core PCE price index accelerated to +2.34% annualized (red), and has remained higher all year than it had been at the end of last year:

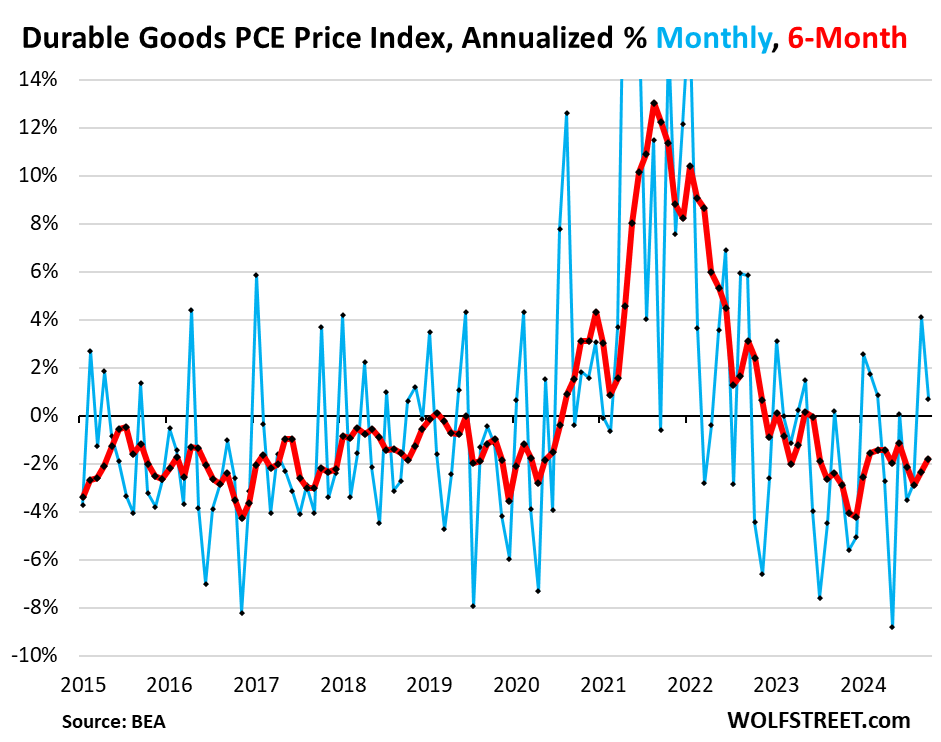

The durable goods PCE price index increased by 0.7% annualized (+0.06% not annualized) in October from September, on top of the big jump in August, which had been the biggest increase in two years, after a series of steep negative readings (deflation).

In October, the month-to-month increase was due to motor vehicles, while prices fell for household furnishings & appliances, recreational goods & vehicles, and “other” durable goods.

As a result, the 6-month index became less negative (-1.8%, red line).

And the year-over-year index also became less negative, see green line in first chart at the top (-1.6%).

In recent decades, durable goods prices trended lower on average due to manufacturing efficiencies, technological improvements, and offshoring production to cheap countries (globalization). Over these decades, the driving force in inflation has been services. During the pandemic, durable goods prices spiked due to the sudden demand fueled by massive economic stimulus that made consumers suddenly willing to pay whatever for goods, and there was huge demand for goods, overwhelming supply chains, giving companies enormous pricing power, and they used that pricing power:

The overall PCE price index, which includes the food and energy components, rose by 2.3% year-over-year in October, an acceleration from September (+2.1%), despite the plunge in gasoline and other energy prices of -12.4% year-over-year and -1.0% month-to-month (not annualized).

Food and energy prices make up the difference between the overall PCE price index (blue) and the core PCE Price index (red). The price spikes of food and energy in 2021-2022 caused the overall PCE Price index to shoot to +7%, while the core PCE price index, which tracks the underlying inflation beyond commodities prices, topped out at 5.5%.

As energy prices have been plunging starting in mid-2022, the overall PCE price index decelerated faster than the core PCE Price index, leaving the core PCE price index with a higher rate.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What are your thoughts on Scott Bessent?

Scott is good friends with George and Alex Soros and with King Chucky and his wife Cami in the UK and lives in a big pink house in Charleston, SC. What more do you need to know about Scott?

I think he literally does not matter.

Forces beyond his control will drive budgets and spending. He won’t be able to do anything from a treasury standpoint that isn’t already being done.

Inflation is coming.

At best he will be a scapegoat for it.

Yeah. He’s being set up to be blamed while King Goldie Locks gets away with the inflation he will cause.

Yes, it really does seem like we’re doomed to repeat the ever higher waves of inflation of the 70’s. What the fed wants the all-mighty fed will get. (Taking away the silly average inflation targeting, but on the downside this time, was the real giveaway there).

The best antidote to all this seems to be spending less on consumption and more time with your loved ones. I hope you all have a happy thanksgiving with your friends and family.

With sticky service inflation and the new administration’s tax on global durable goods, food and energy we may see some eye popping numbers down the road.

The tariffs will only apply to imported goods so food, energy, and anything manufactured here should not change in price.

I read today that the EU tax on imported US autos is 10% while the opposite is only 2.5%. I’d be happy to listen to anyone explain to me why that’s ok. Every tax and tariff should be at least equal to the same thing going the other way.

Imports in 2023

The United States imported 3,885,000 barrels of crude oil per day from Canada in 2023.

The proposed tariffs will include oil and natural gas.

Crude imports from Canada make up more than a fifth of all the oil that U.S. refineries process.

This will add at least 50¢/gallon to gasoline. The additional cost will drive up the prices of everything in the US.

I think we can expect interest rates to stay around 6% for the next 4 years.

The US produces more crude oil than it can use — and so the US exports more than it imports. The problem is that the producing regions are not connected via pipeline to all refineries. Some refineries in the US Midwest are connected by pipeline to producers in Canada and not to producing regions in the US. There are no pipelines across the US Rockies, and so the West Coast is cut off from producing regions east of the Rockies and has to import whatever crude it doesn’t produce. etc. etc.

So maybe tariffs will make pipeline construction more economically desirable? So that the US could actually get its crude oil to US refineries? That kind of stuff is the purpose of tariffs: change the economic incentives to benefit the US economy long-term.

Wolf, the problem is that it takes years to build a new pipeline (especially accross the Rockies). During that time, extra costs (such as tariffs are really going to hurt consumers wesr of the Rockies.

JimL,

Tariffs have two roles:

1. a good way of raising taxes

2. changing the economic math for production in the US, including the construction of pipelines (which in itself is a powerful economic activity).

Tariffs are direct and immediate tax on the profit margins of foreign producers and US importers. They may or may not be able to pass them on. And tariffs don’t stop trade, but they change the math of where something is produced.

The Chinese have used heavy tariffs very successfully in building and protecting their manufacturing industries that now dominate the world. Other countries have too, including Canada.

Tariffs shift the economics to producing more in highly automated plants in the US than producing in factories overseas. This is not instant, but it’s high time that the US protect and build its manufacturing base in order to not be entirely overrun by heavily subsidized and protected manufacturers overseas.

Fulfilling role #1: If tariffs on a product (such as T-shirts) don’t change where the product is manufactured (such as in Bangladesh), they fulfill their role of raising tax revenues for the US, which the US needs more than anything, given the huge deficits. Role #1 is fulfilled.

And yes, someone has to pay for taxes. Tariffs are a direct tax on corporate and importer profit margins, including those overseas, which is why US companies HATE tariffs. Whether or not they can pass on the tariffs depends on a lot of things. Companies are already charging the maximum amount they can get away with and still accomplish their growth goals. If they raise prices, they might lose sales, and then have to roll back prices. So it’s not a direct hit to consumers, it’s a direct hit to corporate profit margins, and then it’s up to the market to spread it around.

Fulfilling role #2: If tariffs fulfill their role of changing where something is manufactured (motor vehicles, semiconductors, components, tech equipment, ships, etc.), then they don’t raise taxes, and don’t fulfill role #1, but vastly improve the overall economy and the labor market. Highly automated manufacturing plants provide great highly qualified jobs, including tech jobs. And they have huge secondary and tertiary effects.

Alberta WCS is 59 $ while WTI is 69 $. This type of refinery exists to capitalise on this difference.

I agree with OI’B that the effect of import tax on inflation may not be as high as people imagine. I think the real problems are the irresponsible fiscal and monetary policies. FED has done extremely terrible job for the monetary policy, until they reversed their course in 2022 (too little, too late). Ever increasing fiscal deficits also contribute to the inflation a lot. If the new administration reins the fiscal deficit (which I have very little hope for) it may help to reduce the inflation. We’ll see in next two years.

Ha! You really think that US makers of goods will NOT raise their prices? They will because they can. More demand less supply. Classic Econ 101 inflationary.

Will be interesting to see impact of tariffs. Just as much as politics and opportunism as well. When tariffs sent in on washing machines but not dryers there was also an increase in cost dryers. A good way to get a one time price bump.

Here is a reality check. Next year, 10 Trillion in US Federal debt will roll over.

40% of that was formally being serviced at below 2% rates, which will now double, sending servicing costs spiking…

So, what can bring the inflation from services down? I will say a massive unemployment, which forces customers to spend less. When customer spending goes down, the demand (on discretionary) also goes down.

When there is less discretionary demand, business owners need to bring down the cost to attract customers.

I don’t have any background knowledge in Economics, so feel free to correct me.

“So, what can bring the inflation from services down? I will say a massive unemployment, which forces customers to spend less. ”

In the past, that has worked. But “massive unemployment” is also exactly what the Fed was trying to avoid.

I came out of grad school in 1981 during the “double-dip” recession when the unemployment rate was 8% and heading to over 10%, as Volcker crushed inflation with double-digit interest rates. And the unemployment rate stayed above 7% for 5 years. It ruined that part of my life. I don’t wish that on anyone.

Today, for many young people who are just starting out, “massive unemployment” is the worst thing that can happen to them – for years to come. In my experience, the Fed was right to not forget its second mandate and back off before triggering this “massive unemployment.” Inflation won’t go away, it’ll be moderate rather than low, interest rates will be quite a bit higher than before Covid, they’ll be normal like in the 1990s, and people will get used to 6%-8% mortgage rates, and home prices will reflect that, but at least young people will have a chance to start building their careers.

Wolf, I def understand and see your point.

Today current economic environment is unique after covid, and before ultra low Interest rates for 10-15 years

Today current economic environment is unique after covid, and before ultra low Interest rates for 10-15 years, and currently hitorical low unemployment rate. Even the Euro Zone with low to negative gdp growth and high inflation has low unemployment rates .

I replied above earlier on my phone, for some reason it did not post the whole comment.

What i also meant to say was that before the September Cut, the Fed Funds Rate has proven Not To be Restrictive to the Economy, and currently right now is still Not Restrictive…… , so they haven’t backed off of anything….

Like this is all going to work out.

The fed is backing off the rate cut pace talk, they figured out that it won’t be necessary.

So…

just hang out and watch the clouds …I idea was to lower the rates.

The feds mandate is price stability..

What does that tell you?…it tells me they aren’t bringing home the bacon any time soon.

Just “turn the page” and start raising rates again, put the squeeze on.

My worry is that we will follow Argentina’s prior

path of inflation with the currency no longer

considered a store of value. How many decades

did Argentina go down that path ?

Argentina has always gone down that path. That’s the only path it knows.

In 1900 Argentina was one of the richest countries in the world. There was even an expression “Rich as an Argentine”. In time we will get there too.

I would encourage you to research the causes of the “Argentine Paradox” and consider the similarities/differences to our current domestic situation. It’s not so much a matter when, but how.

It’s easy to forget that pre-WW2 Argentina had a top 10 economy, comparable to western European nations like Belgium, France, and Germany, and generating ~60% of the per-capita GDP of the USA.

By 1960 Argentina had fallen to #16, generating 35% of the per capita GDP of the USA, closer to eastern block nations like Czechoslovakia, Poland, and the USSR. During this time the peso went from ~4/$ to 80/$, and it only got worse from there. The moneda nacional was abandoned in 1970 after ballooning to 350/$.

What changed between ’46 and ’60? Lots of stuff, but assigning blame is opinion based, and you should form your own. After you do, don’t hesitate to share, there’s always an opportunity for especulación argentina in the inflation comments.

Love Argentina. Land of steak and malbec. Rivals us for its natural splendor. The falls! The neighboring glaciers. Good ol’ boys rave about the hunting. If I had their central bank and political class, I would curse my fate.

Wolf: You have mentioned before how that recession ruined your life. You could look at it in that manner but it comes off as a negative commentary that is somewhat unbecoming of you.

That period is how you got to here and by here I mean you are nationally recognized as an authority figure, and highly respected by a great number of people.

I know lots of highly successful people and with the exception of inherited wealth, they became that way due to really difficult times early in their lives. Something to think about.

I never said “it ruined my life.”

What I said is: “It ruined that part of my life.”

5 years of it. So re-read that thing. I’ve said this many times here before.

I had a freshly minted Master’s degree, no money, no job, and had to make do. I didn’t have parents, and there was no one to move in with. I worked at Taco Bueno for a while, then taught ESL as an instructor for a while, that kind of thing. That’s not what I expected to be doing at that stage in my life. So three years, part of it in abject poverty, a fight for survival. Then I went back to school to get my MBA in finance. During those 2 years, at first, I worked at night part-time as data entry clerk (more abject poverty), then started teaching at the business school while getting my MBA, and at that point, my second year in B-school, things started turning around. That “part of my life” was 5 years, thank you Volcker. I was young, invincible, indestructible, invulnerable, and immortal, and lived through it. But I don’t wish this on anyone. Monetary policy can blow things up.

I’m glad Volcker got inflation under control, but he’s no hero in my book. It was brutal. Lots of small and not so small businesses went under, and their owners got crushed. There was a lot of hardship.

“Something to think about.”

@Louie

I’m thinking about what a pompous prisspot you are. My family, friends and I also suffered in the early 80s and Wolf was saying something important. You didn’t even read him correctly, so intent were you on scolding and lecturing.

All this suffering, I treasure the suffering I’ve been through…more suffering please.

….this story about a man who ran off the road and was trapped for a week in his car, he finally made it out and started to crawl up the ravine, two hunters who mistook him for a bear, shot and killed him….some suffering for the thread.

With interest rates so much higher than the inflation rates back then countless people like myself made a fortune. So many people I still know made a fortune back then.

I don’t give Volcker much credit, if any. That guy is exhibit A where elites crushing working people is concerned.

I remember those years well. I was working as an instrument technician (before I got a degree in electrical engineering) at a power plant in New Mexico. I had taken out a construction loan to build a house. The interest rate increased to somewhere in the neighborhood of 13% while I was building the house. By the time I finished the mortgage payments were so out of sight that I was working all the overtime I could get. Almost put me in the hospital with kidney problems from dehidration. Ended up just giving the house up to foreclosure. I don’t have fond memories of those times.

“It ruined that part of my life. I don’t wish that on anyone. ”

Well, join the club. The Vietnam war ruined 5 1/2 years of my life. It took me 20 years to recover.

Yes, the people who went to Vietnam had it a lot worse than me. No comparison. Thankfully, by the time I and my friends were seniors in high school, US involvement was winding down. Lots of people had it a lot worse than me. And I didn’t bring this up to complain, but to illustrate a point about monetary policy and Volcker and why I think the Fed did OK trying to not trigger “massive layoffs.”

Thank you for your service.

Swamp and Wolf, your histories remind me of this quote:

“Hard times create strong men, strong men create good times, good times create weak men, and weak men create hard times.” – G. Michael Hopf

I frequently reflect on how spoiled the generation I’m (sadly) one of: gen Z. We’re physically & metaphorically fat. We need to know what tightening our belts is like. I believe this isn’t for a masochistic reason, but rather for the long-term strengthening of our young adults.

Regarding your inflation won’t go away comment, it will just be moderate.

I’m curious, what is your definition of “moderate inflation.”

I personally think getting below 2% right now seems almost impossible. But I’m at a loss trying to even make a half-baked guess about where inflation – broadly speaking – might eventually settle down,

Any thoughts?

I’ve lived through 10% to 15% inflation in the late 1970s and early 1980s, and that was NOT “moderate.” We’ve experienced 7%-9% inflation (CPI) in 2021-2022, and that wasn’t “moderate” either. It was high and caused the Fed to crack down.

Moderate would be something in the 3% to 5% range, I guess, just ballparking here.

Wolf,

If FED allows moderate inflation (higher 2 or lower 3) for few more years, will it not get anchored in expectations?

MSM and Wall St already asking for changing the 2% target. Then it will become 3% and so on.

I understand 1980 severe unemployment you mentioned and its impact for many lives. But current FED has got chills too soon. Even at 4.1% rate, they started doing 50 BP cuts.

If not reset like Volcker, FED should stay current higher for longer. All rate cut talks have again started rallies. With this kind of easy money, we will never get back to normal inflation either.

Then question comes to mind, even after working multiple jobs but not able to afford basic home is worth it?

FED has made this housing bubble in US. So it cant be burst with some higher unemployment.

Changing the inflation target will cause long-term interest rates to blow out — like that day! And the Fed has sworn that it won’t change the target, likely for that reason. It made that specific announcement last Friday when it said that it will not even consider changing the target during its review of its monetary “Framework” that happens every five years and is scheduled for 2025. It will just keep talking about trying to get inflation back to 2%, and it’ll be higher and its policy interest rates will remain higher, longer-term yields will be higher, sort of like some periods in the 1990s. A faster growing economy and enough inflation is really the only way to deal with this debt.

Typo above. FED has made this housing bubble in US. So it cant be burst WITHOUT little higher unemployment.

Among other things, the Yom Kippur War & the Iranian Revolution were two of the primary factors that set the stage for high inflation & rates over 8-10 years in the 70’s & 80’s.

While Trump may be able to cajole Zelensky & Putin into a ceasefire, the overall dynamics are different today as to what’s the foundation of inflation. Rapid home appreciation & related gotcha’s like property taxes, insurance, & more people competing for the constrained housing resources along with short-term rentals are all conspiring to lower the resistance of higher inflation.

In addition, we’re definitely past the nuclear fusion is 30 years away parallel, so the national debt is now front & center. Aging workers, competition from AI & robotics, unaffordable cars & resistance to competition from China will make it very difficult to tame inflation just like was the case in the late 70’s & 80’s.

One can only wonder how much longer it is until something rattles the oil market. That’s a sure-fire guarantee for higher inflation. As I’ve been saying for a couple of years now, the Fed is going to do all they can to ensure housing doesn’t fall off a cliff. An orderly drop is what they’re hoping for. I just don’t think there’s enough time left for rates to stay above 6% to really force home prices down 20-25%. For the sake of skipping a recession as the medicine, let’s hope there is.

Will Trump be able to pull of an orderly reduction in federal employment / spending while creating an equal or greater amount of private investment / employment? I hope he’s able to get the train moving in the right direction, but I’m not going to bet my house on it.

Why It’s So Hard To Be A Worker Right Now | CNBC Marathon

426,509 views Nov 27, 2024 #cnbc

CNBC Marathon examines some of the challenges facing the labor market such as job hunting, remote work, and quiet cutting.

A staffing firm Insight Global found that recently unemployed full-time workers applied to an average of 30 jobs, only to receive an average of four callbacks or responses. So why does it feel so hard to get a job right now and is the U.S. labor market as strong as it seems?

Finding fully remote work is getting challenging. During the pandemic, remote work became the darling of the corporate world, and companies going fully remote became the new normal. As the world began to open up, though, corporate America shifted its stance on remote work. Some companies have even threatened to fire workers who don’t return to the office for a certain number of days.

In the 2023 American workplace, a new labor market trend took over where quiet quitting left off, quiet cutting. “Quiet cutting is what some people consider a subcategory of quiet firing,” said Nadia De Ala, a leadership and negotiation coach. This could be a sign that employers are taking back control over employees after the great resignation.

“It ruined that part of my life”

I lived through the same time period. My area went through what can only be described as a depression. Yes it was tough, but it taught me not to rely on the government, the value of a dollar and to save for a rainy day amongst many other things. It’s a lesson that many people need to learn today.

all true points, but the one thing young people don’t currently have is an opportunity to buy assets at reasonable prices, as, at best, the fed has made clear it doesn’t care about asset bubbles, except when they pop, and at worst, is intentionally trying to maintain the asset bubble.

houses at 7x income? stable huge companies at price earnings ratios of 40? bitcoin at 97,000 usd?

Wolf, you are right. But the current FED has ruined the lives of millions of young people by destroying their abilities of buying a home and living in it.

Yes, agreed, the Fed did that in 2008-2021. But now we have much higher rates and QT, so it’s slowly undoing some of the damage, while young people can keep their jobs and advance their careers and get pay increases.

And they can buy a home, but maybe not in the prime location in the most expensive real estate markets in the US. There are many markets in the US where the median price of a house is between $200-300k … such as Detroit which is becoming revitalized and cool, St. Louis, San Antonio, Pittsburg, Cincinnati, Indianapolis, Cleveland, Oklahoma City, Tulsa, Memphis, Louisville, New Orleans, Buffalo, Birmingham, Rochester, Omaha…. a huge long list of big nice markets with median prices of $200-300K.

But young people want to buy a nice big house in San Francisco or in San Diego, or in Washington DC or in New York City. While plenty of young people can afford that, and they’re buying, others cannot. So that’s really the complaint here, that someone living in San Diego could buy a house in Tulsa, but they don’t want to buy in Tulsa. So their job is in San Diego maybe, but get a job in a city where they can afford to buy a nice house? Many people are doing that.

You are right. Some people have the liberty move to affordable areas. But some others may have limitations due to job/family/etc. I think the acts Fed between 2008-2021 is much beyond recklessness. It permanently distorted all the assets, not just housing.

I am not a partizan and don’t want to get political discussions, but my subjective opinion is that the results of these irresponsible FED policies (combined with reckless govt spending) had prominent implications in last three presidential elections, in which party of the elected president changed three times in a row. Many people feel disappointed and elections are the only places that they can show it.

@Wolf’s comments about moving to second-tier cities.

Definitely a good and true point that not everyone can get everything they want, but as a contrast, my wife and I have a re-occurring conversation (maybe due to Holidays and associated blues) about how bad life would suck and what different people we might be (in a negative way) if we had stayed in Central PA rather than moving away to a place where people are happy and prosperous and have more open minds and interesting hobbies, etc. It seems backwards of what one should be doing to move to some of those places (I realize they’re not all bad).

And, again, if you’re not remote, the job you get in these places will likely pay much less. And, even if your cost of living is lower, you now have less options when you retire, etc. On a world scale, you are less wealthy when you live in an undesirable location and inherently are likely to remain less wealthy throughout retirement.

Massive unemployment is certainly a solution to service inflation. However it is literally the worst solution.

If you have mild gangrene on your foot. Amputation is certainly a solution, but it is the last resort.

mass unemployment may be a poor solution, but 5-6% unemployment wouldn’t be. better to knock down inflation even at the cost of the 2% more who will not have jobs in the short term

Sounds like a small price to pay. Unless you are one of the 2% who has to pay it.

Is it possible to break out the components of “Core Services” to see where the pressure is coming from or are they all going up together?

Sure and I did that in the past, but each item is so volatile that it breaks your neck.

If you want to see the details of services inflation, I cover that in the CPI articles. That’s our actual and main inflation index. We only look at PCE because the Fed uses it. The PCE index is broader and covers some non-consumer items. But the data is similar.

Here is CPI for October:

https://wolfstreet.com/2024/11/13/beneath-the-skin-of-cpi-inflation-overall-cpi-accelerated-for-4th-month-core-cpi-for-3rd-month-on-re-spiking-used-vehicle-prices-rising-homeowner-costs/

Today in the PCE, the month-to-month drivers were the acceleration in housing (+0.37%), non-energy utilities (+0.49%), transportation services (+0.62%), food services (+0.34%), and financial services (+0.89%).

I got a dose of service inflation when I brought my Mitzibushi Mirage in for it’s yearly oil change and maintenance. The dealer showed me the price of the Buyer Protection Plan which I bought last year for $675 is now $849. The Dealer service charge when you purchase a vehicle over 10K has gone from $499 to $799. That’s some serious inflation in my book. I wonder if data like this is in the Core service inflation figures? Probably not.

Something like this might be included in motor vehicle insurance. Here is the CPI for motor vehicle insurance:

Or it could be included in motor vehicle maintenance and repair. So here is the CPI for motor vehicle maintenance and repair:

https://wolfstreet.com/2024/11/13/beneath-the-skin-of-cpi-inflation-overall-cpi-accelerated-for-4th-month-core-cpi-for-3rd-month-on-re-spiking-used-vehicle-prices-rising-homeowner-costs/

I’ve saved so much $$ on car maintence by doing stuff myself. Oil changes are easy and shops are a ripoff these days.

Well, I see Wolfs charts shows 37% inflation since 2020 for auto service and repairs, and by my calculations my BPP went up 26% in ONE year, the Dealer new car purchase service charge went up 60% in ONE year. That is way higher than the 37% inflation in Wolfs chart which covers the 4 year period since 2020. Add in my Auto and homeowners insurance went up 20% in one year. Inflation is getting worse not better, especially in services.

The auto insurance chart nails our auto insurance increase (GEICO), totally nails it.

Homeowner’s insurance is not part of these two metrics. It’s a small part of the CPI for OER, which also jumped a whole bunch.

I am just straight up refusing to buy a car because of all of this. I ride a bike and take the bus everywhere and it’s just generally more chill, saves so much money and spares everyone else the added pollution and traffic. I just took an Amtrak train like 2000 miles for a vacation and that was fun and cost like $180 round trip.

Seems like the incoming administration is full of guys who want to gut transit and force everyone to buy as much cars and oil as possible. Let’s hope they don’t get anywhere with that – I don’t think they will considering the momentum is against them.

In the world economy, the players are not only lead by the American team but dominated by its conditions. As in 1929, when New York tanked, the world did also. Today, almost in 2025, the same holds true.

Inflation has one bright spot: gasoline. World prices for crude oil are holding steady and there are enough refineries to efficiently process what comes out of the ground. With the recent election of Trump and his “drill, baby, drill” policy, gas prices should stay modest for the succeeding 4 years.

The Russia-Ukraine war has almost no effect on the world economy. Russia is frozen out of Western markets, but has found alternative buyers in the Third World, and Ukraine is a negligible factor in the world except in wheat. Inflation in services, at any rate, is a domestic matter as services are usually performed locally by chain businesses.

“With the recent election of Trump and his “drill, baby, drill” policy, gas prices should stay modest for the succeeding 4 years.”

🤣 the US frackers have been drill-baby-drill for years as the US became the largest producer of natural gas, crude oil, and petroleum products in the world, and also the largest LNG exporter in the world. Their overproduction has caused the price of natural gas to collapse years ago, and starting in 2014, they managed to crash the price of crude oil for two years, triggering what I called the Great American Oil Bust, and in 2020, in the huge glut at the time, WTI futures went negative even. Drill baby drill, crash those prices, is what they’ve been doing for years, and my site is full of stories about it. Would be kind of fun to start writing about the Great American Oil Bust of 2026-2028 again?

The problem with “Drill baby drill” as a policy is that it grabs the attention of the ignorant who do not really understand the nuances of oil drilling in the U.S., but doesn’t actually change any of those nuances. It is a meaningless political slogan. Not an actual policy. Oil prices matter infinitely more to oil production in the U.S. than who is in the White House. Not even close.

Congrats on being fooled.

Ironically, dem administrations are better for oil & gas equity prices. Lower energy prices = lower profits for producers & refiners.

If the Fed does its job, we should start to see an amelioration in services inflation within the next 3-5 business quarters, as there is a correlation between core durable goods inflation and services inflation.

We got a new correlation fantasy theory here? But there is near-zero correlation between durable goods and core services. Durables goods have largely been in DEFLATION over the past 40 years, while core services have powered inflation.

Only deflation in durable goods seen in the last 40 years was in terms of quality, save for autos courtesy of Japan.

No way is the appliance you buy today gonna last like the one you bought 30 years ago. Denniger talks about this.

We got new el-cheapo appliances in 2006 and not a single one has failed. They’re working fine, quiet, efficient, no problems.

We moved into our house in 1999 and still are using the same Stove and dishwasher that came with the house.

American manufacturers can make crap too. Chinese manufacturing can make quality stuff too. World of difference between brands like Anker and GarbJoyHelpMe. Or Apple and Onn.

Just a bit of Noise or the start of an upwards trend? That’s the interesting question. Obviously if Trump sticks to his guns AND the inflation genie hasn’t been forced back into the bottle things may get unpleasant.

Things have been unpleasant for several years. It’s more of a continuation – the fed is dragging this out – “we’ll get farther if we go slower”

MW: Trump could save $1.4 trillion in cutting federal spending just by nixing Biden era executive orders

Which ones would those be? And over what time frame? Surely not $1.4T a year. Usually these are phrased as “over 10 years”, so in that case we’d be talking $140B a year.

Yes. Simply dumping all of Biden’s executive orders would in fact cut spending by $1.4 trillion a year exactly as I stated.

I’m not buying it. I don’t doubt the source said it, but it’s b.s.

Total budget for 2024 is $6.752 trillion.

Cutting $1.4 trillion is impossible. If that did happen, it would immediately put the US into a depression.

The $1.4T figure is a TOTAL savings estimate for 10 years (2026-2035). Not a per-year savings. The CRFB study you’re citing clearly says its for 2026-2035 in the table column.

MarMar: Here are the study’s five biggest estimated savings categories.

[1] Repeal the SAVE student loan forgiveness plan ($275B)

[2] Repeal other student loan forgiveness plans ($275B)

[3] Reverse Medicaid expansion ($215B)

[4] Reverse SNAP payment expansion ($180B)

[5] Stop the rule limiting vehicle carbon emission ($150B)

MW: SoCalBeachDude drags garbage onto Wolf Street, get labeled as an idiot

That is over 10 years. “In fiscal year (FY) 2024, the government spent $6.75 trillion…” so $1.4 in only one year would be quite a feat.

I also recall that extending the Trump tax cuts that are to expire at the end of 2025 will add a mere 8 trillion, so lets see….

8 trillion – 1.4 trillion = an increase in the debt of a mere $6.6 trillion, and this does not include the other tax cuts being mentioned such as a max corp tax of a mere 15%.

This is hilarious. Utterly ridiculous.

I would love to see your source for this joke.

I bet it is a source that anyone who cares about being informed over having their nuttiness reinforced would laugh at.

Please indulge?

These days people make up their own facts. 80% of people have been caught lying with made up facts.

Not really lying, but not fact-checking or reasonable ballpark checking for the details (such as 1 year vs 10 years). (See my post below)

It is a correct figure for 10 years though. Just not 1 year.

@JimL

I agree with “This is hilarious. Utterly ridiculous.”

It is TEN years, not one year. Consider…

“In fiscal year (FY) 2024, the government spent $6.75 trillion” (from Google) $1.4/$6.75 is 21%.

Is a 21% reduction in one year even conceivable??? ALWAYS do a quick back-of-the-envelop calculation for reasonability.

Happy Turkey Day Wolf and thanks to you for keeping us accurately informed of what’s REALLY happening in our economy.

Special thanks to all the commenters here as well. It’s as much fun to read the often intelligent and sometimes crazy, off the wall comments, as it is to read the articles!!!

Agree, happy Thanksgiving, and safe travell!

A hearty agreement. It’s the crazy comments that bring Wolf to the comment section. Reading Wolf in the comment section is as interesting as reading the GDFA

👍👍

Happy Thanksgiving Wolf & fellow WS commenters!

Tariffs will increase goods inflation. Driving low-wage labor out of the US by deporting illegals will increase services inflation, and food inflation. However, it might lower rents on sh*t rental units. Raising the govt debt to bazillions will increase interest rates. It is all okay with me. I like getting 5% risk-free and state income tax free for spending less than an hour a week in my Schwab account.

I really think nutters are overestimating how fast deportation will go.

Deportation is going much faster than people realize. The devil is in the legal details. The problem is refugee immigration. That most certainly cannot be solved by by quick deportation. Unless of course one doesn’t care about rule of law. Unfortunately many voters do not.

Rule of law? Where do you think you are? This is a banana republic and who has the $ makes the rule. Badges? We don’t need no stinkin’ badges.

Awe, c’mon. SCOTUS this last year ruled in effect the Prez can order anything within the scope of the job description, with absolute immunity = zero accountability. That will be “interesting.” Likewise it ruled that regulators, on any ambiguity in a regulation, no longer get deference — meaning Congress on many occasions has to sort everything with zero ambiguity in advance (linguistically-logically and legally absolutely impossible, not to say politically), or else some local yokel regional judge gets to do it (and say Fifth Circuit, we already know every ruling beforehand, based on Southern cultural politics). That is the fantasy world those ivory tower judges live in: overwhelmed by today’s complexity. So maybe it is not a banana republic as much as Arkham Asylum.

Rule of law?

When we…the tax payer…pay for illegal

Gang bangers to fly to Atlanta and butcher?

How long did she fight for her life because we have a current administration that wouldn’t follow the rule of law?

JimL – “The problem is refugee immigration.”

According to international law, refugees are required to flee to the next available country, the country adjacent to the country they are supposedly fleeing.

But this is not what’s happening. The so-called “refugees” are travelling by boat, plane, bus, train (many assisted by U.S. NGO’s) and they are not taking refuge in the next available country, but travelling through multiple countries until they get to where they want to go. And once they arrive, they are given free housing, food, money, a phone, etc.

The majority of these people are “economic migrants”, not refugees. They’re not stupid, they’re following the money/incentives.

@JimL

It could go exceedingly fast if one makes it a felony with say 5 years in the big house if one does not use Everify, as well as giving free one-way tickets for those who do not pass Everify.

Nothing like self-deportation.

Now with only 4% unemployment how do all those jobs get filled?

NPR has an excellent 2 part article on the last time this was tried (under the Chinese Exclusion Act) and the results stank. Literally. (No more Chinese laundries for instance).

We had a successful bracero program from 1951 to 1964 where Mexicans were allowed to come in and pick our crops, but had to leave when the harvest season was over. The problem nowadays is that employers are addicted to low-wage illegal laborers for more than just agriculture. These employers need to be fined and jailed for a few years. That should stop them from breaking the law, and the illegals will return home when they find there is no one to employ them.

BTW, citing NPR as some sort of legitimate source does not bolster your case.

Affiliated with a healthcare org that just handed out guaranteed raises to nurses of 10%, 8% and 7% over the next three years.

Services inflation isn’t going anywhere. The next day they were all discussing spending the new raises on vacations, dining, hair appointments etc. Not to mention the increased fee the org will charge as a pass thru of higher personnel costs.

Alas, the complexity we live in does not have humans with matching intelligence or ethics. This lapse, at that mundane level, sums up to planetary trouble, as what I saw in the market this morning : a whole row of single-serving single-use sugar-water in nondegradable plastic containers. That this is legal, or rather tolerated and indulged by the multitudes, says it all.

And what do you expect them to ask f9r’ when their cost of living just increased by 25-30 percent over the last five years?

“I didn’t have parents,”

This helps explain my admiration of Wolf Richter

To have a fire in your belly you need to have your back against the wall.

Happy thanksgiving Wolf, and to all here. Safe travels to all who are traveling. I am very thankful for this blog. It’s one of the few things on the internet that I can stand to read anymore!

Amen.

DITTO.

My wife reported $4 for a dozen eggs at the store today!

Is the federal reserve tightening part of the ultimate answer to bringing the services inflation down without a big recession?

What are we thinking for December fed meeting? Cut or hold? I vote hold.

Egg prices are high now due to avian flu. They’ll drop again after it’s over. They always do. We went through that a year or so ago also.

It makes one feel like such an outlier when one is a vegan and actually hopes that people stop buying eggs and butchering the mothers. Chicken flu will be with us in perpetuity.

If it’s any consolation, it also makes the rest of us feel like you’re an outlier.

One thing you can depend upon in any economy, is a vegan informing everyone he is vegan…

….eating the mothers?.

Being an outlier is noble I guess, even more noble would be to start a “save the mother chickens” movement.

Im assuming the Apple tree is Ok with you eating it’s children.

Back to the article, I’ve noticed a shift in the force, the crowd is growing restless with these prices and their trajectory to the moon when it could be stoped. Time to stark Operation “mother chicken”

$4? Dude, cheapest generics at my local supermarket (Ralphs) = $5. Want free range, organic, etc? $7-$9.

Free range, organic feed….2.50

From my neighbors or some of my amish clients.

I was at a rural feed and grain store in NV a while back. Two free chicks with each bag of chicken feed. Hmmm, fresh eggs every day perhaps?

PS The neighbor’s chickens kept my yard completely bug-free until a grumpy complained to animal services. I miss the bug-begotten (surplus) eggs.

Free range organic eggs are $6 a dozen (Egglands brand) at Walmart in the Bay Area. Just a month ago they were $5.49. Seems like more food prices are going up than down or and more are going up than levelling off. At least they are not ALL going up like a year ago.

I just can’t get on board with the moderate inflation and act like everything is fine.

Recession is a normal part of the cycle.

Yeah it’ll suck for a lot of people but out of that will bring new opportunities for the next generation of leaders.

Would be funny if the orange man actually does what he says he’ll do cause that’ll certainly lead to a recession but he might actually make America great again by flushing out the leverage and giving the youth a chance.

Call Trump Trump not orange man. Changing the name won’t fool my AI-powered censorship system.

Thanks for cleaning up the blog ! Keep up the good work on AI research.

Scandinavian countries have tariffs / VAT tax on ICE autos for decades at least in Norway and Denmark where EV cars don’t have the tax . It’s been a few years 20 but I’m pretty sure the ICE tax/tariff is 200 percent and definitely drives behaviors on purchasing vehicles

Everything is NOT fine. At least during the Volcker era everyone knew things were bad and had to tighten their belts. I did so along with everyone else. Now you’ve got one group of people living high off the hog while everyone else watches their standard of living drop and no one helps those later people with anything. If fact, the whole media complex is in complete denial, Wall Street, shills in the Corporate boardrooms to fool the American people, all putting out one lie after another. All you have to do to see what is really happening is to drive into many of the neighborhoods of Washington D.C like I do every other day and see how the other half lives. It is not a pretty site.

Swamp Creature,

Those institutions aren’t in denial they are just well organized, funded and have a common purpose. Controlling the narrative, whether it be government or corporations, requires controlling or owning the media. It is the reason why the Tok Tok ban is being pursued. It is one platform that doesn’t have their content either banned or algorithmly eliminated. Not my thing but the younger generation utilizes it for getting information that won’t be presented in mainstream media or controlled social media platforms. Propoganda is as old as time but it is next level now.

I agree with the creature, these creeping prices, like a virus, are consuming their host….eating them alive would be accurate. I’m aware over the next few years, things are going to get worse, not better. A lot of suffering to come.

The good news is this country is top notch, and will end the suffering humanly.

swamp, best comment i’ve seen on an article all week. the media tried its hardest to get harris elected based on that, and failed. they can’t hide the fact that people are unhappy, and that a booming stock market and home price “growth” doesn’t help the vast majority of people.

It was disconcerting to see media promote the “tariffs are bad” narrative when trade has been so imbalanced for decades. Such talk favors foreign producers and globalists and disadvantages US workers. A political party that supports US workers should easily see the current need for tariffs.

Tariffs are economically inefficient, generally, but are necessary to correct trade imbalances that do greater damage to a country.

Neither political party supports workers other chasing cheap surplus labor wouldn’t be so easier. NAFTA is a good example with the original idea by Reagan, then created by Bush then ultimately passed by Clinton, with little agreement from democratic Congress. I’m not arguing one side or the other as regardless of what they both say, their actions paint a different picture. Sadly Americans seemingly create a contrast where it doesn’t exist but that at least explains Congressional approval so there must be some awareness.

Reality is there will always be a place you can chase low cost labor so the imbalance will always be extreme except where the government is doing it for “national security” concerns with chips.

I was a huge supporter of a rate cut, however I think it should have only been .25% and I wouldn’t have immediately followed it up with another.

I really think that inflation is going to come roaring back, especially given the political situation. I think a year from now inflation is going to be higher than it is now.

Especially given that the budget for the remaining fiscal year is about to be decided in December.

Democrats obviously want to make it for the rest of the year. Sane Republicans will want to keep the choice as far away from Trump as possible so they will agree to any remotely rational agreement they can get that moves the clock as far forward as possible.

Federal deficits are going to increase in the short term and probably drastically increase in the medium term.

Good luck to those who think differently. I hope you are right, however I am betting the opposite.

JimL,

Isn’t it just going to be some sort of continuing resolution? I’m surprised the government hasn’t figured out away around the budget process given the black eye it creates each round.

“I was a huge supporter of a rate cut”

“I really think that inflation is going to come roaring back”

How do you reconcile these two statements?

Too large a rate cut (JimL felt that .5% was too much), and the deportation of workers (primarily food-related and housing), I’d guess, is part of his rationale.

Consider: countries outside the U S aren’t going to sit on their behinds and weather the tariffs. They’ll retaliate and/or amp-up trade with other trade partners. The belt and road initiative from China has widened its partner membership, including all of South America (with the exception, still, of Brazil), much of Central America, lots of countries in Africa, Middle East, Asia and Europe.

China is a big fat loser who is falling behind in AI every day

Tariffs will rescue this economy and combined with AI will make the USA great again and we can crush the commies with our Tesla Optimus bots

Anonymous,

Fantastic sarcasm.

Powell was pressured by Senator Warren who demanded at 75 basis point cut in a much publicized letter. Powell caved and dropped the rate 50 basis point, when in fact, if he actually looked at the overall data as he says he does, and not just one piece of data as he did, he probably would not have cut at all. I didn’t have much respect for him before that, now I have no respect for him (I am sure he is heartbroken to hear this). I will be glad when he is gone.

The real problem with younger people getting ahead is them.

I worked dozens of shit jobs in the 70’s following discharge from the army just to survive.

Look at the youth. Fat, lazy, entitled, and no work ethic. A good depression could be what could save them from poverty in the future.

Gig jobs and stay at home keyboard jobs will not support them in retirement.

I tire of the bs about jobs. There is no job shortage for people willing to work. And there is no shortage of opportunies for anyone willing to go out and do it.

I am over 70 and just finished a small home flip by myself. The problem is whinning instead of sweating. I still keep a part time, real easy job just to stay busy. I am slow as all hell and not worth a flip, but I come to work on time, do the best I can, pay attention, and I am honest. I also have a small vintage resale booth at a local antique mall.

It is not about money for me, it is about staying alive and not driving whats her name crazy! Life is what you make it!

Look at the elderly. Fat, lazy, entitled, and no work ethic. A good depression could be what could condemn them to poverty in the future.

“If these youngins would just yank themselves up by their bootstraps…”

Because lots of them already worked their asses off. It’s today’s youth’s turn!

Seriously, I think part of the problem is social media. 30 years ago, we only had Lifestyles of the Rich and Famous, and tabloids, etc., telling us how good life could be. We didn’t really know much about how “the other half” lived. Now? Instatok and Facegram are bombarding you, telling you how everyone else is stacked with cash. It makes sense that the young generation is feeling the pain from comparisons and wanting a fast ladder up.

Don’t forget that CNBC and Fox Business both have those “how I make $10k/month in my spare time” clickbait stories to get everyone feeling left out.

Yeah okay, I work 60-70 hours a week and take home around 1500-1700 a week after taxes. By millenial/gen z standards, I’m absolutely killing it.

I absolutely hate my job and my life though. And have spent my entire 20s chasing every last damned penny and still don’t really have much to show for it. From 21-26 I never broke 50k/yr despite working 80 hour weeks. From 26-28 I made 80k/yr working 70 hour weeks. I’m now making over 100k/yr but I’m in a situation where if I get fired my career is over and I’m down to 40k/yr jobs again or retail garbage. I also work a very dangerous and absolutely cut throat sector of trucking. I’m driving over an hour one way to work each day. I get 5 hours of sleep a night if I’m lucky and live on call.

I’m one of those worthless young kids everyone complains about and I’d laugh if the system burned to the ground, even if it meant my demise in the collapse. I absolutely hate existence but the dollar rules the day. Meanwhile I look at single wide trailers without plumbing or power 3 hours out in the woods for 400k dollars. Or the 800k dollar popsicle stick construction SFH’s with 500/mo HOA fees.

No joy here, just work for nothing but a digital representation in a banking app.

I can’t even begin to imagine what the truly suffering are thinking. The 15 dollar an hour McJob workers. Must be why every city is littered with the homeless now. I’d rather be a bum and steal food and sleep on a bench than work three part time jobs and live out of a 1990s chevy astrovan.

Try plumbing. Buddy just had electric H2O tank changed. We really did the math on this one. Checked tank price, which plumber may have got for 10% less. Checked travel time, about 15 mins from house. Gave time for pickup, paying etc. Tank was 600 C$ retail. Bill was 1500. Guy there 2 hrs. Full marks for efficiency, had pump to fast empty tank.

No matter how much slack you cut, you can’t get labour tag below 300 hr. Note: outfit refused to break out labour vs parts on bill.

Changing an electric tank is not hard. I’ve done 3 or 4. With Shark Bite connectors you don’t even have to solder, or get distances right, cuz connector lines flex.

I know a guy who does handyman kind of work and he’s paying his bills working 15-20 hours a week. He does random stuff like water heaters and makes a killing for doing nearly nothing.

A lot of trades like that are getting away with highway robbery after covid. I think HVAC is the worst. I know people who are paying 15-20k to have a 2 ton heat pump system replaced. Duct work and all that is already in place, just swapping out the units.

Thanks for the hard work and hope better days are ahead for you.

You wrote beautifully and this was the reason even A candidate like Trump won with good majority .

Powell is not serious about curbing going by this article.

If Powell is dead serious then he’d hike not pause or cut.

Financial conditions were never ever higher even with high rates.

I think the FOMC should have left the EFFR at 5. The creeping up of inflation while they cut rates is objective enough. But is it objective enough for the FOMC? Powell response to the rising inflation is that real rates are above the inflation rate. But he’s not targeting real rates, he’s targeting the inflation rate.

A Big Wet Blanket for Christmas this year when the Fed sits tight on rates.

If you think housing inventory has peaked, you ain’t see nothing yet.

Happy Thanksgiving

I think we may be stuck with moderate inflation because wage inflation lagged the supple inflation. Weird to say..but maybe the decline of labor’s bargaining power buffered and spread out inflationary forces from our double whammy of supply issues from COVID and easy monetary policy, as it relates to services?

Now it seems like in order to obtain wage increases workers have to move employers, which makes workers more sticky.

Just guessing. Too lazy to look up the data.

Inflation will not go away as long as we increase the money supply more than the output of goods and services.

Milton Friedman famously said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

As long as our government runs deficits, we will have inflation. Some of the inflation is hidden by increases in productivity. That is why a big screen TV is so much less than it used to be. We found cheaper ways to make the same TV. If we had not inflated the money, imagine how cheap that tv would now be.

We have got to reign in government spending, not just trim it, but butcher it. Remove entire programs, not reform. Government does very little well, and nothing efficiently.

Friedman was the living embodiment of H.L. Mencken’s aphorism: “For every complex problem there is a solution which is clear, simple and wrong.”

Happy Thanksgiving everyone!!!

Happy Thanksgiving, Wolf and all the readers/commenters here.