Demand for electricity has surged, and so has the price.

By Wolf Richter for WOLF STREET.

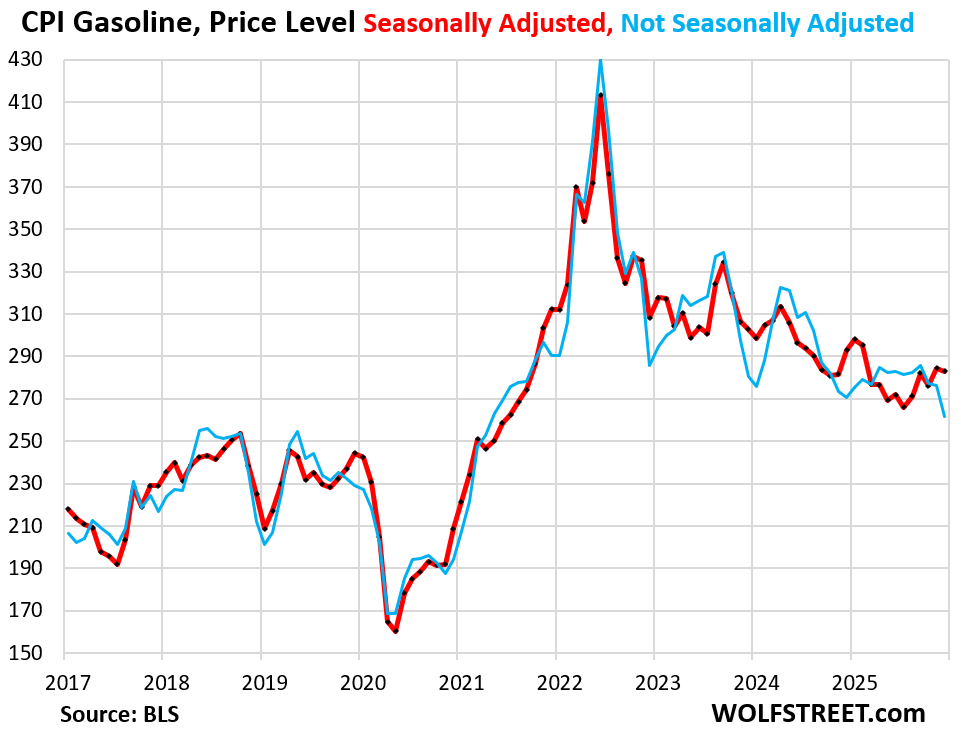

Americans spend a lot of money on gasoline, and gasoline prices have plunged off the horrendous spike that peaked in mid-2022 and then zigzagged lower, but remain substantially higher than before the pandemic. The plunge in gasoline prices over these years was a substantial contributor to the cooling of overall CPI inflation.

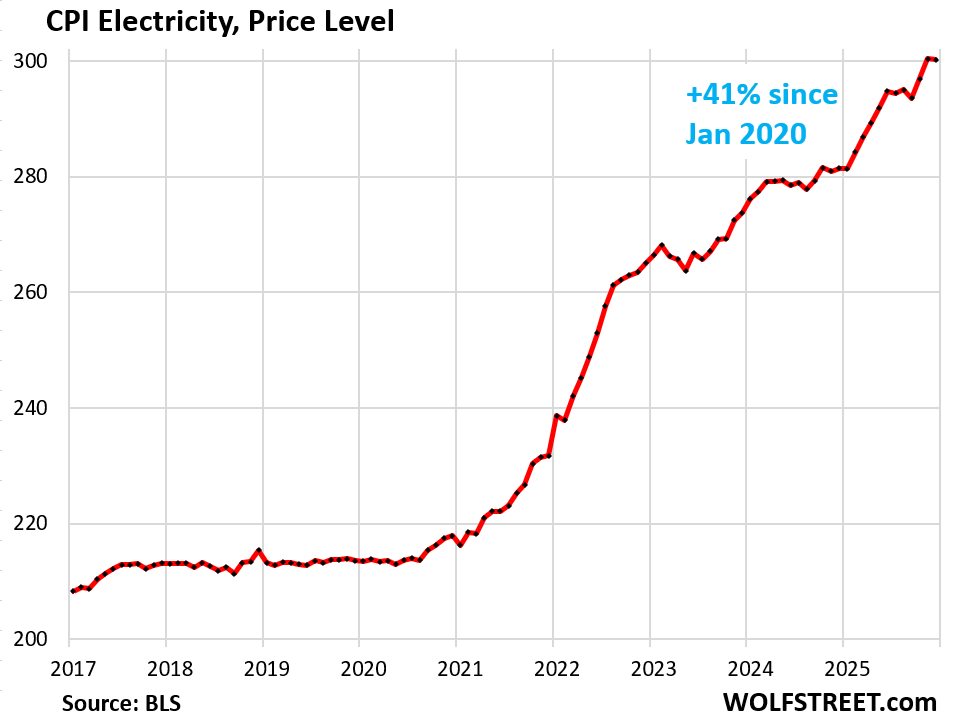

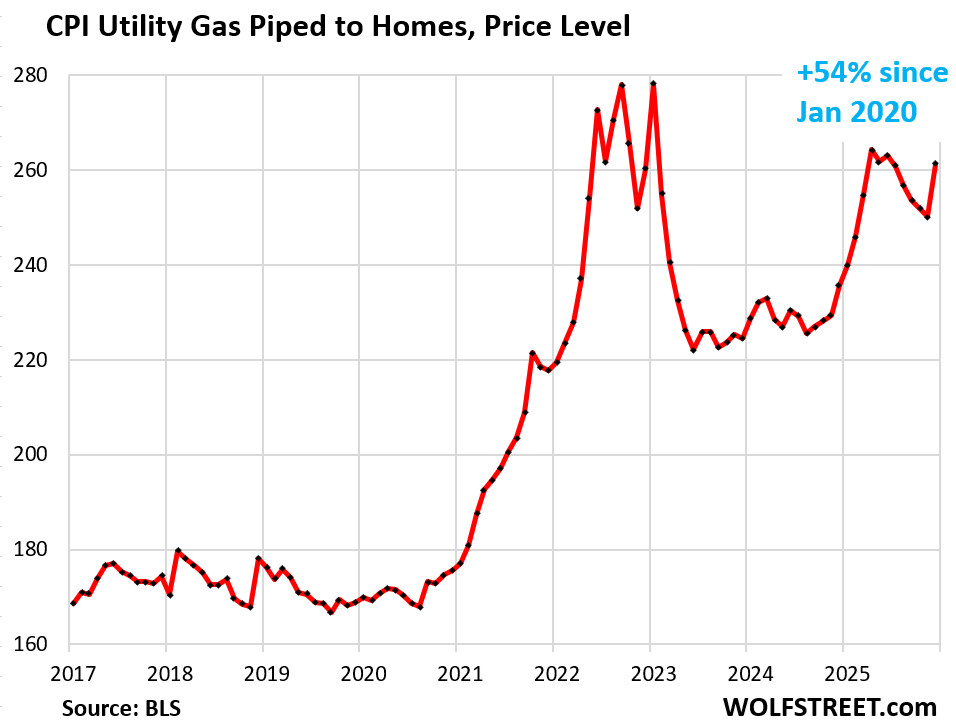

But that’s not the case for the two other major energy costs that consumers pay for directly – electricity and natural gas piped to the home. Electricity costs have soared from record to record, and natural gas costs have risen substantially over the past 18 months.

The Consumer Price Index for electricity has surged by 6.7% year-over-year, and by 41% since January 2020. The price that households pay for electricity on their monthly bills – unlike the prices they pay for commodity-based fuels such as gasoline or natural gas – is not volatile. It’s largely set by regulated utilities that face no competition other than from rooftop solar installations. Monthly charges are a mix of fixed fees, service charges, and charges per kWh used. And they add up.

The surge in demand for electricity by AI data centers is now causing upward pricing pressures at some grid operators.

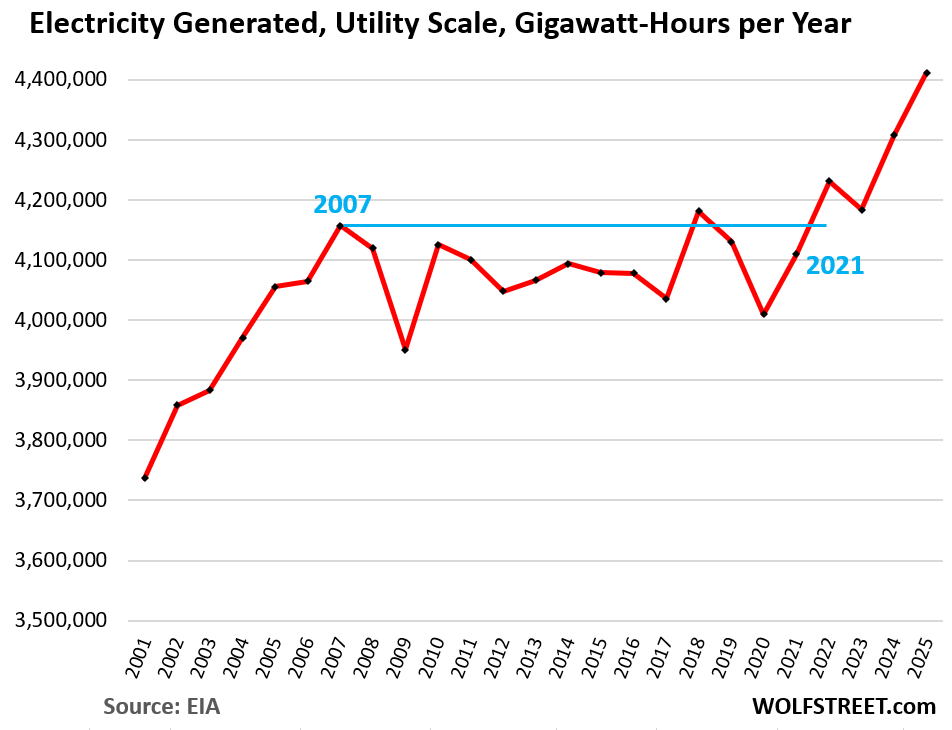

But that surge in demand is only a recent factor, largely in 2024 and 2025; that’s when the quantity of electricity generated began to surge, after spending 15 years in stagnation.

The chart below shows net generation of electricity in gigawatt-hours by utility-scale power generators (excludes rooftop solar). Per EIA data, generation in 2025 through October rose by 2.4% year-over-year. November and December 2025 are estimates. In 2024 and 2025 combined, net generation rose by 5.4%.

The AI-infrastructure buildout has only recently taken off, with many data centers not yet completed or not yet connected to the grid, and many more data centers being planned. The EIA estimates that demand for electricity will continue to surge in 2026 and 2027.

The CPI for natural gas piped to the home has surged by 10.8% year-over-year and by 54% since 2020.

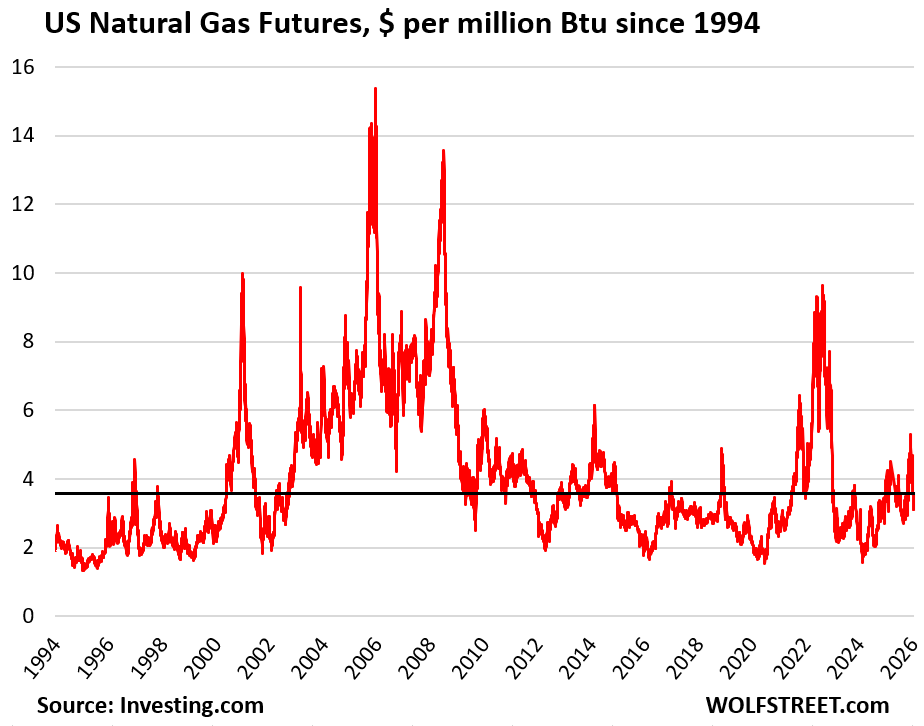

The US has been the largest natural gas producer in the world for over a decade. Surging production triggered a natural gas glut around 2009 that caused the price of natural gas futures to collapse; and except for brief spikes, it remained low, most of the time between $2 and $4 per million Btu., despite the surge in natural gas exports, and increased demand from power generators (replacing coal) and industrial companies.

The price has recently fallen back into that range (currently $3.57 per million Btu). But that’s not the price that households pay their utilities.

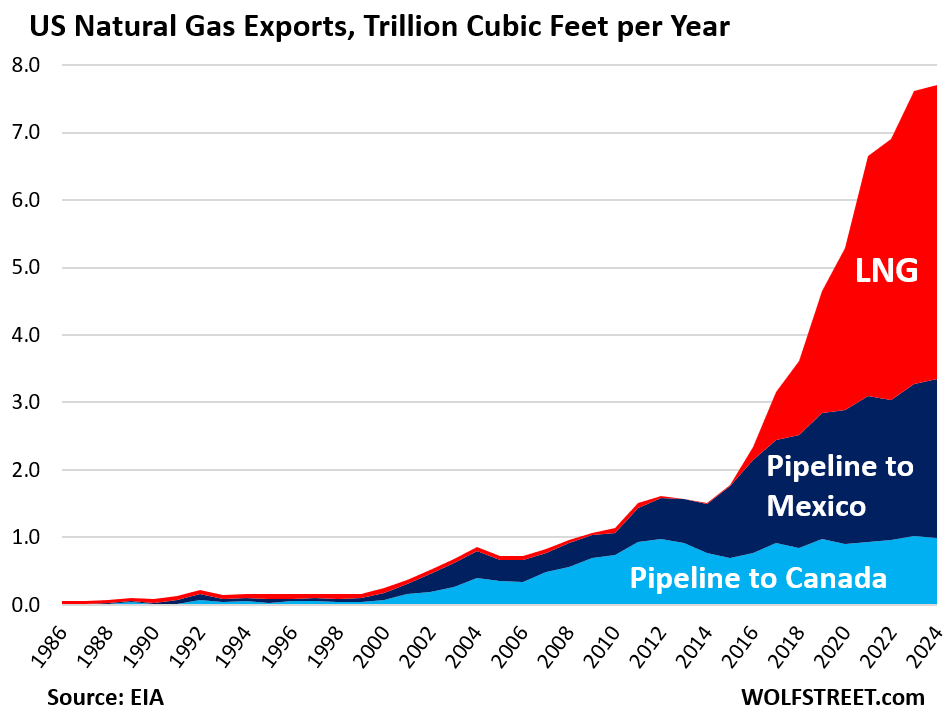

Exports via pipeline and since 2016 via LNG have created lots of new demand. The US has become the largest LNG exporter in the world, and new export terminals have been coming on line every year. The US also exports large and growing quantities of natural gas to Mexico via pipeline. It also has a bilateral natural gas trade with Canada, importing more from Canada than exporting to Canada as some regions in both countries are not well connected via pipelines to their producing regions, such as New England, which gets most of its natural gas from Canada.

Growing exports, growing demand by power plants, and growing use by industrial users and as feedstock in the huge US petrochemical industry are piling a lot of demand on US natural gas production. So far, production growth has been able to keep up.

The price of gasoline has plunged off the peak of the spike in mid-2022. The average price for the US fell below $3 gallon in mid-December and by the weekly measure on January 12 had dropped to $2.91, according to EIA data. But that’s the average. In some states prices are a lot lower already; for example, Texans paid on average $2.45 per gallon and Coloradans $2.40, while Californians paid over $4.00 a gallon (the state is not connected via pipeline to other US oil producing regions).

The CPI for gasoline reflects the national average. In December, on a not-seasonally adjusted basis, it dropped to the lowest since April 2021, and was down 3.4% year-over-year (blue line).

Winter is usually the seasonal low-point, with driving season over the summer forming the high point. And the recent drops in the price were less than normal during this time of the year. So an a seasonally adjusted basis, gasoline had ticked up in the fall (red line).

This large drop in the price of gasoline since mid-2022 helped push down overall CPI.

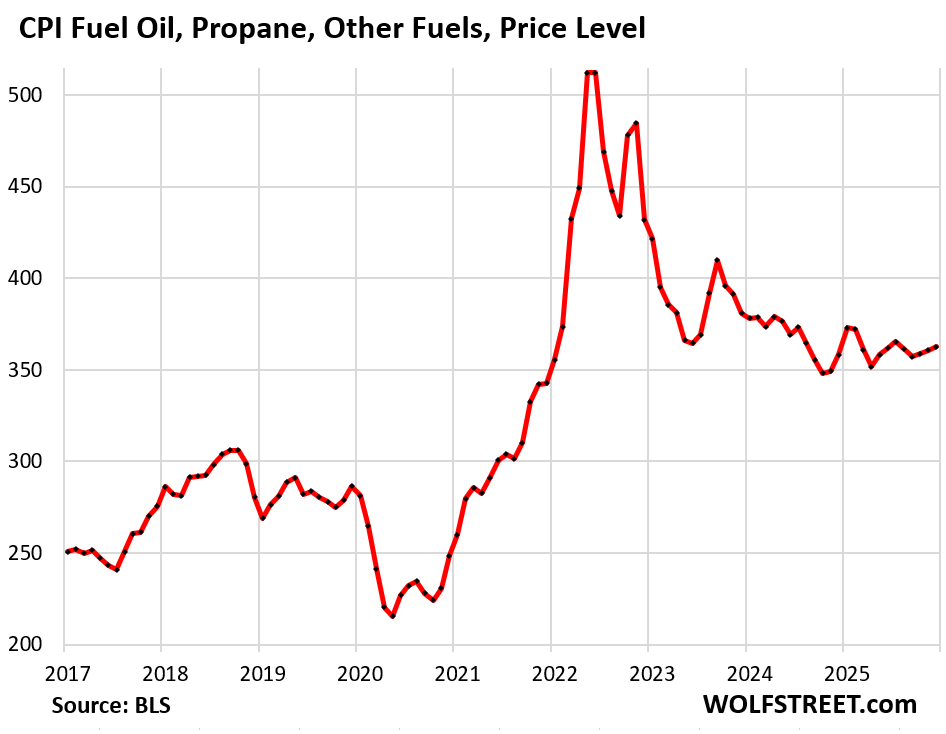

The CPI for “Other fuels” (fuel oil, propane, kerosene, firewood, etc.) had spiked by 63% from January 2020 through mid-2022, and then gave up a portion of that spike. It remains 29% higher than in January 2020. Year-over-year, the index is up 1.2%:

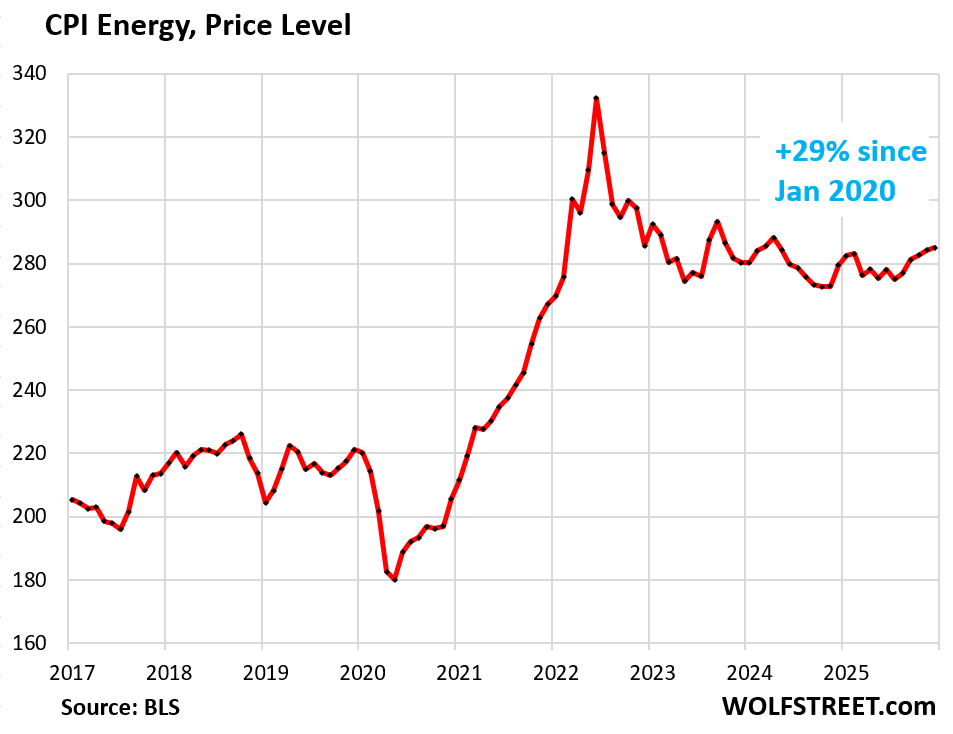

All combined, the overall energy CPI that tracks the above categories of energy that consumers pay for directly has flattened out for the past three years at very high levels, with falling gasoline prices (accounting for nearly half of the overall energy CPI) roughly balancing out the rise of electricity prices.

Inflation is the rate of change of prices. And the rate of change of energy prices has cooled, due to the drop in gasoline prices. In December, the energy CPI was up by 2% from a year ago. But it remains high, up by 29% from January 2020.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

Any thoughts on large scale solar farms as viable energy sources to help with the burgeoning electrical demands? Current administration not keen on solar and wind, but with the tidal wave of demand surging, any and all options are necessary. Comments?

With data through 2024. Data for 2025 will become available at the end of February, at which point I will post my annual “Power Generation by Source” article:

https://wolfstreet.com/2025/02/27/demand-for-electricity-takes-off-us-power-generation-by-source-in-2024-natural-gas-coal-nuclear-wind-hydro-solar-geothermal-biomass-petroleum/

The entire power generation industry understands that meeting demand requires an “all of the above” portfolio of power generators. All forms of power generation have advantages and disadvantages, and there are no free lunches when it comes to energy.

Thank you.

The problem with solar is storage. Costly and often dangerous.

A Guy,

The majority of storage is now a very profitable arbitrage business, buying electricity during low demand times of the day, at a low price, and selling the electricity during peak demand at peak prices of the day. These arbitrage profits have created a boom in battery storage installation. And in the process the help balance the load and have other benefits.

https://wolfstreet.com/2025/09/22/price-arbitrage-buy-low-sell-high-dominates-the-use-of-utility-scale-battery-systems/

Far behind price arbitrage, the other big uses of battery capacity were in that order: frequency regulation, excess wind and solar generation, system peak shaving, load management, co-located renewable firming (pairing wind and solar with battery systems at the same site), and others.

Interesting discussion here.

IMHO – I think it’s all going to be about fission and fusion.

One of the fusion R&D projects is publicly traded RNWF.

Even with all the solar farms and rooftop solar cells in the best areas, solar only makes up 8% of total USA energy generation. It helps, but we need all sources of energy, and favoring one at the expense of others causes massive price distortions.

The highest price component for solar panels was silver before the price of silver rocketed. Now, it’s pretty much hopeless to use silver, so they will have to use other base metals that 1) corrode faster, and 2) conduct much less.

Americans and Canadians are really missing the boat when it comes to rooftop solar. Smallish 6.5 kw rooftop systems including panels, inverter and installation are available in Australia for under $5000. These are mostly Chinese components, and the government in Australia has been quite supportive.

Yep, we in the US are getting ripped off by protectionism, and because prices are high, people think solar isn’t a viable tech.

When we owned our single family home we took a look at solar panels. That was back in 2021 and the “payback” time was estimated to be 12 years.

Since we knew we’d be downsizing within 5 years it didn’t make sense to us. And what if prospective buyers didn’t want them?

The two biggest issues I see with solar panels are: 1) Night and 2) Weather such as hail storms which might wreck all the panels.

The power source – The Sun – is definitely free.

We had a little hail storm come through in June. It only lasted 15 or 20 minutes but it busted up every ones shingle roofs.

My neighbor had solar panels on his roof and they came out OK. but he still had to replace the shingles.

6.5 kw roof top system would cost $20k in usa

There is major market manipulation going on. The latest PJM capacity auction cleared every load zone at the capped price. These same players bid in much lower prices in previous years. They put in max bids cuz they could. Retirements of fossil plants combined supposed planned load growth created a phoney capacity shortage that the sharpies cashed in on.

It is not beyond the realm of possibilities that the supposed planned load growth is put into the interconnection queues with just this result planned.

As far as data centers they are some of the cheapest loads to service. They take deliveries at high voltages, and don’t cause the system problems like the old large industrial loads of yesteryears.

In comparison large scale electrification at the transportation, commercial and residential level requires upgrades all up and down the electric system.

Renewables cuz system problems requiring not only upgraded but new technologies to maintain stability and safety. (Not complaining here, it’s good work for utility engineers) All this drives up costs.

-Old retired utility engineers.

Anecdotal but, was talking with my civil engineer buddy that does infrastructure work last night. He travels all over and is in Wisconsin right now working on a new data center. Said there’s almost no commercial building going on other than data centers. Said the town folks were pissed and didn’t want it.

In a general sense, I usually don’t get fired up about paying bills and whatnot but since all these power utilities are essentially monopolies in their regions, regulators should look at increased rates for business vs consumer. When you think about it, the data center owners are also monopolies – Google, Apple, FB, et all. So screw it- just make the data centers pay through the nose.

Trump stated that the administration was going to make the data centers pay their fair share. Supposedly.

The Dept. of energy had a press release on the 16th regarding this. Though it seemed like it was only regarding the rust belt states.

By coincidence I paid my electric and gas bill this morning – the same day Wolf publishes this article on energy inflation. My one data point experience validates many of the points Wolf is making.

My January bill (combined gas and electric) was the fourth highest ever. Interestingly, 2009 was the record – 10% higher than my current bill. However, in 2009 I used 47% more electric and 14% more gas. This is in southeast Pennsylvania where PECO supplies my electric and gas.

Since 2020 the index for electric cost has gone up 41%. My cost per kilowatt hour has gone up 61%. The cost index for gas is up 54% and my cost per hundred cubic feet is up 48%. I must be getting a real deal on gas /s.

I am retired (since 2010) and on a fixed income – but not a pauper. I am still fully able to pay my bills. But, it does bring a focus on the popular issue of affordability. Pile on the increases in property taxes, insurance, medical costs, restaurant prices, other utilities like water, sewer, phone, internet, etc. You begin over time to get an appreciation of the issue of affordability.

I understand the arbitrage of the electricity markets as well as “free” energy from the sun.

However, people miss the fact that a renewable system will always be more expensive than a fossil fuel system because renewable energy systems cannot operate with fossil backup.

If you add the cost of having a fossil fuel system backup to a renewable system, a renewable energy is very expensive.