At these valuations, “exit hurdles become exceptionally large.”

By Wolf Richter for WOLF STREET.

AI startups’ aggregate post-money valuation (the valuation after the latest round of funding) soared to $2.30 trillion, up from $1.69 trillion in 2024, and up from $469 billion in 2020, which back then had already set a huge record, according to PitchBook.

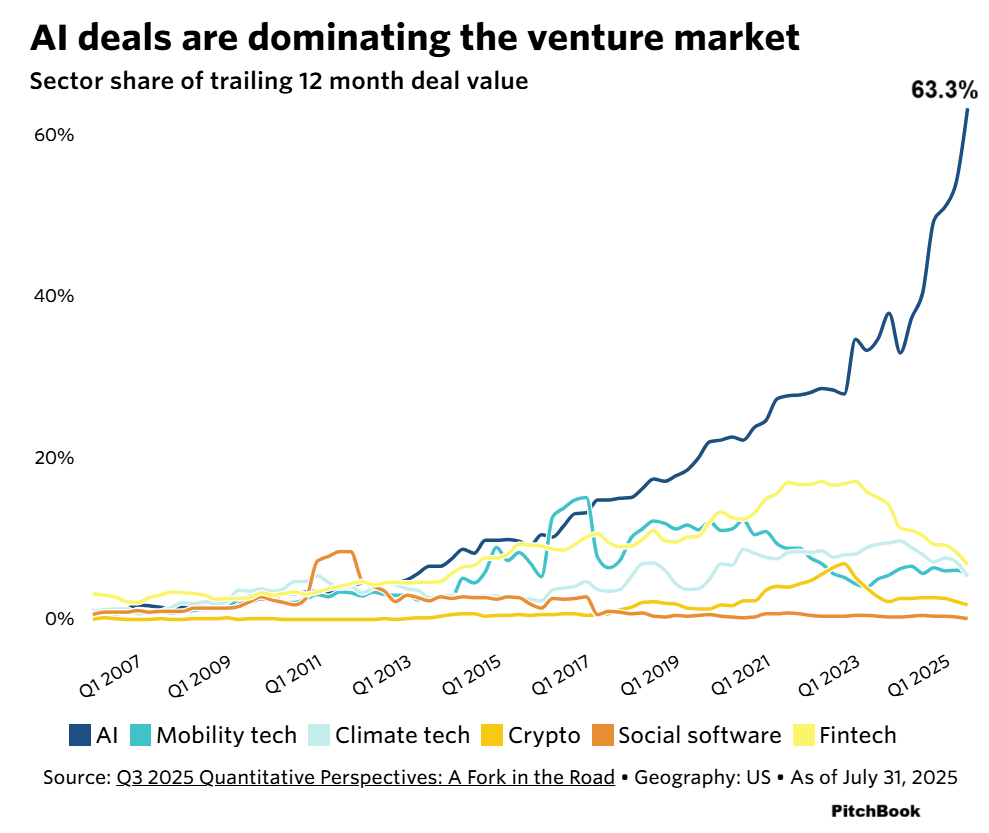

“AI deals have come to dominate the entire venture capital market at an unprecedented clip, dwarfing the quick concentration of investments during prior hype cycles such as crypto and mobility tech,” PitchBook said.

AI startups accounted for 63% of venture capital investments made during the trailing 12 months (TTM), up from 40% over the TTM through Q3 2024, and up from 23% over the TTM through Q3 2020 (blue line in the chart), according to PitchBook’s Q3 2025 Quantitative Perspectives: A Fork in the Road.

OpenAI reached a $500 billion valuation in early September, when it offered eligible former and current employees to sell $10 billion of their shares in a secondary share sale to other investors, led by SoftBank, according to CNBC. In April, OpenAI had reached a breathtaking post-money valuation of $300 billion at a funding round when it raised $40 billion, primarily from SoftBank. The sky is not the limit.

Elon Musk’s xAI is supposedly shooting for a $200 billion valuation in a $10 billion funding round, according to sources cited by CNBC, which Musk denied on X as “fake news. xAI is not raising any capital right now.” Well, not right now. Or whatever.

Anthropic reached a $183 billion post-money valuation, after raising $13 billion in a Series F funding round in early September, according to Anthropic.

And so on. These valuations of AI startups are mind-boggling. How are these late-stage investors going to exit their investments with their skin intact?

These companies would have to go public in huge IPOs with gigantic valuations, and then the shares would have to trade higher from there to allow late-stage investors to sell their shares without tanking the share price.

AI-anything brings in the cash. If 90% implode and take all investor cash with them, and 8% scrape by somehow, but 2% become $1-trillion companies at their IPOs, and are $2 trillion stocks two month later, and are, why not in this bizarro-world, $4-trillion stocks a year later, then it would all work out somehow, that’s kind of how the thinking must be going.

Alas, the biggest AI-anything IPO – and the biggest IPO of 2025 – Figma has caused a lot of heartache. Its shares were priced at $33 at the IPO, popped by 250% on the first day, jumped again on the second day to peak at $142.92, and then plunged by 63% to $51.87 today.

Sure, pre-IPO investors still have enormous gains, but most investors that bought the publicly traded shares are deeply in the red. And if the pre-IPO investors try to sell their remaining huge stakes, they could crush the stock further.

But Figma has a market cap of only $25 billion. AI-company CoreWeave, the second biggest IPO this year, has fared well since the IPO, but it has a market cap of only $68 billion. These are an order of magnitude smaller than what would be needed for late-stage investors to exit their mega-AI companies.

How will these AI companies with mega-valuations of $500 billion now go public at a valuation that is big enough, and then with share prices that rise enough from there, to get the late-stage investors out with their skin intact?

Obviously, we’ve seen over and over again in this immense bubble, that the sky is not the limit and that miracles are being performed on a daily basis. But at these valuations, “exit hurdles become exceptionally large,” PitchBook said.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What is scary is all this AI is being developed to take work away from humans. It no longer a far fetched idea we have seen time and time again in science fiction movies, robots and humans at war and collapse of civilization. All the people on this planet, what exactly we are supposed to do if machines and AI take over. Like I said, not a far fetched idea anymore.

That’s easy – the billionaires, who already own everything that matters, buy newer, bigger yachts while the masses who lost their jobs live in abject poverty.

Taking work away from humans should be a pathway to a wonderful quality of life for all.

It won’t work out that way, of course. But reducing the need for human labour is not the problem.

@Random50, the problem is that the only asset the vast majority of people on this planet have is their labor. If you eliminate need for human labor, then those humans have nothing left of value.

Meanwhile, oligarchs are gobbling up every last morsel of business, land, metals, and crapcoin with the full expectation that the future is just a game of Monopoly where real (and not-so-real things) are simply hoarded, creating no productive value whatsoever, and yet representing the entirety of “real wealth.” Perhaps because in a world of AI, productivity has no value whatsoever?

Of course, the alternative is Communism, but then everyone lives under totalitarianism, and we would still starve, despite everything being automated.

Depends how you define value.

Governments already redistribute income and wealth through taxation. If AI takes on a greater share of the actual meaningful labour (the stuff needed for society to function, not the busy work most of us engage in), there’s no fundamental reason the “free ride” on offer in each country can’t get considerably more enjoyable.

There will always be people who want more than that free ride.

I’m confused by the PitchBook chart. If these are proportions (“shares”) then why aren’t they stacked so they add up to 100%? The pre-2015 years are clearly not adding up to 100% share. Unless there is some category of “other” that’s unlabelled and dominated the venture market in that window?

Correct, you’re confused. You’re not looking at the many dozens of industry categories of VC investment. You’re looking at the 6 most hyped themes in VC investment and what their shares were of total VC investment at a point in time.

Nvidia + Broadcom + TSM = $7.5 Trillion.

“Investors” will need to raise $1000 from every man, woman, and child in this planet to exit at this level. That’s Just for these three.

The Fed does not have enough ink to bail us out.

Wondering the same thing

In general, I think all these AI companies are chasing each others potential, possible future customers — kinda like Worldcom selling fiber capacity to future ghost towns. Duh.

“How are these late-stage investors going to exit their investments with their skin intact?”

If my understanding of AI research is correct, regardless of the stock return, the first AI across this finish line will own the board. There can’t be a second place. Even if investors don’t see a return from their stock investment, they potentially stand to gain direct access to all the downstream revenues and opportunities generated by a true Artificial General Intelligence (AGI).

I don’t think we have any comparable historical examples of stakes this high (and coming this fast), except maybe the nuclear arms race. Of course, this all presumes one of the contenders is successful before some external factor tears the house down.

This is a scary comment. Same as “This time it’s different” was during the peak of the Dotcom bubble (after it burst, the Nasdaq tanked 78% in 2.5 years and took 15 years and lots of money printing to get back to its March 2000 high, and thousands of highfliers went to zero and vanished).

Another scary part is that we seem to be experiencing “this time it’s different” mentality all at the same time, be it the stock market, Crypto, car markets, watch markets, LeBubu and definitely he housing market. As if we simultaneously just think everything can only go up all at the same time, guess easy money for long will tend to do that…

This won’t end well

AI faces a lot of headwinds which it will have to navigate. One of them is copyright laws which will definitely be interesting to watch and the other way is how to monetize it. Building it into products seems easy enough but hard to monetize for direct consumer use. Even if they sell ads, those may not offset costs unless they really reduce cost per query. Not clear what the ultimate business model will be as not inexpensive to provide like YouTube or Google where ads drive revenue. AI will undoubtedly speed forward and reduce costs but I hardly buy into the destruction it is expected to create in the next 5 years. We don’t see to be a great country at retooling our labor force however.

The US federal government has just shut down at 12:00 am EST.

It doesn’t actually “shut down.” But some functions are stopped, for example, the Blue Angels might not fly during Fleet Week in San Francisco and the ship parade might not take place. That happened once before (shutdown vintage 2013).

I bet the guys putting out the cones blocking the lots tourists park to see Mount Rushmore in the distance are out working tonight (so they can bill for overtime after the government reopens like they did at the last few “shutdowns” that are nothing but political theatre). In 1995 I walked into the USGS office to buy some topo make and they said “we can’t sell them since the government is shut down”. When I offered to pay cash and leave it to ring up after the government “opened again” they said no. With less and less people watching mainstream media today I bet 90% of the people won’t even realize the “government is shut down” tomorrow…

Other than the investors, who’s likely to get burned when this goes bust?

Are the banks somehow on the hook for the eventual losses so the Fed has to step in like it’s 2008? Or do they just let it burn like it’s 2001, and what falls, falls?