Household money-market funds surged, large CDs also surged. But small CDs are the hot money; they flee when yields drop.

By Wolf Richter for WOLF STREET.

Despite the Fed’s rate cuts of 100 basis points in 2024, and therefore lower yields on money market funds, households continued to pile their cash into them. Banks have lowered the rates they pay on CDs, and holders of small CDs, always the hot money, have started to cash out. But balances of large CDs continue to grow. On net, their huge pile of interest-earning cash grew further.

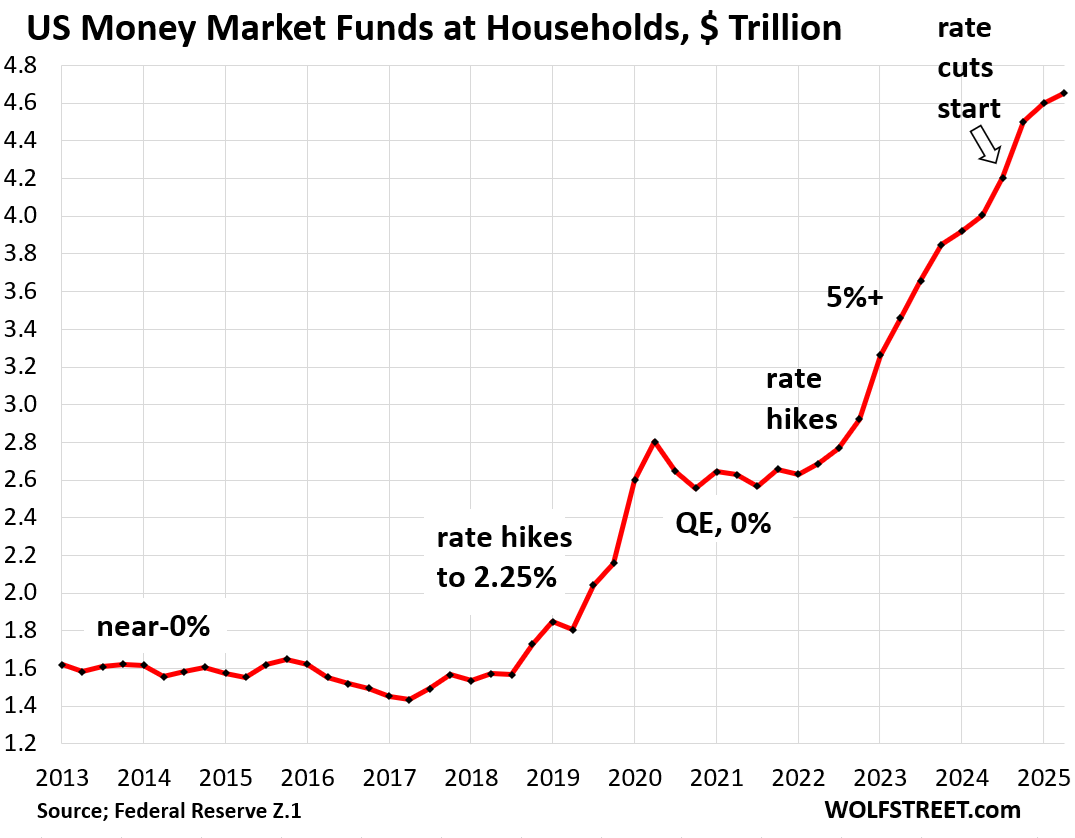

Balances in money-market funds held by households rose by another $55 billion in Q2 from the prior quarter, and by $650 billion year-over-year, to a record $4.65 trillion, according to the Fed’s quarterly Z1 Financial Accounts yesterday. Since Q1 2022, when the Fed started hiking its policy rates, balances have surged by $2.02 trillion.

These money market fund (MMF) balances include retail MMFs that households buy directly from their broker or bank, and institutional MMFs that households have indirectly through their employers, trustees, and fiduciaries who buy those funds on behalf of their clients, employees, or owners.

MMFs invest in safe short-term instruments, such as in Treasury securities with less than one year to run (anything from a 1-month T-bill to a 30-year Treasury bond that matures in a few months), in high-grade commercial paper, in high-grade asset-backed commercial paper, in repos in the repo market, and in repos with the Fed (ON RRPs).

The Fed’s five rates form a floor and ceiling for short-term market yields, such as the gigantic repo market, to which MMFs are big lenders.

Short-term Treasury yields track the Fed’s policy rates expected in the near future. The three-month Treasury yield dropped in recent days and is at 4.03% currently, fully pricing in one 25-basis point rate cut next week, whereby the Fed would bring its five policy rates down to 4.0% at the low end and to 4.25% at the high end.

Many MMFs still have a yield above 4%. But yields of many Treasury money market funds have fallen below 4%.

But when Q2 ended on June 30, the 3-month Treasury yield was still 4.34%. And so the household MMF holdings of $4.65 trillion at the end of Q2 were still earning the yields prevalent at the time, roughly 30 basis points higher than today.

All these yields are still positive in inflation-adjusted terms: CPI inflation – in another nasty surprise that inflation tends to dish up – rose to 2.9% for August.

If the Fed cuts short-term rates aggressively while inflation continues to accelerate, it won’t take long before real yields on MMFs turn negative.

Falling yields, and especially negative real yields, would suggest that households yank their money out. But as we saw in 2020, nominal yields plunged to near-0%, and by early 2022, real yields were around negative 7% and falling further, and household MMF holdings barely dipped.

But when yields rose sharply later in 2022 and through mid-2023, MMF balances exploded and they continue to surge though yields have backed off by over 100 basis points.

So it will be interesting to see how far yields would have to fall before aggrieved households begin to drain those MMFs. And as we saw, it might not make a big dent.

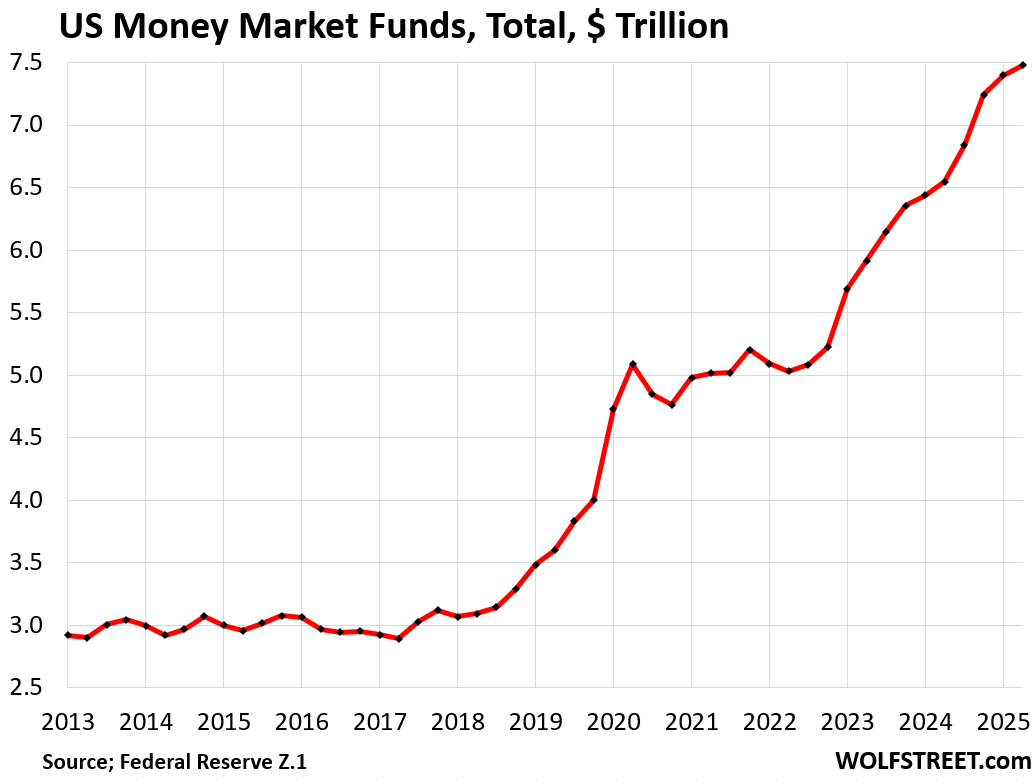

Total MMFs (those held by households and institutions) rose by $83 billion in Q2 from Q1, and by $933 billion year-over-year, to $7.48 trillion. Since Q1 2022, balances have ballooned by $2.39 trillion.

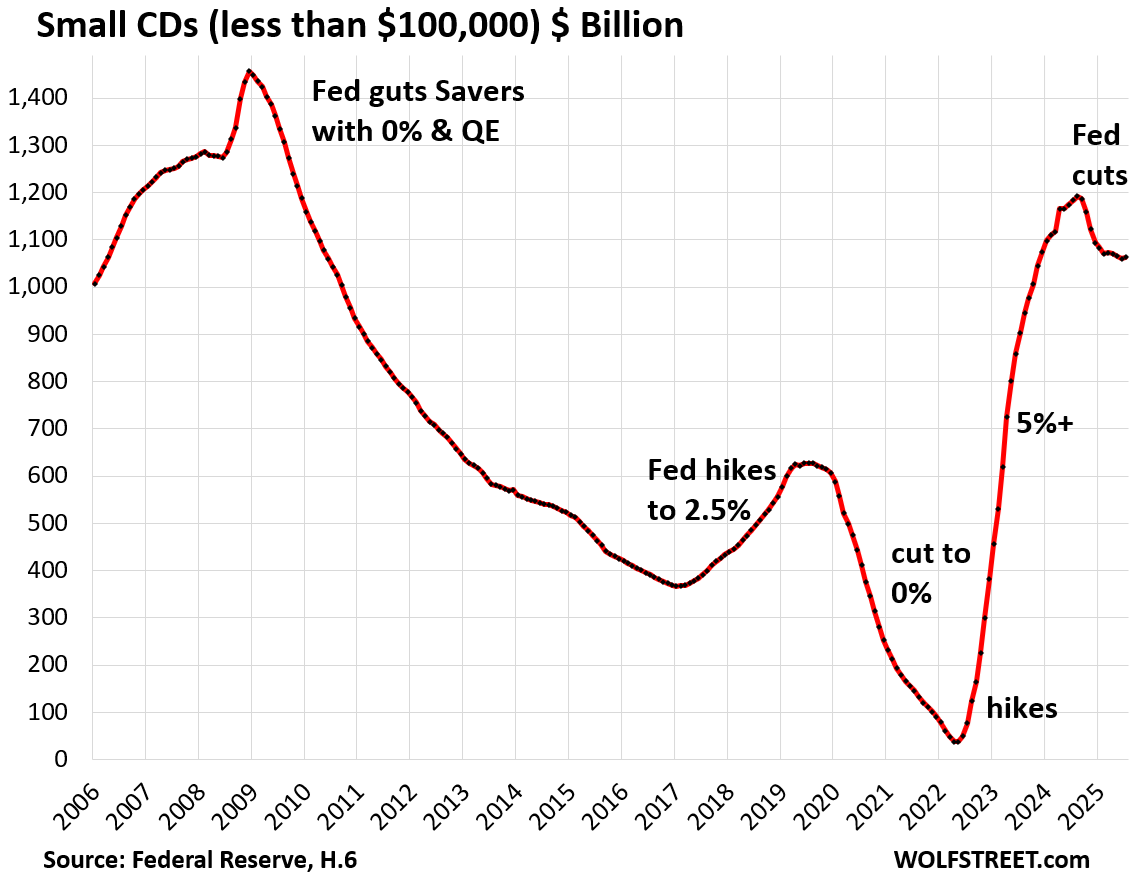

Small Time-Deposits (CDs of less than $100,000) react fairly quickly and strongly to interest rates offered by banks. They’re not “sticky” at all. They’re the hot money.

In July, balances ticked up a hair from June to $1.06 trillion, according to the Fed’s latest Money Stock Measures. But that was down by $129 billion from just before the Fed began cutting its policy rates in mid-September 2024.

In the time frame of Q2, small CDs fell by $13 billion quarter-over-quarter and by $114 billion year-over-year.

As soon as the Fed started cutting rates in mid-September, which caused banks to cut the interest rates they offered on CDs, balances began to fall.

Balances fall gradually as holders don’t reinvest the proceeds from maturing CDs. Some CDs have short terms, such as 3 months or 7 months, others go out further, 2 years, 5 years, and longer. So it takes a while for balances to drop, as we can see in the chart below.

When the Fed gutted savers’ cash flow from savings in 2008, they began cashing out, and by mid-2022, small CDs had nearly vanished. But note, when the Fed started hiking its policy rates, balances of small CDs exploded from near-zero in April 2022 to $1.19 trillion in August 2024. The hot money!

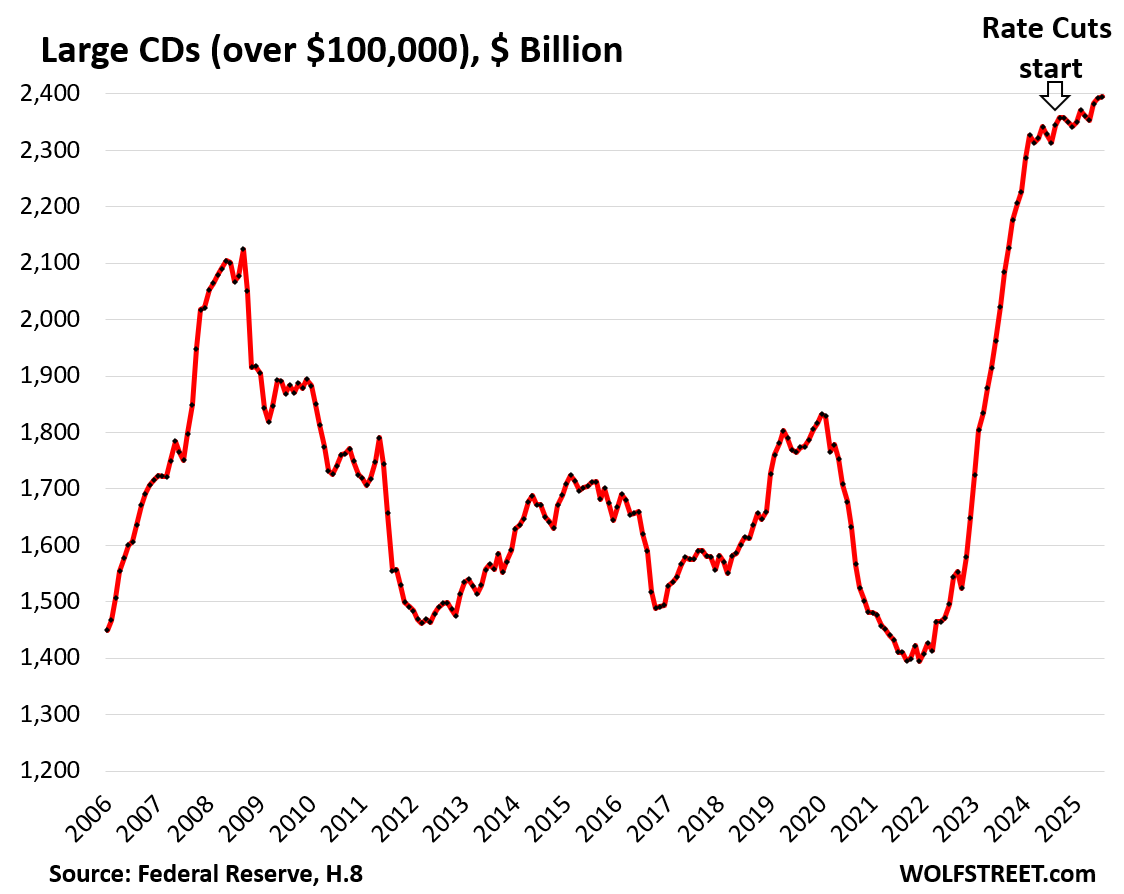

But Large Time-Deposits (CDs of $100,000 or more) continued to inch from record to record, and in July reached $2.40 trillion, up by $82 billion from a year ago, according to the Fed’s monthly banking data.

In the time frame of Q2, large CDs rose by $32 billion QoQ, and by $82 billion YoY.

Since March 2022, when the rate hikes began, large time-deposits have surged by $982 billion.

So, with…

- Household MMFs +$55 billion QoQ and +$650 billion YoY, and

- Small CDs -$13 billion QoQ and -$114 billion YoY, and

- Large CDs +$32 billion QoQ and +$82 +billion YoY

these piles of interest-earning cash combined increased by $74 QoQ and by $618 billion YoY, to a record $8.11 trillion.

In addition, many Americans hold high-yield savings accounts, but they’re not included here.

In addition, many Americans hold T-bills directly, either in their brokerage accounts or in their accounts at the government’s TreasuryDirect, and they’re also not included here.

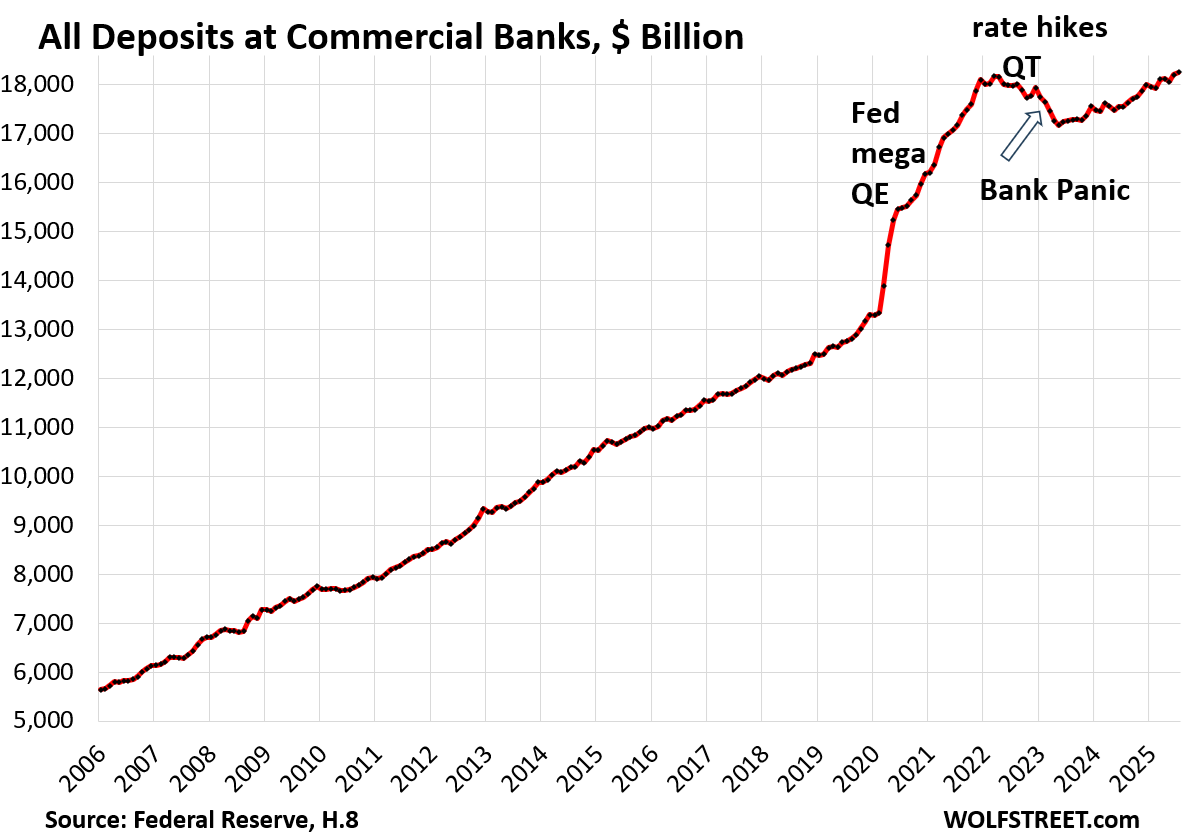

CDs are only a small part of total bank deposits. Total deposits at commercial banks rose to $18.3 trillion in July, back where they’d been before the rate hikes and QT. Balances had dropped by nearly $1 trillion in the first half of 2023 during the bank panic that caused three regional banks to collapse. But the FDIC made all depositors whole, the dust settled, and deposits started coming back.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

MW: As Fed nears highly anticipated rate cut, the market ‘really hinges’ on 10-year Treasury yield

So far, the idea of a lower ST rate has caused mortgage rates to drop. Lenders must think a rate cut is appropriate at this time, even though inflation is still running well above target for the 5th year in a row.

This result makes little sense to me. I sense bondholder complacency.

A year ago, mortgage rates dropped until the day of the 50-basis point rate cut. Then on the day of the rate cut, they rose, and they kept rising until they’d risen by over 100 basis points, while the Fed cut 100 basis points.

We discussed this here in the comments at the time, live, as we were watching it develop on the day of the rate cut. It was interesting.

Wolf, if the federal funds rate go lower, let’s just say zero for the moment, and those in MMFs move to buy Notes instead of Bills, doesn’t that also force the Treasury to finance it’s debt with Notes?

No, MMF must cannot do that. They cannot buy anything that matures in more than one year, and their weighted average maturity must be 60 days or less. Those two are what makes MMFs safe. They’re regulatory requirements.

Wolf Man…

My money in the bank earning maybe 4%….Let’s look a little further…

Beginning of year $1000. End of year $1040 (more or less). My pile of cash at end of year

= BIGGER! Yay!!! Well, uh, no.

That larger pile of cash at year’s end will buy less goods and services that it did on Jan 1st. More pieces of ‘paper’, less purchasing power.

I’m almost finished with my book, ‘Banking for Dummies’.

The idea of yield is to be larger than inflation = positive “real” yield. CPI inflation = 2.9%. Yields over 4% = positive “real” yield. If inflation goes to 3.5% and the Fed cuts to 3.0%, then the “real” yield will be negative.

Read the article. It explains that.

With stocks, you can lose 50% due to market value decline over three years and lose another chunk due to inflation. So a loss of maybe 60% or more. Or you could make more.

That’s “risk.” A nearly risk-free asset, like a MMF, has a smaller potential return, than an asset where you can lose 100% of your principal.

As usual MSM claims to say 7.5 Trillions sitting on sidelines so Stocks will only go up. Complete BS. Now ON RRP have almost vanished. All those Money market funds are invested into Short term/medium term. So its not like that cash is lying around where people can buy stocks.

If those funds money invested into Stocks, Treasury and Bond markets yields will go up in order to entice the investors. Someone has to buy Govt Debt.

Sure those high balances are having wealth effects specially retirees who have piles of cash. Even at 4.3% they are enjoying their new revenue stream. This revenue stream was killed by FED for 15 years.

The “money on the sidelines” is the funniest BS ever, and it refuses to die though we have driven wooden stakes through its heart many times here.