Extend-and-pretend and forbearance deals widely implemented to “cure” delinquent CRE mortgages.

By Wolf Richter for WOLF STREET.

The office and multifamily sectors of commercial real estate loans got further bludgeoned in August, despite large-scale extend-and-pretend and forbearance deals executed in the hopes for better times and lower interest rates and more demand so that lenders don’t end up with the property and a huge loss.

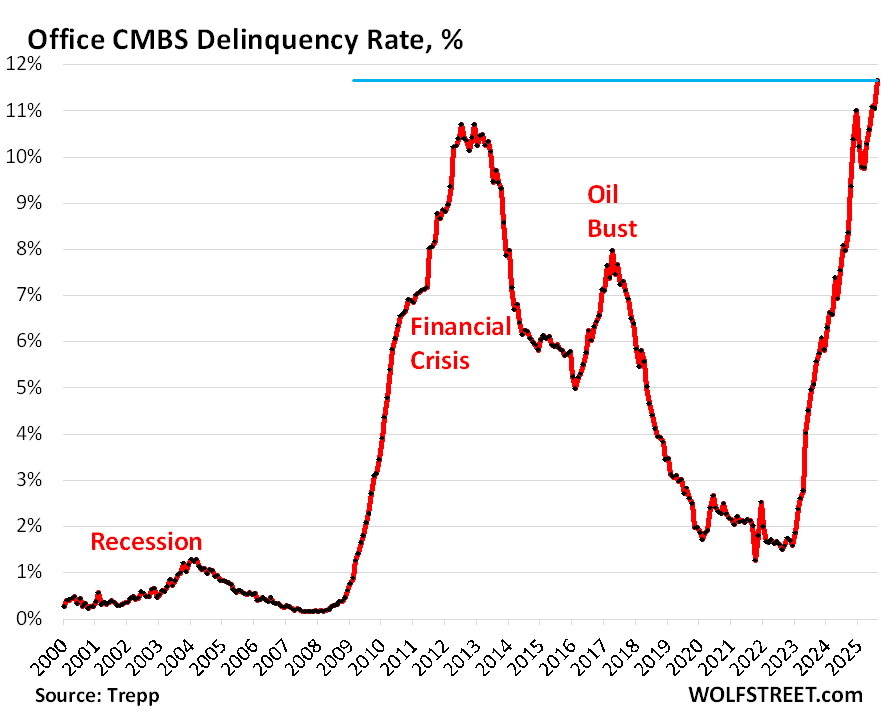

The delinquency rate of office mortgages that have been securitized into commercial mortgage-backed securities (CMBS) spiked to 11.7% in August, the worst ever, a full percentage point above even the peak meltdown rate of the Financial Crisis (10.7%), according to data by Trepp , which tracks and analyzes CMBS.

Back in December 2022, the office CMBS delinquency rate was still 1.6%. Since then, it has exploded by over 10 percentage points.

It’s the older office towers that get in trouble. High vacancy rates in new fancy office towers allow companies to move from an old tower to a new tower, thereby upgrading and downsizing at the same time. This “flight to quality” is increasing the pressure on older towers.

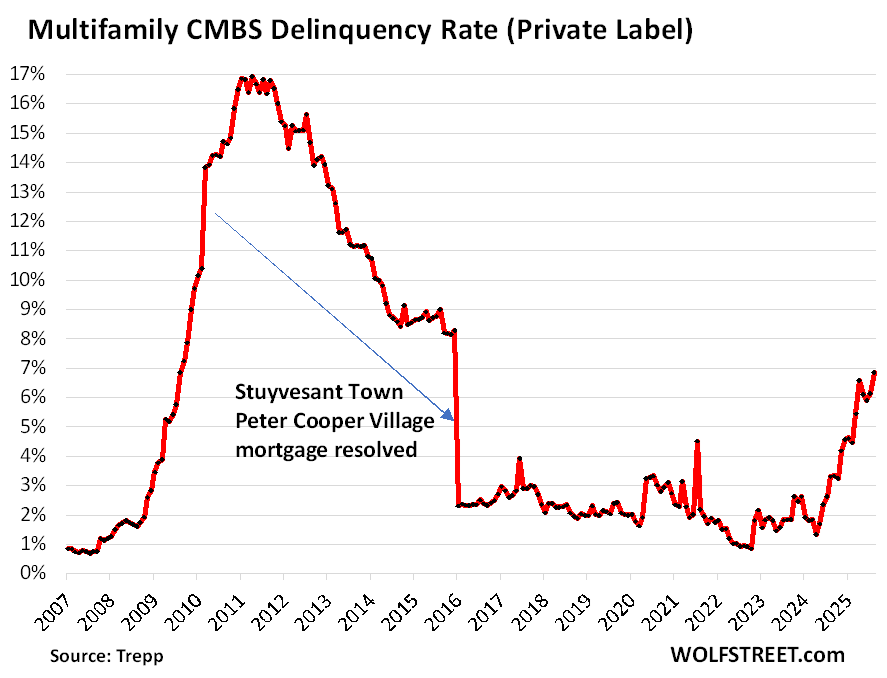

The delinquency rate for multifamily CMBS, backed by rental apartment property mortgages, jumped to 6.9%, the worst since December 2015, just before the defaulted $3-billion loan on Stuyvesant Town–Peter Cooper Village in Manhattan was “cured” through the sale of the property to Blackstone, which caused the CMBS delinquency rate to plunge.

Two years ago, the multifamily CMBS delinquency rate was still 1.8%.

Multifamily has now become the second worst category of CRE, after office CMBS, and ahead of lodging CMBS (delinquency rate of 6.5%) and the long-beaten-down retail CMBS (delinquency rate of 6.4%). The delinquency rate for industrial properties, such as warehouses and fulfillment centers for ecommerce, has risen but remains very low (0.6%).

The CMBS were sold to institutional investors, such as bond funds, insurers, etc. Banks that originated the loans are off the hook.

“Extend and pretend,” a time-honed strategy to “cure” a delinquent loan, is now being implemented for the biggest office mortgage that became “delinquent” in August: The $1.04 billion mortgage on 1211 Avenue of the Americas, a 45-story 2-million square-foot office tower in Midtown Manhattan, built in 1973. In 2015, after a renovation, the property was refinanced and the new mortgage was securitized, with a maturity balloon payment in August 2025. The 4.15% fixed-rate mortgage became nonperforming in August when the maturity balloon wasn’t paid off.

But Trepp reported that a three-year term extension has already been negotiated, where the maturity date would be pushed out to August 2028. Trepp expects the mortgage to be returned from the Special Servicer to the Master Servicer and come off the delinquency list. That’s extend and pretend in action.

Loans are considered “cured” and get pulled off the delinquency list when the interest gets paid; or when a deal is worked out to extend and modify a mortgage that wasn’t paid off at maturity date; or when a forbearance deal was worked out between borrower and lender; or when the loan is resolved through a foreclosure sale; or when the property is returned to the lender in lieu of foreclosure. So this process of “curing” a delinquent mortgage can mean pushing the problem into the future or taking big losses now.

“Cured” through forbearance in August was the $335 million mortgage on Times Square Plaza in Manhattan. The 3.84% fixed-rate mortgage, originated in October 2014, had become delinquent in October 2024 when the borrower wasn’t able to pay off the mortgage at maturity. But a forbearance agreement was executed between borrower and Special Servicer, with the forbearance period lasting through October 2026. This caused the mortgage to get pulled off the delinquency list in August.

The borrower has the option of extending the forbearance period for two additional 12-month periods. Trepp reported that as part of the deal, the borrower will inject $14 million in new equity to cover operational shortfalls; and borrower/guarantor guaranteed the payment of an additional $20 million for future leasing and capex cost required to stabilize the property.

Among the newly delinquent multifamily mortgages was the $62 million mortgage on Park West Village in Manhattan. The 4.65% fixed-rate mortgage on the 850-unit property, built in 1950 and renovated in 2014, was originated in August 2022. In August 2025, it became 30 days delinquent.

Who is on the hook for CRE mortgages?

For office mortgages: A big part is spread across investors – not banks – around the world via office CMBS – discussed above – and CLOs that are held by bond funds, insurers, private or publicly traded office REITs and mortgage REITS. PE firms, private credit firms, and other investment vehicles, are also exposed to office CRE loans.

Banks hold only a portion of office CRE loans. Many banks disclosed write-downs and losses. Many have sold bad office loans to investors at big discounts to get them off their books. And their earnings and shares were dented. And some of these banks were big foreign banks that were aggressively pursuing the US office market in prior years, such as Deutsche Bank.

For multifamily mortgages? The largest category of CRE debt, with $2.2 trillion in mortgages outstanding at the end of 2024, accounts for 45% of the $4.8 trillion in total CRE debt, according to the Mortgage Bankers Association.

Over half of multifamily debt was securitized by the US government (mostly Fannie Mae and Freddie Mac which doubled their exposure over the past 10 years) and the CMBS were sold to investors; and state and local governments hold a small portion of it.

Banks and thrifts are on the hook for 29% of multifamily debt, life insurers for 12%, and private label CMBS – discussed above – CDOs, and other Asset Backed Securities for about 3%.

The relatively limited exposure by US banks to CRE mortgages indicates that CRE is not going to pose a systemic risk for the banking sector, that most of the losses hit investors and the government, and that the Fed can let it reset on its own.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I can understand office but what is driving multi family delinquencies? Is multi family just overbuilt? Are increases in interest rates and insurance pushing multi-family out of profitability?

I am guessing that it is not an issue of everyone suddenly buying homes based on other wolf street articles.

Huge supply of new apartment projects, higher vacancy rates, and much higher interest rates. A 4% mortgage, when it matures, cannot be refinanced with a 7% mortgage at current rents, but rents cannot be raised because there is a lot of supply. If the property is sold in foreclosure at a big loss, the new buyer can finance the much smaller cost with a 7% mortgage and make it work. But someone has to take the loss. That’s what this reset is all about.

Now thats what I call sink or swim. If people must pay 6-8% to finance a home, then buckle up, I don’t feel sorry for these multi-family institutions. Just ridiculous that the government got involved in this one. There’s no way out since long term rates are stuck (poor fiscal spending for too long). No good way to knock that down. Even the current economic plans are ambitious given today’s debt burden.

According to some fund managers, much higher than planned insurance/maintenance and “elevated” interest rates are crushing building profitability despite rent growth, which in turn crushes their values.

Woe to those who bought and financed in 2020-2022 expecting to roll into a similarly priced loan at 5 to 7 years. Or really, any years.

For sure supply growth is a big factor, too. Some areas like TX have virtually no barriers to expansion. You’d have to be nuts to buy MF buildings there.

so we put in new toilet in unit today, due to way old floor was put in the standard size bolts were to short. went to store for longer ones – $9 for $2 item prior

So 30 percent of 2.2 trillion is roughly 600 billion, 10 percent default that’s 60 billion in losses which is probably a few hundred banks total surplus or a large percentage of their outstanding loans…small banks on fdic watch list…but extend and pretend it is as a regulatory model under the DON..

Not bad quick and dirty, back of the envelope estimate of potential losses (although small increases in some metrics make the financial results much worse).

But, that said, extend-and-pretend long predated the Don and will be employed long after him. One variation is to simply “suspend” mark-to-market valuation of bank (etc) loan holdings.

AKA “how else can we forestall runs and/or lure in new suckers”

Trump is a skuzz-bucket – but we’ve had 60+ years of skuzz buckets (of both parties).

Couple this with the fact that the sunbelt multifamily syndicators are a bunch of clueless greedy idiots who over paid for assets and and now are struggling to keep revenue while battling all time high insurance and property taxes. Add to this their inability to run management of these complexes that they have outsourced to 3rd party management firms. Lastly, the undocumented tenant profile constant moving to avoid ICE raids is a new issue.

well explained.

How about horrible mismanagement? The 850-unit Manhattan property that just went 30 days delinquent was issued debt at a relatively low (sub-50%) LTV. A rough back of the napkin calc would expect somewhere north of $2M/month in income vs mortgage interest of around $250K (maybe P/I gets that up to $350K).

I’m sure there are unique challenges in Manhattan, but a typical apartment complex runs expenses in the 30-60% range which should still leave plenty of room for the tiny mortgage payment on this property.

My guess is there are plenty of people who can sell investors on buying into a deal like this but don’t have the right team or experience to make sure it is operated well.

Next up are all of the 3 and 5 year deals syndicated between 2020-2022 before rates took off. Once those reset and vacancy is at 10% instead of the pro-forma 5%, there will be capital calls galore and plenty of non-performing loans popping up all over the sunbelt.

Ain’t that the truth (s)

I always joke I can underwrite any deal on that same napkin. Tell me what the ACTUAL rents are including the economic vacancy and all the other bs.

Now take half of that number and back out the debt service. Boom.

In my experience you make ~$200 door a month net of debt service. Wish it was more. Kinda like 17 in blackjack, lower than you think.

The real $ in real estate (and many assets) is made on appreciation of course. And that has been radically skewed by 40 years of declining bond rates and a constrained building environment in the SoCal’s/NYCs of the world… those folks have been laughing all the way to the bank.

Better to be lucky than good

As an actual landlord, costs are up more than rents.

1) taxes and insurance are up huge as everyone knows.

2) maintenance is up huge (I’d bet more than a few landlords are a roof replacement away from foreclosure)

3) rents in many regions are rising less than inflation.

You can’t raise rents faster than people can pay. Plus the immigration crackdown will result in a decrease in the number of renters as a percentage of the population.

No landlords can’t raise rents higher than the market can support.

What landlords will do is put off maintenance, leading to a degrading of the housing stock unless property tax and insurance hikes moderate (hahaha).

They can also sell.

The immigration crackdown has already started to effect the rental market. It’s why rents aren’t increasing much anymore.

You think a small decrease after 8 million plus people entered this country illegally can impact renta in a substantial way? I think your former statement is more on point. Landlords got greedy during Covid. Mine tried to double my mine so I moved.

RE: Idontneedmuch

Yes, I think the presence of a large population of not so legal immigrants has affected rents in certain areas in the past. I also think that population growth will now slow, and the demand for rentals in those areas will slow.

RE David.

I would love to see a sell-off, including Alall short term rentals. I want to see true price discovery in this country.

@Kurtismayfield I don’t have an exact number but it is important to remember that 1. Short term rentals did not start with AirBnB (You have always been able to rent vacation homes in vacation areas). 2. The majority of short term rentals are “vacation homes” owned by upper middle class and rich people who bought the since they wanted a vacation home in a specific location that are just renting the places to bring in some extra cash when they are not using them.

Really, it’s a double whammy (maybe even triple).

Immigration crackdown – media (assuming you believe any of it) is saying over 1 million have left.

Legal and illegal new immigration – no stats, but I’d bet a massive drop. No one wants to move here, legal or otherwise.

Outmigration – no stats there, either, but a lot of people have decided that he who panics first, panics best.

Airbnb deflation – with the drop off in international travel and more communities banning short term rentals, the business model of STR is on the downswing. Plenty of apartments were rented and then rented out on Airbnb at a profit.

It’s never just one thing, but efforts to make the US a non-desirable place to visit or immigrate to appear to be working as intended. We’re becoming the worlds biggest HOA/gated community (which I know plenty of the commentariat is cheering about). From a business investment perspective, some recalibration of expectations is inevitable.

“rents in many regions are rising less than inflation.”

This is being said after 20%-25% rent increases in 2021-22 – more or less historically unprecedented. And essentially none of that enormous surge has been reversed – simply slowed from “non-survivable” to “slow strangulation”

And…if you look at the huge share that housing costs play in the inflation indices…rent *is* inflation.

Sorry but not really – it is very, very difficult to feel sorry for landlords in toto after post 2021-22 madness.

(My guess is that landlords feel that that the 2021-22 orgy was clawback/payback for the pandemic moritoria…but we’re nearly 3 years past *2022*).

I concur. Been renting duplexes to sorority girls for 20 years. Despite the calls to kill a spider, they are actually great tenants that tell the next generation about how great the rental was and therefore I have never had less than 1-2% vacancy.

To your point, even though rents are up 2-4 fold. taxes and insurance are up by 10x.

I challenge my property assessment every year, but this year it seems like EVERYONE in the county is doing it. The blowback on these government trolls is getting real. Fuck em.

Interesting times.

Yep.

I’ve raised rents 27% just in the past 3 years.

No vacancies.

however, costs have gone up a lot more.

Agree with your comments, also in NorCal we have rent control and incredible renter protections, making it difficult to evict bad tenants or raise rents to keep up with expenses.

And then the Nordes show-up!

There are a lot of office CRE transactions now taking place, but at much lower prices. The office market has completely reset on prices. In Manhattan, the discounts to pre-coved pricing are in the 20-50% range. In San Francisco, the discounts are in the 70% range. The market has completely thawed at these reset prices.

The housing market, however, is still clinging to illusory pricing and remains frozen, with huge inventories and more or less slowly dropping prices.

“The relatively limited exposure by US banks to CRE mortgages indicates that CRE is not going to pose a systemic risk for the banking sector, that most of the losses hit investors and the government, and that the Fed can let it reset on its own.”

Investors here mean pension funds or wealthy individuals or both?

Fannie Mae and Freddie Mac can still go bankrupt if they can’t cover up the default, right?

“Fannie Mae and Freddie Mac can still go bankrupt if they can’t cover up the default, right?”

No, not currently because the US government took them over (“conservatorship”) during the Financial Crisis. They’re now part of the US government and are managed by the US government. After they’re “privatized,” something Trump is talking about, they might be able to bankrupt.

Legally, however, Freddie and Fannie obligations are not backed by the full faith and credit of the United States. In theory, if losses really piled up, the federal government could decline to inject money into them, and the investors would take losses.

That said, no one expects Congress to let that happen, so the bonds guaranteed by Freddie have yields similar to that of the 10 year treasury.

“Legally” LOL. You don’t understand conservatorship, it seems.

Maybe not. I read an article in the NY Times about it a while back, which described Freddie and Fannie as federal owned corporations, but not government agencies, and that the obligations were not the same as FDIC guaranteed debts. I didn’t research it more deeply than that, though.

TSonder305: I’ve read and come to the same conclusion as you that Freddie and Fannie could proceed into a bankruptcy. IndyMac went bankrupt under FDIC Conservatorship in 2008 after all.

Setting aside semantics, Fannie Mae and Freddie Mac—via its Conservator, FHFA (Federal Housing Finance Agency)—may file for bankruptcy (say, Ch. 11 restructuring of debt/obligations or even Ch. 7 liquidation).

What law would prevent FHFA from approving a bankruptcy to restructure the obligations and debts of Freddie and Fannie through, say, a Ch. 11 equivalent bankruptcy? The FHFA has yet to resolve the fundamentally flawed financial operating model of these entities since taking over as Conservator 17 years ago way back in Sep. 2008? All it has done is continued to enable a taxpayer bailout via the US Treasury.

A bankruptcy filing would of course require consent by the Conservator, the FHFA, itself.

Now, the likelihood of a bankruptcy happening with FHFA consent is very low at the moment, probably less than 10% chance, but obviously not zero.

Rather, the organizations are more likely to be “divested” in a going public transaction whereby any continued implicit government backing by the US Treasury could be reduced or even eliminated entirely, with or without a transition period. The chance of the latter happening might be about 50% either way at the moment.

If the US Treasury or government would continue to provide an implicit backstop to Freddie and Fannie post-going-public, then there could be likely unintended consequences because some other peer organizations could also request implicit government backing (quasi taxpayer bailouts).

An Example: IndyMac Conservatorship | Bankruptcy | July 2008

I believe IndyMac Bancorp filed Ch. 7 bankruptcy on 31 July 2008, just a few weeks after going into Conservatorship under the FDIC on 11 July 2008. The FDIC effectively created a “good bank” and “bad bank;” the FDIC shuttered the “bad bank” via Ch. 7 bankruptcy.

So, perhaps the FHFA could also perform a variant of this strategy by stripping out some of the worst assets of Freddie and Fannie, then let those entities to go public without certain toxic assets and without the need for continued government corporate welfare by the US Treasury. That’s basically what the FDIC did with IndyMac in 2008 and what should have happened to Freddie and Fannie in Sep. 2008 under the FHFA.

Wolf,

“relatively limited exposure by US banks to CRE mortgages”

1) I get that “modern day” US banks more or less sell off all the crapola CRE loans they “underwrite”/originate into the markets as fast as they can but…

2) Given the apparent loads of RMBS/CMBS/GeneralBS on banks’ balance sheets, doesn’t that indicate that banks are simply buying back RM/CM risk back in the form of ground up/tranched up/mixed up collections of residential/commerical mortgage loans and

3) While holding RMBS/CMBS/General BS has some advantages in terms of geographic/temporal/risk diversification (vs. simply holding “own cooking” originated whole loans) doesn’t the Madness of ZIRP (and the experience of 2008) suggest that ZIRP-induced systemic risk can quite likely overwhelm the diversification advantages (in other words, “Whole asset classes are sh*t”).

4) So that banks (in their more-or-less assigned role as mortgage holders – in one form or another) are *still* exposed to the risk of their ZIRP-assisted/inspired crapola mortgage loans – just in a more round-about way?

1. yes

2. No. Banks only hold MBS and CMBS that are issued by government agencies (“agency MBS”); they don’t hold private label MBS. The reason is regulations. Agency MBS have similar risk profiles as Treasuries.

3. doesn’t apply to banks since banks don’t hold private label CMBS/MBS.

4. NO, NO, NO, see #2 & #3.

Quit spinning conspiracy theories of how CMBS/MBS are going to blow up banks. They won’t. Get used to it. They may blow up non-bank investors. I keep re-explaining this in articles and comments to you, and you still come up with the same but-the-banks-BS every time.

Banks are sitting on ~500b in unrealized losses from all kinds of bonds that they bought. The question is will there be force liquidation of there long dated treasure holdings? Some people would probably say that is impossible, with the availability of the Fed discount window. If the long bond yield blow out is possible? Will the everything markets panic if the Fed cuts overnight rates and the long bond goes up 2 basis points for every 1 basis point cut? I see the biggest credit bubble in history and all the kings men are trying to keep it growing. Moral hazard is real!

if banks hold them to maturity, there will be no loss at all. That’s how it is with bonds. You collect your coupon interest payments, and when they mature, you get your money back.

There are tons of empty office buildings here in Seattle. Three office buildings near my apartment in downtown are essentially empty, 2 old and 1 brand new.

And if you wanted to run your business in them ,they would want an arm and a leg!

“But no one is here”

Rich leasing guy

“You’re not poor, are you?”

Yeah, the amount of empty store fronts in the city is wild. A restaurant/bar I like to go recently closed, as they jacked up rent. It now sits empty.

Pretty frustrating.

If you google “Red = empty street-level commercial space downtown” “SeattleWA” it will take you to a map some users created that show how many empty storefronts there are in the city.

I seem to recall there is some deal with loans on CRE that it is baked into the loan what the rent needs to be. Perhaps others can clarify.

A guy I know just bought an old municipal building. Over 20,000sqft outside of Pittsburgh. He is going to run a nonprofit computer/tech/game museum thing out of it.

Can someone explain to me why the government is backing loans to real estate investors?

The justification for it is that it makes it cheaper for sponsors to borrow to finance these things, which will increase the supply of housing and make it cheaper.

That’s the theory anyway…

That’s brilliant. But why just real estate? Why not just have the government make everything cheap? Has anyone ever tried this?

How is “extend and pretend” not illegal? Clearly, any new money injected at this point is not an investment, but rather a guaranteed loss.

Because ultimately it’s not the government’s job to prevent investors from losing their money.

That being said, it’s not smart for these people to be extending and pretending. It’s essentially refinancing at below-market rates for the landlords in question, and it’s not exactly cheap for the investors. The relevant investors would be better off taking their losses now and investing in market-rate securities instead.

The thing is, doing the above requires admitting a truth no one but Wolf here dares say out loud: real estate is not worth the amount people have come to think that it is, and that owners of real estate are going to have to take massive losses. We are after all talking about 80 to 90 percent losses here.

Single-family housing is next.

Here in NC around me, there are still lots of MF supply 60-90% complete and coming soon; and more approved. But as you have said, those new places are lux and not inexpensive. More supply has to help, though. Good. Rents are too dang high.

I had been ‘keeping up’ with the CRE stuff, but blissfully unaware of the MF defaults. Thanks.

The Fed’s SOMA website shows CMBS securities held by the Fed.

What are the implications of this in light of the above discussion?

Zero implications. During the QE mania in 2020, the Fed bought about $12 billion of “agency multifamily CMBS,” so CMBS backed by government guaranteed multifamily mortgages (Fannie Mae, Freddie Mac, and Ginnie Mae). The $7.9 billion that the Fed holds now is all that’s left over from those $12 billion it bought in 2020 (they’re rolling off as part of QT). So the Fed doesn’t care one iota about the underlying mortgages defaulting. They’re not the Fed’s problem, they’re the taxpayers’ problem.

Wolf – there are NUMEROUS pressure gauges that are signifying DANGER. ⛔️ ⚠️ if it’s just one, a person could think it’s an anomaly or a malfunction, but when it’s multiple gauges telegraphing danger, one needs to be concerned and take them seriously. I don’t like what I’m seeing. You’re not as blunt as I am – I’m going to declare a Mayday.

Office CRE has been in a depression for 3 years, and I have said so many times. That’s pretty blunt. But for example, industrial CRE is still in pristine condition. So one sector being in a depression doesn’t have broader implications beyond that sector.

“So one sector being in a depression doesn’t have broader implications beyond that sector.”

Bernanke : Real estate downturn is “only in subprime”.

subprime isn’t a sector. It’s a credit rating. The sector is residential real estate, no matter what the credit rating.

Office CRE is a class that transcends sector. No one is randomly building industrial facilities as those aren’t one size fits all. Office CRE cuts across every vertical. Even industrial manufacturers require office space.

Nonsense.

1. “Industrial” = warehouse and fulfillment centers. That’s ecommerce. Most of them are very generic buildings. I explained that in the comments. It’s not factory construction.

Factory construction is NOT part of CRE. These facilities are purpose built, usually by one company to manufacture its goods. Factory construction is up by 200% from pre-pandemic levels.

Office CRE is purpose-built office space. The office building on site of a factory is part of the factory (see above) not office CRE.

Office CRE doesn’t cut across anything. It’s just office space. The buildings are generic. The inside can be customized. Life sciences is a separate category of CRE (medical facilities, labs, etc.)

In Sartell, Minnesota a new factory will begin construction for Niron Magnetics at the end of this month. But it will not be finished for over two years.

Niron makes magnets for many different types of electric motors and wind turbines. This will definitely be a “purpose-built” manufacturing plant.

Sartell basically gave Niron free reign on building this plant as the lure of 200 jobs for the area was a strong one. 79 acres of public land was sold to Niron. The price? One dollar.

Sartell is just north of St. Cloud. The area high schools and junior collages, as well as St. Cloud State University have long focused on training students for high-tech and vocational skill sets. That was one of the draws that brought Niron to this location.

Free land and almost a complete tax abatement to Niron initially is also a nice bonus, eh?

The Rental business is not easy. A lot of corporates have entered the business with these big projects carrying lots of debt. I think they find it is not so easy to make money when the debt component is so high and large operations must also carry full time staff and more carefully comply with all sorts of regulation about who they can and cannot rent to.

Like many people, I was a renter when I was younger and my kids are now renters. From their experience I would say there are 2 options: pay a huge premium to rent from a corporate owned complex and just accept the blizzard of rules, procedures and fees along with slavery like “early termination” clauses or find a small mom and pop owned unit which comes with it’s own challenges but can be much more human. In many states you can find out how much debt a building is carrying. As a renter, you might be better off finding a building that is carrying as little debt as possible owned by human beings rather than a corporation.

“rent from a corporate owned complex and just accept the blizzard of rules, procedures and fees along with slavery”

How true. Every single property management company that I have rented from has been incompetent, crooked and total scumbags. I have never had one positive experience. Every lease I have ever had I either broke or wound up suing the property manager. I am glad I’m done with that sorry episode of my life and now own my own home free and clear and don’t have to deal with these scum any longer.

Typo: This cause the mortgage to get pulled off the delinquency list in August.

-> caused

Thanks.

The proof Wall Street is in another dot-com bubble

US stocks are now pricier than they were just before the dot-com bubble burst in early 2000.

Analysts warn it could be a sign the market is entering bubble territory again.

They point to high price-to-earnings ratios — essentially the cost of a stock compared with the revenue a company generates.

In 2000, the S&P 500, America’s main benchmark, traded at 16.8 times projected earnings. Today, it costs 22.5 times expected earnings.

Put another way, 25 years ago investors were paying about $16.80 for every $1 of expected earnings. Today, that price has risen to $22.50 — a sign stocks are pricier now than just before the dot-com crash.

Wall Street watchers are also concerned about the outsized dominance of big tech firms like Meta, Alphabet, Microsoft and Nvidia.

The ten largest companies account for 39.5 percent of the S&P 500’s total value — the highest concentration ever, according to Morningstar.

That means when these firms rise, the index climbs, but any economic or political setback drags the entire benchmark down.

SoCalBeachDude,

Agree with everything you said- but I’m still too scared to put some gambling money in a few 3xShort ETFs and let it ride, feeding once in a while to keep the chips on the roulette table. I’ve done this twice- right before everything went haywire, late in 2007 & again in 2020, scoring a quick triple and a double, respectively. This time it seems like stocks are trading at huge premiums because no matter what, the companies have solid revenue streams and shares are almost a form of currency, without the same perceived risk of debasement. The share buybacks never seem to let up.

I bought some gold before the pandemic, some more a couple months ago, and I wish I would have become a stacker much sooner. My wife even hounds me to buy more gold- she’s from Argentina.

As for CRE and various sectors of it- glad the contagion is limited, but who really knows for sure. It can’t help much having a foreclosed neighbor weather you’re a homeowner, a multi unit dwelling, or a fancy office in a downtown. These things decay and drag on their neighbors.

At the helm of our ship we have a belligerent bully, Mr. Bankruptcy, with grandiose delusions of his own competence, surrounded by yes man quacks, top to bottom. What could possibly go wrong?

Another poster above talked about pressure gauges sounding the alarm… I don’t think we’re quite there yet… but could be getting pretty close.

As JM Keynes said, the market can stay irrational longer than you can stay solvent.

Analysts are idiots who, under every condition, will find a chart to justify their “hot take” contrarian bear call.

Don’t bet against this market. You don’t know when or how far it will fall. It’ll go down 20 percent, get backstopped, and you’ll wait two years for it to go down another 10 percent.

Trump can at any time do something crazy to pump the market. No income tax under 100k. Housing subsidies. No cap gains on crypto.

There will be small corrections, but we’re keeping the market inflated in nominal terms.

And only 2 companies accounted for nvidias revenue last quarter.

100%. Yeah, their are some scumbag renters to be sure. However, every corporate entity / management company / builder community, etc is guaranteed to be scummy. Every single one of them, in every single state.

Would rather take financial advice from Ol’ Lawrence Yun than live in one of those again… My last one tried to gig me on bathtub caulking. Me: “I know how to mess with these guys, I’ll mess with the bathtub caulking. That’ll show em!” Umm, not.

Wouldn’t bother me to see 80% default rate for all those scummy management firms (and owners) in MFCRE.

@All Good Here Mate I agree with you that pretty much all management companies are “scummy”. The reason is that it is not possible to effectivly manage residential real estate for the insustry range of 5%-10% of gross rents. I was still working full time for the first 20 years of buying investment peoperty. I managed it all myself for the first decade but as I got more property I had to hire a company and I was happy to finally fire them and take over management full time hireing my own people to do everything (and paying top dollar to good people). I had the AC go out in a small building without an on site manager yesterday and I personally drove down and set up a portable 110V AC unit for my tenant (I have a portable AC unit, back up fridge and extra garbage disposer at every peoperty ready to go since they almost always go bad on weekends).

AI

So if you are really that hands on you are really not an investor.

You have just created a regular job for yourself that you can’t be fired from.

To each his own I suppose.

It’s not just the cut of the gross rent but of course you’re paying basically 30% more for each service ticket.

I have to because half my rentals are out of state but at hiring your people increases your profits by a decent margin. That is pretty much the difference in operating margins between my local rentals and the out of state ones. But I bought the out of state ones for lower GRM years ago so the net profit margin ends up about the same.

Treasury yields jump on prospect of USA refunding tariff money…

That headline you quoted is complete propaganda bullshit. The tariffs bring in lots of revenues, which is what is keeping long-term yields contained. Stop those tariff revenues, and long-term yields will blow out.

I cannot believe the twisted anti-tariff bullshit and lies in the media, and the glee with which this idiotic clickbait shit gets spread here.

Markets do what they do because they do it, and only an AI-powered moron would come up with a stupid-ass headline like that after the 10-year yield rises by a minuscule 3 basis points.

I think he’s referring to the recent appeals court decision that the tariffs are an illegal use of IEEPA. If that decision doesn’t get overturned by the supreme court then the thinking is that there are going to be lawsuits to reclaim that money. People are apparently already trying to buy up the refund rights on the bet that this holds, including investment banks like Cantor Fitzgerald.

Stocks will shoot to the sky if the hated tariffs vanish all of a sudden. And today they fell. That headline he cited is just bullshit. And he likes sticking bullshit headlines into here, most of which I delete.

I have a question for the very astute members of this forum.

If we see a downturn in the housing market will Wall Street, private equity, etc… buy the properties dirt cheap?

Maybe, after the drop by 50%-plus. Not before.

But maybe not because they discovered that build-to-rent — building entire developments of 200-500 for-rent houses with a leasing/maintenance office and common amenities such as a pool — is far more efficient and profitable to operate, and attract higher-income renters, than 200-500 individual houses scattered all over the place with a slew of maintenance issues.

Build to rent is exactly what all the big Wall Street landlords are now doing. And they’ve become net sellers of individual houses they purchased in 2012; they’re just too expensive to operate.

Well hell I could have told them that for like a hundred bucks.

I’m still unclear on the multifamily residential problem. The most frequently heard complaint is a lack of affordable housing. But if vacancies are pushing projects into delinquency, it would seem an abundance of supply exists. The degree of operating leverage on a large project creates enormous pressure to fill vacancies.

In the Midwest where our company operates, a new construction studio is around $1800/mo and there are hundreds upon hundreds fresh off the presses. Affordable housing that is in short supply would be the 3-4 bedroom home/apartment for $1000/mo. Though both are “housing”, they are entirely different products. Very little new construction is in the “affordable” bucket because even with incentives and subsidies it is still more lucrative for developers to build market rate apartments.

$1800 for a studio in the midwest is wild. That said, so is $550k for a crap-shack 1200 sqft starter home which seems to be about the going rate out here.

Vacancies do put pressure on rent prices and that has been seen in places like Denver. Unfortunately, in Colorado, and probably other places, increased regulation has significantly increased the cost and time to remove problem tenants so the cost of that also shows up in increased rent for good tenants. Then housing providers are less likely to take chances on marginal tenants because they would rather have a vacancy than someone who isn’t paying rent, possibly damaging the unit and cost even more to evict, if you can. So well meaning, but poorly thought out laws end up increasing vacancies and rent at the same time. They also decrease the incentive for more units to be built, making the problems worse.

@Midwest Ralph asks: “I can understand office but what is driving multi family delinquencies? Is multi family just overbuilt?”

Threre are some tiny pockets of overbuilding that has signifigantly changed rents and vacancy, but I would be willing to bet that over 90% of multi-family delinquencies are related to people overpaying for apartments and/or buying so many units in a short period of time without the managament in place to effcintly run each properties. The poster child of fast expansion is Tides Equites that was founded by a couple S. Cal 20’s somethings in 2017 and five years later they had over $5 BILLION dollars worth of apartments (and no clue how hard it is to effectivly manage a portfolio that big).

@Midwest Landlord when you said : “As an actual landlord, costs are up more than rents.”

Like most landlords I can look at each property and see expenses as a percentage of rent and that number has been getting bigger on most properties most years.

P.S. I’m glad I’m not posting as “Class B Office Investor”…

The office CMBS looks like it has a good positive slope, except for some backtracking about a year ago. The Multi-family CMBS has a good positive slope as well, except that it is only half of the recent record. Perhaps we are getting too excited about the delinquency rates on offices as they still may reflect remote work; whereas the true economy is like the multifamily CMBS and is yet to achieve it’s full disaster potential.

There’s a just released video on ‘that video site’ titled “Manhattan office leasing jumps 20% in August: Here’s why“. It’s from CNBC. It says that office leases were up 20% in Manhattan in August vs. July. Huh? 20% in one month doesn’t make sense. Color me skeptical.

How long can extend and pretend go for until the property is forced to reset? Also is there a way to determine what the impact is to national debt? I’m reading at a bit over 1/2 mortgages being backed by the government and about 7% delinquent. If they reset there will be a loss but is there an average loss overall that can be applied? Is this amount material to total national debt or a drop in the bucket and when would it hit the debt?

US Treasury Yields Brush With 5% as US Borrowing Costs Mount…

Like in “The Big Short” Can anyone create a “Product” for me to short the multifamily CMBS market.

DM: Panic as buyers ditch home purchases at the last minute in record as fears of 2008-style crash grow

Just four years ago, buyers were rushing into deals – bidding up prices and waiving inspections to secure fast-selling homes. Today, they’re moving cautiously.

Couple of factors impacted multi family. Supply decreased. Demand is volatile at best and the environment (inflation, rates, immigration, unemployment) continues to play into the movement and choices of consumers.

Commercial investors “sopped” up the supply of multi families from under would be owners and long term investors.

Did so at high rates, believed that rent had flexibility, rates would come down. They havent so rental prices sky rocketed.

But uncertainty and inflation has kept people from buying, rates have kept people saving and living with family. Now those high rentals are empty and the investors are eating through capital.

Also the number of Airbnb and vrbo increased – not realizing this type of rental is highly dependent on tourism. Which continues to also trend lower.

Influx of migrants and normal immigration has also dried up. Some housing was sponsored by local and federal govt. This has also dried up.

There are cracks in the system.

@wolf could it be inferred that the multifamily delinquencies are another indicator of a housing surplus/increasing housing supply?

Supply plays a role. The bigger role is with the higher interest rates and the HUGE valuations at which these properties were financed or refinanced a few years ago.

There is a lot of new multifamily supply that is coming on the market now. We saw the precursors of that supply in the multifamily construction starts that had surged through 2022 to levels not seen since the boom in the mid-1980. Those units are now being completed and are coming on the market. Starts have slowed down in 2023 and 2024 from those levels.

What about bond funds holding this debt?

It’s just OPM (other people’s money). Same with REITs, etc. No problem. Investors (OPM) got paid to take those risks and now those risks exact their pound of flesh. That’s how it goes.

I live in the fastest growing county in NC and the fastest growing town within said county. This year, everyone’s property taxes doubled. Literally. Does this often happen – the doubling? Slow uptick I get but this seems questionably aggressive. Is this happening elsewhere?

Ouch!

@Wolf, if delinquencies are so high why wallstreet doesn’t care?

Is CMBS market size irrelevant (around 2 trilion)?

Banks’ books not involved (in contrast to the GFC)?

What’s your take on John Flynn complaint with the SEC in 2019?

Thanks,