Food prices also spiked. Energy prices surged due to diesel, jet fuel, and industrial electric power. Ugly all around.

By Wolf Richter for WOLF STREET.

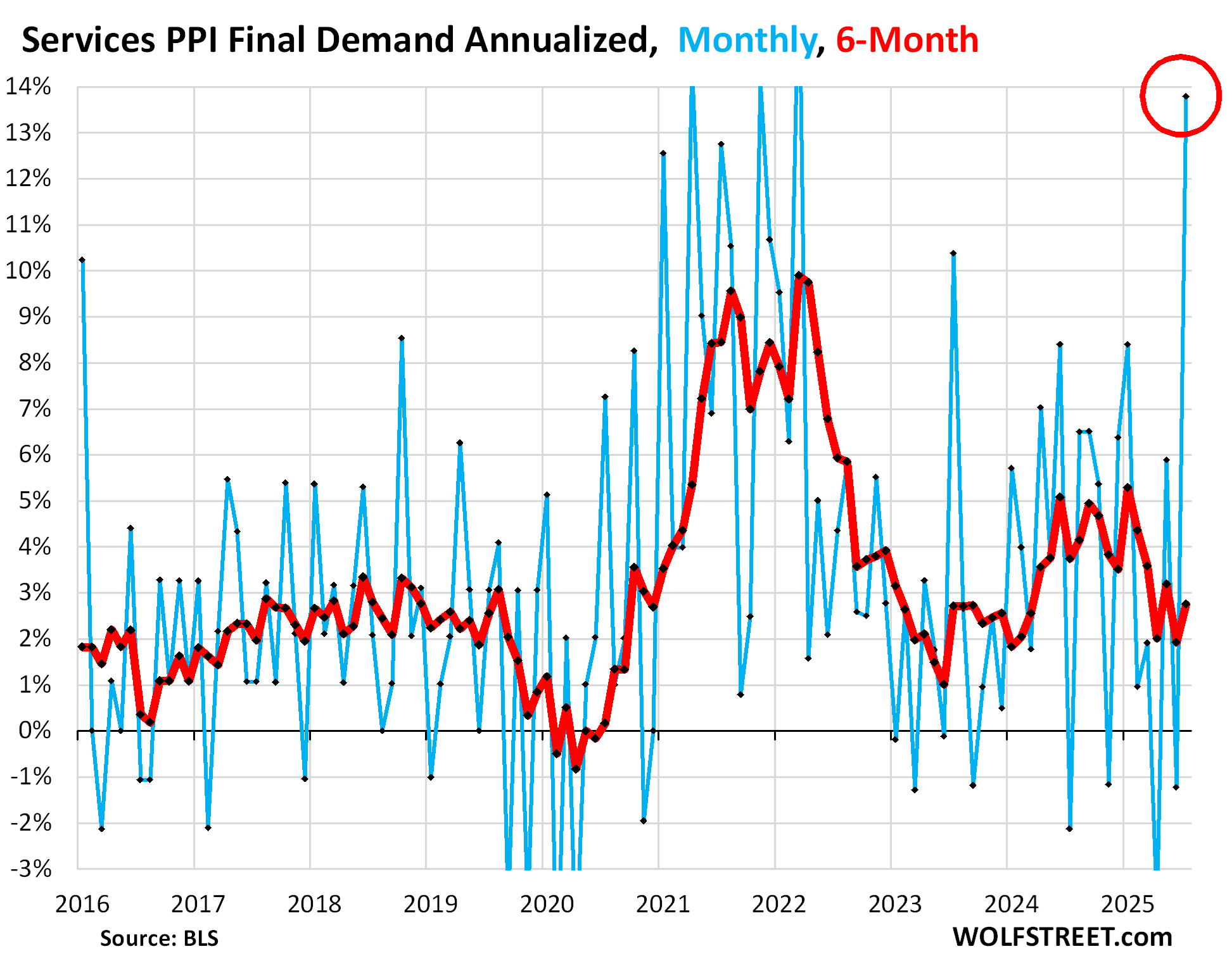

In another inflation shocker – services again! – the Producer Price Index Final Demand for Services exploded by 1.08% in July from June (+13.8% annualized!), the worst since March 2022 when inflation was peaking (blue in the chart). It was broad based: Prices for services less trade, transportation, and warehousing spiked by 0.69% (8.6% annualized), while prices for transportation and warehousing services spiked by 1.01% (12.8% annualized).

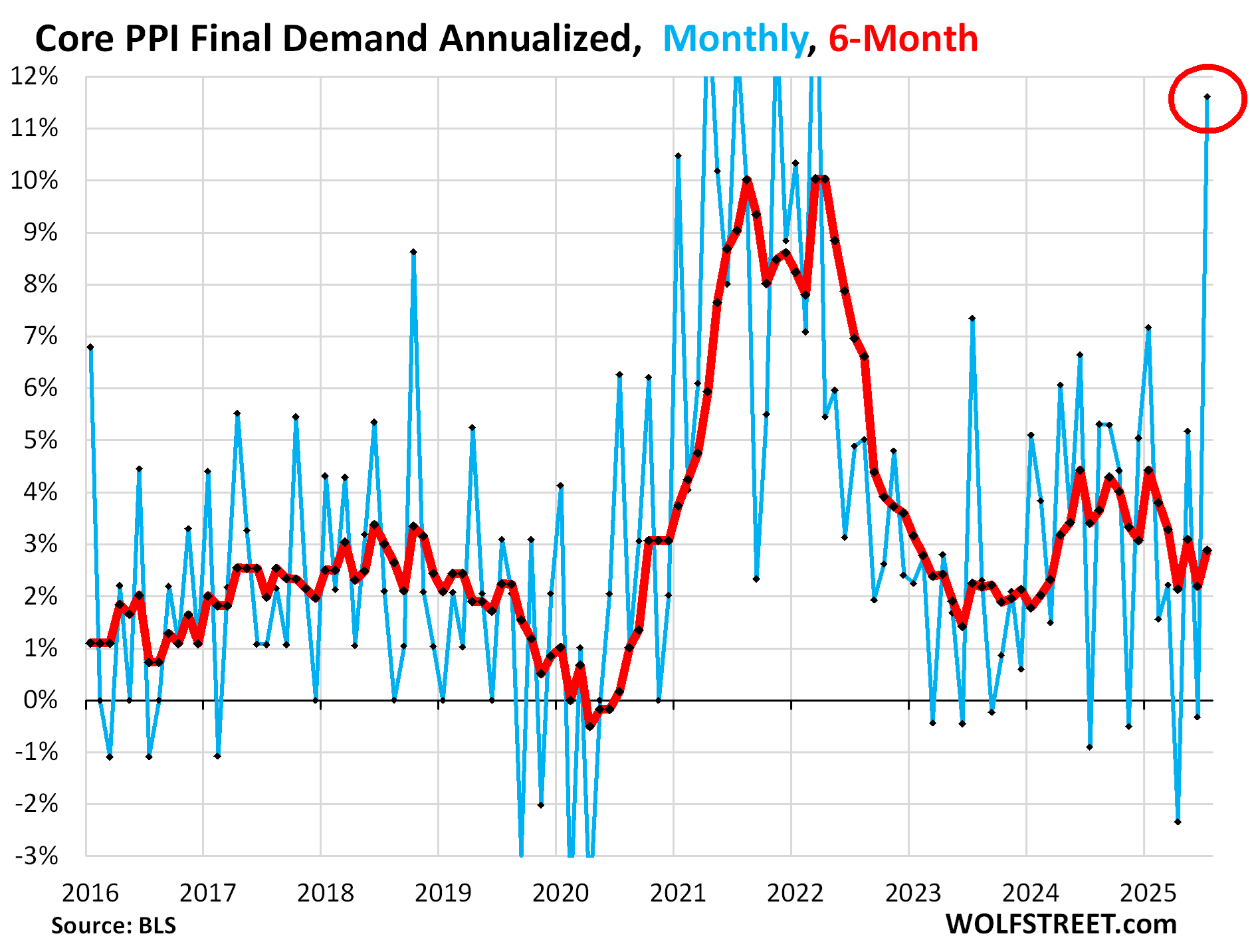

This explosion in services prices caused the “core” PPI Final Demand, which excludes food and energy, to spike by 0.92% month-to-month (+11.6% annualized), the worst since March 2022. And it caused the overall PPI Final Demand to spike by 0.94% (+11.9% annualized), the worst since March 2022, with food prices and energy prices also surging.

The six-month average of core Services PPI, which irons out some of the huge month-to-month zigzags, but also then lags sudden U-turns, accelerated to +2.8% annualized (red in the chart).

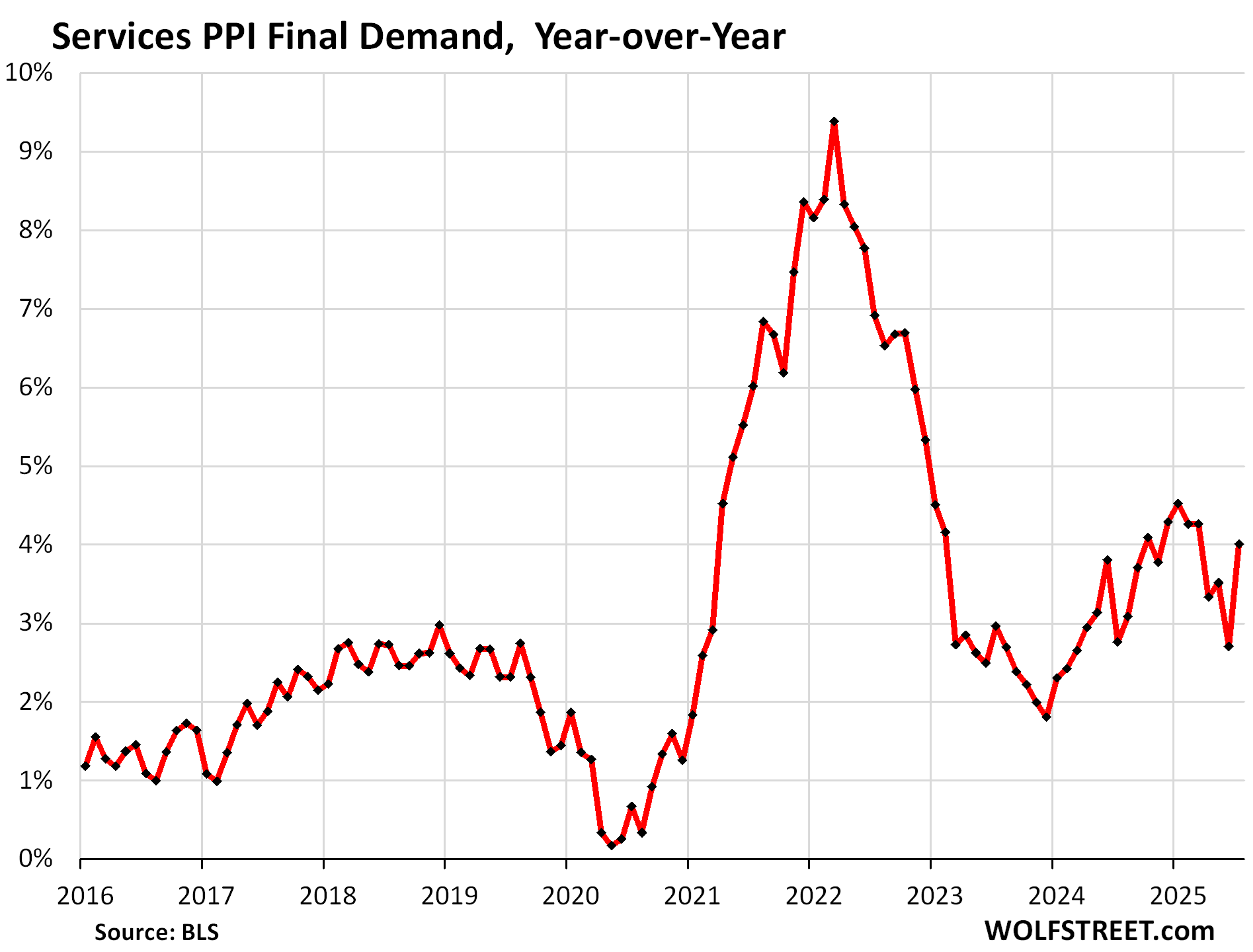

Year-over-year, the core services PPI jumped by 4.0%, a steep acceleration.

Where the new tariffs fit in.

The PPI does not track import prices, and therefore doesn’t directly track the costs of tariffs that companies are paying on imported goods. It tracks prices that companies charge each other, including export prices, and so indirectly, it tracks how companies eat the tariffs or pass them to other companies.

Companies have been paying the tariffs – $28 billion of them in July alone. In their earnings warnings and quarterly reports, consumer-goods companies, such as automakers across the board and companies such as Nike, have already disclosed how much those tariffs are costing them as they have trouble passing them on to consumers because additional price increases would cause sales to fall.

For them, the problem is that they’d already jacked up prices into the sky in 2020 through mid-2022, leading to an extraordinary historic profit explosion. And now they’ve hit consumer resistance.

The tariffs are percolating through the prices that companies charge each other, but have shown up only in small increments in consumer prices, totally overpowered by the renewed surge of inflation in services, which are not tariffed, which often have little price competition, and where consumers do most of their spending. It’s services inflation at the consumer level that is so hard for the Fed to contain, which is why the Fed fears services inflation so much.

Core goods: plenty of inflation, but not nearly as bad as services.

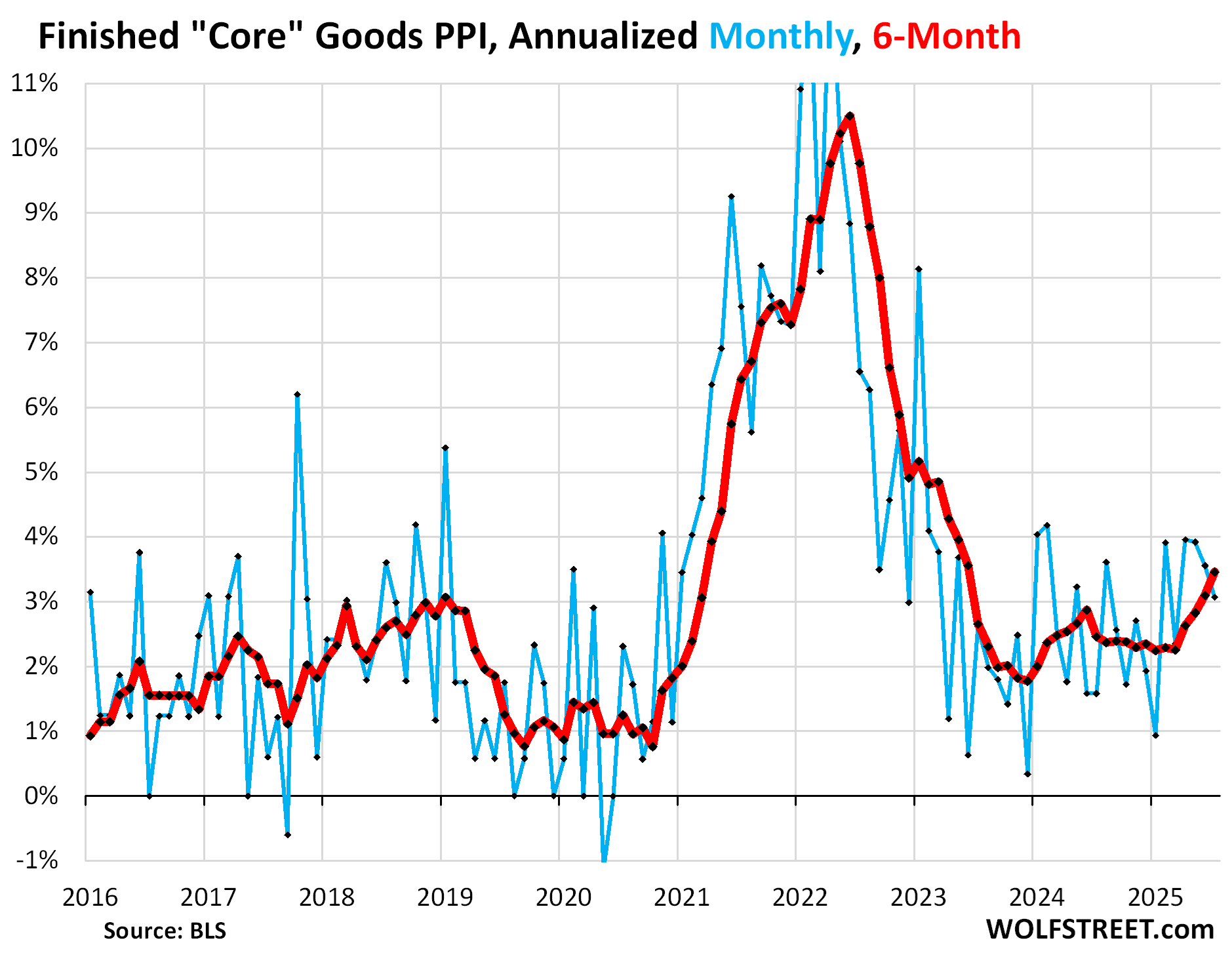

The PPI for “Finished Core Goods” cooled a little, rising by 3.1% annualized, a deceleration from increases in the 3.6% to 4.0% range in the prior three months. This measure excludes food and energy.

The six-month average continued to accelerate and reached 3.5% annualized in July, the worst since June 2023.

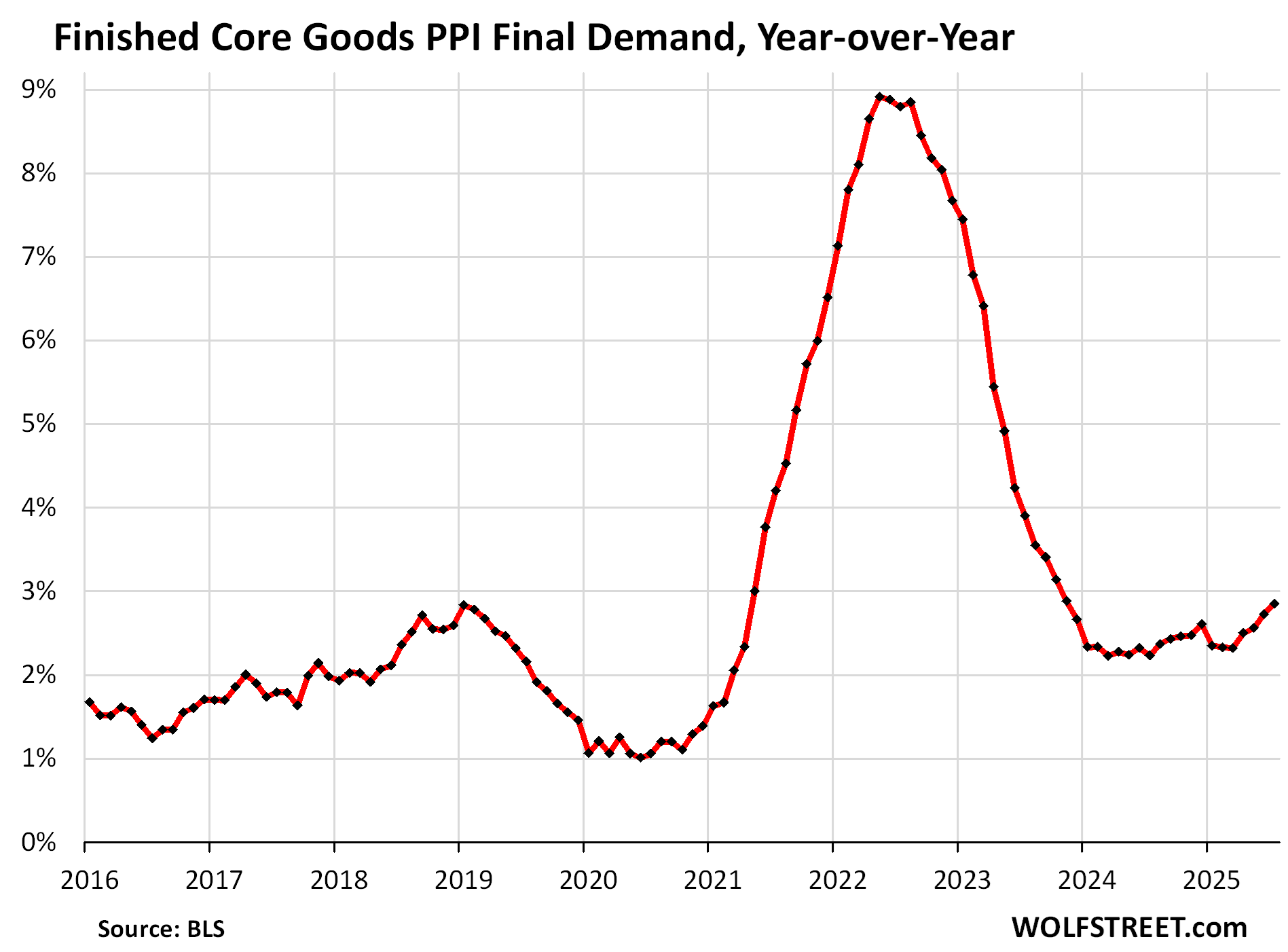

Year-over-year, the PPI for finished core goods accelerated slightly to 2.85%, the worst since June 2023.

“Core PPI Final Demand, which includes all goods and services except food and energy, exploded by 0.92% in July from June (+11.6% annualized), the worst spike since March 2023, driven by the price explosion of the services PPI. The six-month average accelerated to 2.9%.

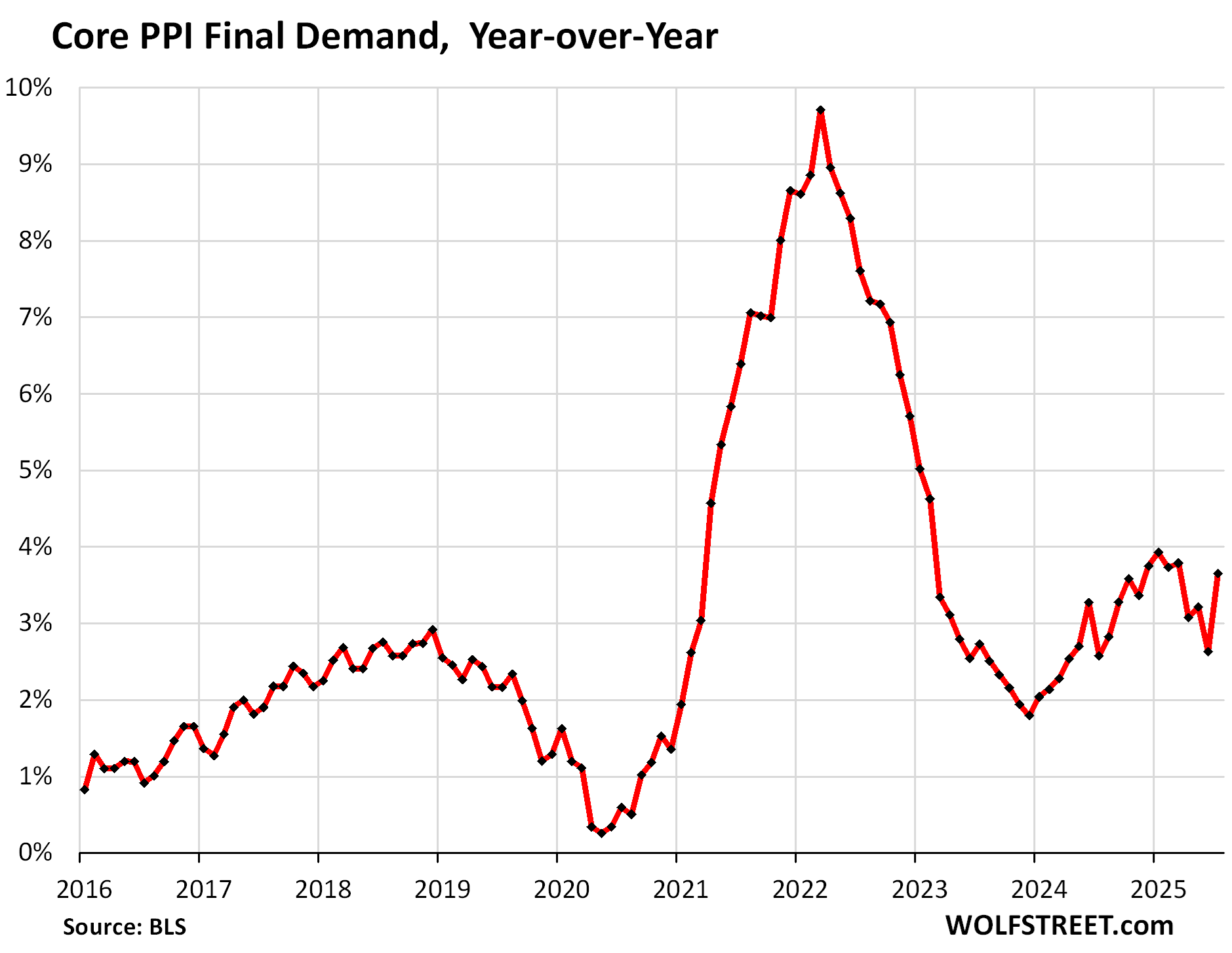

On a year-over-year basis, the core PPI accelerated sharply to +3.7%:

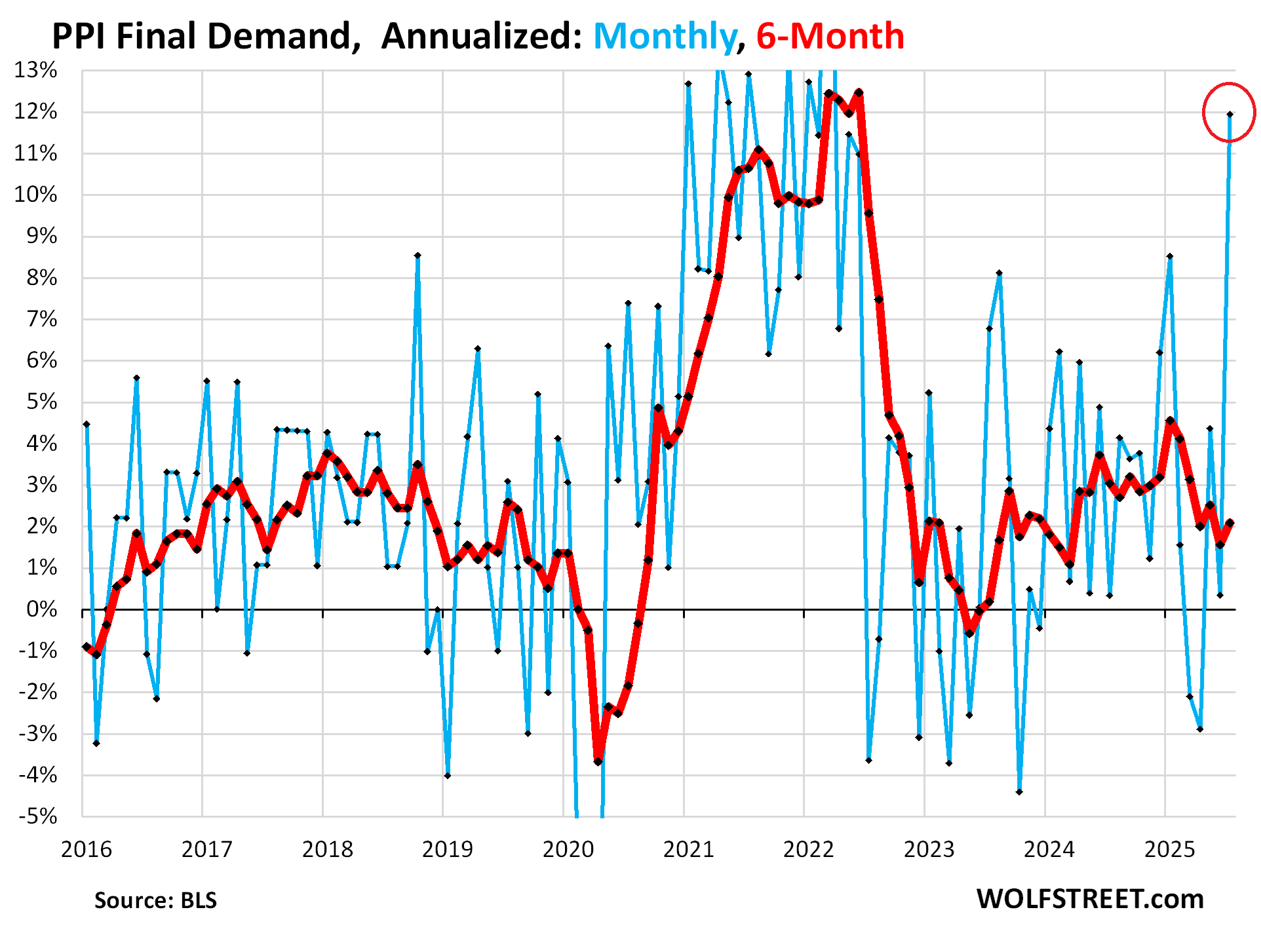

Overall PPI Final Demand exploded by 0.94% (+11.9% annualized), the worst spike since March 2022, fueled by the explosion of the core services PPI.

And it was further fueled by the surge in food prices (+1.4% month-over-month).

Energy prices also surged (+0.9% month-over-month) on higher prices for diesel, jet fuel, and industrial electric power, though gasoline prices declined.

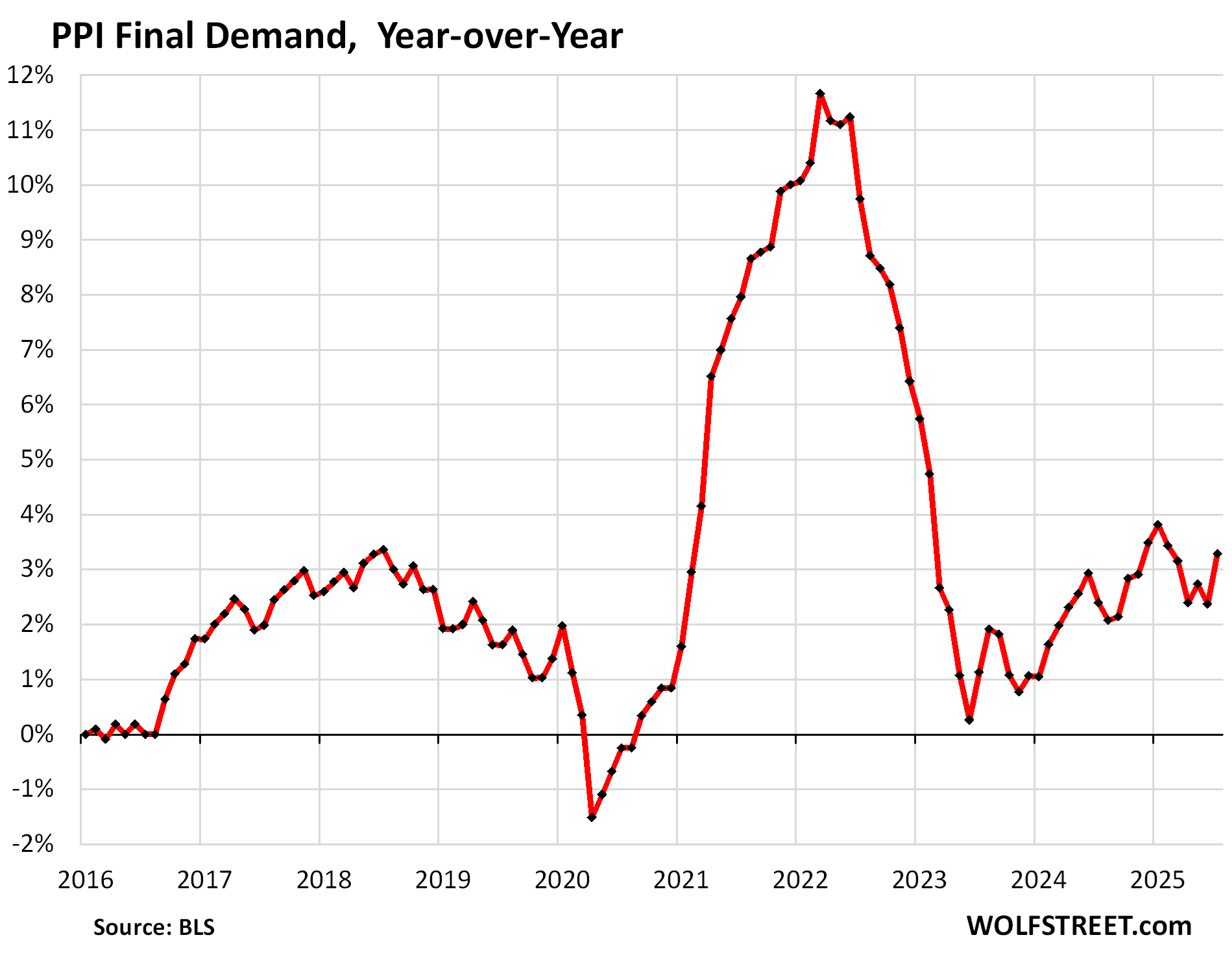

On a year-over-year basis, the PPI Final Demand accelerated to 3.3%, the worst since February.

Note how the acceleration in its uneven manner started in the second half of 2023, with June 2023 having marked the low point at near 0%.

What I expect.

Just by looking at the month-to-month blue lines in these charts, how much they zigzag, I expect further zigzags, big ones too. After a huge spike, we’ve often seen a much smaller increase or even a negative reading, and vice versa.

It’s the sum of those zigs and zags over time that mark inflation at the producer level. So I expect a sharp reversal of the services zig in a month or two. But I also expect the sum of those zigs and zags in the services PPI to trend higher on a six-month basis and on a 12-month basis and drag core PPI and overall PPI with it.

As mentioned, PPI reflects what companies charge other companies – not consumers. Companies paid $28 billion in tariffs in July, and they paid $27 billion in June, and $22 billion in May. Tariffs are a tax, but tax increases are hard to pass on, and tax cuts are never passed on.

But we can see the tariffs percolating through the ecosystem of companies as they’re trying to pass on some of the tariffs to other companies, and these other companies are resisting those price increases.

The far bigger concern here is inflation in services, which are not tariffed, which are a much bigger part of US economic activity, and where roughly two-thirds of consumer spending goes to.

And services inflation at the consumer level, such as tracked by CPI, has been reheating: Two days ago, the core services CPI shot up by 4.5% annualized, the worst in six months. It accounts for 60% of overall CPI. The push came from services other than housing. And today’s explosion of the services PPI is not encouraging, even if the next zag is much smaller.

And one more thing: The PCE price index, a measure of consumer price inflation that the Fed uses for its 2% target, includes some parts of the core services PPI here, such as the category of “portfolio management; securities brokerage, dealing, investment advice, and related services,” which also surged. The July PCE price index will be released on August 29, and it might come in hot due to services inflation, further fueled by the components from the services PPI here.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

May I ask – how do you think this will affect treasury interest rates going forward?

They will head upwards on US Treasuries, both short and long term.

For longer-term considerations, it takes more than a couple of inflation reports. So we have two CPI reports with accelerating services inflation in a row. And we had one PPI report with spiking services inflation. The trends look to be higher, but we need confirmation.

So today, Treasury yields rose modestly. The 10-year yield by about 5 basis points, undoing yesterday’s decline. The 6-month yield by about 3 basis points, also undoing yesterday’s decline.

Yesterday, the media was very successful in misrepresenting the CPI data by their exclusive focus in their headlines on overall CPI, which had been kept down by dropping energy prices, while CPI services and therefore core CPI surged. That surge was worrisome, but the headlines covered it up.

Today, that could no longer be done with the PPI.

For the bond market to seriously react to inflation, we need confirmation. If we get another bad core CPI reading and a bad core PCE reading before the FOMC meeting, and the Fed cuts anyway, long-term yields will like start rising on renewed fears of a lackadaisical Fed in face of surging inflation. The bond market is very nervous about inflation not being contained by the Fed.

The Bond vigilantees are warming up the bullpin. They are salivating over the profits awaiting them when the long term bond market collapses right before your eyes.

Inflation, it is here. You may hear somebody whisper in Washington about a higher, heaven forbid, 30 year bond rate.

Market doesn’t care. Looks like it’s locked in for rate cuts.

The federal funds rates futures market yesterday had a 0% chance for a rate hold and even 2% double cut. After PPI we had a 10% chance of a hold.

It kind of feels like to me the equity shot its load early when cuts started. And now that they bet so much on it, its actually having the reverse effect. The expectation of lower rates might have lead to over-optimism and thus preemptive spending. Which ends up hurting the chances of a cut.

Like why should the fed cut? I hear so many people say they should, but to solve what problem? The stock market sure thinks cuts are coming, but Im not sure why.

I know what you mean. He last cut them around election time, Sept through Dec, 2024. Why? That is the one time I would have to say that he cut to appease the current President and/or the one to be.

If he cuts, I think it is just to show how dumb it is to invite even higher inflation rates back. “Look what you made me do!”

Rate cuts are the decision of 11 men and women, not a single “he”

No, it isn’t at all and sank today on yet another set of delusional notions yesterday that rates would go down. They won’t.

Back in 2022 the market spinners’ narrative was all about lowering rates but inflation ate all their predictions alive and kept right on rolling.

Methinks when the media try to tell you rates will be coming down, and getting you to do foolish things with your money, you might be better off to do the opposite!

Explosive and shocking indeed unless you read WS. I remember reading how inflation has a way of dishing out nasty surprises.

Need to see JP pulling his hair out here.

The stock market is primed for a rug pull.. But it probably won’t happen.

Do you think the tariff increases will be onetime? My guess is a gradual decline in month on month number over next 6 months. And I guess, the difference in CPI an PPI will likely affect corporate profits more, essentially creating more impact on stock prices (lower PE) than bonds.

The other aspect could be decline in dollar (something you may want to cover in article) causing tariff like effect or magnifying it – increasing PPI If dollar strengthens (which seems unlikely) this effect may reverse

Overall – my guess not very bearish for us30y, us10y but a hit on EPS for companies. Who knows – I may be wrong.

I’m not sure how many companies will be applying this, but I have heard some mention that they will slow roll the price increases out over 6 months. We have had a lot of examples of what not to do with how to handle the last couple years of inflation, I think companies are wised up to how they can sneak prices up under our noses.

July PCE will come in hot, but not as hot as now expected. The sensible commenters on this board will call for no Fed cut in Sept, while the administration will point to the number as good news and refresh its call for urgent rate cuts (to lessen the cost of interest, mind you, not because the economy is weakening).

Sensible people will suggest a significant Federal Funds interest rate hike.

Dude

Right on

Year-over-year, the core services PPI jumped by 4.0%, a steep acceleration.

Therefore….lets cut interest rates…

The Fed is clearly stoned.

I may steal “The Fed is clearly stoned” for one of my headlines someday 🤣

I already immortalized the Fed in January 2022 with “the most reckless Fed ever” when inflation was raging at 7% while the Fed was still at 0% and doing QE. Upon reading that headline, the Fed turned hawkish.

Even Shiller wrote something akin to:

The fed while an “independent” agency is not that independent after all. They are subject to political pressure.

He’s talking about this in a part of one of his books around some financial calamities in history

He talks about Nixon’s fed chairman who basically did whatever the administration wanted.

And that turned out just great… /s

The Fed doesn’t do “sensible”. This is the outfit that dropped rates a full 100 basis points late last year for reasons that were pretty dubious even then, and of course poured gasoline on a fire for more than a year in 2021 and 2022 while inflation raged.

Shout this a thousand times from the rooftops, as it is the real reason for cut pressure: “to lessen the cost of interest.”

(However, I’d replace “interest” with “debt,” as a quibble).

The head of the exec branch is a debt guy.

I fear that the media chatter is oriented at shifting everyone’s mental bias to “cut, or don’t cut”, when realistically a rate hike (and recession) is required to stop the inflationary everything-bubble mindset in its tracks.

The Fed is supposed to be the responsible adult that takes away the punch bowl when the party goes out of control.

And the party has been out of control for 4 years.

They thought they’d engineered a soft landing, but I don’t think the plane even came within sight of the sound.

It will be interesting to see if Trump is going to continue “his inflation is low” and “the Fed needs to reduce rates” rhetoric. Maybe one of his staff will clue him in (I doubt it).

No one on his staff or party has the cajones to disagree with him on anything.

Has anyone seen a group of hypnotized masses since the emperor with no clothes?

Seriously, this is starting to get ridiculous or is it scary?

Listening to NPR on occasion I’m amazed they are even still on the air based on the audacity of their reporters to represent a different P.O.V. other than the Trump mandate.

Uhm how about every fucking administration. I swear you people only wake up every 4 years

Exactly. Both “sides” are partisan sheep getting shorn, blinded by their loyalty and manipulated by emotions. They are all the same people, just cheering for different teams. If they could all, collectively, exit the US to “sort out” their differences, this place would be pure bliss.

I call complete BS on the both sides argument. Trump is behaving like a dictator, using the government as a weapon against anyone he does not like and basically shitting on democracy and the rule of law.

Unbelievable people are stupid enough to believe the both sides BS. And just to make sure you know where I come from I voted for Ross Perot during clinton/bush and have been replicating my protest vote ever since because I used to believe the both sides bullshit argument, until trump rolled onto the political scene. Since then I have voted straight blue knowing what and evil self serving sack of shit he is.

100% @Dave. Bravo

Depth Charge is 100% and Dave is a case in point. He has ignored all the myriad of corruptions and abuses of power during the Biden years but thinks Trump is a dictator. This is what partisanship does to people.

Not denying that Trump is vengeful toward his enemies BTW. What did they expect after trying to send him to prison for years? He doesn’t have the reputation of being a nice guy…

Anyone making the ‘both sides are the same’ argument in 2025 has not woken up at all.

+1 for Dave… ODO hasn’t even begun to screw up this country in ways we can’t imagine!

Now that NPR has lost its federal funding, it is funded by viewers, and can easily and clearly state the actual fact with total disregard to the pitiful and pathetic lies spewing out of the White House.

Actually, it disregards truth. NPR is very liberal progressive. Ok if that is your mind set.

SoCalBeachDude, nice sarcasm.

I used to watch Wall $treet Week With Louis Rukeyser before going out to the bars on Friday nights in the ‘80s.

no doubt NPR has been the credible “grifter” for the left and, now they can come out of the closet ! LOL

NPR is too busy reporting on how climate change is affecting the gender preferences of non-binary Palestinian racial apartheid studies graduate students at Columbia.

Oh my! Ok, you dislike Trump. Don’t let that influence you ability to reason.

Not dislike. Still trying to decide between disgust and pity.

Me ability to reason seems ok, from the inside, anyway.

Listen to NPR? National Propaganda Radio. I’ll pass.

I used to. There were some decent shows. But the last several years it got so painfully biased, I couldn’t listen anymore. If tax payers are footing the bill, it should be at lease balanced. We will see if they can make it on their own.

As a side note, I won’t be watching Southpark anymore. They too have become too one-sided.

On a positive note, Minnesota Public Radio often broadcasts the Minnesota Orchestra’s Friday evening concerts live from Orchestra Hall. Both on FM and streamed digitally on MPR’s website. You can listen to these concerts from anywhere in the world with an internet connection!

The recording engineer is superb. The technology used for the broadcasts is state-of-the-art. And most importantly, the orchestra is one of the best in the world.

September 19th will be the first broadcast of the new season. Joyce DiDonoto is the featured guest for this concert.

And since it is broadcast for free, there’s no inflation to worry about!

NPR = National Pravda Radio

Thoroughly discredited as a DNC mouthpiece

Yeah, especially that commie money laundering Antiques Roadshow.

Vile stuff.

The facts have already clued him in and if he ignores that it will, of course, be to his own peril. Facts are facts. Delusions are delusions.

“According to a report from the US Department of Labour (DOL) released on Thursday, the number of US citizens submitting new applications for unemployment insurance fell to 224K for the week ending August 9. The latest print fell short of initial estimates (228K) and was lower than the previous week’s 227K (revised from 226K).

Additionally, Continuing Jobless Claims shrank by 15K to 1.953M for the week ending August 2.”

Where’s the recession?

You will find out soon enough. Until then just keep daydreaming.

This is all very exciting. Thank you Wolf.

Line go up!

Can ANYONE please tell me is there ONE GOOD REASON at this time for a rate cut?

Being REALISTIC of course.

Thank you.

I don’t personally think there’s any good reason at all for a rate cut. Those inclined to advocate for it, though, will point to the past 3 months’ slowdown in the employment numbers, which suggest a risk of a broad economic slowdown over the next few months.

This employment slowdown will be argued to justify a rate cut, by people who unfortunately will then soon enough have cause to shed tears while interest rates rocket back up in 2026, as the Fed is forced to respond to what will, by then, be a level of inflation even the administration won’t claim to love.

The two year yield is quite a bit lower (~3.75%) than the fed funds rate.

Yeah, N-gDp level targeting. The market is forward looking, sometimes 2 years in advance.

N-gDp sounds more like a new type of semi-conductor…….still just an “on or off” electrical device……but maybe does it’s thing faster or cooler……I personally hope it’s cooler.

The fed drug their feet as long as they could to give some people cover to get their stuff in order.

Now get your umbrellas out, a Hurricane of shite is coming for us.

Danno,

Would give maybe 50-100 talking heads something to talk about? That is Hundreds of Millions in advertising money….or more…plus their often 7 figure wages, show production, management, shareholders, etc, etc…….not exactly an ignorable “reason”.

….don’t know about “good” part……that’s kind of a moral call.

Thank goodness that, according to the “Main Stream Media”, inflation is only “transitory”.

Now THAT is really an oldie but a goodie. I often forget the words to those, too…was it Street or Stream? Pretty sure the artist was Hannity, though…..but no idea who wrote it.

Just take a look at the Bonds today

The long end yields all spiked big time.

The rest is all noise, IMO

Moves in the 20 year Treasury bond yield tells me pretty much all I need to know about inflation, although yesterday’s action seemed odd (rates went down despite high core CPI number). The stock market is a useless indicator, driven by mad men and MSM.

I think long rates are too high in 20-30 yr tenure. it is the short rates that need to pick up with inversion of yield curve.

Our deficit is going to be whacked off as gov cannot borrow at cdo projected rates, and they are forced to tax more / take away benefits. A massive depression in 5 yrs is coming as AI replaces 40% white collar jobs.

A puppet fed governor wont help

“as AI replaces 40% white collar jobs”

LOL, that’s what they said about the internet, and it didn’t do that either; it destroyed many millions of jobs, but created many more millions of new jobs, including mine.

That said, AI may be the first technology that on net destroys more old jobs than it creates new jobs. And it may not do that either. Lots of hype about this stuff out there now. You cannot take this stuff too seriously.

Interesting since my oldest (in college) is going to drop down to part time in order to work part time at cleaning up code AI f’d up. New job category. Cleaning up after our AI overlords. It’s San Jose state so he’s right there for it.

When Wolf wrote:

“LOL, that’s what they said about the internet”

I realized I’m old enought to remember when the PC was going to eliminated about 40% of all office jobs.

P.S. When I was a kid I remember than an entire floor of my Dad’s SF office building had at least 100 young women typing on IBM selectric typwriters.

AI might not cause loss of jobs, but I believe it will cause reduced worker wages as office workers transition to reduced occupations. Wealth concentration will increase from already high levels.

It will increase pressure to tax big business so that some of the AI profits are redistributed.

“You cannot take this stuff too seriously”

Excellent!

Can be on or off…..reader’s (or context algorithms’s) choice.

An “opinion” or “choice” may also be produced with some supernatural intervention.

Today could not be ignored. Also see jobless claims post a bit up above. One Two punch.

So rate cut in Sept then? Cool…

Oh man, it’s going to be a good one for all the firework aiming at Pow Pow if he deviates from rate cut fever dream despite these not so good numbers

There are 12 people who comprise the Federal Reserve FOMC (Federal Open Market Committee) of which the Chairman of the Federal Reserve is just one person with one vote. Even Bloomberg today ran a segment with a woman from PIMCO stating this very straightforward fact. Why do we need to keep restating this to the clueless who want to keep claiming that Jerome Powell can and does set interest rates by himself?

He’s the Captain of the ship. I blame him exclusively for what happened to the cost of everything is the USA due to his transitory thoughts.

Well, that just shows you don’t understand the Federal Reserve.

Hmm…you think I don’t know this?..but I am referring to strictly who the King will be aiming his trebuchet at, which will be Pow Pow and him alone.

If we have someone else in charge, I wouldn’t be busting out the popcorn as public lynching by the top dog has never been done to any FED members or chair, rightfully deserved or not..

SoCal, when even 2 people vote against the chair, it is a once in a 30 year event. Yes, several are eligible to vote, but the groupthink is so strong that dissenters are very very rare. It’s Powell’s shop, like China is Xi’s shop.

Does anyone know what the inflation rate for CPI-E is at this time ? Is this info being published (or even still being collected ? ). I did a google search and could not find anything.

For retirees, the key inflation index is the Consumer Price Index for the Elderly (CPI-E), which is a research price index calculated by the Bureau of Labor Statistics (BLS). The CPI-E specifically reflects the spending patterns of those aged 62 and older. While not used for official government adjustments like Social Security’s COLA, it provides a more realistic measure of inflation for retirees.

I have to wonder if BLS numbers in the future are going to reflect reality, or the wishes of some guy in the White House ?

2.9% YoY

You can download the data, including sub-indices, here:

https://www.bls.gov/cpi/research-series/r-cpi-e-home.htm

FRED also has a series on it somewhere.

Thank you. I was able to find the file after a few attempts. Now I just need to locate an app that can open it.

You need a spread sheet to download and use the data, such as Microsoft Excel or the free Google Sheets or the free OpenOffice Calc. I think Microsoft has a free online in-browser version of Excel.

If you Google for it with FRED in the front, you might find a ready-made chart on FRED (St. Louis Fed repository of all kinds of publicly available data from around the world).

This 62 year old just bought a new laptop. I paid the same price as I did for my last desktop computer back in 2014. I wish the prices of vehicles and real estate were the same way.

And your new same-price laptop is probably 10x as powerful.

I’ve been spending $800 for new laptops every few years since 2001 (I always have two of them). Over that period, they become supercomputers, but same price.

Meanwhile aspirants to appointment to the Fed outdo each other in their proposed cuts to the Fed’s rate. Marc Zumerlin is a piker here having called for a mere .5 % cut last time. David Zervos blows right past him in this race. Zervos is unable to see his way to Trump’s desired 3% cut ‘but I could certainly get to 2%’ or 4 times Zumerlin’s call.

Is it something in the water?

Dear Mr. President Sir:

If you appoint me Chairdude of the Federal Reserve, I will praise you as long as I’m in that job, and I will cut interest rates to the negative 5 minutes upon being confirmed by the Senate via an emergency Microsoft Teams conference, during which any final resisters will be zapped remotely via Microsoft’s built-in soon-to-be-revealed AI-powered Teams Zapper.

Having a good laugh right now.

LOL.

Even you said this as joke, we can definitely put some non-zero probability where situation this can happen. Isnt it?

your in the running

Might have better chances runnings the IRS.

😂 😂

just read a story about the last guy. He auctioneered a tie and sent out “Friyay” emails telling workers to go home early.

Oh boy

Just as all of the financial shill sites were penciling in a jumbo rate cut in September…. Any rate cut at all would be a dereliction of duty.

Prices at the grocery store lately are absolutely mind-blowing. And I won’t even get into coffee.

Don’t dare eat out either. I went to a place last night and ordered brisket and Mac and cheese as I’m traveling. $18 for a small plastic container. Young couple with a kid and tattoos all over were ordering what must have been $75-100 of food. This is Sandpoint Idaho, BTW.

Jpow needs to do an emergency hike of 2-4%, crush the parasitic class in this country. Except he’s one of them, as are all those employed by the federal reserve

@Depth Charge Coffee has gone up a lot and I’ve been buying it on Amazon this year and they ship it to me for less than any local store.

@Kyle the price gap between eating out and cooking at home keeps getting bigger. As this is happening my tenants seem to be cooking less and less (I think some young makes in tech that rent from me don’t cook at all and don’t even use the stove to boil water).

P.S. The “poor” in America also always seem to find the money for tattoos and cigarettes…

“P.S. The “poor” in America also always seem to find the money for tattoos and cigarettes…”

And Vapes

Follow them some night and possibly you’ll find another good reason for all of us to use in punching down…like maybe they all dine at the Cheesecake Factory……making my blood boil already.

“P.S. The “poor” in America also always seem to find the money for tattoos and cigarettes…”

Which helps you justify what………?

Putting poor in quotes is a nice touch, too.

SMH and clutch my pearls

the audacity of Tatooing a kid! ⚓️

😆

Why do you think a rate hike will “crush the parasitic class?”

Aren’t they the ones clipping the coupons?

“Over half of the broad-based July increase [in services] is

attributable to margins for final demand trade services, which jumped 2.0 percent (27% annualized). (Trade indexes measure changes in margins received by wholesalers and retailers.)”

Does this mean that wholesalers are passing tariffs on to other companies, even if companies aren’t yet passing those tariffs on to customers?

We know that companies paid about $80 billion over the pas three months in new tariffs. And that $80 billion has been getting spread around amongst companies and cut into their profits — we have seen that too from their earnings warnings. Very little of it got passed on to consumers — we’ve seen that too from the CPI reports. Exactly how the tariffs are percolating through corporate America, how they get sliced and diced, spread around, and absorbed by profits is something the PPI data only hints at.

So I thought you were dead wrong about foreign companies (like from Canada), not absorbing the tariffs, but dammit, I found a study that confirmed exactly what you were saying – for the most part they are mostly eating them entirely or sometimes cost (pain) sharing with a US company.

Not sure how long this will be the case if the percentage keeps going up though.

It gets even more bizarre when you see social media screaming tariffs are a tax on us chants from groups of people that historically do not like corporations. Literally regurgitating corporate rhetoric. I want to lean into their ears and whisper if you refuse to buy their stuff, it will be a tax on them.

But they also want a livable wage! The hypocrisy is wild.

Are you saying that people can’t want both a) lower tariffs and b) livable wages? What a braindead take.

You can want those two things but they are necessarily compatible. Its hard for US workers to argue for a livable wage when their factories have been closed because Wall Street sold out the Jobs to China and other countries that then dump cheap products on the US. Have you looked at Wolf’s Corporate Profit charts? The have enough room to eat the tariffs and pay their employees betters. Or they can move production back to the US.

Many will eat them short term as the response will be is there any good way we can avoid paying these tariffs. Can we find different vendors, do we move manufacturing etc. Once those questions are answered and cost base established, then you’ll see an impact on pricing. Corporate profits are higher than ever, they can absolutely stomach them long term.

But we aren’t even fully settled with what tariffs from every country will even be, much less what the long term picture looks like for each industry. Other than what you buy off Amazon and clothing retailers and other cheap goods, the impact to consumers is going to take time to present itself.

My gut has been telling me that inflation due to tariffs really wouldn’t start working its way into actual prices paid until Q4 of this year. My gut still tells me that we’re going to see inflation tick up and stay problematic through mid-2026 at the earliest, barring any other shocks from energy or a sudden financial blowup somewhere.

With all that said, and I think that new car sale prices are a good indicator of this, I don’t think companies have much pricing power at the moment. Used car prices are ticking back up (to be expected with fewer used cars available due to the pandemic, combined with the *belief* that used = cheaper), but new car final sale prices seem to have hit a ceiling.

I can’t help but think that a rate cut will be serious fuel to the inflation fire, but it seems that Trump is hellbent on making that happen.

Since the tariffs on China have been delayed for three months, yr gut has been watching the news,

Wait a minute. What has been delayed were the 100%-plus tariffs.

But the 30% tariffs on Chinese imports are currently in effect.

Jees I’d forgotten that. God only knows what they were thinking at 100%. Just a bargaining position I guess,

“Jees I’d forgotten that.”

TDS is one helluva drug.

Cutting rates as inflation ramps up and the markets are all at ATH based on nothing more than hopium.

Things are swell if you part of the 1% asset class holders.

Pigmen gonna pig.

Powells afraid of any deceleration in the economy as tax receipts would fall.

Another anecdote in the services pricing discussion: I run an IT services company out of the midwest. Last month we received three requests for price breaks from long term happy clients who are under some financial strain. In the 27 years I’ve been in this business, this is only the second time we’ve received requests like this (first time being 2009).

In terms of new biz development, our sales team has had to get clever with pricing, and our margins are definitely under pressure. Whereas we typically are able to charge $200 per user/mo., we’re increasingly making consessions to earn new business (no charge for onboarding, discounts for year paid in advance, price reductions into the $165/user range, etc.).

Again, anecdotal. We’re still making reasonable profit, but the challenges are definitely out there.

If you’re still making reasonable profit, what were you making before?

There’s a lot of excessive profit that can still be squeezed out of the economy, in favor of consumers.

Reasonable profit means the ability to take a few hundred employees to Hawaii resort for a week and party like it’s 1999….and STILL dish out massive bonuses to the top echelon. That niche has slowed a bit at top end Hawaii resorts in the past few months. let’s see what next winter brings….

Let the consumer eat cake.

That’s the discount for paying a year in advance….a cake per month, and YOUR choice!

“our sales team has had to get clever”

The Midwest has IT?

Holy Moley!

I knew we ran a cable to CA, someone must have tapped it.

“…discounts for year paid in advance…”

I hate being paid full in advance for jobs, and I can’t imagine offering a discount for it.

ok, stupid question here (or stupid person):

Core Services PPI is skyrocketing, but I didn’t figure out the specific reason(s) or sector(s) for this. Would someone please expand on that? Wolf does expect large swings with a general increase, which seems reasonable.

Thanks.

I gave you the two big subsectors in the first paragraph:

“Prices for services less trade, transportation, and warehousing spiked by 0.69% (8.6% annualized), while prices for transportation and warehousing services spiked by 1.01% (12.8% annualized).”

Prices rose in:

– machinery and equipment wholesaling

– portfolio management; securities brokerage, dealing, investment advice, and related services;

– traveler accommodation services

– automobiles retailing

– truck transportation of freight.

These declined:

– hospital outpatient care

– furniture retailing

– pipeline transportation of energy products

Forget the PPI inflation. Get ready for some serious services inflation due to insurance companies scamming homeowners across the country. Because they lost so much money in California, Florida and NC recently these home insurance parasites are passing on all their losses to people who live far away from the hurricanes, wildfires, tornados and floods. So I and neighbors near me in low risk Maryland, who have none of these perils have to pay up. Insurance companies have partnered with Google and have been circulating drones over our houses inspecting roofs and demanding roof replacements when they are not needed. If you don’t replace the roof look for your premiums to go up 40% or more or have your policy cancelled. They are also sending crooked home inspectors to your house before renewing your policy. They are looking for reasons to raise your premiums. I got a letter the other day to set up a home inspection. All of these tactics are designed for one purpose and one purpose only. To get more money out of your pocket so they can improve their bottom line. Homeowners have no choice but to pay up. These insurance cost increases will make the PPI increases look like penny ante. We’re talking 40% to 50% increases YOY. ENJOY

The losses in the LA fires the largest ins losses in US history are not going to be completely covered by insurers based there, or even in the USA.

There is very little if any relation between the location of a disaster and the source of the coverage,

‘Germany’s biggest re-insurers took a $1.9 billion profit hit in the first quarter from claims related to the recent Los Angeles wildfires. Munich Re , the world’s largest reinsurance company, said Tuesday that it anticipated all claims attributable to the wildfires will total around 1.1 billion euros.May 13, 2025’

“Germany’s biggest re-insurers took a $1.9 billion profit hit in the first quarter from claims related to the recent Los Angeles wildfires. ”

Bring on the Violins. I don’t give a s$it about Germany’s re- insurers.

Well, you should as the results of Swiss RE, Munich RE, and the other huge re-insurers in Europe very much affects P&C insurance costs and subsequently rate throughout the USA. That’s just how the re-insurance industry works.

They are kinda like the Fed, for a different type of bank.

No, insurance companies are NOT like banks, not at all, they don’t take deposits that they have to pay back, with interest. Insurance companies take premiums that they don’t have to pay back, and when there is a claim against an insurance company, it might refuse to pay the claim, and the claimant may have to sue.

Insurance companies run the country. They determine most of health-related costs, much of housing monthly costs nowadays, much of what it costs you to drive, some of the cost when you shop (those retailers need insurance too), some of the cost in manufacturing (those factories need insurance too), much of the cost of leisure activities (see what happens when you slip and fall in a hotel or supermarket). Insurance companies are the blood-suckers of our country. No wonder Buffett likes them.

Laughably and totally false. Insurance is a very small part of costs.

Are you dumb? My homeowners, auto, life, health comprise like 1/8 of my monthly spend. That’s a pretty big ass expense and it has only gone up.

SoCalBeachDude. More sarcasm. But maybe not. Maybe you are an insurance salesman. Look at the fine print in any policy and see how an insurance company controls your life. Just today I read insurance companies are using drones to look at the roofs of houses, deciding whether or not the homeowner needs a new roof and how much to screw him if he does not put a new roof on his house.

Properties have ALWAYS been inspected by insurers who cover them and that goes back to when insurance first started in the late 1700s back in Philadelphia by INA and others.

Insurance is my largest expense every year.

My car insurance payment is as much as my car payment. It was actually double my car payment before I had to make a bunch of concessions to the policy. Just a few speeding tickets over the years.

“Insurance companies run the country. They determine [costs]”

I think you have it backwards. The soaring cost of services like healthcare and labor of trades workers/mechanics… And goods like steel and lumber… Determine the costs of insurance. This is a field called actuarial science. If insurance rates don’t align with replacement/healthcare costs, savvy competing insurance companies undercut them and steal their customers to some extent. Free market, and all that.

Insurance is a great example of how tariffs (on goods!) directly contribute to service inflation, though.

Yep, and actuarial matter are all based on the LAW OF LARGE NUMBERS and that has always been the case. All insures must always maintain capital and capacity to pay claims and if what they are insuring goes up in price so much the insurance rates that are established by actuaries.

Ithe fact that someone’s house burnt to the ground in CA. Then they get a new house built for paying anywhere from $1,000 to 50,000 in premiums over a period of time, well that’s pretty amazing.

We have to Risk Pool. If we didn’t we’d be morons.

YES,,, WE, in this class of WE, the homeowners WE, MUST dedicate our income to some kind of ”property” ”insurance” ,,, but, the fact is,,, for some

it is actually more rewarding to ignore the so called insurance industry whose members will drill you to death with their vast ”legal beagles” ( with apology to the wonderful beagles dogs) trying and to be fair usally finding some reason NOT TO PAY what was agreed… And put the money into ”T bills and other Treasuries.”

READ THE FINE PRINT!!!

EVERY DAMN WORD of the fine print…

Otherwise, your just gonna bee another sucker…

Good Luck and God Bless!!!

“I posted this before but I will elaborate with some actual numbers:

“According to AM Best, property casualty insurers made a record $169 billion in profit in 2024—even as they raised prices and pushed for laws to avoid paying more claims, all while claiming the industry was in trouble.1

The $169 billion profit amounted to a 90% increase from the previous year and a 333% increase from 2022.”

profit:

2019 $62B

2020 $62B

2021 $62B

2020 $39B

2023 $89B

2024 $169B

Hard to lay that on Trump….but I’m not holding my breath on him scaling it back either. Maybe ICE needs to snag a few Insurance CEOs….That would most certainly swing the midterms.

There is no federal government regulation of property and casualty insurance rates which are set on a state by state basis by the insurance regulators in each state where conditions and coverages vary substantially.

That should tell just how strong the Insurance lobby is. The industry spends $90+ in lobbying each year(pert open secrets).

If you think AM Best is lying, then provide some data.

He doesn’t post data. He regurgitates articles.

He won’t. He just reposts headlines and hates trump. Lol

Nothing you said contradicts a single word I said and my point is that insurance in the P&C sector is a STATE ISSUE and regulated by individual states and that has nothing to do with any lobbying by the industry. Compared to the banking industry the insurance industry is a very small player in the financial sector.

“…insurance in the P&C sector is a STATE ISSUE and regulated by individual states and that has nothing to do with any lobbying by the industry…”

Laughable. If you don’t think the insurance industry lobbies on the local level, you are on crack.

It’s because their investment income is way up and if they do cut rates their bonds go up in value… insurance is a racket, always was, always will be as a former underwriter I know very well about the club reinsurers who work 6 months out of the year…

Insurance, banks, and utilities. The pseudo-government entities that you can’t live with, can’t live without.

New tariffs are only one side of the story. Small business owners in this report probably still factored in the end of the Trump’s first term tax cuts into their pricing. After the “big beautiful bill” passed, they have now more options to keep prices lower, should consumer resist higher prices.

The lower income tiers of consumers were struck particularly hard by the end of free money from the “American rescue act” and they were forced to cut back spending for a while now already. The higher income tiers are still doing well, with plenty of money in the bank. Still, for some the chance of losing their jobs to DOGE or AI, likely will have restrained their spending – again, this is before the “big beautiful bill” was passed, and tax cuts were made permanent. It just goes to show how disruptive the last election was. They have billions, perhaps trillions of dollars in cash sitting money market accounts and short term treasuries which they will try to invest somewhere else in the coming months. But where?

Stocks? Crypto? Precious metals? Real estate? Or just overpriced Stuff?

As soon as Trump won the election it was signed sealed and delivered that the TCJA was going to be extended so what you are claiming is nonsense

The question here is now that we’re seeing it in PPI will we see it in CPI or have they run out of pricing power and we see it in earnings.

As for the Fed… Cuts are going to happen on growth fears not inflation confidence. Question is how far can they cut before they are more afraid of inflation then growth. Do we see political pressure for YCC and does it work. 🍿 Ready

Sorry, nobody sitting in money market funds is going to ride to the rescue on their white horse to save all the gamblers. Anyone who hasn’t fallen for FOMO by now isn’t going to. And despite the mainstream media, no ,interest rates aren’t going to be going down with another trillion dollars in debt in the past 5 months.

So what are they going to do with the money? Sit on it? Short term rates are at around 4%, and they will come down further, just as the two year bonds already indicate. Even Buffet feels now pressured to start to move into stocks (United Health).

The best outcome would be increased spending. Let them buy a new Porsche or Lexus, and give some money back to the treasury that way.

No. Short term rates will GO UP considerably as inflation starts showing up all over the place and accelerating. Too bad that won’t fix the problems with inflation, though.

Buffet buying a stock that has cratered and retires suddenly wanting to go fomo on stocks is a laughable comparison.

The reason those money markets aren’t heading into the market is these people don’t need the gains and they’ve seen multiple equity bubbles pop. Most want nothing to do with it.

The markets are already pricing a in rate cut for September. If the CPI in August does not rise significantly, or if the job numbers continue to worsen, they will cut. And likely they will cut by 0.5 points. Which is good, they have to get the money moving again. That’s what the economy actually is, moving money. The problem is, those people that have a lot of money either don’t want to spend it, or don’t know what to spend it on. All the asset bubbles show no signs of deflation, so they will have to burst.

Maybe they T Bill and Chill while waiting for rate cuts, roaring inflation… and the resulting spike in long bond yields! Please let it be that and not gambling on bubbles…

Haha Buffett is never pressured into doing anything.

The guy can market count in his head.

That is the equivalent of walking into a casino in Vegas and you can win any game by counting cards.

The guy is the best there ever has been so far. And graham was as well, he just was not born at such a perfect time like WB.

Plebeians don’t realize the interest on tens of millions of dollars whether it’s 4% or 3%, it doesn’t matter. Hell even 1% is still more money than most people can spend in a lifetime so no most people sitting in money markets aren’t going to rush into a bubble to have all of their savings reduced by 80% and have to get up at 5:00 a.m. to go to work.

WHOLESALE PRICES HOTTER THAN EXPECTED…

Inflation Gauge Rising at Fastest Rate in Years…

CNBC Anchor Flips Out Over ‘WHOPPINGLY Big’ Number…

Veggies up 40%!

Electricity prices surging…

Did the CNBC anchor clamor for a 0.5% emergency rate HIKE while at it? Not.

Perhaps he should have!

That would have been a hoot. He would have been fired on air right there.

Well, today even after watching PPI report data, CNBC Sara Eisen asked 50 BP cut to Alberto Musalem. So thats CNBC for you.

Fortunately Alberto Musalem said Labor Market data and inflation data doesn’t not support that. Then she was soooo sad. saying “Thats a NO!!”

She is one of the Wall St Cheer girl out there.. No matter what, just dance..

“It’s services inflation at the consumer level that is so hard for the Fed to contain, which is why the Fed fears services inflation so much.”

Very interesting .

The Federal Reserve is always highly concerned about wage inflation.

Can we finally all agree that it was an error for the Fed to cut last year?

Trump thinks the Fed should cut to zero or by a lot. So clearly “we” cannot “finally all agree” …

I was referring to present company. Or does the president comment on this blog?

Even among present company there are some that think the Fed was OK to cut, including me. For now rates are still OK. CPI is below 3%, 12-month core CPI is at 3.1%, three-month core CPI is below 3%. The Fed is at 4.25-4.50%. What I don’t want the Fed to do is cut now. It needs to hold rates, and if core CPI keeps going higher and hits 3.5%, the Fed needs to hike 25 basis points to 4.5-4.75%. It needs to stay at least 100 basis points ahead of core CPI inflation. If CPI spikes, the Fed needs to hike faster to stay ahead.

Wolf,

Many of us agree 75-100 BP cut needed last year to keep both risk balanced. (to be precise I am in 75 cut in 3 meetings camp). Last Sept, FED did 50 in shock. They misjudged the lower numbers then.

I am sure all those people want FED to hold the rates now. Even increase it if services/core inflation don’t fall in line.

Will FED have guts to do their job and serve to American Public?

We need Price stability. Those who say something will break, something already broke that called Price stability. We never fixed it completely.

One of the decisive moments for FED chair.

I’m actually happy with the outcome of those 100 basis points in cuts: it spooked the bond market, and it drove up long-term yields and mortgage rates by 100+ basis points — 100 basis points in cuts leading to long-term yields shooting up 100 basis points was a historic event — which taught the Fed a lesson, and it ended the cuts. This event is why the Fed still hasn’t cut despite maximum political pressure to cut.

Maybe not but I still think it was bad to cut. It needed and needs to crash

Asset prices will likely decline but will not crash at all in housing based on the present US economic data.

Trump “think framework” kinda scat. If we take this think framework into belief… his belief kinda scat. Are the supporters and enablers also scat? How much scat is out there?

Have you seen the employment figures? The economy is hardly roaring. Inflation is sticky and not helped by all the new import taxes.

And really, the impact of 1% in interest increases, well I think we know by now that it’s not huge on its own. I wish people would see a learning point that fiscal and monetary policy need to move in the same direction when battling inflation, not just relying on monetary alone. But both administrations have ignored this, Biden with his desire to invest more heavily and Trump with his import taxes (the wrong type of tax for fighting inflation) while cutting taxes elsewhere.

Instead we rely on monetary policy at stupidly high levels. Right now more 70+ year olds are buying houses than people younger than 35. At the level of house prices we have (before some wise ass starts talking about 14% back in the day), 7% mortgages are not affordable. A whole generation must sit out and wait for the craziness to end.

USA 30 year mortgage rates have averaged 7.71 % for about the last 53 years. What’s the problem ?

Did you read the bit where I say:

“before some wise ass starts talking about 14% back in the day”

Anyway. House price to income ratio used to be around 3x the median income it’s now between 5x and 6x. And that’s an average across the country, including rural areas, it’s much higher in many major metros.

You can’t look at historical rates when house prices are so much higher. You basically have to double the current rate to get a comparable rate in the 70s. Triple or quadruple it in many metro areas.

Housing affordability right now for first time buyers is worse than it’s ever been. I know you’re trying to be clever but it’s really a very real issue for the millions of younger generations locked out in many areas of the country.

Correct. The issue is not mortgage interest rates, but rather the prices of houses but that is being caused by supply and demand issues and there still remains outsized demand despite the sky high prices of houses.

Ekky,

I can relate and empathize as our generation not able to buy.

But problem is not with interest rate. It is prices. Yes. Every generation inherits some problems. Our generation inherited excessive QE and asset bubble by Fed from 2008. House prices sky rocketed because there are idiots out there who went on bidding because money was cheap. Stock markets are super high and crypto left the earth atmosphere.

Sadly we have to wait out. Even though I have money to buy cash down, I am not going to pay seller that price because they think their home is worth that much. It is BS valuation. Even Buffet is sitting on 350+ Billions cash.

Its cliche but solution for higher prices is higher prices. More and more people wait for prices to correct, Sellers have to come to new reality.

It is All Assets bubble now.

Thanks to FED, I am earning 4.33% on my cash which pays my rent.

Hope FED stays on track for their inflation mandate. Else Bond market will teach them lesson on longer end.

Sandeep, prices are where they are due to a lack of supply. Interest rates aren’t only not going to magically fix that, but actually make the issue worse. And even if prices did fall, it will take many years.

Monetary tightening is very convenient for those with lots of assets already while they increase the federal debt to keep the economy booming.

You’re not being suse, just accepting your losses.

“And really, the impact of 1% in interest increases, well I think we know by now that it’s not huge on its own.”

Good lordy, Ekky. What a pile…

Does anyone have speculation as to why service inflation has been on the rise? I’d guess (but I’m new to all this) that it has something to do with consumers allowing it, but why lately? Has something changed and people are now more tolerate of the price hikes?

SPX 6450 could be it.

All those paper gains making people wanna splurge on life or could just be inflation loop who knows

I agree that psychology is part of it. A new car or fridge is the same price as a few years ago? So the consumer buys it up- even if it costs double to install or service it. New cars and all kinds of software are cheap so they sell- but they all have more recurring subscriptions than ever that folks don’t consider.

I believe tariffs are beginning to become a factor to some extent as well. Look at Wolf’s recent article on CPI inflation for examples of service CPI components. Insurance costs contribute a lot, and treat rates factor in importing lumber/steel to replace houses and cars. Rental cars is a service. Housing is a service, and those material costs impact new builds. Tariffs impact energy infrastructure as well that feeds into all sorts of services. Just some examples- no idea how significant the contributions are but I’d love to see some good data on it.

Your second paragraph is nonsense and self-contradictory. If automakers cannot pass on the tariffs to consumers, then vehicle prices aren’t rising, and replacement costs for insurers aren’t rising. First, tariffs have to drive up goods prices. And they just haven’t done that yet.

In terms of construction, everything that goes into building a house, from lumber and steel to paint and appliances, is being produced in the US, and no builder is forced to buy this imported crap. They can buy USA-made products and dodge the tariffs.

Your whole second paragraph is a compilation of BS that you concocted to promote your stupid anti-tariff political bullshit. You’ve been wrong about tariffs for over six months straight, and now you changed your angle into even more insidious BS.

See: “The Great Demographic Reversal” by Charles Goodhart and Manoj Pradhan.

Powell will be at the Jackson Hole symposium next week, I guess we will see if he gives any info regarding his thoughts. I think right now the Fed is split 50/50 because of political and corporate pressure, Powell will probably be the deciding factor, the entire economy rests on his shoulders, no matter what he does people will hate him, what a shit job it is to be Fed chair!

No, there are only 2 to 3 dissenting voices on the 12 member FOMC who want to consider lower policy interest rates. The majority of the FOMC most certainly does not and will not be lowering rates in September.

Yes that’s what we know so far, but don’t undermine how powerful political and corporate pressure can be, we don’t know any of the thoughts of the other members but we do know they will most likely follow Powell because as Fed Chair he holds the most influence. If rates don’t change, expect a shadow Fed chair to emerge that will be trying to undermine that influence.

Apparently Trump is considering suing Powell over the Fed reno costs. And who knows, when Powell was visiting the site maybe he copped himself a free coffee.

CNBC headline “ S&P 500 ekes out a third day of gains as traders shake off a hot inflation report”

Shake it off is now a theory in business and Wall Steet; not just a Taylor Swift song.

I seriously wonder how equities just keep ignoring everything and shooting higher.

Buy The Dip! FOMO!!!

If there was a dip. There hasn’t been any kind of dip since April! Haha

One guy I follow called if a Bear Scare. 😆

If AGI doesn’t pan out we’re due one hell of a crash.

AGI can refer to Artificial General Intelligence, a hypothetical form of AI that can understand or learn any intellectual task that a human being can. Alternatively, AGI can also refer to Adjusted Gross Income, a figure used in tax calculations. Finally, AGI can also be an abbreviation for Alliance Global Group Inc., a Philippine-based conglomerate.

Indeed, context is everything. Clearly I meant a Philippines conglomerate was going to be the cause of a crashing stock market.

I think at this point it’s going to be a big let down no matter what.

The people who sell and sell often will be ok.

The holders will be cooked.

Mutual Funds will feel a speed bump due to diversification.

Yeah I was feeling pretty bullish on AI but it seems unlikely LLMs will be able to make the leap. The current model of more data is better hasn’t solved the issue of hallucinations and errors at a basic level even if it can also do math at a PhD level.

The models will keep getting better and are a great tool but many white collar jobs simply can’t be fully automated if the AI is prone to the number of errors it creates currently.

This time, it’s because of retail investors, convinced they can’t lose.

“ AI-driven trading systems operate in milliseconds or microseconds”

Mag seven stocks driving the market. If AI picks up an inkling of good news for them it drives the market higher, I think. And everybody jumps on board. (Not me, to old for that.)

If ever any AI bad news it will probably sink the market, I think.

“I seriously wonder how equities just keep ignoring everything and shooting higher.”

Because they printed too much, and there’s way too much liquidity sloshing around in the system, looking for a return. GREED.

Once in a while, it’s fun to push Wolf’s buttons and present a contrarian point of view or idea and watch Wolf’s pressure gauge go off the charts. Watch the pot boil over. Watch him go ballistic. 🫣

Oh my sweet voodoo, inflation!

And yet, here you are.

Pretty disrespectful. He should probably just ban you.

Dow futures up 400 points tonight so clearly all you losers pouring over inflation and All this other insignificant stuff don’t mean squat. If you’re not invested in the stock market you’re really getting left behind.

Nice take, chowderhead. How about that reversal?

GOLDMAN: Risk of stock correction spikes…

Would like to see a chart of the aggregate CPI or the PCE with a 2% annual inflation trendline from 2021 until today.

I stand to be corrected, but are we not up roughly 25% in those 4.5 years….and a 2% annual “acceptable” inflation rate of 2% would have us up only about 9.5% with compounding, leaving us about 15% above the “acceptable” inflation trend line.

That chart showing that we are well above any “acceptable” inflation 2% trend should be reason enough NOT to cut. But it is never displayed nor discussed. YOY or MOM rate of change hides the accumulated damage of inflation.

Based on the St Louis Fed PCE chart and data, in June of 2021 the PCE was 16509. At 2% per year and compounded, we SHOULD BE at 17518.

We are now at 20685.

And they are pushing for rate cuts?

Exactly!

It’s 1972 again…

…the second wave of inflation is just beginning to hit the beach.

Hedge accordingly.

Question for the board, the Fed funds rate reached a low of 1% in 2004 yet the 10 year was 4%+

It doesn’t look like the 10 year responded to what the fed rate was until around 2011 with what I’m assuming was continued asset purchases.

It’s going to be really interesting if the Central Bank cuts rates next month and Bonds dont respond? What else can they do besides print more $$$ to buy bonds??

What effect will reduced corporate profits, due to their tariff costs, have on the federal government’s collection of corporate taxes? Will reduced corporate taxes somewhat offset the revenues the federal government receives from tariffs?

You touch on a “touchy” subject.

All this tariff revenue is hurting those who pay. Now, who pays?

J J Pettigrew,

“Who pays?” Companies. Relax, it’s just a corporate tax increase, after companies got a series of HUGE tax cuts, including in the OBBB (such as its 100% investment tax credits).

Swimmer,

1. US corporations, the big ones, pay relatively little income taxes in the US, and they’ll pay even less after the tax cuts in the OBBB. They route their profits through low-tax havens, such as Ireland, and pay taxes there, such as Apple. So they would pay less income taxes in Ireland?

2. Tariffs are shifting production to the US, but this takes years to implement. Production in the US is a huge tax generator for all levels of government. People no longer have any idea how destructive to US fiscal and economic health offshoring of production has been.

They don’t have any idea, or the beneficiaries simply don’t care?

Wolf,

On point #2: As I posted above about listening to digitally streamed Minnesota Orchestra broadcasts, my DAC is getting upgraded tomorrow from a four year-old mid-level Schiit Audio DAC, which I really do like, to a newer ‘Gungnir 2’ model.

From their website: “By “designed and built in the USA” this is what we mean: we design our products in Texas and California, and we make our products right here, too. The vast majority of the production cost of Gungnir 2—chassis, boards, transformers, etc—goes to US companies manufacturing in the US. And it all comes together in our San Antonio, Texas facility.”

Schiit is now using a new robotic soldering assembly system in their San Antonio facility that will bring costs down, increase quality-control and speed up production, too.

Why am I upgrading? Because the new DAC has an incredibly sophisticated control connection via a Bluetooth module that interfaces with your iPhone. And most importantly, the soundstage of the orchestra will be better. When listening, the location of each musician will be more clear and more accurate. Bottom line, it sounds better.

Yes indeed, all this technology and manufacturing is Made in the USA!

And thank you for supporting the US economy and retail sales, which, thanks to your purchase, showed nice growth in July (article coming). Or maybe your purchase will fall into August, and then we should see a nice bump there too.

Expanding on your question “What effect will reduced corporate profits, due to their tariff costs, have on…” hiring?

As we all know, these corporations got super fat from the free money inspired inflation and valuations have followed. Love ’em or hate ’em, that’s just what they do; capitalists gonna capitalize.

So, assuming the tariffs work exactly as the general Wolfian consensus envisions, should we not expect higher corporate ‘taxes’ (via tariffs) to reduce earnings (already noted in so many earnings calls), and eventually slow hiring. Based on the revisions it may already have done so.

Granted – the long term reshoring of manufacturing, etc. should eventually dwarf this short term pullback. But we don’t live in a long term economy. This ain’t Singapore.

Thoughts?

Good take Wolf. As far as my take on inflation, it’s 1972 again. Only this time with a disastrous DEBT/GDP.

Hedge accordingly.

A return to sanity: 20 and 30 year T-bonds today are back to over 4.9%. At least some people are worried about inflation.

At 4.90, not very!

I wouldn’t touch the 10 year at that level. The 20/30, hahahahahaha.

4.9pc is a very high yield. The inflation may not sustain given weakening high paying tech job market combined with ai.

I believe the stocks are more at risk than bonds.

I expect ppi to scale new highs while cpi goes below 2pc. This will squeeze corporate profits dry.

Real estate will puncture the bubble along with unwinding ai valuations

I’m a peon worker in Property and Casualty insurance but I can promise you this: there are millions of zombie LLCs out there with ghost mortgages and loans that bank underwriter’s did not do their due diligence on before issuing. They think they have a first position loan but if those properties burn – they are SOL!! This problem makes 2009 look like a molehill. The debt obligations that are piled up on the same commercial properties is beyond catastrophic. & Don’t get me started on non profits using and abusing public tax money! I can’t even think of a brick and mortar business that does everything by the book and has operating capital at their disposal. Too much red tape to get anything done within reasonable prices and timelines.

Most of the loans on real estate are NO LONGER WITH BANKS so it may be a real mess, but even if it blows up will have little impact on banks.

Powell isn’t following a tight money policy. Why do you think the U.S. $ is falling?

The dollar surged through Dec 2024, and then fell off from a very high level and has now stabilized at a still fairly a high level. Look at a broad index (not the EUR dominated DXY) such as the Fed’s “Broad Dollar Index”.

Click on “Max” which shows the index back to 2006. You’ll see that the index value is still very high, that is rises or falls periodically, as you’d expect from a currency that is being traded, and that it is now higher than it was in June.

https://fred.stlouisfed.org/series/DTWEXBGS

The NOMINAL US DOLLAR BROAD fell from 2025-01-10 130.0513 to 2025-08-15 120.7606

Sometimes all the market makers get things wrong. The dollar will continue to fall if Powell cuts rates.

The complaint from the left about corporate profits has been solved with tariffs, and it is revealing. As much as they hate corporations, they seem to hate protecting American jobs even more. Let that sink in. The question of where the incidence of a tax will fall is always central to the debate. A shock to corporate profits and a benefit to workers was not an unforeseen outcome.

I’ve always said that the longshoremen’s union is the union that should get everything it demands. Raising the shipping cost doesn’t impact the consumer. It impacts the China factory.