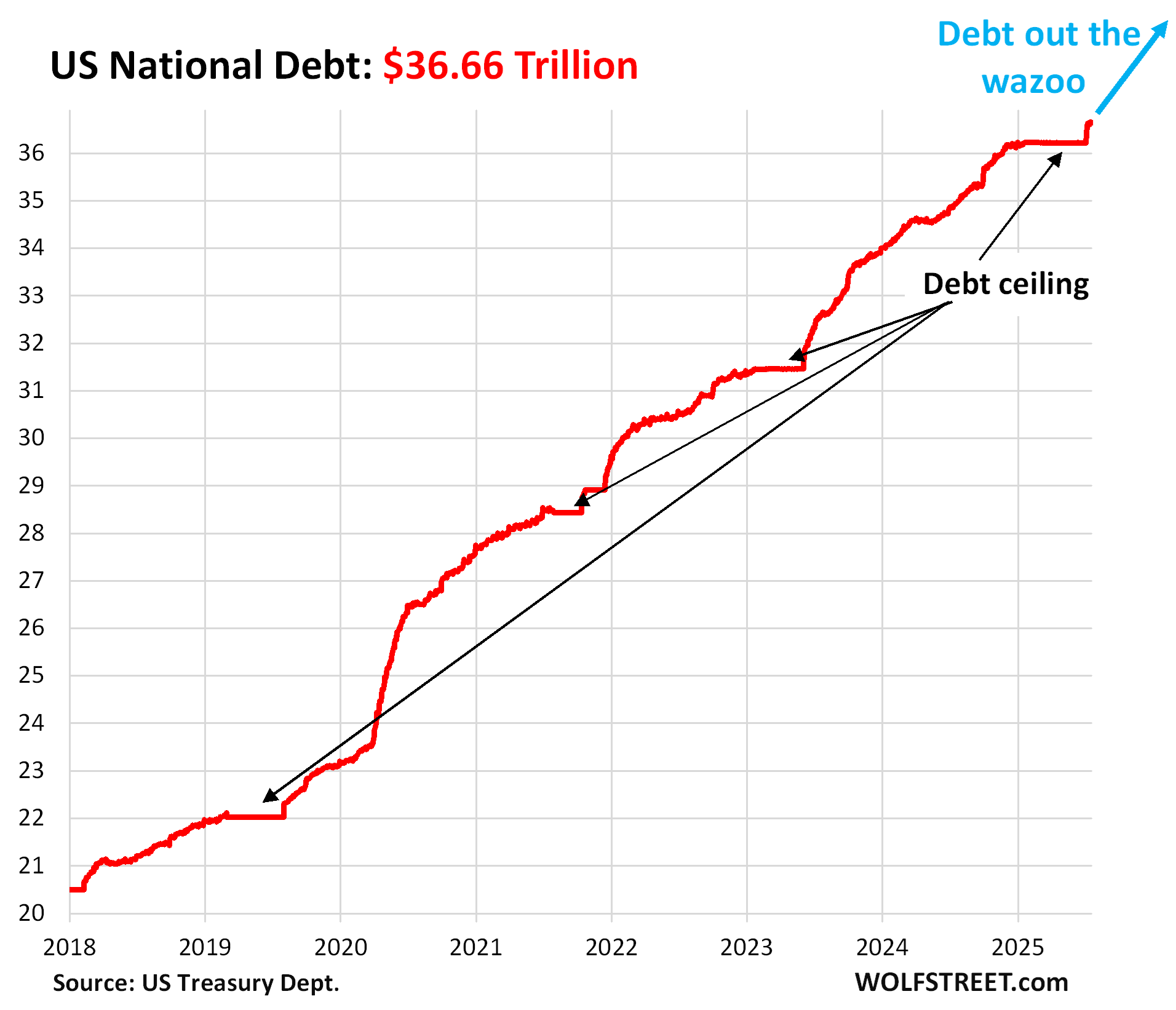

US Treasury debt surged by $441 billion since the debt ceiling, to $36.7 trillion. Foreign demand for this stuff is an increasingly important issue.

By Wolf Richter for WOLF STREET.

The recklessly ballooning US national debt has surged by $441 billion in the two weeks since the debt ceiling was lifted, and by $1.71 trillion in 12 months, to $36.66 trillion. How this debt will blow out during the next recession when tax receipts plunge and expenditures explode is not anything we’d want to even think about.

Will foreign investors continue to buy this debt or will even more of it have to be absorbed by domestic investors? That question is high up on the worry-list. So far, there has been enough demand to keep long-term yields relatively low in this inflationary environment, with the 10-year yield currently under 4.5% and the 30-year yield at around 5.0%. A lack of demand would push Treasury yields up, and mortgage rates with them – until enough new investors find it appealing and buy it. So we keep an eye on who is still buying this debt.

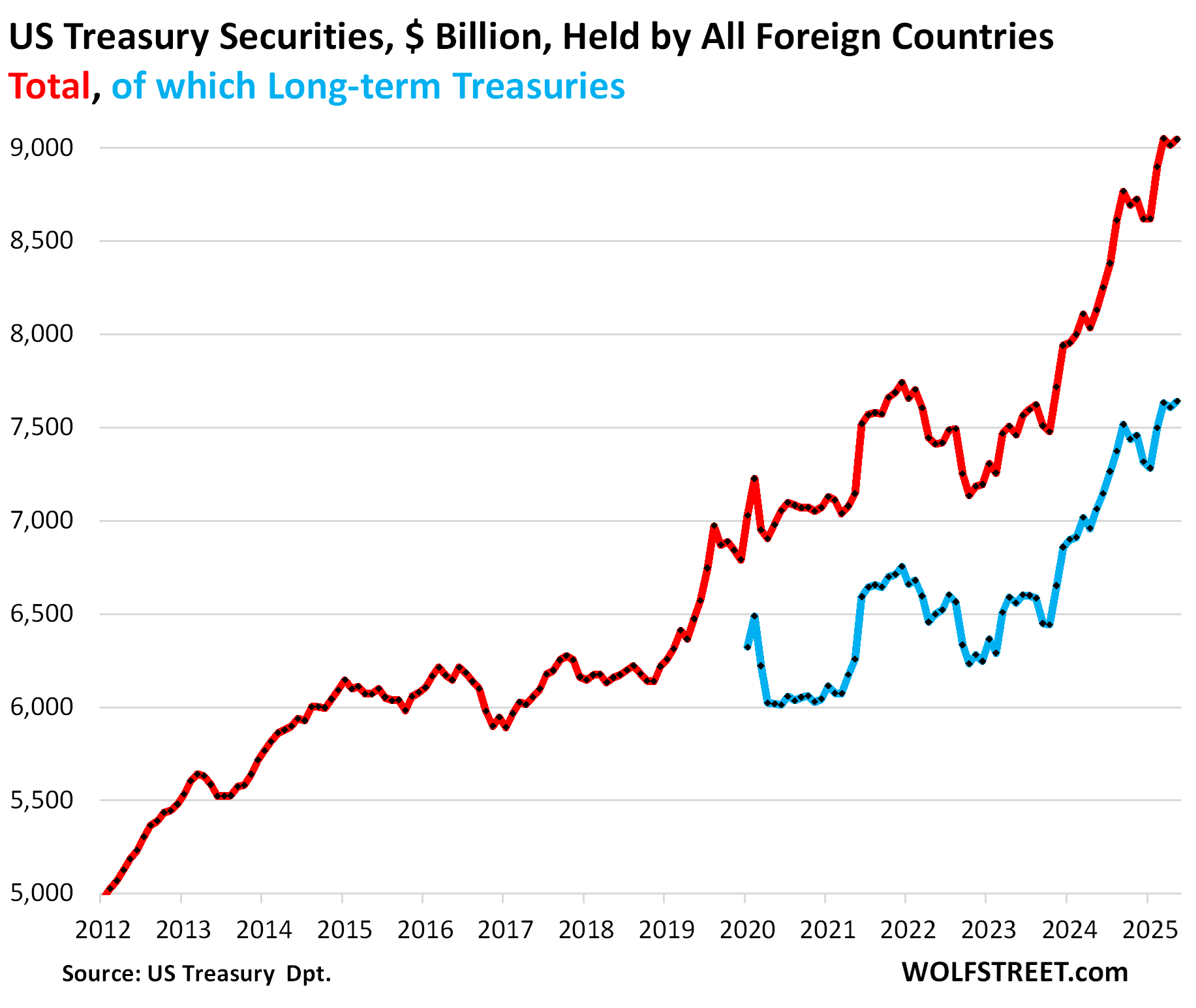

Demand from foreign investors.

Foreign investors increased their holdings of Treasury securities by $32 billion in May, and by $915 billion year-over-year, to $9.05 trillion, just a hair below the record two months earlier, according to Treasury Department data Thursday afternoon (red line in the chart below). Of that total, $7.64 trillion (84.5%) were long-term Treasury securities (blue), and the rest were short-term T-bills.

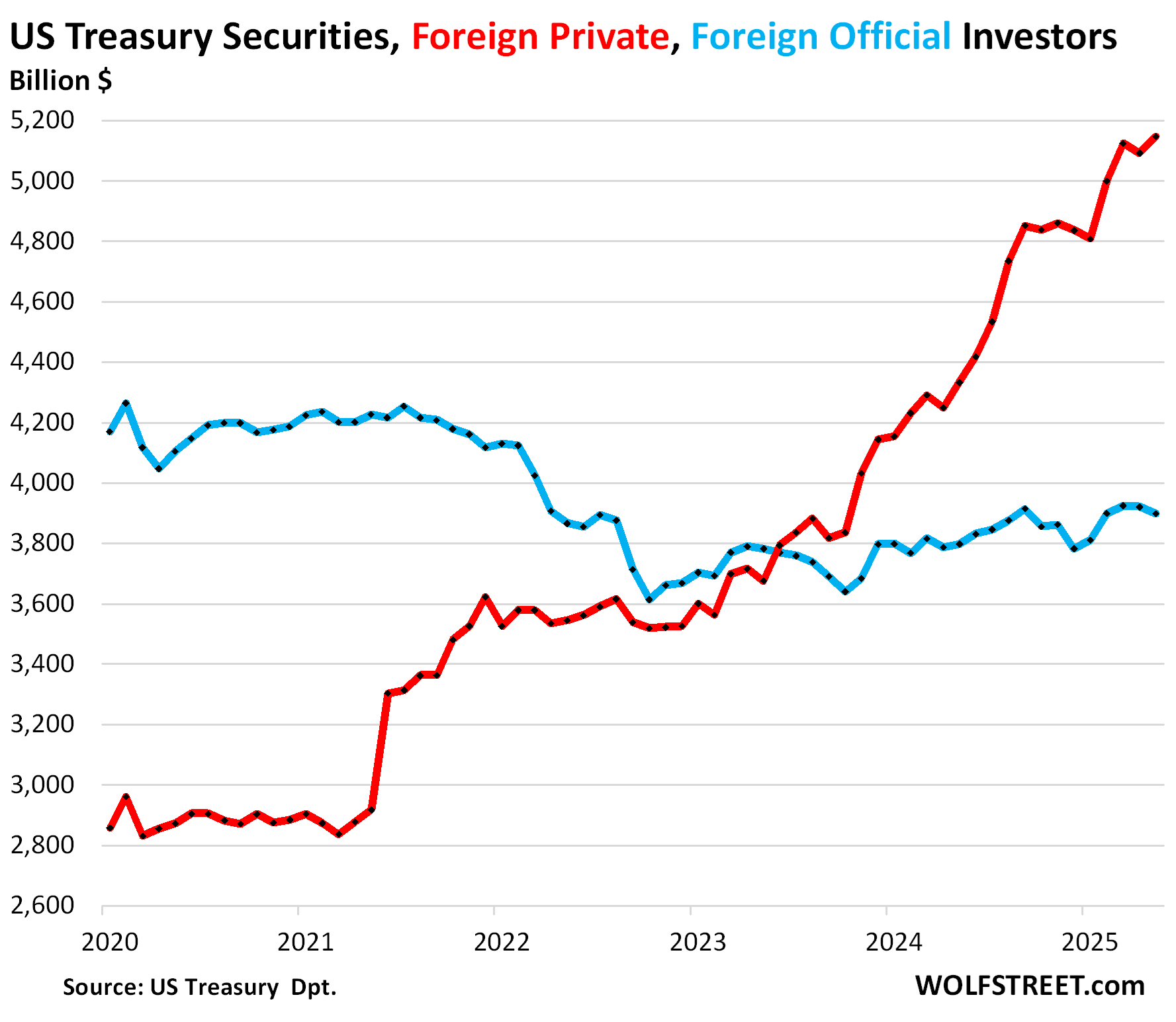

But “foreign official” holders, such as central banks and government entities, have trimmed their stash of Treasury securities over the years. And their holdings dipped again in May to $3.90 trillion (blue in the chart below).

Private foreign investors – such as financial firms, companies, bond funds, individuals, etc., in foreign countries – have piled on Treasury securities from record to record. In May, their holdings jumped by $55 billion, and by $815 billion year-over-year, to a record $5.15 trillion (red).

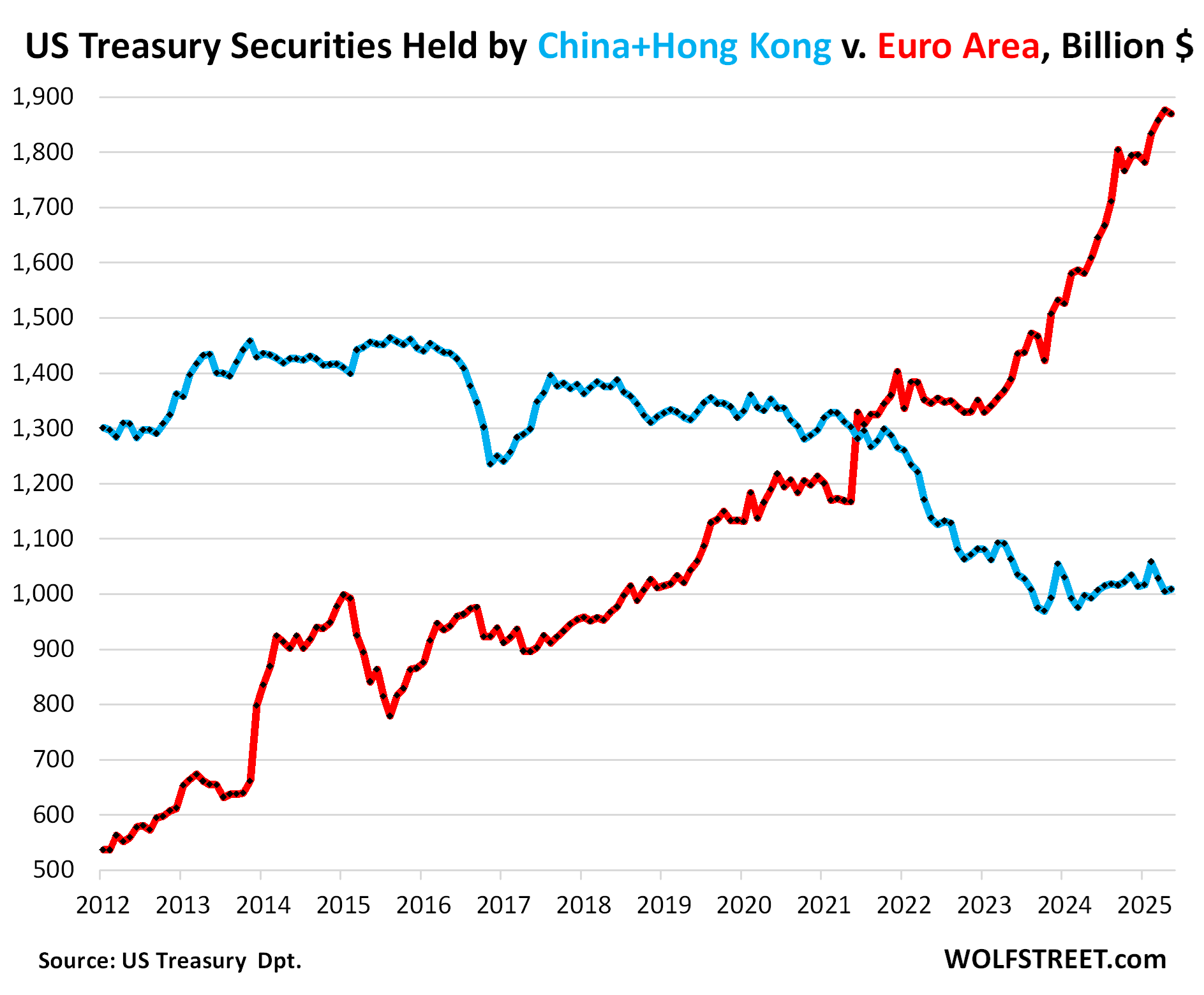

China and Hong Kong v. the Euro Area.

China and Hong Kong combined have reduced their holdings from $1.45 trillion in 2015 to $1.01 trillion in May, up marginally from the low point in October 2023 when they ended the years-long process of unloading.

Month to month, the holdings of China and Hong Kong combined ticked up by $4 billion, and year-over-year by $16 billion (blue).

The countries of the Euro Area have bought US Treasury securities hand-over-fist for the past 12 years, more than tripling their holdings, from $534 billion in 2012 to $1.87 trillion now (red).

Month over month, their holdings declined by $6 billion from the record in the prior month. Year-over-year, their holdings surged by $261 billion.

The biggest holders in the Euro Area are the financial centers (Luxembourg, Ireland, Belgium) and France, whose banking system also functions as a global financial center. Their combined holdings, at $1.53 trillion, account for 82% of the Euro Area’s total holdings. More in a moment.

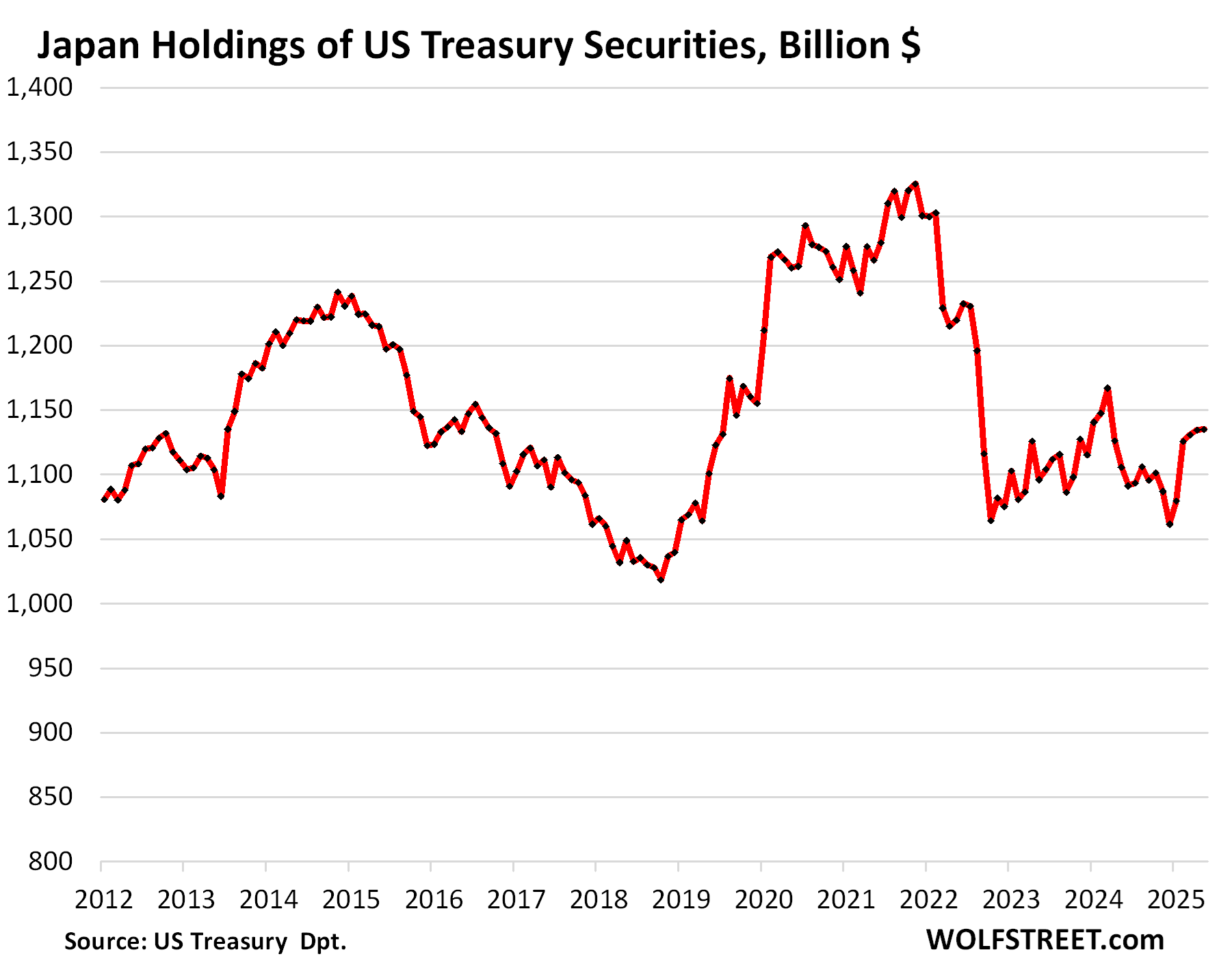

Japan’s holdings of Treasury securities were roughly unchanged in May from April and rose by $29 billion year-over-year.

Despite the large fluctuations over the years, current holdings are roughly where they’d been 12 years ago.

Since 2022, Japan has tried to put a floor under the plunge of the yen, and in the process sold large amounts of its dollar-holdings, including Treasury securities. The Bank of Japan is now engaging in QT and has accelerated QT, which may have been more important in forming a floor under the yen, than the government’s sporadic foreign currency interventions.

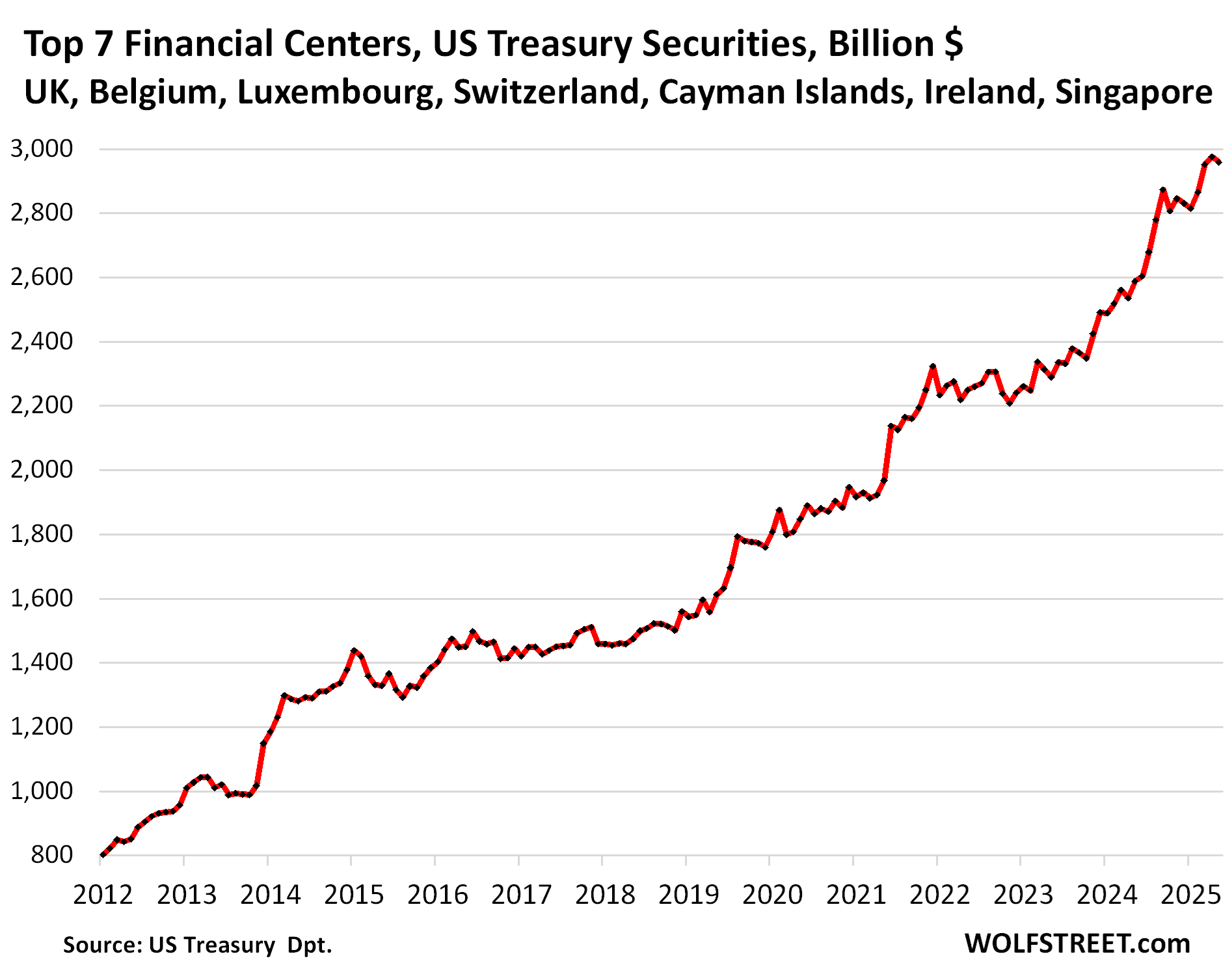

The seven largest financial centers have been on a massive buying binge. Their holdings surged to a record in April, but in May declined by $17 billion, to $2.96 trillion. Over the past 12 months, their holdings surged by $370 billion (+14%!).

But a portion of the holdings at these financial centers are held by US entities. These countries specialize in handling the financial holdings of global companies, individuals, and governments. Ireland is a favorite for US Big Pharma and Big Tech to store their profits. Belgium is home to Euroclear, which has $40 trillion in assets under custody for companies, governments, and wealthy individuals around the world. The United Kingdom here means the “City of London,” the top financial center in the world.

Changes in May, and total Treasury holdings:

- United Kingdom: +$2 billion, to $809 billion

- Cayman Islands: -$7 billion to $441 billion

- Belgium: +$4 billion to $415 billion

- Luxembourg: +$2 billion, to $413 billion

- Ireland: -13 billion to $327 billion

- Switzerland: -$7 billion to $304 billion

- Singapore: +$2 billion to $249 billion.

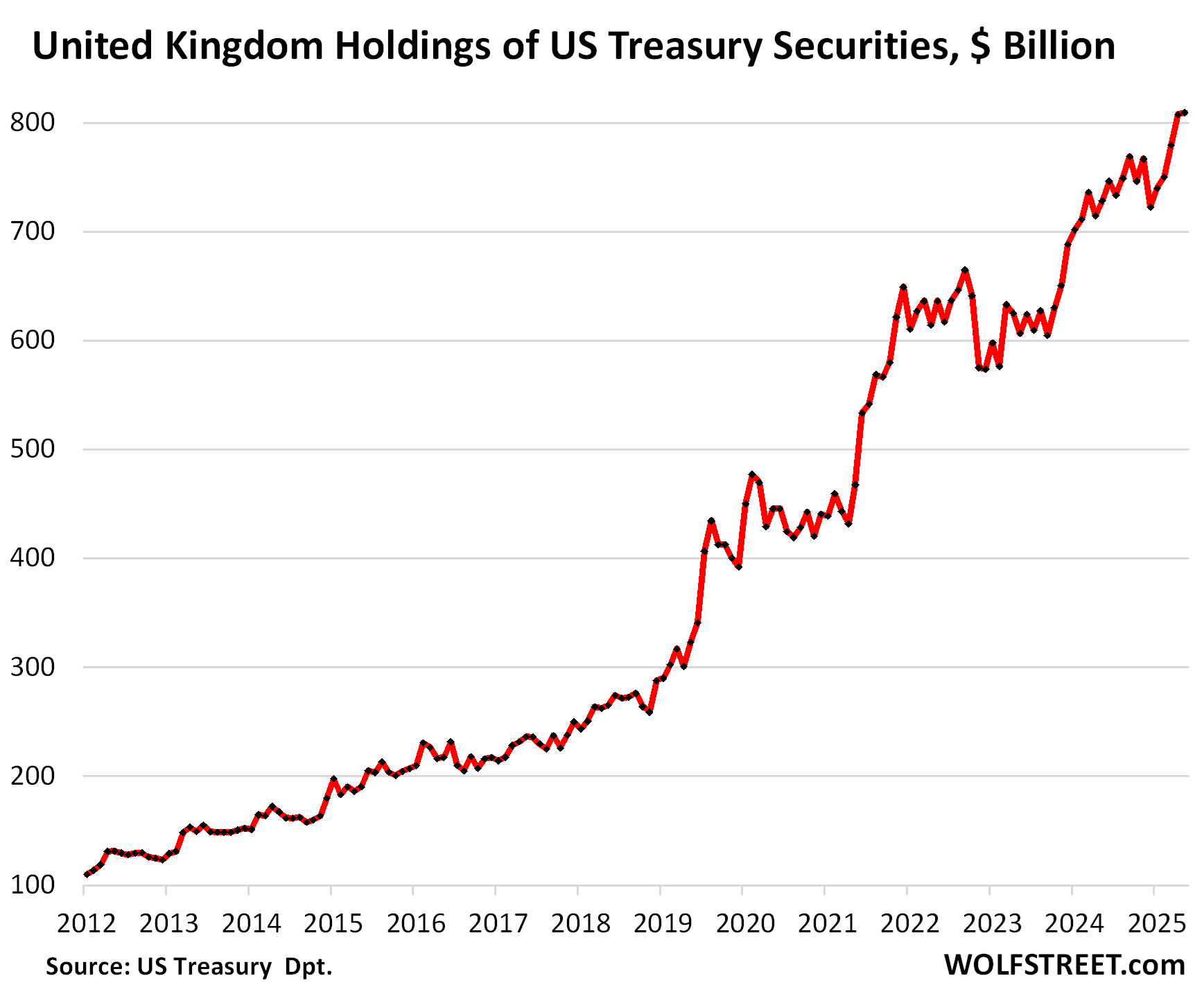

The United Kingdom — actually the “City of London” — is by far the biggest financial center:

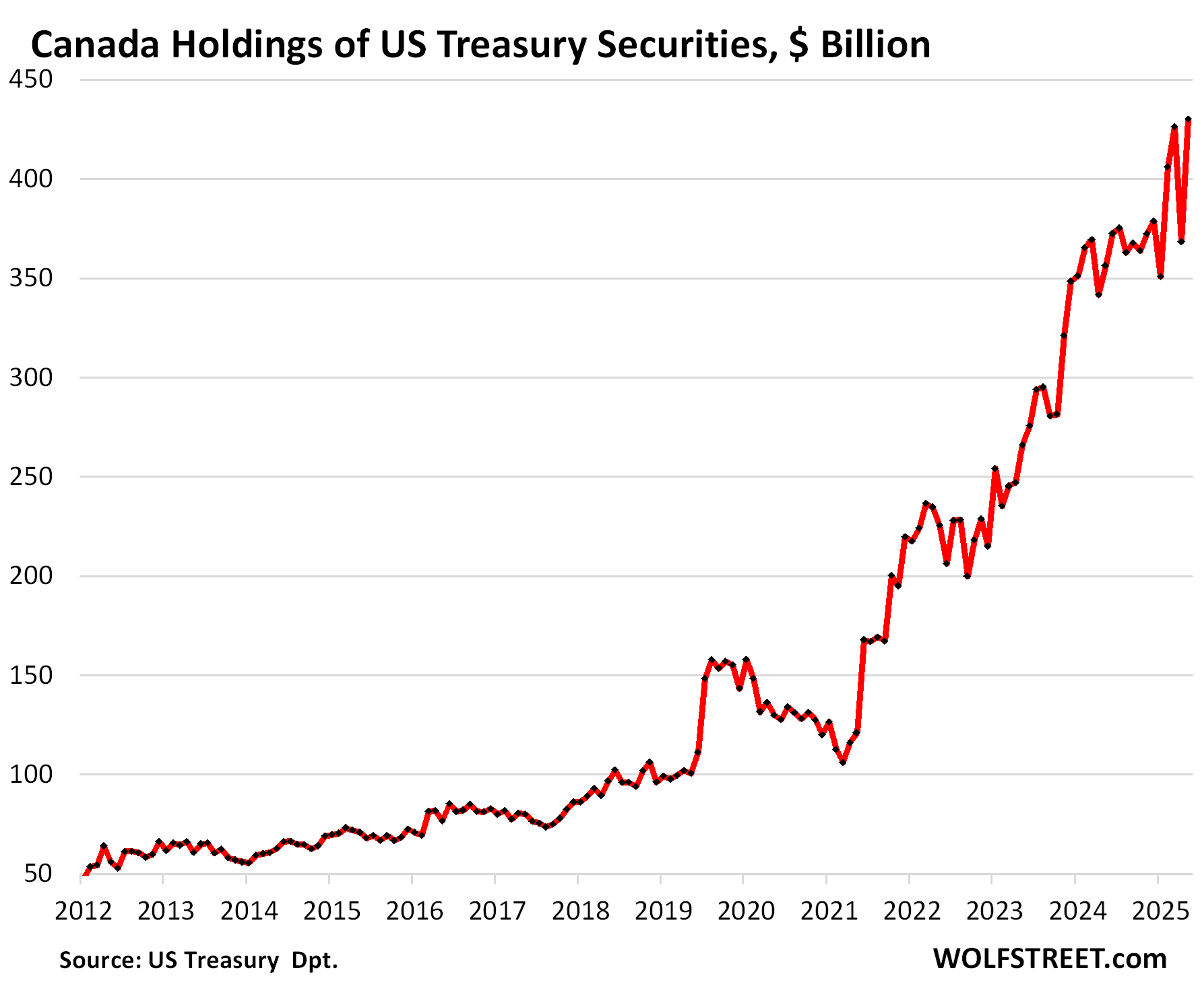

Canada’s holdings majestically re-spiked by $61 billion in May, to a new record of $430 billion, undoing the massive plunge in April.

The trade chaos, which is intensely felt in Canada, has introduced unprecedented volatility in its Treasury holdings. But but but… they hit a new record. Since March 2021, holdings have more than quadrupled!

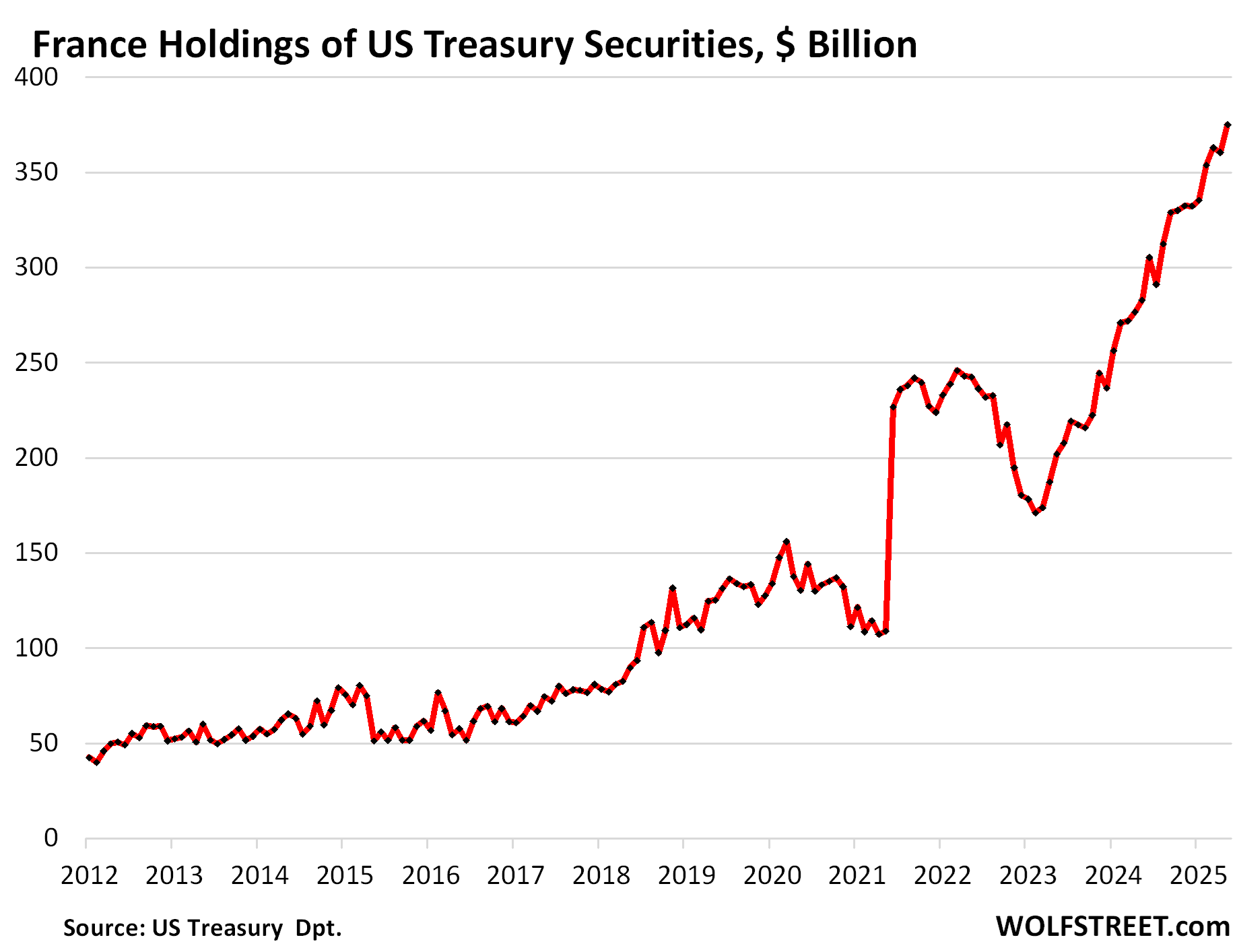

France’s holdings jumped by $15 billion month-to-month, and by $92 billion from a year ago, to a record $375 billion. France’s megabanks are global financial centers.

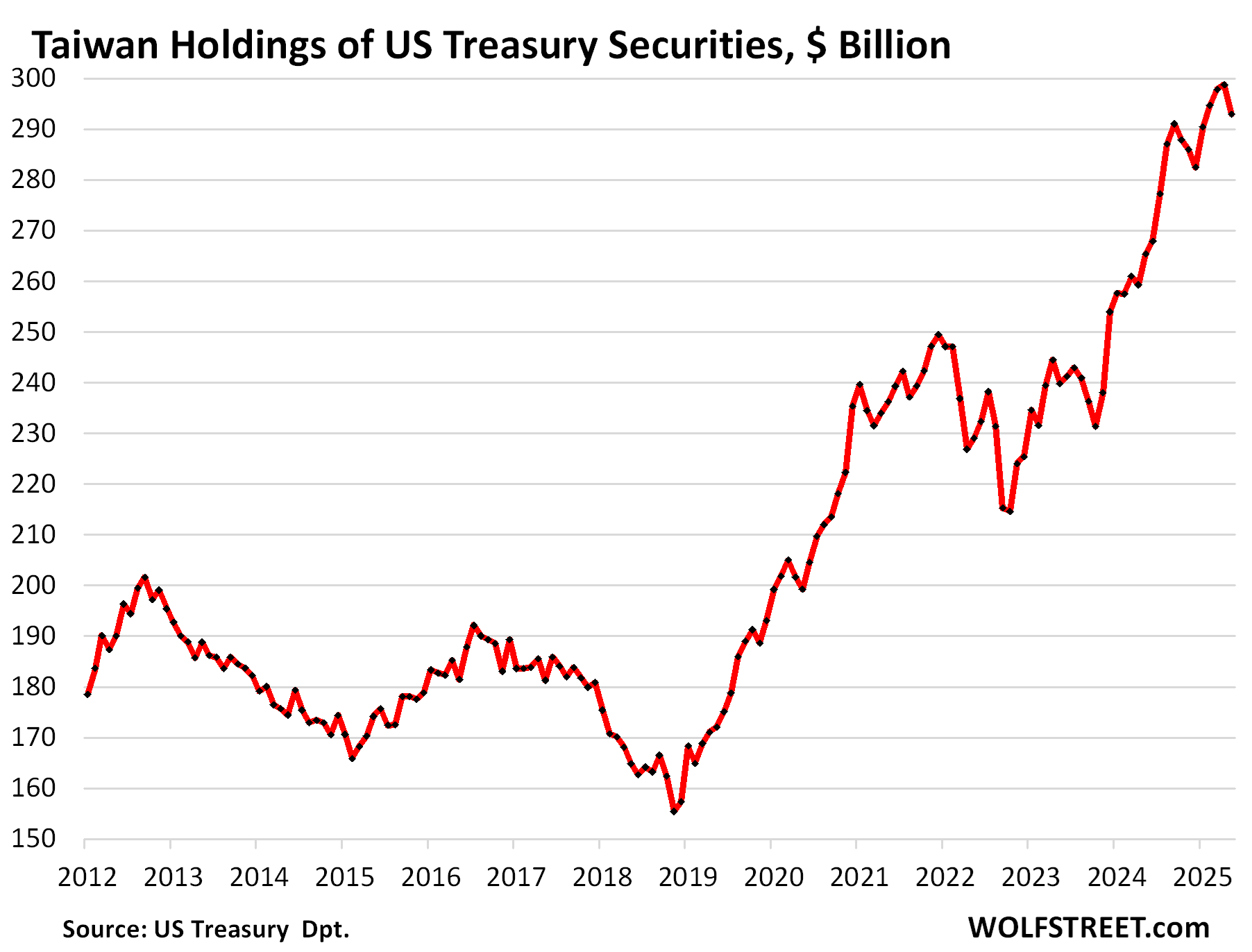

Taiwan’s holdings fell by $6 billion in May to $293 billion, but were still up by $28 billion year-over-year:

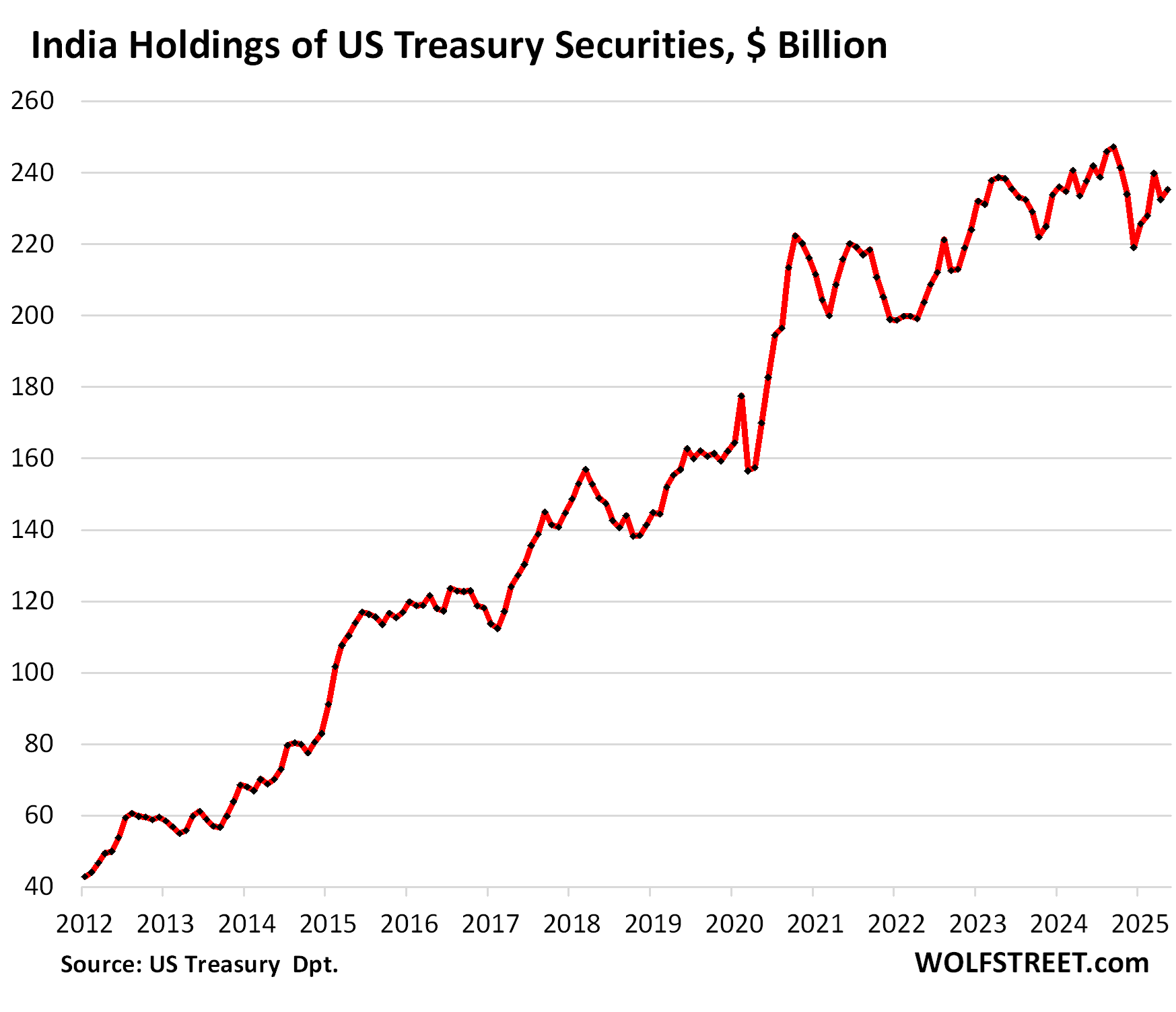

India’s holdings edged up $3 billion in May, to $235 billion, but were still down by $2 billion year-over-year. The high was in September 2024 at $247 billion:

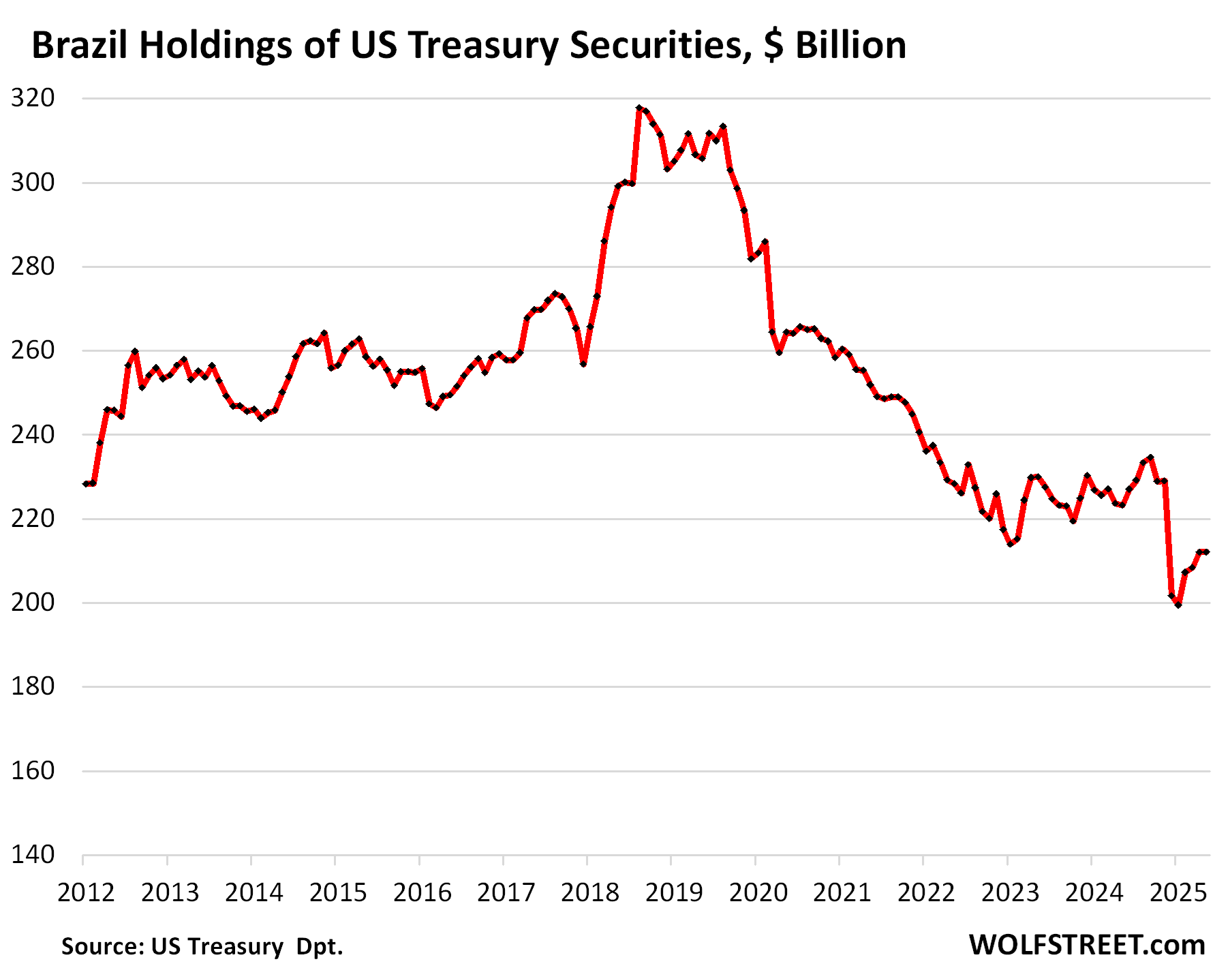

Brazil’s holdings were roughly unchanged at $212 billion in May, and down by $11 billion year-over-year. Since the peak in 2018, its holdings have fallen by one-third:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The graph showing the National debt and it’s escalation from 2018 to current is absolutely mind boggling.

Have a fantastic weekend.

Many Millennials and Gen Z helped current administration to win the election…which is adding $4T to debt. 20% of republican congress members are millinials.

Yes, they too joined the debt holders club.

Wrong sir as of March 2020 Congress was made up of Gen X and Millennials creating $20 Trillion of the $35 Trillion National Debt.

We are all complicit in this financial monster. If you voted you are part of it because all parties have kept this thing doing. If you didn’t vote, same. I gave up voting awhile back because I was no longer willing to throw my support to someone I didn’t support. I’m in it like the rest, just the same.

It’s total effing BS that the politicians are doing this to the country, and cannot be stopped.

Well according to the GOP they have an overwhelming mandate to do what they are doing.

It’s bipartisan – the UNIPARTY.

I don’t even think it’s party specific. It’s baked into the system. People will always vote for funding that is beneficial to them, and it’s not just social programs (though that is a huge part of it). We tend to also want things like funding for the military bases or industries in our area to keep the local economy strong. We expect our representatives to “bring home the bacon” or we promptly fire them. And we hate… HATE taxes. So we vote yes for stuff and vote no for ways to pay for stuff. That’s always been the mandate, regardless of which party is at the wheel. The sickening debt graphs in Wolf’s articles are not just expected, they’re really the only possible outcome.

Boggles my mind who commits their long term capital for such low yields. I guess the saying is still true; a sucker is born every minute.

For decades, the suckers have been conservative investors in fixed income who have subsidized profligate fiscal and monetary policy, as well as private risk-taking.

They’ve earned a yield, but it has been well below RE and stock market gains.

One has to wonder if conservative investors will continue to be the pinata at the party. Politicians and monetary authorities seem to allow for that.

With so much debt in the system esp. Govt debt, I see , inflating away the debt as only way out unless Govt contains deficit spending which would not happen. It basically means higher inflation, higher asset prices , devaluation of USD w.r.t. purchasing power.

Which benefits………THE PIGMEN WITH ALL THE ASSETS.

Depth, instead of name calling, suggest buying some assets for protection.

Hey, it worked for Germany in the 1920’s! It’s much easier to pay off dollars of debt if your dollar is worth 1/10th as much!

Bitcoin might be a balance?

“higher asset prices”…you mean like with real estate rolling over all across the US?

Here is a remedy for your boggle. When one has been successful enough to retire on a large stash, one may not need to continue wealth building. On the contrary that one may be quite content to safely spend the adequate cash flow enjoying time left on earth with zero concern for loss of capital.

Very true.

If you are sitting on [tens +] millions of dollars of assets then a low but very safe return will yield more money than you will “need”, even with an affluent lifestyle.

Why take on more risk for that private jet plus the custom yacht? Dial it back, kick back, and relax.

It’s not their capitol, and ~ they are convinced that it is safe…

After ask it us the reserve currency of the world.

The US dollar has value, and it will ~ until it doesn’t. My thought is that it will last a long time longer than the pessimists among us think…

“The US dollar has value, and it will ~ until it doesn’t.”

True but there are ways of looking at things that are less common but useful.

1) The Long Night of ZIRP (really, basically from 2003 to 2022, with interruptions) stripped away significant “value” from the USD by essentially destroying its earning power in safe/low-volatility USD investments.

2) Real product inflation more explicitly/profoundly destroys USD value by directly destroying the USD’s “store of value” function.

My point – ZIRP was a 20 year warning. And post 2022 inflation has exposed just how suddenly/lastingly USD value can truly evaporate.

But America’s 70 year old degenerate political class has grown very comfortable/hopelessly addicted to using various techniques to transfer the value of private USD savings into immediate “public” expenditures – which the degenerate political class controls.

And this terminal process has been accelerating.

Its people with fixed long dated obligations, and matching assets to those obligations. Not everyone is a retail investor.

The USA has the highest central bank rate of all the first class countries:

Barbados 2%

Canada 2.75%

China 3.1%

Denmark 1.6

Mexico 8% (ugh – country stability?)

South Korea 2.5%

Sweden 2%

Switzerland 0%

UK 4.25%

Developing nations – much higher. I assume it also has to do with country stability

For a good laugh, look up the June 20, 2024 post from the Congress House Budget Committee titled “Via Wall Street Journal: Soaring U.S. Debt Is a Spending Problem.”

It blasts the Biden Admin for using executive orders for irresponsible spending and clearly targets the Inflation Reduction Act renewable energy subsidies, justified as arguing they are irresponsible spending.

The clincher: “If Congress continues to do nothing to rein in out of control spending, the cost to Americans will be great. Since Biden took office, 10-year deficit projections have grown by 80 percent. The revised baseline could be the final wakeup call of the 118th Congress.”

I never understood how the Inflation reduction act would reduce inflation by increasing spending. Am I missing something?

You might be missing that the name was about political communications, like OBBBA, the ACA, etc.

When bills are going to get a lot of public attention, they are an opportunity to send a message (often symbolic) about political priorities.

And Congressors are constantly naming bills in ways that seem ridiculous, because the person wants to trot out the bill while campaigning in the next cycle.

Examples of bills in Congress now:

– Greenlighting Growth Act

– Equal Opportunity for All Investors Act of 2025 (but I thought DEI was dead?)

– La Paz County Solar Energy and Job Creation Act

– China Financial Threat Mitigation Act of 2025

Never, ever listen to what the government SAYS. Always watch what they DO. In most cases what they do will be the exact opposite of what they say. “Inflation reduction” meant “inflation acceleration”. “Big beautiful” means “big and fiscally irresponsible”.

Exactly.

Ignore “say” entirely.

Watch “do” closely.

That’s why the Legacy oligopoly MSM (1950-2000) was such a useful, powerful tool for the political class.

Our debt is 37 trillion dollars and going up at $2 trillion a year. 99.5% of federal revenues go to 4 programs:Healthcare, SS, interest on the debt and defense. Every other dollar the feds spend is borrowed against our grandkids future. I think that is criminal.

SS is a self-funded program and is not part of the budget. Go try again. People need to quit posting this BS about SS.

????

I thought the US government “borrowed” the SS and was to pay back when needed. Pay with what?

This stupid ignorant BS has to stop. It just gets you blacklisted here for abusing my site to spread bullshit and lies about SS. Go somewhere else to do that.

Read this:

https://wolfstreet.com/2024/11/04/social-security-update-fiscal-2024-trust-fund-income-outgo-and-deficit/

I have been reading blog posts and posts on X by Brad Setzer and Michael Pettis for a while now and have come to (somewhat) understand their explanations of the role that (capital account) foreign accumulation of US assets plays in the financing of our (current account) trade deficits. It will be interesting to see whether the current administrations tariff policies have an appreciable impact on the deficits and foreign asset accumulation. I am curious as to whether the readers here —or you, Mish— expect to see any material changes to this foreign asset accumulation resulting from the tariffs? I would also note in this regard that Pettis is no fan of the tariff policies and has written about alternative proposals to tax (via WHT on interest payments) foreign asset accumulation.

I didn’t see Freedonia on the list.

XC – …you never fail to crack me up and put a grin in my day. Mille grazie!

may we all find a better day.

I thought we were already over $37T. Now I can sleep easy.

What’s the breakdown then?

Fed $4.1

SS fund $3?

Foreign $9.05

US private and local governments…$20+ trillion??

Short term money is probably happy enough making around 4.5% right now. I guess I am. I continue to believe the solution is going to be a big increase in the payroll tax structure to “shore up your Social Security”.

From a month ago, all the domestic holders (plus foreign holders):

https://wolfstreet.com/2025/06/20/who-held-or-bought-the-huge-us-government-debt-even-as-the-fed-shed-treasury-securities-in-q1-shedding-light-on-this-iffy-situation/

Thank you, very informative!

What I find incredible is the extra trillion that State and local governments are sitting on compared to just five years ago. A near tripling of cash reserves. This actually provides some real justification for the Federal government moving costs (education) back to the States. I’m all for States and municipalities having some rainy day funds but there’s a reasonable limit.

I also find the share of the debt held by US citizens and nonprofits at well under 10% to be interesting. Most people just don’t know about or think about the national debt. They are correctly assuming that “someone else will buy it” and keep the party going. If inflation eats the majority of the return on those bonds then it’s just China or some insurance company that takes the loss.

I love the Canadian chart! I wish they would stop pouting like children and just come back to the negotiating table and get a fair deal done.

A famous Churchill quote about a tiger comes to mind.

oh and their leader was the head of the Bank of England. Which kinda blows my mind

Well, he was the leader of the Bank of Canada before he was the leader of the Bank of England, eh?

Winston Churchill referencing tigers is: “Dictators ride to and fro upon tigers which they dare not dismount. And the tigers are getting hungry.”

One point is that the base rate as set by the Federal Reserve should be set according to the real economy, however, if you issue so much debt then the quantity starts to put push the real interest rate up, as government spending crowds out private investment.

The US economy is now impacting other countries economies. In the case of the highly indebted UK yields have had to rise not just because of a complete lack of faith in the central banks stoicism in combating inflation, but also because the UK has to demonstrate better value than the USA. While Japan now has an absurdly undervalued currency.

The strains starting to show up everywhere.

For the USA I wonder if Trump realises that while certainly the economy benefits from a reduction in taxation, there is the cost of redirecting 3 trillion USD away from private sector -investment- to public sector expenditure. Anyway, none of the countries seem able to rein in spending so we will see which one blows up first. The UK has been put on notice already by the bond markets.

LoL, our bond market is just beginning to awaken. Just wait as endless streams of refinance and new issuance come to market, especially as the Medicare and Social Security Trusts continues to run down.

Wait until the markets have to eat $20 trillion in issuance in one year.

The conclusion of the recent 2025 Brookings Institute paper on US debt was hilarious:

“By contrast, the U.S. benefits from the

strength of its institutions—including CBO, which pro-

duces high quality, non-politicized analysis; statistical

agencies that produce data independent of political

agendas; and an independent Fed. These agencies

help to maintain investor confidence by preventing

sudden shocks to the market from information gaps or

manipulation. Indeed, CBO has been warning for years

about the pressures underlying rising debt, and CBO’s

projections of the rise in debt from 2024 on have been

fairly stable over time.”

None of this will exist in two years, and our debt market will be out of control as a result. CBO, already puking fiction and ignoring real effects as a result of political pressure.

Welp, the independent Fed is also under severe attack, just like our Supreme Court was coopted.

It is obvious that our political system is failing, and with that failure, our entire system will gradually erode into nonexistence.

As I stated before, we have chosen to accelerate our decline, chosen policies that in the whole ensure the decline will be difficult to reverse with untenable political damage that is the future of failures of our monetary and fiscal systems.

They are inseparable, and solutions are going to end up so painful, they will be impossible.

Apres moi, le deluge.

I’m one of the “Foreign Private” buyers. For the first time in many years, Treasuries are relatively attractive investments. I can’t find any other decent invesments. Credit spreads are low and US sovereign debt offers relatively attractive yields. Equities – particularly US equtiies – are priced to perfection. Property is also expensive, particularly if you believe bond yields are likely to stay high. Long duration treasuries offer a postive real return in all but the most unlikely scenario where inflation considerably exceeds the Fed’s target level for a prolonged period. And there is zero risk with Treasuries. There is no scenario where the US government does not repay its debt in full. Plus there is no witholding tax on Treasury coupon payments.

There’s no such thing as zero risk.

Native born US citizen Gen-X wants a word, please. You may wanna tamper down on that ‘zero risk, no scenario’ sentiment.

Unlikely, yeah sure. No scenario? Not so fast, my friend.

Heard today Inflation 3.5 to 4% before year end.

Bleh

For me as a non-US investor, there is more and more risk in holding assets in the US. Some day the US-gov might decide that foreigners may not take out their dollars, because they live in the wrong country.

Words of that kind have already been used.

Despite the nice yield, compared to the Euro-world, i don’t dare to buy US-debt because of that risk.

I am somewhat shocked to discover $441B new debt has been issued since the debt ceiling was raised. I follow the ONRPP and Treasury General Account balances, and both seem to have barely moved in that time.

1) Wasn’t the reasoning for slowing QT (again) that when the debt ceiling was lifted it would quickly empty the ONRPP (and then move onto bank reserves?)

2) Shouldn’t all this new money from this new debt show up in the TGA?

Republicans are in charge, and so there was no actual debt-ceiling fight down to the wire, and the TGA was never drained to near-nothing. There was lots of cash left. So there is no real urgency to raise new funds. In addition, the tariffs brought in $80 billion suddenly, and the April 15 and June 15 were record tax collection days. So the government collected more in cash and didn’t run down the checking account before the debt ceiling was lifted.

After the 2023 debt ceiling fight, which was down to the wire with a Democrat in the White House, the debt exploded by $1.3 trillion in three months.

Thanks Wolf. I get that there was not a huge shortage that needed to be quickly covered, but $441B is still not nothing, and I am surprised it hasn’t show up in the ONRRP or TGA balances, which have remained essentially flat for the last couple weeks.

Even if foreigners scooped up much of the new debt shouldn’t a lot of that have come from the ONRPP? Additionally I would think the TGA balance would have swelled from the proceeds of all that debt issuance (on top of the additional tariffs revenue)?

Might it be that the 441B is just rollover of maturing debt and replacement with new debt. Minimal net cash change ? I aked myself the same question you raised.

I believe the Treasury has said their intention is to run the TGA back up to 800 billion. But their more favorable cash position gives them more room to manage that return with the least impact on reserves and market ?

danf51

“Might it be that the 441B is just rollover of maturing debt and replacement with new debt.”

No, this is the net increase in the total debt, not issuance. Issuance for rollovers and new issuance were much bigger.

Wolf: Another good factual article. Do you write , more of an opinion articles

I am interested in your opinion as to where this all ends. Bond market, even with high Treasury rates, refuses to buy the debt? Or, hyperinflation someway makes the debt serviceable? Or, a US default? Please take us through your analysis. Thx.

There will always be a buyer if the yield is high enough. At the expense of other assets such as stocks.

I don’t have an opinion on that because there are too many variables. My plastic crystal ball, made in China, is too crappy to nail down where this is going to go. My most likely scenario is muddling along with higher long-term interest rates, continued reckless Congresses and administrations, and higher but not crazy high inflation. I’ve been through the 1970s and 1980s. This economy can handle a lot of shit.

Funny in a way that you would offer only,

”My most likely scenario is muddling along with higher long-term interest rates, continued reckless Congresses and administrations, and higher but not crazy high inflation.”

The two most financially adept older guys I knew back in the 1970s era when I was thinking along the lines of ”the world is going to hell” such as these days, said exactly the same.

The black swan may be geopolitical risk as we back our “adversaries” into a corner. The US Nato General talking casually about the ease with which Nato Forces could take Kaliningrad.

Beware when military arithmetic begins suggesting “use it or lose it” in the face of incessant hostility from your powerful neighbors.

I would suggest you order a true crystal Daum or Baccarat crystal ball from France to get the best and clearest picture!

Buyers of Treasuries are picking up nickels in front of a steam roller.

I disagree. 4.3% and paid back in full in 8 weeks. Not nickels nor a steamroller. Decent return and zero risk.

Longer term has more risk like most any asset.

Amplification: the steam roller is the combination of taxes and price inflation (which may be underreported per ShadowStats plus the govt’s moral hazard to keep the Social Security COLA down). My opinion is that Treasuries are a locked-in after-tax real loss. Not sure why any US taxpayer buys them at this yield.

If you can suggest a low-risk investment that pays more than 4.3% I’m all ears.

And your alternative is ???????

Can’t be the stock market at all time highs and the Buffett Indicator at 2 standard deviations above the historical norm. I’ve seen that movie before. I know how it ends.

>> alternative is ???????

FIVLX is a foreign dividend fund unhedged to USD. GDX looks undervalued. Physical PMs. If one is brave, Platinum may be having a physical short squeeze with implied metal lease rate of 29% p.a.

Those are more risky than the 8 week t-bill.

Well they mainly transport your money into the future without a bank being involved.

Banks profit so much off your money just sitting there.

During a conference call at Bank of America recently, someone complained they were not making enough off of consumer deposits.

It’s literally free money they make off of your money sitting there.

WR: Do you have any thoughts about gold? It had a good run in 24, I see, or imagine, a lot of dark clouds, including the froth in the stock markets.

BTW: I asked Google if AI was over- hyped. The AI response ‘yes’, and went on with reasons.

“The AI response ‘yes’, and went on with reasons.”

🤣 At least, AI is honest occasionally, rather than hallucinating all the time. I also occasionally catch AI when it’s honest.

Don’t fret U.S. Americans.

Plenty of stablecoins are being ‘created’ to soak up all of the excess treasuries required to keep the game moving.

Once BTC reaches a billion the debt will be majikally erased

Obviously not.

Gold will outperform crypto and the dollar.

Gold will plummet to about $20 per pound in the near future.

Sometimes the sarc tag is required.

Tariffs will bring surplus and reduce debts, 27bn in july

With copper, pharmaceuticals coming in mix with higher tariffs and no front loaded imports expect sep, oct to be at 40-42bn.

Thats 5 tn in 10yrs. Top it off with 30pc reduction in education dept, thats another 1 tn in 10yrs

And the source of this bonanza?

Corporate profits so far. They’re all announcing it in their earnings calls. All you have to do is listen. GM for example said that trade policies will take a $5 billion bite out of its profits.

But corporate profits have exploded during the high-inflation years when they jacked up prices out the wazoo and got away with it because consumers were drunken on free money and willing to pay whatever… that’s where part of the inflation came from; so now they’re giving up a tiny sliver of their profits because the free money is gone, and consumers are no longer willing to pay whatever, and companies all know it because they’re dealing with it every day.

SsK, you’re missing something important.

$5 trillion in 10 years. Sure. But you must not be aware that the baseline increase in debt, before the BBB added $3.4 trillion, is approx $18 trillion per year, not counting growth in spending from inflation.

To reduce the debt, that’s going to take $2.1 trillion PER YEAR reduction in spending. $21 trillion. So the $5 trillion in tariff revenue won’t even come close.

There’s a case to be made that the Japanese will be buying fewer US bonds— the election results this weekend set the stage for crazy times to get far more extreme soon.

With massive debt issuance ahead globally and especially the US — seems like foreign buyer patterns will be upended.

The increased likelihood of debt-financed tax cuts in Japan, adds octane to the jet fuel being poured on their deficit black hole implosion. Obviously, the new increased US deficit and debt servicing costs add more fuel to a global backdrop of geopolitical social turmoil …

I think there’s going to be an awakening this week or soon, that a global currency debasement cycle is gaining furious momentum — and a clear demand for higher term premiums wil kick in.

These types of geopolitical risk are obviously being further amplified by tariff confusion — and seems like a lot of carry trade chaos is about to hit.

“Japan could “step into an unknown dimension of the ruling government being a minority in both the lower house and the upper house, which Japan has never experienced since World War Two,” Prof Yoshida said”

And another thing related to treasury stuff —- there’s a lot of serious converging, complex factors colliding, and that goes hand in glove, with way too much complacency:

“The ICE U.S. Dollar Index

DXY

-0.07%

fell by nearly 11% during the first six months of 2025, tallying its biggest decline during the first half of a calendar year on record dating back to 1973”

Redundant

since then (since the beginning of July), the DXY has already bounced by 1.8%.

It was at 100 was it was invented in the 1970s. Now it’s at 98.45. For many years it was a lot lower.

It spiked toward the end of last year, and came down from that spike over the first six months. That’s all it did.

Last September, it was at 100, and now it’s at 98.4, so big effing deal.

Loot at a long-term chart instead of regurgitating stupid outdated headlines.

$439,411,281,813.90 = $36,655,280,579,113.60 – $36,215,869,297,299.70

$441,482,837,931 = $36,655,280,579,114 – $36,213,797,741,182

Wolf,

TGA July16 = $312,085B

TGA July 2 = $372,232B

With $441B in proceed from new debt issuance (plus rising tariff income), I am still struggling to understand how the Treasury’s “checking account” managed to DECREASE $50B in two weeks. Is there a delay in showing up in the TGA, or was there perhaps a massive backlog ($491B?) of unpaid bills that were immedoiately paid off?

Some of this is regular deficit spending…. the US still runs a huge deficit, and new issuance (increases the debt) pays for the deficit.

In addition, during the debt ceiling, the government delays paying for some internal things (“extraordinary measures,” as they’re called). This is why it doesn’t run out of money within two months of hitting the debt ceiling, why the debt ceiling fight can be dragged out for so long.

Last time after the debt ceiling was lifted, the debt jumped by $1.3 trillion in three months, but the TGA rose by only $800 billion. The difference was deficit spending and reversing the “extraordinary measures.”

Thanks Wolf. Are “extraordinary measures” tracked anywhere? The fact that the treasury apparently had $500B in outstanding IOUs in need of immediate payment seems like a big accounting item.

Also do you find it surprising that almost none of this $441B seems to have come from the ONRPP? I realize it fluctuates a lot day-to-day but the impact seems at best minimal which is not what I would have expected for this money supposedly sitting around looking for somewhere better to go.

Did anyone else dig beneath the surface of the June 2025 Month Treasury Report? It showed a $27B surplus, the year prior, June 2024, showed a $65B deficit. Individual income tax revenue was the main year over year difference, to $236B from $185B. Customs up to $27B from $6B. The 27% bump up in income tax revenue year over year looks “extraordinary” to me. Maybe someone can explain this.

June 2025 was first month of June surplus since June 2016. I verified this. This is not the first monthly surplus since 2016, as Jason Smith and others were disinforming on the financial shows. May 2025 showed a $316B deficit and April 2025 showed a $258B surplus. Jan, Apr, Jun and Sep are big revenue months due to quarterly income taxes.

Jan

Total outlays fell by $33 billion in June YOY. You can download the spreadsheet and go through it. It’s kind of tedious. Some departments went up, others went down. On net, outlays fell by $33 billion.

Total receipts rose by $60 billion yoy. Of that increase: +$27 billion additional tariffs, +$51 billion additional individual income tax receipts, +$0.5 billion additional estate and gift taxes, but minus $13 billion in corporate income tax receipts, and a few other smaller items.

US is the cleanest dirty shirt. Treasuries also are paying the highest rates among the reasonably advanced economies. We also have the most technically advanced weapons systems, and Trump is not afraid to use them. We also have huge natural resources, more oil than any other country. If I was a foreigner, I would be plowing into US treasuries. As a US citizen I am plowing into them.

An explanation for the “extraordinary” $51B June 2025 income tax plus up is desired. This amounted to a startling 26% YOY pop. May was up 10% YOY and April was up 11% YOY. The treasury report has a breakdown into withholding and “other” income tax. Each is up individually around 26% YOY. Agree with Wolfs YOY summary including insight into significant $33B outlay reduction.

Download the spreadsheet. You’ll see: stuff bounces all over the place.

Also: record employment, record high wages, massive capital gains, and big quarterly estimated taxes