The massive 10-year home-price spike to 2022 was more than the economy could bear and has done a lot of damage, including to employment, as we can see.

By Wolf Richter for WOLF STREET.

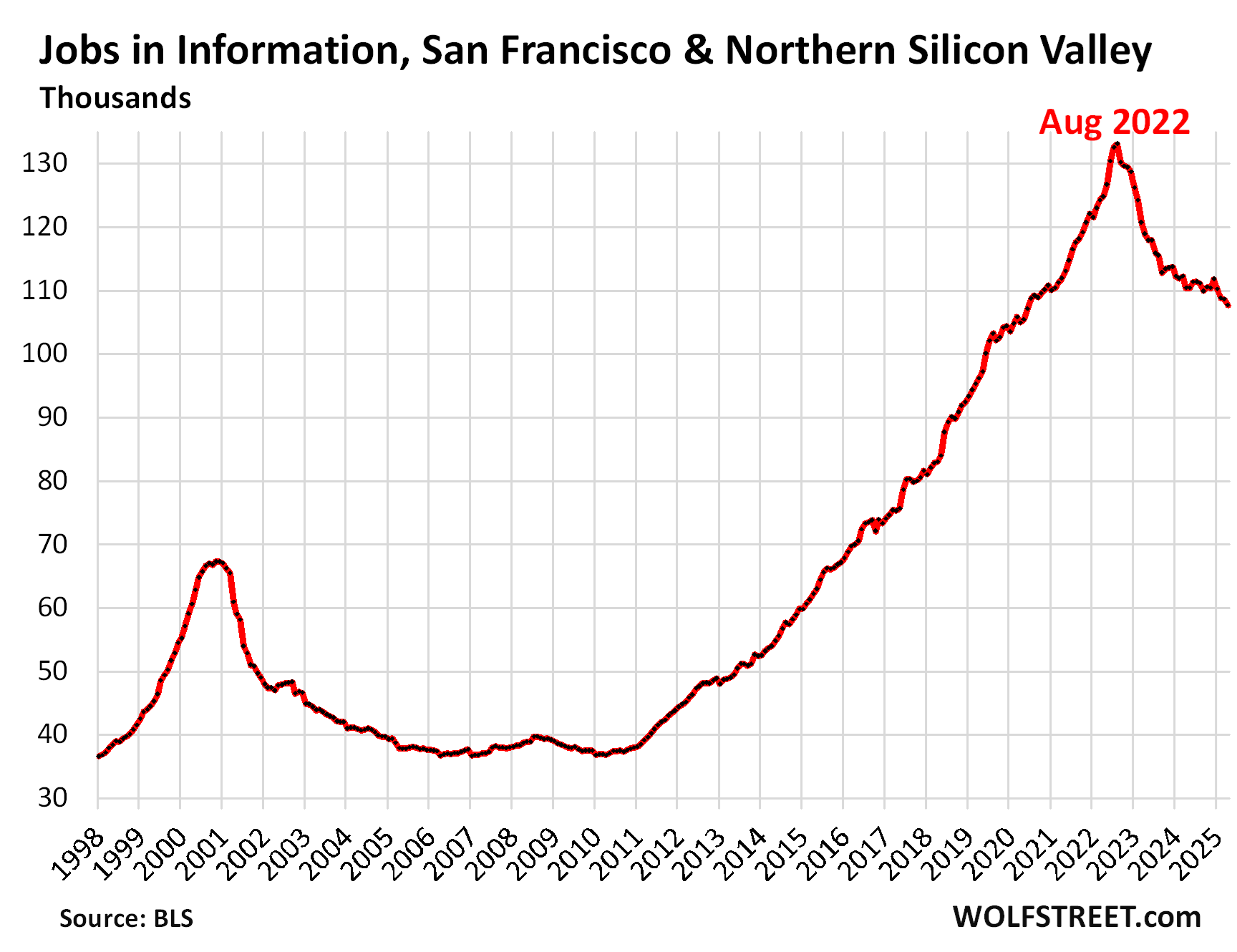

Highly paid jobs in tech and professional and scientific services in San Francisco and in the northern part of Silicon Valley – the San Francisco-San Mateo-Redwood City, CA, Metropolitan Division – started to vanish in the second half of 2022, and this continued through April, despite all the ballyhooed AI-related hiring, per the employment data from the Bureau of Labor Statistics today. And this longer-term trend, along with other factors, is deflating the majestic housing bubble, which we’ll get to in a moment.

Jobs in Information fell to 107,700 in April, the lowest level since June 2020, having now undone nearly the entire hiring boom in that industry during the pandemic. That hiring boom had occurred even as Leisure & Hospitality, Retail, Healthcare, etc. were gutted by massive layoffs.

Since the peak in August 2022, the Information industry has shed 25,400 jobs, or 19% of its total jobs. These jobs are at facilities where people primarily work on web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

During the Dotcom Bust, the Information industry lost 46% of its jobs in this metro, beginning in late 2000 and bottoming out in mid-2006, and then it remained low for another four years, before taking off again. In this tech-employment bust so far, the industry has shed “only” 19% of its jobs.

This metro-level data on nonfarm payroll jobs from the Establishment Survey was released today by the Bureau of Labor Statistics. These jobs are tracked by business location to which the employee is assigned, regardless of where the employee lives. If a worker commutes from the East Bay to an office in San Francisco, it counts as a job in this Metropolitan Division. Same with remote employees.

Despite the job destruction, the Information industry still accounted for 9.5% of total payrolls in April. For the US overall, jobs in Information account for only about 2% of total nonfarm payrolls. That’s how tech-heavy employment in the area is, compared to the US overall.

Professional, Scientific, and Technical Services industries have shed 21,600 jobs since the peak in June 2022, or 9.4% of their total employment. With 207,800 jobs in April, the sector is back where it had been in June 2020.

This big broad sector accounted for 18.3% of total employment in the two-county area. It includes engineering and design services; computer services; consulting services; research services; advertising services; and many other professional, scientific, and technical services.

During the Dotcom Bust, the sector lost 28% of its jobs in the metropolitan division through October 2003. But given how much broader the sector is, it didn’t drop nearly as much as Information, and recovered much faster.

Combined, Information and Professional, Scientific, and Technical Services shed 47,000 payroll jobs since the peak in mid-2022 in the two counties.

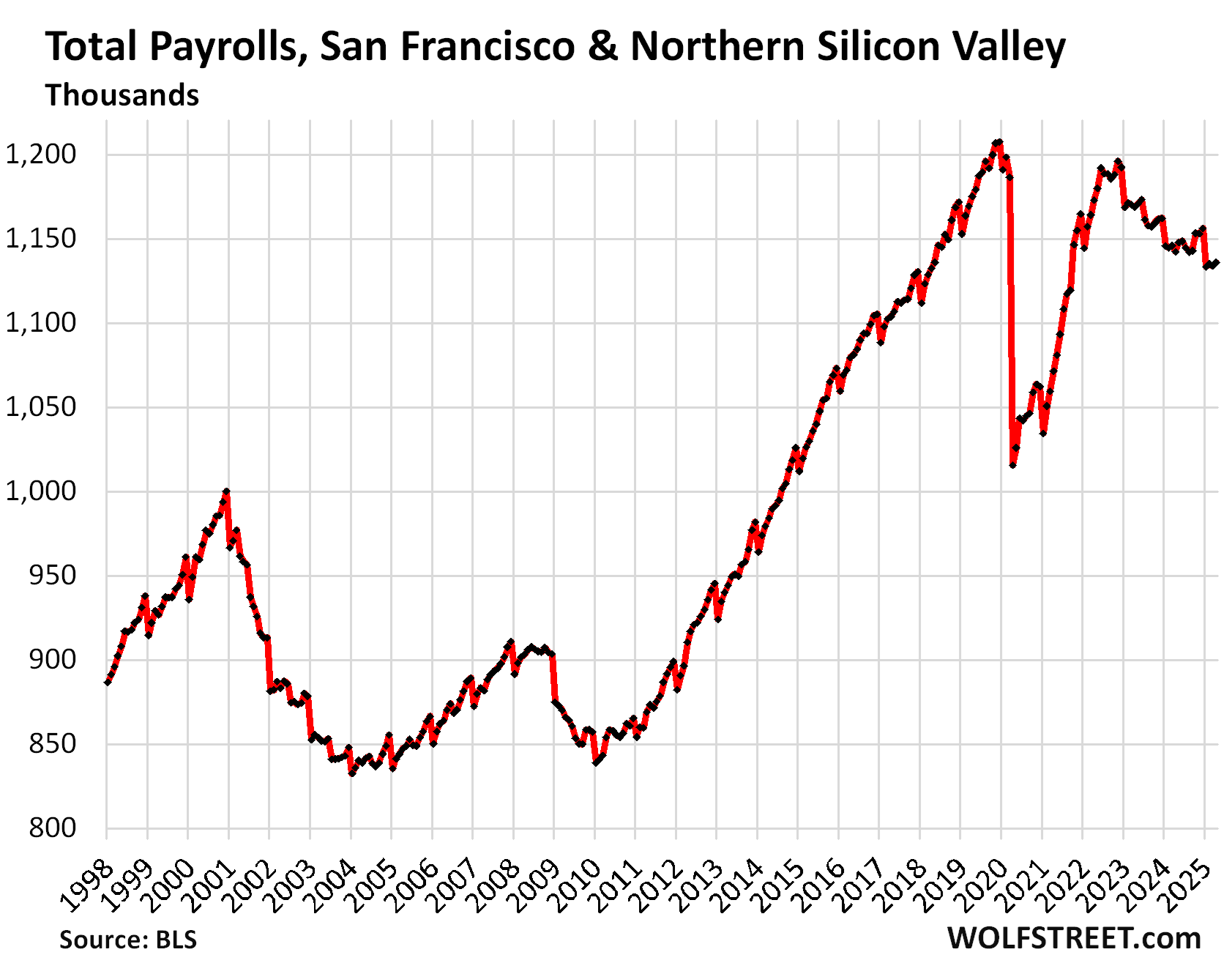

But total nonfarm employment, including government jobs, dropped even more since June 2022: by 56,000 jobs to 1.14 million jobs in April. The absolute peak of employment in the two counties occurred in November 2019 with 1.21 million payroll jobs. Since then, the two counties have shed 71,000 jobs.

The plunge in overall payrolls during the pandemic was driven by Leisure & Hospitality, Retail, Healthcare, and some other industries, that have now largely recovered.

During the Dotcom Bust through 2003, the two-county area lost 16% of its total payroll jobs, a depression-type decline if it were spread across the country. Compared to the Dotcom Bust, the current decline of 5.9% from the peak is relatively moderate.

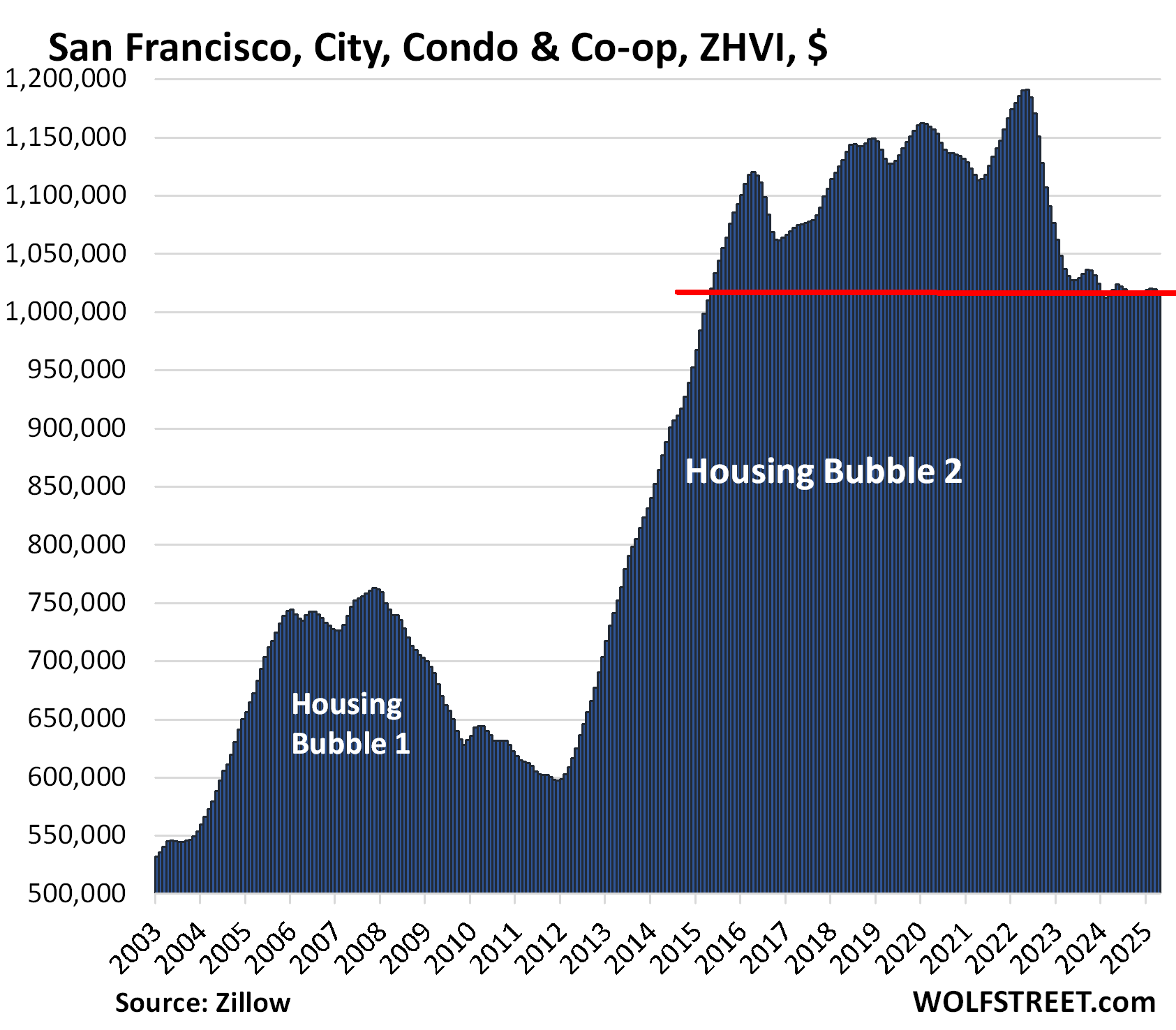

And so home prices gave up some big gains.

Condos and co-ops: In the city of San Francisco, prices of mid-tier condos, seasonally adjusted, edged down in April, are down by 14.6% from the peak in May 2022, according to the seasonally adjusted Zillow Home Value Index (ZHVI).

Condo prices are back to where they’d first been in May 2015, that was 10 years ago!

But over the decade from 2012 through the peak in May 2022, condo prices doubled. Since then, condo prices have given up nearly one-third of the decade-long price spike.

Condos and Co-ops account for about half of the home sales in San Francisco. Nearly all new construction over the past two decades has been multifamily (condos and rentals).

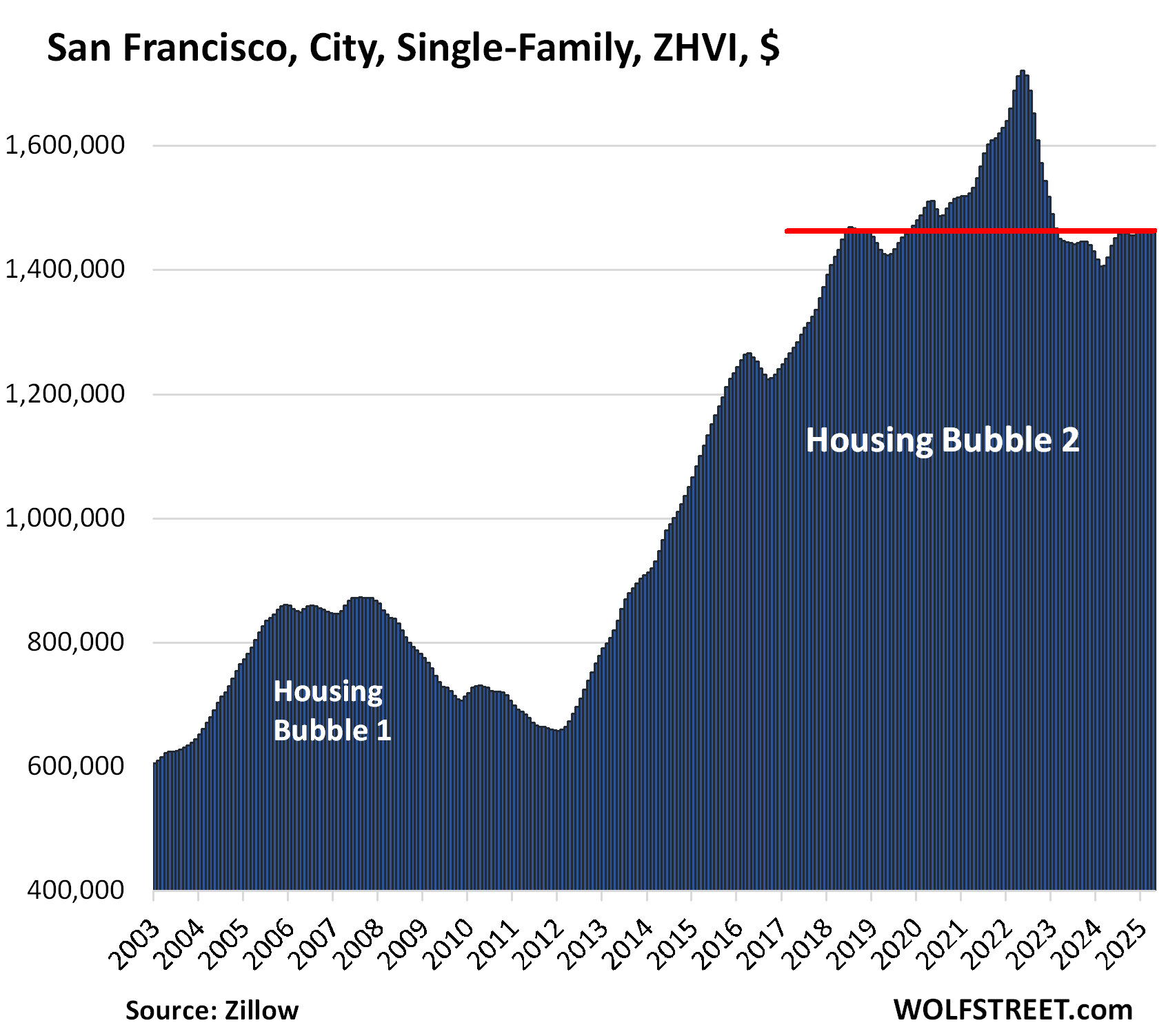

Single-family homes: In the city of San Francisco, prices of mid-tier single-family houses edged down by a hair in April, seasonally adjusted, bringing the decline since the peak in May 2022 to 15.1%. Prices are now back where they’d first been in mid-2018.

In the decade from 2012 to the peak in May 2022, single-family home spiked by 160%. And that has turned into a huge problem for the economy, as we can see in the employment data.

Slowly undoing the damage of the “Housing Crisis.” Some years ago, these price spikes in houses and condos, along with rent spikes, created the “housing crisis,” as it was called in the local media, where regular people with good jobs, such as teachers, could no longer afford to live in the City. Housing had become too expensive for the economy to bear.

That principle also shows up in the payrolls, as super-high-priced housing forces employers to offer super-high wages, and creates a very high cost of doing business. For employers that can move their workforce to cheaper areas, an exit is a major cost-cutting solution. And many big-name employers have done precisely that over the years.

But a long-term drop in home prices may eventually undo the damage that the mindboggling 10-year price spike has done to the economy.

In case you missed it: Housing Bubble & Bust #1 and #2 as Seen through Employment at Mortgage Lenders: They Shed Jobs Again, 38% Gone

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’m curious how the change in tech employment compares between SF/N. Silicon Valley and other geographic areas. Are the businesses going out of business or are they relocating/starting up in other cities and states?

On a nationwide basis, both Information and Professional, Scientific, and Technical Services, in terms of employment, look very different from the San Francisco/Silicon Valley charts, with a huge plunge in employment during the pandemic (that didn’t occur in the San Francisco Silicon Valley area), followed by a hiring boom.

Jobs in professional and Business Services, after the hiring boom, declined a little through October 2024, and for the past six months have been rising again, and Information saw a similar trend — despite the job losses in the San Francisco & Silicon Valley area that are included in the national data.

So this is nationwide employment data:

Also, in Austin, another tech hub with a huge housing price spike, the tech employment boom is coming unglued, and it too is seeing big drops in home prices:

It’s up because tech company stopped everything spoiling It’s employees when covit hit. Save company lot’s of money. Then employees had to fend for themselves plus cost housing went back up.

Foreign workers displacing Americans in tech through H1bs and foreign based IT contracting firms. Ghost job for cap-exempt visas and cultural nepotism seem to be driving this shift.

In terms of the employment figures, if an American tech worker at a company in the Information industry is replaced by an H1b visa holders, the employment figure in the Information industry doesn’t change. But it an American worker or an H1b visa holder is replaced by someone working remotely from overseas, that DOES cut the employment figure in the Information industry.

As I’ve mentioned elsewhere, Austin is a story for the ages – a largely unprecedented example of migrant companies’ self-torpedo’ing (intentional?).

Having lived in Austin for most of the 90’s (and being a huge fan of Google maps…) I am fairly darn familiar with the layout of Austin and its (enormous) Texas environs.

re SV econ refugees, 80% of Austin’s appeal was its far lower cost of living (meaning real estate – because it simply faced nowhere near the geographic/political constraints of SV).

Sure, Austin had a large enough tech work force (55k+ enrolled at UT Austin) and a long standing tech base (particularly in chips/hardware) but SV had those too and in spades.

But Austin offered an escape from SV price-spiral insanity – cost of living (basically meaning housing costs) was perhaps 25% to 40% of SV’s cost of living.

There are a *ton* of things a company can do with that kind of savings.

But most of the SV migrants more-or-less bafflingly insisted upon creating an utterly artificial scarcity in their corporate office relocation choices.

With *hundreds and hundreds* of square miles to choose from to put their relocated corp offices, those “cost-savings-seeking” companies basically refused to consider anything other than *2* square miles (either insanely expensive, from scratch, “signature” towers next to the river – or a very similar hothouse cluster near the Arboretum).

(Ironically, Tesla, requiring *way* more land for its huge factory managed to avoid this particular form of stupidity)

Texas is nothing but endless miles of essentially flat prairie (the “Hill Country” kinda being a joke to anyone from elsewhere who has ever seen a hill or – god forbid – a mountain).

Flat, endless stretches of eminently, easily buildable lands – thoroughly laced with roads. If you have half-a-functioning brain cell it is kinda hard to f=up and not save a boat-load of money by relocating to Texas/Austin – there is simply too much, too cheap land, with too many options.

Those SV emigrants could have put their corporate HQ’s essentially *anywhere* but the 2 square miles they chose and actually, easily achieved the 60%-75% cost savings promised by the relo from SV to Austin – but they utterly, utterly refused to do so.

SV corporate leadership isn’t *that* stupid – I suspect that while the C-level execs may have really wanted the massive cost savings, their underlings (who had to operationalize the relo and *then relocate*) desperately wanted to stay in SV – they didn’t care about the corporate cost savings relative to the disruption of their personal lives – so they intentionally torpedo’ed the whole process through studied stupidiity.

Maddie,

The tech boom ended in Austin at the end of 2022. Those jobs mostly went to India. The construction of data centers and fabricators continued but those jobs still don’t exist.

When I wrote about this last year on this site, I was told I was full of BS and employment in tech was increasing. Then I was shadow banned. That’s fine…but things are a lot worse now…just saying.

A really bad sign was when the Austin Chamber of Commerce “disappeared” its “Expansions and Relocation” page in Jan 24 after running it for like 15+ years.

The relo peak probably was 2021-22 (after many years of good growth too).

2023 definitely was trending down.

And then 2024…was like a neutron bomb.

I don’t know if the jobs went to India or simply evaporated – but the sad part is that Austin could have made the boom last at least a few years longer by actually acting to deliver more on its promised cost savings.

But instead, it went for the easy, sloppy money the relo leadership rather-psychotically was flinging around and now Austin has badly, pointlessly damaged its reputation for cost-savings.

Actually, smart companies should *still* look at “Austin” – only 5-50 miles to the South, East, or North. Texas is mostly empty, easily buildable land.

It seems tech companies want an abundance of nice apartments and amenities nearby, so their young employees spend more time at work and less time commuting. They want to blend work and lifestyle, which means having lots of coffee shops and restaurants nearby. You don’t get any of that if you build in the middle of nowhere.

Hi Petunia,

The paradox you are explaining is with success/prosperity, the Companies outsource to INDIA ( smart workers) but this is the Opposite of Build America. We need /want the tech workers in America, not 3,000 miles away

You want to know how I know the housing bubble is about to burst? My wife just graduated with her Masters of Nursing, and we are liquidating all our savings(home down payment included) to pay off her loans.

You are welcome.

That’s how surfing works too. As soon as I paddle in the set of the day comes.

What a concept, huh ?

Paying back money you borrowed….

Funny, I had to pay for college too!

The only “help” I got was serving in the military in a war in the late 1960’s and the G.I. bill paid $200/month!

Depending on the rate the loans are at that might not be a great choice. Especially if you guys are under the income limit and can deduct the interest. I have student loans at 2.35%, I let them sit because I can earn 4.3% in interest on my savings invested in tbills

a now we have UNH if the nursing charges are true this is past sick

Tech businesses have relocated to Texas in large numbers. Its Republican grounds: lower taxation, less onerous red tape regulations, and so on. It only makes sense.

Except smart and agile-minded young people don’t want to live there.

Oh, and, Wolf provided a chart in the comments above showing the same is happening in Austin (which was cool for a minute).

Maybe you should move to Texas too. Lowest rate of health care. By the way, yes you can find individual homes/neighborhoods that match what the author says but I really think he is writing about Florida and maybe didn’t realize it

Home prices in San Jose have not dipped to 2015 levels. They continue to climb but seem to have leveled a little.

I would think that at this point job levels have less of a correlation to home prices than the interest rates being over 7%

I have to agree here. My thermometer for the area is a 3 bed 2 ba SFH anywhere along the 85 corridor. I remember seeing listings some time after Covid, right above the 1M mark but they have not dropped to these levels in any meaningful numbers yet.

I’m wondering here if WFH for the SF transplants is the bigger mover here.

Awaiting this to come to the Seattle market as well. I see occasional prices dropping but it’s still ridiculously expensive there. Buying a place can easily be 3x renting one.

I live in a nice Seattle suburb and can tell you most people couldn’t afford the homes they are living in if they had to buy them at today’s prices. Payments to purchase a home are 3x higher than the rental payments, as you say.

In my opinion, the RE market here has little to do with price considerations and more about immigration. We have lots of incoming migration from China, India, and Eastern Europe, where folks will do just about anything (and pay anything) to get a tech job and live in the US. It works for the tech companies because they get the talent at a good price.

The RE prices in Seattle might drop hard if and when the immigration ceases, due to lack of tech hiring or constraints on immigration. If you remember what happened during the Great Recession, Washington Mutual (WaMu) was one of the first banks to go belly up. Lots of mortgage loans were provided to people who paid crazy prices for RE. There’s probably some of that going on now. The area is known for expansions followed by busts.

Mid tier home only a little over 1.4 million,damn,I am going house shopping there!

Yes, it’s ridiculous. Completely out of whack.

Less than 5000 sales. Safe to say they’re being bought by the 1%. Top 1% in california, never mind SF is $900k, so the houses are easily bought by even the top 5%.

i live here and have been telling people for a couple years this is coming. the arrogance of the local population of which i am one is always astounding. “prices never drop.here”.. etc. i keep telling them detroit was once the silicon valley of the country but alas people are destined to learn the hard way. For reference i moved here and got into tech when the great recession took my mom and pop business. I have done very well but I’ve always lived as though I could loose everything again.. its served me very well.

The people here never tasted 08.. but they have been tasting the slow grind down for a few years now.

DOW -816; Treasury yields continue to push higher…

Debt crisis threatening to blow up global economy…

MAGA faces 11th-hour drama on big spending bill…

Crisis, explosions, drama? A little too much hyperbole. I was expecting the next line to be “The sun turns the color of sackcloth…”

Many possibilities in the current economic scenario. Not all are negative.

I’ve heard that AI, in smart hands, can reduce the time to write code by 90%. If true, that’s going to impact lots of IT jobs.

AI won’t replace humans, but will make experienced humans more efficient at what they do. This means a given workload will require many fewer people.

I see the tech sector being the earliest adopter of AI applications in the workplace. That’s good news for productivity, bad news for employment as jobs throughout the economy get replaced by AI.

Oh, and those roving info-kiosk AI robots you’ll soon see in hospitals, airports and elsewhere will be made in China–or, depending on the tariffs, somewhere else, but not the USA.

The tech people I deal with for my ads (“ad tech”) already use AI, and the result is that the ads don’t work right and do goofy stuff. Not impressed so far 🤣

For all the billions spent on Internet advertising, I still very, very rarely get one that is of any interest to me at all. I don’t know if google just doesn’t know enough about me, companies that do have stuff I’d like just don’t spend a lot on advertising or if I don’t have enough interest in doodads.

I don’t believe in ad blockers because ads fund transaction-free websites like Wolf Street. Yet I find I have literally trained my eyes to ignore ad boxes. I do not even see them 99% of the time.

However, I know that ads are much more traceable with the internet than with prior tech like magazines or radio. Advertisers know whether they are getting clicks and can boil it down to cpc. So they think they are getting conversions.

At one point many years ago, the cpc for an ad relevant to mortgage refinances was over $10.

It truly makes me wonder if internet ads are a bit like credit cards. Some 25-50% of the population takes them seriously to their detriment, like the % that carries a balance or does so horribly, so the top 50% can have free content (or sweet CC rewards, as the analogy goes).

Wolf gets a tiny fraction of some coin of the realm when we clik on an advertisement. It is kinda fun to bring one up, and then be hounded across platforms/sites with more ads from the same entity. I enjoy watching the persistence and decay rates.

I bought a replacement gas cap for my 20+ year old vehicle and the advertising algorithms decided that I liked gas caps and kept advertising them to me despite the fact that my purchase of the gas cap means that I am one of the least likely people to buy another gas cap any time soon…

I don’t know if they use AI, but I do get the best ads on InstaGram, like ASML, 3D printers, 3D laser cutters, CNC machines, and more. I think I’ve trained the IG ad model well. I find quite a few of the ads interesting, and am very happy I basically get no consumer ads or ads with scantily clad women.

Former IT guy (now retired) here.

My guess is they figured “if the computer – AI – wrote it … why bothering with that pesky testing stage?”.

Then, again, I haven’t written code/programmed “professionally” (for pay) in 10 years.

LOL you don’t understand economics or human enterprise, productivity increases are the reason we aren’t still living 10 to a room and traveling on the back of a mule. If AI can help people code faster, there will be 1,000 times as much coding. There will always be more work to do, the people who claim otherwise are blind to all of human history to suggest otherwise.

There is far more phone traffic than in the past, are there more telephone operators?

AI is just getting started. It will improve faster than we think.

God how I would love to own a company with no employees.

Portlander,

There are obviously lots of types of software development but always surprised when it is reduced to coding. Thar is honestly the easy part and existing tools make that very simple. Automated testing tools also exist which have been used for decades. The real challenge, for at least the software I work on is the critical thinking and analysis. Plenty of tools to aid in that as well. But pure coders may just need to adapt. Even in the 90s when lots of development got outsourced to India the programmers here had to add value in other ways. I never want to back to the 1970s and 1980s coding again and prefer efficiencies to improve.

2 snaps up for Glen.

Coding is table stakes in system development. The jobs currently being lost to AI coding are in India, Poland and Ukraine. Let me know when grok can gather requirements, identify boundary conditions and navigate illogical roadblocks.

I’ve told all my kids that in their lifetimes computers and robots will be doing much of the work that underlies capitalism. But there will always be a big salary in telling the computers and robots what to do.

Can you tell a robot what to do if you haven’t done it yourself? I think AI raises some employee development issues.

It’s like using a calculator. You don’t really understand what’s its doing unless you can do the computations yourself, proficiently.

Glen, you took the words out off my keyboard. But, I missed the early days of designing and coding ‘down to the bone,’ with assembler and C (but I also prefer manual transmissions). I learned to add value by doing project management and documentation and managed to last in the biz for 35 years.

As for housing, I bought a small (1,140sqft) house in SJ off 280 and near to 85 and 101 for $245K in 1996 and sold in 2017 for $1.305M. It’s a good exemplar of the price curve; shooting up to nearly $2M a few months ago and now leveling off and dipping a little.

On Zillow: 1070 Keltner Ave. SJ

Amazon is a huge robot user, and makes all of their mobile robots in Boston (Kiva IIRC). They do use robot arms from other companies with their software.

Work in tech AI has definitely made me more productive and able to produce faster. This just means we can get new features out faster for the same cost. It’s not eliminating jobs. However, outsourcing to India is eliminating A LOT of tech jobs.

That condo chart showing assets are back to 2016 prices is shocking. If it isn’t inflation adjusted then the real returns are even lower!

Tech jobs are collapsing in the UK as well, and this means the daily rate for contractors has really gone down. I am not so sure why, but i don’t think its AI certainly from the AI assists i have tried they are very early days, more like assistance with auto-complete (even that i turned off cos spamming).

Maybe its because there is a business cycle in IT, kind of the original 2000 boom ended because at some point everybody has a webpage and there is a sudden drop in demand.

Is it monetary policy? No I don’t think so either. There has been a flood of job entrants via immigration of course the USA but also the UK and maybe a lot of the work has just been done.

I would say this to anybody who has a kid, let them be computer literate by all means but it is taking on aspects of buggy whip making.

A very good comment, do we really need Windows 12,13,14…20 on? Yet another iPhone or Samsung? Yet all our roads are over capacity and crumbling away, old bridges at the end of their design lives, sewage being pumped into rivers because the treatment works cannot cope. So where are the engineers, scientists and builders to turn this around and where is the money to do it? All being diverted to the god called AI, which is the just the newest version of dBase and which will build nothing except verbiage.

AI could maybe be a miracle for mankind. But computers and the Internet probably could have, too. Instead, it’s turned the mass populace braindead, incapable of forming in-person relationships with other people, and essentially just a way to bleed the last pennies from the proletariat.

All it takes is a little unemployment to restore some sanity to the system.

But there are still many areas of the country where housing prices seem more sticky. The Northeast is a good example, with the greater Boston metro area as a prime example. Even Vermont and New Hampshire have serious problems.

Simply put, new housing can’t be built fast enough and most of what’s been built over the last few decades is located in the southern part of the country, rather than the northern.

Here in Portland, Oregon metro region, layoffs at Intel and Nike have definitely impacted the local economy. However, it is a well-established fact that Portland has more tiddy bars per capita than any other metro in the U.S., so this helps to keep the local economy diversified. And with the freeze in real estate, some of the younger female realtors have taken up pole dancing where tips have at least doubled, due to inflation in the services sector.

…but ‘no taxes on tips’, going forward…

may we all find a better day.

Curious that jobs are 107.7k I think that’s roughly the number of H1B approvals this cycle. Unfortunately no administration has taken an interest to curtailing the abuse of this program.

I’m curious to see how this compares to Silicon Valley/ Santa Clara County which is where most of the tech jobs are.

So the jobs here are in San Francisco County and San Mateo County, and the area (the San Francisco-San Mateo-Redwood City metro) goes all the way down through Redwood City. From Palo Alto on south through San Jose is Santa Clara County. The metro is San Jose-Sunnyvale-Santa Clara, which also includes San Benito County. And that metro’s tech employment is smaller: it only has 92,000 jobs in Information (down from 108,000 at the peak), compared to the San Francisco-San Mateo-Redwood City metro’s 107,000 (down from 134,000 at the peak).

In overall nonfarm jobs, the San Jose-Sunnyvale-Santa Clara metro is slightly larger: 1.146 million versus 1.136 million in the San Francisco-San Mateo-Redwood City metro. In other words, there is more non-tech employment in the San Jose-Sunnyvale-Santa Clara metro, it’s a little more diversified.

Software jobs are commoditizing quickly. It was crazy that some person could go to a weekend boot camp, and become a coder (which for some reason they called an engineer), then make comfortably into six figures. The industry has such a low barrier of entry, and coding is fairly straightforward, the industry was bound to be upended. Now there’s so much software doing the coders jobs that it really makes sense to downsize the industry and pay them less.

^^^This. COVID added a insane amount of software engineers, everyone who didn’t like their job did a quick boot camp and became one. A lot of these people (not all, but a lot) aren’t great engineers because all they did was memorize a very small subset of content. If we went back to 2020 levels of employment and shed a lot of those people it wouldn’t be terrible. Unfortunately what’s happening is a lot of layoffs and outsourcing aren’t performance based so good employees are let go while employees who write code worse than an intern who’s actually studying CS still are employed.

That’s a 37% real dollar drop.

At one time SF was the best place to be period, then came the tech people and ruined it. Austin was the place to go for weekends when I lived in Houston. Then came the tech people and ruined it.

I wonder if they can ever find what they lost!

If your not tech, tech people are as interesting as following nose hair growth clips on tictok.

Mortgage rates rise to a three-month high as Treasury yields surge

Companies still do tech/coding interviews, they give you a problem set to solve and watch you code a solution in real time. Coding is not obsolete yet. It’s still a useful tool to see how efficient and creative people are. Graduates from top tier CS schools who didn’t have golden internships are hustling to find jobs after this past graduation. Definitely a shift in demand. Some are delaying jobs and going into grad schools.

That’s not AI. That’s hiring in India. A lot of US tech companies have frozen US hiring and are replacing US quits and layoffs with India hires

Transition from BTFD just switched to sell the rally! The everything bubble created from credit expansion is deflating in real time!

Thanks for the reminder that businesses ultimately shoulder a large part of increasing housing costs via increasing wage demands. Its amazing Silicon Valley has served as the leading tech area for so long, given the high housing and tax costs, but things might be changing.

Anecdote. A friends kid from the Midwest moved out to San Fran to take an entry level tech job during the pandemic hiring spree. He left after a couple years and moved back to the Midwest. His complaint was that people were just sitting around and productivity was not apparent. He wasn’t leaning at the pace he intended. While out there, he shared a three bedroom dwelling with several other professionals in order to afford housing. He probably had a great time, but from a financial standpoint I think he was barely treading water.