Tsunami of cash is still washing over money market funds. But banks’ fight for deposits is over.

By Wolf Richter for WOLF STREET.

Interest rates paid by money market funds largely track short-term yields in the Treasury market and repo market, which money market funds invest in heavily. But interest rates paid by banks on their CDs largely reflect that individual bank’s need to hang on to cash from depositors or to get new cash from depositors, and lock it in for some time. And that need changes bank by bank based on circumstances.

And those circumstances have improved for banks, and so banks have reduced their CD rates faster than the yields of money market funds, and cash has shifted from CDs to money market funds, with CD balances declining and money market funds spiking from record to record.

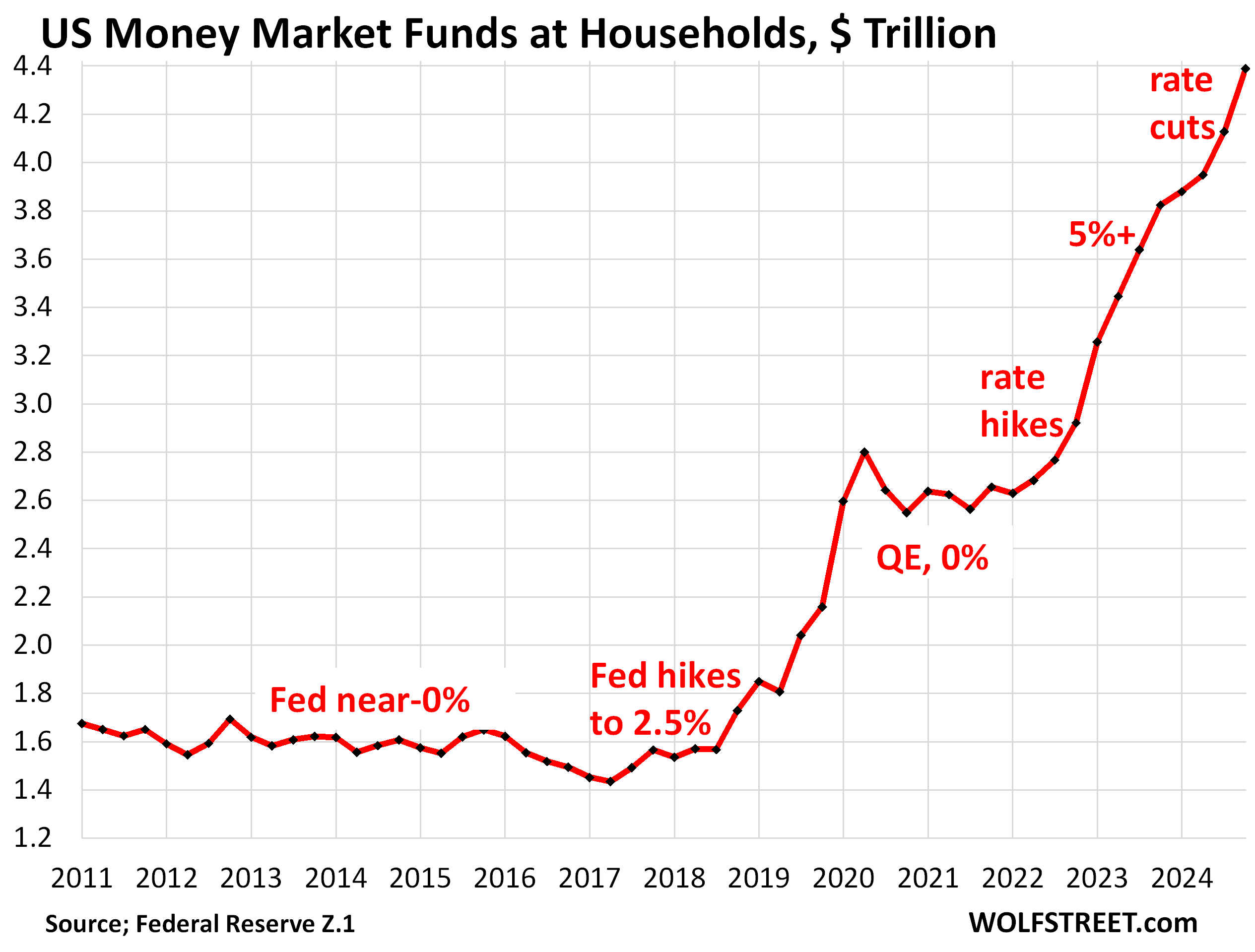

Balances in money market funds held by households at the end of Q4 spiked by $261 billion from the prior quarter, and by $569 billion year-over-year, to $4.39 trillion, according to the Fed’s quarterly Z1 Financial Accounts released today. Since Q1 2022, when the rate hikes began, balances have surged by $1.8 trillion.

This jump in MMF balances occurred even as the Fed has cut its policy rates by 100 basis points, and short-term Treasury yields have fallen about that much since last summer, with the three-month yield at about 4.3% currently. MMF yields have followed them and hover somewhere near 4.2%.

These MMF balances include retail MMFs that households buy directly from their broker or bank, and institutional MMFs that households hold indirectly through their employers, trustees, and fiduciaries who buy those funds on behalf of their clients, employees, or owners.

MMFs are mutual funds that invest in relatively safe short-term instruments, such as T-bills, high-grade commercial paper, high-grade asset-backed commercial paper, repos in the repo market, and repos with the Fed – the “Overnight Reverse Repos” (ON RRPs) that are now almost drained.

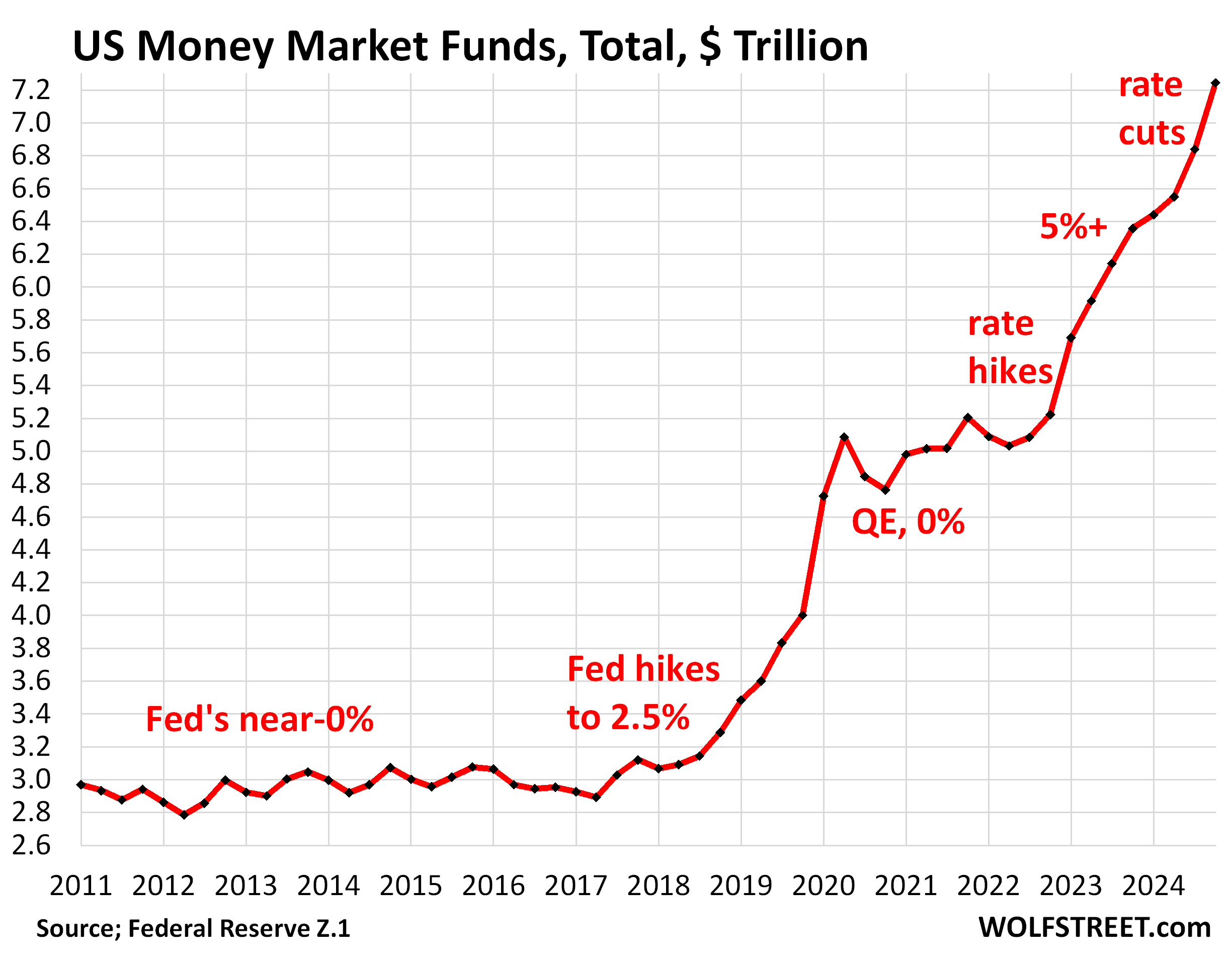

Total MMFs (those held by households and institutions) spiked by $404 billion in Q4 from Q3, and by $889 billion year-over-year to $7.24 trillion.

Since Q1 2022, balances have ballooned by $2.2 trillion. The influx continues despite the somewhat lower yields, likely attracting some cash from CDs, where banks have dialed back the rates more sharply.

Money market fund balances react to interest rates. When rates were near 0%, balances remained roughly stable for years at about $3 trillion. When the Fed hiked rates to ultimately 2.25% by December 2018, a $2 trillion tsunami of cash poured into MMFs. During the pandemic interest-rate repression, balances wobbled along a flat line. But when yields started rising again in 2022, another $2-trillion tsunami of cash washed over the funds, and continued through Q4 despite the somewhat lower yields:

When MMF yields started rising in 2022, banks had to respond by offering higher yields on CDs and savings accounts to hang on to their existing deposits and to motivate new customers to put their cash into the bank.

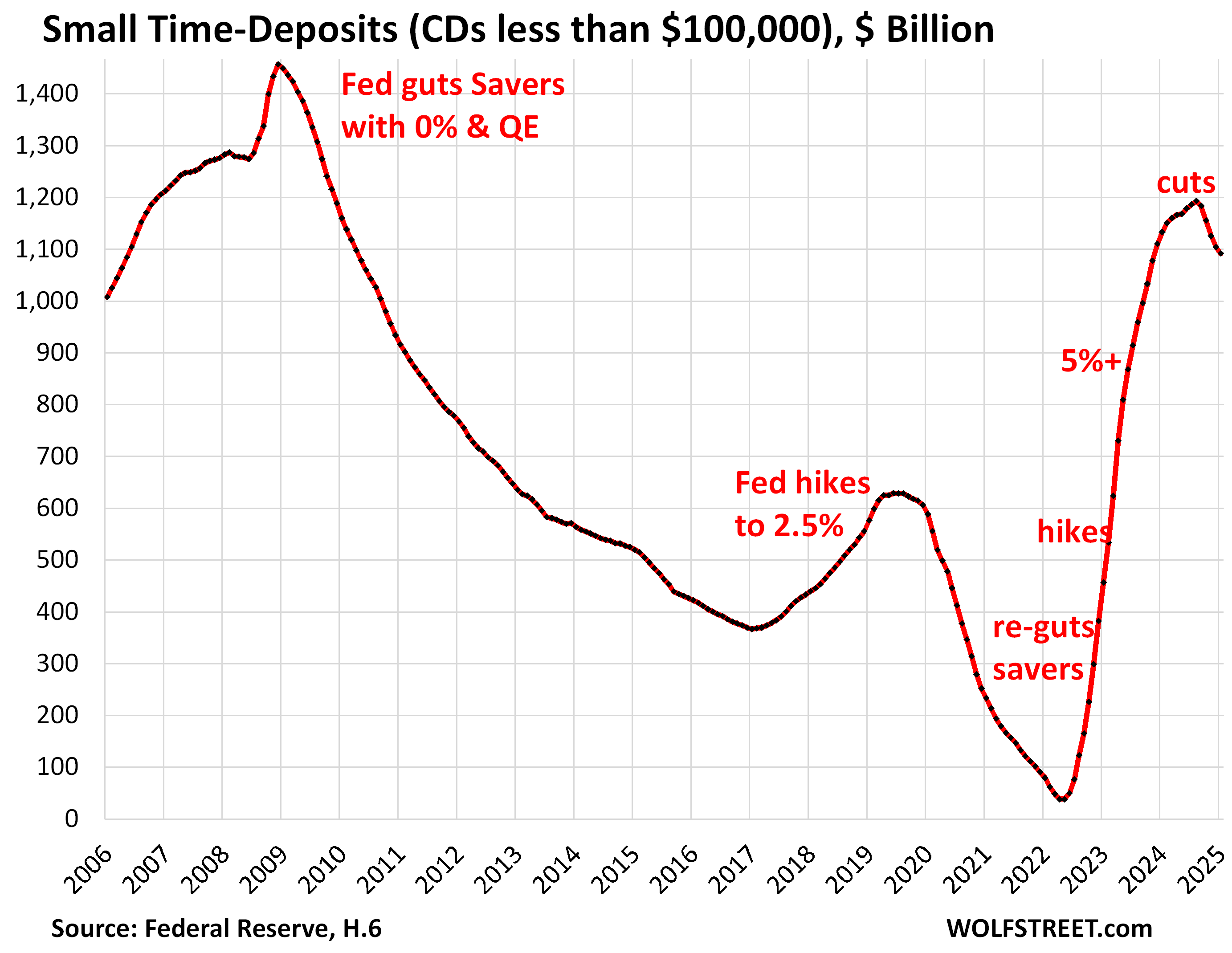

Small Time-Deposits (CDs of less than $100,000), after a huge surge from near zero in early 2022 to $1.19 trillion at the peak in August 2024, have dropped by $100 billion over the past five months, to $1.09 trillion in January, according to the Fed’s latest Money Stock Measures.

These small CDs reflect regular savers. When the Fed gutted their cash flow from savings in 2008, they got out of CDs. By mid-2022, these CD balances had plunged by 97%.

Paying higher interest rates on deposits – loans from customers to banks that form the primary funding of banks – increases banks’ cost of funding, and so they offer higher rates only carefully, and to some customers, such as new customers, and they try to keep as much of their deposits from existing customers at near 0% rates, such as checking accounts or low-yielding savings accounts, and all kinds of corporate accounts.

Banks count on deposits being generally “sticky,” especially in checking accounts and low-yield savings accounts, which means that when rates rise, a big portion of deposits doesn’t get the higher rates but stays at those banks anyway.

But some deposits did leave when yields rose, and banks had to deal with it by selectively offering higher interest rates, including through brokered CDs (CDs sold through a brokerage firm to that firm’s clients).

But over the past 12 months, the battle for deposits has largely settled down. Most banks have plenty of deposits, and have dialed back the yields they offer, and some unhappy customers have moved their cash to MMFs or directly to T-bills.

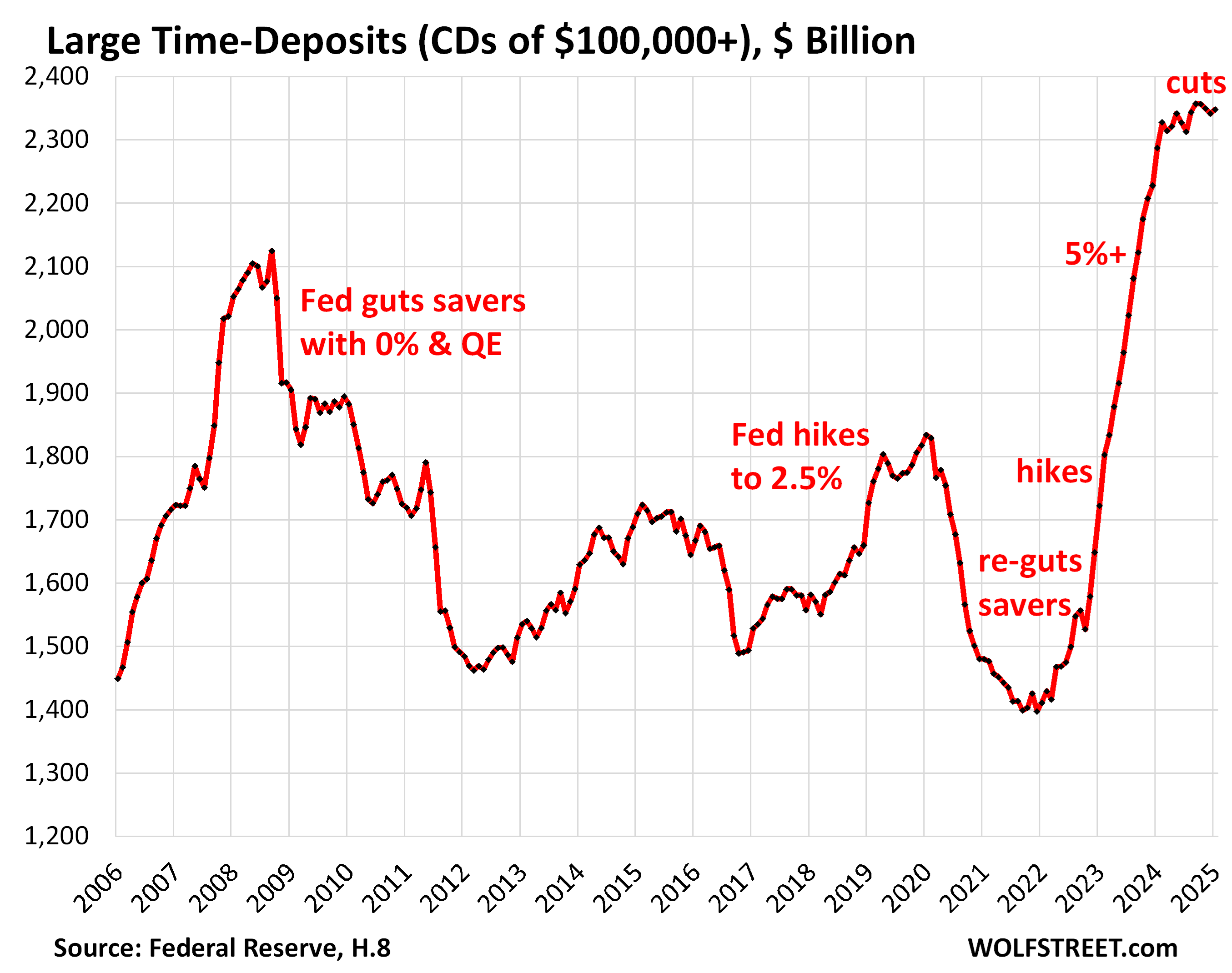

Large Time-Deposits (CDs of $100,000 or more), after a huge surge, have essentially flatlined since May 2024. In January, they ticked up to $2.35 trillion, according to the Fed’s monthly banking data.

Since March 2022, when the rate hikes began, large time-deposits surged by $932 billion, or by 67%:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’m one of those contributors for sure. Young family with good jobs, plenty of cash in a money market fund, and cannot afford to buy a house in the northeast.

What percentage of your monthly household take home income goes to rent?

Median household income in Massachusetts: 107k

Median rent in Massachusetts: 20.4k /year

Median household costs: 596k

To get 10% you need about 60k + closing costs

Oh, and the house costs with those numbers for that median would be 4.1k a month in mortgage, insurance, and taxes.

Since Q1 2022, when the rate hikes began, balances have surged by $1.8 trillion. referring to the total balance of cash in US money market funds, I believe.

IMO, that is exactly what one would expect, given the nose bleed valuations proffered by the sellers of assets which have capacitance, to store value until discharged.

People are holding on to their cash, sensing an inevitable deflation of the asset bubbles.

Thanks

Same. My wife and I have decent jobs w/ combined income nearly double AMI in our PNW county. Two kids, one in public kindergarten and the other in preschool. Have been socking away in a MMF for years now with the intention of using these funds for a home down payment. We’d love to buy a home, but have some trepidation about doubling our monthly payment compared to our current rental and depleting our entire savings (aside from retirement).

If I bought my mortgage payment would be over 4x my current rent for an equivalent property. Na, I’m good!

Thanks for that. There is plenty of cash waiting to purchase, reasonably priced assets.

A good example of the dislocation caused by extraordinarily high prices that ZIRP established is that one could by a thirty year bond at half the value on an assumable, 30 yr fixed rate loan. In other words, the payment at current interest rate is twice as much as the similar person whose selling it and stretched to make the payments at the ZIRP policy rates.

Let me tell you what dumb thing I did when I was a young man. I bought a house at 14 pct plus a quarter for PMI insurance. While making 30g per year.

Humans are not immune from the nesting instinct.

Best wishes and keep your helmet on.

Same! Well, we could afford a house, but we like things like vacation, retirement, and eating.

I have a cd expiring this year at 5% so they probably want to get that off the books and give me one at 3.x%

Vanguard still paying 4.24% but Fidelity has fallen to 3.98%.

That’s the Money Market funds.

The money supply CAGR is 7%/year. So your $ is devaluing each day. 7%/year is your hurdle rate. People have too much in MMFs.

That’s BS. Money supply automatically grows with the economy not adjusted for inflation, as growing and profitable economic activity creates money, DUH. And shrinking loss-making economic activity destroys money. That’s how a modern economy operates. And it’s not inflationary per se. It’s the artificial money creation by central banks that you need to worry about. And they’re doing QT.

The Twist, Limbo, and Mashed Potato came and went. Powell’s pretty old to be doing The QT with those back lowering moves. It’s gotta hurt in the morning. “Bend ze knees!”

Old is the day one never thinks about coming. That was a time of rebellion, believe it or not. I submit, the following generation of music is still ubiquitous, 50 sum years later.

I’m not sure that mourning the loss of original human creativity is shared by any other buds. Sold as progress, the technology companies released their most virulent version of spy ware, AI. They never sought permission. They just did it, FU very much.

I suppose that is the cost of freedom lost to the foolish infection of the basis of humanity by replicating, AI models that only know fulfillment of the objective that they have been trained to accomplish.

By they way, every bump and grind dance moves are variations of the same ancient song.

well i still remember 2008 , i stated my de-risking in december 2024 , i’m good with 4.3% CDs, 4.0% MM , 5.7% Emerging Market Bonds , buying preferred stock JPM 5.9% , BAC 5.7% , Aspen Ins. 6% , SO 6%, DLR 7% , DUK 5.7% 10% Equities. i’m out if the market keeps going up Rates will have to go up to fight asset bubbles and inflation, only way to get rates down , bust the bubble ! i always hear this time is different! the Biden administration sold us down the river buckle up

I’m probably wrong but I think that I agree with enough of what you said to understand the reason for your eclectic portfolio.

Not your Mom and Pop racing form. But more appropriate to the person at the track.

It wasn’t only Biden’s bubble but also the previous seven.

The laboratory ratified monetary policy of Ben Bernanke has failed and is being pilloried as snake oil by the level of interest rates required to slow the obvious growth in the rate of inflation.

With stocks overvalued and dropping in price, MMF slipping under 5% (after next FED rate drop), CD’s n the tank yield wise, what’s left to invest in to beat inflation? Maybe real estate (LOL)?

MFF slipping under 4% not 5%. Sorry!

Tough, I think, to find a good buy-in price for inflation hedging assets: gold and real estate. For now, anyway. With the kind of potential disruptions being unleashed (from the top) across the banking and trade systems, as well as the AI revolution, who knows where prices go?

“what’s left to invest in to beat inflation?”

It really is tragic that the US (an “advanced” economy) doesn’t have a better system for fractional equity investment into smaller “privately” held companies (local/regional businesses – restaurants, motels, used car dealerships – whatever).

(I know there are a lot of control/trust/return distribution issues in smaller private companies, but still)

Obviously those businesses exist (in maximum, optimal, numbers?) so the owners are getting their funding from someplace – but it is likely equity from country club cronies and debt from a bazillion possible sources.

It would be great if that equity part were open to more, smaller investors.

In theory (very, very rough theory) the public capital markets supply this function (fractionalized equity into smaller companies) via Russell 2000 – type companies.

But while there are maybe 5 million US businesses with 1+ employees, the Russell 2000 is well…2000 (I think).

So somewhere between 2000 (or 4500 if you want to look at all the publicly traded companies of any reasonable size) and 5 million, there are a *lot* of US companies that are getting their equity from a very tight circle of sources (and not the yield/return starved masses).

The irony is that there is one publicly traded category for which the public market at the micro/startup that works very, very well (too well).

Over decades, roughly a bazillon zero revenue biotechnology companies have IPO’d…and 90%+ have (predicably) flamed out.

If those investment dollars had been spread among more public market sectors, the results might have been interesting.

It would be interesting to find out exactly why/how pie-in-the-sky biotechs have been able to raise public equity (with zero revenue) for decades and decades.

A rough guess – a mass of Drs. (with money to burn but no time for investment research) are an evergreen source of exploitable capital for the investment banks specializing in pie-in-the-sky biotechs.

But it is a lot harder to turn on investors with the upside potential of regional restaurant franchises, motel networks, or used car dealerships.

So the mass of equity investors keep pumping their 401k funds into the SP 500.

Which is great – when the SP 500 is at a15 or 20 PE.

Much less great when the SP 500 is at a 25 or 30 PE (and really propped up by Mag 7 stocks with a PE of 35+)

Royalty financing may be one solution. It’s a hybrid of debt and equity.

Not very common except in the mining world, but have a look at London-listed Duke Royalty Limited run by Canadians.

I don’t own it and this is not a recommendation to buy, but their business model is interesting.

cas127

I bought a stock 15 years ago and today it’s quadrupled my investment. Pays 9% and has never lowered or missed a dividend. I’ve never lost a wink of sleep over the stock.

“It would be great if that equity part were open to more, smaller investors”

Regulation A does exactly that, where anybody can invest. Problem is there just isn’t many RegA investments today that are worthy of investment

RSP has been mentioned in these comments in the past. Gets you around the concentration issue, and trades at a lower PE ration than the SP 500.

Bitcoin? 😁

Equities tend to beat inflation. Emerging markets appear fairly valued still but that volatility can be rough. Developed ex-US are a tad overpriced but not terrible (in general). The problem in equities is that valuations are very high, especially from a Cape/Schiller perspective and when it falls, it will probably take most of the other markets with it for a while. And, of course, it’s a fools errand to project a top or a bottom.

So the boring advice (that was a bit useless during COVID) seems wise for consideration. Diversify holdings – including bonds and alternatives like gold and real estate / REITs seems like one way to go. And don’t be afraid of holding a healthy amount of cash at these rates like Buffet to go shopping for bargains if everyone panics.

Sorry meant to say USA valuations are very high, as I said not everything is S&P or Tech expensive.

Emerging markets are about 3 times what they should be since the U.S. indexes are still about 5 times what they should be.

How much (if any) of the desire to stay short do increased investor expectations of continued rising inflation and the probable rise in interest rates have on the big rise in MMF deposits you’ve highlighted?

Also, it seems the heightened desire by savers/investors to hold short-term funds plays into the desire by Treasury to fund national debt with Tbills, no?

It’s probably more simple than that, the 4 week is barely lower than the 10 year.

I have limited options for investment with my intitutionally restricted 401a I shifted everything into a treasury based vanguard money market a few months before this crash.

I can’t complain about making a constant 4.5-5.5% regardless of the market performance.

I’ll shifted back in to growth investments once the market bottoms out.

They say not to try to “time the market”. When everything is so obvious why not?

Good luck! I did that with COVID. Got out of everything right before the drop. Didn’t get back in in time though to make any sort of difference….hard to call a bottom. Is the 10% drop over the last few weeks the bottom here? Or does it have another 20% to go? Hard to say.

Well, Too me, an everybody with no investment credential at all, that seems like an appropriate portfolio with minimum risk. Not as if we’re going to go back to work.

The loss of capital overshadows the potential risk hidden in the scheme of higher interest rate, risky securities.

I’m very nervous.

Cash in MMF awaits an anticipated ‘market liquidity event’ –

my gold/silver accumulation event.

I’m satisfied to also participate in gold/silver miner (ETF or MF) –

any recommendations/cautions gratefully accepted.

You have to be kidding me. The miners? They have been wretched investments for at least the last ten years and they will probably be wretched for the next ten years. I used to invest in mining ETFs until I got tired of having my brains beaten out.

AEM Agnico Eagle Mining has been exceptionally good and more than doubled over the last year and a half.Plus it pays what is now a small dividend. That should be rising as the company should be net debt free when they post Q1 earnings. They mine in low risk areas and have huge reserves and relatively low costs.

The rising price of gold is the result of a segment of investors that believe that the fiat currency upon which all business is transacted is being systematically devalued, relative to the historically monetarily stable value of gold in the currency across the ages.

Don’t forget the dollar index falling 4% already this year in the figures. Savers are continually regutted from all directions.

Anything denominated in dollars, including stocks and houses, experience the same as money market funds or CDs or T-bills. No difference. A falling dollar (it’s still very high, the figure you cited is off a multi-year high of the DXY) and inflation hit all dollar-denominated assets exactly the same.

Yes well Europe is hardly the damsel in distress they are currently pretending to be. An Innocent Victim under the umbrella of US military.

Meanwhile, selling duty free into the American “free market” while maintaining a rigid system of protective tariffs.

America’s venture capital investment into developing China was a mistake from average American’s POV. Hiring the third world, Communist Party of China to compete with the American worker.

And I was a young professional, powerless to oppose the economic harvesting operation that occurred.

Chaos is exactly what one would expect of an honest market.

The difference between the ask and bid price is at a historical discrepancy.

I have no crystal balls, but I have been alive long enough to have developed a sense that an economic storm is brewing.

The price of stocks versus the value will converge.

Capital seeks a return. We all work hard for our debt-based currency. So your choices are as follows;

“Full FAITH and Credit”….

or

“Fuck you, PAY ME”

Choose wisely…

“F you, pay me”

Great Goodfellas Quote.

And it really gets at how people can be conned into no-win situations by those who control the levers of power/policy – who are set up to profit no matter which binary outcome actually results…once you buy into their false promises/scenarios.

No percentage in burning out the restaurant unless you’ve got an ironclad insurance policy. You’ll end up eating noodles and ketchup. The POTB don’t like indigestion.

Well, you have to read every page of every document that you sign.

I agree that commercial news is pablum for the masses. The problem is that that is all that available including NPR. Not only mimicking the propaganda spewed at us, almost as a form of torture, but doubling down by having two entitled NYC pundits explain what everyday people across America think.

There’s too much “return” out there for capital and doing nothing, and not enough “work for your money.” We need to see billionaires crawling around the streets on their hands and knees, begging for food and wondering where all their lucre went – a total 180 from the current sitch.

Maybe. There are lots of different forms of capital. Having said that, I agree that productive capital is the most highly valued IMO.

Surely you don’t want crawling billionaires which would probably only happen as a result of a thermonuclear exchange.

Nature doesn’t care if we kill each other.

I have a few 1st Trust deeds, paying 6.5 – 7%. I use my self-directed IRA, payments are deposited tax free until I withdraw any funds. Have a few CD’s coming due and want to find more of these mortgage loans, but with rates dropping, may be difficult. If you can find some with a lot of equity, you should be good.

Interesting, as lately, I am finding short term CDs paying .1-.2 better than my brokers MMF option or short term treasuries. So I have switched accordingly for 1-3 month plays.

Another advantage that MMFs have over CDs is that, at least in California, the dividends paid on all-treasury MMFs like Schwab’s SNSXX or Fidelity’s FDLXX are not taxable at the state level.

Also, some of you might be interested, the weekly flow of funds for the various types of MMFs that compares institutional with retail investors can be found here: https://www.ici.org/research/stats/mmf

in 2008 the difference between MMF and Treasury MMF was the $1 NAV. Bank reserves are shrinking, (QT?) and so figure the competition for deposits will induce them to offer higher rates? This could be prelude to the inverse beggar thy neighbor, while sovereigns need to attract investment and price their bonds accordingly. If the global supply of cash is shrinking, (or the spending power has been gutted) or will be, relative to wars in Europe and Asia global interest rates will expand. There seem to be 2 schools of thought, global recession, reflexive mode, interest rates go to zero (Hendry Acid Capitalist) and the less sanguine global stagflation, due to supply issues and trade wars. Money as a means of commerce not a store of value. Bitcoin is the later.

“Money as a means of commerce not a store of value. Bitcoin is the later.”

The Bitcoin store has lost 25% of its value since about Jan 20. Some thieves ran off with it? Not a very good store.

Here’s a giant pot of oatmeal and some bowls. We promise to produce less shiny spoons as time passes. They’ll surely go up in value. And we’ll find a way to make smaller bowls for everyone. But don’t eat any or you’ll lose out on the big feast. Meanwhile, the porrige in the pot is overcooking and the served gruel gets colder by the minute. Breakfast is served. Got napkins?

It’s not a store of value, it’s the biggest pure speculative gamble in the history of mankind, with zero intrinsic value. And it’s all due to the reckless FED and .gov with their money-printing. And it’s not over with. Not by a long shot.

The part I find so comical is the talk that the US dollar will be pegged to BitCON, or that BitCON will become the currency of the US. Sure, our future currency will be a fake one where billionaire whales privately control it all. Nah, that’s not happening.

My feelings as to the intrinsic value of any given bitcon encompass your descriptions.

A worthless token being purchased for 90k dollars per imaginary coin,

At least Bitcoin did better than the following coins from the high on Jan 19 or 20 to yesterday (source: coinmarketcap.com):

TRUMP -85.9% ($73.94 down to $10.41)

FARTCOIN -90.4% ($2.5508 down to $0.2439)

MELANIA – 94.5% ($12.36 down to $0.6834)

Store of Value, indeed!

Of course, if you had bought Fartcoin on Nov 1 and sold it Jan 20, you would have made 40x your money.

Beanie babies and Pet rocks were once considered valuable too.

And tulips.

Las Vegas without the airfare and hotel!

And online sports betting is gaining!

I will maintain my original hypothesis; techno-elites have long recognized that the exponential inflation of the money suplly was going to be a problem. In the absence of some other place for it to go, mathematically, hyperinflation was assured. Well, that or a gold price that (as Greenspan recognized) “got out of control”. So what to do?

Enter some well-connected billionaires that understood tech and were already wealthy and connected to banking… (Winklevoss twins and others).

In a nutshell; Bitcoin has provided a convenient pressure release valve (that isn’t gold), and (more importantly to the promoters) has allowed those who have gained power and wealth from the current corrupt system to stay wealthy and powerful with minimum effort.

Token coins have zero intrinsic value. A currency alternative without the full faith of an army to back it up. Like the dollar which the token coins are trying to emulate and find an official equivalence like the Yen.

“Token coins have zero intrinsic value”

LOL! Many people/corporations have become exceptionally wealthy and acquired all kinds of real assets as a result..

Yes, maybe some day it goes to zero, but so what? Make hay while the sun shines!

You are free to ignore reality, but that won’t excuse you from experiencing the consequences of ignoring reality.

Bitcoin will go below zero in the very near future. The suckers that bought into this scam will have to pay to get rid of their positions in order to take a long term capitol loss. I will not lose any sleep over any of this. I couldn’t care less.

You realize the suckers you are talking about include the US government as well as many states. If they have their way, they will trade all the gold in Fort Knox for Bitcoin.

I don’t think the USG bought any of that drek but accumulated the tokens through asset forfeiture proceedings as a result of criminal convictions.

Howdy Folks. I heart T Bills too. Is Buffett selling his? Sure would like to know….

I read somewhere that he has a rather large cash position, larger than ever before in the history of his company. Not sure what percentage is T-bills. Does he know something or is he just old and tired?

Howdy Bubba. I’m starting to think that maybe the 20 year has a 25 pct upside if FFR is dropped by 1%.

Wolf!! That’s over $10K per person on average in MMF. Yet people say Americans are in paycheck to paycheck. What is your view?

That “living from paycheck to paycheck” is clickbait ignorant bullshit that keeps getting trafficked because people love trafficking in bullshit. But people who traffic this BS never read the actual articles — they just read the headlines. The articles will tell you that the clickbait headline is bullshit. But with a reasonable headline, those articles would never go viral, which is why clickbait persists.

I ripped this kind of BS apart here: So click on the link and read the article:

https://wolfstreet.com/2023/05/27/americans-ability-to-pay-for-emergency-expenses-or-three-month-job-loss-with-cash-or-cash-equivalent-by-selling-assets-by-borrowing-or-not-at-all/

Note that 65% of households are homeowners, as home prices soared, and note that of the 35% that are renters, many are “renters of choice,” how the industry calls them, that could buy but don’t want to buy for a variety of reasons, and nearly all new rental construction — single-family rental and apartment rental — have for years been higher end for these renters of choice. And stock market participation is the largest ever, as is the number of 401k millionaires.

Only 11% of the households live below the poverty line. And some of them are homeless.

how then can you explain the 40mm + people on food stamps and another 20mm who are eligible but dont receive. Yes they might be slightly above poverty but still.

60mm people who are “food” insecure is a large number

I just explained it to you in my comment above. Can you not do basic math on our own? 40 million people on food stamps = 11.8% of the US population. This is what I said in my comment: “Only 11% of the households live below the poverty line. And some of them are homeless.”

American poverty line definition will be considered way way above middle class in most of the world

The stock market lost 50 percent between 2000 and 2010 before all the artificial qe and zero interest rates, throw in the corona qe to the moon…37 trillion in debt leaving a legacy of debt and destruction for the next generation…these sweet innocent civilians are complicit with oligarchs everytime they drip their 401k…how much blood is on the feds hands..

MR. Wolf, perhaps at some point you would take a look at StableCoins with the GENIUS act supposedly to be voted on and passed.

Regulatory framework for tokenization of various kinds of assets. Unfortunately, the GENUIS act will provide the illusion that the issuers are insured (like FDIC) without the reality – although perhaps the final bill will say something different.

The main thrust for the Government seems to be to create a new tranche of buyers for US debt as coin issuers will (in theory) tie the value of their “coins” (ledger entries) to US debt. So essentially these StableCoins become a kind of tokenized MMF with supposedly lower transaction costs.

We will have to read the final bill to see exactly how coin purchasers stand in terms of ownership to the underlying Treasury security and what mechanism there is to ensure that issuers are not practicing a fraction reserve banking model and only partially backing each coin with 1 USD in US Treasuries – that will surely be the temptation for the Issuer.

“Paying higher interest rates on deposits – loans from customers to banks that form the primary funding of banks – increases banks’ cost of funding…”

An observation and a question.

First, as you noted, deposits are LOANS from the customer to the bank. If the bank runs I to problems get in line as a creditor to go ahead and try to recover your money.

Secondly, ARE these customer loans the primary funding source for banks? I thought they borrowed heavily from the Fed system and lent at a profit.

In any case – given the developments of the last 20+ years in my opinion banks are only for checking accounts and for borrowing from, not lending to. CDs and MMFs are more trouble than they are worth when you can buy Tbills directly.

Your #1: Bank deposits are insured by the FDIC up to the limits. Make sure you understand the limits of FDIC deposit insurance. Even if a bank fails, it has lots of assets that the FDIC will sell, and even without bailout, uninsured depositors (deposits over the limits) will get a portion of their money back, some of it very quickly, and the rest over time.

Your #2. Yes, deposits are the primary funding source for banks. Which is why they’re highly regulated banks. In normal times, like right now, banks don’t borrow at all from the Fed. They can borrow from the Fed if they run into liquidity issues. Right now, banks are LENDING $3.4 trillion TO the Fed (the “reserves”) and the Fed pays the bank interest on it. Right now, commercial banks are sitting on $18 trillion in total deposits (in the article I showed you the CD portion of it).

Your #3: Even the cash in your checking account is a loan to the bank, but you don’t get paid interest on it. It’s an interest-free loan to the bank.

Thank you very much. $18T in deposits, much of it not paying any interest at all..

How easy is it to start a bank? Ha.

You have to get approved by the Fed. There are rules and requirements. Under the new regime as of January, there are all kinds of banks being started. I get the notices of approvals in my inbox, and it’s just raining them into my inbox.

4% interest in one year on

$18 Trillion = $720 Billion Buckaroos!

I’ll take it! 😊

1:04 PM 3/14/2025

Dow 41,488.19 +674.62 1.65%

S&P 500 5,638.94 +117.42 2.13%

Nasdaq 17,754.09 +451.07 2.61%

MW: U.S. stocks close sharply higher to end rough week, as gold settles above $3,000

I’m a source of MMF money. With t-bills sagging, money funds have been at or above bill rates of late. I’ve shed all my govts for now.

Money market funds must look pretty good to people saving for RE right now. Earn 4% while RE prices drop in most cities. That skim is long overdue.

I’d like to think that 4% interest on CASH MONEY would be like pushing the gas pedal so forcefully that your wheels are spinning in place and you’re not moving. The reality is, earning 4% on your cash is analogous to shifting the tranny into REVERSE and flooring it as hard as you can.

It’s a no-win game. Bring back 18% interest rates.

I put the money I’ll need for annual expenses (property taxes, insurance) in T-bills. Treasury direct.