A hot question for an iffy situation. So here are the holders as of Q3.

By Wolf Richter for WOLF STREET:

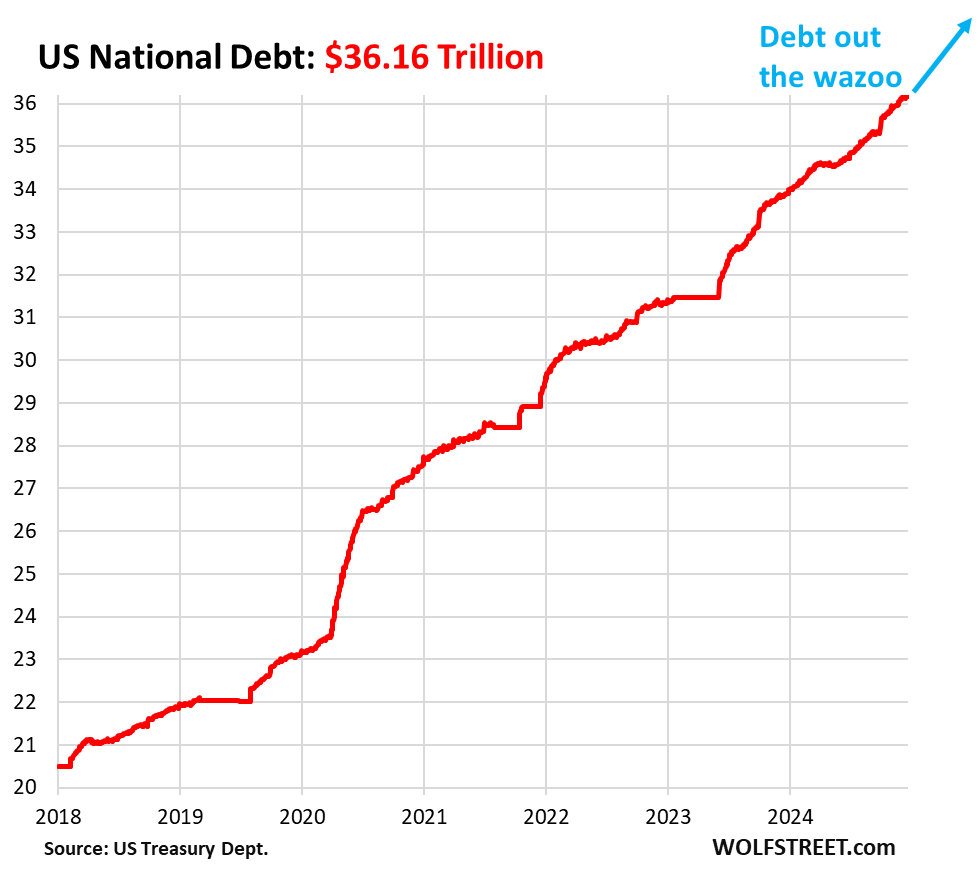

The US national debt keeps ballooning at an amazing rate and has now reached $36.16 trillion. These are Treasury securities that private and public entities in the US and foreign countries hold as interest-earning assets. The question is: Who holds this debt? Who bought it even as the Fed has been unloading its holdings? At the end of Q3, the time frame here, the total debt was $35.46 trillion.

Who held this $35.46 trillion in Treasury securities at the end of Q3?

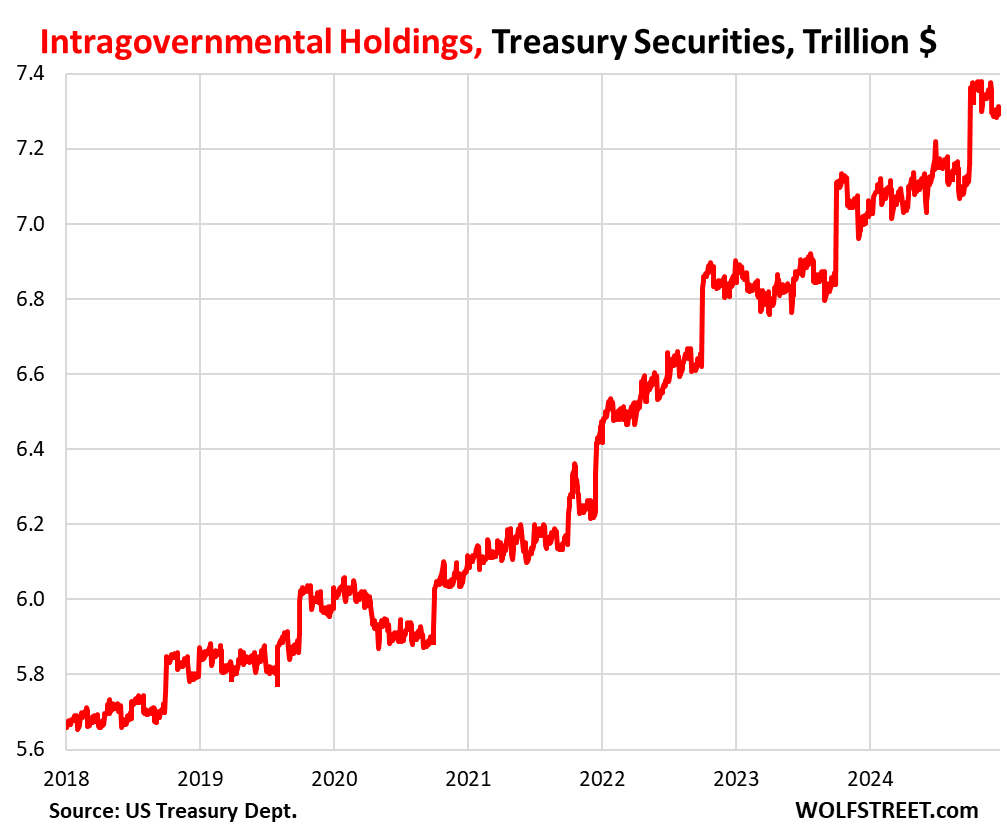

US Government entities: $7.16 trillion. This “debt held internally,” also called “intragovernmental holdings,” consists of Treasury securities held by various federal civilian and military pension funds, the Social Security Trust Fund (we discussed the Social Security Trust Fund holdings, income, and outgo here), the Disability Insurance Trust Fund, the Medicare Trust Funds, and other funds.

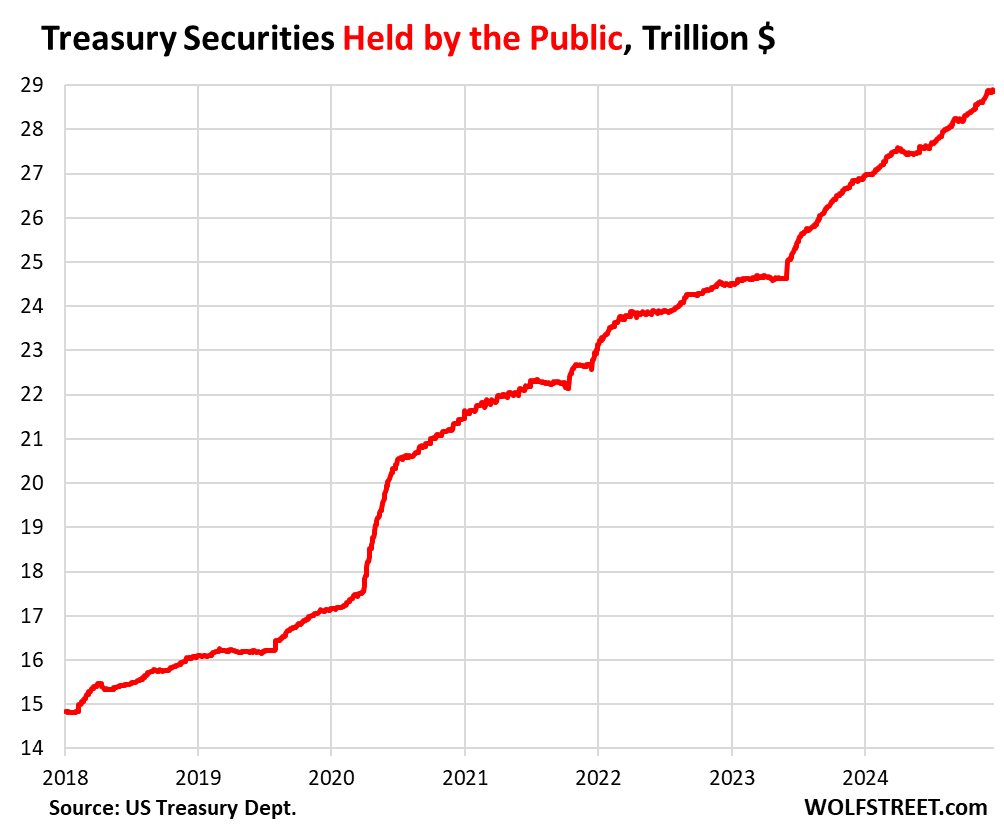

The “public” held the remaining $28.31 trillion at the end of Q3. It’s these holdings we’re going to look at in a moment.

Who is this “public?”

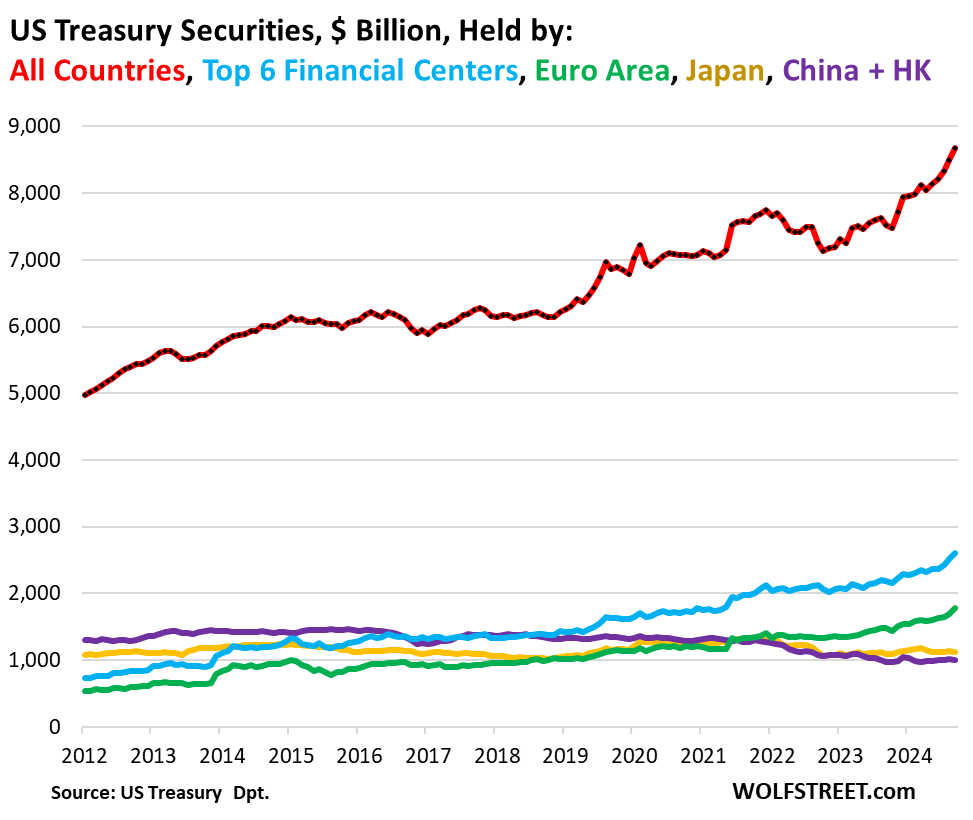

Foreign holders: $8.67 trillion, or 30.6% of the debt held by the public, including foreign private sector holdings and foreign official holdings, such as by central banks, according to Treasury Department data.

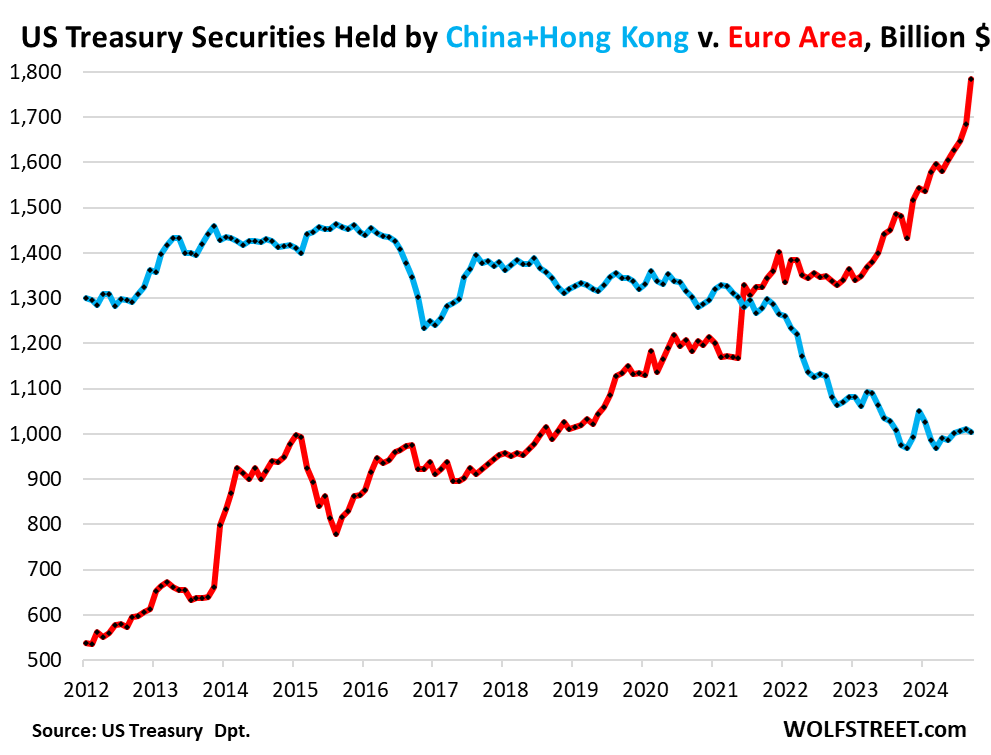

Overall foreign holdings of Treasury securities have continued to rise from record to record. The biggest holders are the top six financial centers ($2.60 trillion), the Euro Area ($1.78 trillion), Japan ($1.12 trillion), China and Hong Kong combined ($1.0 trillion).

Other big holders with rapidly growing holdings include Canada ($370 billion), Taiwan ($288 billion), and India ($247 billion). We discussed the details here:

While China has reduced its holdings of Treasury securities, the Euro Area has more than made up for it:

US mutual funds: 17.6% or about $5.0 trillion of the debt held by the public. This includes bond mutual funds, money market mutual funds, according to the Quarterly Fixed Income Report for Q3 from SIFMA (Securities Industry and Financial Markets Association).

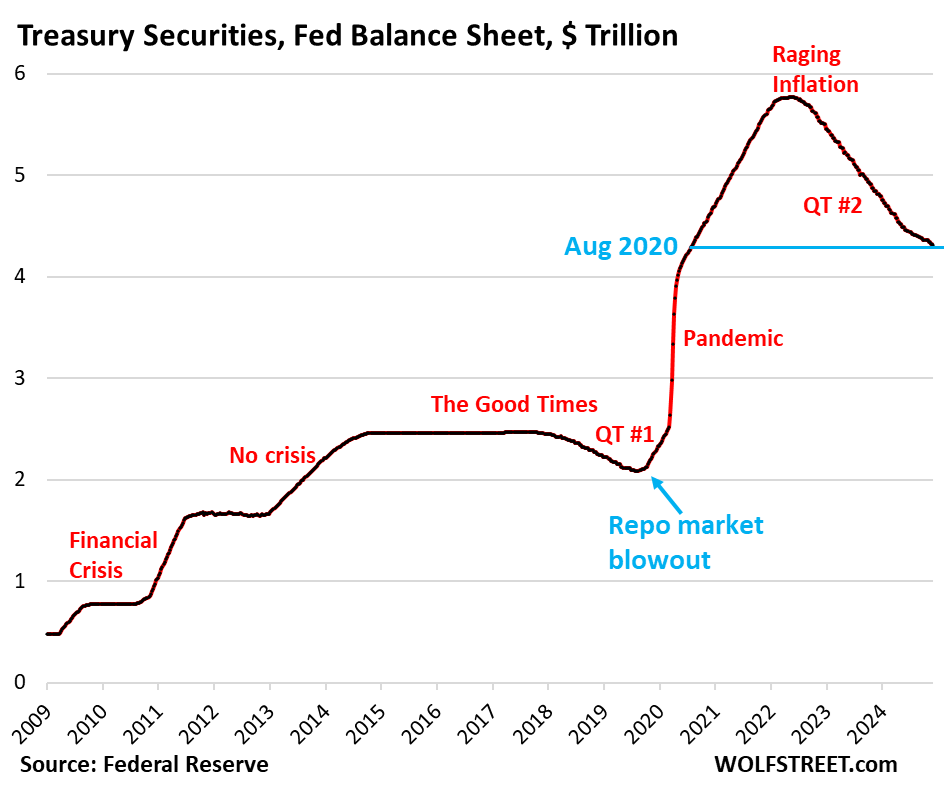

Federal Reserve: 15.4% or $4.36 trillion of the debt held by the public. Under its QT program, the Fed has already shed $1.46 trillion of Treasury securities since the peak in June 2022 (our latest update on the Fed’s balance sheet).

US Individuals: 10.3% or about $3.1 trillion of the debt held by the public, according to quarterly data from SIFMA. These are investors who hold Treasuries in their accounts in the US.

US State and local governments, including in their pension funds: 6.4% or about $1.8 trillion of the debt held by the public, according to SIFMA.

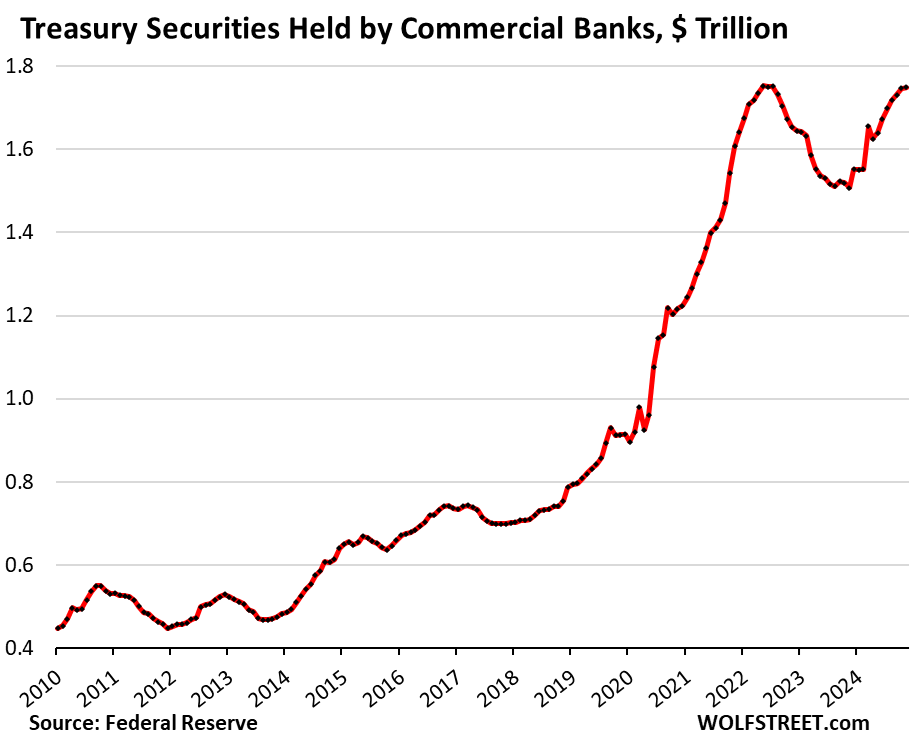

US Commercial Banks: 6.1% or $1.73 trillion of the debt held by the public at the end of November, according to Federal Reserve data about bank balance sheets – back to the record established in May 2022. Banks are re-loving them?

US Private Pension funds: 3.7% or $1.1 trillion of the debt held by the public.

US Insurance companies: 2.3% or $0.63 trillion of the debt held by the public.

Nonmarketable Securities Held by the Public: 2.1% or $0.59 trillion of the debt held by the public, according to Treasury Department data. These securities held by the public cannot be traded in the market and are not purchased at auctions but directly from the government. They include the I series savings bonds and the EE savings bonds, largely held by savers and retail investors. They also include the “State and Local Government Series” that are held by state and local governments, the Government Account series, and other bonds.

“Other”: $0.4 trillion or 1.4% of securities held by the public, according to SIFMA’s report.

The burden of the US national debt: The magnitude and speed of the Interest-Payments-to-Tax-Receipts ratio’s two-year spike is unprecedented in modern US history. It does not look good. Read… Federal Government Interest-Payments-to-Tax-Receipts Ratio Spikes, Debt-to-GDP Worsens Further in Q3.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Merry Christmas and Happy Holidays everyone!!

🎇🧨✨🎁🎀♥️

Thank you for another insightful year. Merry Christmas.

Merry Christmas to you as well. Another great year of commentary!

Merry Christmas Wolf to you and yours! Thank you for all you do to inform!

Merry Christmas, Wolf and all.

Merry Christmas Wolf. Thanks so much. Here’s to a healthy, happy, and prosperous 2025. 🎄

Feliz Navidad, Wolf and all!

Merry Christmas 🎄 Wolf to you and yours!!

Merry Christmas

Wolf, is it possible to identify which amounts of treasuries are hold by stable coins?

Whenever someone investing in cryptos he changes cash into stable coins. Stable coins keeping cash at banks and buying treasuries and other investments

Whenever someone is selling cryptos the opposite happens and treasuries are sold.

Not any expert on crypto stablecoins but ran into the following. No guarantees on accuracy but probably pretty close to reality. Looks like bitcoins ends year with another huge gain. Wowser

Quote;

Ubiquitously recognized as “crypto’s killer app”, the global importance of stablecoins started permeating beyond the crypto industry. Stablecoins continued to export the dollar around the world, crossing an aggregate $210B in supply. USDT ($138B) and USDC ($42B) remained the dominant players, while a majority of stablecoin supply tilted in favor of the Ethereum network, with $122B in stablecoin supply. Altogether, stablecoins facilitated $1.4T in monthly (adjusted) transfer volumes in November.

While stablecoins’ role as a medium of exchange and store of value in emerging economies has been widely explored, momentum around their utility in payments and financial services infrastructure accelerated with Stripe’s acquisition of Bridge. Furthermore, with 99% of stablecoins USD-pegged and nearly $100B directly invested in U.S. Treasuries by Tether and Circle, they also solidified their position as key vehicles for preserving dollar dominance on a global scale.

Tether just agreed to put $775 million into Rumble for an equity stake. Not into Treasuries. Is Tether now backed by Rumble stock? What if Rumble fails? In that case, Tether’s equity stake of $775 million will be worth zero. I continue to be amazed by the BS that is going on in the crypto world.

I think if we get a mini correction soon, the BTFD crowd will be very focused on meme coin acquisition — and I think we’re starting to see a generational disconnect from traditional valuation measures.

The rock solid foundation of treasuries as a safety net is transforming and totally worthless and useless trending coins are being used as bait, to lure in cash flow.

I’m absolutely against a bitcoin reserve, but we’re maybe within weeks of that stupidity exploding.

The concept of using America tax dollars to subsidize bitcoin holders is nothing short of criminal — not to mention using taxpayer funds to devalue our currency. Even if it’s a matter of swapping treasury gold for crypto, that’s criminally insane— and sets a precedent for unlimited fiscal boondoggle con games.

I’m literally furious about this abuse of power that’s being crafted (by gangsters)!

Tether made over 4 billion profit in Q1 2024.

775 million to rumble is nothing.

People give Tether currencies, tether gives people USDC which is pegged to the dollar 1:1. Tether makes pure profit on the float by earning interest on short term treasuries. Supposedly their treasury has enough for everyone to redeem their USDT for fiat as the treasuries mature.

Who buys something for $100,000 when it was $2 twelve years ago???? This could be the biggest Ponzi Scheme in the history of mankind. This is definitely an asset that could totally collapse.

It is worth whatever a greater fool is willing to pay for it on any given day. If it crashed 95%, late buyers would get destroyed, while buyers when it was below $100 would still be mega-millionaires. It is just surreal. Stocks, cryptos, whatever, it’s the biggest bubble EVER. I have not changed my view that the S&P is a lock to see 4500 again at some point. This was an election year, the market was supposed to go up. We’ll see what happens.

The book Number Go Up pursued the criminal dimension, at scale, of various parties’ stablecoin (focusing on Tether) usage internationally. For countless dodgy players large and small, it is a mainstay of their everyday finance. To have this creeping toward the center of our financial institutions frightens me.

Why does the crypto enthusiasts want me to give them my totally worthless U.S. dollars in exchange for their priceless Crypto coins?

Why would they not want to just keep all these priceless coins themselves? Asking for a friend.

Ok but the question is can you show us how much US debt Tether owns?

Paul,

As of year-end 2023, Tether claims to hold $80 billion in US Treasuries “direct and indirect.”

Are there any charts of what it costs to “mine” a bitcoin? Does it go up with the bitcoin price? With the number of transactions? (I’m gonna quit writing things that will be deleted now, and go see if I can learn the algorithm.)

Fossil fuel is money….more than anything right now, most likely.

Happy Solstice.

May the festivus pole grant you many wishes!

Frohe Weihnachten Euch und einen guten Rutsch in 2025! LG

Joyeux Noel!

Merry Christ mas Folks

Prior to burning so much biomass, the days now getting longer was a BIG DEAL…. the Winter Solstice!!!!…..it was really worth celebrating…..ALL cultures/religions do it in some form…..

I suppose it still is a big deal if you like sunshine.

May the weather (and other people) be kind to your attempts at homeostasis.

Merry Christmas Wolf!

Your web site & reporting is a light in the darkness for me.

When given an option to read WSJ or wolf Street, I pick Wolf Street every day.

If more people knew of wolfstreet, it would be bigger than WSJ

Merry Christmas, Wolf!

Thanks for all the information you compile and share.

Merry Christmas everyone!

Merry Christmas Wolf.

Id rather have coal than crypto from Santa.

Be well.

Send via interwebs from Maui.

Brother, those interest are paid by issuing T-Bills. Americans own close to 95% of those T-Bills (Buffett is one the largest investor). So Americans own 77% of their debt and 95% of those bills that pays those interests. That means that public debt is an liability for the government, but a huge asset for Americans. Americans are the biggest lender for the US government.

T-bills are Treasury securities. They’re included in these figures already. You’re double-counting them by adding them again. American entities hold 69.4% of all Treasury securities, including T-bills. Foreign entities hold 30.6%, as the article points out.

Perhaps I missed it if you’ve posted it, but is there a breakdown of quarterly debt broken down into denominations such as 5 year note, 30 yr bond, <2yr bills, etc?

Thank you for your time and Happy New Year.

Waiono

I don’t track it by 2-year versus 5-year versus 7- year, etc., but by T-bills (1 year and shorter), notes (2-10 years) and bonds (20 and 30 years). Data from the Treasury Department:

Marketable:

— Bills: $6.39 trillion

— Notes: $14.4 trillion

— Bonds: $4.75 trillion

— TIPS: $2.05 trillion

— Floating Rate Notes: $606 billion

I only chart T-bills as a category:

Happy Holidays!

I hope Santa brings financial success!

Merry Christmas and Happy Holidays to you Wolf and thank you for your great insights into our economies!

Merry Christmas and a Happy New Year, Wolf!

Merry Christmas, Wolf!

Merry Christmas Mr Richter.

Merry Christmas & Happy Holidays!

The positive side is the chickens are back home to roost. We don’t have a political system that can solve the ever expanding deficit in a meaningful way and of course payments on debt will continue to increase. However seems like there is plenty of can kicking to do before a proverbial fan shows up. We are an individualist society so you have to get your slice of the pie if you have the means to do so.

So….What your saying is, the chicken came home to roost?

Why you would say that is puzzling, if your commenting on this article, the US debt is held by many others as well so the chicken is still out and about.

It could be a drone your seeing disguised as a flying chicken.

The chickens have nothing to do with where the debt is located. The chickens are the poor decisions (multiple very long wars, money printing, tax cuts, etc) with spending money where even in good times the debt piles up and interest payments continue to increase. The US for now, and likely for some time, will still be the safe investment for the world but it does not come with side effects and consequences. I am sure individually people can relate to the chickens but rarely at this level but of course in a representative democracy “we” collectively made and own them.

You also claim it’s a positive thing that the chickens have returned, that the debt is piling up and increasing interest payments as tho it’s a good thing.

I guess I’ll just assume your on a special mission from outer space.

Home toad,

People will have different opinions. I simply believe it is a good thing as actions have consequences. The US, for the most part, has never really had any consequences. It comes with dangers too as the US will have to adjust and recognize the world is changing. Does not appear it wants to do this is a constructive way so this cold war number 2 on the way. That said, I am pro China of which most people are not.

The treasury market is saying that inflation is not yet tamed. Treasury prices seem to trend for decades. If their present behaviour is any indication, then the bond market could be out of favour for decades to come, with all that implies about inflation and the full faith and credit of the U.S. government.

Thank you for this website, WR…. Small time, T Bill investor

Thanks and Merry Christmas. Best wishes to you and your family,

It appears the Bank of Canada is trying to stabilize the Cdn dollar through it’s treasury purchases – the recent charts suggest it isn’t succeeding well, as it seems to have an EKG-like recent history against the US Dollar.

Former residents of Canada: If you contributed even a small amount to the Canada Pension Plan starting in January 1966 or later, you are entitled to a monthly benefit which will go right into your US bank account with no service fees. Start the process by visiting the Service Canada web site.

CPP has no minimum vesting period unlike US Social Security which requires 10 years of of participation to vest your benefits.

I believe that you must have lived in Canada for ten years after the age of 18 in order to receive it. It becomes twenty years to have benefits paid outside Canada.

MW: 10-year Treasury yield hits fresh 7-month high during holiday-shortened session

Mortgage rates end 2024 higher than they started.

Telegraph: Why US borrowing could soon eclipse Greece and Italy as world drowns in debt

America now owes more money than the value of its economy – which should worry us all. When it comes to economic performance, few prime ministers or presidents would welcome comparison with Greece. Images of protests, riot police and the streets of Athens ablaze dominate the international memory, dating from the country’s debt crisis in 2011.

By the pandemic, its debt was more than double the size of its economy, a position matched by some of the world’s poorest and most crisis-ridden danger zones including Eritrea, Sudan and Venezuela. It’s not a club anyone would wish to join.

But astonishingly, economists predict that in a decade’s time, another nation will have joined this dubious roll of honour – the United States of America.

SCBD-

Your post reminded me of a quote from Will and Ariel Durant’s History of civilization, perhaps slated for repetition in upcoming decades?

“Individualism stimulates the able, and degrades the simple; it creates wealth magnificently, and concentrates it dangerously. In Athens, as in other states, cleverness gets all that it can, and mediocrity gets the rest. The landowner profits from the rising value of his land; the merchant does his best, despite a hundred laws, to secure corners and monopolies; the speculator reaps, through the high rate of interest on loans, the lion’s share of the proceeds of industry and trade. Demagogues arise who point out to the poor the inequality of human possessions, and conceal from them the inequality of human economic ability; the poor man, face to face with wealth, becomes conscious of his poverty, broods over his unrewarded merits, and dreams of perfect states. Bitterer than the war of Greece with Persia, or of Athens with Sparta, is, in all the Greek states, the war of class with class.”

— Will Durant, The Life of Greece

Christmas Cheers

And if we want to widen that scope even a bit further:

“…And with their trader’s babble they have killed

The ancient voices that could make them wise.

Their mightiest in trickery and lies

Are chiefs among them. it shall come to pass

When these at last have stolen all the grass

And all the wood, the water and the meat,

And there is more to burn and drink and eat

Than all could use in many moons of feast,

The staving people shall become a beast,

Denied the very grasses of the chief.

But dreaming each to be the bigger thief

They toil and swarm, not knowing how their sweat

Shall turn to blood upon them. Who forget

Their mother, are forgotten at the last.

Already I have seen it in the past

Of spirit vision. It is even so.

These eyes need not to see it.”

— John Neihardt, “Sitting Bull”, circa 1930

A bit further down that dirt highway,

“Then the old jefe he went loco,

Slightly daffy in de coco.”

Unknown writer, Forgotten Cartoon, circa 1950’s.

We’re all riding the Toonerville Trolley on the way to Toontown anyways. Pretty soon the money will be inked on tear out sheets found in the back of comic books. Mail ‘em in (images only) and get some brine shrimp via Amazon! Free delivery!! Subscribe now.

“America now owes more money than the value of its economy” — ?? — wouldn’t it be more correct to say, it owes more money than the annual production of its economy? Aren’t there countless kinds of value outside of its annual production? Fixed assets, intangible assets, all kinds of things that spread outside of one year.

The US government owns lots of land and buildings throughout the country but the Treasury bonds it issues are unsecured.

They are de facto. Too big to fail.

Yes, it’s like you owe $500,000 on your mortgage, but your annual income (personal production, so to speak) is $150,000. The first is a level, the second is an annual flow. But we do compare them (debt-to-income ratios or debt-to-GDP ratios) to estimate the burden of the debt.

Merry Christmas and thanks for educating me.

Merry Christmas and a wonderful New year to you WR. Thanks for all you do.

Merry Christmas Wolf….I’m in Tokyo with mine & you’re in SF with yours!

We are so lucky!

What ever happened to the 3 wise men?

Merry Christmas everyone!

Simple – they recognize a crockful of **** when they see one, and wisely,

disappeared from Dodge.

They are over the high altar in Cologne cathedral. It was built for the purpose I believe.

“US Individuals: 10.3% or about $3.1 trillion of the debt held by the public, according to quarterly data from SIFMA. These are investors who hold Treasuries in their accounts in the US.”

Oh crap, they are on to me. I’m gonna have to shift that $3.1 trillion to crypto.

“I’ll have two egg nogs and a side order of toast.” “Sorry, we don’t serve toast on the side.” “But you do have a Christmas sandwich on toast, right?” “Yes we do.” “Well, then make me a Christmas sandwich, remove the toast, and put it on a side plate.” “But what will we do with the Christmas?” “Keep Christmas. Keep it between your legs!”

Merry friggin’ Christmas, everyone! (Just humoring y’all). Now fork up for the bill!

The Chart you have comparing the “China-Hong Kong” Reduction in US Treasury Holdings, and being Made up with “Euro Area” increase in US Treasury Holdings is interesting.

Could it be that because the “Euro Area” has increased significantly US Treasury Holdings in making up for “China-Hong Kong” reduction of US Treasuries, that this is also an Influence in which the Federal Reserve had decided to Cut Interest Rates, in which they intended to remain and increase the value of US Treasuries so the “Euro-Area” can continue to buying more US Treasuries to offset “China-Hong Kong” Reduction .

It would also be interesting to see how much of the “Euro Area” increase in US Treasuries is from Government (ECB Central Bank, etc..) vs Other, and how much of the Reduction of US Treasuries is from “China-Hong Kong” is from Government (China Central Bank, etc..) vs. Other

Merry Christmas Wolf and thanks for the great writeup

Merry Christmas to all and to all Good Morning! Thanks Professor Richter for your gift of insight!

Feliz Navidad y Prospero año a todos desde Costa Rica. Gracias senor Wolf

Bonne année, bonne santé, beaucoup d’argent dans la porte-monnaie! Merry Christmas and thank you for providing such down-to-earth education, great sense of humor, and sparking very lively and entertaining discussions. Happy New Year to you and all your readers!

Merry Christmas to all …

Well, the 120 % debt to GDP ratio is “normal” for Western countries, as there are many with such a ratio, and the U.S. has higher growth, higher innovation rates than the others.

What is worrisome is that the financial crisis 2008-2010 led to an increase of debt of nearly 40 % (from 60% to 100% of GDP). As the latest housing data are not positive (increasing inventory) another housing collapse would hurt the U.S. even more and then the debt to GDP ratio would go up pretty quickly.

Not a pretty picture after all.

Merry Christmas everyone. It seems to me that if new money can be created out of thin air, not only just here in the US but all over the world, then there really is not a problem as long as inflation stays within normal limits. I know people will say it not right because we’d we be handing over a huge debt pile to our kids and grandkids. But why would our kids and grandkids stop creating money out of thin air?

Merriest Christmas Wolfman! Though I remain on the naughty list. I’ll be touring San Fran in February. Been there a couple of times on business, but never got much time to look around. My son’s giving a presentation at a professional seminar and invited Mom and Dad to join him and ride those Waymo thingys around town.

I highly recommend Chinatown. Should have decorations up for Lunar New Year. Enjoy the city and Waymo tours! Would be great to have additional anecdotes from Wolf’s wonderful readership.

Merry Christmas and happy holidays to all!

Recently discovered you Wolf. Some very insightful data which tend to dispel a lot of the over simplifications one see’s in the media. While the debt is indeed up wazoo and needs to be addressed it is good to see a bit of popular mythology dismissed namely that most of our debt is owned by foreigners like China who could destroy us if they chose to sell off. I’ve been reading these nonsensical bogeyman stories for years. I assume most of them emanated from conservative think tanks or others with a similar agenda.

Even at Christmas you couldn’t leave out the politics.

Wasn’t even thinking about politics chum just commenting on one those popular myths that are basically nonsense.

Merry Christmas, Wolf.

Where do primary dealers fall within this breakdown? US Commercial Banks?

Those Treasuries that they and other brokers hold in the accounts of their clients show up in the category of the clients, such as “Individuals” or “Pension funds” or whatever. So if you have a brokerage account at Goldman Sachs, and have $100,000 in Treasuries in that account, it would show up under “individuals.”

Those Treasuries that Goldman holds in its own account show up under “banks.”

Thanks Wolf.

P.s. have you considered a pie chart for showing this breakdown of ownership?

09:35 EST – shall we begin the airing of grievances?

There’s a housing shortage, but prices are crashing!!! Not in my area of course, nothing but builders as far as the eye can see around here. Mostly illegal labor though, round em up if they won’t vote right!!!

The fed are beholden to wall street. They drink mothers milk from caged virgins while manipulating my assets ever higher so I’ll accept my fate as a powerless wage slave and drive one of their genital shrinking electric vehicles.

My dollars are worthless, but you can’t have any of them, you millennial slacker and/or person born before 1970 who has never experienced hardship!!

90% of the population is dirt broke, they eat ramen every night and have maxed out credit cards! All the consumer spending is being driven by the top 0.1%!! /s

Thank you Wolf.

I started my Christmas day with your excellent recap on U$$A national debt and

yesterday’s article by ‘simplicius.’

“MSM Quietly Acquits Itself with Hushed Admissions of Major White House Coverup”

Simplicius

Dec 24, 2024

∙ Paid

=====

The West’s Kabuki Theater of the Absurd is ever more exposed.

Back in time in 1981 a number of us were alarmed at the US federal debt approaching the $1 trillion mark so we voted for Ronald Reagan for President of the US based on his promises to deal with the ballooning federal debt. We and all of American were in for a very rude shock in the period that followed with the federal debt exploding to more than $2.8 trillion by the time Ronnie left office in 1989. Then came George H. W. Bush and his Vice-President who assured us that federal debt just simply doesn’t matter as the federal government just kept spending like a bunch of drunken sailors.

Now, many years later as we enter 2025 and the federal debt is roaring towards $37 trillion and the interest alone on that debt in US Treasuries is now around $1 trillion a year with the debt increasing by more than $2 trillion a year, it appears that the debt and deficit may matter.

The question, of course, is what do we do about that problem and there are simply no answers other than to increase taxes and to cut 20% to 30% of the excessive federal spending. The question is whether the American people have the will to do that before their government slams at 200 mph into a solid brick wall and implodes.

After few years we would be having the same complain when thr debt hits 100T.

Debt does not matter really if you think logically until it does

Debt might not matter, but the Interest on it certainly does! But for some reason people never seem to think it does.

You forgot the /sarc tag. In the next four years, the debt will go up by at least 10 trillion dollars. Fifty trillion, here we come! Let the good times roll!

My guess is that we will get a lot more inflation before the US government slams into a brick wall and implodes. It took less than 10 years after WWI broke out for the old German mark to become almost worthless. The US$ has led a more charmed life. More than 50 years after the US left the gold standard, the $ is still doing better than the British pound and the C$. My own standard of living is much higher than it was as an indebted graduate student back in 1971.

Great dissection of the counterparties. The obvious danger comes from the ones that we don’t owe to ourselves.

What are they going to do, repossess the chip fabs in Arizona? Or what, do a giant rug-pull, only to invest where? Their value might be confiscated here, in dribs and drabs over the years, but that is a matter of degree, compared to risks elsewhere. But the real wild card might be some new kind of digital asset? That is still periodically a clown car to nowhere, even if the stable genius is touting it (and his family hawking it, out a side door).

Everyone who bought the May 15, 2050 1.25% 30 year Treasury bonds have already seen the value of those bonds decline by more than 50%.

In the event that they’re ever forced to, or just decide to, sell those bonds anytime soon, they’ll take a huge haircut.

Treasuries are risk free until you need to sell them.

Treasuries are risk free only in terms of CREDIT risk — they won’t default. They do have interest rate risk (prices fall when yields rise), inflation risk (like any asset), and reinvestment risk.

Don’t buy anything you can’t hold till maturity.

Merry Christmas, Wolf.

Merry Xmas

Back in the nineties rates on the curve were a cross the board 5-6%. Not all the nineties but most of the years.

Merry Christmas Wolf

Swamp Creature and Ms Swamp Creature

Who bought treasuries, who bought equities?

Just reread a story about “The Dark Lady of Osaka” Nui Onoue — the Warren Buffett stock picket from the late 90’s Japanese stock bubble (who went to jail for a decade for fraud).

The thing that stands out, is the equity mkt cap to GDP ratio of about 140 @ peak euphoria insanity — and the realization that dawned on people, that excess stupidity had gone a bit too far.

So, here we are again, reliving, re-breathing re-imagining epic, euphoric stupidity and seeing how far we can go, before the house of cards rug pull becomes a wake up call.

These values are slightly old, but total mkt cap for Japanese equities is about 958 trillion Yen and Japanese GDP about 4 trillion Yen — almost double the prior ratio!

Meanwhile, our more civilized Buffett ratio in America is hovering around 200%.

That should be a reason to migrate towards low yielding treasury bills — but, who wants a yield of 4.3% when you can buy Doge coin and get 245% in a year, with our leader priming the pump for fantasy nene coins, and simultaneously wanting to devalue the dollar and crash treasury yields to zero?

Obviously common sense isn’t going to matter in our banana republic, so who will buy treasuries?

Who Buys and Holds the Recklessly Ballooning S&P 500 which has now Reached a Market Capitalization of $50 Trillion?

Merry Christmas.

Happy Hanukkah.

Best to all in 2025.

Who buys “crypto?” It’s all just reckless gambling now thanks to the FED.

That matter is certainly not the fault of the US Federal Reserve.

Well, here is a new dimension. One can now siphon money to some very politically connected people that way. I guess folks forgot what a conflict of interest was, or rather, never bothered to learn it, in the rush to supposed riches. That is creating its own feedback loop through that “asset class” and its promoters, alongside the usual desperate gamblers. The sheep get sheared as always, and there are now wide open ways now to skim cream off the top.

Crypto, crypto, who needs crypto.

Crypto, crypto, you need crypto.

Remember to always have an ace up your sleeve at the….feds reckless gambling hall.

Your “ace up the sleeve” is crypto?

🤣

Just like it’s not a lie if you believe it, it’s not reckless if you plan on defaulting on the credit card anyway!

Trump’s going to be disappointed when he learns that the cost of “renegotiating the debt” is mostly borne by the public and not foreign entities.

He, personally, is not the one who will be disappointed, or ending up holding the dinner check in any regard. He has shown a facility for not being the bag-holder, once the dust clears, and for finding new groups to buy into his brand. Exhibit A: the early 1990s, and the “Art of the Comeback.” We are in about the fifth iteration by now.

Bitcoin is a child’s game that the billionaires took to. They needed something to play with all their money. So is it surprising that Trump now believes it is really something and so important to make it part of the u s reserve? I still say crazy.

The insanity of fixing government fiscal problems with bitcoin is understandable, isn’t it?

Happy Boxing Day everyone.

I have done a few stupid dumb things in my life time. But I when I look around and see all the people buying crypto, I see there even more gullible folks out there.

I spend lots of time, everyday, pondering money — not because I’m an obsessed Scrooge — but because I want security and stability for years ahead. I’m about 66, but the timeline ahead is precarious and precious — problematic.

I’m currently in financial purgatory, after selling my house about two years ago. My jackpot ended up in a safe money mkt, where I’ve been content to watch the ai market bubble explode — while I make less than 4.5% now.

Purgatory means, treasury instruments are fairly pointless, all stocks are excessively overvalued, commodities are pointless and crypto useless for predictable cash flow — everything in the financial universe is increasingly useless for monthly income.

I’ve been thinking we’re at an inflection point, where this pandemic bubble will lose some hot air, but the Boy Who Cried Wolf narrative has been flat, under the bus, for years. Nonetheless, I keep looking for strategies to prepare for a mkt reset, recalibration that provides potential opportunity— versus taking on mkt top risk.

In terms of treasuries and issuance, yields and the deficit, how is it possible for people to bet on America’s future? The global deficit is the star of the show — and in this drama, America is well on its way to becoming Japan, in terms of lost decades.

It doesn’t take too much brain power to see what happened to Japan, after its glorious bubble popped in the 90s — the devaluing Yen, zero yields on gov treasuries and an equity mkt that took 30 years to awaken — primarily because a new generation is excited about speculation, while in denial about fiscal stability.

So, as with many baby boomers, I feel cash is king and accept that my 4% return, is better than TINA — but, as inflation is drifting higher, and as monthly costs increase, as cash flow decreases — my discomfort is offset by belief that we are definitely at an inflection point and mkt pinnacle that is entirely unsustainable.

My measly monthly income is enough, and so I’m building a shopping list for potential investments, including higher yielding treasuries — but, in the end, the conviction necessary to buy anything during a serious downdraft will be severely tested.

I don’t think good times are ahead for any of us.

MW: Mortgage rates jump, finish the year at a five-month high

What is it going to take for Congress to raise taxes, cut spending very significantly, and start reigning in the federal debt? 10% yields or higher on US Treasuries or even greater yields?

The super rich should have to pay MUCH higher taxes, and working people who earn less than $50k should have to pay nothing. ZERO.

Is that Bernie Sanders or Pochahantas ? How did they get on this site?

Despite what they say, that Sanders and Warren and most or all of the rest of Congress don’t actually believe that is clear based on their long term voting record of repeatedly increasing the debt to dangerous levels, which threatens to put some heavy ‘tax’, whether inflation, recession, on common workers. Or maybe they do believe it but instead vote for their donors interests rather than what’s best for ordinary citizens.