Too-high home prices cause demand destruction on an epic scale. Buyers’ strike continues in November and December.

By Wolf Richter for WOLF STREET.

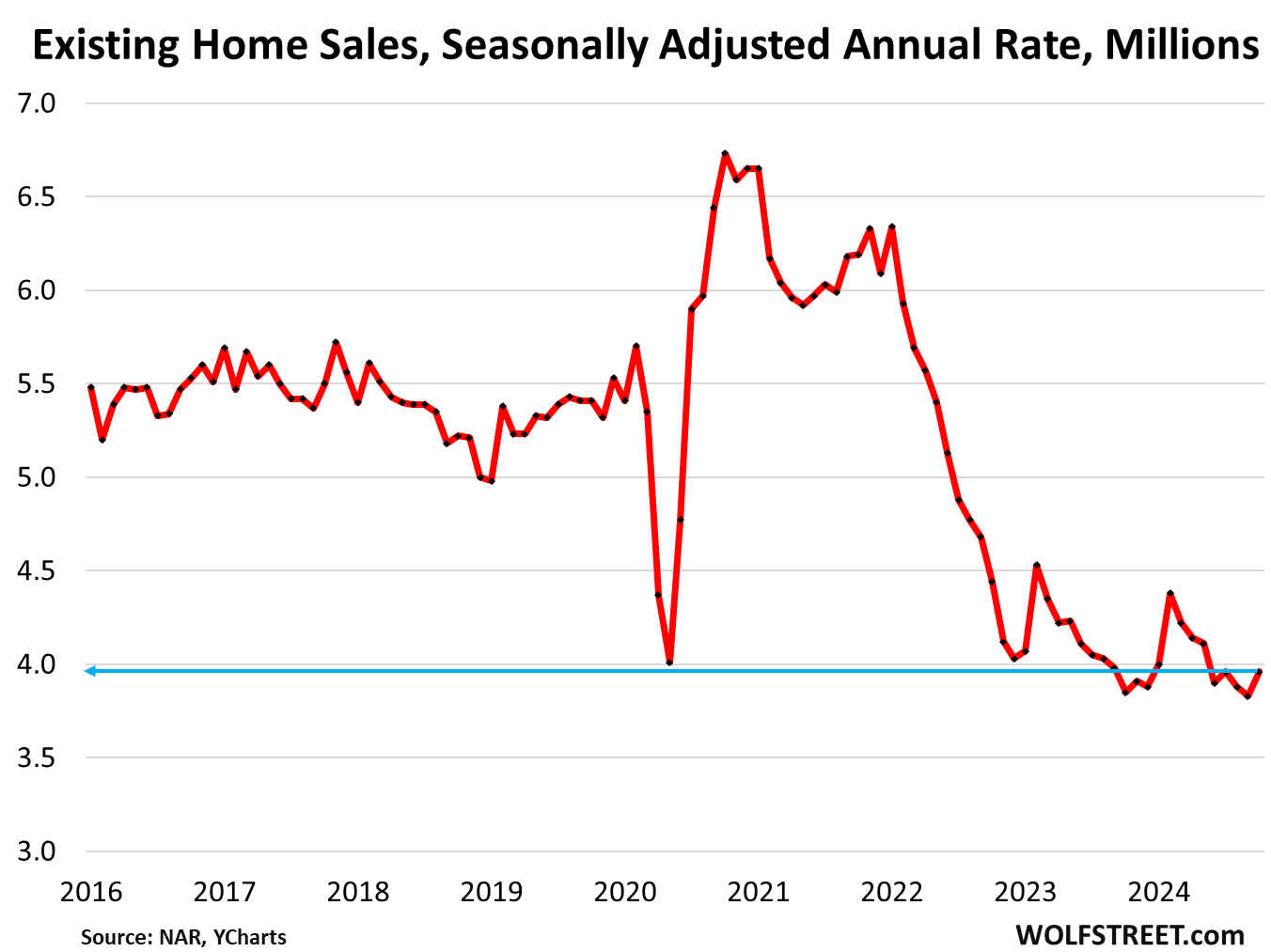

Demand for existing homes has wilted in an amazing manner and is wobbling along rock-bottom. Sales of existing single-family houses, condos, and co-ops that closed in October came in at a seasonally adjusted annual rate of 3.96 million, according to the National Association of Realtors (NAR) today. This was a slight uptick from downwardly revised September.

These below-4-million sales rates, which started in September 2023, are the lowest since the worst months of the Housing Bust. Compared to the collapsed sales rate in October 2023, sales rose by 2.9%. Compared to October 2022, sales were down 36%. Compared to October 2019, sales were down 26.8% (historic data via YCharts):

Too-high prices cause demand destruction on an epic scale.

Actual home sales in October (not seasonally adjusted, not annual rate) ticked up to 348,000 homes. For the 10 months of 2024 so far, actual sales at 3.42 million were down by 2.1% from the crushed levels of the same period last year.

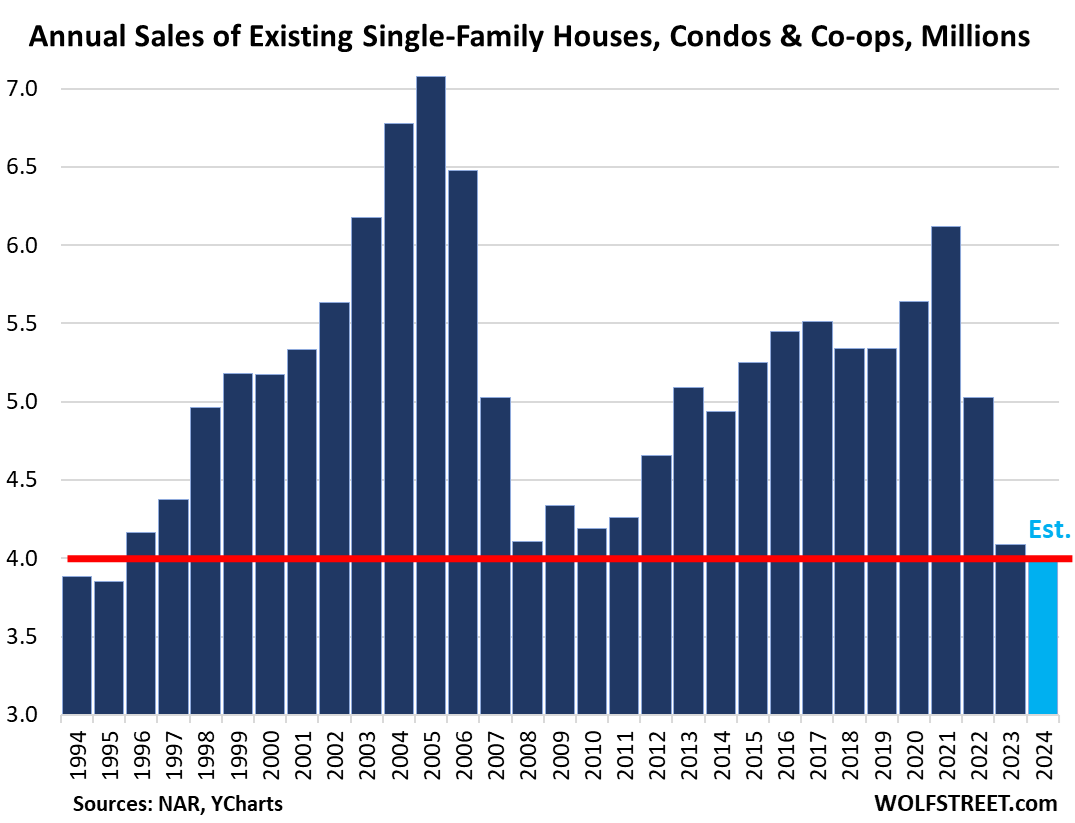

With today’s sales figures, the WOLF STREET estimate for whole-year sales in 2024 comes in at 4.02 million sales, the lowest since 1995, below the worst year of the Housing Bust, 2008, with 4.11 million sales.

This demand destruction is even larger than during the Housing Bust. But during the Housing Bust, demand destruction was caused by an economic and financial meltdown, as the unemployment rate shot to 10% and millions of people lost their jobs and couldn’t make their mortgage payments, and as reckless mortgage lending in prior years bore fruit.

This time around, demand destruction is caused by the gigantic spike in prices – they’re now way too high (historical data from YCharts).

Buyers’ strike continues in November and December.

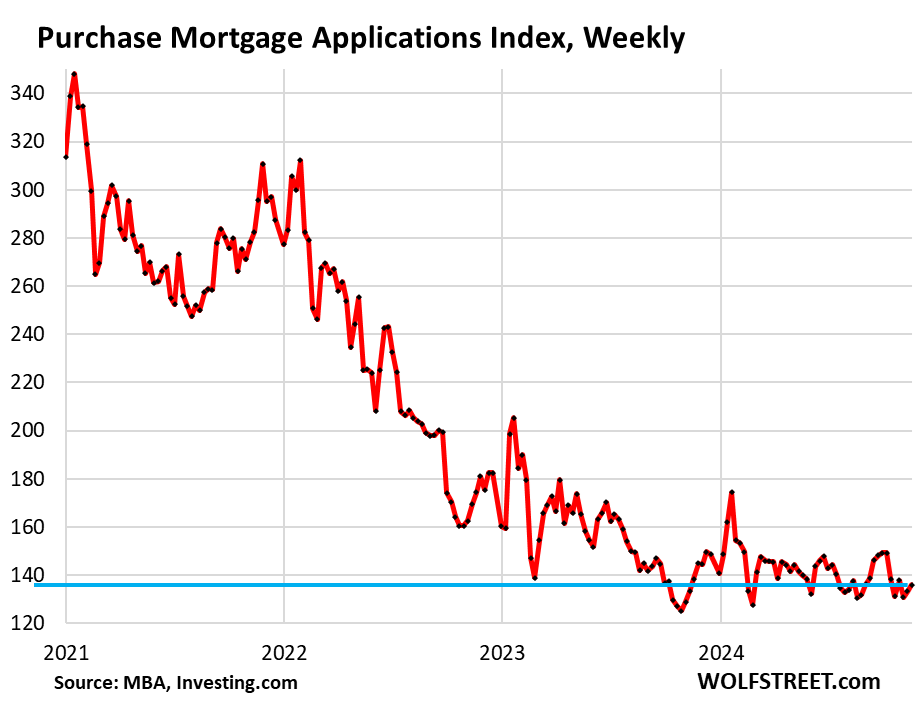

The weekly measure of mortgage applications to purchase a home has been near the historic lows over the past six weeks, including in the latest reporting week, down by 50% from the same period in 2019, according to data from the Mortgage Bankers Association yesterday.

This is an indication that buyers who would need a mortgage to purchase a home will still be on buyers’ strike in November and December, in terms of the closed sales reported by the NAR.

Supply second highest for any October in 7 years, behind only 2018.

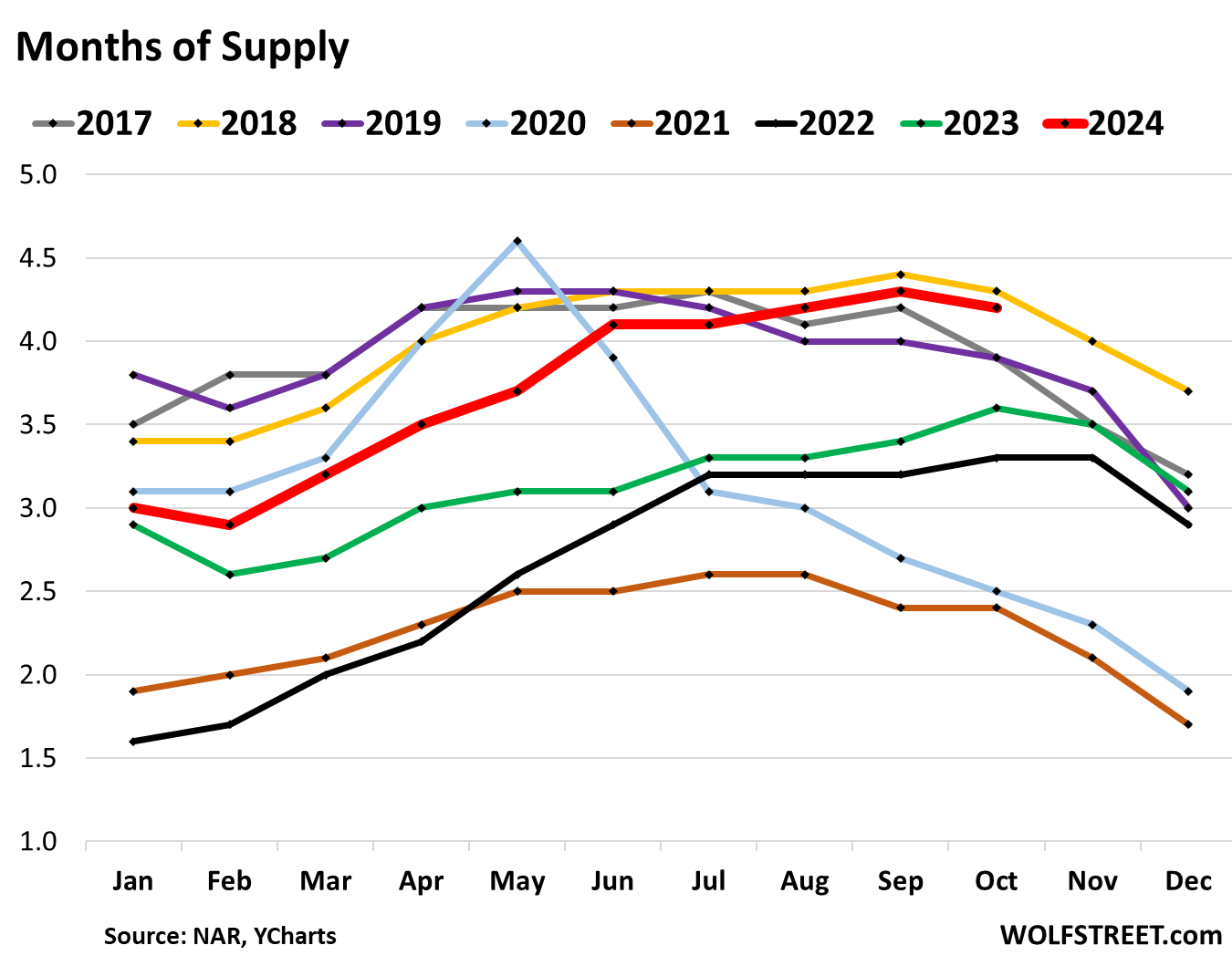

Unsold inventory dipped to 1.37 million homes in October, from 1.39 million in September, which had been the highest in four years, and up by 19% from a year ago, according to NAR data.

Inventory of single-family houses was unchanged at 1.19 million, or 4.0 months’ supply (up from 3.5 months a year ago).

Inventory of condos and co-ops rose to 175,000, or 5.5 months’ supply (up from 4.0 months a year ago).

As demand has wilted this year and inventory has risen, supply in October at 4.2 months (red in the chart below) was the second highest for any October in the past 7 years, behind only October 2018 with 4.3 months (yellow):

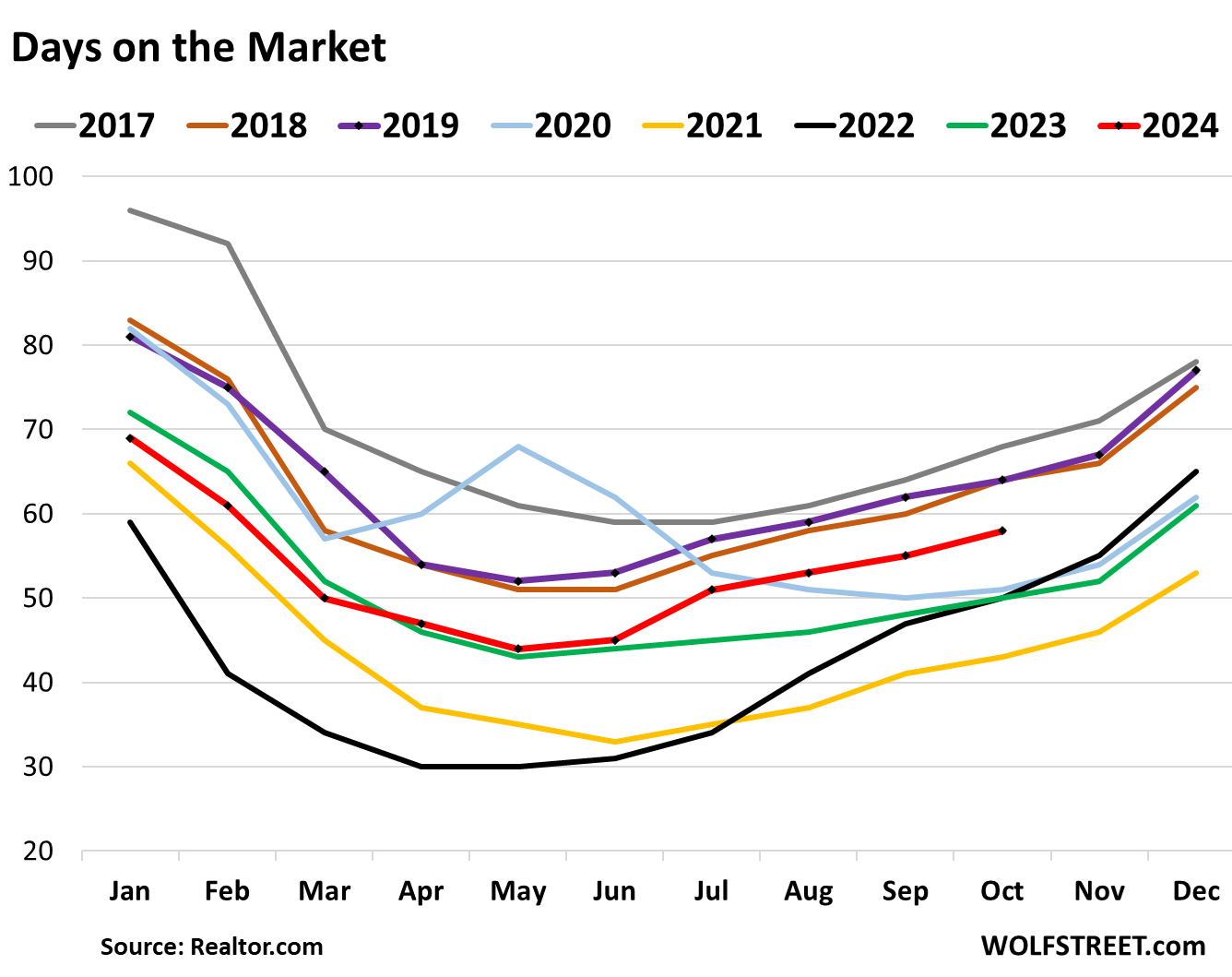

Days on the market rise.

The median number of days before the home is either sold or pulled off the market because it failed to sell rose to 58 days in October, the most for any October since 2019, and up from 50 days a year ago, according to data from Realtor.com. This is in part a measure of how motivated or unmotivated sellers are.

When sellers are motivated and getting impatient or desperate, they will leave their unsold home on the market and cut prices until it sells, and the median number of days homes spent on the market rises.

When sellers are unmotivated, they pull unsold homes off the market quickly if there is no action, and the median number of days on the market falls. Sellers are still not very motivated, but are getting more so:

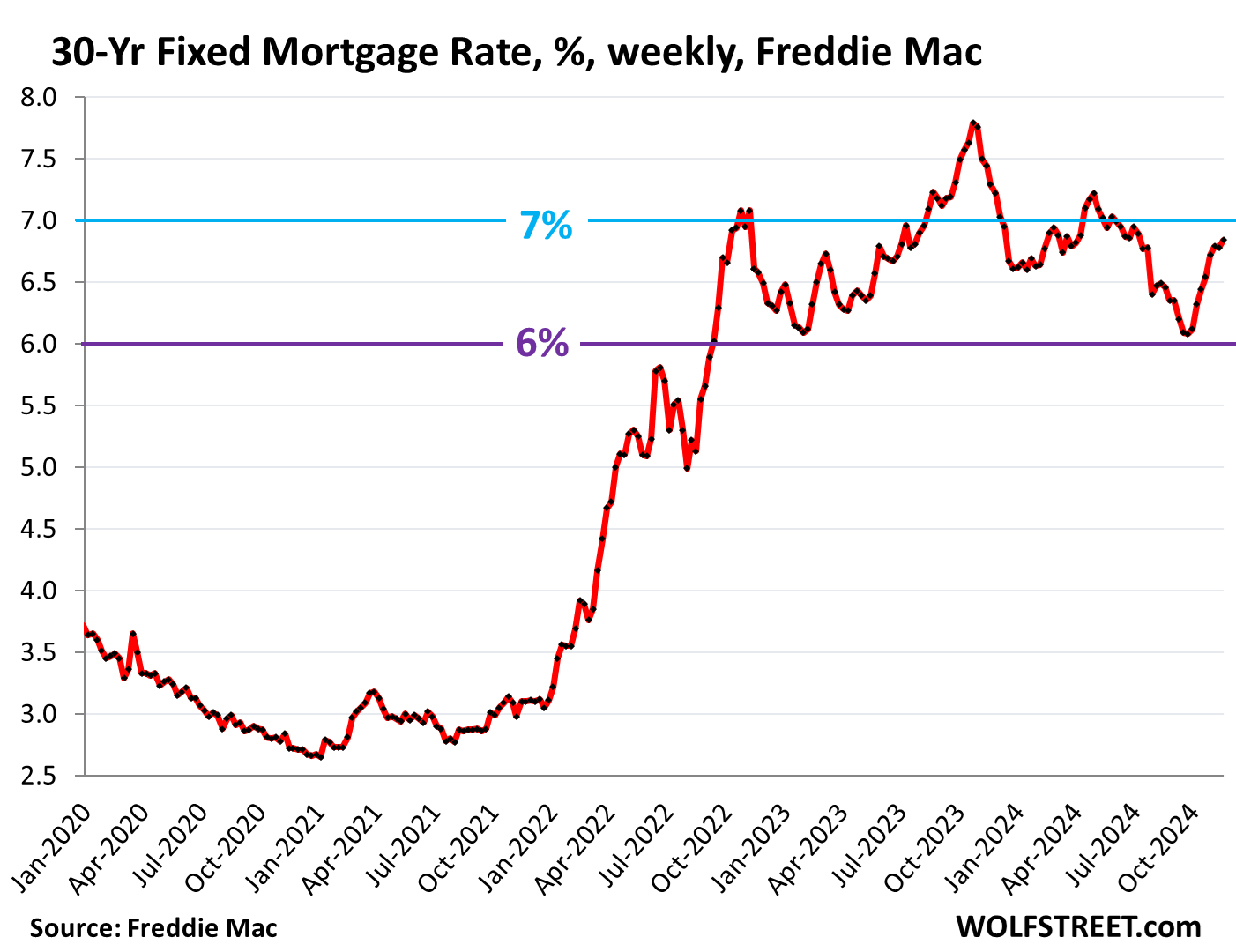

The 7% mortgages are back.

The average 30-year fixed mortgage rate rose to 6.84%, according to Freddie Mac’s weekly measure today.

The daily measure by Mortgage News Daily has been above 7% since October 28 with the exception of two days.

Since early October, Freddie Mac’s measure of mortgage rates has at first ticked up and then surged by 76 basis points, thereby undoing part of the rate-cut mania plunge that kicked off a year ago.

But these higher rates in October haven’t been reflected in the closed-sales figures in October, as those deals were made in prior weeks or months. But they are reflected in the mortgage applications, see above.

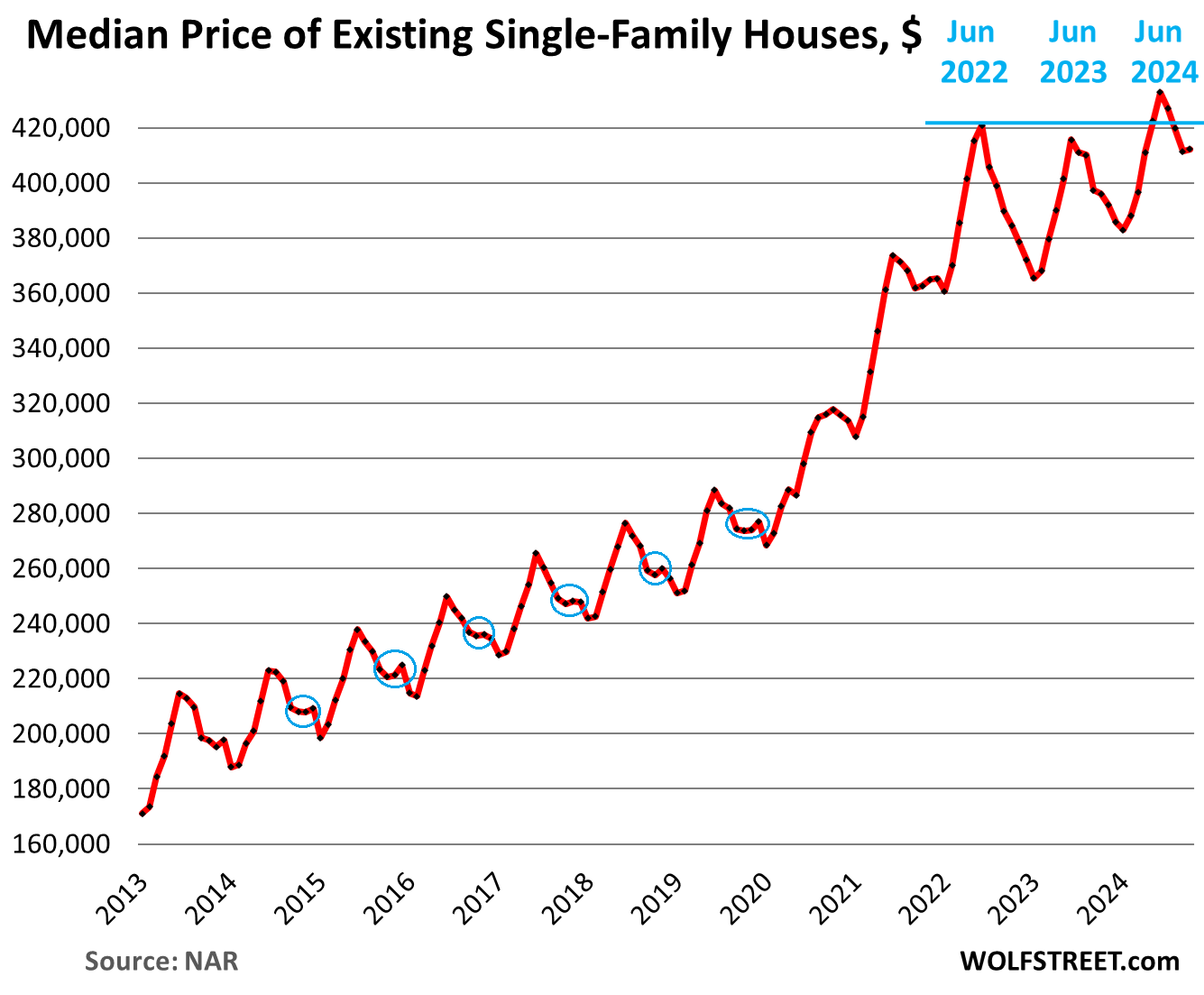

The median price of single-family houses edged up by $800 in October to $412,200, in line with seasonal upticks or flat spots in October through December (circled). Year-over-year, the price was up by 4.1%.

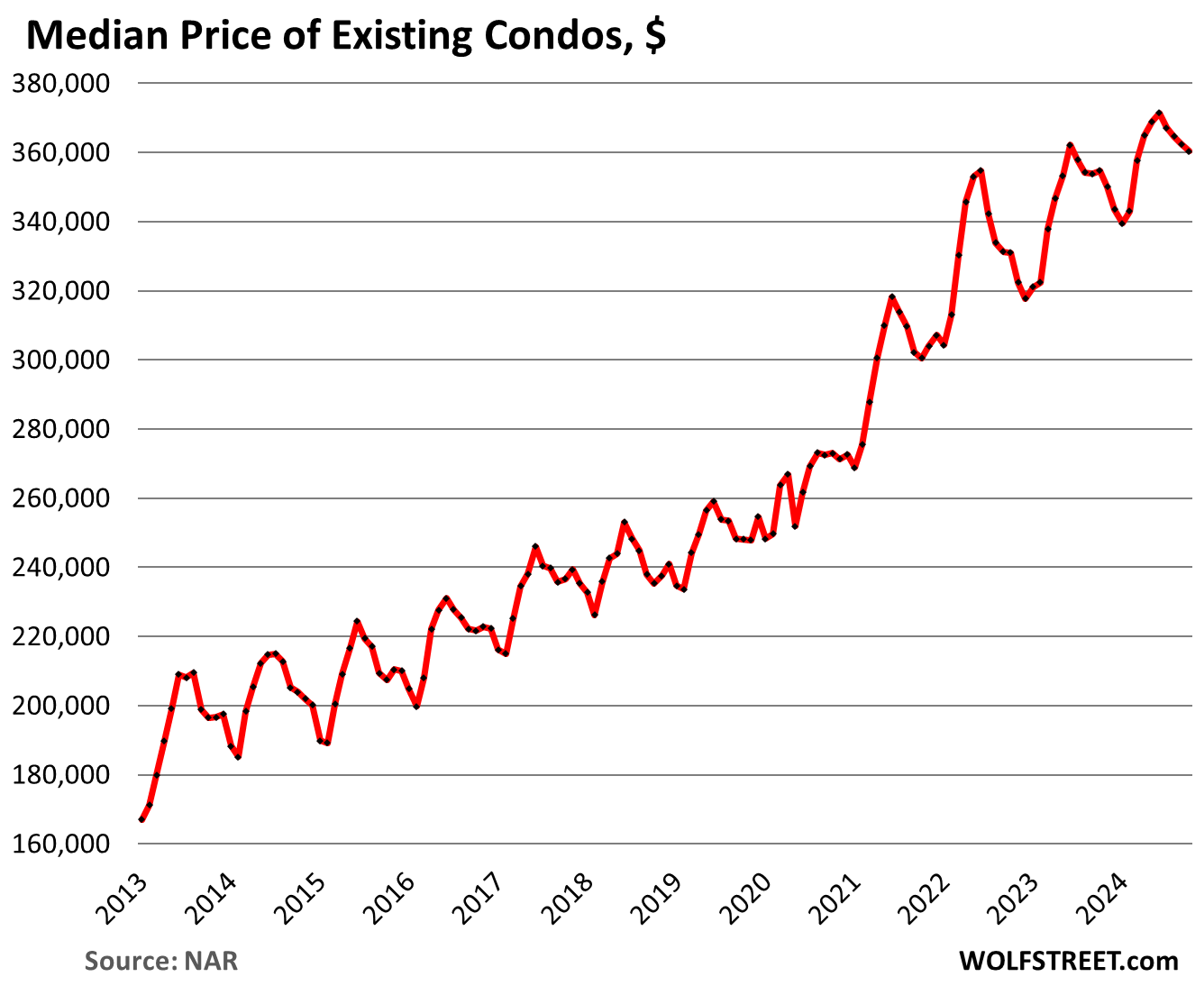

The median price of condos and co-ops dipped by $2,200 to $360,300 in October, which whittled down the year-over-year gain to 1.6%, the smallest gain since May 2023. Unlike single-family house prices, condo prices didn’t book any year-over-year declines in mid-2023, but very small rises.

Home prices vary widely by metro.

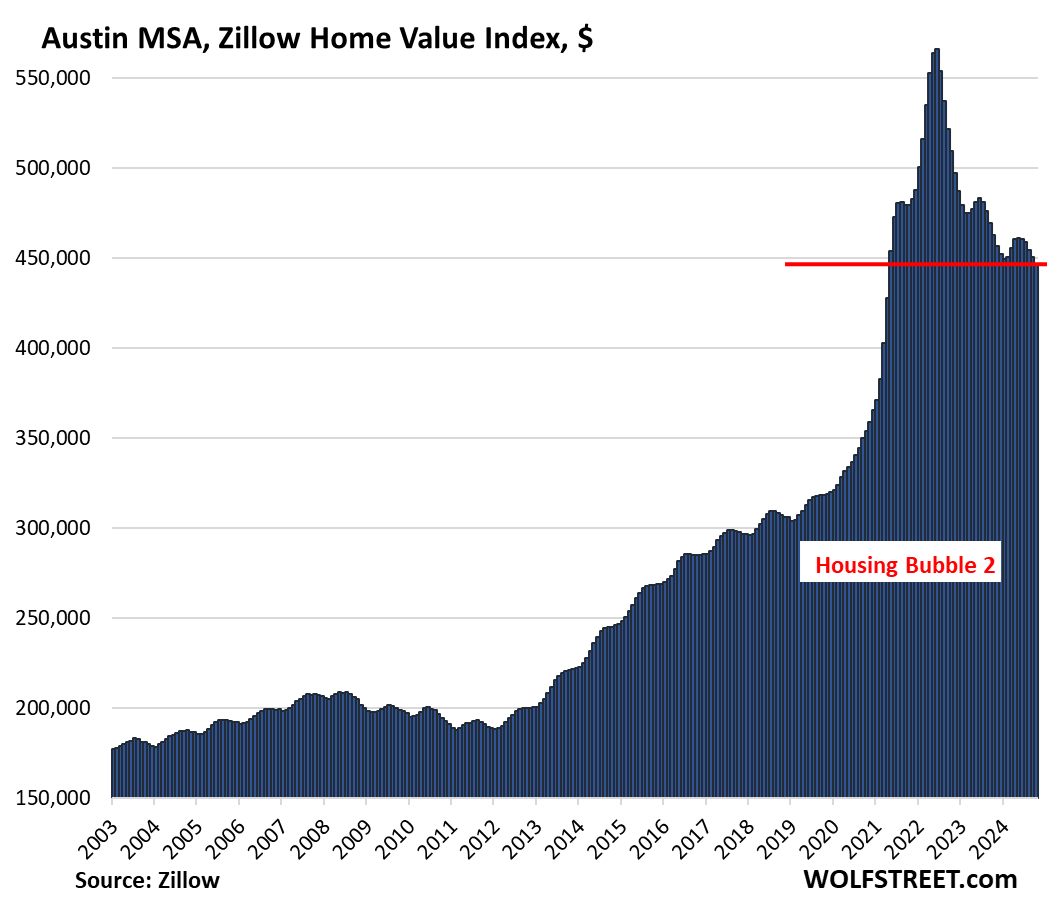

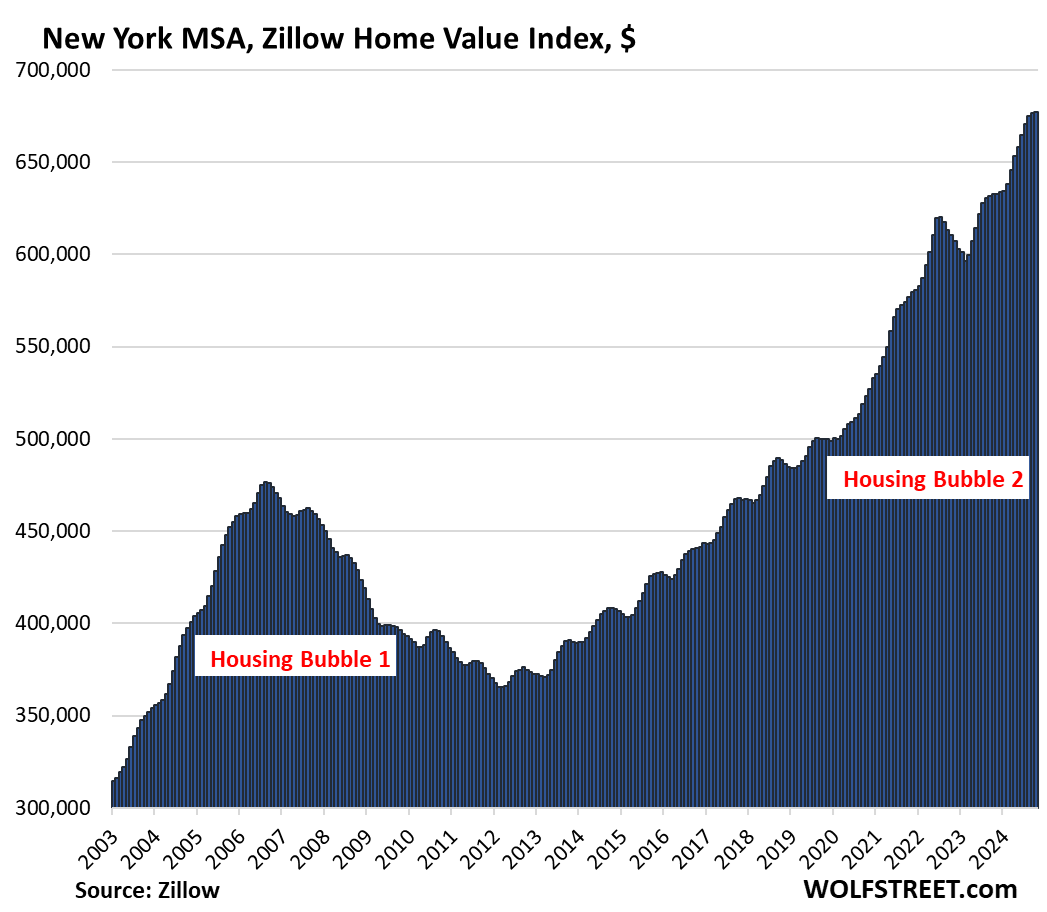

After spiking ridiculously in the prior years, home prices have begun to drop in some metros, such as in Austin (so far -20.4% from the peak in mid-2022), while in other metros, prices have risen until more recently. Of the 30 metros in our lineup of The Most Splendid Housing Bubbles in America, only the New York City metro eked out a new high in October. And there was everything in between. These are the two bookends of the 30 Most Splendid Housing bubbles:

NAR blames everything except the problem: too-high prices.

The median price of existing homes reported by the National Association of Realtors exploded by nearly 50% from early 2020 through mid-2022, fueled by the Fed’s interest rate repression and many trillions of dollars of free money. It was the craziest 2.5-year frenzy ever in the US housing market, as a result of which prices are way too high, and those now way-too-high prices have destroyed demand, and buyers are on strike.

But the NAR always blames something other than the way-too-high prices for the collapse in demand: Last year, it blamed the inventory, then it blamed the surge in mortgage rates. Last month, it blamed “consumers hesitating” before the “upcoming election.” But the NAR always sees green shoots despite the too-high prices: “The worst of the downturn in home sales could be over, with increasing inventory leading to more transactions,” it said today, which are the same green shoots it has been seeing for two years. But it never sees the too-high prices as the fundamental issue now crushing the housing market and the industry that makes its living from selling homes – the industry that the NAR represents.

Meanwhile, commercial real estate spent the past two years massively repricing properties. And deals are now happening because prices have plunged to where they start making sense again. And homebuilders have figured it out too: To keep building and to keep their sales up, they’re offering homes at lower prices and with big incentives and costly mortgage-rate buydowns, and they’re eating market share from sellers of existing homes.

And potential buyers have figured it out, with an ever-larger number profiting from, or planning to profit from, the arbitrage of renting a home versus buying an equivalent home, and saving thousands of dollars a month in many high-priced markets.

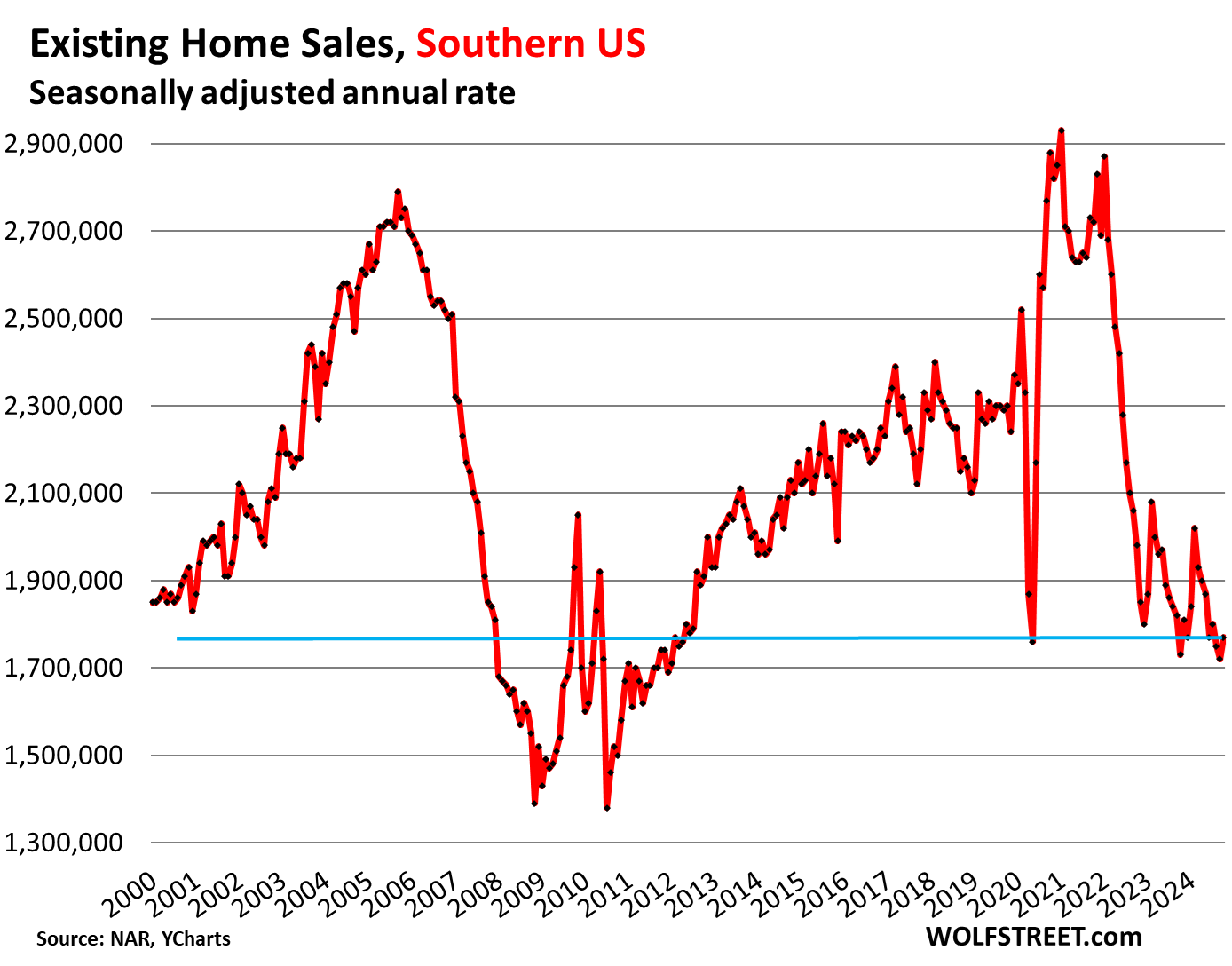

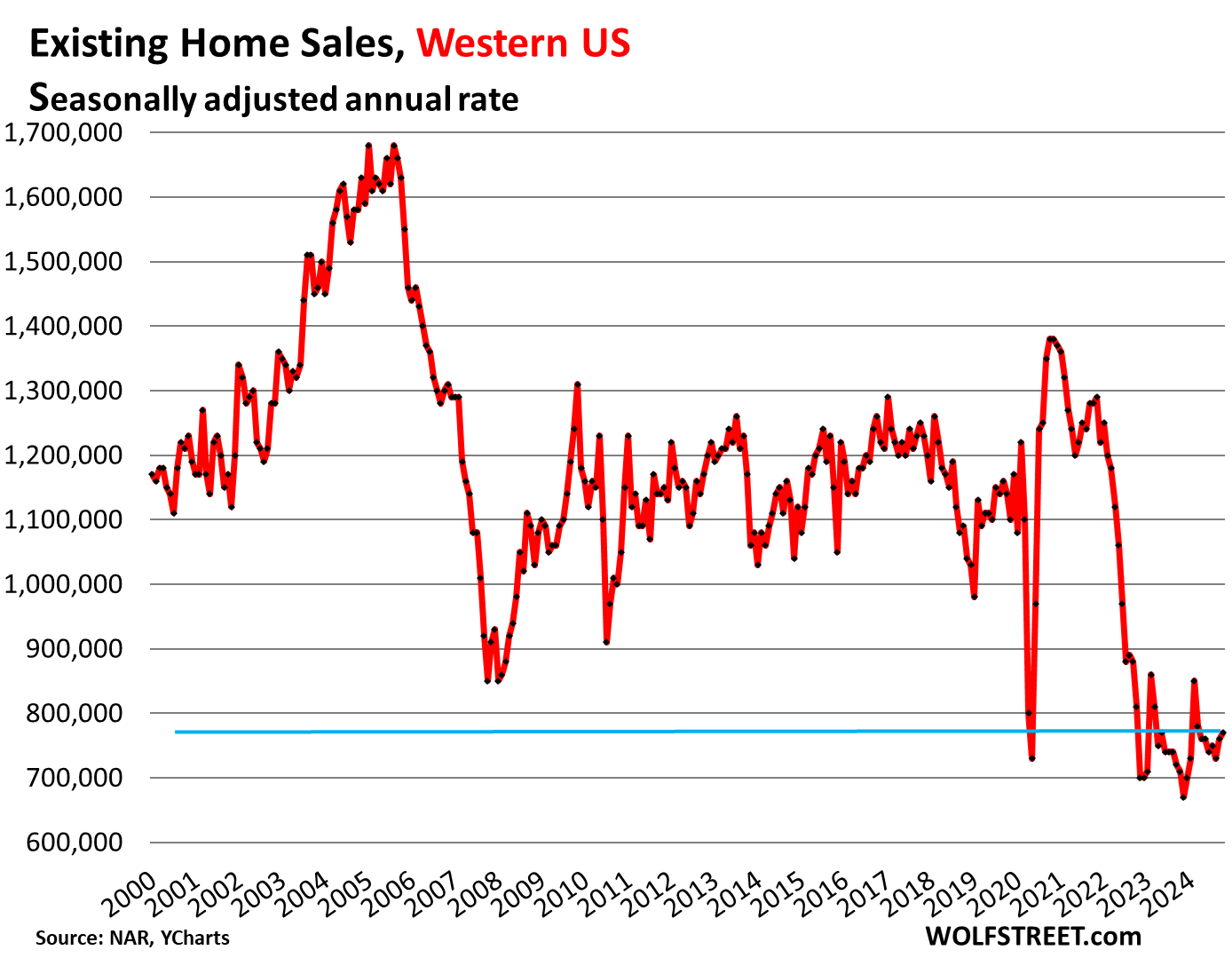

Demand destruction by region.

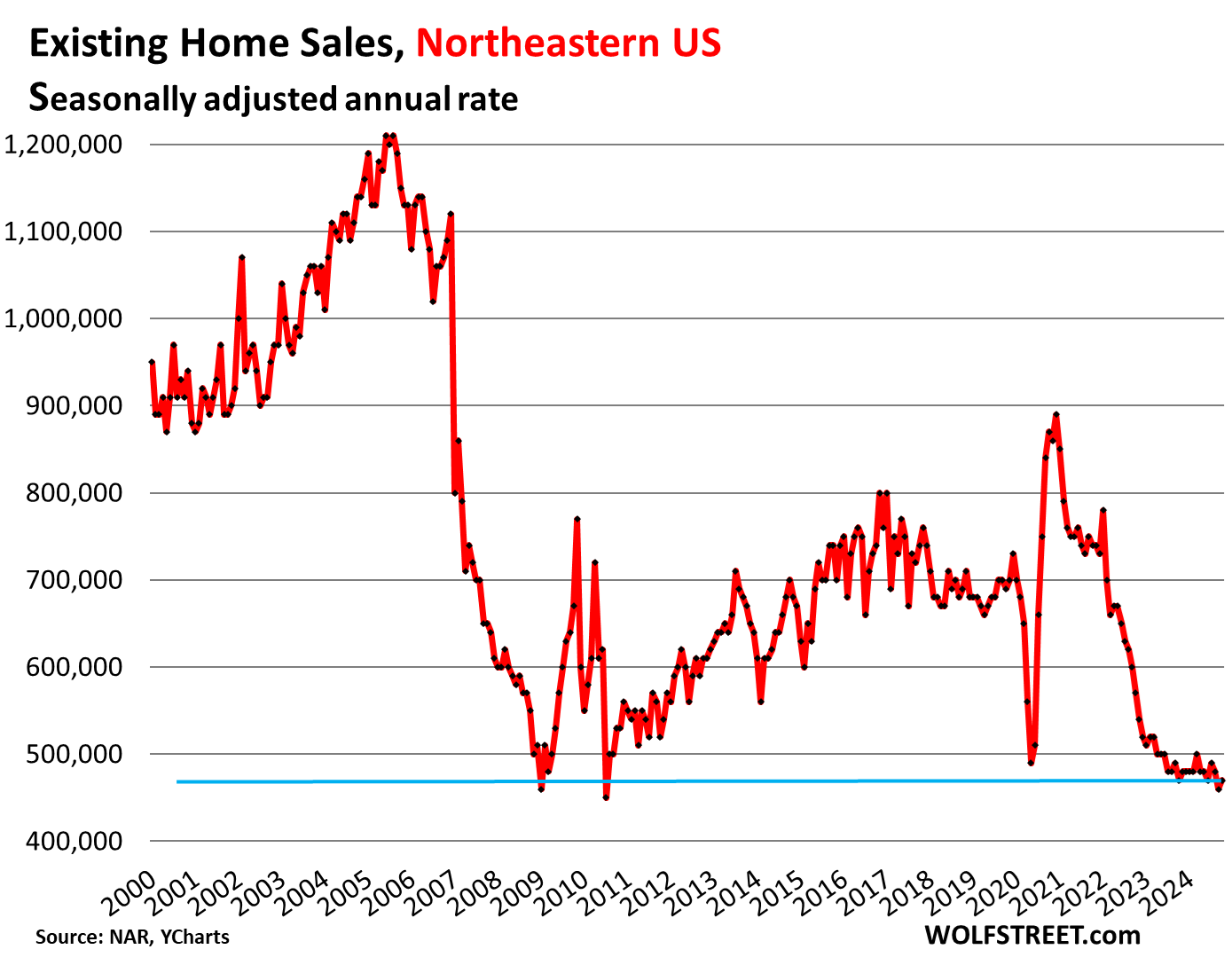

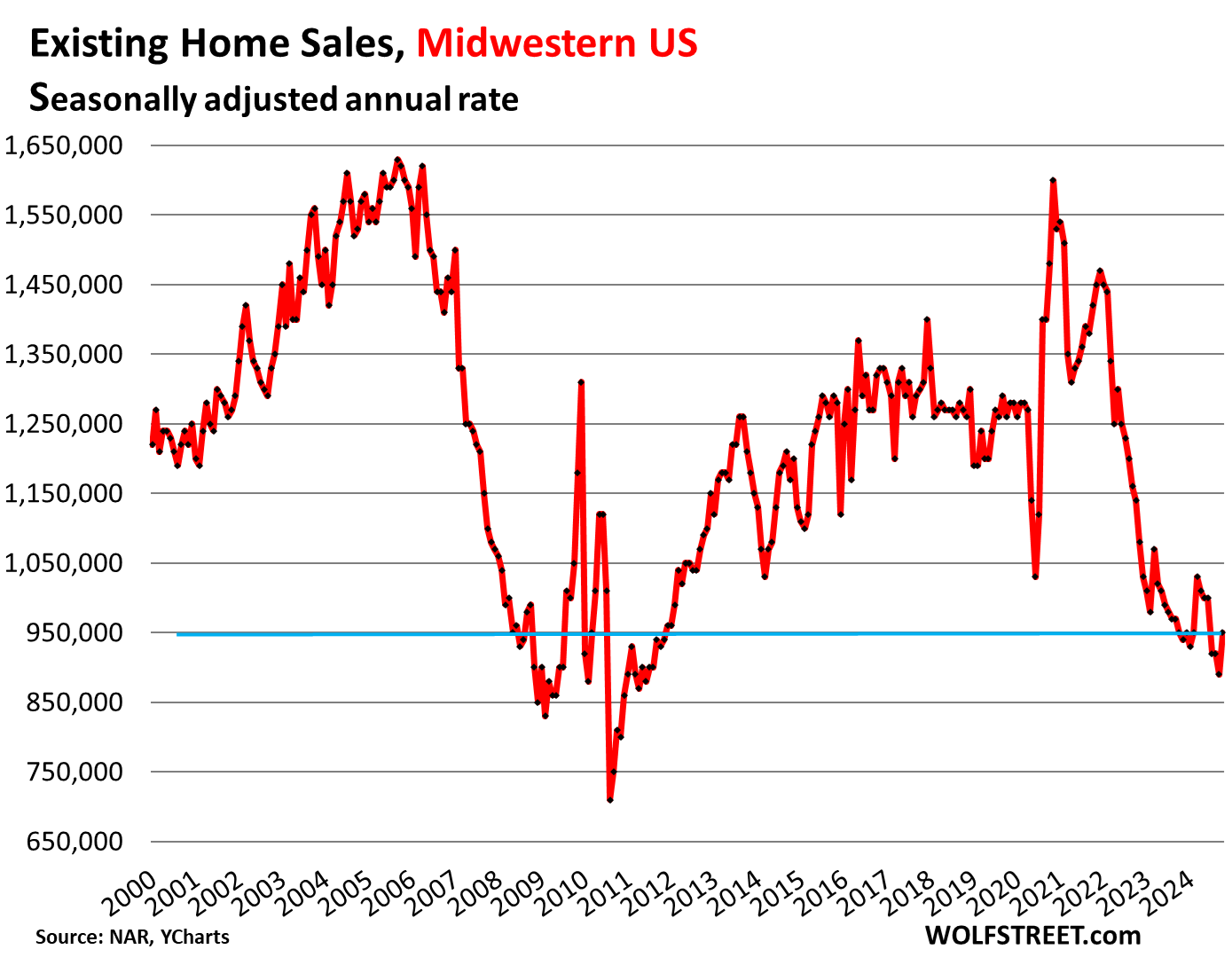

The charts below show the seasonally adjusted annual rate of sales, released by the NAR today, in the four Census Regions of the US. A map of the four regions is in the comments below the article.

Northeastern US: The seasonally adjusted annual rate of sales rose to 470,000 homes:

Midwestern US: The seasonally adjusted annual rate of sales rose to 950,000 homes.

Southern US: The seasonally adjusted annual rate of sales rose to 1,770,000 homes.

Western US: The seasonally adjusted annual rate of sales rose to 770,000:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

As promised in the article, the map of the four regions:

Stuff still selling in Seattle

Life is better west of the continental divide…

TRY to understand the reality: West of the Great Rivers, Mississippi and Missouri, those places are NOW deserts, NOT desserts OW.

Been across all those parts dozens of times looking and eventually wondering.

At least until right at the wet and wonderful coastal areas of the Pacific Ocean…

Surely there ARE or at least WERE oasis in between the Mississippi and the Pacific that did NOT rely on massive energy to be habitable, but just looking clearly at the very very hardy first peoples would convince any rational modern folx.

When I read one of Wolf’s essays on this subject. I always have a bet with myself as to how many comments before someone says ‘not in my neighborhood’.

Same as it ever was… Real estate is a very local market.

In the big crash, our Midwest area lagged the coast by several years on the way down and on the way back up. Currently 90 miles outside of Chicago is still performing strong adjusted for the season. We have for the past several years also seven a large January spike, which has been fun each year theorizing why, and for how long it may last.

Maybe, maybe, maybe, this will be the bubble that doesn’t burst. :)

I’m holding our last rental property to sell in the new year due to taxes. Here’s hoping for the January rush!

Global warming is out of control, giant rivers flooding everything!

Fear not sucatash, suffer not, your demise will not be with water but with old age. In the mean time stay healthy learn to swim and stay positive.

As for this we’ll written article, neither global warming nor great floods can consume the hunger for the knowledge found here on this site.

Well said

Some modest slowing in CT although the market remains strong and prices are holding up which is not surprising since sticky house prices are a well known economic phenomenon. Apart from some areas like Florida home prices are likely to remain at their current elevated levels.

Without substantial job loss, house prices wont move much.

Gotta force people to sell.

What’s coming on the market are in part vacant homes that owners moved out of months or years ago but didn’t put on the market at the time to ride up the price spike all the way. Vacant homes have high carrying costs. Prices declines on top of carrying costs are very strong motivators to sell those homes.

Most of the homes (90%) we’ve been appraising are empty. Owners moved long ago and see the hand writing on the wall. The FOMO has been replaced by Sell Now before the price drops more as interest rates rise. Some of these properties are in mint condition, just renovated by investors.

Wolf — in your view, is it an either or situation where IF for whatever reason mortgage rates collapsed to 3% then the buyer strike would be off or are we past that point and [median] prices will need to come down to end the strike?

^_~

Wolf, a minor typo, though not inaccurate, in the “Buyer’s strike continues” pararagraph:

“Weakly” probably should be Weekly.

Lol thanks for the giggle

The trend in median home price remains intact and, in spite of some price decreases in some desirable urban setting, that tend is still up. Is this an opportunity from builders/developers? Maybe. My hypothesis is that we have entered an era where homes in good locations will never be sold. A person will simply rent them out or they will become air B&B properties. They will simply become another productive asset for the owner or mortgage holder (especially if the interest rate is well below the market rates). Behold the miracle of financialization!

Interesting times.

Most home owners won’t last six months as a landlord. Too many people think it is easy money for some reason. One bad tenant can financially ruin you.

I know a number of home owners who had low rate mortgages and did the “rent it out and have an asset plan” when they had to move for work. Every single one of them hated it and sold as soon as they could.

And Airbnb is banned in most major metros now (thankfully).

My last landlord told me some horror stories from past tennants. One that had 20 cats and let them pee everywhere. Another who was always drunk and one night lit his bushes on fire. Crazy stuff.

it only really works if you have enough of them to scale such that you can hire a full time team to handle things, or if you are handy and local and willing to do things yourself.

otherwise, the little repairs will eat at your margins.

Correct in that many would not make good landlords. But, it’s not because of repairs or bad tenants.

You know homeowners who decided to rent, not professional Lord’s of the Land; people who understand it and run it properly as a business.

Same as why so many small businesses fail. I’ve been doing it 10 years now. Repairs are a standard cost factored into margins. Roofs, water heaters, fences, ac units…is it really a surprise these things wear out?

I’ve evicted one tenant in the very beginning. Single mom who lost her job and I idiotically tried to help her. 15 homes and 10 years. One tenant! Lost 1200 bucks over it. It was a great investment!

So here’s a truth nugget: people who move and rent their beloved home, the one they decorated with all the memories are already crashing.

First, they care too much. My rentals are nice, but I will never live in them. Took years to beat this into my wife’s head.

Second: most of those homes don’t make good rentals in the first place. Per above, they’re built and bought by and for owner occupants.

Third: they had to move. It was a rent vs. sell decision; not a rent for profit decision from the outset. They are not there to manage their asset and probably wouldn’t know how even if they were.

Hope that helps. Also ABB are still all over and I enjoy staying in them. Way better than a hotel.

exactly.

the idea that everyone who has a 3% mortgage is going to hold on to it as a rental is a silly fantasy.

Franz G – True. But I am surprised how many people are becoming landlords of one home. Even when moving to a different city. They will give the landlord a try to keep the low mortgage rate. I know 3 people who moved and are renting their old home so they do not give up the mortgage. What is funny, it two of them are renting the residence they just moved to because of the high cost to buy.

Crazy times. I guess we will see how long they last as landlords. Probably when the house stops appreciating.

This is a very useful and appreciated comment. Thank you

and in certain other areas, they are being taxed as commercial property.

i don’t agree. there just aren’t enough people willing to rent at prices where that makes sense for many people, as an “asset.” and the transaction costs are too high.

most people suck at being a landlord.

Property management companies are not that hard to find. Many people have most probably figured out let an expert handle that

Bad property management is just as prevalent as bad tenants.

-good- property management is very hard to find, in our area. The last one failed to collect rent on time, did not let us know, and shrugged when tenant moved out at the end of the month without warning.

Unfortunately most PM co. don’t have a good reputation.

I’ve never dealt with any stellar co.

Doesn’t matter. The higher rents are already being paid and there are plenty of property management companies out there competing for business. If rates go up, more people will be priced out and the spread between the rent income and the existing mortgage (at a low interest rate) only makes the deal sweeter with plenty to cover management and maintenance and still generate income.

the hole in your analysis is that you are forgetting that there are a lot of empty homes because of the distortions of the past few years. if everyone gives up on selling and puts them on the rental market instead, rents will come down.

in many or even most places, if you bought a house at peak pricing in 2021 or 2022, you either can’t cover your costs with rent or you just barely do.

you’re also forgetting the mental block. people are not willing to pay in rent the same that they’re willing to pay as owners.

so if your costs, even with your 3% mortgage rate, are $3,000 a month, it’s likely that the family who could afford the $3,000 a month if they were buying are not willing to pay more than $2,500 a month in rent. this is especially true at the high end.

the concentration of stocks among the top can last a long time, as there are basically no transaction costs or leakage. that isn’t the case for real estate.

one headache, as people have pointed out below, leads owners to just want to get out.

Bullshit. Location matters. The properties you are talking about are irrelevant. It’s easy to be smart about retail properties. People making poor decisions, with poor credit, in undesirable areas is another thing all together.

“Rental” not retail. AI sucks…

“if everyone gives up on selling and puts them on the rental market instead, rents will come down.”

And if everyone gives up on buying and rents instead, rents will go up…

Franz G – Rent are very sticky. Rarely do they drop for SFHs. Partly because rents do not rise much during the bubble.

Overbuilt areas with apartments….yes, rents for apartments will drop.

You would be surprised how stingy mom and pop landlords are about dropping rent. They would rather have the house empty for several months.

I will only add that home owners (or someone locked in with a low interest rate), know that the asset has value, especially based on the rents being paid.

Asset owners/holders always benefit from the Cantillion Effect. That’s where we are. Not quite feudalism 2.0, but moving in that direction.

I agree with your disagreement. These rentals/Airbnbs will either have negative cash flow, or will be priced out of the market due to above-average carrying costs.

The poor aren’t getting any richer, but rents are going up.

As are property taxes, insurance, utilities etc.

No free lunch for landlords either.

People under estimate how annoying running an airbnb is. Constant questions from guests even though most things are covered in the instructions and if you’re not responsive, bad reviews. Also finding reliable cleaning people can also be challenging depending where you are.

People also underestimate the costs when they just buy them as investment properties without actually pricing out the local services. I managed one in a mountain town for a friend when I was between jobs – she didn’t consider the fact that getting the driveway plowed and the sidewalks shoveled during winter cost $600 a month and that was the cheapest of the vendors in the area. The energy cost of heating the property which was significantly higher. The cost of reliable cleaning people. Any repair was insanely expensive because all the airbnb’s had priced out any trade workers so they have to drive in from an hour away. etc. She was losing a lot of money but then 2020 came and property doubled in value so those missed mortgage payments she had to borrow from her parents didn’t really matter in the long run.

Overall though running an airbnb sucks. And yes, you can hire a management company but the margins aren’t always what people think they will be.

mm1, don’t forget you’re at the whims of the local governments.

if you buy a place where your numbers only work if you can do short term rentals, all it takes is one city council vote to ban it and your model goes out the window.

in some of these places, like aspen, miami beach, and other vacation spots, you may not be able to your costs with a normal long term rental.

even if they’re not banned by the city, the neighbors absolutely hate airbnb properties, as they have constant new people traipsing through. expect frequent anonymous calls to the police, especially if they’re being loud, or to the hoa associations.

it’s very risky.

….in my dream I loaned my body out, I never thought it would be returned in such bad shape, 40 lbs overweight, scratches all over my back, needle marks on my arms and teeth falling out.

Seems to me that the good locations always sell; there are plenty of people with cash. Poor locations sit unless they sell for a discount.

I don’t have it in me to be a landlord. Learned it the hard, but not hardest, way. Glad to figure that out when I was young. I don’t get emotional about stocks, though.

Surely that involves a trade off – income in the short term vs capital loss when they eventually sell

One of the things I like about capitalism is its self-correcting nature: if prices are too out of whack, they tend to adjust themselves to the correct (higher or lower) amount. This analysis by Wolf confirms my own suspicion that the market is being price-gouged and has had ENOUGH. It’s similar to the situation in used cars, when a Subaru Crosstrek was selling for close to its new version’s price. In the end, the customer is always right.

LMFAO!!!!! “Capitalism” requires a respect for capital (i.e. NO BAILOUTS). We have not had such a system for quite some time.

Yup. Jimmy Carter and Chrysler and Ronald Reagan and Harley-Davidson (though Reagan just effectively banned any capitalist competition).

Obama and GM

Obama let GM go bankrupt, wipe out its stockholders, and give bondholders a big haircut. During the bankruptcy process, GM was able to get out of old factories, employment agreements (including the “jobs bank”), and shed all kinds of other stuff, at the expense of investors and workers. During the bankruptcy process, Obama provided GM with a “Debtor in Possession” (DIP) loan so that it could continue operating while in bankruptcy. This loan was paid back and the US government earned interest on it. The US government also bought $49 billion of the new shares of the new GM as it emerged from bankruptcy. In August 2010, GM listed its new shares via an IPO on NYSE, and the government sold some of its shares as part of the IPO. And when the new shares were publicly traded, the government started selling the remainder of its holdings, and by 2013 had sold the last one of them. It recouped about $39 billion of its $49 billion investment, a 20% loss. If the government had held on to all the shares and sold them today, it would have made something like a 50% profit plus collected the dividends along the way.

“if prices are too out of whack, they tend to adjust themselves to the correct (higher or lower) amount.”

In commercial real estate, they’re doing just that. In residential real estate, they very much are not doing that.

sure it is. this article shows that. it just takes a long time, as residential sellers are more emotional about their “investment” than commercial sellers are.

House prices are well known to be “sticky”

The last housing bubble took 6 years to bottom. This one should bottom in 2028

“The customer is always right.”

Only if they have other options to choose from.

Always other options, just may not like them in comparison to the desired ones.

Exactly, which is why a lot of them will give in and pay high prices. A lot of people still want to own.

I apparently “overpaid” on my first house in 2005. Best thing I ever did. Not only did I start building equity, I never had to deal with annoying things renters have to deal with, and I learned how to do a lot of things that have saved me tons of money over the years.

They can’t give in unless they can get the loan

A lot of my friends are renting homes instead of buying one. The are renting for $6K/month but if they buy now, they’d be paying $13K or so /month.

At least in this case, people do have option and hence the reason for demand destruciton.

We need some people to suck in the market for price discovery, albeit slow it is.

@wolf will there be another update on inventory increases/decreases by major metro like was done a couple times in the past?

Maybe. That’s data from Realtor.com. I have in detail posted on it for Florida and Texas more recently, including charts:

https://wolfstreet.com/2024/11/05/inventory-of-existing-homes-in-texas-balloons-to-highest-in-many-years-prices-drift-lower-but-are-still-way-too-high/

https://wolfstreet.com/2024/10/08/florida-housing-market-buckles-listing-prices-sag-to-30-month-low-but-are-still-way-too-high-inventory-piles-up-institutional-investors-turn-into-net-sellers/

As a fortune teller I can see you buying a big new house, how happy you are. Gazing deeper into my crystal ball I see great fortune and success come your way. I can see you skipping down wolf street with a smile.

Over 4 million houses sold in the US…can you just imagine, no other country even comes close, in second is china selling around 10 million…..better get your house soon before their gone.

My crystal ball is broken, china only sold one million homes last year….these china made balls are worthless.

But let me say, sometimes wanting a house is better than having one….same with many things.

“same with many things.”

Like a girlfriend/classic car/motorcycle,hmmm…..,the list is endless!

I think the only way that can be said about a girlfriend is if you are married and your wife finds out…

The arbitrage of renting vs owning also applies to girlfriends!

Jeeeze man, boats and horses!

So are we at the bottom of the housing market?

Is this the end of the 18-year cycle?

Good recovery, thought you were a moron.

1:04 PM 11/21/2024

Dow 43,870.35 461.88 1.06%

S&P 500 5,948.71 31.60 0.53%

Nasdaq 18,972.42 6.28 0.03%

VIX 16.87 -0.29 -1.69%

Gold 2,672.00 20.30 0.77%

Oil 70.08 1.21 1.76%

Related, interest rates on the long and short end of the curve moved up today…

This is turning into the economics equivalent of the immovable object meets the irresistible force.

10 year should be >5%

30 year >6%

Duration is risk.

Yes, but that isn’t the case is it?

4-week T-bill back u[ to 4.5%, 10 year barely at 4.4%.

Negative term premium is unnatural. Like stretching out a rubber band and holding it there, it is constanty “trying” to revert to it’s natural state.

Yields on duration are in a long-term uptrend – I’m literally betting on it.

Wow, I’m finally seeing it. Prices have been dropping but not by much. I check every few weeks, only because a Wolf article makes me think about it, I’m not selling or buying.

So today I checked again after reading this article. Holy cow, for the first time in years there are 4 decent houses under $400K (all $399K lol).

This is in northern California, two and a half hours from SF.

Some of the for-sale signs have been up so long they’re starting to rust!

I don’t see a lot of big homes selling these days. It could be that tastes are changing regarding size of home. Families are getting smaller. Remote work is subsiding. Property taxes, maintenance, heat and AC costs, are all skyrocketing. Why buy that big home when a small one will do? IMO it’s better to keep costs down and retire early with security.

Yes, homebuilders have figured this out too. They know where demand is, and it’s at lower price points, which means a variety of things, including smaller floorplates, smaller properties, less expensive flooring, appliances, finishes, etc. That’s why sales volume of new houses has held up.

Anyone heard of DSCR loans for RE “investors?” My mother in law’s 3600 sqft, all brick, 3 car garage home built in 2000 just sold to guy from out of state using this loan product to purchase what seems to me to be cash flow negative investment once maintenance, property taxes and insurance are factored compared to the going rate for rent. The closing attorney said this guy has purchased 2 other homes in the area in the past couple months. DSCR loans are not based on the individual purchasing it (no income verification) so much as the property being purchased. The lender wants to see at least a 20% profit above the mortgage cost once all expenses are factored in as well as the fact there are no limits as to how many of these loans can be taken out by an individual. To me, the math doesn’t work out on a large single family home like this as a rental due to the potential high cost of repairs, maintenance, non residential property taxes and insurance vs rental income. Am I missing something here? Or is this just another junk loan product being used to “stimulate” a slowing RE market?

DSCR (debt service coverage ratio) loans are kind of normal in commercial real estate. They’re still secured by the property, and often require a hefty down-payment, but the main thing is how rental income covers the debt service cash requirements — in other words, will the property have enough cash flow to pay for debt service. You didn’t mention the down payment. If the down payment was large enough, there shouldn’t be any problem with the cash flow covering the monthly debt service payments.

Back when I was a Mortgage Loan Officer, we just started to see these being offered at the company I worked for as rates began climbing. They were a supreme pain in the ass to process, so we ended up sub-contracting them out to other companies which specialized in non-traditional loan products. I often wonder how those companies are doing these days.

When I was appealing my recent prop tax reassessment, the rep from Vision Gov’t Solutions said that ranches (and single-level living in general) are in higher demand vs other floorplans/layouts.

Anything with stairs won’t work for the (limited) population of able & willing buyers in today’s residential RE market. It shouldn’t come as a surprise that ranches & single floor living are all of a sudden “so hot right now” like Hansel since the median age of all homebuyers is now ~60y/o and median age of first-time homebuyers is pushing 40y/o. Yes, families are getting smaller…but no, they ain’t the ones who have been acquiring new & used homes at distorted prices lately. Because, by and large, they can’t. If they could qualify for that loan—representing a >40% pretax shelter DTI (literally volunteering to be cost burdened rather than taking the rent arbitrage on same product)—then sadly, many would be ignorant enough to take the bank up on the generous offer…but they can’t qualify and so they’ve stopped trying (see mortgage purchase applications volume). Boomers and Gen X might keep the residential RE depression on life support, and maybe a final gasp will be provided by the RE industry’s latest parasitic push to guilt-trip boomers into dispensing portions of their hard-earned life savings as early inheritances for their “failure”-to-buy-homes-and-“achieve-the-American-dream”-adult-children (and normalizing such behavior as a somehow indicative of good or responsible parenting), but this market has shriveled…so it only makes sense to build new homes and market existing homes to the known/likely/suspected buyer-pool—which is decidedly NOT young-ish people with & without children!

In south Texas here, thousands of starter homes are under construction, and 90% of them are one level from 1,200 – 2,000+ square feet in size and sell for about $175/sq.ft.

Young families, singles, and retirees are gobbling them up. I don’t know of any builder building McMansions (maybe those are reserved for the West Coast states?).

Anthony…..here is what is interesting is those smaller starter homes will cause many median home price indices to drop but the median sq ft price really does not drop.

But, there is a big move by the big builders to manufacture a lot of the parts of the house at a plant and ship it to the building site. This will help lower new construction costs some. I just read a couple of such Japanese building companies have bought a couple of US home builders to do such a thing and make building it more efficient.

AA:

Here in our little hood of the saintly part of the TPA bay area, ALL the recent sales of tearer downers have ended up with 2 story houses about 3 times the size of the older ones, and most also include pools, large garages and even a couple of now legal ADUs in the back yard…

Quite the rant.

I still don’t understand people who think renting is a good thing. I do understand when you want to move often and/or don’t want any responsibility. But people who want to own aren’t going to get the American Dream faster by waiting, unless they’re willing to live in a way cheaper apartment well below their means for a while (which to me is a smart move), but those places are limited in availability, as build for rent is meant for renters of choice as Wolf always says.

I will say, ranchers don’t have any show-off factor, so that’s not very American. Gotta have the biggest house in town with pools and all that crap if you’re not a loser…

Agree with most of your points, though. It’s a rant I might make myself.

Not here in inner DC suburb, 60’s brick ranches and split level tear downs sell for $1.2 – $1.5M and their 6,000 – 7,000 sq foot new construction replacements are selling for $3M+.

Seeing a drop in Condo prices here in Washington D.C. for the first time in the last 4 years. We did a nice 500 sq foot 1 BR condo in Capitol Hill (good area) sell for $280K vs $300K 2 years ago. The unit was in perfect condition, unlike my own house which is now held together with duct tape. The owner had to sell and may have picked the wrong time to sell or this is a sign of the next RE meltdown. It’s got to be one or the other.

High prices & interest rates are the primary cause of low sales. But just as important is the fact that millions of people have ultra low mortgage rates and zero incentive to sell. Theoretically, this could last another 27 years or so. Granted, the average turnover is 7 or so years, but this massive distortion caused by the Fed’s reckless ZIRP policy could easily double this average in the coming years.

Show us a graph of all the people who refi’d from mid-2020 through the start of rate increase cycle of ’22-23.

The Federal Reserve never had anything to do with low mortgage rates and the direct cause of that was the yields that the markets set on US Treasuries. Mortgage rates are based primarily on the yield of 10 year US Treasuries plus around 2% top 3% per year.

Please google Quantitative Easing and Federal Reserve Mortgage Backed Securities Purchases. You will learn that the federal reserve had everything to do with our otherwise logically low mortgage rate environment during 2020-2021.

@Jeff: You might want to save your breath. SCBD has been repeating this ad nauseam as long as I can remember reading his posts here. Shows the power of Faith/Belief over Information/Logic.

If prices fall enough, the higher rates won’t matter. In fact, it’s preferable to have a lower purchase amount with a higher rate than vice versa.

That’s why prices /have to/ fall enough…

^^^This

I’d rather have a lower price and higher rate than higher price and lower rate if the monthly payment is the same. This means a large mortgage interest deduction, lower property taxes and lower home owners insurance.

I mean lower prices and lower rates would be great too. But I’d take 20-25% price declines and rates of 7% and celebrate right now.

This is the historical trend. I wonder if it will hold though with all the return to office and work from anywhere getting killed.

2020 created some interesting trends and I wonder as they reverse if the historical norms will hold true.

Not to mention everyone who bought an investment property at 3%. They might decide now is a good time to take their gains and move on.

On the subject of people being voluntarily locked in to a low interest mortgage making them stay put: Has any lender looked at making mortgages transferable? Say you live in San Francisco and get a possible better job transfer to Seattle. Your mortgage rate is say 3.5% and your equity is about half the value of your home. If you could get an equivalent priced house in Seattle, you’d be happy to move. But not if your house payments double. If you could move your mortgage with an uptick in rate to say 4%, everybody would come out winners.

How would the lender come out a winner?

Lmao 🤣 what do you think that the banks are like Oprah everyone gets a free mortgage lol 😂 🤦🏽♂️???

In 2023, Jamie Dimon, the CEO of JPMorgan Chase & Co., received a total compensation package of $36 million, which was a 4.3% increase from the previous year:

Salary: $1.5 million

Performance-based incentive compensation: $34.5 million, which includes:

$5 million in cash

$29.5 million in stock, in the form of restricted stock units (PSUs) that can’t be cashed in for several years

Dimon’s 2023 pay was a record high for him. The bank’s board said that his compensation reflected his leadership, the firm’s strong financial results, and its ability to navigate regional bank turmoil

“You get a 3% mortgage! And YOU get a 3% mortgage! 3% mortgages for everyone in the audience!”

some mortgages made to veterans are assumable by a new buyer, but it’s not the norm

New housing starts and permit applications also came in lower than expected.

In my hot Southeastern housing market, inventory is back to prepandemic levels. This is due to the fact that the normal seasonal pattern whereby inventory peaks in January and troughs in June was broken last year. Instead, inventory remained basically flat throughout the selling season. Although there were definitely sales happening, they basically “ate” any incremental units that were added to the market rather than whittling down the overall inventory as in ‘normal’ years. Prices were unaffected by this pattern though, with median sales price and per square foot remaining basically constant.

So, at this point the big question is what’s going to happen during the Spring 2025 selling season? Will the normal seasonal pattern prevail and inventory cleared by June or will we have another year where it stays high.

If the answer is the latter then my gut feel is that the market might barely scrape by this spring but at the end of it we would be looking at inventory levels significantly above the prepandemic one. If this is the scenario that ends up playing out (i.e., the one that played out last year) than at that point I think the rules of math finally start kicking in and one could see significant price declines in the back half of 2025, especially if interest rates stay high. Until then, I suspect the housing market remains solid as it has been (price-wise).

Correction/Clarification: the typical seasonal pattern of declining inventory during the spring selling season was first broken this year (2024), not last year.

I’m curious where inventory levels are at across major metros. For Denver metro vs 2019 I saw Aug +4% nbd, Sept +7% nbd, Oct+24% (this could move prices if it continues )

That being said these aren’t wolf’s numbers – so not sure how accurate they are.

Boston metro still has below-average inventory, according to Reventure app.

That said, yoy inv growth is +24% which will hopefully continue. I see a LOT of for sale signs on my drive in.

One local Midwest example: Neighbor across the road bought ranch home on 10 acres in July 2023 $436.6k. Something happened and they listed for sale this year. Listed at $479k, 69 days ago. Price dropped a total of $20.9k to $449k. No sale price listed yet, but my bet it is close to $440k. With RE commissions, doubt if got out even. One tiny example does not a market make.

One local example in the saintly part of the TPA bay area:

Small house right behind us listed for about $400/SF and sold the next day, and the listing agent was surprised it took so long, as she had predicted it would be sold by day’s end…

NOT a flooded area, ever, was included in description.

Similarly, all the recent vacant rentals due to price rises in our hood have been snapped up, and all the new folx I have talked to on daily walks have been coming off the beaches…

Similar response from buyers of VASTLY $$$ new deluxe houses gentrifying our very diverse hood recently.

I’m starting to see stuff in Denver metro eventually dropping to close to their fall 2021 sale prices after sitting for awhile.

I’m wondering though what’s going on that these people are willing to take a loss after commissions and closing fees.

Also wondering what’s the floor on the loss they are willing to take before deciding it’s better to just try to rent it out.

This is well done and seems accurate…Florida has a condo crises on its hands, 900,000 units getting repriced early next year…affordability issues reaching a head…the developers want the coastal land and kick granny to the street…is part of it…

U.S. 10-year @ 4.418%. Which will return more on your money, a house or the 10-year?

Hell, the investment rate on the 4 week T-bill was 4.6% at yesterday’s (11/21/2024) auction.

the crazy thing is the fed’s qt is continuing well, and the balance sheet dropped another $40 billion last week, and is now down to $6.92. but crypto and stonks are still trading like the 10 year is .5% and like $120 billion is still being printed every month.

nuts.

But it is getting “printed” more than $120 billion a month. It’s called deficit spending.

The FED tightens on one end while the Treasury pours it in on the other.

no it’s not. that money isn’t being printed, it’s being borrowed. so every $1 the treasury borrows is one dollar not available for other things, including buying assets.

You can’t live inside a 10-year Treasury…

The house, every time. 12-16% annually plus appreciation when structured properly.

After 8 years, none of the investment money is yours.

This doesn’t take into account speed. Save, invest, save, invest; that takes a looong time in work hours.

I buy 2 homes per year cash and increase my monthly SPENDABLE income exponentially and NONE of it is money I spent time earning. I am retired at 54.

The only time my money sits in a 5% account is between deals.

“12-16% annually plus appreciation when structured properly.”

But the house is work. You could buy a 16% mutual fund and collect the dividends while doing no work.

But if you need a place to live…

That is bullshit served up by a defective human being preying on the old and the handicapped, veterans. Selling snake oil that is only legitimate in consumer America if it makes a fortune.

Lame.

Come back and tell me how well you do when you don’t have 15 years of QE and a reckless Fed propping up your investments.

It’s worth remembering that housing is a levered investment for mortgage holders. Government policy has provided much support for many decades, limiting any downside price movement. Without periodic downside, however, RE wealth grows exponentially. The system can’t support it for too long. That’s what we are beginning to see. Pigs get slaughtered, but it’s hard for a pig not to be a pig.

Gov’t (Fed) policy has been to provide support for TREASURIES, not housing. That housing has also benefited from low rates is a side-effect, but the Fed doesn’t actually care about housing.

Analysis is good, numbers is good, but to me the truth is buying property was and still is in fashion for last years, people are stupid people are doing what other people are doing, so that’s how this pile of crap formed.. Hopefully this will end soon and the idiots will start buying bananas and duck tape instead..

IMO you have to be a moron to buy a house like I did at a 15 pct mortgage, a slave to my nasty employer/

I am a homeowner, a landlord and I rent AirBnBs for 2 -3 months/year during the winter months. As a landlord, I am patient to find the right tenant. Short term pain for long term gain. As an AirBnb user, I try to deal directly with the owner and rarely reach out to them while I occupy their home. I try to negotiate better rates from them on the theory that I will respect their property and a 2 -3 month rental is considerably less of a hassle than weekly turnover. As an owner, I’d love to downsize, but my wife still prefers to keep our home. I would expect that the most likely source of future real estate supply will come from the AirBnb owner marketplace. As expressed by others, it is more of a hassle than many have bargained for and WFH is on the decline.

Curious to see how life has been treating all the ‘side hustlers’ whose LinkedIn bios say ‘full-time mom/dad and part-time Realtors’.

Love how the blame is on price. Price is literally determined BY the market. Supply vs demand. Anyone seen the cost of materials lately? Labor? The real issue here is the interest rates. The rates that the fed dropped, but the greedy banks didnt pass on to the consumer. The BANKS are to blame for this slump for keeping their loan rates artificially inflated.

Opposite. It’s NEW houses — despite costs yada-yada-yada — that are being sold at LOWER prices and with big-fat mortgage rate buydowns and other incentives that cost builders a bundle, and they’re still making 20% gross profit margins, which is high, and they can cut a lot more to keep volume up, and they have kept volume up because they don’t have a choice, they have to build and sell houses because that’s their business, and so they sell them for less, no problem.

To problem lies with RESALE homes, and that’s unrelated to construction costs. And there, volume has collapsed because prices are too high.

In response to ML who is telling it like it is. Few of us are equipped with the tempermant required to be a successful land lord. I failed at in 1994 when I chose to accept an asset builder job with guaranteed grant for one year. I thought, I like this domicile, I’ll rent it out.

The first property manager I called, told me the truth. I had announced that I wanted to rent out my home. It was a headache that he didn’t have the time too deal with. The emotional attachment to a home as opposed to renting out a house was sufficient for the vendor to say, no thanks.

So we advertised our home for rent in the local newspaper and immediately rented our home to the ideal tenant, who purchased his own home at the end of lease.

Meanwhile, money for an extended period had become available, and I wasn’t ready to leave. So I advertised the home for rent in the local paper.

Needless to say, the next cadre of renters couldn’t afford the house, didn’t pay the rent on time, etc.

IMO, the average person shouldn’t have to pay the cost of housing that those nit wits at the Federal Reserve engineered. I’m not sure what the equilibrium cost of housing should be. As a first guess, 50 pct less.

The only two other bubbles that I currently see that are selling at a price that is unlikely to be profitable over the next decade or so, hopefully it will be that short. Worse than overpriced housing. The stocks and bonds.

I have been wrong for so long that I could qualify as a negative indicator.