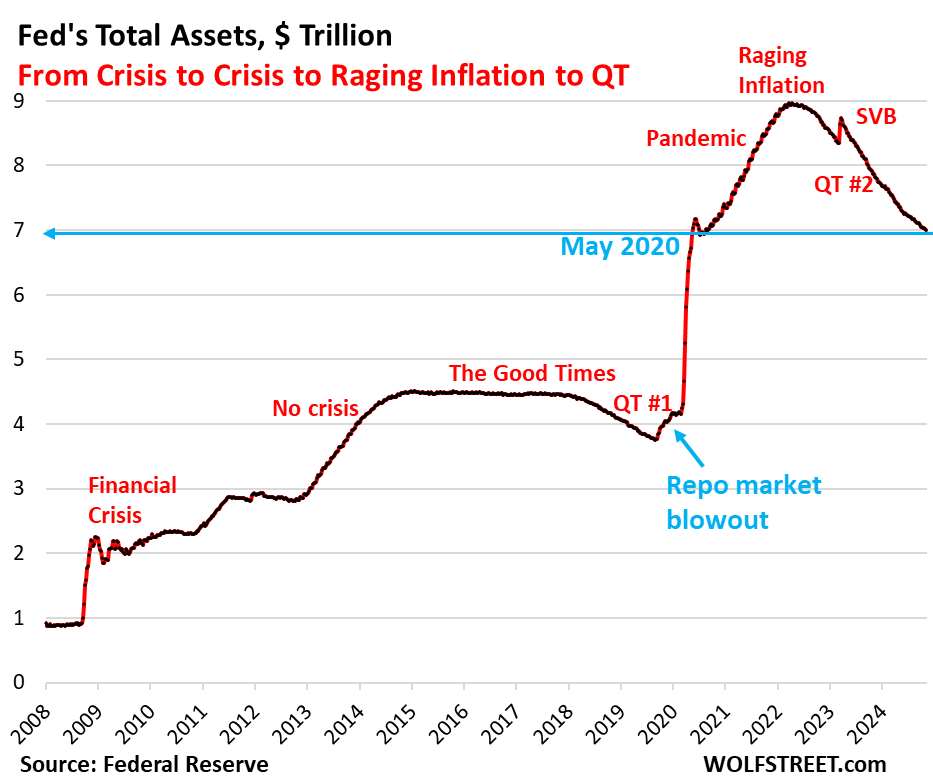

Quantitative Tightening has shed 41% of the assets that the Fed had added during pandemic QE.

By Wolf Richter for WOLF STREET.

Another milestone in the Fed’s QT program: Total assets on the Fed’s balance sheet dropped to $6.99 trillion, according to the Fed’s weekly balance sheet today. The balance sheet first reached this level in May, 2020, after nearly three months of mega QE (blue arrow in the chart).

In October, total assets fell by $53 billion. Since the end of QE in April 2022, total assets have declined by $1.97 trillion, removing 41% of the assets the Fed had added during pandemic QE.

QT assets by category.

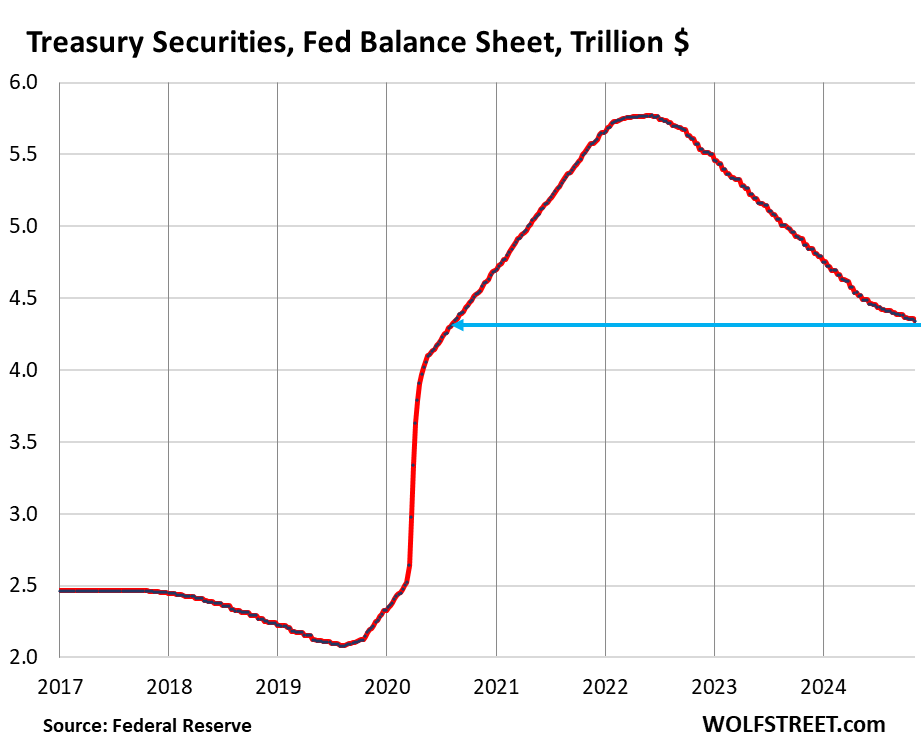

Treasury securities: -$24 billion in October, -$1.43 trillion from peak in June 2022, to $4.34 trillion, the lowest since August 2020.

The Fed has now shed 44% of the $3.27 trillion in Treasury securities that it had added during pandemic QE.

Treasury notes (2- to 10-year) and Treasury bonds (20- & 30-year) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off is now capped at $25 billion per month. About that much rolled off in September, minus the amount of inflation protection the Fed earns on its Treasury Inflation Protected Securities (TIPS) that was added to the principal of the TIPS.

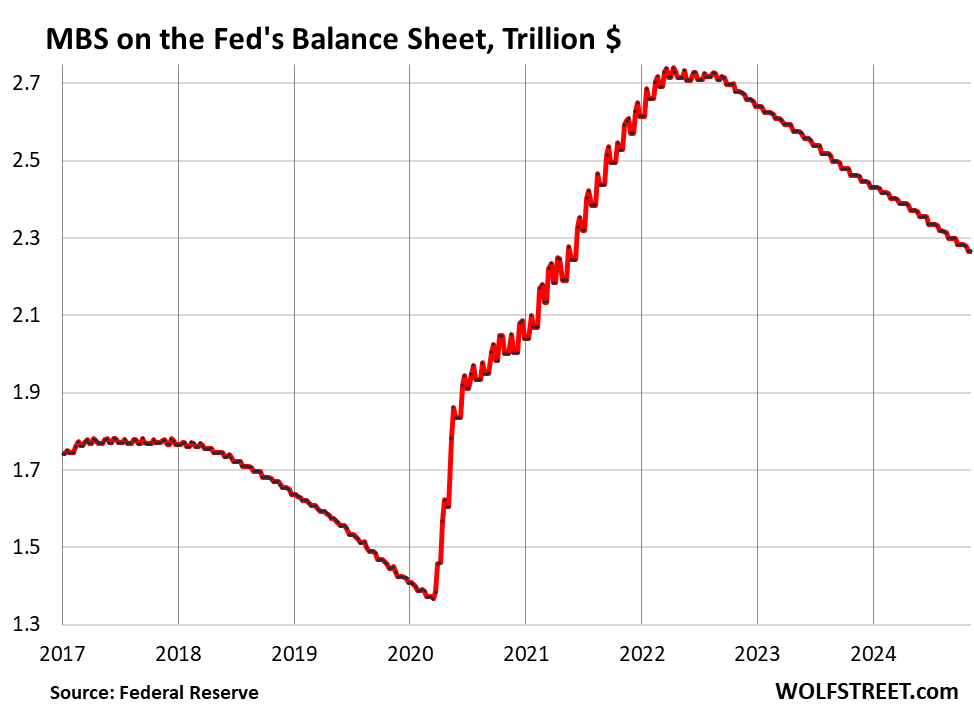

Mortgage-Backed Securities (MBS): -$16 billion in October, -$474 billion from the peak, to $2.27 trillion, the lowest since June 2021. The Fed has shed 35% of the MBS it had added during pandemic QE.

MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made. But sales of existing homes have plunged, as has mortgage refinancing. So fewer mortgages got paid off, and passthrough principal payments to MBS holders, such as the Fed, have been reduced to a trickle. As a result, MBS have come off the balance sheet at a pace that has been below $20 billion in most months.

There has been some discussion recently at the Fed, including in October by Dallas Fed President Lorie Logan, about outright selling MBS to speed up the process of getting rid of them.

The Fed only holds “agency” MBS that are guaranteed by the government, and is therefore not exposed to credit risk if borrowers default on mortgages.

Bank liquidity facilities.

Only two bank liquidity facilities currently show a balance that’s above zero or near-zero: The Discount Window and the Bank Term Funding Program (BTFP). The other bank liquidity facilities are either at zero or near zero:

- Central Bank Liquidity Swaps ($151 million)

- Repos ($101 million)

- Loans to the FDIC ($0).

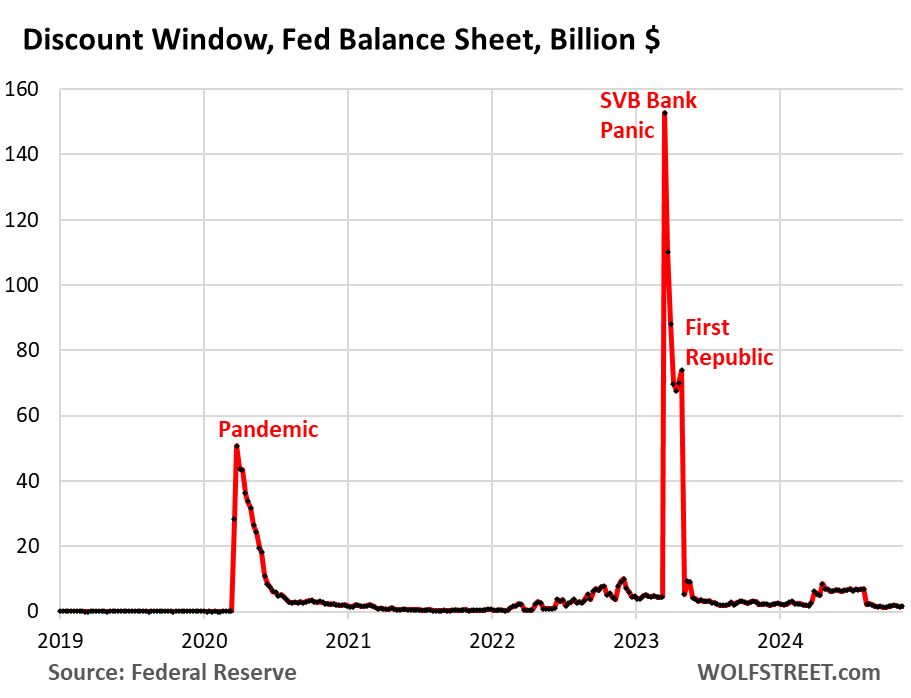

Discount Window: roughly unchanged in October, at $1.6 billion. During the bank panic in March 2023, loans had spiked to $153 billion.

The Discount Window is the Fed’s classic liquidity supply to banks. As of today’s rate cut, the Fed charges banks 4.75% in interest on these loans and demands collateral at market value, which is expensive money for banks. In addition to the cost, there’s a stigma attached to borrowing at the Discount Window.

And it’s “clunky” to use, according to Powell, who has exhorted banks to use this facility to manage their liquidity needs, and to practice using it with small-value exercise transactions, and pre-position collateral so that they can use it when they need to.

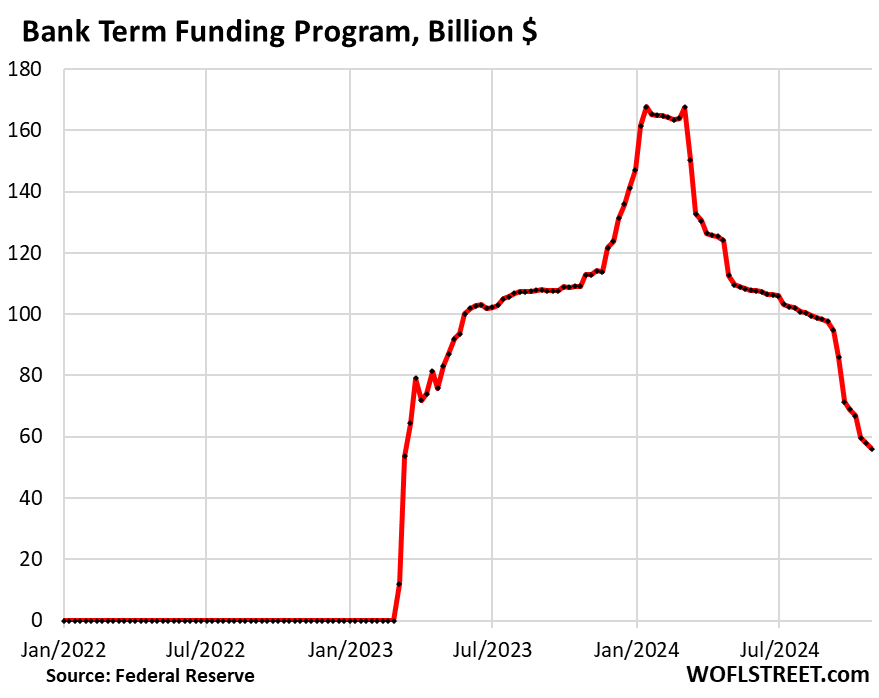

Bank Term Funding Program (BTFP): -$15 billion in October, to $56 billion, the lowest since its second week of existence in March 2023.

The BTFP had a fatal flaw when it was cobbled together over a panicky weekend in March 2023 after SVB had failed: Its rate was based on a market rate. When Rate-Cut Mania kicked off in November 2023, market rates plunged even as the Fed held its policy rates steady, including the 5.4% it paid banks on reserves. Some banks then used the BTFP for arbitrage profits, borrowing at the BTFP at a lower market rate and leaving the cash in their reserve account at the Fed to earn 5.4%. This arbitrage caused the BTFP balances to spike to $168 billion.

The Fed shut down the arbitrage in January by changing the rate. It also decided to let the BTFP expire on March 11, 2024. Loans that were taken out before that date can still be carried for a year from when they were taken out. So, no later than March 11, 2025, the BTFP will be zero, removing another $56 billion from the Fed’s balance sheet by then.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf

Your points have meaning as compared to pandemic levels and i so greatly appreciate your info and point of view.

But, the tone seems really empathetic to the feds overliquified monetary stance. Anything but un-telegraphed affirmative large sales of MBS & Treasuries into the market until zero sooner, next 12 mos, should have been occurring since 2019, is just not acceptable from a responsible monetary stance.

As we know the Fed needs to dramatically reduce as the next bailout is around the corner. It’s always the ones you love the most who cut deepest bud. Always, graciously in your debt sir.

Nonsense. You just want to blow up everything.

Liquidity doesn’t flow where it needs to go instantly. And if the Fed withdraws liquidity too fast, it will suck it up through two pipelines (Treasury and MBS) but the feeder pipelines won’t be big enough and the system collapses.

QE was bad. But there is no reason to purposefully blow everything up afterwards.

I get really tired of this dumb stuff, been hearing it for two years.

Remind me to break out the Hunter S. Thompson.

This is prime time for gonzo man.

He’s greatly missed.

Someone mentioned that the Fed has a tiger by the tail. That tiger is nothing compared to the young first time buyers that have about had it with rates and home prices. Tuesday’s election should have given them an insight as to how far they will go. Maybe that is why the media asked the chair today if he was worried about being booted by the new administration. He replied that such was not possible under the law. Does he actually think that that would stop DT? LOL

In this environment, lower Fed rates = higher inflation = higher long-term rates = higher mortgage rates. So these young buyers then can try to buy a home with a 12% mortgage? We did. Prices will plunge if this happens.

Be careful what you wish for.

Hey Wolf any thoughts on how all of this would net out? Say DT does in fact detonate his “inflation bomb”, bond and interest rates go way up in response and prices collapse. I know that prices need to come down, but is there any possibility that anyone would benefit from that scenario? I’m watching even the financial media struggle to understand how any of this is supposed to work.

What would be your scenario for a healthy decline in prices?

“ Nonsense. You just want to blow up everything.”

The Fed did blow up everything for those who are in the market for a house, so sure, blow up everything for asset holders like they did for asset buyers. The Fed enabled 15 years of malinvestment at the expense of conservative savers. The Fed refused to allow asset holders to suffer the consequences of malinvestment with BTFP and Silicon Valley.

The sooner the Fed allows bad debt to shake out and malinvestment to become losses the better. I only have a few more decades to earn before I retire, and reality will impose its consequences in that time frame, so I’d prefer it happen now so I can still recover.

You won’t have a job, a bank account, a useable credit card, gasoline, or lights that you can turn on when the giant sucking sound sucks liquidity out of the financial system at the speed you want. You people are nuts with your financial death wishes.

Wait a minute…

“few more decades to earn before I retire”

So you’re what… 20 years old? No one buys a house that young. Live a little, have fun, then settle down.

I have about 35 years till retirement, and I only bought my first house about four years ago. Work hard, save up, and you’ll get there.

“You won’t have a job, a bank account, a useable credit card, gasoline, or lights that you can turn”

That sounds a little extreme

Tyler,

No, it wasn’t if you read the entire thread.

Depth Charge: “Anything but un-telegraphed affirmative large sales of MBS & Treasuries into the market until zero sooner, next 12 mos, should have been occurring since 2019, is just not acceptable from a responsible monetary stance.”

So that means the Fed would dump ALL its $6.6 trillion in securities in 12 months. And that was a line of I-want-financial-Armageddon bullshit because it would mean that the Fed would withdraw $6.6 trillion in liquidity in 12 months, and all you’d hear is the giant financial sucking sound, and no one would have any money to pay for anything, amid a collapsed banking system, and payments would no longer be processed, no payroll, no credit card payments, no government checks, no nothing.

To which I gently replied to not upset Depth Charge: “Nonsense. You just want to blow up everything.”

Whereupon MattF replied, citing my reply to Depth Charge’s I-want-financial-Armageddon bullshit:

“The sooner the Fed allows bad debt to shake out and malinvestment to become losses the better. I only have a few more decades to earn before I retire, and reality will impose its consequences in that time frame, so I’d prefer it happen now so I can still recover.”

So that’s the sequence. It started out with I-want-financial-Armageddon bullshit, to which everyone went Rah-rah-rah, yes we want-financial-Armageddon. And so I explained what this financial Armageddon actually means.

People who want the Fed to dump $6.6 trillion in securities on the market in 12 months are idiots. And people who agree with it are idiots. And people who think that the Fed’s withdrawing $6.6 trillion in liquidity in 12 months wouldn’t have catastrophic effects on the overall economy (shutting it down) are idiots.

Aside from the fact the Fed MUST HAVE enough securities on its balance sheet to balance the liabilities, including cash in circulation, which is $2.8 trillion. I explained this a gazillion times. But people who post this clueless shit never actually read the articles and so they’re totally clueless.

I just regret that I didn’t delete the stupid ignorant shit that Depth Chart posted. That shit doesn’t belong here.

Fed probably over eased, but has done a good job of a slow unwind. Now we need to get the fiscal part on a more sustainable footing, which should allow the fed to continue to tighten by small increments for a while longer.

Large sales of MBSs will drive mortgage rates higher. The Fed has a tiger by the tail as far as mortgage backed securities are concerned. Surely there is a model that shows how high the rates would go and for how long. The public is getting frustrated with unaffordability of housing. Normally over the past 40 years home prices would have declined with elevated mortgage rates but not this time.

But they could do… small MBS sales. Feel out the market reaction.

The Fed wants this stuff off their bal sht but it’s going soooo slowwww because of the frozen housing market.

Has the monthly MBS cap ever been hit since the Fed started QT?

“But they could do… small MBS sales. Feel out the market reaction.”

They have been doing “small value” sales forever to keep the machinery working.

And they’re talking about much bigger sales, see Lorie Logan’s speech, that I covered the other day.

Housing is not unaffordable, if you are willing to start with a small home. Try an backyard arrangement, or a tiny home. Many are for sale on the internet. Almost all of them are under 50000 dollars US.

After all I worked hard to get to my level. Why shouldn’t the next generation start with a tiny home and upgrade later?

Yes cheap homes are available, but where would you put it?

America has fallen in love with zoning codes over the last few generations, so you’re going to have an extraordinarily hard time finding a place you can legally put that home. Plan on having to purchase land outside any incorporated city or town, then need to set up a lot of your own infrastructure like water and sewer, and pay very high prices for things like electricity. And it’s very unlikely you’ll be close to many good jobs, so unless you’re fortunate enough to have a job that can be done remotely, plan on a very long and costly commute.

You’re fortunate that small, affordable homes were widespread when you were younger. Unfortunately generations of accumulated red tape has made such homes almost extinct.

This is the dumbest thing I’ve ever read. Home price to income ratio is higher than it’s ever been, and the typical economic boom/bust cycles keep getting intervened with for special interests. So what would normally offer opportunity for people to enter the housing market (or stocks, land, anything really) is no longer a thing. People are forced to play the game and buy at record highs (or pay record rents) and pay the upkeep cost on that with likely 0 appreciation. And your solution is to live in a tent in the backyard or live in a trailer home (sorry …tiny home)? Ridiculous. The solution is to let home prices fall like they need to, so that more than just rich old people can afford a home. Stop being selfish, and be realistic. Just because you love the fact that your home went up in value by 300% does not mean it’s good for the country or sustainable. “I got mine, so screw them”……todays mentality. Pathetic. Get rid of it. Start thinking about more than just yourself, and think about the long term success of the country.

Haha I love how the boomer answer to insane home price inflation is tiny homes😂 Why not tents? These young whipper-snappers need to learn to work harder🙄

@Blake

Free money has essentially created multiple generations of total sociopaths.

They don’t care about the country or the health of society; it’s all FYGM.

The problem with young people is that they waited too long to be born. That’s why they missed out on the “record-breaking secular bull run” of houses and stocks, 100% fueled by money printing and speculation of course.

Next time, try being born *before* the mental illness took over.

Your advice would have been decent before Housing Bubble 2, when prices were merely high. In today’s environment it’s arrant nonsense.

Starter houses are insanely priced. Houses with small back yards are insanely priced. Tiny homes are insanely priced. I don’t know where the hell you think anybody can buy a tiny house with land underneath it for $50,000 but I promise you it’s not anywhere that people actually want to live. Just laughably out of touch.

These $50k tiny manufactured homes end up closer to $250k after delivery, prepping site, etc.

“BP

Nov 8, 2024 at 4:09 pm

These $50k tiny manufactured homes end up closer to $250k after delivery, prepping site, etc.”

Whatever the structure ends up costing, on top of that, you have to buy or lease land to put it on!

Did you start with a tiny home? What’s the durability of these sheds over the next 20 years? 50k to live in a shed….the American dream!

What an out of touch comment. Austerity for the younger generation because…..why exactly? We’ve done everything that’s been asked of us and constantly get the short end the stick. Eat shit.

The brazens of Central banks is the death wish that vexes me.

Japan’s central is rumored to own 10% of all Japanese stocks & much of the Japanese Treasury.

Our central bank Bought Treasuries & MBS.

Wall street would love nothing more if the Fed bought stocks too.

I just wish there were responsible people at the Fed.

Also… in the morning I read zerohedge, then I read wolfstreet. After than I read Mish.

Why is it so hard to find good content on the economy?

It is great to see the balance sheet continuing to be reduced. One aspect I am still struggling to understand (apologies if it has been covered and I’ve missed it) is the mix of bills, notes, bonds purchased, whether during QE or repurchased for amounts over the $25B cap now.

I understand bills are not currently rolling off, and notes and bonds rolling off above the cap are being replaced by other notes and bonds. If during QE the Fed purchased a 7 year note with 3 years remaining would the Fed go out and repurchase another 7 year (or 3 year?) note if over the cap? Or is it some sort of representative sampling of the bond/note market that determines the mix?

7 year.

And that’s somewhat of a problem. And Dallas Fed President Lorrie Logan addressed that here two weeks ago and how to change that, by replacing maturing longer-term notes and bonds with T-bills:

https://wolfstreet.com/2024/10/22/feds-qt-balance-sheet-composition-and-ample-liquidity-dallas-feds-lorie-logan-outlines-the-future-of-the-balance-sheet/

I look forward to when they make that switch to T-bills. If I understand the repurchase strategy correctly, the Fed could have purchased a 30-year bond with 3 years remaining and if it happens to roll off at the end of the month the Fed would replace it with a shiny new 30-year bond, increasing the balance sheet duration significantly.

Thanks Wolf for keeping us updated on Monthly basis.

Balance sheet dropping below 7T is psychological milestone too.

Many people had doubts on whether FED had resolve to do QT and will they do it without blowing off something.

Also in today’s Presser, Powell confirmed he wont Quit if even he is asked to resign. He can’t be fired too (as per him). So till May 2026, we can say QT can continue if FOMC REALLY wants to. Whether they will do it or not is different question.

1. Congress can remove the Fed Chair.

2. Trump hasn’t said anything about Powell.

3. Fed shouldn’t receive any credit for undoing a mess (read risk) it helped create.

Agency MBS are created by government or quasi-government agencies. So, although the Fed is not “on the hook” some other government agency is. I am not sure if that makes much difference in the scheme of large government economics.

What’s the difference between loaning money to Fannie Mae or the US Treasury in terms of credit risk?

Almost zero.

Taxpayers are on the hook.

The Fed can be criticized for its actions, but it’s hard to argue that it’s behaved with rank stupidity in all cases. It’s a hard task they’ve been given — a difficult balancing act — and they deserve at least a B- rating for their psuedo-wisdom.

I am less sanquine. You are giving them credit for solving a problem that they created. I would have preferred that they didn’t create the problem in the first place.

Yes, but that’s not an option. So back here in the real world we have to deal with the cards already on the table.

Where to start on this comment.

No one forced the Fed to buy assets of any kind in 2009 and then again several times in the following years when the economy was gradually recovering.

No one forced them to buy MBS during the pandemic, which is the sole reason prices for a home are now 30-50% higher in most locations.

Many, many people explicitly advised the Fed that the full impact of QE will not be known until it is unwound. We are now almost 16 years into this experiment and we still aren’t at the end of it, and at current rates, we have probably 10 more years.

The Fed did all of this. No one forced them. There has been enormous collateral damage, income inequality, asset inflation, suppression of retiree income, misallocation of resources, and destruction of middle class homebuyers. And there has been absolutely no reckoning, Bernanke was even awarded a Nobel Prize.

Exactly. You nailed it. A lot of people think that just because bad decisions are made, they should get credit for doing the best they can/could. Like there has to be deep, extensive financial engineering involved and they have to keep doing more to solve problems even if it creates more problems in the process. It’s like a financial version of a rube Goldberg contraption. It’s strange that so many people don’t believe the free markets can just be left alone to do what they do best….balance things. It’s the intervention that is the problem, and the more intervention to solve the problems that the previous intervention created. It’s not necessarily stupidity, it’s arrogance, in my opinion. Yet no matter how much time proves that bad and reckless decisions were made, nobody really acknowledges or learns from it. That’s what is frustrating. We just keep pretending we have the best and brightest involved and that there were no better options at hand.

You people drive me nuts with your stupid bullshit. Complain to God about history and ask Him to change history. Maybe He can. I have lots of complaints about history, and God has changed none of them. If you don’t like what happened in the past, go cry into your pillow. But what the Fed is doing now is the right thing: It has been busy undoing the damage it has done during QE and ZIRP.

It wouldn’t have mattered at all who the purchaser(s) of those MBS instruments was or if the Federal Reserve was involved at all in owning any of them. Mortgage interest rates are all based on 1) yields of 10 year US Treasuries, plus 2) between 2% to 3% additional annual interest and have nothing whatsoever to do with MBS instruments. Also, MBS instruments only contain CONFORMING mortgages which are very low amounts relative to actual mortgages especially here in California and other states where house prices are very high and in most cases of $1 million.

Despite the practical challenges, the Fed should hold itself to a higher standard by targeting “adequate” liquidity, rather than “ample” or in more extreme circumstances “abundant” liquidity.

Adequate liquidity, being the true objective I hope, should be separately defined from more than enough liquidity, which, frankly, could also reasonably incorporate abundant.

“Powell, who has exhorted banks to use this facility to manage their liquidity needs, and to practice using it with small-value exercise transactions, and pre-position collateral so that they can use it when they need to.”

Any word on if/when the Fed will impose runnable ratio requirements on banks? This would encourage them to preposition a lot more Treasuries in order to stay under the ratio.

Hey Wolf, can this QT do anything to correct home prices by at least 20% over a year or so ? If not, then why should we care about QT ? They can always print more money by buying crap securities from so called capitalists in our country. Wake us up when the printer is turned on.

The last housing bust lasted 5-6 years. Housing is slow moving, unlike crypto which can implode overnight and is gone when you look at it the next day.

“Quantitative Tightening has shed 41% of the assets that the Fed had added during pandemic QE”

The FED’s bloated balance sheet still carries 59% of the assets it added during pandemic QE years later in spite of the most massive inflation in over 4 decades, and an everything bubble in all asset classes that makes the dot com bubble of the late 90s and early 2000s look like child’s play.

It’s all in how you look at things.

they printed $2.8 trillion in like 8 weeks. and they see an everything bubble as a positive. look at the cheerleaders who think stocks going up independent of economic conditions are a good thing. tsla went up by 18% in two days on the grounds that musk will get a position in the cabinet in d.c. and that will help the company. no specifics needed!

nvda has a p/e of 68 and a market cap of $3.65 trillion.

there’s nothing anyone can say that will convince me that this type of “investment” mentality is healthy.

There’s no reason for the Fed to sell MBS unless they want to book the loss. Bandaid rip maybe? The redemption pace has slowed again as mortgage rates keep rising. The yield curve might end up being straight as an arrow from 3.5% to 6.5%, for the 4-week to 30-year. Mortgages would settle around 7.5 or so in this case. Those $2.27T in MBS really might take ten more years. Or, maybe the Fed could sell the whole thing to the Social security trust fund for say ~$1.8T and let them collect the drip, drip drip of payments.

Did you subtract 41 from 100 all by yourself?

M

Don’t be hard on him.

That was his most rational post in years.

Precisely. Net QE, in the form of assets on the Fed’s balance sheet, is a remarkable $7 trillion, up from a mere $1 trillion in 2008 and down from a stunning $9 trillion in 2022.

It’s not intended as a criticism but I would remove “No crisis” from the chart and extend the period of the ”Financial Crisis”. Would a further $1.5 trillion have been printed absent the Financial Crisis?

I would also question, objectively speaking, the characterization of the increase from 2021. If there had not been an election in 2020, would the 2021 increase have manifested in the same way? If the answer is yes, the existing “pandemic” label is apposite.

Not all parts of the balance sheet provide liquidity to US markets.

$3.3T in Securities held in custody for foreign official and international accounts, for example (table 1A):

https://www.federalreserve.gov/releases/h41/current/h41.htm#h41tab1

Stocks just crossed 38 Shiller PE, the third highest in history and just 2 points shy of the 2nd highest in history.

Yet all I’m seeing on investment forums is:

“Stocks are fairly valued.”

“The market is front-running inflation.”

“Zoom out – crashes are just a blip.”

“Put all your savings into stocks now before it’s too late. I don’t regret it when I did it back in 2011.”

Hold my beer, I’m going all in before the day is over!

How much of the MBS is the Fed leaving on the books in case home prices crash and many are underwater? It’s possible this is coming and if the Fed sold off too much, the market would bear the burnt of it. But if they just hold on the market will barely notice. I’m just curious if my thinking is in line with the Fed.

It’s going to take the Fed years to get rid of the MBS, even if it starts selling them. They’re not going to dump $1 trillion in MBS on the market in just six months.

Obviously that would be a disaster if they tried that. It just seems like the roll off of MBS could be twice the pace without affecting markets much. I’m just trying to understand what their reasoning could be.

Absolute recklessness when easing, caution when tightening is their institutional bias.

Reasonable caution in both directions would be a good thing, but that’s just not the Fed we have.

Lol, you show the charts in longer timeline, biggest expansion of fed liquidity has happened last 30 years. Did the population suddenly increase by that much? We’re supposed to be happy with the trough fed dollars being at the last peak before going back up in next crisis. Fewer and fewer people are benefitting from this.

Most of the economy was also created in the last 30 years. Sorry, but it’s true.

Controversial take: housing prices are determined by supply and demand.

Yes, high interest rates suppress demand. But the real cure is more supply of housing at the new (lower) equilibrium prices. Cutting rates will merely raise offering prices and juice inflation.

Home prices are what’s too high – not interest rates.

Exactly. The share of investor-owned home sales peaked in December, 2022, with 28.7% of all home sales going to investors who weren’t going to live in the properties they were purchasing. 9.9% of all housing stock in the country is owned by rental home investors. According to MetLife Investment Management, institutional investors may control 40% of US single-family rental homes by 2030.

There’s nothing inherently wrong with SFH investors as long as they’re renting it out to long-term tenants. A housing unit is a housing unit whether rented or purchased as far as supply and demand is concerned. The problems arise when investors leave homes unoccupied or use them as STRs.

Builders sell new housing. They don’t sell mortgages. So if prices decrease due to buyers needing to pay more interest on their mortgages, builders will get less, so will supply less.

You’re wrong. Big builders have their own mortgage companies that finance the home purchases and then sell the mortgages to Fannie Mae, Freddie Mac, the VA, etc. And they’re buying down mortgage rates from 7% to 5% to bring down the monthly payments. This has been a huge topic here for something like two years, and you missed it?

They can offer incentives to homebuyers all they want, but if the market rate is 7% and they’re offering 5%, that’s still an opportunity cost that they’re taking on, so they’re still losing out against the situation in 2016 when they could have sold for much more and just supplied a market rate mortgage.

That’s not a controversial take, that’s the conventional take, that somehow never seems to work.

Housing = shelter (a human necessity) that has been turned into a speculative asset. It is neither a commodity nor a consumer good. Many buyers buy homes as an investment, not as a place to live, and can even take them off the market for extended periods, or rent them out, use them as AirBnB, or whatever. Can you image a car dealership taking cars it has paid for off the lot? Repurposing them as rentals until the market recovers? No, you can’t because new cars (excluding big-ticket sports models) aren’t a speculative asset class, but a consumer good responsive to supply & demand pressures.

However, you can be comforted that your economic illiteracy is shared by millions.

Seems like discount window borrowing has been a very good real time indicator of economic contagion and liquidity crises. Is this likely to persist into the future? Where can I find the dataset you show above? I’ve only been able to find quaterly values for discount window borrowing.

https://fred.stlouisfed.org/series/BOGZ1FL713068703Q

You can download all accounts on the balance sheet from the Federal Reserve’s website. You can build a package of accounts and download the whole data set going back many years:

https://www.federalreserve.gov/datadownload/Build.aspx?rel=h41

Discount window loans are are called “primary credit” in the category of “Liquidity and Credit Facilities” under “assets.”

Or you can come here and look at my chart above, which saves you some time.

Gimme Back My “Fed Put” Bullets!

Nice chart. It is good to see the FED continue it quest to remove excess liquidity. Moving in the right direction.

Wolf,

You keep applauding the Fed. The balance is 7x what it was in 2008. Hoorah, keep up the good work! The Fed is owned by privaye banks and every bailout is a defacto bank bailout.

Maybe one day The Bernank will define “Temporary”….

You people drive me nuts with your stupid bullshit. Complain to God about history and ask Him to change history. Maybe He can. I have lots of complaints about history, and God has changed none of them. If you don’t like what happened in the past, go cry into your pillow. But what the Fed is doing now is the right thing: It has been busy undoing the damage it has done during QE and ZIRP.

“Powell sends one crystal clear message to Trump: Firing him is ‘not permitted under the law’” – Article by Robert Schroeder.

This could get interesting.

Unlike 2008, the Fed is now the global lender & borrower of last resort. They have both domestic and int’l interest rate floors & ceilings to enforce.

They have their fingers in a lot more pies, so to speak…

What are your thoughts on tax increases used to fight inflation by funding existing spending to reduce deficits? An obvious target is removing capital gains tax break for people making over a certain amount. It seems like the thing that would benefit the most people so we probably won’t do it.

In my opinion it is very irresponsible for the Federal Reserve to reduce its balance sheet at all, let alone to a paltry $7 trillion, when assets have been bid up to over $100 trillion in the US alone. Just where does any money then come from when folks want to sell assets. Certainly the money supply is direly insufficient. Does the Federal Reserve have any relevance at all anymore to the US economy?

“Just where does any money then come from when folks want to sell assets.”

🤣❤️

Answer: it doesn’t, and they can’t sell it, not at those prices, but they can sell it at lower prices.

The Fed doesn’t need to keep as much on the balance sheet now that they’re shifting that role to regular banks.

Imo that’s what the new discount window changes are (partly) about: by encouraging banks to load up on Treasuries for the (purpose of pre-positioning), the Fed can do QT for longer. The banks putting a bid under bonds helps keep interest rates in check while the Fed shrinks its bal sheet.

I am glad QT is continuing without a crisis in the markets and banking system.

Distilling above comments, has the “American lifestyle” become more difficult to sustain, requiring more byzantine heroics by Fed, government, etc.

I am thinking to preserve happiness and sanity, many are going to have to live simpler and expect a bit less.

Also we may continue to see weird curveballs that challenge our assumptions on future spending and investments.

Lots of people blame the FED for the mess we are in. Rather the FED is left to clean up the mess the best they can.

While the FED rolls its balance sheet off wt QT the econ slows to be counter balanced by increased govt spending to keep this moribund global econ since 08 afloat. QT supports USD valuation especially to its foreign holders who want to rightly ditch the USD because of gross monetary & fiscal miss mgt. All done to keep the lights on in the USA so everybody doesnt starve. The FED lowers rates to keep interest rates in check so that Treasuries rates dont blow through the roof making it possible to keep financing the deficits. Also lower rates compensate for the liquidity being wtdrawn by QT.

I have generally thought Powell to be tone deaf relying on the numbers rather than using some intution in his interpetation. All and all the American people are being put on the hook wt a lower std of living for all the excess spending/borrowing that they did starting when Reagan told them they were exceptional people living in a Shining City on a hill while handing out the cc. Amer because of the excessive spending has become a 3rd World poverty row. Amer including the elites have done it to themselves.

Yay! Good job to the Fed for reducing its Balance Sheet so dramatically (in spite of the naysayers!) while keeping the economy afloat. It could have gone very wrong indeed.