Over the two days since the BOJ’s rate hike & QT kickoff, the Nikkei has plunged 8.2%.

By Wolf Richter for WOLF STREET.

The Japanese Nikkei 225 stock index plunged 5.7% on Friday, the biggest percentage drop since the Covid crash in March 2020.

Since the all-time high on July 10, the index has plunged 15% and has now re-skidded below the previous all-time high in December 1989.

Since the Bank of Japan meeting on July 31 – a wakeup call for the free-money-addicted markets – over those two trading days, the Nikkei has plunged 8.2%.

But wait… The plunge didn’t even unwind the surge in 2024. Year-to-date, the index is still up 7.3%. And since the beginning of 2023, when this massive rally began, over these 19 months, the index is still up 38%. That’s how huge this stock market craziness has been, even in Japan, with foreigners, from Buffett on down piling into the market.

So the last six-and-a-half months of gains have now been unwound in three weeks, escalator up, elevator down.

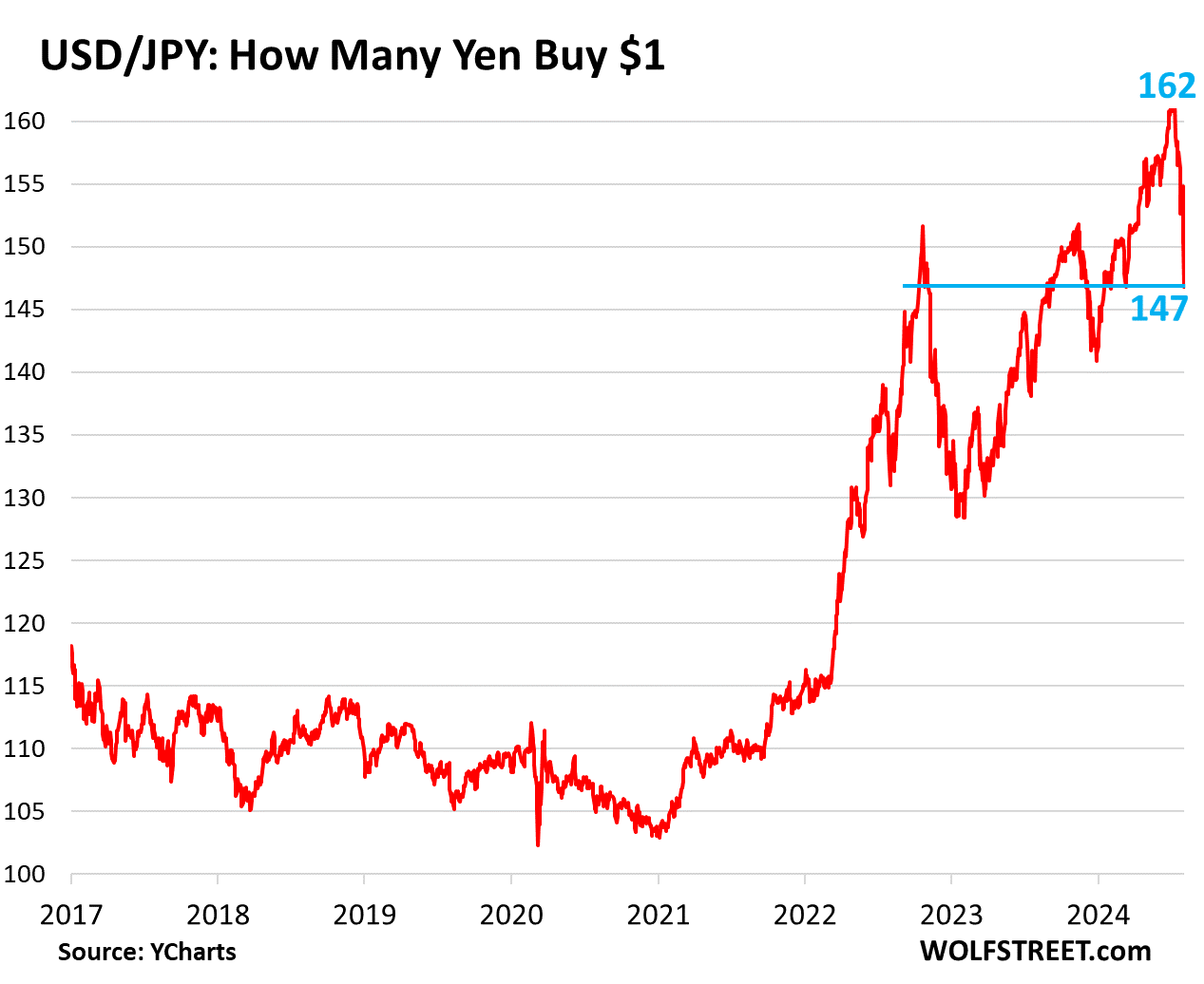

The Yen has been rising from the ashes. In early July, the yen had plunged to ¥162 to the USD, its weakest level since 1982, despite repeated, large-scale, and costly interventions by the government.

At that point, from June 2020, the yen had plunged by 34% against the USD, and by 54% since January 2012, when the Bank of Japan kicked off its crazed monetary policies under Abenomics.

With the yen heading further into the netherworld, the BOJ finally did what we’ve been saying for a while it would have to do to save the yen: It got off its crazed monetary policies (at least a little bit).

The BOJ had to choose between its currency – preventing it from collapsing further — and the stock market wealth that foreigners have piled up.

Today, the yen rose to ¥147 to the USD. This is still a low level for the yen that has traded around the 110-range give or take over the past decade. And the strengthening of the yen so far hasn’t been nearly as big a move as the strengthening from late 2022 to early 2023, after which the yen re-collapsed.

Why suddenly?

Generally, we stick to the dictum that markets do what they do because they do it. And they do inexplicably crazy things: For example, the Nikkei spiked by 62% in the 18.5 months from the beginning of 2023 through July 10, as everyone and their dog outside Japan was following Buffett into Japanese stocks and drove up their prices amid massive hype and hoopla in the US media.

And then they got cold feet, after the spike, and they’re selling. So OK. That’s what markets do.

But something big did change: The Bank of Japan in its painfully slow way started backing off from its crazed monetary policy. That wasn’t a surprise. It has been edging into this direction since late 2022 in tiny baby steps, and the stock market just ignored them.

But the last meeting took. On July 31, it raised its policy rate to 0.25%, accompanied by some “hawkish” comments about more hikes, including in 2024. It announced the amounts of its QT plan – QT itself had been announced at the prior meeting, but not the amounts. QT starts now. In fact, it already started as the BOJ’s holdings of Japanese Government Bonds peaked in February and have edge lower since then. Now QT is getting more pronounced, but the phase-in is slow and will go through 2025 before reaching full speed in early 2026 – as slow as it may be, it’s still QT, which is a big change of direction for the BOJ.

Core CPI in Japan has accelerated to 2.6% in June. But the BOJ’s policy rate is only 0.25%, so it is still hugely accommodative, with the “real” policy rate (policy rate minus core CPI) at negative 2.35%.

But the free money is coming to an end. Markets are going to have to absorb the debt that the Japanese government issues and the debt that the BOJ is inching away from.

And perhaps in looking for a safe haven as stocks are selling off, investors have piled into longer-term Japanese Government Bonds, drove up their prices, and drove down yields. Today, the 10-year JGB yield dropped to 0.96%, the lowest since June – pushing it over 1.6 percentage points below core CPI (2.6%). So OK, markets do what they do.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

1:04 PM 8/2/2024

Dow 39,737.26 -610.71 -1.51%

S&P 500 5,346.56 -100.12 -1.84%

Nasdaq 16,776.16 -417.98 -2.43%

VIX 24.71 6.12 32.92%

Gold 2,480.10 -0.70 -0.03%

Oil 73.94 -2.37 -3.11%

Stocks yo-yoing is to be expected, but that’s a substantial move in oil — what is going on there?

Diminished demand, particularly in the US.

wonder if Japan will start selling/unwind carry trade

ie sell US Treasuries en mass

Poor David Rosenberg

Japan has been living in a fantasy world since 1989 and will now start paying a very dear price to get its economic house of cards built on zero interest rates back to some sort of normal.

And along the way have been providing the Woirld with some of the finest Automobiles and products. Setting an example of how you can produce peacefully and trade.

There was a huge carry trade with Japan paying people to borrow and a lot of that borrowed money was invested in US stocks. Now at least some of that investment will be liquidated and not reinvested.

Interesting, Jdog. I wonder if the current sell-off isn’t a reaction to the yen reversal. Similar to the chicken and egg: who’s zoomin’ who? My first thoughts, hearing that the economy/employment is signaling a slow-down, that the market would celebrate the likelihood of rate cuts.

Wolf, I have a nickel or two in Japanese small-cap value stocks (p/e 10.4, p/b 0.93, p/s 0.53, yield 3.4%).

Just for shiggles, if you were me would you sell or hold? This is not investing advice etc.

I’d never hold small caps for yield — there is a substantial risk of capital loss (and currency risk if you’re a USD-based investor). I’d hold them for capital gains and take the yield. If I don’t think capital gains will materialize, I wouldn’t hold them. If they’re promising well-run companies with good products and a potentially a big future, I might hold them regardless of yield.

If all I want is yield, and be guaranteed no capital loss, I’d go with T-bills. Four months and less is still over 5%

I appreciate the logic in your response — thanks!

> If they’re promising well-run companies with good products and a potentially a big future

Do you have an example of such a company in Japan? I can’t think of any.

There are several etfs listed on Morningstar and you can see some of their holdings at a glance. Those etfs, though, hold very small amounts of each company relative to their whole portfolio, less than 1% for any given holding. Then you’d have to get info on each of those companies to see if they are in “value” territory. After that, if you’re going to buy it on the Japanese exchange, you’re going to pick up some stiff fees/commissions/exchange rate costs… Better to settle for an etf and hold your breath.

Judging from the history of turbulence in the Japanese market, you may want to invest in some sedatives along with the stocks.

MW: Dow on track for worst August start since 2002 as recession fears send stocks skidding

If this market correction continues, I wouldn’t be surprised to see a rate hike greater than .25%.

None of the commenters want to give the Fed any credit whatsoever, but Powell has managed a pretty good soft-landing so far. A little late and we are maimed from the spike in inflation earlier. But maybe he’s got a hot hand and can avoid a recession.

I agree… Powell has done fine. He has gotten QT restarted and the Balance Sheet reduced by 20%. He has gotten inflation down from the 1970’s level 9% to the average of the past 40 years (3.5%). He has avoided any big election year maneuvering. AND he has done all of this without triggering a recession or destroying the Fed’s credibility.

Not a bad run so far…

Hi Wolf, what do you think about the carry-trade practice, i.e. borrowing money in yen, and popping-up stock market in the US, Taiwan, Japan etc.? It started reversing last week, as USDJPY falled from 162 to 146 (as I leave this comment today).

If BoJ keeps raising interest rates, the reversing of carry-trade may keep going, until USDJPY falls into the normal range. I will say USDJPY = 115 is a normal range.

“The plunge didn’t even unwind the surge in 2024”

If 110 is the base, it looks like we’re going to see a lot more plunging in the Yen, not to mention the S&P, T Bond & T Bill yields and lots of other things.

Just when Japan was becoming the inexpensive instagram and vacation destination of the world!

If I was a Japanese retail investor, I’d sell all my Yen denominated investments and park all my investible money in USD T-Bills / money market ETF. The unwind of the Yen carry trade may take many months to deleverage from this complex web, likely holding many toxic USD commercial loans and other low quality assets/collateral. The time to panic in Japanese market is right now and front run billionaires.

“Front run billionaires”

That was worth a good laugh. Thanks.

You can still earn a double digit rate of return in interest in Mexico and with all the smart people moving there and moving their money there the Peso should only appreciate against the U.S. dollar.

Ha, ha, ha,

The Mexican Peso plan.

People have been suckered in into that for the last 50 years.

Avoid the currency if you want to anything left in a few years.

“Ends Free Money”

I don’t see that, because while nominal rates are above 0%, they’re not above the inflation rate, so the real rate is negative. And negative is a gift to someone. A 20% loan might contain some free money, if denominated in Turkish Lira.

It’s the “real” rate (interest rate – inflation rate) that determines if the money is free. I see negative real rates in Japan, and hence I still see “free”.

Clearly not many buyers today in Japan markets down 5 percent in 1 day .

For every seller, there’s a buyer.

Correct, for every sale there is a buyer, its the strike price that moves the indices.

Their stock market has been rigged by the government buying worthless shares and has no one to sell their overpriced shares to. The smart money comes to this same conclusion and dumps en masse leaving the government to hold the bag.

Same ole story from you as the Nikkei was soaring.

Another broken clock projection that has worked out right for a few days

The US economy is much weaker than statistics would suggest. Inflation is highest in costs that affect homeowners most, which is causing them to cut back spending. That lack of spending is now being seen in retailers, and employment is starting to falter meaning we are reaching the latter stages of the beginning of recession…

Here’s my take on where we’re headed: the Fed will now lower the rates, stock declines will have a chilling effect on consumer spending, money will move from stocks to bonds – reducing the yields, and mortgages will have lower rates. This sequence will stimulate home buying (after more waiting and watching of rates) and steady a moderate gdp decline. But, because mortgage rates are in retreat, people may wait on committing to loans, thinking that the rates will keep lowering. It may just delay housing acceleration/price increases.

We may have a gdp decline, but probably not going negative. I don’t imagine that the Fed will sit still on rates and will avoid a full-on recession.

You should look at a long term chart of interest rates. Every time interest rates peak and then decline, it is followed by recession… every time… of course there are always those who claim “this time is different”.

No it’s not. It was the case with some but not all rate cuts. So that’s a fake “rule.” (chart goes to 1955):

https://fred.stlouisfed.org/series/FEDFUNDS

BTW, for your amusement, some of these “rules” have already been crushed. The first big one was the “inverted yield curve = recession” rule. We’ve had an inverted yield curve for two years, and there’s still no recession.

We’re now watching the Sahm rule get crushed because the sudden flood of immigrants entering the labor force is driving up the unemployment rate, while the labor market is expanding, and the economy is growing (+2.8% in Q2 which is above the 10-year average for the US), but jobs are not growing fast enough to absorb the sudden flood of immigrants. So you have a growing labor market along a rising (but still very low) unemployment rate. A recession requires an actual decline of jobs and GDP, among other declines, not normal growth.

Wolf:

I heard Sahm herself say months ago she thought that “rule” would be broken.

The yield curve is not a timing indicator and is a recession indicator when it UN-inverts.

Looking at the 10-2 it’s shot close to zero.

Maybe the bond market will re-evaluate over the weekend. OR Maybe we’ll see a recession starting soon.

The Struggler,

Well, that UN-invert came up in 2019 when the yield curve inverted and nothing happened. And so they said, wait till it uninverts — invert and uninvert were often pretty close together, not years apart as now, so it was kind of a fudge factor — and then still nothing happened. This was the first time that the “yield curve inverts/uninverts = recession” failed. And then we got a pandemic that had nothing to do with the business cycle.

This time its different as the inflation rate has been understated which wasn’t the case when interest rates peaked and then declined in the past. In the past higher interest rates led to recessions because the baby boomers were still working now they’re retired and higher interest rates means more money in their pockets.

My recently deceased mother was a Realtor and she always said the same thing… home sales don’t increase while mortgage rates are dropping because everyone is looking to save money. But once rates start going back up people rush in to close on whatever house they are looking at because they are worried the mortgage rates will go even higher.

Another economic “rule” that wasn’t a real rule was the Phillips Curve. Economics, especially with regard to large scale things (macroeconomics), is more guess-work than science, imho.

Wolf can you post an image like you do for the US Fed’s balance sheet to show the BOJ’s holdings as a percentage of GDP?

OK, I’ll add that to my next BOJ balance sheet update.

Amazing stuff. What I think is ultimately going to contribute to yen strength is that despite all the external savings of the Japanese, when they cash those in, the desire will be for domestic consumption i.e. care home expenses and not imported goods. As in, you can’t repatriate savings unless you want imports. The Japanese want a magic way of repatriating savings without imports and this will contribute to the strength of the yen. Absolutely stuck.

I keep reading sometimes its flows not levels. and when the “flow” reverses for the yen it will imo be an almighty event.

Carry trades have a tendency to unwind rapidly.

I just don’t see that these recent moves change much. Japan wants a weak yen and low rates. I think the govt owns a lot of their stock market too. Having rates go to .25 doesnt seem like it would end the carry trade but I don’t know enough about how the trade works.

Own a Toyota and understand how they’ve kept it going for so long

Wolf – thanks for your coverage on the Japanese Yen.

I lived in Japan two different time periods mid 90’s-2000 and again for a few years before the GFC.

I keep saying, that, we need a Reset and whether it starts first in Europe and/or Japan, and I know it should glib to say, we need Economic karma, but, I like Japan and it will be painful but, I’m hoping with the admirable way their Society kept things relatively cohesive for 30+ years of stagnation, they go thru a Reset or debt forgiveness and the JPY weakens and it will be painful but hope they will come out of it first, and be a leader and then the question is who and when is to follow and how long? Can we print to $60T or Military might keeps our financial ‘cleanest shirt analogy’ for 30-40 years after I pass? Or, will it come sooner, say, a few years after Japan does a Debt Forgiveness?

This is like trying to bring a dead person back to life. 30 years of zero interest rates destroyed Japan and now its too late as Japan is now a basket case beyond repair.

Yeah, sure, a basket case.

You really do hate Japan with all the constant nonsense you post about the country.

They are in a lot better shape than the USA in most respects.

If Japan is a basket case then the USA is the scum on the bottom of the pond case.

Down eight plus percent: Wow.

The comparable move in the NASDAQ would be down 1375.

Looks like Weekend at Bernie’s may finally be coming to an end.