Long, slow erosion of the US dollar’s dominance. China’s renminbi keeps losing ground, many other currencies gain, as does gold.

By Wolf Richter for WOLF STREET.

The US dollar is still by far the most dominant global reserve currency, among many reserve currencies held by central banks, but its share has been eroding for years, as central banks have been diversifying to other reserve currencies, and also to gold. But the process is slow and uneven.

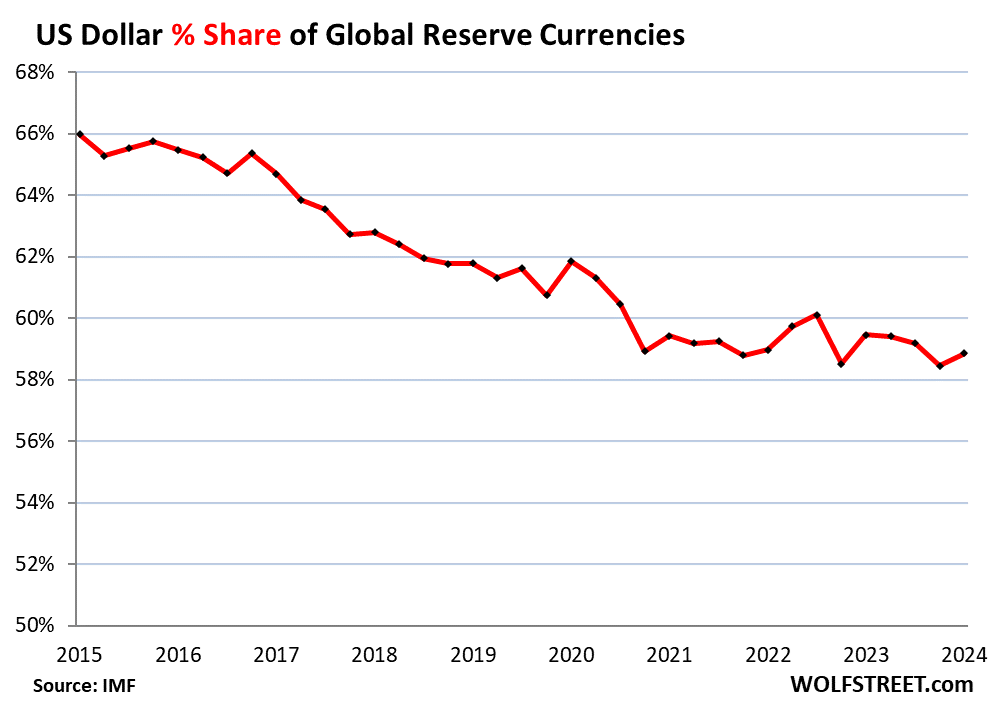

The share of USD-denominated foreign exchange reserves ticked up to 58.9% of total exchange reserves in Q1, from 58.4% in Q4, which had been the lowest share since 1994, according to the IMF’s COFER data released on Friday for Q1 2023.

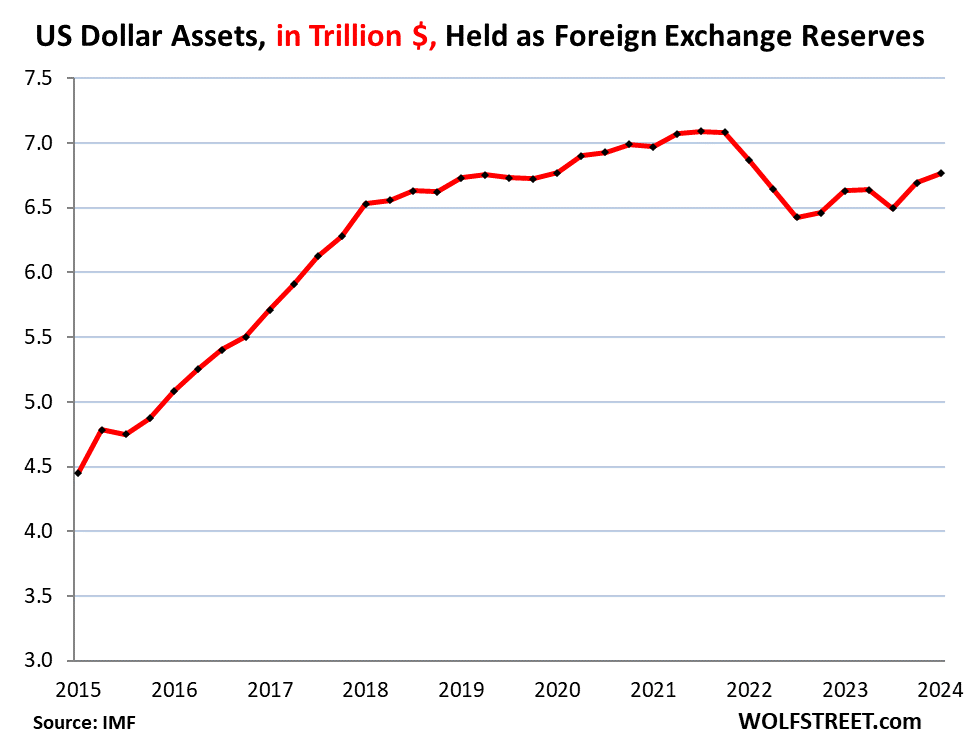

Central banks held total foreign exchange reserves in all currencies of $12.3 trillion in Q1. This included $6.77 trillion in US-dollar denominated assets, such as US Treasury securities, US agency securities, US government-backed MBS, US corporate bonds, even US stocks.

Excluded are any central bank’s holdings of assets denominated in its own currency, such as the Fed’s holdings of Treasury securities and MBS, and the ECB’s holdings of euro-denominated assets.

In dollar terms, holdings of USD-denominated assets at foreign central banks rose to $6.77 trillion in Q1.

It’s not that central banks are “dumping” their dollar-assets – in dollar amounts, their dollar-holdings haven’t changed all that much. It’s that they take on assets denominated in many alternative currencies, and as overall foreign exchange reserves grow, the dollar’s share of the total shrinks.

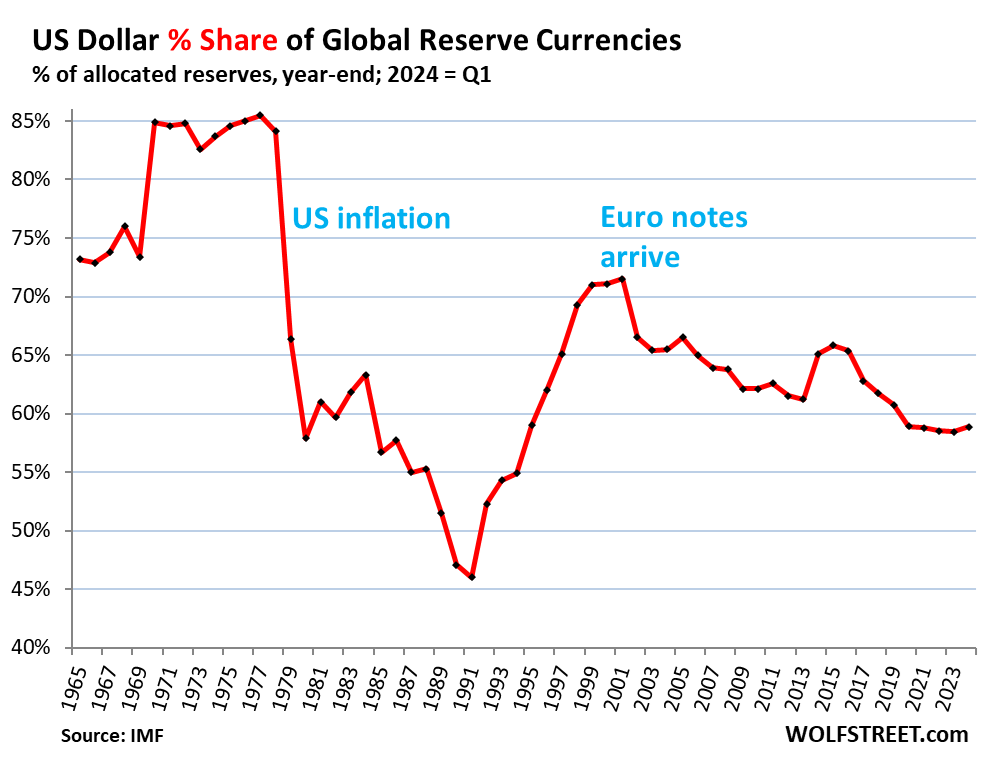

The USD’s share of global reserve currencies has seen a lot of turmoil between 1978 through 1991, when the share collapsed from 85% to 46%, after inflation exploded in the US in the late 1970s, and the world lost confidence in the Fed’s ability or willingness to get this inflation under control.

By the 1990s, confidence returned, and central banks loaded up on dollar-assets again, until the euro came along (share at the end of the year, except 2024 = Q1)

The other major reserve currencies.

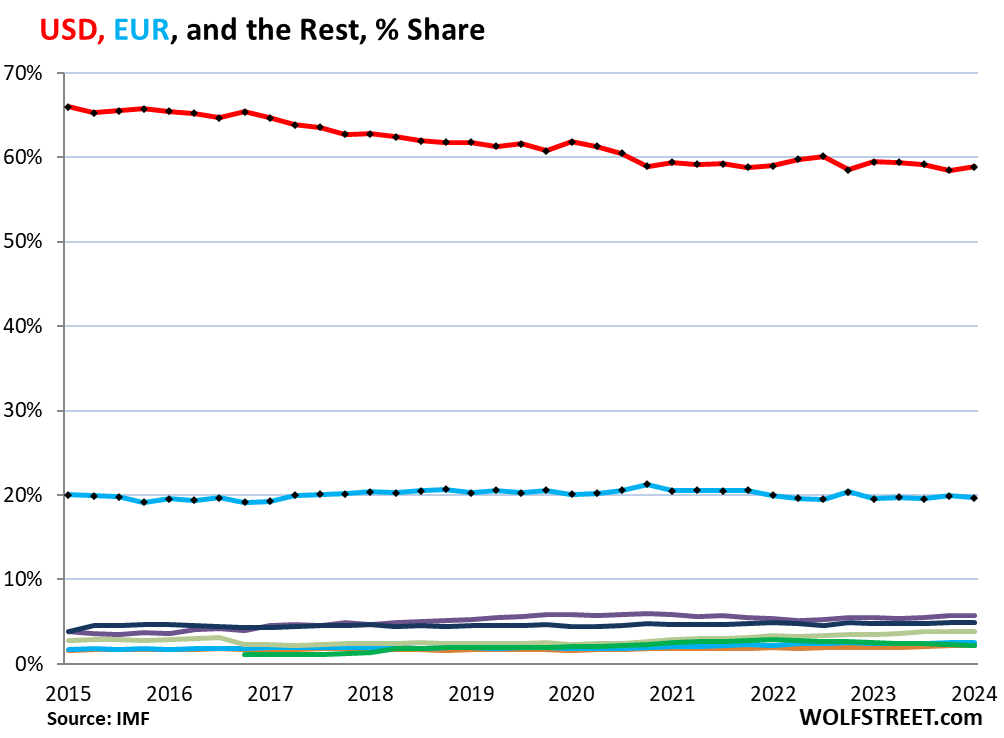

The euro is #2, with a share of 19.7% in Q1. The share has been around 20% for years (blue line in the chart below). The other currencies are the colorful tangle at the bottom of the chart.

What’s hard to see in this chart, but easy to see in the next chart, which holds a magnifying glass over the colorful tangle at the bottom, is that these other currencies, except for the Chinese RMB, have been gaining share, while the dollar has been losing share, and the euro’s share has remained stable. It’s not one currency that’s gaining against the dollar; it’s that a lot of “nontraditional reserve currencies,” as the IMF calls them, are gaining share.

The rise of the “nontraditional reserve currencies.”

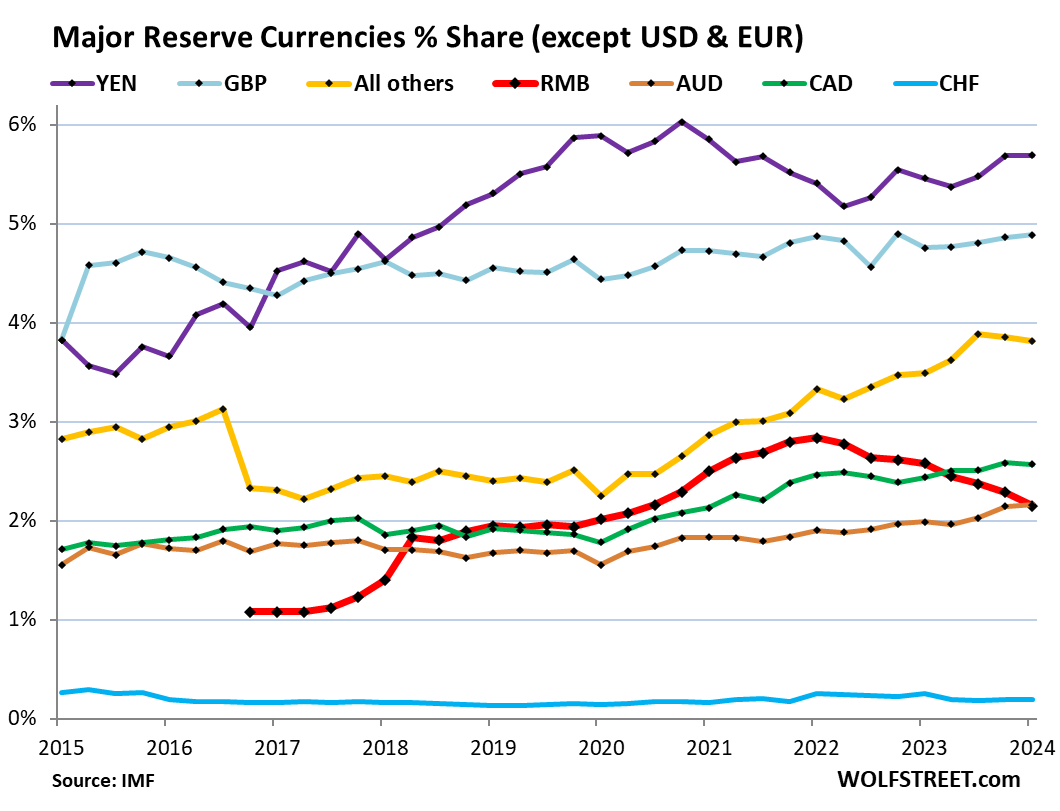

The chart below shows the other currencies magnified. And their shares of the total have been rising over the years.

The exception is the Chinese RMB. China is the second largest economy in the world, yet its currency plays only a small and declining role as a reserve currency. When the IMF, in 2016, added the RMB to its basket of currencies backing the Special Drawing Rights (SDR), many had thought that the RMB would quickly become a threat to the dominance of the USD as global reserve currency. But that has turned out to be not the case.

Depicted in the chart below, by their % share of total foreign exchange reserves in Q1 2024:

- Japanese yen, 5.7%, third largest reserve currency behind USD and EUR (purple).

- British pound, 4.9%, fourth largest reserve currency (blue).

- “All other currencies” combined, 3.8% (yellow). The RMB used to be part of this group. But in 2016, when the RMB joined the SDR basket, the IMF began showing it separately, and as a result of the separation, the share of “other currencies” dropped by the RMB’s share. After that separation, “all other currencies” without the RMB had a share of 2%. This has grown to 3.8% by Q1.

- Canadian dollar, 2.6% (green).

- Chinese renminbi, 2.1%, lowest since Q2 2020, 8th quarter in a row of declines (red), amid capital controls, convertibility issues, and other issues. Central banks appear to be leery of holding RMB-denominated assets.

- Australian dollar, 2.2% (brown).

- Swiss franc, 0.2% (blue).

The IMF found in a 2022 paper that there were 46 “active diversifiers” – countries that have at least 5% of their foreign exchange reserves in “nontraditional reserve currencies.” The list includes major advanced economies and emerging markets, including most of the G20 economies.

The IMF thought that two major factors contributed to the rise of the “nontraditional reserve currencies”:

- The growing liquidity of markets in those currencies, which makes it easier to trade those assets.

- Chasing higher yielding assets elsewhere during the 0%-era in the US and Europe.

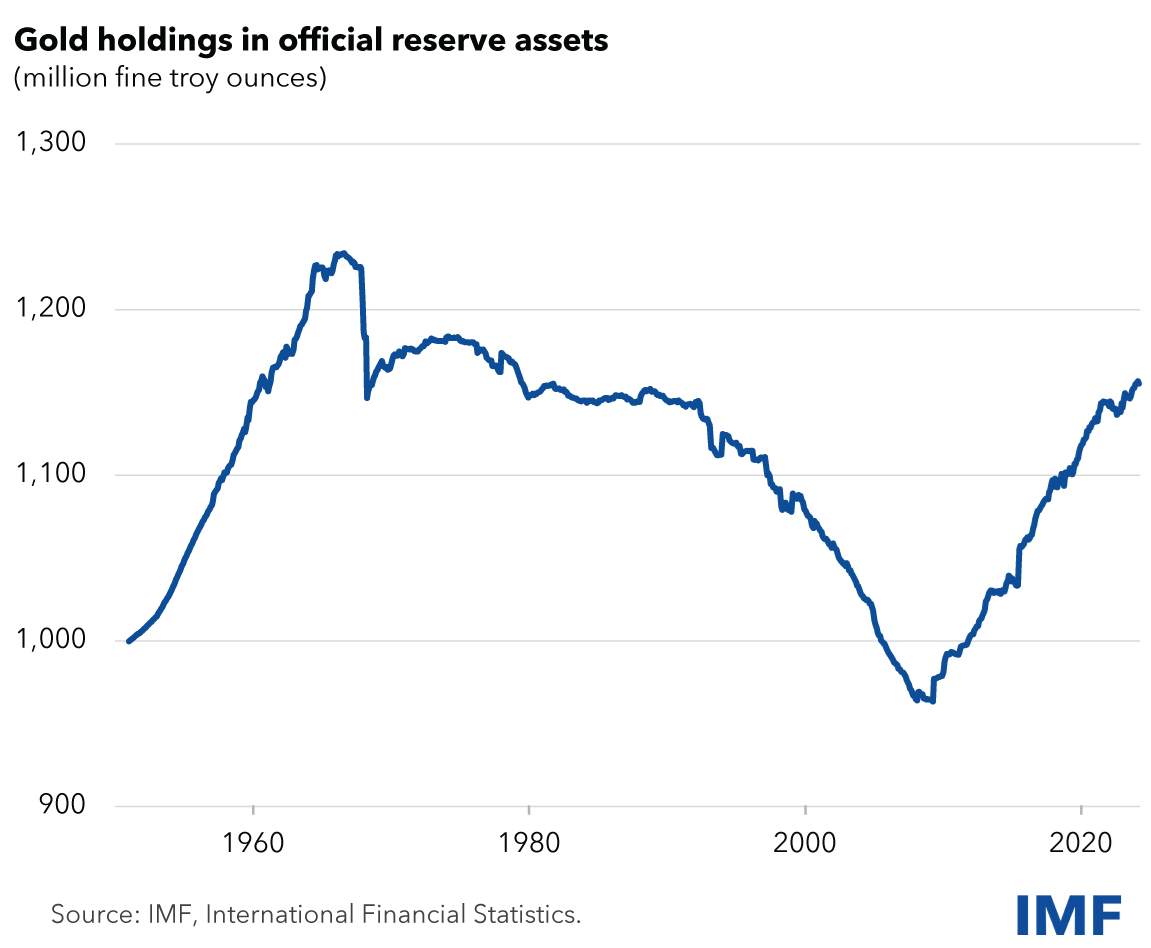

The rise of gold as central bank reserve asset.

Gold bullion is not included in “foreign exchange reserves” of central banks – the data above.

But bullion holdings are in the overall “reserve assets” of central banks. And central banks, after spending decades shedding their holdings, have been rebuilding them for the past decade. According to the IMF, they’re currently at 1.16 billion troy ounces – roughly $2.7 trillion, compared to $12.3 trillion in foreign exchange reserves (chart via the IMF):

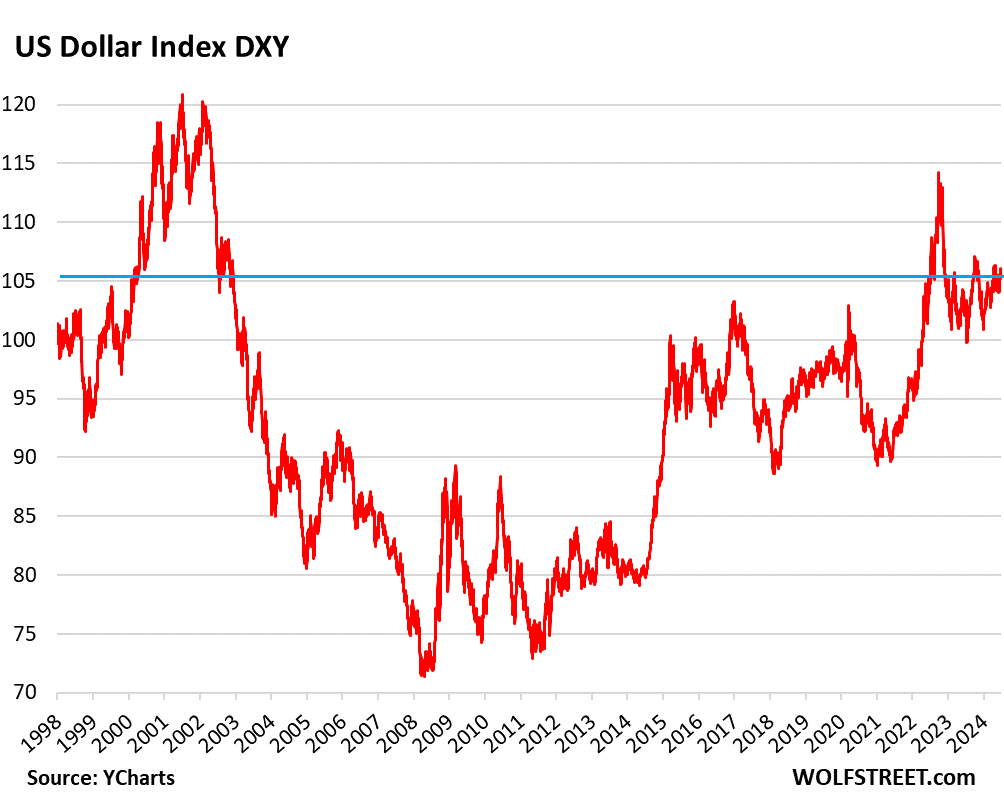

USD-exchange rates and foreign exchange reserves.

Foreign exchange reserves are reported in USD. USD holdings are obviously reported in USD, and the holdings in EUR, YEN, GBP, CAD, RMB, etc. are translated into USD at the exchange rate at the time. So the exchange rates between the USD and other reserve currencies change the magnitude of the non-USD assets – but not of the USD-assets.

For example, Japan’s holdings of USD-denominated assets are expressed in USD, and they don’t change with the YEN-USD exchange rate. But its holdings of EUR-denominated assets are translated into USD at the EUR-USD exchange rate at the time. So the magnitude of Japan’s holdings of EUR-assets, expressed in USD, fluctuates with the EUR-USD exchange rate, even if Japan’s holdings don’t change.

Exchange rates fluctuate wildly. But over the long run, the Dollar Index [DXY], which is dominated by the euro and yen, is back at 101, where it had been in 1999 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

– read a clickbait article about the “death of the dollar”

– the text is all doom about how the dollar is declining and BRICS will wipe out the west

– check the actual data on wolfstreet and in reality it’s just banks buying slightly more Japanese Yen and Canadian Dollars.

It was somewhere in the mid to late 2000’s when I started reading doomer sites. I was sure the US would have to declare bankruptcy any day, the dollar was going into hyperinflation, we’d be out of oil and be walking to work. Then stocks collapsed in 2008 and I thought “here we go!”. Time to buy gold and hunker down!

Then the stock market started heading back up, got a better paying job, paid off my house, lost money on the stupid gold, and started reading wolf street. I’ve sense retired with a nice bank balance and financial security, enjoy seeing how well my family, friends and neighbors are doing, and enjoying life in this great country. Sites like this help folks understand reality and make better decisions.

I bought ‘stupid’ gold since 2013 and banked a 66% profit until now. Really banked, not paper profits. Invested in stocks since 2016 and banked a 44% profit until now. I used both profits to pay off my mortgage.

It all depends on the moment of stepping in and not forgetting to take profits along the way. I guess i got lucky timing it sort of right. It could have gone pear shaped.

I watch(ed) those doomer channels too, but don’t take them too seriously on the apocalypse narrative. I just look for the info that i think is useful to me and don’t get on MSM, where they only sell, sell, sell stuff and push you to buy, buy, and just hodl everything.

Same here. We paid off our mortgage in February from the sale of gold we bought starting in 2008.

Isn’t funny how doom and gloom just never really happen ?

“Isn’t funny how doom and gloom just never really happen ?”

Sounds like you missed the debate ……

Other countries have casinos, but we have the biggest and finest casino of all, everybody comes here. Relax by the pool, play some keno, Putin and Chi in line at the buffet.

Our poker chips are always kept in pristine condition, the table games the slot machines and free drinks keep them coming back.

“How did you go bankrupt? Gradually, and then suddenly ‘- The Sun also Rises, E. Hemingway.

Don’t worry OTB, the bright lights you see really aren’t the freight train bearing down on you, it’s a new day dawning.

When this economic house of cards collapses, you’ll be better off having gotten out 10 years too early, than 1 day too late…

YMMV …

Surely you jest. Or are you just another detached normie?

Same experience here. The doomer folks are like Greta’s climate crowd. “Any day its gonna happen! The end is near!”

Here we are, it’s a new day, the sun is shining. We have problems, but they can be solved with level headed work.

Yes, in the short term, but history runs in cycles. Near the end of the Roman Empire the Denarius was still the coin of the realm and accepted throughout the empire. But a few years later it was just a memory, barter was the way of commerce and sheep grazed in the collossium.

Pro Tip, towards the end of the Roman Empire the Emperors became increasingly senile and deranged. Remind you of anything?

HC

MORE comparisons to the Roman Empire of more than a millenium ago ? Really ?

There is NO wisdom to be divined from that completely disimiliar era to our own.

@outside the box,

Governments are governments.

Currency is currency.

History repeats.

Since Rome’s decline is such a tired trope, the USSR had its fair share of septuagenarians leading the country in the decade or two prior to its collapse.

…because THIS time, we humans are different!…

may we all find a better day.

The ruling Roman class were the first to see the immense value in Christianity…Seneca was there and he commented on it…(look it up)…and they promptly modified it and then organized it into a book….and an inseparable part of their government.

Didja ever wonder who indexed the whole Bible? The Roman rulers, stupid.

As Barry Goldwater said, “Mark my words”.

Rome may have declined. But the State Religion they spotted and then modified to suit the ruling class’s governing desires sure as hell didn’t.

Any further debate on those two posts?

Just one example of many….The chapter name is sure dead on…..

ROMANS 13-4

4 For the one in authority is God’s servant for your good. But if you do wrong, be afraid, for rulers do not bear the sword for no reason. They are God’s servants, agents of wrath to bring punishment on the wrongdoer.

Not very “Jesus-like”, is it? He was more into helping and sharing…..

NBay – …thus the resurgent legs on the “divine right of kings” concept (the Enlightenment notwithstanding, and perhaps now in retreat, given the speed of modern communications and it’s corrosive effects on the value of patient and considered thought). Best.

may we all find a better day.

Thanks for pointing out more aspects of what I try to post here, as usual….patient thinking words hurt many brains, unfortunately, especially when they plan on living forever regardless of what happens……all they have to do is “invest most all of their brains” in a cult. Created by whackos.

And as long as money remains constitutionally “speech”, and there are no BOUNDARIES or ENFORCED rules to this capitalism shit, we may continue switching to the “Divine right of MONEY”….the titles will probably come later….or we have new ones like CEO.

Kalamath Falls, I believe, instituted the first (new) “vagrancy law”.

The fact sleeping is a biological need was pointed out by some judge.

I used to think that was a nice little town.

My soapbox is wobbling….later

Yes, please pay no attention to the 260% gov-debt-to-GDP ratio of Japan or the 105%+ gov-debt-to-GDP ratio of the US.

Or the continuing multi-decade imbalances that led to such results.

Or the utter lack of anything remotely resembling a government plan to even moderately address them…ever.

There is no better cure for encroaching decay and approaching danger than slumber.

Well said!

Not to criticize wolf’s fine work, but why is this even important or interesting? These are the actions of central bankers. Institutions of gov’t. Not market participants.

IMO, the important numbers relate to global trade. US dollars used in trade must increase every year to make up for the inflation caused by deficit spending. If this doesn’t keep up, the inflation stays home for us consumers. Hard to know how that’s going. I was unable to find charts going back very far. But we know unfriendly countries are working to use their local currencies for export markets.

@Harold,

The central banks have become market participants.

Sometimes ponzi’s can last a long time but in all of history no ponzi has lasted forever. Heed the warnings of others instead of just brushing them off.

Nothing has lasted forever, yet… 😉

The oil predictions were the ones that always amused me. I worked for an oil company and everyone knew that the amount of oil available is a function of its price. Lot more available at $100 a barrel than at $50!

Yes but more expensive oil takes more energy to extract. This leads to a lower energy return from the energy used to extract it. The term used is EROI-Energy Return on Investment. Some of the first wells drilled had a return around 100:1, or 1 barrel of oil burned to produce 100 barrels. I think the global average is now around 30:1 and for here in Canada Tar sands oil is about 4:1. As with any natural resource we use the cheapest to extract first and then make our way to lower net energy return sources over time. The EROI of most Renewables is much lower than most oil sources when you look at a full life cycle from mining (steel, rare earths, cobalt, lithium, etc) to building, to installation and decommissoning, when the wind turbine or solar panel is worn out. A lower net energy return decades down the road from now will slow, constrain and eventually reduce economic growth. It’s inevitable.

Just think if you had bought 100k of the stock market in 2000. Wooo! That would be a lot.

You stole Sylvester the cats line, the tuxedo cat with the red nose.

Speedy gonzales, Tweety bird and the loony tunes have all felt the loss.

But on the other hand you have brought life where there was none.

His full name was, Sylvester James pussycat Sr…RIP.

Oh, the article…sorry. let me think….ok got it.

Not too many years from now, one world currency, all these currencies complicate and limit a smooth operation.

Same. It was a timing thing based on age. Rise of internet, access to info, spread of info, early adult….generational combo.

Bought silver and gold. Have held for 15 years. It has doubled and produced no cash flow. Waste. A single rental at same price would have outperformed it by a 1000%. Dumb purchase based on ignorance and fear. Oh well.

Got into real estate in 2010. Again, perfect coincidental timing. I had some equity through working and saving as seed money. Houses have tripled, cash flow now 100% (all paid off) rents up 50% since.

I only take credit for the discipline and physical work involved. Vision formed during the experience. One can’t “do what I did” because one can’t do it when I did…

BTW, my initial puny metals investment would be $660 million had I bought bitcoin…

“lost money on the stupid gold”

depend when you bought.

The UK government’s intention to sell gold and reinvest the proceeds in foreign currency deposits, including euros, was announced on 7 May 1999, when the price of gold stood at US$282.40 per ounce

price today = $2,325

so called “doomers” are not wrong they are just early. Society and currency does not collapse overnight –process can take years, decades. Roman Empire is example, it was collapsing for approximately 200 years. British are another example, one gold pound once buy 5 golden dollars, now paper pound is 1.3 US paper dollar. All paper fiat eventually end up as “rubbish heap of history”

Make sure you keep your gold in a safe location so you will still have it in 200 years when the US collapses 🤣❤️

Warren Buffett father words:

by Hon. Howard Buffett U.S. Congressman from Nebraska The Commercial and Financial Chronicle 5/6/48

Is there a connection between Human Freedom and A Gold Redeemable Money? At first glance it would seem that money belongs to the world of economics and human freedom to the political sphere.

But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty.

You just described my situation exactly. Even the peak oil reference and the head fake of ” here we go”.

Nothing to see here for Americans. You can continue with whatever you’re doing.

Also buying a lot more gold (Au).

“the doom” is part of the political propaganda promulgated in our times, largely GOP. They want Muricans to feel victimized, vindictive, and vanquished unfairly, so that the sheeple will support the ruling elite’s war plans. multi faceted doom propaganda. it foreshortens the citizen’s horizons.

I hope Wolf keeps this site and these articles up for the next 5-10 years. It’ll be interesting to revisit these.

We can take guesses where the dollar’s share might be 10 years from now. 50%?

I see an orderly slow diversification by central banks of their foreign exchange holdings as a good thing for the US in that it might support more financial stability in other countries around the globe.

If this drop in dollar-holdings occurs fairly quickly, such as during the high-inflation period 1978-1985, it would be more troublesome for the US as it might entail much higher longer-term yields for years (what gave rise to the misnomer “bond vigilantes” at the time).

Problem is, decay is slow until suddenly there is a crash. We have exams from history, companies (Intel, Cisco etc.), stock market (1987 crash good example; there was chatter about triple deficits and suddenly the crash).

yes once critical mass is reached it can collapse fast.

“How Did You Go Bankrupt?” “Two Ways. Gradually and Then Suddenly.” Ernest Hemingway,

One thing is quite clear. The gold holdings of many central banks are going up. The unpredictability of US government is balanced against the productivity of US economy.

The downtrend of US dollar in reserve is worrisome development. No country truly needs dollar if there is a convenient way to settle trade balance with gold — maybe digital currency backed by gold.

The BRICS proposed digital currency is rumored to be 40% gold, and the rest Rubles, Rupees, Renminbi and all those other currencies everyone is so avid to hold.

Lots of hype, but one wonders why get only 40% Au and 60% mostly trash when one can have 100% of the real thing…

I have a feeling whatever BRICS comes up with will be little better than crypto crap.

Hi Wolf,

There are two critical problems with all financial prognostications. One, they almost all take an existing system as a given and expect that it (or a reasonable facsimile thereof) will continue to exist going forward. Two, prognosticators almost always rely on historical data as a basis for their future projections. This approach works as long as the system continues intact. When the system begins to fray, however, this approach breaks down. As a fellow American, I laud your optimism and patriotism with respect to the American ‘experiment’, but I believe that we are near one of those systematic breakdown points. Hopefully we will get through this and be stronger on the other side, but one never knows. In 1890, could anyone have plotted the fate of Germany, Japan, UK, Russia or American over the subsequent 75 years? I don’t think so, but I think that we’re at an ‘1890 point’ right now.

Gold is the real puzzler here.

What tale is the gradual shift in central bank thinking on gold telling us?

In addition to the diversification motive, there may be another factor to this: the price of gold had collapsed nearly 50% by 2015, around the time central banks started buying. So maybe the buying was also motivated by “buy low.” That has turned out to have been a good bet.

“And central banks, after spending decades shedding their holdings, have been rebuilding them for the past decade.”

An excellent article. And the graphs are great too. It debunks a lot of doom-and-gloom hustle articles.

What I found most interesting is that central banks are bulking up on their gold reserves. I have read this elsewhere too and to my understanding these banks are having the gold delivered to their own vaults — no intermediary party holding it for them. They want to physically possess it.

Maybe I should do the same….

Would you be willing to share a practical example of why a central bank might prefer to hold one currency in preference to another?

For example, how might Brazil use $CDN instead of $US? Is the government of Brazil buying products from the government of Canada that makes paying in $CDN a better value?

These holdings perform two functions for a central bank: as investments and as a stability tool. So the Central Bank of Brazil might buy Government of Canada bonds to hold as investments and earn yield; and in an emergency, it can sell them to prop up the Brazilian Real.

As mentioned in the article, one reason it’s easier now to diversify away from USD-investments is the much better liquidity in these markets, so it’s easier to sell GOCs or other currency-denominated investments than it used to be.

If the Chinese economy never comes back then its all over for the Canadian dollar. If the Yuan keeps on weakening then its all over for the Canadian dollar.

Interesting opinion- what makes you think the two are so related?

I thought it was interesting to use the stats and then adjust by multiplication for population and gdp of the different countries. Perhaps this is a faulty way to look at boxes of oranges and apples, but it does paint a clearer picture. Some groupings are trending better than others for sure.

If you’re playing financial tug of war, and one team has 9X or 12X as many players on their rope end, you can’t say they are actually 9X stronger and healthier, can you? (better). It would be interesting to have a neutral exchange currency or basket and see how countries shake out in comparison, wouldn’t it?

Ahhh, the old doom and gloom predictions. They are as crazy as the everything is rosy predictions. Have to look at issues with your own lyin’ eyes which is why we thank Wolf for doing the great presentations.

In terms of adjusting for population: Population size is irrelevant. Look at India, most populous country in the world, and its currency isn’t even in the listed holdings. China, second largest population in the world, has a currency that is near the bottom of the listed currencies, and below Canada (with just 41 million people). Minuscule Switzerland has a currency that is big enough as foreign exchange asset to be listed. The size of the population is just totally irrelevant.

What matters more are the liquidity and depth of the markets those currency-assets trade in, the stability and size of the economy and currency, the ability to keep inflation in check, etc. These kinds of considerations matter, not the size of the population.

You can adjust anything to anything, so we might adjust these holdings to the average windspeed in the country, and that might also be “interesting” to look at in a silly way.

Norway would pop up on top of the list. So maybe social democracy is the way to go? 🤔

No one explains economic and financial data better than Wolf Richter! Clear, consice and well explained in a language that every thinking reader can understand.

True!

Howdy Ken Ditto,,,,,,, most articles way over my bald head. Learning what I need to know is fun……..The Lone Wolf rides again…….

I’m camped over here with DFB. A lot of this is over my head. But it’s been the place where the data is precise, and the answers make sense. And the commentary is hilarious at times, but mostly true. :(

Are all the bonds and other assets in the CBs measured by their nominal value or are they marked to market

In response to all the gradualist sentiment in the above comments, yes things don’t change overnight. As long as some semblance of control remains in the Fed and other related entities, there’s always a way to paper over the problems, and that can be especially effective as long as the media is so securely controlled. Historically push comes to shove when war breaks out. If, for example, the “barbarians” never managed to gain a necessary degree of military competence and Rome never got sacked, there might still be a Roman Empire whose patricians would still be devising new ways to paper over the underlying rot. Who knows? But sooner or later the oligarchs/bankers/whomever lose control and things are settled by war. (Remember the good old days when the west thought it could easily destroy the ruble? Just another example of how things might go to hell more quickly when cold wars get hot.). I hear there are currently some rumors of war clouds gathering in some of those ever troublesome hotspots.

“If, for example, the “barbarians” never managed to gain a necessary degree of military competence…”

Unfortunately for us, these barbarians evidently managed to gain military

competence. Worse, it seems that we the enligthened folks have lost lots

of our military competence, and the industry that supports it. IMHO this is

the biggest long-term threat to USD status as world reserve currency.

I would caution about being too complacent about the foreign currency situation. Central bank interest rates and currency valuations are going through a shift right now, is it a seismic shift? IDK. The strength of the Yen holdings have been based on negative interest rates and the carry trade, now with the value of the yen dropping the ripple effects may or may not tremendous. How long will the US maintain higher interest rates than the others? How long can the US afford to pay $1 trillion in annual interest? If the US quietly acquiesces to higher inflation to ease our debt burden, then at least some of the doom/gloom predictions may come tru.

A very insightful article thanks

1) After WWII the dollar ruled. When ARAMCO was confiscated the dollar plunged. During the oil glut the dollar cont to slump until mid 1990’s. Paul Volcker 21% FFER spike didn’t kill inflation. The glut along with the spike did it.

2) The dotcom rejuvenated the dollar. The end of the 2000 bull run and the newly born Euro sent the dollar down to nadir in 2008.

3) In 2009 margin calls sent commodities to the garbage bin. China, buying dollars at nadir, accumulated commodities.

4) Barter trading between nations of real goods and knowledge transfer, bypassed the dollar, along with the Euro, other currencies , gold and Bitcoin.

Wolfs valuable strength is his dogged outing of the most reliable data he can find about what has actually HAPPENED economically.

When he “slips” (rarely) he yields to the temptation to PREDICT future economic happenings. Example: His shorting of the whole stock market in his own accounts, not long ago.

Bad trades are being made ALL THE TIME by definition because there is a buyer and a seller in each trade, and one of them is going to be wrong and will end up with a bad trade. I just wrote about one trade that no one will ever forget 🤣

We all catch a falling knife from time to time. I bought 100 Kmart at $5 at the end game. Newby mistake.

Howdy Folks. ” I heart US Dollars ”

signed A Squirrel

1991 – The collapse of USSR and other East European socialist regimes helped us.

2024. Who is going to help us this time?

History guides us here.

No fiat currency has passed the time test of long term value.

Gold, silver, copper and nickel were once fully exchangeable for paper dollars. 1933 began the end and 1971 finished what once was real money.

5,000 years of history tells the story of precious metals.

B

PS. Gold at $2,300+ the dollar is now worth less than 1% of its value in 1933.

Depends what u did with fiat:

S&P 500 Returns since 1965

In2013Dollars.com

https://www.officialdata.org › stocks

The nominal return on investment of $100 is $32,029.23, or 32,029.23%. This means by 2024 you would have $32,129.23 in your pocket.

If you had put yr 100 in gold?

Brewski,

Gold is an investment. So compare that investment to USD-investments, such as stocks, bonds, real estate, etc. The “dollar” is a MEASURE, like troy ounces is a measure, NOT an investment. You cannot own dollars, just like you cannot own troy ounces. You measure gold in dollars or in troy ounces. You measure bonds by yield or in dollars; you can measure real estate by square footage, or in any currency. A currency is a measure, not something you own. You own the asset that’s denominated in dollars. The paper dollars in your pocket are assets for you, denominated in dollars, in the form of an interest-free loan to the Federal Reserve (which is why they’re called Federal Reserve Notes). This seigniorage is how a central bank makes money, by investing the interest-free loans it gets into something that pays interest. So now go back to your 1933 drawing board and compare gold to USD-denominated stocks, for example. When you get through with that, then you’ve figured it out.

Who knew that gold was just a paperweight compared to investing in USD-denominated stocks back in 1933? I mean, if you had the foresight to predict that the U.S. would emerge as the big winner from the deadliest war in history, invent and use nukes, grab over 50% of global manufacturing, and end up as the lone superpower by 1991, you’d have really nailed that investment strategy.

Just a reminder: past performance doesn’t guarantee future returns, and, is rather contrarian due to trend reversal.

I would be moving money into Russian Rubles.

By all means, DO! What keeps you from it? A long-term ruble chart? The ruble has lost only 70% of its value against the hated collapsing USD over the past 12 years, LOL. It now takes 93 rubles to buy 1 USD. Back in 2012, it took 29 rubles to buy 1 USD.

That’s actually a solid idea—getting a 16% yield on 30-year bonds from a borrower with the lowest debt-to-GDP ratio, controlled deficits, and abundant commodities for collateral is quite promising.

30 year bonds in a currency that has only existed for 25 years?

‘On 1 January 1998, preceding the Russian financial crisis, the ruble was redenominated with the new code “RUB” and was exchanged at the rate of 1 RUB = 1,000 RUR.’

The name ‘ruble’ didn’t change but the 1000 ruble bond was now worth one ruble.

Foreigners are much more aware of currency replacements than Americans. Sometimes to the point of paranoia. Around the same time as the creation of the ‘New Ruble’ the US Mint announced a rare change in the US 100 $ bill. It was merely the intro of an anti- counterfeit stripe, but it set off a wave of panic around the world including Moscow, where the US 100 is the favorite ‘mattress money’

‘No no, don’t worry!’ came the quick reassurance from the Mint. The old ones were still good! As is any US or Canadian or UK bill. But in most of the world, the intro a new currency is expropriation of the wealth stored in the old one.

I think he is joking. Maybe just forgot the ‘sarc’?

The ruble is barely a currency, it’s not money outside Russia, where its use is enforced. If you want to wipe the smile off the face of a Russian exporter, ask if you can pay in rubles.

The much overblown ‘Ruble/Yuan’ trade block has already decayed into the more stable ‘Yuan/Oil’ block. The Yuan is at least money. Maybe the next ruble hookup will be with the North Korean currency.

Re: enforced use of the ruble, don’t know if it’s still like this but not long before the current war, a friend was in Moscow and in upscale Moscow restaurants, the prices were in US$ but you could only pay in rubles. Which you had to exchange at the very bad official rate, or…

But don’t try the alternative now!

Is there anyway to know actual numbers. Physical dollars get lost all the time and many dollars were never a dollar- dirivatives, bitcoin,and belived real estate values, price of gold, are just examples.

The same holds true for gold. It gets lost all the time and much mining is never reported unless it is a publicly owned company or tv show.

Some may think all this is tiny part of the big picture and they would be wrong.

RTGDFA. I gave you the actual numbers, how many trillions of dollar-assets, and how many billion troy ounces of gold bullion, held by central banks. This has zero to do with “derivatives” or “mining” or whatever.

The first “financial insight” article with some substance, that I have seen in years.

Gold has a long history, 3000 years, as a “Store of Wealth”

What is gold worth ? Whatever the market is bear.

How much does it cost to mine 1 ounce of gold ?

$1,300 depending on mining costs.

At $2,300, gold producers should be profitable.

Buy physical gold or gold mining stocks, or ETF’s ????

Why is the USA the largest holder of gold ?

The US Dollar is still the strongest Fiat Currency, and will be for a long time. Nothing will replace the US Dollar in our lifetime.

Yes, the US Dollar has problems with printing, debt, and dilution from printing. Even still, the US Dollar far better than any other currency.

Other nations/currencies have worse Debt to GDP.

Watching the Japanese Yen, 160 to the Dollar is interesting.

Not that long ago, the Yen was 80 to the Dollar.

A 50% loss in purchasing power.

How high can gold rise ? Depends on how much bidding buyers and investors will pay. Bubbles come and go.

Most will never make a profit buying and holding gold.

Realestate and stocks are a better choice if you pick correctly.

Will gold go higher if stock market or AI Bubble crashes ?

NO. Investors will sell their gold to cover Margin Calls.

“Nothing will replace the US dollar in our lifetime”.

At the pace were spending and adding debt to the balance sheet … the US dollar will be replaced by nothing…true.

We have wandered deep into the woods, unfamiliar territory. Jerome says follow me… this way…leaving crumbs along the way.

Mr. Magoo:

Gold can be considered many things. What I have been reading here is gold as an investment, which may or may not make a profit, depending, like any other investment, on when you buy or sell.

It is also insurance. Insurance against what you might say. That is the point – it is insurance against all things you do not know to insure against, from the Zombie Apocalypse to Hyper Inflation to ???

I have always owned some physical gold and silver, and have used it during hard times. Why physical gold? It is always going to be available to you, no matter what. For instance, what might the next “bank holiday” be like? What assets may be frozen? I do not know, hence physical gold.

Magoo—“most will never make a profit buying and holding gold”.

Sorry, but I disagree. Anyone who bought gold up until a month ago IS holding a profit and could sell for that profit if they had a more desired use for the currency derived.

Currency is simply a short term parking place. The illusion of stability of metal based currency is the same. Time and time again, booms and busts happened in those days of legends. How many folks backed up the truck and bought in 1999? From $300 to $2300. Now, when it drops to $1500, are you going to cry or buy?

Same with any assets. Apartments in China are going to be a buy in the near future…. But that drop is tough to take in mental health damage. Only Russian sanctions are propping up commodity markets, and when they are done….

Nobody talks about the flip side of a winning trade….but reversion is a cruel part of investing.

The dollar will outlast me, and everyone who’s reading these comments. Wolf’s Japanese comments about the Yen are far more interesting, and relevant.

After hearing the presidential debate, no one here seems to think that the next 6 months might be a rocky period for the dollar, which is good. I’m interested in how the markets behave this week along with precious metals when this all soaks in. Who’s running the country?

Howdy Brant. Its what runs the country. Here is a hint. $

Bubba,

you’re still the man. Along with Depth Charge and Wolf. I have a hidden cave here in the Ozarks ready for all of us if/when the poop hits the fan.

@ Brant Lee:

Who’s running the country?

It’s not the two old men who were in that abortion of a debate, that’s for sure.

I’d have to say the *bankers* (collectively) are running the country.

I think we found out who runs the US and the world during the GFC.

Goldman Sachs.

nice spike in TNX yield today

Treasury market seems to be renamed

something with a .com appendage

I see that Wolf is quoted in John Mauldin’s latest newsletter. He used several of Wolf’s excellent charts.

I read both and consider Wolf’s more valuable.

1) The weaponization of the U.S. financial system to “punish bad actors” has motivated said evil ones to look for alternatives. And even if you are NOT an evil one, well wouldn’t you be a bit concerned to see the U.S. govt impounding other countries’ financial assets, or cutting them off from U.S. banks, or trying to kick them out of SWIFT?

2) The U.S. dollar is not “strong”. The best way to look at it is that the U.S. dollar is the least stinking egg among all of the rotten fiat currency eggs. Please tell me why it is that in the entire financial history of the world that fiat currencies ultimately die a very ugly death due to politicians debasing the currency to pay for their empty promises? Oh, I forgot. “Things are different this time.” Sorry.

3) The RMB cannot replace the U.S. dollar because nobody trusts China to not use their currency as a weapon. Oh, wait a minute, isn’t the U.S. doing that now? So, what is China doing? They are allowing RMB to be (somewhat) freely exchanged for gold on the Shanghai exchange. The Saudis, Brazilians, and others are taking China up on that offer, and starting to trade more in RMB. No, they are not using RMB as a reserve currency, but they are accepting RMB as payment for their exports to China and then changing the RMB to gold. This trend will slowly reduce the need to use the U.S. dollar for trade.

4) If you don’t own any physical gold or silver, I feel sorry for you. Think of it as an insurance policy. Nobody expects their house to burn down, but they still pay insurance just in case. I don’t own gold to “make money”. I own it because it IS money. The only money that has survived for eons.

5) Please note Wolf’s comment about the late 70s and 80s when U.S. reserve status plummeted. Why? Inflation. You know, that “transient” inflation that we are currently having? Soon to disappear any day now? Oh, pardon my skepticism. By the way, you don’t have to be a “doomer” to realize that the U.S. is in serious financial doodoo for the numerous reasons I have mentioned in my comments on other excellent Wolf articles.

I agree. Gold as insurance. That, I believe, is why so many non-G7 central banks are both buying gold and having it delivered to their own vaults. Even nations need some insurance.

4) Silver. Been collecting uncirculated Morgans for years. Also silver eagles. Not much gold. Still no regrets as all value against the collapsing dollar has been retained. And the numismatic premium is there.

Oh, and speaking of “doomers”, listen to this crazy guy Bill Dudley, who said this week:

“The US is taking a big risk by running large and chronic fiscal deficits. The more it borrows, the greater the chance it’ll end up in a vicious cycle, in which government debt and interest rates drive one another inexorably upward.”

Wow, now that is gloomy, huh? Who is this guy, anyway?

Oh, he is the former head of the NY Fed. Oops.

And how about that decrepit 98 year old guy who is spouting the same doomer nonsense? Oh, that would be Alan Greenspan, the former Chair of the Federal Reserve for 19 years. Huh.

Big inflation solves those problems. But big inflation is an ugly solution. And that’s a huge risk. So it would be FAR better for Congress to get the deficit under control pronto.

In terms of the dollar as a reserve currency, see what happened in 1978-1985 (third chart from the top), when inflation in the US took off. Been there, done that (remember the 15% mortgages?).

This time period you chose happens to be when I was saving 31+% of my income. 10% was a company savings plan. Which I also matched. 11% was another savings plan which was abandoned after it became no longer beneficial for the company. During this time IRAs became available for people like me, so was poking $4,000 into two of those.

Shortly there after our government decided I was saving too much so reduced the amount we could save. These plans were all tax exempt until retirement and we began withdrawing. Taxes took a bite with the exception of no state tax on retirement income.

This was the beginning of Mr. Volker’s raising the interest rate. So am looking for the same type treatment again for a couple years.

Deficits under control?

What would be the implications for economy?

Probably a huge recession,implosion of the financial markets.

This would be a terrible adjustment to reality.

I’m all for it,but nobody knows how far the implications would go.

But they will have to get there ,sooner or later.

The two most important lines in the article in my humble opinion are:

1:The US dollar is still by far the most dominant global reserve

2: Foreign exchange reserves are reported in USD.

If I buy gold it is with US dollars. If I sell gold I get US dollars.

I am not going to get concerned until the US dollar stops becoming the dominant global currency or Wolf says so. :)

Good assessment. None of this matters until we absolutely need to purchase something (like oil or rare earth metals for tech) from a country that does not accept dollars. In short, so long as we can feed, clothe, and keep the population warm in the winter, this can go on for a lot longer. Moreover, we still have a lot of natural resources to utilize/sell and I don’t see us accepting anything but Federal Reserve Notes in exchange. So, this can continue for quite a while. Russia is the only other country with substantial resources to sell. If one were a conspiracy person then the angst against Russia might make more sense. We all know how much the government hates competition. In the meantime, our trade partners buy our treasuries and still need FRNs to buy our stuff. Once goods and services stop crossing borders, troops will.

WB: Trouble is w our current goods & resources to sell— we’re still importing far more than exporting. Currently US averages about $100,000,000,000 (that’s 100 billion) per month in goods trade deficit. 40 years ago, the markets might go ape shit over a small deficit, now no one’s too concerned.

But—these deficits are increasingly being recycled into alternative stores of value rather than dollars or treasuries as others have pointed out and for all of the reasons also pointed out.

If the assets these dollars are being recycled into are still priced in dollars, it’s still dollars, so no effect. As others have pointed out it’s more about control of those dollars and dollar-denominated assets. These dollars are now being taken out of the SWIFT system. Essentially, the assets and dollars are being held in places such they cannot be confiscated. For now, China and the middle eastern allies are happy to trade in dollars. Having said all that, trust is decreasing, one reason why CONgress needs to get their act together and balance the damn budget.

Americans drive in the rear view mirror. Anyone halfway current with what is happening outside of our good old USA would at least have some gold as a hedge for what might happen.

A very wise comment.

John D,

You just said “We paid off our mortgage in February from the sale of gold we bought starting in 2008.”

So you SOLD your gold? So you don’t have it anymore. It was an investment that made you money, and you used the proceeds from the sale to pay off a debt, KUDOS! But now you revert to gold being a religion?

If there’s a sudden drop in the exchange rate / value of the USD, it’s unlikely central banks would buy up more dollars to cover the shortfall. What else? Euros? Not when the ECB has started a new cycle of loosening, and chaos is looming in France. Swiss Francs? Ah no, the Swiss Central Bank just cut rates for the second time this year.

Each currency you look at, makes Gold looks better and better

But wait, a bunch of Doomers on YouTube who make their living making scary videos about the US dollar crashing (with fire in the video frame) told me BRICS was taking over tomorrow!

RE: BRICS: See the comment I left about that (above). Want a BRICS currency that is 40% gold or want the real thing that is 100% gold?

And they are. Right now a week literally doesn’t go by without another country announcing that they want to join BRICS.

The BRICS is starting to be a collection of trashed currencies, is the other way of looking at this.

Yeah, amazing what a bunch of trash can do.

Like the Houthis stalemating the mighty US Fleet.

That shipping inflation is working its way into the charts as I type.

My guess would be that Ethiopia doesn’t have much currency, even of a trashed type.

Golden – think you may have the wrong side of the water, there…

may we all find a better day.

Waiono,

I am pretty sure you have a bad definition of stalemate. The Houthis are doing nothing but being annoying. The U.S. is still doing whatever it wants on the Red Sea.

I recommend taking a look at the website of the BRICS-copy of the IMF/World Bank (i think it’s called “development bank” or something).

That intern must have had a really bad hangover when he hacked that together.

If that’s BRICS……

The US runs titanic trade deficits with China. China is only too happy to use USD to trade. They don’t want to get rid of USD–every day they wake up with another $2.7 billion to play with.

Same with the Gulf Oil states. And the same applies to euro.

What they are doing is moving their banks. Instead of having their USD and euro in SWIFT banks, where their assets can be frozen or seized, they’re quietly moving them to their own banking centers in Dubai and Hong Kong.

There’s no need for a BRICS currency, when the BRICS countries run such huge trade surpluses with North America and Europe. Who needs the hassle? But having those dollars and euro in their banks, instead of ours, means that their central banks can use our currencies to create new loans and new economic activity.

If a person, bank or country claims to have a ton of gold how can you be sure they actually do have it?

That’s right—how can you? BTW—that includes our USA gold supply. Medial , all you can do is count your own.

The British pound has lost about 75% of its value vs the US$ since the days of the gold standard before WWI. But life seems to go on pretty much as normal for many of Britain’s residents even if the current owners of Castle Howard (Brideshead of television fame) have to open their home to tourists to help pay for the upkeep of the estate.

Sheila Bair implemented assessment fees on foreign deposits, which changed the landscape of FBO regulations and signaling the bottom of the U.S. $ I.e., the E-$ market was rocked.

The fundanental flaw in believing in one medium of value, the world has changed and most people just don’t get it.

Look at the markets. There are no investers, everything is a trade. Everything can change in an instant. Why not try a bit of diversification?

Remember that debate. It seems the only leaders speaking the truth and working in their nations best interest are those that use us.

Charts may show you history, trends may show you the future.

Our next generations get their info from TT and respect our system oh so much!

There are plenty of investors. I am one. There are stocks that I have held for over 30 years. I cannot remember the last stock I have held for less than 5 years.

Warren Buffett is another.

Investors are out there. They just do not make headlines so they do not get attention.

Yep. “Full FAITH and credit”… Eventually the trade deficit will matter, in the meantime, who are you going to trust? The Chinese? I don’t think so.

This is the data, thanks Wolf. What I really want to know is how much currency (globally) has been pumped into crypto, specifically Bitcoin. I had a hypothesis 10 years ago that bitcoin was actually a central bank creation to provide a pressure relief valve to prevent gold from rising. Remember, Alan Greenspan was very clear on central banks losing control of the gold price in the 70’s/80’s, and that was with exponentially less debt. Regardless of what PM you favor, the fact is that they carry no counterparty risk, and yes, eventually, like the trade deficit, that will matter.

WB: “… the fact is that they carry no counterparty risk…

Nor does bitcoin. Plus you can easily prove you hold the bitcoin you claim you do. And do so over the internet. It’s true digital cash, as close as you can get to physical cash. I don’t know of a PM you can send across the internet, do you?

Can’t send PM over net? Same reason we can’t you or me or a carrot: all are real.

bitcoin is trackable and can be confiscated and arrested by exchanges, governments and hackers.

On occasion I participate in investment related online forums. Often, but especially in this instance your insights would be a valuable contribution. Your perspectives in this instance seem particularly relevant. Can I share them with attribution and acknowledgment but without your specific permission.

Currency is a medium of exchange. It’s a part of the river. A current. That’s why cash is liquid. It is not a store of value. These are separate functions but people get confused because stored value of measured in currency.

If you are convincing weekend somebody that stuffs dollars into their mattress to instead stuff gold, that’s fair.

Hell freezes over.

Wolf writes about Gold.