People quit quitting, so fewer job openings to fill, fewer people to hire, less churn. Good for employers, not so good for workers. Layoffs & discharges dropped below Good-Times lows.

By Wolf Richter for WOLF STREET.

Job openings edged down in November, but remained relatively high, workers quit quitting maybe because they’re worried about their jobs, and with voluntary quitting back to normal, the churn in the workforce at companies is also back to normal: with fewer people quitting, there are fewer vacant slots that need to be filled, so fewer job openings and fewer hires. Layoffs and discharges fell sharply in November and are well below the Good-Times lows before the pandemic. A labor market that isn’t quite back to normal yet, but is getting there, as the pandemic-era churn that had shifted power from employers to workers is subsiding.

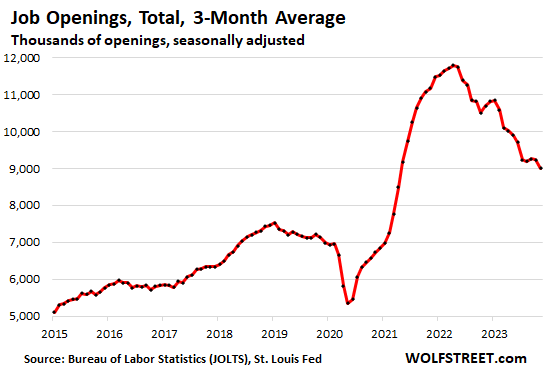

Job openings dipped by 62,000 in November from October, after the drop of 498,000 in the prior month, to 8.79 million openings, the lowest since March 2021. Openings were still 27% higher than in November 2019, according to data by the Bureau of Labor Statistics today as part of its Job Openings and Labor Turnover Survey (JOLTS), based on a large survey of employers and not on internet job postings.

The three-month moving average, which irons out the month-to-month ups and downs and shows the trend, fell by 236,000 in November, after having stabilized in the prior three months:

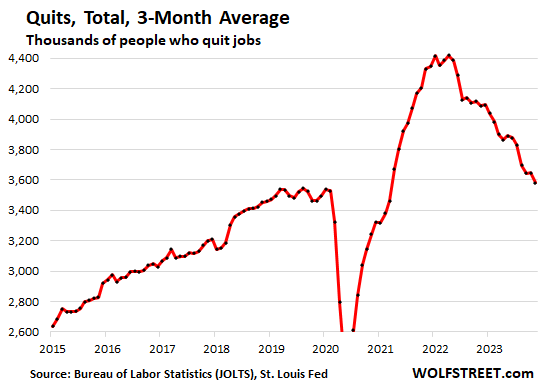

People quit quitting. The layoff headlines since mid-2022 scared workers into hanging on to their jobs, and fewer of them went chasing after the greener grass on the other side of the fence. There is a lot of anecdotal reporting about workers who don’t want to return to the office biting the bullet and returning to the office at least a few days a week, rather than quitting to find a remote job.

Voluntary quits fell by 157,000 to 3.47 million, after having stabilized over the prior four months. The three-month moving average (3MMA) fell by 64,000 to 3.58 million. Quits are now back in the range where they had been during the Good Times before the pandemic.

Fewer quits translates into fewer newly vacant slots – so fewer job openings – and employers have to hire fewer people to fill those job openings – so fewer hires – and it means less churn and a more stable workforce, and that’s good for employers, but not so good for workers. It’s a sign that power in the labor market has shifted from workers back to employers.

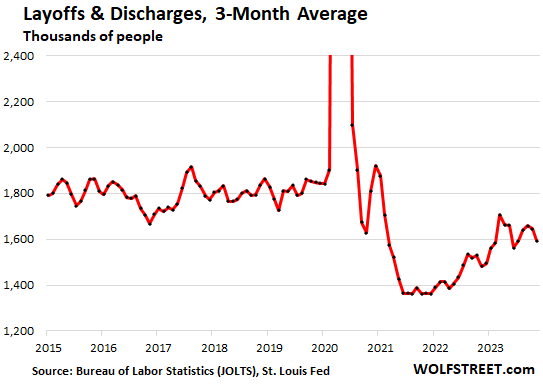

Layoffs and discharges dropped by 116,000 in November to 1.53 million, and are in a historically very low range.

Businesses across the US fire workers for a variety of reasons all the time. When discharges are done for economic reasons, they’re “layoffs,” and when they’re done for other reasons, such as performance, they’re “discharges.” During the Good Times in 2014-2019, layoffs and discharges averaged 1.8 million per month. That was just part of a normal labor market. During the Great Recession, at the peak, layoffs and discharges exceeded 2.5 million a month. In March 2020, they exceeded 13 million.

The three-month moving average dropped by 52,000 to 1.59 million, well below the low points in the years before the pandemic:

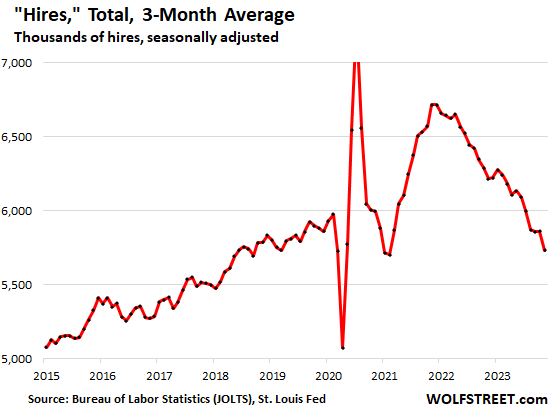

New hires… With fewer people quitting and fewer people getting fired or laid off, there were fewer vacant slots to fill, and so hires dropped further. Hires in November fell by 363,000 to 5.46 million.

The three-month moving average fell by 128,000 to 5.73 million, in the middle of the range of 2018 and 2019.

This is another sign that the incredible churn in the labor market during the pandemic has subsided and that demand for labor has returned to normal-ish levels, and that workers no longer enjoy the power they used to have a couple of years ago.

But job openings vary widely by industry, surging to a record in construction, dropping in most other sectors, and plunging in information (a sector that encompasses many tech and social media companies). We will post this by-industry detail shortly, stay tuned.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

One of the few benefits of money printing madness is that it generated temporary labor shortage helping many workers, including myself, got some decent opportunities.

As the FED is slowly burning some of the gargantuan amount of money it printed, the music is slowing down. It is a still good time to find a long-term position. If the FED continues to burn money for a couple more years, openings may be scarcer.

The labor market is tight due to demographics — primarily low US birth rates and Boomer retirements. This shortage has been on the horizon for a decade and has zero, nada, zip to do with FED policies. It’s forecast to continue to the mid-2030’s when the second of the “camel’s humps” known as “Millenials” fully reach their working years.

Check out the way this chart flattens beginning in 2010: https://fred.stlouisfed.org/series/LFWA64TTUSM647S

Unless Congress approves a massive change to immigration policy, the US labor market will be tight for another decade.

This isn’t magic; it’s not JPowell; it’s just math.

Great, more leverage now for employers to demand the end to hybrid work arrangement. I can see that will be the things to come at my work, on top of tracking badge in and out even though we’re not hourly. Also, probably another reason why I am seeing my work for this year is not putting in extra funds for merit increase to counter inflation..

I mean who doesn’t enjoy being stuck in 4 hrs traffic everyday even though you’re 25 miles away from your work….

It’s happening big time where I live. Rush hour is a disaster, and when I look at job listings, at best they are offering hybrid with many saying in office only.

Even my son who works for city, has to go into work – gets 2 days per week at home.

however he’s exception as he works on weekends-being manager, it’s his world

good thing is we get our to see our grandson more since he wants quiet.

oh, he also is mother when it comes to raising son

It’s gonna get a lot worse because Executives added way more employees under them during Pandemic to get promotions. Now these organizations are busy doing “fake work” and pushing paper.

Many good employees saw this obscene corruption and jumped companies. Now these corporations are filled with incompetent leaders who are busy trying to prove their worth by hyping speculation to project fake growth.

The upcoming layoffs will not target these executives but the lower workers.

For any chance of being competent , productive and profitable, we need to tear down existing companies and rebuild them from scratch. The only method to do this is to stop bailing them out and force bankruptcies. The big investors must hold our corporate leaders truly accountable.

Services is out of control, but they are made up of mostly smaller companies

I like more 3-5 hour work days – making same working less

pandemic was good for my hourly wage

did some appliance work today(changing out parts)

$50 an hour

Looking at the positive, simply a good time to consider job change or retirement if possible. If I had to go in more than 2 days a week I would be considering all options. 100% for 3 years is now my norm. I would even be willing to take pay cut since it would be made up with my time, gas, parking, health, tax bracket and sanity.

I thought about retirement – until bidenomics made everything

spike out of control

2024 – looking at 40% increase in property insurance costs

tried shopping – waste of time

many are JUST NOT ACCEPTING NEW applicants

so another $3k for increased property insurance – and now rents have stabilized I can’t increase as easily as before

don’t get me wrong doing well on rentals, but this is in lieu of pension

so be apprehensive right now

Nothing new here. History repeats. With the decimation of the population in Europe those workers that survived we able charge much higher wages. The big cheeses didn’t like that, enacting laws to fix prices and wages so that peasants could not demand more with increasing value.

So many WFH and Hybrid folks are dead weight in the last 15 years of my experience in business and tech.

Last month I did a consulting gig for a company for a VC funded firm they needed to downsize due to a shortening of funds in 24 & 25.

29 people let go, 24 of those all WFH or hybrid.

Was amazed to see such a high % of those WFH based in idaho.

Things haven’t been so clear cut in my 15 years or so in PE owned and VC funded tech.

People who need to work from home (or strongly prefer) are often the highest output workers and the most independent. But they’re also often low output fly under the radar types too.

People who need to work in an office (or strongly prefer) are almost always the types who wouldn’t have anything to do all day without meetings and making up work. And tend to drain everyone else’s time.

I’d take a mix of high and low output folks who I can manage working from home over a bunch of live-to-work let’s have a 10th team meeting about a new process I thought of any day of the week. At least the low output people if managed correctly don’t get in everyone else’s way.

Best comment here. Nice balanced view.

Managers and companies that can deal with both types of workplaces and workers will succeed and those that can’t will fail.

reminds me of dot-bomb times

I said being contractor – pay me in CASH

when it comes to collecting back rents I sometimes take other items than cash though

not lately as I don’t want worthless fiat $dollars

There’s a related dynamic, where if you (as employer) make ultimatums to get people back into the office…the people who call your bluff are exactly the ones you don’t want to lose!

I think that train left the station a long time ago. It’s been four years since the pandemic, and I have yet to hear of a business having to shut down because of remote work.

In fact, we’re at record profits for Wall St.

The history of groups that try to fight technological change is not very kind to those groups. There are going to be refuseniks and holdouts, just like the buggy whip manufacturers and film industry fighting digital cameras.

so my son works for city – they still have some 600 positions empty since pandemic

he’s tired of doing 3-4 persons work

youngest finance manager(28)

Maybe services inflation will start to drop soon!!!

If services inflation drops soon, it will be because the other sectors are beginning to constrict into low single digit inflation, as all areas of inflation are intimately related with one another.

Wolf, time to update the copyright to 2024 to protect your property.

Thanks!

It won’t help. The generative AI is the innovative model of bypassing copyright in the name of “model training”.

It will mix and reword info so that it’s hard to find the source it copied from.

My son does this in school already although he knows AI will be consistent on basic questions so he takes the content and rewrites in his own words. Writing style is tricky for AI to duplicate since you have to reach it yours first.

Yes, AI is a real threat to publishers like me. I’m not sure where this will be going. So far, I’m not too impressed with generative AI. It creates a lot of fluent bullshit in seconds and is swamping the internet with it. I’m still clinging to my old ways though. It seems people like that. Human to human. Maybe that’s my niche. So far, so good.

If I were a high-earning fashion model, I’d be really worried. I see a lot of fashion ads on this site with AI-generated models. They’re essentially free and instantaneous, no photoshoot-and-Photoshop required.

Wolf — I suspect you and other original writers are good. No bot can accurately approximate the sum result of your work because it lacks the various inputs (observations & sensations) which imbue ones creative process — be it an ice cold swim in the bay, a nervous breakdown, a really good breakfast, or feeling riled because someone in the comments stepped in it.

The organic analog stuff will always have an audience.

I was reading about people training AI models to mimic specific (well known and well published) psychologists on their material as a sort of virtual psychologist, apparently the psychologists themselves were impressed with the results so far, though I wish I could remember their names for reference here. Maybe one day we’ll have a virtual Wolf Richter whom we can ask Econ related questions 😂.

Jokes aside, I think beyond the hype and the smoke and mirrors there’s something serious and legit about the development of “AI” and LLMs. Was reading an instructional on how to train LLMs like GPT on company specific material to deliver accurate (without all the utter BS LLMs like to spit out currently) customer service chat bots, I can imagine some downsizing in that sector down the line because even with human CS it can be very hit and miss right now, a good chatbot may end up being more efficient and effective at some point.

Wolf, you’ll know AI is a threat when it inserts RTGDFA into some article it’s stealing.

It might end up being a certification of origin, like seafood. “Wild-caught American Punditry” stamped on every column. But I’ve known imported shrimp to go in those stamped boxes before, and there’s no technological safeguards that will not ultimately be outpaced by the fakery of technology. Get your seafood from the fishing boats and your wisdom from the trusty sources while they last. I’ve got the seafood covered, anyway.

Pure Wisdom

Served Up Fresh Daily

This is the nature of things with an uneven power equation. Employees won some concessions in a constrained market and those will slowly erode when possible. Even some of the recent contracts were really front loaded given that a slowdown was expected.

Morbid question: if a worker rudely dies without giving notice beforehand, does it count as a quit, a layoff, or a discharge?

😆😂.. I dunno but that’s a great question

LaughingLion,

LOL, there is always someone that wants to find out what happens in the statistically insignificant 0.001% of the cases or whatever.

Seba,

It’s a stupid question if it was serious. If it was not serious, it was a joke. Given the screen name — LaughingLion – I assume it was a joke.

Wolf, I hope you get help for your anger management problem. Yes, it was a serious question. Guess the workers who died during the pandemic are just a statistically insignificant 0.001% or whatever.

OK, you were serious. So now let me just walk you through this:

“Quits” are part of overall “separations.” The BLS explains: “Quits include employees who left voluntarily, with the exception of retirements or transfers to other locations.” I covered another part of separations as well, “Layoffs and discharges.”

And there are other parts of “separations,” including “retirements, transfers to other locations, separations due to employee disability, and deaths.”

So deaths are NOT part of quits. Which should have been obvious to anyone with half a brain that “quitting” at job does not include “dying while employed.” That’s why I thought your question was a joke.

All you have to do is look it up in the text. Use the search function in your browser and search for deaths: https://www.bls.gov/news.release/jolts.tn.htm

What difference would it make?

Unemployment insurance? Sarc

Death makes a big difference because it triggers insurance payouts and retirement benefits get transferred to beneficiaries.

It counts as a job opening.

In many fields, a flock of resumes will be in the mail before the body hits the floor.

Usually when someone dies there’s a discharge.

NO, “death” is a subcategory under “separation,” which is the overall category. “Discharge” is another subcategory of “separation.”

So with labor market in US loosening somewhat (for now), inflation (maybe temporarily) looking like it’s softened, are we expecting hard-core pivot mongering in the coming weeks/months? S&p to the moon etc.?

Perhaps more rate HIKES by the Federal Reserve…

MW: Dow ends down by 285 points after Fed minutes, S&P 500 suffers third straight loss; Fed officials haven’t ruled out further rate hikes, minutes show

The fact that all of FANGMAN sans NVIDIA have succeeded in ordering their employees back to physical offices, at least some of the time, is proof of power returning to employers. These were the same companies that benefited enormously from work-from-home & created tools (Microsoft Teams, Google Hangouts) to enable it.

This is why I think any fears of a CRE/CMBS meltdown are overblown.

Vacancy rates of CRE in most tech centers are over 25%.

About 33% in Atlanta:

https://www.ajc.com/news/wework-could-end-its-lease-in-popular-west-midtown-office-tower/MXEJQJT7RBGAHNINDRFAXYC7HU/

(Article mentions WeWork offices being shut down and leases rejected in Bankruptcy court. So, don’t cancel that CRE/CMBS meltdown yet. Looks like it is just a slow-rolling disaster, vs. a sharp collapse, but either way, the destination is the same.)

Even zoom is ordering people back to work.

*should be back to the “office”

MW: Apple lost $100 billion in market value in one day – more than combined worth of Ford and GM – and ‘lackluster’ sales of one gadget are to blame

Sluggish sales of the $1,599 iPhone 15 – and fears the next model will flop too – led to analysts saying the share price is overvalued.

$1,599 is all that’s needed to explain why it flopped. Whos gonna pay 1600 bucks or $24/month for eternity for a phone that’s upgraded in 12 months?

Precisely. I can buy four mid-range Android phones with virtually indistinguishable performance characteristics for that price, and eight Motorolas if I’m willing to go downmarket into the budget bracket and put up with negligible loss of functionality.

Apple is a cult. I just don’t get it.

DM: US national debt hits $34 TRILLION for the first time in history, as federal funding deadlines loom – and it could affect your finances

The staggering figure, which is a major point of contention between Republicans and Democrats, is equal to $101,233 in federal debt for every person in America, according to the Peter G. Peterson Foundation. The ballooning deficit means the US government spends more than $1.8 billion a day on interest payments alone, the bipartisan group found. Experts warn that a higher debt load could put upward pressure on inflation , keeping interest rates higher, and impact major programs including Social Security and Medicare.

“Experts” have been whingeing about the big scary debt numbers for over 40 years now. If the sky is always falling, why is it that it never hits the ground?

eg-

I’d hazard a guess that it’s because the central bank has the ability to print money ad infinitum. And it has printed a lot over the last 40 years with the blessings of most of the media, the majority of academics, and a large portion economists (see John Cochrane’s “the Fed Deserves a Pat on the Back” article in the WSJournal last week).

So far, the public has only had its “hair mussed” (gratuitous use of Buck Turgidson quote) a little by inflation, but at some point, the debt, and more importantly the interest on the debt, will elicit squeals from the voting public when competing budget items are crowded out in conjunction with even higher inflation.

Until that happens, the “Party On” attitude might continue for a while longer.

Respectfully.

Not on this exactly but since Fed policy is relevant to everything….

how much weirder can this dot. plot gong- show get?

Now we get the minutes of the infamous meeting… and, and, they never said that stuff! Or at least, what the market thought they said. Now looks very unlikely 4 cuts by March and maybe none at all by then.

Unlike many WS commenters, I don’t think the Fed members are trying to enrich their friends. I think Powell’s big concern is his legacy: to overcome his ‘wimp’ label. But if the Fed was trying to play the markets, this insane back- and- forth would be one thing to expect. Imagine if you had access to the minutes as the market reacted to the false impression of the dot. plot? You could short the rally.

As for the lone dot. plot predicting six cuts in 2024, a Big Short guy, Eisenstein? says: ‘You only get six cuts if we are in a very deep recession’

The relevance to bargaining position of labor: tightening conditions, which now look more likely to continue, tend to weaken it.

>Imagine if you had access to the minutes as the market reacted to the false impression of the dot. plot? You could short the rally.

You don’t really need access to the minutes. JPow’s public statements (and those of other Fed officials), plus Wolf’s great analysis of e.g. what the dot plot actually means, would be enough.

But the question you’d have to ask in order to short the market is: if the market looked at the initial FOMC output and saw only fantasies, why do you think they’ll react to the minutes any differently?

‘MW: Dow ends down by 285 points after Fed minutes, S&P 500 suffers third straight loss; Fed officials haven’t ruled out further rate hikes, minutes show’

Courtesy: Socalbeachdude above, who apparently reads the news

If the new trends continue on these charts, it will take 2 years to return to normal hires, normal quits, normal job openings, and normal layoffs; that is assuming normal is the time before 2020. We are in the early innings it would appear.

Less job hopping and fewer quits could also be the result of people being locked into 3% mortgages. Job opportunities are narrowed to what can be found within a reasonable commuting range.

Agreed. That for sure is one reason and why I turned down two offers recently (west coast and south FL). The pay they offered is great for those already in the area and my would-be co-workers with housing and paid off homes or low rates, but not for those like me looking to move into a HCOL city where 7 figure homes are common (uncommon where I am). I don’t even bother looking at jobs posted in NYC or California…

I as a customer am glad employers are getting some clout back over employees. I don’t mind employees getting more pay and improving their lot. What I’ve experienced as a customer is very poor levels of customer service, very poor attitudes of employees, much less care by the employees all while being allowed to pay more for my lesser level of satisfaction. So employees a little more worried about their job might help. When employees are looking to move anyway they don’t invest in their current job.

Was talking to a nephew yesterday. He shows up for work late about 3 of 5 days each week. 20 minutes or so usually. Said he was late 1 1/2 hours and his boss was unhappy. He didn’t bother to even call in about it. He told me he wasn’t worried. “They cannot get someone to replace me. I do a good enough job (said as if he had no ambition to do more than good enough) he won’t do anything. He’d have to find someone else”. I asked him what happens when someone else comes in who does good enough or even good at the job and shoes up on time? He’ll drop you like a hot rock. I’ve had supervision of employees before and one thing they all hate is late arrivals or iffy arrivals they cannot count on. “Nope, he don’t care, can’t find anyone else”. I tried to tell him that will not be the case forever. He’ll have to learn it the hard way.

While probably not true in your nephew’s case, is sometimes happens that companies will put up with a good degree of hijinks from a skilled employee who they are significantly underpaying.

The employee gets a flexibly easy job and the employer gets the profit from his exploitation.

Now, quit reading and get back to work or you’re all fired!

My wife tells me that no one is irreplaceable, but I am constantly trying to make it as difficult as possible. Walt Disney called it “plussing”…

“A picture is a thing that once you wrap it up and turn it over to Technicolor, you’re through. Snow White is a dead issue with me. I wanted something live, something that it could grow, something I could keep PLUSSING with ideas. The park is that… I can’t change that picture, so that’s why I wanted that park.”

Never heard of PLUSSING? According to John Torre,

“To Walt, ‘plus’ was a verb—an action word—signifying the delivery of more than what his customers paid for or expected to receive. He constantly challenged his Imagineers to see what was possible, and then take it a step further … and then a step beyond that.”

TAKEAWAY: Your product/service is the movie. The amusement park is the differentiated experience (DX) you create, reimagine, and constantly improve.

Using the analogy of a see-saw, for JOLTS, if labor on one side weighed 230 lbs a year ago but now weighs 210 lbs and emplyers weighed 180 lbs twelve months ago and now weigh 195 lbs, the see-saw hasn’t budged. Labor (skilled/educated) is in command and demographics say ot will stay that way for decades to come.

Anecdote: my company (engineering) over-hired through 2022, but had a smallish layoff (5%) in November and closed almost all job postings. Some tactical openings are now being posted, albeit cautiously.

Several client contracts either did not materialize, were paused, or got deferred until this year. We stopped hiring early third quarter almost overnight, tried to optimize work among the current workforce, but bit the bullet by the end of the year.

Low-output remote workers were at the top of the list to go. Top performers can work from anywhere; that’s kind of an unwritten but generally understood rule.

Hiring preference has generally shifted back towards local employees. We have a hybrid policy (three days in-office).

One really good sr. engineer resigned a couple months ago because, after six months of all-remote work, he missed the in-office interaction and went to work with a firm local to him. That came as a surprise blow to many.

Quits have declined. They peaked sometime in ‘22.

, he missed the in-office interaction and went to work with a firm local to him’

Jesus. Ai accidentally hired a human

Makes sense to me and more or less mirrors the experience of my current client.

In my client’s case, though, the job openings are really just there to gauge the availability of skills in the market and compenstation discovery. A lot would have to change before they did actual hiring.

I’ll go out on a limb and say that we’ll find a decade from now that the “WFH” movement functioned as a valuable proof-of-concept for the subsequent offshoring of Professional and Business Services jobs by employers.

Rule #1 of winning a boxing match: Don’t walk into your opponent’s shots.