Consensual Hallucination was so much fun while it lasted.

By Wolf Richter for WOLF STREET.

Peloton Interactive – which sells internet-connected stationary bicycles, treadmills, and indoor rowers along with subscriptions on the idea that it would lose money on the equipment and make it back on the subscriptions – reported another massive loss this morning of $242 million for its fiscal Q4, ended June 30, and of $1.26 billion for the fiscal year 2023. How can a company lose $1.26 billion on $2.8 billion in revenues?

It has lost money every single year since its IPO in September 2019. In its 2022 fiscal year, it lost $2.83 billion. How can a company lose $2.83 billion on $3.56 billion in revenues? I mean, I know how. But I’m just shaking my head. It lost a total of $4.6 billion in the five years as a public company.

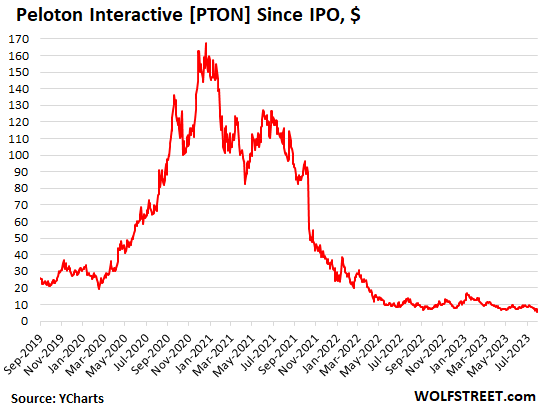

The company has long been a hero in my pantheon of Imploded Stocks. This morning, the shares kathoomphed another 23% to a new record low of $5.38 at the moment, down by 97% from the get-rich-quick peak in January 2021 of $167, at which point it had a market cap of $49 billion. Of that, over $47 billion have since then evaporated. And the shares are down by 81% from the IPO price of $29. But today’s big 23% dive is so minuscule against the Grand Collapse since January 2021 that you can barely see it on the chart (data via YCharts):

Peloton has been steeped in all kinds of more or less horrible messes, recalls, legal settlements, fines, product issues, manufacturing issues, CEO and CFO departures, etc., including that its equipment led to the death of a six-year-old.

Among the messes it disclosed today was that the costs of the recall in May of its original Peloton Bike “substantially exceeded our initial expectations,” and it added that “about 15,000 to 20,000 impacted members opted to pause their subscriptions” — the sacred all-important subscriptions! — in its fiscal Q4 “while they waited for the replacement part.”

Another mess it reported was that its revenues fell by 5.4% for the quarter to $642 million; and by 22% for the fiscal year, to $2.8 billion. “The slowdown exceeded our expectations through May and through the first three weeks of June as consumer spending shifted toward travel and experiences,” the company said today.

This was the second year in a row of revenue declines. The peak year had been fiscal 2021 with $4.0 billion in revenues. Since then, annual revenues have plunged by 30%.

I mean, how could revenues plunge by 30% over two years, after the company blew $4.6 billion in order to buy revenue growth? Do you see what kind of mess this is?

That you can make exercise equipment and lose this much money is itself hilarious. It’s even more hilarious that investors funded these losses enthusiastically in order to subsidize our struggling consumers. It’s always great to see altruistic investors, LOL.

It’s hilarious that, despite the losses all along, investors poured money into the company during the free-money era that the Fed instigated and that had turned investor brains to mush. After the cash that pre-IPO investors had poured in, the company raised another $1.2 billion during the IPO, plus another $1.1 billion in a follow-on stock sale in November 2021, even as executives had dumped their shares at peak prices.

It was all part of what I call Consensual Hallucination. They wanted to invest in Peloton to get rich quick, hoping that losses wouldn’t matter because money was free, that Peloton could just buy some growth with these billions of dollars, and tout its homemade metrics of growth, and that this growth in its homemade metrics would be enough to drive up the shares and allow investors to get rich quick by selling this stuff to a greater fool at an even higher price.

And some did, including executives that sold a ton of shares at bubble prices, including $496 million in shares in late 2020 through 2021, before the big plunge, when shares traded in the range between $80 and $166. Some of the executives that got rich quick are now gone, including the CEO and CFO, but they got to keep their wealth.

Others, as the stock chart above shows, didn’t. There are always lots of greater fools around that are all too happy to pick up the tab and allow executives and other stock jockeys to get rich quick.

The company has burned about $400 million in cash over the past 12 months, and had $814 million in cash left as of June 30, giving it some runway before it runs out of cash. If it can’t raise more cash, or if it can’t get pretty soon to a state of being at least somewhat cash-flow positive, at some point, it’s just over.

The thing is, a company cannot buy revenue growth forever unless investors whose brains have turned to mush keep funding it. But the era of free money has ended. And higher costs of capital cures mushy brains. So maybe Peloton can just continue to shrink its way to becoming more or less cashflow neutral, and hang in there for years as a penny stock. That would be my optimistic scenario.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I *love* how, prior to Peloton’s scandal of it’s equipment “swallowing” as it were small kiddies whatnot, all Peloton ads were pure spandex sex…(pump pump that bike frenzy). After the recall….it’s yoga. The wonders of criminal corporate macchiavellian psychology! Janus!

The latest mania is AI…. so, I think now is a good time to consider the following regarding the new mania = The names have changed but idiocy is the same

1) The fact that Nvidia is making massive profits now from the sale of hugely expensive AI chips, does NOT mean that the buyers of those chips will ever make a profit. In fact, history suggest that it will take many years for any of the end users of these hugely expensive chips to profit.

2) Furthermore, history suggests that only a tiny percentage of those now binging on Nvidia’s AI chips will ever profit.

3) The same logical fallacy occurred during the dotcom mania when Cisco systems was the key supplier of internet hardware, similar to Nvidia’s position now. There was a huge surge in demand for Cisco’s internet infrastructure products during 1999- 2000, which many investors then extrapolated many years into the future…. the same thing that investors are doing with Nvidia today.

4) Computer Infrastructure hardware does NOT need to be replaced every year… and once the surge in demand is fulfilled, the sales of infrastructure products will rapidly decline back down to sustainable long term levels which existed before the mania started….

This is what happened during the dotcom mania, and it will happen again with the AI mania

Amen. But Drunken Fools never learn.

If you are the first to convince 10 to 100 friends and acquaintances to buy AI stocks in whatever Inc cash furnace, then you can get out first before the bust.

Aren’t there a LOT of people who get dragged into these scams simply by being passive index fund owners? Could a ballpark number be put on their collective total losses? Probably not.

This one failing gives me special pleasure…..not sure why.

Maybe they are selling Bitcoin mining GPUs rebranded as AI chips?

How about clover and every other spac ,that chamatha was involved in good to be rich and connected. Also a criminal but no SEC in sight ,scandoulius

Certainly was a mega bubble but being an occasional user and aware of multiple upper middle class users, the fitness subscription itself at $12.99 a month isn’t terrible, better than apple and the “brand” is worth something to someone. If if they were smart they wouldn’t partner with anyone and everyone (Nike/ Netflix). The clothing business brand has $200M in revenue and it brings in $3B+ overall. Streamline it, cut costs. Don’t focus on the hardware alone and its market cap at $1.9 is cheap. Yes it’s burning cash but the rate has slowed and then have about $830M on hand. It needs a Real CEO. Ask yourself how the heck did “Black Rifle Coffee Company” make it when there were a million coffee companies. Targeted Marketing. Peleton’s target market is not young rural gun toting men or 68 year old lower middle class women…. it’s 30-60 y/o upper middle class /wealthy FEMALES (some men) and it has a tight social aspect to it. They have money, just need a leader to right the ship.

its a pandemic lockdown business model. It was viable for two years. I hear lockdowns might come again?

You heard wrong. People got burned once, they will NOT obey more lockdowns to “protect” them from a virus that is lethal mostly to the elderly.

Hindsight is always 20/20, looking back, stock like this, Beyond Meat, WeWork and others are so obvious, it’s almost a no brainer to not short but then again that pesky little thing call market can stay irrational longer than you can stay solvent…

Speaking of the insanity, it’s still out there. Nvidia and not to mention start of this month..Vinfast, I have a feeling at some point you’re be writing about when they’re a penny stock a year from now.

NVIDIA makes the Shield TV, my favorite media streamer.

I need to read up on Nvidia; I feel like I missed some news.

NVIDIA = Intel (the chip folks)

Oops,

My bad I thought Nvidia was owned by Intel

Apparently not.

Intel wishes it were Nvidia. Intel is so out of touch, they missed out on mobile/iPhone (they famously turned down Apple’s request to have them build the iPhone chips originally) and AMD and Nvidia are eating their lunch in accelerators.

Oh, I know who they are. I’m familiar with their video card and chip products, just wasn’t up on the AI-chip thingy.

Unless you’re Google making it’s own dedicated AI silicon (“tensor”) then GPUs are best for the parallel matrix math that runs AI systems.

Where have you been? AI bubble is the new NFT in terms of speculative mania..

It’s all the same thing – too much printed money sloshing around the system.

Nvidia. A great company selling at waaay tooo great a price. Not only are future profits priced in, but profits into the hereafter. I can understand wanting to own the stock, but getting swept up in a story without running the numbers isn’t a very good formula for investment success. You can bet Warren Buffett didn’t get rich by skimping on such mundane things as financial statements and discounted cash flow analysis.

Riding off into the sunset.

There’s no money in the pain trade.

Folks don’t like doing the real work to be healthier and stronger.

Wasting time on exercise machines does not make anyone ‘healthier’ and they are grossly unsightly anywhere in a house.

1. 🤣 instead do: 🍟🌭🥓

2. yes mostdef

Yet if you bought the stock at $20 or 30 and sold out at $140-160, it was a great trade. That’s a Big IF!!!!

I don’t own stocks and every time I see a chart like this, it reminds me why I don’t

McDonald’s 🤤🤤🤤

Don’t have a Pel but exercise machines of any type are not a waste of time and having a home gym where they all are is a worthwhile investment both physically and mentally.

Which comes first? The Pelaton or the trophy wife?

This might be the wrong place to post this….

But I am starting a fitness equipment stationary bike and I need billions of dollars to start it…..If your ok letting Peloton burning your money, please give it to me to burn.

I will run a very straightforward ponzi scam.

I a much better pump & dump than peloton

Awesome… :)

SoCalBeachDude

This comment is total bull shit for more than one reason. I’ve got a bike I purchased for $149 from a mail order catalog and it works great, especially in the hot weather here in DC.

I bought a second-hand elliptical and mounted a second-hand 40″ TV with a Chromecast on the wall in front of it. My biggest regret has been accidentally choosing a great 2.5h movie instead of a 1h series show. I couldn’t stop watching and was completely exhausted by the end.

Maximus Minimus

You can buy exercise bikes that don’t have internet connections. Mine works fine and I use it every day.

Same. Got a used concept 2 rower for the minus 10 degree Wisconsin winters. I put a TV in front of it and walla! Instant Hydro rower with no insane subscription cost.

I guess voila has finally become walla…gung ho has become gun ho……etc has become ekt…there are others…language changes…..even at Harvard educated level….mostly lawyers, though, who become politicians.

No big deal…have just watched a lot of time pass. Wish the damned thumb typed messaging stuff would stop, though….have to Google everything. HMHIC most of the time….

Exercise machines with a screen and internet connection are an advertisement cash machines. Captive audience for dozens of ads. Who wouldn’t buy into it?

wolf – curious how many institutional investors like Blackrock invested 401k money in P? Naturally, they do not have to disclose investments like these, if they are less than 10% of their overall fund….just curious,

love your newsletter, thank you,

rick

Proterra’s bankruptcy filing following its SPAC is another kathoomphing getting attention but for the wrong reasons. People are focused on it being another Solyndra for Biden because it was touted by Biden as a success and because of the incentives created for EV transit buses, but the truth of the matter is that anyone who tries to get into the US transit bus business is a masochist. Low volumes of sales, transit agencies that all want to “have it their way” and FTA regulations that are highly burdensome. In short, it’s a shit show for even the best of companies and Proterra was not that . . .

Peloton’s share price at peak amazed me because stationary bicycles are boringggg…..

‘Real’ bicycle riders have to be constantly in the ‘moment’ because conditions are constantly changing and there is always a lot of risk that must be dealt with.

I guess real bicyle riders are excitement and endorphin junkies and Peloton does not supply that.

We have the bowflex bike and its really not boring. 22 inch screen with amazing scenary from all over the world. it’s quite enjoyable. Peloton is just poorly run.

As to real bike riders, in major cities, I don’t understand the risk vs reward, but I guess risking your life for exercise can be exciting.

You talk about the beautiful view on your screen.

I could tell you about paralleling the Arkansas River from 5000 ft in Colorado past a chain of 14,000 ft. mountains and summiting at the Arkansas’s headwaters at 10,000 feet, or pedaling up a 6,000 mtn in AZ and being able to see 100 miles in every direction for 270° of view from one spot and being all by yourself so you could strip off and bathe in glorious sunshine and a gentle wind. Of bicycle camping near Flagstaff and looking up and seeing 5 Elk staring at you from 50 yards away for 5 minutes, or setting on a guardrail beside a highway eating and suddenly seeing 3 mountain curly horned sheep 100 yards away, or mountain lions and bears at different places and times. I could go on and on with experiences I have had on bicycles.

Bicycle is my dream vehicle and I love to bicycle everywhere.

I don’t like bicycling in home or in gym.

I love to experience the scenery in real.

Still waiting for a day when I can afford to give up my car and just be on bicycle.

I appreciate that but 8 could tell you the same from my convertible and not risk my life. We spent two weeks in yellowstone and had animals coming right up to the truck and making me thankful I was in a vehicle. I like biking but as I said too much risk for me. Lot of stupid drivers out there.

Umm, you weren’t “all by yourself” that time in Arizona. :-)

Forrest Gump on wheels?

According to the CDC:

Most bicyclist deaths occur in urban areas.

Nearly 1,000 bicyclists die and over 130,000 are injured in crashes that occur on roads in the United States every year.

Adults ages 55-69 have the highest bicycle death rates.

@TC. Re: riding outside vs on an indoor static.

You hit the nail on the squarely on the head.

I regularly mountain bike wilder ranch, santa cruz, ca. Have done the same trails for >25 years.

Nothing compares with being out there: being part of the environment, experiencing with all my senses. Every day is different, there’s always a new aspect to observe and contemplate.

Having that intermediated through a screen for $13/month seems a poor substitute.

Then again, for those who are housebound, perhaps a peloton might allow a degree of access. If that’s the case then that’s a significantly smaller market.

Get out into your local state parks. If we don’t use them, we’re liable to loose them.

I have observed so many exercise trends over the years, I knew Peloton would fail, or if it survived would exist only as a small boutique company. Too expensive for average folk, so limited to a small market of fickle wealthy clients. Also, not a unique product, nothing they did could not be replicated by another fitness company (at likley lower cost). Imagine how well Apple would do in this space….

Ultimately, no matter how great an exercise program might be, people eventually get tired of doing it and move on to the next hot trend. Doomed to failure from the start. If not failure, may a stable long term, small, business.

…over a decade ago our county’s central landfill had an area called ‘Recycletown’. One could bring various, still-usable items for dropoff/resale (expanded thriftstore/HFH model) acceptable to the group that ran it. Was amazed, then at the sheer amount of exercise equipment available (treadmills, s/bikes, rowers, XC ski, weights, hybrid concept, etc., take your pick). Could only see anyone purchasing new equipment if they just HAD to have the purchase-endorphin rush and/or the subconscious belief that obtaining a thing constituted completing 90% of the mission…

may we all find a better day.

Exercise equipment ultimately make good coat hangers. LOL

It just makes good stuff to send to landfills in dump trucks.

We used our Nordictrack x-country skiing gizmo to air dry clothing. Much more versatile than a drying rack.

Gifts with insults: here, chubby, try this!

I bought a lot of scrap metal there. Some tires.

Had a buddy from Lasercraft (Silvio) who gave the black guy in the little shed who ran it all a pint of blackberry brandy and took what he wanted free…..a real professional scrounger, parents had land and huge barn, welder and basic machine shop tools. No milling machine, though. He used the old Bridgeport at work….thing was there before I was……They used to make things with a lot of pride in workmanship.

How can a company lose $2.83 billion on $3.56 billion in revenues? I mean, I know how.

I dont get it. Can someone please explain. Isn’t loss of 2.83 on 3.56 profit?

I like “Grand Collapse.” It has so many potential applications.

After enough of the imaginary money vanishes, I wonder if investors will start to care about dividends again. At the risk of being pilloried, in the absense of dividends, what is the true value of a stock to an investor? Apple at ~180 yields 1/2 a percent or so, and I don’t think they mail stockholders free iPhones.

We still have too much money sloshing around the system and Powell is pretty slow to pull the money out.

The mania in stock market is still ON.

Thanks, Wolf. Your coverage of “Imploded Stocks” has helped me maintain my financial sanity over the past couple of years. Profit margin and cash flow actually do matter, despite the nonsense that ZIRP and interest rate suppression unleashed in the investment world. Now if we could only undo the market distortions caused by bailouts, “too big to fail”, loan forbearance and forgiveness, and other moral hazards. Dare to dream!

I’ve heard that exercise equipment like Peloton makes, ends up as a nice place to hang clothing. There’s obviously some reason that people think they need a cool software service contract linked to a coat rack.

My friend has a Peloton. Says its great to dry towels on. Anyone who would pay a monthly subscription for exercise equipment is a fool. Buy a real bike, for that price you can get a nice one which will last forever, Im a Surly brand guy myself, and take it on relaxing rides somewhere. Plenty of rails 2 trails all over the country.

This guy GETS IT. Surly bikes are the good stuff! May the wind always be at your back, brother!

^^^ Big yes on Surly, but you gotta help me out with this wind trick. Here in the Ohio River Valley it’s always a headwind in both directions…

And that’s why we bought the Bowflex bike 2 years ago instead of the Peloton bike. I told my wife Bowflex has been around 40 years and is not a one product company. I don’t want to spend $2000 on a bike that requires interactive media from a company that may not be around in a few years. I wish I’d been brave enough to short their stock. I knew they were doomed after they announced they were building their own factory because they thought the pandemic boom would last forever.

So, Bowflex is no good for hanging clothes, right?

We have now entered the era where people need to put their money and energy in to a real bike so they can get to the store with $5.00 gas prices and raging inflation.

I smile when I think that my bike along with its box of spare parts, and a bag full of spare tires and tubes makes me immune to inflation in transportation costs.

Yes, you save money, improve your health, and help the planet and the future.

I haven’t owned a car in 15 years and sometimes it has been inconvenient but I have generally found work arounds or found out that ‘I really didn’t need it’s.

Now the big issue is getting in the right location for ‘old age’.

When my muscles go I will use electric. When my balance goes I will use 3-wheels.

I paid 100$for a used concept 2 stationary bike three months ago. I use it for interval training 3 days /week and do NOT subscribe to any software. I am very happy with my purchase.

Would I have paid $1,000 . NO

I’ve been doing 4k meters on average 23/24 min 6 days a week for 12yrs,,, listening to the morning talk show guy… great exercise,, I’m 71, healthy, trim and no prescription drugs…

Exercise combined with diet, (cut out the sugars and starches boys and girls) is the ticket for healthy old age..

Your groceries arrived at the store by truck, not bicycle.

Peleton is the ‘Juicero’ of the fitness space. Not quite as dumb of an idea, but in the ball park. Look it up if you aren’t familiar. Great comedy to read about.

Peleton never realized they are just a Zoom call with people huffing while riding a stationary bike? Out of all the hyped up companies, Peleton had to be the most ridiculous effort of Consensual Hallucination.

Remember their commercials last winter? Showed a multi-million dollar ski-lodge home in the dead of winter with some Gen Z’s biking their butts off inside.

Yeah, okay Peleton. For the 7 people that commercial related to… they have enough money to be in Maui that time of year doing real exercising before hitting the beach.

I think Peleton realized that, which is why the CEO and others cashed out early. In fairness, most tech is just nonsense, anyway. AirBNB is just a short term rental service, Uber just a taxi and app- expanded now to food delivery. Zoom was just a glorified teleconference call. In the end, it was just too much money looking for something to do. Perhaps with there being an actual cost to money, we will see actual innovation.

Meh, the low-hanging fruit of innovation was picked long ago. It’s all just marketing hype now.

Yes, unfortunately I feel like it was all just to benefit initial investors and the c-suite people and no one else. Re-inventing the wheel and got retail to hold the bag.

I recently followed up on another imploded stock, Butterfly Network, to see it’s price (down 90%+ from peak). They were also another company with a product that wasn’t unique (healthcare ultrasound probes that can use iPhones to connect and annual subscription, too, no less). It caught my attention back then as (a now former) executive bought a Mercedes CLK-GTR at the time (it’s like a $10m car now). I looked up the company back then and shook my head as I saw it going nowhere but down and it ended up doing so…the multi billion dollar market cap made no sense in 2021. I wonder if the car was bought with proceeds of stock sales, but I have no way of knowing that unfortunately…

AGHM – …uhh, maybe not Maui these days (or, hopefully they’re aiding in recovery efforts…).

may we all find a better day.

I threw a pet rock through the computer of my Peleton, and now its just a boring stationary bicycle.

XC – inspired use of stone-age technology!

may we all find a better day.

I’m glad that I didn’t buy these fly by night operations. One commentor mentioned NXU (formerly Atlis Motors), and they spent more time doing YouTube discussions than delivering a product.

After tens of millions of dollars were invested, they claimed that they delivered a battery pack. And recently, they shut down battery manufacturing to focus on charging stations.

I hope that NXU gets hauled into the SEC. They started off with an IPO of about $29USD, but today it’s about 20 cents. The suspense was that before the IPO, insiders bought the stock for a few pennies quite literally.

Disclaimer: I used my $50USD vice money bought 100 shares of NXU at 50 cents USD, and my losses thanks to the exchange rate was almost $20USD. What a ripoff. Buy at 50 cents, end up with 20 cents and a fear of the stock being delisted.

…it appears that virtual realities spawn the demand for virtual products…

may we all find a better day.

NXU, and WeWorks at the extreme end, and many others to varying degrees, just don’t seem to really have anything new to add. What they do is something lots of people can do. It seems more like a marketplace dominance argument than a “new technology”

Tesla, with it’s autopilot mode I will grant you is a bit different, but that just seems like a crazy willingness to push beyond what the tech is ready for. If you look at some of their other “innovations” like solar roof tile, or big batteries to hook up to your solar pv system, you are back to that extreme marketing over technology positioning.

What I’m getting from WeWork is that they have this “grand big idea” which backfired during the decline in office rental space and high interest rates.

Like NXU, those who gained were those insiders who got pre-IPO shares, and the literally useless CEO, CFO, CTO, COOs who spend more time on social media discussing this “grand big idea” than to deliver results.

NXU took over two years to tweet that they “delivered a battery pack”, after tens of millions was ‘invested’ into the company.

Though I spent USD$50 and lost CAD$40 due to exchange rate and the parabolic decline of penny stonks, I feel like that vice money was used to justify the salaries and wages of the useless failures like the C-suite management and legal team.

Hopefully, the legal team will answer to the SEC.

The SEC is a joke

“Tesla, with it’s autopilot mode I will grant you is a bit different”

Indeed, it’s notably better at killing people than any of the other hyped technologies. Although I suppose part of what’s feuling the current AI bubble is speculation that the latter will catch up.

Pea – in an earlier era, steam engines were notorious for doing the same thing…

may we all find a better day.

When my gym closed in 2000 (like so many people) I got a Peloton (I got a great deal on a reconditioned model since a friend’s son was a MBA student with an internship there). My wife and I still use the Peloton one or two times a week (and pay the monthly fee) since the classes are much better than the spin classes at my local gym (I still miss the great Bay Club spin classes when I lived in SF). At this point in my life the Peloton monthly fee is not a big deal since I’ll spend more for a bottle of wine with dinner mid-week at home but paying it still makes me make an effort to “use” it and work out (and feel bad when I don’t use it). Years ago I had a friend who was a Bay Club member but would go months on end without working out and I sugested he join a cheaper gym and he said: “If I joined a cheaper gym I would not feel bad if I went a year without working out, while today I’ll feel bad after a couple months and go work out”… P.S. I still ride regular bikes but I’m spending less time on my road bikes with so many people texting and not paying attention and usually only get around to riding my Santa Cruz moutain bike at the cabin so I keep it up there (I have my “old school” Litespeed XTR hardtail hangoing in the garage at home)…

I used to bike all the time in the Berkeley Hills. It was quite a climb going up Claremont. Riding through the city got me nice and warmed up for the big climb. But traffic got too dense in the city, drivers became more aggressive, and it became really very dangerous to ride a bike anywhere except off road. I used a sidewalk to bail out once in a while, but cops said I could not do that. So I quit bicycling. Those guys who bike on city streets now have a lot of guts or are flat out stupid.

That’s smart, people hit parked cars around here. Without fail. I think we all need to wear airbag clothing just in case. They’ve developed them for the elderly in Japan!

Gotta keep moving! anyway you can

Why was there ever any market for this garbage in the first place?

Yes, bike trainers have been around forever in various forms, probably about a week less long than bicycles. I used to use “rollers” at home where you can just put your regular road bike on top and get it to smoke. They have been around forever too. Bike trainers address a real problem: riding outside when it’s raining/snowing and cold is not good, so you need something to get through the bad days. And it spread from there to the general population that wanted to get some exercise while watching TV. They ARE boooooooring.

Yeah booooooooring!

The key for my coming old age is to locate in the Southwest where there are far fewer ‘raining/snowing and cold’ days. The 110° summer days can be ridden at low humidity dawn at 85° and then grocery shop on your way home to the air conditioner.

I find 2,500-4,000 feet a good balance of climate and elevation in the Southern Southwest.

That being said about apartment based bike riding, I agree it seems boring. On the other hand, there is no similar physical experience to a 15 mile rode bike ride in the air, sky, land, etc.

Just wondering if a modern stationary bike hurts your ass as much as a real one?

I have had no use for either except for grammar school, then I got my first mini-bike frame/tires at 12 and rebuilt it..shop lifted all jack shaft parts/bolts…..(sorry)……found used Clinton 2.5 HP, cleaned carb….and that was IT!….NO power=NO more wheels for me. I loved hiking/walking till I trashed back at 67 building (unfinished) container house….last of cement foundation finished me off…..only needed 4 bags to finish pour, but if you are going to town might as well get 20. From the heat going home that night I knew waking up was gonna be spasms and hospital.

Pouring the foundation, AFTER you leveled, joined, stacked (2-2-1), and connected the insides of all 5 containers is a lot tougher than the usual foundation, but as usual, I changed my plans a lot.

Wonder what the breakdown in revenues and revenue loss is between subscriptions and equipment.

If the loss leader equipment revene is tanking, wouldn’t that seem to drag down on profitable subscription revenue as well? If subscription cancellations, non payments, or just end of term non renewals are increasing, with lower new equipment sales…pretty dark sky ahead.

Another Juicero op?

Cancel my question. They have it in their latest reporting letter. Equip is down and subscriptions also down but not by much. By the way, they are also redefining how they report subscription stats….I don’t really understand what they are doing. Likely putting more lipstick the pig I’d guess.

In Q4:

Products: $220 million

Subscriptions: $422 million

Subscription revenues: +10% yoy

Product revenues: -25% yoy

“get rich quick by selling this stuff to a greater fool at an even higher price.”

Yes, this was the main driver. Hallucination would be the only reason somebody might actually believe that pandemic luxury workout equipment sales volumes would be maintained in the long term. But nobody actually believed that. They didn’t buy the business model. They bought the steep trend thinking that they would get their timing right, and I’m sure some of them did. It wasn’t hallucination, just a classic example of the greater fool theory. For those with the right risk appetite, perfect timing would mean multiplying their money over 8 times quickly (albeit unlikely). However somebody willing to be happy with merely doubling or tripling their money (in and out fast) and walking away would have had a pretty good probability of doing so even if they got in fairly late on the initial spike. Riskier than I’d be willing to handle, but certainly not irrational or hallucinatory.

Yea, somebody bought the stock driving the price of the last stock sold to the greater fool at a price some 1000x it’s current price. Of course, it was not individual investors that really had anything to do with the stock market orgasm. It was the professional traders, buying overpriced stock for the hopeful participants of their company’s pension plan.

The first time I saw a commercial for this stationary bike company, I said to myself that that was not a sustainable enterprise.

But it was that most that America could manage. To think of the billions of dollars supplied to this predictable failure, is a testament of the foolish nature of the QE era.

When the ridiculous went mainstream. Money for nothing and the chicks for free.

Agree.

Hope Wolf allows my link to a short article that shows how you get people to vote FOR an aristocracy ruled country without even knowing it.

Just hit “I’ll do it later, and you can read it all.

“They wanted to invest in Peloton to get rich quick, hoping that losses wouldn’t matter because money was free, that Peloton could just buy some growth with these billions of dollars,”

Isn’t this the same mind set as the DC crowd!!! print money (investors) and continue massive budget deficit spending!!… ofcourse multiply by a significant factor..

Gees…just looked, starter bike kit at $1,650 plus $240 a year subscription for some AI vision to yell..”move it, move it, move it” at me?

We have many stocks trading at insane valuations.

Top of these is NVDA and many other high flying stocks.

Looks like these stocks have not yet gotten the memo about high rates for longer.

How did it skyrocket from a 52-week low of USD$112 to about USD$480 as of today? The yield doesn’t even reach 1%. You can get T-bills for 5% these days!

Did nVidia do a business deal with Colombian cartels to sell the snow?

It’s the casino

Man, that drop from 95 to 50 must have been a really painful day for many stock holders.

Put on the Tom Petty song Freefallin’!

When do we play Last Dance With Mary Jane (one more shot to kill the pain…)? Seems appropriate for the state of economic affairs right now.

Perhaps some of the empty commercial office space that’s abandoned, can be used as showrooms for overpriced exercise equipment — that might produce future income to help banks pay interest on their BTFP loans.

I can also see these showrooms having kiosks to look at NFTs or have bidding booths for whatever seems like a really cool thing.

Also see:

“The danger to banks affected by downgrades is that their efforts to raise money with bond sales could get more expensive, thus placing even more pressure on their profits.”

I have enjoyed all these comments. I want to add to the guy who threw a rock thru screen and now it’s just a stationary bike: how about a kit that converts it to a road bike. For 2K more an E-bike.

Moving on, there is some S coming down that won’t seem as funny.

The banking problems in the grossly over- banked US with 5000 FDIC banks are just beginning.

Nick Kelly,

“…in the grossly over- banked US with 5000 FDIC banks”

Back in the 1980s, I was hired to run a big car dealership and its subsidiary, a big auto-parts wholesale-distributorship. They had big problems (losses, running out of cash, accounting problems, you name it). My job was to fix those issues. And one of my jobs was to go to our local bank and ask for a lot more money.

So I called our VP of commercial lending at our local bank (Tulsa), no branches, just one two-story building, and made an appointment for that afternoon, and I went there, and we sat in his office, and I explained what I would do to fix the issues, and why we would need a whole bunch of money to do that, and I had to persuade him that I’m the guy that can pull this off.

We sat there for an hour and talked. Then he agreed to the loan package: term loan & line of credit secured by parts inventory (which is where the accounting problems were, so that was dicey) and receivables. Then I showed him every few months in person how things were going, showed him the improvements, etc.

It saved the company. And soon we made money and started paying down the loans (they all had rates over 10% which was a strong motivator to pay them off quickly).

That’s the benefit of doing business with a small local bank for which you are important. The mega-bank for my business today, LOL. Every time I go there, I meet someone new, and thank god my company isn’t in trouble and doesn’t need to borrow money to cover a cash hole (they want to lend me money now when I don’t need it, but if I ever need it because I’m in trouble, they won’t give me the time of the day).

Well, that’s the 80’s for ya. I was making yellow cake at the time. Those banks do not exist anymore, do they ?

Taking a risk on loans you can’t sell to the taxpayer. Preposterous.

A relative in real estate told me the same, he preferred doing business with small local banks. If he ever needed some leeway on terms and conditions he knew management and they knew him so they would likely be flexible.

It also meant moving several times as the small banks were swallowed up by giants.

So “economy of scale” has a few flaws in it? Monopolies aren’t all that good?

We used to have a couple of Roosevelts who also felt that way.

See my Guardian 12 year old link just above…(I hope)..the country is being taught it doesn’t want those types around at all.

I was actually considering buying a Peloton bike a few months ago as an alternative to running due to a foot injury. The monthly subscription was the biggest turnoff and I decided against it. It doesn’t sound like Peloton will be in business much longer.

Just buy a used stationary bike and put on one of the many YouTube walking or biking tours on your 85 inch 4K TV.

Very entertaining article that begs the question that “during the free-money era that the Fed instigated and that had turned investor brains to mush”. If they were delusional then, unable to discern that this was not a viable business model, are they now rational, or are they still delusional about asset valuations.

Like your previous article on the state of the housing market. In that case there is definitely an incongruity between the equilibrium price between buyers and sellers, that the capitalist model of free competition, is sufficiently sophisticated to explain how in the hell could the largest market in the economy become so disjointed.

Certainly not the Fed !

Aristocracy has an indefensible advantage that eventually fails. Only to rise again. The state of the US has more to do with an internal rot than an external threat.

An entitled aristocracy has twisted a hard won democracy into a capitalist pawn.

Not one asset bubble has subsided. The markets are still synthetic. The price of assets is being set by monetary policy rather than competition.

dang – good observation.

may we all find a better day.

And they are not done by any means, dang and dustoff….wish Wolf hadda posted my link on how they Bs’d poor people into voting against themselves…and for a new Gilded Age…….first move was the so called “tea party”. An ostensibly “grass roots” movement, but really was what they call an “astroturf party”….set up and paid for by Billionaires……..with a nasty agenda.

Funny (not really) thing is, it may be totally out of the original instigators control now, just like climate change may be.

NBay – ah, hubris. Dr.Frankenstein never imagined his creation escaping his control…

may we all find a better day.

As we wander around, searching for some way to justify this company without once facing the amount of money that was wasted:

From the article, “It lost a total of $4.6 billion in the five years as a public company.” I find that kind of loss as symptomatic of a system that has lost it’s way.

…my mind’s eye is seeing ‘used cash-burn machine’ lots similar to used-auto ones…

may we all find a better day.

They should put some AI in their bikes.

Then – to the moon baby.

Back about 35-40 years ago, I was a Realtor and saw the inside of thousands of houses. Exercise equipment was a joke back then. It is human nature to have good intentions for about 6 weeks, then quit. When I first heard of Peloton I knew it was a gold-plated version of what I saw decades ago. Human nature hasn’t changed.

Like the gym I go to. Busy after Thanksgiving and New Year for a couple of weeks, then quiet again.

Ha Ha….I bet you do see that over and over, just like I see weight loss pills, systems, devices, services, etc, etc, on TV over and over…only all year long.

I don’t have any fries, burgers, or bacon emojis like Wolf does, or you’d get them.

It’s still overvalued

My ass has never met a bicycle seat that did not make it sore. Stationary, pedal or electric. At least with the electric off the automobile roads, I can go 13 miles instead of one.

I am surprised that the ARPU for the subscription business is $45/sub/mo.

They lose about $560 per bike sold which is customer Aquisition cost. and They need about 1.6M more subs just for to subscription gross margin to cover opex – but subs are churning at a high rate and bike sales are declining.

I don’t see a happy ending for current shareholders.

In some ways this is simply the path that ALL publicly held fitness companies follow. It is just that the speed is amplified now.

In my garage are a dozen Nautilus machines that I bought from gyms and military bases within driving distance from me. I got them for $50 to $200 each when the going rate to put them into the gyms was $3000-$5000 a piece. When the man (Arthur Jones) who invented the Nautilus machine (and its “craze”) cashed out after eighteen years of running the privately-held company he was in the Forbes 400.

Over the next 13 years the new company was run by Wall Street types who extracted what cash they could before putting the company up for an IPO. It has been publicly-traded ever since and its chart resembles Peloton’s an awful lot. As I type this it’s stock price is one dollar even… roughly where it has been for about 18 months. What has kept it alive through SEVERAL cycles like that is consolidation and divestiture… continuously giving Wall Street a story it likes to hear to get a stock boost… and then a stock fall as the story wears out.

Meanwhile the Nautilus equipment quality has steadily declined and other private manufacturers have been more innovative in the space.

Contrast that story with the story of the Total Gym of Christie Brinkley/Chuck Norris fame. owned by the same two guys since the mid-1970s… no Wall Street analysts or stockholders to worry about. No real competition because they are never distracted from what they are selling to a different “bright and shiny object.”

The bottom line is that watching all of this play out in the part of the fitness equipment world that I hang out in… I have come to the conclusion that not all business models work well as publicly held companies. Fitness companies seem to be such a story.

@Wolf Looking forward to the article on better.com SPAC IPO implosion :-)

Next week, maybe. I don’t want to stack them up too high. I have the URL http://www.implodedstocks.com, which forwards to WOLF STREET, but WOLF STREET is about a lot more than imploded stocks, I hope.

Peloton bikes are expensive and are considered high end. How did they lose so much money?!

They’re more expensive to make than what people are willing to pay for them?

The company never intended to make money, and never figured out how to make money. It tried to buy growth with billions of dollars in investor cash that it burned, but turns out, that doesn’t work forever, LOL.