In the first 10 months of Housing Bust 2 (now), the median price plunged a lot faster than in the first 10 months of Housing Bust 1 (2007-11).

By Wolf Richter for WOLF STREET.

There better be a halfway decent spring selling season, which is supposed to already have started in San Francisco and Silicon Valley, because this is getting pretty bad, pretty fast. But it’s hard to imagine just how good the spring selling season can be amid countless reports of layoffs, working from home somewhere else, with big numbers being thrown around about how many people have left Silicon Valley and San Francisco. The City of San Francisco alone lost about 56,000 residents, or about 6.3% of its population, in the period of 2020 through 2022, according to Census data, even as about 12,000 new housing units were completed over the same period.

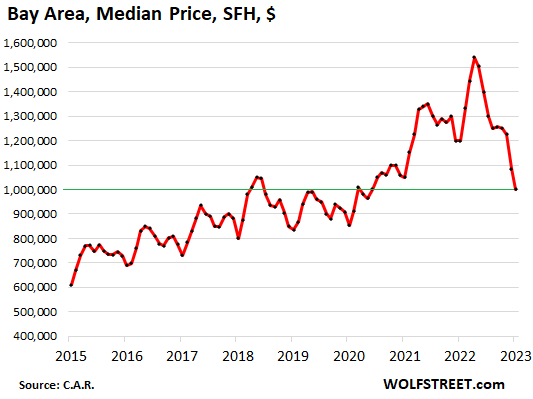

The median price in the nine-county Bay Area plunged by another 8% in January from December, by 17% year-over-year, and by 35%, or by $540,000, since the crazy peak in April 2022, from $1.54 million to $1.00 million, according to the California Association of Realtors.

Sales of single-family houses in the Bay Area plunged by 37% in January compared to January last year. The sales plunge has been in the same year-over-year range for months.

Seasonally, January is generally the worst month of the year for the median price of sales that closed in January, reflecting deals that were negotiated in December. So there are hopes that this is going to turn around during the spring selling season that everyone is praying for.

But where is this prayed-for demand during the spring selling season supposed to come from? People are now worried about their jobs, and buying a still ridiculously overpriced home, as mortgage rates are once again close to 7%, is probably not the number one priority. In addition, there’s the fear of trying to catch a falling knife. The area has lost population. And amid layoffs and hiring freezes, not many people from elsewhere are now being brought in with promises of high salaries.

But the 35% plunge hasn’t done a huge amount of damage yet in the broader sense because the spike in prices leading up to it was so steep and so crazy that not many people actually bought homes at these crazy prices in 2021 and 2022. Most people who bought in 2019 or before – the vast majority of homeowners – are still above water.

In other words, the 35% plunge hasn’t even worked off the entire pandemic-free-money spike. But the illusions of sudden wealth have evaporated as fast as they’d appeared.

As you can see from the jagged line in the charts, median prices are volatile and they’re seasonal, and they can get skewed by the mix of what actually sells, etc. etc. So they need to be handled with care. But this plunge is nevertheless historic.

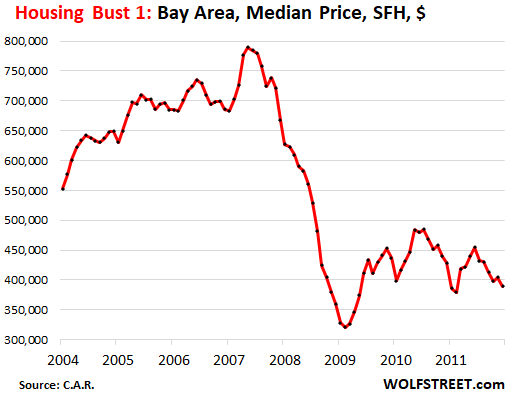

Blast from the past: Housing Bust 1 v. Housing Bust 2. During Housing Bust 1, which started in the Bay Area in mid-2007, the median price plunged by 59% in 21 months, from May 2007 ($789,250) through February 2009 ($321,110), when it hit bottom.

Ominously, during the first 10 months of Housing Bust 1, the median price plunged by only 23%, compared to 35% in the 10 months so far in Housing Bust 2. This chart is a blast from the past, Housing Bust 1 in all its glory:

The five big counties of the Bay Area.

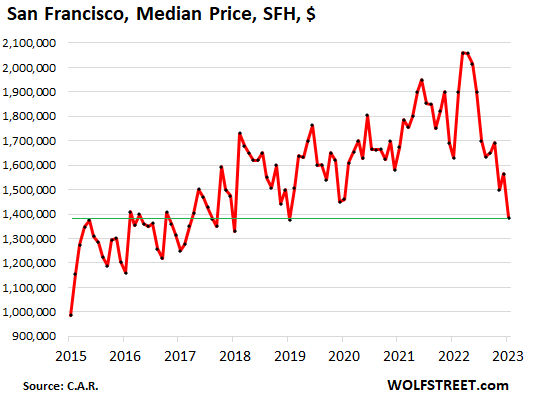

San Francisco: The median price of single-family houses plunged 33%, or by $675,000, from the breath-takingly idiotic peak in March 2022, falling from $2.06 million to $1.38 million in 10 months. Year-over-year, the median price plunged 15%.

The median price in January was about even with January 2019. The first time that the median price hit $1.38 million was in February 2016. The spring selling season better be good:

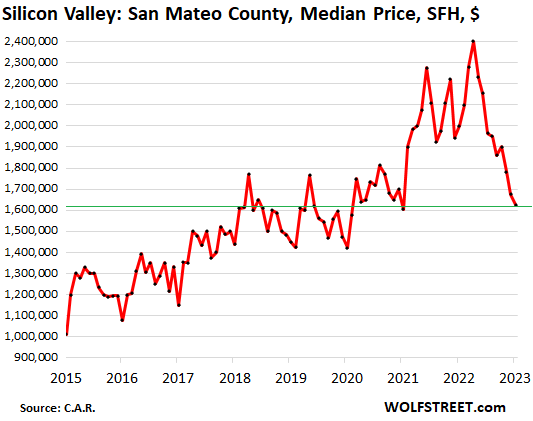

Silicon Valley: San Mateo County: The median price of single-family houses plunged by 32% from the peak in April 2022, by $776,000 in nine months, from $2.40 million in April to $1.62 million in December. Year-over-year, the median price plunged by 19%.

This median price was nearly flat with January 2021 and was first seen in February 2018.

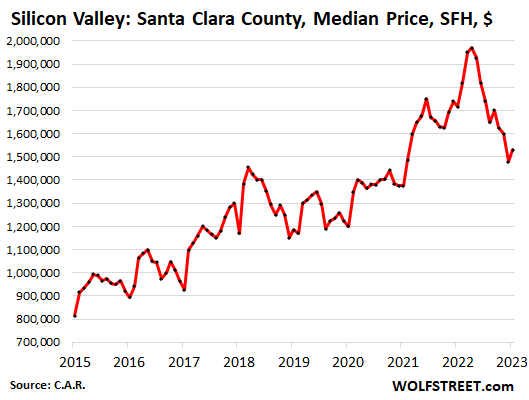

Silicon Valley: Santa Clara County (includes San Jose): The median price of single-family houses ticked up in January, but was still down 22%, or by $440,000, from the peak in April 2022, having dropped from $1.97 million to $1.53 million in nine months. Year-over-year, the median price was down 11%.

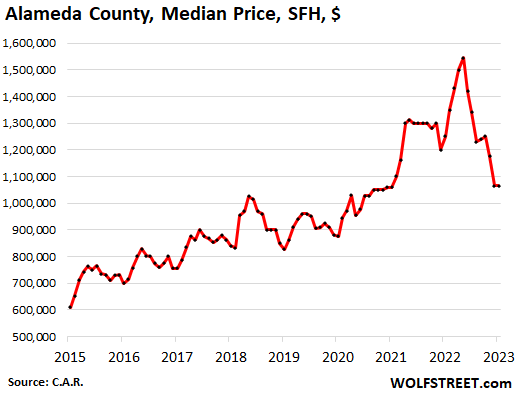

Alameda County (East Bay, includes Oakland): The median price of single-family houses plunged 31% from the peak in May 2022, or by $479,000, from $1.54 million to $1.06 million. Year-over-year, the median price was down 15%.

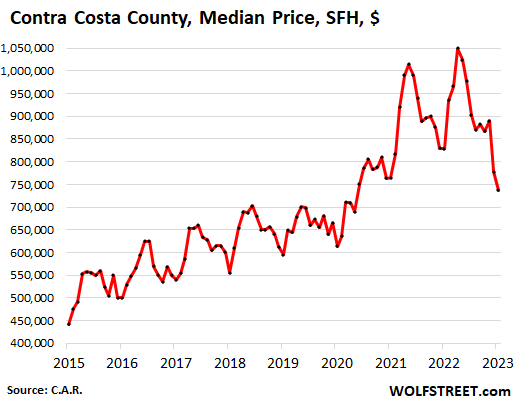

Contra Costa County (East Bay): The median price of single-family houses plunged 30% from the peak in April 2022, or by $313,500, from $1.05 million to $736,500. Year-over-year, the median price was down 11%.

Median time on the market in the Bay Area ballooned to 32 days in January before the property sold or was pulled off the market because it didn’t generate a deal. This was up from 28 days in December 2022, and from 12 days in January 2022.

So a good spring selling season – or at least not catastrophic – is now what everyone is praying for. In January, mortgage rates had dropped to near 6% and the stock market had jumped, but that’s already over. The daily measure of the average 30-year fixed mortgage rate is already back over 6.75% according to Mortgage News Daily, amid renewed inflation fears and frustrated Fed-pivot hopes.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A snapshot of where the country is headed, pumped up on trillions of fake fiat paper currency! Fake wealth!

“everyone is praying” . . . rather medieval, don’t you think?

Yes, there is a weird human tendency to pray when SHT fan, really it was their own ignorance that led them there.

I don’t understand how people look.at a three bedroom house priced at 1.6 million and even consider purchasing when the price should be 250000

The whole system has failed and the end result is a steady increase in a breakdown not only in the economy but a breakdown of just being able to find worth in just staying alive.

If it’s so awful, you can always migrate. Plenty of people trying to get in.

Nate, I have lived in the city for over 20 years. This city has a few very hard years ahead of itself. The downtown is at historic vacancy rates and this area is what keeps City Hall afloat. Without the city income generated by downtown, the city is screwed.

I have not seen this city in a dirtier state than it is today. I wish all the progressives, with their bat-shit-crazy ideas and no real way to make these ideas work in a capitalistic economy, just step aside.

Was in Cleveland recently and THAT city is far CLEANER than San Francisco today.

Then why didn’t you stay in Cleveland? Move to Cleveland! Go, go, go!!! Housing is a lot cheaper too. Hurry up, don’t let the door hit you in the back on the way out. San Francisco is way too congested and crowded.

BTW, if you want to go see a depressing downtown, go to Tulsa. I went there recently and stayed at a hotel there (the former City Hall building). But housing is cheap.

The thing about San Francisco is that despite the tech industry and the crash that people are saying occurred because of all the free money of COVID San Francisco Bay area is one of the most beautiful spots to live in in the entire world. Also San Francisco itself is a isolated small land mass so never fear give your take a few years it’ll be back on top with or without large infusion of more tech but I believe Apple and Google and possibly even Twitter will be back and all the naysayers can watch and weep. Don’t forget that at the very worst the market has gone down to 2016 levels and they were already quite high then So if someone bought before that time they haven’t lost a penny and hold on a couple more years and it will be back up where it deserves to be. Come visit us in San Francisco, it’s a beautiful place to live.

I AGREE WITH EVERYTHING YOU SAID. IS THERE REALLY ANYWHERE ELSE IN THIS WORLD TO LIVE? WE HAVE IT ALL RIGHT HERE IN THE BAY!!

Huh companies that are based on advertising. Good puzzle how far can they push it they produce nothing. Don’t know. We’ll see.

You need to vote some pro-business people into office. The downtown is suffering. Companies are finding it too hard to be in business in SF. We need downtown if we are to survive.

Nothing is going to revive the glory of the office towers. That has passed. That won’t happen anywhere. The office sector of CRE is worse off in Houston, Dallas, and other cities that have even higher vacancy rates than San Francisco.

What needs to happen:

1. Older office towers than can be converted to residential need to be converted to residential. This can likely only happen after they’re sold for cents on the dollar at a foreclosure sale to a developer. You cannot do that it you have a high cost base.

2. Older towers that cannot be converted need to be sold in a foreclosure sale for land value, get torn down by the new owner, and the land get redeveloped with residential buildings.

So you’ll have some office towers and some residential towers downtown. That would be great — but it’s expensive, and takes years, and first investors/lenders/CMBS holders that are holding paper backed by these office towers need to lose their shirts at foreclosure auctions so that the developers can come in with a much lower cost base and make the conversions or redevelopments work.

Not in Sacramento region. Prices still strong and I get regular texts and phone calls from investors looking to pick up my rental homes.

Your analysis of Los Angeles would be eagerly received.

The fact that run of the mill single family homes are worth well over $1 mil is mind boggling.

No wonder these people fanned out among the remote work craze and ruined things everywhere. Previously worth $200k homes in my previously sleepy new retirement and work from home mecca are now $500k homes. Must seem like a bargain to the buyers.

But this has ruined all expectations of sales prices and rent prices in this town and devastated the working class.

I really hate to wish bad fortune upon anyone but i legitimately hope that there is a hard downward push in the tech industry to bring salaries down to reality.

The imbalance has ruined many small towns and is destroying the quality of life for people that are struggling to find housing.

In what city/state do you live?

Rural New England.

Same almost everywhere I look these days HM:

From both coasts and anywhere, including any kind of friendly flyover, story appears to be that WFA, etc., has driven away or into poverty many local folks who don’t live on dirt their grands or great grands homesteaded.

Going back down now from what I hear/read.

Question is, how far down and when???

Don’t we all wish we had the answers???

Mom’s fave quote was, ”If wishes were horses every beggar would ride.”

( early last century wisdom, eh )

Wife has WFH for 5 years. It’s quite cozy, peeps are gonna learn and downtowns will be gutted. Another relative has done it for 20 years, the odd biz trip but whatever if all you are doing is pounding a keyboard why not stay home.

Mortgage delinquency rates ticked up in Q4 2022 for the first time since the pandemic. Noise or the start of a concerning long term pattern?

Note that 4% is way lower than the housing bust 14% rate. Maybe wishful thinking on my part as I need to move a house in a couple of years that tripled in price quickly, but it looks like we won’t have the short sale mania that really destroyed housing last time.

It isn’t an issue to drop a house values 15% to move them, it is an issue if 10% of the houses for sale are short sale at a 30% discount. That really created a lot of re-sale pain during the last bust as jingle mail customers walked, and the responsible homeowners paid the price attempting to compete with bank owned short sales.

Fingers crossed on limited short sales during the next few years.

This is really not the problem,out of control property tax increases ,insurance increases,and maintenance. Will lead to homelessness .In about 10 years I’ll be broke on a fixed income.

Reality is reality, you cannot bring reality down to reality

And where does your legitimacy come from?

And the worth generation be it via tech tends to raise everyone’s wrath upwards, it’s called capitalism

I just returned from Reno after a 7 year hiatus and the seem on the up

Some working class are for sure rices out the market, but higher paid jobs will eventually work there way into blue collar hands

This is shocking. Thank you for this article. I await your analysis on Irvine, CA.

Have lived in the Bay Area 60 yrs, fascinating place.

Land values are more volatile than the houses on top. Bay Area has some of the highest % of land to home prices in the country so it stands to reason in a down market to see this. The price graphs have shown large price swings for years.

It’s a fair time to buy and the $ one saves in price will easily cover the additional internet carry until rates slide back down.

+sub

I predict it will be similar: could Chinese, CCP or CCP crony investors, who owned property through white gloves until now in both markets, need the capital to move? Reportedly, thousands of rich Chinese are fleeing China and its shambolic, kleptocratic leaders. The global economy is linked and of a whole like a gigantic tapestry; we are surprised when our corner rises and falls after some one pounded the far end.

A tidal wave of housing demand is building across Muricka!!!

If you’re going to San Francisco

Be sure to wear some flowers in your hair

If you’re going to San Francisco

You’re gonna meet some gentle people there

For those who come to San Francisco

Summertime will be a love-in there

In the streets of San Francisco

Gentle people with flowers in their hair

All across the nation such a strange vibration

People in motion

There’s a whole generation with a new explanation

People in motion people in motion

For those who come to San Francisco

Be sure to wear some flowers in your hair

If you come to San Francisco

Summertime will be a love-in there

If you come to San Francisco

Summertime will be a love-in there

LOL!! Thanks for the laugh GringoGreg, you nailed it

When that song came out I was paying $50.00 per month rent for a very sweet studio across the street from campus in Berzerkeley, and had many friends in SF paying the same for ”flats” of various and sundry sizes and locations…

Get the hint???

IMO, ( perhaps a bit skewed ,,, ) :::

It would be best for the SF bay,,, ALL of the SF Bay area (known locally as THE bay area of course) for everyone who can possibly do so to leave and go home or go to some new to them flyover and grow their own food, etc., etc….

Please LMK when rents go back to $50 for a decent one person habitat::: I will be there ASAP:: LOL

Thanks. That was a treat.

Went to realtor com and listed “recently reduced” in frisco.

Lots of price reduction amounts higher than the median priced homes in flyover country.

Amazing.

Although with the rise in bitcoin price last few days I’m sure the Btc hodlers can bid these babies back up. Haha btc gonna crash soon for sure.

What does a city in TX have to do with the bay area?

people are fleeing cali for Texas….. duh!

I do believe Scooter was referring to Rodolfo referring San Francisco as Frisco, which is in Texas. San Franciscans hate it when you refer to their town as Frisco…

Receo,

LOL. yes!

The closest we have here is Fresno.

Local Austin people are begrudging those migrants from foreign sister states. On S. Lamar, under a passover bridge, the TV head says: “Dont move to Austin”.

So why does my neighbor here in eastern Washington complain about all the California transplants ?

Oh I get it some of them are moving to Texas… I see.

Natives no matter what part of the country like to pretend their town/state are soooo special. Comical.

Randy – are you sure your complaining neighbors don’t have a connection to any of the number of Californians and Texans who immigrated to the Spokane/Cd’A area mid-’80’s early ’90’s?

may we all find a better day.

Reply to AUS:

The neihhbor who complains claims he grew up here in Spokane Valley.

Its not just Californians he doesn’t like (though mostly). When I told him I thought the climate here mostly sucked (it has a few plusses) he said I should move back to where I came from.

Ahhh. Clichéd responses…

I’ve lived here 23 years so I’ve come to know the climate pretty well.

And no I’m not a native Californian not even close. Did live in Texas for 11 years.

Put me down for not liking “Cali” also. I don’t know if it’s derogatory or a play on back when Ahhnold was Gov. It is a Spanish “i”, though.

That movie genre with tough talking and “cool” (for the times) people and lotsa crime, that was so popular after the war and now being shown a lot again on TV (cheap content?) was where you’d find words like “frisco”.

I lived most all my life in Sonoma/Mendocino counties sometimes considered part of the Bay Area and sometimes not, and Luther Burbank was right.

That is not true, BTC is going to zoom up due to housing crash, people finally realized that investing in houses no longer safe and adoption of BTC is becoming obvious around global, buy some BTC right now while it is still only around 25k, you will have to pay a lot more in the near future

Sam,

LOL, that was funny. Thanks for the morning laugh. I hope your humor was intended. If not, it was even funnier.

I think my magic beans will be worth more than BTC after the crash. They have the potential of going further up. Cannot wait until musk takes space x public, then to the moon!

At the end of the day, I see nothing wrong with housing prices collapsing to normal levels relative to economic reality. Those who own their homes will just feel a little richer. There are not many of those with the credit who bought at the peak, as the Wolf says, and no one forced them to do so. In the end, a price sriver will give those who need a roof a chance to buy a home. And the speculators will understand that the property is to be lived in and not to be profited from

“property is to be lived in and not to be profited from”

Golly, somebody should have mentioned this to the Fed during 20 years of speculation fueling ZIRP.

More like 30 years…since the days of Alan Greenspan.

No kidding. Most overrated FRB chairman ever.

Overrated, agreed.

I remember the “Maestro” biography (he was credited with the 90’s long boom and hit the exit just as the long collapse got going…).

But he still couldn’t touch the idiot-academic arrogance of “Zimbabwe Ben” Bernanke (“We have a technology called the printing press…).

Yes, upvote many times.

When rates are suppressed you encourage using leverage to buy assets. That is a one time boost to prices, but then you are stuck. Unless you keep zirp going, prices have to fall unless government keeps prices up with some kind of scheme to prop up houses like a big credit for first time home buyers.

They’ve been propped up for years with the mortgage interest deduction and other tax exclusions. Recently trimmed a bit but set to return bigtime in 2026.

People still aren’t making payments on students loans, how much do you think that money is going towards mortgages at the moment?

my son is 41 and still has about $30,000 debt. I used to tell him to pay it off as quickly as he could. Now I tell him not to pay it off, because a portion probably is going to be forgiven.

He has saved about $100K in IRA plus a pension. He is a renter and feels like he is going backwards.

I know one guy about 35 with student loan debt and he has gone further in debt buying dilapidated housing and trying to rehab and rent them out.

70k in a Roth would be more useful as a down payment than 100k in a conventional IRA. Especially for someone in the 24% or lower bracket.

No crash in San Jose. CA. Prices aren’t dropping much.

Maybe you haven’t looked at Zillow much lately. Prices have pulled back 15% across the board, and for lower end homes are down well below the $1m mark that they were just a year ago. You can buy a small home in San Jose right now for $750k. That hasn’t been the case since 2019. It’s STILL overpriced, but if this trend continues in the Bay Area, then lookout below.

We are due for not just a drop to long term trend, but a true bottom. Might not happen. I don’t wish for it. Everyone that remembers the great depression as an adult is dead. That is a good setup for it to happen again.

I bought in early 2021. I’d love to have a housing crash in my area so I can ask the city to assess my property taxes back down…

Good luck on that. Fed, state, and local have been riding high with covid $$$ & property taxes.

Your assessed value may certainly go down. But you can count on sob stories as they tell you they HAD to increase the mill rate.

I give you my 100 upvotes too!

The real demons are the ones who are on TV saying, ” I’ll buy your house.”

I am all for capitalism, but these money-grubbing investors and corporate speculators are taking houses out from under the young families who actually need housing. They also are responsible for the run-up in prices. Young families build up neighborhoods and communities. Yes, the correction is here. I hope the families who (out of desperation to house their families) bought at or near the peak will survive and speculator can eat dirt.

1) The Bay Area : down 500K, or 62%, from 800K 2006 peak to 300K within two years. Up 1,200K from 2008 bottom to 1,550K.

2) Prices doubled : 2 x 800K (in 2006) = 1,550K. // SPX : up from 667 in 2009 to 4,800 in Jan 2022. The Nasdaq : up from 1,000 in 2009 to 17,000 in Nov 2021.

3) Jan 2023 low test 2006 high. The trend is up. The trend is strong. When the test will be over prices will rise, first slowly then faster, until the next correction, adjusted to inflation.

4) The Bay Area 3 years Lazer : 2015 to 2018 highs. // a parallel from

2017 low. The Lazer blew up the Bay Area. After turning around the

Bay Area will reach/breach the Lazer, before the next correction.

5) C/S pairs like : bought in 1975 sold in 2025, or bought in 1995 sold in 2025 are likely to lose their positive bias.

Can anyone follow this? It must have meaning inside the poster’s mind, but lost in translation to the outside world.

Yes Incan follow these though sometimes a bit difficult and love to see the posts . Description of the patterns that may occur over time combined with some technical analysis.

Ross – as Wolf has pointed out, Michael’s splendid posts are in ‘Engelish’…

may we all find a better day.

We love Micheal, I asked Wolf about this a couple years back. So far as I can tell most of these “cranial meanderings” as I call them, are essentially like stock market calls. Use your magic decoder ring if you dare.

Higher highs and higher lows. Zoom out on any historic housing chart, buy and hold baby! Steady ramp to the north east on the charts! Nothing to see here.

Seems like chartist lingo/technical analysis.

Not sure how valid it is for median home prices but interesting to read nonetheless.

All chart and technical analysis is linear until it unexpectedly soars, or falls off a cliff. Then you start anew, after claiming ‘Nobody saw it coming’.

Actually, pretty well all forecasting is that way.

SF fall down go boom. If the place with some of the most expensive, prime real estate in the country can suffer such a horrific decapitation, imagine what is in store for places like Boise, Idaho. No disrespect to Boise as a city, but a 75% drop there would not be surprising.

Boise is kind of a special case too…hordes of CA refugees were responsible for its runup (see WA, OR, NV, CO, UT,…). The CA refugee rate will fall off…but I don’t think the flow will stop.

All those surrounding states have huge supplies of buildable land – absent political rent-seeking, they are fully capable of building large quantities of affordable housing (something CA gave up on for 40 years). That ensures the CA refugee flow will continue.

…land, mebbe, water and adequate infrastructue? Not so much…

may we all find a better day.

Water is a legit issue for the more southerly states in the West, not so much for ID, WA, OR, CO, and parts of UT (so that leaves NV, AZ, and Southern Utah).

As for infrastructure, I get your point but (as with so many things) there is this air of mystery/impossibility about things that were readily accomplished in the not distant past (AZ added millions and millions from 1950 through 2000 and millions lived there pre-1950…so how did technologically inferior times manage solutions? I get the arguments about sustainable populations, etc., but I also get the strong vibe that certain factions aren’t exactly exerting themselves looking for solutions.)

CA lost 700K residents in the last two year. How many of those ended up in Boise? A lot more than native Idahoans would have liked. SF is literally at the forefront of what failed ultra left, liberal politics & social climate are doing to our once great nation.

I’d love to see a 75% drop across all zonker markets. Alas, that’s probably not going to happen. Our MMT-based uniparty won’t that happen. They’ll step in with mortgage & rent relief sooner rather than later.

Uh huh. Wow! Thanks for sharing!!!!

So – therefore – in Boulder CO, Aspen CO, Telluride CO, where those same ‘failed ultra left, liberal politics & social climate’ are also located, I can expected to see the same drops? Right? Isn’t one proof of a good theory its predictive value?

I mean, being as this is a liberal character and values issues, and clearly not the effects of mass layoff, higher interest rates, people working from home and able to telecommute, etc. Those communities are going to get destroyed.

Seriously. Just keep your truth bombs coming. “Boom!”

Related: I hear there is a Disney movie with a gay character. Also, Target has gender neutral bathrooms. Any thoughts on how that stuff has effected their share price?

This isn’t about same gender bathrooms.

It’s about leaders of many cities including SF deciding that people can camp anywhere they want, openly use drugs and solicit prostitution, blame police for all of societies ills, and foster criminal behavior by either ignoring it or refusing to jail and prosecute criminals. Fortunately SF is stepping back from the abyss by recalling Chesa Boudin, but other cities like Philly have even worse DAs and safety and order in our large cities is far below similar cities in Europe.

The horror! Street people might leave due to humiliation!

“No disrespect to Boise as a city, but a 75% drop there would not be surprising.”

Totally agree. I was transferred to Boise in Oct 2019 and prices were already way out of control for the local median income earners.

I was searching for used furniture and both families I spoke to at their homes told me their late-teen / early 20s kids couldn’t even afford to move into the cheapest apartments, let alone buy a house.

I moved out of ID in mid-2022 to southern AZ for work again, and was amazed that the same types of houses I’d been looking at in the Treasure Valley went from $300k to $550k and above, all without a commensurate increase in income levels. There is no way those prices don’t decrease immensely without either massive increases in income (not gonna happen) or with ZIRP (and we know that isn’t happening).

Southern AZ is no different, the income levels don’t come close to keeping up with anything above ZIRP’d rates, so prices will need to fall much farther from here.

I have my eye on the Phoenix market and my spreadsheet, where I’m tracking prices in the sub-division I want to live in, shows the avg price has dropped $ 40K since fall. I think prices will continue to drop, at least I hope, going into summer.

Won’t get back to 2019 prices but get closer to what I want to pay.

PHX should end up noticeably below 2019 prices.

Have you seen the Case-Shiller index charting HB1 vs. HB2? This bubble is much bigger.

I lived in the metro area for most of the period between late 2001 and early 2011. Unless the job market has changed drastically, incomes don’t support anything close to these bubble prices. Not to mention the asset mania hasn’t even burst yet.

Wonder what people would do if there was a power outage in phoenix,in the middle of summer.

>Treasure Valley went from $300k to $550k and above, all

>without a commensurate increase in income levels.

Welcome to fed.gov loan guarantees.

You can see the boom cycle playout. People over optimistic on technology earnings bidding up valuations to unsustainable levels. High wage earners borrowing money bid up real estate, thinking their wage is secure.

Before you know it real estate prices are built on an overly optimistic future that can not materialize. A true bottom usually is based in a pessimistic outlook for the future.

Home prices in the interior west will dip for sure. But the reason for the bubble in the interior west is people moving from CA. That movement is still ongoing, and it will insulate some of the price drop. Boise dropping 75% doesn’t seem likely to me, it’s still too affordable relative to CA. But I certainly wouldn’t be buying in the interior west this year.

I agree with you.

If SFO can fall this much then no a good news for other places.

But people with bias has reasons to think that we are special and this time is different.

No I don’t think that is so….. In parts of California there are tech companies, and they are the driver of way-way-too-high salaries. This drives localized higher prices for everything. It’s high time tech companies come back to earth in everything they do. Hey – Show of hands, how many people here go to work and it’s not a cubicle, but an amusement park, complete with free $10. coffee’s Indoor skate-board arena, maybe your choice of brightly colored e-bike to cruise between buildings on the company campus, and a couch for afternoon naps? Anybody?? well not me either…. So as long as you do not live where this kind of “Stuff” fueled the bubble, your effects will be “sympathy effects” because it’s in the news that home prices are falling like a rock in frisco.

It is a good thing though, that if you pound the keyboard for a living that you can do it at home, keep cars off the road, be happier & thus more productive, and possibly even live where you want. The stumbling block there will be stupid company managers & execs accepting work from home.

On the rising edge of the bubble in Cal. Tech Land, I remember the evening news showcasing little bungalow 3 room houses on a lot the size of 10 parked cars being among those homes now selling for a million bucks, and thinking “no-way” & “it can’t last” – so for me anyway, I’m not surprised, Does anybody really think that that bungalow with sell for 2 Million in 4 years? 4 million in 9 years? – Anyone? If that ever does happen it will be because the value of the dollar has gone to zero.

.

I live in Boise, a 75% drop is unlikely. Median home price is around $460k, so a 75% drop would mean low $100k. To be sure, prices have declined and will likely to drop some more, and this is a good thing. But the quality of life in Boise is too high for prices to go that low (which is getting into small Midwest town territory). We have a mild four season climate with lots of sun and little precipitation/snow yet abundant water, skiing within 30 minutes, tons of hiking and mountain biking in and around town, some of the best fly fishing in the US, rivers and lakes and wilderness all around. The downtown is clean, safe, thriving with great restaurants and coffee shops. Universities, a good airport, diverse economy. There’s a reason people are moving here. Most of the people that came during the pandemic either paid all cash or locked in a 30-year fixed 2%, and long time homeowners are sitting on a ton of appreciation (prices here were increasing rapidly even before the pandemic).

Everyone thinks the same about their location.

I don’t live in Idaho but know it pretty well, there aren’t many places with these attributes, and people are looking for this kind of living. No way does it become as cheap as Topeka.

Mostly true !

I live a little over 300 miles NNW of Boise. And it gets quite hot here in the summer. 45 to 50 days 90+ highs the last 2 years. Admittedly usually not that many hot days. But its still hotter in Boise. Oh yes I know hot weather, lived near Dallas for 11 years.

Not much rain. Good but drought concerns are starting to become a concern for the NW as well.

Eastern Washington was in the most extreme drought classification through most of the last half of 2021.

Also: transition from hot summer to chilly fall is quick. Eastern US falls are definitely nicer than here in the NW.

I’m sure of it. They last longer.

It is nice here though not to worry about getting caught in thunderstorms.

But no free lunch (with that lack of precipitation (drought concerns, wildfires).

I’d like to know where these locations are. We spent weeks traveling around the Western US checking out relocation candidates and nothing quite compared to Boise as far as larger metros with these attributes. Spokane and SLC came close, but both have much higher crime. Spokane winters have a lot less sun and a lot more snow. SLC is more expensive with a serious water problem and air quality issues as the Great Salt Lake continues to shrink. Smaller cities/towns offer some of the same outdoor opportunities but often lack amenities like diverse dining, airport with decent connections, or universities. Don’t get me wrong, Boise had a stupid crazy run-up in prices during the pandemic, which wasn’t sustainable and prices will likely decline further. But 70%? I don’t think so. The premise was that Boise will get hit harder than SF and I’m not buying it. SF housing is much higher (by about 3x) and has farther to fall, very dependent on tech (also taking a hit), crime ridden and mismanaged, and remote work isn’t going away. Whereas Boise housing is already close to the median home price with less room to decline and, as stated previously, has a very high quality of life.

Sounds like my town. Great fly fishing, skiing an hour away, hiking, biking, winters are mild.. blah, blah, blah..

But Nate might be right, if people came with California money and bought with the low interest rates, I don’t see much of a drop in price either.

Remember when Kunal said house prices in SF would never fall? Bahahahahahaha!

Waiting for his rebuttal in 3…2…1

Which narrative will it be this time? Millennial will keep the market strong and this is just a gully, FED will pivot or he personally witnessed a house near him going for over asking?

Having read some Kunal posts… I’m going with option #3 as his first.

Good ol Kunal! Hahah. Where are you ol chap? Lol.

…still trying to figure out if Kunal is an anagram for SoCalJim…

may we all find a better day.

WOLF

Great article and great charts, as always. I am glad you put up the 07-09 chart for the Bay area for comparison. That was a crash. So far after this bubble, we have a reversion to a proper trend line in the Bay area. Actually, another 10% drop or so would reflect an orderly trend line from late 2019 pre-Covid.

2023-2025 will be interesting. Other markets do not have the exodus issues of the Bay Area and I think most of USA will just revert to what would have been a normal trend from 2019 or so. The Bay area looks like they are headed slightly below trend over the next couple years.

The “normal” trend of 2012-2019 was wholly founded upon the abnormal 20 years ZIRP…which has ceased to exist (mortgage rates normalizing now to 2x+ of ZIRP era rates).

He has no clue (still) that the asset mania goes back much further than 2007.

This crash is moving a LOT faster than the last crash, as I pointed out.

In Housing Bust 2, prices crashed 31% in 10 months. In HB1, prices crashed only 23% in the first 10 months, and it took 13 months to crash 31%.

So if you call HB1 was a “crash,” what do you call HB2? A “super crash?”

A fast crash!

Not in Austin!

It would be interesting to compare volume over those same time periods. My senses is that the current bubble #2 has dropped much faster than bubble #1, but with much lower volume.

AAron..

Yes. How much is really changing hands? Is there data?

Is real estate falling in Red States? FL ?

@longstreet, prices are falling in red UT

GDFC!

A “Felix Baumgartner”

Does the speed of the fall simply mean it will reach its bottom faster? What is the relationship of housing prices to rents in the Bay Area now? There is talk of population levels but it feels to me that there are still lots of people here with the income to pay 4-8K a month on rent. How many of these people are going to take this price collapse as an opportunity to buy a house?

I’m surprised by the speed with which it has gone down. I think the speed of the fall will slow during the spring selling season, and there might even be an uptick. There SHOULD be an uptick, seasonally. But the rug got pulled out from under the fundamentals and the craziness of this market, and I think the bottom isn’t in sight yet — though people will call the next uptick “the bottom” — that’s guaranteed.

As always: if you get a good deal from a desperate seller (low enough price), and you can afford the house, and you need to move on with your life, and you understand that a house is an expense not a money-making highly leveraged gamble, well then, go on with your life. That has always the case.

Not sure about apartments, but in my area (East Bay), buying a SFH is at least 2x renting the same SFH.

So financially, it makes more sense to save and wait instead of buying (but, of course, there can be non-financial reasons to either buy OR rent).

It’s a process, not an event.

The stock market (not even the NASDAQ) hasn’t entered a real bear market yet. Prices are still higher than the February 2020 pre-pandemic peak.

More layoffs (many more), as C-suites try to rescue the stock price.

I think sales will go up, but not prices because of rising rates and more job losses. People will want to GTFO, so the few buyers around will be able to low bid. I’m referring specifically to SF as its facing a perfect storm with the tech unicorn meltdown and a collapse in the quality of life that’s in the media eye almost daily.

@TonyT. The same is true in Seattle area. I just rented a house, that was for sale in the fall, for 40% less than what the mortgage would have been. Why pay more?

Crash is so 2008..next one needs more marketing posh to grab the attention of them Tik Tok folks..how about the Great housing Supernova of 2023-2025?

Supernova can be interpret as good or bad so both housing camps should be happy spinning their narratives with it

WOLF

I would respectfully still call it a “bubble deflation” as relates to the Bay Area…..so far. I agree the pace is crazy fast compared to 1st 10 months in the GFC, but still hasn’t hit the trend line. I have no doubt it will – and then some – but again – I think it will be peculiar to the Bay Area for the reasons you state. I will predict the “crash” will not overtake the 59% drop in 21 months that we saw in the GFC.

I know everyone likes to hammer on me being a RE shill, and I prolly was back when I owned RE. Now – just observing the data – GREAT data – that you compile, and throwing my theories out there – based upon my past experience with RE. :-)

“I know everyone likes to hammer on me being a RE shill, and I prolly was back when I owned RE. Now – just observing the data – GREAT data – that you compile, and throwing my theories out there – based upon my past experience with RE.”

Your credibility is gonzo. You drank the Flavor-Aid and went full Realtorbabble. All of your predictions and theories have proven to be fantasies from the lens of a greedy speculator. There’s no coming back from all of that. Might as well post under a different moniker, flimflam man.

Crashier, and maybe the crashiest.

A crush

[ Nod to my friends in New Zealand ]

Most of the home prices should fall much lower than what it was in 2019.

IN 2019, homes were still unaffordable with low rates. Now, the rates are much higher and it means it can fall much below 2019.

I keep hoping for an acceleration of decreasing prices in Florida to get some relief.

Still too many homes that sold in 2020 for $500k listed at $800k+.

You are forgetting about the ten years of crazy before 2020.

Yes – Wolf- I would have liked to see your charts go back to 1995-ish…..

History is taught elsewhere. This article was about the details of what is going on NOW. And you cannot see the details of NOW on a long-term chart.

It’s like every time someone posts a stock chart, and you demand to see it going back to 1995. There may be times when this is appropriate in order to make a point about something long-term, but if you discuss the price fluctuations, what matters is the current and recent data not ancient history.

Also, if you actually look at the article, you will find a separate chart in it for the period leading up to and through Housing Bust 1, for comparison purposes, and its own scale, so you can actually see the details in it.

Monk

In FL myself right now. As Wolf’s article points out – this appears (at least to me) to be a Bay Area phenomenon because of unique employment exodus issues etc – not even a crash yet – but will be in a year or so. From where I am sitting, I see FL and the majority of the country just reverting to the mean 2019(ish) trend line, which is still pretty unaffordable !!

Many neighborhoods in Miami have seen similar drops in prices. Everyone wants to think Florida is different but most likely its just a few months behind. Some neighborhoods in Miami went from 1.4 million down to 800k in just a few months

I have seen two closed ales in Florida this week I was watching where sellers took 20-25% below their ask. Hadn’t seen that in FL yet (one was in Pinellas Co the other in the Keys). Of course the $1.25mm ask was 2x what they paid in 2017-2019 and the seller still made out well at $1mm closing price. Financing going good get tough as more of these comps show up.

I am going to look at something in the Florida sticks on Sunday. The asking price is roughly 50% higher than what was paid in 2017.

I can afford it right now as-is. But simply out of spite, I’m not going to offer more than a couple grand more than they paid in 2017 unless there’s been some serious improvements / upgrades.

If they want to play ball, great. If not, I’ll just wait. As many have stated here… those who panic first, panic best. Applies to housing also. There’s other houses out there…

Wait till the next major hurricane hits Florida. Because of climate change, and the warmer than normal waters in the gulf (+3 degrees) the risk of a major hurricane hitting the Florida from the Gulf has increased 10 fold. Insurance companies hire Meteorologists who have tipped them off to the risks of insuring properties in these high risk areas. A lot of the major companies will stop issuing homeowners insurance period. Smaller ones will go out of business if another catastrophic storm hits the areas. LOL getting paid for your claims.

We have noted a period of persistently transitory disinflation in home prices. Upon reversion to the mean, we might expect a transition to transitory deflation with additional dispopulation leading to equity readjustments at the bound.

Should the California Effect spill over to other parts of the country, it will be given effect by emergent seasonal and geographical considerations toward normalization.

Would SF qualify as an area where residential real estate is experiencing disdeflation?

Negative first and second derivative or some other calculus mumbo jumbo.

No. Just simple DEFLATION as prices start to revert to their mean.

bki, I’m pretty sure this is a riff on Powell-speak, right?? If so, big thumbs-up for you!

My local newspaper had this on 15 February:

‘Home sales decline in the Twin Cities, but prices post modest gains.’

In January 2023, buyers signed 2,650 purchase agreements, 19.3% fewer than in 2022. The median price of all January closings was $342,000, a 2.7% increase over last year.

There were 3,285 new listings during the month, 10.6% fewer than last year. But there are 14.5% more listings at the end of January compared to last year.

In general, it’s a balanced market in the Twin Cities.

That means the bottom of the market is falling out, as Wolf has explained numerous times before. It’s not a good sign.

Actually, it’s a very good sign. It’s what needs to happen broadly across America. The Fed created this asset monster of housing, and now they need to own it by making sure they keep the pedal to the metal with rate increases. Rent & mortgage relief along with ultra low rates bloated the housing market well beyond sustainable levels.

I agree 100%, my apologies I was not clear my commentary was from the perspective of the market and the morons who think getting rich off owning a house is a human right.

Buy now or be priced out forever!

No. The Federal Reserve had nothing to do with that which is 100% the fault of idiot speculative borrowers.

The prairie states didn’t have the crazy run up during the pandemic and aren’t overvalued as much. It’s warm weather states and the interior west, especially ski towns, that went nuts.

Hey, the sun is shining. It’s up to 15 F. Beauty of a day. Time to ride …

Ha ha yes I feel you, I’m in Colorado and it was a balmy -6 F for my morning ski on Wednesday!

The median sales price of a house sold in the United States was $423,600. in the fourth quarter of 2021. The median sales price of a house sold in the United States was $467,700. in the fourth quarter of 2022. This is from the Federal Reserve Economic Data series compiled from Census data.

The number of active listings in the U.S. has fallen from October 2022 – January 2023 according to the most recent data published by the Federal Reserve, taken from realtor.com.

San Francisco was overpriced to begin with and lost out to WFH trends. What will happen next to the broader economy is anyone’s guess. The long term trend in real estate is price appreciation.

“The number of active listings in the U.S. has fallen from October 2022 – January 2023 according to the most recent data published by the Federal Reserve, taken from realtor.com.”

I would think that this is normal for Fall and Winter. Inventory should increase as we approach the end of Winter and beginning of Spring.

There is a record number of homes under construction in buildings with 5 or more units. This pushed the total number of homes under construction into record territory. This might dampen real estate speculation going forward.

This.

I only wish that the sources of this info could tell us which month in 2023 the new inventory will start hitting the mkt (my guess, May…you would think that builders try hard to hit peak renting season).

I’ve been seeing the “record starts” stories for nearly a year now and 12 months seems like enough time for some complexes to get completed.

WFH trends are being blamed in the Bay Area, but what about Boise, which purportedly greatly benefitted from all of those inbound WFHers. Nice crash there. Maybe it has more to do with interest rates, incomes, loose lending, speculation, STRs, and their relation to the price of homes in those cities. Probably the increased rate of crash Wolf mentions is exacerbated by the WFHers, but those prices were going down, one way or another.

The long term trend in real estate is appreciation as much as the long term trend in dollars is debasement.

WHF means you are not trapped within a commute to the office. Hence residential RE speculation and over pricing will get smoked. You could live in Peru if you wanted. People will figure that out and do as they please.

Most markets continued to see accelerated price appreciation from 2021 to 2022 (at least first half of 2022), so comparing those numbers YOY is missing the current picture.

Prices are coming down compared to normal seasonality in most markets now, and we’ll soon see YOY sales prices down significantly across the country – but especially for places like Boise, Phoenix, Las Vegas, Austin, Denver, etc.

Boise is already down 11% YOY.

Forbes article referencing the NAR:

Existing US home sales price June: $414k.

Existing US home sales price December: $367k.

Presumably the difference in prices versus what David reported is: solely existing homes vs. all homes… including new construction.

San Fransico is probably the most extreme market. But here in boring PA the same thing is happening on a smaller scale. From what I read, investors bought large amounts of real estate so it follows they stand to lose the most on paper. We regular folk just stay in our homes and don’t know if we are up or down. So if investors get nervous, they need to sell in an illiquid market. There is a potential credit crisis or mini crisis here as collateral declines. And so is anyone else a little nervous about the big REITS ? Oh like Avalon Bay?

I noticed even the rental market drying up in the Swamp and neighboring suburbs. Last year a Ranch style house in great shape of 1,200 sq foot rented for $4,000/month site unseen. Now as I recently posted, a house next to mine sat unrented for 6 months. I call it the “RENTAL HOME FROM HELL” A new tenant, a single mom, moved in for $2,500/month and the property manager left all the remnants from tree debris in the front yard. She also subletted the street parking to a junkyard dog contractor who doesn’t live there but uses the street to park his gigantic truck which is probably not allowed in his HOA community.

Wha?? Those rent #s are kuh-razy. What sort of maniac would fork over that kinda bread each month to live in any city in FLA?? — the flaccid wang of the country with incurable electile dysfunction and jort-loving wife-beating vulgarians everywhere…

bul – you keep sugar-coating things!

may we all find a better day.

Wait until the tech layoffs start taking effect.

… and for the past decade, all leftist pundits wrote about how everyone wanted to live in a high-priced, high-density, high-taxed city such as San Francisco.

…and, in the words of Master Berra: “…no one goes there anymore, it’s too crowded…”.

may we all find a better day.

Good, sadly 35% down from the peak and housing still wildy unaffordable for most working class.

Even worse in bubblicious areas like LA/OC doesn’t feel like the crash even started yet, at least not from all the shoot for the moon asking price you see on Redfin. From time to time, you still see not so great looking houses sell for a Mil on Zillow. I always wonder if listing can be fake on Redfin or Zillow mark as Sold then find its way back on listing later. I certainly see that with pending and contingent to illicit last of the FOMO buyers..

We need buyer and transactions so that price discovery happens.

I think we need patience to see home prices going down more and more.

I am in San Diego and seeing the impact ( price reductions ) first hand in my neighborhood. I guess, it is ~18% or so from peak.

case schiller index is the one which gives the most accurate pic.

I’m eyeballing golf resort type housing in SoCal SD and OC, still moving like hotcakes, no declines, houses going in a week or two at asking or above.

Yeah, sure, this is the premium market, but still more buyers than sellers and no declines.

Makes me want to look elsewhere but damn I hate the cold and extreme heat, not many places like socal.

hahaha, premium market got hit particularly hard. Activity fizzled. That’s one of the reasons the median price dropped because sales slowed hard at the top, which changed the mix, with fewer high-end homes in the mix, which brings down the median price. Happens every time in a downturn, the reason being that the wealthy are not forced to sell their vacant properties… they can afford to just hang on to them and hope for better times.

Sharper

I thought the same thing – lived in SoCal 16 years but wisely escaped. AZ has a bad rap for its hot summers – but that’s only in the PHX Valley and ONLY during the day (summer nights are beautiful in PHX). As long as you don’t need metropolis, you can get SoCal type weather in many affordable places in AZ (Prescott, Payson, Sedona etc). You just don’t have access to the beach. I went to the beach like 5-6X in my 16 years in So Cal and I was less than an hour away from it. Hiking in AZ is the best – statewide – and mostly free.

Pretty much all the same applies to Vegas (but the gambling backdrop can be annoying). I would like to say the same for ABQ in NM, but spent some time there and it’s not as good of a vibe – and Santa Fe is great but too cold in winter.

A 2 million dollar monster home 1 block from me has been sitting for 2 months with no activity whatsoever. They dropped the price to 1.9 million. Still no action. They leave all the lights on all day and night. Why do these Realtors do that? They must be getting desperate. Who has to pay the electric bill?

I’m seeing a similar phenomenon here in central texas with respect to some of our more esteemed badminton resort communities. Be patient!

BTW — what is a hotcake and why are they the definitive metric for expeditious movement?

The most interesting thing now, for housing, is falling inventory.

As Treasury rates go higher, mortgages are pulled higher. The disconnect between established home owners with low mortgage rates and payments, will continue to make the housing market less liquid.

Sellers are trapped in a feedback loop where if they sell, their cost of living for shelter explodes. That concept fuels a sellers strike, as people become hesitant and reluctant to lower prices. The lack of inventory reenforces the premise that homes can maintain higher valuation.

The fascinating thing, is this feedback loop is like nonlinear rainstorm accumulation, where water run off is contributing to higher levels of aggregate water building up behind a dam.

Interestingly, the same feedback loop is occuring in stocks and bonds, with pressure and risk rising in our biblical economic drama. Everything is fine, with super healthy banks and consumers and everything is priced in, from 6 hour option trading to high valued homes and a massive convergence of excess greed that has no consequences. All is well until the dams break…

One recent CA initiative that passed may help the inventory situation among long time Bay Area homeowners who are otherwise reluctant to sell and move due to higher costs of owning afterwards – the (2020 I think) proposition that allows those over 55 to sell and take their existing tax base with them to their new house (which would otherwise have a much higher new tax rate).

So somebody who pays 3-4k annual property tax on a house they bought 30-40 years ago can move to a much more expensive house, affordable by the equity they gain from selling their existing house, and pay that much still instead of maybe 12-15k per year. This is a big incentive for those on fixed incomes or retirees, and is not just a one time plan, but can be done over and over if desired. That partially addresses those who were unwilling to move previously due to this tax increase, and should open up some inventory as this group of boomers expands. Other distress sales may eventually add to this inventory if the economy continues to struggle.

I have been in the Bay Area for about 40 years, and have seen several RE boom and bust cycles. Enough to know that another will probably come, and buying at the peak of a current one (which is a guess, but can be reasonably guessed with some experience) is folly. The FOMO does get to a lot of people though.

I laid around in waiting my first decade here, saving money by living with roommates and always having my eye on an eventual purchase. That came in a small suburban house walkable to BART for commuting, after 8 years, even though at an 8% interest rate, which I later refinanced lower. The prices then would make people cry today. I doubt I could have afforded much in today’s world though.

Nevertheless, trading up over the years has landed us an ideal house for our situation, a large north bay place with a backyard patio 180 degree view of the bay and open space. I consider myself more lucky than smart in this regard, an accident of when I was born and arrived in California rather than being so clever. I once thought I was too late to ever afford a decent place even in my early days here, but it worked out with some planning and lifestyle sacrifices.

There is no place I’ve been to or lived that I like as well as here (only parts of San Diego county could get me to maybe reconsider that). The regular California bashing on the internet leaves me chuckling, as I’ve lived in a lot of those other places and know the difference. But the dream is much tougher to attain today. I do expect a window from this latest price drawdown – picking the right time, a small place, and a mortgage rate that can hopefully be re-fied lower in the future may work for first time homebuyers. Eventually the market will bottom and rise again if history is a reasonable guide, though I doubt to equal the heights of Spring 2022. Still, there are good reasons people want to live here and be homeowners.

“the (2020 I think) proposition that allows those over 55 to sell and take their existing tax base with them to their new house (which would otherwise have a much higher new tax rate).”

This is age discrimination towards the young. I don’t know how a court of laws could uphold such thing. Further, to allow some oldster to pay a different, lower tax rate than a young family next door is disgusting.

Looks to be support @ 1 million in SF pricing. This support is coming at the spring buying season so it might hold till around June in real time or august with Case-Shiller. The points you bring looks like a Perfect Storm for SF. The cheer leaders ( NAR, Zillow, Redfin ) have been able to hide behind ” Year Over Year ” for these nine months but the worm has turned and the next 6 months will be the worst year over year #s ever! The market wont be declining any faster just the year ago number will be the the last blow-off of the greatest bubble in history.

I am sure the bulls will find some other statistic to hide behind.

Sellers still asking pie in the sky prices in Phoenix with a serious looming water crisis. And corrupt AZ state leaders in bed with dvelopers are hastening the crisis.

Water crisis? In a state that’s supposedly going to be producing a ton of semiconductors sometime in the next few years? Hard to believe, or maybe the state is robbing Paul to pay Peter.

New semiconductor wafer fab sites will be popping up all over the west. TI just announced an additional 300mm wafer fab will be built in Lehi Utah, as well as Dallas TX, Richardson TX, and Sherman TX.

Yeah, note that TI’s announcement for Lehi included stuff about how much more water efficient they’re going to be (and that they’re going to try to get some of that sweet government money)

You need low humidity for a wafer fab so you are correct. You won’t see them in Boston or Miami, they are just too costly or impossible to operate.

Moi,

As compared to arid Taiwan?

What a ridiculous assertion. Global Foundries has fabs in New York and Intel is building one in Columbus. Neither of those are known for their dry heat.

Y’know…water as an essential element to all things living may be a smidge overstated. I haven’t had a glass of water since 1993; I’m doing alright.

Michael Burry said that one of the best investments in the near future will be water. We’re heading for severe draughts across the Southwest USA lasting a decade. People will be killing each other for water rights. See the movie “Chinatown” for a preview of what is to come.

Reminder to everyone that [enter city name] is special and people will just pay more to live there. Pay no mind to this temporary dip in housing prices.

“Not in my area!” – everyone

You see it in every comments section. “My area won’t crash because…..” and it’s always a real estate speculator or somebody who just really doesn’t want to accept that their house price is crashing. It’s called “denial,” and it runs very deep.

That’s the party line in Austin: “Austin is different.”

It’s groan-a-rific, yes — but I think I sometimes wonder how powerful the active ingredient in collective denial might actually prove to be. Kinda like the recession that everyone forgot to RSVP to last year. People do what the want based on personal bias; in a bout of bents vs sense, the former seems always to prevail.

“Living in my parents garage is not too shabby!” – everyone else

Wolf, how does Marin County look in comparison to your big five?

Marin has a small market with a small number of transactions, which cause the median price to be all over the place. So huge caveats about this median price here.

But if you really want to know… the median price collapsed by 43% or by $911,000, from the peak in April, to $1.2 million. This a huge price drop in 9 months, to be taken with a grain of salt. Year-over-year, the price plunged 17%:

Chart for your amusement only:

That chart looks like the charts of a lot of profitless unicorn tech stocks over the last month. Steady uptrend to needle shot around “earnings” and then collapse.

Thank you! Amusing indeed!

That chart is the stuff of nightmares for house horny speculators.

People like to slag kids off for living in their parent’s basement or garage but maybe it’s just a smart move. I’d put my kid up if it meant it gave them a bit more thrust or leverage over the bastards.

Hell (or heck, if you prefer) — it all boils to survival. You’re not lame because you’re not forking over a disproportionate amount of your hard earned money to line the fat little pocket of some greedy passive-income obsessed jackal — er, sorry— mom-n-pop landlord. You’re shrewd.

I say save that bread for when the gravy is good & hot. If that means hiding away in mom-n-dads basement, hey — welcome home.

Searching for my “This too shall pass” badge. The real estate industry needs an enema.

What’s funny is they’re getting one, good and hard. Not only do the lower prices cut into their commissions, but the lack of transaction volume has laid waste to their finances. The NAR should cease to exist. They don’t provide anything useful anymore. There’s literally nothing they do that can’t be handled by buyers, sellers and the title company, cutting them out altogether.

We are members of the NAR. Forced to belong to this corrupt organization. I get their magazine every month. I read a recent issue the other day. I could not find one piece of useful information in the publication. Totally WOKE BS from cover to cover.

According to Wolf’s charts, the current housing bubble is crashing faster than the last. I’m thinking as mortgage rates continue to rise, the crash will start to accelerate even more, especially since there are so many layoffs and people moving out of California.

If you are sick of California, try moving to Maryland. This is the greatest state in the Union. I love it here. We have great traditions, with the likes of ex governor and former VP Spiro Agnew. His photo is hanging in the State House in Annapolis Maryland.

If something goes up 100%, it only needs to crash 50% to get back to where it was before? 35% gone and 15% to go. Pretty soon we will be there.

But I keep hearing people on this blog and elsewhere: “But not in my area, things are still pretty strong here and homes go under contract in a week at asking price.”

Deniers include some folks who live in the bay area.

As for Phoenix, welp, summer is coming, the Airbnb bust is here, and short term pffffft. Again. Lather, rinse, repeat.

The real estate bubble machine is relentless, and the only solution will be another splatter. Now, higher interest rates will take a significant amount of time to fully bite. Now. The stupid instant gratification bunch will once again be blown out of wall street and main street. The pandemic was literally a once in a lifetime event, and the joke that interest rates went to was also part of this.

So, that stupid $1 million mortgage at ridiculously low rates will never be repeated. Sooooooo, now that mortgage will run $7k per month without taxes or insurance… um, well, ok San Fransisco is special, just ignore the fact that you can only rent it out for $5k…….um, well, number don’t lie, but liars make funny figures.

In short, welcome back to a reality that only the old remember well, and it will be a huge shock to the under 40 crowd of living with higher interest rates.

Just think, Casey Serin is back into mortgage origination and real estate….

Wolf, I think if you can find some of your partners to do a finance 401 article on how Black Scholes risk free underlying interest rates underly valuation calculations would be edifying to some of your readers.

It would be very interesting to look at the same charts for average monthly mortgage payment instead of average selling price. That would give us a view from an affordability perspective. I have a feeling the homes are still overpriced when factoring 6-7% mortgage interest rates.

Yes, they are.

If it would highlight anything noteworthy, are there any data to compare “Median Days on the Market” between HB1 and HB2?

They’re no longer comparable. Now everything is electronic and near-instant. The pandemic further sped up tech in real-estate transactions. From the moment you and your agent decide to put your home on the market and the moment it actually appears in the electronic listings for the entire world to see is nearly instantaneous. In the olden days of printed paper listings, it took weeks. Every step in the process took days or weeks. A home doesn’t come off the market until it is pulled or until the sale closes. Now sales can close in days, rather than weeks. So the whole time frame shank. All long-term charts will show you that. So we’re not going back to those old days.

The economic ship doesn’t turn quickly, whether in the Bay Area or the USA. CA is forecast to have a state budget deficit but we don’t see the numbers yet. The May Revise from Sacramento will be key since it will reflect the impact of CA tax returns filed by mid April. So, I would appreciate Wolf’s great work updated in 3-5 months, when the Spring house sales season results become public. But housing is a long term asset that doesn’t move quickly so the Spring trend will likely continue on into 2024 at least. There will be no quick respite for those who need to sell their houses. But there will be plenty of panic.

Fed Reserve is lying while inflating intentionally. Transitory until inflation is so fast they got scared and bumped interest rates until they felt they could control this at a high rate. So now it’ll stay hovering around 6%, slow soft default while they jabber and gaslight about inflation, intentionally pretending they are trying to slow this thing down but not really. Instead of defaulting on the people responsible for this, they are defaulting on the poor, while equities take less of a beating than cash in the long run.

I no longer have faith in the fed reserve to do what is necessary to bring the rates down to 2%. We will be at high inflation for a long time until there are riots before they move high enough on interest rates to bring this inflation back to 2%. They are just slowing it down so the masses can get used to high inflation and blame it on Ukraine war or whatever…

I am considering buying a home late this year or next anyway, because although I believe that housing should and will come down and what is happening is wrong, I don’t actually believe it will come down enough to be worth the wait due to Fed manipulation… no bargains like in 2008. No hard crash. Fed may squirm and do whatever they can to avoid actually legitimately tackling inflation.

I should have bought stocks in March 2020 and a house in 2020. We may never get back to those levels. San Francisco aside, due to its already inflated market, tech layoffs, exodus, and WFH. Maybe I should buy a hotel in SF for all those having to fly in from Boise or wherever for their 1 day in the office… Still cheaper than owning a home in SF…

World is changed forever in so many ways. Jerome Powell will go down in history as an invertebrate and he won’t care. Should have figured this out once they were saying transitory. We all knew it was a lie…

Hoping this crash accelerates. If it does, I’ll be relieved and wait it out. Its very frustrating watching the Fed slow walk this.

Having been thru 2007-2011 (the gold standard in collapses) this one, so far, is happening faster. Patience.

Will the FED ever do this again? (Cutting rates near zero for a decade, QE, etc. )

Stepping back, for perspective, it’s interesting thinking about the big picture with housing and stock performance.

I sold my house in June and I can look back at the process or changes during a twenty year period, the process of wealth accumulation.

My house was bought as a place to live, with an emphasis on security and future value (appreciation).

Looking at the economy today versus then, I’m much more tuned into the excessive gamification of the housing market. This is a generational and demographic, Darwinist evolution.

A young person might dismiss this, but shelter used to be more about living in a house for the sole purpose of living life, versus engaging in speculative risk.

One doesn’t need to examine the Great Depression or Savings and Loan Crisis to realize there is risk in being over leveraged. However, I think this era, with its demographic mix that includes a strong presence by people around thirty, who are being exposed to innovative new financial processes that are adding higher levels of risk into the economy.

The gamification of housing, equities and obviously crypto, is linked to a modern society that grew up in atmosphere of unprecedented radical technological evolution.

These new players on the economic chess board are disconnected from prior, traditional rules and behavior, reinventing societies, as if there’s been a destabilizing post war transition.

As many crypto gods falter, their ashes have already morphed into the new Pegasus of ChatGpT excellence, where they no longer need to think, because, AI is their very own Jim Jones, offering fresh, invigorating kool aid wisdom.

With that backdrop, it’s easy to understand how a person like Powell has lost total credibility and how the Fed and all economic data is increasingly disconnected from reality. That lack of economic focus and direction, the failures of economic religion and successes of speculative nonsense, are fueling economic insanity.

The housing bubble globally or San Francisco is irrelevant, because this ubiquitous gamification of betting on a house, betting on 401ks, betting with 0dte, betting on rate hikes, rate cuts and FOMO on every aspect of life is like a hurricane spinning chaotically towards landfall.

Everyone is working so hard to outthink everyone and continually find an edge for greater leverage, so they can have more than anyone else. Instead of Rome burning, it’s like entire world is in a super cycle of self destruction.

I started out thinking of poker, but we do seem to be in a period of excessive stupidity.

“Basically David Sklansky described the different levels of thinking in poker, and the idea is, that to win, you should always be thinking one level higher than your opponent.”

Interesting observation, thanks!

Makes sense to me.

“My house was bought as a place to live, with an emphasis on security and future value (appreciation).”

Prior to the past 25 years, houses only increased in value at the rate of inflation. They are actually an expense – a big ticket consumption item – when you factor in maintenance, repair and taxes. The carrying costs of houses are massive, and they are illiquid. Once the bust sets in, some houses never find a buyer and sit for 5 years+.

Dr D

“The gamification of housing, equities and obviously crypto, is linked to a modern society that grew up in atmosphere of unprecedented radical technological evolution.”

They all grew up in an atmosphere of no fair return on savings, in an era of people doing anything to get a fair return on their money. Scrambling and taking great risks to do so. This led to housing speculation, buy stocks (you can’t lose), and crypto.

It is generational, and most young people just want a home to live in – not an investment. Who owns the vast majority of real estate in the Bay Area (for that matter, in this country) – it isn’t young people. Who has an outsized voice in preventing housing from being built, thereby restricting housing options for prospective new home owners? Existing home owners (especially in places like CA with a a very heavy NIMBY presence that can shut down almost any project) – and existing home owners are generally not young.

It is generational, agreed.

“Other key points from C.A.R.’s January 2023 resale housing report include:

At the regional level, all major regions recorded year-over-year sales drops of more than one-third. The Central Valley dropped the most of all regions at -43.3 percent as eight of the 12 counties in the region registered sales drops of more than 40 percent year-over-year in January. Southern California (-41.1 percent) was another region in the state with a drop of over 40 percent, followed by the Far North (-39.6 percent), the San Francisco Bay Area (-36.9 percent), and the Central Coast (-35.1 percent).”

I suppose if you’re one of the few TESLA owners now living out of your car you can always get a portable ICE generator to keep the batteries charged while enjoying the winter of love in Golden Gate Park or the roadside American graffiti in Modesto.

Interesting tidbit unearthed in random rabbit hole:

““In some ways, 2023 is reminiscent of 2020, when the world’s economies shut down because of the pandemic and no one had a clue where we were headed,” Hackett Associates Founder Ben Hackett said. “Cargo volumes are down, and the economy is in a contradiction of rising employment and wages that promise prosperity at the same time high inflation and rising interest rates threaten a recession. The economy is far from shut down, but the degree of uncertainty is very similar.”

That seems to be supportive of slower housing speculation and adds in more hesitation, waiting for hurricane. Self fulfilling?

Excuse me but how does home prices down 30% yoy and oil price down >20% yoy chime with inflation?

Home prices (asset prices) don’t enter into measures of consumer price inflation, such as CPI. Rent factors are big in CPI.

Crude oil prices do not enter into consumer price inflation directly either, because consumers don’t buy crude oil. But via gasoline prices, and via various indirect ways (transportation services, goods produced with plastics, etc.).

Gasoline prices were up 1.5% in January from January last year (not “down > 20%”)

SF is the poster child for overpriced housing and isn’t quite representative of the rest of the country. I’ll probably catch hell for saying this, but with the exception of places like Tampa in FL and Austin in TX, prices are down, but not crashing like CA.

CA is (or was) full of newly minted tech millionaires and billionaires, overpaid employees of zombie companies and money losing IPO’s, crypto bros, asian flight capital and just plain old speculators and gamblers posing as investors who fought each other for overpriced houses in a high tax, high crime, high density, high traffic, wildfire prone, low water, low service state.

What took everyone so long to figure out there are a lot better, less expensive, high quality places to live? The exodus will only accelerate and prices there will continue to crumble.

Unfortunately, single family homes have become just another speculative tech stock, with every dip or rip overanalyzed to death, just like the stock market.

REAL real estate investment is a long game based on steady rental income, positive cash flow and careful use of leverage. It’s a great way to create a lot of wealth and tax benefits over time. It’s NOT a commodity to be traded like stock futures, watching every tick up or down in price.

Housing in all of usa went up like crazy because of cheap money.

The opposite would happen when the cheap money goes away.

I know as human we are susceptible to think we are special, our place is more insulated and this time is different.

Hi Wolf. This sentence:

“During Housing Bust 1, which started in the Bay Area in mid-2007, the median price plunged by 59% in 21 months, from May 2007 ($789,250) through February 2009 ($321,110), when it hit bottom.”

…doesn’t seem to agree with the corresponding graph, which appears to show the peak as July 2006 and the trough as April 2008.

Chart is now fixed (do hard refresh in your browser if you don’t get the fixed chart). Excel peculiarity related to when timelines start.

Wolf,