Workers still leveraging this historically tight labor market, but a little more cautiously?

By Wolf Richter for WOLF STREET.

We’re going to look at two different data sets released today that show from different perspectives how tight the labor market still is, how much power has shifted from employers to workers, how much job-hopping and churn is still going on, and that the tech layoffs are still not large compared to the gigantic overall labor force, and that most of the laid-off people are getting quickly absorbed by other companies, including by non-tech companies that employ armies of tech workers, such as automakers, industrial companies, oil and gas companies, etc. These companies have gotten outcompeted for tech talent by the lavish compensation packages offered by tech companies. And those non-tech companies are now hoping for better access to the tech labor pool.

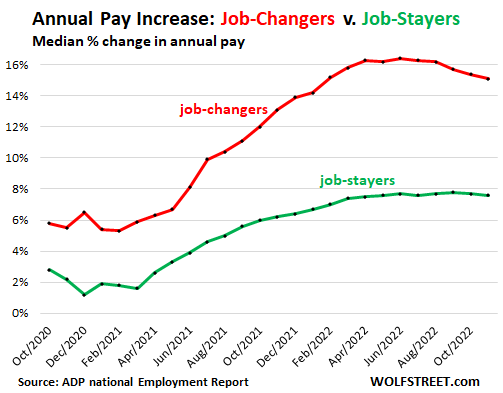

The reason for the still huge amount of job-hopping and churn is the promise of the greener grass on the other side of the fence, despite large pay increases for people who stayed.

And the grass is still greener, a sign of aggressive recruiting by employers. The median annual pay of workers who changed jobs increased by 15.1% in November; while for workers who stayed in their jobs, it increased by 7.6%, according to the ADP National Employment Report today. But this huge pay increase for job hoppers was down by about 1 percentage point from the 16%-plus range earlier this year – a sign that perhaps a little more caution has entered into the hiring equation.

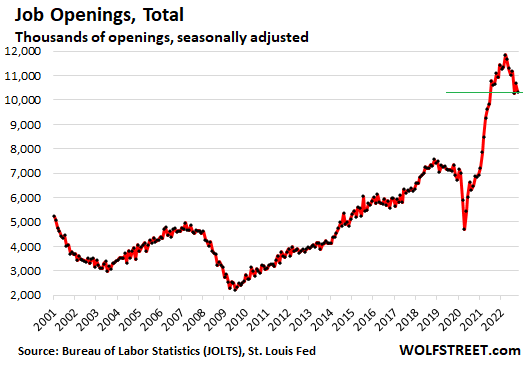

Fed Chair Jerome Powell in his speech today dedicated considerable time describing the issues of the still far too tight labor market – including the still huge number of job openings and just how little cooling was actually visible.

He was referring to the Job Openings and Labor Turnover Survey (JOLTS), released by the Bureau of Labor Statistics today, based on what 21,000 businesses said about the number of job openings they have, the number of people they actually hired, the number of people they laid off, the number of people who quit, etc.

Job openings fell by 353,000 in October, undoing some but not all of the gains in the prior month. At 10.33 million, job openings in October were still higher than in August, and were still up by 3 million, or by 41%, from October 2019.

While they remain in the astronomical zone, they have come down by about 1.5 million from the peak in March 2022 – and this includes a portion in the tech sector where the layoffs have been, as we’ll see in a moment.

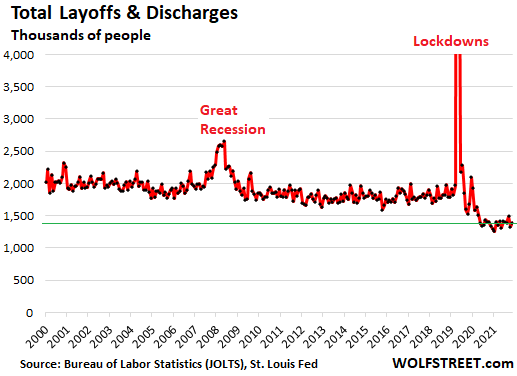

Layoffs & discharges rose by 58,000 in October, after having fallen more than that in September, and were still lower than in August. Employers reported that they laid off and discharged for whatever reasons 1.39 million employees, and while that sounds like a lot, it is historically low in the huge work force in the US, and down by 23% from October 2019, which had already been a tight labor market:

Laid-off workers were quickly rehired.

Most people that were laid off found new jobs quickly in this sea of job openings, and we see this everywhere, including in the actual number of people who filed for unemployment insurance with their state unemployment offices.

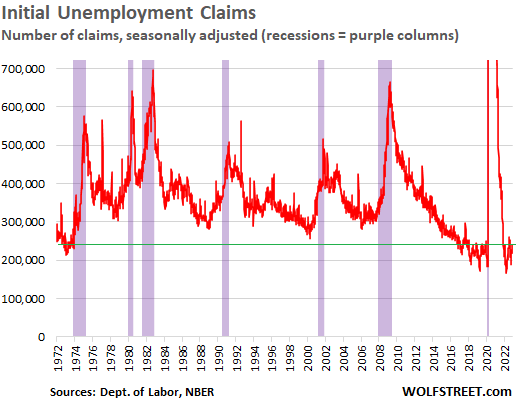

The number of initial claims for unemployment insurance, at 240,000 last Thursday, was up from prior weeks, but was still below where it had been in August and July, and was in the same low range where it has been all year, and historically low.

In other words, most of the people who were laid off found a job so quickly or already had a new job lined up that they didn’t file for unemployment compensation.

When looking back at the past decades, we can see that the number of initial unemployment claims would have to rise well above the 300,000-mark before the labor market begins to soften meaningfully:

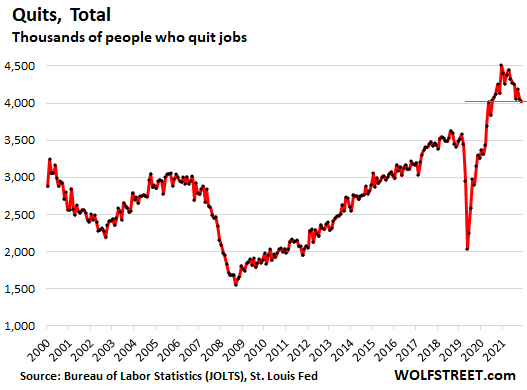

Voluntary “quits” dipped for the second month in a row, to 4.03 million, the lowest since May 2021, a sign that employees are getting a little more cautious about riding the job-hopping train, and perhaps a sign that some job openings to hop into have vanished.

But the number of quits is still historically high, up by 18% from three years ago, and still far higher than at any time begore 2021, a sign that workers are still arbitraging the labor market in large numbers to increase their pay – and they did increase their pay as the ADP data above for job changers shows:

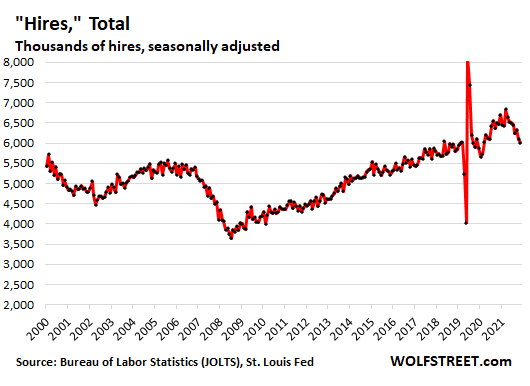

The number of new hires fell for the second month in a row, to 6.01 million people in October – but still up by 4% from three years ago, and higher than any month before the pandemic. Hiring is still handicapped by the tight labor market, the difficulties in actually being able to hire people away from other employers.

Most of the 1.39 million people who were laid off and most of the 4.03 million people who voluntarily “quit” became part of the 6.01 million people who were hired by other employers.

Job openings in major industry categories.

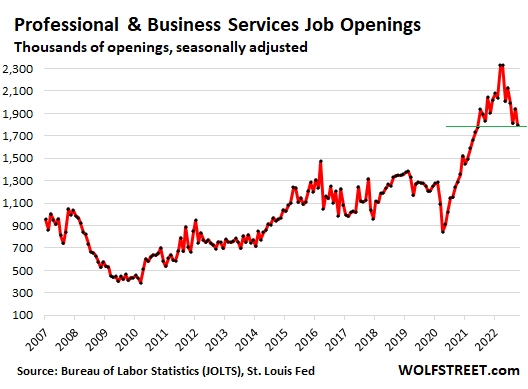

Professional and business services, a big category with 22.4 million employees in Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

This is where part of the tech jobs are, and where part of the tech layoffs have occurred.

- Job openings: -146,000 to 1.79 million, lowest since May 2021, but still very high

- From 3 years ago: +49%

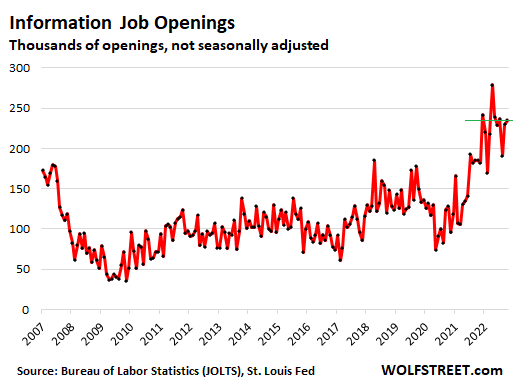

Information, a small category with 3 million employees in web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

This is also where some of the tech layoffs have been. But job openings have risen over the past two months!

- Job openings: +5,000 to 235,000, very high, still screaming labor shortage!

- From three years ago: +57%

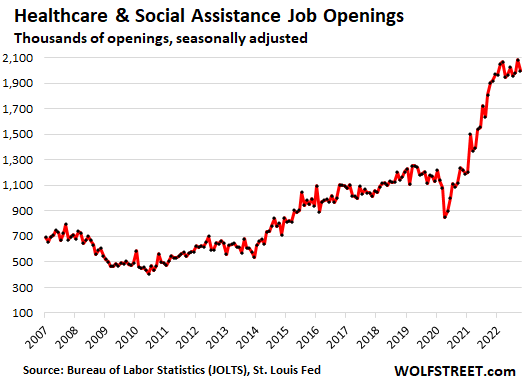

Healthcare and social assistance, a large category with about 21 million employees: job openings dipped from the record in September, amid continued staffing shortages:

- Job openings: -86,000 from record in the prior month, to 2. 0 million

- From three years ago: +69%

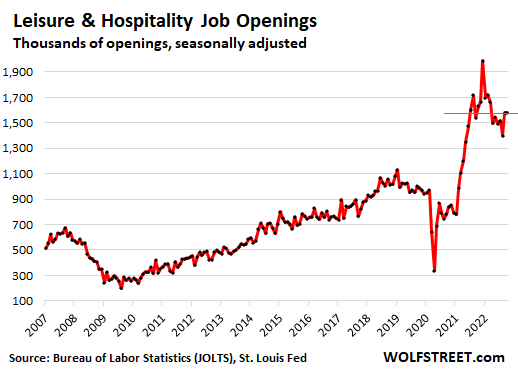

Leisure and hospitality, with about 16 million employees, with restaurants and hotels still struggling with staff shortages:

- Job openings: unchanged at 1.58 million

- From three years ago: +59%

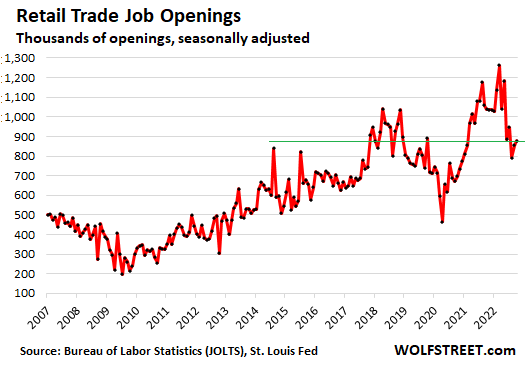

Retail trade, with about 16 million employees, has now normalized in terms of job openings. This is the only sector where job openings are now roughly back where they were before the pandemic.

- Job openings: +24,000 to 879,000

- From three years ago: -1%.

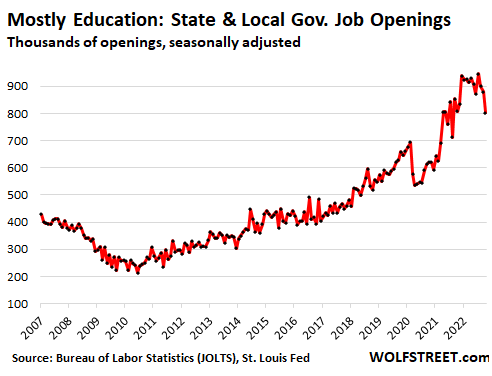

Education – as indicated by state & local government job openings, most of which are in education. The teacher shortage seems to be abating a little:

- Job openings: -78,000, third month in a row of declines, to 802,000 openings, the lowest since March 2021

- From three years ago: +22%

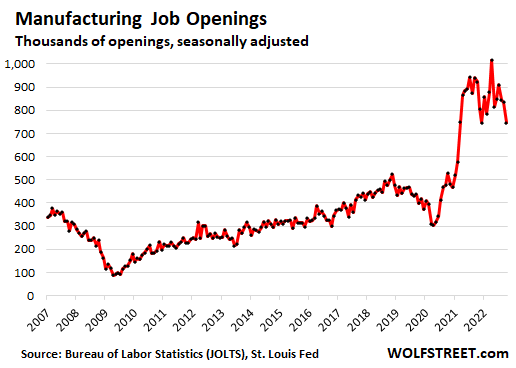

Manufacturing, with about 13 million employees:

- Job openings: -89,000, third month in a row of declines, to 746,000, lowest since December 2021, but still very high, and speaking of a labor shortage

- From three years ago: +87%!!!

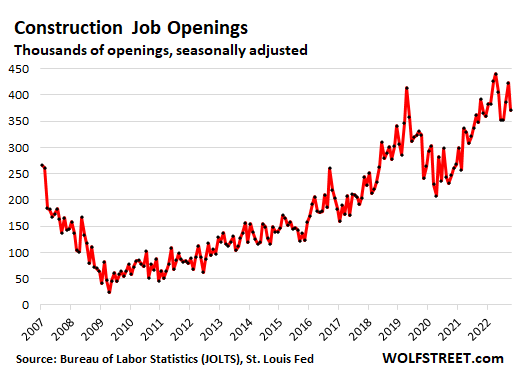

Construction, with about 8 million employees, in all types of construction:

- Job openings: +52,000 to 371,000

- From three years ago: +15%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Take this job and shove it. I ain’t workin’ here no more!

Shocked this is still the only ironic account I see on here. Keep up the funny content dude I doesn’t go unnoticed.

Anyways, I just split with my large tech based company(who just started hiring freezes) to another tech based company. 50% pay increase with much better benefits. I work in corporate finance and it seems like the market has only been heating up for what I do, with that said they’re excited for me to come in and reduce the need for ancillary roles, aka cuts. So the hatches are being tightened down but not for everyone. I will try and sway C levels to move those folks into roles more suited for their skill sets but in this age there are no guarantees. It’s every millennial/Gen Z/Gen X for themselves out there. Save yer money kids.

Seriously?? Did you just log in to celebrate yourself for having a skillset worthy of a 50% pay bump??

This subject does not concern you.

That’s not even the largest increase I’ve heard of. The bigger ones are in sales and BI. Hell even a sibling of mine just made a huge move up in a totally different field. Point I’m trying to make for the younger folks on here is don’t be discouraged by doom and gloom, get you resume out there and capitalize on this strange job market. If my dumbass can do it, so can many others.

He didn’t say what he was making before; not so dramatic a swing if you’re pumping gas or buffing plates and move up to a professional vocation. Happens often. Plus, local minimum wages are shooting up all over, which probably helps shim things a bit. It’s $20 an hour here in Austin.

The only instance I can recall of someone who was already a skilled professional who realized a comparable compensation increase with one hop and no readily discernible additae valorem was a contract lawyer I know who went partner. And I believe that was overall compensation—not take home. But then I’m just a doof saying stuff on the internet, too.

Anonymity on the web ensures a blank check for hyperbole & hyper-gratuitous rounding errors. If it sounds too good to be true…but like the guy said — it’s a weird economy. So hell — maybe…

Stock prices are down a lot amongst tech companies ( as Wolf has documented) so changing jobs and repricing RSU’s moght be his 50%.

I cant post in your lower comment, you are saying companies are looking for BI? I dont have a finance degree, but I am great with Power BI and SAP.

Do you think that will matter?

PBI and SAP will go a long way. Add in some SQL and you’ll get interviews with BI teams, most if not all of the BI team at my last company didn’t have finance degrees. Half my old team didn’t either, we had backgrounds ranging from ops to financial crime analysis. Most reporting outside accounting closes delt with sales reporting anyways, just counting widgets. Polish up the resume and get it out there.

We’re both long retired “tech” workers. And we STILL get phone calls/texts/emails from recruiters on a weekly basis. They are literally scraping the bottom of the barrel for any warm body that knows which end of the “mouse” to click.

And we’re not unique. Our friends and acquaintances who were “techies” say the same thing.

I’m not actively looking but I still get emails from recruiters a few times a week. It’s startups I’ve never heard of or some “fortune 500 client I can’t name” rather than Facebook or Amazon. I’d guess established companies or small ones that scored their funding already and are trying to staff up. OTOH my current employer just said not to expect much of an increase this year so they’re gambling that people are comfortable enough. It looks like the jobs are there but the mix is changing. It’s slowed down some but there is definitely still hiring pressure.

I sense a bit of gilding here. In my experience, recruiters have never been a gateway to any opportunities I’d give a second look at. And while hopping around might yield a bump, if you’re somewhere with a good team or good culture, good history, stable protocols, it can prove a miserable trade-off. It’s all situational, but hopping & bopping isn’t as easy as it’s a being presented nor is it a panacea.

If you had to pick one, Wolf, which is worse, a tight labor market giving qualified folks more bargaining power on the job, or low interest rates inflating the prices on good, services, and financial assets?

There seems to be some sort of trade off.

False choice. Big tech companies and big companies in general have always offered massive compensation packages, glitzy offices, LOL, big-name-career-builder entries for your resume, and fringe benefits that were hard to compete with for a small to medium-size company. We had to offer higher pay than they, in addition to good health insurance, 401ks, etc., to attract good people because we couldn’t offer the other items on the checklist, such as big name recognition, glitzy offices, business class travel to exotic training locations, etc..

Not having enough qualified employees is an ancient problem. But at the same time, the business has to be able to not only survive, but thrive, or else eventually it’s over. When 60% of your expenses are payroll related expenses, you cannot afford to pay whatever, unless you can charge whatever for your products. This is also an ancient issue.

But when I did this, interest rates on commercial loans where at 7% at the low end and at 16% at the high end, and it worked fine. It made you sharp and focused, and it made you think more clearly about investments and borrowing and taking on debt, and that’s a good thing. A lot of the executives today cut their teeth in the era of free money, and now free money has ended, and they need to learn the ropes.

Life in business is full of hard trade-offs. Free money has covered them up artificially and has thereby caused a lot of issues that are now coming out.

For most or all of the 21st century (at least), tech companies have had an advantage with bubble caused artificially cheap cost of capital which later until recently was essentially free.

It’s easy to outcompete the competition for talent in the labor market with this advantage.

Historically high federal spending, coupled with historically low federal tax rates, coupled with historic QE, coupled with a decade of interest rate repression, coupled with unprecedented pandemic response (stimmies, PPP, enhanced unemployment, student loan pause, etc.). A little bit of 401k and housing pullback has happened; however, there’s never been a better time to be an employee. Good luck, J. Powell, at trying to end this party.

I may have missed it But seen No Mention of Construction Workers being laid off ( A good thing ) because when that happens then the rest of the Job Market will Follow .

When you see that ( Construction Workers gone ) all hell is going to brake loose. For a True Economist not some J Powell or some mirror image look alike to correct simply a task unobtainable in any short run . The 40 Years mentioned by Wolf of downsides not seen comes to mind .

Mass Construction Worker lay off’s of course is coming of course with no avoidance . 7 % / 8 % mortgages with Inflation Set paints a Bleak

Horizon with no short term correction. Fasten Seat Belts and pass the Prozac and make that a double Dose for Powell remembering the 50 Million reasons

My experience tells me you have it backwards. Construction (not just housing) is usually toward the tail end of layoffs caused by a slowing economy. That is because most projects have been in the pipeline for 18 months or so. First you have financing and planning, then engineering, then permitting and other regulatory hurdles, then bidding and procurement and finally the construction work. When the rest of the economy is tanking (layoffs abound) we typically remain busy for another six months before the bottom drops out. I would often watch the Realtors. When they start crying the blues, it is time to start battening down the hatches.

Construction is binary. Housing construction usually leads us into a recession – presumably a sensitivity to Fed rate increases. An extreme example here is when housing peaked in 2005, and the rest of the economy went down in 2008 and didn’t get called a recession until 2009. Usually you don’t have a lending bubble that delinks the timing so severely.

Large construction projects, as dave jr notes, are a lagging indicator. And lagging by a lot. I work in the large construction area. We generally can stay employed for up to 2 years after everything else has gone down the tubes: 2010 was a great year – 2011 not so much. The extreme example is when you get school districts building high schools (very long lead time) at the same time as they are laying off teachers.

WSJ noted that capital spending by corporations is up. To the extent that this is large construction projects, that would indicate very late business cycle.

It is amazing that hawkish comments from 3 members of FOMC including Mr. Bullard recently is in stark contrast what Mr. Powell said today.

Just like before, he really wanted to be hawkish but perceived and ended up as ‘dovish’ ( slowing the rate in Dec and possible pause in early ’23) The mkts are calling him as bluff and zoomed up.

Proves he is NO Mr. Volcker but more like Mr. Burns. He has lost his credibility, again!

Have you read the speech notes? No Dove there,not even a ChickenHawk. No pivot, algo driven Dow response,and MSM vacant cerebrum nonsense.

His Q&A was incredibly dovish. It more than squashed the written speech. I encourage you to watch the entire Q&A. It speaks volumes vs the transcript.

JeffD,

For you anything the Fed does or says is dovish. As soon as you see it or hear it, and even if you don’t hear it and don’t see it, it’s dovish. There are lots of people like that. It doesn’t matter what Powell says, it’s dovish because it has to fit into their pre-set scenario.

You’te right, and me and everyone else who heard different are wrong. That’s why long treasury yields plummeted, and mortgage rates fell by 100 basis points. The wisdom of crowds is just a meaningless falsehood.

“The wisdom of crowds is just a meaningless falsehood.”

Wiser words were never spoken. That idiotic “wisdom of crowds” drove the 10-year Treasury yield BELOW 0.5% in mid-2020. This was totally braindead stupid, but it was the “wisdom of crowds” — and the moron who bought those 10-years at the time, believing this idiocy of crowds, lost a ton of money.

The crypto implosion the same thing — the wisdom of crowds. It’s everywhere. There is nothing stupider than a crowd.

Nothing has changed, same plan he laid out a long time ago. Markets rally on pushed narratives. This dovish narrative the algorithms push, yes it’s all wired together, comes around every couple months to rally the markets to dump on more ignorant people such as yourself.

I listened to his entire speech as well as the Q&A afterwards. It can be found at “Brookings Institution” on the tube. What has changed is he went from tough talk and “the risk of doing too little outweighs the risk of doing too much” to slowing rate hikes and “we don’t want to overtighten.” THAT’S the “pivot” in his speech and demeanor, and all that was needed to set markets on fire.

Sure, he said “there’s a lot more work to be done,” blah, blah, blah, but then he was busy showing that inflation would be coming down next year with his fancy charts and crap. He’s Arthur Burns Redux. This guy says a lot but does very little. QT is so paltry it is having zero effect. Part of Powell’s job is to manage expectations, and that means tough talk to get markets to behave. Powell has set fire to the biggest speculative mania in the history of the world, and he just dropped another zephyr on it with his wimpy speech.

Did you miss the parts in the last year where he consistently said a soft landing is possible? His goal was never to crash the economy. He has said there will be pain, higher unemployment, etc but never said anything about crashing the economy.

I mean you can cherry pick words to fuel your pivot narrative all you want, but the same plan he laid out a long time ago with rates and QT is in full swing, not a single thing had changed, not even people cherry picking words from his speech to fuel the pivot narrative, you guys show up after every single speech. And yet the rate hikes and QT continue on.

I can cherry pick from his speech as well.

“cutting rates is not something I want to do anytime soon”

Depth charge

“we don’t want to overtighten.” THAT’S the “pivot”

SPOT ON!

With the power of perception, front running has become almost daily ritual in the mkt these days.

Any even of hint of ‘slow down, will review future rate increase or any modified versions of pause, is just enough to ignite speculative burst from the front running crowd.

It is all above the Fed’s future rate policy and NOTHING else, just it has been like since ’09.

Fundamentals and the reality means absolutely NOTHING!

I strongly suspect this will be repeated quite often in the coming weeks, including highly anticipated ‘Santa’ rally.

All b/c of lack of credibility at the Fed lead by Mr. Powell talking ‘hakish/dovish’ with forked tongue. It is a sad commentary b/c no one learned from GFC!

“Fundamentals and the reality means absolutely NOTHING!“. Ah! That’s the beauty of markets! There’s a hefty dose of sales and marketing going on, exactly as in 2008-9. Every statistic is massaged to make the retail investor comfortable and completely oblivious of economic reality. Which is why Wolf is beyond useful. What’s actually going on? That’s indispensable information.

John

Think when was the last time Fed started buying MBSs and Corporate bonds before March of ’09? Same with QEs and ZRP at near zero?

When was the last time Fed suspended ‘ mkt to mkt accounting standard? Banks and Corps can assess the real value as they imagine and nothing to do with current value in the open mkt.

Under the Crony/Predatory capitalism any thing can be justified.

A good job market with low unemployment rates allows the Fed to keep hiking!

A truly twisted labor market…

So last year at Amazon, they were offering all sorts of bonuses to drivers to get them to stay on through the holidays. Hourly bonuses, OT, etc.

This year, nothing is being offered to current drivers.

Amazon did throw out a $3,000 bonus offer for new hire drivers that complete all required shifts/requirements and make its through the holidays…. So, I guess if you could entice a buddy to work for them through the holidays, you could potentially, share the bonus or something?

It never seems like there is a shortage of drivers at Amazon as there are always new faces. Apparently my DSP is short 10 drivers and the entire facility is short around 30 – 40 drivers. Amazon is bringing in drivers from other regions in an attempt to make up for the short fall.

Things get more bizarre…

I am in the process of moving to a new place. One of my new roommates, tells me that he works for Amazon at a different facility where they deliver the big box items and that he works for Amazon, not a DSP like I do. My new roommate tells me, he is going to quit as they owe him over $1,000 dollars and that payroll has no idea what is going on. It sounded to me like Amazon goes through so many employees that payroll can’t keep up with what is going on at the shit show with the big smile!

The dept. of labor to the rescue?

With the turnover rate at Amazon, starring them in the face, the cowardly turds at the dept of labor do nothing as they wait to retire!

Oh wait, they do go after the small little DSP’s and require to see one thing. That I clock a 30 minute lunch break, not take a lunch break, mind you, just clock it!

That is your tax dollars at work!

@GeorgeW

Shit show sounds about right. Forbes had an article on October 24 about turnover and chaos at Amazon. Their average annual employee turnover is 150%. Amazon tracks this – they turn over about 3% per week. Estimated cost of all this turnover is estimated at $8B annually. In some of their more remote warehouses, the churn is so bad that there’s physically no one left in the area who WOULD work at Amazon, that hasn’t already and been chewed up.

Three things to remember:

1. Fed interest rate policy has a lag. Let’s round it off to 8 months. It really hasn’t had time to bite.

2. Coming off of zero, first 2% of raises aren’t going to do much, but much higher than that hurts.

3. Layoffs are the last railcar to run off the bridge. Economic bottom is being put in when the layoffs get going.

Regarding job hopping, I’ve found that a nice 15-20% pay bump gets eliminated over time. The employer forks over the increased pay initially to attract you, but then they quickly reduce future raises (relative to the existing workforce) so that the benefit of the bump is completely removed in 3-5 years.

Companies have pay ranges to maintain, and they stick to them. This is also why a lot of companies try to entice candidates with one-time hiring bonuses, as opposed to increased salary.

Nothing hurts morale worse than people getting paid different amounts for the same job.

Nothing hurts morale worse than people *finding out* they are paid different amounts for the same job.

That’s why you job hop every 2-3 years. Each new job is a bump up to a higher pay range. If you get lazy and just sit tight, you fall behind with those small annual raises. As you said.

My father taught me this long ago.

Wow, I do that too the hard part is making them believe their job is a career and the past employers are not your fault. Over my lifetime working I have 6x my pay vs 2%.

1 in 5 MIA are caregivers. Hats off to those who are sacrificing to take care of parents or child with ongoing health issues. Many finding out that there is no pot of golf at the end of the American dream of debt and despair. Reality of the high turnover paper chase is that someone left in the company with the most experience ends up overburdened, shouldering all the day responsibilities even after the hired guns, I like to call them Seagulls…..swoop in and shit on everything and abruptly leave.

Looking at all of these charts it occurs to me that it would be an impossibility for all of these positions to be filled. Or is this an illusion because there is a massive number of people who just aren’t looking for work? But at what point does their “not looking” simply become “never looking”?

The more I think about it, the harder it becomes to make any sense of it, let alone the apparent disconnect between equity valuations and earnings in a rising rate environment on top of it all.

So I’m still sitting on a pile of cash, waiting for the crash that never comes …

It still amazes me to see the numbers on job sectors.

Only 13 million manufacturing jobs in the U.S.

But over 22 millionaires in the U.S.

Talk about the land of milk and honey. We don’t produce squat but still getting richer.

The US is the second largest manufacturer in the world, after China, and way ahead of any other country, and most of that actual manufacturing work is done by machines. Automation is HUGE. And the people that work in manufacturing in the US are skilled and there are lots of tech jobs in manufacturing, requiring engineering degrees. It’s not 1900 anymore.

Wolf – think it’s generally agreed it isn’t 1900 anymore (though certain parties might welcome that – highly recommend Tuchman’s ‘The Proud Tower’), but I continue to encounter a lot of my contemporaries who are fixated around 1955…

As always, not enough thanks to you for your tireless, stellar efforts…

may we all find a better day.

@91B20

Thanks for the recommendation. That’s an era I’ve always been interested in. The world would have been so different if the very flimsy chains leading to war had been cut at any of the dozens of opportunities.

Thrill-as long as we’re reading Tuchman, you might follow with her earlier (publication, not historically) ‘The Guns of August’ (not our Mr. Frost) and her much later ‘The March of Folly’ for dessert…

Best to you, and-

may we all find a better day.

“But over 22 millionaires in the U.S.”

If inflation keeps chugging along at anything close to its current rate, then everyone under 40 will become a millionaire if they live until retirement age.

They may round off the price of a loaf of bread to the nearest ten dollars because our money will be next to worthless, but hey it sure will sound nice to hear everyone declare themselves to be millionaires.

Isn’t the average cost of a house in San Francisco already well over a million dollars? That would have been unfathomable to my parents when they paid ~$25,000 for a house in 1973. Back then a million dollars would buy you ~40 ‘starter’ homes in most small towns.

Since the Fed rigged the ‘rules of game’ after March of ’09, any one thinking logically got slapped on his/her face, with financial repression.

If the November inflation rate comes below 7.77 expect another rally. Unless it goes above 8% again, Fed will remain passively dovish.

Does any one believe Mr. Powell wants to tank the mkts before X-mas/New year!?

Mkts remain disconnected with the Economy on the ground

Culprit: Ill thought out monetary policies of the Federal Reserve accountable only to 15 mega global banks who own it. Rest is hogwash.