It’s not that mortgages are bad, it’s that mortgage volume collapsed. And the stocks of the biggest mortgage lenders collapsed after IPO or SPAC merger.

By Wolf Richter for WOLF STREET.

The latest entry in the long litany of mortgage-lender layoffs is Citibank, which let go some people in its mortgage unit. Well Fargo, JPMorgan Chase, and numerous other banks, along with the non-bank mortgage lenders, have laid off staff starting late last year.

The biggest mortgage lenders aren’t banks. They’re nonbanks: Rocket Companies (owns Quicken Loans), United Wholesale Mortgage (owns United Shore Financial), and LoanDepot have cut their staff by thousands of people. LoanDepot also exited its wholesale business. AI-powered mortgage lender startup Better.com became infamous when its CEO mass-fired people via Zoom, which was followed by more layoffs. Some mortgage lenders have filed for bankruptcy. Others have shut down.

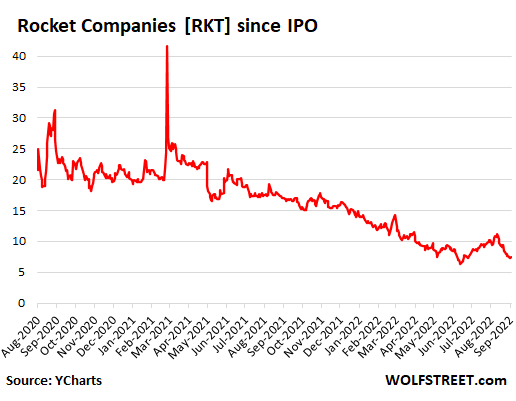

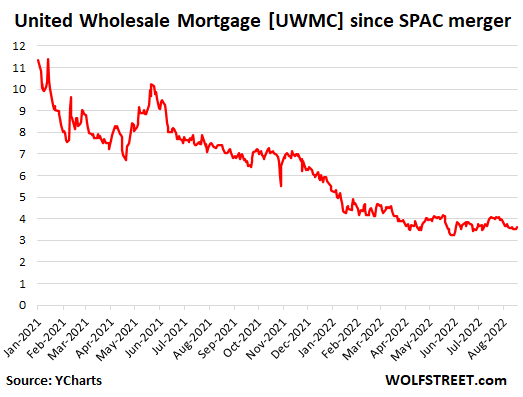

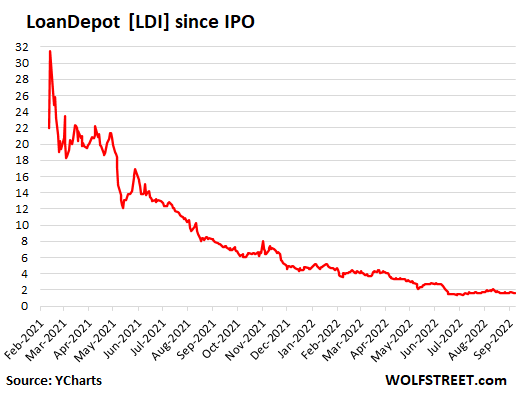

The stocks of the three biggest mortgage lenders have collapsed: Rocket Companies by 82%, United Wholesale Mortgage by 75%, and LoanDepot by 95%. All three went public either via IPO or via merger with a SPAC during the housing mania over the past two years amid immense hype and hoopla. All three have been inducted into my Imploded Stocks.

But mortgage lenders are not getting in trouble because homeowners are suddenly defaulting on their mortgages or whatever.

They’re getting in trouble because their revenues have collapsed because mortgage origination has collapsed, particularly refinance mortgages, where origination has collapsed to 22-year lows because few homeowners are going to refinance an old 3% mortgage with a new 6% mortgage, unless they have to in order to draw cash out, and that can be done more cheaply with a HELOC.

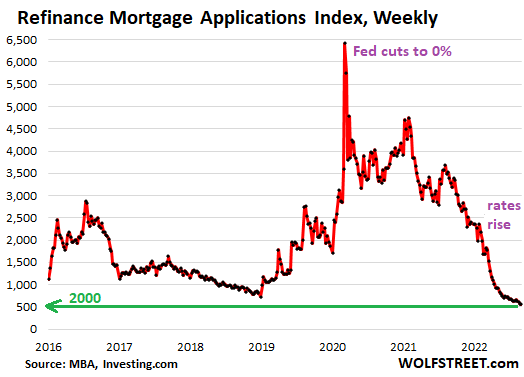

Applications for mortgages to refinance an existing mortgage fell by 1% in the latest week, having collapsed by 83% from a year ago, to the lowest level in 22 years, according to the Mortgage Bankers Association’s weekly Refinance Mortgage Applications Index, released today:

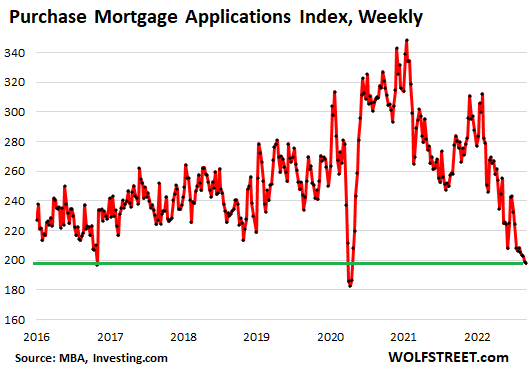

Applications for mortgages to purchase a home dropped by 3% in the latest week, as the newly returned 6% mortgage rates put a further damper on home purchasing activity. The MBA’s Mortgage Purchase Index has now plunged by 23% from a year ago and is approaching the lows during the April 2020 lockdowns:

The plunge in applications for purchase mortgages has for months shown up in home sales: Sales of new houses plunged by 30% year-over-year in July; and sales of existing homes plunged by 20%.

But it’s not mortgages that are going bad…

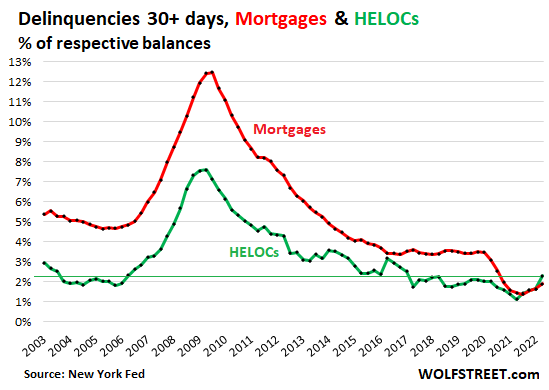

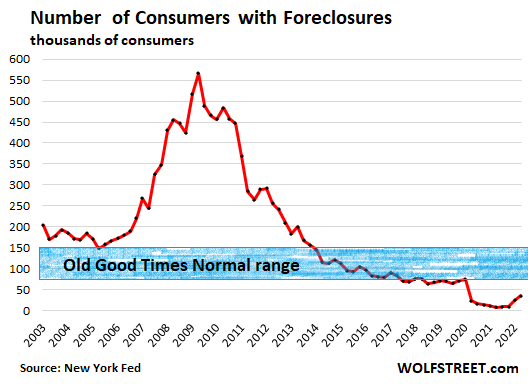

The mortgages that are outstanding have been holding up well. Delinquencies and foreclosures have started to tick up, but from the super record lows during the era of forbearance, when delinquent mortgages were moved into forbearance programs where homeowners didn’t have to make payments, and their mortgage was no longer considered delinquent.

The spike in home prices since spring 2020 allowed homeowners to exit forbearance in various ways, including by selling the home, paying off the mortgage, and walking away with extra cash. But the forbearance programs are being phased out.

So mortgage delinquencies have started their trip back to normal: Mortgage balances that were 30 days or more delinquent ticked up to 1.9% of total mortgage balances in Q2 but remain well below the lows of the Good Times (red line).

Foreclosures have also started to tick up but are still far below any of the prior lows before the pandemic:

For mortgage lenders: A collapse in revenues from mortgage origination.

The three largest mortgage lenders are nonbanks; they hold the mortgages they originate for only short periods of time, until they have enough mortgages together to sell them to Fannie Mae, Freddy Mac, the VA, Ginnie Mae, etc., which then securitize the mortgages and sell them to investors as MBS. These mortgage lenders, by not keeping mortgages on their balance sheet for long, slough off the credit risk to the buyers of their mortgages (and ultimately to taxpayers that guarantee many of these mortgages).

But during the period that mortgage lenders hold the mortgages, they’re exposed to the risk that mortgage rates spike, causing the value of the mortgage that has a lower interest rate to decline. This isn’t normally a big issue, but it was a big issue this spring when mortgage rates spiked by historic amounts in weeks, causing some losses among mortgage lenders.

These losses came just as revenues collapsed. Nonbank mortgage lenders get their revenues from net interest income (small portion of total revenues), gains on origination and sales of mortgages, origination income, servicing fees, etc.

At Rocket Companies, which surpassed Wells Fargo years ago as the largest mortgage lender – revenues collapsed by 48% in Q2, to $1.39 billion.

The company went public via IPO during the housing mania in August 2020 at $18 a share. Its shares [RKT] have collapsed by 82% from their high in March 2021, and by 59% from their IPO price, to $7.54 (data via YCharts):

United Wholesale Mortgage underwrites and provides closing documentation for mortgages originated by brokers, small banks, and credit unions. Its loan origination volume plunged by 51% in Q2 compared to a year ago.

It went public via merger with a SPAC. The merger closed in January 2021. The SPAC’s shares peaked after the announcement but before the merger closed, with an intraday high on December 28, 2020, of $14.38. From that high in December 2020, shares have collapsed by 75%. The chart only goes back to the date of the completion of the merger, to the first day the shares traded under their new ticker [UWMC]. From the closing high on that day, shares have plunged by 68%, to $3.61 (data via YCharts):

At LoanDepot, revenues in Q2 collapsed by 60% from a year ago, to $308 million, generating an astounding net loss of $223 million, compared to a net profit of $26 million in Q2 2021.

The company went public via IPO in February 2021 at $14 a share. During the first two days, shares performed a spectacular hype-and-hoopla “pop” intraday to $39.85, and then collapsed by 95% from that high, and by 88% from the IPO price, to $1.66 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

These folks made a lot of easy money when the policies of the federal government were driving house prices to the stratosphere, so I can’t feel too sorry for them when the situation reverses. As an aside, I wonder whether this crazy housing market would be a bit less crazy if the federal government exited the mortgage-guarantee business.

“Government is not the solution to our problem, government is the problem.”

Uttered over 41 years ago and still so true.

“Government is not the solution to our problem, government is the problem.”

That’s what happens when corporatists corrupt government.

The real truth of the matter is, as you and I know, that a financial element in the larger centers has owned the government of the U.S. ever since the days of Andrew Jackson. So far as the billionaire class is concerned the purpose of the government is to give subsidies, provide them with a scapegoat, and look the other way when they evade taxes.

Civil government, so far as it is instituted for the security of property, is in reality instituted for the defense of the rich against the poor, or of those who have some property against those who have none at all.

– Adam Smith, Wealth of Nations, V, 1, ii.

Unamused, I don’t disagree, so it baffles me why you still carry the water for a political party that in the last twenty years has morphed from being a party that claimed it was for the working man, into a party that was like it’s opposition across the aisle from it: bought and paid for by the corporatists on Wall Street.

Cb is not cb

I read, probably here that the US backstops 75% of all residential first mortgages. No Moral hazard. The EU socialized health care, we socialized mortgages…

We socialize banks.

I think you mean that we socialize bank risk and bank losses. The profit they get to keep.

well when USSA economy only produces financial paper

what do you expect

1% still doing fine

Brilliant insight into govt subsidization… I thought the market was created to beef up the banks’ hegemony of mortgages as a new cornerstone for more national system stability for the bank lending channel. Interesting that it ultimately creates a high-demand platform for a wall street trading tranche as a financial commodity. Your insight is simple and elegant

No going to happen. Looking at Wolf’s 30+ delinquencies chart, the point that mortgage forbearance returns will be somewhere in the 6-7% range. To get there, unemployment will have to move up close to Larry Summers’ recent 6% prediction. Will we actually get to that level of a recession? That’s hard to say. But, I don’t see it happening over the next 12 months. With the right black swan event; however, we could see unemployment approaching 6% by late 2023.

Most swans are white. Draught, flooding and war may crash the market for food internationally. With national debt payment crash shortly after as countries either choose to buy food instead of servicing debt. Or stop servicing debt after social unrest have thrown them into chaos.

Large flooding, wildfires, technical breakdowns and the like in a country is no black swan either. They happen ever now and then.

I agree with you. There will be numerous (many) sovereign defaults coming up, whether commodity prices are the proximate cause or not. Many countries are over leveraged, and any meaningful economic “slowdown” will push them over the edge. Many have been on the edge for years.

I think US safe haven flows from abroad are becoming evident, holding up the US dollar and stocks so;mewhat, for example. No idea what that might mean for house prices.

Re plheep, well those US dollars flowing to a safe haven is just returning. That is, those US dollars are issued as debt in the USA.

Anything that stop the outflow of US dollars from the USA also stop the inflow. To continue the game, new debt must be issued. The prospect of that with mass defaults may be limited.

I am shocked to see gambling has been going on in this establishment!

A different flavor of 2008, a much more classic housing slump. I can hardly wait.

Meanwhile, draw down your HELOC while the funds are still available….

Credit crunch on deck for next year starting for all B credit companies and people.

A rated people (800 plus) will still have access to more expensive money.

When you can get a 5 year CD from your local bank, normalized finance will be delivered by the Fed.

So many comments have desired a return to tighter money, now buckle up.

Oh yeah, C rated foreign markets will splatter. Dollar denominated debt? Toxic waste….

We are all subprime now!

Be careful what you wish for. That toxic dollar denominated foreign debt could easily blow up the entire world economy.

This may very well happen. The number of countries that are fiscally insolvent is much larger than publicly acknowledged. With Th EU trying to figure out what to do with larger messes like Italy and Spain, the PIGS are going to run under the wire until it’s too late. Again.

Failed countries, like zombie businesses, are, sooner or later, going to have to be held accountable. And that’s going to be a whole lot of “pain”.

20 billion in Russian gas creates 2 trillion of German economic activity and the PIGS are the problem? Who is leveraged?

House: the Russian gas didn’t create German wealth, it was an input to German- created wealth. Something that Russia, with the gas, is unable to do. There are no Russian consumer products outside Russia. Oddly, it isn’t even self- sufficient in oil and gas tech.

(See all the news about the Siemens gas compressors. These are ‘aero- derived’ built by RR who sold the div to Siemens. Why can’t Russia build them?)

Yes, the absence of the gas as a result of the largest war in Europe since WWII is now a problem. How does Germany, the elephant of the ‘frugal five’ continue to bailout the PIGS, and their bloated dis-functional public sectors?

On paper the EU owes the Bundesbank a trillion euros.

Mr. House

“Who is leveraged?”

Energy companies, Utilities ( supporting Banks) in Europe.

1.5 Trillion of derivative based on the value 20 Billion gas from Russia

1. Read an article 7 or 8 years ago saying to be careful investing in Rocket Mortgage because the business model was risky.

2. County zoning needs to adapt to current reality of home affordability being at worse level ever and come up with more solutions for bottom 50% of income owners. Demographics are different than 50 years ago.

Risky!? How could planning for exponential growth in a cyclical industry possibly go wrong…

HollyDawg-wasn’t it assumed it would be different this time?

may we all find a better day.

” How could planning for exponential growth in a cyclical industry possibly go wrong…”

That’s the definition of a ponzi scheme, a practice approved by the same USSC justices, preferred by corporate conservatives, who legalized bribery and fraud, justices who quite naturally assume no financial or criminal liability.

Yep. California’s zoning ridiculousness creates huge problems. Zoning is designed to create artificial shortages and thus high prices.

Ccat-ain’t nothin’ ‘artificial’ about water resources in the West. Water from out of the locality has fueled the bulk of CA’s massive development since WWII…

may we all find a better day.

Has the spread between HELOC and Mortgages rates ever looked like this?

There is less than a .5% difference right now between here is money to buy a house (mortgage) + here is cash to do whatever you want with it (HELOC).

The era of free money and cheap money has passed. Those of us following this site for a while have commented several times that nobody with a 3% or less loan would have any desire to refinance. It’ll take a lot of down pressure on the market to get these folks to stop making payments so these loans will likely never see a refi. These houses will become rentals when people decide to upgrade and likely not get sold for a long long time. They’ll be some HELOCs and such but nothing meaningful from this market share for a while. Loan agents will be doubly hit by this downturn as well as the fact that a robot can do most of what they do. Anymore, a real estate site combined with a virtual loan assistant will put a lot of the real estate sector out of business. Escrow companies will be needed for much longer but in the short term they’ll be laying off folks really soon, too. Nothing good is on the horizon.

Not everyone has the luxury of buying a new home while renting the old one. I believe the vast majority of people are forced to sell, for job change or whatever other reason. Consider the fact that if people buy a new home, it will carry a mortgage rate of 6%+.

His scenario isn’t going to happen at any scale. All prices are set at the margin, including housing. It doesn’t take that much incremental supply to send prices much lower, especially with a return to more normal rates.

The primary reason I believe housing prices won’t crash even worse than 2008 this time (at least any time soon) is because I expect more mortgage forbearance and foreclosure moratoriums.

The economic fundamentals are worse than 2006 and the housing bubble is bigger or much bigger, depending upon the market. So, by any sensible expectation, the bust should also be, except due to government efforts to keep housing as expensive as possible for as long as possible.

That’s what “affordable housing” actually means. For most, a chance to become a debt serf where the buyer can “afford” the monthly payment, as long nothing goes badly wrong in their life.

> All prices are set at the margin ….

> That’s what “affordable housing” actually means. For most, a chance to become a debt serf …

That is the current marginal value of (relative to an advanced modern economy) serf-level labor. Many humans cannot carry their weight economically, competing with bots, etc., while juggling feature-bloat car payments, etc. CA will legislate fast food pay at $22/hour meaning lock in inflation, or rather hand off the jobs to bots. I certainly will not subsidize any aspect of that slippery slope (including its contribution to runaway health care costs with the slop they sell as food) in any way, shape or form. It is an entropy machine running hot. I don’t see how it all pencils out.

phleep-ah,the conundrum-‘efficiency’ (automation,bots, etc.) pay no taxes, the exploded human community that used to on more-prosperous pay scales, but now ‘can’t carry their weight’, not disappearing fast enough from the global equation. the pencil is reaching stub proportions, indeed…

may we all find a better day.

I am sort of in your camp on forbearance. The Gov and the fed would like to see speculation in housing drop but they do not want salt of the earth middle and lower class people to lose their homes in a recession.

Those will be targeted for forbearance by the Gov but Wallstreet will lobby congressman and will get some type of deal too. LOL

” For most, a chance to become a debt serf where the buyer can “afford” the monthly payment, as long nothing goes badly wrong in their life.”

The solution proposed to fix this was Communism. It didn’t fix it. Primarily due to human greed and laziness.

Capitalism allows us all to be debt serfs where we can barely afford the mortgage/taxes/insurance OR barely afford rent(which includes taxes and insurance along with a profit to the land Lord).

Of course we can refuse to play the game and live alone in a handmade leather tent eating homegrown vegetables and fruit. It would be hard to post here without spending money.

I disagree in one respect. Take Europe for example. I think because of debt and low growth the maximum real short term rate in the longer term is around minus 1%. In the US it’s pretty close to zero.

Nominal rates may run high, but real rates are probably going to continue falling due to multiple factors. Fed might try to keep nominal growth above 4% which might mean inflation might run above 2% because real growth trend is sub 2%.

Cheap money will return. Fed Rates will rise, inflation will start to come down, the stock market and housing pricing will decline, the recession will hit, and people will lose their jobs. Then, the Fed will lower rate once again to start the cycle over. Cheap money will return and refinancing will be begin again.

So inflation hasn’t even begun to abate and you’re already talking about future inflation. Got it.

Why would someone want to rent a home for 3k a month (with costs of 2K a month) when the value is falling 10k a month? We just need to have a good 6-12 months of constant downward pressure. People always look in the rearview mirror for their clues on future prices and when all they see are upward trends, they think real estate is worth far more than it is. Let them see falling prices and demand will dry up and supply will rise.

Investment supply-demand curves just dont act like regular supply-demand curves.

With today’s regulatory environment, I don’t know if this is still even possible, but my grandfather did something interesting back in the 50s.

He provided mortgages (slightly undercutting banks) out of his own pocket.

This was when a new atomic facility was built nearby. The influx of people with guaranteed decent incomes was huge. He never had one single default. He helped out many people and made good money doing it.

My pockets ain’t deep enough to do that. But, it makes think about current times. There’s always something going on somewhere that’s going to provide (pretty much guaranteed) for folks somewhere. They might have to move, but they will.

If you know where that place is, and you have the money, it could be quite the opportunity.

That said, there’s still the current day issue that RE is way overvalued. Big monkey wrench there.

Nevertheless, there’s always an opportunity hiding in bad times.

People with enough money to buy multiple houses don’t get into the lending business; they get into the landlording business.

This is definitely somewhat more-true now than it was in the 1950s. Nationwide, computerized, oligopolized credit ratings are a huge part of that. Renters were a risk, but a mortgagee can’t abscond with the land.

Back then, your “credit rating” amounted to taking off your hat and convincing grandpa that you were a God-fearing family man — and that you verifiably had a job at the boom boom plant.

In the mostly stable financial environment of the 1950’s, what you describe made some sense.

In today’s environment, it doesn’t. Anyone taking long-term paper at fixed rates after the credit cycle likely bottomed in 20202 on a grossly overpriced asset (housing) is likely to find themselves in one of the following situations:

Holding it to maturity to avoid selling it at a loss due to spiking rates.

Getting ravaged by inflation which will almost certainly noticeably exceed current mortgage rates many years from now.

Foreclosing on deeply distressed collateral underwritten at bubble level prices.

The more likely outcome is that anyone who tries your suggestion will temporarily receive above market rates (versus short term options) and lose big later.

Hard money loans are available to house flippers.

I can see using a lease option over 30 years. Pay me every month on time and I’ll give you this house. If not, even one month late and you must leave and I keep the money.

Well, best of luck to you, but I hope the good Lord never entrusts you with too much money.

Your indoctrination has failed.

There is no such thing as too much money.

The Rent-to-Own agreement is nothing new. Scum-bag landlords aren’t either.

Not to let scum-bag tenants off the hook either.

Long term lease with immediate surrender upon default in the far distant past was called a vive-gage, Latin for a live hand (holding onto the land) rather than a mort-gage, dead hand. Or so I’ve read.

I don’t think it will work as described. There’s a saying in the law: equity abhors a forfeiture. That’s why so many procedures and chances to cure have been developed in the foreclosure process. If the outcome looks particularly egregious, courts will likely interpret the contract to allow the lessor a chance to cure.

Lessee a chance to cure.

Most private loans these days are 5 years, 15 years tops. Mostly to investors and also to people buying homes which can’t pass any bank inspection, or land. They were at 10% last I checked, probably higher now. Banks are at 11% for personal loans. At least in my area.

It’s fairly common (or used to be) in my area for people to buy a fixer with a large down and a private loan which gets transferred into a mortgage or equity loan when it is able to pass bank inspection. The private loan is often a killer as it’s short term compared to mortgages.

Lending hard money to RE investors who can’t get loans for rental property is very profitable since the interest rates are naturally higher than bank rates for a primary home.

One of the features of the Dodd Frank Act was to limit the amount of private lending that can be done to homeowners. Subject to a small exception, (there is an exception for one per year or three per year under different circumstances) all homeowner lenders have to be “Loan originators” and the loans have to be fully amortizing and meet the same underwriting criteria.

With that said, an individual can do 1 to 3 seller carry backs per year and they do not have to be fully amortizing. (a balloon in 5 years for example)

” Hard Money” is generally focused on non owner occupied property and it is does not have the restrictions for underwriting and terms.

For the companies they did not creat the process or the Fed. Mtg brokers know their business is just a few interest rates hike from being eliminated which happened and I assume eyes wide open during the reckless Fed days.

I still think a lot of the housing pain won’t be distributed but will be centered in the cities highlighted by many of Wolf’s Atticus’s of the inflated housing prices the last 2-3 years. Interest rates from the Feds now have a Canadian model to pursue but are reluctant to lead the race in QT. Sept has the 95 billion to roll off!

What ever happened to Network Capitol Funding, located right in Wolf’s back door of Irving California??? . They were on the air on our local station here for 7 years on Sat at 1PM. Suddenly, they were replaced by some stupid talk show garbage.

“For whom the Bell Tolls” That is not the case today. Current borrowers, on average, owe just 42% of their home’s value on both first and second mortgages. It is the lowest leverage on record. Losing some value on paper shouldn’t affect those owners at all. (Early Adapters took Advantage of QE)

There are, however, about 275,000 borrowers who would fall underwater if their homes were to lose 5% of their current value. More than 80% of those borrowers purchased their homes in the first six months of this year, which was the top of the market. (Late Arrivals to the Dance). All good things come to end. Can’t get blood from a turnip. Nobody’s lining up for the 6.5% all you can eat mortgage buffet. Seem more and more lining up for QE haircut and shave special….

I’d argue that most home prices will drop 5% by the end of this year in most markets (in the USA). Inflationary periods run years, not months; something a huge majority of the population has little experience with. I expect housing prices will drop for a minimum of two years, possibly longer, depending on where the prime rate goes.

I’d also point out that expecting the Fed to stop raising rates at 6% is a pipe dream. If this inflationary cycle lasts another 2-3 years, which is very possible, we may again see the double digit prime rate.

The issue in this market is not over-supply, but under-demand. Huge gap that will get even wider with mortgage rates increasing again. The smartest sellers will get out now, or as soon as possible.

Be first out the door in a falling asset. Incomes dont support monthly payments with home prices and current mortgage rates. That is all you need to know.

I agree. We sold our condo in Bozeman MT two months ago. Made a quick 50% profit after only owning for 2 years. We are currently renting in Southern California…not saying renting is great, but a crash in America is just starting. You can see it in many cities right now. The only people believing home values will keep going up are homeowners and real estate agents. Values will fall back to 2020 levels. I think we get back to that level by end of 2023.

But those rosy numbers you bring up are based on the highly inflated home prices of the housing bubble, and as home values drop (as they must, if the US economy is to be saved from these runaway asset bubbles) then a huge portion of that equity disappears, and things don’t look so good for majority of US homeowners. This kind of “all is fine” reasoning just comes off as another version of the “this time is different”. No it really isn’t as far as basic economic relationships, if anything the excesses are so much bigger with the current everything bubble that the crash is going to be much more severe and widespread.

The last 75 years have literally been The Age Of Inflation. A relative bought a house in San Marino, CA, in 1975 for $57k cash…..at the time, no bargain. Prop 13 grandfathered in minimal pty tax increases. Zillow Zestimate is now $3.2 million. No matter when you buy in the real estate cycle, if you pay cash and hold the RE long term, you will have a roof over your head and inflation proof your wealth. Bonds, bills, and CDs are sucker bets with actual inflation far exceeding any return. Buy RE with cash, live in it, enjoy it, never ever mortgage it, and hold on to it if you can…..it sure beats a blue tarp or a tent.

Timing is everything

Zillow estimate 😀

A lot of readers come here for good insights, unfortunately your comment is not one. It is simply insane for majority of people to not leverage the bank when the *real* interest rate is negative. Specially more in real-estate tax friendly countries (most 1st World countries), where you can apply deductions/amortizations on 100% of your house value, and not only on your down payment.

Bingo. Why would i pay off a 3% mortgage with money currently earning 6-10% in bonds and dividends?

Negative real rates are a time to get leveraged and buy hard assets.

Stephen,

Agreed, better to buy a bond that AFTER TAX exceeds the rate you are paying on your mortgage after tax. Money is currently not earning 6-8% in anything remotely low risk, though.

For those who don’t have mortgages, it’s trickier. You have to borrow when rates are low, then make otherwise unnecessary interest payments until, hopefully, you see bond yields then rise high enough to more than cover your interest payments, AFTER TAX.

I used caps here because knocking 40% of the interest out via tax means you need one helluva change in yields. Even in this whack environment mortgages bottomed at, what, 3%? Call it 2.25% effective after you deduct the max $750k’s worth of interest. Well, after a strong dose of rate increases by the Fed, 30 year bonds are yielding a whopping….3.5% (rounding up) which is 2.5% or so after tax. So you still lose.

Not saying it can’t be done, just that you need some luck from the market* to push rates far enough for you.

* There is no market, as everyone here knows.

@Gattopardo

This is why I love midstream MLP’s. As stable a high yield as is possible. Certain names were yielding 12%+ during March 2020 crash when we went whole-hog into them. Today’s buyer can’t expect to realize the same type of return due to unit price increases since then. But we play long games around here.

I have an uncle that bought $25k of farmland in Illinois 25 years ago that is now worth $500k

Wolf-probably not germane, or achievable, here, given the vast number of contributing factors, but do you consider a best (if any) method(s) for comparing U$dollar-value of a given earlier year versus the present (maybe -1 year for data consolidation)?

may we all find a better day.

Detroit, Cleveland, Buffalo, Newark, Camden, East St Louis, Trenton, Youngstown, Flint, etc. enter the chat.

This is good advice, with one small caveat.

I rather like owing fixed-rate 3% against a hard asset in an era of 10% inflation. Seems like a damn good deal to me.

I could pay off my mortgage tomorrow, but why do that? That cash is earning 6-10% in bonds and highly stable dividend-producing infrastructure equity. Why would I ever surrender such a positive carry? The bank is paying me 3% to live in my own home.

“That cash is earning 6-10% in bonds and highly stable dividend-producing infrastructure equity.”

Sadly, I am not making that yet. Not safely. My parents did during the last inflationary period with 15% government insured savings accounts and bonds.

I am waiting and ready to dive in to the safe end of the pool for 10-30 years.

With 10 year TBills at currently at 3.3%, and a 3% mortgage, it is getting closer but still a loss with taxes. Even more of a loss with inflation but when stocks/bonds are going negative and inflation is rising, 3.3% is better than burying cash or gold in a mattress.

You have to go further into the risk profile. Treasuries won’t get you there.

My preferred vehicle is midstream MLP’s. We were able to buy at great distribution yields in 2020. I think our best tranch ended up around 12%. The unit prices have appreciated since then. Today’s buyer can’t get those sorts of numbers in the same space.

Stable and predictable cash flows, sound management, strong track records. Vital to the continued existence of modern life. And tax advantaged.

Cash-flowing physical infrastructure.

What a crazy world for the Fed! CPI still above 8%, EFFR still below 2.5%. The stock market shooting up, making the Fed want to tighten harder, while the mortgage market, the lifeblood of the economy, is collapsing and making the Fed want to ease. Meanwhile, other Central banks are hiking 0.75%, so the Fed feels compelled to hike 0.75% at its next meeting to cover them. They might switch to the magic eight ball as a monetary tool.

It will be a Bizarro World for awhile, thanks to the long lead-up of interest rate suppression, marbled into all kinds of prices and assets. It has gone, I think, nonlinear. So even the Fed may wind up with its goals and tools moving around like the mischievous dancing croquet hoops of Lewis Carroll. Fighting the Fed might begin to make sense, as stock markets have been testing.

As usual, phleep, a very interesting and creative image: the marbling of interest rates into the economy. But I’m picturing the marbling of fat in meat, and on the other hand, the marbling of chocolate in a coffee cake. Don’t know which is worse?

Is it my imagination but airfare has been falling?

Round trip from my city to NY is usually $250 to $300. in October i can find round trip tickets at $160 to $200.

Maybe it is just the time of year?

October is a pretty slow time in NYC (assuming NYC).

Foreign tourists flock there in the summer and Broadway really doesn’t start up until later in the fall. Thanksgiving and Christmas are always crowded.

From my experience, April and October have always been the cheapest months to fly, especially long-haul/intl. I used to live “between” two countries for almost 5 years, flying back and forth every month or so. I think my record was a $279 round trip direct flight from NYC to Moscow, Russia back some time in 2014 or 2013. Never seen that kind of price again lately (even before Covid, let alone now after Ukraine).

There are many factors in play. Maybe pent up travel budgets have been played out? This, along with sky high hotel and restaurant prices, could be driving demand for flights lower. And the airlines were having problems ramping up over the summer – this may also have been resolved. Increased capacity, lower demand, fuel costs stabilizing or even lowering.

I work for a private real estate investment company and we’ve had a moratorium on leasing office space to mortgage brokers for the past 12 years. In my boss’s words ‘they’re the first ones to throw the keys at you’ when their business slows down. Suffice to say the default rate is much higher on average than other small office tenants ie CPAs, Lawyers, Psychiatrists, etc.

“All three have been inducted into my Imploded Stocks.”

How about ‘Imploded Stocks Hall of Shame’?

;)

Nice crayon coloring technique.

Quick question for Wolf and anyone else here who might know:

If I have a mortgage through one of the lenders mentioned in this article, and they go ker splatttt and end up bankrupt and dissolving into fat, tears and recriminations, what happens to my mortgage?

TBH, I like our mortgage company a lot. Their site is easy to navigate, and its way easy to make extra payment s on principle. I’m truly concerned about them being swallowed up by some corporate monster run by folks who would boil their grandmothers for glue if it made their stock options go up a quarter of a point

If somebody buys your loan receivable, they buy it. It is the ancient respected legal device of assigning a contract (receivable). It’s not up to you. But they cannot materially change your contract. How they administer and interpret, within the contract’s terms, could vary some, but there are limits proscribed the contract itself (and any applicable legal limitations on them).

Pablo,

Mortgages are income-producing assets, backed by collateral. And they get sold routinely. Your mortgage has likely already been sold, and your “mortgage company” is just the servicer that takes your payments and forwards them to the entity that turned your mortgage into a MBS. Your mortgage company earns a fee from servicing your mortgage. If it gets liquidated in bankruptcy court, some other servicer will end up buying its servicing business. Throughout, you will just keep making payments. At some point, they may inform you to change the recipient of the payments. You do have to pay attention during this process to make sure that the mortgage payments go through.

phleep and Wolf, thank you to you both. It’s not much of a house, but we live here, and I’ve already chopped off 12 years in the space of eight. As long as no one gets in the way of me paying extra on principle every month, and being done with this mortgage waaaaaaaaaaaaaaaaaaaaaaaayy before 30 years are up, I’m okily dokily with that !!

Were you thinking that if the mortgage company goes broke, your mortgage is null and void? No such luck.

I refi’d a loan with Loan Depot and pay them every month.

When I looked at the Freddie Mac website, they actually own my loan.

Loan Depot is actually my loan servicer. They collect my payments, send me statements, send my tax forms.

Freddie probably bundled it up into an MBS.

I may be indirectly paying the Fed for my house.

Loan Depot likely takes a cut for doing all of the collection/documentation work. I don’t know what % the Fed is actually making on my loan with Loan Depot and Freddie as the middlemen skimming their cuts.

I worked in subprime & prime on both conforming and non-conforming in mid 2000s, and after seeing the nonsense that went on I swore off ever being involved in mortgage industry again, no matter the role. Fact that people are being laid off and stock is plummeting just confirms my inherent bias against this joke of a business. Furthermore, I have no sympathy for those who purchased shares of these organizations.

Mike P. from Rockledge?

Toto Wolff and Michael Masi

With better loans we see lower delinquencies/defaults, as evidenced in the article, however from my point of view, I think much more pain is coming… (*)

As a former employee, in the mortgage line-of-business, for one of the Big Banks mentioned in the articles opening paragraph, hopefully I can add a few more insights that may help in projecting a future default trend-line. My experience began in July 2004.

As we know, the appetite for anything and everything “mortgage’ was insatiable leading up to 2008 causing underwriting guidelines to only, more-or-less, require a pulse and an appendage that could operate a pen.

Due to Dodd-Frank (or so I was told), the underwriting pendulum swung from that extreme all the way to the other.

Full income verification, reserves requirements (mostly for non-agency), strict debt-to-income limits, full appraisals, etc., was the norm. Basically, nothing was “stated’. Everything was verified.

Essentially, the free-for-all had ended, and one had to…brace yourself…qualify. Further, if an applicant could not receive a conditional approval via Fannie, Freddie, Ginnie, or the non-agency desktop underwriting platform it was a usually a full-stop. Sometimes co-signors, gift funds, or other compensating factors could provide the missing piece. Occasionally the bank would make exceptions for customers with $1M+ on deposit (in house) and keep those unsalable loans on the books.

I’m sure the community here is aware of this; however, I wanted to provide a quick review and lay down a little context, just in case.

This has been the standard (outside of the HARP programs) from roughly 2011 until I left the bank in 2019.

(*)…due to:

Debt-To-Income Ratio (DTI)

It was common, for me, to see people barely meet the 43-45% DTI requirement. Case-by-case, conditional approvals could go up to 50%.

The potential issue here is that non-reported liabilities are not included, such as: child/day care, school expenses, medical, living expenses, etc.

Even though one met the requirement, that person may barely break-even month-to-month. With today’s prices, a 45% DTI ratio, in 2017, could be 60% today.

While mortgage delinquencies are still low, it may be fair to consider that the home is usually the last obligation to default on. Credit cards and vehicles go first. Checking those stats could be an indicator.

Reserves

Simply: Murphy’s Law. Here today, gone tomorrow.

All non-agency loans require, at least, 6 months housing reserves. Often more, depending on the product. Some Interest Only products require up to 24 months.

These reserves need to be seasoned for at least 60 days. It was common to explain the guidelines to some applicants so they can maneuver their funds, in advance, into a simple savings account to avoid having to source the deposits which could lead to a never-ending paper chase.

For the sophisticated homeowner, this guideline could be easily “gamed.”

The banks end up making riskier loans based on reserves that could be liquidated the day after funding OR which were never truly the homeowners to begin with. As long as the funds were shown “not pending” or “deposited” on the two bank statements prior to application, that box was typically checked.

“Oh and please, Mr. and/or Mrs. Borrower, don’t go moving those funds around until after the loan funds. Thank you :)”

Fixed Period Adjustable-Rate Mortgages (ARM’s)

Not as popular as pre-2008 as most either learned their lesson or heard the legends, although still a factor.

A lot of these ARM’s can hit the full rate adjustment cap on the first adjustment which can be 5%. A 7-year fixed period ARM at 3% from 2015, adjusting next month, may see 8%.

If this loan was unable to refi into a 30-year fixed, when rates plummeted, then this homeowner may be in big trouble – especially if DTI and reserves compound. Even more-so if the fixed rate period is Interest Only. Yikes!

Collateral

Obvious reasons.

Essentially, while loan quality improved, there are still a lot of land mines out there that could blow these delinquency numbers up a lot higher than some may predict.

We don’t have sub-prime, this time, but we do have inflation starting to burn hot, raising rates, and, perhaps, a lot more folks being laid off.

Can SRS shoot back to a 4-digit value? Seems too obvious.

Yeesh. If i was in CA still i would be getting yelled at by Newsome for using too much electricity. Sorry, for the novel everyone. Was juggling and didn’t notice.

Not to worry Ricky ! Those of us who are working class and want to better our position will take all the advice we can get

Nice overview, Ricky. Well written. Thanks. Some of the terms are interesting: “seasoned” deposits; loan “products”… Not unlike a visit to the grocery store.

Good points Ricky. Do we know what is the percentage of active ARMs including IOs? The other thing you mention is the DTI risk and that’s where financial stability may get super stressed with inflation.

It’s a risk not unlike in auto industry, where personal budgets were stretched out by financing SUVs and trucks with $800 a month (7 year loans) payments, but now with inflation rampant in every category and rates being much higher, what kind of an impact will this have on Johnny Trucker’s ability to make mortgage payments and auto loan payments? This is not a question for today, but perhaps for 2023-2024.

I’m not sure credit cards and auto loans are the first to go. I seem to remember a lot of strategic defaults back in 2008 when home owners walked away from mortgages but kept current on their auto and credit cards.

Back in 2008, I remember hearing that the last thing to be shuttered was the cable tv/internet service. All other utilities were already shut down, foreclosure notice on the front door.

I agree there are lot’s of surprises coming down the road. Especially if unemployment climbs. Lot’s of double income millennials with low mortgage payments but high childcare costs. There is a big baby boom going on right now. In Denver child care costs are over 3k for an infant if you can find a space.

The rise-up in mortgage costs is indeed going to be disrupting but not sure where you’re getting the “baby boom” thing from–we have a lot of doctors and nurses in our friend and associate circle and all say that birth rates all over the US have dropped to the lowest levels by far they’ve ever seen. Maybe Denver is isolated case but I can’t really see why. The CDC and Census data back up that anecdotal observation, record low US fertility rates and heading lower. And in fact those high childcare costs in US cities are a big reason for it, as are high housing costs and the housing bubble. If anything lower cost of living esp for homes could help to at least slow down the collapse in US birth rates, although yes if there are economic shocks and other factors pushing up cost of living with less economic security, this could push it down further too.

Stiffed grift.

Is anyone tracking the impact of inflation is having on potential new or refinance mortgage applicants?

Suspect that a wide swath of regular income earners are delaying or outright cancelling any plans to apply for a new or refinance mortgage. Less appeal to refinance an existing low rate loan into a 6% loan unless there is some emergency in progress.

And the impact of the Inflation Reduction Act’s massive new money has not weighed in on inflation yet. Don’t be fooled by the temporary fuel costs reprieve. There is no way that can last, nor can massive increases now be avoided. Then where will budgets be? New home, refinance? No way. That light at the end of the tunnel is truly the locomotive’s head lamp.

Anyone know of how to short Commercial Backed Loans.

There is a street not far from my house that is a commercial area with small offices / warehouses.

In the past 6 months I now see a “For Lease” sign on every building. I counted over 10 in just a 1/2 mile.

I have never seen so many commercial spaces for lease in this area. Not in 2009-2010 nor in 2001.

Find out who holds the loans. Some have been rolled into CMBS. But others are held by local and regional banks. If a local bank holds those loans, and is heavily concentrated in CRE loans (some are), then you could short the bank stock, if it’s publicly traded.

Dumb question from a dumb civil engineer, why can’t Rocket continue to offer 3% loans because some making money out of thin ai.. I mean leveraging money, has to be better than firing all of your employees? And Rocket, or whatever loan company, would have the market cornered.

I think they could but since they predominately sell the loans to Fannie or Freddie, they would have to absorb the prorated interest rate difference on the loans in order to sell them. This would mean cutting costs ie staff.

They could hold the loans but there would be a loss if treasuries are paying over that amount. ie they are holding 3% loans while Treasuries are paying 3+%.

Does any lender want to hold 3% loans in this market?

Essentially, they could dominate the market with 3% loans but would take a loss with every loan. They could make it up with the volume of origination and refi fees for awhile.

If rates ever do plummet down again, they would be in a good position in the market if they held the loans. It is a gamble.

Could rocket just art holding their own loans?

They could finance all of their own loans and offer them at a cheaper rate. Anybody could do that as was pointed out in a comment above.

Could they make any money if they financed mortgages at 3% while every other lender is charging over 5%?

They would likely corner the mortgage market with a huge demand. If rates ever fall again, they’d have a huge customer base. It would be a gamble.

Could they take that loan amount and invest it in something else paying better than 3%? Where is Rocket obtaining this money to lend? Would any investors loan them money at less than 3% so Rocket could create 3% mortgages, take their cut, and make money?

In addition, some lenders finance their own mortgage loans but typically at a higher rate. Non-conforming loans (riskier – zero down, low credit score)) and Jumbo loans (higher loan amounts than allowed by Fannie or Freddie).

I had a co-worker who purchased a non-conforming house a few years ago. They couldn’t get a loan through a bank or mortgage lender so they financed through an investment firm. They did pay a higher rate than a mortgage lender or bank would have charged.

Some investment firms may charge a lower rate if you have all of your billions invested with them. They already have your money so you can’t walk away so you are less risk.

Flippers use hard money loans for short term at very high interest rates.

start*