It sticks to plan, QT like clockwork: What the Fed did in details and charts, and my super-geek extra-fun dive into the “To Be Announced” market for MBS.

By Wolf Richter for WOLF STREET.

The Federal Reserve’s quantitative tightening (QT) completed its three-month phase-in period on August 31. During the phase-in of QT, the plan called for the Fed to allow its holdings of Treasury securities to drop by up to $30 billion per month by letting them mature without replacement, and allow its mortgage-backed securities (MBS) to drop by up to $17.5 billion per month, mostly from pass-through principal payments.

In September, the pace of QT roughly doubles with the caps doubling to $60 billion per month for Treasury securities and to $35 billion for MBS. So how did it go in August?

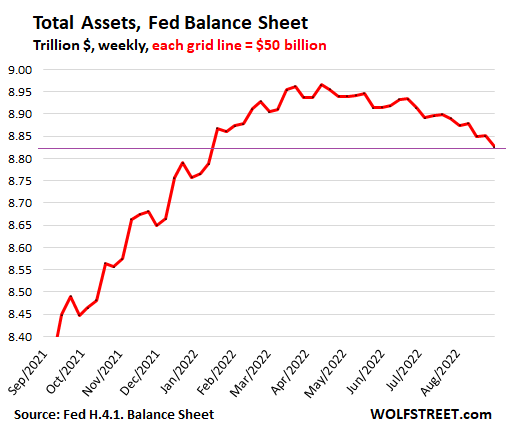

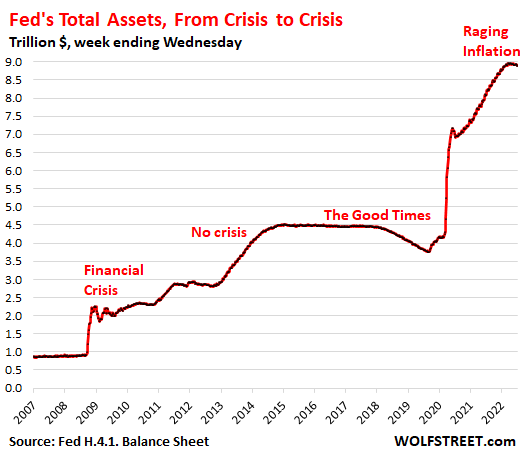

Total assets on the Fed’s weekly balance sheet as of August 31, released on September 1, dropped by $25 billion from the prior week, by $48 billion from the balance sheet of August 3, and by $139 billion from the peak on April 13, to $8.83 trillion, the lowest since January 12.

QE created money that the Fed pumped into the financial markets by purchasing securities from its primary dealers, who then sent this money chasing assets in the financial markets and in other markets, including residential and commercial real estate, all of which inflated asset prices, and drove down yields and mortgage rates and other interest rates, which was the express purpose of QE.

And in early 2021, QE suddenly helped fuel the raging consumer price inflation that the Fed has now set out to battle with rate hikes and, you guessed it, QT.

QT has the opposite effect of QE: It destroys money, pushes up yields, pulls the rug out from under asset price inflation, and contributes to bringing consumer price inflation back down.

QT is straight forward with regular Treasury securities, complicated only by the Fed’s holdings of Treasury Inflation Protected Securities (TIPS). But MBS are a different creature, as we’ll see in a moment.

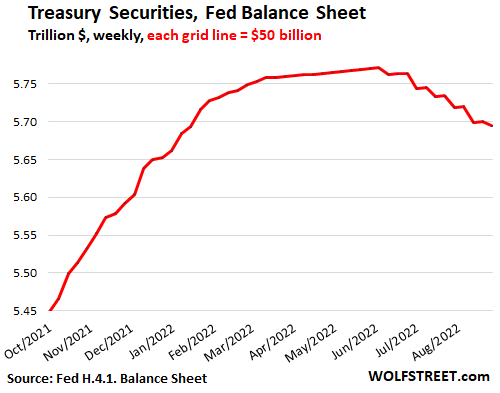

Treasury securities: Down $76 billion from peak.

Treasury notes and bonds roll off mid-month and at the end of the month, when they mature. Today’s balance sheet includes the roll-off on August 31.

TIPS pay inflation compensation (income). But it is not paid like coupon interest. Instead, it is added to the principal value of the TIPS. When TIPS mature, holders receive the amount of original face value plus the accumulated inflation compensation that was added to the principal over the years (similar to your I-Bonds).

In August:

- Treasury notes and bonds: down $30.4 billion.

- TIPS Inflation Compensation: up $6.0 billion, earned and added to TIPS principal.

- Net change: -$24 billion from August 3 balance sheet.

This inflation compensation of about $1.5 billion a week is income that the Fed earns that will be paid in cash by the Treasury Dept. when the TIPS mature. The Fed adds this income to the balance of the TIPS weekly. You can see it in the chart below in the slight upward slope in the period after QE had ended in mid-March and through June 6, before QT started.

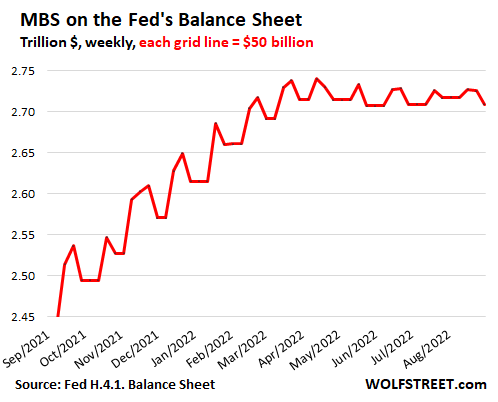

MBS, creatures with a big lag: Down $31 billion from peak.

We’re going to do some super extra special geeky stuff today, a WOLF STREET deep-dive into the Fed’s transactions of MBS in the To Be Announced (TBA) market that I uploaded to my server and that I will walk you through in a moment. This will without doubt be the most fun you’ve ever had. But before we get there…

MBS come off the balance sheet mostly through pass-through principal payments. When the underlying mortgages are paid off due to a sale of the home or a refi, or when regular mortgage payments are made, the principal portion is forwarded by the mortgage servicer (such as your bank) to the entity that securitized the mortgages (such as Fannie Mae), which then forwards those principal payments to the holders of the MBS (such as the Fed).

The book value of the MBS shrinks with each pass-through principal payment. This reduces the amount of MBS on the Fed’s balance sheet. These pass-through principal payments are uneven and unpredictable.

MBS get on the balance sheet 1-3 months after the Fed purchased them in the “To Be Announced” (TBA) market.

And that’s what we’ll have fun with now.

Purchases in the TBA market take one to three months to settle. The Fed books its trades after they settle.

I uploaded to the WOLF STREET server the spreadsheet that I downloaded from the NY Fed containing a portion of its MBS operations in the TBA market. To make the walk-through easier to follow, I color-coded the spreadsheet (download my spreadsheet “NYFed_MBS-ops” here).

The spreadsheet shows how each of the MBS are flowing into the Fed’s balance sheet, and how long the lag is for each MBS:

- I marked in red: all MBS purchases that settled in August (settlement date = Column J). They settled on Aug 11, Aug 16, and Aug 18.

- The Fed’s weekly balance sheet is always as of Wednesday, and is released on Thursday.

- MBS that settled Aug 18, showed up on the Aug-24 balance sheet, but they coincided with a big pile of pass-through principal payments that ended up overpowering the skimpy purchases and reducing the balance on that day.

- The MBS that settled on Aug 11 and 16 showed up on the Aug-17 balance sheet, and you see how the MBS balance rose.

- Now go to column C (yellow) “Operation date,” when the MBS were purchased in the TBA market.

- I marked the MBS that were purchased in June with bold red (column C). And they showed up three months later on the Aug-17 and Aug-24 balance sheets.

- Now go to what the Fed purchased in May, before QT, which I marked in green (column C = purchase dates). There are a lot of them, $108 billion (I added them up in column Y). Keep scrolling down all the way down to line 265 to see them all.

- In Column J (settlement dates), you see that the MBS that the Fed purchased in May, before QT, settled in June and July, during QT, which is when they showed up on the balance sheet. That’s why people thought that the Fed wasn’t doing QT.

Wasn’t this hilarious fun? I thought so!

The Fed is doing exactly everything it said it would do; you just have to understand the mechanics of the TBA market and the balance sheet.

MBS: down $31 billion from peak, to $2.71 trillion:

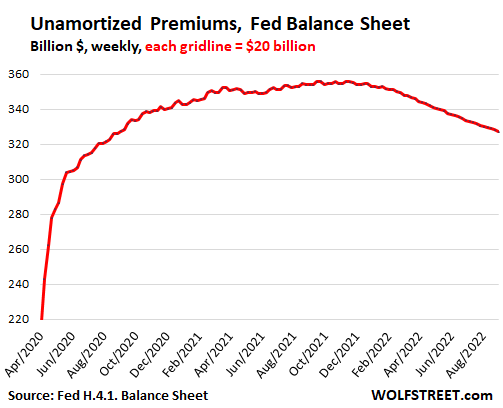

Unamortized Premiums: down $29 billion from peak, to $327 billion.

All bond buyers pay a “premium” over face value when they buy bonds when the coupon interest rate of that bond is higher than the market yield at the time of purchase for that maturity.

The Fed books securities at face value in the regular accounts, and it books the “premiums” in an account it calls “unamortized premiums.” The Fed then amortizes the premium of each bond to zero over the remaining maturity of the bond. At the same time, it receives the higher coupon interest payments. By the time the bond matures, the premium has been fully amortized, and the Fed receives face value, and the bond comes off the balance sheet.

The “unamortized premiums” peaked in November 2021 at $356 billion and have now declined in a steady process by $29 billion to $327 billion:

For your amusement, how we got to Raging Inflation:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

For the current inflation disaster at hand, this QT seems pitifully slow. Just look at what the Bank of Canada has done thus far. The FED should announce they are speeding this up, then do it.

It’s good to see Fed actions finally matching its words. Also good to see the QT deniers proven wrong.

I also feel that QT won’t revert the damage that QE has already done and will keep doing for months as it would take > 18 months to only neutralize liquidity tied in > $2 trillion reverse repo.

The working class seem to be permanent losers. Many who followed memes like bitcoin, space, Robinhood are now hit with hard reality : They must work again at lower salary to expense ratio.

In the last graph, the slight decrease from the peak looks minuscule and ridiculous. Should have stopped QE completely one year ago, yet they kept buying 120 billion of bonds month after month. Absolutely criminal.

“In the last graph, the slight decrease from the peak looks minuscule and ridiculous.”

Yeah …. how about the whole chart ? ha (not just from 5.8 trillion down to 5.7 trillion).

It’s gonna take years. If they continue.

Mark,

Yes, it’s going to take years, that’s the stated purpose, and it’s going to continue for years, like clockwork, in the background, that’s the plan, taking down asset prices along with it, hopefully not all at once, but over time.

By my calculation, about 40 years at this pace to go to zero. Why does the Fed need a big asset book? Is it just than baggage from monetizing the debt?

dpy,

The Fed’s assets CANNOT “go back to zero.” They were NEVER zero to begin with. They HAVE TO BE HIGHER than the Fed’s liabilities, the biggest ones of which are cash in circulation (paper dollars), reserves, the government’s checking account (TGA), and RRPs. So four years from now, the minimum amount in assets to balance out the liabilities might be close to $5 trillion.

I will spell that out in a day or two.

Dpy,

I believe the Fed has to monetize some debt in order for there to be currency in circulation and bank deposits/reserves.

I’d argue that doing it over years and years is just extending the pain. It’s much better to just rip the band-aid off then deal with it. The FED is inducing maximum pain on the have-nots. Notice how it’s no problem to absolutely flood the rich with liquidity at the slightest hint of a downturn, but when inflation starts destroying the middle class and poor, “we woudn’t want to upset the markets.” This slow-roll QT is designed to allow inflation to become entrenched – to put a permanent, higher floor under asset prices.

As Wolf reminds us nothing goes up or down in a straight line! Honestly, it is great to see the FED is tightening.

We really need to revert back to Economics 101 = SUPPLY and DEMAND.

The US needs to return to policies that will allow the Americas to be a supplier (not of QE or QT money supply) of all energy sources, food and water.

“We really need to revert back to Economics 101 = SUPPLY and DEMAND.”

Sounds good!

Let’s also revert back to English 101 = SEE SPOT RUN (no egghead multisyllabic words, please!)

And Math 101 = 1+1 = 2 (algebra, geometry, and calculus are the devil’s work!)

Lest we forget American History 101 = Geo. Washington cut down a cherry tree (everything else is cultural Marxism conspiracy!)

Not to mention Physics 101 = Newtonian physics (banish Einstein back to his Marxist snakepit!)

Let’s reduce everything to “101”, ‘cuz thinkin’ and stuff is hard!

When you’ve taken “101” in any subject, you too can be an expert! I’m going to go see my doctor (who never got past Medicine 101) now!

(not quibbling at all with the article or the need to undo the damage caused by ZIRP and QE infinity)

Also introduction to Biology and Civics.

“Biology has no laws” -Francis Crick

But I still second Flashman’s notion….101 will do.

And sorry, but you DO need calculus for Newtonian physics.

It’s the partial derivatives I think you have a (sarc?) beef with.

And it’s nice to see Wolf gloating, it’s been a long time coming.

You cannot offshore the majority of your manufacturing/value added industries without the Compliance of the Fed. It is only in creating the illusion of Wealth, with new counterfeit money inflating the stock and bond market, that the American people were tricked into believing all was well.

Now that the horse is gone, the hinges are off the door, the barn has burned down, and the deed is lost, the Fed says, “it’s high time to close the barn door.”

Few, if any, realize their Personal Guarantee is the collateral for the Fed.

And if the Fed is Tightening why is the National Debt keep hitting new highs? Something don’t add up here, the country is bankrupt, borrows more than it brings in. The government is still recklessly spending. Just where is this money coming from, if not the Fed?

Wolf, It might not have been the most fun I’ve had in my life, but reading your piece today has been very, very, informative. Thanks.

I agree. Pure wisdom dispensed fresh daily.

How about redoing the first three graphs to make the starting point January 2020, before the start of Covid?

I think Wolf really needed to set the record straight and prove that QT is actually starting to happen. That requires the higher starting point on the vertical axis because otherwise the QT rollover gets hard to see.

Like, look at the 4th graph: QT so far is less than a 1.5% trim off the peak, which is why it’s almost invisible in the big picture.

In a month or two maybe Wolf will put a little red arrow on the right side of the 4th graph and mark it “QT”, ’cause otherwise it’s hard to see it without squinting while using a magnifying glass with the browser set to maximum zoom…

Maybe that’s why the financial markets are still orderly… the Fed has hardly done anything yet!

Eventually. For the overall picture, go back to the last chart, which starts in 2007.

Wolf, in third chart, MBS decrease seems to be in range of noise and you have explained the lag well. However, let’s evaluate state based on logic.

Let’s start with Assumptions that you can confirm:

Assumption 1: Because of recent extreme low MBS rates, most folks would have refinanced reducing the principal payments.

Assumption 2: MBS rates of 6% are still not sufficient for investors to compensate for 50% losses possible from frozen housing markets due to unaffordability.

Predictions based on assumptions:

1. Principal payments will not be enough to roll off $35 trillion of MBS.

2. Fed will have to sell MBS outright to meet the cap for MBS reduction that will require either a steep rise in MBS rates or a Fed Put guarantee to investors buying MBS that Fed will decrease rates after 2 years and then buy these MBS at an even higher prices to compensate investors for their losses.

3. If Fed does the latter, housing price may keep increasing due to Fed put to infinity destroying leftover US economy. So its not an option.

4. If Fed does former, housing prices will be crashing really fast resulting in bankruptcies.

Conclusion:

So the most logical outcome seems like Fed can’t really reduce MBS holdings. What do you think?

Wolf does not want to answer that. What we see that FED wants to put its feet on throat of people to not afford any home. With a next to nothing home price reduction and double mortgage rates. It is more UNAFFORDABLE!

Price come down pretty hard for a while, and then home prices are more affordable. It’s not a secret.

SS,

Your #2: “..will have to sell MBS outright to meet the cap for MBS reduction”

Yes, this is the situation that the Fed has mentioned several times when it may start outright selling MBS to make up the difference. For example, if in month X, $27 billion in pass-through principal payments occur, it might sell an additional $8 billion in MBS to get to the $35 billion cap. They’re already talking about this.

No, in terms of the second part of #2 and your conclusion (“can’t really reduce MBS holdings”)

The pass-through principal payments will continue because people are ALWAYS making mortgage payments, and even if refi’s have slowed dramatically, there are still some refis. Home sales (mortgage payoffs) are down 30% but there are still lots of home sales (mortgage payoffs), and they will continue. And once prices come down, volume will rise again. We’ve seen this every time. In addition, if there is a surge in foreclosures, it will trigger a flood of mortgage payoffs (eventually funded by the taxpayer via the GSEs and agencies), and therefore a flood of pass-through principal payments.

So MBS passthrough principal payments will continue at a good clip, and if foreclosures and forced sales rise, at a much faster clip, and so MBS will continue to come off the balance sheet at a good clip, but it may be less than $35 billion a month further down the road. So the Fed can sell some MBS to make up the difference.

In terms of sales of MBS: The Fed will lose money when it sells the MBS outright, because investors would only buy at market prices. And the Fed accepts the fact that it will lose money on the outright sales of MBS. It’s a small loss, in terms of the Fed’s size. The fact that the Fed accepts to lose money when it sells MBS at market prices, and the fact that buyers buy at market yields/prices in hopes of making a profit will resolve the issues you mention.

So don’t worry, those MBS will come off the balance sheet just fine.

SS,

Even if you assume that no homeowner ever refinanced again and no one ever pays their mortgage off early (which are obviously ridicules assumptions), the Fed’s MBS holdings would still decrease over time as regular monthly principal repayments are made.

It’s very unlikely that the Fed is going to sell MBS anytime soon. To do so would likely cause 30YFRM to spike even further than the 6.24% yesterday. This would lead to a major downward repricing, forcing the yield to spike from all those 3% and below bundled mortgages into MBS. And, this would cause the Fed to loose a ton of money which eventually is going to happen with treasury runoff, if it goes on long enough.

Thanks for responses and insights.

My still unresolved question: Was double fisted MBS buying necessary? If so, for how long was it really *necessary*?

It wasn’t ever necessary at a national policy level. So maybe a better question would be “for whom was it really necessary?”!

No, it wasn’t necessary. It should have never happened. Even the Fed hates dealing with MBS, including for all the complexities outlined here.

Wolf

great article again – i enjoy these regular Fed Balance sheet updates. Question from Wisdom Seeker – “for whom was it really necessary?”!

would be interesting to see who are the biggest MBS providers – you mention Fannie Mae – any insighs

Wolf said: “No, it wasn’t necessary. It should have never happened. Even the Fed hates dealing with MBS,”

———————————-

if it wasn’t necessary and the FED hates dealing with it, then Why was MBS buying done?

To drive down mortgage rates and inflate home prices — you knew that.

@ Wolf –

the biggest reason:

Allowing for re-financing, allowing borrowers to more easily make their loan payments ………. saving bankers

This bailout of overleveraged entities saved the banks, gave the imprudent undeserved cash flow and wealth, and punished the prudent through increased asset price support and increased consumer price support by the bailout of the overleveraged and the banks.

The Fed buying MBS is the primary cause of the home price inflation over the last two years. Just like them buying treasuries, having bought up so many government back mortgages, the Fed forced rates down to historic lows. Therefore, the Fed owns whatever happens to the housing market over the next 12-24 months.

Yep. And Biden screwed up by renominating Powell. If he had nominated someone other than Powell and said exactly that (the Fed overstimulated the housing market and needs to be held accountable) it would have been great political maneuvering. But Biden will get knocked for it because for some reason he renominated Powell despite everything the Fed f’d out outlined here.

It’s good to see Fed actions finally matching its words. Also good to see the QT deniers proven wrong.

However, I feel that QT won’t revert the damage that QE has already done and will keep doing for months as it would take > 18 months to only neutralize liquidity tied in > $2 trillion reverse repo.

The working class seem to be permanent lovers. Many who followed memes like bitcoin, space, Robinhood are now hit with hard reality : They must work again at lower salary to expense ratio.

@ SS –

Most liars match some words. That doesn’t make a liar any more credible, just more random. Perhaps we should wait for a period substantially beyond 3 months before we celebrate how wrong QT deniers are.

“The working class seem to be permanent lovers. Many who followed memes like bitcoin, space, Robinhood are now hit with hard reality : They must work again at lower salary to expense ratio.”

No reason to expect any other outcome, especially with government policies of the last multiple decades.

Combination of mass immigration weakening labor’s bargaining power, increasing industry concentration also weakening labor bargaining power, and higher government deficit spending (the real root cause of inflation since that’s what FRB “printing” finances) debasing the currency.

Most. Fun. Ever. 🤩

COULD ONE EXTRAPOLATE $4.5 TRILLION IS THE SWEETSPOT FOR LIQUIDITY, CETERIS PARIBUS, AND THATS WHERE THE FED IS LOOKING TO END UP WITH QT?

No. The Fed would love to get there but can only suck so much liquidity out. They’ve acknowledged $2-3 trillion drop would be ideal (and maybe optimistic). At that point, they should have mostly longer bonds that would roll over veeeeery gradually. $4.5 trillion would be 10 years away.

Ceteris paribus is a theoretical abstraction. It has nothing to do with the real world which actually exists.

” It has nothing to do with the real world which actually exists.”

Intended or not, that is a pithy description of neo-classical economics!

The real world that existed when Adam Smith was writing about economics and the real world today are completely different.

As a result many of the concepts that he espoused in his economic theories actually existed and worked in the real world in the middle and late 1700’s.

They don’t work today because the markets and money have been perverted by numerous actors including the subject of this article, the Fed.

Will the FED actually ever sell any Treasury Bonds, or will they just roll off without being replaced?

The question I have is who would buy them in such quantity, unless they get discounted a heck of a lot. I would bite at maybe 8%.

Ev Last,

Not according to the FOMC’s current plan. This is from their July meeting minutes:

“Regarding expectations for the evolution of the Federal Reserve’s balance sheet, market participants expected the Committee to increase the monthly caps on System Open Market Account (SOMA) redemptions beginning in September, as announced in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet issued in May. Treasury coupon principal payments would first fall below the $60 billion cap in September, with the remainder of redemptions met with maturities of Treasury bills…”.

So, they will meet their $60B cap through note/bond maturities and then by Tbill maturities. And they have over $300B in Tbills currently on their balance sheet. So there is no need for them to sell treasury notes or bonds to achieve their stated goals, yet.

Johnny5,

The problem with a “cap” is that some months, roll-offs are below the cap, and they’ll fill the gap with bills. But other months, the roll-offs are far higher than the cap, and then the Fed will buy enough Treasuries to maintain the cap.

For example, in Sep and Oct, the roll-offs are below the cap. In Oct = $44 billion. So the Fed will make up the $16 billion gap with bills. But in November, the roll-offs = $110 billion. This is $50 billion above the cap. So the Fed will let $60 billion roll off and replace the remaining $50 billion.

If there were no caps it would average out nicely over time. But I think the Fed worries that a $110 billion Treasury roll-off in one month, plus the $35 billion MBS draw-down, could send tremors through the financial markets. So it put the caps in place. The Bank of Canada doesn’t have caps. Whatever rolls off rolls off.

I hope this continues until morale improves.

But, still scratching my head. Most estimates have the Fed topping out around 4%. And who knows when they’ll stop reducing the balance sheet?

So, where will CDs and treasuries top out?

I’m admittedly in the “I don’t wanna lose what I have” contingent. I’d much rather make a little than risk a lot.

September rate hike should be 100 basis points. Feds being late to the party is no excuse for continued incompetence. The monster has already been created through QE. Wall St. Has to take its medicine. Everyone has made plenty of $$ betting on the next big IPO. From Oat Milk to MEME stocks to RIVN overpriced and undeliverable electric vehicles.$1.00 Bamboo chef stir fry mix from Walmart selling for $5.00 per pack on Amazon. What’s sad is the Feds thinks job cuts is the answer.

Powell said in Feb of 2021 that we must “unlearn” what we know about M2.

Well, a few months later we had an inflation spike, painted as “transitory”., propelled by the explosion in M2. This is our astute monetary leadership?

A disregard for inconvenient realities?

M2 became disconnected because of monetary savings (after the DIDMCA). The larger the volume or percentage of saved deposits, the slower the velocity of circulation (secular stagnation).

> What’s sad is the Feds thinks job cuts is the answer.

But where did those jobs come from? Like the bubble values, many came from all that hyped-up stuff you just mentioned. Such jobs would sensibly disappear with the bubble enterprises that created them. Why should these linked things be asymmetrically “fixed” by the Fed? How is that consistent with a supposed “debt free state of mind”? Debt free for who?

Seems like people around where I live in Bethesda, MD just outside of the Swamp are doing pretty well. Noticed a lot of $70,000 Tesla cars showing up on people’s driveways. They are parked on their 2 car driveway in front of their 1.8 million dollar monster home. Looks like Bidenomics is working great for those at the top of the income scale. For the rest of us poor slobs all we can look forward to is a declining standard of living in order to continue to feed the prosperity of those at the top 1%. ENJOY!

I hope QT can operate in the background for a long time. That means more fun in the future.

The mere fact that I am reading this at midnight after an epic day in the mountains makes me a supergeek.

Many years ago I dreamed of that sort of physically, geographically and intellectually emancipated and richly connected lifestyle. Here it is.

Fully appreciate the forensic analysis of the modalities of QT.

The existence of denial in the face of facts is a complex psychological and self-serving phenomenon. In fairness, I suspect reasonable people have simply misunderstood the time-lags involved and question the Fed’s resolve.

Of greatest importance is that, in the context of the money printing that preceded it, QT-proper, now underway, is about as consequential as it can possibly get for financial markets.

It’s a lot easier to understand when someone understands human motivation.

The FOMC doesn’t like looking bad just like anyone else, especially with their peer group.

The FRB is not going to destroy the basis of their influence – USD as global reserve currency – voluntarily. That’s why claims that the FRB will resume QE implicitly at all costs to preserve fake paper wealth are nonsense.

The FRB doesn’t exist in a vacuum either. It’s not like they can do whatever they want while everyone else (especially those with influence) just sits around and won’t do anything.

AF

If was straightforward to do (or indeed my role), I would pull together a few comments in this section to coalesce around your third paragraph.

While I would tweak it a little to fit more closely with my thinking, I would also go further by stating that further QE, even if reactivated, would not achieve the objectives that it once did; all of were ephemeral in any event.

There is a twist to mortgage-backed securities. These securities and following from that part of the US dollars in circulation is backed by real estate value. If the real estate value tanks, part of the backing of the US dollar tanks. Now, what might be one consequence of a housing market crash?

The status of the US dollar may as well be hurt by a real estate price crash too.

Very informative article…..and the spread sheet was quite an add on!

But I still have one questions…

Why did the Fed suddenly become interested in the long end of the market?

Why did they take on this program of buying long term mortgages (2006)?

Do they have duties to perform in the long end?

I still think former Fed governor Fisher let the cat out of the bag when he admitted the Fed intentionally FORCED investors to take more risk by flattening the yield curve, forcing long rates down. (see “The Power of the Federal Reserve” PBS documentary)

That seems outside their mandates and mission statement.

Could someone help me out here please?

When Treasury notes and bonds mature, isn’t the Fed (who had purchased them during QE) paid the face value of said assets?

So when these Treasuries are rolled off the Fed’s balance sheet as they mature, how is it that money is destroyed when the Fed is receiving the face value of maturing assets, in other words, money? Aren’t maturing Treasuries simply replaced with money at maturity — instead of destroying money?

Thanks in advance.

It’s simple… the money remitted by Treasury goes poof and disappears (instead of being used to purchase additional securities).

What’s the actual official accounting mechanism for this “poofing” process? The Fed after all is receiving money (the Treasury remittance). It cannot just leave it out there somewhere and simply pretend it doesn’t exist? How does the Fed book the destruction of said monies? For unless the Fed officially “kills” this money, it remains alive and kicking, in whatever area of the ledger it still occupies.

accounting? LoL

AISI, the Fed holds on its books Gov bonds (asset) balanced by $xxx Gov loan (liability) to the value of those bonds. The $xxx start off (are created out of thin air) in the Gov account. Thus the Fed’s books balance w.r.t this loan to the Gov. During the time the loan exists the $xxx may move around, to other accounts, on the Fed’s books but can never leave. By definition the $xxx move back to Gov account when the bonds mature (and so Gov buys them back), that’s when the $xxx disappear (along with the bonds).

I’m dumb as a dog but I’m thinking if the fed can print at will they can also destroy… this is the dog talking.

It goes back to the same place from which the Fed conjured the funds to pay for said securities in the first place… that is, to nowhere. The Fed created the money out of thin air and now it is burning money back into thin air… back to wherehence it came.

When a FED held bond matures under QT, the Treasury has to come up with the cash by selling a new bond to someone. So overall, the Fed’s bond holdings go down but the government debt remains at the same level. In essence, QE inflates government debt in perpetuity.

Rusty Blade,

The Fed doesn’t have a “cash” account, like a regular bank has. It created the money (credits) to buy the securities with, and when the Fed gets paid from the government’s checking account at the Fed (the TGA) when the Treasury securities mature, the Fed just destroys that money (credits), just like it created them before. QE and QT are opposites.

The New York Fed has a pretty good description of the flows and some of the accounting involved, but it’s a lot geekier than my article. It requires some prior knowledge to dig through and make sense of it. But give it a try. That said, you’re probably better off, in terms of your headache, just going with my explanation ;-]

https://libertystreeteconomics.newyorkfed.org/2022/04/the-feds-balance-sheet-runoff-and-the-on-rrp-facility/

Saw that. Wondered how the o/n rrps are reduced? Doesn’t the FED have to reduce the “award rate”? And wouldn’t that contribute to inflation?

Interesting question. I’ve been expecting the Fed to make a “technical adjustment” to the RRP rate, as it does occasionally to the FF target range, something small such as 5 basis points, just enough to trigger a shift in where these funds flow. But that hasn’t happened yet, and might not happen.

Since RRPs are demand based, the balance depends both, on the rate the Fed pays on RRPs and on the yields that Treasury bills pay, because that’s the alternative. When Treasury bills yield more than RRPs, Treasury money market (MM) funds will buy bills and pull money out of RRPs.

Generally, if money flows into Treasury MM funds stop and then reverse, as liquidity recedes, MM funds will be either selling bills or pulling funds out of RRPs or both, depending on yields. If they start selling bills, those yields will rise, making them more attractive again. That won’t happen with RRPs, where the Fed sets the rate.

So I think – just speculating here – we’re going to see higher bill yields that exceed the RRP rate, and as liquidity recedes, funds will shift out of RRPs for two reasons: a shift to bills, and a decline in MM fund balances.

Interestingly, reserves have already plunged this year, and this is bank cash. So banks are putting their cash to work somewhere else where it yields more. Eventually, we’ll see something like that with RRPs.

Thanks a lot Wolf!

However my understanding was, the Fed is forbidden to buy Treasuries directly from the US Treasury. Am I correct in assuming that only the so-called Primary Dealers can purchase Treasury debt directly from the government? And if so, then the Fed didn’t create the money for the initial purchase of the Treasuries, no? The Primary Dealers paid for them with their own money? What am I missing here?

Furthermore, as our friend HARDIGATTI pointed out above; does the Treasury not have to sell new bonds in order to find the money to extinguish (is that the right word?) the older bonds maturing in the Fed’s book? If so, then we are only being hoodwinked into assuming that the maturing bonds are redeemed and the money destroyed? For, in the aggregate, as HARDIGATTI explained, the debt is never actually extinguished? (Perhaps this could only be achieved by the Fed directly selling bonds into the open market?)

I suspect these things are way more opaque and unclear than they appear, made so perhaps with the intent to keep us little people in the dark about their machinations.

Thanks again Wolf, and thanks to all our friends above who graciously shared their thoughts.

Yes, the Fed purchased the securities in the secondary market, not from the Treasury. Still, they were purchased using Fed funny money conjured out of thin air.

The government can and does issue new debt to finance some or all of the remittance it sends to the Fed to pay off those securities.

When the Fed buys Treasury securities in the open market they are basically swapping an interest-bearing asset (say a long-duration bond) with a non interest bearing asset (cash) which in theory causes interest rates (especially long term ones) to go down. This is the point of the whole exercise because otherwise the Fed’s other tool – the Federal funds rate basically only controls short term rates. QT then reverses this scheme, or at least is supposed to in theory ;-)

You’re getting lots of stuff mixed up here, and I don’t have the time to sort it out for you.

RB,

Anyone can purchase Treasury issued debt directly from the Treasury. You are right, however, when you say it is illegal for the Fed to buy Treasury issued debt from the Treasury at auction.

As I understand things, the Fed is legally bound to buy and sell existing Treasury debt through dealer banks. Their so-called “open market” transactions must be funelled through these dealer banks, otherwise the Fed would be flouting the law. They cankot operate like a retail investor, because the folls who created the Fed were not so stupid to allow the Fed to magic money into thin air to finance government debt to infinity and destroy the economy with real monetary inflation.

The question for me is when dealer banks buy Treasury securities at auction, are they forced to use reserves to do that, such that the Fed merely debits the buying banks reserve account and then credits the Treasury General Account (the federal government’s account at the Fed). If this is the case, then the federal government is an entity with the power to convert reserves into real economy money (i.e. credits in ordinary bank accounts). The way the federal government would do this is is as follows: issues the checks for folks, who then deposit those checks in various bank accounts. When a cheque is deposited, the Fed transfers that amount from the Treasury’s General Account to the account of whatever bank the check was deposited at. The bank’s assets increase (their reserves increase) and their liabilities increase a corresponding amount (the amount added to the person’s bank account), since deposits at banks are liabilities to the banks.

To the people who believe the FED should do this or that (instead of ceasing to exist): since you essentially believe the FED does something important, why not create a FED-inspired committee for each thing people need or like:

A FED just for shoes – my wife would like to be involved in this one

A FED just for Internet Service Providers – to ensure we don’t have too much or too little internet

A FED just for food – fight obesity AND starvation!

A FED just for movies – Betamax didn’t have to die!

… and many more FED inspired committees could be improving your life every day

Think what a great job it would be sitting on one of these FED-inspired boards! You could just move prices up or down and/or buy or sell stuff at will!

I think that’s called ESG….

Money and credit supply must be regulated somehow, just as blood pressure and blood oxygen and body temperature and heart rate must be regulated. As must all aggregates that only function within limits. One can mock such things, yes. But to actually not have that regulation means not being alive; veering out of viable limits. That’s why medicine seeks to bring such variables within normal limits. It is called alive and healthy. One can propose alternatives, but I didn’t hear any here.

“veering out of viable limits” wow ok let me know what limits your source of life, your beloved FED abides by…

And would you be interested serving as chair of the FED of education?

Here’s ONE alternative:

All,,, repeat ALL of the ”factors” you mention are just more NONSENSE…

NON sensical in any hard core ”tough love” scenario, no matter if child raising instead of just letting children grow up with NO sense and massive nonsense as is currently in vogue,,, and equally for the financial chaos currently manifest,,,

NON sensical in any ”reality” and real asset based economy; and to be sure, sooner or later, and at this pint in time it certainly appears to be getting sooner by the day!

ALL,,, repeat, ALL of the gazillions beyond measure of the various and sundry and now very extensive ”financial derivatives” that may have had some relation to reality at some pint in the past, but clearly do not NOW,,, are just the very beginning,,, and will clearly be the basis of the foundational crash coming sooner AND later, until the whole financial house of cards is fallen into the incinerator.

Anyone thinking otherwise is welcome to put or pour their wealth into that incinerator, as has been done many times in the last 400 years or so…

That’s a great analogy with medicine! It keeps somewhat sick people alive longer.

However, when taken to extreme government central planning, it becomes Socialism or Communism.

Central planning by corporations and banks is called Fascism.

Neither work optimally but I believe some kind of control is needed on capitalism. Otherwise, grifters would rule the world.

Anything goes and anything is legal.

The best form of government is a benevolent dictator with in-depth knowledge of arts, sciences, economics. It is hard to find that person.

Unfortunately Bob, we have the experience of thousands of years to tell us that ”power corrupts, and absolute power corrupts absolutely.”

Surely there have been ‘benevolent dictators/kings/queens” but sooner and later, almost all have have become as corrupted as every other system of GUV MINT has done over the years.

Corruption is THE problem, no matter what form of GUV MINT we peons must endure…

This is complete garbage. The US functioned very well and grew much faster prior to the institution of the Fed. The open market of bond buyers and sellers can easily perform this so called regulatory function you describe. There will still be recessions and panics because we are still human beings, but we won’t have ridiculous market distortion that massively benefits speculation and the government would quickly need to live within its means. Everything about the Fed is not beneficial to you and I and it should be abolished.

Interesting analysis. I’ll just note that the TIPS Inflation Compensation that you highlighted will be pausing over the month of September as the inflation index adjustments are now flat (actually very slightly negative). Of course, that may change again come October (TBD).

TIPS use annual inflation rates, just like i-bonds, for the inflation compensation adjustment.

The September inflation adjustments are based on the July – June reference CPI change, which was slightly negative.

See https://www.treasurydirect.gov/instit/annceresult/tipscpi/2022/CPI_20220810.pdf

“If inflation were to drop below the 2% target rate next year, does anyone think the Fed would let it run that low long enough to average out the current period of rising prices? Mark me down as skeptical” Judy Shelton, WSJ 9/2/2022

Precisely. IF the Fed’s objective is 2% average inflation, logically they must promote some sort of roll back in prices. They most likely will not, meaning more inflation at lesser rates is there objective. Accumulative and compounded, and burdensome and destructive. This must be pointed out and emphasized in inflation discussions.

It’s kind of fun speculating about the magical return of 2% inflation, isn’t it?

Even the Fed in its “median” projections doesn’t see 2% inflation for years, and these projections have so far underestimated this inflation every time. The last projection (from June) saw PCE inflation at 2.2% at the end of 2024.

Indulge me for a moment. What would be the effect of dispensing with the QE/QT thing and simply wiping The Fed’s balance sheet clean?

Hmm.

None of The Fed’s machinations would be necessary if the financial markets weren’t rigged and otherwise operated on priniciples of corruption. What The Fed’s actions do is normalize corruption and turn the general population into to go-to slop bucket for financialized toxic waste.

I still think it was a mistake to legalize fraud, but that’s just me. Playing Jenga with national economies and the ecological infrastructure is guaranteed to create problems neither The Fed nor anyone else is capable of coping with, but that is exactly the kind of game being played here.

Games require rules or you don’t have a game. If you throw out all the rules can you still call it football, or do you just have a melee that is merely called football?

Let’s find out, shall we?

Something has to determine supply of money. One cannot simply wipe it away. It has to be referenced to something. Football with no rules is called war or anarchy, Hobbes state of nature, the war of all against all, in which life is nasty, brutish and short. Exhibit A would be certain times in Beirut. Ultimately what you get is gangsterism.

@ phleep –

1. so what is the supply of money referenced to, and how has that been working out?

2. gangsterism – isn’t that what we have?

(Perhaps we really we have more of a plantation system ….. where most are just cows, herders or a few ranchers ….. with the gangsters at the top.)

“war or anarchy, Hobbes state of nature, the war of all against all, in which life is nasty, brutish and short.”

And how different is that from what you have now, really?

unamused…a question.

If Fed Funds had been pegged at 2% and 30yr mortgages at 5.5% for the past 13 years….would we be better off, worse off, or the same as we are now, economically speaking?

Better off of course ……… at least the common citizen would be better off. Big Mouth Buffet and members of the financial engineering class, not so much.

The real wish should be for no pegs at all, particularly that theft allowing a peg of 2% inflation. For that matter, no FED at all.

The effect would be nil as we are already living in 1984.

No one knows what the Fed is doing to do in a few months. They are tightening, but the consequences haven’t really become painful yet. Wait til pensions start imploding or Europe implodes and then we will see if Powell is still talking tough.

The Fed is telling us, all other things being equal, a best approximation of what they will do in a few months. They are holding to their stated course, to regain credibility. Powell’s comments, appropriately, are hedged to address the unknowns you are mentioning here. And this financialized economy has an amazing array of tools and widgets to hedge, diversify, and prepare for contingencies, at low cost. Yes, the black swan could always happen, outside anyone’s radar or contingency planning. But yeah, a reasonably likely serious stress test would be (will be) interesting to watch. I think the fall season often brings some wobbles. My shorts are in place.

@ phleep –

1. How long does it take for practiced, opportunistic liars to regain credibility?

2, What are these shorts that you have in place, what is the cost, and how are they going to save you? What positions are these shorts offsetting?

cb

Guess you are NOT using option trades as a risk management tool. PUTS vs CALLS at different time frames.

One could also use ‘swing’ trading between enhanced long and short inverted ETFs, although this is possible only IRA accounts. Also need to monitor one’s portfolio very closely. If trend and timing are against you then you are f…kd.

No matter what the ‘reversion to the mean’ is progressing with of course along with strong bounces, like today- 845 point intra day swing. This kind of volatility will be common b/c of fight between the ‘Forces of Perception vs the REALITY on the ground.

@ Sunny129 – I don’t have the background knowledge or market smarts to understand your strategies. I enjoy reading them but can’t grasp the picture.

Phleep seems to think Powell’s words are credible and describes an “amazing array of tools and widgets to hedge, diversify, and prepare for contingencies, at low cost.” Then Phleep concludes with “My shorts are in place.” …………….

Phleep set the stage and left the tease. I want to see the cards. Then we can determine how well the hand was played.

Come on Phleep –

How about some support for the Big Talk?

2, What are these shorts that you have in place, what is the cost, and how are they going to save you? What positions are these shorts offsetting?

Even if the Fed decides to pause or ease, how long will it buy them? QEs are probably not as effective as they have been, rates might not come down to 0 if the inflation is at 4/5%. What are they going to do? Print another trillions and call it something else, and be back to same situation 2 yrs later?

“What are they going to do?”

Blow up Housing Bubble 3.0. It’s all they know how to do to “fix” economic downturns.

Wolf said; “QE created money that the Fed pumped into the financial markets by purchasing securities from its primary dealers, who then sent this money chasing assets in the financial markets and in other markets, including residential and commercial real estate,”

—————————————–

How do we know that “primary dealers then sent this money chasing assets in the financial markets and other markets.”? Do we have access to primary dealers’ balance sheets, cash flow statements and spending actions?

Yes, we have access to their balance sheets and income statements on a quarterly basis, and you can look at them. They’re all posted at the SEC. You can search for them in the SEC’s EDGAR data base. Primary dealers are big commercial banks, investment banks, and broker-dealers. They’re all publicly traded and publish their balance sheets and income statements quarterly.

I use this constantly. You can search by stock ticker, such as JPM, then click the button for 10-K and 10-Q filings.

https://www.sec.gov/edgar/searchedgar/companysearch

@ Wolf –

Thank you for humoring and helping this sophomore. (Though I might be overstating my class standing)

Wolf, thanks kindly for your attention. I’ll keep this going at other opportunities. This theoretical disagreement in the importance and relevance of bank reserves is very interesting to me – it seems like a foundational issue to resolve. I’m not sure which is right, atm, but I enjoy very much the information exchange.

Anyways, turns out I can’t buy a mug, since I’m not in the US. Can you increase the minimum donation for your Canadian readers to cover costs of, say, shipping to Canada?

Many Canadian readers have bought a mug via an address in the US, maybe a friend or a relative or a coworker. So if you know someone in the US, time to give them a call :-]

In addition to the shipping costs, there are the hassles of having to deal with customs. I just don’t have the time to do it.

Wolf, I did not read this article. It is enough to have it on hand when I feel I need to understand this stuff in detail. I understand your points. I still feel the Fed is trapped by an indebted and spendthrift government, but I respect your judgment, for now.

You are way better than an “opinion” site. It’s nice to have someone else do all the actual work.

This amount of QE is equivalent to taking one trash bag off the top of a landfill that runs a mile deep.

*QT

This article alone was worth my $100 donation.

Thank you, Wolf. Does this mean the Fed CAN actually engineer a relatively slightly bumping landing, or are we still going to crash and burn. :-)

Asset price may “crash and burn” well, maybe slowly over time with many ups and downs. I don’t think the economy (such as the labor market) will, tho. QT doesn’t have a huge impact on the economy itself.

Sounds like those waiting for a home need to be patient a little longer. Wolf, I gained valuable insight on the inner workings of the FED MBS strategy. Do I understand that the FED took this unprecedented journey into MBS land as part of the COVID response? This allowed many people to tap into the equity of their homes to “help” during financial uncertainty. The unfortunate side effect is the everything bubble. The outcome is either a housing correction or a burst. What is the baseline that a burst takes place? Is it a 20%+ correction in house prices or a 30%+ price correction. Is this timed on the % the FED owns of the MBS in whole? If you explained this, I apologized in advance, for not comprehending your article. I promise I am not trying to waste your time. I am a little

lost.

Will the Fed stop buying MBS and let those they have “roll off” like Securities? That would have a major impact on Fannie Mae and individual homeowners.

I don’t think the majority of the population understands how much lag is built into this inflation reduction response. It took almost a decade to dig out from under inflation in the ’80’s and this generations shot at it is going to be a lot more “painful” than Powell is willing to admit.

Oh my gosh. That was the Most Bountiful Supreme fun I’ve had in years.

The Fed made its QT pledges, similar to a person starting a diet on New Years Day. Let’s see what happens. So far, they’ve turned down a few bagels and lost a quarter pound.

Good analogy. One thing in the favor of this being more sticky — it has been coordinated by Central Banks worldwide. That coordination makes it hard to get out of, sort of like being a member state of the European Union.

China CB is easing. BoJ is not tightening at all.

What, they can’t even keep track of a Quarter Pounder?

Inflation is burning holes in everyone’s wallets and purses, so why are the FedSters only doing less than $100 Billion per month in QT? Fight fire with fire? So if our target is back to the still-too-high balance sheet level of Good Times post GFC of $4.5 Trillion, which makes sense to me but I am just a peon who was robbed thousands upon thousands of dollars of Interest Income during this sad period since 2008, then $95 Billion per month, capped like you would a volcano, TAKES ALMOST 4 FRICKING YEARS TO GET BACK TO ANY CLOSE-TO SANE LEVEL AT THE FED.

There will be energy and food riots well before month 47! Some Americans may not even make it through the winter coming up with the cost to heat a dwelling, rented or mortgaged, going up tremendously in the 20% to 30% range.

An ivory tower study from I think PA puts the interest rate effect of QT as it is now written at 50 basis points or 1/2 of a percent. Hummm. I think the effect will be much greater (bond investors in 20-year plus maturities are going to demand some 200 to 300 basis points just to write a check) because we are now in a bond bear market where only the brave or very foolish put in a bid to buy, the defaults with a sagging economy have only just begun, inflation at even 6% is not baked into 20- and 30-year bond yields yet, and higher taxes at almost all governmental levels is going to be highly detrimental to American consumers going forward. And there will be 87,000 more IRS agents, many with side arms, coming to collect those taxes, peasants. Like in Medieval days when the Tax Collector was accompanied by sword wielding soldiers.

It’s a giant mess, and as my late mother used to say: “Jay and Friends, since you made it, you clean it up!!”

Nah, but QT will drive down asset prices — stocks, bonds, real estate, cryptos, etc — for years, likely with big ups-and-downs because nothing goes to heck in a straight line.

I think there will be a great re-sorting of asset prices where not all assets go down. Well maintainted homes in the toniest and best located areas will hold thier value. Short dated and newly issued bonds at the ‘correct’ higher rate will be fine. Stock in companies that operate efficiently in value creating industries will thrive.

Long dated bonds, crap shacks in marginal locations, companies with low to negative cash flows, cryptos with no cash flow or intrinsic use will all suffer.

Diligent research and proper asset allocation are skills that have atrophied in the last ten years. Expect much nashing of teeth.

I remember 2009 when people were very seriously discussing if 1 trillion in QE would fundamentally warp and distort pricing mechanisms in the market and sow the seeds of a collapse.

Now we’re at 9 trillion.

Look out below!!!

re “Now we’re at 9 trillion.

Look out below!!!”

according to Wolf, the Fed must have at least $5T is QE on its balance sheet b/c “They HAVE TO BE HIGHER than the Fed’s liabilities”. So, in a few years, as the Fed’s liabilities continues to increase as they did during the post GFC “good times”, Wolf will simply, again, say QE then has to be $10T b/c Fed’s liabilities doubled. See the logic, the more the Fed monetizes the debt the more its is justified to monetize the debt. This is music to the ears of the MMT croud, of which I never thought Wolf would indulge into.

You beat me to it as I was typing. Their baseline keeps increasing.

Isaac S.,

Pointing out that the Fed needs to maintain a certain level of assets on its balance sheet to match its liabilities is not pushing MMT, it simply acknowledging a basic fact of balance sheet accounting. Any functioning economy needs currency in circulation, bank reserves, etc. in order for it to run smoothly. The only way those things get into the economy is through the monetization of treasury debt. Obviously, too much of those things creates massive distortions in the economy, like the raging inflation we have now (which Wolf has pointed out over and over again).

I don’t know where Wolf is getting the minimum $5T number from, but presumably a minimum level of liabilities would not include any excess reserves held at the Fed and it would not include any overnight RRPs.

re “the Fed needs to maintain a certain level of assets on its balance sheet to match its liabilities is not pushing MMT, it simply acknowledging a basic fact of balance sheet accounting.”

I think you are wrong about that. The central thesis of MMT is that the Fed can monetize as much treasury debt as they want until it creates unacceptable inflation. So, all this COVID stimulus we saw them do was there first MMT experiment, which did not go well, but likely gave them some upper bounds on how much monetization of treasury debt they can do in the next socialist round of helicopter money.

The Fed = US Treasury = MMT… balance sheet will never mean revert and will always expand… mark my words!

But now, as Wolf highlighted above, it’s never going below $5 trillion. And they’ll probably ramp up QE at some time in the future, whenever they determine they can, and the next baseline will be over $10 trillion or something. They have permanently distorted the economy and debased the currency.

The US Federal Reserve and other central banks around the world cannot tame inflation. The pain will keep coming and every 10 to 12 years expect prices, cost of living to double. This will mean 5% to 6%+ interest rates for many years so get ready to keep paying for all the socialism and government social programs because it will always get worse. If you think your loans being forgiven is free think again.

The reduction in the Reserve Bank’s assets, may reduce reserves, but aren’t those inert? Isn’t the real action taking place with the money stock?, which is still growing regardless.

Reserves are not “inert.” They’re a measure on Wednesday night of what is a huge amount of flow in and out since the banking system runs payments between banks through their reserve accounts at the Fed.

The balance of reserves has already plunged by $1 trillion since the end of 2021 (beginning of taper), to $3.25 trillion currently.

In all the mumbo jumbo things the FED says, the bottom line is they want economic growth. They will not say it but the goal it to void recessions. They always will say they want a soft landing (no recession) after the economy gets over heated.

They want economic growth that is not too hot (high inflation) so they give a target 2%….what ever that really means.

How do they juice or slow down an economy….interest rates (in the past). It takes 6 months for interest rates to take effect.

So the new tool was QE and balance sheet expansion and now balance sheet reduction via QT. Results are very quick.

But, this is a new CB tool. An eye opening report I read that was written by a Central Bank (France Central Banque) earlier this year that said Central Banks balance sheet size does not matter. It is only a financial tool to guide the economy.

Long story short, they said stop worrying about CB balance sheets. CBs will increase (buy assets) to juice the economy and decrease (sell or roll off) to slow it down.

They said look at the Central Bank of Japan where its balance sheet is over 90% GDP. and no problems there. The U.S. is around 30% so it can still triple in size without any issue.

So time will tell I guess if they are right or wrong but this is just an insight into Central Bank thinking.

ru82

“They said look at the Central Bank of Japan where its balance sheet is over 90% GDP. and no problems there.’

?

Did they also say nearly 90% Bonds are held by BOJ and almost no growth over 2 decades. Debt to GDP of Japan is nearly 240% highest of all countries. USA is over 130% conservatively. Per Warren Buffet, once the Debt to GDP goes over 90%, it will be a drag on the economic growth!

The BOJ started the whole thing….in 2000. ZIRP.

The BOJ is going to pay for it later with high inflation, interest rates or massive bankruptcies, debt bailouts and slow, malaise GDP for many years. The BOJ is like a desperate person clinking on hopes that somehow life will not get too expensive but it always does with central banks, governments money printing, added, increased taxes, bad economic, socialist policies.

Garth Turner, a housing bear, predicts that the interest rate in Canada will be above 6%. This means that the FED might also follow suit, or is it Canada who is following the FED?

All I know is that the wealth manager and politician Garth Turner knows that interest rates will be higher than 4%.

QT creates a game of musical chairs played on a daily basis by the banks. Reserves/deposits from small depositors bleed out daily and the banks must adjust their assets and liabilities over time. Easy enough part of the game.

But they dont know when theyll get hit by a big withdrawal that disrupts their carefully laid plans. Maybe a large corporate shifts relationships? Or several large depositors make big payments? And on that day, any one bank may have to make a sudden turn to another bank to borrow the money over night to cover regulatory ratios. No bank wants to lend to another bank in difficulty so they all have an eye on eachother during this process.

Happens enough times and banks stop lending to eachother and they turn to the Fed. Boom, a little crisis in the making and the Fed reverses course on QT to avert the possibility of said crisis. Just like 2019.

The Fed must tighten carefully and skillfully. God speed.

Wolf,

Aren’t reserves only used by banks and other direct clients of the Fed to settle transactions among themselves? Reserves cannot be spent at Walmart, in other words.

This is, imho, a crucial question to resolve, because it seems like a lot of people believe that reserves are like big sacks of cash that a monopoly man looking banker walks out of the Fed holding to then buy all sorts of goodies, like bonds, equities, on secondary markets like the NYSE. But this just isn’t the case, is it? Sure, a bank can buy assets off another bank and pay for those assets in reserves, but a transaction of that nature doesn’t add to the money supply in the real economy — the reserves are essentially locked away at the Fed until the bank buys something else off another bank.

Nevertheless, it seems to me that a majority hold the view that QE and its insane money printing (digitally crediting banks reserve accounts as they sell bonds to the Fed) is the equivalent of crediting the general population with trillions wbot then go hog wild buying houses, bonds and equity.

Conflict, as far as I see it, exists among the financial information consumer crowd over two opposing theories about what exactly banks do (and can do) with reserves: one says they do very very little and can mostly be ignored; while the other treats reserves like cash or the debit card you use to buy twinkies at the gas station. One says QE renders prestine forms of collatoral very sparse, making monetary and financial markets worse, while the other says the exact opposite, as if we’re being hosed down with money in the streets.

Let me just address the “reserves” part of your comment.

US commercial banks have $18 trillion in deposits, which they owe their customers. With those $18 trillion in deposits (the banks’ liability) come $18 trillion in cash they received from their customers, an asset. They do all kinds of stuff with this $18 trillion in cash, including buying Treasury securities, lending it out, buying real estate, and, of course, putting currently $3.5 trillion on deposit at the Fed, where it earns interest. A bank’s reserve account at the Fed is a cash account. As I said, the bank uses this cash to pay other banks or pay the Fed, and the rest earns interest, sort of like an interest-bearing checking account.

Bank cash that is put on deposit at the Fed (= “reserves” on the Fed’s books, and = “interest bearing cash” on the banks’ books) is the most liquid interest-bearing asset a bank has and ranks highest in its regulatory capital. And it also represents cash that the bank doesn’t know what else to do with that would earn more money.

Thanks for your reply. One camp says that the banks take that 18 trillion $ and converts them into asssets by buying non risky securities (Treasuries are ranked as high as reserves as far as regulatory limits are concerned). I think you’re in that camp.

The other camp goes so far as to say that reserves are merely inter-bank tokens that are mostly useless. The interest they earn on them earns them more useless tokens. You are not in that camp. What you’re saying is that the banks can use reserves to do more or less whatever they want with, right?

the reserves are just $3.5 trillion of the $18 trillion in deposits. Reserves earn interest, lust like Treasury securities but are more liquid. Reserves are NOT AT ALL useless to the banks because they earn interest, are super liquid, and are the highest rated asset in the regulatory capital structure. Reserves are measures on Wednesday evening. But they’re in constant flow.

Last week’s T-bill auctions resulted in large basis point increases over the prior week:

1-mo T-bill auction rate yield rose 16 bps to 2.509%

2-mo T-bill auction rate yield rose 12 bps to 2.780%

3-mo T-bill auction rate yield rose 14 bps to 2.941%

4-mo T-bill auction rate yield rose 13 bps to 3.176%

6-mo T-bill auction rate yield rose 13 bps to 3.334%

The Overnight RRP award rate is = 2.5%.

In order for the Fed to shrink their $2.2 trillion of RRPs, I think they must either lower their “award rate” or, the auction yield rate needs to rise much higher — which will exert downward pressure on stock prices.

Question:

Why do T-Bills maturing on Thursdays consistently yield LESS than those maturing on Tuesdays? For example:

Tbill due 10/04/22 ask yield = 2.420 YTM

Tbill due 10/06/22 ask yield = 2.232 YTM

Tbill due 10/25/22 ask yield = 2.534 YTM

Tbill due 10/27/22 ask yield = 2.495 YTM

Tbill due 11/01/22 ask yield = 2.650 YTM

Tbill due 11/03/22 ask yield = 2.560 YTM

That is so weird.

Tbv3,

“In order for the Fed to shrink their $2.2 trillion of RRPs, I think they must either lower their “award rate” or, the auction yield rate needs to rise much higher — which will exert downward pressure on stock prices.”

The Fed will shrink its RRPs ($2.5T as of 8/31) by allowing the assets on its balance sheet to shrink.

If it lowers the award rate on the overnight RRPs without shrinking its balance sheet, that will just send some of that money chasing after a limited supply of Tbills, pushing their value up and their yields down until the yields fall to the level of the overnight RRP award rate. Ultimately, that money just ends up back on the liability side of the Fed’s balance sheet, either as RRPs, bank deposits at the Fed, or currency in circulation (it could also end up in the Treasury account at the Fed if the government taxed that money out of the economy).

Assets = Liabilities + Equity

Very eagerly awaiting Wolf’s upcoming report about how the Fed’s liabilities prevent QT from going below $5 trillion as a baseline.

One serious question I have on the matter: Why were liabilities so inflated in the first place compared to 2007? Would RRP’s being diminished also lower the $5 trillion baseline, thus allowing QT to theoretically (eventually?) go lower than $5 trillion?

RRPs and reserves are demand-based. Meaning: too much liquidity in the financial system, and so banks deposit excess cash at the Fed to earn interest (“reserves), and Treasury money market funds deposit their excess cash at the Fed (RRPs) instead of at the banks.

After years of money-printing, there are $x trillion in excess liquidity in the US financial system, and that creates demand for reserves and RRPs. “

Some of that liquidity will get burned up when leveraged bets in the markets blow up, when leverage gets reduced, etc. And that is already happening, and reserves plunged by $1 trillion YTD though QT has barely started. But there is still a long way to go.

QT will result in lower reserves and lower RRPs because QT removes liquidity from the markets and the financial system. But as I mentioned, that’s not the only thing that removes liquidity.

Wolf, thanks for taking time to reply in detail.

The way I understand your comment is such that, by the time QT whittles down the balance sheet to $6-7 trillion, there will have been plenty of liabilities wiped off as well and lowering the theoretical QT floor well below $5 trillion.

Wolf , echoing what others say about your insightful articles.

Would be excellent if you can explain in layman’s terms (me) what this article is saying about level of liquidity in the banking system after which QT will need to be paused. To be honest , much of the article went above my head

The “doomsday scenario” is for the markets. QT will reduce asset prices just like QE inflated asset prices. Everyone in the markets HATES that. THAT is the “doomsday scenario” that article was worried about.

I am late to this thread but recently I was made aware via a source that the Fed’s original MBS pre-payment assumptions are not coming in as at the levels originally estimated. Rate hike and credit markets have already slowed pre-payments via re-financing. No kidding. Thus MBS reduction via QT may not reach the set target. Also this source said that the Fed quietly as committed to keeping the housing market stable as they are publicly pledging to fighting inflation. This is especially important with mid-term elections around the corner. After November – look out.