US natural gas prices tripled from the 10-year average, now linked to global prices, with 7 LNG export terminals now operating and 15 more approved.

By Wolf Richter for WOLF STREET.

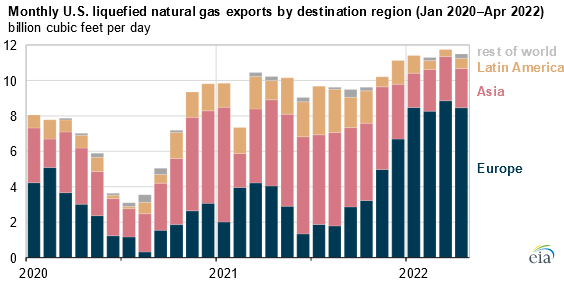

Exports of Liquefied Natural Gas (LNG) from the US to the rest of the world jumped by 18% over the first four months of 2022, to an average of 11.5 billion cubic feet per day (Bcf/d), compared to the annual average in 2021, according to the EIA today.

Exports of LNG have been increasing at huge rates – by 49% in 2021, by 31% in 2020, by 68% in 2019, by 53% in 2018, and by 279% in 2017. This growth comes as a function of the completion of new LNG export terminals.

The US has become the largest natural gas producer in the world. In 2016, large-scale LNG exports started, much of it shipped to Asian destinations, with China, Korea, and Japan at the top in 2021. But due to the massive demand from Europe so far in 2022, and higher prices at the trading hubs in Europe, US exports have shifted to European destinations.

In 2021, the US shipped 34% of its annual LNG production to Europe. But over the first four months this year, a massive shift occurred, when 74% of US LNG was exported to Europe, tripling the volume to 7.3 Bcf/d, and accounted for 49% of total LNG imports, according to the EIA today.

This shift from Asia to Europe was driven by spiking spot prices for LNG at European trading hubs that incentivized US exporters with destination flexibility in their contracts to ship LNG to the EU and the UK.

At the same time, LNG exports to Asia plunged by 51%, compared to the annual average in 2021, to 2.3 Bcf/d.

Exports to China have plunged from an average of 1.2 Bcf/d in 2021 to just 0.2 Bcf/d over the first four months in 2022, amid the lockdowns, a mild winter, and high US LNG prices. Exports to Japan and Korea also fell (chart via EIA, Europe includes Turkey):

Since Germany, which desperately would need the LNG, doesn’t have any LNG import terminals – though they’re now being fast-tracked – US LNG was shipped primarily to France, Spain, the UK, Turkey, and the Netherlands.

Surging Export Capacity.

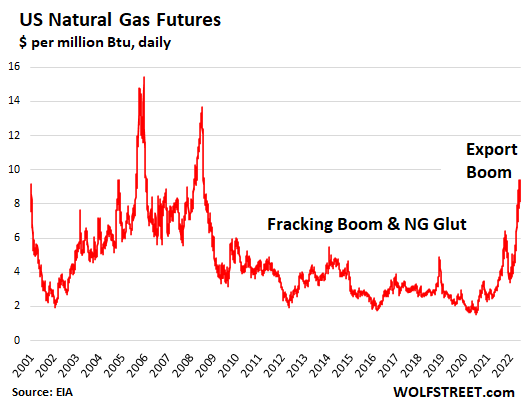

There has long been a small LNG export terminal in Alaska. But the first large-scale export terminal began operating in 2016, by which time fracking had created a natural gas glut in the US, and its price had collapsed. LNG export operators arbitraged the cheap price of natural gas in the US and the much higher prices they could get globally by exporting LNG.

The increase in LNG exports in 2022 so far is the result of additional export capacity coming on line so far this year:

- Train 6 at the Sabine Pass LNG export facility added up to 0.76 Bcf/d of peak export capacity. Began operating at the end of 2021.

- The first five blocks of Calcasieu Pass. The facility will have 18 liquefaction trains with a total peak capacity of 1.6 Bcf/d. All of them are expected to be operational by the end of this year.

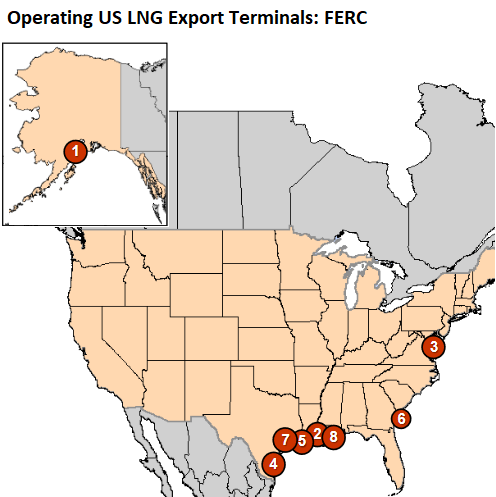

Operating LNG Export Terminals.

The small terminal at Kenai, Alaska has been operating for years; the other seven started operating in 2016 and later (FERC data):

- Kenai, AK: 0.2 Bcf/d (Trans-Foreland)

- Sabine, LA: 4.55 Bcf/d (Cheniere/Sabine Pass LNG –Trains 1-6)

- Cove Point, MD: 0.82 Bcf/d (Dominion–Cove Point LNG)

- Corpus Christi, TX: 2.40 Bcf/d (Cheniere – Corpus Christi LNG Trains 1-3)

- Hackberry, LA: 2.15 Bcf/d (Sempra–Cameron LNG, Trains 1-3)

- Elba Island, GA: 0.35 Bcf/d (Southern LNG Company Units 1-10)

- Freeport, TX: 2.14 Bcf/d (Freeport LNG Dev/Freeport LNG Expansion/FLNG Liquefaction Trains 1-3)

- Cameron Parish, LA: 0.74 Bcf/d (Venture Global Calcasieu Pass Units 1-4)

Future LNG Export Terminals.

In addition, there are three US export terminals that are approved and are now under construction, according to FERC:

- Cameron Parish, LA: 0.92 Bcf/d (Venture Global Calcasieu Pass Units 5-9) (CP15-550)

- Sabine Pass, TX: 2.26 Bcf/d (ExxonMobil – Golden Pass) (CP14-517, CP20-459)

- Plaquemines Parish, LA: 3.40 Bcf/d (Venture Global Plaquemines) (CP17-66)

And there are 12 US export terminals that are approved but not yet under construction, according to FERC:

- Lake Charles, LA: 2.2 Bcf/d (Lake Charles LNG) (CP14-120)

- Lake Charles, LA: 1.186 Bcf/d (Magnolia LNG) (CP14-347)

- Hackberry, LA: 1.41 Bcf/d (Sempra – Cameron LNG Trains 4 & 5) (CP15-560)

- Calcasieu Parish, LA: 4.0 Bcf/d (Driftwood LNG) (CP17-117)

- Port Arthur, TX: 1.86 Bcf/d (Sempra – Port Arthur LNG Trains 1 & 2) (CP17-20)

- Freeport, TX: 0.72 Bcf/d (Freeport LNG Dev Train 4) (CP17-470)

- Pascagoula, MS: 1.5 Bcf/d (Gulf LNG Liquefaction) (CP15-521)

- Jacksonville, FL: 0.132 Bcf/d (Eagle LNG Partners) (CP17-41)

- Brownsville, TX: 0.55 Bcf/d (Texas LNG Brownsville) (CP16-116)

- Brownsville, TX: 3.6 Bcf/d (Rio Grande LNG –NextDecade) (CP16-454)

- Corpus Christi, TX: 1.86 Bcf/d (Cheniere Corpus Christi Stage III) (CP18-512)

- Nikiski, AK: 2.63 Bcf/d (Alaska Gasline) (CP17-178)

The Price of Natural Gas in the US tripled.

So if US consumers, industrial users, and power generators are wondering why the price of natural gas is suddenly so damn high and roughly tripled from the 10-year average – after over a decade of having benefited from the collapsed prices during the natural gas glut (RIP) in the US – it’s because US natural gas prices are now increasingly arbitraged against global prices, and they’re much higher.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“In 2021, the US shipped 34% of its annual LNG production to Europe. But over the first four months this year, a massive shift occurred, when 74% of US LNG was exported to Europe”

Thereby generating windfall profits from low supply and resultant high prices on both continents.

Chaos creates opportunity. Market stability is not conducive to profiteering. Disruption allows for the game board to be rearranged in more favorable ways, especially if politicians can be coerced into suspending any remaining restraining regulations.

Exactly. Thanks for bringing this to the forefront.

Some industries that use Nat Gas in the U.S. have been fighting against increasing nat gas exports at the current rates. Right now low nat gas is great advantage….but soon may not be.

Plus, consumers will have to start paying much higher utility bills. I think if the gas is produced on U.S. Government land….it should be kept domestically. Afterall, we the people own that land and those mineral rights.

I’m more or less fine with trying to restrict export use of NG produced on public lands…but are you suggesting that the Feds/States aren’t currently *taxing* NG produced on public lands?

It is rare for the G not to extract its cut, one way or the other.

And yet the fossil fuel industries are notorious for managing to slime their way out of paying their fair share of taxes.

“ Thereby generating windfall profits from low supply and resultant high prices on both continents.”

“ Plus, consumers will have to start paying much higher utility bills”

Does anybody else see the taxpayers picking up the tab for the poor people this winter…

The govt is corrupt and run for the benefit of corporations. Corps paid for the corrupt votes, pay for corrupt news, pay for corrupt vaccines. There is nothing that happens without the corps benefitting.

The corps are failing and the world contracting in population so they are now trying to lock in their standing and guaranteed monopolies.

That’s what the US military industrial complex is there for.

Why doesn’t Congress enact a law simply prohibiting any exports of LNG from the United States? If so, problem totally solved in a second.

But but but The Germans! After they laughed at Trump when he said they should not be dependent on Russia.

Germany needs NG as an intermediate while it transitions to renewables.

Trumpelthinskin wants Europe to be more dependent on his campaign contributors in the US fossil fuel industry. Vlad helped him with that as part of the quid pro quo for the reacquisition of Ukraine.

All very geopolitical, Game of Thrones meets Dr. Strangelove. Oceania has always been at war with Eurasia, and the war with Eastasia never happened.

But of course the advice was strictly self-serving to the US.

Since Europe didn’t listen, the US doubled down with poking the bear (it did it for 30 years): Ukraine was for all practical purposes part of USA’s NATO. See “Joint Statement on the U.S.-Ukraine Strategic Partnership”, published on September 1, 2021 on whitehouse.gov.

You are talking about our corporate fed Congress? Good luck with that.

Helping the voters at the expense of the billionaire corporate donors? Yeah I’m sure Congress will get right on that!

SoCal,

I’ll assume you are kidding.

And in the long run, the G is going to need export barter goods (NatGas) once the rest of the world gets fully sick of taking our green tinted, toilet paper IOUs.

That is what annual trade deficits amount to…IOUs.

And the US has issued trillions and trillions of them over the last 50 years of ever growing trade deficits.

I am very serious. The US government should simply shut down 100% of LNG exports from the US. Period.

You mean put the companies out of business that built these very expensive LNG plants with government approved permits? And, what would we do with the gas then? Shut down the gas producers and pipelines?

Geez, last week we moan about the lopsided trade deficit. Make up your minds.

It used to be illegal but congress changed the law. We were energy independent a short time ago but as a capitalistic country we do what is best for profits not what is in the national interest. Capacity to produce and refine is manipulated by the industry. Unfortunately, our educational system has degraded to the point where reasoning is not taught. Do you think President Biden has caused the inflation, oil and gas shortage in the 16 months he has been in office? These circumstances were baked in the cake long before he took the oath.

Sorry posted on wrong article instead of ‘Gasoline Spikes to Nearly $5 US Average’ article.

Wolf you can delete the original comment and this reply.

Europe got hooked on Russian gas and now they’re finding out just how at mercy of a single point of supply they really are. Google “We were all wrong’: how Germany got hooked on Russian energy”.

In Germany’s defense: it was absolutely logical to use the Eastern fossil fuel connection inherited from the Cold War era and that cheap gas had a huge part in making Germany the #1 European economy. On the production side the Russian gas fields easily have 100+ years of proven reserves, a quantity guarantee which far outweighs the geopolitical risks associated with it. I have no doubt that after a peace agreement is reached they will be amongst the first to resume the Russian gas purchases.

Europe should have diversified its supplies.

Reagan, as President provided many warnings.

I think it’s a straw man argument to say it’s not diversified. Europe relies on 3 main fields for fossil fuels: the North Sea, the Middle-East and Russia.

France had intersts in adding North-Africa as a 4th leg, but in all fairness their development plans were quite delusional and the Arab Spring kind of destroyed their credibility when it comes to dealing with the local governments (Sarkozy was part of the scheme to overthrow Gaddafi in Libya to gain control of the local fields, but it all went catastrophically wrong). The US LNG exports may seem big, but due to technical limitations they cannot grow enough to fully replace Russia.

Gadhafi made the mortal sin of demanding that the oil and gas from the ground beneath Libya’s soil be paid for in gold — not the almighty petrodollar.

Secretary of State HRC, “We came, we saw, he died. Hahaha.”

Look at the photos of Tripoli before NATO warplanes destroyed it in spring of 2011, and compare them to photos of Tripoli today.

Ronald Reagan fought that fight as long and as hard as he could. And got laughed at by all the “experts” in Europe and the U.S. for being too “belligerent.” When he prohibited American companies with specialized equipment from participating in the building of that pipeline, France nationalized the subsidiaries of those companies based there. Although Reagan eventually had to yield to the realities of Alliance politics, fortunately he was able to limit the pipeline being built back then to just one strand rather than the originally planned for dual strand.

Then… being the kind of guy who never gives up… Reagan convinced the Saudis to open the spigots in late 1985 and crush the price of petroleum just after the Soviets started to earn hard currency from that pipeline. The rest as they say… is History.

That the end of the Cold War brought about muddle-headed thinking in the U.S. and Western Europe is a stain on our generation… not his.

Reagan was a complete and total ignorant stooge for Corporate dominance of America and nothing more. He was given a script and played his simplified part with trained actor conviction….and armies of scriptwriters.

“Speak a little faster Mr President” -CEO of Merril Lynch on podium with him.

“Balance the budget you dummy!” – my old fashioned conservative and successful businessman stepfather EVERY time he saw the B actor on TV.

But there were some Government social programs he started for the corporations that REALLY proved successful, one of the most successful in the world.

Here’s one;

https://en.wikipedia.org/wiki/File:US_incarceration_timeline-clean.svg

Maybe that’s why Putin is hoping to secure Ukraine. Ukraine has the 2nd most reserves of Nat gas in Europe, mostly untapped. Russia doesn’t need the gas but also doesn’t want Ukraine for competition. Plus the pipeline route from Russia to EU through Ukraine is strategic.

That is a good point that I have read elsewhere. Nor does he have to grab it all. Just seizing the Donbass and all of the coastline that Ukraine has would not only steal Ukraine’s most productive industrial areas and petroleum reserves, it would limit Ukraine to being a farming nation… about as much of a military power as Kansas.

I’m not sure that 100 years of reserves in *Russia* really provides Germany with much more than being continually vulnerable to Russian leverage for 100 years.

The incremental savings from Russian gas (versus alternative suppliers/sources of energy) may not be worth it.

If one of the legs of your stool keeps getting termites…it ain’t much of a stool.

I’m not sure that 100 years of LPG in *the US* really provides Germany with much more than being continually vulnerable to *American* leverage for 100 years. As if 80 years hasn’t been enough! It’s all about the Benjamin’s, baby, and we sure ain’t gettin’ any of them !

Do you mean that being vulnerable to Russian leverage is worse than vulnerable to USA leverage, tell that to Iraq, Lybia, Syria, Iran etc etc… The USA is the most untrustworthy regime in the world…. The people are great (like most countries) but the Government is a bunch of criminal mafia types..

“Do you mean that being vulnerable to Russian leverage is worse than vulnerable to USA leverage,”

Yes, that should be fairly obvious.

Time for Nuclear Power Plants to produce the Electricity and then Hydrogen for future car technology.

As a civilian (called Tiger cruise) I was out in the middle of the Pacific ocean on a nuclear powered aircraft carrier. Along comes a supply ship and over came the hoses with fuel. The PA announces “Yes Yes, we are taking fuel on. Our jets don’t operate on nuclear power”. War machines require carbon fuel

That was a great article in The Guardian. It really laid out how foolish the German leadership has been going back decades.

The Guardian!! ROTFL!!😂😂😂

You should read the article rather than laughing. I am as conservative as they come, but it was absolutely brutal towards leftist politicians in Germany (and Europe) who sleepwalked their way into this trap.

SpencerG, my apologies but there are only so many hours in the day. .don’t want to waste them on tbe Guardian. Besides, I don’t need to read it to see how Europe sleepwalked into this debacle…I’m old enough to have watched it

Whatsthepoint… I am not offended. But it would take longer than a minute to read this article. It was a COMPLETE takedown of the German myth that had taken hold in the country that it was the German left that had destroyed the Soviet Union rather than Ronald Reagan (the American myth). For instance, I had no idea that as far back as Henry Kissinger that American officials had warned the Germans that they were trying to ride the back of a tiger. Nor that they had stiff-armed Jimmy Carter.

I have told my friends that one thing that I have taken from this invasion is the need to keep an eye on the “myths” that other nations tell themselves. Ukraine is “Little Russia” and the Americans promised that NATO wouldn’t move East are two Russian national myths that led to this. German engagement ended the Cold War (rather than the American military buildup in the 1980s) is the German myth that left them exposed.

I love the way people quote the totally communist Guardian newspaper….

SpencerG- if you’re referring to the Patrick Wintour piece of a week ago, quite agree, excellently written and detailed. He is an old pro among the Guardian editorial staff. As with all news sources, pick and choose nowadays, the universally trusted voices are all gone. This place and the German papers that I delivered on my bike when I was a kid are my regular reads. Thanks for the article tip.

Yeah… that’s the article. I didn’t know who the author was but I could he tell he was a cut above as a journalist with one sentence. Most people are aware that the Germans never built a LNG regasification facility because they saw no need for American natural gas. But he included this tidbit…

“When I spoke to a Qatari energy official last month, he recounted how they spent five years trying to break into the German energy market, only to find their route blocked at every turn.”

In other words he took the time to seek out someone from beyond the German-American spat to see if it was just delays, hubris, etc. What he discovered didn’t let the Germans off the hook at all. They weren’t just stiff-arming the Americans… they were ACTIVELY avoiding diversifying their petroleum suppliers.

The whole article is a takedown of the German myth that they have been telling themselves since the Berlin Wall fell that it was GERMANY that was responsible for that through its engagement with Russia starting in 1970. And a BRUTAL takedown of that national myth.

They are finding out how much the US didn’t like this Western Europe + Russia economic dynamics (and in the future + China, with its Belt and Road project).

US is scared shitless of this — the center of gravity of the global economy would shift away from it.

Well, there is a 700mil population (EU), just across the Atlantic, used to high energy consumption, whose leaders have decided to abandon cheap supplies of gas +oil from (RF), and replace those supplies with 3x + priced supplies from (US).

As a result, purchasers EU, as well as sellers US, are looking at their energy prices going up happily, two or three or more times than what is was last Christmas.

Say 600 out of 700 mil Europeans as well as 250 out of 350 miles North Americans are being fekked, not just with their car fuel prices but food prices as well as these rely on that same fuel too.

It’s already clear to see here in U.K., and I hear the same from friends in Germany France and Italy.

Neoliberal globalisation at its best. By the elite, for the elite. Plebs = go die in the ditch. What’s not to like.

“…used to high energy consumption…”

IIRC per-capita energy use in European households is half or less that in the U.S.

👍and even more hilariously, no way Europe/UK isn’t still importing oil from Russia, it’s going in record amounts to India, being refined in ‘private’ refineries and then shipped out at a huuuge markup…India, pinky swear, doesn’t know where it’s going. It’s called circumventing your own sanctions, or trying to scrape the dogs**t off your shoe after you’ve stepped in it.

The UK has never imported that much from Russia, about 3%…(which including mainly diesel)

I guess just like the USA…

Got any alternatives in mind?

In a TERRIBLY DOWN MARKET for the last six months…all of my O&G E&P holdings have done exceptionally well…AR, CPG, OXY, MRO, CTRA, FANG, DVN…the list goes on. Warren Buffett (BRK.A) (BRK.B) now owns 15.2% of OXY. These Oil & Gas companies are virtually PRINTING Free Cash Flow. At least for now anyway. YMMV.

“Boom” sounds kind of bad when it comes to describing an industry specializing in high-energy density transportation. It’s all fun and games until a ship or terminal blows up, hope you did not curse them Wolf. From what I understand there are a million safety checkpoints and restrictions just like anywhere in oil & gas, but it’s not like nuclear where the sites are engineered to a point of Homer Simpson-like fool-proofness. Half the world rushing to get an LNG terminal on their doorsteps with 50+% YoY growths just seems scary to me.

By the way, I assume Shell’s messed up Prelude project is making big money now, so that likely covers part of the export that was rerouted from Asia.

Europe showed its fealty to the American Empire with sympathetic massive virtue signaling and then committed economic suicide by replacing cheap pipe-line gas for very expensive LNG . The political blow back for this fealty has begun. Inflation has collapsed the Estonia Gov’t and the same inflation neutered BOJO today by a 148 vote of no confidence in his party. Any vote above 133 means a PM is the walking political dead. Macron is terrified of a legislative defeat in the Parliament this month and for Seargent Schultz of Germany, well, its Auf Wiedersehen. American Gas suppliers are laughing all the way to the bank. I thought replacing the 100+ year old Coca-Cola brand with New Coke was the top of of the list for self inflicted carnage. This Eurocide by gas has topped the list.

DR DOOM,

Inflation started spiking in January 2021, well over a year ago, and I have been screaming about it for well over a year. This inflation was triggered by central banks and government stimulus. By January 2022 — before any sanctions or whatever — inflation had already reached 40 year highs. Crude oil and natural gas already started spiking in 2021. Have you already forgotten?

Hi Wolf,

This was an extremely interesting article including comments. I found another website with some info about crude.

This is from a highly respected AIMCat who wrote:

“Thought I’d pass along the following boots on the ground information concerning US oil supply. I just finished speaking with a friend and neighbor of mine who is a tug boat captain who runs oil along the west coast. He works three weeks on and three weeks off and has been at sea for a many years. He is very highly experienced and his tug is cutting edge. (Don’t want to give too much info about him).

This week, he was due to unload his oil in Long Beach but mid morning Tuesday, he was told to turn around and anchor in a big bay because there was no storage available to unload. He said tankers are stacked up with the same problem, the storage tanks are FULL of oil. I asked him how the supply levels were compared to 4-5 years ago and he said the same, full. He also said that they are pumping the hell out of oil in Alaska and there is a ton coming in from overseas.

My friend also stated emphatically that he is no communist but the profits being generated by these fuel prices is outrageous and in his opinion, the high prices are a scam. He is shipping the same amount of oil he has shipped for years! His evidence is that there is no oil shortage.”

Reminds me of another former time when TPTB tried to inflate oil prices.

Wolf, for the millionth time, this is ALL because Biden shut down the energy industry!!!! Duh.

/s

I worked for Coca-Cola during the great formula change of about 1984. It turned out to be the greatest move in corporate history although the company never admitted it was on purpose. Sales of Classic soared on return.

Also, during the Coke flavor switch, the company switched from cane sugar to corn syrup, the sneaky bastards.

“Also, during the Coke flavor switch, the company switched from cane sugar to corn syrup, the sneaky bastards.”

And thus ruined Coca-Cola forever. I can’t stand the nasty film left in my mouth by HFCS. I doubt I have had more than a case of Coke Classic made in America since 1990. Overseas is a different matter… they still use sugar in most places… no tariffs to protest American farmers.

Oops.

… to protect American farmers.

SpencerG

“The CORN syrup aka Fructose! the Mexican Corn (maize) used to be nearly 80% protein and 20% carbohydrates but Food Industry decided to genetically modified ( early 70s) and reversed that ratio, to produce ‘corn syrup a cheap substitute for SUGAR but deadly to humans increasing obesity since 80s!

If you can see a documentary’ KING CORN’ which was shown in Canada but banned here, gives an entire different story. I think it is still available online! Very informative and educational.

I think it was mostly just to get fermentable sugar for the STUPID biofuel midwest pork project.

Sure, fructose is a bit cheaper than sucrose, but if if idiot Spencer drinks so damn much sugar water he can tell the difference, then he is likely an example of what the real problem is;

Ad riddled Americans shoving sweet shit of all kinds down their input hole.

And likely doing nothing to burn off the calories….NOTHING.

Alexa, will you change the channel? I LOVED that zombie commercial where he gets home, picks up the remote, his arm falls off, so he switches to asking Alexa, then his ear falls off and he asks her to turn up the sound.

You learn more from commercials than you do (gag) “content”, if you can even tell the difference anymore.

Alexa, order some more Metformin and Insulin.

Estonian here – inflation did not cause the collapse of the government.

Aside from LNG, recent unit coal trains presumably from Utah for export to Asia in Richmond, CA. We can’t burn it but the CO2 ends up in the atmosphere one way or another. I wonder if the 100 car corn ethanol trains are on their way to The Bay Area refinery for our “special” California blends. Never mind the displacement of good food growing farmlands for ethanol. A plethora of questionable decisions raising various prices.

Repost this under the correct article.

USA NG suppliers did not create the problem. Hundreds of these companies went bankrupt while NG was cheap Chesapeake and Sand Ridge a couple of the larger ones.

If government requires NG from their land to stay local who would drill it? And at what price would that get? What about the air waves for cell phones ?

Cheap energy allowed the USA to thrive for decades.

The higher energy cost will be devastating and has happened over the course of just a couple of years and EU has accelerated the process plus Russia ban.

One of the great wealth creators of the 20th century was energy and being in the ownership of the people not the government.

Free Markets should be embraced not manipulating by the whims of special interests.

Not sure If the figures for the lng plant size is accurate. I’m sure the source is not Wolf.

A 132 BCFD Florida lng plant hard for me to imagine or much less a pipeline and wells to supply the beast.

The theme still the same maybe the units are off a bit.

Without the sanctions policy against Russia . there would be much less need to import LNG gas . By definition LNG shipped by boats is going to considerably more expensive than natural gas shipped by pipeline .

The European gas situation is a perfect “Eigentor”, i.e. kicking the ball into your own goal following US directions. Genius.

No, that part of the pipeline infrastructure is purpose-built to deliver crude oil and natural gas to Europe. It cannot be just switched to deliver this stuff to China. If Russia cannot deliver this via pipelines to Europe, it has very hard time delivering at all to anyone.

The stuff that goes to ports and onto tankers can be shipped to anywhere. But pipelines are different. A gas production field with a pipeline connection to Europe cannot suddenly sell it to China.

That said, the sanctions are not nearly harsh enough. Russia is waging a brutal war on the Ukraine. It should pay a huge economic price for it — and that’s already happening. And if I have to pay a little extra for my gas, fine. At least the US oil and gas companies are booming.

When all those companies were going bankrupt, didn’t a lot of the wells get shut down? Are there numerous wells sitting idle that could be reopened? How does total gas production now compare to production _capacity_ during the glut? Sorry for all of the questions, but these seem to be relevant to predicting the future outcome of the current shortage, at least once the gas production companies get done with finally taking in the dough from those questionable fracking investments of a decade ago.

EIA.gov info the units posted for the plants must be different but again theme is the same

Cheap NG finished for USA will start paying global price.

More than just inflationary a potential for higher inflation and interest rates not showing up in our CPI yet.

Refinitiv Output and Demand Projections

Data provider Refinitiv said average gas output in the U.S. Lower 48 states fell to 94.5 billion cubic feet per day (bcfd) so far in June from 95.1 bcfd in May. That compares with a monthly record of 96.1 bcfd in December 2021.

Refinitiv projected average U.S. gas demand, including exports, would rise from 85.3 bcfd last week to 86.4 bcfd this week and 89.bcfd in next weeks.

And given this is a private industry initiative chasing an export market I do not see a good solution. Export bans I disagree with. Transformational change for USA is here.

Wolf

Could you post your source for data for the new plant builds? These units for gas are easy to get wrong. Many are annual, monthly, daily, LNG units etc.

Ben Sargent,

Gosh, that was weird. I just looked at these figures in the lists of plants (now corrected). I had copied and pasted the lists over from the FERC document, which is in some kind of format similar to a PDF but isn’t a PDF. And turns out, the digits before the decimal and the decimal itself didn’t make it. So instead of 0.76 what made it over was 76. Or instead of 1.86, what came over was 86, through the entire list except in the first line and last line of the list, which were displayed correctly. I have no idea what caused this. I think I got them all corrected now. Thanks.

https://cms.ferc.gov/media/north-american-lng-export-terminals-existing-approved-not-yet-built-and-proposed-8

My not-gonna-heat-it-this-year pool is almost warm enough for mortals. Can’t swim anyway. Too preoccupied not driving my V8.

Natural gas is like electricity: it is an important concept that is fuzzy in the minds of many people. Meanwhile oil/gasoline is easy to grasp. There is the filling station, there is the pump, let’s pull up to it.

I’ve often thought that if there’s ever a global catastrophe and all knowledge is lost, we’ll forget there ever was such a thing as electricity. Every bit of power that once went into our homes and our factories will go into the nebulous ether of the ideasphere . . .

The Eloi will forget. The Morlocks won’t.

In the near future, the demand for NG for heating will be replaced by demand for NG for cooling. Has a nice symmetry to it, doesn’t it?

AC for crops in the future will be fantastically expensive, but there won’t be that many people left to feed and eventually demand for it will die out.

Coal gasification is a 19th century technology and Germany is ramping it up. Germany can become independent from coal and oil From the East by the end of 2022, and largely do without its natural gas by summer 2024, according to German economy and climate minister Robert Habeck, Green Party. The process is slow because they don’t want it to be disruptive, at least not to Germany. The goal is to transition to renewables from fossil fuels entirely in a few years.

Una,

Well, which is it…coal gasification (if truly available…why the wholesale, rapid shutdown of coal production over the last years?) or imminent wholesale renewables (if truly available, why the incremental pace over those same years?).

I don’t know if Germany is going to thread the needle that cleanly.

My recollection is that Germany was real big on calling vast wood pellet usage “renewables” in a bit of pretty dubious Green accounting.

I don’t know if Teutonic happy talk on renewables is going to line up with reality in the short term.

Ok don’t see the happy talk happening so far.

If solar and wind are such super cheap sources of utility scale power, I would expect they would be getting built out a lot faster.

I’d be a lot happier with nuclear plants all over the place. I was promised them as a kid…

People forget. When lp tank goes kaboom. Area can get rebuilt right away. When nuclear goes kaboom. Ain’t living there forever. Plus what to do with the million yr dirty drinking water. Tick tick tick tock

The Germans still are big on wood pellets. There are several production and shipping facilities built by them over the past decade near where I live on the Gulf Coast. They keep expanding them in fact.

This is true. Germany recently moved entire towns to get at new coal reserves. And Renewables, AKA Green Energy is now burning trees to make electricity, this is stupid as trees remove carbon from the air….. I don’t think you move towns for short term anything….

Go to YT & watch a film called Planet of The Humans. About our strange energy future…

Burning wood to fire a power generator is considered carbon neutral because trees remove the carbon from the air, and burning them puts that carbon back into the air. The net effect is carbon neutral. They’re not using old growth for this, but trees from tree farms. They can also use recycled wood, and other wood waste.

One writer says he thinks we all (EU and US) will be paying the same price for NG, which is more. It dazzles me that six months ago NG was going to be outlawed, (and some utilities have a moratorium on new gas hookups) because it wasn’t green enough. Pres is going to cancel the tariff on solar panels. So is my electric bill going to match my gas bill someday? NG is still about half the BTU cost equivalent of gasoline, which means double the mileage instantly, and nobody is doing it?

Well…the *Iranians* have a pretty good sized CNG auto industry if that makes you feel any better…

Storage problems, Pumping problems, Infrastructure Problems.

These export terminals never should have been built. Building major new fossil fuel infrastructure now is sheer madness.

The cost of renewables has steadily and dramatically declined for years and beats just about everything else already, while the cost of everything else can only keep going up. So you’re quite correct, it doesn’t make sense economically and it doesn’t make sense ecologically.

Or existentially: it would be more cost-effective to build out renewables, particularly since fossil fuels are likely to end up costing just about everything.

The problem with path dependencies is that once you’re committed to something you’re pretty much stuck with it, and the fossil fuel cartels insist on their path dependency.

I think you have drank the kool-aid of the enviros.

The way they get to this type of conclusion is to completely ignore how you need to match supply and demand in real time.

Yes, if you assume that a solar panel that produces X amount of energy over the life of the panel on average cost of $0.10/kwh (or whatever the value) and ignore the systems effects that I need power 24/7, but the solar panel (almost by definition) only produces power 12 hours a day, then you might conclude (incorrectly) that I can power the entire system with the average output cost of the small incremental panel. You cannot do this. Unless no one in the system wants power at night (think about lighting!). Yes, storage is possible, but adds to the cost and is VERY expensive. The system cost of storage is added to consumers and should be attributed to the unreliable sources of power/energy.

Renewables are actually great in a system – until a point. Once they no longer add marginal value to the system they are included in, they are not a panacea. 100% renewables does not work – something less is more optimal regardless of simple narratives espoused in the media. Explain to me how this will wort in the real world and what are the actual costs and trade offs involved.

You may be unamused but I am unconvinced.

Nobody has noticed, that most of this panic started last Autumn when Germany, which uses large amounts of windmill power, suddenly found itself with a three month (plus) period, with no wind. Basically Europe, from October to January had a very calm, not very cold period, with very low wind speeds. It was the same off the normally windy UK….the electricity from wind power just failed…and if the wind fails, you use NG to produce electricity…

The country also sat up when Texas went through it’s unusual freeze.

One offs will continue.

“One offs will continue”

No comment needed.

Path dependancies-

It’s very hard to convince somebody of something when his income depends on his not understanding it.

MarMar

Maybe you could provide a reason private companies should be prevented from making private company investments?

If USA does not provide these fossil fuels someone else will.

Electric cars utilize fossil fuels for electric generation.

If no more fossil fuel infrastructure then transportation factories and their vehicles should be shut down as well.

Untrue. You’ve resorted to the Damning the Alternatives fallacy. Minus ten.

EVs need not rely on fossil fuels at all, and an increasing number do not. The Bentley runs on electricity generated from hydrogen, which is generated by electrolysis from electricity from a windmill, and no, my chauffeuse do not want to talk to you.

Excuse me? EVs are loaded with plastic and rubber which come from oil, and lithium batteries which require massive diesel powered earth moving equipment to mine.

Yup, there’s a lot of fossil fuel behind the scenes that are required to make an ev & to power that ev. Every green energy has its carbon tracks, one way or another. Open pit mines to wind generator props in landfills. Plastics to rubber.

Yeah. I’m getting really nauseated with the selective outrage over fossil fuels and the environment. On one hand it’s fine if China burns coal to produce some virtue-signaling snowflake’s iPhone, or a Tesla, but heaven forbid an American have an ICE car. It’s gotten absolutely ridiculous.

And the rush to EVs has nothing to do with the environment anyway, it’s about enriching a bunch of fat cats who have all their bets lined up for a world where battery powered everything rules the day. This is not a reasoned approach, it’s a greedy one.

domestic production data

https://www.eia.gov/dnav/ng/hist/n9070us2m.htm

not much change over the past few years.

i guess they figure Americans will switch back to coal

rjs,

Overproduction of NG caused the price to collapse, which caused hundreds of billions of dollars of losses for investors and countless bankruptcies among drillers, including one of the pioneers of large-scale NG fracking, Chesapeake. The industry is now making money and they’re loving it, and they don’t want the price to collapse again, and so they don’t see any immediate need to plow money into drilling only to collapse the price again. Same with crude oil. The oil and gas industry is totally on cloud nine right now at those prices, and they’re going to try to keep them there. And a big ramp-up in production is going to crush prices all over again. Check the energy stocks, which reflect this strategy. The companies and executives are being richly rewarded for holding down production. Production in the US is not a matter of “can” but of “want to.”

Sorry,

Blaming export terminals for high gas prices is like blaming guns for shootings.

Both are means and part of an observed event but not the real actors.

Nat Gas prices skyrocket due to Europe paying Russia for gas deliveries in a frozen account, in effect not paying especially since the west is also confiscating Russian assets. And consequently Russia no longer delivering until real payment, no rocket science here

And then the merry go around with increase of nat gas prices on the open market.

Moosey,

You didn’t get the point. US export terminals connect the US natural gas market to the global market and increased demand on US natural gas (high demand, more price pressures), and linked US prices to global prices.

Until 2016, there were no major LNG export terminals, and the US was essentially a natural gas island in terms of pricing, and it produced more than it consumed (and exported some of it to Mexico via pipeline), which caused prices in the US to collapse, while they soared globally. So now in the US, we’re paying something close to global prices. That’s what you’re seeing.

The LNG terminals are all on the east coast and gulf coast. I don’t believe there are NG pipelines that cross the Rocky Mountains (or are there?). So, why is the price of NG high on the west coast? Exports to Asia are down. And the terminal in Alaska has been operating for years, so that impact is already reflected in historic prices. Are west coast NG suppliers gouging their customers because they can?

It’s crazy! My previous company had a $1B project on the books 15 years ago to build an IMPORT terminal that was never completed.

My how the times have changed!

Products in short supply globally move to markets with the best margins after transportation.

When politicians of one of the largest petroleum and gas producers in the world, curtail and strangle their production, the markets react to the created “shortages” by moving what there is to those areas providing the highest margins.

They don’t export to achieve lower margins.

CreditGB – i.e. free markets work!

Government regulations just change the path of least resistance.

I recall a few years ago a big dust up here in Tacoma over plans to build a LNG export terminal at the port. It was protested heavily and never went forward.

Always informative reads!! This seems to be a growing and long-term opportunity. So where are the best individual investments to be made? XLE? UNG?. EPD? OXY? ….? And where is there high risk?

UNG isn’t an investment. It’s for short-term trading only. It will eat you alive long-term because of the decay. Look at the 15 year chart. Also get ready for the K-1 during tax time, which is a bitch.