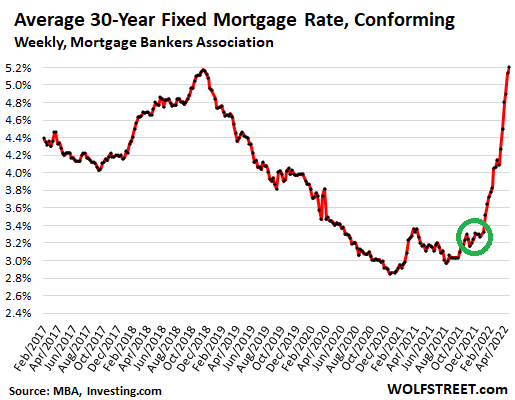

At the time rate locks were issued for those deals, mortgage rates were still around 3.2%.

By Wolf Richter for WOLF STREET.

Home prices spiked in crazy leaps – including by about 30% or more in Phoenix, Tampa, and Miami year-over-year – according to the S&P CoreLogic Case-Shiller Home Price Index today. But this raging mania took place with mortgage rates of late last year, given the long lag the Case-Shiller Index.

The long lag of the Case-Shiller Home Price Index.

The home price data released today was called “February” and represents the three-month average of closed sales that were entered into public records in December, January, February, reflecting deals that were agreed to a few weeks earlier, roughly in November, December, and January.

But wait… Many of these homebuyers were pre-approved and had rate locks from prior weeks and months. In November and December last year, the average 30-year fixed rate hovered at around 3.2%, according to Mortgage Bankers Association data, which is when homebuyers got the rate locks for most of these deals in today’s data (green circle in the chart):

The home price data in the charts below does not yet reflect any part of the spike in mortgage rates that commenced in January. But it reflects the crazed run-up beforehand when buyers were desperately trying to buy a home with their still low rate locks.

The mad scramble at the time.

During the time reflected in today’s Case-Shiller home price data, there was a mad scramble to get the deals done before mortgage rates would rise, and this mad scramble is splendidly reflected here with some crazy spikes.

The overall National Case-Shiller Home Price Index for “February” (average of closed deals entered into public records in December, January, and February, and made in prior weeks and months) jumped 1.7% from the prior month and 19.8% year-over-year.

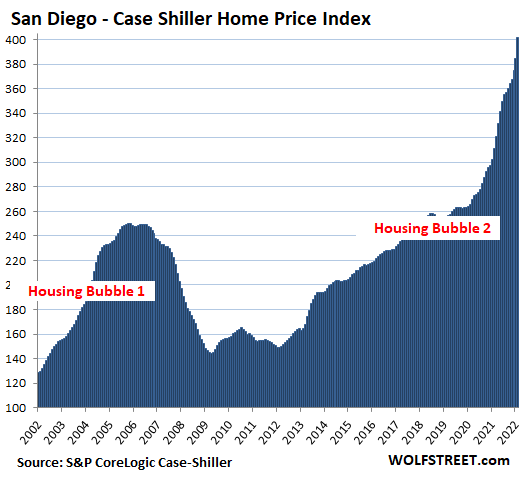

San Diego metro: Prices of single-family houses spiked by a holy-moly 4.5% in “February” from the prior month, and 29.1% year-over-year. The index value of 401 means that home prices exploded by 301% since January 2000, when the index was set at 100.

This price growth amounts to 4.3 times the rate of CPI inflation (+70%) over the same period, crowning San Diego the Number 1 most splendid housing bubble on this list:

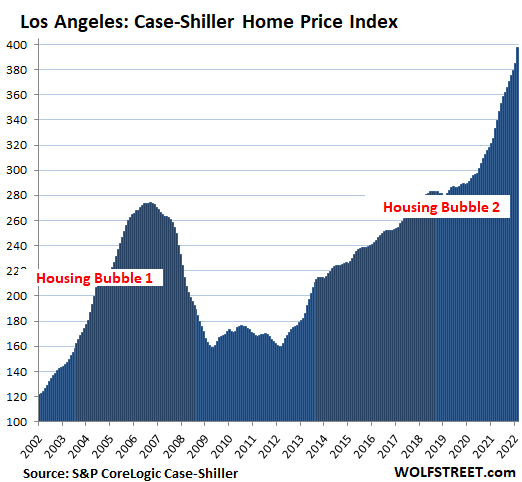

Los Angeles metro: The Case-Shiller index spiked by 3.2% in February from January and 22.1% year-over-year. With an index value of 397, house prices exploded by 297% since January 2000, crowning the Los Angeles metro as the Number 2 most splendid housing bubble on this list.

It’s just house price inflation: dollar losing purchasing power.

The Case-Shiller Index’s “sales pairs” method – comparing the price of a house when it sells in the current period to the price when it sold previously – tracks how many dollars it takes to buy the same house over time. The index includes adjustments for home improvements. By tracking the purchasing power of the dollar with regards to the same house, the index is a measure of house price inflation.

All charts here are on the same index scale, going just past 400.

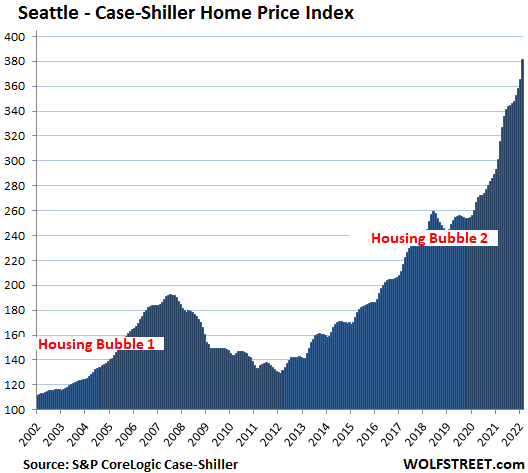

Seattle metro: House prices spiked a holy-moly 4.4% for the month, and 26.6% year-over-year. Since January 2000, house price inflation in the Seattle metro amounts to 281%, four times the rate of CPI inflation:

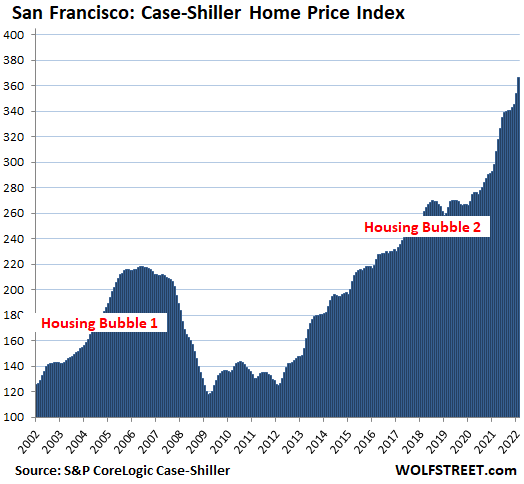

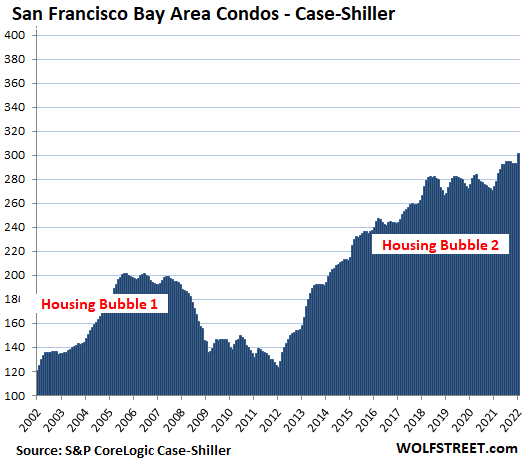

San Francisco Bay Area: Houses and condos have separated a few years ago, with condo prices lollygagging around, and house prices spiking. The Case-Shiller Index provides separate data for condos and houses for the five-county metro.

San Francisco Bay Area single-family house prices spiked 3.7% for the month, and by 22.9% year-over-year:

San Francisco Bay Area condo prices jumped by 2.6%, a big outlier, the little thingy sticking out on the right, after months of wobbling around and declining. The index is up 10% year-over-year. But since June 2018, condo prices have risen just 6.6%:

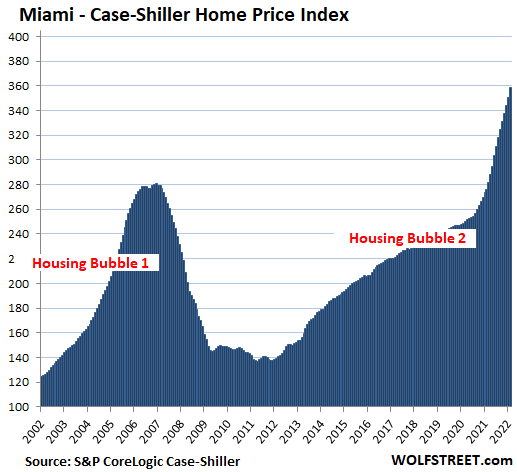

Miami metro: House prices spiked 2.3% for the month, and 29.7% year-over-year, the fastest since January 2006, on the eve of Miami’s can-never-happen-here epic Housing Bust:

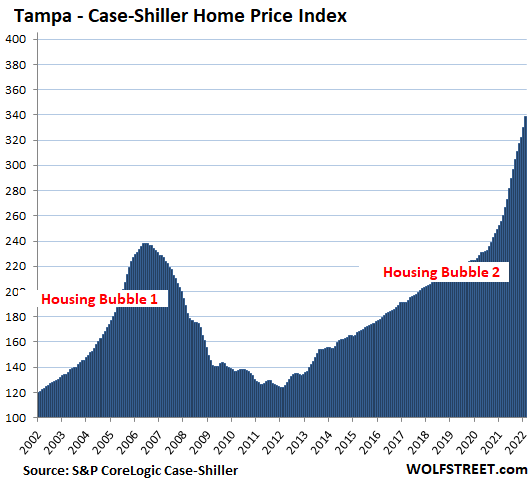

Tampa metro: House prices spiked by 2.7% for the month, and by 32.6% year-over-year, another record spike for the Tampa metro, wiping out the record spikes in the prior months, and out-spiking the crazy spikes on the eve of the housing bust:

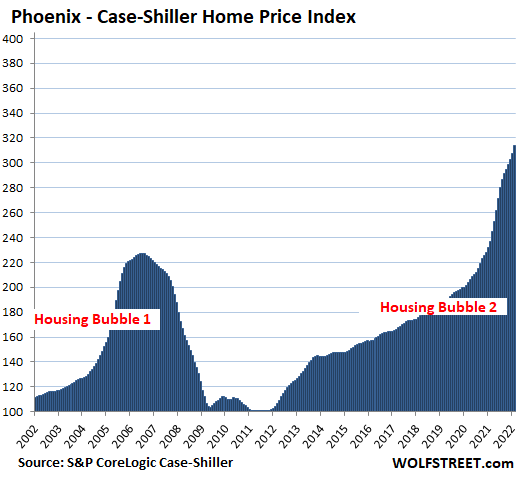

Phoenix metro: House prices spiked by 2.2% for the month, and by a record 32.9% year-over-year, the eighth month in a row of 30%+ year-over-year spikes:

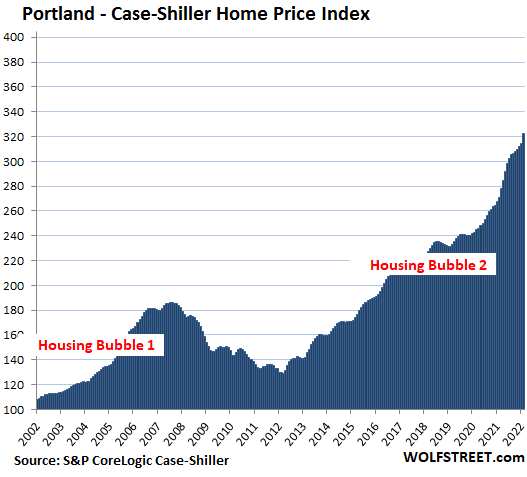

Portland metro: +2.5% for the month, and +19.0% year-over-year:

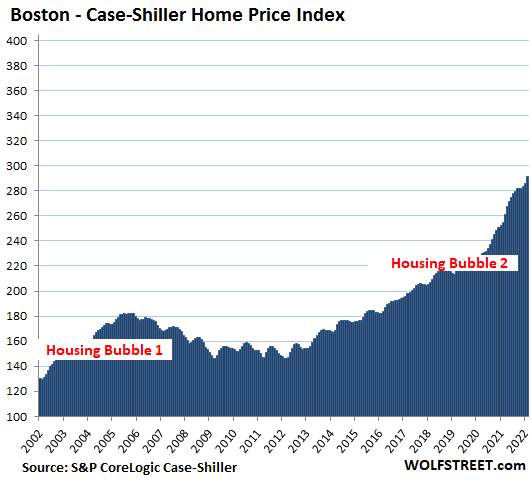

Boston metro: +2.1% for the month, and +14.6% year-over-year:

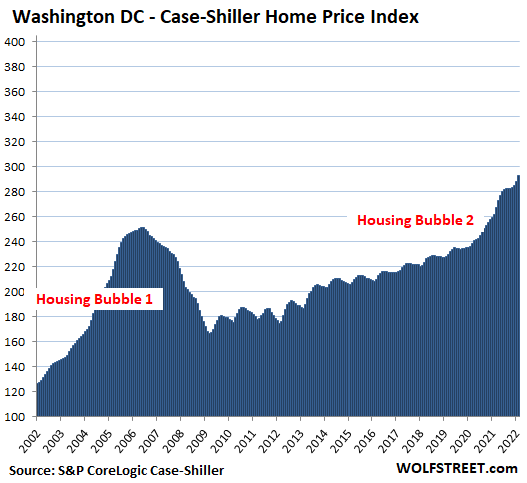

Washington D.C. metro: +1.7% for the month, and +11.9% year-over-year:

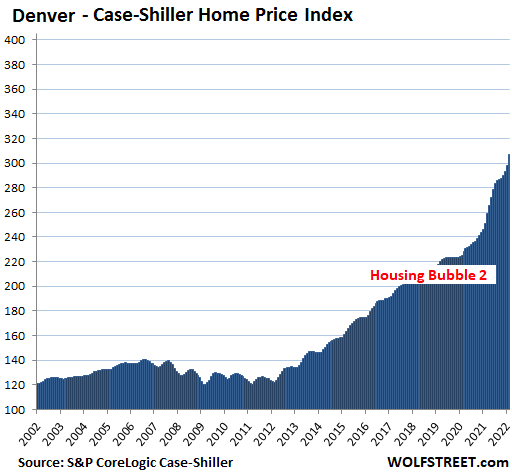

Denver metro: +3.1% for the month, and +22.3% year-over-year:

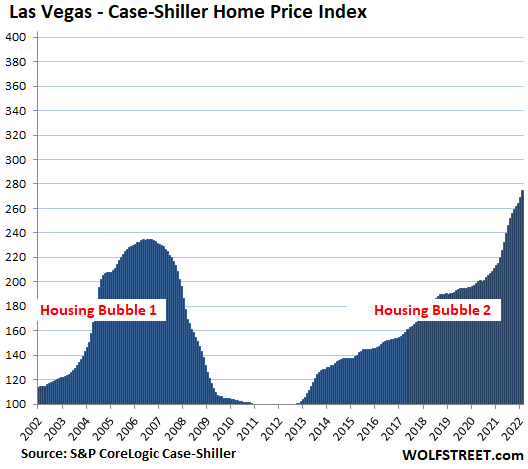

Las Vegas metro: +2.1% for the month, and +27.5% year-over-year:

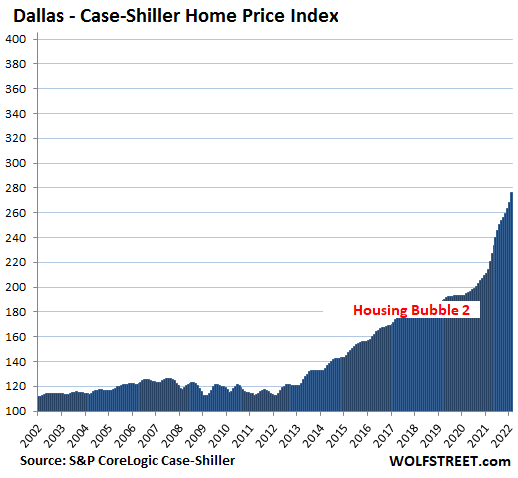

Dallas metro: +2.9% for the month, and a record +28.8% year-over-year:

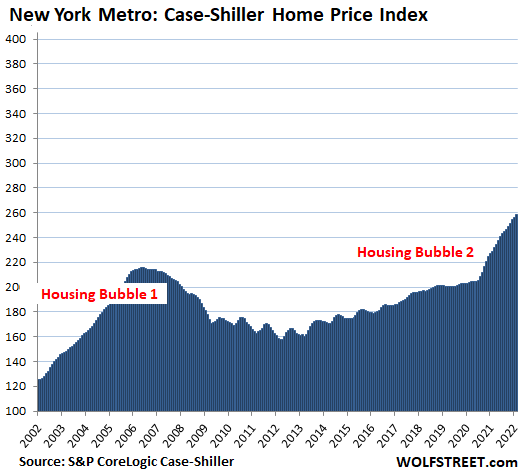

New York metro: +1.1% for the month, and +12.9% year-over-year. At an index value of 259, the metro has experienced 159% house price inflation since January 2000, compared to 70% CPI inflation.

The remaining metros in the 20-metro Case-Shiller Index – Atlanta, Charlotte, Chicago, Cleveland, Detroit, and Minneapolis – have experienced house price inflation since 2000 that doesn’t measure up to these splendid housing bubbles here, and they therefore don’t qualify yet to be included in this illustrious list.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Where is my buddy Kunal. I just made 10K on Tesla puts. And still have 2/3 of puts left. Go Tesla!

This seems BS. No one should make unhedged shorts on Tesla as they are very expensive. Many short sellers have given their money to Tesla. Andy, you are about to do the same.

Bill Gates will not lose as much on his shorts because, he has a custom bulk deal with computers rolling over the positions in an optimized manner that allows him to retain the short for months at a very low premium.

Please don’t encourage other people to take expensive unhedged shorts on Tesla that will never make money.

Leo, Im not quite sure you realize what put options are. I certainly do not borrow any shares.

Put options can include future short options….it depends on the put.

I shorted tesla at almost 1200, and sold just over 700, only to back in at 1100, and still hold that position.

Until the current hawkish FED do a 180, shorting Tesla is the safest position in my portfolio, all the good news are already priced in.

Looking at it the way you do, is an inductive fallacy, Leo.

Well TSLA is known to be a highly volatile stock but it only goes in one direction on the long run, up. So congratulations on hitting the jackpot and don’t forget to cash out while you still have time. Long term you will only lose shorting TSLA.

TSLA will be priced like other automakers. It’s just a question of when.

But will it be priced like GM, Toyota, AMC, or Studebaker?

So do you think AAPL will also be priced like other phone makers like Samsung, LG, Vivo, Xiaomi etc. or PC makers like Lenovo, HP or Dell?

For this I guess Apple margins need to come down to their levels. Apple makes a ton more money compared to these companies due to their ridiculous margins and I think Tesla will be able to enjoy Apple like margins in automobiles.

“I think Tesla will be able to enjoy Apple like margins in automobiles.”

That’s why Tesla fans are the funniest entertainment out there.

Thanks. I got out of July and August, and kept Sept, Oct, Nov. Should be in $400 range by then.

If Tesla goes that low, Elon’s deal for Twitter will implode

Lala, Twitter deal may implode anyway. There is a reason Twittr is trading significantly below that offer now. Funding secured?

Someone else who doesn’t realize puts are not shorts?

Freaking fanboy, don’t you have a Thunderf00t video about Tesla that you have to go debunk?

The prices and valuations of the stocks you listed aren’t the result of any supposed fundamentals but the asset mania and fake growth from government deficit spending.

The asset mania includes the bond mania which collectively:

*inflates multiples;

*lowers interest expense inflating profits;

*lowers the cost of financial engineering (stock buybacks), and

*enables a noticeable proportion of their customer base who are actually broke to be able to “afford” to buy their products (such as iPhones) through access to credit under the loosest credit terms ever

Fake growth creates artificial demand by providing consumers with income they otherwise would not have.

No, it isn’t different this time.

The resulting bust will be 100% attributable to Federal Reserve policy errors.

Just flip the chart upside down and we see that both the value of our dollars and the value of our labor is going to Heck in a straight line, denying wolfstreet dictum.

The bubbles are the problem, not the busts.

The actual policy error is the very existence of monetary policy.

Moved from the mountains of CA to a cabin in southeast MO. Some Bay area person “baytard” bought our house for 100% of what we paid 17 yrs ago. Waiting this crap out at my parent’s cabin. Will buy better when the market crashes? If I’m wrong my wife and I will live our days out in the ozarks. Could be worse.

You’re decrying making a profit? Weird dude!

100% from 17 years ago in northern CA? Actually kind of feel like you should have made more money…?

Read article mountain no ocean side

Still. Over 17 years?

Do you mean 200% of what you paid? Or 100% more?

Looking at the San Diego chart, when turn downward, how low could it go, and where might it settle?

Kool Aid drinker seems to think it will just level off, at least that’s the reason my friend stated when he recently bought a smallish home in SD over asking.

The hot hand fallacy thinking is so prevalent one might think this is the new norm for decades to come.

Job losses and a recession will certainly cool off the housing market.

The San Diego downturn from ’90-’95 was about a 15% price reduction. The ’07-’12 bust was about 40%. My thought is that it will be worse than the ’90’s but not as bad as the most recent bust. Either way, as Wolf has said these things take years to play out. We many not see a bottom until we are pushing 2030.

Agreed – the buyers will just be more cash buyers and less financed – prices will hold or dip only slightly. The working class folks (who want to BUY a home) will be relegated to the Midwest and South where housing remains super-affordable.

That said, there are some beautiful places to live in the Midwest !!

Everyone in SD feels that prices are never going down.

Heck my realtor contacted me last week to jump on this price appreciation while we still can!

It’s going to take a few years to play out, there’s still too much investor money driving the market that isn’t affected by these interest rate hikes.

America’s finest housing bubble. It will soon be slaughtered.

This and other charts published in April have an ominous “top of the roller coaster” feeling to them, don’t they?

Yup, these charts say it all. A mosquito that has had a lobotomy could figure out where this is headed.

Up up and up? Seems to be the gospel of people living in Culver City, Irvine, Brea and cities like them in SoCal are saying?

Worst case scenario, it will just level off right?

I have pet mosquitoes. Coupl of them seem oblivious.

If you think you are too small to make a difference, try sleeping with a mosquito.

Dalai Lama

colorado,

there is a bug that drink tears and would poke the eye with its mouth part to get some of that sweet sadness

Anyone who has followed Wolf for years, like me, understand we have peaked in this housing cycle. I bought puts on the Jan 24 XHBs. Easy stuff.

I’m also counting on the bubble bursting at some point but none of the data in this article shows any sign of that (with the caveat that this is from the time before the interest rate spike). As I noted in the article on China, in the Bay Area (which is the market I am looking at), if there are 100 buyers for each house and higher interest rates make 50 no longer able to afford the monthly payment and the recent stock market crash makes 25 no longer have the down payment, that still leaves 25 buyers per house so prices won’t go down. I don’t think high interest rates is enough in these expensive markets to bring house prices down without a recession that leads to layoffs. The supply of houses vs. the demand is still way too great.

You keep posting this but the market doesn’t work like that. If there are 100 buyers per house the other 99 do not end up sleeping in their cars if they don’t get that particular house. They either already have a home or are in rentals.

Thing about housing is there is always a better house and many people have a latent desire to upgrade. When the fed makes it possible for them to do this by reducing borrowing costs, large numbers of these latent buyers can suddenly appear on the market. And just as quickly they will evaporate when financing conditions change.

I agree

I think Wolf has done a great job running the numbers here, but it makes me wonder if the national, aggregate numbers are showing high housing costs nationally when in fact it’s just the many local hot spots throwing the average.

People are flocking to all of these places that Wolf analyzes.

People are flocking AWAY from California, and the Bay Area in particular.

Your hypothetical if accepted reduces the buyer pool by 75%, which would likely remove or reduce the over list bidding amount and thereby reduce closing prices. If you want to continue with this hypo, i think you have to further reduce the buyer pool due to raging inflation and its effect on home purchasing power/ability to service debt. Then you may be looking at a 90+% buyer pool reduction.

In the end, negative consumer/investor sentiment will be the final nail in the housing mania coffin, just as it has been in all prior manias in all other asset classes.

A real stock market crash will eliminate a much higher proportion than you assume, especially in the Bay area where an outsized proportion of wealth is the result of inflated technology stocks and employment due to cheap financing from loose credit.

There hasn’t been one during the lifetime of anyone reading this article. This is the same stock mania dating back to the late 90’s but the dot.com bust and GFC were temporary and so was the financial stress.

Wait and see what happens when financial markets fall for years, with a rising interest rate cycle.

For starters, in a sane market, every single one of the cash burn perpetually money losing companies will either shrink to profitability or cease to exist.

JOSH

I agreev- as I stated in a related post above. Buyers will just be more cash buyers and less financed – prices will hold or dip only slightly. Working class folks (who want to BUY a home) will be relegated to the Midwest and South where housing remains super-affordable.

Cash buyers are about 25%. If you lose the remaining 75% of the buyers, all you have left are the 25% cash buyers, and you don’t have a market anymore. You have a collapse like we’ve never seen before.

Or heck, if you lose 20% of your buyers because they can’t afford it, what kind of market do you have? Let me help you. When volume craters by 20% from here, you have a market that will be described as “frozen,” and after a while of it being “frozen,” it “thaws” at much lower prices.

That’s how price discovery works.

The problem is that you don’t have a cash buyer for every house that needs to be sold. Far from it. So when you have to sell a house to someone who left the market because they cannot afford it, you’ll have to lower the price. Or you don’t sell. So if you have to sell, guess what?

Yet, I keep hearing in the news that a new bubble is “impossible” because lending standards on mortgages are stricter than they were in 2005-2008.

If that is actually true – there is evidence that this might not be so true – then we’re just not going to get a banking crisis, like we did last time; but we might still get a housing bust. And if we just get a housing bust and no banking crisis, the Fed might not step in, given the inflation problem we now have. And no matter what happens, mortgages won’t trigger another banking crisis because now most of them are guaranteed by the government and are spread out among investors, not banks. Banks don’t hold that many mortgages anymore.

“Banks don’t hold that many mortgages anymore.”

That rings a bell from my days in tickets. StubHub gets its inventory on consignment. i. e. the seller lists the tickets for sale on StubHub’s website. When sold, the seller gets paid, as does StubHub. Until then, StubHub is simply offering up other people’s inventory on an open market.

Back in the day, on the street with paper tickets, a broker buys the tickets to then resell them, but in the meantime, cash is invested & the broker stands a risk to make a profit or loss. (I specialized in having inventory on consignment from clients & did the buy/sell too). But with its business model, StubHub has no skin in the game.

Banks really have no skin in the game anymore either. Make a mortgage to a borrower, do this a few hundred times over and over again, as fast as possible, and package ’em up to sell off before the ink on the mortgage contracts is dry.

What could go wrong? For the mortgage lending banks, not much if they have a well-oiled system to do this. They do not keep and hold the paper anymore.

And thinking about this, to echo “historicus” & “Depth Charge”, that’s where are system is broken. The Fed holds $2.7 trillion of this paper.

The price and value of this paper needs to be set by a free-market in order to maintain an equilibrium and keep the proper the price of mortgages between borrowers and lenders.

It is doubtful that this will ever return to the USA. Makes me sad that my country is no longer the land of the free (market).

Dan Romig,

The Government Sponsored Enterprises (the GSEs such as Fannie Mae, Freddie Mac, etc.) have reasonably strict underwriting requirements for mortgages that they buy, and that mortgage lenders have to follow if they want to sell the mortgage to them. This is not necessarily the case for some of the government agencies, such as the VA, the FHA, etc. that try to make mortgages available to subprime-rated lower-income borrowers with very low down-payments. That’s where the biggest losses (for the taxpayers) will be.

It’s their rules and guarantees that are hoped to keep the financial system from imploding. And there will be losses if there is a sharp housing downturn, but most of the losses will be absorbed by the good old taxpayers, not the banks :-]

The confluence of a recession, bear stock market, increasing interest rates and enormous inflation in every sector outside of housing will likely render LTV/equity mostly meaningless. You can either service the debt or not. Remove FOMO and replace with ice cold feet and see what that does to the market.

May be it’s the low rate that made to look “subprime-lending-standards”, a “strict-landing-standards”.

The price runups are not limited to houses. In 1972 I paid $200 per acre for 87 acres of timber and pasture land in East Texas. I sold it in 1992 for 800 and thought I had done well to keep up with inflation with my investment over 20 years. This afternoon I talked to the fellow who just bought the same place, same acreage, now 30 years after I sold. He paid $5000+ per acre. The only difference between then and now is the timber has 30 years more growth adding maybe $500 value per acre.

Did you factor in 20 years of tax payments? Rural raw and is almost useless unless it’s productive farmland, and nearly valueless unless it’s said farmland or it’s got mature timber on it or happens to experience a miraculous zoning change shortly after a developer buys it. The taxes alone generally take most of the gains out of the investment. Then there’s the headache of trespassers. I’m prepared for a 90% drop in land prices in most areas.

One can often find a local person to run a hunt club/keep the property lines cut/deter trespassers/grow enough crops for farm use/ and pay enough to cover taxes. If the land has deer/bear/etc.

This is quite common with real rural land, not almost city adjacent.

Depth Charge, with the issue regarding trespassers, is the concern that they get on your land and squat on it?

Surely just walking through isn’t the issue is it?

Your best comment in quite some time by the way, thank you for sharing.

“Trespass” may mean timber theft. If you have valuable timber on your land, even a little, and there’s no one around to notice and stop them, someone may show up with a truck and chain saw and just steal it.

D.C. You make some good points but when I had the place, I leased it out for grazing and cut some timber sufficient to cover taxes. Now-a-days the taxes are a much bigger issue because the tax appraisals are revised every year to match the market.

Good timing to bid up LV and Phoenix housing. Will water be a problem with reservoirs at all time lows?

Good timing to bid up SAND states?

Hasn’t Phoenix been the most bubbly market in the US as of late?

The majority of water used in Arizona is for agriculture (I believe it’s about 70%). According to the water management folks, that will be the first water cut off – which effects everyone nationwide, not just PHX property values, as the cost of food will increase along with certain crops not being planted.

In our little slice of heaven, we have 8 productive wells for @ 2,000 homes…. plus river water access….. which feeds the aquifer that supplies the wells. The local native American reservation has rights to river water that they use and pump onto the soil to replenish the same aquifer. Water supply stress testing was just done and the “experts” claim that there’s in excess of 100 year’s supply available where we live. Our area does not rely on the Colorado.

There’s little chance of anyone connected to a municipal water facility running out of water. However, what’s making the news are those communities that rely on trucked in water (Rio Verde Foothills for example) supplied by municipalities. RVF relies on Scottsdale. Scottsdale notified them that they are cutting off access to that water. The water haulers have to seek another source and the costs will rise due in part to the longer distances covered by the trucks. Some of the homes in RVF are in the millions of $ and others are horse ranches with significant investments. Those will make headlines…. and dummies are still buying them for a premium. Scottsdale doesn’t want to annex RVF because the cost to provide infrastructure is cost prohibitive (most are on acreage – not tract whacks).

So net net, what will this do to the area long term?

If it just means slightly more expensive water, then I don’t think that will slow down RE in the Phoenix area will it?

@Peanut Gallery

I have a lot of in-laws in Maricopa Co. and based on their experience, the water issues affecting Phoenix while sometimes exaggerated, are still real and can potentially get acute. Agree with most of what El Katz says, that said the water problems creep up in all kinds of direct and indirect ways with increasing frequency, and I think it’s fair to say that Maricopa can properly support a decent sized population, but well less than it’s current number, est. 1 to 2 million less, and a lot less sprawl. It’s true that like in CA, agriculture is a big consumer of available water but the ag sector is also a huge engine for everything else in the Phoenix economy.

A lot of the finance, tech, healthcare, entertainment and other businesses is ultimately fueled by the Maricopa ag sector, so if the farms can’t get enough water, then a huge, huge segment of the whole Maricopa economy disappears too (plus food shortages and higher prices all over the US like El Katz said). The sharp cuts in Colorado River water allocation did in fact hit the ag sector first, and some of the exurban or deeper suburban neighborhoods also felt the hit, reservoirs and groundwater sources are being depleted, so there’s no practical way to un-couple Maricopa from the Colorado and the worsening shortages. The Phoenix area unfortunately has some of the worst sprawl and building inefficiencies west of the Rockies which further tax that water supply. The native American tribes have been pretty good at water management and they have many top-priority riparian rights, but their supply to help Maricopa is also limited.

Now having said that, I should point out some of my in-law relatives do have wells and other sources connected to the Salt River and they are going reasonably well, but there have been a lot of practical issues there too. The Salt inflows are way down and they’ve had to move up the river swaps, plus a lot of wells have had a terrible time with contamination. I wouldn’t say corruption in AZ is terrible compared to other states and Ducey is by no means the worst of the lot. But with the USA now being run as a government by bribery for a decade (thank you Supreme Court and Citizens united decision), a lot of long building pollution issues with the Salt River have gotten worse, regulators get pressured by many polluting companies to look the other way and the cleanup keeps getting delayed. It’s been a source of major frustration there (my in-laws are constantly kvetching about it) and this too puts the water supply into more peril.

Just all-in-all, the water issues are another reason Phoenix’s real estate market and housing bubble are among the worst in North America. Housing prices there would be lunatic even without the water issues, but pile those in top, and it’s safe to say a normalizing interest-rate and financing environment should cause a housing crash there much worse than seen in 2007. The county simply cannot support that high a population, and no way justify mortgages and rents the way they currently are.

Miller, I appreciate your point of view. Thanks for sharing!

I think just the pure YoY price gains alone make Phoenix seem overvalued.

But there are a lot of attractive things about it, still, even with the water problems. And there are reasons why people retire there by the droves. Canadians descend upon Maricopa county every fall/winter, and create a lot of demand for housing there too…

Haha like I commented on the previous article, as always SoCal didn’t get the memo and blew the lid off the definition of FOMO..it takes a certain level of stupidity to make this bubble that much bigger.

Even as rate increase at this rate and price this stubbornly high, you still got people tripping over themselves paying well above asking.

Maybe if you huff hopium long enough, it can turn things into reality..guess we will find out soon enough.

Greed knows no bounds. I remember last housing bubble when they were running all of those flipping shows, and some guy was flipping a house in Compton or something. He had no real money to do anything, and simply painted some walls and dragged in an old piece of carpeting from another flipped house to cover up the nasty, dirty floors. The carpet remnant didn’t even fit the room. Supposedly “it sold.” Same behavior.

Houses are shelter and should have never been turned into speculative tools. What CONgress and the FED have done is morally reprehensible.

Totally agree with you on the houses are shelter part. If people want to be stupid and gamble with NFTs, then by all means. I don’t need NFTs to raise my kids or to function as necessities in my life. On the other hand, a roof over my family’s head, it really shouldn’t left to chances, being at the right place at the right time or bet the farm and be at risk of landing in the wrong side of the trade. Yup, you can always forget about homeownership and just rent but with the way rent prices are going insane lately, it’s also not a very good argument either.

Whatever, I guess this is all signs of late stage capitalism, everything that can be turn into money making opportunities, no matter how essential will become just that. Just waiting for the moment when we are at Total Recall scenario where you have to pay for the air you breath. Wouldn’t be surprise to see that in my lifetime.

For now, I will just work hard and continue to save my schadenfreude and hoping for one day when and if the market turns to unleash them.

Financialization on steroids.

Carbon trading is another one if it doesn’t exist already.

Fed knows no other way. Can’t do surgery when all it got is a hammer.

Oh btw, adjustable rate mortgages are back in fashion. This is the land of monthly payments after all.

Reminds me of the last housing boom. Some speculator bought a crapshack in Inglewood for $400k in 2007, it went for $85k a couple years later.

When you see the really marginal neighborhoods going through the roof, the end is nigh.

Mike G,

When you see the really marginal neighborhoods going through the roof, the end is nigh.

I didn’t understand.

Buffett said that when the tide recedes, can you see who is swimming naked?

Is that the same meaning?

I can wait.

Wolf, would you please kindly include charts of rust belt / midwest not-so-splendid semi-bubbles?

Yes. I would like to see some of the Midwest cities like St. Louis, Kansas City, Omaha, Des Moines, Memphis, Oklahoma City.

Or maybe a reference where to go look.

They’re not “most splendid”. Not yet.

Go to:

fred.stlouisfed.org

Select:

Category

Select:

House Price Indexes under Prices

There you will see Case-Shiller data and “All Transactions House Price Indexes” for many municipalities, counties, states, the country, that are not covered by Case-Shiller. A treasure trove of information. Data extend further back in time and offer a longer-term perspective.

Proph, thank you for this info. I just went thru most of the All Transactions HPI charts and see that most metros looked to be about 5-10% above trend line, very few are on trend, and a bunch are about 20% above. A handful may be higher but those are mostly ones that didn’t bubble up in early 2000s. The 20 percenters are Atlanta, Vegas, some metros in the mountain states and the NE and NW, and all of FL. I’m not seeing anything 40-50% above trend as it happened in the last bubble. Based on that, I don’t expect a big crash but more like stagnation or 5-10% correction.

I hear all the talk of migration to FL but I believe actual migration data was negative. And in any case all these people moving from the proper cities in the NE to ultra suburban FL for the “warm” weather that is actually scorching hot, I want to see how long they last before hiking back up to the NE. So I do think FL, AZ, Vegas will see again the biggest dips.

In Omaha a listed house has been on market 3 weeks, 8 months ago they were selling 10-15 k over asking a house is a home not a investment it’s all so a huge liability

Here’s Case-Shiller index for Cleveland:

fred.stlouisfed.org/series/CEXRSA

And for Detroit:

fred.stlouisfed.org/series/DEXRSA

Thanks for the links!

I was over looking at the corelogic site and they had a heatmap of all the U.S. states. The Southwest and the Southeast had a 20% YOY price increase. Many of the midwest states were in the 5%-10% range with the exception of Oklahoma, Arkansas, Missouri and Iowa were 10-15%.

You could probably sell a dump in San Diego and buy half the city of Danville, IL.

As a wise man said to me once “you have not made any money in your gains unless you sell first”. There are not enough buyers for all these gains to be realized.

As in 2008, many are bragging about gains in their 401k and in their homes until they lose most of it. The market has not really gone anywhere in the past few years adjusting for inflation.

Read Wolf’s article about the Chinese stock market (and some others) being at 2007 levels. It will happen here too as it has in the past. In fact, it already has happened if you look at the many stocks that are done over 50% (even former giants like NETFLIX and Facebook) and the banking sector being at 2017 level.

Those who especially claim that PPT will turn on the printing presses again will ride this to the bottom.

Building generational wealth has never been EASIER!!!

Yes, so easy to build wealth these days. No factories, no educated labor force, no real inventions, no work ethic required. Just buy a house, cryptos, and stocks and find a greater fool to buy digits and paper with borrowed money.

Isn’t it funny how much of that “generational wealth” can suddenly disappear?

Great post. Next step maybe is to transfer all the “generational wealth” to kleptocrats in a fire sale? What a difference a day makes.

Roman soldiers became freeholders of land (they helped conquer) and then debtors and then dispossessed and then serfs. It took awhile after that for markets to re-sort.

And even if you start and grow a real business, some recent President says you didn’t do that.

phleep wrote: ” Next step maybe is to transfer all the “generational wealth” to kleptocrats in a fire sale? ….

Roman soldiers became freeholders of land (they helped conquer) and then debtors and then dispossessed and then serfs. …..”

That seems to be a trend in all Human societies. A few people end up owning everything. Does not seem to matter if the society starts out along Libertarian or Communist lines.

Eventually a 1793 or 1917 type event reshuffles things around.

We’ll find out when the asset mania crashes back to earth. Not only will prices crash back to earth, so will economic activity subsidized by artificially cheap financing and lax credit standards.

On a per capita basis, it’s my inference that the country and much of the world is actually poorer now than it was years ago, measured in real production and physical capital infrastructure.

Much of what passes for intellectual capital has little or any actual value except in this distorted economy.

30Y mortgage rates : 4% in Oct 2017, 4% in Dec 19. 4% down 1.2%

to 2.8% / up 1.2% to 5.2%.

NDX up 10K from March 2020 low to 16,764.85. Institutions sent it down 38% to 13,000.

People talk about a ticking clock with all these bubbles…….especially from Mr Wolf’s charts

to kind of quote the film Margin Call

I don’t hear no ticking…just silence….nothing

There’s an old English song (listen on youtube) called

I’m Forever Blowing Bubbles (its also a soccer chant for West Ham)

There is some wisdom in the song lol

Anthony, not yet

US10Y 3.25% in Nov 2018, down to 0.333% Mar 2020, retracing 0.489%

of the move to Mar 2020 low in Mar 2021. The 10Y, after a minor correction in Aug 2021, is up to 2.89%, or 0.886% of the move now, in Apr 2022. After few months of some reaction ==> corrections.

If NDX become a waterfall chart later this year, gravity with Germany

might send the 10Y underwater. Recession, or exogenous causes, like fear of WWIII, might overpower the fear of Fed Powell.

The FANG : Netflix is dead, Meta is comatose, MSFT retraced 0.382%

of the move from Mar 2020 low. MSFT is a keystone company. It’s in the Dow, SPX and NDX. AAPL do nothing all day for 6 months. If China hit AAPL the whole market plunge.

Forget about Tesla. Tesla customers, fearing the Twitter puke, will turn their back on Ilan.

What happened to your numbered bullet points?

It’s going to be interesting how it plays out. Saw a heat map of construction rate per number of employed people in different areas in US. Certain areas have construction running at 3X long term trend going right into the run up in interest rates. Looked like Florida might have potential to be most over supplied. Raleigh, coastal Carolinas and Austin were some other hot spots I remember.

Capitalism could kill all of us. It’s like a perverted religion, but maybe worse. Of course a society needs some kind of market system to allocate goods and services, but what has evolved (devolved?) in the US is a sick joke that threatens all of us with possible poverty and starvation, or even nuclear annihilation. (The biggest winners in the Ukraine war are US defense corporations.)

Capitalism is not the issue. Free markets are not the issue.

It is the constant meddling, the central banking alchemists attempting to manage every tick, prevent any business correcting natural cycle, and the whimsical creation of massive amounts of money injected into the system….like doping a horse……wins a race or two…then cant leave its stable.

Mercantilisms, crony capitalism, feudalism, oligarchy and even fascism are all capitalism as good as anything. To those at the top they pay nice dividends too.

Meddling by central banking alchemist, that is a private banking cartel in unison with the government is just another shade of capitalism. Anything to rake in profit to those on the top. Very probably boom and bust, but usually those at the top get away with it anyway.

And you can hear Powell..

“Seabiscuit…wake up!”

The problem most people have with “capitalism” is that it doesn’t result in their preferable outcome.

An actual private market economy (aka, “capitalism”) will generally utilize resources “efficiently”, but will never provide everyone with guaranteed minimum living standards.

That’s why it supposedly “fails”.

It’s absolutely not as simple as just central banking. Totally disagree with that point of view.

I’m in a rural county of 24,000, and as of two weeks ago, there were only 55 active homes for sale on the MLS. Most homes have sold here for cash since the last housing crisis. My home value has more than doubled since I purchased in 2015.

I’m building a home with a large second garage/barndominium on the local lake, and I am hoping that the barndominium gets finished before some calls hot potato. Then again, a third of the population is 65 and older, and the Boomers are retiring daily by the thousands, so the correction may not be as bad here as elsewhere. It’s all a big guess until it happens.

@ Nemo I think some of those retirements will be delayed or reversed. Like the Barndominium on the lake!

There was a time when home builders could afford to build the homes that buyers could afford to buy. But no longer.

What changed?

Wages materials= lumber,copper appliances everything,went through the roof quit building 3000 sq ft homes

Exactly. Nobody builds the 1500 sq ft 3 bd ranch anymore. You know all those houses build in the 1950s and 1960s.

SuckCal Jim: “building generational wealth has never been easier”

Are you referring to boomers piloting 36′ motorhomes getting 5 mpg across the fruited plain……paid for with a reverse mortgage or GS18 retirement? The cherry atop the cake is the obnoxious Spending Our Kids Inheritance bumper sticker.

My observation is that piggish stupidity is pretty evenly distributed. Which is to say, to the extent you “empower” some formerly disenfranchised group, their stupidity moves instantly to the front, and conserves the overall mismanagement and folly. If the young or whatever group haven’t screwed up their world, it is simply because they haven’t had the opportunity.

Those boomers will be dead in a heartbeat (pun intended). Try changing a tire on the interstate as an obese man with incipient heart disease. All those assets will fall in the laps of the young. Are you ready to believe they will suddenly be a more wise species?

Old men don’t change tires on the freeway. They have people that do that for them. Haven’t you noticed?

Although, I could, unless it was a long delay to get some help, I’d call for assistance…

$15 a year on insurance, or in the case of my new truck, Toyota provided free for 5 years…

It’s not so much macho, but more personal safety related…

Florida has the Road Rangers to help for free, just call the highway patrol…

You, or anyone for that matter, do not want to be on the the side of the road and get splattered…

I want things with lots of flashy lights between me and the morons on their cell phone…

COWG, yes, the roadside tire changing is pretty dangerous these days, especially in big towns like Houston where we live.

Changing a tire on the freeway will get you pasted to the pavement by a big truck, while changing one on a neighborhood road will get you robbed and murdered.

Call roadside assistance or AAA. (if you have them)

In the short term, seasonal and other factors are likely to keep prices highly elevated (spring selling season, insanely low inventory, folks still having cash leftover from stimulus and stock market gains, etc.). However, in the medium term different factors should start putting some serious pressure on the housing market (rising interest rates, wobbly stock market and economy, fall and winter sales lull).

As such, prices are likely to stabilize over the next few months but an appreciable downward movement in prices, if it happens, probably won’t start until sometime in the fall.

Max Power

I agree wholeheartedly. There remains room to run and real estate moves slowly.

MAX Power

Mkts are diving south, every other day. Once the mkts go south, seriously, then housing will follow. Late this year and early next year. I feel like this early 2007!

Compared GFC, Global debts are in record territory, Ukraine war is NOT abating. That war will be slow attrition! I doubt if mkts tolerate rate increases to 2.0 let alone 3!

Soft landing fat luck!

Max Power, that sounds about right.

To repeat Wolf: RE moves slowly

I see no problem with any of these graphs that are going absolutely vertical. **smh**

They’re indeed vertical, right?! I thought the same thing.

When the Everything Bubble started having baby bubbles on top of it… you know it’s the blowoff top…

I went through a hard reversion in San Diego in ’09. I’m ready for another, but I do not relish this moment. The memory is vivid and fresh.

The first mental adjustment is to a lower basis in my home, mentally. This means a much lower expectation of cash extraction, whenever. The run-up was just froth, like stocks lately. The next thought is, my cash will grow more valuable.

That is, until the Fed comes back in (as in ’09) and radically readjusts my asset values for me. It is difficult to plan with such a vast remote thumb on the scale.

I don’t think the Fed will be able to respond the way they did last time. There is too much cash sloshing around, which is why we have massive inflation. They are stuck now, plus the risk of losses due to mortgage default now resides with the tax payer almost entirely. The Fed won’t have to lift a finger when housing tanks to save the banks, plus there is likely to be continued pressure on them to fight inflation. I’ll even use my favorite saying… It’s different this time.

Banks did wind up with a lot of un-sell-able house inventory last time. I guess the Fed prolonged this by bailouts putting in an asset price floor, sparing them fire sales and the resulting price corrections. My neighbor defaulted, moved in her new druggie-felon boyfriend, and they had a prolonged phase of making my life as dismal as their dim brains could, on the Fed’s dime. The guy was dissecting cars in our parking area when he was not shooting up and nodding off.

SocalJohn

FWIW, futures markets are pricing in rate hikes in the short term and rate CUTS 2-3 years out…..

People are THAT skeptical lol

The US Dollar is doing superbly well on the DX and is up 0.75 today to a new high of 103.50 as commodities go tumbling like a rock thrown over the edge of the Grand Canyon.

This is the subtle, quiet untrumpeted story of 2021 and 2022!

DXY on a rampage right now.

More demand for the dollar is… good?

$126 billion in ‘value’ vanished in Tesla stock yesterday as it plummeted more than 12%.

Well, don’t underestimate their fanboys, already busy throwing their panties at Tesla stock again. Back up 2% today and wouldn’t doubt it up 10% by end of month.

The power of a cult and false idol..

I’m so glad Elon wasn’t born in the USA. It will spare us the grotesque tragic farce of him as US president.

Now up only 0.6% at the close, at $881

Not exactly a big huge bounce-back after yesterday’s plunge.

Squeezing Elon,s nuts haha

All prices ultimately revert towards and to their means, and housing will be no exception in this regard.

The US markets have all turned red for the day and the only real question is how far they will fall as speculators run for the exits again today. The same thing will happen very quickly in the real estate markets as tens of trillions of dollar simply vaporize from absurdly elevated property ‘values’ which were driving up to those levels by mindless stupid speculation.

SoCalBeachDude

Every day here after, US mkts will try lift off towards GREEN but at endo fthe hard REALITY seeps in and they dive towards RED

For those trading options, this is a nice set up but bounce could be fierce real for a day or two. And then south wards

I buy puts excepting that (most) morning will always open with dip buyers with HOPIUM until mid day or soon after, indexes gyrate crazy and dive like today. this will be repeated in most of the days.

My Bull mkt I focus are within the secular BEAR is energy mostly natural gas, fertilizers, Agri-Etfs, Grains, seeds Cos and LNG shipping Cos. So far so good but periodic corrections will happen. My puts are on all indexes, EUrope and Emerging mkts including China.

West Coast recruiter calls about a job.

I ask if it pays enough to buy a three bed two bath in a reputable neighbourhood.

He says no.

I say no.

LOL, sounds about right!!!

What industry do you work in?

They were a hot commodity when the pandemic struck. Now Toronto-area townhouses are showing some of the biggest sales declines in this strangest of softening spring real estate markets.

Property website HouseSigma released data on Tuesday showing the median price of a GTA townhome plunged 22 per cent between Feb. 1 and April 19. Condos showed the least sales decline — 6.8 per cent — in the same period, according to HouseSigma. Semi-detached and detached houses tumbled 13.5 per cent and 12.1 per cent, respectively.

While the region’s blazing home prices have continued to rise on a year-over-year basis in 2022, March showed a slight downturn of 2.6 per cent from the February peak. Real estate experts say the softening has continued into April with some segments of the market showing more fortitude than others.

Among detached houses in 25 GTA communities, only Burlington saw a slight price increase of about 2 per cent. Every other community experienced a decline in the medium price of detached houses, which escalated most dramatically during the pandemic.

Chinese are taking there money home

To spend on what? Shanghai roach motels?

What is the use working hard and paying taxes to the Canadian government, when the “Chinese investor” launders billions through Vancouver & Toronto real estate and applies for welfare?

Remember that if you donate to the wrong cause, Trudeau will FREEZE, SEIZE and LIEN your bank account in that order!

Wolf, can you do Case Schiller vs M2 and vs MBS balance at the Fed? Just wondering if there was a correlation 🤣

Vanilla Creamer invaded the Judge for “better” taste, at 12PM

Creamer not doing a good job of Monet management,he has no skin in game sticking with losing stocks every hedge fund manager knows better than to take these losses = LOSER

How does Case Schiller look at a property like this that is flipped

Here is the Case-Shiller methodology. It explains all the ins and outs:

https://www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-corelogic-cs-home-price-indices.pdf