Are these crazy used-vehicle prices finally triggering some resistance among buyers?

By Wolf Richter for WOLF STREET.

When are potential buyers of used vehicles finally burned out on paying these ridiculous prices? When is price resistance finally setting in? When are people finally going on buyers’ strike so that prices would have to come down from that ridiculous spike? Buying a car is for most people a discretionary purchase: They could easily drive their trade-in another year or two; they don’t have to buy a car now, unlike groceries. Buyers can pull back, which they proved during the Great Recession.

And in June, July, and August, it seemed we had the tepid beginnings of some sort of price resistance when used vehicle wholesale prices dipped a little; and with a lag, retail prices dipped a little. But then the whole thing exploded again.

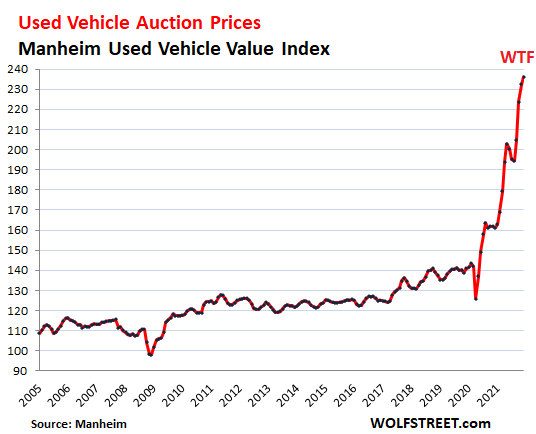

In December, the ridiculous spike in wholesale prices, tracked by the Manheim Used Vehicle Value Index, rose another 1.6%, and was up 47% from a year ago. Manheim, the largest auto auction operator in the US, pointed out that the underlying dynamics that already started to shift at the end of November, shifted further by the end of December, when sales declined and supply jumped again, and was sharply above average. This ridiculous spike looks to be getting ready to turn the other way:

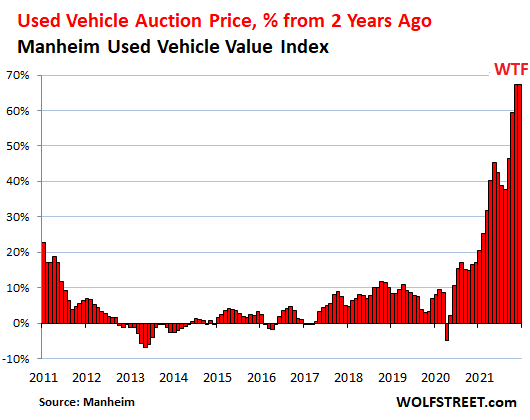

Compared to two years ago, before this craziness kicked in, the Manheim Used Vehicle Value Index spiked by 67.4%, which is of course utter craziness:

Non-adjusted prices.

Prices in the Manheim Used Vehicle Value Index are adjusted for the mix of models and mileage, and for seasonal factors.

Typically, non-adjusted used vehicle prices drop in the second half of the year. And in December, the non-adjusted average declined by 1.1% from November and was up by 43.4% year-over-year, according to Manheim.

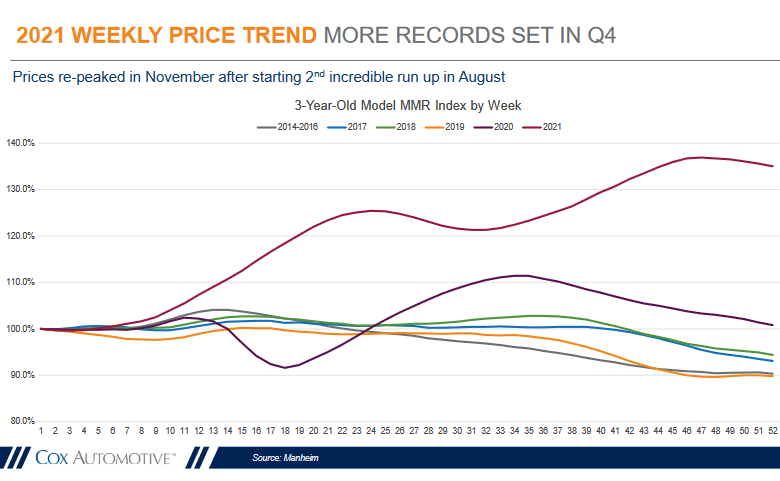

The chart below is from the Q4 presentation by Cox Automotive (which owns Manheim) on Friday January 7. It shows the percentage changes of non-adjusted prices of 3-year-old models per year. In each year, prices declined in the second half – except in 2021 (red line at the top), when prices of 3-year-old vehicles exploded until week 46.

The chart also shows the peculiar price movements in 2020 of 3-year-old vehicles (purple line, second from the top), with prices falling through week 18 (lockdowns) then surging to set new records. But even in 2020, on this non-adjusted basis, prices declined in the second half (click on the chart to enlarge):

The average daily sales conversion rate at the Manheim auctions declined in December to 53%, “close to normal for the time of year,” and compares to a conversion rate of 52% in December 2019, according to Manheim. “This indicates that the month saw balance between buyers and sellers, and as a result most vehicles showed price depreciation,” it said.

Retail sales in December down year-over-year.

Used vehicle retail sales in December – sales on dealer lots – at a seasonally adjusted annual rate of 20.4 million vehicles, flat for the month, fell 5.5% from December 2020.

The year-over-year decline in sales is not due to lack of inventory for sale. That’s for sure. There was suddenly plenty of supply.

Supply in December balloons to above average levels.

Supply of used vehicles on dealer lots at the end of December jumped to 54 days’ supply at the December rate of sales: 10 days, or 23% above the average of 44 days. It was the second month in a row with above-average retail supply; in November, supply had jumped to 49 days, from 39 days in October.

Supply at wholesale auctions at the end of December jumped to 33 days, also 10 days above the average of 23 days. This too was the second month in a row with above average supply: In November, wholesale supply had jumped to 29 days, from 18 days in October.

Price resistance might finally set in.

I’ve been fooled by the hope that price resistance would finally kick in when in June, July, and August, the crazy wholesale price spike started to unwind a tiny wee bit, only to watch it with utter astonishment as it exploded higher in the following months.

But now supply ballooned to above normal levels, and retail sales dropped year-over-year, and the dynamics are saying that the WTF price spike has gone as far as the market will bear. I don’t expect prices to collapse to anything close to 2020 levels – prices of consumer durable goods are sticky, unlike commodities. But if volume continues to drop, and dealers are sitting on inventory, then they’ll be more eager to make deals with their retail customers, and they’ll be more prudent in bidding up prices at the auctions – and we should start seeing that over the next few months.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Stimulus is drying or has dried up. Tradesmen I talk to in home construction weekly are tightening their belts now. There is a growing anxiety that was absent 6 months ago. I still do Environmental Consulting for the owner of a large mobile home park. It’s 30% section 8 housing and the rest Latino Tradesmen. Christmas stuff, such as lights, nativity scenes were unusually rare this Christmas. Mismatched tire hulls with useable tread left at independent tire jobbers when new tires are mounted are becoming common again on work vehicles. This is the big one. The Compacting Trash Dumpster provided by Waste Management is exchanged for an empty every Friday. It was only half full on Wednesday after Christmas. When Christmas falls on a weekend it takes 2 guys 2 hours to move all the overflow around the dumpster and the owner has to get an extra dumpster. Not this Christmas. The park has been in operation since 1989. Me and my partner’s Engineering company laid out all the Civil and lot design and have been the owners consultants and Publc Water Supply and Waste Water treatment plan contractors since then. Every time this type of behavior presents itself bad shit has happened in the economy. This has been a fundamental, where the tires meet the road economic canary in the coal mine.

Very useful anecdotal evidence, thank you – and that seems to be the only type we can rely on these days!

Unmatched tires around here also, partly on cost and partly on availability.

– there was a report from the ECRI that showed that economic momentum peaked in the 1st quarter of this year (think: stimulus).

Oooops. It should have been “in the 1st quarter of 2021”.

Dr Doom,

Very useful info, thank you. My family is finishing up a commercial project several years in the making and also opening a small taphouse, Mrs. Meadows and I are accidental landlords… bye bye savings hello debt! We shall see how it plays out. I have much respect for tradespeople, we paid them very well… concrete, brick, plumbers, electricians, sheetrock, paint, mechanicals. wow

Dr. Doom,

Insightful information and analysis. A ‘proof in the pudding!’

Thanks for sharing.

It’s “the proof of the pudding is in the eating.”

/pedantry

When you included the Demographics of the “park”, you were describing what is, many times, normal in such similar parks and areas. So, I would not be so quick to say it is the “ecnomony” when it can simply be normal cultural choices and thus a misleading indicator.

This is one dude that will be sitting on the sidelines for another vehicle until these outrageous car prices calm down.

Car broker friend of mine who I buy all my cars from says he made more money last year than ever before. He’s been in business over 30 years

Duh?

Me too.

Here, too. I refuse to pay bloated prices for a used car. Sadly, many Americans don’t care.

Wolf’s wealth effect chart seems to have somehow applied itself to those all income levels. It’s crazy!

Most likely the all the folks that wanted to buy a used land galleon have got one. Anyone who didn’t buy one just didn’t have the money or couldn’t get a loan.

Wait a bit, the next buyer’s panic will be for freezers to store food in anticipation of inflation and shortages.

Actually, CP, the freezer panic already occurred at the beginning of the pandemic…

Just cross checked the 10cf chest type I bought back then…

Price is $100 higher… but available…

Thanks for the update, guess I missed out on the chance to queue up and score a cheap Frigidaire 24.8 cu. ft. Chest Freezer.

My idea is to just eat less cause the prices are so high. Need to lose about 5 to 10 pounds.

One does not buy cars every day.Or every month.

Today at the supermarket I was unpleasantly surprized by the price of butter: $7.5 per lb.

For the past 20 years it fluctuated around $2.5 mark.And today it skyrocketed.

Looked up the wholesale price of butter at Chicago Mercantile Exchange.Price in 2000-2021 was stable,$1.20 per lb (minimum amount 40,000lbs 😀).In 2021 it skyrocketed to $2 and in Jan 2022 it skyrocketed to $2.75.

I am not going on strike.And I have no intention to switch to “I can’t believe its not butter” or Crisco or similar crap.

Well,all that $$$TTT in stimulus money conjured into existence like Rabbit out of Illusionist’s Hat is Fools Gold.

Brent. Unless you live in a 2 horse town out in the middle of no where, you need to shop at a different store.

Or, if you’re buying that fancy imported French butter (Echire ?). Maybe try a domestic brand, like Land-O-Lakes or something

😀

Land-O-Lakes,thats what I am buying too.

Breakstone is my second choice.

You may skim the headlines:

“Butter prices skyrocket 40% on labor, supply woes: USDA”

“Butter Up !”

In due time the price of butter will reach the New Normal everywhere,meaning 2.2x of CME wholesale price.

Land o’ Lakes butter was on fire sale just prior to the holidays. The local Safeway had it for $.97 a pound – both salted and unsalted – and you could buy up to 4 in a single transaction. Now it’s pushing $6.

@El Katz

$.97 per lb…

Imagine – in 1920 the price of butter was $.50 per lb when my ancestors working in manufacturing earned $3 per day and seamstresses earned $10 per week.

I guess $6 – $7 per lb is a norm and $.97 is a deviation from the norm.

I just paid $2.50/lb for butter. Today. At my local market and they had cases of butter on sale.

I agree, you need to shop elsewhere. You’re being hosed.

The hedonic equivalent is Olive Oil, which is a bit more expensive, but many choices.

My High School Wop buddy is adamant in saying that ALL olive oil sold in stores is donkey’s piss.No exceptions.I second that.

He knows one guy who knows another guy in Naples who sends us homemade olive oil from there.It has a flavor of fresh-cut grass.

During depression my aunt ate lard sandwiches,all they had

There was hierarchy of fats:

1.Butter

2.Schmalz

3.Suet

4.Lard

5.Tallow

6.No fat al all – just dry bread

Your aunt was probably lower middle class 😀

Dirt poor wore flour sacks to school,pain and suffering were terrible my grandmother a farmer was butchering a hog every week but we’re self sufficient people better wake up to reality

During depression my dad ate jam sandwiches F:

”Take two pieces of bread and jam them together.”

OTOH, still remember sandwish bread being TEN CENTS,,, PER LOAF,,, when I was working the only supermarket in Collier County, FL in the early 1960s!!!

Chicken and pork were from 19 to 39 CENTS per pound.

19 Cents for whole chicken or pork shoulder roast,,, and up for ”select” pieces, etc., etc.

Lots of free bones and scraps for the pups,,, though the pups didn’t usually see them until they were out of the soup pot…LOL

Lock up your butter!

Strangely enough, this isn’t an historical first. “The Dollop” did an hilarious podcast on butter heists & murders… during the depression. Ominous?

It’s all gonna die pretty fast when I Jack rates.

Dealers, that sell new cars, have their lots empty. They do not have enough new cars for sale. May be in order to be in business they are buying more used cars?

At least that’s the picture that I see at my local Toyota dealer. Their parking lot has significantly less new cars than in summer, but much more used cars of different brands.

Maybe they’re being smart and not buying as much new inventory as they would have in the past. They know what’s coming, a SIGNIFICANT slowdown in new car sales. And, they know that new car prices will have to come down, primarily via incentives for the current model year. Personally, I’d love to see things get bad enough we actually see MSRP come down this fall once the 2023 models start arriving on the lot. Probably not going to happen, but one can wish.

Long time in the biz and there will be a 30 to 40 pct

Dealer culling.

There has to be retail stability for growth

I know many dealets most well heeled that want out.

The daily expenses are between 5 to 10 k and rising. In one hand and out the other.

Shame where we are headed by design this camnot be accidental.

MSRP will not come down. MSRP is static (in most cases, unless it goes up) and is mitigated by incentive spending.

There’s limited production – not a conscious decision by dealers to slow down new inventory purchases. Manufacturers have several avenues available to them to make sure that doesn’t happen, which are buried in the franchise agreements.

The limited production/supply is the result of parts availability. It’s easily detected in spare parts availability (don’t wreck a car right now…. a friend of mine has had her car laid up for 2 months now due to a lack of sheet metal on a car that is still in current production).

IvanA is correct. Various brands of used mixed in with new in order to not scare away customers who would think that the dealership is essentially “closed” due to lack of inventory. Those big stores eat a lot of $ just to cover expenses.

Some softening of pricing and volume at auction could have been the result of “inventory taxes” at the end of the year. Certain states (Washington being one of them) tax inventories at CYE. We used to hold shipments for the dealers to help them mitigate those expenses.

And what do stop the automakers from adjusting production volume to anticipated sales?

Factories are already shut down due to parts constraints, so why restart them if demand is falling?

Excellent way to eliminate small dealers

J-Pow can do many things.

He can not rebuild the supply chain that our glorious

state & federal politicians have destroyed.

But at least they got that virus thing under control.

If production is shifting to higher end vehicles to capture higher margins, it seems to me that prices for average every day cars and trucks will rise as the fleet of available vehicles ages.

This is what I see, oficcially base model prices did not go up, but you cannot find base model to buy.

I wonder what car rental companies are going to do, they usually do not buy limited editions.

Presently, they’re running their fleets longer and for higher miles. The rental rates are high enough that they can build capital to purchase more highly optioned vehicles. The import brands are still making their mid range sedans… but the SUV’s are in stupid-land.

Most of the stuff I hear is about people looking to sell their gently used vehicles because prices are so high. “I can get more than I paid for it a few years ago” seems to be the sentiment. These prices are not going to last. It was a once in a lifetime anomaly. My only concern is somebody totaling my truck so I HAVE to buy another one.

Lol, I have two paid off ten year old cars and every time I drive I’m white knuckled at 10 and 2. You’d think I was driving a new Ferrari with no insurance.

That was the circumstance with a friend of mine that drove a 20 year old low mileage Jeep cherokee. Told me that he planned to drive it forever and was meticulous about the maintenance. The he had a small accident one step above a fender bender ( no airbag deployment). Then he found out it was effectively unrepairable because the parts needed were out of production and out of stock. No body shop would do the job using used parts for liability reasons. So he is riding the bus waiting for used car prices to come back to earth.

He should get one of those one-wheelie motorized things you stand on without handles and buzz around the city on that. ;)

That’s pretty strange to me because the body shops where I have had wrecks fixed always went for used sheet metal parts first and stated so in their estimates. Even auto insurance companies bought off on used body parts being OK to use.

Now if the Jeep was so old that even used parts were not available, I can understand that situation.

Speaking as a long-term owner of old cars, 20 years seems to be a practical limit for keeping a vehicle on the road. By that point, new parts production has ceased, and existing inventory has been depleted. By this point, the salvage yards have sent their inventory to the crusher, so used parts become scarce. Specific models (like your friend’s Cherokee, or the Volvo’s I drove) may have specialty yards that handle older parts, but you will pay a significant premium.

And the accumulated wear-and-tear begins to add up. I found that the biggest problem was not the major mechanical parts like engine and transmission, but rather the dozens of parts you don’t normally think about that now need replacing. I once conducted a 9-month-long search for a set of rear springs for a 23-year-old car. Or three days spent laboriously patching a wiring harness after a mouse chewed it because I couldn’t find a new harness.

I’m still a huge fan of used cars: My current vehicle was purchased in excellent condition at 5-years-old with 49k miles for 1/3rd of what it cost brand new. My hope is to drive it for 5 to 8 years with the limiting factor being rust. Including repairs, I expect my cost of ownership to be roughly 1/4 of what it would be starting with a new car.

Well, the number of used 2021 cars out there is now set. In the future there will be less used 2021 cars on the market than say used 2019 cars. That make the availability of used 2021 less than availability from previous year and maybe of newer cars. The 2021 cars are probably higher spec than say a 2018 car on the average.

If new car prices stick, those 2021 cars may not fall that much in price as what else is available is older cars often with a lower specification.

We are currently on a 12 year old SUV and an 11 year old sedan. Barring catastrophic failure we won’t be in the market for replacement any time soon.

If the fed doesn’t go full Volcker there will be no drop in prices anytime soon on anything. My crew, as predicted, came to me for raises, which I’ll be giving them soon (unless I want to lose them). As I said in previous posts, I’m going to be letting tenants know to ask their employers for more money and I fully intend to raise rents. A few here vilified me but I can assure you I’ll still be well behind the curve as I didn’t raise anything for a couple of years and now am way below market. I’ve already given notice to my customers that I’m raising my rates and not to even think about asking me to estimate materials costs as it’s impossible. This is the new normal for a while. Nobody knows when this will end, but we all know that a shock to rates will send us into immediate recession. 2022 will be very interesting. The one reality is that this really sucks for everyone and anyone who thinks it’s wrong to charge more or ask for more will be woefully underprepared for what’s coming down the pike.

You can ask whatever you want for rents, you’ll only get what the market will bear. You can always tell the rookie landlords – they endure crushing vacancies because they price their rentals too high. Not saying that’s you, just sayin’.

to be fair, he did say that he’s currently priced below market. if that is true, he can easily replace them if they don’t go along.

I have periodically scanned here in the Boston market, which is always relatively “hot”, even during the GFC. There are some rentals you can tell were someone’s first investment and they overprice because they use comps better than their property (which they of course think is gold).

They sit for months and the listings fall to the bottom of the page before being refreshed. Yea, that $200/month more you want does you little good when you just lost 2x $3k a month in rent. You’d think they realize after two weeks there’s a problem, when all of the other listings that were online when they listed have since been rented…

“If the fed doesn’t go full Volcker”

Look how long it took for even his extreme efforts to have a positive effect. Any interest rate increase at the Fed adequate to address inflation will have huge impacts on the mother of all bubbles “everything bubble” and all of the massively inflated, on-paper-only “wealth” they have created.

Must be tough , being a real estate predator ( withe Fed at your back).

People with investments in real estate think that this time is different and things would be crazy for a while.

This is always the case but I think real estate is one of the investment tightly tied to mortgage rates.

Of course all the news out of Washington will be total lies meant to push interest rates down before March. In Canada no one is getting raises except for minimum wage jobs due to a hike in the minimum wage.

I bet you won’t lower your rent if, or when, prices go down.

The financial crisis of 2008 would beg to differ. We’ve always been below market and will do what’s needed to keep places filled. Also, CA’s rent control laws keep us from raising rents over a certain amount each year, tied to the fake CPI.

I rented a house from a mega landlord after we lost our house in the GFC. They didn’t care that we had bad credit, they even took a lower offer because nobody else was interested or had money. We didn’t need a good credit score, just cash for the deposit and the rent.

Are you talking about lower prices for NEW renters, or actually lowering the price for re-signing renters?

Why would they? If house prices go down due to interest rates, it will be a function of monthly payments (people who want to pay $2,800/mo. will still pay that much with the new interest rates, it just means less overall in house price).

Rents are typically not sensitive to asset prices or interest rates, absent broader macroeconomic conditions such as unemployment.

Just curious. Where has your cost structure on owning your property exploded higher? Landlords I’m familiar with do not have huge employee payrolls compared to most businesses. I know one guy who owns 90 apartments and collects his own rents with his partner. Payroll? One accountant. Repairs fairly even. So? Don’t raise the rents too high. They’ll be empty.

Taxes are thru the roof insurance up every year

Charge your tenants the rent YOU would want to pay for your place.

TBwcW/DC/JW-from my years of visiting Wolf’s most-excellent site, this sounds kinda like an actual ‘price discovery’, no matter the amount/long tail of macroeconomic monkeying around (apologies to Monkey Business and actual monkeys everywhere…).

may we all find a better day.

The FED funds rate in the early 1970s peaked about 12% before dropping to about 5% in the late 70’s. It peaked near 19% in early 1981. So, it went up by a factor of almost 4x. If the current rate goes from .25 to 1.25%, it will have effectively done exactly the same thing mathematically. Does anyone really think that a 1.25% FED funds rate is going to cause a recession? No, probably not. It doesn’t have to rise to much more than probably 2.5% for it to start to create a real drag on the economy. At 3% or above, things would get dicey. And, bond yields don’t have to get anywhere near double digits. So, the FED doesn’t have to go full on Volcker at least in terms of near equivalent highs.

So, start raising rents ASAP, because you might not be able to ask these sky high prices much longer.

The semi-conduc-cartels will continue to throttle supply and reap record profits! And the car companies and dealers who are reaping record profits on lower sales are on-board too!

The international corporations-cartels-oligopolies are quite happy to throttle supply to reap record profits in this once in a generation opportunity!

There are only so many car buyers at these prices as it’s a durable good. I expect those prices to come down in nominal and real terms because there are many auto makers.

Semiconductors is interesting because, as you correctly point out, there are only a few fabs continuing development of the latest nodes – TSMC, Samsung, Intel. Due to the enormous investments involved, I don’t see the near-monopoly being broken for many years.

However, lots of chips don’t need the latest nodes. Presumably those prices should come down sooner or later?

It’s not just the semi-cartels but, also, the oil-gas-coal-uranium cartels, shipping cartels and any other sector that can keep supply constrained while keeping employees at sub-optimum levels. With the two biggest inputs in food production spiking even higher diesel and nat gas the largest cost input of fertilizers you can expect food prices to continue to inflate! Russia makes more $$$ with less product flowing with Nord Stream2 offline than if it were operating! Corporations and cartels now have a wuhan flu excuse to throttle production and hike prices!

The NatGas price spike appears to beover, at least in the US.

Prices are 30-40% off the recent highs, back to within the historical range (past 10 years) and well below the 2003-2008 range.

Food inflation isn’t being caused by energy prices.

I agree. The only real solution is a recession. Not a fake one like March 2020 but a real one that last at least a year.

I think you are forgetting competition. It always seems to show up when profits are very high.

If allowed to compete. With international corporations-cartels-oligopolies/monopolies large enough they can easily stop competition. Buy for example buying them …

Jay if you followed international news you would know in Britain and europe fertilizer plants have been closed due to hig nat gas prices. In Australia and other food producing nations fertilizer and diesel prices continue to spike higher! Fertilizers and diesel are the largest inputs for the actual food production. Labour becomes a factor in the harvesting and processing, some more labour intensive than others. I guess you have to explain everything to the uninformed!

1) For entertainment purposes only. SPX monthly, log :

2) Draw a support line from Mar 2009 low to Mar 2020 close.

3) This support line visited Sept 2011 close, Feb 2016 low and Dec 2018 low.

4) Take a parallel line from Mar 2000 high.

5) SPX will correct. When, how far and how deep, nobody know.

6) SPX might imitate a similar chart between Dec 1974 to 1982 lows that cause the Oct 1987 crash.

7) JP will not allow it.

4275 is the SPX trap door. What springs it?

85 oil 2.4. To 2.5. TYX. It’s just when.

Getting good low buy-in prices for every longer-term asset has been THE key strategy in my life (alongside working very steadily in between). That, and using debt only very sparingly and strategically. Eat well or sleep well: I’ll take “sleep well” every time. I consume assets only for good cause.

What, a person can’t abstain from housing or transportation? The thing was to live like a poor guy until a good moment came to buy. For this, I was happy to sacrifice relationships with superficial hurry-up consumer types. The sum of it all is superior health, fitness, free time and stress management, a sweet life in a really nice place, with people I respect all around me.

phleep-nicely said. An addendum (in my case, anyway)-learning, and continuing to learn, as many practical repair-renovation skills in terms of consumer goods as i could over my lifetime has allowed me to live modestly but well simply on the staggering amount of virtually ‘free’ castoffs from our ‘disposable’ society-harder to do these days given the increased amount of non-or ‘factory-only’ repairable products, but hey, one must learn to adapt to their location and times…and they’re ALWAYS changin’…

may we all find a better day.

“The sum of it all is superior health, fitness, free time and stress management, a sweet life in a really nice place, with people I respect all around me.”

I agree with all of that, minus the people.

So glad I bought 2019 4Runner in Jan 2019. No sunroof, no Google, no ApplePlay, no Alexa. Was worried the 4.0l engine would be phased out and replaced by crap 3.5l Atkinson cycle. And it has a single disc cd player. Didn’t need it at the time, but sure glad I have it now. Prices now at least $7,500 higher, if you can even find one. Paid 37.5k cash deal 1st customer monday morning mid-month. 4wd sr-5 premium with 3rd row seats. On another topic, try finding #10 cans of freeze dried beef, chicken or basics now. Warehouses were cleaned out by spring 2020.

Those run forever, but 16 mpg is atrocious.

Consumer borrowing has been increasing rapidly since late Q3, which is exactly what I figured would happen when the stimuli dried up and forbearances ended. The ruling class isn’t stupid. They handed that money out with full confidence that they’d get it right back, plus interest.

It more insidious than just a return to pre-stimulus borrowing, though, because of rampant inflation across all sectors. Prices are higher, people are even further in debt, and at some point our collective indebtedness will exceed our capacity to make payments on the debt.

So yeah, price resistance is coming one way or another.

I wonder when the health care cost bubble is going to pop. Roll eyes

I have a front row seat on this working in healthcare. More than 30 years experience. The inflationary cycle in healthcare will not be broken until the people who utilize healthcare are paying the majority of their healthcare costs. Currently employers still cover the majority for most people. As soon as employees bear the majority of cost you will see real change.

Agreed. We employers are getting fed up with it and have started throwing a fit over downright ridiculous bills that come straight out of ours pockets. The bitching still falls on deaf ears so far, but it’s something we had never really done in the past. I urge other employers being squeezed by this to start doing the same.

If the average person understood just how bad the public is being raped by insurance companies, drug companies, and some provider systems, it would be reformed in two shakes of a lamb’s tail. Those making money from status quo benefit from the ignorance of average joe.

We are starting to push more of the cost onto employees. What used to be 90-100% covered by us is going to look more like 60-70%. Maybe that will help nudge things the right direction.

Five years ago, I would have told you that our healthcare system is all fine and just needs a few tweaks. The more I learn about it, the more I want to burn it all down and start over, out of frustration.

random guy 62,

You should look at what Medicare reimburses verses what the hospitals and medical professionals bill.

July 2020 I had my appendix removed. The hospital billed Medicare $28,000. Medicare said no, we are only allowing $7,000. My portion was about $1500 because I hadn’t met my annual deductible yet. But you get my point. The hospital is not going broke being paid only 25% of what they are billing. The Medicare reimbursement rate is the true cost of medical care.

The federal government’s contribution to federal employee healthcare insurance is 72% for 2022.

Re “The Medicare reimbursement rate is the true cost of medical care.”

No, it’s the true price.

The actual cost is lower still.

Medicare has a lot of bloat in it, including a lot of unnecessary “why not, Medicare will pay” testing and procedures.

Wisdom Seeker,

I stand corrected.

Hospital are now nicer than hotel rooms and always adding on ,costs money

“The Medicare reimbursement rate is the true cost of medical care.“

In that case why hasn’t anyone considered Medicare for All? Oh wait…

Update from a midwestern truck parts manufacturer.

For the past year, our costs (and prices) have gone nowhere but to the sky. As of late December, things have cooled significantly.

Metal prices have retreated by about 25% from their Q4, 2021 peak in Q1, and our suppliers are forecasting trends flat or further downward into 2022.

Our sales were unprecedented in FH, 2021, but tapered off from there to end in a muted December, which is usually our second busiest month.

What this means for us is that we work through a massive backlog and try to catch our breath from a crazy year. Supply chain issues slammed our ability to ship on time, though we were lucky enough to skirt major shipping delays. One order of a Chinese part (we only buy a few) had a lead time of 2-4 weeks, and it just arrived seven months late. Good thing we maintain significant safety stock on imported parts.

We had to raise the limit of our credit line as a high order rate and difficulty shipping translates into a huge pile of inventory and a reduction in cash. In doing so, our banker said he is getting similar requests all around for the same reason.

It seems like all that stimulus money and cheap borrowing created a rush for goods in late 2020 and early 2021. We, like most producers, cannot all simultaneously ramp up overnight to meet that level of demand. That’s just not how it works. As a result, we all tripped over ourselves trying to get ahold of materials and costs shot through the roof. That rush has slowed.

One large customer usually places the bulk of their annual spend on order at the beginning of the year. This year, they placed half their usual and said “there is more coming but we are going to wait until things calm down” to add the rest. They are not alone in this sentiment.

IMO, we just passed the peak of the stimulus effects. Now we just HOPE for a soft landing.

Congrats on the increased business, but in the upcoming year do you anticipate a ‘return to normal’ or a dip, in that this huge demand was basically customers buying in advance?

Great information and really helps to illuminate the current reality of business owners and manufacturers.

Thank you. I comment with these to try and illuminate what it’s like for businesses like ours at the moment.

The industry “experts” are forecasting strong demand through 2022 and beyond. Some of that is because people who wanted trucks in 2021 simply couldn’t get them. All the while the existing trucks are racking up miles, so at some point a want becomes a need. Assuming no high-level economic shock, they will probably be right.

We are cautiously optimistic, but I roll my eyes at nearly all forecasting. 14 months ago, steel industry “experts” I had read were completely blind to the increases coming just a few months later.

We are still bare bones on discretionary spending. Even with the government cheese helping to bolster our cash position in 2020 and 2021 (and keep people 100% employed), our cash flow and income from operations are horrible right now. The unbelievable rise in the price of raw materials outpaced our ability to raise prices quickly enough given the length of our sales cycle. That is now flipping, and we just hope for a soft landing to try and recover some of margin sacrificed on the way up.

Obviously some companies came through the past two years smelling like a rose, but we were not one of them. Our cash position is trashed, and our current appetite for spending is zero. If our sentiment is more widespread, our economy is going to be in for trouble.

Just to illuminate how 2021 played out…

Q1, 2021 steel prices were up, but not crazy. In Q2, they got downright crazy and stayed there through year end. They are starting to normalize now.

In early April, we implemented a surcharge and slashed our quote effective dates to two weeks. Standard is 30 days, but 90 -180 days is common with larger accounts. All existing orders would be shipped at the agreed price (maybe because we were being too nice). All new orders would be subject to a floating surcharge. In reality, we found resistance increasing the surcharge when it came time to ship. Some customers refused to pay it.

We had about 4 months of work on the backlog going into that storm. The majority of the work was due within 2-3 months, but maybe 40% was due later in the year.

Materials comprise about half of the selling price, so you can imagine the impact on normal low single-digit profitability when your raw materials triple almost overnight.

For decades, we have increased prices every 1-2 years by 2-5%. Many of us in the industry were simply not prepared to deal with that kind of volatility, so we winged it with mixed results.

You can reduce much of your over-head and costs simply by moving production to China.

This has been the winning strategy for the past 30 years.

My business would be in that group that put off buying a new work truck.

No putting off for another year,

Regardless of price.

Hoping to replace some excavation equipment as well.

Thanks for the update.

Best new vehicle for basic get around is Honda Navi for about $2500 out the door. Analog 110cc scooter from quality manufacturer. Fast acceleration and 50 mph and 100 mpg.. All you need for most trips.

Until you’re flattened by a 16 year old girl texting while driving.

This weekend is the first time since September we’ll have three straight days without rain. I’ll pass on your scooter.

The gullible public believes prices will go up forever. Not so. Prices will start falling (not rising as fast) with the distributed lag effect of money flows, volume times transactions’ velocity.

“The gullible public believes prices will go up forever.”

Hahahahaha, in my lifetime, that “gullible public” was correct. Except for a few brief dips, prices did nothing but go up, from record to record, as the dollar’s purchasing power dropped. And this trends is now steepening. I have no idea where you come up with your twisted gobbledygook. Who puts this stuff out there?

I watched house prices plummet 65% after the last bust. That wasn’t “twisted gobbledygook,” it was reality.

In the mid 1980’s, real-estate in Texas lost 96% of its pre-crash values. Properties went for cents on the dollar. The banks went bankrupt and mortgages became unavailable.

Once one lives through a crash, one never forgets it.

Depth Charge,

“I watched house prices plummet 65% after the last bust.”

Stock prices went down too. House prices are like stock prices, they’re asset prices, and those prices go up and down.

But were talking about cars here, and by extension other consumer goods, and that’s how we measure inflation, such as via CPI.

I gotcha, Wolf. But this whole thing is a one-off. I do not see these used car prices sticking. No, not at all. I see them coming right back down.

My first laptop, a Grid Computer, cost $10,000. My first economy-class airplane ticket from Detroit to San Francisco costs ~$700. My parents paid $40,000 for their house in Detroit fifty years ago. Those same houses sell for $20,000. Paid $1200 for a floor model 32-inch TV in 1987. In 2019 paid $700 for a 50-inch TV.

Yeah, I agree, it’s ridiculous when people cite a few cherry-picked products and real estate in a bankrupt city to prove that inflation doesn’t exist. This was a comment about consumer price inflation not real estate in Detroit. Sheesh.

Didn’t say inflation does not exist. Just pointing out that not all prices go up, which is what you implied when commenting on another post. BTW, still waiting for the tremendous crash in used-car prices you predicted in 2019.

Bob,

Hahahaha, find the article that you think I wrote in 2019 where I predicted a “tremendous crash in used-car prices.” What goofball statement.

No Prices have hit a wall and the money that was in savings in gone.

Deflation from here until the QE machine starts up again…

WE. ARE. DOOMED.

Danno,

I’d love to have a little deflation. But that’s wishful thinking. In my entire life, there were only something like three quarters with a tiny little bit of deflation. The rest of the time, it was inflation and rampant inflation. Now we’re in rampant inflation.

That said, price spikes like this cannot persist. So when used vehicle prices dip, other prices that weigh much more in CPI will hit CPI full blast. We already see this coming with the CPI for housing costs, which accounts for 1/3 of overall CPI, and which is now soaring. So good luck waiting for deflation.

QQQ hopped in a time machine back 6 months

Crazy seeing QQQ ads with major actors on NFL commercial slots. Looks for that last sicker to join.

Any comments on RV’s? Interesting to ponder. Similar price appreciation but different dynamic than automotive. Could the current hot market end up in a glut? Maybe not with more people living in them full time.

The normal state of the auto industry is that of a glut. Lots of inventory, too few sales, lots of discounts and promotions, etc., trying to move the iron. But prices still rise even during a glut. That’s the normal state, and the industry knows how to handle gluts. 2021 was a huge exception. Eventually, we’ll get back to normal, a state of glut. That may not be happening in 2022, but it will happen.

@ Boomer —>All “Towable RV” sales are up 43.6% YTD, at 506952 units versus 353,109 as of December of 2021 (per RV article, forget the site, only have the chart in front of me as I’m in the market for 2022).

With RVs being notoriously poor quality, the rumor is quality has fallen to even further lows for what was manufactured in 2021, so buyer beware as factors, mostly based in Indiana, did not have the labor supply or labor quality needed and so dealers are dealing with nightmare product, and multi-month waiting lists to get major issues repaired.

And yes, I think their is already a glut of low quality RVs, and I suspect the boom is has a lot to do with housing being too expensive, and younger and older folk living in RVs full time. And it seems the younger folks are buying van campers, up 101%. That said, class C is only up 29% and class A up 33% so I suspect quality might be better on the more expensive motorized units.

I know a woman with a new RV. She told me there was a 4 month waiting list to get it into the dealer for warranty work.

Recently sold a 2019 Lance 650 camper for $33K. Made $10K over price paid in 2019. Could of received several K more, if I would have delivered, but sold my F150 last year.

Who was the sucker who bought it, and where did they come up with the $33k?

D/C

A retired couple. They live in a 4000 sq ft. home all by themselves. They offered me a good sum of money to upgrade their truck’s suspension and tires, but I’m done messing with the self upgrades. They better stay on ‘flat land’ until they do.

A friend of a friend had his beater work van stolen. He bought it in 2010 for 6k, put over 100,000 miles on it living in it part of that time as a rock climber. This was before vanlife was a thing. He is getting an over 12k payout for a haggard ass work van with 250k on it.

He was initially really bummed but then saw what he was getting. I have no idea how it was computed that piece of crap was worth 13k.

My long time auto mechanic does plenty of repair work for RVs in the summer season. A couple things he mentioned about them really stuck with me:

– Mechanically, RV’s are generally a mish mash of parts form various sources, an engine from one company, braking components from another, suspension, steering from others etc. Finishings too are specialized and unique. This makes already complicated sourcing and repair issues all the more so.

– Secondly, the mountainous terrain where I live in British Columbia, is an RV killer. Often, RVs are over loaded with home comfort ‘necessities’ and perhaps towing a vehicle /motorcycles / bikes / boat as well. Maybe that’s fine starting out from flat or gentle lands but hit the steep mountain roads in the heat of the summer and you end up in the shop waiting and waiting to get the tranny, braking or cooling system stresses repaired.

By contrast, my road adventures are still funky with some light camping gear and a foamy in the back of the SUV.

Caveat Emptor: Funky and foamy doesn’t cut it with the Ladies.

That’s a bonus, not a caveat.

Rv service and quality had always been poor. I used to build parts for three of the big class A coach manufacturers. Their parts logistics and documentation were horrible. Many a time they would contact us to special build an obsolete part ( sometimes those could be from 3 years ago). Said they were in a big hurry because the customer was stranded at some RV dealer till they got the part. These were coaches that cost from $600,00 to $900,000 new.

We just got back from a 3-hour road trip from Nashville today and every new RV dealer lot we saw was packed with the typical low-quality brands.

Fed has run emergency stimulus 98% of the time the last 14 years. Economy will be in worse shape in future as demographic trends are poor and double damage from covid and anti fossil fuel stance. Don’t get out over your skis taking risk.

Good read over on ZH: Was 2021 Peak Speculation?

By Lance Roberts

One of the many charts: the total value of companies with shares priced at more than 20x sales. In 2000 just heading into dot.com crash 3.6 trillion. Now 4.5 trillion.

There is a quote from an interview with Scott McNealy just before the 2020 crash. He was then CEO of Sun MS, and explained how crazy it was for folks to pay 64 $ for his stock, a mere 10 times sales. For them to recover their investment in ten years, he would have to ‘pay nothing for supplies, not pay the 30K + employees and also pay no taxes.’

Also charts and analysis of co share buybacks, a huge influence on the pyramid of ‘value’

Sorry, Typo! Interview with McNealy is before 2000 not 2020.

nick kelly,

I deleted the rest of what you said about the stuff on ZH, unrelated to your topic above. What happens on ZH, stays on ZH. Please don’t drag this stuff into here.

Used cars prices would fall quickly if Bill Dudley was Fed chairman…

Bill Dudley – served as the president of Federal Reserve Bank of New York from 2009 to 2018 and as vice-chairman of the Federal Open Market Committee

Bill Dudley per Bloomberg:

Yet Fed officials remain incongruously dovish over the longer term. Consider their latest set of projections, released following the December meeting: In an economy with above-trend growth pushing unemployment below the level consistent with stable prices, the median forecast has inflation melting away, falling to 2.6% in 2022, 2.3% in 2023 and 2.1% in 2024. This could be justified if they expected to tighten monetary policy sharply, but they don’t. Their median projection for the federal funds rate at the end of 2024 is just 2.1%, well below the level they deem to be neutral.

This is a remarkable, even surreal forecast: Inflation won’t be a problem, even if the Fed does little to rein it in.

I see only a couple ways for this Alice-in-Wonderland fantasy to come true. First, today’s inflation could prove transitory, allowing the Fed to keep interest rates low — but this is inconsistent with the Fed’s own near-term analysis and hardly plausible when the ratio of unfilled jobs to unemployed persons is at an all-time high and wage growth is picking up markedly. Second, the neutral federal funds rate could be much lower than officials’ 2.5% median estimate, making the 2.1% rate projected for the end of 2024 much tighter – but there’s no evidence to support such a hypothesis, and indeed no Fed officials changed their estimate of the long-term neutral rate in December.

More likely, the Fed will have to leave the enchanted forest. This means becoming a lot more hawkish, both in the near term and over the next few years. As the economic recovery pushes unemployment unsustainably low — something that may already have happened — wage growth will spill into consumer price inflation. The Fed will have to respond by taking interest rates above neutral well before the end of 2024.

How high might rates go? If inflation is running above the Fed’s 2% target, they must adjust both to compensate for higher inflation and to achieve tight monetary policy. So if inflation subsides to 2.5% to 3% as supply chain issues dissipate, then a federal funds rate peak in the 3%-to-4% range seems reasonable.

This is a much steeper path and higher peak than financial markets currently anticipate — roughly double what Eurodollar futures imply. Markets are starting to catch on, but only very slowly. At some point, the reckoning is likely to become disruptive, triggering a sharp rise in interest rates and a large drop in bond prices. The “taper tantrum” may have been merely delayed, not avoided.

I don’t have a lot of respect for Fed governors who only speak their mind once out of office.

So are dealers trolling for trade ins? I need to unload my 20y old Silverado before my new Ford PU arrives this month! They moved it up a week. My local used car guy has been adding inventory slowly, almost all late model PUs, and SUV. I was really amazed talking to him, the product is commoditized, makes buying and selling a lot easier. Housing will eventually get there too.

Put it on Facebook Marketplace and it will sell quickly, like everything else from ATVs to houses.

Don’t have FB? I don’t either but use my wife’s account to sell things quickly.

Enterprise really wants me to buy one of their rental vehicles. They started me sending emails again. But they sure think that their ex-rentals are gold-plated or something.

Dudley, better late than never.

Here’s hoping for some good questions tomorrow for Powell.

Like, why is the Fed buying MBSs hand over fist (40,000 million a month for nearly 2 years) driving mortgage rates well below inflation and half of what can be argued as normal.

Some more comments by Dudley.

From Dow Jones News

Former NY FED head Dudley…..with 20/20 hindsight.

Where were you Bill?

“The first mistake, Dudley said, was how the Fed “operationalized” this framework. The central bank promised they would not lift the benchmark interest rate from zero until it saw 2% inflation for at least a few months and full employment was reached……

The Fed’s second mistake was in misjudging the strength of the labor market, Dudley said……

The third mistake the Fed made was to view inflation as “transitory,” he said……

The final mistake was the Fed was too worried about spooking the bond market and causing another “taper tantrum,” Dudley said.”

Only 4 mistakes? Really?

Maybe Powell should have been reading the comments on this site.

The FED needs to be neutered, reigned in to where they have almost no authority to do anything without approval. And QE – extraordinary measures which = destroying the poor to give to the rich – needs to be relegated to the dustbin of history.

I suggest you study the History of the FED.

DC

There is way too much latitude in this “system”.

30% bump in the money supply, on a whim by a cabal?

Interest rates MUST be connected to inflation….as it was prior to 2009.

Something in the vein of a “Taylor Rule”…..perhaps broad parameters, but firm. Inflation auto responded to by rate hikes….period.

The politicians and the Fed have been too closely knit in the past 12 years. IMO.

It seems to me the FED knows exactly what they are doing. Especially the ones that recently “retired”

Right. Which is why, to this point, they have done ZERO to stop inflation. They want inflation. They openly said it. And now they are slow-mo-ing their response, continuing QE for another 3 months.

I see a convergence of several trends here in PDX. All the new apartment complexes with high rents have underground Parking that the Tenant has to pay for. Since most of the renters just squeak by affording the apartment they park on the street to save the parking fee. But, catalytic converter theft has gotten to such extreme levels here that they are being snatched from public streets in broad daylight and secure airport parking lots. Some property managers I know say this is beginning to affect them and feel they will soon have to lower rents, give out free parking or both. Not being able to use the public right of way to store your vehicle could have yet-to-be-determined effects on the property market and vehicle prices. After all who wants to buy a new SUV when it could be chopped in the street at any time.

Until inventory of new vehicles stabilizes we will probably continue high demand for used. What are the choices? Chip shortage is real, look at Ford.

Well, the number of used 2021 cars out there is now set. It is less than the number of 2019 cars..

The choice is then either new or older.

The choice is to NOT buy. For most people, a vehicle is a discretionary purchase: they can easily drive their trade-in for another year. That’s perhaps what we’re starting to see now.

Unless they were using public transport and dont want to anymore due to covid. Or their previous car got totaled. (Whether because of an accident of because the transmission gave out)

Given the number of still decent trade-ins, which is huge, most of people could just keep driving what they have.

With the age of the average car ticking up is not that a sign that keeping the car a little longer is happening?

Or are there numbers that tell there is no change in how long people on the average have a car? The vehicle registry may have that data if someone can get it out.

Someone above mentioned Rental Car companies.

How are they handling this? Are they buying used cars to rent?

I believe part of it is that they’re just not sending cars to auction anymore, so when you rent, you might be getting something with 60k miles instead of 6000

My brother, who owns a horse farm forty kilometers from Gothenburg, bought two used vehicles for his two middle kids (who moved to the US) from a recommended local lot nearby in October. He said everything else he saw was junk or sorta-new with a smiling virgin price tag. Paid a fair price, which most locals wouldn’t, they’ll get their in-law “deal” and brag everybody senseless. Coming from Sweden he feels like he got a very good price, and they were pristine and have been trouble free so far. The seller had other cars that he himself called junk, and lately hasn’t had much on display.

I think there’s going to be an orphan class of vehicle years where between the availability and cost of replacement parts and technicians with the diagnostic equipment and competency in using it a gap emerges. If EV’s are going to make traditional mechanic’s training into a new vocation, the existing talent won’t be replaced structurally. If they haven’t all quit too by then. An interesting niche opportunity.

And if you want to charge your batterycar at home, it’s unfair to the multiply-housed and others who can’t park next to the meter box. And those who can are gonna watch that sucker spin(figuratively, all smart meter now). Assuming sufficient ampacity at nominal voltage during peak load, the cheapest and easiest adaptation of a charging facility to a residential electrical service is still a chunk of money, not counting bureaucratic and materials problems. And when everyone drives home and plugs in, then flees into the AC in August, every weak point in the system compounds to failure. Lots of electrical infrastructure and building systems downstream of the meter weren’t designed for the loads they carry today. Now the energy potential represented by the network of gasoline storage tanks and dispensers that blanket most of the world is just…gone? It’s not like plugging in a string trimmer overnight. Doesn’t pencil out. With much better battery and energy management technology, those problems will fade, after everybody’s paid through the nose for their bagphone or Amiga.

Those big retiredfolks RVs are getting backyard pads with electric/plumbing under them, and the surviving spouse living in them, behind their kids house around here. You can leave during storms in them and sit on the highway and see too much of each other in a windswept aluminum box that smells of cats or yapdogs.

Sunday morning I was fixing a steam table and listening to the restaurant workers talk about their search for cars that sell for hundreds instead of thousands. Shortage there too. Used to be people drove those cars to the scrapyard and caught a ride home. Now they don’t leave the family.

1) SPX might correction in mid year.

2) Today shakeout didn’t violate : Nov 5 to Dec 4 // parallel from

Dec 3,not yet.

3) Nov election might produce a more balanced, sane congress, filtering the radical left.

4) After a correction SPX might rise to a resistance line, parallel to a monthly : Mar 2009 to Mar 2020 close, linear chart…hugging the resistance line for years.

5) Capital will rotation from the FANG and the Metha world to IWM. Mid west small mfg will benefit the most. They will solve the clogging, reducing inflation.

6)

My vehicle died last month. I hope prices on used vehicles becomes more reasonable as I haven’t been able to replace it yet, and am borrowing a vehicle from my parents. They’re very kind to lend it, but that’s not really a long term solution.

Dad says I should get a Honda Civic. I don’t care so much about brand…but do NOT want another VW. Never again.

I had good luck buying 10 year old Buicks with the 3.8 L. A lot of older people drove them so sometimes you can find with low mileage and cheaper than Honda.

That sounds promising, thanks for the recommendation! :)

Spend 10 minutes and check that the supply of new vehicles, especially Toyotas, has been increasing rapidly in past 2-3 months with the chip shortage passed or alleviated for now. Seeing surge in new cars in my area.