But even the comparison to 1974 fails because back then, the Fed had already pushed short-term rates to 9%. Today: most reckless Fed ever.

By Wolf Richter for WOLF STREET.

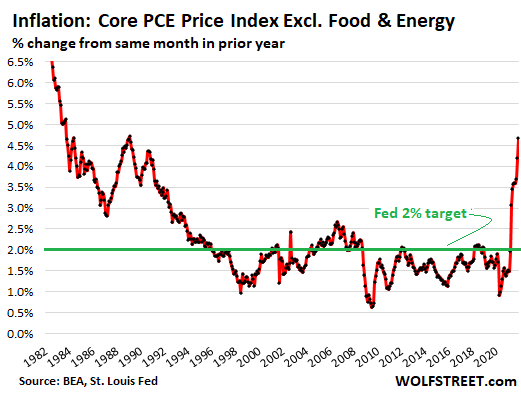

The Fed purposefully uses a special price index for its 2% inflation target: “core” PCE, which excludes food and energy. The core PCE and the headline PCE are the two lowest lowball inflation measures that the US government produces, understating actual inflation even more than other measures that the government produces, such as CPI-based measures.

And this “core PCE,” which understates inflation by the most, spiked to 4.7% in November, the worst inflation reading since February 1989, according to the Bureau of Economic Analysis today. Over double the Fed’s inflation target. And the trend doesn’t look good either:

Inflation is shooting higher even as this Fed is still repressing short-term interest rates to near 0% and is still printing money hand over fist, though less than it did two months ago. And the Fed has finally backed off its ridiculous claims that this inflation, caused by enormous historic amounts of money printing and interest rate repression, is just temporary and due to bottlenecks and supply chains.

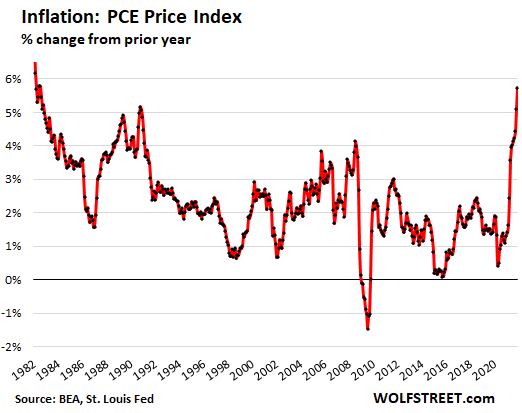

The overall PCE inflation index that includes food and energy, the second-lowest lowball inflation measure the US government produces, spiked by 0.6% in November from October, and by 5.7% year-over-year, the worst reading since 1982.

For having triggered this inflation, and for having refused to acknowledge it, and then for refusing to deal with it for a year-plus, this Fed will go down in history as one of the most reckless Feds ever.

But it’s not like 1982:

Today, the Fed is still repressing short-term interest rates to near 0% and is still printing money. “Real” (CPI adjusted) short-term interest rates are negative 6.7%, and this inflation is spiking straight into the sky.

In July 1982, inflation was coming down, short-term interest rates were over 12%, and coming down, “real” rates were a positive 6%, and the Fed wasn’t printing money at all.

More like 1974…

The comparison should be between inflation today and inflation in 1974, when inflation was spiking just like it is spiking today, and when Powell was still in college. There is practically no one left at the Fed or on Wall Street with any professional experience in this type of inflation spike.

But even that comparison isn’t valid because in January 1974, with the same core PCE inflation reading as today, and spiking as today, the Fed had already pushed short-term interest rates to over 9%, compared to near 0% today.

In 1974, the Fed was fighting inflation. Today, the Fed is still fueling inflation.

That’s why this Fed will go down in history as one of the most reckless ever. Despite this massive spike in inflation, the Fed is still printing money and repressing interest rates to near 0%. It had been jabbering all year about this inflation going away on its own, and all year, this inflation has gotten worse and worse, driven by massive historic money printing and interest rate repression.

Markets know how to deal with bottlenecks and supply chain issues: Prices rise until demand for those goods collapses and shifts to other goods and services, and prices revert.

But inflation from money-printing and interest rate repression isn’t going away on its own – it’s going to continue until short-term interest rates are pushed above the level of inflation, with long-term interest rates substantially above the level of inflation. And that cannot happen in the current environment until the Fed engages in substantial Quantitative Tightening and massive rate hikes.

And you know what’s coming…

An image of Fed chair Jerome Powell, confronted with the consequences of his reckless monetary policies that he will now have to deal with, as imagined by cartoonist Marco Ricolli for WOLF STREET:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I thought the parallel was 1984. Well, my TV definetly watches me.

CPI and PCE are a fraud and intentionally so by the govt. The only thing worth looking at is the PPI, since the govt can’t lie about that.

“In 1974, the Fed was fighting inflation. Today, the Fed is still fueling inflation.”

Damn skippy, Wolf! And, they’re vastly under-reporting inflation resulting from their dousing the housing market with JetA fuel, insanely low mortgage rates.

The FED has [ZERO] credibility given the two diverging truths. And, they are single handedly remaking the home ownership playing field. When 20% or more of the homes are being bought as investments, there’s something really, really, really wrong with the housing market.

It is different than last time we had inflation as consumer, business and government balance sheets are loaded with so much debt that somewhere around 1% increase in rates is all it’s going to take to kill economy.

Long term trend probably is not high inflation unless governments intentionally run policies to make it so.

Nonsense. This “rate hikes will kill the economy” is propaganda put out by debtors terrified of losing their shirts. But there are millions of sensible savers who have waited half a decade to get their turn.

It’s true that a rate increase will kill off leveraged borrowers with poor revenues. But that’s long since overdue to happen, and those businesses will then be rebuilt by people with deeper pockets and more financial sense.

An interest-surge recession would put the economy in the hospital but it wouldn’t die. And it would have a huge effect on both inflation and reckless future borrowing. Both would be good.

Also, not sure you’ve noticed, but the government’s current policies are nearly all pro-inflation: either constraining supply (lockdowns, energy sourcing mandates, paying people not to work) and/or goosing demand (relentless and accelerating deficit spending even in boom times, “one time” stimulus spending that gets perpetuated even when the crisis has passed).

Wisdom

Precisely!

Why is it that the Fed SPIKES prices, then the mantra is that those spiked prices must never retreat, adjust to reality, and must be defended at the cost of PUNISHING a vast majority of the people in this country with a damaging inflation?

The net effect….People WORKING hurt, those “cleverly invested” and assets fluffed by the Fed…doing just fine.

Shouldnt the Senate Banking Committee be holding the Fed to their mandates? (Stable Prices, moderate non extreme long rates)

The picture is of Powell pulling his hair. I DO NOT SENSE any concern in Powell. He could cut QE faster, begin non investing of maturing securities if he REALLY cared.

We need « like » buttons on comments

Powell’s undergrad degree was politics and then he studied law. Undersec of Treasury under GHW Bush (called Reagans economic policy Voodoo Economics – and served one term)..

It doesn’t matter what useless degree the titular head of the Fed has, the guidance for their central planning is provided by simplistic garbage economic theory fed with at a grossly inadequate number of data points while also being fed with inaccurate data manipulated for political reasons (ex., CPI). Simplistic garbage theory > simplistic garbage modes + inadequate and manipulated input data = another fine mess you’ve gotten us into, Ollie.

It is time for a “formula” guided monetary policy.

IF inflation is X, Fed Funds must immediately rise to Y.

To have this secret cabal deciding sometimes and not deciding other times based on the board selections and political “wind” direction is too loose.

We sit and wait for Fed action, as history and prudence would dictate and justify with what is transpiring, yet we get nothing but a slow down of stimulus in a hyper inflation.

The New PRICES coming in January 2022 will be a SHOCK to the nation.

And the Union Strikes will be plentiful, perhaps paralyzing.

Maybe then Powell can pull his hair.

Second sentence was at least something positive about him for sure! Maybe Bush even got the words from him?

Meanwhile, Wall Street is completely unconcerned. The S&P 500 will reach a new record close today. The bull thesis looks something like this:

1) Inflation will slow next year.

2) If inflation doesn’t slow, strong consumer spending & corporate profit growth will outweigh any tightening.

3) Wall Street will always have a veto over excessive monetary tightening. Powell has $50 million+ of his own money invested in the markets. After a crash, Powell will delay or cancel tapering/rate increases, as he’s always done.

Hence the markets being completely unconcerned about inflation.

The thesis is very simple. 3 rate hikes planned next year to combat 10% inflation. Bonds yields will continue to be suppressed as fed has no plans for qt. All that equals nowhere to put your money except stocks. S&P 6000-6500 next year. No doubt

Agree. Gold probably goes to $1,000.

Exactly right. We live in bizarro world where up is down and down is up. Bad news is good news and good news is even better news. Nothing matters except the Godzilla Fed crushing everything in its path. To infinity and beyond!

I can’t afford gold, but maybe silver?

I can’t afford silver. But maybe new tires when the time comes?

And they the same end of the day where would you rather put your money? In a manipulated treasury of a bankrupt govt which has to print every time it has a small crisis or in a company like Apple which actually earns cash hand over fist?

would apple be earning cash hand over fist without the credit bubble and stimulus?

Just a few months ago, there were zero rate hikes planned for next year; now its three; soon it may be more. This is a rapidly moving target.

Never have there been truer words said, Wolf!

The Fed’s forward guidance is for the Fed Funds Rate to be 0.9% this time next year, QE to have ended in March and QT started this time next year shortly after liftoff.

BUT that is based on their forecast of 2.6% inflation and 3.5% unemployment. So their forward guidance is -1.7% real fed funds rate.

So if inflation is actually 10% as you predict and unemployment is in line with FOMC forecast, then nominal Fed Funds Rate should be 8.3%. If unemployment is <3% with 10% inflation, Fed Funds Rate should be even higher say 9-10%.

The FOMC will continue to tighten its forward guidance and accelerate QT and rate hikes if monthly inflation and unemployment data continues to surprise them to the upside and downside respectively.

Don’t hold your breath! The FED will do everything they can to make it look like their acting with hast all the while actually doing way less than they should be doing.

if i had tons of excess cash around, i’d rather burn it than buy stocks at p/es of 40.

Beware spiking “Everything Volatility” around the March 15-16 Fed meeting in 2022, in regards to your SP500 6000-6500 thesis. I have contingencies and hedges for any move between 4000-6000, as I think this range of possibilities are a directional coin flip in 2022/2023. Somewhat concerned as the boat leaned heavy to one side as the majority moved in unison in 2021 to the non-contrarian side…by the tune of $1 trillion retail alone, the same amount as the last 19 years COMBINED. At some point the Fed might realize that the inflated stock market wealth effect is not helping lower inflation expectations, and may attempt a controlled stock market deflation versus interest rate hikes beyond 1% in 2022 (good luck with both those Jay)…

Also note if the Fed reneges on quickly increasing interest rates directly (after markets puke 20%) and attempts to, most likely in vain, lower inflation through the bond market via slower mechanisms, I’d be concerned rates might quickly increase as the Fed would have to do an actual “Balance sheet reduction” in reality, because even once QE goes to absolute zero (still simulative as Wolf has written many times due to Fed replacing them as they mature) , there is the issue of “allowing runoff” being an unrealistic optionality, per WSJ below:

The maturity structure of the Fed’s holdings makes it difficult to fight inflation through higher interest rates based on runoff. More than 97% of the $2.6 trillion in mortgage-backed securities owned by the Fed won’t mature for at least 10 more years. The maturity horizon on the Fed’s $5.6 trillion in Treasury securities is more varied; still, only about 20% will come due in the next year, while 38% will mature in one to five years, and 42% have maturity dates longer than five years out.

“Hence the markets being completely unconcerned about inflation.”

Why would they be concerned? The FED announced massive money printing at its last meeting. The markets, prepared for some sort of strict reversal from the FED, instead got more of the same. They rocketed straight up with the news. The FED has morphed entirely into an asset pimping and pumping machine, nothing more.

Personally I wouldn’t sell any of my S&P holdings until I see Bitcoin go back to 3000. If pet rocks are worth 50k then an actual money making company should be at infinity

All crypto is a result of the most reckless interest rate and money printing policies in history. There is an ocean of cash out there starving for yield. The FED, on purpose, pushed everybody out on the risk curve. Crypto is the biggest financial scam in history.

Can’t argue with the logic, but maybe that’s the flaw–logic no longer applies.

Just want to say I really hope calling crypto pet rocks will catch on. I just find that hysterical.

Au contraire, mon ami! The gold miners are making money like there is no tomorrow and they are being annihilated. Companies which actually make money are treated like dirt – it’s the high rollers who burn cash who have stock prices in the stratosphere.

“55% of the world’s top 100 banks are investing in the crypto and blockchain space. ”

-business insider

You are wishing something that can’t be manipulated by anyone get trounced, while reading an article about how problematic it is to have manipulated fiat.

Not wishing for anything. Simply stating that until the pet rocks are worth like pet rocks should be, I’m not selling the stuff that actually makes a profit

Depth,

I am very disappointed in the Fed. They have put more pressure on seniors to go out on the risk curve at top of the market, than at any other time with minus 5% – minus 10% real rates.

Those who only care about themselves are winning. No real reforms have succeeded, so the ultra-rich still do not have to pay a significant percentage of the taxes on their income that other, non-crooked Americans must pay.

Under the Dodd Frank Act, called a “reform” act, your deposited money will be taken by the ultrarich banksters in “bail ins” when this all collapses. The banksters’ deceptively named “Federal” Reserve continues to lend to them at 2.5% a year (WAY below the rate of inflation) then the banksters get to charge you 20% to 27% a year in interest and fees on credit cards with those funds.

As the ultrarich make money in quasi-slave factories in China, they do not have to pay taxes on those foreign earnings, which are excluded from US taxation; however, those factories and the funds from them are being used to arm the PLA to invade its neighbors and blow up our navy. No doubt, this will turn out great — for our country’s enemies.

RH,

Nice post and I said way back in the 90’s that making a backward country like China a industrial super-power with our latest tech would come back to bite us.

The rich lobbied both the Rep and Dems to accept China into the WTO in the 90’s so they would do the manufacturing, and we would turn into a “service economy”, and China has ate our lunch, become a world/military/economic power – all at the hands of greedy US elites, – and people called me a “protectionist”.

Yeah I believe in self-reliance as a country and is Natl. and Economic/Military Security, and today is a huge disruption of all the above, – businesses slobbered over cheap labor, and has ruined our country of millions of jobs, – China got rich along with the US elites, and the middle-class got screwed.

This is a huge reason for so much of our political turmoil today, and past 20 years.

As far as the Fed goes, they have lost their marbles, and all of this QE, QT, CPI, CPE has turned into a HUGE experiment, that will come to a bitter end.

Yes I was in college too in ’74 and my econ prof said all this would occur with China, and I told him it would be the ruination of our country – and the moron laughed at me – bet he isn’t laughing anymore!!

I mostly agree, Martok. However, if you were to consider the idea of malign design and not mere incompetence, the actions of the “Fed” for decades slot right in to their spots as intended to transfer US wealth to their bankster owners and make total sense.

The Elite’s message is we care about you and the planet.

The Elite’s reality is to off shore stuff to slave labor with factor fueled by dirty oil and transport goods around the world on diesel ships and trucks. Plus don’t look at me while I am flying on my 2 mpg jet aka 250 gals burned per hour between New Zealand and Monaco.

@RH – I never considered it was intentional of the transfer of wealth as you say – “the “Fed” for decades slot right in to their spots as intended to transfer US wealth to their bankster owners”.

You probably are right.

@Old School,

Agree with your statement:

“The Elite’s reality is to off shore stuff to slave labor with factor fueled by dirty oil and transport goods around the world on diesel ships and trucks”

I will add to countries that don’t have the same environmental standards as we do, – and they currently are moving from China to Vietnam for cheaper labor, and the last new super-computer I built had a Intel processor that was stamped, – “Made in Vietnam”, but packaged in the USA all over the box, – it really got to me, how the Elites have sold-out the USA.

It painfully reminds me of this statement:

“While Vladimir Lenin said capitalists would sell communists the rope to hang them, China proved the West also would provide it the money to buy the rope”

Old School

The Fed doesn’t give a s$it about seniors.

regarding 2), no one has been able to explain to me how consumer spending will remain so strong with inflation out of control, wages not rising anywhere near enough to counter it, and no more fiscal stimulus.

As soon as you figure that one out, let me know why the FED doesn’t allocate home prices within CPI without combining three metrics:

1) Case-Schiller purchase vs resale growth

2) Mortgage Payment growth associated with #1

3) Wage growth

For the life of me, I don’t see how economist tolerate this “owner’s equivalent rent” survey scam.

Because the consumer who spent $100 on gasoline last month spend $200 this month and made the same purchases.

yes, but that’s $100 they don’t have to spend on other things, like more discretionary purchases.

Jackson Y

Agree with the complacency.

Now much of stock trading is algo and AI driven, so it is unlikely potential Fed policy changes are programmed in.

BUT BUT…

A more simple explanation might be at hand. There are those that KNOW the Fed will do little and let the situation run farther. Is that not more likely? Is it far fetched considering the recent Fed governors front running policy decisions and most probably advising others of Fed policy made behind the curtain? I suggest a more “formula” driven monetary policy in which the Fed MUST stay between the rails. Currently they are not. Can anyone imagine the Fed would just look at 6.8% CPI and 9% PPI and not lift a finger? That is essentially what we have, and all we hear are crickets. There should be outrage, but all we get is “we cant raise rates, prices might drop, assets values decline.” Remarkable era we are in.

As planned for the Great Reset, The FED’s objective is to be the lender & buyer of last choice. They want to own everything and eliminate the middle class, turning everyone into serfs. They lie about everything. We live in a debt based world where everything has to be fueled by more and more debt. It can never stop!

The reality is the world economies are in free fall. The FED can never meaningfully raise interest rates or taper QE. They will just continue to provide the illusion they’re working to tame the run-away inflation they’ve created.

The question for 2022 is – are we content to let them continue to ruin our lives? If anything is reckless, that is.

And the next question is: If we are not prepared to let them continue to ruin our lives, exactly What do we intend to do about it?

At some time, it will blow up. Exponential economic growth and a finite world will some day crash. The price hike from scarce resources will have nothing to do with monetary inflation. And this can not be remedied by any financial measure.

Double D,

Are you going to vote for the R’s who are bought and paid for by Wall St or will you vote for the D’s who are bought and paid for by Wall St?

if we had such a party here, i would vote for a far right party like the national front in the uk or the national rally in france.

Good. We’ll know who to blame when jackbooted, goose stepping psychopaths come for we who dare to question their brutal methods. I am sure all your relatives who died to protect our freedom are very proud of you.

the only jackbooted psychopaths these days are on the left.

Exactly.

Double

“The FED can never meaningfully raise interest rates or taper QE.”

Disagree.

The Cause of the situation ….fake low rates and subsidized debt creation …can NOT ALSO BE THE CURE. That is illogical.

The Fed is WAY LATE, and must act. The longer they wait the worse it will get. Irresponsible leaps to mind.

The markets have no choice? TINA and they must outpace inflation?

Not in the 1970s. That’s the most recent Federal Reserve which took inflation seriously & wasn’t captured by Wall Street.

Jackson Y

I think the point of change was 2009.

Prior to 2009, the Fed did keep Fed Funds at or above the inflation rate. Imagine that!!

In 1999 and 2006, inflation was running at levels below current, and the 30yr mortgage rates were 6%, now 3.1%

I would post the chart link if I could.

CPI vs Fed Funds

copy this and search

journal.firsttuesday.us/wp-content/uploads/Inflation-Fed-funds-rate.png

Is anyone here experienced in placing small amount fx options/forward contracts?

Wondering if anyone here is experimenting with putting their money in foreign higher yielding accounts and hedging forex risk?

I have Canadian quarters somewhere.

I have a coffee can full of the old Canadian pennies. Paid a penny each for them. They now contain 3¢ worth of copper each.

A few months ago I was remarking on what a good value foreign bonds were providing, and wanted to see about buying some. It was then that I found out, as an American, my government did not allow me to. They are doing everything they can to prevent you from getting a return. I bet Weimar Boy Powell and Co. have a way around it for their own personal accounts.

Which country and which company? I think that only applies to certain usually state-affiliated companies in geopolitical rivals and perhaps only for new issuance. Still, I was able to buy Gazprom shares when oil dropped in 2020, so US policy can’t be all that restrictive.

Don’t expect an answer. As far as he is concerned our entire government is the ONLY one of the many other institutions we have that is an enemy, and we need to be SAVED from it and nothing else….maybe by some stable genius.

“Weimar Boy” is really really really getting OLD, too.

Oh well, everyone has a right to rant, I do it too.

At the time I was talking sovereign bonds out of Russia I believe, ivanislav.

Sorry Wolf, didn’t mean to copy and paste that whole thing. I had highlighted 5 and 6. This guy is following me around, baiting me everywhere. You’ve seen it. He’s not responding to your posts, he’s picking fights with me. He’s been doing it for months on end.

Depth Charge,

You have to learn to just let it go, here in the comments. It makes your life easier. I know you’re pissed off as hell about a lot of stuff, and rightly so. And I’m too, and lots of other people are too, and you’re not alone. But you also get pulled into the endless name-calling strings that then channel your anger. I have to stop them at some point. Just take a deep breath and let it go and move on to a more interesting comment.

You’re right, Wolf. Sorry to even waste your time on such silliness.

“Sovereign bonds out of Russia”…?…OK, I see….damn gub’mnt!

But you are OK with providing capital (to make a buck for yourself!) to an already very powerful and dangerous dictator that has seized Crimea, severely damaged our democracy attempt, and doesn’t appear to be stopping his expansion or crippling of other nations?

The alternate to economic and other sanctions is KILLING KIDS!

The Fed SAYS that their target is 2%, but their actions are saying something different. If you watch what they’re doing, rather than what they say, it indicates their real target is at least where inflation rates are now, if not higher. It may be time to realize that their extended-term target may be in the range of where inflation rates are now. It’s true that inflation in this range causes problems for Americans, but from their perspective these problems may seem manageable. And their high-level goals are reachable with this level of inflation. A problem from our perspective, but not from theirs.

Cannot compare at all 84 rates were sky high and coming off huge recession/depression 79-82 The 70s cannot even because your house in 1970 this is gues was worth 35,000 by 1980 maybe worth 75,000 house now buy it it’s up 20 percent in a month!!!! we are doomed this may go to 2023-2-24 but 2025 should be the crash of all crashes. Will, they just fold or try to bail out everyone with 70,000 TRILLION bailout HAAAAA

“Despite this massive spike in inflation, the Fed is still printing money and repressing interest rates to near 0%. It had been jabbering all year about this inflation going away on its own, and all year, this inflation has gotten worse and worse, driven by massive historic money printing and interest rate repression.”

Nonsensical jabbering is all the FED does. The FED is like a Fire Captain who turned into a fire bug. Instead of attacking a 5 alarm inferno with every resource available, they backed up some fuel tankers to stoke it. “We’ve got to make the fire bigger to make it smaller” is apparently their mantra. They are diabolical at this point. Pure evil.

That reminds me of an old economics joke. A student and his Econ prof are walking and the student spots a $20 on the ground. The prof walks right by it, and the student asks why he didn’t pick it up. “If a $20 bill had really been there, someone would have picked it up.”

Sorry, PG, there’s not much arbitrage there. The big institutions flood those trades, and the hedge cost eats most of the spread.

That’s what I figured but thought I would ask and at least start some conversation. Thanks Gattopardo

That’s a GOOD one Gatto! LMAO!

Maybe I should have taken at least “some” Economics.

Some doubt that raising rates will have the desired effect on inflation. This is marginally beneficial to everyone, except savers and in many cases the vendors eat the price increases. Although if that eats into profit margins why are stocks going up? Oh yeah they can borrow money cheaply and make money that way. Adding up all the points, inflation – bad, cheap money – good, cheap money wins.

Which articles are you referring to?

Raising rates will suppress demand. And if things really truly all come down to supply and demand, then over time that should suppress pricing a little

\\\

“…which excludes food and energy…”

\\\

The problem with the problem is that it can be measured.

\\\

Any guesses what parameters will they remove next to reduce inflation?

\\\

\\\

Sorry for the second comment in a row.

Proposed corection – “…confronted with the consequences of his reckless monetary policies that WE will now have to deal with…”

HE will have a nice vacation in the Alps and Caribian, and will never suffer the consequences of his doing. We will!

\\\

The FED has produced tent cities across the land. They deny it, but that doesn’t fly. It’s like the kid with chocolate all over his face saying he didn’t eat the brownies.

And all along, they smile as they do it. Cheshire cat grins from those creeps Bernanke and Yellen, assuring us that printing too much is always the right thing to do. Jerome Weimar Boy Powell, stiff upper lip, madly engaging in his “shock and awe” program while his underlings front run the stock market to get every penny they can, rapacious greed on full display.

The economic distortions that these asset pimpers and pumpers have created are mind-blowing. You see numbers and prices on things that could make anybody blush. Single wide trailers on small parcels of land pushing $300,000. These were, historically, where the poor would live. Now the poor are on the asphalt.

Lumber prices, spiking up to an unimaginable level of almost $2,000 per thousand board feet, more than 5x their historical level. Steel prices following suit. Used automobiles increasing over 40% in less than a year, putting the screws to the working poor. Gasoline spiking, making it an even more untenable situation for those on budgets.

And all the while Weimar Boy Powell saw no problem whatsoever, boldly proclaiming that he was going to “let inflation run hot, and that “it’s transitory.” This guy should have been relieved of his duties long ago, pulled off the job by his lapels in favor of a human being who understands what’s going on. Instead, he was just rewarded with another term for the carnage he’s wreaked.

Look man, there’s no way out. What would you do if you were in their shoes? They’re terrified of the hard default that would occur the country had to pay market rates, so they choose the liar’s path and are trying to arrange a soft default that preserves the status quo.

i was always taught by my parents to face the music. not kick the can down the road. in any case, their decisions are not making things better, they’re making things worse, as they’re incentivizing more debt creation. would congress be talking about spending another $3 trillion to hand out for people to buy amazon crap if the government had to pay market rates to borrow it?

Jake,

There are several generations worth of imbalances built up. No bureaucrat wants to deal with that house of cards collapse. I suspect that most bureaucrats reach their positions as social climbers, not deep thinkers or doers with an actionable vision of what needs to be done.

I recently heard the idea that politicians are really just role-playing control, while actually sitting on top of self-organizing organizations – organisms if you will – that operate independently. If true, those “in control” wouldn’t know how to manage the fallout, were it to occur.

When was the last time Congress passed a budget?

And now we have MSM, and politicians wailing because someone said no to a few trillion more.

Corporations own the congressional staff. They write the laws and spending bills.

MSM and congressional leaders

Are outraged when the peasants

Ask if anyone actually reads the bills.

Tom12,

Sure, they read it. Take, for example, this one:

The Consolidated Appropriations Act, 2014 (aka the Cromnibus). It was a great piece of legislation — for Citigroup — who’s lobbyists wrote its own provision in it, and it was only 1,603 pages long.

But my favorite part is on page 334:

“Sec. 8046. None of the funds appropriated by this Act may be used for the procurement of ball and roller bearings other than those produced by a domestic source and of a domestic origin: PROVIDED, That the Secretary of the military department for such procurement may waive this restriction on a case-by-case basis by certifying in writing to the Committees on Appropriations of the House of Representatives and the Senate, that adequate domestic supplies are not available to meet Department of Defense requirements on a timely basis …”

I sleep much better at night knowing this provision is there.

Full disclosure: I use SKF bearings from Sweden in the machine tool I designed and built for coping thin-wall steel tubing.

The hard default would clean itself up within four years, and moe likely after four months. Well worth it.

“They’re terrified of the hard default that would occur the country had to pay market rates”

This is nonsense – a lie which provides political cover for the FED.

Well it’s hard to argue a counterfactual. We don’t know what interest rates would be without their intervention. I suspect that with current spending levels they would be 5-10% and we would enter a deficit and debt spiral.

Bingo!

That yields two groups of people. Those who want to admit it and those who don’t. Hence the extreme polarization we’re experiencing. It doesn’t matter which group you’re in you are not going to be changing your opinion. If you’re in the group ripping people off you believe in it because the alternative is even worse. And if you’re in the group being ripped off you don’t like it and that will never change.

They might be trying to arrange a soft landing but everything they try exacerbates a hard landing. The only hope was for a hard landing whose consequences might be severe but thankfully short. We’re long past that point now.

You nailed it. Well said.

I agree with this. Not enough attention is given to pricing people out of the housing market and the impact ultra loose monetary policies have on wealth inequality. The Fed and ECB distort the data and say the must vulnerable are beneficiaries of their policies. It’s not correct. People with lots of assets get richer. People without assets or who are looking to purchase assets, aren’t just worse off in a relative sense, they’re going backwards in absolute terms.

DC, with all this time to bitch and moan… why don’t you try your hand at writing a romance novel? ;)

Well, I don’t know about “all this time.” It doesn’t take me long to make a handful of comments each day and to read Wolf’s posts, but thanks for the suggestion. It doesn’t sound like the kind of writing I’d like to do, though.

A romance novel where Powell is the heartthrob hero!!! Yessssssss, go for it.

Competing for success up against the likes of Nicholas Sparks, in the cutthroat, cruel and heartless romance book publishing industry, would be a tall order for anyone. But Mr. Sparks has certainly done well for himself and his loved ones.

It’s a little bit tougher for non-genre literary novels, alas.

Depth

“The FED has produced tent cities across the land.”

Powell says he walks past the tent city in Washington and that makes him want to keep rates at near zero to promote employment,.

What could be more intellectually dishonest?

Record job openings…….rates near zero have no impact on the drug using and chosen idle. Yet those same rate policies FLAME an inflation that slaughters the saving/earning people of this nation.

The net effect of Powell’s disingenuousness is that his policy HURTS the workers of the nation, and have no impact at all on the tent denizens.

But it is a good excuse for the “rich guilty” to keep rates too low.

Powell has done more damage to the country than the terrorists of 911. He should be sent to Gitmo, and given a permanent residence there. Same for Benanke.

With expanding debt and hence credit (which acts just like currency and money), government revenue increases in proportion to amount created based on the income tax.

Should expansion stop, let alone contract, without any increase in velocity, governments at all levels see substantial decreases in revenue. Certainly not all politicians, but at least some, along with some Fed members understand this. They have at their disposal an irredeemable paper currency.

A politician’s go-to is the same as it has been throughout history…

There had been substantive checks on an unlimited money power at the federal level, but they are now nearly all eliminated.

The power of the states to do something about it has been neutered. The ability of individuals to do something about it, when many of those same people reap massive benefits to such system, is faint at best.

All money is debt.

Debt on one side of the ledger…

Asset on the other side.

Purely a coincidence, but basically peak B0omer employment cycle. lol

peak B0omer = 1957

1974 = 17 year old

2021 = 64 year old

And now after over 50 years of hard work we boomers get kicked in the nuts vote them all out change is good

Voting has been made illegal. Before voters picked their representatives now the representatives pick their voters to make sure they never have to lose an election. Almost no districts are competitive, just the way they like it.

@E

You’ll love the song, “We are the 99%” currently top of the Amazon Christmas list!

The Fed hasn’t publicly admitted they’re worried about asset price inflation. Nevertheless, they must be worried about the huge rise in risk assets and the disconnect between asset prices and reality. Financial market bubbles are bad for economic stability and are a direct consequence of central banks’ policies.

they actually have admitted that, but their actions are not doing anything to rein it in.

it’s like being worried about your constant weight gain while you’re stuffing your face with cheeseburgers.

Where on earth do you get the idea that those things worry them?

NJB

I sense the Fed is enjoying the entire matter.

Their slow play is a confirmation.

“In the long run, and even in the medium run, you wouldn’t want to bet against the American economy.” — Jerome Powell

I think that’s about right. The foundation of the central bank is the American economy, and that’s been growing (and occasionally briefly contracting) since the beginning. Powell’s got his head in the right place. At least he’s starting from the right basic principles.

Bahahahahahahahahahahahaha!!!!!

Interesting comment…..well thought through.

Lol. You crack me up, DC.

can i have some of whatever you’ve been toking? the american economy hasn’t really grown in 10-15 years. the only thing that is keeping us going is inertia, that is, people want our dollars because they think we’re the strongest, and they think we’re the strongest because we were in the past.

Good one

Catxman

SO, inflation is good.

The Fed is there to lend money 4% under the inflation rate to the mortgage industry for 30 yrs.

The Fed is there to pump the money supply 30% + when they feel the markets need some boosting…

This is just like doping a race horse……..look at him run!

Dead in stall one morning, and no one seems to know why

Catxman

you say

“The foundation of the central bank is the American economy,”

I think you have it backwards.

The FOUNDATION of the American economy IS the central bank.

Injecting $4 Trillion into the economy, out of thin air, is why things are where they are, not the virtues and efficiencies of the American economy, as admirable as they might be.

The Fed subsidizes the economy by scalping the value of the dollar. An old game, but never played this big.

Catxman

I’m getting a headache reading this Bull S$it

Wolf, is it possible that Powell has actually succeeded in raising the floor to a new level (with $10T new dollars) and we’re at a more elevated threshold.

Something has to account for the $10T influx of cash. Doesn’t there have to be a new normal.

Not Wolf. Just another like minded individual that agrees with the statement ^^. Bottoms have been increased. The COVID economy has dealt the working poor a major defeat and as the same time enriched home & stock owners across the board with vast real and un-realized gains. This all happened in just short of two years!! Think of the power the FED has for the “next” black swan

Nathan

“Think of the power the FED has for the “next” black swan”

What are they going to do? Print more money and cut rates?

All the “make happy” buttons are pushed. The Fed never withdrew from their stimulus project…..even with record stock, housing prices and record job openings and very low unemployment.

Raining money for years now

If the idea is that there are too many dollars chasing too few goods,

can anybody explain why the inflation in domestic US prices, for used cars, gas, meat etc can also be seen in UK pounds, euros and yen?

I mean, if I turn up in the states with pounds, exchange them for dollars, I also see the inflation. But if its due to the quantity of dollars then for me, in pounds (or whatever), I shouldn’t see the same price increase.

Or put it another way, why when I buy meat in the UK with pound sterling, there is no dramatic price rise (the normal relentless one yes but not spiking) but the equivalent meat in the US also bought with pounds sterling does have a price spike?

Anybody care to try an explanation for this? I mean why prices in the US are going up in all the global currencies?

$USDGBP is rising since June 2021. You need more sterling to buy

meat in US. This week USDGBP hit ma200, a resistance, so buy a lot of meat in US and put it in your fridge. Do it fast, because the dollar will rebound, get a lot stronger.

Haven’t eaten any meat except on two holidays and brother’s birthday (I request chili beans) at sister’s for about 8 years. Still testing my once a day Medieval European peasant diet (except Skippy super chunk PB instead of lentils).

So far, so good, and that extra $60/mo from SSC equals half my food spending, so I’m glad to have it.

I’m pretty inflation proof, other than value of small savings is shrinking in CDs.

I’m happy.

Make that ALL grocery store spending….go every 8-10 days.

Which makes me an OK Boomer in the adjective sense.

I don’t whine about 4000 sq ft home taxes, or country club, gated community, country club, or golf course fees, like the ones where the phrase is used a bit differently…

…..seems like it ought to have a comma, as in……OK, Boomer.

Just hope it’s not an idle threat.

We started and support this class warfare, not the kids.

Because they have been doing the same thing with the Euro, Yen, Pound and Yuan. While the USA has been the worst printer thru Covid, there is something like 7 trillion of negative yielding (nominal) government debt while the reported inflation in the zone was around 5%. No doubt their stats on CPI are about as good as ours.

It is a lot harder to have a currency crisis when your trading partners are doing the same thing.

It’s not a bubble, it’s currency devaluation.

The longer it takes you to realize this, the more (not less) risk you take on.

To Hyperinflation as an Artform:

Sadly…

(1) After missing out massively on the rise of the stock market since 2020, and (2) after suffering massive loss of purchasing power since I moved to cash and equivalents in 2020, I have reached the same conclusion as you. It’s CURRENCY DEVALUATION (and wealth transfer), not a bubble. Cash is trash. Cash is truly risky. The Fed has made it so, and as Wolf points out, there is no end in sight (just a few little baby steps so far by the Fed). The only question for those holding cash is how quickly you dollar-cost average your way back into equities and other non-cash assets. Darn. Oh well.

doubting thomas, while currency devaluation may be happening, it’s still a bubble. if it wasn’t, all prices would have gone up basically in lockstep. real estate is up about 15-20%. tech stocks are up 150%. bitcoin is up 1000%. you get the picture. what’s happened here is that currency devaluation has caused people to flee to assets, creating a bubble there. it’s not an either/or scenario.

Jake W – I have no strong disagreement with your counterpoint to my comment. In fact, I am ever-so-slowly dollar-cost averaging back into stocks because I know that, despite the fact that cash is trash, a quick movement of my cash horde back into stocks may reward me with a 30% downward correction. Who knows? There is no good outcome to this monetary policy disaster for those of us who “conservatively” bailed out of stocks and into cash during 2020. We can only mitigate the damage. It’s a troubling time for many of us. I remind myself several times a day that it’s only money.

Doubting

” The only question for those holding cash is how quickly you dollar-cost average your way back into equities and other non-cash assets.”

FOMO always works, right?

Inflation not only hurts the holders of cash….it hurt businesses also.

Let’s not forget that. Higher wages, higher inputs, and selling to a group whose buying power is disappearing. That doesnt pencil out well. Inflation is damaging and evil. It may pump asset prices for a while, but the end game is not pretty.

Look at Turkey. People ran to equities to get out of their cash.

Then suddenly one day, they couldnt keep the stock market open.

I guess you will invite the Fed to appear and save the day if that happens here. Always the Fed.

Historicus – Again, I have no argument with your logic. But given the Fed’s current reckless behavior with respect to inflation, what’s the smart move (is there one?) for the investor? With due respect, we can end the debate if you will answer this question: Is your portfolio weighted towards cash equivalents or towards non-cash investments?

Reckless or Feckless

I came to the same question.

The Fed cannot raise rates. The only option to cure inflation is a deep correction, or recession.

and the only way to induce the deep correction or recession quickly is to raise rates.

the baseline is now too high due to the wasteful stimulus from last year.

wrong !

no, not wrong.

THE FED MUST RAISE RATES.

They are so far behind the curve, they have made it far worse.

For 7 decades prior to 2009, Fed Funds equaled the inflation rate.

That is the historical norm. It was even the norm in 2018 for a brief moment.

I am in disbelief there are people on this site that think spiking prices must be defended by the Federal Reserve. In a real world, real prices do NOT NEED defending. I guess those that say the Fed cant raise rates truly are admitting the fragility of these propped up markets, that they MUST have the Fed subsidies…or else.

Nearly all Central Banks are raising rates. The Fed is way behind the curve. Rates are going up. The only question is “How Fast”.

Michael

“The Fed cannot raise rates”

Ridiculous. The suggestion is people who lent money at low rates cant be hurt. That people that bought stocks and real estate at high levels cant be harmed.

Why is that?

There is a vast majority of this nation waiting to buy both in the event of a dip or drop, yet it seems there are those who wish that never to happen, that “I’ve got mine” attitude. Pull the ladder up.

Wolf posted a chart of how the wealth of these asset run ups were distributed throughout the nation/society.

https://wolfstreet.com/wp-content/uploads/2021/10/US-wealth-effect-monitor-2021-10-02_category-per-household.png

The problems we have are from the fake rates and the subsequent subsidization of debt creation by the Fed. To maintain that posture is to suggest that the CAUSE is also the CURE. That is illogical.

Rates MUST rise. I suspect the rise will come more from QE ceasing and balance sheet roll off rather than announces rate hikes. The announcing of hikes might come AFTER the rising rates due to actions mentioned.

Wolf, how about getting to redraw that cartoon of Powell, showing a smirking, self-satisfied cynic who’s done the job he set out to do.

Do you think Powell will ever face the consequences of his actions? Don’t you think that, going forward, no matter what, he faces a life of comfort and privilege? No matter where goes the economy, Powell has looked after Jerome very well. He”s golden.

get MARCO to redraw

Unless you’re artistic Wolf.

I was in Dollar Tree today all products 1.25

I was there and there were no products.

jk

I asked in our dollar tree why the shelves were half empty. Lack of workers or supply chain. Answer was mostly lack of workers. Soon it will be $2 Tree.

And the shelves were empty. No joke.

I was at Dollar Tree here on Tuesday.

All prices were still $1.00, but there were a lot of empty spaces on the shelves. IMHO, that is what a successful retail operation should look like on Xmas eve.

I did ask the clerk if there was any truth to the email rumor that prices were going to $1.25 here. She said that they had heard nothing. But that there was more than one “Dollar Tree” operating here in the USA.

A few things I want from the 70s

1. Those funky music. In particular Psychedelic rock.

2. Colorful dresses, big orange-brown sunglasses, Afros, big belts

3. Lean people both men and women. Men with muscles and mustaches.

4. Free love and women who can talk philosophy and spirituality

5. Scientific and computer and medicine revolution

Stuff I do not want from 70s

1. Tensions between different people

2. Secret Operations in a remote country

3. hard drugs and crime

4. government eyeing on everything

5. Increase in power of corporate

I dont want to start a problem or something. Did anyone feels like “our guy” is making sense in his comments? He was gone for three months (three months retirement for the previous original guy). Now after his return he is making sense. The replacement is not like the previous “our guy”. He try very hard to make sentences like Yoda but he fails ultimately. I wish him special holidays. holy + day -> holiday.

How about Randy Newman for Fed chair? He comes from that era of good music everywhere and was part of it. Very experienced, looks the part, and knows the world very well. And he still has his faculties too. Sail Away.

They’d cancel him for “Short People,” which is an absolutely awesome song.

He made so much sense he got deleted for it, and then I got deleted for laughing about it. Excess lack of civility, I’d say, and leading nowhere.

By the way, after fighting my way out of a strict Southern Baptist (just my mom, the old man went along with it all to keep the peace) upbringing (no easy task), I now like a good old pagan Solstice Celebration as much as anyone, just to shake off the gloom and assure everyone the days are now getting longer. Don’t care much what it’s called, a party is a party.

CHEERS!

My 1979 hockey team’s photo from Alexander Ramsey high school in Roseville, Minnesota:

19 white guys all with long hair & 10 of them with mullets.

1 black guy with a huge-ass afro.

My hair was a copy of Tulsa, Oklahoma’s David Gates from the band Bread. Not a good look for me in retrospect.

Best line from the movie ‘Bulletproof’:

“This is a ’70s porno. You know how I can tell? Because the guy’s dick has sideburns.”

OK, after checking back & looking at the photo, not quite as long-haired and that many mullets. But still a nice group of us with the late ’70s look.

Considering the players, I got a great laugh out of that….not very abstract at all.

Takes all kinds to make a good comment section.

If the Fed raises rates aggressively the real estate, stock and bond markets would collapse. And we all know what that would do for pension funds and most everything else. Which is why they will do absolutely nothing.

Gilbert….

“If the Fed raises rates aggressively the real estate, stock and bond markets would collapse.”

Spiked prices are to be defended?

Prices can not go back to where they were a year ago?

Come on man.

How can the perpetuation of fake rates that subsidize debt creation and inflation also be the CURE of the situation?

The CAUSE can not be the CURE.

What the Fed has created is inverted reality, historically completely out of whack, and damaging to the People of this nation.

Rates must stay low to keep the markets way above values they have never seen? What of the 7% (inflation) being STOLEN from the workers/earners/savers of this country that bounce out of bed each morning, turn the lights on and fill the shelves in the stores you visit?

I was there. I am a loser. Drafted in 1966, my pay was $3/ day to be indentured servant of USA. In 1971 I bought a 2 bdrm, 1 bath house in Portland Or for $11,000 @7% interest. Zillow says current value is $550,000. Same house, 50 years older. Get it? 50 times higher value…or 98% loss of the dollars value. We fall for the lie that “a little bit of inflation is good.” After all, we have more , our house and stocks are worth more. Try living on the interest earned on $1,000,000 in savings.

Read John Hussman on future stock market returns; should scare the s**t out of you.

I have asked smart financial planners “what do I invest in to preserve the purchasing power of my earnings now for a long retirement?” They understood, but did not have an answer.

Call me whatever, the stock market is rigged. Small investors will not win, most will lose whatever winnings they temporarily acquire.

Still, I buy. I expect more losses, but at some point the paper dollar game, Petro-dollar will lose reserve currency status.

Do you know what Central banks buy? What the IMF, BIS, and World Bank buy for stability? They buy and add to their inventory an internationally recognized monetary unit that is not anyone’s else’s debt. They store it securely so it is not taken from them.

You can buy profitable producers, some paying dividends, at fire sale prices. I mean in the range of 8-12 TTM/PE.

Thank you Wolf for your insights and teaching.

You made me think of a mattress stuffed with SDRs……and most think crypto and that electronic art are really weird “stores of value”.

It’s getting pretty surreal in Econ-land.

“An image of Fed chair Jerome Powell, confronted with the consequences of his reckless monetary policies that he will now have to deal with”

Looks like the Fed is trying to postpone swallowing the bitter medicine of raising rates (and allowing the stock market to crash) till it gets shoved down its throat.

Hopefully the inflation will shove it so far down the Fed’s throat that it cannot spit it out (reverse course). Seems like an entertaining movie is coming to town.

Stocks all time highs…

WHO KNEW the Fed would not raise rates to meet the obvious coming inflation?

Historically and normally, the Fed would stand to their duties and raise rates in lockstep with the inflation. This would serve to tamp down the inflation and protect the holders of dollars from being harmed.

NOT THIS TIME. Who decided, who knew? This all is by decisions made behind closed doors by the unelected.

It is time for a Taylor Rule or some standard that we can all rely on rather than the whims of the power brokers who have hijacked the Fed.

“When the capital development of a country becomes a by-product of a casino, the job is likely to be ill-done,” JM Keynes. ‘Nuff said. The prices quoted are not reliable, in fact are probably completely unreliable. The crypto speculation reminds me of the old adage of a man standing next to a hole in the ground, hawking silver. When asked who he was the reply is ‘A liar.’ The government’s regulatory incompetence has reached an all-time low. It is the only reason cryptos even exist. They fund worldwide criminal enterprise. Powell’s personal holdings in stocks should prohibit him from being a Fed Governor. He is obviously conflicted.

The problem is not so much Fed monetary policy as Fed regulatory policy and I see those vultures circling, though not a fair pejorative, they always come off badly usually because the regulators only show up after the building has collapsed, to point fingers. Chinese regulators stepped in front of the train, and so far the line is holding. The US is not so lucky. This is why a lot of high end global investors prefer China, where bad CEO decisions will get you executed. Now Congress is taking back some of its constitutional authority over the money supply (and with the partisan divide that policy will not be even, creating more Fed problems) the Fed’s supply of Wall St bank money, and its deregulated financial environment may be near an end. (Insider trading is a sidebar) . For corporate America the policy straddle is nirvana. the Fed is still pushing cheap and easy credit and monetary bailouts and Congress is handing out cash to consumers so they can raise prices. The punch bowl isn’t the issue, its the table the punch bowl is sitting on. Now you lower it so all the little people can get a sip and that changes everything.

I dunno about that, I just read that the guy in charge of printing the money in China (literally) handed out about 300 billion worth to his buddies. Perhaps he’ll be executed, but I’m sure at least a little bit of that scrip is floating around Vancouver real estate and/or offshore accounts.

Yup! It’s different at the moment.

‘Wages’ is the dog that hasn’t barked so far, this time round.

If they don’t bark loud and soon, there’s a wall coming and inflation could drop like a stone as people run out of spending power.

The big question for me is if Mr. Market and/or the Fed will increase rates to a real rate of return.

So far Mr. Market is hiding (maybe Argentina, Turkey or Brazil. The Fed is too busy trading their accounts and making big bucks while the party roars ahead.

The longer this takes, the more pain will be incurred during the hangover.

Merry Christmas and Happy New Year!

B

The real rate is in negative territory for at least a decade.

The real inflation currently on the ground is 20% plus.

I don’t think anything changing substantially.

FED is doing best: Front running the market with their personal trading , raking in $$ and jawboning the market.

Do you think in 2022, a 1% overnight rate would make a dent on inflation which is at 20% plus.

Jon,

I’m glad someone has the guts to stand up say the truth. Inflation is currently at 20% and rising. Government published figures are total bull s$it. David Stockman says it 13.6% and climbing. Currently rents in the Swamp are going up at 20% annual rate. Bidding wars are occurring on rental properties that are in good locations and have the required amenities. Used cars are going up at 40%. Gas prices haven’t dropped on dime after doubling in one year. Homeless camps are now one block from the Supreme Court. J Powell is upset that he has to look at these homeless camps on the way to the Ecles building at 14th and Constitution. He wants them moved to the low income areas of the City.

Hello, could you recommend books or articles that explain the recession 1974 and 1982? I would like to study about the causes and consequences. Thank you for your comments

The way inflation is calculated has changed significantly since 1974. When we see charts like the one in your article are the inflation numbers normalized? If not, the current rate of inflation is significantly higher.

Read the article.

I drove into the heart of the Swamp (Washngton DC) today Christmas day to visit my daughter’s family. About 80% if the residence of the city were out of town so there was no traffic and it was a nice sunny day. I was struck on the way home of how beautiful the City was at Dusk. All the monuments were lit up. A few tourists were walking around looking at the sights. I’ve been in nearly every City in the USA at one time in my life. I would say that San Francisco and Washington are the two nicest cities in the USA in spite of their problems. That might explain why so many people want to live in these places.

I agree. I used to live in Rosslyn, just a walk across the bridge from Georgetown, and there were many aspects in DC that I found spectacularly beautiful.