The phenomenon of a spurt in buying during the early phases of rising mortgage rates – until they reach a magic number.

By Wolf Richter for WOLF STREET.

Actual sales of all types of existing homes fell 8.2% year-over-year to 526,000 homes in October, with sales of single-family houses falling 8.2% year-over-year to 469,000 houses in the month, and sales of condos and co-ops falling 8.1% year-over-year to 57,000 units, according to data from the National Association of Realtors today.

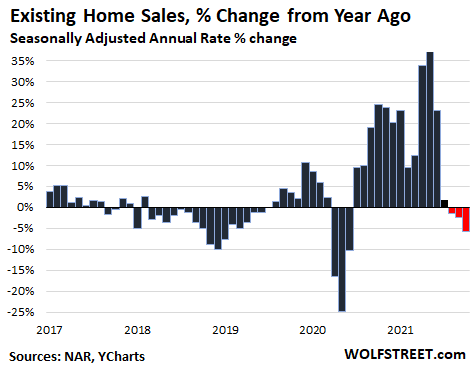

The NAR then converts the actual sales to a “seasonally adjusted annual rate” of sales, which for all existing homes fell 5.8% in October from a year ago, the third month in a row of year-over-year declines, as the blistering boom has lost some steam (historic data in the chart via YCharts):

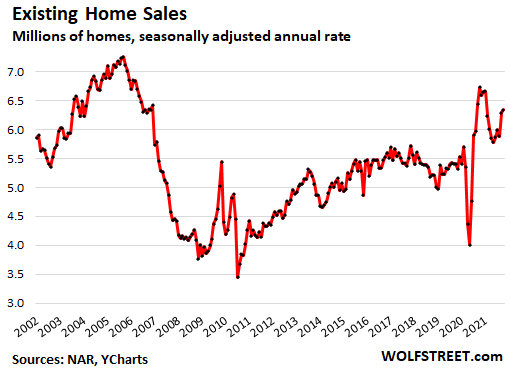

The “seasonally adjusted annual rate” of sales in October of 6.34 million homes, up 0.8% from September, was well below the levels of October through December last year, and far below the peaks during the 2004-2006 era.

By Region, the seasonally adjusted annual rate of sales fell year-over-year in all four regions: By 13.8% in the Northwest, by 6.3% in the Midwest, by 3.5% in the South, and by 5.1% in the West.

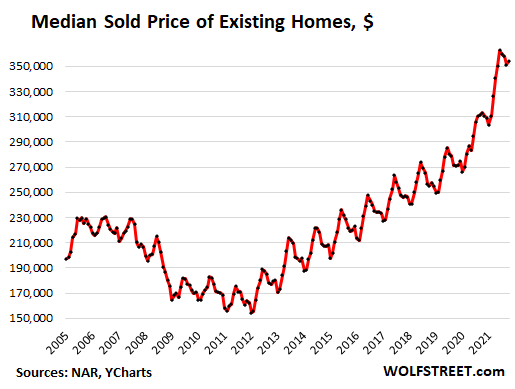

The median price rose 13.1% year-over-year, backing off the peak-frenzy spikes in May and June of over 23% year-over-year. The increases in September (12.7%) and October (13.1%) were the slowest all year.

At $353,900, the median price is down by 2.4% from June as seasonality has returned to the housing market, normally with a peak in June or July and a low point of January or February. Seasonality had completely blown out the window last year.

In terms of single-family houses, the median price, at $360,800, was still up 13.5% year-over-year, but down 2.5% from the peak in June. The median condo price, at $296,700, was still up 8.7% year-over-year to, but down 4.6% from the peak in June:

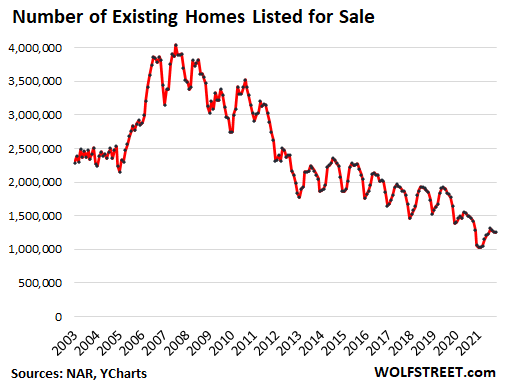

Supply of homes listed for sale remained at 2.4 months at the current rate of sales, which is very tight, but up from late last year and earlier this year. The number of unsold homes on the market dipped to 1.25 million homes, seasonally adjusted:

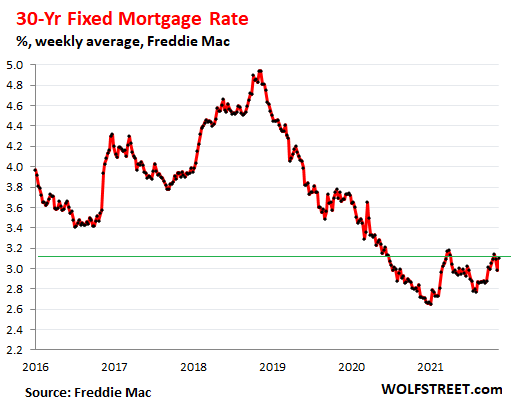

Rising mortgage rates. The average 30-year fixed-rate mortgage last week was 3.1%, up from 2.87% in mid-August, according to Freddie Mac data.

Long-term rates are going to rise. The Fed has now begun to taper its asset purchases. There is talk that it will speed up the taper. Even at the current pace, the Fed will end adding to its balance sheet by mid-2022. That would be the end of QE. And there is talk that the Fed will let its balance sheet decline sooner, all in an effort to let long-term rates rise.

QE has pushed down long-term rates; and the end of QE followed by a balance-sheet reduction will allow long-term rates to drift higher. And this will be reflected in mortgage rates.

A well-established phenomenon when mortgage rates begin to rise: Potential home buyers try to lock in a low rate before rates rise even more, which leads to a spurt in home sales early in the phase of rising mortgage rates.

This phenomenon of the fear of rising mortgage rates is what is now supporting home sales, “despite low inventory and increasing affordability challenges,” as the NAR report put it.

But as mortgage rates then rise beyond some magic number, the additional costs put a damper on demand. Last time it happened was in 2018 and steepened when the average mortgage rate rose past the 4% mark toward 5%. Somewhere in between was the magic number after which home sales began to swoon.

Given the sky-high prices now, the housing market may be even more susceptible to higher mortgage rates than in prior years, and the magic number may be quite a bit lower than it was in 2018 as insurmountable affordability pressures for many people will sap some demand.

All-cash sales rose to 24% of total sales in October, up from 19% in October last year. Cash buyers include institutional investors and individual investors and second home buyers that have the cash, or can temporarily borrow against their portfolio and get a mortgage later.

Within that group, individual investors and second-home buyers – including those not putting their old home on the market to ride up the price increases for a while longer – purchased 17% of the homes, up from 14% a year ago.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

‘All-cash sales rose to 24% of total sales in October, up from 19% in October last year.’

Is there a time series for this? I realize there have always been some cash sales, but is it different this time? I am surprised to see increase from last year.

The hedge funds and reits are buying up huge pools of single family homes, all for cash. This year they have access to bigger pools of homes, thanks to zillow. With the big new DC giveaway, there will be tons of money for affordable housing. The hedge funds are front running to get as many houses as they can, to resell to the govt or put on section 8 list.

i hope they all burn down.

Jake,

Now that housing has now been neatly folded into the Wall St Casino, I tend to agree.

I do not like the current course of society our overlords have chosen.

Jake

I doubt they will burn down.

But I’m guessing that when taper gets well underway, and higher mortgage rates follow– there will be a lot of mortgage agreements that will suddenly suffer spontaneous combustion.

I suspect now many likely think (hope?) big time inflation will save them.

My big question: will the taper rooters then chicken out and will the Fed fire up the printing press again to send emergency money to save the poor hedge funds–and any others that might get burned in the fire– of course only those poor souls that are in danger of losing $50M or more.

Amen. I suspect that the major, alleged “billionaires” are fronts for the trillionaire families, who own/control US media and can manipulate news to drive their alleged companies’ stocks up and up. How else can you explain some valuations? For example, a certain, ordinary, electric car maker’s stock is valued like it can make “superpowered” electric cars —- that can fly you to the moon and back safely. LOL. Watch “Britain’s Second Empire: The Spider’s Web.”

It’s all part of the great consolidation, like the end game of Monopoly.

“You will own nothing and be happy.”

Change that to “You will own nothing.”

That’s a bingo!

Any program that gets “affordable” prefix attached to it gets manyfolds more expensive.

You think childcare is expensive, just wait for “affordable” childcare.

The number of listed homes for sale is still way too low to provide a basis for a balanced market. Prices are not moving higher now. Sales moving down. Just need alot of homes to hit the market next year. People are holding onto real estate because they believe it will do well in inflationary times, but that is just wrong. Higher inflation means higher interest rates (soon) and less money to spend by consumers. We are still 3-4 months away from retail sales falling, watch credit car balances, which were paid down, first rise, then retail sales start to fall, at about the same time, price increases in homes fall flat and start to fall down, which then releases pent-up sales volume of home sellers, and then we get to see what the down-cycle looks like. I think the stock market is also getting ready, slowly, to turn upside down.

people still need place to live

and when they look around they realize staying put is OK and likely best option

Just watched a you tube video of a middle class couple that got wiped out in 2008 – 2009. Guy worked in construction. Had a home and three rentals. Lost his business and all four homes, one at a time. They got caught with too much debt and tenants couldn’t pay. Wife had a stroke so they lost it all and ended up living in a ratty travel trailer for years.

They got burned and then decided to live debt free and become savers. You and I know Fed has been screwing their savings over for 12 years.

I watched video just to get a refresh on how bad it was in GFC. I think that is why government was doling out money right and left after covid hit. Once damage is done somebody has to pick up the losses and middle class couldn’t get wiped out again.

Over the last month or so, I have posted that I am seeing all time inventory lowes ( in number of listings ) in select east and west coast zip codes I watch. We are talking outrageously low. So, this housing report is what I expected.

Furthermore, the inventory continues to rapidly decline in expensive areas. Remember, wealthy buyers are not influenced by the rising rate rush you describe above. Buyers are taking what little is left. It is getting to the point that many potential sellers are not going to sell their homes because there is nothing to buy. This is crazy and if the listings continue to decline, this springs price jump might be historic.

“springs price jump might be historic”

Great time to buy! Now or be priced out forever.

Don’t forget to ask your bank if you can get a slightly larger mortagage to buy some crypto too! Now or never!

Caveman, you left out an important part of my statement.

I said “if the listings continue to decline, this springs price jump might be historic”

The if is important. At this point, it seems likely that listings will continue to decline, but don’t forget the if.

socaljim has been correct on here year after year, while doomers have said “the big crash” is just 6 months away.

Let’s see who is right come May. My bet is on socaljim.

I have been in real estate in expensive areas of coastal California since 1986: lending until 2006 and then as a realtor since then. Listen up to SocalJim.

In my very expensive neighborhood we have only five available listings and one is a $34mn dollar ranch. Then one down my street that is closing next week for well over its ask had TEN bona fide offers on it.

What we are seeing here in Carmel is sellers unwilling to sell for a vareity of reasons. Mostly it seems to be the fear of where can they buy next? Most all sellers I represent are moving out of CA.

Lastly, when the kids in DC put forth their tax the rich plan on those earning over a million a year, I expect even fewer listings as new cap gains rules should put a serious freeze on upper end listings. Why would you sell with the butcher knives out? See what the lower and middle markets do with an entire segment saying nope. A machine tends not to function smoothly with one of its gears slammed shut.

sc7

To hedge your bet:

Suggest you might want to read Rogoff and Reinhart’s book “This Time is Different.” I know, it was written over ten years ago, so maybe a little out of date.

Not sure what socaljim was saying in 2006.

The “Heyj@ss Effect” (high crime) in Chicago metro: Buyers of $500,000 Leave It To Beaver houses in the western ‘burbs are coming from hipstervilles Lincoln Park, Wrigleyville and Wicker Park with their small kids.

The end of the greatest asset mania of all time (the one we are in now), whenever it happens, will put an end to what you describe.

It’s not like we’re talking about mostly real wealth and an organically robust economy supporting these prices.

Thank you for all you have done promoting my glorious boom! This spring will indeed be an historic event! Home prices will rise like never before! Inventory will disappear (Redfin/Zillow shadow funding by U.S. gov’t resumes)! Rocket mortgage ads will brainwash the masses until even senior citizens can recite them line by line! Buyers will come out of the woodwork to take on ever higher, unpayable mortgages! Investors will cash out of Tesla/Bitcoin and buy homes! People with 3 million lying around will panic and buy 2 houses each in Seattle or 1 in the Bay Area! The stock market will continue to bloom! I will print so much money my fingers turn green! This is truly the beginning of the age of plenty! Behold!

Why bother with Seattle or the Bay area. Check out 113 S Dianthus St in Manhattan Beach, CA. 3+1, 5.6M … has a slight view. 18 years ago, sold for 1.3M. Better hurry.

Even the alley around the corner is the front yard to several million dollar houses. NUTS!

I hope everyone knows my “Better hurry” comment is sarcasim.

Great work J-Pow!!!

Continuing to buy mortgage backed securities in the midst of a massive housing boom that makes the 2007 housing bubble look like a small blip, is pure genius. Every rich American will be relieved you were re-appointed Fed president. No-one can print money like you.

Do you really think that a different person being appointed would change anything?

SoCalJim – Agree that inventories are crazy low. People just are not selling because they believe home prices can only go up. That is the very nature of a bubble.

Yes, still some suckers buying homes at inflated prices, but as mortgage rates rise, we are finally seeing demand dry up and the next phase is going to be even less demand, until the number of homes on the market slowly starts to increase. This is a process that takes time.

I think those price increases are nearly finished on a nationwide basis, but maybe still some upside in specific markets. Only a fool would buy now, smart money would be selling or holding.

This is really all about a lack of home supply due to owners holding onto properties for the price gains and investors jumping in and bidding things up. This is not about a healthy demand based on rising personal incomes. Sure incomes are rising, but inflation is rising faster. The biggest increase in income is all about speculation right now. That doesnt last and when it turns, things get ugly.

A lot of people don’t understand “ready, willing, and ABLE buyers. Prices rising faster than wages. Zero percent mortgage at higher price means you can’t even afford the principal. Now let’s raise the rates. Can’t end well. We’re running out of qualified buyers.

This

Sadly I completely agree. In San Diego the towns that had historically low inventory last year are sitting at 1/4 that inventory today, if lucky.

I have been seeing an interesting trend where investors are picking up properties and then immediately listing them for rent. Nothing new, but they are attempting to rent out a house they bought for way above market rent (to try squeeze out a 6% ROI) and the rentals are just sitting there. In reality they will get a 3-4% ROI, which is dog doo-doo, and they are banking on appreciation.

And unless something changes they will probably get the sky high appreciation in 2022 because there is no inventory.

The big catalyst I see for a changing housing market is if home prices go down, because the OpenDoors of the world, ibuyers paying above market to obtain properties, are essentially banking on appreciation to make their model work, and to boot they are holding onto large amounts of inventory.

If RE falls enough that ibuyers start to fall then we might see a larger correction.

Biden just nominated Weimar Boy & Weimar Girl. Lord help us.

You missed the small print. I’ll post something on this small print shortly.

Thanks Wolf. I’m surprised the market interpreted this as hawkish (yields up, gold down, etc.)

Of course, the two nominees had to pay lip service to fighting inflation in their acceptance speeches – this was politically necessary – but it’s not as if the two don’t have decade-long track records from how they actually vote on policy.

i think i’d almost rather have brainard, in some weird way. while weimar boy will print for his wall street buddies, brainard will print for every poor person. printing is bad whenever it’s done, but at least the latter would be a change.

Potaetoes, potahhtoes, perhaps, Jake W?

It was hawkish…

https://wolfstreet.com/2021/11/22/powell-brainard-suddenly-make-inflation-1-priority-in-their-thank-you-statements/

This is actually a good plan by Biden or whoever is controlling him behind the curtain. If he nominated “Weimar Girl” and s**t hits the fan, he will get blame for it 100%. With this, if the bubble blows up (and it’s a big IF), he can still blame it on “Weimar Boy” and indirectly Trump. Oh BYW, they have the person they wanted second in command. I’m sure the solutions will be more money printing and rate suppression for the rich!

You’re welcome! I, Jay Powell, Chair of the Federal Reserve of the United States of America, saved us from certain doom and an inevitable great depression!!! From here on out, GDP will rise every year!!! Spending will increase every day!!! and nothing will ever go down!!! I have brought happiness and prosperity to the United States of America (and joy to my own portfolio *wink*). You are welcome for all I ha e done!!!!!!!

I was just about to point out the same thing, Powell for the foreseeable future? I have a buddy who told me a few months back that the fed doesn’t know anything but low interest rates, and he was right. I like your reference to Weimar. Between the Weimar kids, no inventory being built, and the fact that it’s gonna be 80 on Thanksgiving day in San Diego I only see housing going up up up here. Maybe not everywhere, but things are routinely selling in the high 900k and a few 1m now, and I’m talking old, small footage, center city houses. Oh my.

Here’s one data point.

Within 5 miles of my home there are 20 houses for sale. Of these, zero have Zestimates. At least 90% of houses not for sale have Zestimates. I imagine Zillow cannot come up with any way to rationalize the advertised prices, which the Zestimate matches for historical legal reasons, so they just don’t try.

Of those 20 houses for sale, 3 were purchased earlier in 2021, and price reductions since mean the owners will take a loss if they have to pay any sales commission.

I live in a desirable rural area in the South where custom home building has been all the rage since 2017, to the point very few spec homes are built annually because there aren’t enough subs, particularly framers, to go around.

Over the last 12 months, prices to build a nice but run-of-the-mill custom home have been around $250 a square foot for some of the builders when a year prior, the same homes were being built for about $180 a square foot.

My neighbor works at the largest community bank in the region with about 75% market share, and he said new home construction loan applications were down 75% last quarter, so we’re running out of suckers from big cities who will pay ridiculous prices to build a home.

It appears people have had their limit in existing and unbuilt home prices.

Where is this “desirable rural area in the South”?

I don’t mean to sound glib, but I did not know such kinds of places existed?

Western NC

Sounds glib.

“so we’re running out of suckers from big cities who will pay ridiculous prices…”

In my rural scenic area this is what the local realtors pray for. But all real estate is local, and if we get the hard winter the forecasters are predicting, then those same buyers turn tail and become sellers. Realtors here call it the”winter kill.”

Same thing here. Lovely place to live except during winter, so people who have sold their home in the city move here and the following spring move back out, selling at a loss. But a new contingent of buyers have appeared: summer people. They have also sold their city home, bought here, but also bought in the south. Best of all worlds.

Funny you mention framers.

My buddy owns a framing company and he just bought his second Lamborghini.

And here I went to school to be an engineer. No Lambo for me!

Engineer huh?

You better buy a new box of bandaids to hold your glasses together!

No Lambo for you!

did he buy it with business profits or did he repurpose a ppp loan for it?

$250 per sq foot is at least 20% low….unless they are paying minimum wage with a lot of under the table stuff all the way to occupancy including low end fixtures. I could see that 2-3 years ago, but not now.

Charolette county SW Florida. Builders are quoting 190 to 210 for upper level, but not custom. Add approx 20 for upscaling and delays. Quoting 20 to 24 months with all the delays from time of contract. 15 to 18 months if everything ready. This is from 3 different firms about a week ago.

C’mon P, you especially should know that location will absolutely determine cost per SF for every type of construction, but especially for SFR where OSHA is seldom seen or heard…

Last time I checked with my next door neighbor, a very good GC here in the saintly part of the TPA bay area, he said $120/SF for ”conventional” CBS 3 & 2,, split plan now being the go to… nothing fancy for that for sure,,, and does not include any land, etc., or appliances or furniture,,,

I was working on the very best SFR in the Port Royal subdivision of the Naples, FL area in ’62 when we were building old style with ”real” plaster on walls and ceilings, etc., etc., for $12.50; those same exact houses selling now in some cases for over $1,000.00 per SF.

Kinda makes one who knows that the ”official” BLS inflation calculator currently saying $114.50 might be just a tad low— or total BS, eh?

Most people don’t buy houses (or cars). They buy payments… so let’s do some math:

If rates were to go from 3.2% to 5% then on a $350K mortgage, a homebuyer would be looking at an additional $370 in payment per month. Looked at it another way, the same payment at 5% as the current payment 3.2% would only buy a $283K house. So, to keep up with the same payment at 5% house values would have to fall almost 20%.

I guess folks better hope interest rates never go up.

Right or wrong, that specific math was enough to give us cold feet a couple months back.

At 5%+ interest rates you might be able to refinance someday. At 3ish% you probably won’t, and at any given point in the future if you want to sell it will be to a set of buyers who are paying more for a mortgage.

That being said, I have no idea what’s going to happen, and whether our cold feet were justified.

that’s what i’ve been telling anyone who will listen to me. if you are 100% sure you are not going to move for 30+ years, then yeah, why not, buy at the inflated prices and get a 30 year fixed at 2.9% or whatever it is. if there is any chance you’ll have to move, just remember that if rates are higher, as they likely will be, you won’t be able to sell and be above water.

Or overpriced homeowners are praying rates don’t go up!

You mean the cash buyers who paid 10% to 20% over asking price?

Sums it up perfectly.

“… If rates were to go from 3.2% to 5%…”

Not going to happen. The FED is trapped and can not raise rates or their precious stock and bond markets would crater.

I just recently learned about another source of All-Cash purchases. My son is having a house built in a new subdivision that is 75% Intel employees. A large percentage of the new homeowners are H1B engineers and scientists from other countries. Recently we were out looking at the progress of his house and met the new neighbors who were from India. With them were a couple of unrelated Indian guys. They mentioned that they were the “money guys”. So I am assuming there is a grey market “shadow banking” system running within various H1B employee communities.

Seneca’s cliff,

That’s an interesting observation, in terms of specialized lenders for H1b people.

But note, the biggest mortgage lenders today are shadow banks. Quicken Loans surpassed Wells Fargo years ago. Shadow banks also secure the loans with a lien on the house, and that’s a mortgage and counts as a mortgage. The situation you describe appears to be a lender that specializes in lending to H1B people, and secures the loan with a lien on the house, which would be a mortgage, and thereby it would count as a mortgage. They’d be nuts not to secure the loan.

I’m guessing here based on H1B folklore. The buyers can be a combination of upper level Indian managers pooling their money to provide housing for Indian workers, as an investment. Or it can be the contracting firm the Indians work for, buying the houses to house the contract workers, they know they will be placing at Intel.

My thinking too when I read the above post. The “unrelated people” are the landlords.

Got to be on good terms with my LL at a motel in CA while TDY a few years back,,, he was a college professor in India and had bought two motels in CA for his retirement and explained the process to me:

He changed his name and became a ”cousin” of the family who are the largest actual owners of hospitality housing in the world for the additional financing he needed in order to buy for cash, with the family having a partial interest in his RE…

He sold out to the auto dealer next door eventually, for something like a 500% profit.

Same story from another motel owner in KS a few years later, though different family name.

Both families been doing the same thing for centuries it appears.

That’s good management!

Your son will be living next to a house with up to 4 guys per bedroom, plus a bunch more in the living room and dining room. Then there’s the extra cars too. These guys want to live as cheaply as possible and save all their pay.

The H1B folklore might be correct for some areas but the H1B’s purchasing homes in my son’s subdivision are higher level and live one family to a house. These are $550,000 to $780,000 houses and from what I can see from the older parts of the subdivision they are mostly exclusively a husband and wife with one or two kids and one Honda Accord. This is the area where Intel has its prototype fabs and each tool ( semiconductor making machine) is staffed by at least one PHD in physics, chemistry, materials science or engineering. A couple people have remarked that this subdivision feels a lot like 1950’s America with nuclear families, everyone leaving for work at the same time, newer sedans ( to trucks or big SUV’s) and kids playing in the park.

Soon their moms and dads will be coming from India with the rest of their siblings. This is why they buy the big expensive homes, multiple incomes will eventually support it. This is just how they normally live. I see it in my own area.

Not much different than lots of cities in California. When I lived in Thousand Oaks in the late 1980’s, Hispanics were filling rental houses with multiple families and friends. The cars were parked everywhere.

Yep, I grew up in Thousand Oaks. It’s still going on, but now it’s not just hispanics it’s whites too. Also happening in Simi Valley and Camarillo.

It’s gotta be the great weather in Ventura County, Harv.

I would if I was a young guy starting out. Never underestimate the deprivation a young man will endure in pursuit of a goal. Nevermind, go ahead and do that. WTF am I thinking. Short people everywhere.

Remember when people had a sense of humor? And a sense of privacy?

I present:

Randy Newman – Short People

I laughed then felt guilty.

Sounds glib.

“You have to pick them up just to say hello.”

“Short people look further away than they really are.”

Historically, short people invariably end up on top.

This sort of arrangement has been going on for years. Back in the early 80s a friend sold his house to a Chinese restaurant owner who was bringing kitchen help here to work in the restaurant. Eight of them lived in a two bedroom house, only going out for work. After a year they cycled back to the mainland and replacements took their place. The restaurant owner became a very wealthy man.

mortgage interest is only deductible mostly if used to acquire the residence. does anyone know if a cash purpose as a bridge which is then financed within a certain period of time is considered by the irs to be “acquisition financing?”

Loan interest is always deductible in a home loan, regardless of when the loan is executed, up to $10K / year based on current tax law.

Higher mortgage rates?

I think what is important is how far below inflation people can borrow

for 15 to 30 years for their mortgage. And that has actually widened.

What’s important is the borrower’s income and how fast it goes up later or if they even have a job at all in the future.

The nominal rate is what the borrowers has to qualify under and make the mortgage payments, not the “real” interest rate. Wages or incomes don’t necessarily mirror the inflation rate, especially for each individual.

Homes are long term purchases for the primary purpose of having a stable place to live at a set price per month vs. renting, where prices only go up over time. Renting also eliminates the forced savings and appreciation benefits of owning.

With inventory at historic lows, it’s not likely prices will drop (much), even if mortgage rates move up. This isn’t a speculative market. It’s a market starved of product

“It’s a market starved of product”

Are you saying that need for a shelter is multiplied during a few years?

The rising trajectory of long term rates is an illusion. The Fed would implement YC controls before that happens, but they won’t need to. Since 2008 we have been in a deflationary trend, in important commodities, and the dollars purchasing power. Some commodities like NG have had their price destroyed by oversupply generated on the back of cheap corporate credit. The reversion to mean seems like a new bull market. Same with yields. The Fed and Deficit spending since 80′, has created a long term deflationary trend, aided by cheap imported goods, and until recently no wage growth in our main supplier, China (but plenty of wealth inequality). Will Chinese buyers jump back in to the US housing market to avoid their own? Or will the current property owners be forced to sell in order to raise cash? The owners of Evergrande sold a billion in stock at a steep loss (perhaps to make the payments on his bonds?) The real plus for housing is the declining trend in the currency, which goes up every day in Forex just to demonstrate how screwed up things are.

America needs to do this also would stop blatant theft of workers dollars

So Biden’s chances for reelection vastly diminished with Powell as his choice as I see it . With many unhappy with all the losses of income under Powell . I don’t see how Biden could Ever be re-elected . I find this News very Bad to choose Powell and most certainly will affect the Home market .

You can refinance a rate, you can’t refinance the principal.

I’ll wait thankyouverymuch

NDX & SPX misbehaved !

So Wolf, what would you project 30-year mortgage rates to be in 12 & 24 months?

1 year = 4.125

2 year = 4.875

Since the national debt is only getting bigger, there is no place for interest rates to go but down. Watch the debt ceiling circus coming up soon.

1 year = 3.75%

2 year = 4.25%

We’re not getting near 5% for at least 4-5 years.

Keep in mind the way CPI used to be calculated inflation is already approximately 13%. With just a little regression to the mean we could be at 5% before you realize it.

1) Existing home sales on the right : in the last 11 dots home sales were meek.

2) The angle between 2005 & 2020 tops is pretty shallow. Sales reached a lower high, despite covid panic. This chart, at this point, doesn’t indicate booming RE sales.

3) There is an uptrend line between 2013 high and 2017 high. 2017 is a very complex pattern. There is a parallel line from 2014 low. It’s a very focused channel, a Lazer.

4) In 2020 sales jumped > the Lazer, decayed to 2018 high, and currently osc slightly above.

5) In the next wave, sales Might drop inside and settle below.

6) There will be a test, before the next jump.

On average, are young American couples (late 20s, early 30s) able to purchase a house/an apartment at current prices? I’m asking because where I live (Europe) they have been priced out of the market, and have to compromise (either on location or size).

Volvo,

Depends on location: Northeast coast (from DC to Boston) and west coast, not really. Though of course plenty of nuance. Inland is generally a lot more doable.

Though in any hot shot city regardless, not really.

Clear as mud right?

Pretty much. I’m late 20s make 1k /yr over local average wage for the metro area I live next to and I can only afford trailers out in the woods. And that’s only ones that are unable to finance due to being in disrepair. Rents locally are a solid 30-40% of my after tax income for a 1 br outside of town. Now granted, I’m single and only have a single income but the situation is pretty bad. However I moved to an area with good wages and a slightly lower cost of living. The area I came from was utterly hopeless. Average wages for a single person were ~30000/yr and homes were 300k as a minimum. Rents were all 1200 and up unless you lived in the absolute ghetto.

Our situation isn’t as bad as Western Europe, Australia, or Canada but it’s no picnic for new home buyers or renters in the past couple years.

However if you were able to buy after the collapse in 2008-2013. You’ve likely cleaned out if you had any sense. Buy a cut price foreclosure in 2013, refinance at insanely low interest rates, be light years ahead everyone else if you save your money and plow it into smart investments. Sadly most Americans who did this took a HELOC or cash out refinance to buy depreciating assets and toys.

Thanks for your reply. I’m mid 50s and I’ve got two kids slightly younger than you. They’re the first generation in a very long time who’ll be worse off than their parents. I hate this fact.

I make well above average for my age early 30s and can’t afford my city. Not on a coast either..

It is what it is.

Volvo,

I’m halfway between you and Trucker. Our generation is fine. We’ve got our avocado toast and are into yoga. :)

I’ve been single my entire life. I never felt like I could afford to buy. Three years ago my mom died and I bought her house for cash. No, I didn’t get a special deal. That would have cheated my siblings of their inheritance. So at the young age of 72 I’m a first time home owner.

Truth is, I could have bought several decades earlier. But I’ve always been a believer in keeping myself liquid. For those of you who love the big city please realize you are choosing a high COLA area. And high housing costs are guaranteed. What’s it to be? The big city life or affordable housing? These are the choices one has to make in life. They’re character builders.

I can sympathize with your situation. A niece is similarly trapped even though she is a well paid attorney. She lives in the Boston area and does not think a house is anywhere in her future. I tried to explain to her that the root cause of her problem is the FED. All I got in return was a blank stare. If a well educated person doesn’t get it then we are in deep trouble.

Gilbert…

The blank stare means nobody wants to listen to an old geezer. She was being polite.

😌

You can always buy in the south of the US but nobody wants to live there. That’s why it’s cheap. Think of the south of the us as Morocco.

Which city has the beauty and cultual diversity of Casablanca?

Yes, please do, and stay away.

Except the south has unbelievably depressed wages and the cost of living isn’t that much cheaper. I came from the south. It’s an unmitigated shithole for people born and raised there. Even the people I know who went to college and got legitimate degrees are sucking eggs financially. The south only works if your company fled high tax, high wage areas to skim cheap labor and idiotic anti workers rights and anti union mentalities and you got to follow them with your salary intact. Or you retire there.

I would never move back there in a million years. Poverty, awful weather, crowded, bleak life of debt and having to rely on others to support yourself until you die and rot in your crappy trailer. At least in most other parts of America a working class guy with a couple skills can stand on his own still if he rejects materialism and debt.

My husband and I make double the median income for our area and can afford a small starter home in a traditionally middle class area if we max out our budget.

– Rates went down since early 2019 and bottomed in (very) late 2021. And those rates have remained (more or less) flat ever since say mid 2020.

– Although I wouldn’t rule out another leg down in long term rates.

– Rates not falling anymore in combination with rising real estate prices could be (and are probably) the reason why “existing home sales” are down.

The calls dont stop.

Close to 30 yrs, and have never turned away this many jobs.

Fly over, only the 1 percenters own 7 figure homes. Still have the grey hairs buying, no shortage of young couples

As well.

Have no doubt this will tank.

Grateful I’m debt free, and the youngsters cant handle doing this work.

Just struck me. This is the 2008 GFC under a new guise. Back then the ARM was blamed along with lose lending practices. Well this is like wholesale reduced interest rates of an ARM. What do you do when the entire market interest rates re-adjust. WOW. This is a built in crash waiting to happen

70th birthday last Friday. Owned rentals 30plus years. Closing sale on last rental in 2 days. A gamble? Maybe. You’d have to be crazy to buy in this market. But I ain’t going down with this ship.

“Sounds glib.”

Happy B-Day, Gomp.

–NJGeezer.

Thanks

GOMP

Good for you !! I had rentals 15+ years and sold them past 3 years to investors and carry the paper on them (10% Interest only loans). Passive income is great but at 10%, even that feels like losing to inflation now.

I hope you made enough on your sales to retire comfortably. :-)

What is it with you Americans and always setting yourselves up to retire as quickly as possible? Do you not like your work? Possibly you should try doing work you actually enjoy. I am hoping to die at the age of 104 with 8 projects still half finished!

What are you doing with the sale proceeds?

Capital Gains of course

“… Fed has now begun to taper its asset purchases.” Is this really the case Wolf? Or is the minimum monthly purchase the only thing that has changed?

It has tapered its asset purchases starting in mid-November (last week) to where its balance sheet increases at a rate of $105 billion a month, down from $120 billion a month. Starting in mid-December, its purchases will be trimmed to get the balance sheet to rise a rate of $90 billion a month.

This will become apparent in Treasury securities over the next few weeks.

Changes in direction of MBS take 2-3 month to register because the Fed buys them in the TBA (to be announced) market, and those trades take 2-3 months to settle, and the Fed books those trades when they settle. Meanwhile, MBS generate a lot of pass-through principal payments for the Fed (reduce its balance sheet) that it tries to replace with new purchases. So MBS form this jagged line on the chart, and it takes a while to see a change in direction.

We’ve been through this before and we know how it works and how the Fed does it.

Uncle Joe, although he may fall asleep at a meeting, is not heartless. Wolf has explained how inflation disproportionately adversely affects the less affluent. Wolf carefully reviewed the “thank you” notes.

I think Uncle Joe told them to take away the punch bowl.