It’s a ridiculous comparison, but hey, the CEO walks on water.

By Wolf Richter for WOLF STREET.

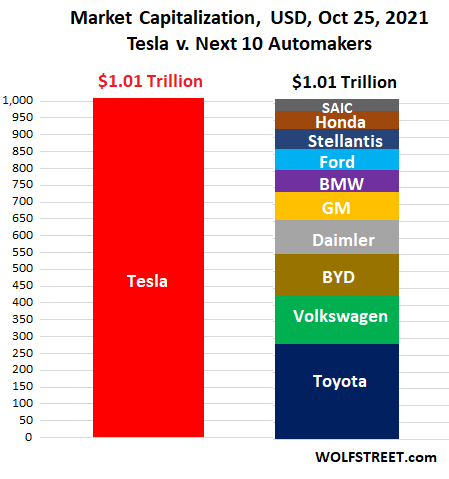

Shares of Tesla [TSLA] jumped by 12.7%, to $1,024.86 on Monday, which pushed the company’s market capitalization to $1.01 trillion. This might not seem a huge amount these days, when trillions are flying by left and right, but it’s still a huge amount. Tesla now has a price-earnings ratio of 332, in an industry where PE ratios of 10 to 30 are typical in good years.

But Tesla is special, CEO Elon Musk walks on water, and nothing and no one can touch them, especially not regulators, who get routinely brushed off.

And with this market cap of $1.01 trillion, Tesla was worth as much as the next 10 most valuable global automakers combined: Toyota, BYD (China), Volkswagen (VW, Porsche, Audi, Skoda, Seat, etc.), Daimler, GM, BMW, Ford, Stellantis (includes FCA), Honda, and SAIC Motors (China):

Tesla’s share price gain on Monday puffed up its market cap by $115 billion in just one day – on news that it might sell $4.2 billion of low-margin rental cars to Hertz through 2022. Let that sink in for a moment.

That potential sale of 100,000 rental vehicles compares to 2-3 million rental vehicles that the other automakers sell to rental fleets in the US in a normal year.

That gain of $115 billion in a single day was larger than the market cap of every automaker, except the three most valuable of them: Toyota, Volkswagen, and BYD. The $115 billion single-day move added a Daimler plus Nissan plus Renault to Tesla’s market cap.

So how nuts is this?

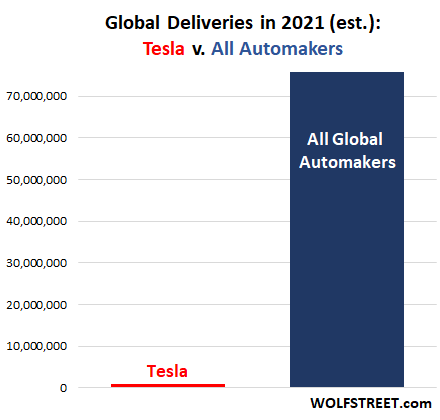

In terms of global market share, a different picture evolves. Yes, Teslas global sales have soared over the years – from nearly nothing to very little.

So far this year, Tesla delivered 627,000 vehicles globally, of which 241,000 in Q3, a huge accomplishment, given the semiconductor shortages. For the year total, deliveries might approach 900,000 vehicles, which would be a huge push and would require a lot of walking on water. But it’s a round number, and we’ll work with it.

Total deliveries globally of light passenger vehicles by all automakers combined might come in at 75 million vehicles, which would be down substantially from 2019.

If these projections are on target – if Tesla can deliver 900,000 vehicles and all automakers globally combined can deliver 75 million vehicles – then Tesla’s global market share would surge to a record breath-taking dizzying 1.2%:

Hertz shares jumped 10% on Monday ahead of a share offering, and Tesla jumped 12.7%. But why does Tesla get into low-margin rental fleet sales if there’s strong retail demand? Read… Tesla Rental Deal is Propaganda Coup for Hertz’s “Selling Shareholders” & for Tesla. But Rental Fleets Are Low-Quality Sales Automakers Don’t Tout

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This line, “That gain of $115 billion in a single day…..”. The 10 others less the biggest three is $450 billion (1000 – 550). So Tesla’s one day jump was just under a quarter of that, not more than all of it combined. [Or did I read this wrong?]

Ahh, just wording. You’re refering to each company’s market cap (including the smaller ones not on the list), not those 7 firms as a group. Got it.

I misread this too! Now I understand. Wolf may want to rephrase it slightly.

Wait for it. Tesla added another $50 Billion just this morning.

I am agnostic about Tesla and Musk. And have avoided the stock markets for decades – nothing more than gambling dens without the drinks and the eye-candy.

BUT. Fedex lost huge money for years (why would anyone pay $10 for a letter to cross the country when the Post Office was doing it for 5 cents).

Economies of Scale made Henry Ford, and despite all the government subsidies Musk has taken to get started down the runway, Tesla may well become very profitable.

333 times earnings profitable? All Musk needs to do is increase earnings 10 fold and it’s 33 times.

In this final blow-off of stealing money from savers, printing money and credit like there is no tomorrow (not a pun), Tesla is just 1 of the pack.

Done.

No it’s total market cap. Tesla’s total market cap = the top 10 auto makers total market cap.

What Federal Reserve bank creates in a month, Tesla created in a day.

We need “Musk is worth more than half of all billionaires combined” chart.

andy:

Other than the daily churning of shares, is there a buyer for all of Tesla at $1 Trillion valuation? Doubtful.

Kam,

Elon can create a Spac and buy Tesla for 2 trillion.

The markets would go to infinity and beyond.

Are you game for the ride?

Musk is now worth more than all of Exxon

“…larger than the market cap of every automaker, except the three most valuable of them…”

$115 billion compared to the market cap of each automaker separately, not combined.

I am trying to bone up on the mining industry as green energy basically replaces fossil fuel with increased mined materials to build out green infrastructure. Entire value of all mining is worth about half of Tesla’s market cap. That is an unbelievable statistic to me.

its a mad mad mad mad mad mad mad mad world.

Its a mad mad mad mad XXXL ClownWorld, courtesy of the Fed and Uncle Sam.

FIFY….

Dalio has pretty good handle on big picture which in some ways is common sense. Asset vales are not real as they can not be converted into real future consumption because they are too darn high.

Isn’t Hertz filed for chapter 11? And the market is listening to a dying company, as long as what they want to hear.

This is usually what happens in a cult.

That’s why I all Tesla nuclear Tesla results will be the same

That is exactly what I thought.

Who’s paying for this……guessing Tesla.

Hertz is dead in the water….have been for a while…

I wonder what Hertz’ creditors thought of the announcement ?

This will never happen…..but it had the effect.

Maybe the Fed will print the money for Hertz to buy the TSLA cars.

Why not?

Hertz apparently worked some bankruptcy magic and exited bankruptcy in July…

“Hertz’s Plan will eliminate over $5 billion of debt, including all of Hertz Europe’s corporate debt, and will provide more than $2.2 billion of global liquidity to the reorganized Company. Hertz also will emerge with (i) a new $2.8 billion exit credit facility consisting of at least $1.3 billion of term loans and a revolving loan facility, and (ii) an approximately $7 billion of asset-backed vehicle financing facility, each on favorable terms. The Plan provides for the payment in cash in full to all creditors and for existing shareholders to receive more than $1 billion of value.”

historicus,

Hertz may be dead in the water, but Musk can walk on water.

Think about it.

You hit on it. Neither Hertz nor Tesla are structured to where they can handle an big economic shock without government bailout.

Hertz out of BK bought by PE outfit that is WAY too smart to commit to buying 100K E cars without knowing how fast they’ll rent.

These will be the AirBNB of cars. They will charge a premium and people will line up. People get used to luxury and want it when they travel. Great deal for all parties (stock holders of both companies, yuppies and young people wanting a test drive of these cars). Time will tell how this plays out. I think it will be an experiement

I’d consider renting one for a week to see how driving an electric car feels (just driving it locally). It’s possible that if I’m renting a car (on vacation), I’d prefer an electric car. The issue for me, would be if I do so on vacation, is figuring out if I can charge it at hotel. Even if they have charge spots (at hotel), they could be full.

There could be alot of people who would rent electric, to have a change of pace. But, starting big is risky. I could imagine this working well at start, the question is whether it stays a good idea.

I wonder if some hotels will eventually charge to reserve an EV charging parking spot.

Yo !

Can this shows the market think all those ICE automakers are doomed because will have to dump entire factories, IP, logistics, etc… ?

Right on! Accepting the metaphor of “the market thinks”, the market has no idea of how to think about negative interest rates and negative P/E.

My main theory of Tesla’s evaluation, is that the biggest factor for stocks is milestones (good and bad). GM and Ford are already as big as they are going to be in terms of magnitude. Tesla can grow alot more, meaning the stock could rise dramatically from here.

Tesla will have overall mainly good news for years to come (because it’s growing). The rest will be mainly stagnant and possibly shrinking slowly; suppressing their stock market price with disappointing news.

The self driving software is potentially far more valuable than all their cars. But, the fact they actually ship cars, gives them more credibility. I imagine the software will be easily stolen though. Especially, as governments will demand source code access to allow self driving cars onto the road.

I do think ICE cars will be mostly phased out, and that the current supply chains the current ICE car makers have, won’t be nearly as valuable as most people think. But, there’s no reason that the current big ones won’t be able to switch over, just as easily as Tesla could build up.

I also think cars, because of their large value, will be a major item, included in future trade agreement negotiations. Over time, we could see alot of the major car markets essentially restricted to local car makers. It’s possible that in some markets, building the factory there and using mostly local parts will suffice, but it will vary. Self driving cars could also lead to a reduction in demand for cars. It’s possible that in some car markets in Asia and Europe, there could be a bunch of self driving public small busses, that are much more comfortable than current busses; stuff like this and cars on demand, could greatly reduce car demand. The European and Asian car makers, could be seen as hugely overvalued for this reason. America’s car market, because of urban sprawl, could easily exceed the value of all foreign car markets, because the utility of owning a car personally will be far higher. I don’t have much confidence in the Chinese or Indian car markets, as its a financial disaster for them to have private cars.

New word: future. Recently, TSLA was priced at >$3000, considering its navigation systems to be used in self-delivery vehicles, ongoing SpaceX synergies and Boring transit systems. Musk sees far ahead of conventional makers. His makes cars 3X faster than VW or Toyota and the world wants EV not ICE. His motors and batteries are best. The Hertz deal adds icing to the cake.

‘Old’ car manufacturers are priced on day to day facts. Tesla’s valuation is priced on hope.

Perception is everything……………….for a while.

Alan Greenspan and Ben Bernanke are the parents of this trillion dollar bag of hot air by juicing the stock market so that the market cap wealth will never be delivered as real earnings. It’s as phony as a Mississippi stock certificate.

You either didn’t read the article or ignored it entirely.

There are no future “fundamentals” that “justify” TSLA’s market cap. There will never be sufficient growth where it makes any sense to pay $332 for a $1 in earnings which isn’t even real money. It’s an accounting number. If someone here doesn’t believe me, go try spending earnings at the grocery store.

The only worse long term “investment” is holding negative coupon debt to maturity.

“There are no future “fundamentals” that “justify” TSLA’s market cap. ”

I think they are comparing to Amazon(?) A long time ago they were a book seller and everybody said there aren’t enough books to sell to justify the stock price. Now Amazon is a lot more than that.

Rockets, Flame Throwers, 18-Wheelers, etc.

Whether that’s “like Amazon” or enough “future fundamentals” is the question.

My guess- it won’t be like Amazon. Heck, Amazon, might not be like Amazon is now, in ~5-10 years. I have no clue.

I don’t invest in individual stocks (almost never), so the stories never impact any action I take.

Musk is just another one of those tech company leaders with a couple of screws loose, from what I can see. He is quite driven, like they all are, so there’s that. See: Steve Case, Marc Andreesen, Jerry Yang- all smart people in the right place at the right time. Time passes.

It’s all about making the vehicles profitably. All these other companies are debt ridden dinosaur fossils that make inferior products. If Tesla can execute GAAP eps of around 2 per share every quarter next year, then the pe will be around 125 at the current price. Considering Tesla has 2 new factories coming online basically now, and huge demand, I think it’s possible this happens. This is of course the chip shortage doesn’t cut into their production further. I remember when Tesla PE ratio was 1000. Then it went to 600. Then it went to around 300. Next year it’ll probably be in the 100s. This stock is not a value stock. And shockingly I don’t think these valuations are crazy. Maybe I’m crazy.

Musk also generates massive profits with only tiny amounts of investment capital.

… and the Hertz deal is great marketing. Lots of folks want to try out a Tesla but Tesla has no showrooms. This is like setting up a car dealership for almost free.

Tesla has showrooms – they call them stores – all around the country where you can take a test ride. As usual, lots of comments with no knowledge of the facts.

I own a Tesla, and I’ve owned the stock before. I sold it like an idiot in May 2020 :).

It’s a wildly over valued company, no question. Elon drives one hell of a narrative.

It’s a great car, too. I can’t switch away from EV + autopilot that actually works again. Autopilot that you can rely on changes the driving experience entirely. I find it near impossible to drive an ICE.

Elon though is not the entrepreneur I once thought he was. He seems more evil the older he gets. It will be interesting to see how it all shakes out.

Just a small tidbit… talk to some smaller aerospace manufacturing suppliers and you’ll hear how evil Musk and Spacex really are.

I summon my Tesla with a whistle.

Musk is the epitome of a bull market personality. Just wait until the mania crashes and burns. His reputation is going to go down in flames with the stock prices of his two companies.

As documented here, TSLA “profits” during most of it’s history were from “regulatory credits”.

More recently, the company’s finances were rescued through a secondary market stock offering at insane bubble prices.

Without both, the company would have failed or been bought out at very low fraction of it’s market cap.

Fake it till you make it. Just at an enterprise level

In my well to do area of South Florida, Tesla’s are literally a dime a dozen. I suspect because of it’s vehicle cost and it’s nitch market status that as new luxury EV’s enter the market in 2022 their sales will decrease. (body styles are now old) I have always felt that because of simplicity and synergies of design that Tesla would be valued higher as a software company and a seller of their high tech skate and battery platform. Let other manufactures slap on bodies and interiors. JMO

@Sailorgirl: Do you hear anything about the real-world range in your area? With the traffic and the need for year-round AC, I wonder how well the EV would actually do. Thanks.

The real range is like going to work and back, plus round trip for lunch. Drop the kids off to soccer practice and violin lessons. Drive to Costco. Pick up grandpa at the airport. Tops.

Tesla can expand 50% per year, others cannot. Tesla has more room to grow; dinosaur car companies are laden with billions upon billions of liabilities (ie. employee pensions). Tesla is electric from the ground up, legacy car companies are saddled to ICE.

Tesla is what Ford was at the beginning of the 20th century.

I think the problem most have with this is the mis-belief that no other company will be able to compete with Tesla in this space. They will have competition at some point and that competition will erode Tesla’s market share and share price over time.

In China, the world’s largest car market, the big Chinese manufacturers are far ahead of Tesla.

What is their combined market cap? A million yuan?

andy,

There are two Chinese giants in the “next 10” by market cap in the first chart above.

BYD’s market cap (converted to USD = $125 billion) is just shy of Volkswagen’s market cap. BYD is kind of a conglomerate. It makes all kinds of vehicles, including electric buses in the US, and it makes its own battery cells (from what I remember).

SAIC has a much lower market cap (converted to USD = $34 billion) — lower than Honda’s.

I wouldn’t say that there are far ahead. They are quickly catching up though — NIO and Xpeng are notable examples.

Not to mention the Koreans: Kia EV6, Hyundai Ioniq 5.

If you use Toyota which used to be the high bar of auto production you can see Tesla’s future if they were to get to be a high volume manufacturer making 10 million cars per year with no where else to grow. Toyota valued at around PE of 10 and price to sales around 1.

Give it up, those like the poster above don’t want to understand math and economics.

I see your point, but rejoinders such as Old School’s are useful to other readers (me, for instance) who do wish to understand. Without them, wild ideas pass unchallenged. Isn’t that worse?

No, it’s the exact opposite. When Ford was as old as Tesla is now, Ford’s graphs were the reciprocal of Tesla’s graphs. Ford was SELLING as many cars as all the other makers combined. Ford’s market cap was ZERO because it was a privately held company.

Nicko2-

Everyone is going to be selling electric vehicles. You should be comparing Tesla to Netscape which did well until Microsoft took over the browser market but then Google ate their lunch (Firefox and Safari 1/20 share each). The new F150 can act a generator for your house; that’s pretty handy in hurricane prone Florida (not to mention the dealer network).

Please tell us how TSLA is going to take a larger percentage of global sales, the only possible way of returning a $1 Trillion market cap to it’s shareholders on $42 Billion in sales. The market cap is too big, it’s just that simple.

Wolf has shown us the 100,000 Teslas to Hertz is actually bad news for TSLA sales.

This blow off top for Tesla is a gift for those who sell.

Tesla can reduce the price of Y and 3 by 25% and still make money on each car. So basically they can sell every car they can produce for quite a while. Good luck competing with that other automakers. Tesla has locked in massive battery production with the Mega Factory which broke ground last month in California.

Not quiet. Their net margin is under 10% so I have a hard time seeing how you came up with that.

No freaking way. Not buying that level of profit is baked into these cars.

This is a fantasy.

Whilst the valuation is crazy, you are missing the point as to why Tesla is valued more than other car makers.

In 2014 Musk targeted 500,000 sales in 2020. (This was when Tesla had produced a few thousand) ms y thought it impossible yet they achieved it. Now they are forecasting 20 million in 2030.

Meanwhile all incumbents have billions invested in stranded assets and overall they haven’t yet produced a competitive product against Tesla’s. Legacy auto also have much larger debts than Tesla.

So it looks like it will be an apple/Nokia moment. Although on a slower timescale.

Musk via spacex on his own saved the US space program. He wasn’t taken seriously by the incumbents yet spacex has become the foremost space company leaving countries like Russia behind. With a record like that and considering the TAM of the transport sector it’s no wonder Tesla is valued more than the incumbents.

20 million vehicle sales by 2030? They are going to have about a 25% global market share or the auto market is going to explode in unit volume growth?

Did they really make such a ridiculous forecast?

Phones that fit in your pocket with big screens and internet access were new, electric cars are not.

Good luck selling 20 millions vehicle at $30K+ USD a pop. BMW in a good year sells around 2.5-3M vehicle globally.

Of course, Musk promises and predictions are never far-fetched. ;-)

Marketing and vaporware and the particular susceptibility of messianic hope and online meme crowd behaviors have led to this level of magical thinking. It vaults far beyond real world valuation metrics. Aspects of Musk are good, but many are bad. He acts like an eternal 14-year-old visionary with easy disregard for many aspects of reality. To me, he has not grown to a CEO adulthood, and his open disregard for legitimate truthfulness as required by securities laws (as in his fake tweet about taking Tesla private with funding at a stated level supposedly secured, and I’ve never seen a shred of substantiation). I’m disappointed the SEC didn’t deal more sternly with him at that point. To paraphrase Keynes, Musk can stay magically popular longer than most short sellers can stay solvent. But like so many other stories where reality hops in a cartoon space ship and takes off, I think I know how this ends. Of public personalities of this era, I see parallels with Trump: a vast field of breathless fans, most of all, keeps the machine aloft. Whatever merit is there, at some point bubble dynamics appear and can take over.

And I have diversification concerns about too much balanced on one individual. He seems to think he can switch hats effortlessly and hit home runs in all spheres. We’ll see. It worries me that his own personal wealth is so great he creates a sort of reality-distorting force field very hard to challenge or interrupt. And he’s not that funny.

Barnum is alive, well, and working hard…(with a long-game personal view that is genius at harnessing the power of the sucker at a time when serious long-game views are not en vogue…).

may we all find a better day.

Maybe I miss something but I CANNOT understand how it is possible that a company that declared bankruptcy 1 year ago (HERTZ) could buy 100,000 cars (which are also very expensive) from Tesla and what is the interest of a user who by renting an electric car will have to refuel every 300 miles (if they find the electricity distributor)

Outside of COVID crazy times, EVs without incentives are still way more expensive out the door than ICE vehicles. As such, EVs still make a tiny fraction of overall light vehicle sales. There is no reason to believe that by time price parity with ICE vehicles arrives (and subsequently EVs actually become mainstream), the other auto makers’ EV offerings wouldn’t be up to par with Tesla’s.

Look for example at the reviews for the Ford Mustang Mach-E or the Kia EV6. These vehicles are their manufacturers’ very first try at a from-the-ground EV vehicles and they actually compare very favorably with the Model Y. Given this, the claim that the offerings from those other manufacturers won’t be able to compete with Tesla by the time price parity arrives in 4-5 years is simply ludicrous.

Teslas haven’t qualified for federal incentives for a while. All its US sales are now without federal incentives.

G,

Stock pump for impending IPO for the hedge funds who want to sell the stock to suckers…

Hertz hasn’t bought anything yet… they said they MIGHT….

Their statement should be illegal… it’s bullshit like this that ought to be outlawed…

Hell, Wolf could do the same thing… issue a press release saying he might buy 100,000 Teslas to build a rental fleet… up, up and away…

Jeez…

If you look at hertz and Tesla they have one thing in common, their return on capital has been less than their cost of capital for at least 12 straight years. It’s basically what you get when money printers remove a hurdle rate from projects and steal Grandma’s savings.

We don’t know the details. Rental cars are always financed in some way. One of the ways this is done is by loans that are secured by the cars; then these loans are securitized in to Asset-Backed Securities (bonds) and sold to investors. This is routine. But it could also be that there is a special deal between Tesla and Hertz to where Tesla funds those cars (in a lease-like arrangement) and then at the end takes those cars back and sells them as used, same as its regular lease-turn-ins.

So when you rent a tesla do you charge it outside the rental facility for 3 hours before returning,, because you know you get a full charge and you bring back a full charge right?

No. Because the rental facility will charge you a $10 recharge fee and then use their own level 3 charger to fully charge it for < $5. No clue!

Has Elon heard of a concept called – Paying a Dividend?

Elon is mulling over a dividend payable in bitcoins. This way the stock and the dividends apreciate. Win/win.

EVs are being shoved down out throats. Nobody wants them. Nobody is excited about them. Nobody talks about them. It’s all part of the green movement to destroy the remainder of the US middle class

Dividend? I’m not so sure that particular financial product is relevant to Tesla. Capital gains, sure. But dividends?

Casino tokens have one price when bought at the casino to play, another when bought in bulk by the casino.

When bought at the stock exchange casino the price of shares depend on the chance buyers imagine there is for a win at the casino. Just like casino tokens.😉

Price is what you pay, long term earnings is what you are stuck with unless you can find a buyer.

I have a brother who is pretty intimidated by the increase in EVs on the street. He owns an automobile parts franchise and is thinking about selling his business and retiring. I told him that EV cars must need parts too; he responded that his three best selling items are oil, oil filters, and radiator coolant — none of which are used by an EV car.

Most EVs do have some liquid cooling circuits for the battery and maybe the electric motor. I’m not sure how often you’re supposed to change the coolant though.

There’s at least 250 million light vehicles in the United States. It’s going to take a long time to replace them all with EVs, even if every car sold from here on out is electric.

And the #1 issue is ease of charging going any sort of distance.

Tesla owners can go anywhere in the USA with chargers on all major routes. WTH you talking about?

Yup, no thanks. Now if they come out with a replaceable battery module that can be swapped out at a station, I will sit up and pay attention.

These will be sealed units as per power engineering tradition.

The ritual of the oil change is part of mechanical engineering tradition.

Power electronic systems are a couple of exponents more durable than the equivalent mechanical assemblies.

With EV’s, it will be meagre times for the traditional mechanics workshop.

I wonder how much maintenance and repairs on an EV would be if you amortized the eventual cost of battery replacement over the life of the car. How would it compare to an ICE vehicle?

If charged with best practices, teslas can still be going strong on original pack after 300000 miles. Drive train intended to last 1 million miles. Many owners report 1/4 the maintenance and fuel costs. Not to mention time savings. A new battery pack after 300k miles seems like a fair bargain. Most people won’t own a car long enough to achieve those mileages.

“If charged with best practices, teslas can still be going strong on original pack after 300000 miles. Drive train intended to last 1 million miles.”

Baloney

You must own Tesla stock !

I would advise people in his situation to sell because once more people realise EVs are the future and they require a lot less maintenance than ICE vehicles, businesses like tire brothers so lose value very quickly.

And it’s better to retire while one is healthy enough to enjoy retirement!

MiT:

Tesla’s have a radiator and coolant to cool the battery packs.

They will still require tires, wheel alignments, suspension parts, window regulators, switchgear, etc., etc..

I am a EV fan and wanted to buy tesla but didnt because I expect better in quality for a $50K car.

I have been driving EV for last 5 years but never needed to visit any repair facility.

If one can think logically, EVs are epitome of simplicity although automakers make it very complicated.

I can see if EVs are adopted in a big way, repair facilities need would go down big time.

Perhaps he could specialize by offering oil filters and parts for vehicles not likely to disappear. I have been consistently surprised at how high the prices go for ‘no longer manufactured’ parts go for on Ebay.

Another winner is selling bumper stickers “I SOLD TSLA over $1000”

His most impressive feats have been his Falcon series of reusable launch vehicles, the Dragon spacecraft and Starlink global internet system. About the latter and the other massive satellite constellations for the same purpose planned by others, I hope this doesn’t set us up for the Kessler Syndrome.

With his Starship, I think he’s bitten off more than he can chew with FAR more development challenges and risk than the Falcons. I don’t see how a launch vehicle with 30 (or whatever the current, constantly changing number is) of Raptor engines can ever be man-rated, at least without many more flawless launches than will ever be achieved considering the mass that those would place in orbit would be far more than current demand. He hopes to create the demand with extremely low cost to orbit, but I don’t see him achieving that extremely low cost or creating the market to put that much mass in orbit even if he did.

Why? Back to those 30 Raptors. They’ve only just gotten 3 of them to work somewhat reliably on the last launch and I see the odds of cascading catastrophic failures among those 30 tightly packed engines to be high which will prevent both man-rating and low cost to orbit. See the Soviet N1 to know what I’m talking about.

All that said, his efforts are far better than the horrendous waste of $23 BILLION thus far for development and years behind schedule Space Launch System (SLS), better called the Senate Launch System since it is nothing more than a Space Shuttle jobs continuation program. I could go into great detail about what a stupid fiasco it is, but I’ll just point out that to amortize the development costs alone, if there were 23 launches of it in the future, the development cost expense for each launch, not even including the actual hardware, will be $1 BILLION PER LAUNCH.

I thought Captain Kirk is flying on Bezos starships.

He’s probably not wealthy enough to take the SpaceX Dragon orbital trip or, at least, doesn’t want to spend that kind of coin. So, he goes on Bezos’ suborbital trip. Afterwards, seeing an overweight Capt. Kirk crying led me to wanting to tell him to man up. Definitely not steely calm imaginary astronaut or starship captain material.

Heck, I saw Spock cry in the original series, but not Kirk. He came close during his last words in the final scene of one the most outstanding episodes, “City on the Edge of Forever” where he actually said something one didn’t hear on 60s TV, the word “hell” when he said, “Let’s get the Hell out of here.”

Suborbital? I thought they landed in a different county. Didn’t quite make it to Wichita.

That was one of the best episodes.

A German V2 went as high in June 44, 500K feet. It could have been adapted to carry one person but with different nose cone replacing war head. The explosives were about 1500 lbs but compact so not enough volume in cone. Could they have solved the parachute re-entry prob?

After the vastly greater probs developing V2?,,,,yes, but they had other priorities.

The first US ventures into ‘space’ were with captured V2.

The Scud missile today is essentially a V2 copy.

It’s fun to read the drawings for the V2.

Apparently they had “electric” and “pneumatic” factions amongst the designers and obviously this was never resolved so the V2 has both kinds of systems doing roughly parallel things.

I think it is funny considering the situation: I imagine meeting after meeting with apoplectic white-coated gentlemen screaming and throwing chairs with the SS being increasingly frustrated from the lack of progress and from being unable to decide what lot to shoot to resolve the conflict because they are not the experts here. In the end someone gives up and everyone’s speciality is somehow included in the final design.

Whilst starship is a different ballgame his track record speaks for itself.

There are a significant number of his big plans and projects that haven’t panned out. You just don’t hear about those after they don’t.

Thunderf00t on YouTube has gone into great technical detail on debunking those that don’t. To find some of them, search on his channel using the keyword combination Musk Busted.

Musk has had some ideas which were fairly easily proved by analysis to be bad ones that got so much attention because of Tesla and SpaceX. As this column points out, hype provides Tesla with much of its insane market cap. The same thing applies to the perception of any of his projects.

I wager that Starship will be one of his duds… a REALLY big one. A risk I didn’t mention which is a necessary part of his system: placing SO MUCH expensive launch and recovery related infrastructure within range of a catastrophic launch failure with kilotons of TNT explosive yield. There’s even a lengthy YouTube video entitled “SpaceX Starship Explosive Potential, and Big Bang Theory.”

Tesla is an electric car, battery storage, tunnel borer, and rocket developer all rolled into one.

If the Jetsons, Captain Kirk, or Dr Who owned a company, it would be Tesla.

Underground, overground, up in space… Tesla owns the future like no other.

A $2,000 stock price is now possible.

Until Apple arrives with the i-Car.

Apple is not intending to build a car. It has approached BMW, no go, and is talking to Hyundai about building the car. Apple proposes to provide the self- driving app. Apparently H is thinking of giving this to Kia, if it goes at all, fearing reputational damage to main brand.

Does anyone see the irony that the Fed has pumped up stocks so high that Congress is going to start taxing billionaires stocks before they are sold? It’s all getting to be a big joke.

One thing about the wealth tax is how do you know who has to pay it unless everyone have list their assets? It will not raise the money they are counting on so they have to keep dropping the threshold. They probably just want to get political points by taxing billionaires and see if it will survive legal challenges.

It’s not a wealth tax. It’s a mark to market tax, and it applies only to public investments with established market values. This is why Elon Musk was tweeting against it today. He is a target of the tax. He and his buddy Peter Thiel think they should be billionaires without paying any tax whatsoever. AS you know, Thiel is the one who claims to have legally amassed $5 billion in an IRA having a contribution limit of $6,000 per year.

Musk said today that if the government comes after the billionaires’ money, they’ll come after our money next. He uses typical fear tactics to attack a rational policy.

When it comes to taking our money, the person we should fear most is Musk. Average Joe taxpayer is paying ridiculous subsidies to the world’s richest man and people that buy his expensive automobiles. Go figure.

Here is what you are not taking into account. The tax on unrealized gains will increase the tax basis thereby reducing future realized/unrealized gains until it all unwinds and then poof! no more tax revenue. You will end up with realized losses to amend past return and push forward toward future returns.

Or worse, you will force liquidation at inappropriate times causing and higher volatility in the market.

Typical political pandering.

That makes no sense. The economy generates new unrealized gains every day. The tax would apply only to gains accrued each year.

In years when there are stock market crashes that create losses, billionaires would get a loss carryback/carryforward so they are made whole. That’s the way capital gains and losses are treated now.

Is there a better argument against the proposed capital gains tax that would apply only to billionaires?

Bobber, you are thinking too myopically about wealth. Unrealized gains/losses relate to ALL capital assets. What happens when real estate holdings increase in value? Or vintage Autos? or Yachts? or Art? or any other type of capital asset? All these and more comprise methods of storing wealth.

Fundamental to all taxation is you tax realized gains/losses because the Cash is typically available to pay the tax. When taxing wealth, the cash doesn’t necessarily exist to pay the tax. This forces liquidation which simultaneously changes the taxable value.

Billionaires don’t keep billions of Cash lying around. Most of their wealth is tied up in illiquid or semi-liquid assets.

Who does the appraisals each year? Wealth isn’t just the Stock Market? What about Bonds? Precious Metals? etc.?

Taxing ONLY publicly traded Stocks, would capture a small portion of the wealth. What about privately held companies? The issues are as boundless as our imaginations.

Don’t get me wrong, this will be good for business. Every time Congress tinkers with the tax code we do a booming business.

Steve, you are arguing against a proposal that doesn’t exist. The tax is proposed to be on public investments, so it’s off the mark to discuss complications with other assets such as real estate, private business assets, etc.

Plus, I hear the tax is projected to generate $200B to $300B over 10 years. That’s not immaterial.

Sure, nobody wants more taxes, but it’s plain unacceptable to let billionaires accumulate hundreds of billions of wealth and avoid paying tax on it. These gains are realized in an economic sense because they can convert to cash at any moment.

It’s time to start taxing billionaires. They’ve had a tax-free ride for far too long, while ordinary citizens pay for it.

Bobber,

First, 200B to 300B over 10yrs is 20-30B a year against a 3.1T budget, that represents 0.967% of the annual budget. THAT is immaterial.

Second, taxing unrealized gains only against Stock, misses a material amount of a Billionaires wealth. Also once the tax is paid, the basis increases and also increases the probability that a loss in the future will be much higher (then they just carry the loss back 3 years) or the gains are much less. Either way the estimated revenue will be much less that foretasted.

Thirdly, if you want to tax Billionaires, there are much better mechanisms to achieve this. Simply make it illegal to borrow against owned Stock or use owned Stocks as collateral for loans. Or simply make the Capital Gains take effective ONLY for newly issued Stock purchase and not purchases in the secondary markets.

Lastly, the Federal Government doesn’t have a revenue problem, IT HAS A SPENDING PROBLEM.

They may only tax unrealized gains on Stock now but they will not stop there.

STeve, I agree with most of your points, but I’m not holding out for perfection. They can’t even raise tax rates on those making more than $400k right now because of lobbying resistance. That rules out the best options.

“they’ll come after our money next”. Yeah, what money?

The listing of assets is what they really fear, they will be hiding something dodgy, like the UK government officials bribes account, and suddenly this will become tax evasion!

Looks a little like a ponzi scheme.

Ponzi scheme is little

Tesla scheme is a whole new level of scheme and a quazillion time larger.

Your comparison is like stating that Jupiter and an asteriod look a little the same since both circle the sun.

IMHO, Wolfs comment that it is nuts is an enormous understatement but in his defense, I do not think the english language has a word for it to express it any better.

May be it is time to introduce the Tesla Scheme.

The real question from a marketing perspective, who is the better dancer, Elon Musk, or Greta Thunberg? She wins hands down, but then she supports his efforts at climate change.

Incentives for charging networks and raising the sales requirement before EV credit phaseout are both on the table as part of the infrastructure bill. I would not short until that bill is either passed and we for sure know the details, the bill fails, or the fed raises rates. The whole automotive sector is overvalued right now, it’s a shrinking industry not a growth industry. People are buying less cars/trucks and the companies make money through the financing deals, I don’t see how these stocks hold up to the growth targets in a lower vehicle sales environment, even with the “EV revolution”. The only reason Tesla looks in good shape is that they are having success in China, or so it appears, which could change on a dime.

China will have a hard time justifying expansion of Tesla within China, given that Tesla furthers the interests of the worlds richest man. That doesn’t fit will with China’s communist philosophy.

Perhaps China will steal Tesla’s production techniques and become a nightmare low-cost competitor.

Evergrande has an EV business, they are in parlance an old fashioned American conglomerate. They have yet to produce a single vehicle, but then what does that matter? Beijing may not bail out these companies but they aren’t going to let them disappear, and they aren’t going to subsidize consumers (health care and SSN do not exist in China) They may take a page out of Henry Fords book and go vertical. Tesla in China is not looking too good right here.

“Perhaps China will steal Tesla’s production techniques and become a nightmare low-cost competitor.”

I’ll bet that’s already a given. By the way, the Chinese already know how to make cars. And the computer tech is in their hands already.

China is exactly as “communist” as the situation requires.

Like some of the “Christians” around these parts who are like: “If God didn’t want me to cheat on my taxes (and the wife) he would step in and save me!” – on any day of the week, except at the Sunday performance where they’re the holiest of all.

Tesla is the biggest ponzi scheme in history. Other companies can learn from Tesla about financial engineering.

I don’t believe Tesla the company is a Ponzi, but the stock almost certainly will go down in history of losing the most market cap of any company to date unless US government funnels tens of billions to the EV industry.

Tesla is NOT a business or company it is a meme, treating it like a company is madness, its a pyramid religion, i could easily see it quadrupling from here as it expands into areas no one would ever have believed, Tesla sunglasses anyone? or Tesla green jeans, Tesla sneakers, Tesla recycled toilet paper? market cap 5 billion.

The saying goes””Don’t test drive a Tesla unless you are prepared to buy it”

Selling sunglasses wont support the trillion dollar valuation.

Tesla shareholders will lose their investment. Elon will still be left with billions to pursue his evil agenda. Republican Party will be one of the beneficiaries.

Tesla Market Top. Grab your Parachutes!

I hear the Hertz Teslas will be made out of Rearden metal.

Really seeing just a contemporary replay of Juan Trippe and his Pan American Airways. The personality pushed techno change to it’s limits (even the shuttle was piggybacked on the 747 to get about), but the core business entity had the seeds of it’s own destruction sewn-in. Failing to get that one nation/one carrier plan through left a concern that would ultimately nose dive when the protectors were all gone. But it took many years to play out, and there were lots of ripple effects across an entire industry which are still occuring.

How likely is a Tesla to burst into flames in my garage? But seriously, might like to consider buying one, but am I going to be liable for disposing of exhausted batteries in 10 years?

Of course not, you just sell it for more than you paid for it in 10 years, because depreciating assets have been changed into appreciating assets care of Weimar Boy Powell and his cabal of economic terrorists.

Recycling of auto parts is as old as the auto industry. It’s a big profitable business. Recycling of laptop batteries has been done for years. Recycling to EV batteries is just getting off the ground because there just wasn’t a lot of supply of 10-year old EV batteries. Plus, there is the re-use factor of old batteries by utilities and others that don’t need high performance and low weight. They can stack them and use them until they cannot hold a charge anymore, and then they get recycled.

So no, you will not be responsible for “disposing” of the battery. Someone is going to take it from you and make money with it.

Wolf – Tesla bulls would say that you are looking at the current state of affairs and that they are discounting the future sales. But when you look at markets like China and Europe, which have alot more competition in the BEV market, you see that Tesla market share is collapsing. Chinese BEV car makers are taking a much larger share of the NEV (BEV and PHEV) market. BYD sold over 70K NEV cars in the past month in China, alot more than Tesla. Xpeng only sells 10K, but it is in massive factory expansion mode.

China has funded a very diverse BEV car maker universe and all that competition coming will mean a fragmented marketplace and intense pricing pressure on gross margins.

So we see EXACTLY what happens when Tesla gets real competition. It is now selling alot of the cars made in China into the European market, which is allowing it to sell all of the product made in Fremont into the US marketplace.

Just about every car maker can sell everything it can manufacture in the US market due to chip supply constraints. This is a one-time occurrence and it wont last.

Even Cathie Woods is smart enough to be liquidating Tesla stock right now.

Bubbles gonna bubble.

The sad thing is that it’s a positive feedback loop: because people think Tesla is different, it has access to cheaper capital, and can eventually outspend other players, regardless of what they do.

Musk and the people responsible to get him to where he is at now consistently reminds time and time again why I really want to unplug from this F up version of The Matrix…or perhaps this is the best version we can hope for..

phoenix ikki, you just talk once in awhile. we are here and we will take care of you.

if it wasn’t for the fed, everything would be functioning smoothly, get your food/ widgets in response to supply and demand. paradise lost.

money theory … there is no perfect

your wife breaks down in her car, 1973, lonely country road, no cell phones, no service. the good old days NOT

If a small rural deli in New Jersey can have a market cap of $107 million, with TTM sales of $22,000 (and losing money), why can’t Tesla have a $1 trillion dollar market cap? Or two trillion?

super bad ass beyond believable keeps singing these song

Why wouldn’t Tesla buy GM, close a bunch of their factories, and secure their position as one of the “Big 3”?

Because GM is NOT FOR SALE for one thing!

‘…low margin fleet sales’? Hertz paid retail price for their Standatd Range Model 3’s $42k. I’m not sure how that shows weak demand?

You have NO idea what Hertz paid because you have no idea what’s in the contract and how the Model 3s are equipped and if they come with FSD or other options. The info didn’t even specify whether it’s ALL Model 3s or may be other models later on, such as the Model Y or some Model S. We only know the first batch is Model 3s. And now we know Hertz is trying to get Uber drivers to rent half of them…

TSLA don’t have the BEV Sales lead in DEU, losing ground in CHN, and will face more competitive BEV Vehicles in all Markets.

Figure TSLA will start to lose USA BEV Market Share gradually as VOW, Ford, gain theirs and CHNese start exporting to the USA.

That being said, in California – TSLA’s Largest BEV Market in the USA – Grid Sections still face Annual Brown/Blackouts, Forest Fire Disruptions, and we’ve recently added Battery Facility Fires to the Grid Disruption Causality List.

Obviously, this is a 3 Season, Metro/Suburban Commutermobile Market. TSLA Sales aren’t affecting the General AutoMarket Shares in the BOS-WDC Corridor during the Autumn-Winter Months. The Occasional Nor’Easter-induced Power Outage will have Suburban/Ex-Urban Residents think nothing much as they are on NatGas, Heating Oil, and or kick in their Stove/Fireplaces while driving errands around in their ICE+(P)HEVs.