“Normalization” or “deceleration,” as this phenomenon is called, is setting in.

By Wolf Richter for WOLF STREET.

Prices of existing single-family houses, condos, and co-ops dipped in July, reverting to seasonality for the first time since 2019, amid surging price reductions. Single-family house sales dropped 4.1% in July, from a year ago, the first decline since the lockdowns. Condo sales rose. Inventories rose for the fifth month in a row. And new listings are catching up with pre-pandemic trends, as sellers emerge from the woodwork. All this according to data from the National Association of Realtors today.

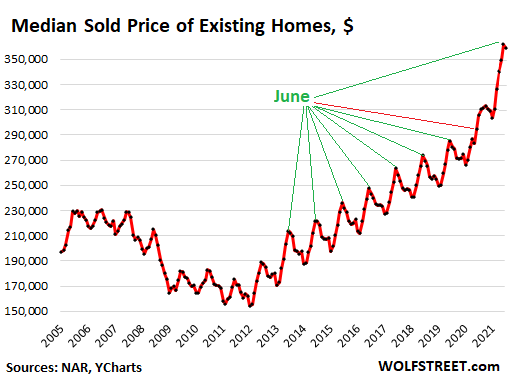

Home prices dipped in July from June, breaking the crazy spiking prices for the first time this year. Back in May and June, the median price for existing homes had spiked by a historic record of over 23% from a year earlier. But in July, the median price dipped to $359,000, reducing the year-over-year gains to a still gigantic 18.8%.

During the pandemic, all seasonality was thrown out the window. But in July, prices reverted to seasonality, dipping from the seasonal peak in June. Reverting to seasonality is the first step back from the craziness, and toward “normalization” or “deceleration” as this is now called, (data via YCharts):

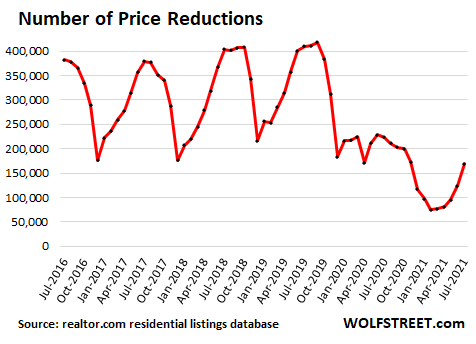

Price reductions surged by 37% in July from June, the fifth month in a row of increases, and the largest month-to-month increase in the data provided by realtor.com’s residential listings database. The number of price reductions in July was still relatively low, but the recent surge shows the beginnings of a sense that “normalization” or “deceleration” is setting in:

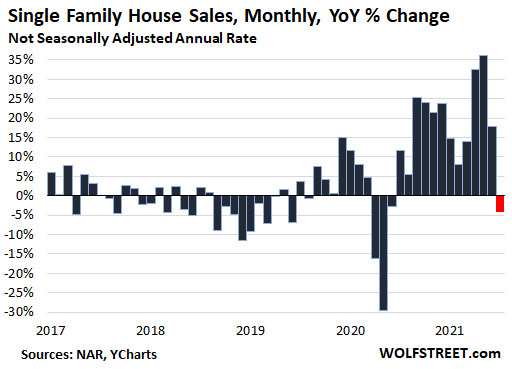

Sales of single-family houses on a monthly basis, and not including condos, dropped 4.1% year-over-year in July, to 516,000 houses, the first year-over-year decline since the plunges during the lockdown. July last year was when the spike in home sales began:

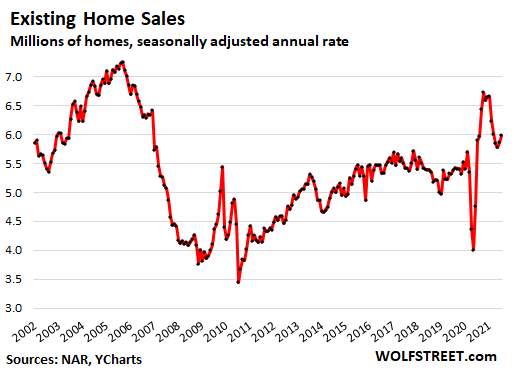

Sales of house and condos combined, and expressed as “seasonally adjusted annual rate of sales” ticked up in July from June, to an annual rate of 5.99 million homes. Year-over-year, that was up 1.5%, the smallest year-over-year uptick since the lockdowns, with house sales down 0.8%, but condo sales, which had collapsed last year, up by 22% (historic data via YCharts):

Sellers emerge from the woodwork.

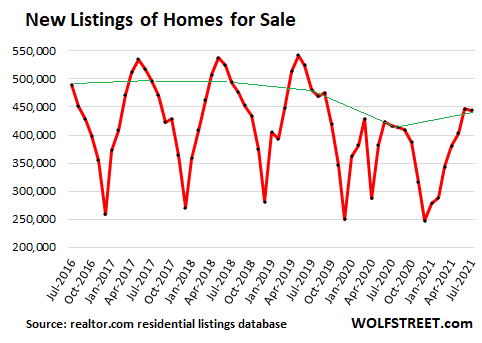

New listings normally drop sharply in July from June, continuing their drop from the seasonal peak in May, but not this year.

In July, new listings were down just a tiny bit (-0.6%) from June, and were up by 6.5% from July 2020, the fourth month of year-over-year increases in a row, and the largest one, as new-listings momentum has been picking up. New listings in June and July reached the highest counts since September 2019 (data via realtor.com residential listings database; the Julys are connected by a green line):

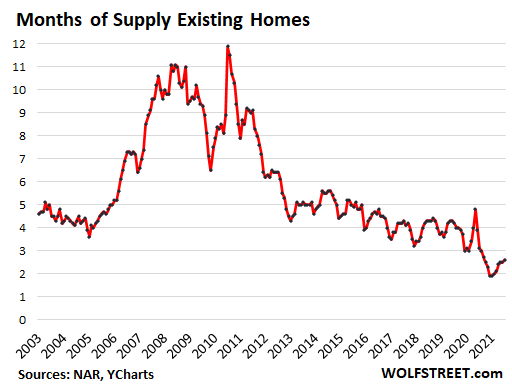

Inventory of unsold homes listed for sale rose to 1.32 million homes, the fifth month in a row of increases. Inventory is still tight, but is at the highest level since October 2020.

Supply of unsold homes on the market rose to 2.6 months, up from the low point of 1.9 months in December and January, and the highest supply since September 2020 (historic data via YCharts):

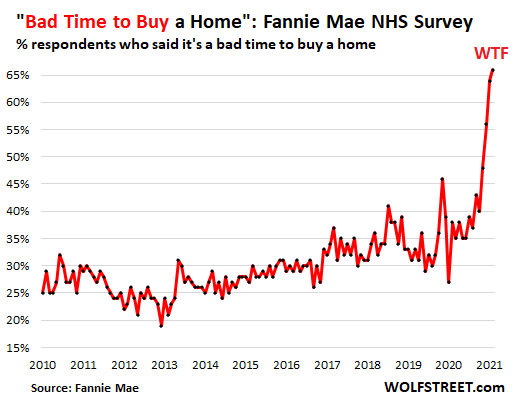

Americans concur: Terrible time to buy a home, perfect time to sell.

This is still a historically perfect time to sell a home, after prices have spiked at a record pace and are now sky-high, though they dipped a little; and mortgage rates are still historically low, though the Fed is now mumbling about trimming back its support for mortgage rates by ending QE; and supply of homes on the market is still low, though it has been rising all year.

And Americans concur: It’s a terrible time to buy a home. According to Fannie Mae’s monthly National Housing Survey for July, which started tracking buying and selling sentiments of homeowners and renters back in 2010, a record 66% of the respondents said that “It’s a bad time to buy a home”:

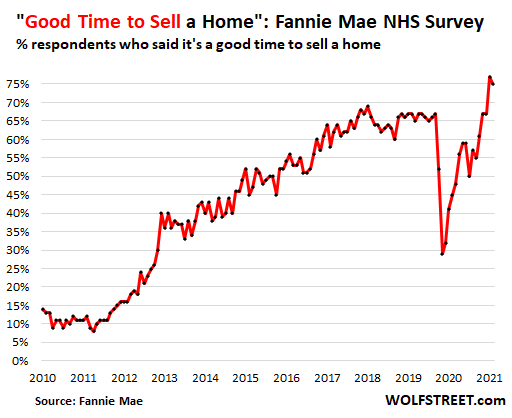

And 75%, the second highest after June’s 77%, said that “It’s a great time to sell a home”:

Investors and second-home buyers still have the hots for buying. In July, all-cash sales had a share of 23% of total sales, unchanged from May and June, but up from a share of 16% in July 2020. Cash buyers include institutional investors that can borrow at the institutional level, plus individual investors and second home buyers that have the cash, or can temporarily borrow against their portfolio and get a mortgage later.

For the past 15 months or so, the theory for homebuyers was to not sell the old home that is now vacant, and instead ride up the price gains of both homes all the way, and then sell the old home at the peak. That math has worked out. And some of those now vacant homes have come on the market, and more are likely to come on the market after Labor Day. Further price declines might put a sense urgency behind those potential sellers.

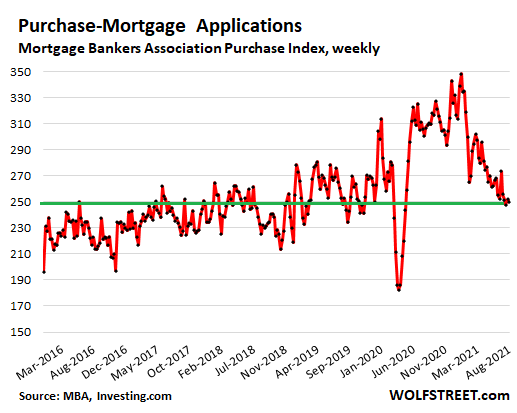

But buyers who need a mortgage fade. Mortgage applications to purchase a home in the week through August 18 has plunged 19% from the same week last year, according to data from the Mortgage Bankers Association. Compared to the same week in 2019, mortgage applications have been between flat and sharply lower on a year-over-year basis since early June – in other words, here too “normalization” or “deceleration” has set in despite record low mortgage rates (data via Investing.com):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In HB1, which came first: did asset prices drop and then did inventory increase, or did inventory increase and the prices drop?

In the current HB2 that we’re in, what will precipitate a sell off – if at all?

If your talking about the housing bubble of 1819, prices collapsed and inventory increased.

Homeless depot lumber price alert

2x4x8′ = $3.89 today

Awesome! I pity anyone that had to buy a truck load during the past year when they were selling for ~$8 each!

The real question, prices on OSB, 2×12, plywood, PT, so forth have these come down to previous levels or still much higher than before. HD, LOWES ca afford some loss leaders to get people in and make it up on all the other stuff.

osb was $21 sheet from $60

The charts I recall seeing somewhere (I can’t remember where) showed a massive build-up of inventory in 2007, something like 9 or 11 months. The build-up occurred because people were unwilling to lower the price to where the demand was at the time. This is what I believe happened, but I could be wrong.

What we’re seeing today is more similar to the dot com peak in 2000. Stocks (primarily tech stocks) are expensive relative to houses. In the 2000-2002 crash, home prices remained stable because people believed that home prices can’t go down on a nationwide basis because it had never happened before in the post-WW2 era. This time, there is recognition that home prices can come down, but the question is whether TINA keeps prices stable. Arguably the March 2020 crash may have been the analogue to the 2002-2003 lows in the markets. Stocks crashed, but home price didn’t have time to turn lower. From this viewpoint, another 10 year bull market lies ahead of us … or something like that.

Inventory before prices. Wolf’s charts show that from 2005-2009, for existing homes, “Months of Supply” surged long before prices dropped significantly.

The psychology of this is that when a bubble pops, most sellers are slow to accept lower prices.

The difference this time is that the run up up until 2006 or so was much more gradual than the runup from last year. That’s important because it means that the “lower prices” are still somewhat fresh in seller’s minds. It’s not 10 years back, more like 18 months back.

Vice versa as well. If we’re going into the psychology of this, we have to consider that the prices are fresh in buyer’s minds as well. And in that particular case, I would imagine they would like to see a price normalization well under pre-pandemic prices.

just came back from mountains

in July home went on market and bingo – pending

later in month some 4 or 5 in same neighborhood came on market

NOT 1 has gone pending

hope this is sign

Lower interest rates are the big issue here. Once the debt ceiling is cleared, interest rates take off and then inventory goes through the roof and the prices being pad fall.

Much of the future price declines will be driven by banks that refuse to lend anything close to the sales price.

Of course, since most banks dont hold the mortgage, but sell it to the government, it is we-the-taxpayer who is on the hook for the coming tsunami of foreclosures.

How many AirBnbs can cover their cost of carry when they renew at 5%? In Canada renewals are every 5 years. Or immediately if on variable.

some of best real estate markets were govt induced

just think of RTC days

Georgist,

I watch a tax attorney on you tube. He said that in USA IRS ruled that you only had to rent the property a little bit (I think 2 weeks per year as an air bnb) to get to treat it like a full rental property.

This makes it easier to cash flow the property as you get to claim depreciation which basically offsets interest rate expense. Maybe you book a loss on the property rental that offsets your wage income taxes and the depreciation helps cash flow it to hold it for the appreciation.

Be curious if anyone on here is doing that.

Old School, that’s partially true, but you can’t use it the other 50 weeks and get those benefits. Google “5 IRS Rules for Renting Out Your Vacation Home.” The Kiplinger link explains it pretty well.

RightNY

I was just brainstorming that this how people are holding empty houses. Don’t know for sure this is true.

On using the home for only two weeks, he says you can go stay in the home while you work on it. Wink, wink.

Actually, WS, your psychology remark struck a chord… psychologically speaking, does the average buyer today have the history of real estate knowledge as many of us do… Does the average 40 yo really care about the historical pricing of real estate ? Or do they say “ It is what it is?” Can anyone tell them with any degree of certainty things will change? We all know what can happen, and happen quickly, because we’ve experienced it. But very few of today’s 40ish and under have experienced inflation and or asset crushing economics…. I predict many personal distresses from this crowd… that Reddit guy a few posts back might be the poster child where this is going…

A house in L.A. was worth $100k 40 years ago with sub 20% interest rates, and now the same tired used up home is worth $800k with sub 2% interest rates.

I’m 41. Bought my first house in 2005. Was under water and miserable until I paid to get out in 2015. There are a LOT of people my age who got burned in hb1. We’re paying close attention here.

Almost all sellers chase the market down. They’re “not going to give it away”. The specific details of the market are different from time to time, but the impact of human beings’ emotions and rationalizations is a constant.

Exactly. I knew a guy who had a house unrealistically listed for $2.3 million. He had multiple offers at $1.8, but wasn’t going to “give it away for a song.” That was in 2007 or 2008 and then the market crashed. He ended up selling it years later for $1.3, after a series of disastrous tenants.

This time is not different.

It’s been 10 years of slow growth around 2% real, 4% nominal annualized. How the heck did SP500 go up 13% annualized and housing 8% annualized and inflation be at 2%? Somebody is playing with the printer and the accounting books.

Very simple… yes, everything went up, but it did so at the cost of multiple expansion.

The CAPE ratio went from 15 at the depth of the Great Recession to almost 40 today.

Looks like somebody would have figured out running up asset values would make society rich a long time ago. I am kidding, it’s advanced Fed economics by the smartest people around aka a ponzi.

Max Power:

For those who dislike the pointed use of acronyms without explanations (including this commenter):

“CAPE Ratio”

“Cyclically Adjusted PE Ratio”

“An extremely high CAPE ratio means that a company’s stock price is substantially higher than the company’s earnings would indicate and, therefore, overvalued.”

Max, you mean Cyclically Adjusted Price-to-Earnings Ratio”

CAPE is an acronym wrapped around an acronym, encompassing a riddle wrapped around an enigma…

Sierra7,

Don’t think it’s a big deal these days as you can Google things so quickly to see what they mean. For 95% of people it shortens the text.

No one knows what will “Cause” a sell off until after the fact.

It’s a change in mood and a number of seemingly extraneous factors can cause the mood to change.

Perhaps the realization that the Vaccines are not working as advertised and a few nasty variants showing up might be the “Trigger.

”

It looks like my prediction of a June peak wasn’t too far off, which is nice.

I was wondering if I’d lost my touch.

Are you talking about visas?

@ Wolf – ban the use of acronyms.

What is the value of something when it can be financed at a negative real rate? You can’t really say unless you know what future real rates are going to be when the property is sold. You can ask yourself are real rates likely to be higher or lower than the current all time low.

For some additional context, a few years back I saw a stat saying there were about 75 million single family homes (out of about 130 million households/families) with the balance being apartments (although it is hard to find stats claiming 55 million apartments).

Out of the 75 million SFH, 50 million still have mortgages on them (and were therefore much more affected by interest rate changes).

Just thought these numbers provided some context for Wolf’s.

I hear people buyers who rationalize that inflation will drive the home price higher. I beg to differ.

Higher inflation will eventually lead to higher interest rates. Higher interest rates will lead to lower home prices, as future buyers cant afford the monthly payments.

The beauty of the real estate market has always been that it is the highest leverage investment an individual can make. That cuts both ways and an all-cash purchase has unlimited downside. At least with a mortgage you can hand the keys to the banker and walk away at a 10% loss.

That’s true, but with the accounting rules banks do not have to mark to market and wait for the Fed to reflate the bubble to get the asset back to a gain instead of a loss.

But that is a short term view. If you buy a home for cash, and stay in the home because it is your home and you have to live somewhere, eventually the price rises again which also doesn’t really mean anything. If you sell the home and buy something else at any given time, the move is lateral and relative as that new home will also be set at a lower price. It’s only an issue if you change locales for whatever reason.

If you sell high and decide to rent then rent will also be high.

Sure, you might grind your teeth about what you paid for the house when you bought it, but it should be no more than, “Gee I should have bought Apple when Forest Gump did”.

If you have a mortgage and bought high, the incentive is there to walk away, provided the recourse laws let you. Otherwise, it’s bankruptcy time. Now many folks don’t care about declaring BK, but I would be ashamed to do so.

Two variables are of interest to me besides a declining home value. Is your mortgage interest partially deductible against your income? And is the mortgage payment the same or close to rental rates?

To me, an all cash purchase has unlimited upside…..over time. Mind you, I just about always pay cash and don’t buy any product if I’m not willing to pay outright for it. It took me years to get there.

Having said this I am watching my local market with great interest. A guy down the road from me is getting greedy. It is an estate sale, delayed to squeeze maximum executor fees from the situation (other family members), and because the executor believed the prices would rise forever. There the house sits, priced 30%! too high, and no offers. They are also trying to sell it themselves to avoid RE fees. The only change is two new signs on the main road.

regards

Paulo (an others)

The “home attitude” change from buying for a living abode to buying for asset appreciation alone has destroyed our housing “markets” and the “Commons”. I don’t see any going back to just viewing a home purchase as a place to live, raise a family etc…..we have crossed that “Rubicon”.

Sad.

@gametv.

one would think your statement is true:

Higher inflation will eventually lead to higher interest rates. Higher interest rates will lead to lower home prices, as future buyers cant afford the monthly payments.

But if you go back in time. during times of rising inflation and rising interest rates the price of houses went up.

the higher interest means the monthly mortgage payment buys less of a house so people just buy smaller houses.

An all-cash purchase, by definition, has a very defined downside – the amount paid for the house.

An apartment in my house in central Stockholm that was bought for SEK 6 million a year ago just sold for almost SEK 9 million.

This housing and stock market evidently will be different from the last couple. It’s gone on longer and maybe it’s not through sucking in all the “market participants” yet.

It seems very wrong that things are not priced on fundamentals, but on Fed policy decisions.

Wolf, are you reading the same article you posted?

“The median existing-home price for all housing types in July was $359,900, up 17.8% from July 2020 ($305,600), as each region saw prices climb. This marks 113 straight months of year-over-year gains.”

“Properties typically remained on the market for 17 days in July, unchanged from June and down from 22 days in July 2020. Eighty-nine percent of homes sold in July 2021 were on the market for less than a month.”

“Individual investors or second-home buyers, who account for many cash sales, purchased 15% of homes in July, up from 14% in June but even with 15% from July 2020. All-cash sales accounted for 23% of transactions in July, even with June and up from 16% in July 2020.”

You negatively cherry picked the article you posted. You must have really missed out on the real estate bonanza over the last five years.

I dare you not to take this post down

Yea, I know everyone thinks this market is insane (it is), but the title is making a mountain out of a molehill in the data.

The market is certainly (finally) losing the ridiculous steam, but this is also typical seasonality. A bunch of doomer posters will come in here declaring this is the peak and the burst is ’round the corner. Just like they did in 2015, 2016, 2017, 2018, 2019, 2020.

It is far more likely that we are bouncing off a price ceiling and price growth will finally cool off. There are no factors that point to any measurable crash around the corner.

We’re all going to die. Just because we don’t know the exact date doesn’t mean we’re wrong. And if we’re really out-of-shape and in our seventies, the answer is “soon.” The housing bubble burst should be viewed in the same way. Yes, it hasn’t burst for half a year of doomsaying, but it will. Because there’s nothing holding these incredible levitating prices in the air. I mean, WINNIPEG is up that many basis points? Winnipeg, MANITOBA? Who the F. wants to live in WINNIPEG? You see my point.

Ok, so some local markets may cool off.

I’ve been hearing “it will” since 2012 when the rebound in prices was seen as “the bubble re-inflating”. These prices are being held up by inflation and the massive devaluation of fiat currency.

Real values may very well fall, but that doesn’t mean nominal values will. In built-out markets with good job centers, there are still way more buyers than sellers, with nowhere to build, especially as long as NIMBYs keep preventing high-density housing.

I used to work north of Gimli, Catxman. You nailed it and I really enjoyed your comment. It’s one of those, “you had to be there” kind of moments. Great people, good hockey team, excellent fishing, and “I’m outta here”.

With climate change won’t it be like Chicago except without 50 shootings per weekend?

Totally agree. They say that real estate is local, and my local market is still on fire (not in the Greenville, Ca way).

Real estate is on fire in most of the markets not only in USA but all over the world for the last 18

Months.

Don’t believe my words.. just look at the numbers

Jon, no real estate is not on fire. It’s more that fiat currencies are worth less, due to insane printing.

What were the “factors” in 2007-2008? I’m really tired of hearing, whether it’s about stocks or real estate, that there’s no catalyst. In a massive bubble, there doesn’t have to be a known factor ahead of time. The catalyst is only known after the fact. And the bigger the bubble, the less remarkable the catalyst has to be.

Everyone knew in the 1910s, there were massive tensions brewing. The fact that no one knew exactly what the shot heard round the world would be doesn’t change that.

In 2007/2008, you could get a NINJA loan. There were CDOs and synthetic CDOs. Many subprime buyers had loans with >100 LTV on adjustable rates. There were people employed part-time owning multiple properties. There was an oversupply of housing versus demographics.

None of that is present today. Maybe there’s a catalyst out there, but if there is, it will simply be very different than 2007-08, so the impact is likely to be different.

Just because values are high, does not mean it is a bubble. Lending is still relatively tight, and speculative investment on leverage is not high right now. 20% down is the norm in most markets, supported by healthy incomes. The cash buyers can afford to weather storms.

Housing in suburbs has seen a fundamental shift in demand, with WFH, one that may be permanent. In many places, particularly those with good schools, there won’t be enough supply to meet demand for years. It will simply become a luxury good that is more expensive than it was in previous generations.

In fact, anywhere densely populated, single family housing is simply unsustainable. The answer is to build denser housing.

I believe this current covid surge is likely to be the catalyst.

It could get ugly when kids go back to school and cooler fall weather arrives driving people back indoors.

First, the fact that there are no NINJA loans today doesn’t mean that underwriting is “good.” There are still plenty of loans where the borrower only put down 5%. This means that if people lose their jobs if a real recession starts, those borrowers are in trouble. Second, there is a huge amount of speculative investment. It’s just that a lot of it has come from institutional investors and funds. Watch what happens when the margin calls start.

Third, if WFH is permanent, and people want suburbs, then they don’t want cities, and cities will crash. You can’t have it both ways. Everyone I see who uses WFH as a reason why housing prices stay high never manage to explain what happens to the urban housing, and what happens to all of the housing lived in by the people who serve the professional working class.

There were no NINJA loans, CDO’s and the like when the SoCal housing bubble of the late 1980’s crapped out in the early 1990’s.

It used to be that there were regional housing bubbles like it, but never a nationwide one. Caveat emptor!

“None of that is present today.”

Liar.

@Xavier,

I do believe there are a multitude of regional bubbles right now. Boise, ID, places in Maine, Florida where there is no tie of the rapid rise in prices since January 2020 to any local economic factor are the most susceptible. I don’t see it on a nationwide scale. Some of the traditionally hot markets haven’t grown all that much above their usual YoY increases.

WRONG!

There are a multitude of factors that will lead to melting prices.

1. Higher interest rates. Unless inflation tames down, interest rates will follow. Recently J Powell expressed that he didnt understand why interest rates had fallen in the past 5 months. That liar! He knows why. The market was starved of new issuance to the tune of $250 billion a month as the Treasury used up their balance. That ends in October with the raising debt ceiling. The very simple reason that the Fed wont cut the $100 billion in asset purchases per month is that the Fed is scared as hell that when they issue a ton of notes/bills/bonds the interest rates will soar. That means higher mortgage rates.

2. Mortgage forebearance – Coming to an end

3. End of the stimulus payments

4. End of the Federal unemployment payments.

5. No more PPP free money for small business

6. End of eviction forebearance – As renters can get evicted, landlords will try to sell their properties because they are sick of taking the risk, or else those people will be forced to move in with relatives or into smaller places. More supply of housing opens up as all these moratoriums that have kept people in a home or rental without paying end.

7. Reversal of FOMO – As prices fall, demand will fall. Investors will realize what a bad deal a leveraged asset is in hard economic times. Even if you own a property outright, the price you can sell it is based on what other people can afford to pay.

Good summary!

For the 7), it will be interesting to see how it all will develop when Case-Shiller peaks.

1 – I’ve been hearing interest rates will rise and crush everything for years. Let’s check back in December and see where we are. Even if they do rise, let’s say to maybe a 4.0% 30-year fixed rate, it simply will shift demand down. A dual-income, white-collar family in the Boston area in 2012 could buy a 4 bed, 2.5 bath house in the 2010-2016 era. 2017 to today, they can only afford a 3 bed, 1.5 bath house. People need and want housing, based on lifestyle. People will move down market. They have and continue to buy.

2 – The number of people on forbearance continues to drop precipitously. Those still in forbearance can sell and almost certainly make a healthy profit based on current gains. With the current months of supply, even if they all listed at once, it would just about get us close to a normal market.

3 – No one getting a $1,200 check is using it to buy a house. This made no material difference to the housing market.

4 – Disproportionately, this impacted service sector workers. Maybe this will impact some markets heavy on this sector like Las Vegas, but today’s homeowners are largely in jobs that weathered the pandemic just fine.

5 – Small business owners aren’t enough to make a dent here, and will likely sell and take profits if they need to get out of a house. Again, will help inventory normalize, not a catalyst for a crash.

6 – Much of this supply is not where the heat has been. Multifamily properties have not seen the value increases, nor are the same properties desired by white-collar, working families. Single family homes are where the heat is, and will continue to face demand from investors and owner-occupants alike.

7 – If investor demand for suburban SFH does cool, it may make the market slow down enough to start fulfilling the desire of owner-occupant buyers. As long as there are more dual-income, professionally employed families looking to buy than houses available, with any even moderate dip in pricing, they’ll re-enter the market and absorb the inventory.

So tell me, are you ready to place a statement right now as to what you think the “crash” will be? When will it start, when will it bottom out, and what will the decline be?

1 – at this point, interest rates CAN’T go any lower. That was the difference when it was 6%

2 – except that if ALL of those people sold to make a profit, then prices would drop, and they’d no longer be making a profit.

It bears repeating that prices are set at the margins. Right now, nobody is selling, and people can’t be foreclosed upon, so prices are high.

Do you really think single family housing is going to be entirely held by HODLers, like Bitcoin?

All valid points but only time will tell.

Interest rates will never go up again. The ruling class knows it would crash the Federal budget just to pay the interest on the national debt. Can’t tax the ruling class or cut corporate welfare masquerading as the “ defense “ budget. Or can we ?

I’ll summarize why you are correct:

No, it’s not “different this time”.

No, the United States is not exempt from the consequences of living beyond it’s means.

No, “wants” and “needs” do not mean that those who desire something will be able to afford it. In the real world where everyone ultimately exists, people or the society collectively have to be able to afford it. It should be obvious that the US economy since March 2020 is completely unsustainable.

There is no required “trigger event” in any market to “cause” a price decline. Psychology alone suffices. No “reason” is necessary.

SC7 – I enjoy your intelligent remarks.

I said melt down, not necessarily crash. I would view a simple return of prices to pre-COVID as a melt-down, as that would entail about a 20% drop in many places (not sure about national average).

1) I have explained my thesis on interest rates several times and it basically is that if you look back at December 2020 to Feb 2021 interest rates were moving up fast, then the Treasury started to use the 1.8 billion in the general account to fund things instead of selling Treasuries and interest rates went in reverse. How do people not see that starving supply to the tune of $250 billion per month is not essentially the same as buying $250 billion per month? So the Fed said they were buying $100 billion per month, but the actual impact was $100 plus 250 billion or $350 billion per month. We are headed to the debt ceiling battle and once that is raised, watch out for massive interest rate increases. Yields look to be putting in a bottom here before the debt ceiling is resolved, despite the fact that they are still being starved of supply. Everyone keeps saying that the Fed will never allow interest rates to rise, but as long as inflation remains, it simply cant increase the purchases of Treasuries above $100 billion per month. Once the debt ceiling is lifted the government will need to sell $300-400 billion per month or more to fund the deficit and also to put some money back in the general account.

2. Still millions of people adding selling pressure.

3. When you give people $1200 in cash they might not buy a home, but it props up the economy and puts it on steroids. So companies that are doing well in this environment will not be doing as well in the future. That causes companies to cut back on expenses and their stock drops and they even maybe cut back on hiring and salaries drop or dont rise to meet inflation. So some people get alot more than an extra $1200 in their pockets as a result of either owning a business or working for a company doing really well, or because of stock market gains. The percentage of turnover in homes in a given year is pretty small, so if the extra money causes just 3-4% of people to decide to buy a new home, you have a massive shift in the supply-demand balance.

4. Once again, this is the juice that pumps up the incomes in the whole economy and the unemployed are not buying homes, but they are buying tons of crap from companies that then employ people and people make money from stocks, etc.

5. The amounts of money that went out to small business owners was huge. Once again, this is all the knock-on effects of record amounts of cash washing through the system all at the same time.

6. All markets are a matter of supply and demand. If there are massive vacancies in multi-family homes and rents or condo prices drop, a family might decide to rent or own a condo instead of paying up to buy a home. Supply and demand are fungible across different property types to some extent in the aggregate.

7. So much of the buying pressure is FOMO and investors who think they will make profits on higher prices. Those things are psychology-based and once the massive stimulus injections wear out, the FOMO turns into fear of not getting out FONGO.

I’m not saying I have a crystal ball, but the limited supply and massive demand at the moment are not based on sustainable increases in incomes.

But even just seeing a change in interest rates will be enough to move the market from increasing prices, to melting prices. It will take multiple months for it to happen. At the end of the day, inventories need to rise, or else sellers will not cut prices. Many owners think that prices will go up forever, so they have no reason to sell. That will reverse as interest rates rise and demand softens and inventories build.

I say prices start to drop by December-January at the latest and it depends alot on what happens with interest rates and the stock market. Since there will not be alot of distressed properties driving prices down, the price decreases will take a longer time to unfold.

Gametv,

This is a great summary of the imminent conditions that will cause disturbances in the economy!

The most advanced fighter jets today would crash instantaneously with a small wind gust without the constant control of high speed computers controlling everything on the plane to keep it in flight.

Does the Fed use these computers to keep the economy in flight to handle all of the turbulence you mentioned above?

I suspect they do. My cynical side also says they each have a golden parachute on-hand in case the plane augurs in with all of us onboard.

If I were paranoid, I’d suspect that instead of flying us to our dream destination, they are flying us to a bleak remote airfield where they can safely unload all of their gold while leaving us stranded.

According to Zillow between now and October about 850,000 homeowners will exit forbearance. An estimated 25-50% are expected to list their homes. Atlanta, Houston, Chicago, Dallas, Washington DC and Baltimore have the highest # of borrowers behind on FHA loans so those markets are expected to be affected more than others. So much so the market may flip from a sellers market to buyers market in some areas.

What do I know? And I’m not a realtor….just somebody trying to buy a house.

In Atlanta, it’s almost certainly going to be concentrated in on south and west sides centrally, east-west corridor along I-20 and from Hwy 78 to I-20 going south on the perimeter.

One demographic group is going to impacted most, just as it was during housing bust 1 in 2008 to 2012.

You have to take some risk to have anything in life. With a home or a stock portfolio the key is to take the appropriate risk for you and your situation.

Just because your home or stock portfolio went up for sequential years doesn’t mean too much unless you sell at the top. If you live long enough what you think can’t happen in finance tends to happen.

Fed and Congress did a big save in 2020 or a large number of people would have been bankrupt and foreclosed on. Society in general was so financially unprepared that 1/3 of the population at least had to be rescued. It might not play out that way next time.

Wow- 5 years! You know Canada didn’t have a 2008 crash ( maybe because the govt insurer hadn’t been told it HAD to have a large quota of subprime)

In fact it’s been 27 years since a housing correction in Canada. Does that mean it can’t happen, or that it’s overdue, and therefore will require a larger one?

rich,

“You negatively cherry picked the article you posted.”

“Cherry picked” my ass. What a brain-dead comment. Those are long-term charts with long-term data, all the relevant data, nothing picked.

But you didn’t even read my article!! You have NO idea what the article says.

You didn’t even read the subtitle.

You didn’t even look at the pictures. You should have at least looked at the pictures. Sheesh.

Adios.

He’s just mad he’s sitting on four homes right now that he’s been reducing by 10% WoW to try and get someone to buy.

There’s no way these can be considered “normal” prices. No freakin’ way. It’s a bubble and everyone with a brain knows it. And when it bursts, it’ll take prices down 15, 20% across the board. The more in-demand cities will sustain a smaller hit — such as Vancouver and San Francisco — but even they will see a shrinkage in median home price. If I owned a house and was looking to sell, I’d rush to get to Re/Max right now and tell them I wanted to sell. And if there was any hesitation in buying my home, I’d slash the prices accordingly just to unload it. Because the crash is coming, and fairly soon. A plateau then a major dip, baby. It’s coming.

Been there. Sold ours back in April. In limbo as I type. We just made a bid on an awesome property @ about 20% below market and plan to build our forever home on it.

Wish us luck.

How do you define market price ?

In my hood San Diego surest way to lose a home is to offer asking price.

If you like a home be prepared to offer 15 percent more than asking price.

The average price is 700k.

Yeah its all local. In my SE WI neighborhood where my rental is, there was a house sold in the last 2 years for 30K, then flipped for 120K about 3 months later. There are several 3bdrm homes for sale on that block right now for between 60K-90K. They’ve been sitting for a while, but are ripe for fixing up and flipping or renting.

I’ve offered my rental to my tenant for about 14K under the current market price, because he’s not missed a payment in 2 years. As always, RE is hyper-local.

Same here in Bend.

Catxman – If work from home truly takes hold over the coming years, the need to live in a crowded, dirty city is reduced. Why not live in someplace beautiful? I’m not sure cities and their surrounding suburbs will be the best place to store money in real estate.

Since these excessively expensive cities are mostly land value, an exodus of people to less crowded places where new homes can be built would actually reduce home prices in aggregate.

Lots of buildable land is the enemy of higher home prices. If the government really wanted more affordable housing, it would enact building policies that made it easy to build a home, or maybe put an extra tax on undeveloped land, so people would stop stockpiling raw land. That would also lead to a boom in home building, which would create jobs.

But you can imagine that Blackrock, who has lots of lobbyists doesnt want that.

Yes, I think that real estate will hold up well in the “beautiful” areas. Particularly well in those areas of vacation homes for the wealthy. Real estate Aspen and Martha’s Vineyard, for example, probably won’t drop at all.

Depends on how broke country is and how future is going to be taxed. I remember Great Britain was so broke after one of the wars that many of the great residential estates were destroyed because taxes made them a liability instead of an asset.

There is no normalizing happening. Home prices in my hood have gone up by 30% or so in last 1 year ish and the price ascent is not abating.

I see many price reductions because people are asking astronomical prices.

I’d discount this article by WR as a blip in data as I don’t see either inventory rising in a meaningful way or prices coming down. The rate of price increase aka inflation has definitely slowed down but not way the prices are going down.

Give it another week – the numbers will start coming down.

In San Francisco prices of houses have come down. And prices of condos also dropped, but they have been about flat for three years. July was not a good month for house prices in the entire Bay Area.

In San Francisco, the median house price dropped by 8% or by 175,000 in July from June. Well over half the homes sold in SF are condos:

SF and certain cities are probably just ahead of the game.

Remember, if nothing else, SF is already overpriced. As this spills out over the rest of the country, eventually, prices elsewhere will have to come down as well.

There will never be enough foreign buyers to boost this market, the Fed and the government will sooner or later run out of monetary tricks to prop up this market.

Well think about that—-who would want to live in the Bay Area any way??? Have you been there lately??? And you think property values should be rising??

Jim,

Not sure if you’re being sarcastic. I live in San Francisco, three blocks from the Bay, and I go swimming in the Bay several times a week, and I run along the shore, and go up and down the hills to go to the doctor or to restaurants or whatever, and I walk all over this place, and it’s a beautiful city. The fact that this place is packed with way too many people, including with way way too many tourists, tells me that I’m not the only one who thinks so.

Click on the “Wolf Richter” tab. Further down on that page there are a couple of pictures of the views from our place. Go take a look.

Jim,

The simple answer is a whole lot of people. In the SF bay area, there are approximately 7M people give or take. Despite what the news keeps pounding out, it’s still a place with a whole bunch of opportunities.

Like everywhere else, there are problems, may be more than a lot of other places, but still, people come here because there are also opportunities

Jim

Even Nikita Krutchev said SF was his favorite city in the whole world. I choice SF for my outprocessing from my tours in the Navy, at Treasure Island, and Hunters Point shipyard. The greatest weather in the USA. No place is perfect. Can’t be all that bad.

Being able to see Alcatraz from your house is pretty cool.

Swamp, why do you say SF has the greatest weather in the world? Days are often cool and gloomy. Santa Monica I can understand, with its weather that never gets hot or cold.

I love the fog. It as its own personality. It billows over the coastal hills. It comes through the Golden Gate in a long white sausage that may curve right over Alcatraz. The fog does amazing things. Sometimes it’s thick and misty. Other times, you’re in the sun and down the block is the fog, and you’re looking at it, and it’s looking at you…

I went 2 years ago to SannFran. Stayed at the Westin by Union Square. Took my wife for a vacation. 1st time for both of us. The Fog was cool. Saw a lot of the landmarks. Had some good food.

Problem is we saw too many drug addicts shooting up just around the corner of the Westin hotel and Union Square. Saw a guy overdoes right in front of us.

I am afraid i will never get my wife to go back to san fran. Unfortunately The drug overdose is her favorite story to tell when the topic of san fran comes up during small talk. so she is not doing the city any publicity favors. She seems to forget the other nice attractions

ru82,

The problem with Union Square is that the area is near the Tenderloin/City Hall area, which are a few blocks where all this stuff happens, and some of the hotels are right next to the Tenderloin or in the Tenderloin. I always recommend to friends NOT to stay at any hotels in the area, though some of the biggest most expensive hotels are in that area.

And if you’re in one of those hotels, know the few blocks of the Tenderloin and stay away from them. In that specific area, on Powell or east of Powell is OK.

I think you’re better off staying in the Fisherman’s Wharf area. There a lot of hotels for tourists (not convention hotels).

ru82, same experience here. Last time I posted something about it Wolf took offense, but let’s just say that the elected DA of San Francisco’s upbringing has the potential to make him more sympathetic to criminals than others might. So I don’t see anything changing.

RightNYer,

That’s just effing BS. And that’s why I took it down last time. I left this one up to tell you that this is effing BS. The shit that happens on ZH stays on ZH. Don’t drag this shit into here.

RightNYer,

It’s actually brain-dead BS, to be more precise, because the drug problems in the Tenderloin have been going on for decades, and the DA started in 2020. Do you get now why this brain-dead shit on ZH needs to stay on ZH and not be spread around here?

RightNYer,

It’s actually brain-dead BS, to be more precise, because the drug problems in the Tenderloin (the topic of the comment) have been going on for decades, and the DA started in 2020. Do you get now why this brain-dead shit on ZH needs to stay on ZH and not be spread around here?

And now you’re spreading more bread-dead shit.

One more load of this shit, and it’s adios.

All you need to know is earned income is way down. The thing that makes the situation look good is Fed easy money and congress dropping money into peoples bank accounts.

The Fed is “giving it all she’s got, captain”. In other words they are can kicking hoping that the economy does what it normally does which is recover. It’s still an open question whether they can pull it off.

We seem to be on the the road to France where government is the economy and the private sector is the tail.

Housing market may be going up as people try to figure out DC’s playbook for next 10 years. Good interview on Standsbury with Lawrence Lindsey former Fed governor. He is PhD economist I believe.

He says DC is going to try to run inflation above nominal GDP for much of this decade. He said personally he is investing:

1. Real Estate with low interest rate financing.

2. Buying miners because it’s betting on the commodities going up in price

3. Shorting treasuries.

Kind of bold calls. He says government is needs to get their balance sheet in order and is going to do it through inflation plus taxation.

In the dozen or so zips I follow, all suburban coastal Southern CA, Boston, MA, and NYC, I see another wave of buying … much smaller, but it is on.

Finding a decent property for sale is very hard. I see nothing but green ….

SoCal is probably an abberation as people here have become drunken with price gains in real estate. Let’s all look at the market 5 months after mortgage rates hit 4%.

Agreed, Boston is still on fire. I am still routinely seeing closings $50k, $100k, $150k above list price. I am starting to hear some contingencies are being accepted on certain properties, but waiving them all is still the norm.

We’re still a long way off from the supposed “crash”. There has been a fundamental demand shift to the built-out suburbs. Even in the city now, things are heating back up. Rent prices are also escalating big time. Every renter I know is facing increases of $200 to $400 per month.

Again, you can’t have it both ways. The people seeking housing in the suburbs are the people who were previously in the cities. If one is going up, the other should be going down.

Unless of course, it’s based on a bubble.

You can keep saying it, it doesn’t make it true. Demand was so outsized in Boston, people were simply stuck renting. Now, enough of those renters have flocked to the suburbs, which are also fully built out, pushing demand up there. It took just enough pressure off of the urban market to cool things off last year, but still enough heat for YoY price gains to materialize

Maybe Boise, ID and some other “I’ll move 500 miles away because I’m WFH” cities, which saw 30%+ gains will retreat a little, but I do not see any cause for a national crash. Any area that is built out and has job centers, amenities galore, good medical systems and education (most major urban cores) simply has more people (by demographics) that want to live there, than housing available. Thus, prices go up across the board. Gaps in urban vs. suburban demand just impact where the pressure is. We could very well reach an equilibrium where enough people want to live in both types of areas, that prices simply remain high everywhere, across the board. The worst of both worlds.

And where exactly will the money for “prices to remain high everywhere” come from?

Who are the people bidding up city apartments/houses if all of the people with money are busy bidding up the suburbs?

@RightNYer

I don’t know how else to get my point across here. In Boston, there are far, far, far more people that want to live in both the city AND the suburbs, than there are housing units. There’s more than enough of a buyer pipeline to keep prices high in both areas. There is tech, biotech, education, healthcare, all concentrated in the area. People literally cram in with multiple roommates into some of the worst housing stock in the US just for the opportunity to live here and go to one of the universities (Harvard, MIT, Tufts, Brandeis, BC, BU, NEU all top 50), or take on of the job opportunities. Tons of great companies to work for here, many of which provide RSU packages. There are many DINK couples pulling in $150k+ each plus RSUs. They can easily afford $800k+ houses, even with a 4% mortgage rate. It is sad, but most working class people can no longer afford to buy in the area, city, suburbs or even exurbs.

The rate of building in eastern MA is not at all close to the rate of population growth. All that is happening is some pressure that would have continued in the urban core has moved to the suburbs, slowing the rate of price growth in the city, and inflating it in the suburbs. Both areas have greater than 1 interested buyer per listing (one listing recently got 72 offers). Until and unless that ratio changes, I don’t expect prices to significantly fall here. That will take some type of massive change to the area itself.

Because people often stretch their budgets here, I do think a large enough increase in mortgage rates could cool things off. When rates increased at the end of 2018, things did start to slow a bit, and 2019 was a fairly mild year for price growth. Everything that applies here is similar to Seattle, SF Bay Area, and other major metros with diverse employment and educational opportunities.

I don’t have a dog in this fight, I bought into the market in 2015 and moved around a few times, I know I certainly can’t get as much house here as I would like. I couldn’t care less about paper equity, but I see the fundamentals here and just don’t see how or why things will change when the area is fully built out and on the water. I feel very sorry for people I know still renting, many of them pay more for rent that increases every year then I do on a mortgage for a much bigger home.

Asset prices are in the 95% – 100% percentile. We are one hot war or one policy change from the possibility of dropping to the 10% percentile.

Not sure with housing, but stocks tend to be mirror image events in that the biggest over valuation is followed by extreme under valuation.

Fed has determined they want to carry the ball and show what they can do, but they might have made the biggest policy mistake since they were founded.

Unfortunately sc7,,, no one, clearly in my years of watching the RE mkt since WE, in this case the family we, lost two out of three properties in 1956 so that WE could keep the house we were living in,,,

no one can predict either WHEN or how far down any crash is going to happen/go.

Folks that suggest otherwise are just trying to get others to buy into their fantasy/profit center…

Also, follow some better zips in Oakland Co, Michigan … hot hot hot.

Not not not.

Climate change is causing massive reallocation in RE. That’s what the seller buyer ratio means. Imagine thousands of homeowners fleeing Las Vegas when the water turns off, walking away from their mortgages. Then suddenly the market in LA spikes. Do those homes get taken out of inventory? Forget money management, choose the right place to live, or forever suffer the consequences.

Any species alive today got here because they could adapt, even humans. Go to our local beach. Old homes built on the ground. New homes built 10 ft in the air on stilts. Now the home on the ground looks out of place.

whole of southern CA is under extreme water scarcity issue. We don’t see it but the fact remains SoCal gets 80% of water imported from other places.

Of course Las Vegas is worst. I truly doubt if people feeling from LV for water would come to SoCal.

US rental vacancies dropped in the most recent quarter report.

There is an eviction moratorium.

Not all areas are the same. California’s population dropped in 2020. Other states are seeing new arrivals wanting to buy or rent real estate with little on the market.

The Colorado River is low, potentially affecting Los Angeles, Las Vegas, Phoenix and Tucson.

Yes, water is a huge issue in So Cal. I have heard that before the missionaries, the LA Basin had no permanent residents because of lack of water. As the water dries up we could see So Cal house prices drop to zero, like some kind of giant desert ghost town. The only bright side is that Phoenix and Las Vegas are worse.

Seneca’s Cliff,

Water won’t dry up in LA. But CHEAP water will dry up.

Desalination is very expensive, but there is a lot of Pacific water just off the beach, and LA can desalinate enough water to keep the taps running, but it costs a bunch (and then there are the environmental issues of desalination, including turning the water off the beach into a nasty brine). More water recycling is also expensive.

So this means there will be water, but it will be expensive water. You’ll be taking showers with whiskey and baths with beer, and reserve water for drinking :-]

In addition to DeSalination LA will have to go to water reuse like Singapore. The technology is in place to apply high level treatment and filtration to tertiary treated sewage water, the biggest roadblock is the “Ick” factor. Desalination is only practical when there is cheap natural gas to power it. Once nat gas becomes rare and expensive LA will follow the path of other failed desert civilizations in history.

Carlsbad Desalination-

Each day, the plant delivers nearly 50 million gallons (56,000 acre-feet per year (AFY)) of fresh, desalinated water to San Diego County. Not cheap and all the issues WR outlined. But really happening today

I have children just entering the work force 1 in trades the other in business. I’ve often told them since they can live any where in the USA to stay in their hometown state of MI, especially where farmland on our farm is available to them to build a affordable simple ranch house surrounded by the world’s largest freshwater deposit of the Great Lakes. We truly take it for granted here in Michigan. I truly believe that water will be a MAJOR issue in the USA in the years to come.

Living in NC we tend not to have long term water issues, but we pay the price with unbearable humid summers. You just learn to stay inside.

Something else to consider when thinking location, location, location.

Fresh water quality, quantity and natural distribution are disrupted by fracking. The potential risk for fluid travelling along and lubricating previously inactive, dry or tight faults also increases the risk of earthquakes.

The real issue with the 35 million Californians whose water comes from far far away (including desalinatiion plants) is when the Big One hits, it’ll likely wreck the distribution system of pipes bringing it to people.

You’ll never have a better time to sell your abode if you’re in SoCal, as luck would have it-the farthest away from fresh water.

People in San Diego are always bragging that it never rains.

#tragicomedy

SD’s water mostly comes from the Colorado River, and I heard rumors of it drying up, and one of the leads in the SD U-T today was the possibility of SD homes being worth a cool million clams by next year.

What’s a 1974 3/2 SFH worth when no water comes out of the tap?

We’re running out of water here in Central Oregon, yet people are still flocking here. The air is full of smoke all summer, yet people are still flocking here. Median house is $670, yet people are still flocking here.

Hi Wolf,

Here in southwestern Maine the prices continue to rise and inventory is tight – bidding wars abound – no signs of a pullback. It’s a combination of free money and folks trying to get away to a perceived ‘safe” location in case of civil unrest.

Until and unless the FED raises rates this will continue until it can’t.

I’ve posted before that I’ve notice “Priced Reduced” signs in the heart of the DC Swamp for brand new renovated properties. Bidding Wars are over here. People are starting to back out of deals. That’s all an indication that we’ve probably reached the top of the spike in RE. Anyone buying now will be underwater within a year.

We just had a deal go south because the dude who signed up for a refinance didn’t remember signing the documents and said he didn’t sign anything.

Another good article, Wolf, providing me with useful info I can impart to my foreclosure relief clients.

I want to bring up something beside the point, but which is clear in the first chart you provided in this article, which shows the median price of housing over a span of 16 years. I am not a statistician by any means, so my handling of the numbers may be suspect.

Nonetheless, here is my analysis and conclusion. If you look at the whole time span from mid-2005 to mid-2021, median house prices have gone from about $230,000 to about $359,000, an increase of about $129,000, or 56%. In that same time span, wages have increased a small amount, but wages have increased nowhere near 56% during that time. If you look at the time span from mid-2012 to mid-2021, median house prices have gone from about $155,000 (the effect of the Great Recession) to the current $359,000, an increase of about $204,000 or 132%. Again, wages may have increased a little during that time, but definitely nowhere near132%.

One would think that with housing being a critically important necessity of life, that wages would have to march pretty much in lockstep with the costs of the things that are necessary for living (the “cost of living”?), but they have not. In fact, there is a complete disconnect between wages and cost of living. How is it that no one of any influence, especially in government, has addressed this incredible disparity? How can a society survive when these conditions exist?

Prices are a function of available credit.

Available credit rises when the cost of carry (interest rates) goes down.

Why has nobody tackled it? Because the general populous are happy to screw even their own kids for a quick gain.

I don’t know many parents that screw over their kids unless it’s giving them too much and making them lazy.

Most parents I know paid for most or all of their kids college education. I know I sacrificed for four of them.

GOOD ONE.

Next time, read up on “the American B00mer”.

Two parts in there, G….

First re credit, absolutely correct because it’s the payment game… gimme the right payment and I don’t give a damn how you got there….

In regard to the second, maybe, maybe not..

Offered my daughter and husband a house I own on a lake for the mortgage payment… just move in… said house with $70K + equity…thought I was screwing her over and trying to make money off her… still trying to figure that one out…

What a crazy turn of events that threw all the numbers right out the window from that standard trend over past chart data ranges. Trends all got kinked up and will in time hopefully return some semblance of normal. However the FED holding their hose is surely going to either burst the main or rupture as some unknown seem.

What a wild ride this has been so far. What else is left in 2021

The NAR says there’s a chronic 5.5 Million shortage of houses. Let’s do a poll people. Do you believe the words of Lawrence Yun or Wolf? ;)

Of course the NAR said there was a shortage of houses back in 2007 as well.

I think Lawrence Yun is here posting as SocalJim.

I do think there is a shortage of housing stock. I certainly hear financial people talking about it.

We have exported a lot of inflation, but you can’t export housing inflation. Most of the stuff to make it is big and heavy and is made in USA or Canada.

US isn’t really that interested in making physical things anymore, because the process is environmentally impactful. I liked what the head guy at Barrick Gold said that if you live in a city, look around nearly everything there came out of mine. We tend to not like those dirty industries, but we like to enjoy the nice things they provide and complain about the price. Price is mostly a Fed issue.

Housing is now a global asset class — and the whole thing is financialized. Houses and condos are treated like stocks. Investors own houses and condos for whatever reason, and no one lives in them. You can never build enough houses when investors confuse them with stocks that you just buy and hold.

It’s when prices fall and investors are trying to sell their holdings, that it will become apparent just how much housing there is.

Yes. That is the reason for the bubble. The idea that the population suddenly supports much more demand for housing now than it did 2 years ago is a joke.

This analysis is right on. Almost everyone I know owns more than one home. When we do appraisals in the DC Swamp, nearly every home we go in is empty. Where are the owners living?? In a tent. No way. They’ve bought or rented another home already, and have two homes tied up. Thus, because of the irresponsible conduct of the Fed in pegging interest rates below the free market rate, they’ve created this massive distortion in the housing stock.

Stocks do not require the level of care and attention that houses do. When that care and attention is hired out to people with no real skin in the game, don’t expect it to be done well.

I expect, over the long term, all this corporate investing in housing to not go as well for the “investors” as they think it will.

That’s exactly why “housing as a service” has become en vogue. When the family size is less than 4, it’s difficult to justify ownership.

I have an issue of the magazine from the NAR dated summer 2007. The lead article says, “while prices have been softening lately, there has never been a better time to buy a home”.

Lawrence Yun was on the radio here WMAL, touting the same bull s$it he’s been touting for the last 10 years.

Most excellent reporting as usual. Thank you.

The article is the article, take from it what you will. The reality is real estate like the economy, is cyclical, as we have witnessed before. I am no doom and gloom purveyor, as I am a real estate investor and have been for decades. I am gleefully sitting on the sidelines (“patience is a virtue”), waiting for the bubble to pop, yet again. If 65% of Americans are saying it’s a terrible time to buy a home (and rightly so), you can assume that at some point this will translate into an inventory stockpile. This article is music to my ears!

Yep, it’s awful tempting to buy something at such insanely low interest but for what I’m looking for; (a shanty 2 hours into the backwoods), I’m not turning loose of my signature for liability to a 300k loan.

Think I’m going to wait for it to deflate and buy land and build rather than try and buy someone else’s mess. Wouldn’t that be nice? 30 or younger with land owned outright and one of those dopey trendy tiny houses paid for by my mid thirties. Debt is a cancer. If only the weight of the system would buckle unto itself. Patience.

The only thing that will initiate a big crash is a rise in rates.

Rising rates generate *forced* sellers. En masse.

Will they raise rates? They will try not to. Very hard.

Could be other reasons too. If stock market crashes, companies are going to eliminate jobs really quick by the millions. It’s the inverse wealth affect.

Hot war can cause things to go south in a hurry.

Fed will try to save it again, put might not be able.

The truth would also hold that negative rates would keep the market afloat. I know that 2% rates are looking really tempting. But then it’s either sing on for 15 or 30 years. Details always clog the thinking. Borrow the banks money for near zero interest with the 180 months or 360 months worth of payments? Or get to the end zone with no mortgage but risk not being able to step up into something bigger for the next generation

Really believe this is a once in a lifetime fulcrum

I like Michael Bluejays rent vs buy calculator. It’s fun to play around with. To get an answer you have to guess the future. What is future appreciation of house? What is future rent inflation? What is future opportunity cost?

To make a good decision you really need to stress test about five different scenarios to see in which case buying is better than renting. It’s not going to be all 5 out 5 most likely, but at least you can feel confident you know what you are committing to.

Sc7 is certainly writing lengthy comments today. Is he trying to convince me/us of the “rightness” of his position on the topic or himself? I sold real estate in the early 80’s, and some early parallels(cracks) are beginning to emerge.

He’s a scared bagholder. “Thou doth protest too much, methinks” comes to mind.

I love how he keeps insisting that neither Boston suburbs nor cities are in a bubble because there are plenty of people who want to live in both. How that is different from 2 years ago, I don’t quite know.

Because it’s…. Well, it’s … it just is, OKAY?

I’m sure lots of folks like Boston….

Me, I’m more suspect when people talk funny, you have yellow dogs with no heads running around, it gets cold as crap and of course, Gods gift to the baseball world…

All in good fun, sc7 … relax… appreciate your comments…

COWG, haha right. I get that the country is way more crowded than it was 40 years ago, but if you look at the current state of the housing market, all signs point to bubble. It’s not about price, it’s more about behavior.

People getting into bidding wars, waiving inspection contingencies, people not selling and instead renting a house out because “prices will continue to go up,” etc. That’s what people do in bubbles, regardless of the asset class. Whatever population increase we’ve seen in the past 3 years doesn’t come close to explaining this.

Your population quote tickled a brain cell…

Didn’t I read in one of Wolf’s articles about how 150 million – ish people were receiving some sort of govt assistance here lately…

Which is about the same as the US population increase since 1980-ish I think… no point here, I just find it interesting…

So appx 1/3 of this population increase is 25-40 years old and have known nothing except casino world in regard to finance…

So now you have appx 50 million or so who really don’t have anything to invest for their futures, that they are now thinking about… you have stocks or housing… that’s it… cause and effect … or way off base?

Add in the constant psychological pounding from everywhere, parents who drew the lucky economic straw, and never experienced economic stress, you may have a very toxic soup if/when the assets they are counting on go poof…

Thelma meet Louise…

RightNYer, the only argument you have for me is “prices went higher, therefore bubble”. Two years ago, Boston prices still steadily marched up, as they always do. What I’ve posited is this, the city has grown in price much slower since the start of the pandemic, while suburbs have exploded. All that has happened is a portion of the ridiculously outsized demand for property inside the city limits has now shuffled to the already undersupplied suburbs, and lit the same fire there that has been raging in the city since 2010. Bidding wars, waived contingencies, etc. have all been in place here since even the depths of the Great Recession. Desirable, supply-constrained areas will always see demand, particularly parts with good access to job centers and good schools.

I have agreed that a rise in interest rates can slow the market, and may even pull prices back a much needed 5% or even 10%, but that still takes us back to early 2020 levels. There’s no reason articulated by anyone as to why the market there is going to crash like 2008, where, oh yea, Boston only crashed ~13% and hit new highs by late 2012.

As for Depth Charge, you’re incredibly wrong. I am equity rich in my home, investments, and flush with plenty of money sitting in cash. I have absolutely nothing to be scared of, and in fact, I am wishing prices would recede a bit for people I know who I want to see own property who can’t. Sad ad-hominem attack.

Mad Puppy, people like you have been posting “I’ve seen it back in 70s/80s/90s”, while ignoring fundamental differences in the economy and demographics. I’m arguing on here only because it is laughable how many times people on here have called for “The Crash (TM)” around the corner and ripped on SoCalJim, while prices have just climbed higher, and higher. Maybe one day they’ll be right.

Boston MSA is plus 280k in the last twenty years…

So, are people rushing to Boston?

Doesn’t look like it…

The more likely scenario is a circular churn of business/ industry retreading existing work force…

Higher paid people want to spend… median income City of Boston = 71k…

Nowhere else to build so prices for reasonable commute are going to rise with scarcity…

So yeah, probably not a bubble but an inflationary climb within the MSA…

Doesn’t make it immune from price decreases, though, if something happens to the economy there…

“As for Depth Charge, you’re incredibly wrong. I am equity rich in my home, investments, and flush with plenty of money sitting in cash.”

“Equity rich.” That’s why you’re scared, because deep down you know it can all disappear just like last time – WHICH IT WILL. Historically, house prices are 2x median yearly income. History is our guide.

Depth Charge,

Its so sad how bitter you are, really. Whether I’m equity rich in my house or not does not matter. Unless there’s a massive drop so large that we will have bigger problems across the US, I will be above water, paying less for a nice house than most renters on my ultra-low rate mortgage. My house is not an investment, it is a place to live. I do not need to touch retirement equities for nearly 30 years. I have enough in cash reserves for if/when there is a dip to either jump in and buy the dip, or sustain myself for multiple years if need be. Better to pay <$2k on my mortgage than be a sucker trying to make $3k+ on rent if I lost my job.

I am not the slightest bit scared, as I said before, I welcome a healthy drop, it will help some of my priced-out friends get homes in the area. You are simply bitter.

Keep waiting for house prices to return to this historical figure you keep talking about, and ignore demographics, increasing population, concentration into knowledge centers. Single family housing is unsustainable as long as our population grows. You're going to wait a long time.

COWG I think makes a more apt point. Reality is, as Socaljim notes there are much bigger issues to worry about if Boston's economy tanks. That means the world's leading industries will also tank. And even in that case, owning is still better than paying rent, which barely budged even in the depths of the GFC.

*Do you sell your largest hard asset in an inflationary environment?

*Do you sell your largest hard asset in an inflationary environment when the Fed continues to buy MBSs at rates well below that inflation? (essentially lending money to home buyers, long term well under inflation)

*Do you sell when the Fed doesnt LIFT A FINGER to stop the inflation?

The Fed has broken the real estate market…..mortgage rates are less than half of what rates were in lesser inflation eras of 1999 and 2006.

The buyers know it….and will take all they can get.

The sellers know it too. Like any illiquid market, the gaps between bids and offers widens.

Broken.

Who is advising the Fed on these MBS purchases? And is there a conflict of interest in partnering with outside entities that have direct interests in real estate?

It’s kind of a bifurcated outcome. Fed is fighting a deflationary outcome in asset prices with printed money and Zirp. Everyone seems to be on one side of the boat that assets are going to keep going up. Might not happen.

GFC and Fed response after covid tells you asset prices are very vulnerable.

“Fed is fighting a deflationary outcome in asset prices ”

Surely you jest.

The Fed is PROMOTING inflation….outright, blatantly and admittedly.

Stable Prices is their charge…and they ignore this.

Turing right in a car (promoting inflation) so you dont go left (deflation) is not a tactic that make sense. The Fed should stay in their lane (stable prices, moderate long term rates)

The fed wants people to believe that inflation and productive growth are the same thing. Making money sitting on a house adds nothing to productivity and doesn’t grow the economy. I assume they know this too, but at this point, who knows what they know.

Maybe pointing to the stock market and housing and saying, look how much they have grown, is the best they can do. Productive growth is something that will never come from the fed. I don’t understand why people expect it. They make nothing, innovate nothing.

FED are the smartest people and what they are doing are all deliberately and willfully.

People who think Fed works for common people are the naïve ones.

Seasonal

Everything sc7 says about Boston now was said about the Vancouver area circa 1980. I was offered twice what we paid for our place by a realtor a year after we bought it, and in less than another year, prices dropped 50% or more. 100% up and 50% down gets you right back where you started. The speed of the turn-a-round was breathtaking, and for those caught up in it, it was akin to catching a falling knife. The only parallel I can recall was the dot com blow out where friends lost much of their retirement nest egg after espousing similar views. You have to have lived through one/some of these experiences to fully understand it is never “different this time”. Good luck, sc7.

My Florida experience was similar to yours. Less than two years after purchasing, the house doubled. At the lowest point it was down 50% from the purchase price. The collapse was fast too. Our income disappeared in weeks along with our equity.

At the time, I had thought the market was ridiculously priced. But in truth, I never saw it coming. I thought any decline would be over time. I was wrong.

Not sure why you’re wishing me “good luck”. I am still far better off than a renter in a home with plenty of equity to sustain a drop (I’m living here with no intent to move), a rock-bottom mortgage rate, plenty of money in retirement accounts I won’t need to touch for 30 years, and a healthy amount of cash.

The visceral reaction from everyone to anyone who uses some data to disagree with the narrative here is really telling. It must be tiring being so bitter.

I don’t know who is bitter and who is not (or how you know), but I can tell you that it’s tiring seeing the word “bitter” over and over again in your comments. Relax, we’re all just guessing here.

Now somebody tell me when something real happens, like a falling knife. Then I’ll make some popcorn and ready the dry powder.

It’s tiring see people try to project bad things on me (and use incorrect assumptions about my situation) for just using facts that challenge the hivemind narrative. It seems no one really wants to debate here, they all just want to project doom, (and have been wrong year after year after year).

No one has been more consistently right than Socaljim, whom everyone loves to rip on.

sc7,

What we are trying to point out is that plenty of equity and cash may not save you, if you have no idea how bad things can get. I bought my house with 40% down, and we had 100K in savings too.

The equity went in in the first couple of months, so did our income, the savings lasted 2 years. We honestly thought things would improve much faster than they did, they didn’t. Eventually, we had to sell our wedding rings to eat and keep the lights on.

That’s how bad things can get. And we knew people who had it worse than us. And people who were totally untouched too. Before this happened to us, we thought like you, that we had prepared for a rainy day.

Petunia,

That’s a terrible story, I’m sorry you went through that. Doom can strike anyone, I could get in a car accident tomorrow and die, but I am about as well-insulated as I possibly can be from most likely financial scenarios. Sure I am not completely immune to the worst scenarios, but I never claimed I will be. I don’t see how I’d be any better off not owning. This is why I have always bought far below what I can afford “on paper”.

I point out “bitter” posters, because I simply make a counter-argument against the continued doom narrative (which has been wrong for years and years), and multiple posters made incorrect assumptions about my situation while knowing absolutely zero about the actual facts. Then when I retort them, they imply a wish for doom upon me. It is sad.