Repos are different from QE; they’re in-and-out transactions that don’t endlessly pile up, unlike QE.

By Wolf Richter for WOLF STREET.

The Fed today followed through on long discussions and announced the establishment of two standing repo facilities: A domestic Standing Repo Facility (SRF) and one for Foreign and International Monetary Authorities (FIMA repo facility). The minimum bid rate is set higher than the market for overnight interest rates, which will discourage counterparties from using the facilities unless pressures are driving the overnight rates higher. Initially, the minimum bid rate is 0.25%.

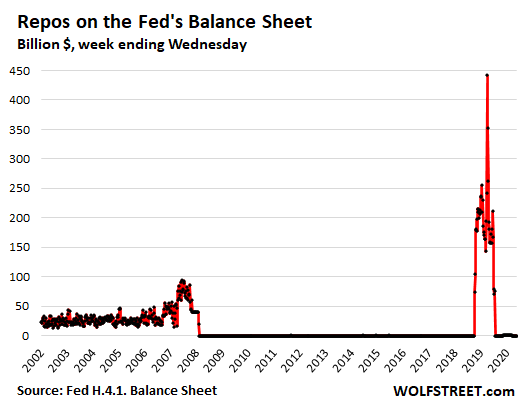

This is back to the future. The Fed had an SRF that it used for decades as part of its monetary policy tools and to provide instant liquidity to the market when the big S hit the fan, such as during 9/11 and during the early parts of the Financial Crisis – instead of QE. This facility nearly always carried a balance, but of varying amounts, and most of the time, fairly small amounts.

Repos (repurchase agreements) are in-and-out transactions where the Fed buys securities from a counterparty for cash with a contract to sell those securities back to the counterparty at the end of the term and take back its cash. At the time, repos were mostly “overnight” repos, maturing and unwinding the next business day, when the balance goes to zero. Then there might be a new repo of a different amount. What the Fed announced today are also overnight repos.

During a crisis, these repo amounts spiked. After the crisis, the balances fell, and during regular times, the amounts just wobbled along at relatively low levels. Unlike QE, they don’t keep piling up since they’re in-an-out transactions.

But when the Fed started QE during the Financial Crisis, it shut down its Standing Repo Facility.

Then, in September 2019, the repo market blew out – two years after the Fed had started shedding some of its QE assets. At that point, the Fed stepped back into the repo market in a big way until it calmed down in early January 2020.

But as the Fed was starting to wind down the repo balances in early 2020, suddenly all heck broke loose in the financial markets due to the pandemic, and even the Treasury market started going into convulsions, and the Fed opened up its repo vault until it got QE going.

In April 2020, with QE in full massive swing, the Fed raised the minimum bid rate for repos, making them less attractive, and the facility fell out of use, and balances went back to zero by July 2020:

Today’s announcement makes the existing repo facility permanent, and it adds some specifics. Bringing back the SRF is something the Fed has been talking about and writing about for years.

One of those papers was by the Federal Reserve Bank of St. Louis, in March 2019, “Why the Fed Should Create a Standing Repo Facility.” The third reason listed in the paper: The SRF would allow the Fed to reduce the assets on its balance sheet without causing the kinds of problems that suddenly cropped up six months later, September 2019, when the repo market blew out. Very prescient.

Today, in its back-to-the-future moment, the Fed said that the SRF “will serve as backstops in money markets to support the effective implementation of monetary policy and smooth market functioning.” And it allows the Fed to deal with the type of Treasury market convulsion that occurred in March 2020.

Repos are different from QE in that they’re in-and-out transactions. They don’t endlessly pile up, unlike QE. They’re used when the market needs liquidity and is willing to pay for it; otherwise they’re not used or little used.

Under the SFR announced today, the Fed offers to buy Treasury securities, government agency debt securities, and government-backed MBS on an overnight basis, totaling no more than $500 billion, from the primary dealers, later to be expanded to other large banks, at a minimum bid rate of 0.25% initially, which is “out of the money,” as Fed Chair Powell pointed out today.

Under the FIMA repo facility, the Fed offers to buy Treasury securities on an overnight basis from foreign central banks. This allows the foreign central banks to convert their Treasury holdings in custody at the New York Fed into dollar liquidity. The minimum bid rate is 0.25%, with a per counterparty limit of $60 billion. The statement said that this will “help address pressures in global dollar funding markets – the infamous “dollar shortage” – that could otherwise affect financial market conditions in the United States.”

In the future, obviously, the Fed can do whatever it wants. But this looks to me like an effort to get back to a situation where not every run-of-the mill crisis triggers more knee-jerk QE, one bout bigger than the previous one. And it looks to me like some form of preparation to make “balance sheet normalization” work out better next time than last time, which ended in the repo market blowout.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The fed released a paper earlier this year, “The Fed’s Discount Window in “Normal” Times”, basically showed how if the banks don’t over risk there is no need for an SRF. Very math heavy, not sure if that’s a fair summation on my part. Still, is a permanent SRF simply an easier pill to swallow than QE? It’s all YCC isn’t it?

The theme at my work (primary metals mfg) is price increases to our customers, now, or we are out of a job. Raw material costs have hit the point where they must be passed on. The interest rates are so fabricated at this point…it’s become an inflation and borrowing economy. I still fail to see how this creates maximum employment. The best we have to show for it is share buybacks for big tech.

Sticking to one of your points. The buck stops here was an old slogan. I think we will get a new one. The cost increase must be passed on down the line. The price and taxes must go up to support the system. Ugly cycle where things just get more and more expensive.

Dad taught me one rule from being in sales. Everything doubles in cost down the line. Item costs $1 to make it is sold for $2. Sold to distributor for $4. Sold to the consumer at $8. Everybody gets their cut to support the market.

See where you are coming from…but a lot of links on that supply chain ain’t adding 100% in value (to justify their 100% price markup).

Everything boils down to competitive pressure/leverage and you would think that the internet’s democratization of info would really batter a lot of those low-value-add intermediaries.

Perhaps it has…but I suspect a lot of BS remains to be wrung out of high inflation industries (homebuilding leaps to mind)

YCC???? Yield Curve Control?

Wolf – you should ban acronyms ………..

How about we call Yield Curve Control what it is? – Interest rate suppression. Pure money creation, to reward profligate insiders at the expense of prudent outsiders.

There were “Term Repos” of at LEAST 2 weeks in 2020. Are you sure these are all only overnight?

The Media always discusses this as Covid related, few articles mention, as this one does, that “Something” broke in late 2019.

Deutsch Bank Bankrupt? JPM losing depositor money on more bad bets?

Not to be snarky, but the Fed is all about the bucks starting there…

cl

Neat!

It’s good to see that the government has more than one tool other than QE to deal with problems that crop up.

Dealing with short-term timeframes allows greater flexibility in jolting the markets. Fiat currency is built for flexibility and short-term manipulations. Unlike gold or silver, which are blocky means of payment, the dollar bill can accommodate repos easily. That’s one advantage of working with known currencies.

There need to be more tools for central banks to deal with problems, tools that are not always debt-related. In the sense that repos allow you to come in and get out fast, similar tools could be picked up and dropped after just one usage.

The Fed needs to harness the power of the public purse. During World War I in Canada, Victory bonds were sold to finance the war effort. This was an example of the government reaching out to private citizens to get something pristine and public done. If common citizens can be tapped into, the government can begin to move a little away from its overbearing, dominant QE policy toward a more consensual approach for financial matters.

The key is to view the citizenry as a temporary stopgap aid to problems. Repos have an ephemeral quality to them, and this kind of timeframe is appealing when you’re dealing with common people. Turning over debt endlessly leads to bad problems and bad habits; it is short-term solutions that max out civil strength and general populace power.

My thinking is the Fed is coming to the conclusion that QE causes more problems than it solves. I have a feeling the genie is about to escape the bottle and the Fed needs a plan-B right now.

If Fed really thinks that qe causes more problems than it solves then they would start tapering keeping on mind mind blowing inflation numbers

The real inflation out there is 15 %

Tapering may cause more problems than QE if the goal is to keep the stock markets on the road to the moon.

Punishing People for Saving!!!

Intentionally promoting INFLATION (5% now)

Intentionally pegging interest rates at ZERO!

People are denied the American tradition of working, saving, thrift to get on their financial feet.

It’s time the Fed started taking care of the WORKING PEOPLE of this country!

Instead they give the People a 5% pay cut (inflation), as Powell worries about the unemployed when there are RECORD JOB OPENINGS! And Powell admits that COVID fears and child care and looking for different work is keeping unemployment high.

Wait a second. What does the Fed and zero interest rates do to assuage those problems?

Stop this insanity.

Catxman,

I am a common citizen. I have a retirement/investment portfolio. My securities in the portfolio are equities (stocks) and a diverse set of bond funds.

Please explain to me how the Fed can harness the power of my portfolio. I do not want to exchange my portfolio on a short term basis for a .25% yearly return — which is virtually zero on a short term transaction.

The 3 Year Treasury yield curve right now in .38%. I do not want to own, nor do I own this ‘safe haven’ for my cash; nor to I want to liquidate any of my holdings to do so.

And I’m not trying to to be glib or condescending in any manner in this inquiry, but I don’t know how any direct dealing this common citizen can have with the Fed would be in my best interest.

“A temporary stopgap to problems?” The problem is that the Fed has engineered it so I can’t park my cash in Treasury notes with any return back to me. Thirty years at a 1.90% return and inflation at a 5% future cost doesn’t appeal to me.

The wind will be from the north tomorrow in Minneapolis. I’ll be riding past the Federal Reserve headquarters along the west side of the Mississippi at noon. WolfStreet comment readers know what advice I’ll give to Chairman Kashkari as I pass by.

I’m a cyclist too, Dan. Please give KashNKarry my “best” as well.

Being from Joisey, I bet you can guess what that would be.

Happy Trails.

Dan Roming, It is not about you or the mom & pop investor.

Since you are not at the meal you are on the menu.

Well, if you are on the menu, you are definitely at the meal, no?

The Fed has one major tool which is to manipulate interest rates either directly or indirectly. In a way it’s fiscal policy as it takes income that would have been savers and transfers that to debtors without anyone voting on it.

I guess if we don’t like that we have to not save in the Fed system and buy precious metals, but that comes with the inconvenience of storage and price volatility.

As Hussman states the Fed has put a lot of cash into the market and have suppressed rates hoping that you will spend it like a hot potato. But I don’t like buying over priced assets so I will just hold onto it and eat the 5% inflation by better shopping. Maybe Stocks and housing have reached a permanently high plateau, but I doubt it.

IMO, the FED is dragging its feet to get a clear signal that the housing market has peaked and has entered a controlled descent. Wolf wrote an article recently that lays out that the $40B/mo MBS purchases are really like $80B. The FED has to let the housing market get into deceleration mode first before they start tapering, because they don’t want to be blamed for its acceleration when mortgage rates move up above 4% towards 5% as then taper their MBS purchases.

‘The Fed has to let the housing market get into deceleration mode first before they start tapering, because they don’t want to be blamed for its acceleration when mortgage rates move up above 4% towards 5% as then taper their MBS purchases.’

A mortgage rate towards 5 % will send the housing market into violent deacceleration

They can “harness the power” of citizens portfolios, but they will have to pay real market rates (i.e. not manipulated). You are then looking at yields in the 5-6% range at least based on inflation and/or government default risk.

5% inflation and the Fed says their are not even thinking of raising rates. Where is the outrage?

The working people of this country just took a 5% pay cut…..

and Powell is worried about the unemployment rate WITH RECORD JOB OPENINGS!

It’s time the Fed took care of the workers of this country by controlling prices with monetary policy rather than trying to get people off the couch because they are looking for better work, getting paid too much by the govt not to work.

No Fed policies will deal with that…and it is NO REASON TO KEEP RATES AT ZERO.

Powell is starting to look like a paid liar.

Yes, the lack of outrage is baffling. But people are probably more focused on getting free stuff and stimmies and never make the calculation what inflation actually costs them. And the MSM are playing nicely along… keeping people ignorant.

5% pay cut, after taxes. Wink Wink

“never make the calculation what inflation actually costs them”

Typically, the G frames intermediate goods/services providers for the inflation that the G creates (in order to paper over the G’s f-ups).

That is why the old MSM media oligopoly was in bed/so valuable to the G…it gave the illusion of there being a high profile gvt watchdog.

Hi Historicus. Well put. There is only one thing I would quibble with: Inflation is more than just a cut to your pay: True, a $50k income might buy you 5% (about $2.5k) less than last year (unless you are one of the lucky ones whose income kept up with inflation). But say you are someone who has been studiously building up a retirement nest egg, and you have managed to get to say $500k. That nest egg has been devalued by $25k, which is 50% of your income of $50k. So it’s more like you’ve been hit with a 50% tax. And you can expect the same tax next year and for the foreseeable future!

Dan,

NIRP and ZIRP did support your portfolio. Do you think index funds would be at ATH is rates were 16%?

Oh yeah it did. Dad & I sold our business eleven years ago and my portfolio has done quite nicely as a result of the Fed’s policies.

The only thing you can do is cut back, and how will that work out in a consumer driven society? There are no safe investment returns for the steady Eddies.

I have cash in the bank. Yesterday my wife told me I should replace my kayak. Today I got out the epoxy and mat and am fixing it better than it ever was. I wanted to buy that new kayak and I want to buy a new tractor, but instead replaced the clutch in the old one last week. Sitting on cash and waiting for a property to come up…..hopefully in a lower priced market. :-)

Catxman said:

“Its good to see the government has more than one tool other than QE”

“If common citizens can be tapped into”

________________________________________________

The thieves need less tools, not more – and its all money creation for insiders and interest rate suppression for the rest.

The common citizen has been thoroughly tapped into – through interest rate suppression and inflation. The common citizen is being bled by a parasitic system.

CB:

Right on target!

The common people are just getting the royal finger!

Thoroughly disgusting!

Insane psychopaths.

Thank you, Wolf. The fog is lifted a bit now.

I expect overnight repos to become 30, 60 and 90 days or more as it will become the preferred method to maintain same or more amount of liquidity in the system while winding down QE , so basically no changes to the amount of dollars being pumped.

Thinking these are the new form of life support for the world economy. Expect several other countries to adopt this similar approach. We tried what other countries have done with success. But this is like the type of discovery that happens during a war. Rapid growth and lessons learned at epic paces. Perhaps this is the solution that will stabilize everything

Giving them an ‘A’ for effort

Who said the FED ever wants to Stabilize things,unless,of course,someone is Making them want to Stabilize things.FED never cared about employment-thats just pretty talk for the plebes/those on the menu.My wuestion is this,How many Foreign counterparties will there be and from which countries=insights into their financial achiles tendons.Love to know which entities are in more serious trouble than their p.r. Lets on….hsbc???! :-)

Many countries like Europe

Give them an ‘F’ for what they deserve.

Yes, they already have extended to multi-weeks.

Wolf, my hat’s off to you. Every posting is an education in economics, even if they can be a bit rich (like this one). I’m pedaling as fast as I can!

My compliments and a big thanks!

This is utter insanity…IMO

“…overnight basis, totaling no more than $500 billion…”

They are able to move half a Trillion USD in/out of the system without so very little insight. That is a massive type of account to leverage to smooth out any future crisis. No questions asked I would assume. Approved by the US government

Yes, the magnitude of anything the Fed does is just mind-boggling.

$8.2T on their balance sheet and counting. If Congress passes $1.2T in mostly real infrastructure, $3.5 in fake / humane infrastructure and a $5T 2022 FY budget, the FED’s balance sheet will be at $12T by the end of 2022. Compared to $4.5T from 2015 to 2017, that is an mind-bobbling number. And this SFR had better be worth its salt for us to avoid the REPO market’s overnight jump to 10% in Sep. 2017. Wee doggy, we are in a world of hurt.

“…the FED’s balance sheet will be at $12T by the end of 2022.”

No, it won’t be. As you can tell from the super-low yields in the Treasury market, there is huge appetite in the market for US debt, including 10-year debt. This appetite drives down yield. The Fed doesn’t have to buy it. If the appetite for US 10-year debt vanishes at 1.3%, it’ll come back at 2% and then at 3% and then at 4%, etc. That’s what yield is all about.

Right now, investors are buying junk bonds at 3.3% yield. They would love to buy 10-year US Treasuries at 3.3% instead if they could. Yield solves all these issues.

What? You thought it was the president the one thst managed the economy?

Well…till the people don’t realize that Fiat Currency is worthless…at that point we’ll see the chaos!

QQ. Which currency in your opinion around the globe isn’t fiat at this time?

Quote: “QQ. Which currency in your opinion around the globe isn’t fiat at this time?”

Well…the eggs of my chickens, for example. The wheat. Anything you need to survive. everything else is kept up by trust. If I lose faith in money, the money ends up having value. If the trust in eggs ends, I will always be able to eat the eggs and survive.

they just create money at will …………….

no leverage necessary …………

and really no moving ……….. just creating and diluting

interest rate suppression and inflation

Just watched a documentary on National Geographic about a coming Seattle Mega Quake. Worst case scenario – 45K dead, 20-30 years to rebuild. The repair bill could top … $100B. At first I thought I misheard :) The series came out in 2020

Seems like a cheap parlor trick to see how many fools are out there that believe that the Fed can ever normalize rates. Bernanke to his credit just flat out lied about normalization.QE to infinity and purchasing power toward 0. Late stage fiat systems do not reverse. Fiat,by design, eventually eats out the substance of the people.

hmmm, seems like Jedi-master Powell’s jawboning is working on you too Wolf? Say it ain’t so :P

“In the future, obviously, the Fed can do whatever it wants. But this looks to me like an effort to get back to a situation where not every run-of-the mill crisis triggers more knee-jerk QE, one bout bigger than the previous one. And it looks to me like some form of preparation to make “balance sheet normalization” work out better next time than last time, which ended in the repo market blowout.”

The FIRE next time.

“Under the SFR announced today, the Fed offers to buy Treasury securities, government agency debt securities, and government-backed MBS on an overnight basis, totaling no more than $500 billion,”

One can safely assume that $500 billion is a moving target depending on the extent of the crisis and the scramble for cash.

There are not many people out there that understand the repo market like Jeff Snider. Perhaps a collaboration with Jeff and the Wolf on this topic?

I am still looking for Jeff Snider to define what bank reserves are.

cb,

I’ll tell you what reserves are: cash that the banks deposit at the Fed and earn interest on (0.15% currently). The banks don’t call them “reserves” on their balance sheet, they call them “cash” or “cash equivalent” with a tag “interest earning.” They’re “reserves” only in Fed lingo, not in bank lingo. When you see a chart of “reserves,” it’s always the Fed’s liability account for cash that banks deposit at the Fed, and that the Fed owes the banks.

Thank you. Are reserves only cash, or can they be held in the form of Treasuries?

“… can they be held in the form of Treasuries?”

No. Reserves are cash (in the electronic sense, not paper sense) that banks put on deposit at the Fed.

Thanks for taking a position on this. There are a few gurus out there that have made bank reserves a hot topic. There is also a great deal of confusion on the subject. One of the gurus, Brent Johnson of Santiago Capital and author of the dollar Milkshake theory claims “bank reserves are not cash.”

I’ve tried to explore his position through tweets, but no response. Typical. I’ve yet to see Jeff Snider, Brent Johnson or George Gammon define what bank reserves are, though quick to tell you what they aren’t with the implication being that bank reserve by themselves are largely impotent as to inflation unless they are lent out as loans.

I say BS. There isn’t even a reserve requirement anymore.

Thanks again. And thanks for clarifying that they may not be “cash” as some pedantic hair-splitter would define cash, but they certainly are digital dollars.

All they need to do is go to a bank balance sheet and look at the top line of the asset column. It’s all there, as I described. When a bank puts this cash on deposit at the Fed, it becomes “reserves” for the Fed and remains “cash” for the bank, but now its “interest-earning cash or cash equivalent,” or something like that. It’s really very basic. There is no mystery to it.

@ Wolf –

Brent Johnson, the “Milkshake Man”, just provided the following explanation of what bank reserves are:

“They are a liability of the Fed that has been credited to the commercial banks accounts at the Fed. These balances can be transferred back and forth between commercial banks but they cannot leave the Fed and enter the real economy.”

My follow up question to Brent was:

“Thank you. They were credited to the commercial bank accounts at the Fed in exchange for what?”

That’s exactly what I have been saying. His statement is from the Fed’s point of view. The banks put their cash on deposit at the Fed (an asset for the banks, a liability for the Fed), which then the Fed calls reserves (a liability on its books, money that it owes the banks), and the banks still call it cash (asset).

“they were credited to the commercial bank accounts at the Fed in exchange for what?”

I told you this already a bunch of times: in exchange for cash!

@ Wolf –

Brents response: “In exchange for treasury bonds. It is a liability swap.”

My response: “Much appreciated. I am not following the liability swap aspect. Am I wrong in my thinking that the treasury bonds were an asset of the bank?”

His answer is BS.

It’s really not a good idea to try to get answers on complex bank accounting from Twitter in 240 characters. And it’s not a good idea to get the answers in the comments. And this is my last response on this topic.

Separately but related:

Banks can, and do, buy (actually borrow) paper-dollars (“Federal Reserve Notes”) from the Fed. There are about $2 trillion out there. Banks pay for those paper-dollars with securities (post collateral), such as Treasuries or other.

Primary dealers also sell securities to the Fed as part of QE, and the Fed pays them cash for those by crediting their reserve account, where this cash is then instantly available for withdrawal to be plowed into other securities or assets (which is one of the mechanisms of how QE pushes up asset prices).

This may be your last response, but recognize that less than 1 in 100,000 people have a grasp on the truth of this subject. This is an area full of misinformation. Many accoladed “experts” on the subject, I suspect don’t have a true grasp. It is important to understand what bank reserves are and how they work and what limitations and uses they have.

I have such faith in your comprehension, memory and intelligence that my default position is to give you the benefit of the doubt. The quest to solidify facts is an ongoing process.

Wolf said: “Separately but related:

Banks can, and do, buy (actually borrow) paper-dollars (“Federal Reserve Notes”) from the Fed. There are about $2 trillion out there. Banks pay for those paper-dollars with securities (post collateral), such as Treasuries or other.”

——————————————-

Can’t banks just withdraw some of their FED held bank reserves as cash? Whatever portion that they, particularly as there is no longer a reserve requirement?

Reserves are the banks’ most liquid instantly accessible interest-earning asset, more liquid than Treasuries. There is no trade involved. Currently, reserves yield more than Treasury bills. There are all kinds of considerations here. But yes, in theory, a bank could post cash (reserves) as collateral, but why would they? They will post as collateral the least liquid and lowest-rated asset that the Fed accepts, which could all kinds of securities.

If Jeff Snider doesn’t get neither do I. The money starts out as a liability – the Fed borrows the collateral to buy a Treasury bond – from themselves – and the cash from that collateral/liability turns into reserve assets on the bank side? – so the banks dont’ really own the money – like customer portfolios they use for leverage – the Fed keeps rolling over bonds it QEed onto its balance sheet, like rolling repos over only much longer and slower – the intended purpose of the money is for bank loans but there is way more than anyone needs because the implied purpose of all this is to stimulate growth. The money gets parked in MM funds, and the banks cannot pay the interest so they use the cash reserves to buy treasuries, through the REPO window, at least temporarily being the agent which monetizes US debt. The taxpayers are buying their own debt. Which is how you hope the system would work without the kabuki. As Wolf says there are more than enough bond buyers waiting. However with excess liquidity the fear of a liquidity trap, and the Fed losing control of the money system is a real problem. The real solution is to shrink the money supply. That has historical consequences once the process begins.

If the bank owned the Treasury Bill/Bond purchased from them by the FED, then why would the bank not own the purchase money?

What happens to your mortgage when your lender files Ch11? You don’t own the house. The Fed is puzzled why 10yr yields are dropping. All those bonds bought on the cuff don’t need to exist. Banks don’t really own anything. They have other peoples money they manage for a fee. They take a lot of liberties with that money, which is property of the US government. When banks actually own property is when they are really in trouble.

Ambrose Bierce said: ” What happens to your mortgage when your lender files Ch11? You don’t own the house.”

____________________________

I contend that my lender going bankrupt in no way affects whether or not I own the house.

cb,

Correct.

My lender went bankrupt (local bank in Tulsa back in the late 1980s). And the FDIC, which took over the lender, sold the mortgage to a mortgage firm, and I made my payments to a new address. In essence, nothing happened. Over the years, my mortgage was sold three times.

A mortgage is a valuable income producing asset on a bank’s books. If the housing market collapses, and the borrower defaults, the lender forecloses on the house and sells it. So the mortgage was replaced by a house which was replaced by cash. A mortgage’s value practically never goes to zero, even in the worst of times (unless there is fraud and the collateral doesn’t exist). So it nearly always has at least some value. The lender might still take a big loss on the mortgage, but nearly always recoups much of the value. It’s always an asset, and it can be sold to another bank or investors – perhaps at a discount – or it can be securitized with other mortgages into MBS.

I was thinking that it would be good for the hard money crowd to run a press conference right after the Fed and make their case with the argument about how easy money got us into this mess.

Let reporters ask questions and give precise, clear answers unlike the Fed’s mumbo jumbo language that is like the teenager saying I am going somewhere and will be home sometime tonight or maybe tomorrow.

Proclaim Fed is saying it’s not worried about inflation being sticky, so you better take some money out of the bank and buy gold. At least buying gold gives a blue color guy a job digging gold out of the ground instead of an investment banker trying to sell a pig in a poke aka spac.

I would pay $5 to have Key and Peele do a debrief after the next Fed press conference. “Luther” has got to be present. That would be golden to say what he meant to say was….

We all deserve a cheap laugh at the expense of the mega elite 1%

Ha,I miss them!!!! :-) Exactly right!Luther,Luther,Luther!! :-) Pretty sure nobody these days can claim to laugh enough,everything soooooo serious

Old…

Seems the questions yesterday were limp. And the answers more limp.

1. If you say the unemployed are looking for other jobs, are being paid generously to not work, and have COVID and child care issues…..

HOW WILL KEEPING INTEREST RATES AT ZERO solve those issues?

2. Did you ever save money? Did your parents save money? What do you tell the people today that “save their money”? How can you remove the fundamental of our society, hard working, saving and thrift as the keys to getting on your “financial feet”? You promote inflation, and keep rates at zero,. Some say intentional theft…your answer please.

3. You say inflation is transitory and due to bottlenecks. How long, at what point in time will the persistence of this inflation make you say, “we were wrong”? 3 Months, 12 months?

4. Why the complete disregard, with this dual mandate game, of the third mandate..the one you constantly ignore…”promote moderate long term interest rates”? Moderate means “not extreme”…and we have had EXTREMELY LOW, record low long rates for 12 years. The wisdom of this mandate, in part, is to prevent irresponsible debt creation that pulls wealth forward from future generations while piling on debt to that same generation. What say you Jay Powell?

5. How does “stable prices” translate to your 2% (22% off the dollar in ten years) target?

6. What is your relationship with Blackrock, and what are the limits of that relationship?

I Invite other questions for the Fed Chairman…

The questions to Powell were very soft ball and disappointing, pretty much the way it is with the ECB. It’s unbelievable that the Fed can get away with such non answers about inflation and tapering.

It is time for the Fed to “take care of the workers, earners, and savers” and less time on trying to entice the idle back to work…

just an excuse to keep interest rates zero.

Questions pretty much the same way to politicians at election time. Ask the right questions media, or be black-balled.

Historicus. We do have a debt problem. We have too much private debt, because our ‘investment’ structure is dominated by lending, which creates spending and debt. Rather than currency. We also use unnecessary debt at the public level, the government level. QE was an example of that. And yes, it does not work very well. The real problem lies in our neoliberal macroeconomics. It is full of fantasies. Unreal. We need to elect people to Congress who understand our national finances. Therein lies the problem. Ignorance. The FED is not the right institution. Congress is.

Simple we are going to global system of digital money total control never worked

historicus, I completely agree with you that the Fed has totally screwed the conservative saver who prefers to put their cash in an FDIC-insured bank account as opposed to riskier investments. But I think the Fed’s response would be “We’ve printed trillions in order to pump up a stock market into which you could have invested your cash savings and received handsome returns.” Of course, they’d be ignoring the possibility of another Dot.com bubble burst or GFC event that set back many investors years in achieving decent returns. And they’d be ignoring the fact that many 65+ year-old savers can’t afford years to recover from such events.

historicus,

I don’t think of inflation as stealing my money anymore. I just think of it as saving at slower pace. :-) I’m somewhat serious because I can’t let go of the values my parents gave me/us. It might be an idiotic POV, but it has worked for me and still limps along.

A person could throw up their hands in defeat and go buy stuff, but that could lose value as well. Even though returns suck, I still have my money. And if this tanks the price of assets might well be reduced; those assets that people are acquiring right now. It’s kind of like the guy driving around in the leased Merc pretending he owns it…..living like he owns it. We all know people who do this, (without mentioning those names that will force me on to Moderation Island for the day).

@ Paulo –

Respectfully,

It is stealing your purchasing power, and from some it steals the opportunity to get ahead.

Repo and Reverse Repo are 2 hamster wheels running in the opposite directions.

Yep

What tangled webs we weave….

Jerome Powell….

Along with our responsibilities to promote the stability of the financial system.

Nope, not mandated by Congress and the financial media lets it slide into oblivion.

“The Fed Policy actions have been guided by our mandate to promote maximum employment and stable prices for the American people….

Along with our responsibilities to promote the stability of the financial system.”

Jerome Powell, Federal Reserve Chair…

Government agencies assigning themselves rights, responsibilities, rules, etc…

We the people, HA!…You the subject…

Why is the THIRD MANDATE always carved out of discussions?

“promote moderate long term interest rates.”

Answer: Because the Fed is in stark violation of this mandate just like the stable prices mandate.

Moderate = “not extreme”, and the wisdom to this mandate is to prevent the dropping of long rates to “immoderately low” levels, thus allowing massive debt creation which would pull wealth from future generations and burden them with that massive debt. Sound familiar?

And not a question from any “panelist” about this violation. But, they cant even see the violation of the second mandate “promote stable prices” as the Fed Chair boasts of some newly conceded 2% inflation goal…which rips at least 22% off the dollar in ten years….and that’s “stable prices”?

Evidently promoting financial stability is code words for supporting stick market when prices fall too far just as if it’s a Mississippi stock certificate.

I had another idea admittedly stolen from Black Lives Matter. Someone should get a permit to paint ‘Savers Lives Matter” in big yellow letters in front of Fed HQ.

Also, a statue would be nice in front of Fed HQ honoring the world’s first Central banker John Law and how he screwed the French people.

If I was retired, I would head over to the Eccles building and walk around with various signs, castigating the FED. Not sure if the area’s “vibrant,” though. Might be a dangerous proposition.

George

“Nope, not mandated by Congress…”

I’m not so sure that the Fed is single handedly in control of the nation’s money supply ….. like when M2 rises 27% in less that a year…

I am certain the Fed is not mandated to TAX, ie promote inflation, on the People of this nation.

The Constitution is clear. Minting, and this would include “digital minting” and taxation are Congressional powers and may not be delegated. And Congress must answer to voters.

How would a 2% annual tax on the holders of dollars do in Congress…and with the voters?

What we have is taxation without representation…..ring a bell?

I would like to believe the FED is not here to destroy America… but since the meltdown in 2008, it seems they have been trying to stay ahead of reaper. Throughout history, no social order has been fair and equal. There has always been the wealthy and the poor. And the wealthy have always had more power. There is no use in complaining about the power of the wealthy… it is what it is. But for a golden moment in history, America created a strong middle class and innovation and prosperity flows from that middle class. Today, America’s wealthy need the middle class and therefore, I would think the FED’s mission would be to protect the middle class as best as they can. Maybe that’s what’s going on here.

This might be why there’s 7 million disillusioned that refuse to go back to work. They’ve given up trying to fight it.

The FEDs mission is to protect the banker class

Happy talk about freedom and equality rings hollow in a society organized as a hierarchy, the very definition of inequality by design.

Is hierarchy the only possible design for a complex human society? Dear Leaders want us to believe there is no alternative. Certainly, the wealthy need the rest of us, just like ticks need deer and moose to survive.

Do workers need parasites to suck their blood? So far, only people with hemochromatosis (iron overload) benefit from leeches. The rest of us would benefit from an effective leech and tick removal program.

All this whimpering about economic inequality in America’s “rigged game”… But where did Henry Ford come from? Where did Carnegie and Thomas Edison rise up from? They were all products of the working class.

I know… these examples are ancient history…

But where did Bezos come from or Bill Gates or Steve Jobs? All products of the American Middle Class. All common Americans with a vision and the tenacity and resolve to make it real… and of course some luck and providence mixed in.

So, this game we find ourselves in can be won in both small and magnificent ways. But it will not be won by our moaning and outrage. It took me quite a few decades to figure this out. Now, I can only wish I knew this sooner. I hope my observations may help some younger folks so they can get an earlier start and win big.

NotDeadYet,

Yes, cite the examples that became immensely rich at the expense of the hundreds of millions of people who, despite their “tenacity and resolve,” got run over in the process. That’s what the American dream is all about. Don’t be shy about it.

They are panicking and obviously feel the need to “do something” no matter how dumb it is.

So they are accepting MBS now. Hmmmmm……. Does anybody smell a rat there ? The Big Short reloaded ? So if any of the banks need to get rid of the dog shit on their balance sheets – the FED is there for the rescue.

And the foreign repo facility – the world is awash in yankee dollars from Uncle Joe’s stimmi checks. They don’t know what to do with’em. And now the FED offers them even more ?

Panic.

I am beginning to believe it’s as simple as when the real economy is too weak to pay the real interest on debt, the Fed has to step in a get rates down to a serviceable amount. It’s a bad sign.

@ Old School –

Believe it. It’s true.

The most ibvious answer is generally the best answer, all lying and mumbo-jumbo aside.

I think of it just slightly differently.

“The Fed has to step in a get rates down to a serviceable amount” not for the real economy but so the federal government can pay interest on the federal debt.

“So they are accepting MBS now.””

They’ve accepted MBS for repos since Sep 2019. These are all government guaranteed or government issued MBS (Fannie, Freddie, Ginnie, etc.).

Then why make it news ?

So now even the government backed Mortgage brokers can join the money printing circus. Swell.

What’s new is that the emergency repo facility, which has been active sine 2019, was turned into a permanent repo facility, just like it was before 2008.

It is what it is, Wolf. Shy has nothing to do with it. Have we as a people benefited from the innovation of those titan sons of the working class I mentioned?

I would say yes. Here you and I are electronically communicating on a vast infrastructure rooted in the effort, innovation and drive of those people. Do some people get run over? Sure… with Edison’s affordable electricity, the whalers were not needed to fuel whale oil lamps. With Ford’s affordable cars, blacksmiths and horse stables quickly vanished. And look what affordable refrigerators did to the ice block businesses. Things are in constant flux, Wolf. Rather than curse the darkness, I think we need to light a candle and instead of being “run over”, perhaps we should learn to be a little nimble.

I’ll leave you with this: I had a friend who was a West Point Graduate and enjoyed a long, successful military career. I asked him the secret to his success and he answered, “When the elephants dance, get off of the ballroom floor”. btw, thanks for your efforts here. I find the articles and comments much more balanced and informative than other sources.

After times when banks became insolvent, banks are required to keep a certain amount of overnight reserves to make sure they have enough liquidity to start the next day. During the 2008-2015 foreclosure crisis 500 banks failed due to the poor quality of loans they underwrote. There were loans written without proof of income or assets. People were going all in on real estate until the builders built too many homes. Close to the peak of the foreclosure crisis, condos in Florida were sold for $50k.

I have heard multiple times and from multiple people that the thing that saved the system during GFC was eliminating the mark to market rule for certain assets held by the banks. Seems crazy that pencil whipping a balance sheet is all it took.

@ Old School –

Wrong. That is part of what RUINED the system. Other parts were bailing out preferred parties by buying there bad assets and suppressing interest rates to bail out overleveraged investors. They just created a bunch of new money to “paper over” the problem of too much debt created money in the first place. And who gets bailed out – insiders and the imprudent over extended borrowers and investors at the root.

The wealthy who had deposits over $100,000 (FDIC insurance limit back then) withdrew their deposits as banks started going down like dominoes. The government recapitalized bankrupt banks making bank mergers possible. Rather than deal with hundreds of small banks, it was easier for the government to deal with a few large ones.

Old School:

“When the capital development of a country becomes a by-product of a casino, the job is likely to be ill-done,” JM Keynes.

The fed has taken over the repo market to suppress interest rates. They are offering a permanent place to get cheap money to keep real interest rates from being revealed in a real repo market. This cheap borrowing facility will destroy the ability of repo lending outside of the fed ecosystem.

The fed is clearly signalling that they cannot allow interest rates to rise, no matter how many real markets they have to destroy. BTW, I didn’t bother listening to the announcement, because they are only formalizing what they are already doing.

It’s funny that for all the Phds at the Fed they don’t believe in a market price for money. I assume they believe if you control the price of money you can improve the functioning of the economy.

I thought a basic truth of economics is that price controls leads to shortages, in this case a shortage of real savings aka real investment. Maybe they need an online university to teach us Fed economics.

@ Petunia –

Concise and correct!

(and they will continue to buy garbage off of insiders — QE, or whatever the choose to call it)

But this cheap money the Fed is offering is more expensive than the market money under most conditions. So counterparties will have to pay a premium to get it. What it does do is when there is a mini panic in the short-term funding market, it keeps it in check.

Options :

Stimulate the economy, suppress rates, or DOW 10K.

Wolf,

I’m sorry I have to disagree with you about the fed money being more expensive to borrow. Everything about the credit markets is now fake, due to fed manipulation. If they weren’t afraid of real rates they wouldn’t have killed the independent repo market.

My conservative estimate, based on being around this crap for so long, is real overnight rates 10X higher.

Petunia,

“Everything about the credit markets is now fake, due to fed manipulation.”

We totally agree!!

But within that fake manipulated market, the Fed’s repo money is more expensive than the fake manipulated market rates — that’s the better way of saying it :-]

Yes, but the backstop allows to be wild risk takers and leveragers. It skews the system in favor of insiders.

A repo man spends his life getting into tense situations.

“Their sh*t’s scared, they know I’m not a cop”

“Don’t care how long it takes, d*ldos! Repo Man’s got all night, every night.”

“…what’s in the trunk?…”

“…ohhhh, you don’t want to look in there…”

may we all find a better day.

Bringing back SRF is a good thing. I am a little foggy on the history, but I recall when the SRF was tossed out there was a guy, forget his name, that warned against doing this. It was either after an administration change or it was after a Fed chair change. It was totally boneheaded thing to do and there were many critics. Bringing back the SRF will fix a lot of problems that have been gumming up the Fed’s machinery and actually may reduce the chances of increasing QE during a crises. I am not condoning Fed QE actions, just pointing out the the SRF existed way before QE was even a concept.

Fed repos always existed in the past, but it was a last resort form of borrowing for those who could not borrow in the normal repo market.

In the past, doing a fed repo was considered the walk of shame for the member bank. It was a signal the bank was in trouble and everybody knew it. While the facility existed, it was rarely used for this reason.

Hope JP takes off his silk underware

Hope Putin f his az.

T-bills being used as collateral by Wall Street and rehypothicated several times over in the banking system is a mystery to me. I expect to learn all about it when hedge funds start blowing up like Lehman Brothers.

1) Sept 11 2019 in China.

2) USD/CNY weekly gap up twice in Aug 2019, reaching a peak @7.18.

3) There were a lot of selling in Sept 2019. Selling means dollar short.

4) The deflating USD/CNY means troubles. A financial virus.

5) Xi shut down Wuhan.

7) Selling USD/CNY means troubles. It’s not about taking profit, or

inflation, it means dollar short.

8) Currently repo at zero, but when SOFR minus FEDRATE rise, troubles

start and the Fed will not catch up. The FEDRATE pipeline is

too narrow for the next storm.

9) Raising FEDRATE upper bound isn’t about inflation, it’s a defensive option.

1. old wine in new bottle. repo or reverse repo is just another name for the financial aid for the irresponsible players and punishing the good.

2. QE is the mother of all problems. Money printing the father. Repo is the son. Reverse repo is the sistah.

3. This little family has cousins like housing inflation and stock market growth. Everyone is doing fine.

I like your style. I have been thinking about creating a graphic like the cave man progressing to modern man in about six steps, but instead showing the central bank progression from John Law with stock certificate to Greenspan with Tech bubble to Bernanke with housing bubble to Powell with Covid bubble. Could be some fun graphics.

OS

You’ll dig the intro for ‘The Big Bang Theory’ where the guy starts as a fish, slithers onto the shore, stands up, starts to walk with a club, gets a mobile phone, trips as click bait and falls back into the sea.

30secs, brilliant to music.

“The need for a monetary authority to act as LLR arises in the case of a banking panic – a widespread attempt by the public to convert deposits into currency and, in response, an attempt by commercial banks to raise their desired reserve-deposit ratios. Banking panics can occur in a fractional reserve banking system when a bank failure or series of failures produces bank runs which in turn become contagious, threatening the solvency of otherwise sound banks.”

Taken from page one of the following link:

https://www.richmondfed.org/~/media/richmondfedorg/publications/research/economic_review/1990/pdf/er760103.pdf

All of these programs are for one reason: prevent a substantial contraction in credit that leads to cascading defaults. That is ultimately the reason given by advocates who wanted to establish the Fed after panics in late 1800s and early 1900s. The nominal numbers have grown to the Trillions, but the principle has been the same since inception.

QE was, and is, effectively lender of last resort. REPOs are a means to hopefully avoid having to do QE. That’s the theory, but in practice….

So here’s my question. Is the current use of QE any different from MMT? My point is that Congress is passing such large deficit expenditures that the FED is basically having to pick up the slack that foreign governments and investors can’t buy. I would like for the FED to produce a simple graph that shows all the sources of bond purchases over time: FED, US investors, US banks & foreign investors & banks. I would have to imagine that in the last 18 months, the FEDs % of these purchases has risen dramatically. China’s holding are slowing going down with Japan raising theirs.

Again, the only difference between today and MMT of the future is that the FED hasn’t been officially absorbed by Congress. Either way, we’re knee deep in MMT waiting on inflation to flare up so badly that Congress has to raise taxes to get rid of all the excess money in the system. Or the FED raises short-term interest rates dramatically. As expected, good luck with that!

Oh and well educated at that lengthy spike in treasury rates (i.e., insolvency that radically reduces demand for treasuries) would be nice. Thanks1

The money stock can never be properly managed by any attempt to control the cost of credit.

Care to elaborate?

Do you earn less than $1,000,000 a year? then shut up !!!, do as your betters tell you and believe it, clear??.

That’s a bit of an indictment of QE in general, and hopefully we will avoid “knee-jerk QE” in the next crisis.

Which means, without knee-jerk QE during the next recession, the “FED put” will be less, and government stimulus will be more.

Where is government going to get the money for stimulus if the Fed doesn’t monetize it?

Treasury could print it themselves. They don’t need the Federal Reserve to monetize it.

This is what Kennedy did back in 1963. I don’t know if you remember the $2 $5 and $100 banknotes with red serial numbers and seals. But I remember them from when I was much younger. I believe they were called “United States Banknotes”.

There are even some silly conspiracy theories out there that claim this is why Kennedy was assassinated—the bankers did not want competition for their green seal FRN banknotes..

1) CCL (Carnival Cruz) is a cost center do nothing all day.

2) In the seventies the airlines went bk.

3) In the 70’s/80’s shipping co, transporting frozen food, fish, or cows

from Argentina & Australia went bk. Volume was down, sailors & energy up. The unionized stevedores pandemic strikes.

4) In the seventies commodities traders went out of business. After the closure of the Suez canal and ARAMCO oil embargo,

commodities went wild. Soybeans & Wheat importers didn’t have enough capital to finance the commodities tsunami. The banks refused to lend.

5) In the early eighties Voltaire saved the banks. Mortgage rates plunged.

Once the “Everything Bubble” bursts, we can only hope the Fed launches a new “Stock Equity Reverse Repo” with 30 year terms, as with the entire planet long now, who else is going to buy all this hyper-inflated equity paper???

Note the Rydex bear/bull ratio at all time low versus SP500 Chart per NorthmanTrader:

https://pbs.twimg.com/media/E7dZ1HcWQAUMDZw?format=png&name=medium

So, what risks do the big banks take to earn tens of billions of profits like big tech companies?

It seems they can get mortgage guarantees, repo facility, emergency bailout money, etc., for any reason whatsoever, so where does the risk come in?

In a well-functioning market, you should have to take a big risk and make a big investment to make big profits.

Zuk buy JPM.

Having difficulty seeing that these two repo facilities accomplish a great deal in terms of addressing what I think is the underlying issue: a shortage of U.S. T-Bills collateral for repo financing in the eurodollar market.

This repo collateral shortage is in large part due to the Fed’s own purchases of Treasuries at $80 billion per month plus portfolio runoff under their ongoing QE program, which Powell said at his post-FOMC presser yesterday are not being reduced. Furthermore, I believe the Fed has already been providing repo funding in quantity. But maybe I’m missing something here?

Fixed income money managers use repo heavily. The most common trade we did was buy Treasury notes or bonds, then repo them out. The repo was rolled over and over to make the cash available for a long term investment. Usually, the cash was invested in MBS, ABS, CMBS, something along those lines.

In effect, the repo allows fixed income managers to take over the MBS buying activity fron the FED. That is what is going on here.

A little more … this works because most existing MBS, ABS, CMBS are premium because their coupon is much higher than today’s rate. What this means is most existing MBS, ABS, CMBS securities/pools are short duration because of loan refinancing. So, money managers borrow at repo rates lower than the expected yield on most MBS, ABS, CMBS … so, money managers get paid to take over what the FED is doing without adding much duration to their portfolio.

So come on man, tell the really interesting part:

“The most common trade we did was buy Treasury notes or bonds, then repo them out”

How often did you re-re-repo a treasury out ? ten times ? twenty times ? How often did your counterparties re-repo that same treasury out because they thought they were a bunch of Einsteins just like you guys ?

Got gold ?

Actually, what stops you from re-re-repoing a treasury out is duration risk. Why? Because the duration risk of the treasury you repo out stays on your portfolio. If you repo out a treasury, then use the cash to repo out another treasury, your duration risk doubles if the treasury issues are simular. When you run a fixed income portfolio, you have duration limits that you have to stay within.

Now, when it comes to premium MBS, the duration risk is small, and you can take some of that on after a repo without blowing out your portfolio duration. However, they add convexity risk to the portfolio, so you can only go so far with that trade.

“Under the FIMA repo facility, the Fed offers to buy Treasury securities on an overnight basis from foreign central banks. This allows the foreign central banks to convert their Treasury holdings in custody at the New York Fed into dollar liquidity. The minimum bid rate is 0.25%, with a per counterparty limit of $60 billion.

What exactly is the “bid rate”? Is it something that somebody pays somebody else (sounds like it) and, if so, who is paying whom?

What exactly does the term “counterparty limit” mean? Whatever it means, is it possible that that limit will/could be raised to, say, $600 billion or even more, or is that literally an impossibility or doing that would simply make no practical sense?

Thanks, Wolf.

Ishkabibble,

The bid rate is the minimum interest rate (APR) that the Fed charges for giving out cash via repos. A repo is a sale with a subsequent repurchase of the sold item on fixed date. It is essentially a loan backed by collateral. So the Fed effectively lends out cash at 0.25% APR overnight, and gets securities as collateral.

So, on July 29, 2021, central bank X “sells” the Federal Reserve $60 billion of its “treasury securities” for $60 billion USD “cash”. Literally one day later, on July 30, 2021, central bank X pays the Fed $60 billion, PLUS $150 million “interest” for $60 billion in treasury securities, correct?

Continuously rolling over debt is not paying anything back so they already have the benefit of MMT. Once more, recently pawning the national debt has been taking place, more MMT but with the sick twist only an unsound currency could get away with. This cash raising scheme involves the Fed now taking the assets it bought with borrowed money, and pledging them as collateral to borrow the money to fund still more of the national debt. Perfect and instead of us refusing their script, some argue about who will next lead this openly corrupt Ponzi institution. This is the end game so yes, it’s MMT on forward.

The interest rate of 0.25% is annual percentage. So for a 24 hour repo, the interest on $60 billion = .25/365*$60 billion = 41 million.

Gotta get that “J-Pow We Got This ! Money Makin’ Machine! Downturns NO Longer Tolerated!” merch out, commemorative t-shirts, mugs, blankies….it’s a brand new day in ‘Merica. “We Got This!”

This feels like 3-card monte deal. The FED is hiding the money from the marks.

Just like we withdraw trops from Someistan, but, there is always some troops left behind.

The yellow dog is howling at the moon.

Because that’s where it will go: to the moon.

Thank you, Jay Powell. You have made it worth the wait.

Patience uktimately pays.

The FED has figured out a way to justify ever increasing amounts of stimulus which benefit the wealthy at the expense of the working class and poor, under the guise of attempting to help the latter.

“smooth market functioning”

A shock absorber. I think we sussed that a while back at the normal RR stage, if I recall correctly. Memory again.

In philosophical terms, it’s extraordinary the lengths that humans go to, to obfuscate their activities from public scrutiny on any easy to comprehend level.

Has the 3 cup trick now morphed into a 4 cup trick?

Wait for the next enhancement of the ‘Game’

I’ve forgotten where I am, do I mean Covid no it’s Inflation here isn’t it ?

I read just now the NY Fed announced the first ever $1 T Reverse Repo facility for overnight keeping at .05%. Will there be a stampede?

Can someone in laymen terms….explain exactly what the Repo Market does for those who use it….under what circumstances do they go “Oh, we need to go here”. To access the repo market they sell their cash like securities for cash and simply by them back the next morning? …and they do this for an interest rate? Is that the entire basics? And this provides them VERY short term liquidity?