Stimulus and bailouts had a huge impact, for those that got them, and for those that didn’t.

By Wolf Richter for WOLF STREET.

In the world of struggling businesses, debt defaults, bankruptcies, and closures, there is now a clear dividing line.

On one side are those businesses that got bailed out by the government, whether they needed it or not, such as the $25 billion in grants and loans for a handful of airlines, or the $525 billion in PPP loans handed to 5.2 million business entities, from minuscule to large, and some fraudulent. On the same side are businesses with access to the capital markets that got bailed out by the Fed whose corporate bond buying programs drove credit markets into frenzy, eager to fund nearly anything.

But on the other side, are those businesses who didn’t get any of this – neither from the government, nor from the Fed, nor from the frenzied credit markets; and those businesses, often already limping for a while, got run over by the Pandemic.

In terms of publicly traded companies.

In September, another 54 large companies filed for bankruptcy, after 54 had already filed for bankruptcy in August, according to S&P Global Market Intelligence, bringing the total for the year as of October 4 to 509, the highest for the same period since 2010.

These are companies that are either publicly traded (minimum $2 million in assets or liabilities), or are private companies with debt that is publicly traded (minimum $10 million).

The largest bankruptcy filers in September included two Texas-based oil and gas producers: Oasis Petroleum, with over $3 billion in liabilities; and Lonestar Resources with $626 million in liabilities.

Energy companies were only in third place among the sectors with the most bankruptcy filings year-to-date. Here are the S&P’s top five bankruptcy sectors, with the number of filings so far:

- Consumer discretionary: 103

- Industrials: 70

- Energy: 58

- Healthcare 47

- Consumer staples: 27

The long list of chain-store retailers that have filed for bankruptcy during the Pandemic got longer in September with filings, among others, by off-price department store Century 21 (Sep 10), candy-seller It’Surgar (Sep 23), and Forever 21 (Sep 30).

Many retailers, when they file for bankruptcy, end up getting liquidated.

The Federal Reserve Bank of San Francisco, fretting about over-indebted companies becoming even more over-indebted during the Pandemic, said that the number of companies that have defaulted on their debt this year so far “is on course to be the highest since 2009.”

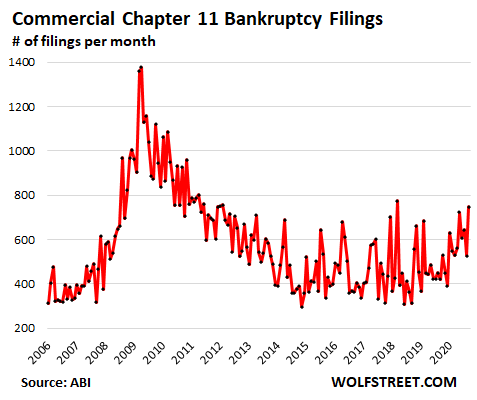

Commercial Chapter 11 bankruptcy filings surge.

This type of filing occurs when a business attempts to restructure its debts while continuing operations, usually with shareholders losing the company, and with creditors taking it. Chapter 11 filings are seasonal, spiking during tax season in March or April. With the tax-filing deadline moved to July 15 this year, the spring spike stretched out over five months. And you would expect, given seasonal patterns, that filings would then taper off. But that’s not what happened.

In September, commercial Chapter 11 filings jumped by 78% year-over-year to 747 filings, the highest since the seasonal spike in March 2018, and beyond that the highest since 2012, according to data released today by the American Bankruptcy Institute. It was the seventh month of double-digit year-over-year increases. From March through September, commercial Chapter 11 filings jumped 40%, compared to the same period last year. Clearly, these companies didn’t get any bailouts:

Most small businesses, when they file for bankruptcy, do so either under Chapter 7 (for corporations, partnerships, LLCs, and sole proprietorships) or under Chapter 13 (individuals only, such as sole proprietorships).

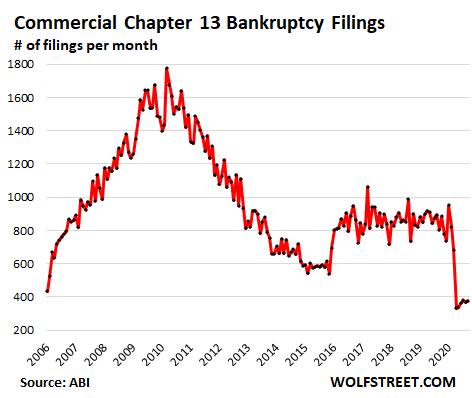

Commercial Chapter 13 bankruptcy filings.

The ABI separates out “commercial” Chapter 13 filings from personal Chapter 13 filings. Commercial Chapter 13 filings are filed by individuals whose sole-proprietor business could no longer pay its obligations, such as bank loans, shop rent, goods suppliers, etc.

But here is the thing: The owners of these small businesses were among the recipients of the PPP loans, and among the recipients of the federal unemployment program for the self-employed (PUA) and then the extra $600 a week in unemployment benefits.

A record number of small businesses “quietly” shut down (more on that in a moment), and many of the owners didn’t need to file for bankruptcy because the inflow of government cash allowed them to pay their obligations, work out a deal with the landlord, and shoulder the remaining burden. So commercial Chapter 13 bankruptcy filings plunged in April to just 332, the lowest in the ABI data going back to 2006, and have ticked up only a little since then, with 377 filings in September – an amazing sight during an economic crisis:

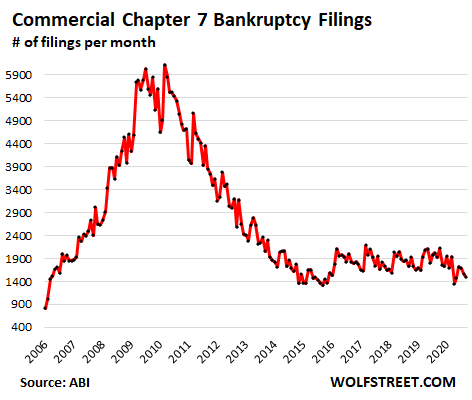

Commercial Chapter 7 filings.

These filings by corporate entities, partnerships, and individuals (sole proprietorships) dropped in April to the lowest since 2015, and have since then zig-zagged higher, but remain low, with 1,503 filings in September. These types of businesses too were among the recipients of the PPP loans, if they continued operations; and most recipients of PPP loans didn’t file for bankruptcy. And many of the individuals who shut down their businesses were among the recipients of PUA benefits and the extra $600 a week and could pay off their creditors and shoulder the rest.

Consumers are still flush with government cash.

Consumer bankruptcy filings fell 36% in September, compared to a year ago, to 37,024 filings, as consumers were still flush with government stimulus money and the extra unemployment benefits of $600 a week through July, and the $300 a week for at least four weeks afterwards, much of which was processed late and arrived in lump-sum payments weeks or months late, therefore dragging into the fall. We have seen this stimulus money play out in record retail sales and record reduction in credit card debt.

Small businesses closed quietly.

From March through mid-July, over 420,00 small businesses – or 7.1% of all small businesses – permanently and quietly closed their doors, more than typically in an entire year, according to a study by Brookings, released in September.

The analysis found that “many small businesses are financially fragile and not equipped to weather a prolonged period of substantially reduced revenues”:

- 47% rely on personal funds of the owner to fill a two-month revenue drop.

- 88% rely on the personal credit score of the owner (such as working capital funded by personal credit cards).

- Only 44% have had a bank loan over the past five years.

Small businesses account for about 99% of all businesses in the US and about 47% of jobs in businesses. If these 420,000 businesses are representative of national employment, “this means we have lost at least 4 million jobs that will only return with the creation of new businesses,” the report said.

Small businesses are prone to failure. But also many new small businesses are being created. This process of new businesses being created has now restarted strongly, but has been far outstripped by the tsunami of business closures. The report:

Even if for the remainder of the year losses simply keep pace with those in previous years, we will see a doubling of the ordinary annual rate of small business losses to more than 700,000 (or 12 percent).

That likely optimistic scenario would see around 50 percent more business losses than at the peak of the Great Recession, and the largest loss of small businesses since records began in 1977.

This speaks of the large-scale damage to American businesses. While some businesses massively benefited from the crisis, many more took on heavy damage; and of them, many already shut down, and more will shut down – most of them quietly, and only some with bankruptcy filings.

And without all this stimulus and bailout money?

The biggest programs have ended: the PPP loans for smaller businesses, the Payroll Support Program for larger businesses, the extra $600 a week in unemployment benefits, and the extra $300 a week in unemployment benefits. President Trump, in a series of tweets just now, pulled the rug out from under bailout negotiations until after the election. So for now, it looks like businesses will have to deal with this economy on their own.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Looking at what happened during the Great Recession things will only get worse. Look for the peak in two to three years from now. Keep your powder dry. It’s gonna get rough.

I feel like things are getting better. Unemployment is dropping. Most traffic is back to normal. Stock markets have recovered and then some.

Housing at ATH. Consumer debt has dropped. With the exception of the travel industry, most businesses are almost back to normal and we do not even have a vaccine.

The FED will buy up a lot of the toxic Commercial Real Estate debt. Just like they did all the home mortgages.

The FED will save the banks who may have bad business loans.

Mortgage forbearance will continue until not needed. The GSE back almost all loans anymore so they really do not need the cash flow.

Most businesses are back to normal? How many small business owners do you know, just out of curiosity?

Amen. This crisis is worse than the one that FDR difused. While some areas of the economy, such as online retailers, are doing fine, there are too many, key areas of the economy that are in deep trouble: e.g., malls, airlines, movie theatres, restaurants, personal services, etc. The government just cannot bail out this much of the businesses and individuals in the economy.

Bailouts just made to over-leveraged, large companies, e.g., like the “Federal” Reserve bank cartel’s bailouts of cronies and banksters, who are traditionally undercapitalized for the risks that they choose to bear, will not have large impacts on the overall economy. Too much of the economy consists of smaller businesses that have diverse characteristics and are not among their cronies.

The US government faced a $211 TRILLION burden of federal liabilities long BEFORE this pandemic even started. State and local governments and most pensions will also soon become increasingly overwhelmed and need federal bailouts. Only the US government can access its printing press to provide those bailouts.

Pensions are in a fools’ paradise: they have seen the value of their holdings peak recently, even though those holdings have not grown much for decades. However, these valuations will collapse when reality sets in and the bonds and similar, fixed-income holdings of pensions will lose value over time, as inflation slowly grips the US economy more and more.

Since the bankruptcy process will allow entities to continue but with new owners, and often involves the laying off of tens of thousands of employees, which would be the case to a proportionately lesser degree even with smaller companies, letting all troubled companies just go bankrupt is problematic. I opine that the government probably just has to take a large equity share in any companies that it bails out (e.g., 99%) and focus on bailing out only companies that are essential to the economy.

Then, it might be in a position to meet its upcoming liabilities of which the much-publicized national debt is a minuscule portion.

We cannot just accept the “Federal” Reserve bankster cartel’s clear plan, which is to create such massive inflation over time that our pensioners get less and less each year in REAL monetary aid until as in post-Soviet Russia, they have to eat out of trashcans.

Note that does not mean that I would oppose the individual paid that is necessary now, because so many persons are in such dire financial straights. If things continue as they are now and more are in dire straights, I fear that like the Nazis in the post-WWI, Weimar Republic or the Soviets in post-revolutionary Russia (whose revolution was not initially communistic), more radical nuts/psychopaths (like Hitler or Lenin/Stalin) will be raising legions of followers.

Thank God for Chapter 11. We can hold on to lots of really bad ventures and sell them later to a new round of suckers. Maybe the employees might like to take it on in exchange for the big unfilled hole in the retirement plan?

all companies not viable ought to file bankruptcy

let them fail – ie convert debt to equity

for newly unemployed we should RETRAIN THEM

that’s only stimulus needed

Retrain them to do WHAT???

To scratch out an existence on $10/hour?

Might ae well make it $10/day

Does Trump think spiking a stimulus bill is going to get him re-elected?

The question is whether the red states – who are opening/have opened up – were actually benefiting from stimulus as much as the blue states – who are locked down still.

c1ue,

Which state is still “locked down?” Like, what can you NOT do in California other than going to indoor bars, strip clubs, and similar? (I know, someone is going to ask, “are outdoor strip clubs OK?”)

Even in San Francisco, indoor dining is open. Outdoor dining has been open for months. People with jobs are working. Many work at home, others like my wife go to work every day. A mask mandate and staying 6 feet apart is not a lockdown. You need to get your vocabulary straight.

I took my wife out last Thursday to celebrate her birthday.

The Thai restaurant we went to – which used to be packed – we were literally the only customers for the 3 hours we were there (4 to 7 pm).

We went from there to Sanraku, a Japanese sushi place in the Metreon that we have frequented in the past. They were open – it was literally their first day open. There was 1 group of 3 Asian looking people waiting for pickup vs. a place that was formerly packed on Thursday evenings. There was no indoor dining and the outside seating closed at 7. Bought a couple of beers (2 bottles in a paper bag) for solidarity.

Next place: another bar between the 2 places above which was moderately busy pre-COVID. 4 or 5 outdoor tables only, no indoor. 1 pair of men when we arrived; it was full when we left at closing (9 pm) but the 11 total patrons is 1/3 or less of a normal Thursday crowd, and the utilization is far lower than that.

So: technically all 3 are “open”, but in reality – none of the 3 are anywhere remotely close to where they were pre-COVID either in capacity, percent utilization, etc. I doubt any of them are even cash flow break-even at the moment.

And so yes, we are still in lockdown. Businesses are still not having employees on site – meaning the businesses serving those employees are still locked down regardless of whether they choose to be open (and empty).

This isn’t just belief – I go about town on my own affairs fairly regularly, and the foot traffic in the downtown areas is still nonexistent.

Equally: the convention center is still closed. No Salesforce, Oracle, Google etc (although Oracle was going to not be in SF this year anyway). No meetups.

Car traffic seems to be coming back, but it is a mystery where these people are coming from/going to.

In contrast, I have been in several red states and Brazil in the past month. I can’t say what “normal” activity level is because I wasn’t in those places very recently, but it is enormously higher than in SF right now.

So thank you for trying to set my vocabulary right – I am more interested in reality.

What you describe — and I see this too — isn’t a lockdown. This is a collapse in demand at specific businesses and a decline in economic activity in certain places. But the restaurants we really like to go to are hard to get reservations for. San Francisco is emptying out – well, that’s exaggerated, but a lot of younger recent arrivals have left. You can see this everywhere. This is NOT a lockdown, but people leaving a ridiculously overpriced city, causing a sharp decline in economic activity.

I personally thought the Drive-thru strip clubs were an awesome idea.

They just needed an ATM dispensing disinfected cash

@clue I have gone out to eat a few time lately. I would say the restaurants are at least 50% full and this is indoor.

Places like the local Olive Garden now have people waiting outside waiting for a table to open.

Many drive through always have a line. Some buffet places have even opened back up.

@ru82

Can you say where?

There are certainly areas which have seen higher activity in SF: anecdotally, the Divisadero area, Noe Valley among some of them.

Perhaps/likely it is because those are residential areas.

Downtown where I’m at:

Safesforce tower – I wonder if more than 2 dozen people, outside of security and janitorial, go in there?

Google, Microsoft + LinkedIn, multiple WeWorks all seem to be completely dark. Slack, ditto.

The streets used to be literally swarming at lunch and in the evening – Wednesday was early Thursday, Thursday was early Friday.

Maybe this activity all moved to the places where people live, hence my question to you.

Note I have traveled in CA – in Fresno and environs, people are out and about. Business is down for most people but it is moving.

Ru82, how much of this consumption is due to consumers being flush with cash from government “stimulus” and white collar people thinking their jobs are immune?

San Francisco county is in the “Moderate / Orange” category so yes it is not as locked down as other counties. San Diego County and many other coastal counties like OC, Ventura, Santa Barbara, SLO are in the “Substantial / Red”, LA county is “Widespread / Purple”. So your restrictions in SF are less than many in the state. this is based on covid19 dot ca dot gov as of today, updated every Tuesday. As an example SD County is 25% max for indoor dining, LA is outdoor only, plus lots of other restrictions.

It’s semantics, lockdown vs restricted. California is not “open”. Florida is open. As the article states, many small business are suffering and will continue to do so until this thing is over.

BTW: Always appreciate the insight and articles…

It’s like another government shutdown – the GOP gleefully shrinking the pie.

Or just Donald Trump negotiating.

How’s any of this going to help him in blue swing states he needs to win?

Neal – The states are in control of their own destiny. If the blue states/cities aren’t operating, it’s on them. There is NO federal lock down. People need to look at who is truly in charge of their local situations and extrapolate to determine if that is what they want for the country. Look at which cities are literally being allowed to have their businesses burned to the ground; some even celebrating this new-found anarchy.

@c1ue Good point. I think some of the Blue states need the stimulus to pay all the big salaries their state employees receive. LOL

Even if the economy was doing well, the blue states will probably need stimulus/bailouts now and in the future. LOL

Preposterous. At least get your spelling correct. It’s Martial Law, not Marshall.

With three of his supreme court justices deciding the election he doesn’t technically need to get voted in.

And someone just a few hours ago instructed Govt to stop negotiating an additional relief package.

Talk about owning the problem. Market dropped 600 pts immediately.

It is unfortunate there is a virus and it has an effect on how we live and do business. Ignoring the problem and/or making it political isn’t helping very much.

I am not very optimistic after today. Best of luck, Wold Streeters.

Must correct. I cut my finger and not typing very well. Wolf Streeters, not Wold Streeters.

And yes my finger hurts as the end seems to be missing. It’s in the greenhouse somewhere. Still not optimistic.

See, Paulo, if you sat on your butt all day that wouldn’t happen. But then, sitting on our butt’s is not living, now is it?

OUCH!

Take care of those fingers. The replacements available are unsatisfactory, to put it mildly.

I once cut a fingertip off when a piece of wet gal slipped across my fingers. It had an outrageous burr a few mm high from a blunt 40 year old guillotine. Sliced my fingertip off like a carving knife. It was a mess for a while but it grew back. Try not to look at it.

Same happened to me, cut a tip of a thumb. Took about six month to grow it up and it is still numb.

I’m missing just a little bit on two knuckles.

Just means we’ve lived a little!

re: “… It’s in the greenhouse somewhere.”

Now, if you were the alien in the original ‘The Thing’ movie–played by James Arness–your fingertip could grow a whole new you (but it would need human blood for nourishment).

Paulo, not to worry. Fingers are organic with nitrogen and lots of beneficial nutrients. You couldn’t have lost it in a better place. Ask me how I know. (Hint: machine shop.) It will (painfully) grow back as good as new. Bandages were not designed for keyboards.

Much more important to him that the senate focus on approving his SCOTUS nominee before the election so that she will be deciding to his favor when the legal challenges to the election results happen.

Same shirt, different day.

Will we given a chance to witness, how the mkts run WITHOUT any interference from Fed or any kind of jawboning from FOMC members?

I very much doubt it. Trump will reverse himself soon once the indexes go below 200MA line!

I know I’m far more left than Wolf & his readers, but I think it’s downright criminal for elected officials to collect 6-figure paychecks, vacation multiple times a year, get hooked up w/Cadillac healthcare packages- and countless other benefits granted to people in positions of power- (all provided via taxpayer money) yet are unable to negotiate a relief package for the millions of struggling Americans. At the very least it’s a dereliction of duty. There isn’t an emergency in SCOTUS. There’s an emergency in the people not being able to eat, stay housed, and get healthcare in the middle of a pandemic. How is it that congresspeople who represent hard-working Americans refuse to recognize the gravity of this moment? I hope it all gets burned down to the ground.

There is an emergency in SCOTUS ‘cos they will be called upon to hand over the election to one particular candidate.

Oh, my bad. I mistook that for the Death of Democracy…ya know, just another day ¯\_(ツ)_/¯

++++++1000

A guy tossed a match into the mess today, so burn it will. A great many people are going to be homeless and hungry by the time Feb gets here.

ALL.TAX.PAYMENTS.WITHHELD.UNTIL.RELIEF

That would get congress’s attention.

Doesn’t have to be everyone. I think 5 or 10 percent of Americans refusing to file would wallop Washington upside the head with a 2×4.

GirlinOC

I was thinking today that Dems might want to think about taking a 20% pay cut with balance going to food banks. All elected politicians should do it, but it would be a smart move, imho. Plus, it is the right thing to do. It would send a pretty good message.

Is that before, or after, when they grab more of that insider-trading cheddar??… you know, the stuff THEY, by their own hand, are Legally allowed to engage in .. whereas, if any of the lowly mokes tried such endeavors … they’d be vigrously, and with great relish, jailed!

They don’t do ‘right thing’ .. They do however, do “GIMMIE!” just fine.

You hit the nail on the head. Kind of. I was taught everyone is responsible for themselves. Sink or swim. Your comment is the antithesis of what I was taught.

GirlinOC,

I consider myself a social liberal and fiscal conservative(stay out of my bedroom and treat my tax dollars as sacred), therefore I am not represented in the halls of our dear leaders.

To reply to your statement about our representatives though, I will offer this.

We get the best representation money can buy, unfortunately the money comes from Wall St, lobbyists and TBTF corporations……

Regulatory capture, crony capitalism, socialism for the well off and disaster capitalism for the little peeps

The 2 party system has got to go, we need more parties so they are forced to negotiate

Maybe one day we will end up with one party, like a lot of other world powers. Then we won’t bash the news anymore, will we? Or bash anything else, for that matter.

I agree. We need at least a 3rd party as mentioned and for many reasons.

Maybe we need a ‘to go’ election. Everyone pick ‘toppings’ on their deluxe ‘we need this now pizza’, at their local ‘toppings election’ site. Instead of the current fake two options ‘all you need, decided by us’ menu, all of our needs would be decided locally.

Representation for the people, by the people…. oh wait, sorry… I guess too many hands in the pie.

I’m NOT far left, more like right of center but I agree with you about our socalled “ elected officials” I also agree that the little guy needs some assistance although I may not agree with how much and for how long

They all were not negotiating in good faith to begin with. Its a covid cares act stimulus, so why add pork like bailout fund for states and state pensions.

And they were one trillion apart.

And its just to cover a few months, so another stimulus will be needed in the spring.

And its only going to be a 5 or 6 week deferral either way.

And i would bet they are talking despite the “order” which is just a boss saying something and we know the structure of the bureaucracy allows wild west interpretation of those orders

Besides, now we have our central bank “genius “ PHD’s saying to Congress its better to do more stimulus than less” and nobody is recognizing that for what jt is,

It is recognition that our Fed is saying we have to go large to hopefully keep something in the system from imploding.

What leads you to believe that congresspeople represent hard-working Americans?

I agree completely with your view of our government leaders though I am more to the right, really more libertarian. However, the senate is working on the supreme court nominee. The relief package is in the house and if they presented a reasonable bare-bones proposal without pork it would be approved tomorrow.

The rest of you need to stop with the fear-mongering of the SCOTUS deciding the election. It will be decided by the people, the ones voting.

True and keep in mind Govt demanded the lock down, not the other way around

Dear Girl – you don’t have to be left-leaning to be disgusted with it all.

Although this has already been partially walked back by the feckless leader, it is the correct thing to stop the pillaging of our children and grandchildren to provide support during the pandemic. So-called stimulus on the part of the government adds to our long-term debt. The role of the government in these kind of situations has been vastly and unjustly scaled up in a way that is not sustainable. So I think it is correct to not spend my children and grandchildren’s money in this way.

The FED wants it all and they will get it The sheeple cantthink past next week Happy1 though I totally agree with what you’re saying

Yeah but some people’s children and grand children don’t have much to eat these days. Not even cake.

Harbor Freight opened a new 3B line of credit and is going to pay a special dividend? Meanwhile Transocean is probably going to file. The drilling sector could lead the economy lower.

Another reason to like Harbor Freight: No bombing the airwaves with commercials claiming “We only care about YOU” and “We’re all in this together” when you know damn well the companies only care about C-suite bonuses (aka ‘Shareholder Value’).

Anyways, how does a privately-held company issue a dividend?

When I ran my Sub S Corp, I issued dividends every year. It’s allowed.

To Add: My Sub S Corp was privately held, as is all of them (S Corp). (not a public corporation).

Thanks for the info.

I suppose it does make things easier with the country ending up with about twenty government-backed corporations running EVERYTHING (while paying no taxes) and the stock market consolidated down to six profitable stocks.

Love those new commercials from Amazon about how much they’re supporting small businesses. From what I’m hearing they take the ideas for themself and shut down the original seller.

So we end up with an economic model that is a fusion of government and the largest corporations. Excuse me, but isn’t that the economic basis for fascism?

Correct IMHO r2/3,,,

And, unfortunately for We the Peedons (thanks, Unamused) that financial base can and has/is been/being used by both extremes of the left and extremes of the right and the current fascism teams of all varieties to enrich themselves at the expense of the folks who actually make something.

The ”Grand Experiment” of the formerly democratic principles and policies of USA appears to be going that way no matter which group or party controls any of the three branches of our guv mint that were intended to balance out each other BECAUSE the rich folks who own everything else also own and control both major parties AKA political machines, and thus are able to legitimize their theft.

It appears they have made up their mind for us to elect a new pres, at least one reason being their control of the incumbent appears to be less than usual, etc., etc.

The fact that every election usually goes to whomever can provide the most money to buy the most brainwashing is everything we need to know, eh?

But, maybe not always…

I guess we shouldn’t complain VV, we have the best government money can buy.

By cutting off the negotiations, until after the elections, the ball and the consequences of NOT having 2 nd stimulus falls squarely on Trump and GOP! Dems couldn’t have asked for more!

Trump thiks that voters will vote for him to get the next stimulus!? Amazing!

Mkts are left to their own fate NOW! For change the reversion to the mean can proceed without constant interference by EASY-PEASY money spigot from Fed!

Earnings reports are trickling and so is the 2nd wave of Covid 19 – Twidemic mixed with Flu – both have similar symptoms!

Today was a feast in the late afternoon for those traders with option experience! The addiction to the EASY-PEASY money has gone too long!

Volatility is a friend of nimble traders!

I have been adding a short term volatility play to my portfolio for a few weeks now. I went short SPY around the same time Wolf did (round 2) along with puts expiring on the 16th. Puts got hosed, hopefully this vol play won’t. I just went negative on the year. :(

You shorters look pretty smart as well as courageous. Well done.

I don’t know enough to play the market and never really wanted to learn. But good on you guys. I think it will start paying off PDQ.

I will admit that today I wondered who was selling before the bombshell, and who will be buying just before a reversal?

I agree Paulo I don’t have the stomach for playing the markets It’s always been real estate and precious metals for me and I’m not starving yet anyway Hope your finger heals fast I sliced off a piece of my left index finger once installing a sheet metal ceiling and it took years to regrow totally Nasty stuff

Second wave or expansion of the first which was never controlled or contained enough for various reasons.?

It’s going to be very interesting to watch who gets bailout money after the election. No matter who wins this is a big hammer to be holding over the States to deliver to the winner, or else.

Bad as 2020 has been, 2021 isn’t going to be any better.

One should be wondering, what is going to happen to the Mkts ( NOT the economy) before and right after the election day!?

Btw: Covid 19 is NOT going away!

Strap your belt for the roller coaster ride with unprecendented volatility!

Blackmailing the people, as a whole, may not work out very well.

Threatening to make sure your kids go hungry can have some very bad consequences.

Let’s not forget all the small businesses that were hanging on until the “protesters” destroyed them. I saw a video of a sneaker store in Santa Monica, CA, which was very profitable, closed because it was ransacked. These stores have a very curated inventory which is impossible to replace. It has to be amassed over time.

Another small business, a vintage store in LA was luckier. They too got ransacked but were able to reopen because they had inventory in storage. This vintage store can never replace the items that were looted as well.

Then the same looters or those who know them will complain that certain areas in the country do not have affordable cornerstores, cool cafes,artgalleries,unique/curated apparel or whatever. People need to learn the past riot history in Watts,Detroit,Chicago,etc.Glad you brought this up.If against All odds you can lineup everything involved to start/maintain a viable,trulysmall biz,can you now afford xontinuity insurance + riot/looting insurance/disaster insurance?Same people will complain there are no good jobs closeby,also!

The sneaker store in Santa Monica was minority owned and employed minority people from what I saw in the video.

Of the 420,000 small business that closed during the pandemic, can you venture a guess as to how many closed because of protesters/looters/ransacking?

I’d venture a guess that it’s much less than 10,000, making it much less than 2.3%, so from my perspective, just bringing that up is evidence of a desire to politicize the issue.

Calling it a desire to ‘politicize’ the issue, and thereby dismissing it, is a sign that you have little regard for the effort it takes to establish and run such small businesses.

Idiots wrecking them like that is beyond criminal.

Even ‘only’ a thousand businesses going under that way would be a thousand unforgivable crimes which have probably ruin lives : that is a fairer perspective.

Zantetsu,

The looters and rioters already politicized the issue.

Algorithmic amplification bias works even on smart people. One shoe store versus reality… ugh. Wonder why we find ourselves in this pickle.

Yert,

You can use the sneaker store video as a data point in a sample, and as you know, statistical samplings are meant to be amplified. There are plenty of other data points out there. Feel free to add Minneapolis, LA, Seattle, Portland, etc. The videos are a fraction of what really happened.

The issue was politicized before they ever took to the streets. Remember racism and Covid are the same thing, minorities are dying at twice the rate of whites. Ask working people, they will tell you, “It’s because they do the work..” The Labor Dept is under fire for shelving complaints about noncompliance on Covid safety in the workplace. People who cannot afford 100K for a helicopter ride to the hospital are the ones dying of Covid. Those protesters will get more ammo when the court overturns ACA. I understand the thread here is pro-business, and you all wonder why are you in the middle? So maybe some boutique shops get trashed in a neighborhood which has been redlined, and where there is no decent grocery store. So when you soundbite the issue, just know it comes back to you tenfold.

To those commenters about the “riots” and small businesses being trashed:

If we didn’t live in a country that has a demonstrably totally corrupt political/judicial/financial (add any more parts) system we wouldn’t have the riots.

We are a “society” not a church cookie party.

And, incidentally…. “everything is political”.

It is undoubtedly a very small proportion of these businesses.

But also undoubtedly very real and in some of these cities, there will be long-term consequences of disinvestment in those neighborhoods. Minneapolis and Chicago in particular. it will probably be a decade before capital flows in some of those neighborhoods.

Not a decade. Why would I ever again want to insure a business in “those neighborhoods.” Or lend them money.

More people die from the flu than riots.

The flu is not man made and did not burn your store/business down to wreck your life and family livelihood.

Wolf, I think it’s Forever 21, not Century 21.

Discount department store Century 21 (not related to the real estate broker) filed on Sep 10

Fashion retailer Forever 21 filed on Sep 30

I should have included Forever 21 and might still add it.

That’s what happens when you refuse to grow up. Remaining at 21 years old is never a credible business/life plan.

It’s Century 21. I used to shop them in NYC, at their only store, all the way downtown. It sold expensive designer clothes at discount. Just like Loehmanns, the other designer discount store, up in the Bronx, which I think is also gone.

Petunia , they also had aQueens Center store in Rego Park I used to take my wife there all the time when I lived in Queens in the early 80s

Places where there’s a high population density will have a very difficult time, and much (most?) of that isn’t because of government shutdowns. People don’t want to congregate with the public:

Restaurants, bars, transportation, apartments and office buildings where elevators are needed will be avoided because people don’t want to take those risks.

Note: the general population is a lot more risk averse than they were decades ago. For better or worse, that’s just the modern world.

I really only see hypocondriacs in the large cities. Walked into a department store in Columbus, OH recently and was greeted by what looked to be an actual surgeon.

In my small city there isn’t much aversion going on.

Come to the Faber College neck ‘o the woods…saw an old ex-Navy guy yesterday wearing full gas mask with dual canisters. Thought about telling him “War’s over man, Wormer dropped the big one”, but realized it might give him flashbacks to when the Germans bombed Pearl Harbor. All clear!!

That old guy at least has some idea of risk stratification. Assuming he was well into his 80’s, at his age to catch the virus is a probable 25% risk of death. Sounds smart to me.

Germans bombed Pearl Harbor? WTF ?

Frederick,

Sarc alert.

Yeah, that is working out great in North Dakota.

Funny, the high rise apartment market in Istanbul is soaring presently with no top in sight

The Turkish Lira is sinking like the Titanic. People are buying assets as they normally do when their currency devalues.

It’s more than that Interest rates are at very low levels historically speaking Lots of people buying precious metals as well The builders are offering a lot of perks and extras to get buyers to pull the trigger too

Yep have a family member who has nursery business. Told me he had best year ever with people unemployed improving their homes. Took a cool $1M for ppp and told me didnt need any of it because business was so good. But hes not concerned because funds are below the audit threshold and wont ever be audited. All money right into his pocket.

Brent,

I know a guy who I consider a scammer (scamming investors), and with the noose tightening on him, he got a $1 million-plus PPP and a disaster assistance loan from the SBA, and he must have used fake payroll data to do this because he doesn’t have a payroll except for himself and a couple of low-paid fresh-out-of-college people. There is lots of this crap going on. It may have well been the most abused federal program ever.

Canada has a PPP version called CERB. There was some scamming but many have been caught and people turn scammers in. One thing that has happened is an explosion of homeless on the mild west coast. Apparently, folks from back east took their CERB cheques and hopped a bus before the winter hits. Tent encampments are springing up.

In BC our economy isn’t too bad, actually….all things considered and if you aren’t a restaurant worker. The price of lumber is as high as it has ever been and the forest industry is going flat out. At a local office they have a sign on the highway advertising for workers, and list what they need. Unfortunately, like everything these days the jobs require high end skills, mostly machine operators.

Not sure if I read this here, but many tales of babysitting teenagers who do a few “jobs” a month, or less, getting the full monte from feds.

Nothing wrong with that. It’s not like they are cheating people out of National Healthcare, roads, schools or job training programs.

My landlord who does not work was collecting the 600 a week. While everyone continued to pay her rent………

Those people are all investing in real estate. Probably SFHs. Only half kidding.. Maybe only 1/4 kidding.

Lynn, the only money they’re putting into real estate is what’s left over after buying stocks.

None of these programs were implemented to help the citizens. They were implemented to keep money flowing to the corporations.

Do any of you really think the government is working in your interests?

JDog (and others):

“We get the government we deserve” Nothing more, nothing less.

Family member is going to be in for a surprise on their taxes…

I was under the impression that if ppp was used to meet payroll, then the loan would be forgiven. If he qualified for the loan and used it for such purposes, he may not have done anything unlawful…

jmayer,

There was a “need” requirement in the self-certification list. I don’t remember the wording. So if you have record revenues, and applied for PPP, you violated the “need” requirement, and thereby fraudulently obtained a PPP loan.

They deemed all loans under 2 million were made in good faith, so no “need” requirement needed for those, just free money.

Now you made me look it up. From the SBA #2 condition:

“Current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant.”

The word wasn’t “need,” as I said, but “necessary to support ongoing operations.” If you have record profits — so by definition, the loan is not “necessary” — and you apply for the loan, you committed fraud. Here is text, and it’s fraud, and you can go to prison, regardless of size of loan:

“I further certify that the information provided in this application and the information provided in all supporting documents and forms is true and accurate in all material respects. I understand that knowingly making a false statement to obtain a guaranteed loan from SBA is punishable under the law, including under 18 USC 1001 and 3571 by imprisonment of not more than five years and/or a fine of up to $250,000; under 15 USC 645 by imprisonment of not more than two years and/or a fine of not more than $5,000; and, if submitted to a federally insured institution, under 18 USC 1014 by imprisonment of not more than thirty years and/or a fine of not more than $1,000,000.”

I thought they removed the “need” requirement when they passed it. I hope I am incorrect because my problem with the PPP is I have no faith that our government sent this money to those businesses that needed it.

If you email me, I’ll send you the PDF with the SBA’s “final” regulations (since I saved the PDF). That’s easier for me than trying to dig up the link and send you the link.

email is here:

https://wolfstreet.com/contact-us/

Small Business Act

Question 46

“Any borrower that, together with its affiliates, received PPP loans with an original principal amount of less than $2 million will be deemed to have made the required certification concerning the necessity of the loan request in good faith.”

My self respect is worth more than a million dollars to me though. Sorry about your family member.

I am starting to think that while the current plague is no where as deadly as the black plague in the dark ages it might make as big a difference in history because our economic system is so much more fragile and easily disturbed. The black plague brought an end to feudalism and ushered in an era of increasing power for the serfs. The current pandemic may also reset the economic and social order when the dust finally settles. The big powerful and well leveraged may be gone and replaced by the small and the nimble. A bunch of independent accountants working from home may replace the last of the big 5. Once we give up big buildings, do we need big companies any more? People once made a living weaving cloth in their homes (cottage industries) and were pulled in to the mills with the rise of steam power. Covid may scatter them back to the cottages with the Satanic mills left behind in bankruptcy.

Seneca’s cliff- The global economy has defined supply chains, as one example. This and its cousin- just in time manufacturing (around for 40 years)- are certainly fragile. Covid may turn this around. If so, look for larger “localized” areas of production for tangible goods- food, clothing, electronics, etc.

Some big supply failure would have to occur (to force a change), and I’m not sure what it would be. No iphones? No California wine? Some medication unavailable? I don’t know.

The result might be fewer mega-corporations with complex supply chains and more smaller entities closer together.

I have a nephew who is a senior manager/engineer for a complex supply chain in automotive. He is in charge of all north American logistics. This is a big big multi-national that everyone has head of. He used to have to fly all over the World and meet/greet. He now works from his home and says he’ll never go back to the old way of doing things.

The cars keep getting built. :-)

Seneca/Wke-perhaps focus on absolute business/societal efficiency eventually destroys any reasonable business/societal resiliency? (Privatize all profit/socialize all risk). While we seem to have favored Horatio’s blinders in recent decades, history’s wheel groans on…

hoping you are not among the collateral damage,

may we all find a better day…

All we can be certain of is that there is an ongoing acceleration in most of the trend people know about. Automation, fusion of e-commerce with brick and mortar, contactless payments, on and on and on.

Where this will end, no one knows. But as Wolf’s recent articles on movie theaters and office space points out, the underlying impact will be huge, we can expect entire industries to collapse. While it’s not quite a great depression yet, that is only dependent on a person’s particular point of view.

Most business’s close quietly apart from the giant chains and historically well known names. I get auction notices several times a week for metal working machines of all types. I often try and figure out what business is closing down to create this auction. It is almost always a kind of secret. I often have to go to google street view, look for the sign and find out that way. There is almost never any news in the local papers about the closings.

Interesting perception. The “Black Plague” lasted well over 100 years. (most of the 16th Century) You figure to be around in the next century when the dust has settled?

Mercantilism created the middle class, (15-17th Century) which destroyed feudalism, not by empowering the serfs, but by creating a third class of people who had the ability to garner wealth. (And it was the church more than the aristocracy who fought it the most, which is why it took almost 200 years between Jan Huss and Martin Luther to create enough backlash to cause the Reformation.)

The Industrial Revolution “those Satanic mills” were what gave rise to the common people actually having discretionary income; those who adapted. (18-19th Century)

The Borg are right, “assimilate or die.”

Good thoughts but going to pick a bit:

Better to say 18 hundreds rather than 18 th century which is the 17 hundreds. There was no Industrial Revolution (i.e., steam power) that early , although there were big improvements in agriculture. e.g., Tull’s seed drill which put the wheat seed in a hole instead of scattering it by hand.

As to improvement for common people: true but primarily in England at first. The inventions that allowed the steam- powered English textile mills to flood the world with cheap fabric wiped out the spinners in India, China, etc. Then factory cook ware wiped out metal beaters, etc.

With ’15 th century’: that is the 14 hundreds. If feudalism was dying then it was dying very slowly, even in England, where estates were held ‘in fife’ and could be seized by the King.

From the start of the 14 hundreds until 1789 is 389 years, during that time what many would call feudalism was alive and well in France.

BTW: I always have to stop and ponder for a sec

when reading about ‘X century’ to figure out which years those are. It would be nice if ’18 century’ meant 18 hundreds. Only prob is what to do with AD 1 to 99.

You are true about the momentous changes from the plague. But you have to also remember that the biggest fish, “the big and powerful and well leveraged” , ie the king and nobles, still ruled the country and put down the Peasant’s Revolt. Hope the peasants do better this time.

The black plague killed an estimated 30 to 50% of the population of Europe in 5 years during the mid-1300s. It had vast societal and geographic implications for Europe. It is as close to an extinction event as we have in recorded human history

The current pandemic is a problem for sure but with implications in order of magnitude lower than the plague, like 30 or 40 times less mortality. To even compare the two in this way is wildly inaccurate.

Zombie companies got second chance stimulus money.

The Consumer Price Index 12 month increase was 1.3% in August.

I’ll bet the social security increase won’t be as high as 1.3% and the medicare increase will be higher. Boil the frogs.

Perfect,,, perfectly succinct summary Pet!

While we elderly frogs who planned and saved and had ”enough” slowly slowly come to a boil, we can have hopium that the younger frogs who are more mobile and more athletic and more woke and more everything else worthy of mentioning on the survival scale will notice more and take actions more early and more thorough.

Really and truly, with the kids safe as a result of learning hard work ethic early on by means of ”piecework” bribery, etc., it’s the grands that are going to have to pay the piper for the absurd trashing of the dollar going on these days.

In spite of my belief that there are, in fact, no ”laws” of economics — or any other ”social science”,,, there seems no doubt at all, based only on the degradation of our money by the Fed for 100+ years, that sooner and later the piper must be paid one way or another.

I am learning to play the concert C flute and hoping that I am considered a sub-category of piper.

The reason all those businesses closed quietly is because they aren’t large. In America it’s go big or go home literally.

I wonder how many business owners will take advantage of the bailout money to wind/shut down their businesses prematurely? I know there are many owners who have been looking for an exit like myself, and now there are a several more reasons to retire or downsize using government support programs. Once the stimulus runs dry, I expect revenues will be reduced. The personal exposure of financial guarantees/liabilities to finance a business has become too compromised by a loss of freedom and mountain of deficits.

It’s frustrating to watch policy choices that skip over individuals as economic actors. What’s the point of bailouts to wall st. speculators, large profitable corporations or the already wealthy? They relentlessly lobby to reduce their own tax obligations, aquire tax payer subsidies, receive special access to low interest rate Fed backed loans and generally do everything possible to hoover up wealth while leaving those on the losing side with the tab. Normal individuals and small and medium businesses can’t compete with those special priviledges. It’s just not sustainable. Minimum wage barely covers a room and food these days. If working full time doesn’t cover that what’s the point? I see lots of comments that this wages are too high or too low but we need to examine the actual buying power of the median wage and ask what is being exchanged. If I work 40 hours a week I damn well expect a roof, food and some occasional fun even at the lowest end of the scale.

Minimum wage should barely cover shelter and food. If it does more there’s no incentive to work harder or smarter. Those who are happy with the minimum should not be the median, because if they are that means greater poverty.

I have a nephew who’s 24 and living at home. He complains that people like his uncles are the reason he can’t find a job or buy a house.

His uncles point out that they went to public schools (not private), they had paper routes, recycling routes, ran errands, etc from the time they were 15 and put themselves thru college while supporting themselves because their parents kicked them out at 18. And all the while our elders told us how good we had it.

I don’t know when schools stopped preparing kids to be self-sufficient, but between them and the parents our society has done a grievous harm.

Probably about the time that paper routes stopped generating enough money to go to college and a job at a roller-skate drive in stopped being enough to buy a house…pull your bobby socks up.

Not to mention college was WAY cheaper back then. Adjusting for inflation, the cost of going to college is much higher now.

Boomers just don’t get it that they can’t compare apples and oranges. Like how many of their parents went to college by delivering newspapers?

“But it was the Depression.” And right now it isn’t?

Note to Boomers: It’s not entirely your fault, but you played a very significant part.

Every single time I come across the word “Boomer” or “Millennial,” I’m looking forward to the hilarious BS to follow, and I’m rarely disappointed. Sure enough, this whole thread here is a perfect example ?

Prices will rise to what the market can bear. That includes college. When loans where the lender is protected from defaults became available for anyone who could fog a mirror for any useless degree, what did we expect?

Accounting for the Rise in College Tuition

Grey Gordon, Aaron Hedlund

September 28, 2015

http://www.nber.org/chapters/c13711.pdf

Excerpt:

“These results accord strongly with the Bennett hypothesis, which asserts that colleges respond to expansions of financial aid by increasing tuition. Existing theories can fully explain the increase in net tuition between 1987 and 2010. Our model suggests demand-side theories have the most predictive power. In fact, our results show the Bennett hypothesis can fully account for the tuition increase on its own.”

Credit Supply and the Rise in College Tuition: Evidence from the Expansion in Federal Student Aid Program

New York Federal Reserve

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr733.pdf

OK Wolf et alia:

As a War Baby, AKA ”silent generation” AKA Pre boomer,,, I had a morning paper route ”contract” of 125 papers required to be thrown by 0530, then with the same bike towing my mower, a lawn care contractor later in the AM, then piece work proof reader / typist in the afternoons and evenings, age 13-15.

Still had plenty of time to fish successfully at the bay front from 0530 until I could mow at 0900 so as not to irritate the neighbors, and pursue hunting in the groves after dark some days…

Do I think the young boomers, etc., are lazy? Some are, some are not, just as in my day when some of my age peers did their best to avoid any work at all.

”Nothing NEW under the sun.”

EXCEPT the very unusual increase in college expense, per MB: My very nice apt across Bancroft from Lower Sproul was $50 per month, now $2500; tuition was really just the student ”fees” that supported hospital, sports tickets, etc.

The usual pay for labor was at least $5 per hour, and there were lots of piece work options,,, very unfair to folks wanting college education today IMO.

No bobby socks, I’m a generation behind that. Point being that I was earning money and paying income taxes at 15.

It is not more expensive to go to school. State universities (in CA for example) are just as affordable as they were when I was carrying a full load and working 50 hours a week to get my first degrees. I’d work all school year and then bend sheet metal, or repair HVAC, or do carpentry, or paint houses 80+ hours a week all summer to pay tuition. I actually made more money in the summer than the salaries I was offered after graduation. It is more expensive to go to an expensive school, but if you can’t afford the cost there move your ass someplace you can afford like we had to.

The problem is not that things have gotten expensive, the the problem is you just don’t know how to put aside what you “want” and get what you “need”. There’s a very big difference between those two.

Umm… Have you paid attention to all the jobs deemed essential during covid? Huge swaths of them pay between minimum and $15 per hour. Smarter and harder than what? Store clerks? Stockers? Delivery drivers? EMT personel? Home care workers? Do you think society doesn’t need these folks? Or do you think they all deserve to live in their cars or in tents because the purchasing power of their pay has plummeted since the time when errands or paper routes would have any hope of putting even the hardest working young person through the cheapest college available?

I’m not just talking about the people working for others. Lots of folks that worked “smarter and harder” have small businesses. They’re obviously working smarter and harder if they can exist at all in the uneven playing field we call an economy. Politicians usually aren’t racing to give them huge tax breaks, subsidies, or free infrastructure upgrades at tax payer expense like they do for Walmart or Amazon. In fact if they run businesses that compete with those behemoths they are usually some of the taxpayers on the hook to cover the very costs that put them at a competitive disadvantage.

Comments like this, from people like this, make me look forward to fifteen to twenty years from now.

I’m so tired of this holier than thou nonsense from the Boomers about how they “worked their way through school.” Yeah, it was easy to do that when tuition at the local state school was $500/semester. Now it’s about $10,000, and no, incomes from those low level jobs have not increased by 20x.

When will Boomers ever come to accept that the world they handed to the next generation was not the same world they grew up in? When will they learn to accept sacrifice and stop supporting policies that do nothing but inflating THEIR assets at the expense of everyone younger just starting out?

Boomer logic detected. Let me tell you how things worked 40 years ago and how these lazy kids just wont pull themselves up by the bootstraps like we did back in the day when min wage closer to 15 bucks, housing cost half the price, and college debt was measured in grands.

With each passing year boomer self responsibility brigade sounds more and kore tone deaf.

KGC obviously doesn’t speak for this boomer. My bootstraps have never been so short! When tightened, they’ve always seemed to break at the most inopportune moment. Big club and all that …

I’m most assuredly not alone in that assessment.

I see that you didn’t trudge to school barefoot through the snow, and it was uphill coming and going.

The uncles could buy a house or shelter at a much smaller portion of their income. The job market is jammed up with uncles that are 70, retired from a govt job but now working for a gov contractor to “double dip.”

Of course depends on where you live and COL.

Hey KGC, schools are not supposed to train kids to be self sufficient. That is the work of parents. Nowadays schools are told to teach diversity, dog bite prevention, how to avoid an std, and every other thing parents are too busy to do. Now self sufficient life skills? righhhhht. What about the 3 Rs and some practical skills?

Aren’t active shooter drills all about personal responsibility?

Our 8th grade grandchild can’t read or write cursive! I guess it’s not taught anymore (along with U.S.history). Being in Texas, there is no hope for him to land one of those generously paid California public jobs in the future ($200+K lifeguard?) or even learn to “code” so he could make even more.

I think it’s the military for him or oilfield work (Woops!).

@Anthony – no ability to read/write cursive is ok. And, with touchscreen smartphones kids don’t even have to learn to type at a keyboard.

The paper routes and equivalent kinds of jobs that teenagers in America used to do to create resiliance, self esteem and thrift are now done by mid-thirties immigrants.

Where once if you bought an appliance in a department store, their employee, who paid taxes, unemployement and social security, a 45 year old guy named Pete, who had grown up locally, would deliver it in a company owned truck.

Now it’s dumped on your doorstep by “contractor” peon Pedro from Tegucigalpa, using his own poorly maintained vehicle.

As we in after World War I, this country needs to stop all immigration except those with education and needed skills.

I think it is odd that Amazon and Walmart, 2 of the most successful companies in the world have over 30 to 40% of their employees receiving entitlements from the government. Yet the owners make billions per week.

This should be illegal. These companies are using tax payers to subsidize their labor costs. The government should levy fines or extra taxes on these companies for the exact amount the government pays in entitlements to their employees. Or make it illegal for their employees to receive entitlements. What would happen, nobody would work for these companies unless they increased their wages?

It would have been far simpler to just raise the minimum wage to keep pace with productivity but half the politicians are on the side of the bosses and the other half didn’t have the guts to go against them.

Honestly, the funniest part about this is how you manage to disrespect both your parents (the elder generation who rightly told you how good you had it) and your children in the same post while painting yourself as the hero. I only know of one generation that is so aptly capable of that kind of triple speak. Well done. Still setting yourself up as the example (but we probably disagree on the example of what).

Don’t forget a couple of “masterpieces” that generation came up with:

1. Repeal of Glass Steagal (Thanks Bill!!!)

2. Serial bubble (Thanks Bernanke!!!)

3. Private Equity (the roll call is so long it’s hard to fit everyone here!!!)

4. Expansion of the Military Industry (no money for healthcare and education, but infinite money for foreign “adventures”)

We can do without all of those.

The true minimum wage will always be 0. No one is required to hire anyone. Raising the minimum wage will only lead to higher unemployment and a drive to automation. These lower paying jobs are essential for people to gain experience or make a little money to go to school. They are also motivators to better yourself.

The US may have a high wealth gap, but I don’t know of any country that has a higher standard of living for the lowest earners.

“don’t know of any country that has a higher standard of living for the lowest earners“

You could try a quick google search haha

Boomers just wont stop booming. Just because you say something doesnt make it true! Esp when anyone with a cell phone can confirm that you are wrong. Repeating the fake news your heard on tv just makes look like a fool and sheeple u luv 2 hate.

The countries with higher standard of living for lowest wage earners are in Europe, but the cost is higher long term unemployment, especially for youth. No such thing as a free lunch and all…

I am most definitely not a boomer and am very open-minded to facts. We have it pretty good in this country.

I like this website because it offers different views without criticism. I would appreciate it if you had an opposing opinion that you would state it clearly rather than demeaning yourself.

The true maximum wage/income is also 0. No one is required to utilize a business either. It’s weird how people are so focused on the MINIMUM wage. Why not attempt to reduce the MAXIMUM wage. There’s so many CEOs out there doing lousy jobs with golden parachutes. I don’t see people like you complaining about it. There are a ton of foreigners out there doing a bang up job running businesses in third world countries where they are paid a pittance compared to the level of compensation in America. Why not bring them in to replace the executives here. The shareholders will benefit no?

Same with politicians. H1B should be expanded so that people from overseas can run for office here. Less chance for corruption since they don’t even know the entrenched interests here.

I think CEO salary including bonus should not be more than 20 times the average wage of employees on a 40 hour week.

In that way the CEO has to pay more to the employees to get an increase himself.

True.

He very very wrong.

It may be the strong immunity systems that kills you when you contract covid-19.

Of course if it wasn’t a presidential year in America there would no NO stimulus checks of any kind just like in the rest of the world. The voters are figuring it out this time around. Biden is stretching his lead.

I do not gamble but checked the bookies:

£100 on Biden winning will give you £160 back

£100 on Trump winning will give you £270 back

I am surprised at the difference as I thought it was quite close.

I just put £200 on Trump winning.

Another example of corruption

Those who are connected get funds from the government , those who are not file one one of the Chapters.

Since about a third of the comments are political, here is another. Many pundits across the political spectrum are appalled at the reckless behavior causing the spread of Covid in the White House.

If someone knows they are infected and negligently infects others, at what point does either civil or criminal liability begin?

It’s a political-economy so it’s not surprising to see it played out here.

As far as criminal liability, it could be multi-jurisdictional.

Bankruptcies reduce the number of competititors. They also reduce capacity or slack. It is concievable that fewer companies will enable demand and prices to increase. I am thinking inflation.

In the early 1990’s when globalization was the whole rage I was driving down Monterey Rd. (San Jose CA) with my youngest son (at the time around 22-23 years old, well employed. We came up on an individual who appeared to be SEA (South East Asian) pedaling a bicycle loaded down with black plastic bags of presumably recyclables. The area was and is still known to be occupied by many recycling businesses.

At the time I was employed by a very large retail chain and very immersed in the “globalization” discussions.

I was not happy at the way the process was being pursued. To me it only meant that American labor would eventually be crushed to the lowest global common denominator.

I said to my son: “Take a good look at this individual on the bicycle. That will be too many American jobs in the not too distant future. Almost all the jobs that will be exported to other lower labor cost countries will never come back. Take a good look!”

That’s the path we were on. Our economy has been trashed by political and corporate interests. You have not been invited to the table. Now the pandemic is making it infinitely worse. There is no solution. Gather your acorns and keep them close. The worse is yet to come.

Too many grasshoppers expecting too few ants to save them.