It might look a little bloody at the top, but it barely unwinds seven weeks of mind-boggling gains.

By Wolf Richter for WOLF STREET.

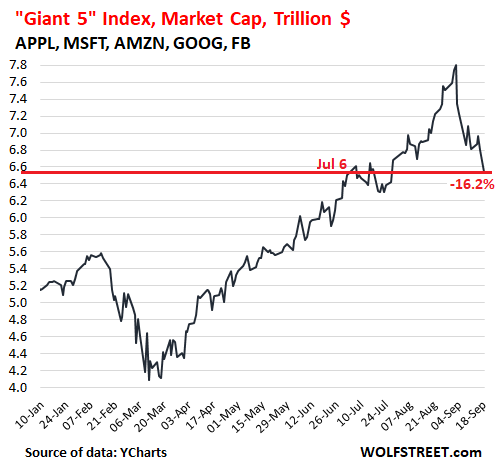

The Giant 5 stocks – Alphabet, Amazon, Apple, Microsoft, and Facebook – as of the close on Friday, fell 4.0% during the week and are down 16.2% from their collective closing high on September 2, a drop of $1.27 trillion in combined market capitalization (data via YCharts):

While a drop of $1.27 trillion for just five stocks might have sounded like a lot of money back in the day, time has moved on; these days, trillions are whooshing by so fast it’s hard to count them. That drop of $1.27 trillion amounts to a little more than one Alphabet at its peak ($1.175 trillion on September 2), meaning that if Alphabet’s shares had gone to absolute zero, while the rest of the Giant 5 had remained flat since September 2, the index would have been a little higher today.

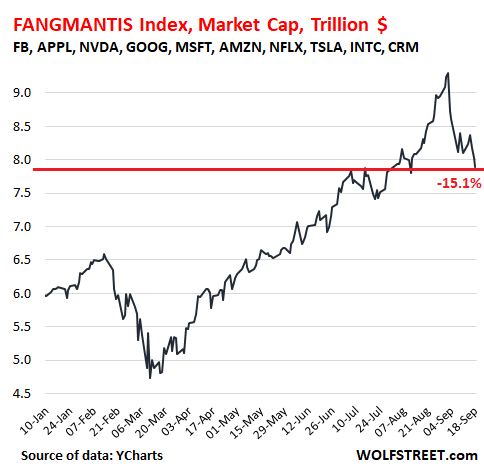

With five more highflying stocks – Nvidia, Netflix, Tesla, Intel, and Salesforce – tossed into the mix, WOLF STREET’s FANGMANTIS Index fell 2.5% during the week, and is now down 15.1% from its closing high on September 2, or by $1.40 trillion. This took the index back to where it had first been on July 7.

What slowed the decline of the FANGMANTIS versus the Giant 5 this week was that Tesla jumped 19% during the week (still down 11% from its closing high), Intel rose 1.6%, and Nvidia eked out a 0.5% gain, while all others fell (data via YCharts):

Alibaba [BABA] doesn’t make the index because it’s not a common stock but an American depositary receipt (ADR), issued by a mailbox company in the Cayman Islands that has a contract with an entity of Alibaba in China. Other big ADRs are in a similar boat, such as Taiwan Semiconductor [TSM].

The closing highs of the 10 stocks in the FANGMANTIS index occurred between August 31 and September 2. Their declines from their individual closing highs range from 4.3% (Intel) to 20.3% (Apple). While the top of the list might look a little bloody, with Apple down 20.2%, it’s really almost nothing, unwinding barely seven weeks of mind-boggling gains:

- Apple [AAPL]: -20.3%

- Facebook [FB]: -16.5%

- Amazon [AMZN]: -16.3%

- Netflix [NFLX]: -15.6%

- Alphabet [GOOG]: -15.5%

- NVIDIA [NVDA]: -14.9%

- Salesforce [CRM]: -13.7%

- Microsoft [MSFT]: -13.5%

- Tesla [TSLA]: -10.8%

- Intel [INTC]: -4.3%

And the rest of the market without the FANGMANTIS?

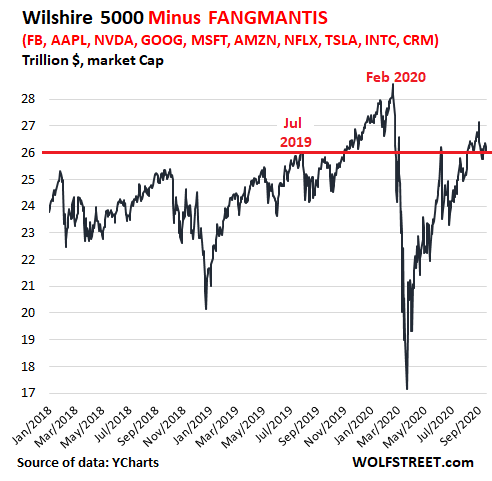

Even after the steep drops, the FANGMANTIS still accounted for 23.2% of the total market, as reflected by the Wilshire 5000 Index, which is composed of 3,415 stocks listed in the US. So how did the rest of the stock market do without those 10 huge highfliers?

The WOLF STREET “Wilshire 5000 minus FANGMANTIS Index” ticked up 0.5% during the week, but remains down 4.0% from September 2, down 6.4% from the pre-crisis peak in February, and is about flat with July last year. So it really hasn’t done much, despite the harrowing volatility in between (Wilshire 5000 data via YCharts):

The Big Disconnect.

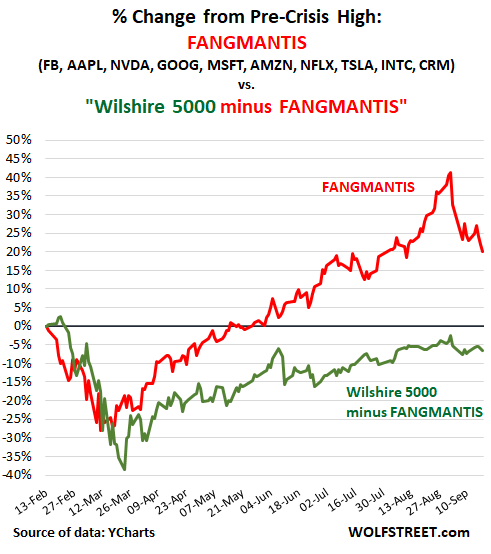

So how did the rest of the market without the FANGMANTIS do compared to the FANGMANTIS, since February 13, which was the pre-crisis high of the FANGMANTIS? As of the close today, the rest of the market (green) was still down 6.4% from February 13, while the FANGMANTIS (red), despite the drop since September 2, were still up 20%:

A word about the biggest mega-stocks.

Big stocks have a way of fading. When they’re at the top, everyone assumes they’re always at the top. During the dotcom bubble, Cisco [CSCO] was number one, having surpassed Microsoft. In March 2000, shares peaked at $79, giving the company a market cap of nearly $550 billion, and folks were sure it would hit $1 trillion soon; what came soon was the dotcom bust, and Cisco’s shares are down 50% today from that peak 20 years ago. Today its lowly market cap of $168 billion (thanks to massive share buybacks, which reduced the number of shares outstanding) ranks below that of a sneaker maker.

After the merger between Exxon and Mobil in 1999, and the plunge of Cisco in 2000, Exxon-Mobil [XOM] became the largest stock in the US and stayed that way for years. But its share price has plunged over 60% since 2014, and in August, it got kicked off the DOW.

The stock market is full of these kinds of stories. The biggest stocks can get very expensive for stockholders in a hurry, and when these stocks are so huge, as they’re today where five stocks were valued $7.8 trillion, even a moderate hit to just these five stocks blows out over a trillion bucks in a matter of days.

It just looks so tempting. Read… Great Time to Turn a Nest Egg into Scrambled Eggs

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just a blip, buy the dip.

Just a dip, buy the blip?

Just BUY BUY BUY….

Believe in the Cramer.

I would love to be in on those calls that he gets from his buddies at GS, hey Jim, can you pump stock ABC today, got a ton of calls on it, and I need the bonus this quarter… yeah, sure, just come over on the weekend, got my Cubans ready and waiting.

That guy is such a tool, and cnbc are such tools for constantly posting articles titled “Cramer says this” and “Cramer says that” as if I give a rat’s butt about anything “Cramer” says. Like there’s some cult of personality around this market sage and we should all be hanging on his every word. I completely ignore him and have never read one of those articles.

In fact, I ignore pretty much every article posted there, I mostly read the titles just get an idea of what people in that over-analysis game are thinking to see if it gives any hints about general sentiment.

I did read one very good article yesterday in which a very intelligent researcher explained why stock picking strategies never worked well and are working even worse now. I would like to it but such links are not allowed here I think. It was the single most reasonable and rational analysis I have seen outside of wolfstreet in a long time.

The title is “Stock picking has a terrible track record, and it’s getting worse” if you want to Google it.

Trusting any financial news is usually a way to get played, but Cramer tends to be consistent as a reliable source of contraindication. If he says buy buy buy, that means his buddies are ready to unload. If he says sell, well, that’s a little more difficult, but probably there is someone on the other side asking him to drive the price down either because they want to buy, or because they want to sell.

Jimbo is at least somewhat knowledgeable in the art of market manipulation. Then he got wise and figured out that he doesn’t want to do the actual deed, just be the enabler and the beneficiary of such action.

Check my title for the appropriate link. I put it up for a bit a while back, but got tired of doing it. It’s a hilarious video from the last decade where Cramer is telling people how he manipulates markets

Yes, much better!

That is like the comments by the commentator at CNBC, who just claimed that things are better than expected. The captain of the Titanic could also have said that right after the Titanic hit the iceberg: the ship has a huge hole, but it is otherwise in better than expected shape.

Of course, both our economy and the Titanic are about to sink. However, the 15 billionaires who own our news media, according to Forbes Magazine, probably do not want to see the stock market tank.

Aside from a few stocks, like Amazon, which has an efficient delivery system and has successfully addicted Americans to its services, a lot of the current, popular stocks are now only keeping its values due to investors’ normalcy bias and fleeing to perceived, safe havens. Even Amazon’s price-earnings ratio is so high that it probably has long been grossly overvalued.

Reality will ultimately triumph. Thus, a lot of us will lose our shirts. Physical gold held by investors can be confiscated by the government as it was in the 1930s, “fake,” paper “gold holdings” at certain companies will result in their bankrupties if investors ever try to pull out their gold en-masse, and money will be hyperinflated out of its value. Therefore, there is no safe haven visible.

Another great article; thank you for your work. However, wanted to point out that something is not right with this section: “That drop of $1.27 trillion amounts to less than one Alphabet at its peak ($1.175 trillion on September 2)…” Perhaps google was worth $1.275 trillion?

Ha, the numbers are right but “less” is “more.” Thanks. Just my dyslexic manner ?

It was very kind of them to peak out at 7.8 Trillion Market Cap, Wolf.

Nice. Severe fictitious value in marketing, media streaming, and computers? These graphs provided says everything that is wrong with our economy and wall street. That fast money can get real slippery fast. Hold on tight.

I’ve let go. Good bye art.

What about PEs? Can you do a graph showing the silliest PE ratios please?

There’s way sillier stuff than absurd P/E ratios.

Snowflake IPOed this week giving it a market cap of 60 billion plus. It’s not even profitable.

Meanwhile Teradata, also a database company with actual real earnings only has a market cap of 2 billion plus.

Teradata is the reason Snowflake exists. I don’t believe SNOW should be priced where it’s at but Teradata fumbled its leading share by forcing boxes on people who wanted more flexibility. Their arrogance or ignorance to the biggest trend in tech has put them on the path to being Blockbuster

And Oracle is the reason Teradata exists. Snowflake is currently priced as if it will eventually take over the entire database market.

It’s not going to happen. Oracle/MySQL/Postgres is enough for 80 to 85% percent of the market. Cloud based solutions assume that all companies will be the size of FAANGS, but they are more the exception rather than the rule.

I work in tech, and I notice that a lot of technical papers nowadays (with clever algorithms, etc) are super specialized. Like almost no company (again with the exception of FAANGS) will gain any advantage deploying these super specialized techs.

I bought my first SPY puts today- spread out at strikes between 300 and 220 (more at the lower end, fewer at the upper), and with expirations between October 16th and November 20th. I am prepared to go further out in the future next month if the market disagrees with me.

I was hoping to wait for a vaccine announcement to do so, but I don’t think the air will stay in the market balloon long enough.

Spend the money and buy puts at least three to four months out with a 60 delta. It’s a synthetic short

Yeah, you are probably right- I am being a bit of a skinflint by buying the nearer expirations right now. I will reassess over the weekend.

The options chains are broken. Volatility is high, which indicates you should use spreads, but the Risk Reward in at-the-money spreads is no different, and absurd break evens. The tail wags the dog, (overnight futures). There is a slightly better opportunity in the options of the leveraged products, with the SPXU under $10 the options cost less. One contract on SPY is 100 shares times $XXX.

The last time VIX went to 80 in three weeks, so you’d be buying next month at the top.

I wouldn’t go out into November 20th. If Trump wins (I hope. I have love/hate feelings for the guy) then you will see a rally like you never saw. I think between now and Nov 4th, a lot of volatility.

There will be no rally if Trump wins. This may be an unpopular opinion with wolfstreet editors, but it is true.

I don’t care about these guys unwinding. What worries me more is that the USD has been dropping in lockstep with the market.

Mr Market is anticipating a 10 trillion dollar balance sheet.

The US stock market will erase $10T on the flip side.

Still valued too high for fundamentals.

Wouldn’t mind seeing those companies fall another 50% especially those darlings like FB which should be trading at under $50 a share and Tesla at $20!!

Tesla is a company that just loses money, a realistic value for theiy shares should be 20 cents not 20 bucks. Heck even 20 rats would be too much.

Let’s put these valuations in prospective

Total market cap

Korea-1.27t

India-1.81t

Ger-1.85t

Fr-2.27t

India-2.59t

With a current total market cap of just under 6.6t, these stocks market caps are exceeded only by the total market caps in China and Japan .

Let’s put these valuations in prospective

Total market cap

Korea-1.27t

India-1.81t

Ger-1.85t

Fr-2.27t

India-2.59t

With a current total market cap of just under 6.6t, these stocks market caps are exceeded only by the total market caps in China and Japan .

Fundamentally, Facebook, Google, Microsoft et al have immunity from libel because of Section 230 of the, get this, The Communications Decency Act of 1996. Without that immunity this is a different market.

I downloaded Wiltshire 5000 data going back to 1970 from the St. Louis Federal Reserve (FRED). Looking for months when stocks were 2 standard deviations below the 200 day moving average gave these results out of 662:

January – 6%

February – 9%

March – 12%

April – 2%

May – 5%

June – 4%

July – 4%

August – 9%

September – 17%

October – 13%

November – 11%

December – 8%

This is approximately the same as asking, when was the Wiltshire 5000 below the 200 day, 2 standard deviation Bollinger Bands and for how many days each month? You can pull up a chart on any service to show that.

This is just the past, not a prediction or forecast. Check out the free data, it is interesting.

And? You confirmed pigeonhole principle?

The tide is turning from high to low. Soon, as winter approaches, those who rushed out to Tahoe and bought houses will find out what a drag winter is being stuck in a blizzard, and that the city’s nightlife will soon enough be back online. The low prices of the city will be a mad rush in the opposite.

Rush in, rush out. The dependency on online retail will also decrease and folks will want to some degree, shop in a shop.

You don’t get to $3k share by unwinding your gains on every correction.

If a meteor vaporized Florida tomorrow the Fed would print tens of trillions in stimulus and hand it out to everyone left who in-turn would buy more stuff on Amazon. And it goes without saying that they’d also be directly monetizing QQQ & S&P. Only a matter of time before the Fed is literally printing new money to buy AMZN shares via the indexes.

Please explain to me again step-by-step how this scheme fails before the USD first goes to zero?

Amazon buys another $10B in treasuries?

The Fed has said rates will be zero for at least three more years. Some say this a bluff and that interest rates will actually be zero for decades to come. It’s interesting to ponder what that would look like and who would be the winners and losers.

If you are retired like me, I am going to be a loser unless I can join the Mafia and work for them on “collections”.

Otherwise, my savings gets spent down with no hope of making any interest to counter the draw. (I am one of the lucky ones with something saved(

Anthony A,

And, yet, after essentially 20 years of ZIRP, the gutting of interest rates (mostly thru DC money printing) gets essentially zero coverage on any mainstream TV network (left or right).

Nothing speaks louder as to the essentially incestuous relationship of the mass media and DC than that fact.

Every dollar holder on the globe has been expropriated for two decades but it is the subject “that dare not speak its name” among the media…because DC cannot survive without that expropriation at this point.

Anthony A. You can always buy some Ford Motors stock like I did, FOR THE DIVIDENDS. Bwa-hahaha!

Old School,

Without trying to predict the future, we can look at the past on this topic: The policy interest rate in Japan have been near zero since 1995. Stocks are still down 40% from 1989. The banks stock index is a tiny fraction of where it was 30 years ago.

Has the Fed said anything about why this time it’s different, and why things don’t unfold the same way that it did in Japan?

One reason is that the 12 regional Federal Reserve Banks are owned by the banks in their districts, and they don’t want their bank stocks to get totally crushed for 30 years.

Yes, the Japanese market index is down over 40% from 1989, but in their share market their have been some huge winners.

Japan is still a stock pickers’ market once you get past the mega caps.

As I’ve said before and I’ll say it again: Japan offers some of the best valued companies in the world today.

When I was a kid one of the other kids said why dont they make more money? I said we would have more money but just the same candy/toys/bikes. The adults thought I was very intelligent. They got that wrong.

FANG rotation to energy stocks, if SPX uptrend cont.

Read the Fed statement, re: inflation and low oil prices. Factor in China’s new credit bubble, while China is planning to cut back on oil imports 40%, (prices too high?) and you might come to the conclusion that higher oil prices are for US consumers only (inflation) while energy exports and the business side suffers. Energy workers laid off, pay $5 for gas at the pump. Fed meets inflation target…

Wolf,

Strong article, as usual, but I think two related issues could be linked in, with your usual levels of research and graphical representation.

1) The correlation of ZIRP with the airless cattle cars of equity overvaluation…that is more of a multi-year, multi-decade phenomenon at this point.

2) Related to point 1, even as the “peak overvalueds” cycle out (or merely down), less or disfavored stocks/sectors seem to cycle up (what I think of as the “sloshing bucket” system of ZIRP).

That is, while individual ultra-hyper overvalued equities may (eventually) cycle down, the inward pointed bayonets of ZIRP keep investors (foolishly) in the equity mkts…the money just moves to previously less favored sectors.

This has the result of keeping broad equity indexes fairly stable…or, at worst, in a slow downward glide path.

But, still, in aggregate, idiotically overvalued…primed for the next shock…when panic overwhelms even the loathing of guaranteed zero (or subzero, in Euroland) investments.

Before all Western gvts steered their economies into the death spiral of 100% plus Debt-to-GDP levels, fixed income invts could be allowed to rise above ZIRP…providing a safety valve/off ramp for equity overvaluation.

But gvt fiscal degradation now necessitates the opposite.

Because the G cannot survive without ZIRP (at 100% debt to GDP, each small 1% rise in interest rates consumes a full 1% in GDP growth…simply to keep the G debt death spiral from getting *worse*…), oceanic instability becomes built in to the overvaluation of individual equities.

The markets are becoming a mix of 2001, 2008 and 2015 all combined in one. Is the tail wagging the dog? Yes!!! The wealth effect works, FED pumps money directly into stocks and people spends more. Then the tide goes and the proverbial naked people shows. We have effectively became a command economy.

Good article on the hedge about valuations of growth stocks and their outperformance vs rest of market like the four years leading up to 2000 tech bust. Quick reversal to where value outperformed for a while and growth cratered. Seems like the setup today as some value is not expensive.

Exxon rose in value after 1999 as conventional oil fields were rapidly depleted. Natural gas fields were also declining in production. Persian Gulf hydrocarbon producers were getting rich. Canadian tar sands were refined to make light crude. SASOL in South Africa turned coal into oil.

It was known oil companies were only able to extract a percentage of the total oil contained in oil reservoirs. Some oil reservoirs had layers of impermeable rock full of oil. Drilling companies improvised horizontal wells, with numerous wells drilled from the same drilling pad. They improved fracking technology. Oil started to flow. Oil became a more common commodity.

Now we have a huge decline in travel affecting the oil/gas and tourism industries.

It is not the same as 1999.

Um, Gulf War 2 ring a bell?

Russell 2000 (IWM) is still holding the line. May even turn higher. When small caps turn south this goose is cooked.

Most my puts are in green, incl Tesla (bought tsla and aapl day after the split). Few Amazon puts and SHOP were too early. Will make it up with Nvidia. Based on my observations June is were it’s at.

Don’t quite understand why Intel features in your FANGMANTIS selection. It seems, judged from past ten 10 years performance, a fairly consistent, stable company with the ‘correct’ conservative ratios (ie. P/E around 10 and a moderate 2.6% div). Is it because you needed another vowel?

Because it’s big, big market cap (higher than NFLX), big tech, and starts with an I.

Any time an index is called FANGMAN or FANGMANTIS, there is a tongue-in-cheek element to it.

Go wider??…FANDANGOMANTISSISSIMO!

It ain’t over till the fat lady sings.

So, really, you just needed the letter I to make FANGMANTIS work, is that it?

Cause Intel really hasn’t participated in the rally at all, far from it, it’s going backwards. I think AMD would fit better. FANGMANTAS, or may be O for Overstock, FANGMANTOS, Although that has been dropping as of late.

Or MASTANGFAN?

a pullback was kind of overdue….11% comp correction….

lots of cheap stocks out there, rotation is key….

Frwd PE on some sectors is near 12…

follow the money, plenty of fed free hot cash in the system

death rates and hospitalization are going down, they have some drugs working getting the same folks dying in April out in 4-5 days now….

I would tread lightly on shorts as Munchkin can do a lot here…

It is one of those misnomers that stocks with high P/Es are not good investments, the reasoning goes the stock deserves the higher multiple, and has room to expand. Since market P/E feeds back into the valuation of individual stocks there is a virtuous circle. (Works in reverse as well). Corporations relying on credit to raise their P/Es will start growing their business when the economy recovers. (First you borrow the money then you put it to work) Wall St reallocates to open up new parts of the economy, like renewable energy, and financial, social, political and cultural firewalls. Virus prevention, political cyberhacking, domestic terrorism. To accomplish this we have to continue to push the faux threats, like China, and ignore the real threats like Russia proxy voting in our elections.

If we want to be honest, both China and Russia are threats. They are just threats in different ways.

Russia is basically your standard 1-D threat, the axis of attack may be different, but essentially, it’s one that can get isolated.

China is a whole different kind of a threat, it’s a multi-dimensional, multi-vector threat. One that really challenges the US for its mantle of superpower. To say people think a multilateral world is a good thing, that’s true as long as you’re not #1.

If you think China is a false threat, then you haven’t been paying attention. Whether one likes it or not, China is #2, US is #1 in terms of power and influence position. It’s only natural that there be conflict. By the way, it wouldn’t matter one whit if China is a communist dictatorship or a liberal democracy, it just has to be that dynamic between #1 and #2.

Don’t underrate Russia. Putin’s objective is to invade Portugal as he has always wanted a warm water Atlantic port. And, in the process also acquiring Poland, Germany and France. Then sweep south into Spain and Italy and Africa. What the heck are you folks smoking?

You can’t argue with people who think the US Empire is better than slice bread.

All men are created equal, but some are allowed to invade more countries than others.

I don’t underestimate Russia, look what they did with a few dozen trolls and a few million bucks, talk about high returns on investment/asymmetric warfare.

But mark my words, China isn’t even really trying right now, all they are doing is shaping the battlefield if it ever came to that. China knows that it’s more profitable to keep the status quo ante from the last decade. They will keep that going as long as possible. After all, do you see Apple moving its supply chain elsewhere?

Just consider for a moment how deep the consumer electronics supply chain is embedded in China, good luck trying to change that over a few years, there is every incentive for US companies not to do that. Where is leader Tim going to find his 100K+ qualified manufacturing engineers from?

pssst… MB, just a hint, the US Empire has kept things fairly stable over the last 60 years, I mean no WWIII, and one could say objectively that through 2000, the world was advancing nicely, right? That’s gotta count for something. I figure if we can hang on until 2050, that’ll be a good thing. Yeah, a bunch of little brush fire wars. But nothing catastrophic.

MCH, there’s zero World War till 1914 either, and no thanks to the US. And certainly the US didn’t stop WW II.

The US is legitimately the biggest threat to world peace. Countries are arming up in response to us. And who can blame them, seeing we are not trustworthy, plus the mess in the Middle East. But again as I said, you seem to be one of those who believe that some certain colored people are better than others.

> FANGMANTIS

That’s some FAST NAMING you pulled off there, mate!

And from lockdown Melbourne where our number of cases has fallen and we are looking at easing of SOME restrictions in 8 days or, but given the targets needed to ease in October, it is almost impossible to meet.

That means even if meet the target on 28 September we will have another MONTH of lockdown and curfew. Already we have been locked down longer than Wuhan and most other places in the world. We still ahve the curfew and no movement of more than 5 kilometers from you house even with the easing. Ridiculous.

The targets to meet for a further easing in October are so ridiculous that I doubt we’ll meet them. Well, maybe, as the number of people getting tested has fallen well under 10,000 per day. Maybe if that number continues to fall, the number of cases will also fall, but I’d guess that Dictator Dan will move the targets then.

The lockdown has impacted everything. Our main library has been closed for about six months and the local branch only open for a couple of weeks before it was closed again.

The real estate market which includes rentals, sales, and construction is basically dead. For example, here is the impact on auctions:

“This time last year there were 672 reported auctions in Melbourne, according to Domain data. Last weekend there were none.”

Yet, the State government can not provide ONE example of where the virus was caught from RE inspections or sales.

Just in this one sector the impact has enormous with the entire ‘supply chain’ involved in the sales process being hurt. People that sold can’t settle, people that HAVE sold and settled can’t buy. People can’t refinance and landlords can not find new people to rent their properties. You can’t even inspect a property for sale or rent in person.

In our area we had a ‘big’ listing week with 8 properties listed. One is a development site that they want to put three townhouses on a 1200 square meter block. The driveway on the side of the lot will probably take up at least 10% of the block!!!

With the lockdown and no construction for more than 5 people on a site or something like that, it’ll be a long time on the market.

We’ve had a total of 8 houses that settled so far this month – 8 houses in 20 days and with the three month standard settlement time, well you can see what is going on.

It makes sense why, but I am still so shocked that we’re in a bubble in a deep recession. The frenzy of retail investors is pretty freaking insane right now. I have joined quite a few FB investing groups to see what’s going on, and it’s just wild reading most of the posts.

The only thing that seems like it will pop the bubble at this point is antitrust action against any one of the big tech companies. That will end their invincibility and likely set off a lot of uncertainty, especially after the last few years of the general public increasingly turning on or becoming concerned in some way with big tech.

At this point, another potential COVID wave along with more fiscal funding seem to be one of the potential baked in events so I don’t see how that is the catalyst.

I do wonder if another potential path is a better outcome than anticipated today with COVID (as in, no major spike in the winter due to widespread masks wearing) that allows inflation to become reality much more quickly (stagflation, really) than expected. That scenario will still take quite some years to play out, but it would break the TINA thesis if we entered a rising rates regime.

PS I’m a huge fan of your content, thanks for regularly posting great articles like this one. I run a relatively new weekly finance newsletter, and I have included some of your articles in our snippets section.

Prices of the FAANGs only have meaning as a measure of liquidity. The FAANGs are momentum plays, and when the money stops pouring in they could easily fall another 50%.

It’s almost a joke to discuss their valuations as having any meaning.

Has anyone looked at the “Covid” stocks like Zoom and Peloton? Crazy.